Invoice Paid in Full Template for Easy Tracking

When conducting business transactions, keeping accurate records of completed payments is essential for both parties. A well-organized method of documenting that a transaction has been settled can prevent misunderstandings and offer clear proof of payment. Having a consistent approach to confirming and tracking such settlements ensures smooth operations and maintains professional credibility.

There are various methods available to confirm that a debt has been cleared, but using a standardized document is one of the most efficient and reliable options. This document provides not only the necessary proof but also a formal acknowledgment that the amount due has been received in its entirety. It serves as a reference for both the payer and the recipient, ensuring that no future disputes arise regarding the status of the financial transaction.

In this guide, we will explore how to create and customize such documents, highlighting essential details that must be included. Whether you’re a freelancer, a small business owner, or managing large-scale operations, understanding how to structure and use this confirmation can save time and improve your record-keeping practices.

Invoice Paid in Full Template Overview

When a financial obligation has been settled, it’s important to document this clearly and professionally. A document confirming that all amounts owed have been received in their entirety provides assurance to both parties involved. This form not only serves as proof of payment but also helps maintain accurate records for accounting and future reference.

The document serves as a formal acknowledgment of completion, ensuring transparency and reducing the chances of any misunderstandings. Whether you’re dealing with a one-time transaction or part of an ongoing business relationship, having a structured form to confirm the settlement of a debt is essential for effective financial management.

In this section, we will discuss how to structure such a document, key components to include, and how it can benefit both businesses and individuals in keeping their financial records clear and up-to-date.

Why You Need a Payment Confirmation

Ensuring that both parties involved in a financial exchange have clear documentation of a completed transaction is crucial. A record of the settlement not only helps to avoid confusion but also provides a formal acknowledgment that all obligations have been fulfilled. This is especially important for businesses and individuals who need reliable proof for accounting, legal, or tax purposes.

Without a confirmation document, there may be disputes about whether an amount has been settled, which can lead to misunderstandings and administrative errors. This simple yet essential record can safeguard both the payer and the recipient by offering undeniable proof of transaction completion.

The following table outlines some key reasons why having a confirmation is important:

| Reason | Explanation |

|---|---|

| Legal Protection | Provides evidence in case of disputes or legal inquiries. |

| Financial Tracking | Helps keep accurate records for tax reporting and budgeting. |

| Professionalism | Shows that the transaction was handled formally and with care. |

| Prevents Errors | Reduces the risk of double payments or missed transactions. |

| Client Trust | Builds confidence with customers by ensuring transparency. |

Benefits of Using a Template

Using a standardized form to confirm the completion of a financial transaction offers several advantages for both individuals and businesses. By relying on a consistent format, you ensure that all essential details are included, reducing the chance of errors and making the process more efficient. This approach simplifies record-keeping and makes it easier to manage multiple transactions over time.

Time-Saving Efficiency

A ready-made document allows for quick customization and immediate use, saving time compared to creating a new record from scratch every time. With predefined fields, all you need to do is input the relevant information, which speeds up the process significantly. This efficiency is especially valuable when managing high volumes of transactions.

Professionalism and Accuracy

Using a structured format demonstrates professionalism and attention to detail. A well-designed document shows that you take your financial responsibilities seriously, enhancing your reputation with clients and partners. Furthermore, a consistent format helps ensure that no important information is omitted, making the record more reliable and precise.

In summary, relying on a standardized format not only streamlines the process but also helps maintain a high level of organization and professionalism, which is essential for effective financial management.

