Invoice Payment Terms and Conditions Template for Professional Transactions

Every business relationship requires clear agreements that outline how financial exchanges will be handled. Without well-defined rules, misunderstandings can arise, leading to delayed receipts or disputes. Establishing precise expectations from the start is essential for maintaining smooth operations and ensuring both parties are aligned on their responsibilities.

In this guide, we’ll explore how to draft clear, professional outlines that cover all necessary aspects of a financial arrangement. By setting proper expectations in writing, you can help avoid confusion and foster trust with clients. These agreements also serve as a legal safeguard, ensuring that both sides understand the implications of delays or breaches.

Whether you’re an entrepreneur or a seasoned business owner, creating effective agreements is key to a successful partnership. This article will provide the necessary steps for crafting straightforward rules that protect both your interests and your clients’.

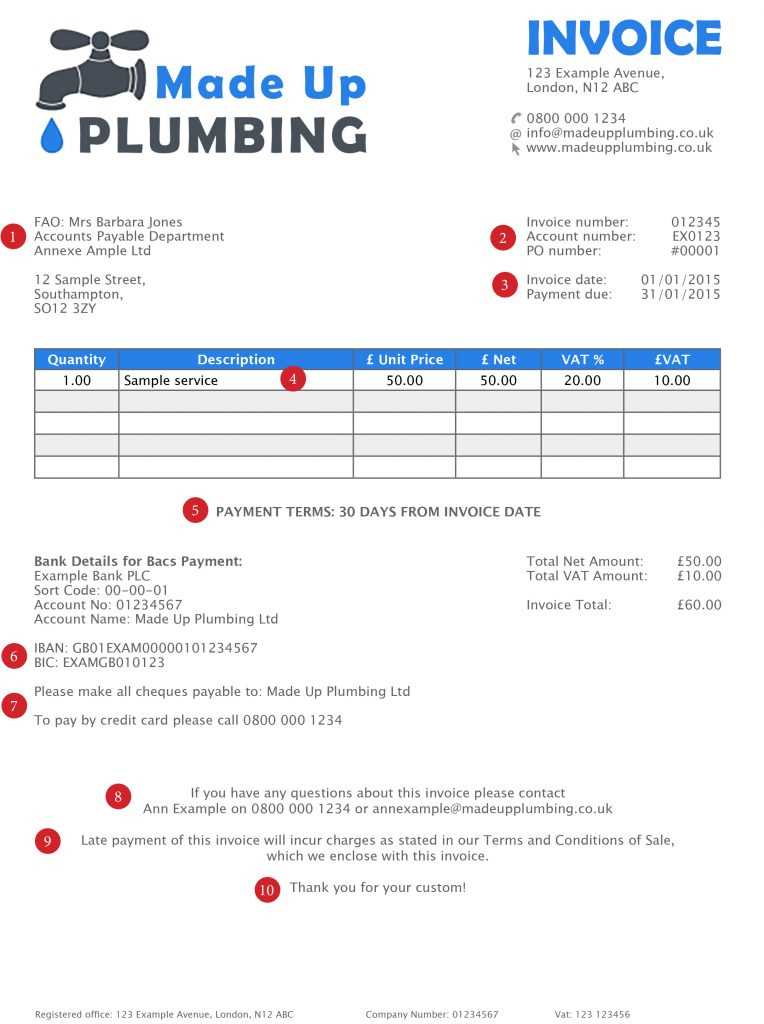

Invoice Payment Terms and Conditions Template

Creating a clear, professional document that outlines financial obligations between parties is crucial for maintaining healthy business relationships. A well-drafted set of rules helps both the client and the service provider understand their responsibilities, deadlines, and penalties, ensuring smooth transactions. It prevents confusion and protects both sides in case of disputes.

To craft an effective agreement, begin by specifying key details such as due dates, amounts, and preferred methods of settlement. It’s important to clarify how late payments will be handled, as well as any discounts for early settlement. This ensures that both parties have realistic expectations and understand what actions will be taken if deadlines are missed.

Additionally, including information on how disputes will be resolved or what legal framework governs the arrangement can further strengthen the document. By establishing these clear guidelines in advance, you create a sense of security for both clients and vendors alike, making future interactions more predictable and professional.

Why Payment Terms Are Crucial for Businesses

Clear financial guidelines are essential for any business to maintain stability and predictability. Establishing explicit expectations around when and how payments should be made helps avoid misunderstandings that could disrupt cash flow or harm business relationships. Without these clear rules, companies risk experiencing delays, disputes, or even loss of revenue.

