How to Use an Invoice Procedure Template for Streamlined Billing

Establishing a clear and organized system for managing financial transactions is essential for any business. This structured approach helps ensure that payments are tracked accurately, deadlines are met, and errors are minimized. By using a predefined format, you can maintain consistency and professionalism in all of your monetary dealings.

Effective financial management requires the ability to easily create and follow steps for issuing requests for payment. A streamlined system provides not only clarity for both parties but also supports transparency, allowing businesses to manage cash flow more effectively. The right framework can significantly reduce the risk of miscommunication and improve overall efficiency.

In this guide, we’ll explore how to set up a reliable structure that adapts to your specific needs, ensuring smooth financial operations. Whether you’re a small startup or an established company, having a well-defined process in place will save time and foster better relationships with clients and partners.

Invoice Procedure Template Overview

Creating a well-structured approach for managing financial transactions is essential for any business. This organized framework helps ensure that all payment-related tasks are clear, repeatable, and error-free. A consistent format reduces confusion and ensures all necessary steps are followed each time a payment request is made.

Key Components of an Effective Framework

- Clarity: Each step in the process should be clearly defined, from the initial request to the final confirmation of payment.

- Consistency: A standard structure ensures that every transaction follows the same guidelines, reducing the risk of errors.

- Efficiency: A streamlined approach helps save time, making it easier for both businesses and clients to complete transactions quickly.

Benefits of Using a Predefined Structure

- Improved Accuracy: When steps are laid out clearly, there’s less room for mistakes.

- Time-Saving: Standardizing the process allows for faster execution and less administrative effort.

- Better Communication: A set framework ensures both parties understand the terms, deadlines, and expectations.

Why Invoice Procedures Matter for Businesses

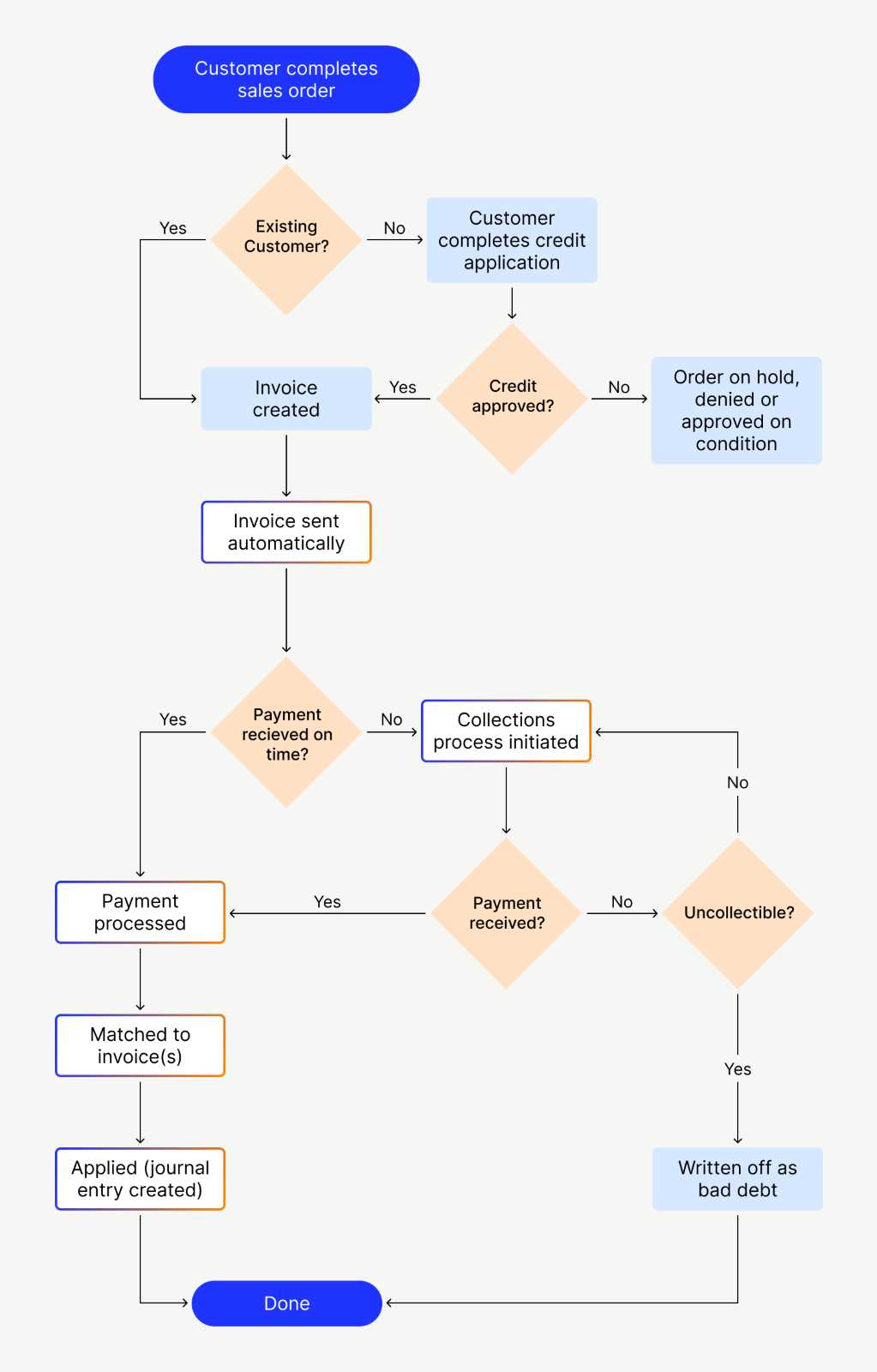

Having a clear and structured system for managing financial requests is crucial for businesses of all sizes. A well-defined approach ensures that all transactions are completed accurately and efficiently, fostering trust with clients and partners. Without such a system, businesses risk confusion, delays, and potential errors that could harm their reputation and financial stability.

Ensuring Accuracy and Consistency

With a consistent framework in place, businesses can reduce the likelihood of mistakes. Each step of the transaction process is outlined, making it easier to maintain accuracy. This consistency also helps to avoid misunderstandings between parties, ensuring that all terms, amounts, and deadlines are clearly communicated and agreed upon.

Improving Cash Flow and Timeliness

When financial requests are processed smoothly, businesses can ensure timely payments, which directly impacts cash flow. A standardized approach enables quicker turnaround times and minimizes the risk of late payments, helping businesses maintain a steady financial flow and avoid unnecessary delays.