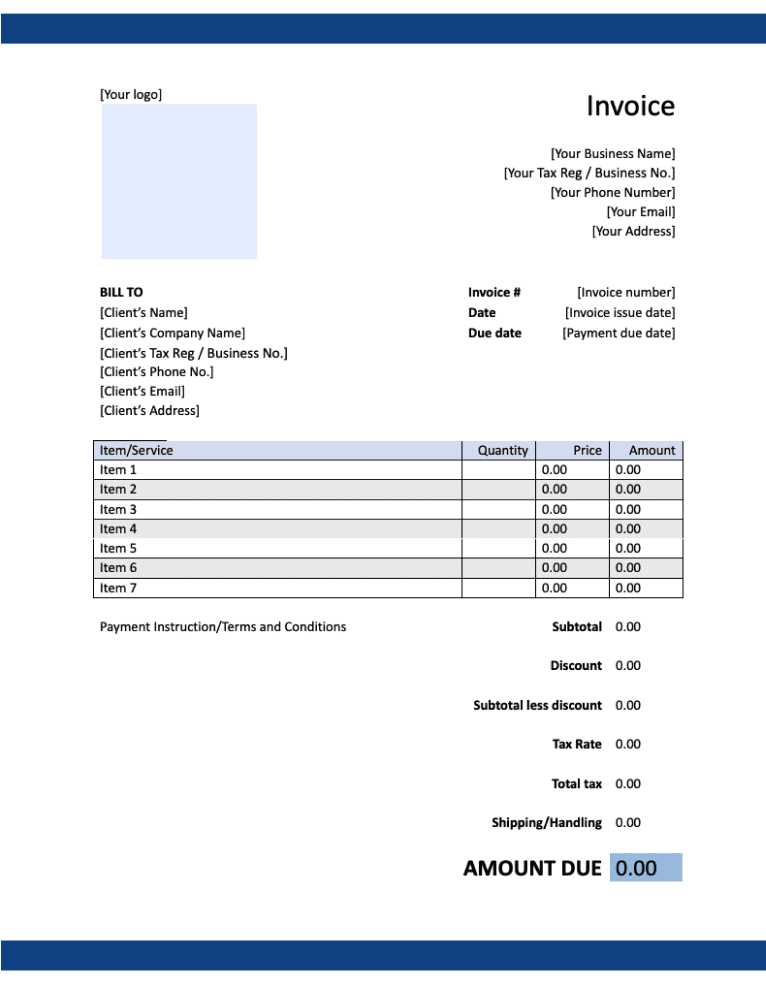

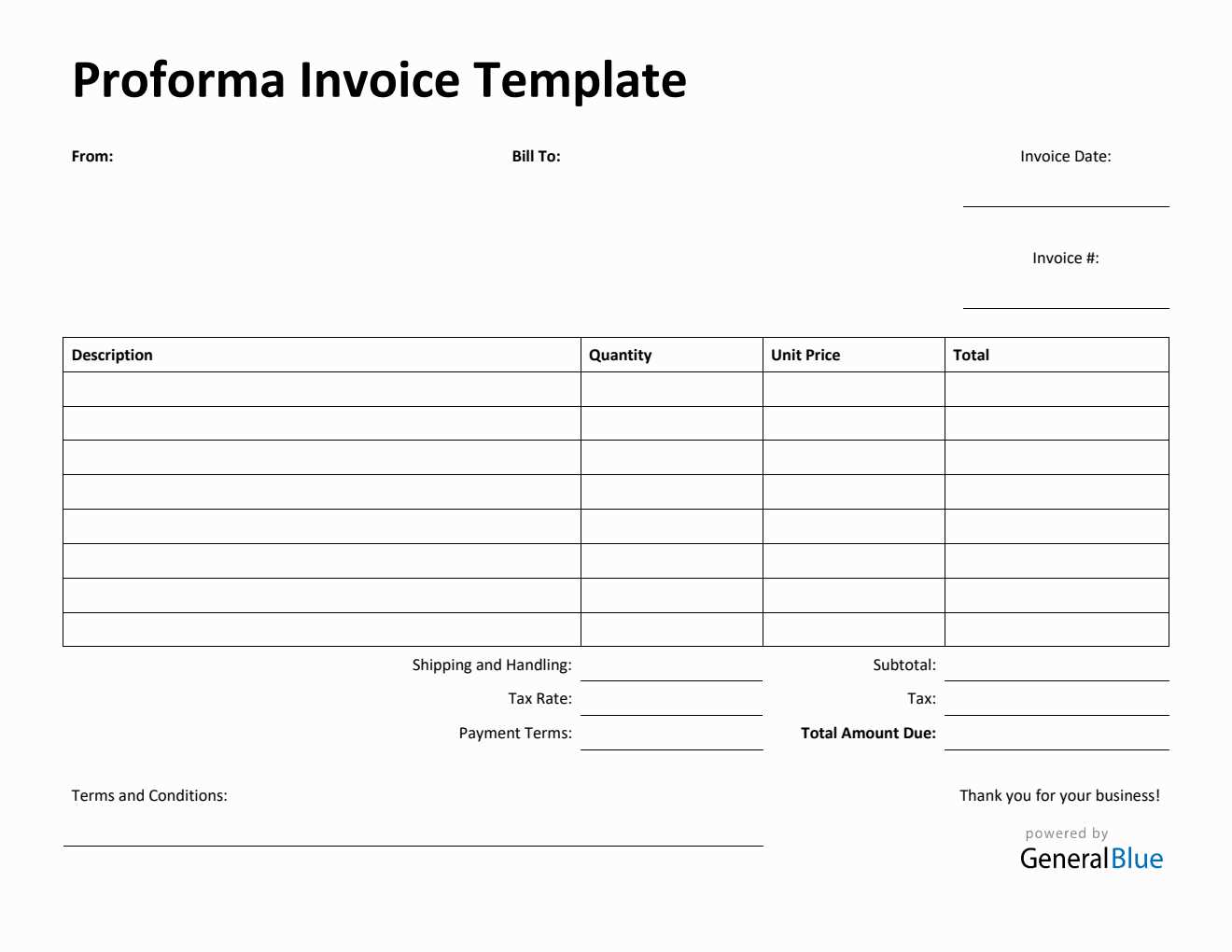

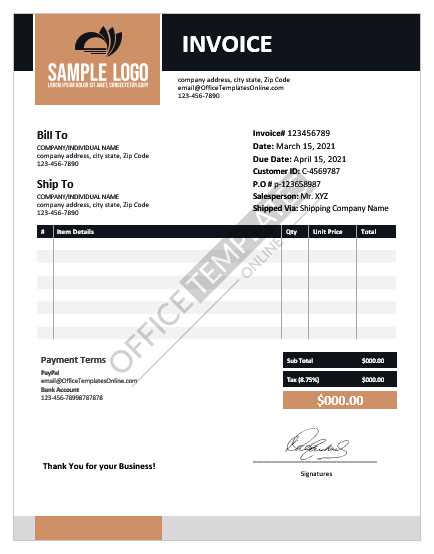

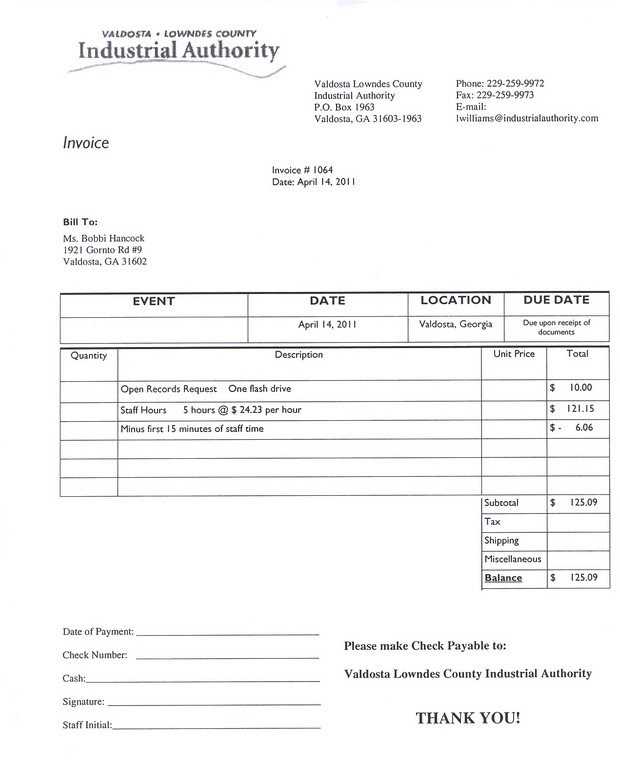

How to Create an Invoice Template

Creating a standardized document to confirm that a financial obligation has been settled is a simple yet effective way to manage transactions. By designing a form that includes all necessary details in a clear and organized manner, you ensure that the process is efficient and professional. This type of record can be reused for future transactions, helping maintain consistency across your business dealings.

Step 1: Define Key Information

To start, make sure that your document includes all essential elements. At a minimum, it should contain the recipient’s and payer’s names, the amount settled, the date of the transaction, and any reference numbers. Additionally, clearly state that the debt has been cleared in full, ensuring no ambiguity regarding the payment status.

Step 2: Design a Structured Format

The format should be clean and easy to navigate. Divide the document into sections for each key piece of information, such as the payer’s details, transaction amount, and settlement confirmation. Using bold headings and clear labels for each section can make the document easier to read and more professional in appearance. You can either design it manually or use software tools to help structure the layout.

In conclusion, creating a well-structured confirmation form ensures clarity, reduces errors, and boosts professionalism in your business transactions. Once the document is created, it can be reused as needed, saving time and effort in the long run.