These agreements are particularly important for maintaining a healthy cash flow, which is vital for ongoing operations and growth. By setting specific deadlines for when balances are due, businesses can plan their expenses and investments more effectively. This structure ensures that funds are available when needed, preventing potential financial strain.

In addition, well-defined agreements create a sense of trust and professionalism between clients and service providers. When both parties know what is expected of them, it fosters a more positive working relationship, which can lead to repeat business and long-term partnerships.

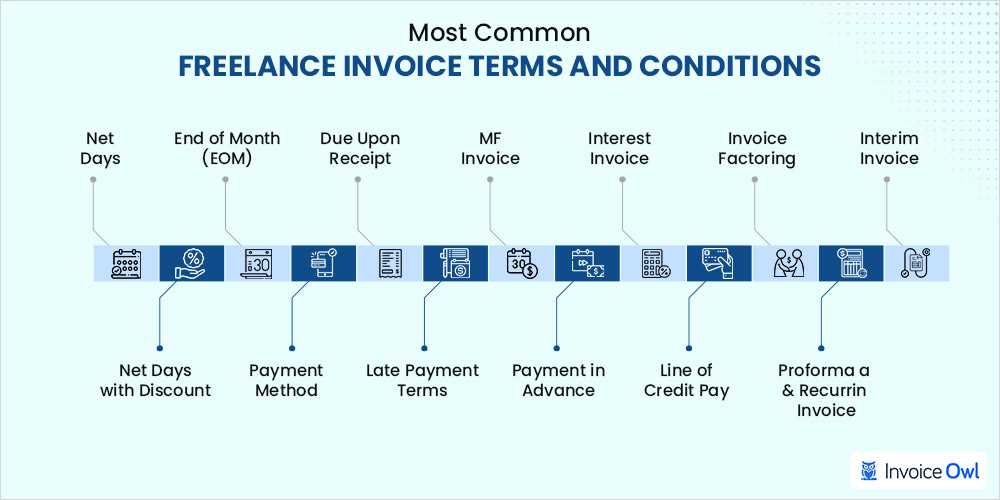

Understanding Common Payment Terms in Invoices

In every financial agreement between businesses, certain arrangements specify how much is due, when, and how it should be settled. These guidelines provide clarity for both parties, ensuring that all obligations are met on time and with minimal friction. Understanding the most common structures in such agreements is key to managing cash flow effectively and maintaining strong client relationships.

Some of the most widely used arrangements include Net 30, which means the full amount is due within 30 days of the agreement date, and Cash on Delivery (COD), which requires immediate payment upon receipt of goods or services. Other variations, such as Net 60 or Advance Payment, also exist, each offering different levels of flexibility or urgency for settling debts.

Being familiar with these common structures allows businesses to decide which method aligns best with their operations and client preferences. Moreover, it helps avoid confusion or delays by setting clear expectations right from the start of the relationship.

Key Components of Payment Terms Agreements

Effective financial agreements between businesses must include several essential elements to ensure clarity, fairness, and accountability. These components outline how obligations should be fulfilled and specify the consequences if either party does not meet their responsibilities. Without these critical details, misunderstandings can arise, potentially damaging professional relationships.

Due Date and Payment Schedule

The due date is one of the most important elements of a financial arrangement. It establishes when the client must settle the outstanding amount. Clearly stating whether payment is due immediately or within a certain period (e.g., 30 or 60 days) helps both parties manage their expectations. In some cases, a detailed schedule may be necessary, especially for larger projects where installments are involved.

Late Fees and Penalties

Specifying late fees or penalties for missed deadlines is another critical component. This serves as an incentive for timely settlement and protects the service provider from delays that could impact cash flow. Including a clear explanation of these charges ensures both parties understand the consequences if payment is not made on time, providing additional security for businesses.

By including these key elements, businesses can establish clear expectations, reduce the risk of payment delays, and foster more professional, trustworthy client relationships.

How to Write Clear Payment Terms

To ensure smooth financial transactions, it’s essential to articulate clear expectations regarding when and how funds should be transferred. A well-structured document can prevent misunderstandings, delays, and disputes. Writing precise guidelines involves balancing flexibility with clear boundaries, creating a document that is both professional and easy to understand.

