Invoice Number Generator Excel Template for Streamlined Billing

In any business, maintaining organized records is essential for smooth operations and financial management. One of the most important aspects of tracking transactions is ensuring that each document can be easily identified and referenced. A systematic approach to labeling these documents helps both businesses and clients stay on top of payments and records.

By utilizing an efficient method to create unique identifiers, companies can enhance their workflow and reduce the risk of errors. These identifiers help to quickly differentiate between different records, improving accuracy and saving time during auditing or reconciliation processes. With the right tools, the entire process of generating and managing these labels can be simplified.

Automating this process not only ensures consistency but also minimizes human input, reducing the chances of duplication or misplacement. The flexibility of widely available software makes it easy to tailor the system to your specific needs, allowing businesses of all sizes to implement a solution that fits seamlessly into their operations.

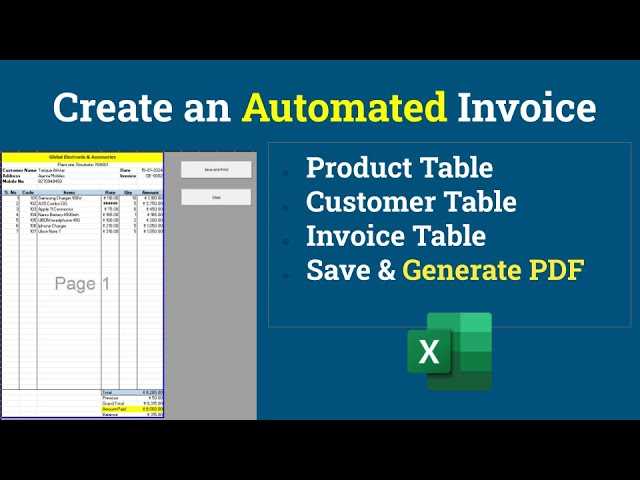

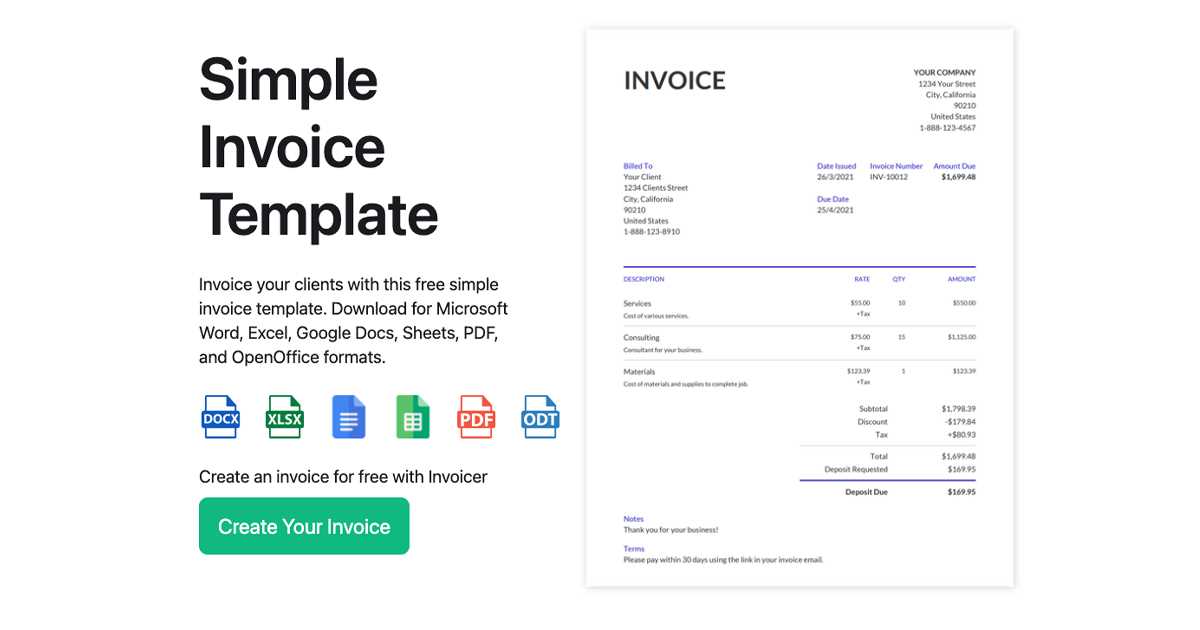

Invoice Number Generator Excel Template

Managing a series of documents that require unique identifiers can be a challenging task without the proper tools. A well-designed system for creating and organizing these identifiers helps businesses stay organized and ensures smooth processing of each transaction. By leveraging software that automates this process, companies can save time, reduce errors, and improve overall efficiency.

Key Features of the Tool

This tool provides a simple yet effective solution for businesses looking to streamline their tracking system. Some of the notable features include:

- Automatic creation of unique identifiers for each transaction

- Customizable formats to fit business requirements

- Easy integration with other records and documents

- Tracking capabilities to monitor the status of each document

- Security measures to prevent data tampering or loss

Benefits of Using This System

Using this automated solution offers several advantages that can help businesses maintain accurate and up-to-date records:

- Efficiency: Streamlines the creation of unique identifiers, saving time and reducing administrative work.

- Accuracy: Eliminates the risk of human error, ensuring every entry is correctly documented.

- Consistency: Maintains a uniform system across all documents, which simplifies tracking and auditing.

- Flexibility: Customizable fields and formats make it adaptable to any business needs.