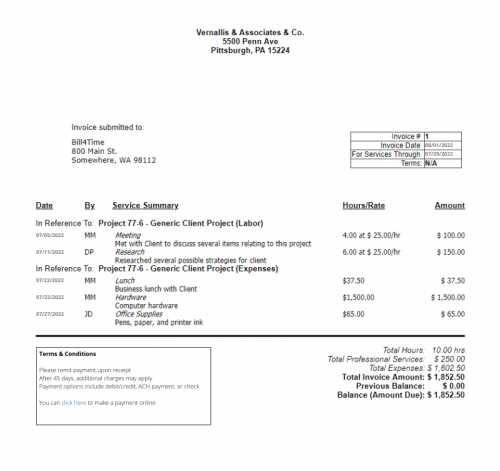

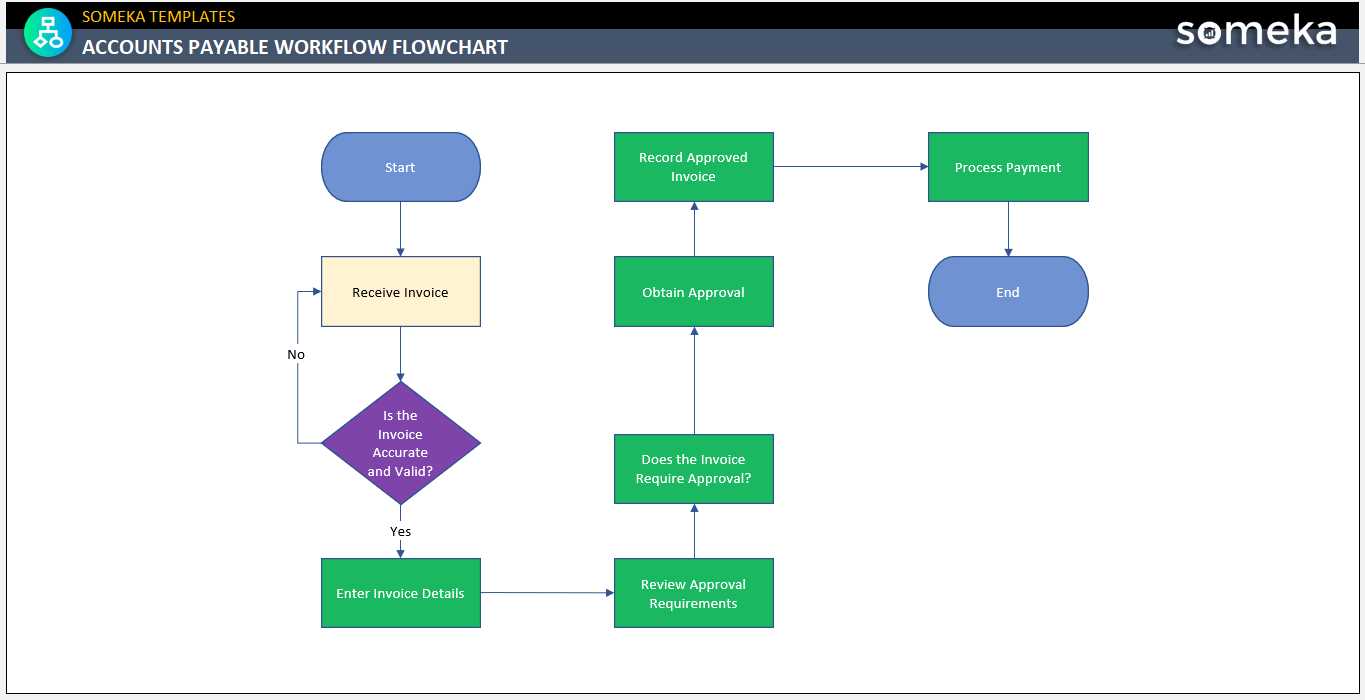

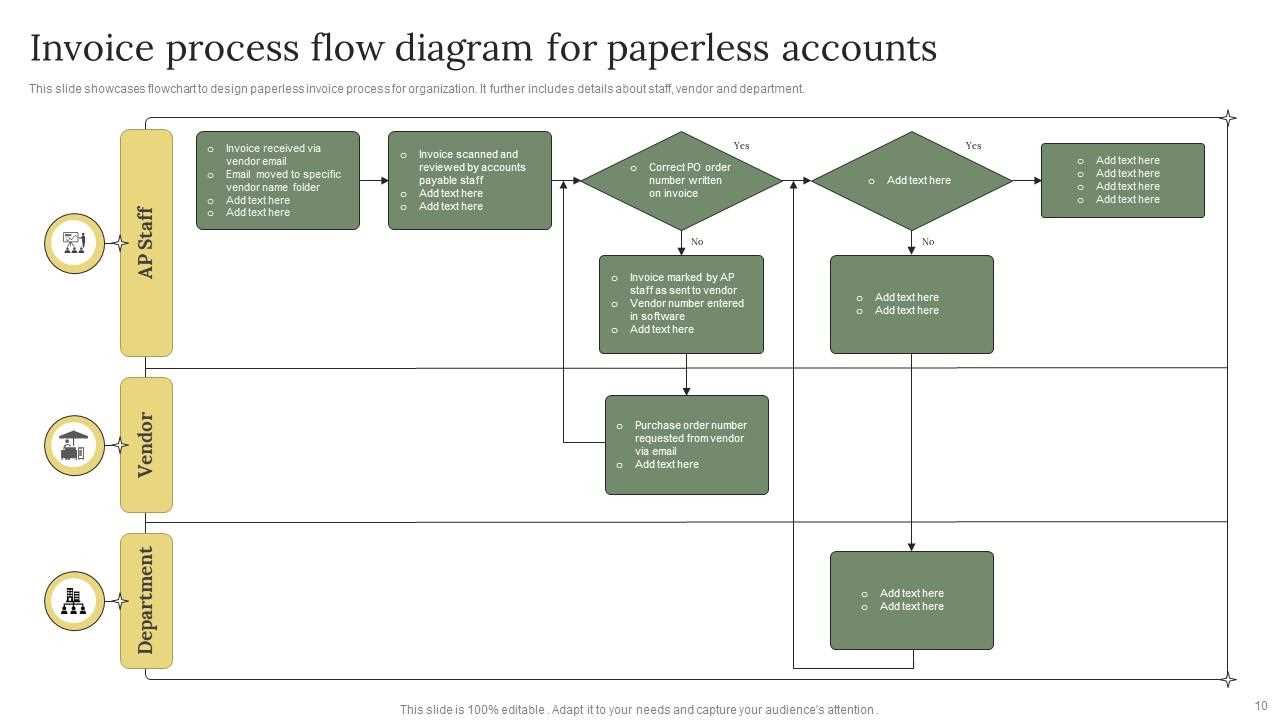

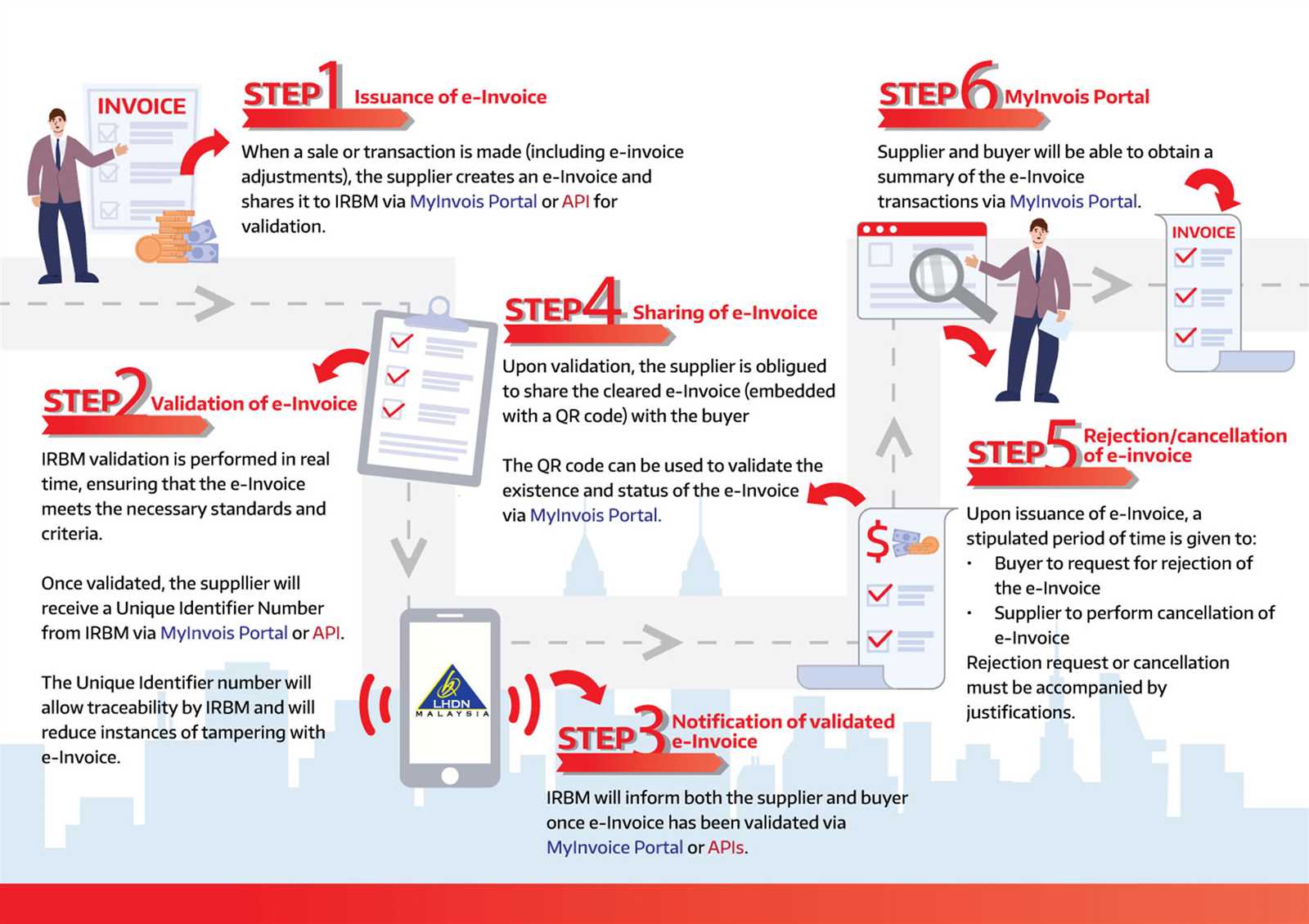

Steps to Create an Invoice Procedure Template

Establishing a clear process for managing payment requests begins with creating a reliable and repeatable structure. This ensures that every financial transaction is handled the same way, reducing errors and improving efficiency. The following steps outline the key actions required to develop such a framework that can be adapted to various business needs.

| Step | Description |

|---|---|

| 1. Define the Purpose | Determine the overall goals for your process, such as ensuring accuracy, improving cash flow, or reducing delays. |

| 2. Identify Key Information | List the necessary details to include in every request, such as amounts, due dates, and payment methods. |

| 3. Design a Clear Flow | Map out the steps involved, from the initial request to the confirmation of payment. |

| 4. Standardize Documentation | Create consistent forms or documents that can be used for every transaction, ensuring uniformity. |

| 5. Automate Where Possible | Utilize software tools to streamline repetitive tasks and reduce manual work, such as reminders and tracking. |

| 6. Review and Adjust | Regularly assess the system to identify areas for improvement and make necessary updates. |

