Comprehensive Invoice Outline Template for Efficient Billing

Efficient billing is crucial for maintaining professional relationships and ensuring timely payments. A well-structured document can help communicate essential information clearly and reduce the chances of errors or misunderstandings. By following a set structure, you can create consistent and accurate records for every transaction.

Whether you’re a freelancer, small business owner, or part of a larger organization, having a standardized approach for documenting payments is key. The right framework helps you include all necessary details, from payment instructions to terms and conditions, while keeping the format easy to understand for clients.

Customization is an important aspect of this process. Depending on the nature of your services or products, you may need to adjust the layout or content to suit specific needs. Incorporating clear sections for pricing, discounts, and payment options ensures a smooth transaction and reduces follow-up inquiries.

In this guide, you’ll learn how to create a professional document that not only looks organized but also meets legal requirements and supports clear communication with clients. A thoughtfully crafted bill reflects the credibility of your business and fosters trust in your financial dealings.

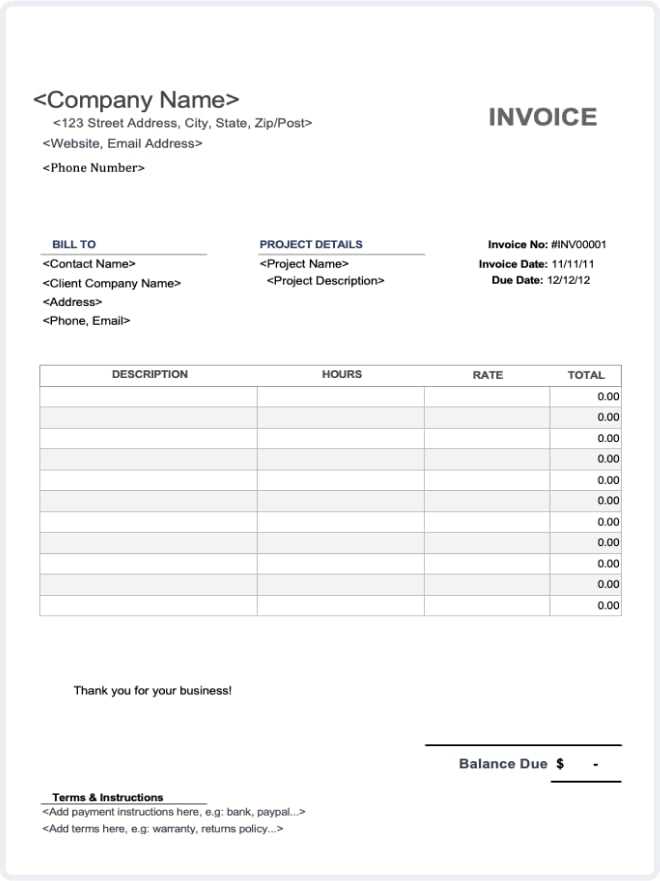

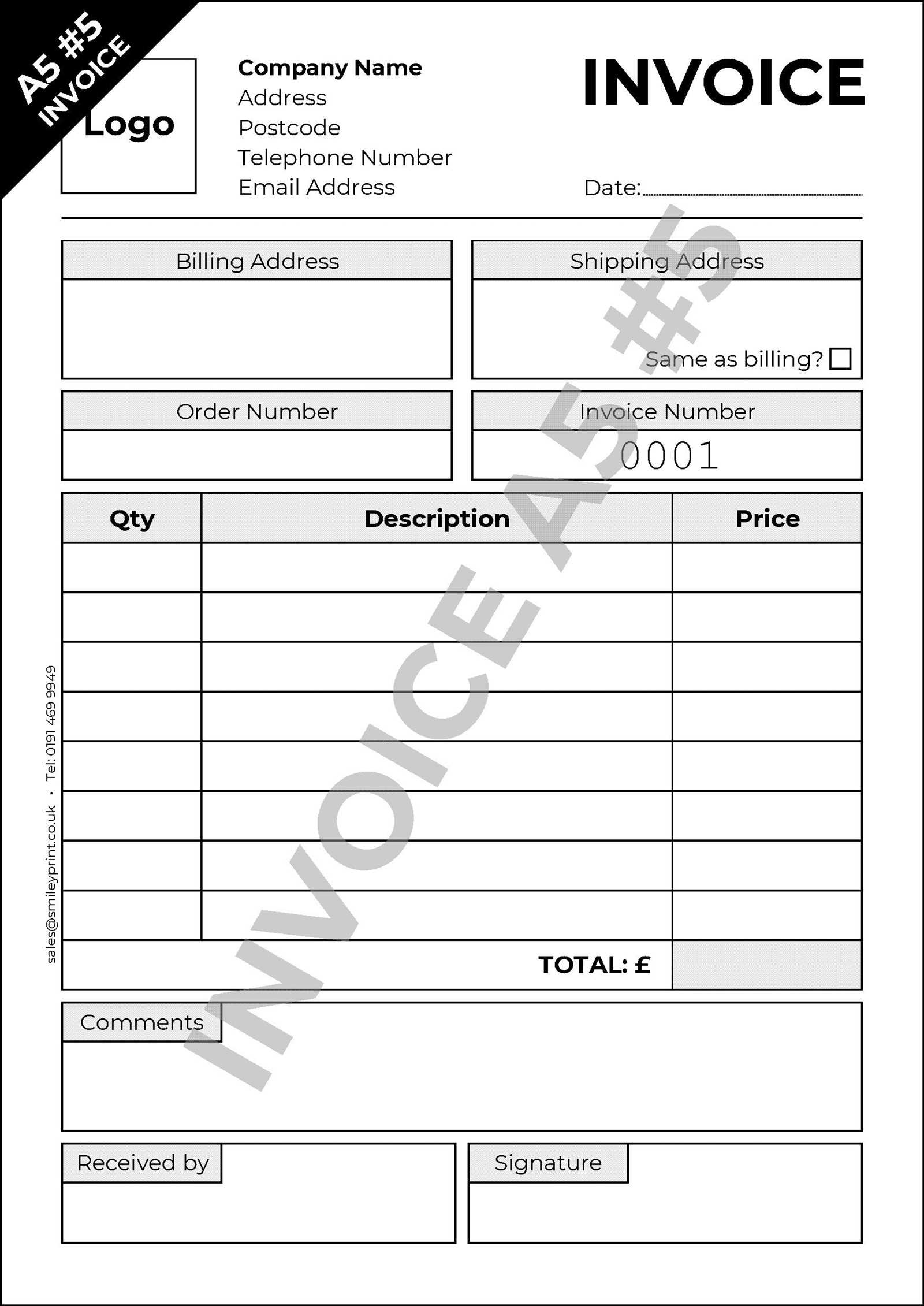

Invoice Outline Template Overview

Creating an organized document for billing is essential for any business, as it helps to present charges clearly and ensures that both parties are on the same page regarding payment terms. A well-structured layout serves as a guide for including all necessary details while maintaining a professional appearance. Understanding how to arrange the various sections and elements can streamline the process of generating these records, making it easier for both the sender and the receiver.

