How to Create and Use an Invoice Receipt Template

When managing business transactions, it’s essential to keep accurate and clear records of payments made and received. A well-organized document can help both businesses and customers ensure that all financial exchanges are properly noted. These documents serve as proof of payment and can be used for future reference or in case of disputes.

Designing a customizable document for tracking payments can save time and minimize errors. Whether you’re a freelancer, a small business owner, or part of a larger corporation, having a reliable and easy-to-fill format helps maintain professionalism and simplifies accounting processes.

In this guide, we’ll explore how to create an efficient and customizable document for confirming transactions. You’ll learn what key information needs to be included and how to make adjustments to fit your specific needs, ensuring that both you and your clients have clear and accurate records.

Invoice Receipt Template Overview

Managing financial transactions efficiently requires a well-organized document that records payments and confirms the completion of a sale or service. These documents serve as proof of exchanges, helping businesses keep track of payments and providing customers with a clear record for their reference.

Having a customizable structure for these documents ensures that the necessary details are included while offering flexibility to adapt to specific business needs. Whether it’s for a one-time service or ongoing transactions, a professionally designed document can make the billing process smoother and more transparent for both parties.

In this section, we will look at the key features and benefits of using a standardized document format for confirming payments. By understanding its essential components, you’ll be able to create or choose the right version that best suits your business operations and client interactions.

What is an Invoice Receipt?

A payment confirmation document is an essential part of any business transaction. It serves as a written acknowledgment that a payment has been made for goods or services provided. This document acts as both a record for the seller and a proof of payment for the buyer, ensuring that both parties have a clear understanding of the transaction.

Such documents are typically used to track financial exchanges and are important for bookkeeping and accounting purposes. They help businesses stay organized, maintain accurate records, and provide clients with evidence of their payments.

Key features of a payment confirmation document include:

- Clear identification of the buyer and seller

- Details of the products or services provided

- The amount paid, including any applicable taxes or discounts

- The payment method used (e.g., cash, credit card, bank transfer)

- The date of payment

- Any relevant transaction or reference numbers

By including these crucial elements, this document ensures that both parties are aligned in their understanding of the transaction and can refer back to it if needed for future dealings or record-keeping purposes.

Why You Need an Invoice Receipt

Having a written confirmation of payment is crucial for both businesses and customers. It provides clear documentation of a transaction, helping both parties maintain accurate records for future reference. Without such a document, tracking payments and managing finances becomes significantly more challenging, potentially leading to misunderstandings or disputes down the line.

For businesses, this document is vital for effective accounting and financial reporting. It allows you to keep an organized ledger of completed transactions, making it easier to monitor cash flow, prepare taxes, and ensure timely payments from clients.

For customers, a payment confirmation offers peace of mind, confirming that they have settled their dues and protecting them from potential billing errors. It also serves as a reliable reference in case any issues or discrepancies arise regarding the transaction.

Key reasons to use a payment confirmation include:

- Provides an official record of the transaction

- Helps businesses stay organized with financial tracking

- Ensures transparency between the buyer and seller

- Reduces the risk of billing disputes

- Facilitates easier returns, refunds, or adjustments if necessary

By incorporating this document into your business practices, you can enhance trust with your clients, improve internal processes, and ensure that all transactions are properly recorded and accounted for.

Key Elements of an Invoice Receipt

A well-structured payment confirmation document includes several essential components that ensure clarity and accuracy. These elements provide both the buyer and the seller with the necessary details to understand the transaction fully. Including all relevant information not only protects both parties but also helps streamline financial record-keeping and auditing processes.

The main components of a payment confirmation document include the following:

| Element | Description |

|---|---|

| Buyer and Seller Information | Full names, addresses, and contact details of both the buyer and the seller for identification. |

| Transaction Date | The exact date when the payment was made and the goods or services were provided. |

| Items or Services Provided | A detailed list of the goods or services purchased, including descriptions and quantities. |

| Total Amount | The total payment made, including any taxes or discounts applied. |

| Payment Method | The method used for the payment (e.g., cash, credit card, bank transfer). |

| Transaction Reference Number | A unique identifier for the transaction, often required for tracking or verification purposes. |

Including these elements in a payment confirmation ensures that both parties have a comprehensive and clear understanding of the exchange. It also facilitates smooth future transactions and serves as a reliable reference in case of any disputes or questions.

How to Customize an Invoice Receipt

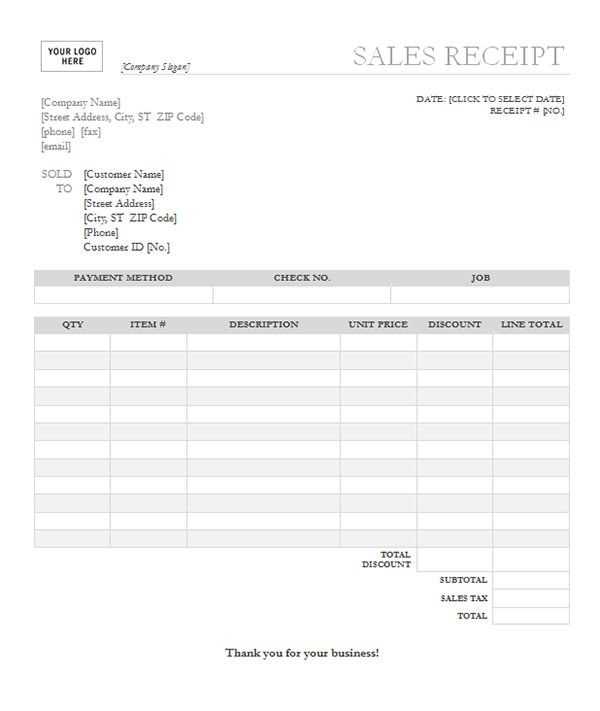

Customizing a payment confirmation document allows you to tailor it to your business’s specific needs, ensuring that it includes all relevant information while maintaining a professional appearance. By adjusting the layout, design, and content, you can make sure the document accurately reflects your brand and provides the necessary details for both your records and your customers’ peace of mind.