The following table outlines the most important elements to include when drafting your financial arrangement guidelines:

| Component | Description |

|---|---|

| Due Date | Clearly state when the total amount must be settled, such as within 30 days after receipt of the goods or services provided. |

| Methods of Payment | Specify accepted methods of settlement, such as bank transfers, checks, or online payment platforms. |

| Late Payment Penalties | Define any additional fees that will be applied for overdue payments, such as a percentage of the outstanding balance per day or month. |

| Discounts | Include any early payment incentives, such as a percentage discount for payments made before a specific date. |

| Dispute Resolution | Specify the process for resolving disagreements regarding the financial arrangement, such as mediation or legal proceedings. |

By including these key components and ensuring clarity in every section, you create a solid framework for managing financial obligations with clients and vendors. Well-defined guidelines contribute to smoother transactions and reduce the potential for conflicts down the road.

Setting Payment Deadlines Effectively

Establishing clear deadlines for financial obligations is essential for maintaining smooth business operations. Setting realistic, well-communicated due dates ensures both parties understand when funds are expected, minimizing confusion and preventing delays. A well-structured deadline system can also promote timely actions and reduce the chances of overdue payments.

To set effective deadlines, consider the nature of the project, the client’s payment history, and industry standards. For larger projects or ongoing services, it may be beneficial to break the payments into smaller installments, while for shorter transactions, a single due date may suffice. The following table outlines the key factors to keep in mind when determining payment deadlines:

| Factor | Recommendation |

|---|---|

| Project Size | For larger projects, break the payment into milestones or installments to avoid large lump sums and maintain cash flow. |

| Client History | If the client has a history of delayed payments, consider setting shorter deadlines or requiring upfront deposits to ensure timely receipts. |

| Industry Standard | Research common due dates within your industry. For instance, 30 days is standard in many sectors, but some may require quicker settlements. |

| Urgency of Service | For time-sensitive services or products, consider setting immediate payment upon delivery or a much shorter window, such as 7–14 days. |

| Client Communication | Ensure the deadline is clearly communicated at the beginning of the project. Providing reminders closer to the due date can encourage timely payments. |

By setting appropriate deadlines, you ensure that funds are received promptly, reducing financial strain and helping maintain good relationships with your clients.

Early Payment Discounts and Incentives

Offering discounts or incentives for early settlements is a powerful strategy for encouraging timely financial exchanges while improving cash flow. By providing a reward for clients who pay ahead of schedule, businesses can increase the likelihood of receiving funds promptly, thus reducing the risk of overdue debts and enhancing customer loyalty.

Benefits of Offering Early Payment Discounts

Providing a discount for early payments not only helps with cash flow but also fosters positive relationships with clients. The key benefits include:

- Improved cash flow: Early settlements provide businesses with quicker access to funds, which can be used for other investments or operational costs.

- Reduced collection efforts: Fewer overdue invoices mean less time spent on chasing late payments and less administrative burden.

- Stronger customer relationships: Clients appreciate the opportunity to save money, leading to higher satisfaction and the possibility of repeat business.

- Competitive advantage: Offering discounts can help a business stand out from its competitors, especially in industries with tight margins.

How to Structure Early Payment Discounts

There are several ways to structure incentives for early payments. Consider the following options:

- Percentage-based discounts: Offering a fixed percentage (e.g., 2%) off the total amount for payments made within a specific period, such as 10 days.

- Flat-rate discounts: A fixed amount off the total balance (e.g., $50 off for early settlement) can also motivate clients to pay sooner.

- Tiered discounts: Providing a larger discount for payments made earlier within a set window, such as 5% for payments within 5 days and 2% for payments made within 10 days.

When implementing early settlement incentives, it is essential to communicate the offer clearly in your agreements, specifying the conditions and deadlines for the discounts to be valid. By doing so, both parties will have a clear understanding of the benefits and avoid any confusion regarding expectations.

Late Payment Penalties and Their Impact

Late fees are often used as a deterrent to ensure timely financial settlements between businesses and their clients. By outlining clear consequences for overdue balances, businesses can reduce the risk of delayed payments, which can negatively affect cash flow. When structured properly, these penalties can encourage clients to prioritize payments and help businesses maintain financial stability.

Understanding the Importance of Late Fees

Late fees play a critical role in managing overdue accounts and maintaining an efficient cash flow. Without these penalties, businesses may experience delays that disrupt their operations and increase the risk of running into financial difficulties. Setting an appropriate penalty ensures that clients have a clear understanding of the consequences of late payments and helps enforce a culture of responsibility.

Some of the common impacts of implementing late fees include:

- Encouraging timely settlements: Clients are more likely to prioritize paying on time to avoid additional charges, which ensures a steady flow of cash.

- Compensating for delays: Late fees can partially offset the inconvenience and additional costs incurred due to overdue payments, such as administrative costs and missed opportunities.