What is an Invoice Number Generator

At the heart of business transactions, it is essential to have a system for creating distinct identifiers for each record. These identifiers play a key role in tracking, organizing, and managing all financial documents. A well-designed system automates this task, ensuring that each document is assigned a unique reference, allowing businesses to easily access, categorize, and verify their records with minimal effort.

How It Works

This system operates by automatically assigning a unique label to each transaction or record based on a set of predetermined rules. By using a combination of sequential values, dates, or custom codes, the tool ensures consistency and accuracy in document organization.

| Feature | Description |

|---|---|

| Sequential Assignment | Documents are automatically assigned identifiers in a consecutive order to avoid duplication. |

| Customizable Format | The system allows customization of the identifier format, enabling businesses to include specific details such as dates or client names. |

| Automation | The process of generating identifiers is automated, reducing manual effort and minimizing human error. |

Benefits of Using This System

Using an automated system for creating these identifiers offers several advantages:

- Time-saving: The system handles the creation of identifiers, freeing up valuable time for other tasks.

- Accuracy: Automation ensures that each document receives a unique and correctly formatted identifier without the risk of duplication.

- Easy tracking: The consistent system makes it easier to locate and reference documents quickly when needed.

Why Use Excel for Invoicing

Managing financial records can be a complex task, especially when handling multiple transactions. Using a versatile tool to automate and organize the creation of billing documents can simplify this process significantly. The right software can make it easier to maintain accuracy, track payments, and customize your documents to fit business needs.

One of the most widely used tools for managing these processes is spreadsheet software. It provides flexibility, ease of use, and a variety of features that help businesses streamline their financial management tasks. Here are some key reasons why this software is often the preferred choice for managing billing records:

- Flexibility: This tool allows you to design your own system, customizing it to fit your specific business requirements.

- Data Organization: Spreadsheets offer a simple way to store, sort, and filter data, making it easy to manage large sets of information.

- Cost-Effective: It is often more affordable than specialized software, especially for small businesses with simple needs.

- Automation: Built-in formulas and functions can automate calculations and streamline repetitive tasks.

With the ability to easily track, update, and modify records, businesses can ensure that their documentation remains accurate and accessible. Additionally, the system allows you to quickly generate consistent documents, improving overall efficiency and reducing the risk of errors.

Advantages of Customizing Your Workflow

Another reason to use this tool for financial tracking is the ability to personalize your workflow. By customizing your setup, you can:

- Adapt your system to match your specific invoice formatting requirements.

- Quickly add new features, such as client data fields or automated payment reminders.

- Ensure that all information remains organized, even as your business grows.

Benefits of Automatic Invoice Numbering

Automatically assigning unique references to each document in a transaction process provides a streamlined and efficient way to manage records. By eliminating the need for manual entry, businesses can reduce errors and ensure consistency across their documents. This approach saves time and allows for better tracking, helping businesses stay organized and focused on their core operations.

Here are some of the key advantages of using an automated system for assigning references to your records:

- Reduced Errors: Manual entry of references can lead to duplication or incorrect formatting. Automation ensures every reference is unique and accurate.

- Time-Saving: Automatically assigning references eliminates the need for time-consuming manual tracking, freeing up time for more important tasks.

- Consistency: An automated system ensures that each document follows the same structure and format, providing a uniform approach to managing records.

- Improved Organization: With sequential or customized reference formats, it becomes easier to locate, sort, and track all documents efficiently.

- Scalability: As your business grows, automated systems can handle increasing volumes of records without requiring additional effort or resources.

How Automation Enhances Efficiency

By reducing the need for manual oversight, automated systems make it easier to manage large volumes of data without the risk of losing track or making mistakes. This allows businesses to:

- Keep records accurate and up-to-date at all times.

- Quickly reference any document when needed for accounting, auditing, or client communication.

- Focus more on growing the business rather than managing repetitive administrative tasks.