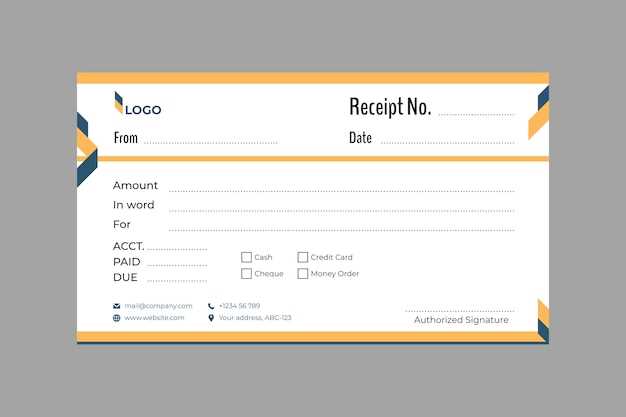

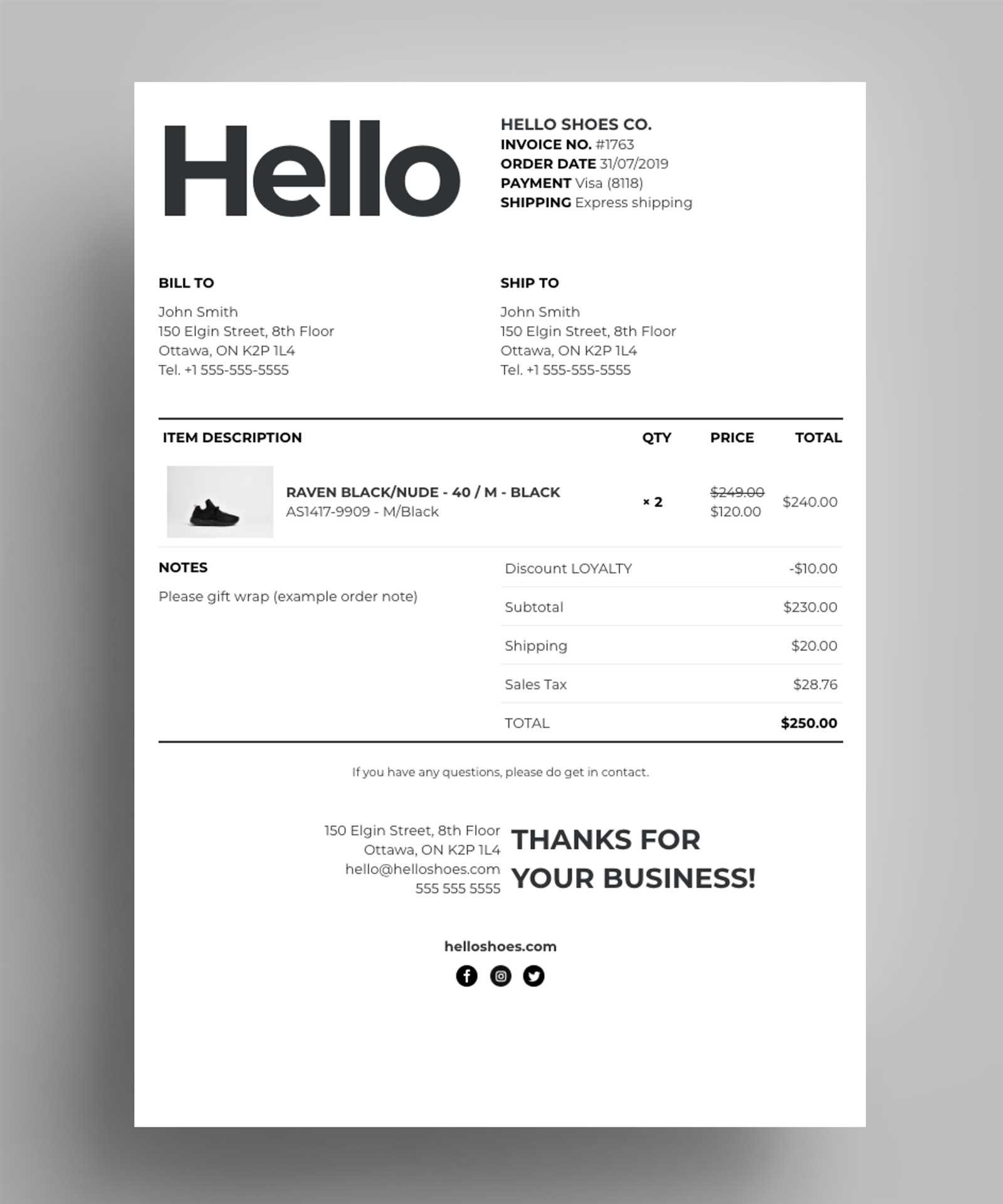

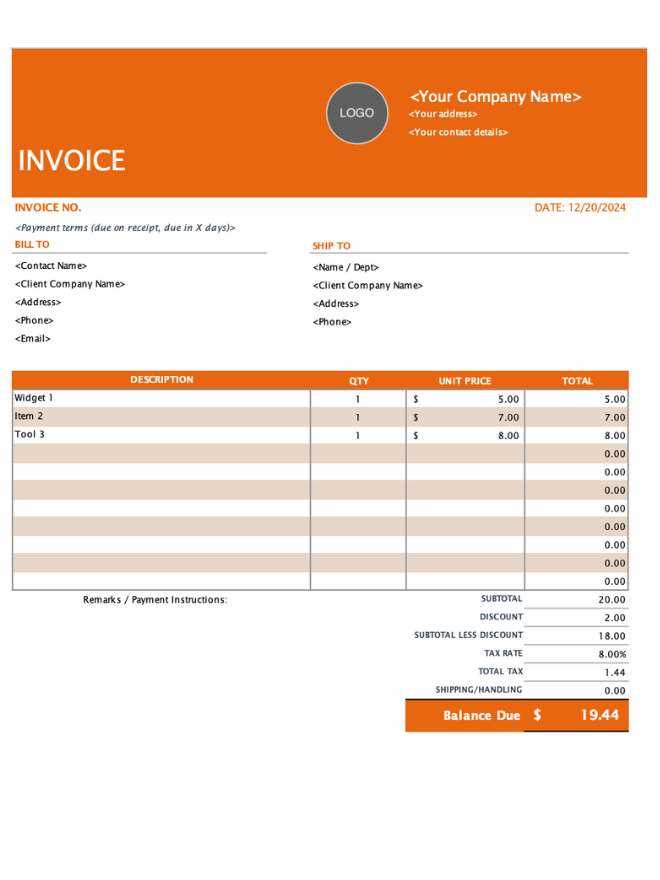

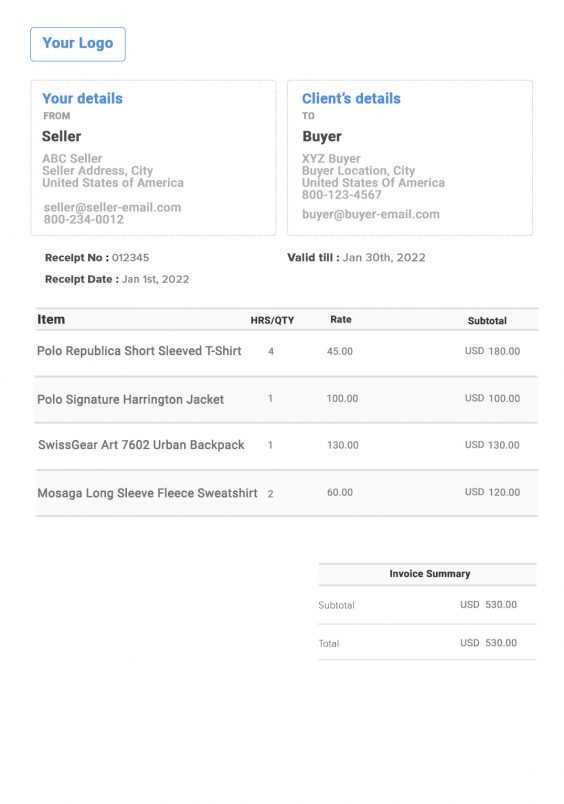

Adjusting the Layout and Design

The layout of the document is crucial for clarity and ease of use. Choose a clean, simple design that makes it easy for clients to find the information they need. Ensure that your business logo is prominently displayed, and use clear section headings such as “Transaction Details,” “Payment Method,” and “Amount Due.” If you have a specific color scheme or branding guidelines, incorporate these into the document to maintain a consistent image across all your business communications.

Including Relevant Information

Beyond design, the content of the document must be customized to include specific transaction details. Make sure you add the following items:

- Business Information: Your company’s name, address, and contact information should be listed clearly at the top.

- Transaction Details: Include a description of the goods or services provided, the date of payment, and the total amount.

- Payment Method: Specify whether the payment was made via credit card, bank transfer, or another method.

- Customer Information: Ensure the customer’s details, such as their name and contact information, are accurate.

Once you have included these key details, review the document to make sure that it is both professional and easy to understand. By customizing the structure and content, you create a more personal and efficient way to communicate with your clients while streamlining your business operations.