- Strengthening cash flow: When clients pay on time or are penalized for delays, it helps businesses maintain liquidity, which is essential for growth and covering operational expenses.

Structuring Effective Late Fees

It’s important to carefully structure late fees to ensure they are both fair and effective. Here are some common approaches:

- Fixed fee: A set charge applied after a certain period, such as $25 for every month a payment is overdue.

- Percentage-based fee: A percentage of the outstanding balance that increases the longer the payment is delayed, such as 2% per month.

- Grace period: Offering a short grace period (e.g., 5–10 days) before penalties apply can provide clients with flexibility while still encouraging timely payment.

When determining the amount of the penalty, it’s important to balance the need for timely payments with fairness to your clients. Excessive penalties could result in strained relationships, while too lenient penalties may not have the desired effect. Clearly communicating the penalty structure in advance can help avoid any misunderstandings and ensure smooth business operations.

Flexible Payment Options for Clients

Offering flexible options for settling financial obligations can greatly enhance customer satisfaction and encourage quicker transactions. By providing a range of methods and schedules, businesses can accommodate different client preferences and capabilities, fostering stronger relationships and minimizing payment delays. Flexibility can be a key factor in ensuring both sides are satisfied and that financial exchanges proceed smoothly.

Flexible methods allow clients to choose the most convenient way to complete their transactions, whether that involves smaller installments, extended deadlines, or varied settlement channels. The right flexibility can make a significant difference, particularly for larger projects or clients with fluctuating cash flow. Here are some common approaches to consider:

Installment Plans

Breaking up a larger sum into manageable installments is an attractive option for clients who might not be able to pay the full amount at once. This structure allows clients to pay over time, typically with equal payments made at regular intervals (e.g., weekly, bi-weekly, or monthly). Offering installment plans can reduce the stress of a lump sum payment and make it easier for clients to commit to larger projects or services.

Extended Payment Deadlines

For clients facing temporary financial difficulties, extending the deadline for settlement can be a helpful solution. Providing an extended grace period or agreeing to a longer due date gives clients more time to gather the necessary funds. This shows understanding and can strengthen the business relationship, ensuring future cooperation. However, it’s important to balance flexibility with the need for timely settlements to maintain cash flow.

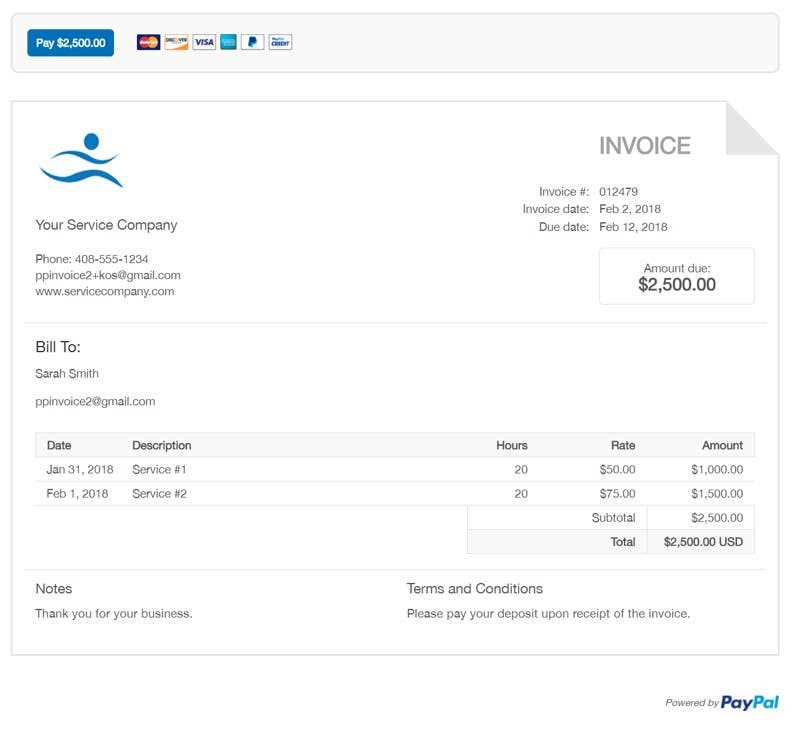

Multiple Payment Methods

Allowing clients to choose from a variety of methods for settlement can greatly simplify the process for both parties. Options may include:

- Bank transfers: A standard method for businesses and clients to transfer funds directly.

- Online payment platforms: Services like PayPal, Stripe, or other digital wallets that offer convenience and speed.