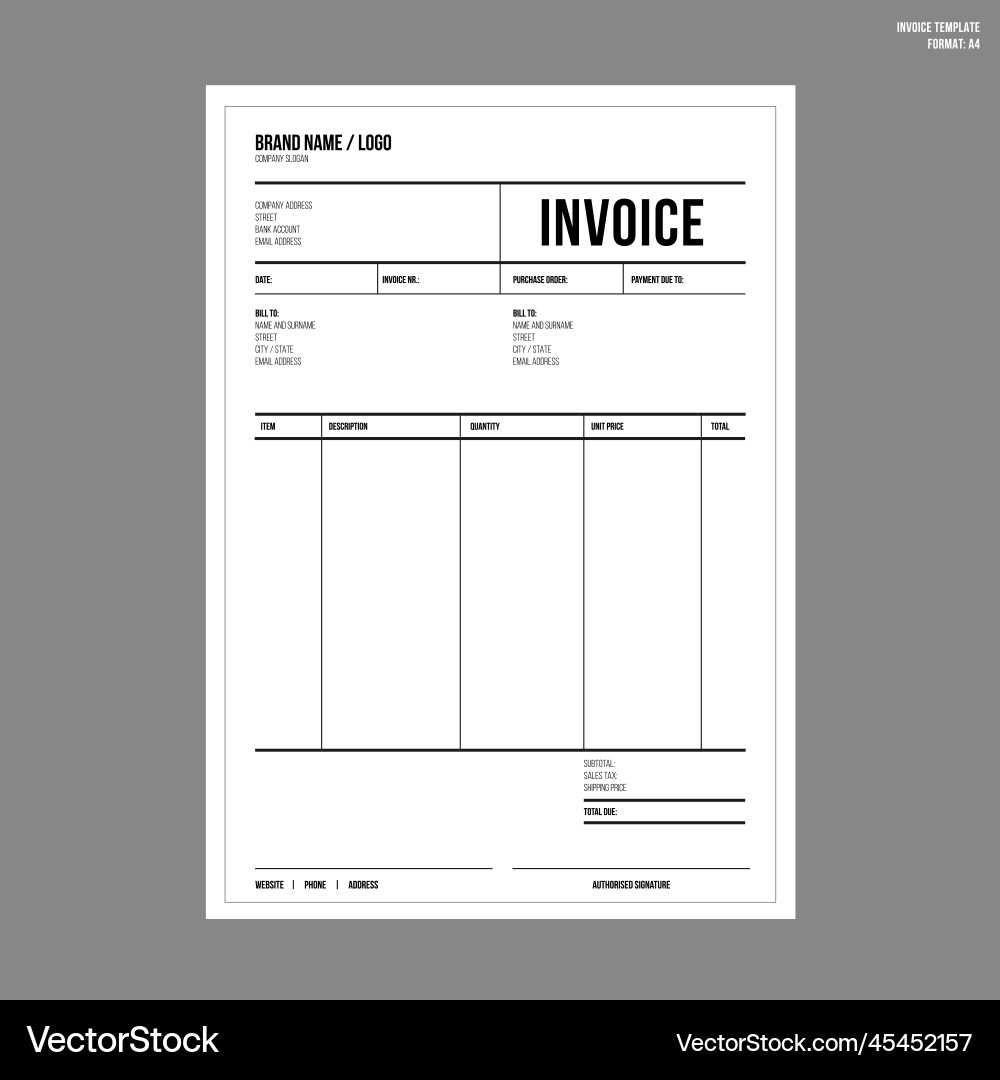

Key Components for a Billing Document

The document should contain several critical elements that will make the transaction transparent and ensure that all the details are captured correctly. These components typically include:

- Header Information – Basic details about the sender and recipient.

- Description of Goods or Services – Clear breakdown of what is being charged.

- Pricing and Totals – The total amount due, including any applicable taxes or discounts.

- Payment Instructions – How the recipient can pay and due dates for payment.

- Terms and Conditions – Any rules or policies that need to be followed during the payment process.

Benefits of a Consistent Format

Using a standardized structure offers numerous advantages. It reduces errors, saves time in preparing documents, and makes it easier to track payments. A consistent format also builds trust, as recipients will feel more confident when they see a professional and clear document. Additionally, this consistency can help in keeping accurate financial records for your business.

Why Use an Invoice Outline

Having a structured format for billing documents is essential for ensuring clarity and consistency in financial transactions. A well-organized framework provides a clear path for including all necessary details, reducing the chances of missing important information or making errors. By following a predetermined structure, you can create a document that is both easy to read and professional.

Organization is one of the primary reasons to use a set framework. When you follow a consistent structure, each section of the document has its own designated place, making it simple to fill in the required information. This eliminates the confusion that can arise when critical details are scattered or overlooked.

Additionally, using a predefined structure saves valuable time. You don’t need to reinvent the wheel every time you prepare a record for payment; instead, you can focus on customizing the content for each transaction. This efficiency is especially beneficial for businesses that handle a high volume of transactions.

Another key advantage is professionalism. Clients are more likely to trust a document that appears organized and well-presented. By adhering to a clear and consistent format, you not only ensure that all the necessary details are included, but you also convey reliability and attention to detail.

Key Elements of an Invoice

To ensure a smooth and clear transaction, it’s essential to include specific details in a financial record. Each section of the document plays an important role in communicating the terms of payment and confirming the agreement between the two parties. The following key components should be present in every record to make sure that all necessary information is properly conveyed.

- Sender and Recipient Information – This includes the names, addresses, and contact details of both the business and the client, ensuring proper identification and communication.

- Description of Services or Goods – A clear breakdown of what is being charged, with detailed descriptions to avoid confusion.

- Quantity and Unit Price – Information on the amount of goods or services provided, along with the price per unit, allows for transparency in the transaction.

- Total Amount Due – The final sum, which may include taxes, discounts, and additional charges, providing clarity on the amount the client needs to pay.

- Payment Terms – This includes the payment due date, acceptable methods of payment, and any late fees or discounts for early payments.