Key Information to Include in the Template

When creating a formal document to confirm the completion of a financial transaction, it’s important to include all relevant details to avoid confusion and ensure clarity. These key pieces of information help both the payer and the recipient understand the status of the transaction and can serve as an official record for future reference.

The following are the essential elements to include in the document:

- Transaction Date: The date when the payment was completed or received.

- Amount Settled: The exact sum that has been paid, ensuring it matches the agreed-upon amount.

- Payer’s Details: The name, contact information, and relevant identifiers of the person or entity making the payment.

- Recipient’s Details: The name and contact information of the entity receiving the payment.

- Reference Number: Any invoice or order number associated with the transaction for easy tracking.

- Transaction Method: Specify the method of payment, such as credit card, bank transfer, or cash.

- Statement of Completion: A clear statement indicating that the amount has been fully settled, with no remaining balance.

Including these key elements ensures the document is comprehensive and professional, providing both parties with the necessary proof of the transaction’s completion.

Best Practices for Tracking Payments

Effectively monitoring and recording financial transactions is essential for maintaining organized and accurate business records. By using consistent methods and tools, you can ensure that all payments are tracked correctly, minimizing the risk of errors and discrepancies. Implementing best practices helps streamline your financial processes, making it easier to stay on top of your business’s financial health.

Using Digital Tools for Tracking

One of the most effective ways to track payments is by utilizing digital tools such as accounting software or spreadsheets. These tools can automate calculations, generate reports, and reduce the likelihood of manual errors. By inputting payment data into a reliable system, you ensure accuracy and save time on administrative tasks.

Regularly Reconciling Records

It’s crucial to reconcile payment records regularly to ensure that all payments have been accurately recorded. This includes matching payments with corresponding invoices and bank statements. Regular reconciliation helps identify any discrepancies early, preventing issues from accumulating over time.

The following table highlights some of the best practices for tracking payments:

| Best Practice | Benefit |

|---|---|

| Automated Tracking Tools | Reduces manual errors and saves time. |

| Frequent Reconciliation | Ensures records are up to date and accurate. |

| Clear Payment References | Helps link payments to specific transactions for easy tracking. |

| Detailed Record Keeping | Improves transparency and makes audits easier. |

By following these best practices, you can ensure that your payment tracking system is efficient, accurate, and reliable, helping you maintain strong financial oversight for your business.