- Credit or debit cards: Allowing clients to settle balances using their preferred card offers more flexibility.

- Checks: Though becoming less common, checks may still be used, particularly for clients in certain regions or industries.

Offering several options ensures that clients can choose the method they’re most comfortable with, increasing the likelihood of timely settlements.

By providing these adaptable options, businesses can enhance client satisfaction, encourage quicker settlements, and reduce the likelihood of overdue balances, all while maintaining positive professional relationships.

How to Structure Payment Installments

When clients cannot settle the full balance at once, breaking the amount into smaller, manageable installments can be an effective solution. Structuring these installments properly ensures that both parties have a clear understanding of the amounts due, as well as the schedule for each payment. A well-defined plan also helps maintain cash flow while offering flexibility to clients.

There are several approaches to structuring installments, depending on the size of the transaction, the client’s financial situation, and the nature of the service or product provided. Below is a guide on how to structure installment plans effectively:

| Installment Structure | Description |

|---|---|

| Equal Installments | Divide the total amount into equal parts, with the same sum due at regular intervals (e.g., monthly or weekly). This method is straightforward and easy for clients to manage. |

| Percentage-Based Installments | Start with a larger deposit and then structure smaller subsequent payments. For example, a 30% upfront payment, followed by three 20% installments. |

| Milestone-Based Payments | Tie payments to specific stages of a project or delivery of goods. For example, a first installment upon signing the agreement, the second after a product prototype is delivered, and the final payment upon completion. |

| Flexible Installments | Offer clients flexibility in choosing the frequency and amount of each installment based on their financial situation. This allows clients to pay in ways that work best for them, such as smaller payments over a longer period. |

When determining the structure, it’s important to consider the client’s payment capacity and the total value of the transaction. Offering clear, written guidelines on due dates, amounts, and penalties for missed payments can help prevent confusion and ensure that both parties remain on track throughout the process.

By creating a payment plan that works for both the business and the client, you can ensure timely settlements while also maintaining a positive working relationship.

Defining Currency and Payment Methods

When establishing the expectations for financial transactions, it is essential to clearly specify the currency in which the amount is to be settled and the acceptable methods of transfer. This eliminates any ambiguity and ensures both parties are on the same page regarding the logistics of the exchange. Defining these details in advance can help avoid misunderstandings and streamline the settlement process.

Currency selection is particularly important when dealing with international clients or vendors. Clearly stating the currency helps ensure there are no surprises in conversion rates or unexpected charges. Similarly, offering multiple methods for transferring funds can provide convenience and flexibility for clients, increasing the likelihood of timely settlements.

Choosing the Right Currency

For businesses with international reach, specifying the currency in which the transaction will occur is crucial. Common options include:

- Local Currency: For transactions within the same country, using the local currency simplifies the process and avoids conversion fees.

- US Dollar (USD): Widely accepted globally, using USD for international transactions can avoid confusion when working with clients across different regions.

- Euro (EUR): Similarly, the Euro is another global currency commonly used for international dealings, especially within Europe.

- Other Currencies: For businesses with a more regional focus, it might make sense to use a specific currency depending on the market they serve, such as the British Pound (GBP) or Japanese Yen (JPY).

Available Payment Methods

Allowing clients to choose from a variety of methods for completing the transaction provides greater convenience and can encourage prompt payment. Common methods include:

- Bank Transfers: A direct and secure method for both parties to transfer funds through financial institutions.

- Credit or Debit Cards: A fast and flexible option, especially for clients who prefer to settle balances via cards.

- Online Payment Platforms: Services like PayPal, Stripe, or other digital wallets allow for instant, secure transfers and may be more convenient for clients who prefer online options.

- Checks: While becoming less common, checks may still be used, particularly for clients in certain regions or industries.

By clearly defining the currency and available methods of transfer, businesses can avoid confusion, ensure smooth transactions, and offer flexibility to clients, fostering positive and efficient financial exchanges.

Setting Up Payment Terms for International Clients

When working with clients from different countries, it is essential to establish clear guidelines for how financial obligations will be handled. These guidelines should account for factors such as currency exchange, international transaction fees, and the preferred methods of fund transfer. Setting up these expectations in advance can minimize misunderstandings and ensure both parties are aligned throughout the transaction process.