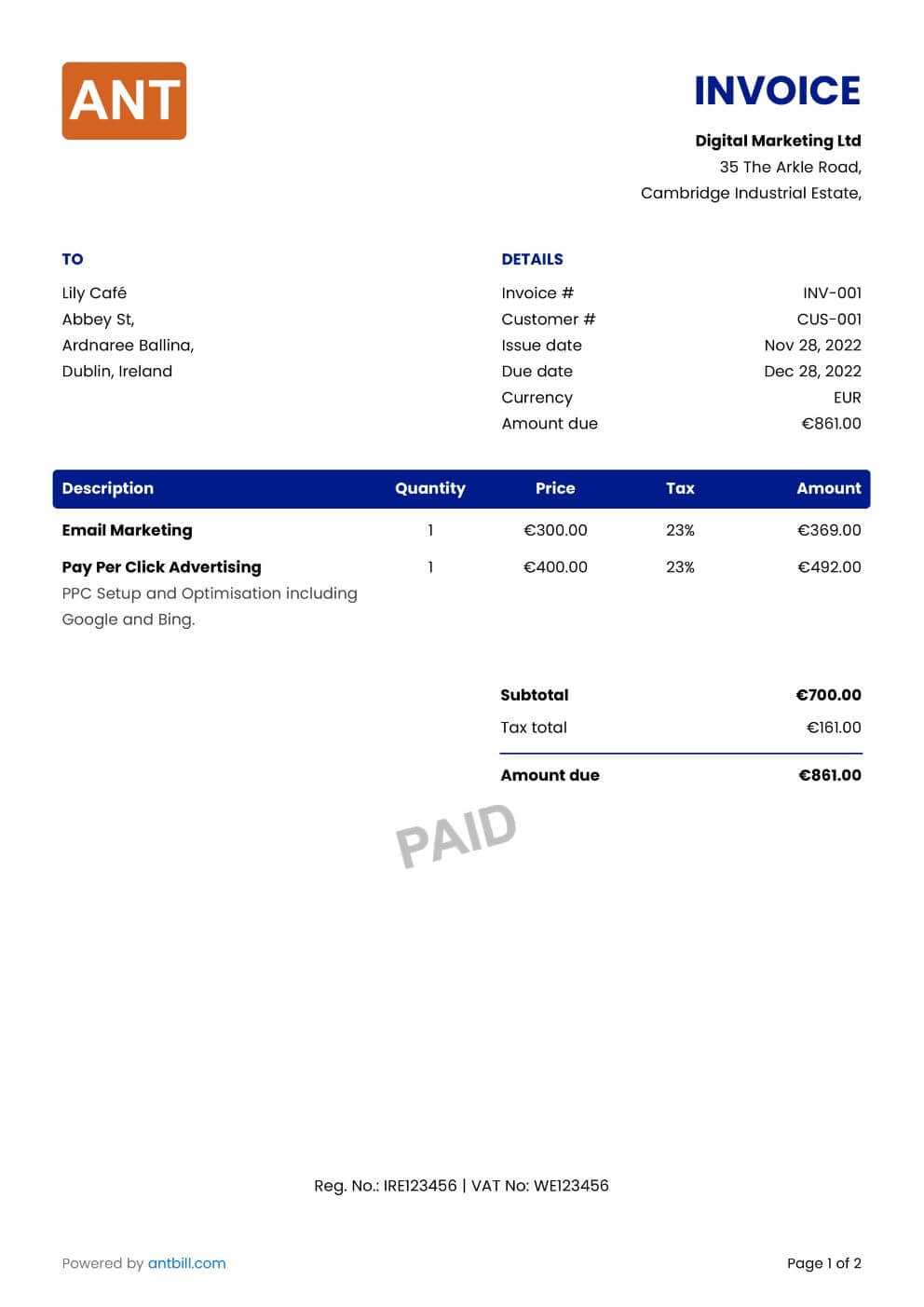

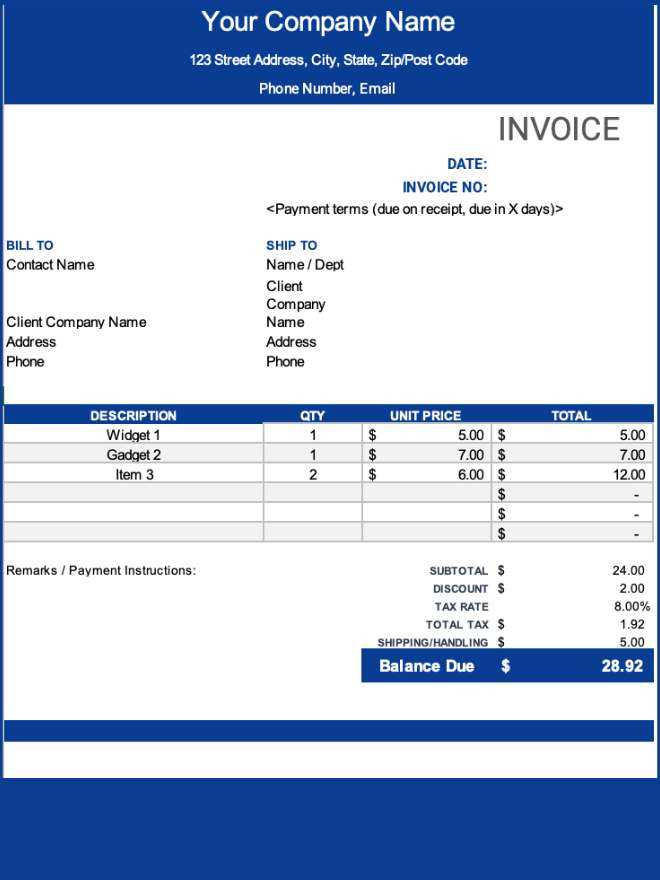

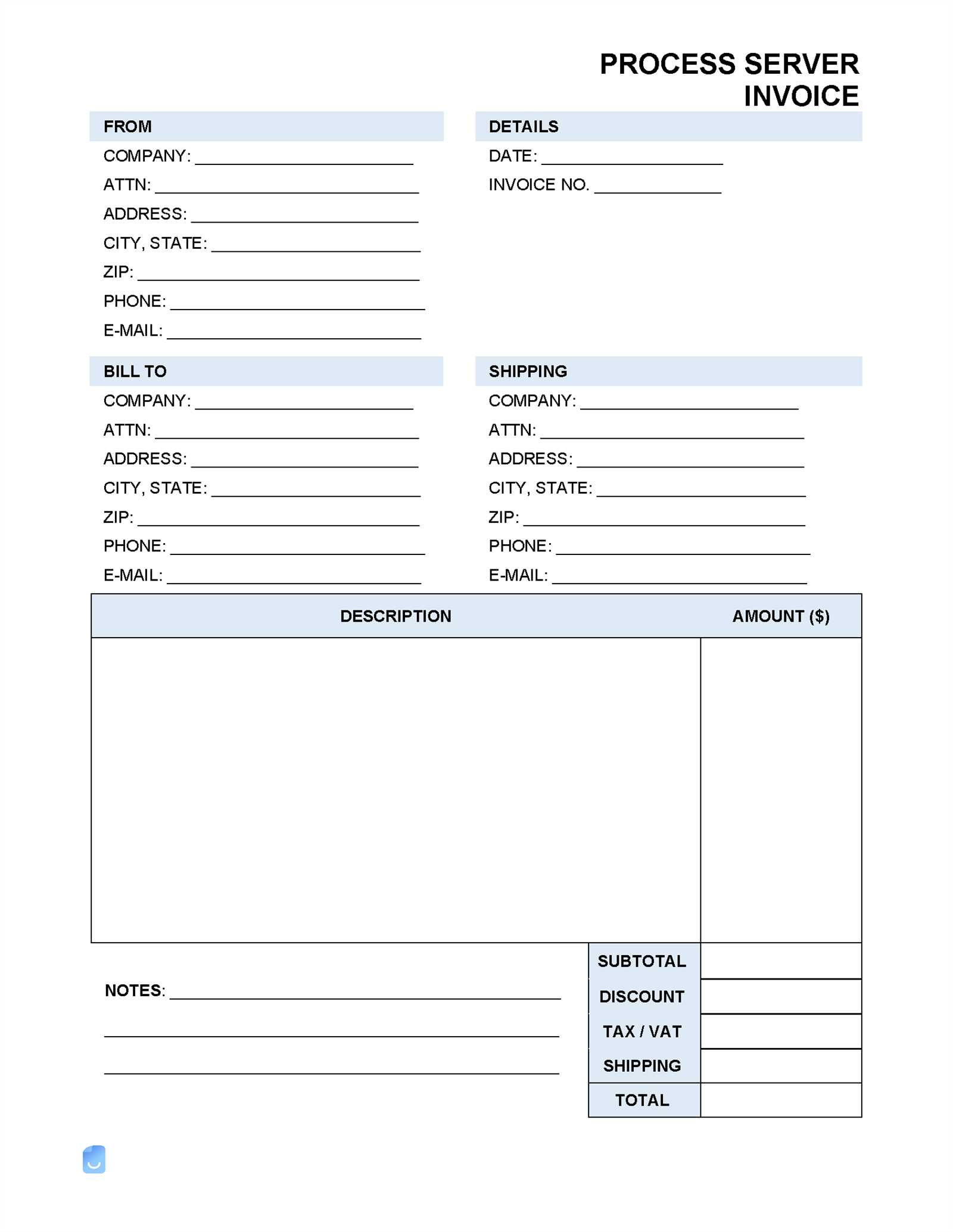

Essential Elements of an Invoice Template

To effectively manage payment requests, certain key components must be included in the document to ensure clarity and completeness. These elements serve as the foundation for the entire process, ensuring that both parties understand the terms, amounts, and expectations. Below are the critical sections that should be included in any payment request form.

Key Information to Include

| Element | Description |

|---|---|

| Contact Details | Include both the sender’s and recipient’s names, addresses, and contact information for clarity and communication. |

| Unique Identifier | Assign a distinct number or code to each request to make tracking and referencing easier. |

| Itemized List | Provide a detailed breakdown of services or products, including quantities, descriptions, and prices. |

| Payment Terms | Clearly state the due date, late fees, and acceptable payment methods. |

| Total Amount | Show the total amount due, including taxes, discounts, or any other adjustments. |

Additional Considerations

Beyond the basic elements, it is also important to ensure that your document is professional, easy to read, and consistent with your company’s branding. Including a payment reference, terms of service, or any legal disclaimers can further protect both parties and help avoid disputes.

How to Customize an Invoice Procedure

Adapting a payment request system to suit the specific needs of your business is essential for maximizing efficiency and ensuring smooth financial operations. Customization allows you to adjust the process according to factors such as the types of services you offer, your customer base, or any legal requirements you must meet. By tailoring the structure, you can better align it with your company’s goals and operational preferences.

Steps for Personalizing Your Payment Request Process

- Assess Your Needs: Identify the key aspects of your transactions that require special attention, such as varying payment terms or industry-specific requirements.

- Adjust Formatting: Choose the layout and design that best represent your brand and ensure clarity for the recipient.

- Include Custom Fields: Add any additional information that is specific to your business, such as purchase order numbers or discounts for early payments.

- Integrate Automation: Consider using software tools to automatically generate forms and manage reminders for outstanding payments.

Things to Keep in Mind

- Maintain Flexibility: Your system should allow for changes as business conditions evolve, such as adjusting payment terms or adding new services.

- Ensure Compliance: Make sure that your customized structure aligns with any legal and tax regulations in your jurisdiction.

- Prioritize Clarity: Even when customizing, always prioritize clear and easy-to-understand information for your clients to avoid misunderstandings.

Benefits of Using Invoice Procedures

Implementing a clear and standardized approach for managing payment requests brings numerous advantages to businesses. It helps streamline financial operations, reduce errors, and ensure timely payments. By creating a structured system, businesses can maintain professionalism, foster better relationships with clients, and improve their overall cash flow.