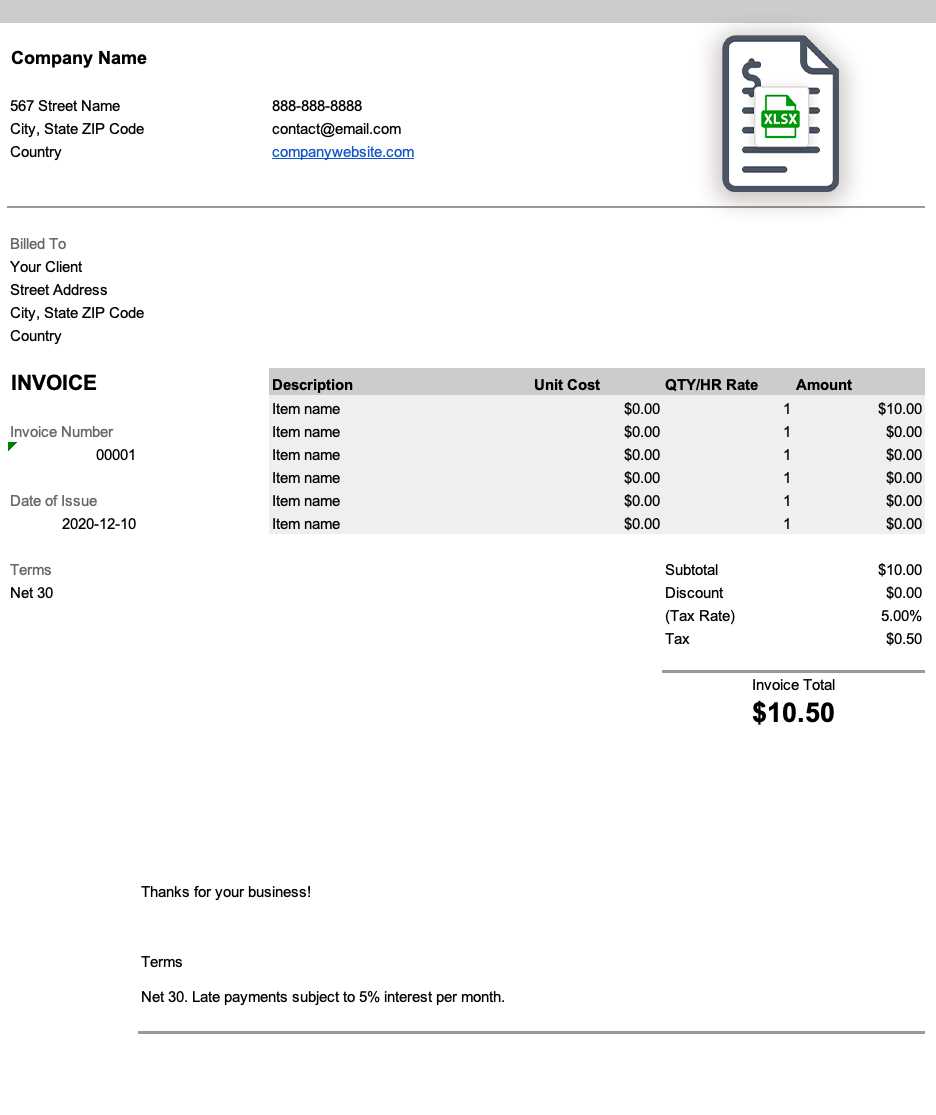

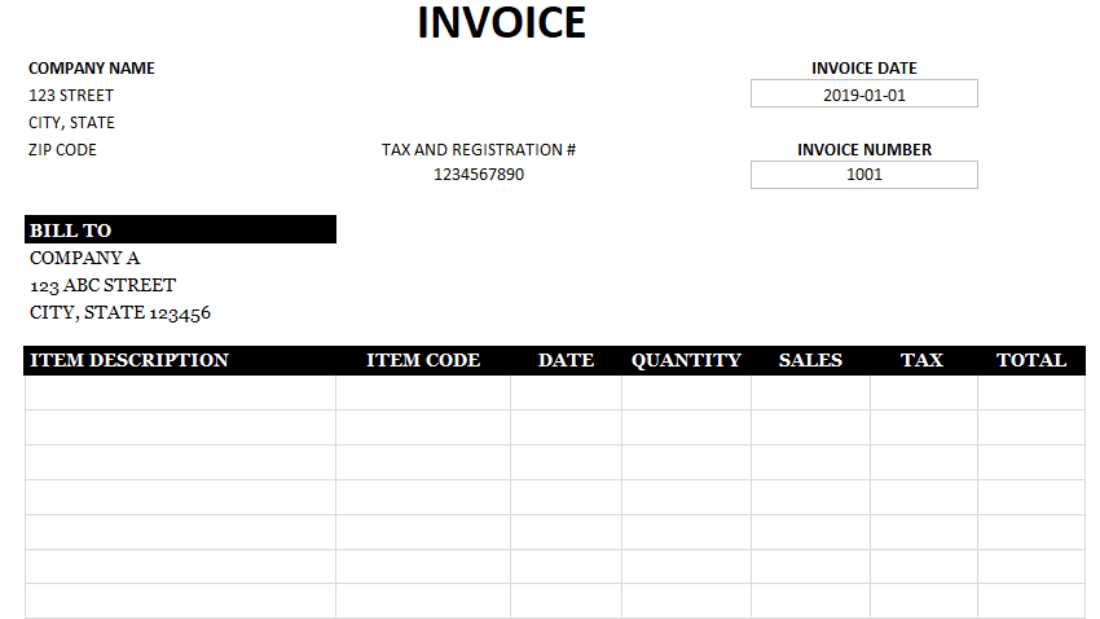

How to Set Up the Template

Setting up a system for automatically creating unique identifiers for each document requires a few simple steps to ensure everything runs smoothly. By organizing key fields and using the right functions, you can create a seamless process for assigning references to your records. Once set up, the system can work autonomously, saving you time and reducing the risk of human error.

Here’s a general guide to help you get started:

- Step 1: Open a new workbook and create the necessary columns for your data, such as date, client information, and any other relevant details.

- Step 2: In a separate column, set up a formula that will automatically generate the unique identifier. This could be based on a sequential format, date, or custom text.

- Step 3: Use formatting options to ensure consistency across all records. For example, you can add leading zeros or ensure the identifier is always a specific length.

- Step 4: Lock the formula cells so that they remain unchanged when new data is entered. This will prevent accidental overwriting or modification.

- Step 5: Test the system by adding a few entries and checking if the identifiers are being generated correctly.

Once everything is set up, you’ll have a streamlined process that automatically generates consistent and accurate references for all your records.