Choosing the Right Template for Your Business

When selecting a document to confirm the completion of financial transactions, it’s important to choose one that aligns with the needs and style of your business. The right form can help streamline your workflow, maintain consistency, and present a professional image to your clients. Different types of businesses may require specific elements or layouts, so understanding your needs is key to making the best choice.

Consider Your Business Type

The structure of the document should reflect the nature of your business. For example, if you run a service-based business, you may want to include sections for service descriptions, while product-based businesses may need more detailed pricing breakdowns. Think about the specific information that your clients need and how the document can best communicate that information in a clear and organized manner.

Customization and Flexibility

It’s essential to choose a document that can be easily customized to fit different situations. Whether you need to adjust for varying payment amounts, multiple services, or different clients, flexibility is key. A customizable form allows you to quickly update or adapt the document for new transactions, ensuring consistency without the need to redesign each time.

In conclusion, choosing the right format involves understanding both your business needs and the expectations of your clients. With the right document in place, you can ensure professionalism, efficiency, and a smooth transaction process every time.

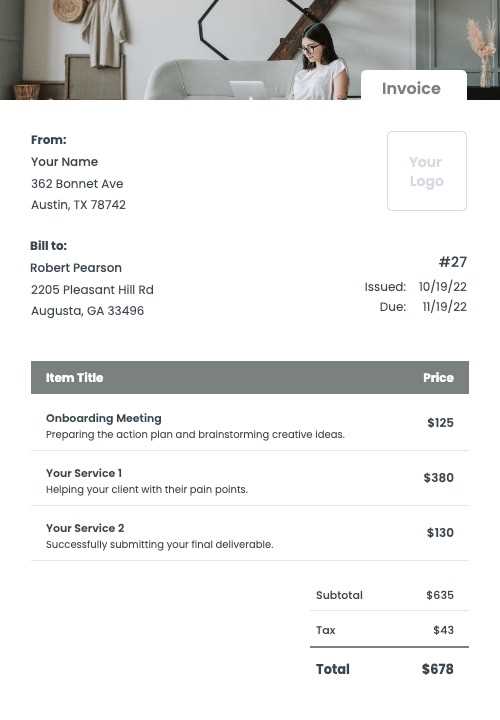

Customizing Your Paid Invoice Template

Customizing your document to reflect the unique needs of your business helps ensure clarity and professionalism in every transaction. A well-tailored record not only enhances your company’s image but also makes it easier for your clients to understand the terms of the completed payment. By adjusting the layout and content, you can create a document that fits seamlessly with your brand and business practices.

One of the most important aspects of customization is adding your business’s logo, contact information, and any relevant terms or conditions that clients need to be aware of. This personal touch not only helps in branding but also ensures that your clients always know who to contact for any future inquiries.

Key Elements to Customize:

- Business Information: Include your logo, address, phone number, and email to ensure clients can easily reach you.

- Payment Terms: Specify terms such as the payment due date, any applicable late fees, and accepted payment methods.

- Transaction Description: Customize sections for itemized services or products, including a brief description and pricing details for transparency.

- Design and Branding: Match the colors and fonts of your document to your company’s branding guidelines for consistency and professionalism.

By customizing your payment confirmation document, you create a clear, professional, and personalized experience for your clients, ultimately helping to improve communication and trust in your business dealings.

Common Mistakes to Avoid with Templates

When using standardized forms for documenting completed financial transactions, it’s easy to make mistakes that could lead to confusion or misunderstandings. Common errors often arise from overlooking key details or failing to personalize the document appropriately. Avoiding these pitfalls can ensure that your forms remain clear, professional, and legally sound.