Key Advantages for Your Business

- Improved Accuracy: A well-defined structure minimizes the risk of mistakes, ensuring that all details are correct and consistent.

- Time Efficiency: With a standardized method in place, the process becomes faster and more predictable, saving valuable time for both parties.

- Better Cash Flow: When payment requests are clear and organized, businesses are more likely to receive timely payments, improving overall financial health.

Additional Benefits

- Reduced Confusion: A consistent format makes it easier for clients to understand payment expectations, reducing the likelihood of disputes.

- Enhanced Professionalism: Using a structured approach communicates reliability and professionalism to clients, reinforcing trust in your business.

- Scalability: A reliable system can easily be scaled as your business grows, making it adaptable to changing needs and increased volume.

Common Mistakes in Invoice Processing

Despite its importance, managing payment requests can often lead to mistakes that impact cash flow and relationships with clients. These errors can range from simple oversights to more complex issues that disrupt financial operations. Identifying and correcting common mistakes can help streamline the process, reduce misunderstandings, and improve efficiency.

One of the most frequent issues is failing to include all necessary details, such as accurate payment amounts, due dates, or correct client information. Missing or incorrect data can cause delays in processing and confusion for the recipient. Another common error is improper formatting or unclear instructions, which can lead to payments being overlooked or misinterpreted.

Additionally, not keeping track of outstanding payments can result in missed opportunities for follow-ups, delaying cash flow and creating unnecessary administrative work. Overcomplicating the process with unnecessary steps or missing standardized templates also contributes to inefficiency, increasing the chance for errors.

Improving Efficiency with Standardized Templates

Streamlining financial document creation and processing can significantly boost efficiency within any organization. By adopting consistent and structured forms for all transactions, businesses can save time, reduce errors, and ensure that key information is always included. A standardized approach removes the need for repetitive setup and minimizes human error, leading to faster and more reliable results.

When all documents follow the same layout and include the same essential components, it becomes easier to manage and track payments. This consistency also simplifies the review process, as staff can quickly identify and address any discrepancies. Additionally, standardized formats ensure that both the sender and the recipient have the same expectations, which helps prevent misunderstandings and delays.

Moreover, templates can be automated using digital tools, further reducing manual work and making the entire process more efficient. This approach not only speeds up the workflow but also enables businesses to scale their operations without the risk of losing control over document accuracy or consistency.