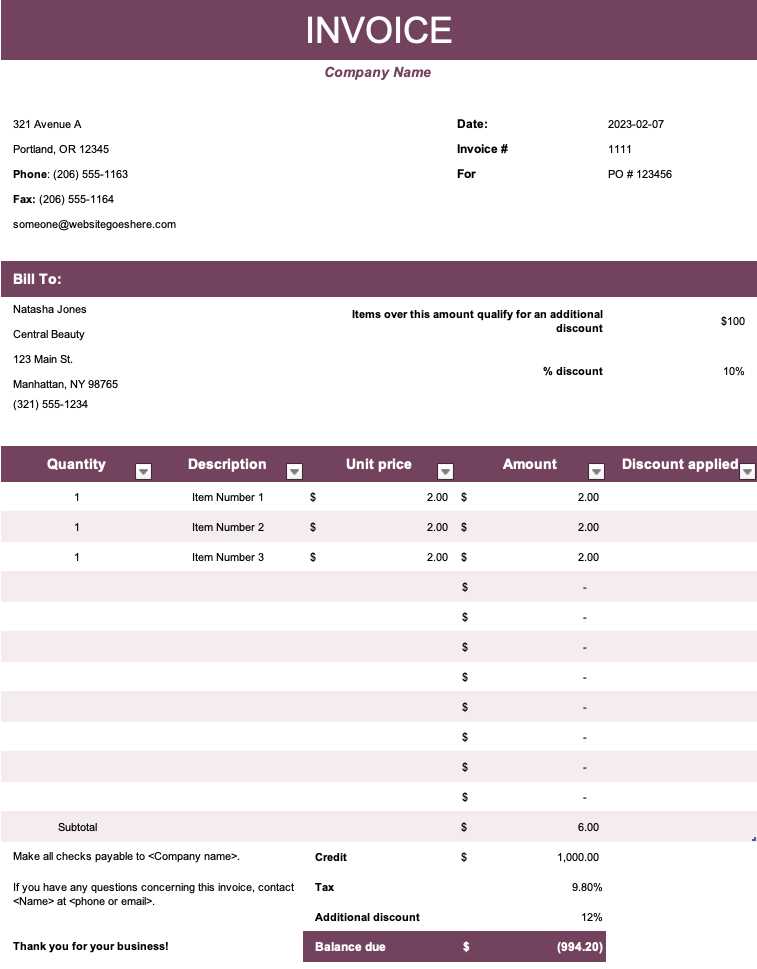

Customizing the Invoice Number Format

Personalizing the structure of document identifiers allows businesses to reflect their unique needs and preferences. Whether it’s adding dates, client-specific codes, or a sequential pattern, customizing these formats ensures that each record is easily recognizable and aligned with company standards. This flexibility makes it easier to organize and retrieve documents when needed.

Common Customization Options

Here are a few ways to personalize the identifier format to fit your specific requirements:

- Sequential Patterns: You can set up a system where each reference follows a numerical sequence (e.g., 001, 002, 003) to maintain consistency.

- Date Integration: Including the current date or year in the reference (e.g., 2024-001) helps you easily categorize records by time period.

- Client or Project Codes: Custom identifiers can also include specific codes tied to clients or projects for quick identification.

- Letter Prefixes: Adding a prefix, such as “PO” or “SO”, can provide additional context for your records, helping to distinguish between different types of documents.

Benefits of Customization

Customizing your identifier format allows for greater flexibility and control over your records. It ensures that each document serves a specific purpose and can be quickly identified without confusion.

- Brand Consistency: Tailoring the format to align with your branding can create a more professional and cohesive appearance across all records.

- Efficiency: Quickly identifying documents based on unique formatting can save time when searching through large volumes of data.

- Scalability: Customization ensures that your system can evolve with your growing business needs without losing its structure.

Ensuring Sequential Invoice Numbers

Maintaining a consistent and sequential system for assigning unique identifiers to each document is essential for organization and clarity. When each reference follows a set order, it becomes easier to track records, prevent duplication, and ensure that no records are overlooked. This structure is especially important for businesses that need to maintain a clear and organized log of their transactions over time.

To implement a sequential system, it’s crucial to set up a reliable method that automatically increments each reference with every new entry. This ensures that your documents are organized in a logical, easy-to-follow order, minimizing the risk of errors.

| Method | Description |

|---|---|

| Automatic Increment | Set up a system that automatically increases the value by one with every new entry, ensuring a smooth and continuous flow. |

| Manual Tracking | In the absence of automation, manually updating the reference for each document can still maintain sequence, though it requires more attention to detail. |

| Validation Checks | Incorporate validation rules to check for gaps or duplicates in your references, helping to ensure consistency across all records. |

By following these methods, businesses can keep their document system orderly and efficient, ensuring that each entry is properly recorded and easy to access when necessary. Whether through automation or manual tracking, maintaining sequential organization is key to successful record management.