Due to the complexities of cross-border transactions, it is important to structure the agreement in a way that accommodates both the client’s needs and the business’s requirements. Below are some critical considerations when setting up payment arrangements for international clients:

Currency Selection

Choosing the right currency is vital when working with clients outside your country. The currency you specify will determine how much the client has to pay in their local currency and avoid confusion with exchange rates. Here are some common options:

- Base Currency: The currency most commonly used for international transactions, such as the US Dollar (USD), Euro (EUR), or British Pound (GBP).

- Client’s Local Currency: This may be preferred by clients who wish to avoid currency exchange fees, though it may require you to deal with fluctuating conversion rates.

- Multi-Currency Agreement: For large or ongoing international partnerships, agreeing on multiple currencies or a payment option that allows currency conversion at the time of settlement might be useful.

International Payment Methods

There are numerous ways to facilitate international transactions, each with different advantages and costs. Offering multiple methods ensures flexibility and can help reduce delays in processing. Some of the most common methods include:

- Wire Transfers: Bank-to-bank transfers are one of the most secure and reliable methods for international transactions. However, they may incur significant fees and require several days for processing.

- Credit/Debit Cards: Widely accepted globally, credit and debit cards offer convenience for clients and quicker processing times, but international fees may apply.

- Online Payment Systems: Platforms like PayPal, Stripe, or Wise are increasingly popular for international transactions due to their speed, ease of use, and lower fees compared to traditional bank transfers.

- Cryptocurrency: Although less common, digital currencies like Bitcoin or Ethereum can be a quick and cost-effective option for cross-border transactions, especially for businesses dealing with tech-savvy clients.

By clearly outlining the currency and available methods for settling financial obligations, both the client and the business can avoid confusion, ensure a smoother transaction process, and maintain a strong working relationship despite geographical distances.

Importance of Consistent Invoice Formatting

Maintaining a consistent format for financial documents is essential for ensuring clarity, professionalism, and efficiency in business transactions. A well-organized structure not only makes it easier for clients to understand the details of their financial obligations, but also helps businesses avoid errors, reduce confusion, and foster trust with their customers. Consistency in document layout is key to streamlining internal processes and presenting a polished image to clients.

When the layout and content of these documents are uniform across all transactions, it becomes simpler to track and manage records. Furthermore, consistency in formatting can save time during audits, reduce administrative errors, and improve communication with clients. Below are some reasons why adhering to a consistent structure is so important:

Clarity and Understanding

When the structure of financial documents is uniform, clients are able to easily locate important information, such as due dates, amounts, and breakdowns of services or goods provided. A consistent layout minimizes confusion and ensures that clients understand their obligations without the need to repeatedly ask for clarification.

- Clear Headings: Use of consistent headings for different sections helps clients quickly navigate through the document.

- Standardized Dates: A consistent method for displaying due dates and invoice dates reduces the chance of errors or misunderstandings.

- Itemized Breakdown: A clear, uniform breakdown of charges helps clients easily understand how their total is calculated.

Professionalism and Brand Identity

Consistency in formatting also reflects the professionalism of the business. A standardized design reinforces brand identity and presents the company as organized and detail-oriented. When a business consistently uses the same style and structure, clients begin to associate that uniformity with reliability and trustworthiness.

- Branding Elements: Incorporating the same logo, fonts, and colors into every document creates a cohesive brand experience for the client.

- Template Design: Using a well-designed, repeatable format makes your documents look polished and reduces the need to start from scratch each time.

By adopting a consistent approach to document formatting, businesses can improve communication, reduce confusion, and present themselves as professional and reliable, which can lead to more satisfied clients and better long-term relationships.

How to Avoid Payment Disputes with Clear Terms

One of the most common challenges businesses face is disputes over financial obligations. These conflicts often arise due to misunderstandings or a lack of clarity regarding the expectations set for the transaction. By clearly outlining the specifics of how, when, and what is expected for settlement, businesses can prevent most of these disputes. Well-defined guidelines help both parties avoid confusion and create a transparent framework for the exchange.

Ensuring that all aspects of the financial arrangement are clearly documented from the beginning is key to preventing future conflicts. By clearly communicating details such as deadlines, amounts, and methods of settlement, businesses can manage expectations and create a smoother process for both parties. Here are some ways to avoid disputes through clear agreements:

Be Specific About Due Dates and Amounts

When establishing an arrangement, it’s important to clearly state the due dates for each installment or full settlement, as well as the exact amount due. Avoid ambiguous language and make sure both parties understand what is expected and when. Using specific dates or clearly defined timeframes (e.g., “within 30 days after delivery”) reduces the risk of misunderstandings.

- Clearly Defined Amounts: Break down the total into specific numbers, showing what each part of the transaction entails.