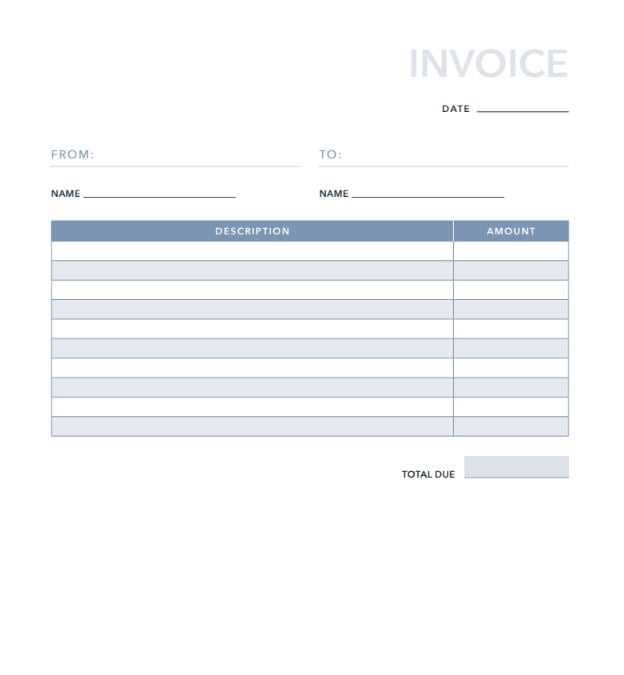

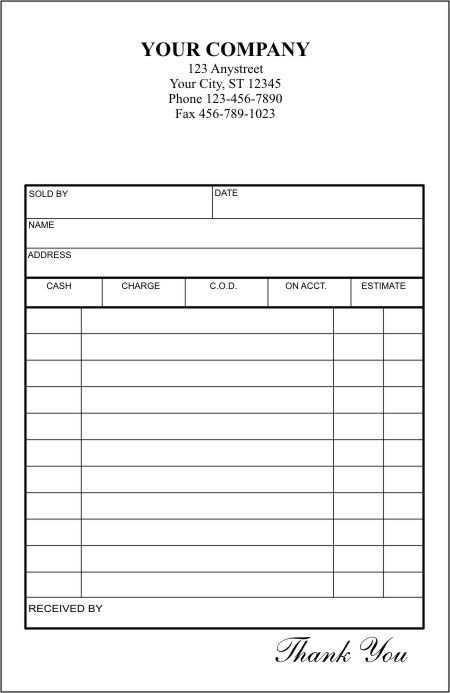

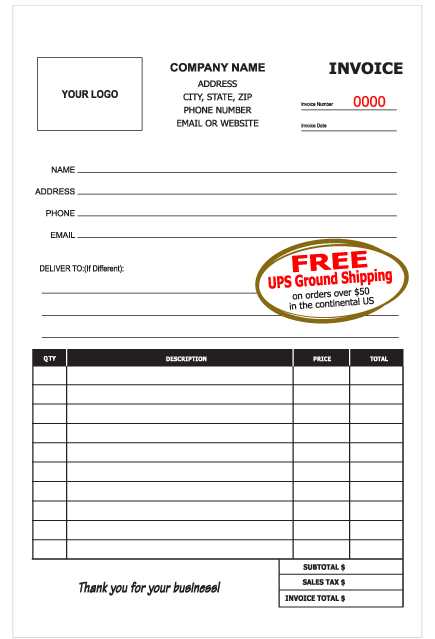

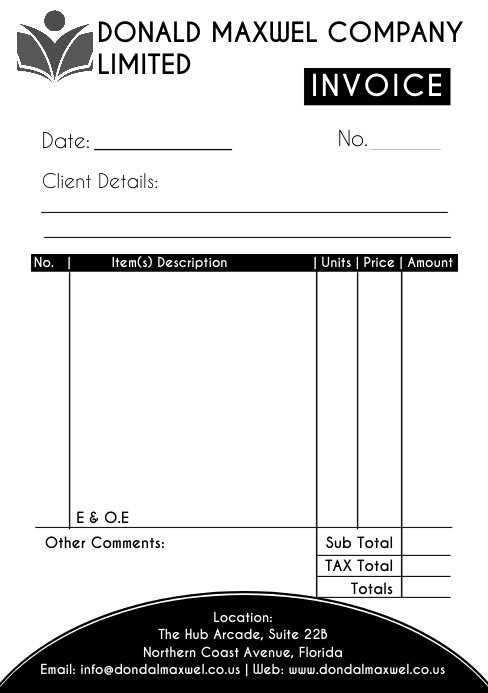

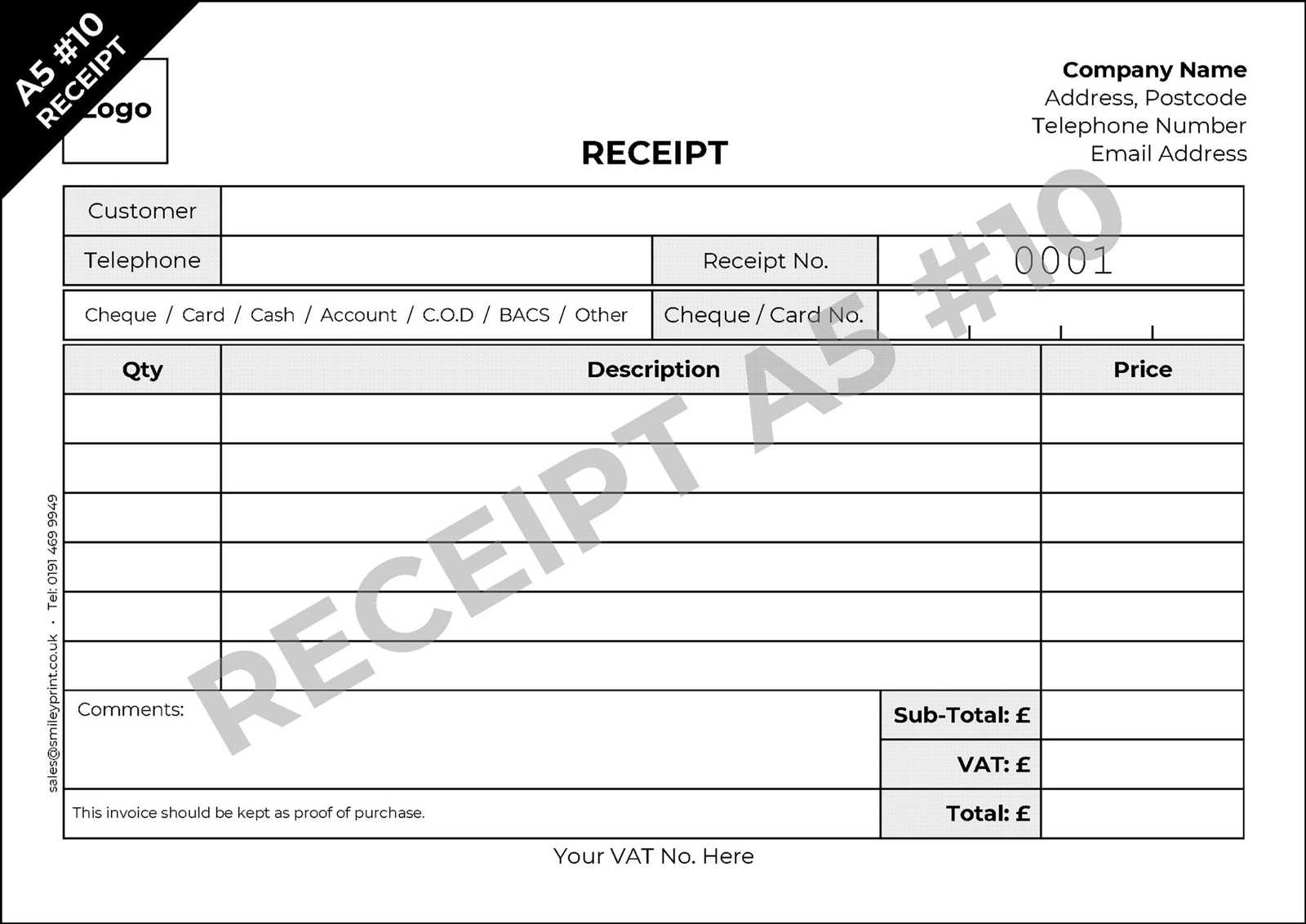

Free Invoice Receipt Templates Online

Finding a pre-made document structure for payment confirmation can save you valuable time and effort. Many online platforms offer free, customizable formats that allow you to quickly generate professional-looking records without having to design them from scratch. These ready-to-use solutions cater to various business types and transaction scenarios, ensuring that you can easily tailor them to your specific needs.

Free templates often come in different formats such as Word, Excel, or PDF, giving you the flexibility to choose the one that suits your workflow best. You can adjust the fields and layout according to your preferences, adding your company details, transaction specifics, and any other necessary information with ease.

Some advantages of using online templates include:

- Time-saving: Get a professional document ready in just a few minutes.

- Customizable: Easily adjust the content to fit your specific business needs.

- Variety of formats: Choose from different document types like Word, PDF, or Excel.

- Cost-effective: Access high-quality designs for free, without the need for expensive software.

By utilizing these free resources, you can streamline your payment processing and create organized, accurate records for every transaction.

Best Practices for Invoice Receipts