- Unique Reference Number – A unique identifier for each document, making it easier to track and reference in future correspondence.

- Legal Terms and Conditions – Any additional rules that govern the transaction, such as return policies or warranties, which protect both parties.

By incorporating all these elements, you ensure that the document is complete and clear, reducing the potential for disputes and improving the overall experience for both parties.

How to Customize Your Template

Customizing your billing document is essential to ensure that it reflects the unique needs of your business and the specific details of each transaction. By adjusting various elements, you can create a personalized format that suits your brand and simplifies the payment process for your clients. The key to a successful customization is balancing clarity with functionality, so that the document remains professional while meeting your unique requirements.

Adjusting the Layout and Design

The first step in customization is determining the layout. You may want to choose between a simple, straightforward structure or something more detailed with various sections. Consider the following:

- Logo and Branding – Adding your logo and choosing colors that match your brand identity makes the document feel professional and cohesive.

- Section Placement – Organize sections like payment details, client information, and descriptions in a way that suits your style. Clear headings and consistent formatting are essential for readability.

- Font and Spacing – Select readable fonts and appropriate spacing to ensure that the document is easy to follow.

Including Specific Details

Incorporating unique fields is another way to personalize your record. Here are some examples:

- Service Descriptions – Tailor the descriptions to reflect your business’s offerings. Whether it’s consulting services, digital products, or physical goods, being clear about what’s being sold is crucial.

- Payment Instructions – Include your preferred payment methods and any relevant account information, along with due dates and penalties for late payments.

- Discounts and Promotions – If applicable, adjust the sections to feature any special discounts, promotional offers, or bulk pricing for returning clients.

By customizing these elements, you can make your documents more user-friendly and suited to your business needs while maintaining a professional appearance.

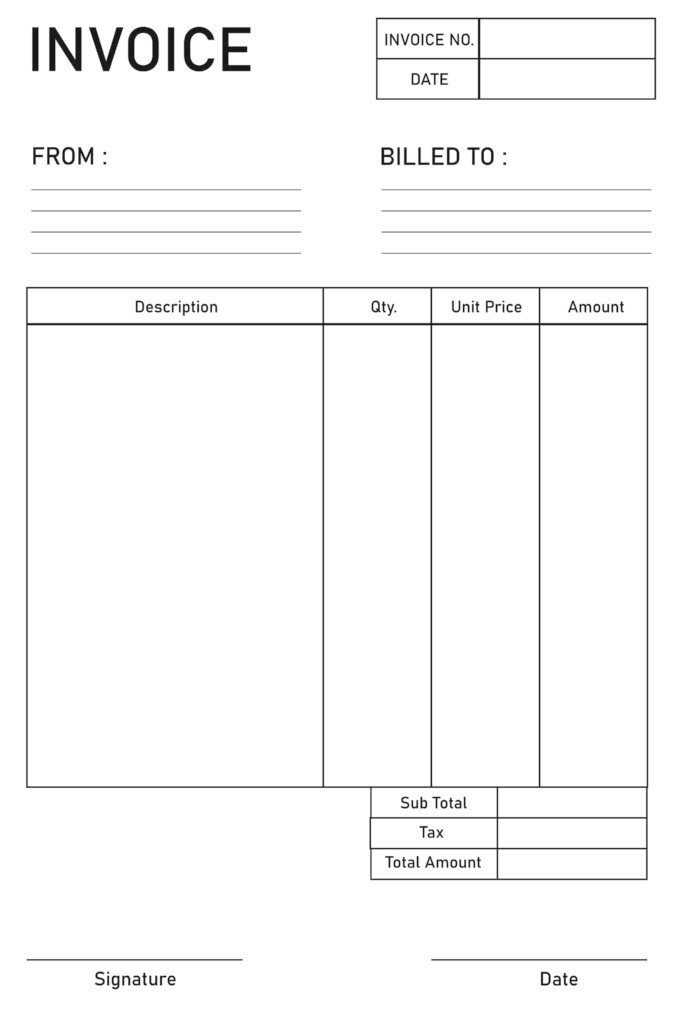

Best Practices for Invoice Formatting

Proper formatting plays a crucial role in ensuring that your billing documents are clear, professional, and easy to understand. Well-organized records not only present the information effectively but also reduce confusion and mistakes. By following a few simple guidelines, you can create a document that is both functional and visually appealing, helping to foster trust and prompt payment from your clients.

Keep the Layout Simple and Clear

A clutter-free design helps your client focus on the key details. Avoid unnecessary graphics or excessive information that might distract from the important points. Organize sections logically and make sure there is plenty of white space to separate each part. Consider using a table format to clearly display the itemized list of services or products.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $100 | $500 |

| Web Design | 1 project | $1,500 | $1,500 |

| Total | $2,000 | ||

Highlight Critical Information

Important details like the due date, payment instructions, and the total amount should stand out. Use bold text or larger font sizes to draw attention to these areas, making it easier for your client to locate them quickly. For example, ensure the total amount due and due date are easily visible and at the top of the document.

Maintain Consistent Formatting

Consistency is key to creating a professional appearance. Use the same font style and size throughout, and align text neatly. Avoid mixing different fonts or colors that can make the document look chaotic. Keeping things uniform will give your document a polished, cohesive look.

By applying these best practices, you create an efficient and polished document that encourages prompt payment and reflects well on your business.

Designing an Effective Invoice Layout

The layout of your billing document plays a vital role in how easily clients can understand and process the information. A clear and structured design ensures that all critical details are immediately visible and that the document is easy to navigate. The key to an effective layout is balance: it should be clean, simple, and organized, allowing the reader to quickly find the necessary information without unnecessary distractions.

