Invoice Payment Template for Streamlined Billing and Easy Transactions

Managing financial transactions with clients is an essential part of any business, and having a clear and professional structure for requesting and receiving funds can make all the difference. An organized system helps both parties ensure transparency, avoid confusion, and facilitate timely transfers. Creating a reliable document to communicate amounts due is an important step in streamlining this process.

With the right structure, this document not only makes the payment process smoother but also reflects the professionalism of your company. By using a well-designed form, you can provide all necessary details–such as amounts, due dates, and instructions–while maintaining a clear and formal approach. This reduces the chance of misunderstandings and supports a positive relationship with your clients.

Whether you’re a freelancer, small business owner, or part of a larger organization, having an easy-to-use and customizable system for requests is a valuable tool. It simplifies the communication of amounts owed and allows you to track outstanding balances efficiently. Implementing an efficient format can ensure that payments are processed promptly and correctly, contributing to the financial health of your company.

Understanding the Basics of Invoice Payment Templates

Efficiently requesting funds from clients requires a structured approach that conveys all necessary details clearly. A well-organized document allows businesses to specify the amount due, due date, and other essential terms in a way that is both professional and easy to understand. These documents ensure that both the sender and the recipient are aligned, reducing the chances of confusion or missed payments.

Key Components of a Structured Document

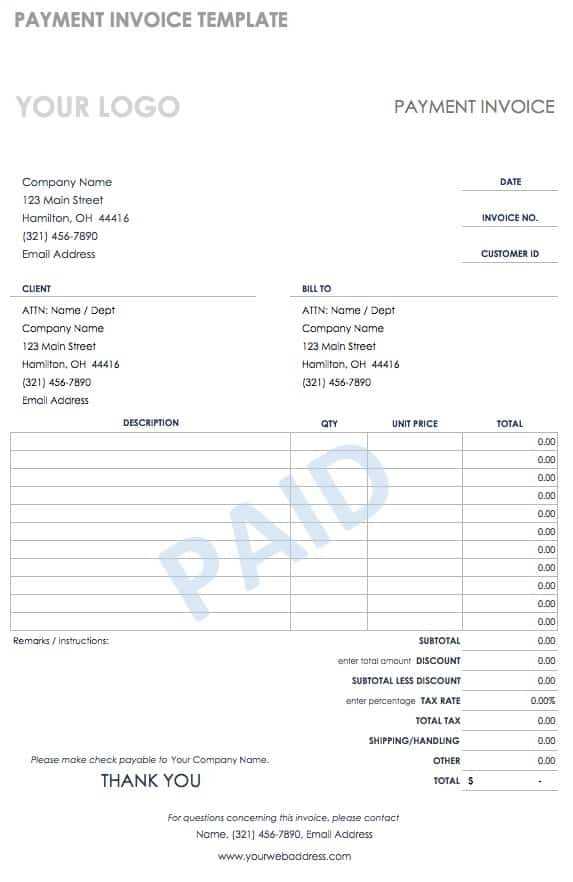

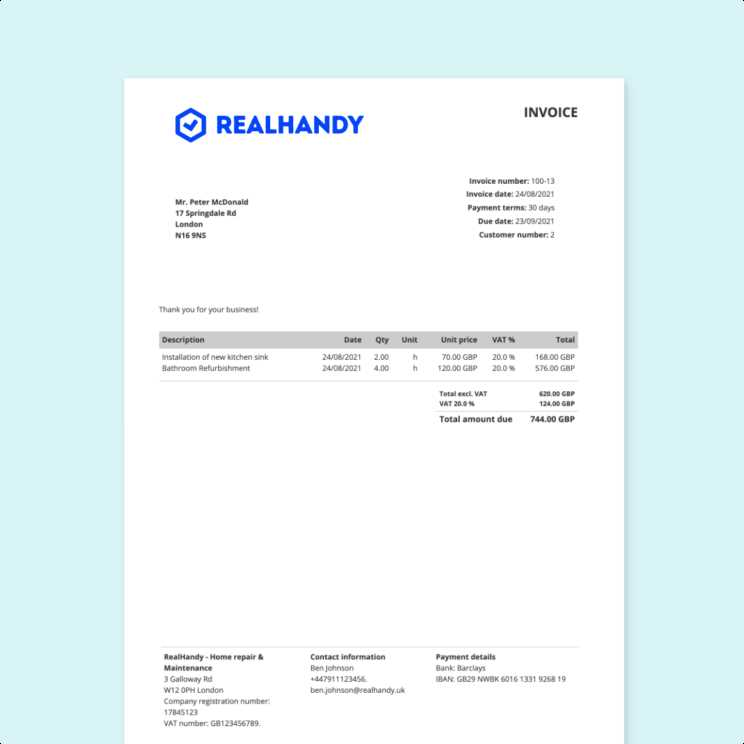

To create an effective document for requesting payments, there are several critical elements to include. These components help ensure accuracy and clarity, making the entire process more straightforward for both parties involved. The most important elements include:

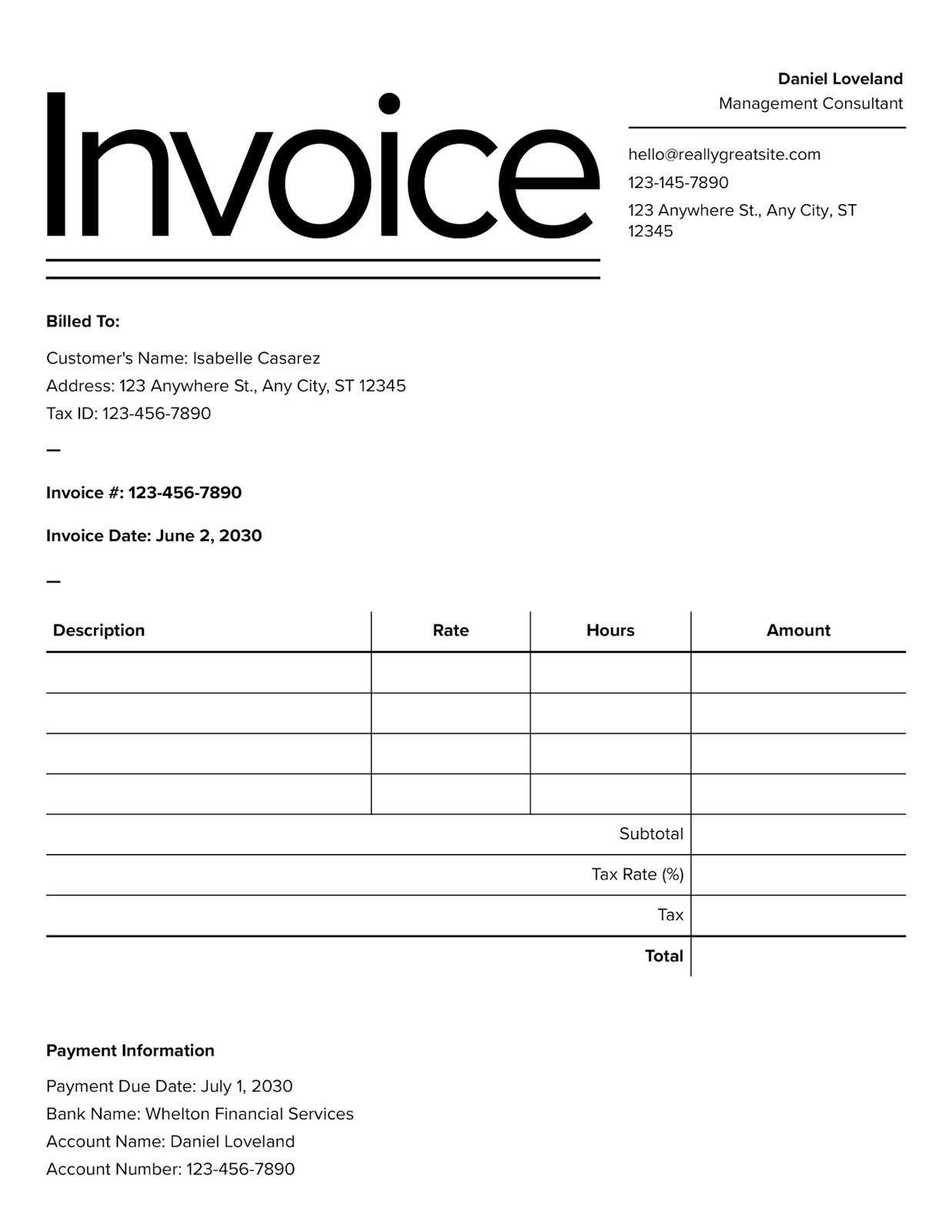

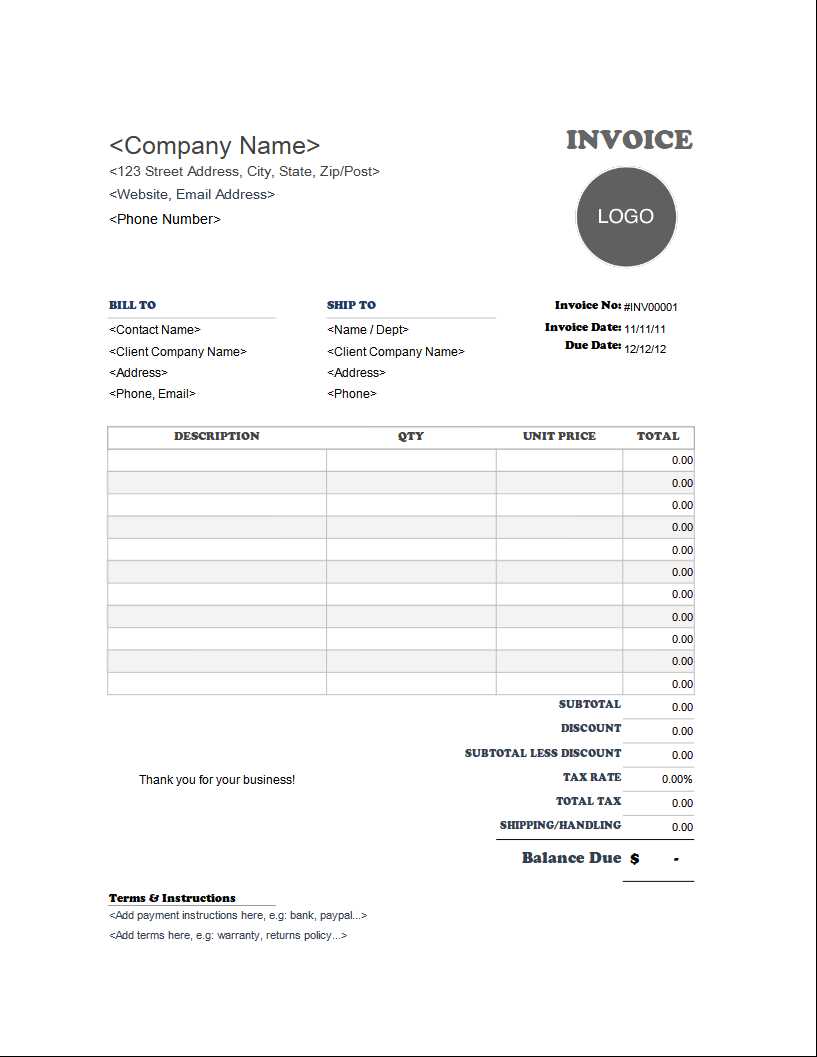

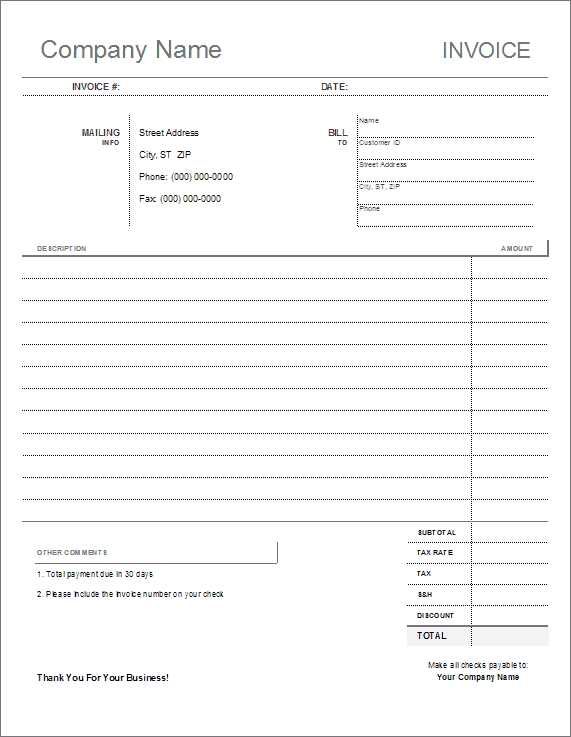

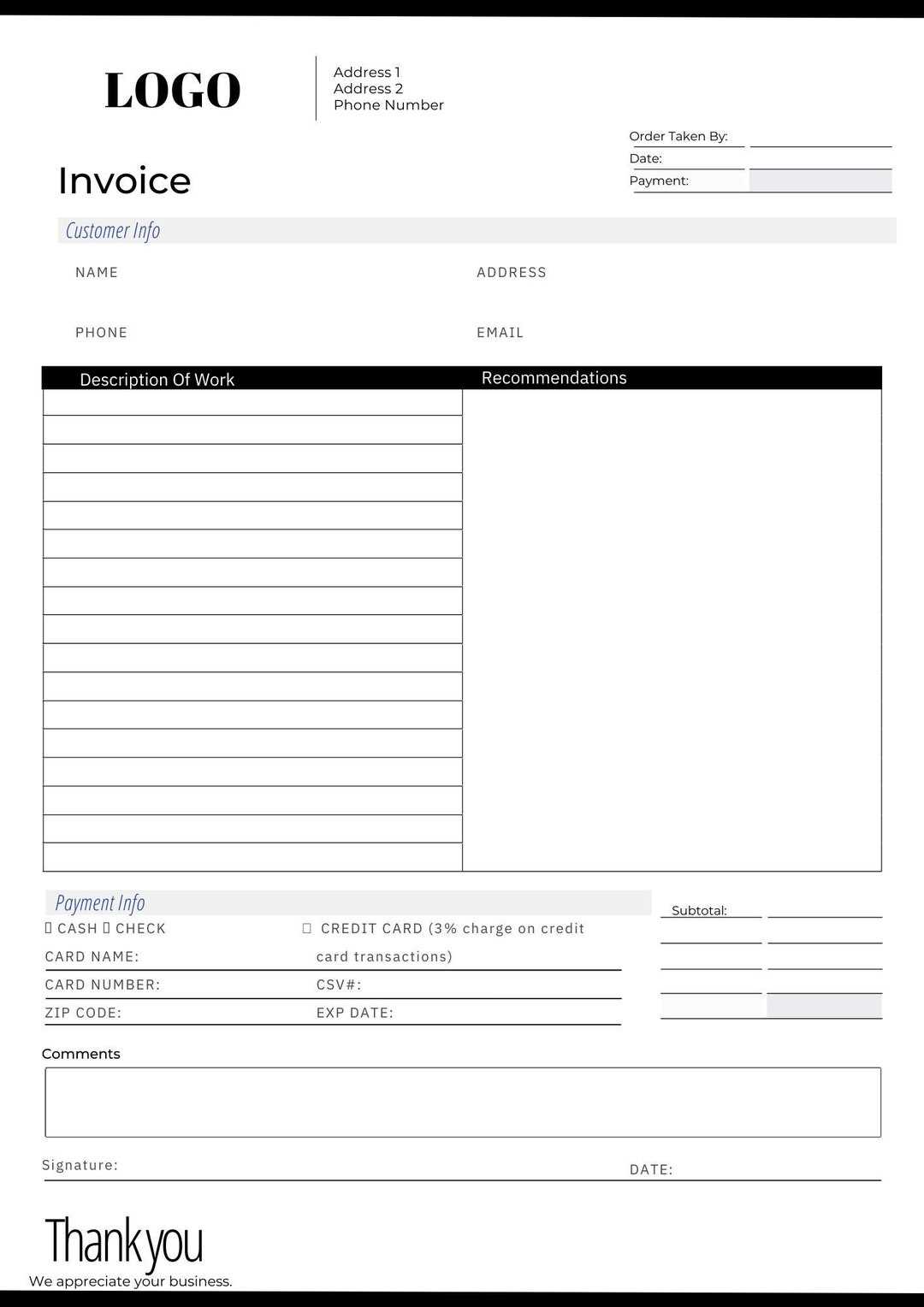

- Header Information: Include your business name, contact details, and the recipient’s information.

- Amount Due: Clearly state the total amount requested.

- Due Date: Specify the exact date when the payment is expected.

- Payment Instructions: Provide clear guidance on how the recipient can submit the payment.

- Terms and Conditions: Outline any additional terms, such as late fees or discounts for early payment.

Benefits of Using a Structured Request for Funds

Using a standardized format offers several advantages for businesses, both large and small. A consistent structure promotes professionalism and helps ensure that all necessary details are included. Additionally, these documents are easy to modify for future use, allowing businesses to streamline the billing process and improve efficiency.

- Clarity: Clear communication reduces confusion and mistakes.

- Professionalism: A well-organized document presents a positive image of your business.

- Time-saving: Pre-designed formats can save time when creating requests for funds.

- Accuracy: Ensures all critical information is included every time.

By understanding these key components and benefits, businesses can create effective documents that simplify financial transactions and foster positive client relationships.

Why You Need an Invoice Payment Template

Having a consistent and reliable document for requesting funds from clients is essential for any business. It not only streamlines the financial process but also ensures professionalism and clarity in communication. Without a structured approach, the chances of confusion or delays in receiving payments increase significantly. A standardized format helps businesses avoid errors and provides a clear record for both parties.

Benefits of Using a Standardized Document for Billing

Implementing a consistent structure when requesting payments offers several advantages, especially when it comes to efficiency and accuracy. The following points outline why using such a document is crucial:

- Consistency: A standardized format ensures that every request for funds contains the same key information, reducing the likelihood of mistakes.

- Clarity: Clear and concise details on amounts, due dates, and payment methods help avoid misunderstandings between businesses and clients.

- Time Efficiency: Having a pre-built format saves time, allowing businesses to quickly generate requests without starting from scratch each time.

- Professionalism: Using a well-organized document reflects positively on your business, showing that you take financial matters seriously and respect your clients.

- Record Keeping: A formal document provides a clear and trackable record of financial transactions, which can be helpful for both auditing and tax purposes.

How a Structured Request Benefits Your Clients

When clients receive a clear and well-formatted request, they can easily understand what is due and when. This transparency builds trust and enhances the business relationship. Additionally, a straightforward document reduces confusion and ensures that payments are made promptly.

- Easy to Understand: Clients can quickly identify what is owed and how to submit their funds.

- Prevents Disputes: With all the necessary details outlined upfront, there is less chance of disagreement over the terms.

- Reduces Delays: A professional and clear document encourages timely payments.

By adopting a standardized approach for requesting payments, businesses can ensure smoother transactions, build stronger client relationships, and

Key Features of an Invoice Payment Template

Creating a professional document for requesting funds involves including several essential elements to ensure clarity and accuracy. A well-structured document should be easy to understand, easy to complete, and include all necessary details for both the sender and the recipient. These key features provide the framework for smooth and timely transactions, making the entire process more efficient and transparent.