The following table outlines some of the most frequent mistakes and tips for avoiding them:

| Mistake | How to Avoid It |

|---|---|

| Missing Important Details | Ensure all necessary fields, such as payer details, payment method, and confirmation statement, are included. |

| Using an Inconsistent Format | Stick to a consistent layout for all documents to maintain professionalism and clarity. |

| Incorrect Payment Information | Double-check the payment amount and method to ensure the information is accurate. |

| Overly Complex Language | Use simple, straightforward language to avoid confusion, especially for clients who may not be familiar with financial terminology. |

| Failing to Update Templates | Regularly review and update your forms to reflect any changes in business information or payment policies. |

By being aware of these common mistakes, you can create documents that are not only professional but also easy to understand, ensuring smooth transactions and clear communication with clients.

How a Template Improves Professionalism

Using a standardized form to confirm completed transactions enhances the professional image of your business. It ensures consistency, clarity, and a polished appearance in every communication with your clients. A well-structured document reflects your attention to detail and your commitment to providing a high level of service, which can help build trust and credibility.

A customized document can be tailored to match your brand, providing a professional look that reinforces your company’s identity. Additionally, it helps streamline your workflow by reducing errors and providing a clear, organized presentation of the information. By adopting this approach, you are also setting clear expectations for your clients, which can lead to more efficient business interactions.

Benefits of Using a Standardized Document:

- Consistency: Ensures that all clients receive the same high-quality communication and documentation.

- Clarity: Presents all information in an easy-to-read format, minimizing confusion.

- Branding: Reinforces your business identity with consistent use of logos, fonts, and colors.

- Efficiency: Speeds up the process by eliminating the need to create documents from scratch each time.

- Professionalism: Demonstrates your attention to detail and commitment to providing excellent service.

By utilizing a standardized document, you not only improve the efficiency of your transactions but also enhance your company’s image, helping to foster stronger relationships with your clients and making a lasting impression of reliability and professionalism.

Tracking Partial vs Full Payments

Managing payments effectively requires tracking both partial and complete transactions to ensure accurate records and timely follow-ups. Differentiating between these two types of payments helps businesses monitor their cash flow and maintain clear communication with clients. Knowing when a payment is partially received versus fully completed allows for better financial planning and prevents misunderstandings.

Handling Partial Payments

Partial payments occur when a client pays only a portion of the total amount owed. It’s essential to clearly track these payments and note the remaining balance. By doing so, businesses can send reminders, plan for future payments, and ensure no amounts are overlooked. It’s also important to indicate any terms related to partial payments, such as deadlines for completing the balance.

Managing Full Payments

A full payment signifies that the entire amount due has been settled. It’s crucial to confirm and document the completion of such transactions to avoid any confusion later. Properly marking these payments as “complete” or “settled” in your records provides a clear overview of your financial status and prevents future disputes with clients regarding outstanding balances.

By tracking both partial and complete payments, businesses can ensure better financial management, maintain accuracy, and provide clear communication to clients, enhancing trust and fostering long-term relationships.

Legal Implications of a Paid Invoice

When a financial transaction is completed and documented, it carries important legal consequences for both the business and the client. Ensuring that the payment has been fully settled and properly recorded is crucial to avoid any future disputes or misunderstandings. A completed transaction serves as proof of agreement and can have various legal implications depending on how it is documented and acknowledged by both parties.

Once the balance has been cleared, the agreement between the client and the business is considered fulfilled. This not only confirms that the payment terms have been met, but also that the seller has delivered the goods or services as promised. A properly documented settlement helps protect both parties in case of future legal matters.

Key Legal Considerations:

- Proof of Transaction: The record of a completed payment serves as evidence in case of disputes over the terms of the agreement.

- Contract Fulfillment: A fully settled transaction confirms that all contractual obligations have been met, preventing future legal claims.

- Tax Compliance: Properly documenting completed payments helps businesses stay compliant with tax regulations by providing an accurate record of revenue.

- Dispute Resolution: Having clear documentation of the settlement can help resolve disputes efficiently without the need for lengthy legal proceedings.

By ensuring that all financial transactions are properly recorded and acknowledged, businesses protect themselves legally while maintaining trust and transparency with clients. A completed financial record is not just a business formality, but a critical element of the legal and financial structure of any transaction.