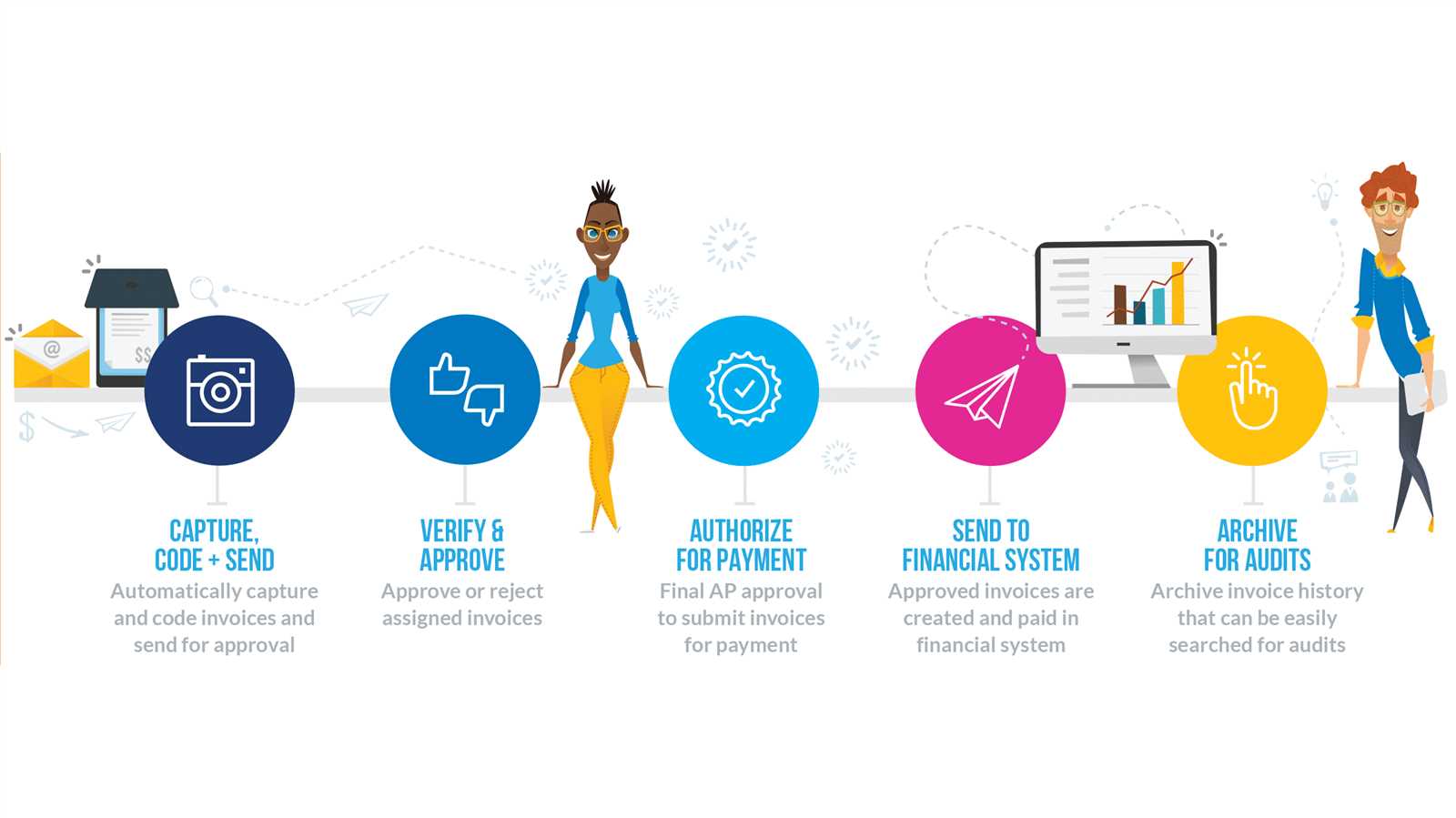

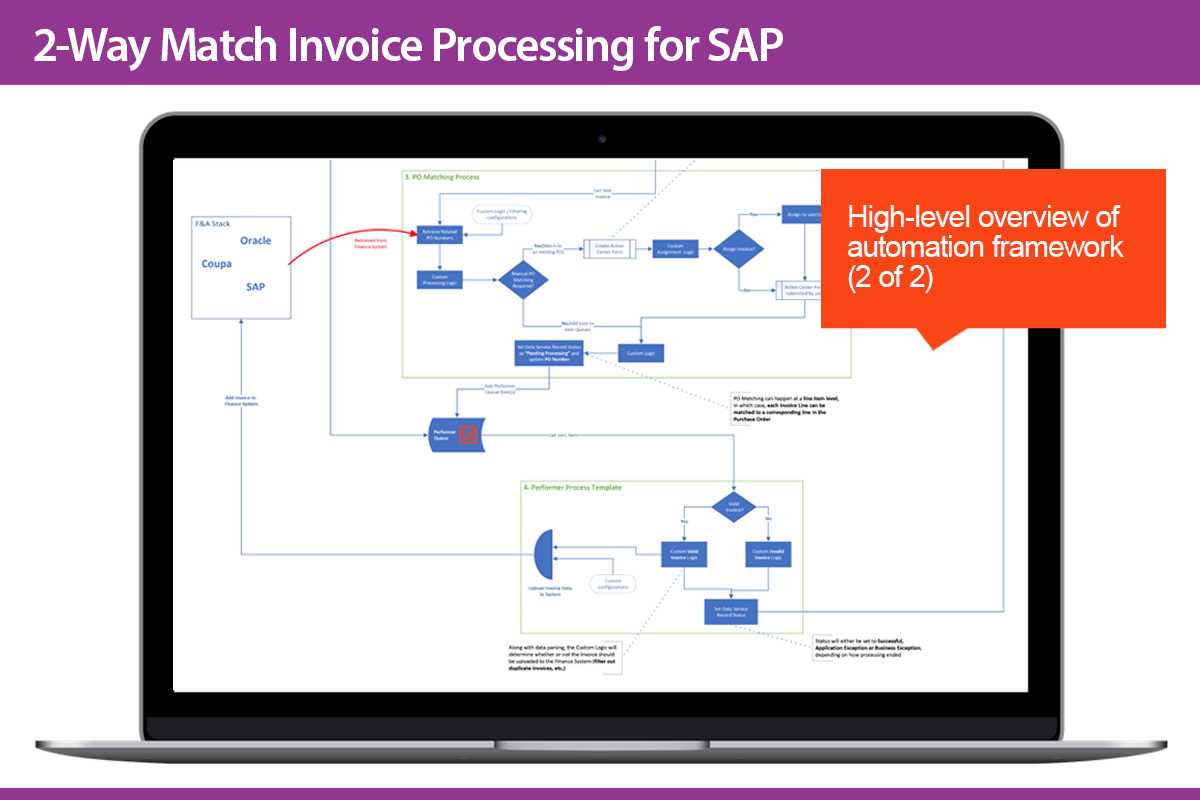

Integrating Automation in Invoice Procedures

Incorporating automation into your financial document management process can significantly improve both speed and accuracy. By leveraging software tools and automated workflows, businesses can eliminate repetitive tasks, reduce the risk of human error, and ensure timely processing of all payment requests. This integration allows for smoother operations, freeing up time for employees to focus on more strategic tasks.