- Unambiguous Deadlines: Use fixed dates instead of terms like “ASAP” or “soon,” which can be interpreted differently.

Establish Acceptable Methods of Settlement

Clearly outline the preferred methods for transferring funds. If multiple options are available, make sure that both the client and the business are aware of the methods that are accepted. This includes specifying which currencies, payment platforms, or bank details should be used. Providing the client with enough flexibility, while still ensuring the process remains efficient, can help reduce friction.

- Preferred Platforms: Indicate if you accept digital wallets, credit cards, or bank transfers, and mention any specific platforms or accounts used for these transactions.

- Accepted Currencies: Make it clear whether you will accept payments in the client’s local currency or if the transaction must be in a specific international currency.

Include Penalties for Late Payments

While it’s not ideal to have penalties for overdue payments, it’s necessary to protect the business from delays that may affect cash flow. Outline any additional charges or interest that will apply if the client does not settle the balance by the specified date. Make sure to communicate these penalties upfront so there is no confusion later on.

- Clear Penalty Structure: Clearly specify the interest rate or flat fee that will be added to overdue amounts.

- Grace Period: If applicable, include a grace period before penalties begin, giving clients a reasonable window of time to pay.

By providing clear, well-structured expectations at the outset, businesses can avoid confusion, prevent d

Customizing Your Invoice Payment Template

Adapting financial documents to fit the specific needs of your business and clients is essential for ensuring clarity and professionalism. Customizing these documents allows you to reflect your brand identity, meet your clients’ expectations, and streamline your accounting process. Whether you want to highlight certain details or create a distinct format that resonates with your business style, customization offers flexibility and ensures that all relevant information is presented in a clear, organized manner.

Personalizing the layout and content of these documents not only enhances their effectiveness but also makes them more engaging for your clients. A well-tailored document helps your business stand out and fosters better communication. Below are some key considerations when customizing your financial documents:

Branding Your Documents

Incorporating your business’s brand elements into the document design helps reinforce your company’s identity and gives the document a polished, professional appearance. Here are some ways to effectively brand your financial documents:

- Logo and Color Scheme: Use your company’s logo and a consistent color palette to align with your other marketing materials.

- Font Style and Size: Choose fonts that are easy to read and align with your brand’s style, ensuring consistency across all communications.

- Header and Footer Customization: Add a custom header or footer to display your company’s contact details, business registration information, or website link.

Tailoring Information to Client Needs

Customizing the content to suit each client’s preferences or the specifics of the transaction ensures that all necessary details are included and easily understood. Consider adding or modifying sections based on the type of work or services provided:

- Detailed Breakdown: If the transaction involves multiple products or services, include a breakdown to ensure transparency and minimize confusion.

- Client-Specific Instructions: Add any special instructions or details about the project or agreement that are relevant to the client’s expectations.

- Discounts or Promotions: If applicable, clearly highlight any discounts or special offers that the client is receiving, so there is no ambiguity.

By customizing your financial documents, you can streamline communication, reduce misunderstandings, and create a more positive experience for your clients. A personalized approach not only helps build professional relationships but also enhances your business’s credibility and trustworthiness.

Legal Considerations for Payment Terms

When creating guidelines for financial arrangements, it is crucial to consider the legal implications that accompany these agreements. Clear and legally sound guidelines help ensure that both parties understand their obligations, minimize the risk of disputes, and provide a framework for resolving conflicts if they arise. By adhering to legal requirements, businesses can protect themselves from potential liabilities and foster a trustworthy environment for both the client and the service provider.

Understanding the legal aspects of such agreements is essential for ensuring that the terms are enforceable and that both parties’ rights are protected. Below are key legal considerations to keep in mind when setting up financial guidelines:

Compliance with Local and International Laws

When creating a financial agreement, it’s important to ensure that the document complies with relevant local, state, and international regulations. Different regions have different legal frameworks that govern business transactions, so it’s essential to be aware of any laws regarding contract formation, consumer protection, and financial disclosures.

- Consumer Protection Laws: Many countries have specific regulations that protect consumers, so it’s important to ensure that your guidelines comply with these laws.

- International Law: If working with clients internationally, you must ensure that your agreements adhere to international trade laws and any specific requirements that may apply in the client’s country.

- Jurisdiction: Clearly state which jurisdiction will apply in the event of a legal dispute, especially for cross-border transactions.

Clear Enforcement Clauses

To avoid any confusion or legal challenges, it’s important to include clear enforcement clauses in the agreement. These clauses define what actions will be taken if the client fails to meet their obligations, including any penalties or legal recourse that may be pursued. These provisions not only help protect the business but also provide a clear path for resolution should a dispute occur.