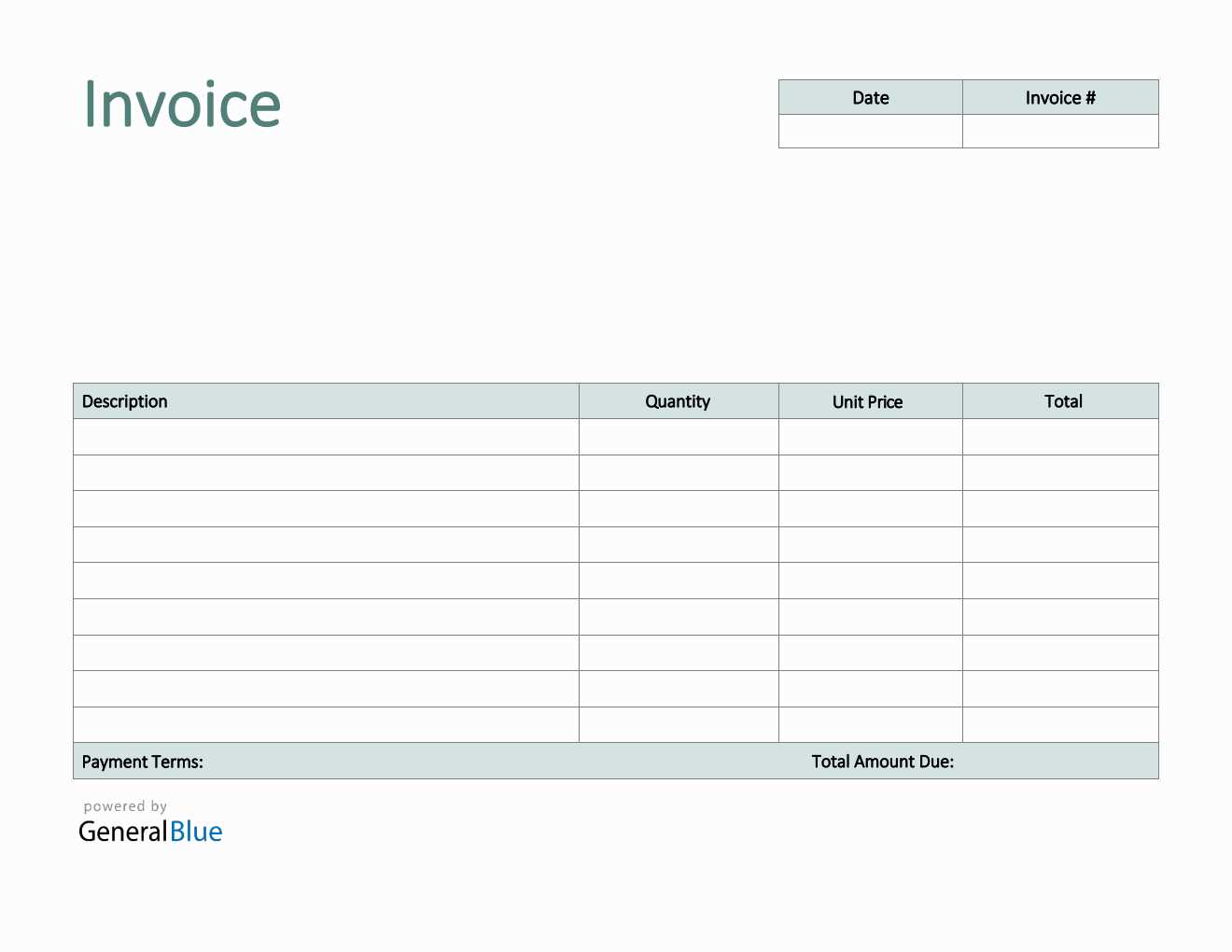

First, consider the overall structure. Your document should have clearly defined sections that separate different types of information. For example, start with your business’s contact information at the top, followed by the recipient’s details, then move into the list of items or services provided. Use headings and subheadings to demarcate each section, ensuring that the reader can easily follow the flow.

Additionally, proper spacing is essential. Avoid overcrowding the document with text or data. Leave adequate margins around the edges and space between sections. This will make the document look less cluttered and easier to read. You can also utilize borders or subtle shading to separate sections and guide the reader’s eye through the document.

Finally, ensure that the most important information stands out. The total amount due, due date, and payment instructions should be highlighted in some way–whether it’s through bold text, larger font sizes, or a different color. This helps prevent any confusion and ensures that the client is immediately aware of the most critical details.

Common Mistakes to Avoid in Invoices

While preparing financial documents, it’s easy to overlook some details that can cause confusion or delay in payments. Even small errors can have significant consequences, such as missed payments or strained client relationships. Avoiding common mistakes ensures that your document is professional, clear, and efficient, leading to a smoother transaction process for both parties.

One of the most common mistakes is failing to include accurate details. This includes incorrect client information, wrong pricing, or missing product/service descriptions. Double-checking all details before sending the document helps to avoid misunderstandings and ensures that the client knows exactly what they are being charged for.

Another frequent issue is unclear payment terms. It’s crucial to clearly outline the payment due date, acceptable methods of payment, and any applicable penalties or discounts. If the payment terms are ambiguous, clients may delay their payments or ask for clarification, which can cause unnecessary back-and-forth communication.

Missing or incorrect reference numbers can also create confusion. Always ensure that each document has a unique identifier, which makes it easier to track, refer back to, and resolve any disputes that might arise. Without this, both you and your client may struggle to locate the specific record in future conversations.

Lastly, failing to keep the document visually clear can lead to unnecessary complications. Overcrowding with excessive text, poor alignment, or inconsistent formatting can confuse the recipient. A clean, organized layout helps the client focus on key details without getting distracted by clutter.

How to Include Payment Terms

Clearly defining the terms of payment in your financial documents is crucial to ensure both parties understand the expectations regarding payment schedules, methods, and any penalties or discounts. Properly outlining payment terms reduces the chances of misunderstandings and late payments. Including this information clearly helps your clients know when and how to pay, fostering smoother business transactions.

Key Details to Include

When outlining payment conditions, make sure to include the following elements:

- Due Date – Specify the exact date by which payment is expected. This avoids confusion and sets clear expectations for your client.

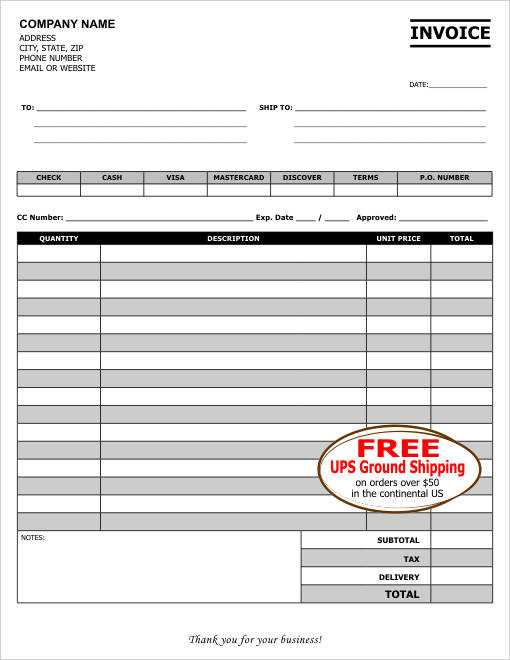

- Payment Methods – Clearly state the acceptable methods of payment, such as bank transfers, credit cards, checks, or online payment platforms.