Essential Elements for a Comprehensive Request

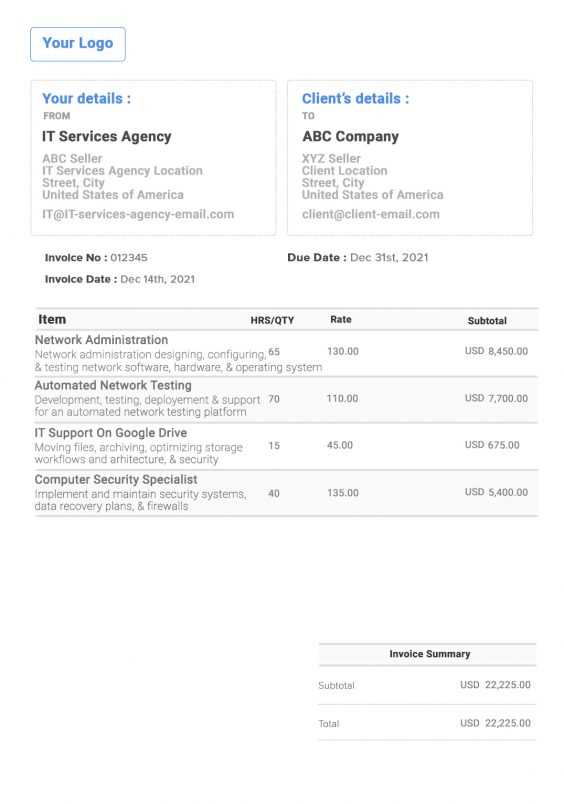

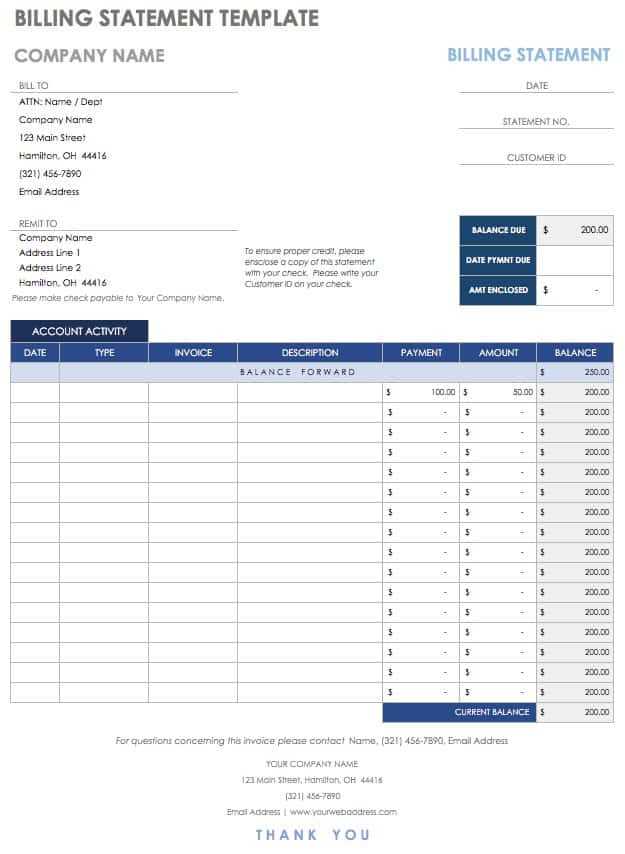

When designing a document for financial transactions, it is important to include the following critical components:

- Business Information: This includes the company name, address, and contact details. It helps establish the sender’s identity and provides easy access to contact information in case of queries.

- Recipient Details: Clearly listing the name and address of the recipient ensures that the request is directed to the correct party.

- Transaction Summary: The specific amount due, along with a breakdown of services or products provided, should be detailed to avoid any confusion.

- Due Date: Including a clear due date sets expectations for when the funds should be received and helps avoid unnecessary delays.

- Payment Instructions: Providing precise instructions on how to submit funds, including preferred payment methods and account details, makes the transaction process straightforward.

- Terms and Conditions: Including any applicable terms–such as late fees, early payment discounts, or refund policies–can prevent disputes and ensure mutual understanding.

Additional Features to Enhance Functionality

In addition to the essential components, the following features can make the document even more functional and user-friendly:

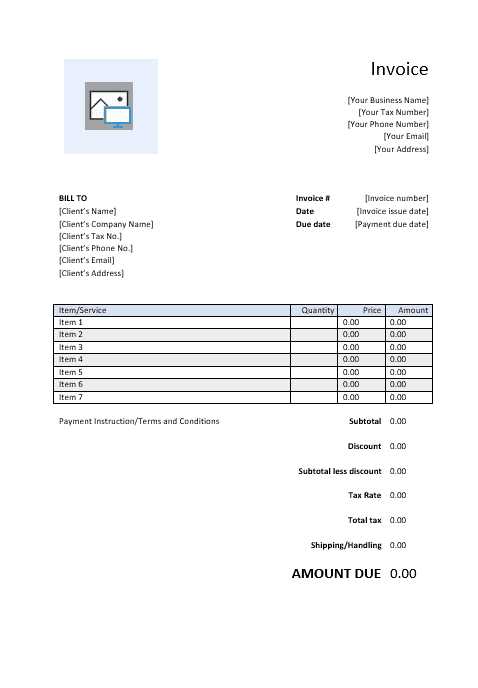

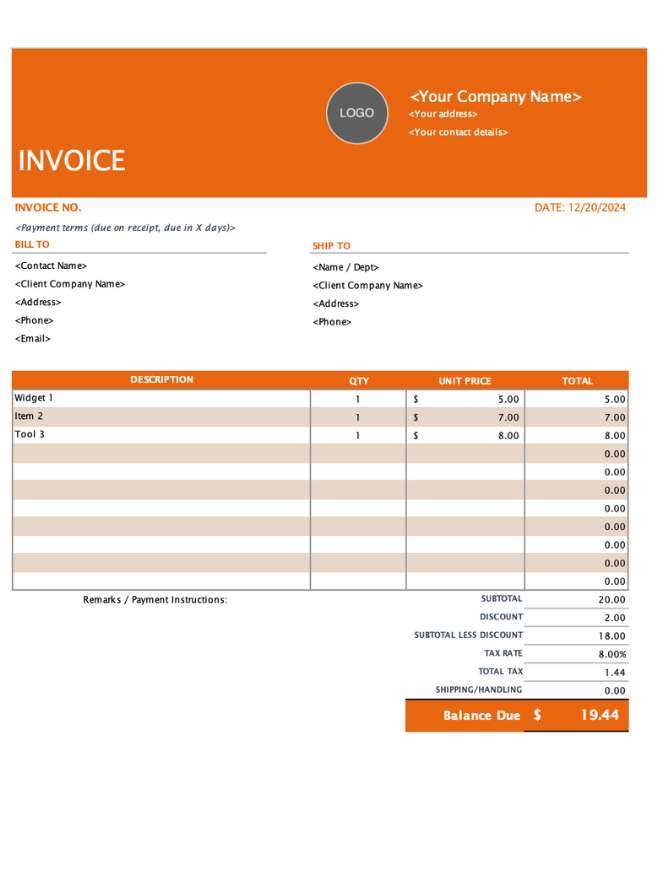

- Branding: Adding a company logo and a consistent color scheme creates a professional look that reinforces your brand identity.

- Sequential Numbering: Assigning unique reference numbers to each document helps with organization and makes it easier to track past transactions.

- Clear Formatting: Using bold headings, well-organized sections, and ample white space improves readability and makes the document e

How to Customize Your Invoice Payment Template

Customizing a document for financial requests is essential to reflect your business’s unique identity and meet specific needs. By adjusting various elements, you can tailor the structure to ensure it works seamlessly for your operations while maintaining professionalism. Personalizing this form can enhance the client experience, making it more intuitive and efficient for both you and your recipients.

Step 1: Modify Basic Information

The first step in customization is adjusting the basic details. This includes adding your business logo, name, contact information, and legal details to ensure your branding is clearly represented. You should also input the recipient’s name, address, and other relevant contact information to make the request specific and personalized.

- Logo: Insert your company’s logo to create a branded document that reflects your professionalism.

- Contact Information: Add your business address, email, and phone number for easy communication.

- Recipient Info: Ensure the recipient’s name and details are accurate to avoid any confusion.

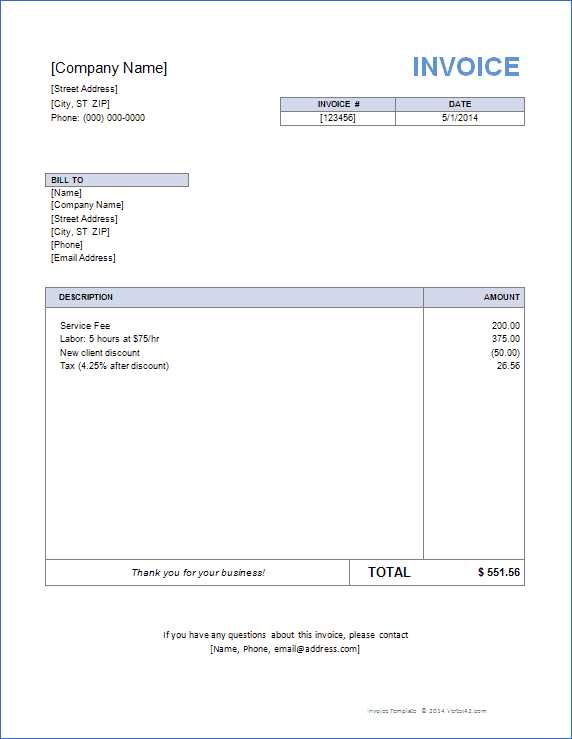

Step 2: Adjust Transaction Details and Formatting

Next, customize the specific financial details. Include an itemized list of products or services provided, along with their corresponding costs. Be sure to update the amount due and payment terms to match your current arrangement. Pay attention to formatting–use clear headings, bold text for important details, and enough spacing to make the document easy to read.

- Item Descriptions: Provide clear and concise descriptions of goods or services rendered to justify the amount requested.

- Amount Due: Specify the total due, including any taxes, discounts, or additional fees.

- Due Date and Terms: Clearly state when the funds are due and any applicable conditions, such as late fees or discounts for early settlement.

- Payment Methods: Offer multiple payment options and provide clear instructions on how to submit the funds.

By following these steps, you can ensure that your financial request document is not only effective but also aligned with your brand and business practices.

Common Mistakes to Avoid with Invoice Templates

Creating a document for requesting funds may seem straightforward, but small mistakes can lead to confusion, delays, or even disputes. Ensuring accuracy and clarity is crucial for maintaining a smooth process and positive client relationships. Below are some common errors businesses make when drafting financial request forms, and tips on how to avoid them.

Key Mistakes to Watch Out For

Mistake Impact How to Avoid Missing Contact Information Delays in communication and confusion about who to contact in case of issues. Ensure both your business and the recipient’s contact details are clearly listed at the top. Incorrect Amount Due Clients may question the charges or delay payments due to inaccuracies. Double-check the calculations and breakdown of charges before sending. Unclear Payment Terms Misunderstandings regarding due dates or late fees can lead to delayed or missed payments. Clearly specify the payment due date, accepted payment methods, and any terms related to late fees. Lack of Unique Reference Number Difficulty in tracking past transactions, leading to confusion during audits or future correspondence. Assign a unique reference number for each document to maintain an organized record system. Overcomplicated Layout Recipients may struggle to find important details, causing delays in processing payments. Use a clean, simple layout with clear headings and adequate white space for easy reading. By avoiding these common mistakes, you can create a more efficient and professional process, ultimately ensuring quicker and more reliable transactions with your clients.

How to Add Payment Terms in Templates

Including clear and precise terms in a financial request form is essential for both businesses and clients. These terms outline the expectations for payment, ensuring that there is no ambiguity about deadlines, late fees, or available discounts. By establishing clear conditions, you can improve cash flow, minimize disputes, and maintain a positive professional relationship with your clients.

Steps to Include Payment Terms

When customizing a document for financial requests, adding the appropriate payment terms is crucial. Here are the key steps to follow:

- Define the Due Date: Specify the exact date when funds should be received. This helps avoid delays and ensures both parties are aligned on when payment is expected.

- Late Fees: Clearly outline any late fees or penalties for overdue amounts. For example, “A 5% late fee will be applied for payments received after 30 days.”

- Early Payment Discounts: If you offer discounts for early payment, state the terms. For instance, “A 2% discount will be applied to payments made within 10 days of the issue date.”

- Accepted Payment Methods: List the payment methods you accept (e.g., bank transfer, credit card, check) to give your clients clear options for submitting funds.