- Late Fees and Interest: Clearly specify any fees or interest charges that will be applied if payments are overdue, and ensure they comply with applicable laws on interest rates and penalties.

- Dispute Resolution: Define the process for resolving disputes, whether through mediation, arbitration, or legal action.

By considering these legal factors, businesses can create agreements that are fair, transparent, and enforceable, ensuring smoother transactions and minimizing the risk of legal conflicts.

Integrating Payment Terms with Accounting Software

Streamlining your financial management processes is crucial for maintaining accuracy and efficiency in business transactions. Integrating financial guidelines with accounting software can significantly simplify tracking, invoicing, and reporting, allowing businesses to stay organized and save time. By automating the process, companies can reduce errors, ensure compliance, and make financial management more efficient overall.

Accounting software offers powerful features that can help businesses integrate key financial details directly into their workflow. This includes setting up automated due dates, tracking outstanding balances, and applying discounts or penalties based on pre-set rules. Below are the main benefits of integrating financial instructions with accounting platforms:

Automation of Key Financial Processes

Accounting software enables automatic tracking of outstanding balances, due dates, and client payments. This reduces the need for manual intervention and ensures that financial obligations are met on time. It also helps businesses avoid late fees or errors in processing.

- Automated Reminders: Set up reminders to notify clients of upcoming deadlines, reducing the chances of missed payments.

- Real-time Updates: Keep track of payment statuses and account balances in real time, ensuring that you have up-to-date information for financial decisions.

- Integration with Bank Accounts: Seamlessly track deposits and payments as they are made, automatically reconciling them with your system.

Enhanced Accuracy and Reduced Errors

By using accounting software to handle financial details, you can reduce the risk of manual errors, such as miscalculating amounts or entering incorrect dates. This ensures greater accuracy in your records, which is especially important during audits and financial reporting.

- Standardization: Set standardized guidelines within the software to ensure consistent tracking and management of all transactions.

- Preventing Data Entry Mistakes: By automating repetitive tasks, you can reduce the chances of data entry errors that often occur in manual processes.

- Customizable Reports: Generate reports that are tailored to your needs, making it easier to analyze financial performance and identify areas for improvement.

Integrating these financial protocols with your accounting software not only saves time but also increases efficiency, accuracy, and accountability in your financial processes. By utilizing the full potential of accounting systems, businesses can enhance overall performance, maintain better client relationships, and focus on growth while managing finances effectively.

Best Practices for Invoice Payment Management

Efficient financial management is essential for any business, and establishing a solid structure for handling financial obligations ensures smooth cash flow and reduces the risk of disputes. By implementing effective strategies, companies can improve their collection processes, maintain positive client relationships, and secure timely revenue. Here are some best practices for managing financial agreements with clients.

Clear Communication with Clients

Effective communication is key to ensuring that clients fully understand their financial responsibilities. When financial details are clearly stated and regularly communicated, misunderstandings are minimized, leading to smoother transactions.

- Upfront Clarity: Ensure that all clients are aware of the financial obligations from the start. Clearly communicate deadlines, expectations, and amounts due.

- Regular Reminders: Send reminders before due dates to give clients enough time to fulfill their obligations.

- Open Dialogue: Encourage clients to ask questions if anything in the agreement is unclear. Providing transparency can prevent confusion and disputes later on.

Automating the Process

Automation helps reduce human error and ensures that financial details are always up to date. Using technology to manage financial transactions can significantly increase efficiency and ensure timely actions are taken.

- Set Up Automatic Reminders: Use software that sends automatic reminders or notifications when payments are due, helping clients stay on track.

- Track Outstanding Balances: Use accounting tools that automatically track unpaid balances and highlight overdue amounts, allowing for timely follow-up actions.

- Automate Reports: Set up automated reporting to regularly track the status of all outstanding payments, providing insights into financial health.

Offer Flexible Payment Options

Flexibility in payment options helps clients manage their obligations more effectively. Offering different methods of settling debts can reduce friction and ensure that clients can pay in the most convenient way for them.

- Multiple Payment Methods: Allow clients to pay through various platforms, such as credit cards, bank transfers, or online payment systems like PayPal or Stripe.

- Installment Plans: For larger amounts, consider offering installment plans, allowing clients to pay over time while still maintaining regular payments.

- Currency Options: If working internationally, provide the option for clients to pay in their preferred currency, which can reduce confusion and simplify transactions.