Comprehensive Invoice Payment Options Template for Your Business

When managing financial transactions with clients, clear communication of how payments should be made is crucial. Providing your customers with a straightforward method for settling their bills not only ensures smoother operations but also minimizes the chances of errors or delays. A well-designed document outlining the available ways to pay helps establish trust and reliability in your business.

Effective documentation serves as a guide, making it easier for clients to understand the steps required to complete their purchases. It eliminates confusion and sets clear expectations for both parties. Whether you are dealing with local or international customers, offering diverse ways to transfer funds can cater to a wider audience and improve the overall customer experience.

In this section, we’ll explore how to create a robust structure that covers all necessary details. From traditional bank transfers to modern online methods, understanding the various alternatives available can empower your business to streamline financial transactions and maintain positive relationships with clients.

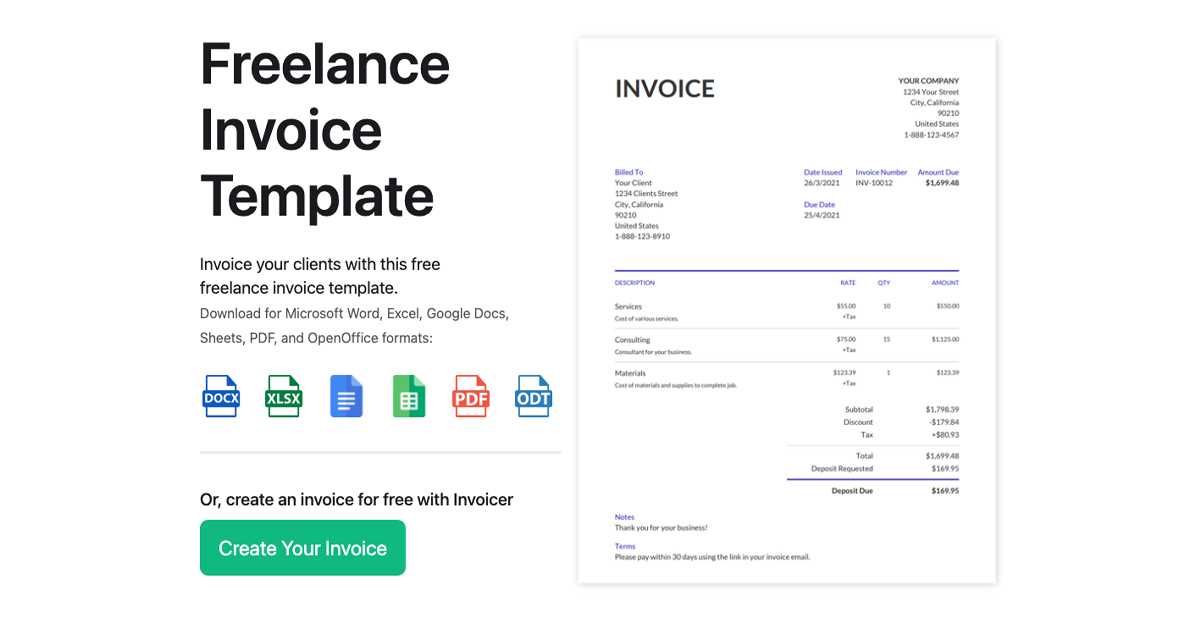

Invoice Payment Options Template Overview

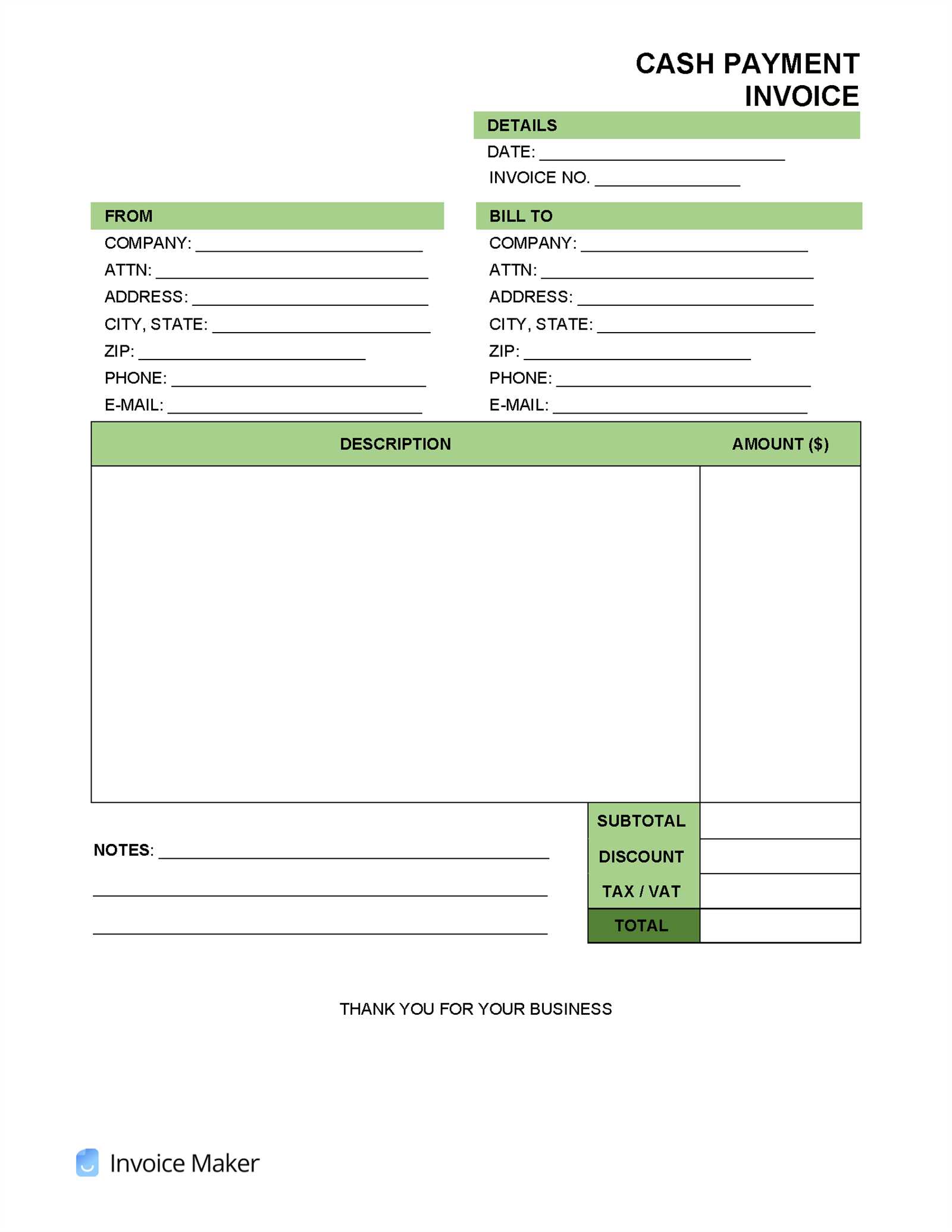

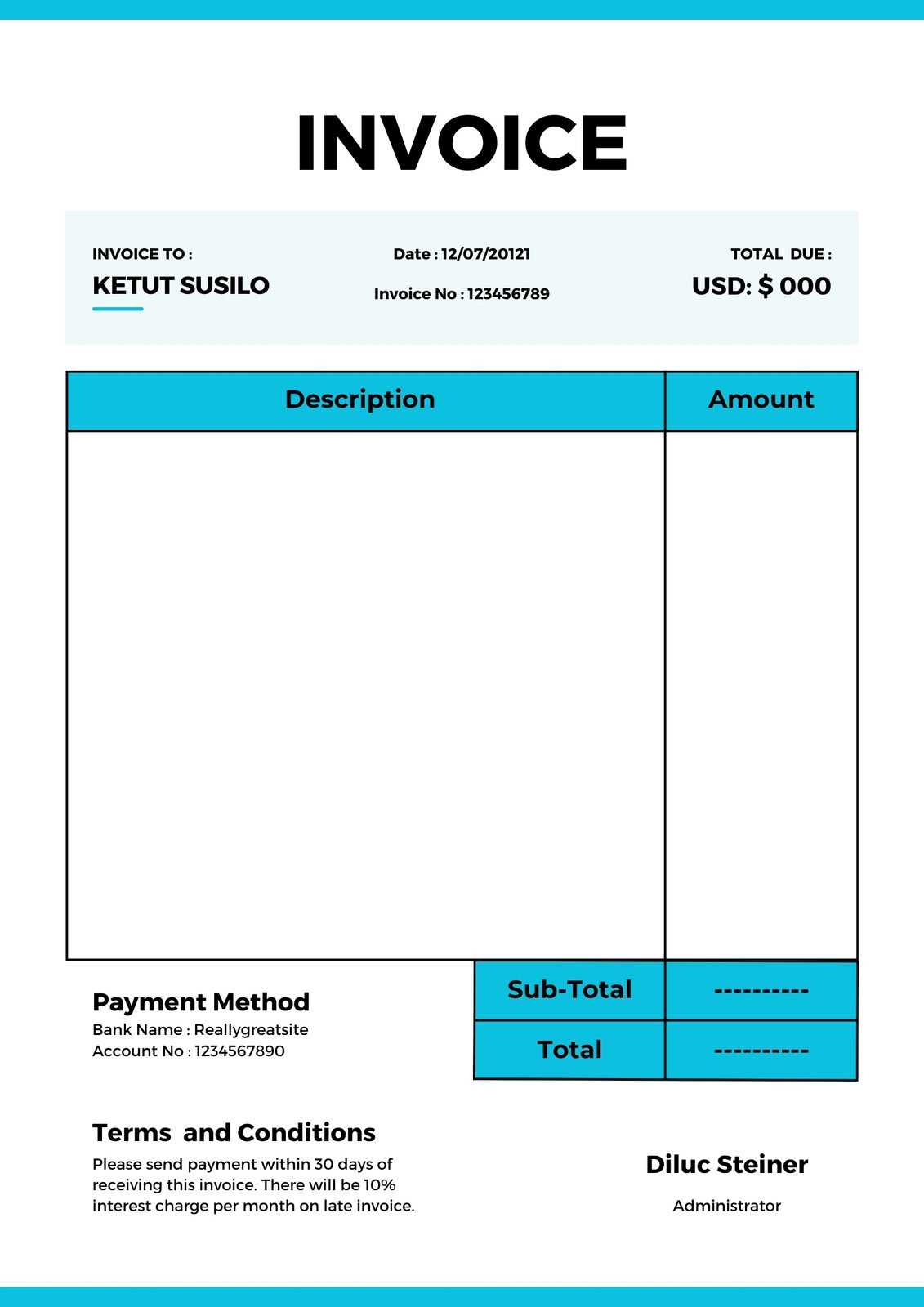

Creating a clear and organized document that outlines the ways in which clients can settle their dues is essential for smooth business transactions. The structure of this document plays a vital role in defining how funds are to be transferred, ensuring that both the business and its customers are on the same page. By providing detailed instructions, a business can avoid confusion and streamline the process.

Key Elements to Include

At a minimum, such a document should specify the methods available for making payments, along with relevant instructions for each. Whether through bank transfers, credit card processing, or online platforms, each method must be clearly explained with the necessary details. Additionally, incorporating terms such as deadlines and any fees associated with certain methods ensures that both parties understand the expectations.

Why Clarity Matters

Having a comprehensive and easy-to-understand outline helps avoid misunderstandings, especially when it comes to how and when funds are expected. A well-designed layout not only saves time but also fosters a sense of professionalism and reliability, which can improve client satisfaction and trust in the long run.

Why Payment Methods Matter for Invoices

Providing clear and varied ways for clients to settle their accounts is crucial for maintaining smooth financial transactions. Different individuals and businesses prefer different methods for transferring funds, and offering flexibility in this area can help ensure timely settlements. When the process is straightforward and convenient, both parties are more likely to have a positive experience.

Having a range of ways to send funds allows businesses to cater to the preferences of their clients, whether they prefer traditional bank transfers, credit card payments, or newer online platforms. This not only facilitates quicker transactions but also improves the chances of receiving the funds on time, as customers are more likely to use a method they are familiar with and comfortable with.