To ensure smooth business transactions, it is essential to follow certain best practices when creating and managing payment confirmation documents. By maintaining consistency, accuracy, and professionalism, you not only protect your business but also build trust with your customers. A well-organized document can minimize errors, avoid misunderstandings, and streamline your accounting processes.

Key Best Practices for Payment Confirmation Documents

Here are some fundamental guidelines to follow when creating or managing payment confirmation documents:

| Best Practice | Description |

|---|---|

| Clarity and Simplicity | Keep the document clean and easy to read. Avoid clutter and unnecessary details that may confuse the reader. |

| Accurate Information | Double-check that all details, such as the transaction amount, payment method, and customer information, are correct and up to date. |

| Timely Issuance | Provide the document immediately after receiving payment to avoid confusion and establish clear communication with the customer. |

| Use of Professional Design | Ensure the document reflects your business’s branding. This adds credibility and makes the document look professional. |

| Retention for Record-Keeping | Store all documents in an organized system, both digitally and physically, for easy access during audits or future reference. |

Additional Considerations

Along with these core practices, it’s important to maintain a consistent format across all payment confirmation documents. This ensures that both your team and clients know where to find specific details. Additionally, consider offering digital versions of the documents to enhance convenience and reduce paper waste.

By following these best practices, you can create more efficient business processes, improve your relationship with customers, and keep your financial records in excellent shape.