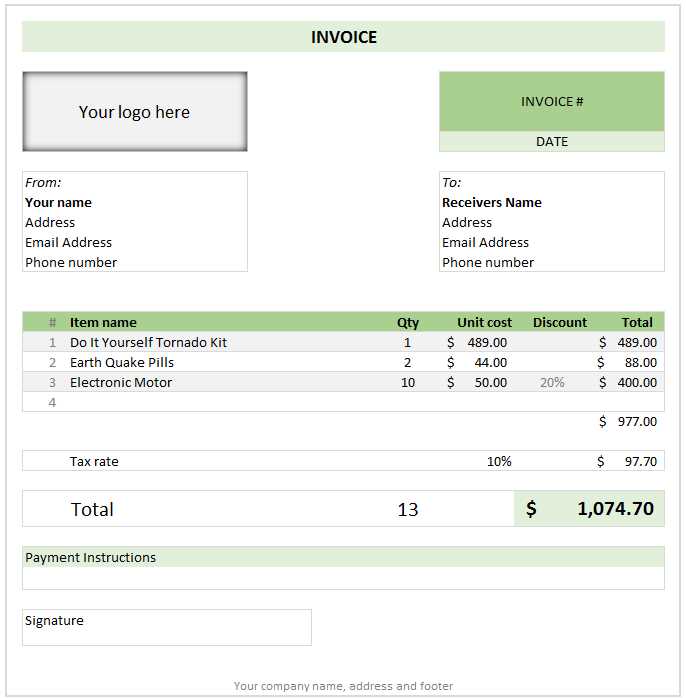

Tracking Invoices with Excel Templates

Efficiently managing and monitoring financial transactions is crucial for any business. Using customizable systems to track each document ensures accurate record-keeping and enables businesses to stay organized. A well-structured system helps you follow the status of each record, monitor payments, and ensure that no transaction is missed.

Here’s how you can track your documents effectively using a structured spreadsheet system:

- Automated Entry: Create a structured layout where key data such as client name, date, amount, and status can be entered automatically, reducing the chance for errors.

- Status Tracking: Implement a column dedicated to tracking the status of each entry (e.g., paid, pending, overdue) so that you can quickly see what needs attention.

- Sorting and Filtering: Utilize sorting and filtering options to easily find specific records based on dates, clients, or amounts, enhancing efficiency.

- Payment Reminders: Use conditional formatting or color coding to highlight overdue records, making it easy to follow up with clients in a timely manner.

- Analytics: By setting up data summarization formulas, you can generate reports on outstanding payments, total income, and other key financial metrics.

With these tracking features, businesses can ensure they are always on top of their financial records, minimizing the risk of lost or forgotten transactions and improving overall cash flow management.

Integrating Date and Time in Numbers

Incorporating time and date into document identifiers offers a practical way to keep track of transactions while ensuring each entry is unique. By combining these elements, you not only add a chronological context to your records but also simplify sorting and searching for specific entries. This method allows businesses to easily categorize and retrieve documents based on when they were created, improving overall organization and efficiency.

To successfully integrate time and date into your reference structure, you can use a combination of formulas and formatting. Here’s an example of how this can be done:

| Method | Description |

|---|---|

| Date Prefix | Start each entry with the current date (e.g., 2024-03-15) to instantly categorize by date. This makes it easier to filter records by specific time periods. |

| Time Suffix | Append the time (e.g., 14:45) to the reference, allowing for even more precise tracking if multiple entries are made on the same day. |

| Custom Format | Combine the date and time in a custom format such as 2024-03-15-1450, creating a fully unique reference for each entry. |

By embedding time and date directly into your references, you ensure that each entry is identifiable not only by a unique code but also by its exact creation time. This makes sorting and filtering much more efficient, especially in businesses that deal with a high volume of transactions on a daily basis.