How to Share Paid Invoices with Clients

Once a financial transaction has been settled, sharing the relevant documentation with clients is an important step in maintaining transparency and fostering trust. Properly distributing this record ensures both parties have a clear understanding that the transaction has been completed, and it serves as a reference for future dealings. There are several methods to securely share this information with clients, each offering its own advantages depending on the business model and client preferences.

Methods of Sharing

One of the most common methods of sharing completed transaction records is via email. By sending a PDF or a digital file, businesses can ensure that the client receives a copy of the document immediately. This method is cost-effective, environmentally friendly, and allows for easy storage. Additionally, secure file-sharing platforms offer another safe way to share sensitive financial records, ensuring the document remains protected from unauthorized access.

Using Online Portals

For businesses with an established online portal or client management system, sharing financial records through a secure login area is another excellent option. Clients can access their completed transactions at their convenience, providing them with a record that can be easily downloaded or printed. This method offers the benefit of automation, reducing the need for manual handling of each document and providing clients with real-time access to their payment history.

By choosing the most appropriate method to share completed financial records, businesses can enhance client satisfaction and ensure that both parties have a clear understanding of the transaction status. Transparency in communication is essential for maintaining positive, long-term business relationships.

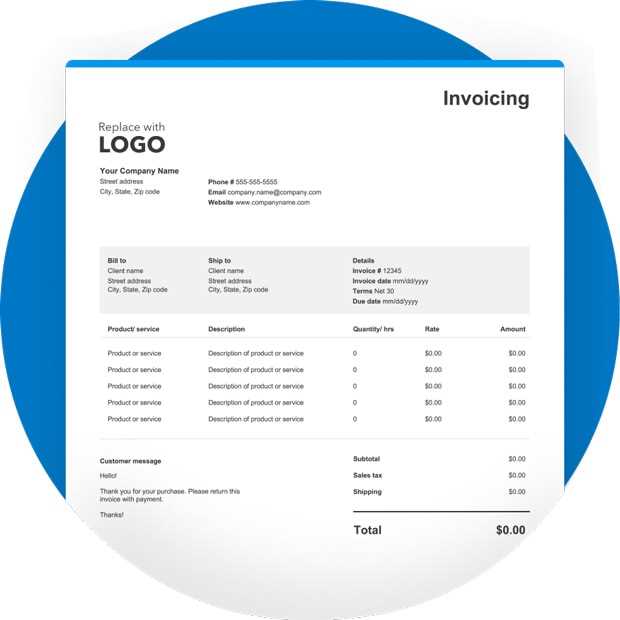

Digital vs Paper Invoice Templates

When managing financial transactions, businesses often face the choice between using digital or paper documents for recording payments. Each approach offers unique advantages, depending on the business’s needs and client preferences. Understanding the pros and cons of both options can help companies decide which method works best for their operations and ensure that the transaction records are kept organized and accessible.

Advantages of Digital Documents

Digital documents provide several key benefits, particularly in terms of efficiency and accessibility. With electronic records, businesses can quickly create, store, and send payment confirmations without the need for physical materials. These records can be easily accessed, shared via email, or uploaded to secure online platforms, offering convenience for both the business and the client. Furthermore, digital formats are environmentally friendly and often reduce administrative costs.

Benefits of Paper Records

On the other hand, paper documents may still hold value for businesses that prefer traditional methods or operate in industries where digital access is limited. Paper records are tangible, which some clients may find reassuring, and can be filed and stored in physical archives for reference. In some jurisdictions, paper records may be necessary for compliance with certain regulations or for businesses that deal with government agencies that prefer hard copies.

Ultimately, the decision between digital and paper records depends on the nature of the business, client preferences, and operational goals. Many businesses now opt for a hybrid approach, using digital records for everyday transactions and paper for specific legal or formal needs.