Key Benefits of Automation

- Time Savings: Automating tasks like document generation and follow-up reminders reduces the amount of time spent on manual input.

- Improved Accuracy: Automated systems reduce human errors, ensuring that all data is correctly entered and processed.

- Faster Processing: With automation, payment requests can be issued and tracked much more quickly, speeding up the entire process.

- Better Tracking: Automation tools allow for real-time tracking and easy reporting, helping businesses stay on top of outstanding payments.

How to Implement Automation

- Choose the Right Software: Select a platform or tool that aligns with your business needs and integrates easily with your existing systems.

- Set Clear Triggers: Define automation rules, such as when to generate documents, send reminders, or escalate overdue payments.

- Monitor Performance: Regularly evaluate the automated system to ensure it’s functioning smoothly and making the desired impact.

By embracing automation, businesses can make their financial operations more efficient, reduce overhead, and ensure a more reliable process for both staff and clients.

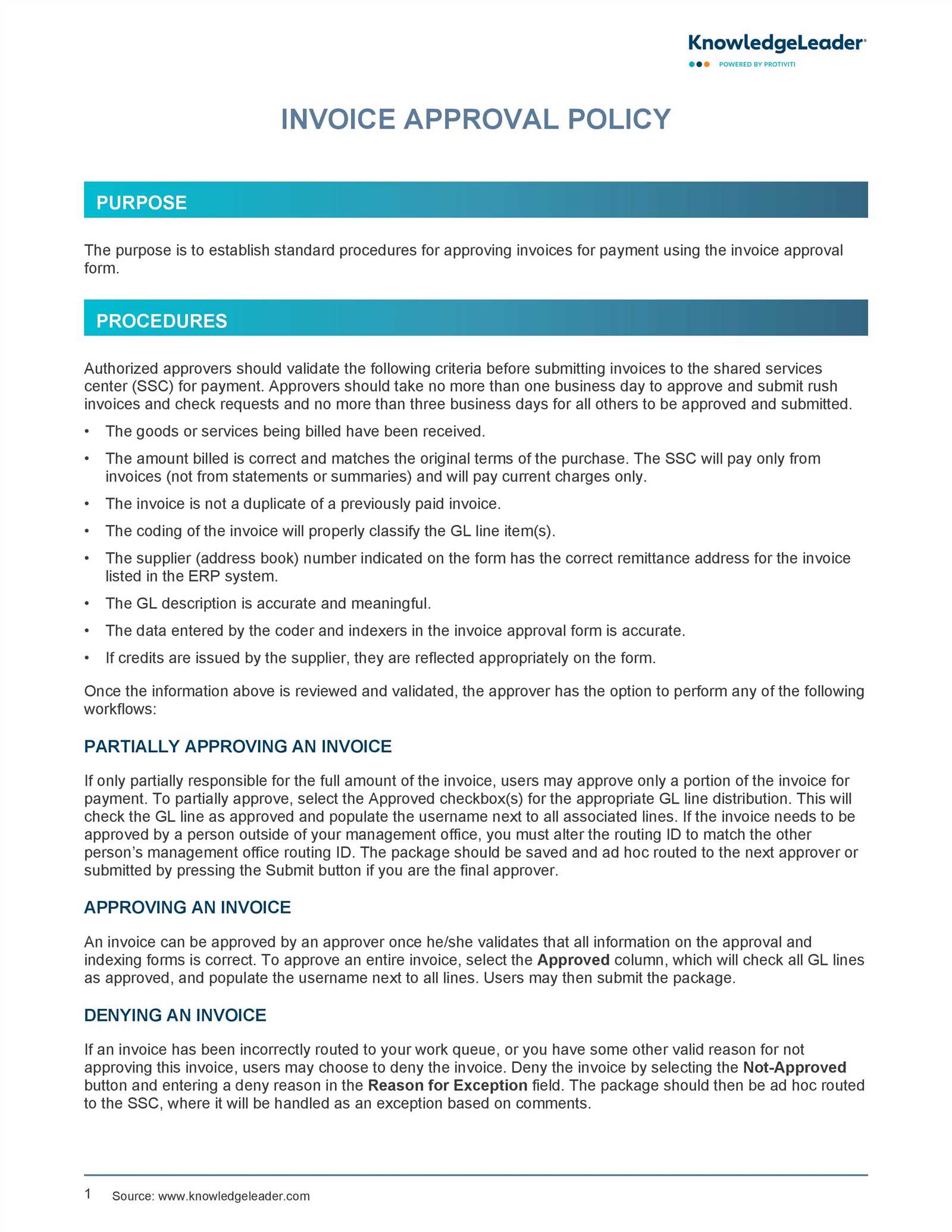

Ensuring Accuracy in Invoice Procedures

Maintaining precision in financial documentation is crucial for avoiding costly errors and ensuring that all transactions are processed correctly. Inaccurate records can lead to delays in payments, disputes with clients, or even legal issues. By implementing clear guidelines and utilizing proper tools, businesses can significantly reduce the likelihood of mistakes and streamline their financial operations.

One of the primary steps in ensuring accuracy is to always double-check the information before it’s sent out. This includes verifying client details, payment amounts, and dates. Additionally, establishing a review process can help catch any discrepancies early, preventing potential issues from escalating.

Automation tools can also play a critical role in improving accuracy. By using software to automatically fill in standard fields or generate documents, you reduce the chances of human error. Furthermore, integrating tracking systems can help monitor each step of the process, ensuring all information is up-to-date and correct throughout.

Choosing the Right Template for Your Business

Selecting the appropriate framework for managing financial documentation is essential for creating a smooth and efficient process. The right structure ensures clarity, consistency, and accuracy in every transaction, which is vital for maintaining positive relationships with clients and ensuring timely payments. A well-chosen format can also help streamline operations, reduce errors, and enhance professionalism.

Factors to Consider

- Business Size and Complexity: Smaller businesses might benefit from simpler layouts, while larger companies with more complex needs may require more detailed and customizable formats.

- Industry Standards: Certain industries have specific requirements for documentation. Make sure the format you choose complies with these standards to avoid compliance issues.

- Customization Options: Choose a system that allows easy customization to meet your specific needs, whether that involves branding, payment terms, or unique data fields.

Types of Formats

- Pre-designed Templates: These are ready-made formats that can be quickly adapted to your business needs, ideal for businesses looking for convenience and speed.

- Customizable Options: If you require more flexibility, consider a system that allows for significant customization to create a framework that fits your brand and operational needs perfectly.

Choosing the right structure for your business involves balancing ease of use, customization, and industry-specific needs. The right choice will support smooth financial processes, improve efficiency, and contribute to overall business success.