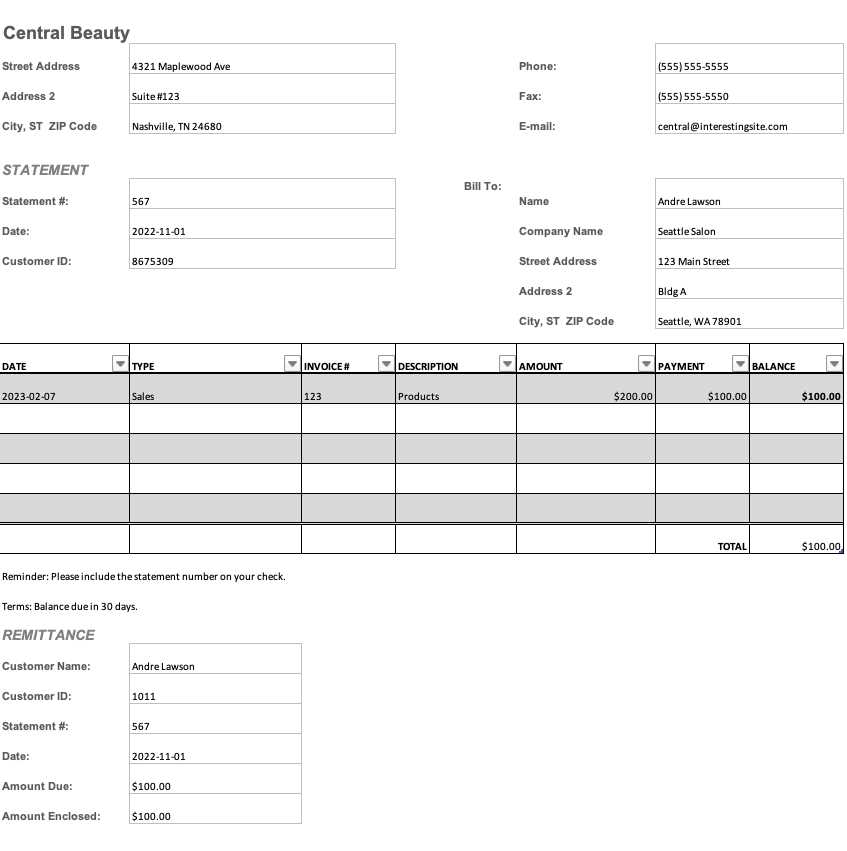

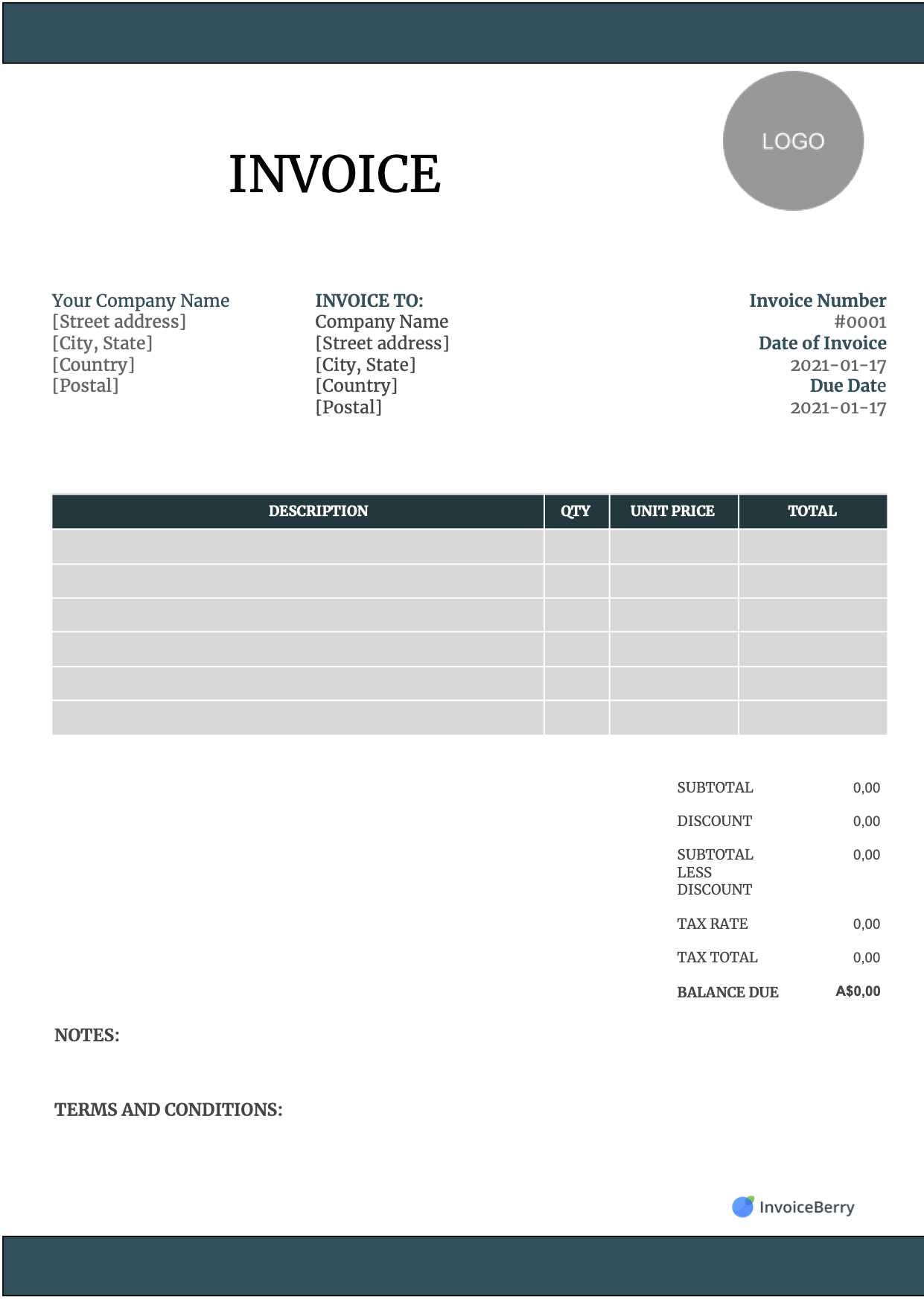

Adding Client Information to Templates

Incorporating client-specific details into your record system is essential for creating a personalized and professional approach to managing business transactions. By embedding relevant client information into each entry, you can ensure that all documents are easily traceable and connected to the right party. This approach enhances communication, improves organization, and streamlines follow-up procedures.

Key client information that can be included in each entry consists of:

- Client Name: Including the full name or company name ensures that each entry is linked to the right client.

- Contact Information: Adding phone numbers, email addresses, or physical addresses makes it easier to contact clients for updates or follow-ups.

- Project or Order Details: Including specific project or order references helps connect the transaction to particular services or products.

- Payment Terms: Including agreed payment conditions can assist in managing expectations and following up on overdue entries.

By including this information directly in your system, you ensure a well-rounded overview of each transaction and enhance your ability to stay on top of client needs and communications.

Managing Large Invoices with Excel

Handling high-volume or complex financial records can become overwhelming without an organized system in place. Efficiently managing large records requires structure, clarity, and easy access to relevant data. With the right approach, even the most detailed transactions can be tracked and processed seamlessly. A well-planned method can help ensure accuracy, prevent errors, and improve overall workflow efficiency.

Here are some key strategies for managing extensive records:

- Use Structured Spreadsheets: Divide your data into clearly labeled columns such as client details, item descriptions, amounts, and payment terms for easy tracking and filtering.

- Incorporate Summarizing Formulas: Use built-in formulas to automatically calculate totals, taxes, and outstanding balances, reducing manual entry and improving accuracy.

- Apply Conditional Formatting: Highlight key data, such as overdue amounts or large transactions, to draw attention to critical entries.

- Use Data Validation: Implement rules that ensure only valid entries are made, minimizing human errors and ensuring data consistency.