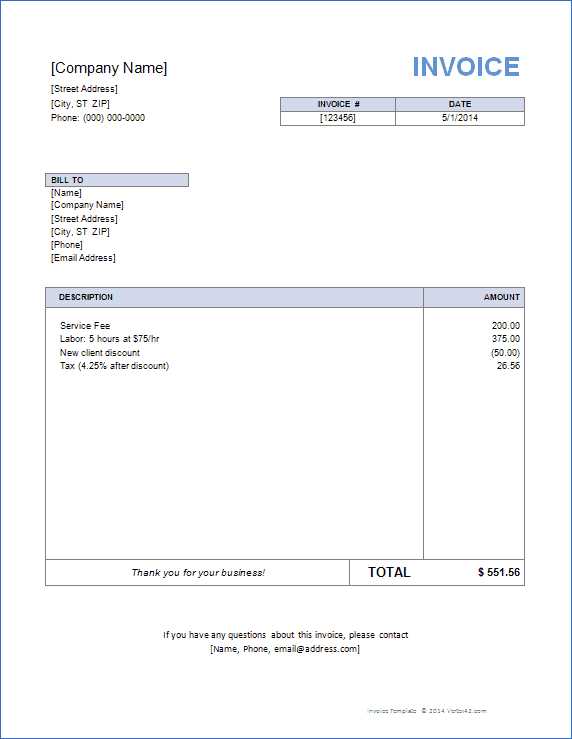

How to Fill Out an Invoice Receipt

Filling out a payment confirmation document correctly is crucial for ensuring accuracy and transparency in business transactions. By following a structured approach and including all necessary details, you can ensure that both parties have a clear and reliable record of the transaction. Whether you’re handling a one-time purchase or an ongoing service, this process should be simple and straightforward.

Here are the key steps to follow when completing a payment confirmation document:

- Step 1: Enter Business and Client Information

Start by filling in the name, address, and contact details of both the buyer and the seller. This helps ensure that both parties are properly identified and any future communication is directed to the correct addresses.

- Step 2: Specify Transaction Details

Describe the products or services provided. Include relevant details such as quantity, description, and unit price. For services, clearly outline the type of service and the duration, if applicable.

- Step 3: Input Payment Information

Indicate the total amount paid, including any applicable taxes, discounts, or additional fees. Be sure to break down the costs clearly so that the client can easily verify the charges.

- Step 4: Add Payment Method

Record how the payment was made (e.g., cash, credit card, bank transfer). This helps establish a clear payment history and can be useful for future reference.

- Step 5: Include Transaction Date

Ensure that the exact date of payment is recorded, as this is critical for both the seller’s accounting and the buyer’s records.

- Step 6: Add Any Reference Number or Notes

If applicable, include a unique reference or transaction number. This can help track the payment in your system or provide an easy way to look up past transactions.

Once all the necessary fields have been filled, review the document for any errors or missing information. After confirming everything is accurate, send the document to your client as a formal confirmation of the completed transaction.

Common Mistakes in Invoice Receipts

Creating payment confirmation documents may seem straightforward, but even small errors can lead to confusion or disputes. It’s important to be mindful of common mistakes that can affect the accuracy and professionalism of these records. By avoiding these pitfalls, you can ensure that your documents are clear, reliable, and help maintain smooth business operations.

Typical Errors in Payment Confirmation Documents

Here are some of the most frequent mistakes businesses make when preparing payment confirmation documents:

- Missing Customer Information: Failing to include full details of the client, such as their name, address, or contact information, can cause confusion and make it harder to track transactions in the future.

- Incorrect Payment Amount: Typographical errors or neglecting to include taxes or discounts can lead to discrepancies. Double-check that the total amount is accurate and consistent with the agreement.

- Omitting Payment Method: Not specifying the payment method (e.g., credit card, bank transfer, cash) leaves the document incomplete and unclear, especially in case of disputes or refunds.

- Failing to Include a Transaction Date: Without a clear date of payment, it’s impossible to track when the payment was made, which can be problematic for accounting purposes or future references.

- Not Including a Reference Number: Missing a transaction or reference number can complicate future verification and tracking of payments. This is particularly important for businesses that handle high volumes of transactions.

- Unclear Descriptions of Products or Services: Vague or incomplete descriptions of the goods or services provided can lead to confusion. Ensure that all items are listed with sufficient detail to avoid misunderstandings.

How to Avoid These Mistakes

To ensure your payment confirmation documents are flawless, always follow these simple tips:

- Review the Document Thoroughly: Double-check all information before sending it out to avoid any errors.

- Use a Structured Format: Stick to a clear, standardized layout to ensure that all necessary details are included every time.

- Use Automation Tools: Many software tools can automatically fill out certain fields, reducing the chance of human error.

- Establish a Consistent Process: Develop a set procedure for creating and reviewing these documents to minimize mistakes and maintain consistency.

By staying vigilant and following best practices, you can avoid these common mistakes and ensure that your payment confirmation documents are accurate and professional.

Benefits of Using Digital Invoice Receipts

In today’s digital age, businesses are increasingly turning to electronic documents for recording payments and transactions. Digital solutions offer a host of advantages over traditional paper-based methods, from saving time and money to improving organization and accessibility. By adopting digital payment confirmation records, businesses can streamline their processes and offer clients a more efficient and eco-friendly experience.

Key Advantages of Digital Payment Confirmation Documents

Here are some of the main benefits of using electronic formats for payment records:

- Cost-Effective: Digital documents eliminate the need for printing, paper, and postage, significantly reducing overhead costs associated with traditional paper-based processes.

- Faster Processing: With digital records, businesses can quickly generate, send, and receive documents, speeding up the overall transaction and documentation process.

- Enhanced Organization: Storing digital payment confirmations in an organized, searchable database makes it easier to manage records, track payments, and retrieve documents when needed.

- Eco-Friendly: Using digital formats reduces paper waste and the environmental impact associated with printing and storing physical documents.

- Improved Accessibility: Digital records can be accessed anytime, anywhere, as long as you have an internet connection, making it easy for both businesses and clients to review or share the document.