Benefits of Multiple Payment Methods

Here are some key reasons why offering various ways to transfer funds can benefit your business:

| Benefit | Explanation |

|---|---|

| Increased Convenience | Clients can choose the method they are most familiar with, reducing potential barriers to completing the transaction. |

| Faster Settlements | Offering modern online options can speed up the transfer process, leading to quicker cash flow for your business. |

| Wider Client Reach | Different payment methods can attract a more diverse customer base, including international clients who prefer specific platforms. |

| Reduced Risk of Delays | Clear instructions for various payment methods help avoid confusion and delays, ensuring smoother transactions. |

Creating an Effective Payment Options Template

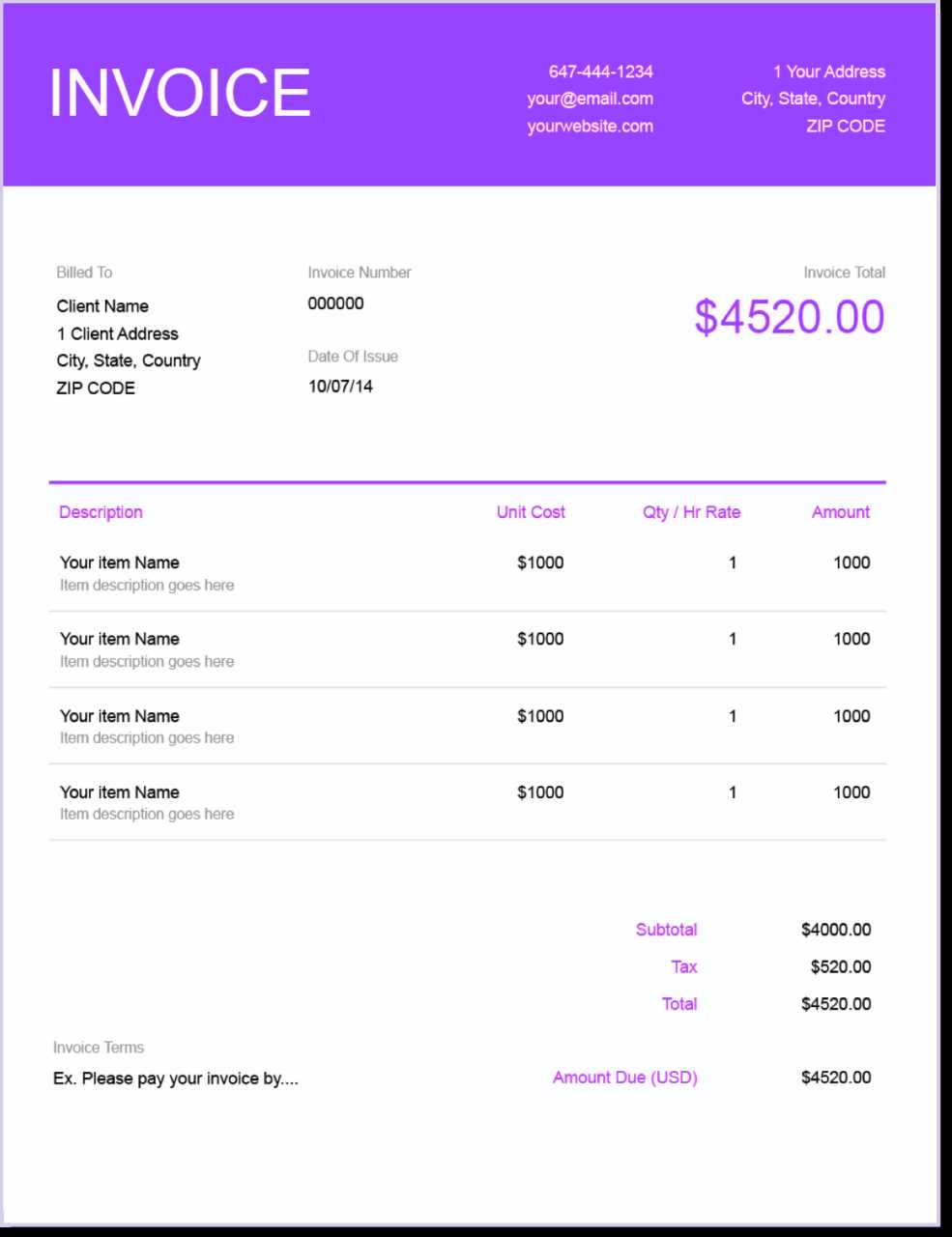

Designing a clear and efficient structure for outlining how clients should complete their transactions is essential for smooth financial operations. An effective document not only lists the available methods for transferring funds but also provides precise instructions that are easy to follow. By organizing the information in a user-friendly manner, businesses can eliminate confusion and ensure prompt payments.

When creating such a document, it is important to consider the following elements to ensure it meets the needs of both your business and your clients:

- Clarity of Instructions: Each method should be described step-by-step, with detailed information on how to use it, including any necessary account details or links.

- Visual Appeal: Organizing information in a clean and professional layout will make it easier for clients to locate the relevant details quickly.

- Flexibility: Offer a variety of methods to suit the preferences of your clients, from traditional bank transfers to modern online services.

- Deadlines and Terms: Clearly state any deadlines for completing the transaction, as well as any additional charges or fees associated with different methods.

Additionally, it’s important to consider how clients access and interact with this document. Here are a few strategies to enhance accessibility:

- Ensure the document is mobile-friendly so clients can view it on different devices.

- Provide contact information for support, in case clients encounter issues while making their transfers.

- Make sure the format is easy to update, allowing you to adjust details as your business evolves.

By following these principles, businesses can create an efficient and straightforward guide that reduces confusion, increases the likelihood of timely settlements, and promotes positive client relationships.

Types of Payment Methods to Include

To ensure a seamless experience for clients, it’s important to offer a variety of methods for transferring funds. By accommodating different preferences, you can help ensure that the process is convenient and efficient for everyone involved. Each method comes with its own advantages, and selecting the right combination will depend on your customer base and business needs.

Traditional Bank Transfers remain one of the most reliable ways to settle debts, especially for larger amounts. Providing your clients with detailed account information, including routing numbers and IBANs, ensures smooth transactions. While this method may take longer to process, it is often favored for its security and familiarity.

Credit and Debit Cards are another popular choice, particularly for smaller transactions. Clients can quickly process transfers through their card providers, often with little to no hassle. This method provides instant confirmation, which can help speed up the overall process. However, it’s important to note that fees may apply, depending on the card type and provider.

Online Payment Platforms such as PayPal, Stripe, and others have gained widespread popularity due to their ease of use. These services allow for fast, secure transfers, often with the added benefit of international compatibility. Many clients prefer these services due to their user-friendly interface and the ability to manage payments directly from their mobile devices.

Cryptocurrency is an emerging method for modern transactions, particularly for international clients. With increasing interest in digital currencies like Bitcoin or Ethereum, offering this option can attract tech-savvy customers. However, businesses should be aware of potential volatility and ensure they have the necessary infrastructure to handle such payments.

By including a variety of methods, businesses can provide flexibility and cater to a wider range of client needs, ultimately making the process smoother and more efficient for both sides.