- Leverage Filters and Sorting: Make it easy to sort through large records by client name, date, or status, enabling fast access to the data you need.

- Segment Data into Multiple Sheets: For particularly large sets of records, consider separating the information into multiple sheets or tabs for better organization.

By using these techniques, businesses can efficiently handle large sets of financial records, ensuring everything is easily accessible, up-to-date, and properly calculated. This organized system reduces the risk of mistakes and allows for faster decision-making, making the management of even the most complex transactions easier to manage.

Tips for Error-Free Invoice Generation

Creating accurate financial records is essential for maintaining professional relationships and ensuring smooth business operations. Mistakes can lead to confusion, delays, or even payment issues. To prevent errors during the creation of each entry, it’s important to establish clear and consistent practices that minimize human error and ensure the process remains organized.

Here are some effective strategies to ensure flawless record creation:

- Double-Check Client Details: Ensure all client information, such as names, addresses, and contact details, is correct before finalizing any document. Small errors here can lead to big confusion later.

- Use Consistent Formatting: Establish a standard format for each record to ensure uniformity. This makes it easier to spot mistakes and ensures consistency across all documents.

- Automate Calculations: Whenever possible, use built-in formulas to automatically calculate totals, taxes, and discounts. This eliminates manual errors in math and saves time.

- Implement Validation Checks: Set up data validation to prevent the entry of incorrect information, such as invalid dates or incorrect amounts.

- Review Before Finalizing: Always take a moment to review the details of the document before sending it. A fresh set of eyes can often spot things you might have missed.

- Keep Templates Updated: Regularly update your system to reflect any changes in client details or internal processes. Keeping templates current prevents outdated information from slipping through the cracks.

By adopting these best practices, you can significantly reduce errors and ensure your financial records remain accurate and reliable, leading to smoother business operations and stronger client relationships.

Saving and Sharing Your Templates

Once you’ve created an efficient system for managing financial documents, it’s crucial to keep your work easily accessible and shareable. Properly saving and sharing your files ensures that others can benefit from your setup, while also providing a secure way to store important information. Whether you’re sharing with colleagues, clients, or keeping a backup for yourself, a good saving and sharing strategy will streamline your workflow and improve collaboration.

How to Save Your Work

When saving your work, always choose a format and location that ensures both accessibility and security. Here are some tips for efficient saving:

- Use Descriptive File Names: Name your files in a way that makes it easy to identify their contents at a glance. For example, include the date or client name in the file name.

- Organize Files in Folders: Create specific folders for different categories or clients to keep your documents neatly arranged. This helps prevent clutter and ensures you can quickly locate any file when needed.

- Backup Files Regularly: Store your files in multiple locations, such as on your computer and in the cloud, to protect them from accidental loss.

Sharing Your Files Securely

Sharing documents with clients, team members, or stakeholders should be done securely to ensure that sensitive data is protected. Consider the following methods for safe sharing:

- Use Cloud Storage: Platforms like Google Drive, Dropbox, or OneDrive make it easy to share documents with others while maintaining control over permissions.

- Set Permissions: When sharing via cloud storage, always set proper permissions to ensure that only authorized users can view, edit, or download the file.

- Send Password-Protected Files: For additional security, consider password-protecting important files before sharing them, especially if they contain sensitive information.

By following these best practices for saving and sharing your files, you can improve efficiency, ensure easy access, and maintain security, allowing your workflow to run smoothly.

How to Protect Invoice Data in Excel

Securing sensitive financial data is essential to prevent unauthorized access and ensure confidentiality. Whether you’re handling client details, payment records, or transaction amounts, it’s crucial to implement measures that protect this information from potential breaches. In this section, we’ll explore how to safeguard your documents from misuse and ensure that only authorized individuals can access or modify your data.

Protecting Your Files

One of the first steps in safeguarding your records is to ensure the file itself is secure. Here are some methods to protect the entire document:

- Use Password Protection: Adding a password to your file ensures that only people who know the password can access the contents. This is a simple but effective way to secure your data.

- Encrypt the File: Encryption adds an extra layer of security by converting the file into unreadable data without the proper decryption key. This makes it much harder for unauthorized users to access the information.

- Use Secure File Locations: Save your files in a secure location, such as encrypted cloud storage or a password-protected folder on your device.

Protecting Specific Data Within Your Files

In addition to protecting the entire document, you can also secure specific cells or ranges that contain sensitive information. Below are some options to control who can access or modify parts of your data:

- Lock Specific Cells: By locking certain cells, you can prevent unauthorized changes while allowing others to freely edit other parts of the document. This is useful when you want to restrict access to critical information while still enabling others to interact with less sensitive data.

- Hide Sensitive Data: Hiding columns or rows that contain private information can reduce the risk of accidental exposure. You can also protect hidden data with a password to add an additional layer of security.

- Set Permissions for Collaboration: If you are sharing the file, make sure to set appropriate permissions so that only designated users can edit or view specific sections of the document.

By implementing these security measures, you can help prevent unauthorized access and ensure that your financial records remain confidential and protected from potential threats.

Using Excel Templates for Multiple Businesses

Managing records for multiple companies can become complex, especially when you need consistent documentation for each one. The ability to use a single file to handle various sets of business data is a powerful tool. By creating distinct structures within the same framework, you can streamline your workflow and save time, while ensuring that each business has its own customized format. This approach allows you to keep all the information in one place while tailoring the layout and contents to meet the specific needs of each company.