- Secure Storage: Electronic documents can be securely stored with password protection or encryption, reducing the risk of loss, theft, or damage compared to physical paperwork.

Improved Efficiency and Customer Experience

By using digital payment records, businesses can enhance customer satisfaction by offering quick, convenient, and easily accessible proof of transactions. Additionally, the ability to track and manage digital records efficiently can help businesses maintain accurate accounting and improve their financial reporting.

Adopting digital payment confirmation documents not only helps your business operate more efficiently but also fosters a modern, professional image that clients will appreciate.

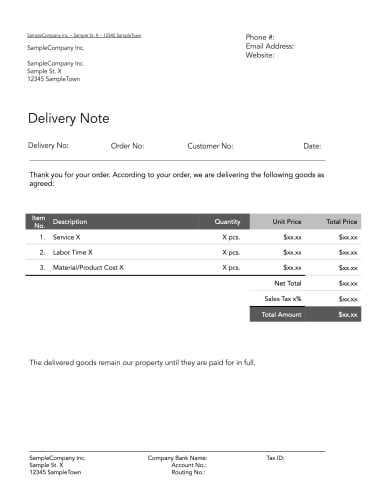

Invoice Receipt vs Invoice: What’s the Difference?

While both documents are related to transactions, there is a key distinction between a payment confirmation and a bill. Understanding the difference between these two types of records is crucial for businesses and customers alike, as each serves a unique purpose in the financial process. Although they may seem similar at first glance, they play different roles in tracking payments and managing accounts.

Understanding the Key Differences

The primary difference between the two documents lies in their function within the transaction process:

- Payment Confirmation: This document is issued after the buyer has made a payment. It serves as proof that the transaction has been completed and that the seller has received the agreed-upon payment. This is typically given to the buyer once they’ve settled their bill.

- Bill or Statement: This document is issued before payment is made, outlining the amount due for goods or services provided. It serves as a request for payment and details the terms and conditions of the transaction, including deadlines and any penalties for late payment.

When to Use Each Document

Understanding when to use each type of document is essential for smooth business operations:

- Payment Confirmation: Issued after payment is completed. It acts as a receipt for the transaction and helps both parties keep a record of what has been paid.

- Bill: Issued before payment is made. It outlines the charges and asks for payment, typically including a due date and instructions for how the payment should be made.

By keeping these distinctions in mind, businesses can ensure they are using the correct document at the appropriate stage in the transaction process, helping to maintain clear communication with customers and accurate financial records.

Legal Requirements for Invoice Receipts

When conducting business transactions, it’s crucial to be aware of the legal obligations regarding documentation that proves a payment has been made. Various jurisdictions have specific rules about the information that must be included in such records to ensure compliance with tax laws, consumer protection regulations, and general business practices. Understanding these requirements can help businesses avoid legal issues and maintain transparent relationships with customers.

Generally, the legal requirements for payment confirmation documents include the following:

- Identification Information: Both the seller’s and buyer’s names, addresses, and contact details are typically required for clarity and accountability.

- Transaction Details: A description of the goods or services provided, along with the quantity, price per item, and any applicable taxes or fees. This information is essential for proper record-keeping and tax purposes.

- Payment Information: The total amount paid, the method of payment, and the date of the transaction should be clearly stated to verify that payment was completed.

- Legal or Tax Information: Some jurisdictions may require certain tax identification numbers or VAT registration numbers to be included on documents, especially for businesses that operate internationally or in specific industries.

- Unique Reference Number: Many regions require a unique transaction or reference number for tracking purposes, helping businesses maintain an organized record of payments.

Failure to include the necessary information may lead to issues with tax authorities or other legal bodies. It’s important to stay informed about the specific regulations in your region or industry to ensure that all legal requirements are met and that your records are compliant.

How to Track Payments with Invoice Receipts

Tracking payments is a vital part of managing any business, ensuring that all transactions are accurately recorded and reconciled. Proper documentation of each payment helps business owners monitor cash flow, maintain accurate financial records, and resolve any disputes that may arise. By using well-organized payment confirmation documents, businesses can create an efficient system for tracking and verifying payments.

Organizing Payment Information

To track payments effectively, it’s important to include key details on each document that confirm the transaction:

- Transaction Date: Clearly marking the date of payment helps you match payments with their respective due dates and track when payments were made.

- Amount Paid: Recording the exact amount ensures that you know how much was received for each transaction and can prevent underpayments or overpayments.

- Payment Method: Knowing how the payment was made (e.g., credit card, cash, wire transfer) can be useful for accounting purposes and tracking payment sources.

- Reference Number: Including a unique identifier for each payment helps with tracking and organizing payments, especially when dealing with multiple transactions.

Effective Tools for Payment Tracking

To streamline the tracking process, many businesses use accounting software that integrates with digital payment confirmation records. These tools can automatically categorize transactions, generate reports, and offer real-time tracking of incoming payments. Using such systems can save time and reduce the risk of errors, making it easier to reconcile accounts at the end of each financial period.

By keeping accurate and organized records of all completed payments, businesses can ensure that their financial operations run smoothly and efficiently.

How to Organize Invoice Receipts Efficiently

Efficient organization of payment confirmation documents is essential for maintaining smooth business operations, particularly when it comes to bookkeeping, financial reporting, and audits. Whether you are managing a few transactions or handling large volumes, creating an effective system for storing and retrieving these records can save time, reduce errors, and improve overall workflow.