How to Handle Invoice Disputes Effectively

Disagreements over payment documents are not uncommon in business transactions. Handling these disputes with professionalism and efficiency is essential for maintaining good relationships with clients while ensuring financial accuracy. A well-organized process for addressing conflicts can prevent misunderstandings and lead to faster resolutions.

The first step in handling any dispute is to remain calm and objective. Carefully review the details of the transaction to understand where the disagreement stems from. This could be due to issues such as discrepancies in amounts, unclear payment terms, or misunderstandings about the provided goods or services. Once the issue is identified, it’s important to communicate directly with the other party.

Effective Communication: When engaging with clients, always approach the situation in a professional manner. Clearly outline the points of disagreement and provide evidence or documentation to support your case. Be open to hearing their side and consider any valid concerns they may have. Keep communication respectful and focused on resolving the issue rather than assigning blame.

Negotiation and Resolution: If the dispute is not immediately resolved, consider offering alternative solutions such as discounts, payment plans, or adjustments to the original terms. This shows a willingness to compromise, which can help build stronger client relationships. Once an agreement is reached, ensure that the updated terms are documented and agreed upon by both parties to prevent future confusion.

By addressing disputes promptly, professionally, and fairly, businesses can avoid prolonged conflicts and maintain a positive reputation with clients and partners.

Incorporating Payment Terms in Your Template

Clearly defined payment conditions are essential to ensure timely transactions and avoid confusion between parties. Including these terms in every document helps set clear expectations and facilitates smoother financial exchanges. The inclusion of payment guidelines ensures both parties are aligned on when and how payments should be made, reducing the potential for misunderstandings.

Key Payment Terms to Include

When outlining payment conditions, it’s important to address the most critical elements that influence both the timing and method of payment. These include:

- Due Date: Specify the exact date by which the payment should be made.

- Late Fees: Mention any applicable penalties if the payment is not received by the due date.

- Discounts for Early Payment: Offer a small discount for early settlement of the amount due.

- Accepted Payment Methods: List all the available methods for making a payment (e.g., bank transfer, credit card, online payment platforms).

- Payment Installments: If applicable, provide information on whether payments can be broken into installments and the schedule for those payments.

Table Example of Payment Terms

| Payment Term | Description |

|---|---|

| Due Date | Payment is due 30 days after the transaction date. |

| Late Fee | A 5% fee is charged for payments received after the due date. |

| Early Payment Discount | A 2% discount is available if payment is made within 10 days. |

| Payment Methods | Bank transfer, credit card, PayPal. |

Including these terms clearly and consistently in your documents not only helps prevent payment delays but also fosters trust with your clients. Clear terms contribute to smoother transactions and ensure that both parties are aware of their obligations from the start.

Managing Late Payments in the Invoice Process

Late payments are a common issue in business transactions, impacting cash flow and financial planning. Effectively managing delayed payments is crucial to maintaining a healthy business relationship with clients while ensuring timely financial stability. Having a structured approach to address overdue payments can help minimize disruptions and ensure that your operations continue smoothly.

To manage late payments effectively, it’s important to first set clear payment terms and communicate them with clients before the transaction. This provides a reference point in case of delays. When payments are overdue, take the following steps:

- Send a Reminder: Start with a polite reminder email or call, often within a few days after the due date. Reiterate the payment terms and gently remind the client of the outstanding balance.

- Send a Formal Notice: If the reminder goes unanswered, send a more formal notice, outlining the overdue amount, any applicable late fees, and the consequences of continued non-payment.

- Offer Payment Options: For clients who may be facing financial difficulties, consider offering payment plans or negotiating partial payments to ease the burden and encourage timely resolution.

- Enforce Late Fees: If your agreement includes penalties for delayed payments, be sure to apply them consistently. This can act as an incentive for clients to settle balances promptly.

- Seek Legal Action: As a last resort, if payments remain unresolved and are substantial, consult legal counsel to explore debt recovery options, such as collections or small claims court.

By taking proactive steps and handling overdue payments with professionalism and consistency, you can maintain positive relationships with clients while ensuring that your business remains financially secure.

Tracking and Organizing Invoices with Templates

Efficient tracking and organization of financial records are essential for maintaining smooth business operations. By using standardized documents to record transactions, you can easily monitor the status of outstanding payments, ensure accurate financial reporting, and maintain a clear overview of all financial activities. The key to staying organized lies in consistently applying an effective system for managing these documents.

One of the best ways to organize your financial records is through the use of structured formats that allow for easy tracking. Here are a few strategies to help you manage your documents effectively:

Centralize Your Data

Keeping all your financial information in one centralized system is crucial. This can be achieved by using digital tools or accounting software that allows for easy access to all records in one place. Having a consistent naming convention and a well-organized file structure will help you locate any document in seconds, reducing confusion and saving time.

Regularly Update and Review

To stay on top of your financial records, it’s important to regularly update them. Set aside time each week or month to review documents, check for discrepancies, and ensure that all data is accurate. This helps you catch any potential issues early, avoid missed payments, and keep your financials in order.

By following a well-organized system and consistently tracking your financial documents, you can improve your business’s efficiency and reduce errors. This not only helps with day-to-day operations but also provides a clearer financial picture when it’s time for audits or tax filing.

How to Update and Revise Invoice Procedures

As businesses grow and evolve, so do the methods they use to manage their financial transactions. It’s essential to periodically review and refine the steps involved in recording and processing payments to ensure accuracy, efficiency, and compliance with changing regulations. Revising your workflow not only helps improve internal processes but also ensures that your financial system remains adaptable to new business needs.

To update and revise your financial handling process effectively, follow these steps:

- Assess Current Practices: Begin by evaluating your existing system. Identify any bottlenecks, outdated methods, or errors that need addressing. Consider input from team members who interact with the process daily to spot areas for improvement.

- Research Best Practices: Stay informed about industry standards and best practices for managing transactions. Implementing the latest tools and strategies can help streamline your process and make it more efficient.

- Implement New Tools: With the introduction of new software or automation tools, you can simplify repetitive tasks, reduce human error, and track payments more effectively. Choose tools that integrate seamlessly with your existing systems.

- Standardize and Document the Process: Clearly document any changes to the process. This ensures that your team understands the new procedures and can follow them consistently, reducing confusion and errors.

- Train Your Team: After implementing revisions, ensure that everyone involved in the financial workflow is trained on the new system. Regular training sessions help keep the team updated on changes and ensure smooth transitions during implementation.

By regularly updating and revising the steps involved in managing financial records, businesses can stay competitive, minimize errors, and create a more effective system for tracking and processing payments.