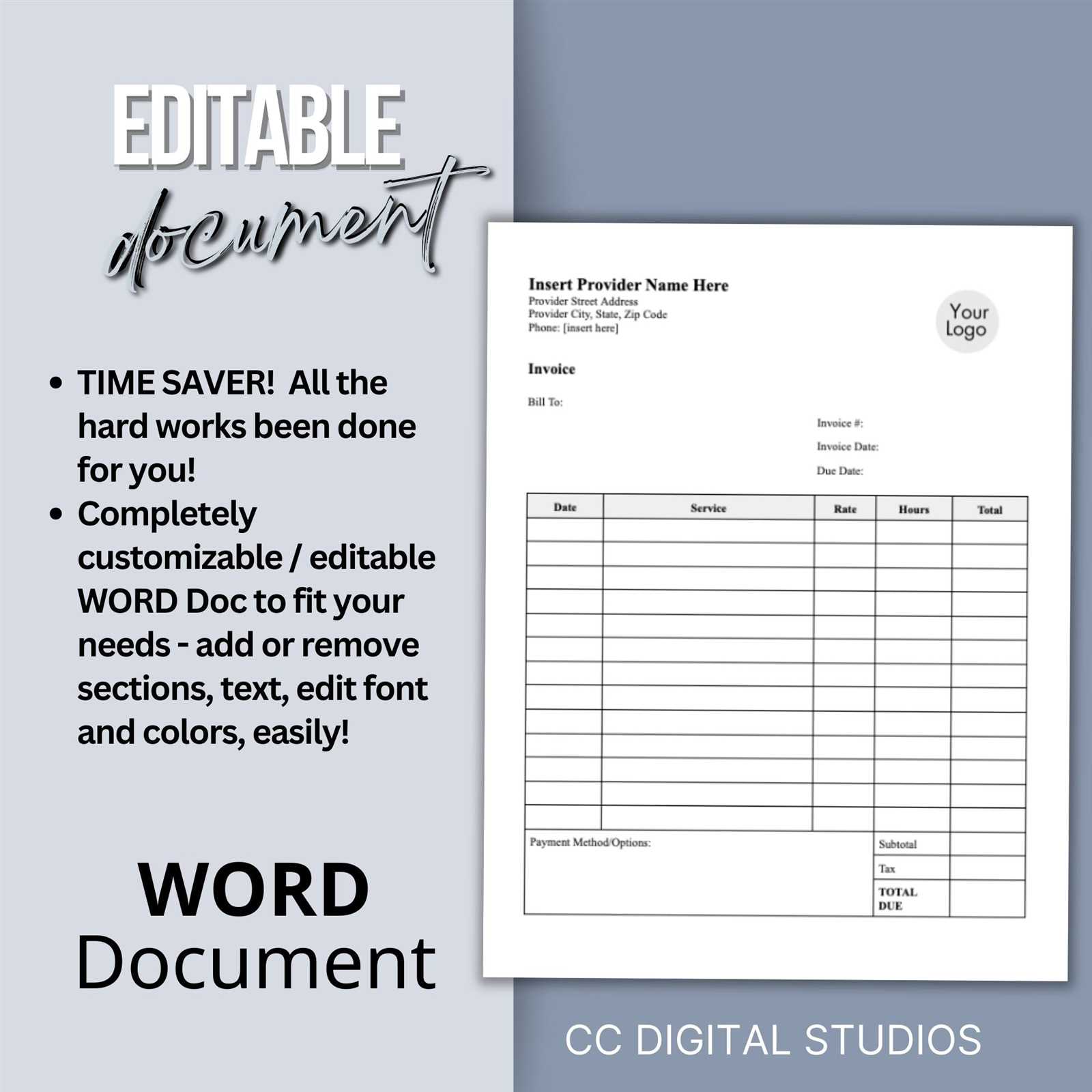

How to Customize Your Invoice Payment Template

Personalizing a document that outlines how clients should complete their transactions can help streamline your business’s operations and enhance customer satisfaction. Tailoring this document to fit your specific business needs not only improves the overall experience for your clients but also reinforces your brand identity. A customized approach allows you to clearly communicate relevant details, such as due dates, available transfer methods, and any additional terms or conditions.

Adding Business-Specific Information

To make the document unique to your company, start by incorporating your business name, logo, and contact details. This ensures clients know exactly who they are dealing with and provides them with a point of contact should any issues arise. Additionally, including your website or a customer service number can provide further convenience for your clients.

Incorporating Clear Instructions

Each method of completing the transaction should be described in simple, easy-to-follow language. Provide all the necessary details, such as account numbers, links to online platforms, or instructions for using digital wallets. Ensure the terms are clearly defined, including any applicable fees or deadlines for completing the transfer. The more specific and concise your instructions are, the less likely clients will encounter confusion or delays.

Consistency is key when customizing these documents. Whether you’re using digital or paper formats, maintaining a consistent style and tone across all communications builds trust with your clients. Choose a clean, readable font and organize the information in a logical flow to improve the document’s usability.

By tailoring this document to your company’s needs and ensuring it’s easy for clients to understand, you can improve overall transaction efficiency and maintain positive business relationships.