When working across several businesses, one of the key advantages is the flexibility to adapt the same format to different industries or requirements. Whether it’s customizing the design or adjusting data fields, you can easily modify the structure to fit the unique needs of each enterprise. This approach not only reduces the effort needed to create documents from scratch but also ensures consistency and accuracy across multiple companies.

By leveraging the right system and organization, handling diverse businesses with a unified set of tools becomes a simple and efficient task. It’s essential to maintain clear boundaries between each company’s data to prevent confusion, while also benefiting from the efficiency that comes with using a shared structure for all your records.

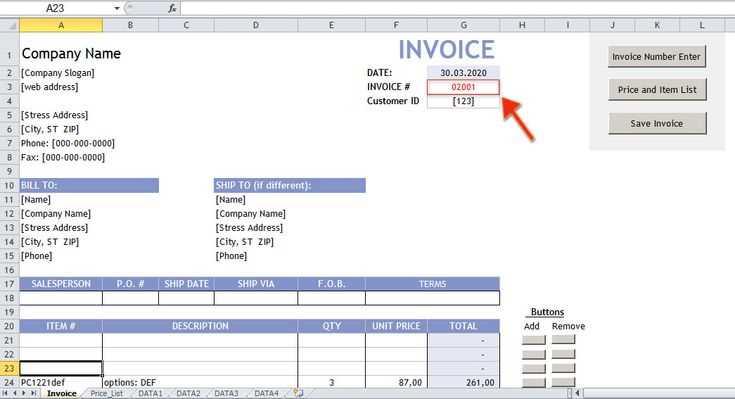

Automating Numbering with Formulas

Automation can save valuable time and reduce the likelihood of errors in any process. When it comes to creating sequential identifiers for documents, using built-in calculations within your software can streamline the task. By applying simple formulas, you can automatically generate a unique code each time a new record is created, eliminating the need to manually track or input the next identifier in line. This ensures consistency and reduces human error.

With formulas, you can set up a system that automatically updates each entry’s identifier based on previous values, or even integrate it with other data points like dates or customer names. This flexibility makes the process more dynamic and tailored to your needs. Let’s look at how formulas can be applied to streamline the workflow:

Common Formulas for Automated Numbering

- Simple Incremental Formula: Using basic addition formulas to increase the last value by one for each new entry.

- Dynamic Date-based Formula: Combining the current date with a unique sequence to create a custom identifier.

- Text and Number Combination: Using CONCATENATE functions to merge dynamic elements such as text and numeric values into one seamless identifier.

These methods help automate the creation of unique identifiers without manual intervention, ensuring that each record is properly labeled and easy to track.

Common Mistakes to Avoid with Templates

While using predefined structures for creating documents can save time and improve efficiency, it’s important to be aware of common pitfalls that can compromise accuracy and usability. Even the most well-designed tools can become ineffective if not used properly. By avoiding certain mistakes, you can ensure that your documents are generated smoothly, consistently, and without errors.

Let’s take a look at some of the most frequent missteps and how to steer clear of them:

1. Ignoring Consistency in Formatting

One of the easiest mistakes is not maintaining a consistent style across all entries. Inconsistent formatting can make your documents look unprofessional and can cause confusion when reviewing or sharing them. Make sure to define a clear structure for your text, numbers, and other elements, and stick to it.

2. Failing to Update Fields Regularly

It’s crucial to ensure that all dynamic fields are updated regularly. This includes numerical sequences or other automated inputs that might require adjustments over time. If these fields are neglected, they could result in incorrect or outdated data, leading to issues with tracking and record-keeping.

- Forgetting to update the sequence: Make sure to adjust the starting point or increase the value each time you add a new entry.

- Not refreshing linked data: Ensure that all linked fields, such as dates or client names, are correct and up-to-date for each record.

3. Overcomplicating the Structure

It’s easy to get carried away with adding too many elements to your document setup. While flexibility is useful, a complex structure can lead to confusion and errors. Aim for simplicity and clarity. Limit the use of too many different formats, formulas, or design features to ensure that the end result is both functional and easy to understand.

By being mindful of these common mistakes, you can enhance your productivity and ensure that your documents meet your needs efficiently and effectively.

Updating Your Template for New Needs

As your business evolves, so do your requirements. What worked well in the past might no longer meet your current needs, and it’s essential to keep your system flexible and adaptable. Updating your document structure is key to ensuring that it remains efficient, accurate, and aligned with your business goals. By making timely adjustments, you can continue to streamline your processes and maintain smooth operations.

1. Identifying New Requirements

Start by assessing what has changed in your workflow. Perhaps you’ve added new services, expanded your customer base, or introduced different payment options. These changes may require you to modify your approach to creating and managing records. Consider the following:

- New fields: Do you need additional sections for new information such as tax details, service categories, or client preferences?

- Updated data formats: Are there new formatting conventions or data types you need to accommodate, such as different currencies or additional contact information?

2. Adjusting Structure and Automation

Once you’ve identified the new elements, it’s time to modify the structure. This could involve adding rows, columns, or new sections to your existing setup, as well as adjusting any automation or calculations. If your needs have become more complex, consider breaking the process into smaller, manageable steps to ensure that everything is clearly organized.

- Streamlining calculations: If your processes have become more complicated, look into automating complex calculations to save time and reduce errors.

- Adding new categories: Ensure that you can easily categorize and track the new services or products you’re offering.

By regularly reviewing and adjusting your system, you ensure that it evolves with your business and continues to support your operations efficiently.