- Currency and Amount Details: Specify the currency used and ensure the amount requested is clearly stated. This is especially important for international transactions.

- Additional Conditions: If there are any specific conditions that apply (e.g., refunds, returns), be sure to include them so that the client understands the full scope of the terms.

Example Payment Terms Clause

Here’s an example of how you can word payment terms in your financial request form:

- Payment is due within 30 days of the issue date.

- A 5% late fee will be applied to all amounts overdue by more than 15 days.

- A 2% discount is available for payments made within 10 days of the issue date.

- We accept payments via bank transfer, credit card, or check.

- All transactions are in USD.

By clearly defining these terms, you set expectations from the outset,

Best Practices for Creating Invoice Templates

Designing a well-organized document for requesting funds is crucial for ensuring clarity and maintaining professionalism. A well-crafted request form not only makes the billing process smoother but also helps avoid confusion, delays, and potential disputes. By following best practices when creating this document, you can streamline your financial processes and foster better relationships with your clients.

Key Considerations When Designing Your Document

When creating a document for financial transactions, it’s important to follow certain principles to ensure it is both functional and professional. Here are some best practices to keep in mind:

- Keep It Simple: A clean, uncluttered design makes the document easy to read and understand. Focus on the most essential information and avoid unnecessary complexity.

- Use Clear Headings: Organize the content with distinct sections–such as “Services Rendered,” “Amount Due,” and “Payment Instructions”–so clients can easily find the details they need.

- Consistent Formatting: Maintain consistent fonts, font sizes, and alignment throughout the document. This enhances readability and creates a cohesive look.

- Be Specific with Dates: Clearly state the due date and any other important timelines. If there are payment terms (like early payment discounts or late fees), these should be unambiguous.

- Include Relevant Payment Instructions: Provide specific information on how the recipient can send funds (e.g., bank transfer details, online payment link, or mailing instructions). The easier you make it, the faster the payment process will be.

How to Improve Client Experience

In addition to the technical aspects of the document, consider the client experience when designing your form. A positive experience leads to quicker payments and stronger client relationships.

- Professional Design: Use your company’s branding (such as logo, color scheme, and fonts) to make the document look polished and aligned with your brand identity.

- Provide Contact Information: Make it easy for clients to contact you if they have any questions or concerns about the request. Include your business address, phone number, and email address.

- Multiple Payment O

Different Types of Invoice Payment Templates

There are various ways to structure a document that requests funds, and choosing the right format depends on your business needs and the nature of your transactions. Whether you’re a freelancer, a small business owner, or part of a larger organization, understanding the different types of request forms can help you streamline your billing process and maintain clarity with your clients. Each type serves a specific purpose, and selecting the appropriate one ensures smooth communication and efficient transactions.

Standard Request for Funds

This is the most commonly used format for businesses of all sizes. It includes basic information like the amount due, a description of the goods or services provided, and payment instructions. The standard format is ideal for most transactions as it provides a clear and straightforward approach to billing.

- Key Features: Clear breakdown of items/services, amount due, payment method options, and due date.

- Best For: Routine transactions with clients, small and medium-sized businesses, freelancers.

Pro Forma Request

A pro forma document is typically used before a transaction is completed. This type of document provides an estimated cost of goods or services, giving the client an idea of the amount they will need to pay once the transaction is finalized. It serves as a preliminary request and is often used in international trade or larger projects where exact costs may not be known upfront.

- Key Features: Estimated amounts, no immediate payment required, serves as a preview of costs.

- Best For: Pre-transaction agreements, international shipments, projects with varying costs.

Recurring Request for Funds

This type of request is used for ongoing services or subscriptions where the same amount is billed at regular intervals, such as monthly or annually. It’s ideal for businesses that offer subscription-based services, membership programs, or long-term contracts.

- Key Features: Fixed amounts, scheduled billing dates, recurring charges.

- Best For: Subscription services, retainers, membership programs.

Credit Note

A credit note is issued when an adjustment needs to be made to a previously sent request. This could be due to overcharging, returned goods, or other reasons requiring a reduction in the original amount. It helps ensure the client is billed corr

How to Ensure Accurate Payment Information

Providing accurate details in a document requesting funds is essential for smooth transactions and maintaining trust with your clients. Errors in billing information can lead to confusion, delays, and potential disputes. By carefully reviewing and verifying all details before sending, businesses can ensure a seamless financial process and avoid unnecessary complications.

Steps to Ensure Accuracy

Here are key practices to follow when adding payment details to your document:

- Double-Check Amounts: Always confirm the total amount due, including taxes, discounts, and any additional fees. Mistakes in pricing can lead to payment delays or client dissatisfaction.

- Verify Client Information: Ensure that the recipient’s name, address, and contact details are correct. This helps avoid sending the request to the wrong party and ensures all communication reaches the right person.

- Confirm Payment Methods: Be clear about the accepted methods for sending funds. Whether it’s bank transfer, credit card, or check, include accurate details such as account numbers or links for online transactions.

- Clearly State Due Dates: Specify the exact due date for payment to avoid misunderstandings. If there are any grace periods or late fees, include those details as well.

- Use a Consistent Format: Maintain a consistent format throughout the document, especially when listing charges, payment methods, and terms. A disorganized structure can lead to errors or confusion.

- Include Relevant References: If there are any purchase order numbers or contract references associated with the transaction, include them to help track the payment and avoid disputes.

Review and Final Checks

Before sending any request for funds, it’s always a good practice to do a final review. Consider having a second person look over the document to catch any overlooked errors. A thorough review process helps ensure that no details are missed and that all information is accurate and complete.

By taking these precautions, you can avoid mistakes and create a clear, professional document that facilitates prompt and accurate payment from your clients.

Tips for Keeping Your Invoice Template Professional

Maintaining a professional appearance in your financial request forms is essential for establishing credibility and fostering trust with your clients. A polished, well-organized document not only enhances your reputation but also facilitates a smoother transaction process. Here are some key tips for ensuring your request forms reflect professionalism and clarity.

Focus on Consistency

Consistency is crucial for maintaining a professional look. This applies to the fonts, colors, and layout you choose. Using uniform fonts and sizes for headings, subheadings, and content ensures that your document is easy to read and looks cohesive. Avoid using too many different font styles or colors, as this can make your document appear cluttered and unprofessional.

Use Clear, Simple Language

Make sure your document is clear and concise. Use simple language to avoid misunderstandings. Include only the necessary details, and structure your content logically so clients can easily follow along. Avoid jargon or overly complex terms that could confuse the recipient.