Integrating Templates with Accounting Software

As businesses grow, managing financial records efficiently becomes increasingly important. One of the most effective ways to streamline this process is by integrating payment records with accounting software. This integration allows for seamless tracking, automatic updates, and eliminates the need for manual data entry, which can reduce errors and save time. By linking documentation directly to accounting platforms, businesses can maintain accurate and up-to-date financial records with ease.

Benefits of Integration

Integrating financial documents with accounting software provides several advantages:

- Automated Tracking: Automatically record and categorize payments, minimizing the need for manual input.

- Reduced Errors: Minimize human error by ensuring data flows directly from payment confirmations into the accounting system.

- Increased Efficiency: Speed up the reconciliation process by reducing the time spent manually updating financial records.

- Better Reporting: Access real-time financial reports and insights, making it easier to track business performance and profitability.

Key Features to Look For

When selecting accounting software to integrate with financial records, consider the following features:

| Feature | Description |

|---|---|

| Compatibility | Ensure the software can easily integrate with existing systems and payment methods. |

| Automation | Look for software that automatically updates payment statuses and balances based on incoming data. |

| Customizable Reports | The ability to generate detailed financial reports tailored to your business’s needs. |

By integrating payment records with accounting software, businesses can significantly improve their financial management processes. This integration ensures smoother operations, greater accuracy, and more efficient tracking of financial transactions.

How Often Should You Update Your Template?

Regularly updating financial documents used for tracking payments is essential for ensuring accuracy and relevance. As business needs evolve, so too should the way transactions are documented. This helps maintain clarity, compliance with the latest legal regulations, and adapts to any changes in your financial practices or client preferences. Updating these documents also provides an opportunity to refine processes, streamline workflows, and improve the overall professionalism of your business operations.

Factors That Determine Update Frequency

The frequency of updates depends on several key factors:

- Business Changes: If your services or products evolve, you may need to adjust the details on your records, such as adding new items, changing pricing, or updating payment terms.

- Legal Requirements: Changes in tax laws or business regulations may necessitate updates to ensure compliance with local and international standards.

- Technological Advancements: As new software and digital tools emerge, incorporating these into your documentation can improve efficiency and reduce human error.

Best Practices for Regular Updates

To keep your financial documents effective, follow these practices:

- Review your documents at least once every quarter to ensure all fields are up-to-date and relevant.

- Make adjustments whenever there are changes in your pricing structure, terms of service, or payment methods.

- Periodically evaluate the design and usability of your documents to ensure they are user-friendly for both you and your clients.

By regularly updating your financial documentation, you can improve workflow efficiency, remain compliant with current standards, and maintain a professional image with your clients.

Free vs Paid Paid-In-Full Templates

When it comes to choosing documents to track completed transactions, businesses often face a choice between free and paid options. Both types come with their own set of advantages and drawbacks, which can impact how well they serve your company’s needs. Free options may seem appealing due to their lack of upfront costs, but they may also come with limitations in terms of customization, support, and features. On the other hand, paid documents often offer a higher level of professionalism and additional features that can improve your business processes.

Key Differences Between Free and Paid Documents

Understanding the differences between these two options can help you make an informed decision about which is right for your business:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization options | Advanced customization features |

| Professional Appearance | Basic, simple design | Highly polished, professional layout |

| Support | Minimal or no support | Dedicated customer support and resources |

| Updates | Infrequent updates | Regular updates with new features |

When to Choose Free Documents

Free documents can be a great choice if you’re just starting out or working on a tight budget. They can provide the basics you need to track completed transactions without any financial commitment. Free options are also suitable for smaller businesses or those who don’t require advanced features or frequent updates.

When to Choose Paid Documents

Paid options are ideal for businesses looking to scale or improve their financial documentation processes. These documents often come with more robust features, such as automatic calculations, branding options, and additional customization. They are also more likely to be updated regularly and offer better customer support, ensuring your business stays compliant and efficient in tracking completed payments.