- Late Fees – Indicate any additional charges that will be applied if payment is not made by the due date. This encourages timely payments and protects your business.

- Early Payment Discounts – If applicable, mention any discounts offered for early settlement, motivating clients to pay before the due date.

Best Practices for Payment Terms

To ensure your payment terms are easily understood and followed, keep the language clear and concise. Avoid using complicated legal jargon that might confuse your client. Instead, write terms in simple language, outlining the specific conditions without ambiguity. For example:

- Example of a Late Fee Clause: “A late fee of 1.5% will be applied for every 15 days after the due date.”

- Example of Early Payment Discount: “A 5% discount will be applied if payment is received within 10 days of the due date.”

By including these key details in your document, you establish a clear understanding of the payment process, which helps avoid disputes and promotes a more efficient and timely transaction flow.

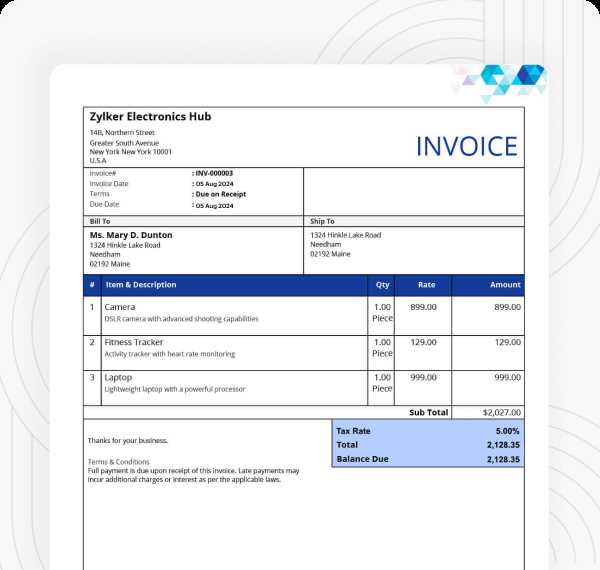

Including Taxes and Fees in Invoices

When preparing financial documents, it’s essential to clearly display any applicable taxes or fees in order to avoid confusion and ensure transparency between you and your client. Including these charges not only complies with legal requirements but also helps your clients understand the full breakdown of the costs. Being upfront about additional charges prevents any surprises and ensures smoother transactions.

Understanding Tax Breakdown

Taxes can vary depending on the location, type of product or service, and local regulations. It’s important to explicitly state the tax rates applied and how they are calculated. This information should be clearly displayed to avoid misunderstandings.

- Sales Tax: If applicable, list the percentage rate used for the sales tax and calculate the tax amount based on the total cost of the goods or services.

- VAT (Value Added Tax): For international transactions, make sure to mention the VAT rate and how it is applied to the total price.

- Other Taxes: Include any other relevant taxes, such as environmental fees, luxury taxes, or regional taxes.

Incorporating Fees

In addition to taxes, you may need to include various service fees or additional charges, such as shipping costs, handling fees, or rush order charges. These should be itemized separately from the main cost, so your client can clearly see what they are being charged for.

- Shipping Fees: If delivery is involved, include the shipping charges based on the delivery method and destination.

- Handling Fees: If applicable, mention any fees for packaging, processing, or special handling services.

- Other Charges: Clearly list any other fees, such as administrative charges or special request fees.

By clearly listing all taxes and fees, you provide your client with a complete and transparent cost breakdown, reducing the likelihood of disputes or confusion about the total amount due.

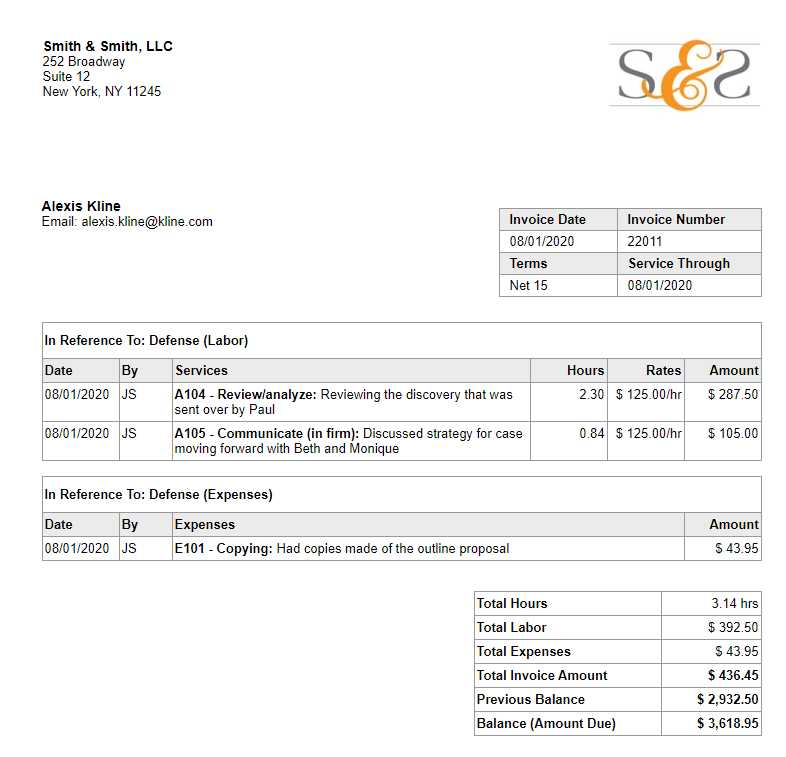

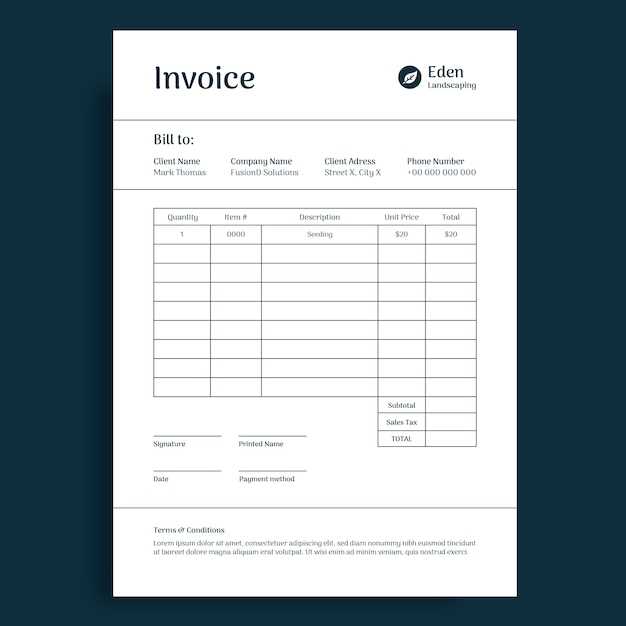

Choosing the Right Invoice Style

Selecting an appropriate design for your billing document is a critical step in ensuring clarity and professionalism. The style not only reflects your business identity but also influences how your client perceives the document. A well-chosen format can make it easier for the recipient to process the details, leading to faster payments and fewer misunderstandings.