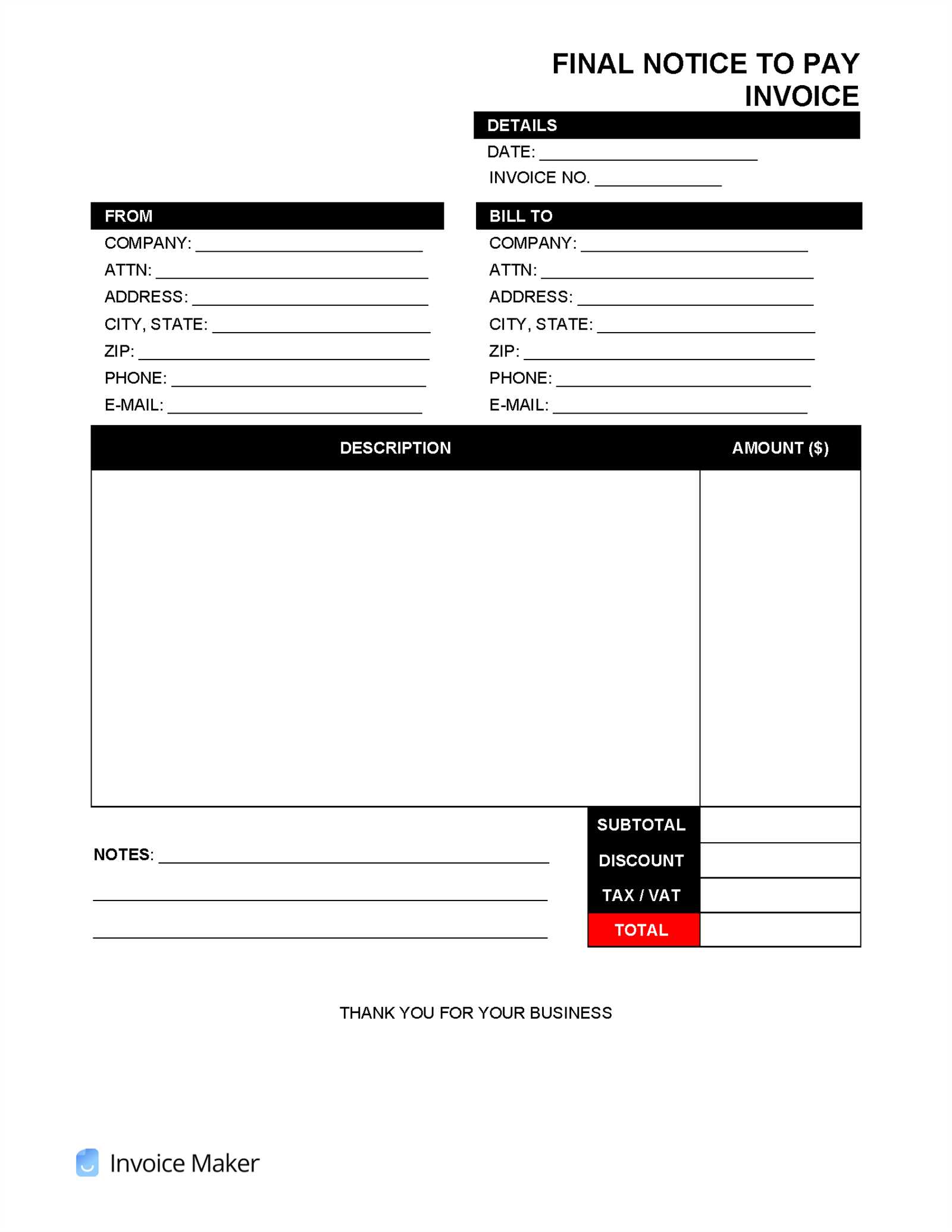

Understanding Payment Terms and Deadlines

Clear and well-defined terms regarding the timing of transfers are crucial for maintaining smooth financial operations. Setting expectations upfront about when funds are due helps avoid confusion and ensures that both parties are aligned. By specifying deadlines and outlining conditions for late payments, businesses can manage cash flow more effectively and reduce the likelihood of delays.

Here are some key elements to consider when defining timing requirements:

- Due Date: Clearly state the exact date by which the transfer should be completed. This helps set clear expectations and encourages prompt action.

- Grace Period: Consider offering a short grace period after the due date for clients who may need additional time. This flexibility can help maintain good relationships.

- Late Fees: Outline any penalties for missed deadlines. These can act as a deterrent for late transfers and provide an incentive for clients to pay on time.

- Payment Frequency: If you’re working with recurring transactions, make it clear when the payments are due each cycle (weekly, monthly, quarterly, etc.).

Setting these terms clearly from the beginning prevents misunderstandings and helps clients plan accordingly. It’s also important to communicate these conditions in a way that is accessible, either within the document itself or as part of your contract. Additionally, consider offering multiple methods to settle accounts within the stated timeframe to make the process easier for your clients.

By addressing these aspects upfront, you create a transparent process that benefits both your business and your clients, ensuring timely transfers and reducing potential disputes.

Integrating Digital Payment Options

In today’s fast-paced business environment, offering digital methods for completing transactions has become essential. Clients increasingly prefer to use modern, secure online platforms to handle their financial dealings. By integrating digital solutions, businesses can simplify the process, increase efficiency, and cater to a broader audience. These platforms not only streamline the process but also enhance convenience for both parties involved.

Online services like PayPal, Stripe, and Square allow customers to complete transfers from the comfort of their computers or mobile devices. These platforms provide an easy, fast, and secure way to handle transactions, often with just a few clicks. By including such methods in your structure, you provide your clients with an efficient alternative to traditional bank transfers.

Security is one of the main reasons for the popularity of digital solutions. With features like encryption and fraud detection, clients can feel confident that their information is safe during the transaction. As an added benefit, these platforms typically offer instant confirmation of completed transfers, allowing for faster processing times and quicker access to funds.

To integrate these digital solutions effectively, make sure to clearly outline how clients can use them in your document. Include any necessary links, instructions, or account details to ensure a seamless experience. Offering a variety of digital platforms, such as credit card processing, e-wallets, or cryptocurrency, allows your clients to choose the most convenient method for their needs.

By incorporating these digital methods, businesses not only meet the needs of modern consumers but also enhance their operational efficiency, contributing to faster cash flow and improved customer satisfaction.