Incorporate Your Branding

Personalizing the request form with your business logo, colors, and fonts adds a touch of professionalism and reinforces your brand identity. By incorporating your logo, you signal to your clients that the document is official and comes from a credible source. Ensure that your branding elements are subtle and don’t overwhelm the content.

Maintain a Clean Layout

A cluttered or disorganized document can give a bad impression. Keep the layout simple and neat. Make sure the essential details, such as the amount due, due date, and payment instructions, are easy to locate. Adequate white space is also important–it makes the document easier to read and avoids the appearance of overcrowding.

Double-Check for Accuracy

Accuracy is key in any professional document. Double-check that all information is correct before sending, including names, dates, amounts, and payment instructions. Small mistakes can undermine the professionalism of your document and lead to confusion or delays in payment.

Include Relevant Contact Information

Provide clear and complete contact details so that your clients know how to reach you if they have questions or need assistance. This includes your business name, phone number, email address, and any other relevant communication channels. Clear contact details add a layer of transparency and reliability to your request.

By following these tips, you can ensure that your financial request forms remain professional, clear, and effective, leading to more positive interactions with your clients and quicker, smoother transactions.

Using Invoice Templates for Quick Payments

Using a structured and well-designed financial request form can significantly speed up the process of receiving funds. By streamlining the way you present your billing details, you make it easier for clients to understand the terms, process the payment, and avoid any delays. A well-organized document ensures that all necessary information is included, reducing the chance of errors or confusion that could slow down the transaction.

How a Structured Document Can Speed Up Transactions

When you provide clients with a clear, easy-to-understand request, they are more likely to pay quickly and without complications. Here’s how a carefully designed document can help expedite the payment process:

- Clarity and Precision: By presenting all necessary details, such as due dates, amounts, and payment methods, you eliminate the need for clients to reach out for clarification, speeding up the process.

- Standardization: Using a consistent format for all your requests makes it easier for clients to recognize your document and process payments faster, as they are already familiar with the layout.

- Quick Reference for Clients: When all relevant information is clearly outlined, clients can quickly find the payment instructions, reducing the chances of missed payments or delays due to misunderstandings.

Key Elements for Fast Payments

To ensure quick and smooth transactions, make sure your financial request form includes the following elements:

- Clear Amount Due: Display the exact amount that is due, including any taxes, discounts, or fees. This eliminates confusion and ensures clients know the exact figure they need to pay.

- Due Date: Clearly state the payment due date to avoid misunderstandings or delayed payments. Clients can prioritize payments when they know exactly when they are due.

- Accepted Payment Methods: Provide detailed instructions on how to submit funds, whether through bank transfer, online portal, or other methods. The easier the process, the faster the payment will be.

- Early Payment Incentives: If applicable, include information about any discounts for early payment. This can motivate clients to settle the balance sooner.

By using a well-structured financi

How to Integrate Payment Methods in Templates

Integrating payment methods into your financial request form is essential for providing clients with multiple ways to settle their balances. Offering various payment options ensures that clients can choose the method most convenient for them, speeding up the transaction process and improving your cash flow. Here’s how you can effectively incorporate different payment options into your documents.

Types of Payment Methods to Include

Choosing the right payment methods to include in your financial request form depends on your business model and the preferences of your clients. Here are the most common methods to consider:

- Bank Transfers: Provide your bank account details, including the account number, sort code, and any other relevant banking information. Make sure to include clear instructions on how clients can initiate the transfer.

- Credit and Debit Cards: If you accept card payments, include a secure online payment gateway link or specify card details clients can use to pay via phone or email. Ensure that the process is simple and secure.

- Online Payment Platforms: Many businesses use platforms like PayPal, Stripe, or other services. Include the necessary payment link or account details for clients to pay directly through their chosen platform.

- Checks: For clients who prefer to send physical payments, provide your mailing address and clear instructions on how to issue a check. Be sure to specify if you require a particular payee name or reference information.

- Cash on Delivery (COD): In cases where goods are delivered in person, cash on delivery might be an option. Specify the terms of COD clearly, including the location and the exact amount due.

Best Practices for Including Payment Information

When incorporating payment methods into your financial request form, consider these best practices to ensure clarity and ease of use for your clients:

- Highlight Key Payment Information: Make sure your payment details are easy to find by placing them in a prominent section of the document. Use bold text or separate payment details into its own section.

- Provide Clear Instructions: Clients should have no trouble understanding how to make a payment. Include step-by-step instructions where necessary, and make sure all details are clear and accurate.

- Include Multiple Options: Whenever possible, offer multiple ways to pay. This will cater to a wider range of clients and help you receive payments more quickly.

- Ensure Security: When dealing with sensitive payment information, ensure that

Free Invoice Payment Templates vs Paid Options

When choosing a document format to request funds from clients, businesses often face the decision between using free or paid options. Both types have their advantages and limitations, and the right choice depends on your specific needs, business size, and transaction volume. Understanding the key differences can help you make an informed decision about which option best suits your requirements.

Comparing Free and Paid Options

Both free and paid formats can help streamline the billing process, but they offer different levels of features, customization, and support. Below is a comparison of the two types to help you evaluate which works best for your business:

Feature Free Options Paid Options Customization Limited customization; often basic designs with few personalizations. Highly customizable, allowing you to tailor the format to your business branding and specific needs. Support Limited or no customer support. You may have to rely on forums or self-help resources. Full customer support, often with dedicated teams available to assist with any issues or questions. Ease of Use Simple and easy to use, but sometimes lacking advanced features that simplify repetitive tasks. More complex but typically offers advanced features like automatic calculations, recurring billing, and integrated payment gateways. Integration May not integrate with other software (accounting, CRM, etc.). Often includes integrations with accounting software, payment processors, and other business tools. Cost Free to use, with no ongoing fees. Requires an upfront cost or subscription fee, but may offer more features and benefits in return. Features Basic functionality such as itemized lists, total due amount, and due date. Advanced features such as automatic reminders, multiple currency support, and tax calculations. Which Option is Right for You?

The choice between free and pa

Legal Considerations for Invoice Templates

When creating financial request forms for your clients, it is essential to understand the legal requirements and implications involved. A well-crafted document not only ensures that you are paid promptly, but it also protects both you and your clients by adhering to relevant laws and regulations. Knowing the legal considerations can help you avoid disputes and ensure compliance with tax rules and contractual obligations.