When deciding on a style, consider the nature of your business and your client’s preferences. For example, a creative agency might opt for a more visually engaging design, while a law firm might prefer a simpler, more formal layout. The right design should balance professionalism with readability, ensuring that the document communicates key information clearly and efficiently.

Factors to Consider

There are several factors to keep in mind when choosing the appropriate format:

- Business Type: The industry you’re in plays a big role in determining the style. Creative businesses often benefit from a more artistic layout, while service providers might prefer a clean, minimalistic design.

- Client Expectations: Understand your clients’ preferences. Some may prefer a simple and straightforward document, while others may appreciate a more detailed and visually distinctive design.

- Readability: Prioritize easy-to-read fonts, sufficient spacing, and clear headings. Avoid cluttering the page with too many elements that could distract from the essential information.

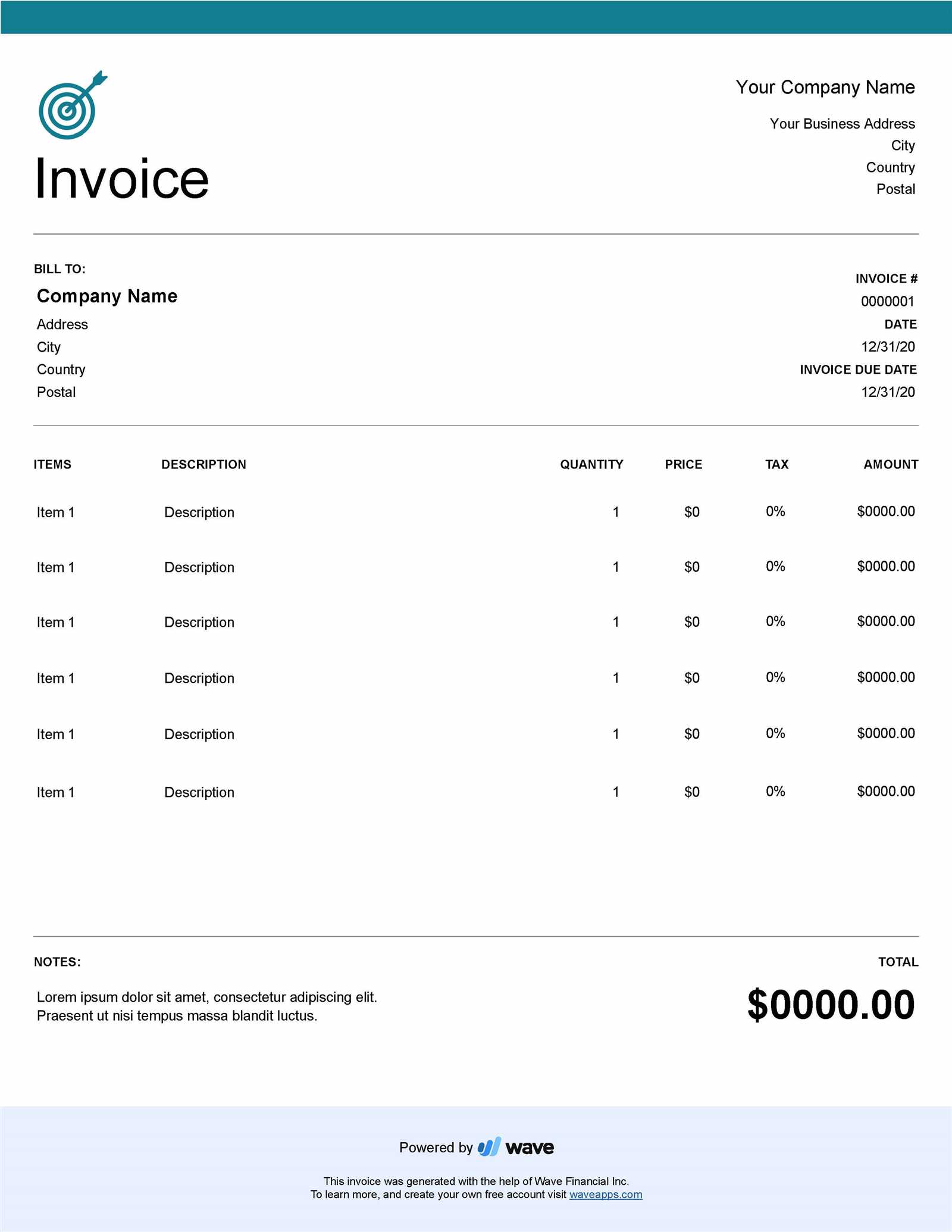

Common Styles to Choose From

Here are a few popular layout styles for your financial documents:

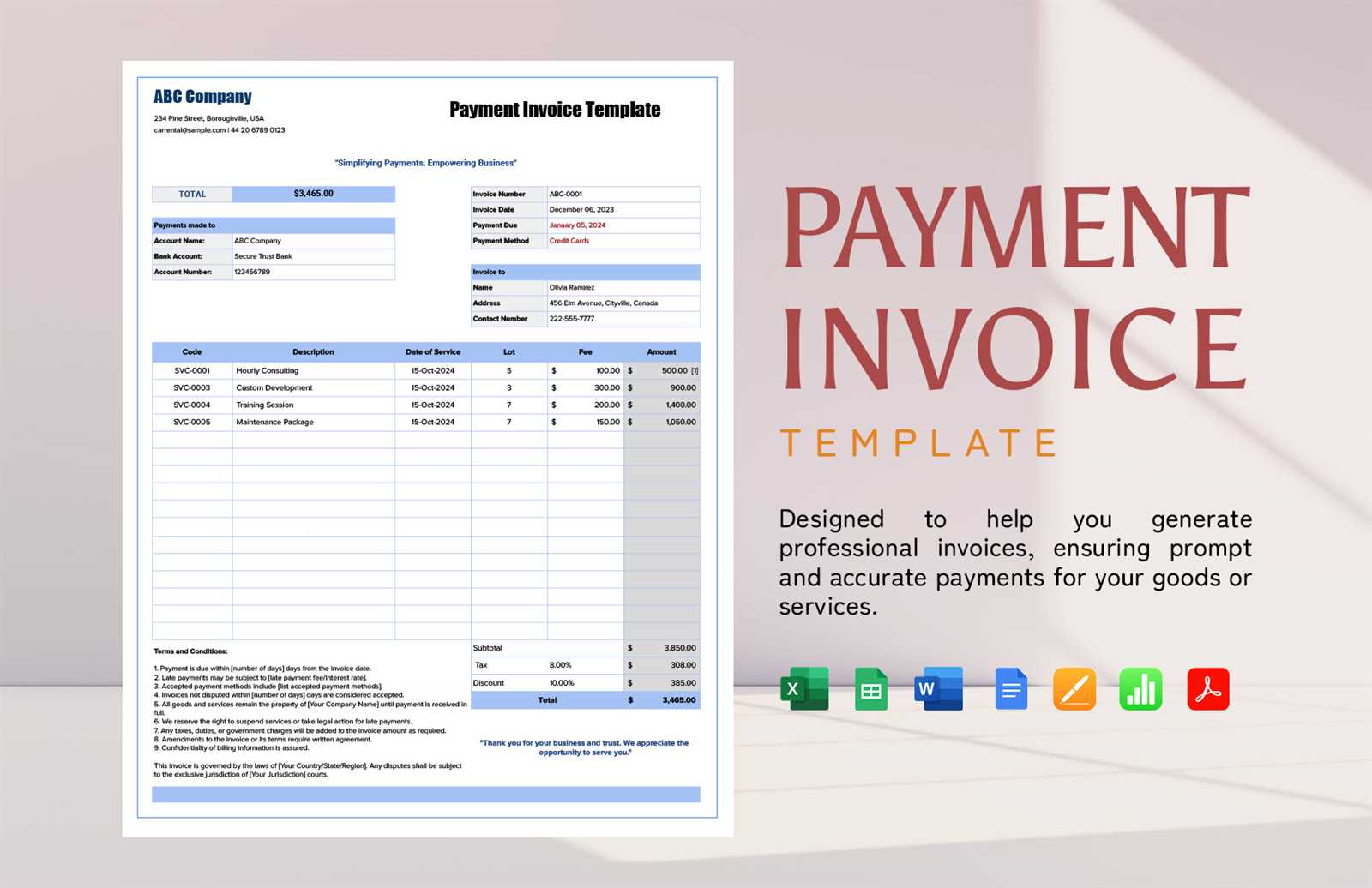

- Traditional Layout: A clean and professional design, typically featuring a header with business information, followed by a list of services or products provided, and a clear total amount due.

- Modern Layout: A more contemporary approach with bolder colors, stylish fonts, and creative sections for easier navigation.

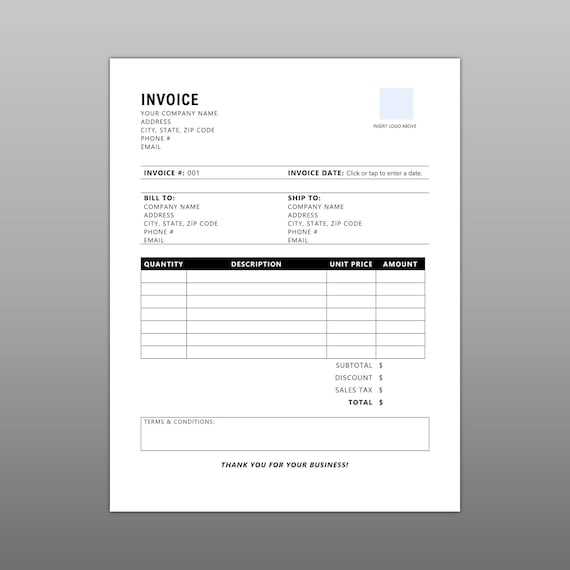

- Minimalist Layout: Focuses on simplicity with a lot of white space and straightforward sections, making the document easy to read and less cluttered.

- Itemized Breakdown: Detailed layouts where each service or product is listed separately with its price, followed by a total at the end, which works well for complex transactions.

Choosing the right style is key to ensuring your document not only looks professional but also communicates information effectively, improving your overall client experience.