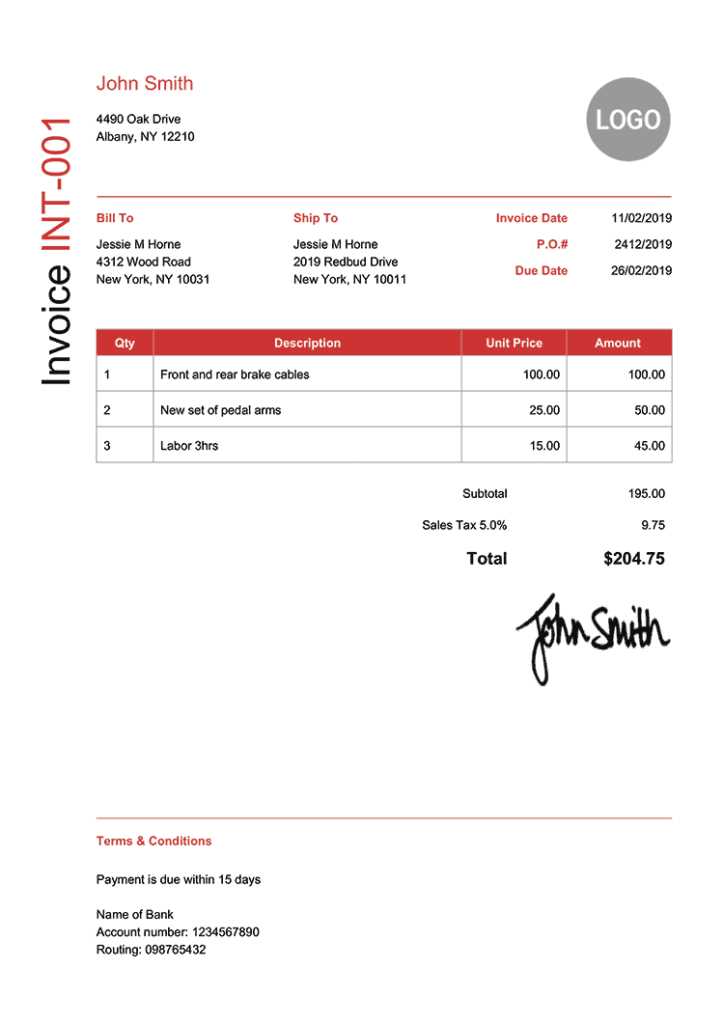

How to Add Bank Transfer Details

Including clear bank transfer information is essential for clients who prefer to settle their balances through traditional methods. Providing accurate and easy-to-follow instructions ensures that funds are sent to the correct account without confusion. The more detailed and organized the information, the smoother the transaction process will be for both parties.

Key Information to Include

When adding bank transfer details, it is crucial to provide all the necessary information for a successful transfer. Here’s what to include:

- Bank Name: The name of the financial institution where the funds should be sent.

- Account Holder Name: The name registered with the account, which should match the business or individual receiving the funds.

- Account Number: The specific account number where the money should be transferred.

- Routing Number / IBAN: For domestic transfers, include the routing number; for international transfers, provide the IBAN or SWIFT code.

- Bank Address: The physical address of the bank branch, if required for international transactions.

- Reference Information: Suggest a reference code or invoice number to ensure the funds are correctly attributed to the transaction.

Formatting and Clarity

To avoid confusion, make sure the bank details are presented in a clear and easy-to-read format. Use bullet points or tables to separate each piece of information, making it simple for your client to follow. Double-check all details to ensure they are correct, as even small errors could lead to delays or misdirected funds.

Providing these essential details will help ensure smooth and timely transfers for clients who prefer bank transactions, reducing the likelihood of errors and misunderstandings.

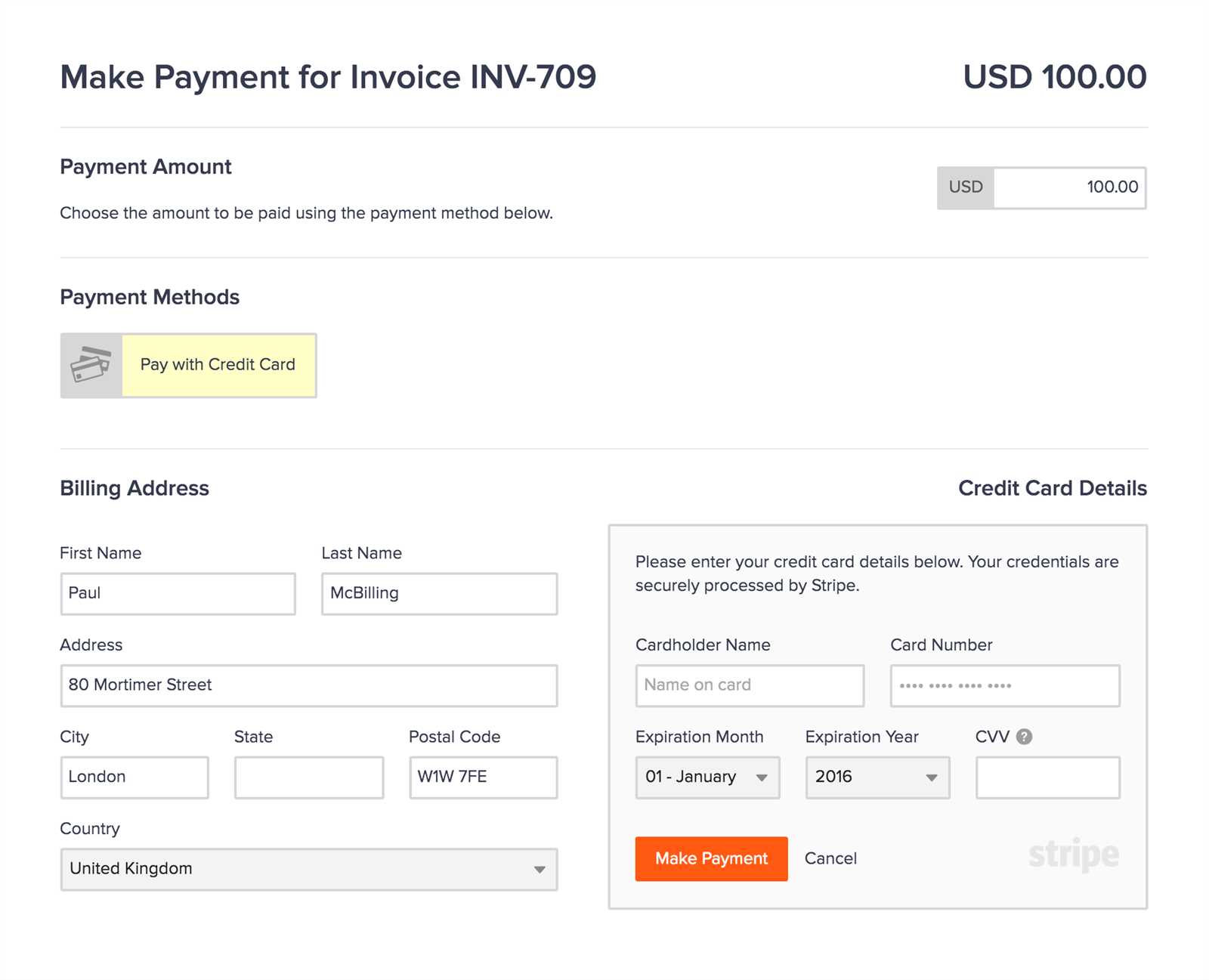

Setting Up Credit Card Payment Instructions

Providing clients with clear instructions for completing a transfer via credit card is essential for ensuring a smooth transaction process. Credit card payments are one of the most widely used methods, thanks to their convenience and security. By offering simple, straightforward guidance, businesses can help clients navigate the process without confusion or unnecessary delays.

Step-by-step instructions are critical when outlining how to complete a transfer through credit card. Clients should know exactly where to input their card details, what fields are required, and any additional verification steps needed to finalize the transaction. Below are key elements to include:

- Credit Card Information: Specify what details are required, such as the card number, expiration date, and CVV code. Clearly state how these should be entered to avoid mistakes.