Key Legal Elements to Include

There are several essential elements that should be included in your financial request form to ensure that it complies with legal standards. These elements help ensure transparency, accuracy, and legality, and can prevent potential issues in the future:

Legal Requirement Explanation Business Information Include your full business name, address, and contact details. This ensures that your client can easily reach you for clarification or issues. Client Information Clearly state the client’s name, address, and any other relevant details to confirm their identity and avoid mistakes or disputes. Unique Identifier Each document should have a unique reference number to make it easier to track and ensure that no request is duplicated. Detailed Breakdown List services or products provided with accurate pricing and quantities to avoid confusion. This is essential for clarity and legal transparency. Due Date and Terms Specify the payment deadline and any applicable terms (e.g., late fees, early discounts), to clarify the agreement and prevent potential legal conflicts. Tax Information Include any applicable taxes, such as VAT, sales tax, or service tax, along with the tax registration number (if required by law). Payment Methods Clearly outline accepted methods for payment and any required bank or online payment details. This ensures a smooth transaction process and reduces potential misunderstandings. Ensuring Legal Compliance

In addition to including the necessary information, it’s important to ensure your documents comply with local, national, and international regulations. Depending on your location, there may be specific laws governing how financial requests should be issued, es

How Invoice Templates Save Time and Money

Using pre-designed financial request forms can significantly streamline the process of billing clients, saving both time and money. By reducing the need for manual creation of documents, businesses can focus on more important tasks, leading to increased efficiency. These standardized documents allow for quick generation, consistent presentation, and fewer errors, which ultimately saves resources in the long run.

Time-Saving Benefits

Time is a valuable resource for any business, and automating the creation of financial documents can free up time for other important activities. Here’s how pre-made forms can help save time:

- Quick Generation: With a ready-made structure, you don’t have to start from scratch each time. Simply fill in the necessary details, and the document is ready to go.

- Consistency: Using a consistent format for all your requests ensures you don’t waste time figuring out how to lay out each document. This consistency also helps clients process your requests faster.

- Reduced Errors: Pre-designed forms help eliminate mistakes, such as missing fields or miscalculations, which often occur when creating documents manually. This ensures faster and smoother processing.

- Easy Editing: Many ready-made documents are editable, allowing you to make minor adjustments quickly and without hassle. Whether it’s adjusting the amount or adding new items, edits are easy to implement.

Cost-Saving Advantages

In addition to saving time, using standardized documents can also save money, especially for small businesses or freelancers. Here’s how:

- Reduced Administrative Costs: By eliminating the need for custom document creation, you reduce administrative overhead. This means fewer resources are spent on document preparation and correction.

- Fewer Mistakes: As mentioned, using a pre-designed form reduces the risk of errors. Fewer errors lead to fewer disputes and follow-up communications, which helps avoid additional costs.

- Faster Processing: When your clients receive clear and professional-looking financial requests, they are more likely to process them promptly. This reduces the likelihood of delays in receiving funds, improving your cash flow.

- Automation: Some pre-designed forms can be integrated with accounting or invoicing software. Automation reduces manual labor and eliminates the need for paid bookkeeping services to create and manage documents.

By using ready-made financial request forms, businesses can significantly cut down on the time

Optimizing Your Invoice Template for Clients

Creating a document that is both clear and user-friendly is essential for fostering positive relationships with your clients. The easier and more professional your financial request forms are to understand, the more likely it is that clients will process them promptly and without confusion. Optimizing your documents not only improves client satisfaction but also enhances your overall workflow by minimizing back-and-forth communications.

To make your request forms as effective as possible, focus on clarity, simplicity, and accuracy. Here are some key strategies to consider when optimizing your documents for clients:

- Keep It Clear and Simple: Avoid clutter and use straightforward language. Ensure that all sections are easy to read, and don’t overwhelm your clients with unnecessary information.

- Organize Information Logically: Group related information together. For example, list services or products separately from payment terms, and make sure totals are clearly distinguished from itemized costs.

- Highlight Key Details: Make sure essential information, like the total amount due and due date, is clearly visible. Use bold text or color to draw attention to these important details.

- Provide Multiple Contact Options: Include a variety of ways your clients can reach you, such as email, phone, or online chat, in case they have questions or need to discuss the request.

- Include Payment Instructions: Make it easy for your clients to pay by including clear instructions on how to submit payment, including account details or links to online portals if applicable.

- Ensure Accuracy: Double-check all information for accuracy before sending it out. Clients will appreciate the attention to detail, and you’ll avoid the need for corrections or disputes later on.

By implementing these strategies, you can make your financial request forms more client-friendly, ensuring that they are not only clear and concise but also professional and easy to process. This can lead to quicker responses, fewer misunderstandings, and stronger client relationships.

Common Errors When Using Invoice Templates

While using pre-designed financial request forms can greatly streamline the billing process, it’s easy to overlook some common pitfalls that may arise. These mistakes can lead to confusion, delayed payments, or even legal issues. Understanding these errors and how to avoid them can help you maintain professionalism and ensure smoother transactions with clients.

Here are some common mistakes to watch out for when creating and sending financial request forms:

- Missing or Incorrect Client Details: Always double-check that the client’s name, contact information, and billing address are correct. Errors in client details can lead to misunderstandings or delayed payments.

- Inaccurate Totals: Failing to properly calculate the total amount due is a common mistake. This can cause confusion or disputes, so always double-check the math and include clear breakdowns of all costs.

- Omitting Payment Terms: Not specifying payment terms clearly–such as due dates, late fees, or accepted methods–can result in delays or missed payments. Make sure these are always included in a visible location.

- Overlooking Tax Information: If applicable, make sure to include any necessary tax details, such as VAT or sales tax. Leaving these out can lead to incorrect payments or legal complications.

- Inconsistent Formatting: Using inconsistent fonts, styles, or layout can make your financial request form appear unprofessional. Stick to a clean, simple design with consistent formatting throughout to ensure clarity and professionalism.

- Unclear Item Descriptions: Always provide detailed descriptions for the goods or services rendered. Vague or ambiguous terms can confuse your clients and delay payments as they may request further clarification.

- Failure to Include Unique Identifiers: Each document should have a unique reference number or code. This helps both you and your client keep track of transactions and avoid confusion when handling multiple requests.

- Not Using a Professional Design: Even if you’re using a free or basic template, a poorly designed form can harm your business’s reputation. Ensure that your document looks professional and is easy to understand at a glance.

By being mindful of these common errors and taking the time to review your financial request forms carefully, you can avoid unnecessary complications and ensure smoother, faster transactions with your clients. A little attention to detail can go a long way in building trust and maintaining professionalism in your business dealings.