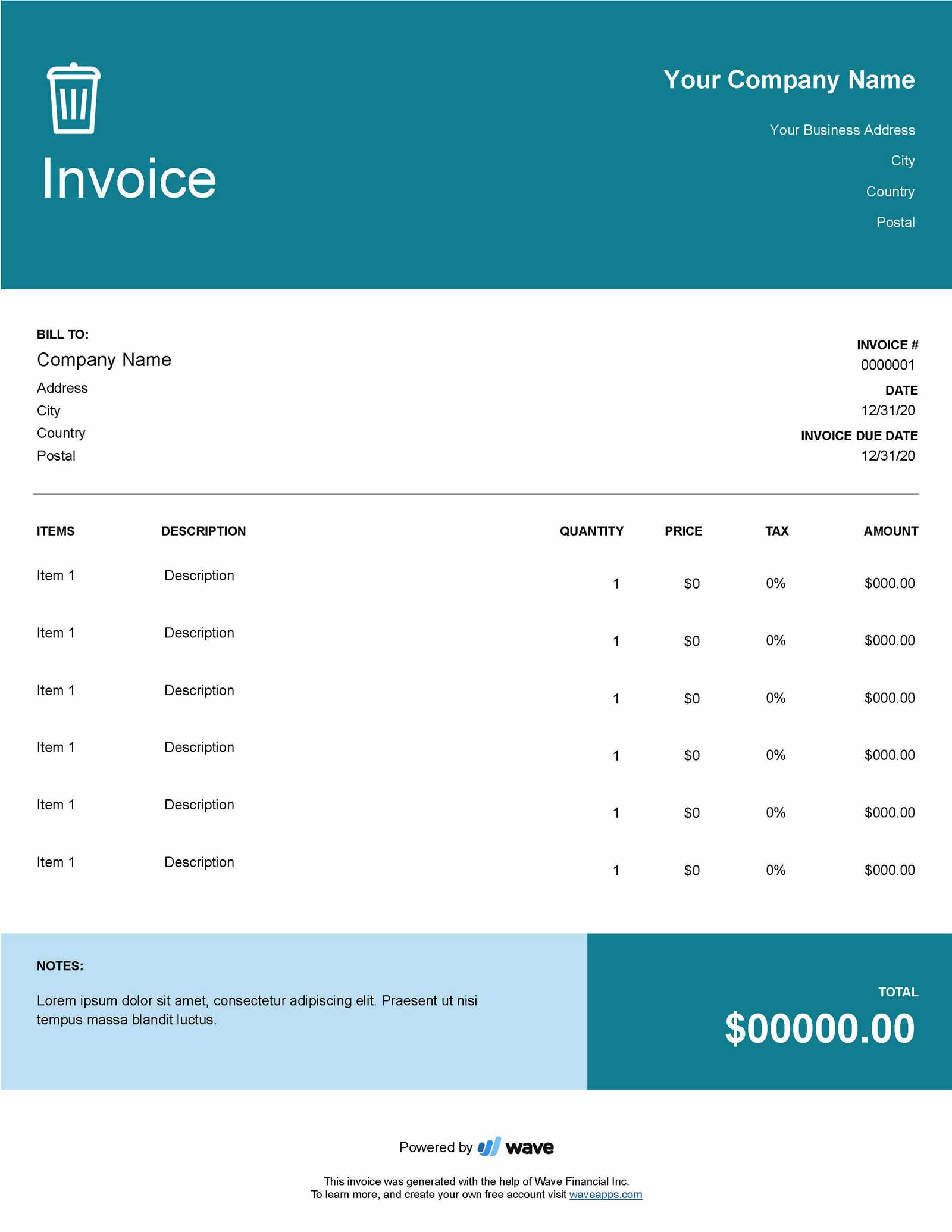

Free Templates vs Paid Templates

When choosing a design for your billing documents, one of the key decisions you’ll face is whether to go for a free or paid option. Both have their advantages and drawbacks, and the right choice depends on your business needs, budget, and how much customization you require. Understanding the differences between free and premium designs can help you make an informed decision.

Free options can be a great starting point, offering basic designs that are often sufficient for simple transactions. On the other hand, paid designs tend to offer more advanced features, better customization, and professional touches that can enhance the overall appearance and functionality of your documents.

Benefits of Free Options

Free designs are often the first choice for small businesses or those just starting. Here are some advantages:

- No Cost: As the name suggests, free options require no financial investment, making them ideal for businesses on a tight budget.

- Quick Setup: These designs are often simple and easy to use, allowing you to get your documents up and running with minimal effort.

- Basic Functionality: For straightforward transactions, free designs usually provide all the essential features needed, such as fields for pricing, tax, and contact information.

Advantages of Paid Options

While free options may suffice for some, there are several reasons why many businesses choose paid designs for their documents:

- Enhanced Customization: Paid designs often allow for more customization, letting you adjust colors, fonts, and layouts to better reflect your brand identity.

- Professional Quality: Premium designs are generally more polished, with attention to detail in formatting and visuals, providing a more professional and credible appearance.

- Advanced Features: Paid options may offer additional functionality, such as integrated payment gateways, automatic calculations, or the ability to manage multiple currencies.

- Customer Support: Many paid options come with customer support, meaning you can get help if you encounter any issues or need assistance with setup.

In the end, the decision between free and paid designs comes down to the complexity of your needs and the level of investment you’re willing to make. For businesses looking for a simple, cost-effective solution, free designs may be enough. However, those seeking a more tailored and professional appearance might find the investment in a paid design worthwhile.

Tools to Create Professional Invoices

There are various tools available that can help you design and generate billing documents efficiently, allowing you to create polished and professional-looking records. Whether you’re looking for an easy-to-use software solution or a more advanced platform with additional features, choosing the right tool can save you time and enhance your credibility.

These tools often offer pre-built designs, customizable fields, and additional features like automated calculations and multi-currency support. Some options are free, while others come with a subscription or one-time purchase price. The choice depends on your business needs, the volume of transactions, and your preference for automation versus manual control.

Popular Tools for Creating Billing Records

Here are a few widely used tools for crafting professional documents:

- FreshBooks: Known for its user-friendly interface, FreshBooks provides an all-in-one solution for small businesses, offering customizable designs and automated payment reminders.

- Zoho Invoice: This tool offers a range of features, including templates, time tracking, and integration with accounting systems, making it a popular choice for growing businesses.

- QuickBooks: A comprehensive accounting platform that includes features for generating financial documents, QuickBooks allows for seamless integration with your business’s financial data.

- Wave: A free option that is especially useful for freelancers and small businesses. Wave offers customizable billing designs and basic accounting tools.

- PayPal Invoicing: If you already use PayPal for payments, their invoicing feature lets you quickly create and send professional bills, with the option for clients to pay directly through PayPal.

Each of these tools offers unique benefits and can help you streamline the process of creating accurate and visually appealing records. By choosing the right tool, you can ensure that your financial documents are both functional and professional, improving efficiency and customer satisfaction.

How to Track Invoice Payments

Keeping track of payments is a crucial part of managing your business’s financial health. Knowing when payments are made, which invoices are still outstanding, and which clients have settled their balances can help prevent late fees, ensure cash flow, and provide an accurate overview of your finances. There are several effective methods for monitoring payments and maintaining clear records.

Whether you prefer to manage payments manually or use automated systems, maintaining an organized approach can save you time and reduce the risk of errors. Below are some key strategies to help you efficiently track payments and stay on top of outstanding amounts.

Manual Tracking Methods

For small businesses or freelancers with a limited number of clients, manually tracking payments may be a viable option. Here are some common techniques:

- Spreadsheets: You can create a simple spreadsheet to track payments. Each entry should include the invoice number, client name, amount due, due date, and payment status. This method allows you to easily see what has been paid and what is still outstanding.

- Physical Records: If you prefer to keep hard copies, you can use a physical ledger or filing system to keep track of payments. This can be time-consuming and prone to errors, but it is still a valid method for businesses with a small volume of transactions.

Automated Tracking Methods

For businesses with higher transaction volumes or those seeking a more efficient method, automated systems provide more functionality and reduce the risk of manual errors.

- Accounting Software: Tools like QuickBooks, FreshBooks, and Zoho Invoice allow you to automatically track payment statuses. These platforms can send reminders to clients, update payment statuses, and even send receipts once payments are made.

- Payment Gateways: Platforms like PayPal and Stripe offer integrated solutions that automatically track payments, making it easy to manage and reconcile accounts.

Tracking Payments Using a Table

Below is an example of how you can organize payment tracking in a simple table format:

| Invoice Number | Client Name | Amount Due | Due Date | Payment Date | Status |

|---|---|---|---|---|---|

| #001 | John Doe | $500.00 | 2024-10-15 | 2024-10-20 | Paid |

| #002 | Jane Smith | $300.00 | 2024-10-18 | Pending | Unpaid |

| #003 |