- Payment Gateway Link: Provide the exact URL or a clickable link that directs clients to the secure portal where the transfer will take place.

- Billing Address: Some platforms require clients to enter their billing address to verify the payment. Include this as part of the instructions.

- Security Measures: Reassure clients about the safety of their data by mentioning encryption and secure processing methods used by your chosen platform.

- Confirmation: Specify that a confirmation message or email will be sent once the transaction has been successfully completed, so clients can be sure their transfer was processed.

Clear communication is key to making credit card transactions as simple as possible. Ensure that all the necessary information is presented in a well-organized format, so clients can quickly follow the steps without any confusion. Additionally, consider offering multiple credit card platforms (e.g., Visa, MasterCard, American Express) to cater to the preferences of your diverse client base.

By providing easy-to-follow and detailed credit card transaction instructions, you can facilitate faster and more efficient transfers, which leads to a better overall experience for your clients.

Including PayPal as a Payment Option

Integrating PayPal into your list of available transfer methods can significantly enhance the convenience and flexibility for your clients. With millions of active users worldwide, PayPal is one of the most trusted and widely used online platforms. Including it as a payment method can make the transaction process faster, easier, and more secure for both you and your clients.

Here are key points to consider when adding PayPal to your list of available methods:

- Account Setup: Ensure you have a PayPal business account set up to accept funds. This will allow you to receive payments directly to your PayPal balance or linked bank account.

- Payment Link: Provide a direct link to your PayPal account where clients can complete the transaction. You can also generate a “Pay Now” button to make the process even more user-friendly.

- Currency Compatibility: PayPal supports multiple currencies, which is useful for international clients. Make sure to specify which currencies you accept if applicable.

- Transaction Fees: Be transparent about any fees associated with using PayPal, whether they are fixed or percentage-based, so that clients are fully aware of the costs involved.

- Security and Protection: Highlight the security features that PayPal offers, such as fraud protection and data encryption, to give your clients peace of mind when making the transfer.

By offering PayPal as an option, you provide a quick and secure way for your clients to settle their accounts. Whether for local or international transactions, this method’s accessibility and reliability can help improve client satisfaction and speed up your cash flow.

What to Consider for International Payments

When dealing with clients from different countries, it’s important to account for the unique challenges and considerations that come with cross-border transactions. Differences in currencies, payment methods, and even time zones can affect the process. Properly addressing these factors ensures a smoother experience and helps avoid delays or confusion. Understanding the specific requirements for international transfers can improve both efficiency and client satisfaction.

Key Considerations for Global Transfers

Here are some important aspects to take into account when setting up international payment methods:

- Currency Conversion: Make sure you specify which currencies are accepted and provide accurate conversion rates, if applicable. This avoids any misunderstanding regarding the amount due.

- Transaction Fees: International transfers often come with additional fees, such as currency exchange fees or international transaction charges. Be transparent with your clients about these costs.

- Time Zones: Consider the time zone differences when setting due dates or deadlines. International transfers may take longer depending on when the transaction is initiated in different regions.

- Payment Methods: Ensure the payment methods you offer are widely accessible in the regions where your clients are based. Some methods may be more popular in certain countries than others.

- Bank Details: Provide complete and accurate bank account information for international transactions, including SWIFT/BIC codes and IBANs, to ensure funds are transferred without error.

Common Fees for International Transfers

When processing cross-border transactions, several fees may apply. The following table highlights some of the common charges associated with international transfers:

| Fee Type | Description | Possible Cost | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Currency Conversion | Fees for converting one currency into another during the transfer process. | Varies by currency and platform; typically 1-3% of the total amount. | ||||||||||||||||

| Transaction Fees | Charges applied by banks or payment providers for processing cross-border transfers. | Can range from $10 to $50, depending on the method and country. | ||||||||||||||||

Recipient Bank

Managing Recurring Invoice PaymentsHandling regular payments for ongoing services or subscriptions can be a challenge if not properly organized. Ensuring that your clients are billed consistently and on time is essential for maintaining a steady cash flow. By automating and streamlining the process, businesses can save time and reduce the risk of missed or late transfers. Clear communication and proper setup are key to ensuring a smooth experience for both you and your clients. Automating the Process is one of the most efficient ways to manage recurring transactions. By setting up automatic billing cycles, you eliminate the need for manual invoicing each period. Many online platforms and payment processors offer features that automatically charge clients on the agreed date, whether that’s weekly, monthly, or annually. This ensures that payments are made on time without requiring intervention from either party. Setting Clear Terms is crucial to avoid confusion later. Be sure to specify the duration of the recurring arrangement, the amount to be transferred, and the frequency of payments. Also, include any terms related to cancellations or changes to the payment schedule. If there are fees or adjustments, make them clear upfront to prevent disputes down the line. Communication with Clients is another key factor. Keep your clients informed about upcoming charges and any changes to their billing schedule. Sending reminder emails before each transaction can help avoid missed payments and provide transparency. Additionally, give clients an easy way to update their payment details or pause the arrangement if necessary. By automating and managing recurring payments effectively, businesses can ensure they maintain a steady cash flow while offering convenience to their clients. This approach not only saves time but also reduces errors and the likelihood of delayed transactions. Common Mistakes in Payment Option Templates

Even with the best intentions, errors can occur when setting up financial instructions for clients. These mistakes can lead to confusion, delays, and potential disputes. To ensure smooth transactions and a positive experience for all parties, it’s essential to be aware of the common pitfalls in structuring your payment details. Addressing these errors beforehand can save time and effort in the long run. Here are some common mistakes to watch out for when providing your payment instructions:

By carefully reviewing and double-checking these aspects, you can avoid many common mistakes and ensure that your clients can easily and efficiently complete the transfer process. Clear, concise, and accurate instructions not only minimize errors but also help establish trust and professionalism in your business dealings. Best Practices for Clear Payment Instructions