Steps for Organizing Payment Confirmation Documents

Here are some best practices to help you keep your payment documentation organized and easy to manage:

- Digitize Your Documents: Moving to digital records allows for easy storage, searchability, and backup. Scanning paper documents or using digital solutions to generate receipts will make it simpler to track payments and access records whenever needed.

- Use Folders and Subfolders: Organize documents by categories such as transaction date, customer name, or payment type. This enables quick access to specific records and helps you avoid clutter.

- Label and Name Files Clearly: Properly naming your digital files with unique identifiers (such as transaction numbers or dates) makes it easier to find specific documents without confusion.

- Set Up a Consistent Filing System: Whether physical or digital, use a consistent method for organizing records. Consider using chronological, alphabetical, or numerical systems based on what works best for your business.

- Backup Your Files Regularly: If you store documents digitally, ensure that backups are created frequently. Cloud storage solutions or external drives can protect you from data loss due to technical issues.

Leveraging Technology for Efficiency

Using accounting or financial management software can automate much of the organizational process. Many software programs allow you to categorize, store, and retrieve documents with just a few clicks, as well as generate reports on payments received. Automation reduces manual work, decreases the likelihood of errors, and speeds up the entire process of managing payment confirmation documents.

By implementing a clear and efficient organizational system, businesses can ensure they are well-prepared for audits, reporting, and future transactions, while also minimizing administrative burdens.

Automating Invoice Receipt Creation

In today’s fast-paced business environment, automating routine tasks can significantly improve efficiency, reduce errors, and save valuable time. One of the most beneficial areas for automation is the creation of payment confirmation documents. By leveraging digital tools and software, businesses can streamline the process of generating these records, ensuring that they are accurate, consistent, and produced in a timely manner.

Benefits of Automation

Automating the creation of payment confirmation documents offers several key advantages:

- Time Savings: Automation reduces the time spent manually filling out and formatting each document. Once set up, the process runs on its own, allowing staff to focus on more critical tasks.

- Consistency and Accuracy: Automated systems ensure that all necessary information is included in each document, reducing the risk of human error and maintaining uniformity across records.

- Faster Processing: With automated generation, payment confirmation documents can be produced and sent instantly after a payment is completed, speeding up the transaction cycle and improving customer satisfaction.

- Improved Record-Keeping: Digital automation allows for easy storage, retrieval, and management of payment documentation, ensuring that records are organized and easily accessible for future reference or audits.

How to Implement Automation

To automate the creation of payment confirmation documents, businesses can follow these steps:

- Choose the Right Software: Many accounting, invoicing, and financial management tools offer automation features. Popular platforms like QuickBooks, Xero, and FreshBooks can automatically generate these documents once a payment is received.

- Integrate with Payment Systems: By integrating your accounting system with your payment gateway (such as PayPal, Stripe, or a bank’s payment platform), documents can be generated automatically based on payment information.

- Set Up Templates: Create predefined templates within your software, which can be automatically populated with transaction details such as customer names, payment amounts, and dates.

- Enable Auto-Delivery: Many platforms allow you to automatically send the payment confirmation document to customers immediately after payment, reducing manual intervention and speeding up the process.

By implementing automation, businesses can significantly improve the efficiency of their financial documentation processes, reduce the chance of errors, and provide a smoother experience for both staff and customers.

How to Store Invoice Receipts Securely

Secure storage of payment confirmation documents is essential to protect sensitive financial data and ensure that records are available when needed. Whether you are storing physical documents or digital files, ensuring their safety from loss, theft, or unauthorized access is crucial for both business operations and compliance with legal regulations.

Best Practices for Secure Document Storage

Here are some effective strategies for keeping your payment confirmation records secure:

- Use Strong Passwords: For digital records, always use strong, unique passwords for your storage platforms, whether cloud-based or local. Passwords should combine numbers, symbols, and a mix of upper and lower case letters.

- Enable Encryption: Encrypting sensitive documents, especially those stored digitally, adds an extra layer of protection. Encrypted files can only be accessed by individuals with the proper decryption keys, preventing unauthorized access.

- Backup Regularly: Regular backups are vital for protecting data from loss due to hardware failure, software issues, or cyberattacks. Store backups both locally and in the cloud to ensure redundancy.

- Organize Files with Access Control: Establish a clear file organization system that is easy to navigate while ensuring access controls are in place. Limit access to financial documents to authorized personnel only, and keep an audit trail of who accesses the files.

- Use Secure Cloud Storage: Cloud storage providers often offer advanced security features, such as encryption and multi-factor authentication, to keep your documents safe. Choose a reputable provider with strong security measures in place.

- Physical Security for Paper Records: If you keep paper copies of transaction documents, ensure they are stored in a locked, secure location. Use fireproof and waterproof cabinets to protect against physical damage.

Compliance and Legal Considerations

Many countries have specific regulations regarding the storage and retention of financial documents, including payment confirmation records. It’s important to be familiar with these laws to ensure compliance. In some cases, documents may need to be stored for several years for tax or audit purposes, so it’s essential to have a secure and organized storage system in place for long-term retention.

By following these best practices and utilizing secure storage methods, businesses can protect their financial data and maintain the integrity of their transaction records, ensuring peace of mind for both the business and its clients.