Providing your clients with clear, straightforward instructions is essential to ensure that financial transactions are completed without confusion or delay. Well-structured and easily understandable guidelines not only reduce errors but also foster trust and professionalism in your business. When drafting these instructions, it is important to focus on simplicity, accuracy, and accessibility to meet the needs of all customers. Use Simple Language – Avoid jargon or overly technical terms that might confuse your clients. Keep your instructions concise and easy to follow, using clear, everyday language. Be specific about the steps involved, but avoid unnecessary complexity. Provide Step-by-Step Guidance – Break down the process into manageable steps, especially for clients who may not be familiar with the method you’re offering. Using bullet points or numbered lists helps make the instructions more digestible and ensures nothing is overlooked. Highlight Key Information – Important details, such as account numbers, deadlines, or security codes, should be clearly marked and easy to find. Consider using bold or italics to make critical information stand out, but be careful not to overdo it. Offer Multiple Methods – Where possible, give your clients more than one way to make a transfer. This flexibility allows them to choose the method they’re most comfortable with, improving the likelihood that the transaction will be completed successfully. Be Transparent About Fees – Any additional charges, such as transaction fees, should be communicated upfront. Clients appreciate knowing what to expect before initiating the transfer, which helps avoid any surprise costs later on. Include Contact Information – Ensure that clients have access to support in case they encounter any issues or have questions. Provide clear contact details, such as an email address or phone number, to help resolve any problems quickly. Double-Check for Accuracy – Before sending out your instructions, review them thoroughly to ensure that all the details are correct. Small mistakes, such as incorrect account numbers or missing links, can lead to delays or failed transactions. By following these best practices, you can create clear, concise, and effective guidelines that make it easy for your clients to complete their transactions accurately and on time, enhancing their overall experience with your business. How to Handle Late Payments in TemplatesDealing with overdue transfers is an inevitable part of running a business. Late payments can disrupt cash flow and create unnecessary stress, but by establishing clear guidelines and protocols, you can address the issue effectively while maintaining positive client relationships. It’s essential to outline the steps for managing delays and ensuring that your clients understand their responsibilities. Set Clear Terms – Clearly define the expected due dates in your documents and outline the consequences of failing to meet them. By stating the timeline up front, you set the expectation for timely completion, which can help prevent delays from occurring in the first place. Include a Grace Period – Offering a short grace period can help accommodate clients who may face occasional delays. This shows flexibility and understanding without sacrificing your business’s financial health. Clearly state the duration of the grace period and the penalties for exceeding it. Apply Late Fees – Implementing a late fee is a common practice to encourage prompt transfers. Ensure that the fee is reasonable and clearly communicated beforehand. Specify the fee structure, whether it’s a flat rate or a percentage of the amount due, and include it in your documents to avoid confusion. Send Gentle Reminders – A polite reminder can be an effective way to nudge clients who may have simply forgotten about the due date. Be tactful in your communication and offer assistance if they encounter any issues completing the transaction. You might want to send reminders at different stages: a few days before the due date and then again if the payment is overdue. Offer Payment Plans – If a client is facing financial difficulties, offering a structured payment plan can help them fulfill their obligation without causing strain. Provide clear terms for how the installments will be processed, including the frequency and amounts of each payment. Communicate Professionally – When following up on overdue transfers, maintain a professional and respectful tone. Avoid sounding accusatory, as this could damage your relationship with the client. A polite, solution-oriented approach is more likely to encourage prompt action. By proactively addressing late payments and making expectations clear, you can maintain healthy cash flow and avoid friction with clients. Implementing these practices in your procedures ensures that both you and your clients are on the same page when it comes to financial responsibilities. Security Considerations for Payment Methods

When handling financial transactions, ensuring the security of sensitive data is paramount. Both businesses and clients must be confident that their information will be protected from fraud, theft, or unauthorized access. Properly securing transfer details and choosing trustworthy platforms are essential steps in minimizing risks. By following best practices and adopting secure systems, you can safeguard both your business and your clients. Key Security Considerations include the following:

Compliance with Legal Standards is another important consideration. Ensure that your business is compliant with all relevant regulations such as GDPR (General Data Protection Regulation) and PCI-DSS (Payment Card Industry Data Security Standard). This will help protect both you and your clients legally and prevent potential fines or penalties. By implementing these security practices, you can greatly reduce the risk of financial fraud and d Ensuring Mobile-Friendly Payment Options

In today’s digital age, an increasing number of customers are making financial transactions directly from their mobile devices. Ensuring that your systems are optimized for mobile use is essential for providing a seamless user experience. If your transaction methods are difficult to navigate or process on smartphones or tablets, you may risk losing potential clients. Making the process mobile-friendly not only boosts convenience for your customers but also enhances your business’s accessibility and efficiency. Designing for Mobile UsabilitySimplify the Process: Mobile users often expect quick, easy transactions. Therefore, minimizing the number of steps required to complete a transfer is crucial. Keep forms short and only request necessary information. Use large buttons and clear instructions to guide users through the process. Optimize for Small Screens: Ensure that your payment platform is fully responsive, meaning it adjusts seamlessly to different screen sizes. This ensures that users on smaller devices don’t have to zoom in or scroll horizontally to enter details or navigate the process. Choosing the Right Tools for Mobile PaymentsMobile-Optimized Payment Gateways: When selecting a payment processor, make sure it offers mobile-optimized features. Platforms like Apple Pay, Google Wallet, or other mobile-friendly payment methods can provide clients with a faster, more secure checkout experience. Test Across Devices: It’s important to test your payment system on a variety of mobile devices and browsers to ensure compatibility. Make adjustments as needed to address any issues with functionality or layout. By focusing on a smooth, responsive design and choosing the right tools, you can ensure your financial systems are convenient and easy to use for customers on the go. Mobile-friendly options are not only crucial for customer satisfaction but also for staying competitive in an increasingly mobile-first world. Final Thoughts on Payment Template DesignDesigning clear, user-friendly financial documents is crucial to ensuring smooth transactions and fostering positive client relationships. A well-organized structure not only makes it easier for customers to understand how to complete their transactions, but it also enhances the professionalism of your business. By focusing on simplicity, transparency, and flexibility, you can create a system that works for both your clients and your business needs. Key Elements of Effective DesignClarity and Simplicity: Avoid clutter and complicated instructions. Ensure that all necessary details, such as amounts, due dates, and methods, are clearly displayed. Use headings and bullet points to break up information and make it easy to follow. Consistency: Maintain consistency in the layout, fonts, and colors across all documents and communications. This helps to create a professional and cohesive look that clients can easily recognize and trust. Flexibility and AccessibilityMultiple Methods: Offering a variety of ways to make transfers can accommodate different client preferences. Whether it’s bank transfers, credit cards, or digital wallets, providing options ensures that clients can choose what’s most convenient for them. Mobile-Friendly Design: With more users accessing financial systems through smartphones, it’s essential to ensure that your documents and processes are optimized for mobile use. A mobile-friendly design improves user experience and helps prevent potential issues with accessibility. Ultimately, the goal of any financial document design is to make the process of completing a transaction as simple and seamless as possible. By taking the time to carefully design these documents, you’re not just ensuring that the transaction goes smoothly, but also building trust with your clients and creating a positive experience that encourages future business. |