Invoice Notice Template for Quick and Easy Billing

Managing payments efficiently is a critical aspect of any successful business. To ensure timely settlements and maintain healthy cash flow, clear communication with clients is essential. One of the most effective ways to remind customers of outstanding amounts is through formal billing reminders that are easy to understand and professionally presented.

In this guide, we will explore how to create a well-structured document to remind your clients of due payments. By focusing on key elements and design principles, you can streamline the billing process and reduce delays. Whether you are a freelancer or running a large enterprise, having a reliable system for payment reminders can enhance your overall business efficiency.

Customizing your reminder format is just as important as its content. By personalizing the communication, you can ensure that clients feel informed and confident in making payments on time. With simple tools and best practices, even the busiest professionals can maintain organized and timely invoicing systems.

Invoice Reminder Template Overview

When it comes to collecting payments from clients, clarity and professionalism are key. A well-organized reminder document serves as an important tool to prompt customers about pending balances, ensuring timely payment while maintaining positive relationships. This document should be clear, concise, and contain all necessary information for the client to process their payment without confusion.

Why You Need a Reminder Document

Sending a formal reminder ensures that clients are aware of their outstanding amounts and any deadlines that might be approaching. A structured format reduces errors and confusion, helping both parties stay on the same page. Additionally, it establishes a professional tone that reflects your business’s reliability.

What to Include in the Reminder Document

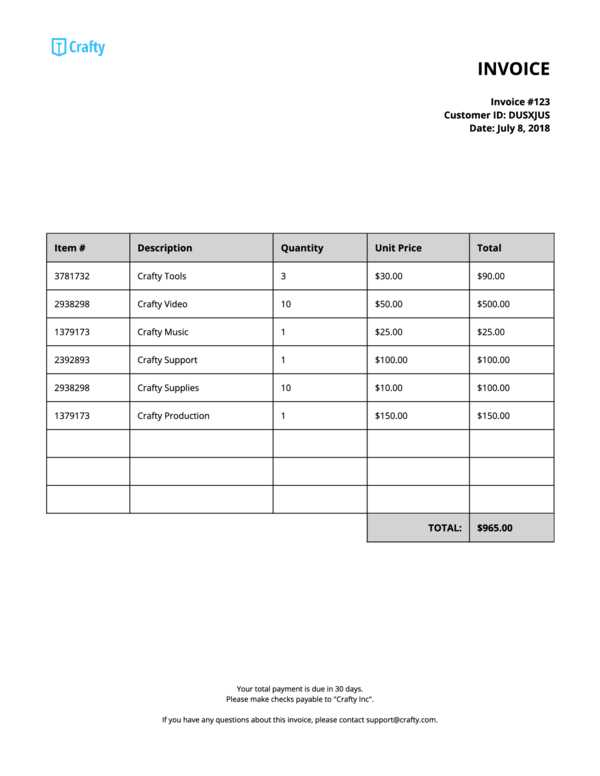

A well-prepared reminder document should include several key components to be effective. Below is an overview of the critical details to include:

| Component | Description |

|---|---|

| Client Information | Name, address, and contact details of the recipient |

| Payment Due Date | The exact date by which the payment should be made |

| Amount Due | The exact figure that needs to be settled |

| Payment Instructions | Details on how the payment can be made (bank details, online payment methods, etc.) |

| Late Payment Terms | Any penalties or fees associated with delayed payments |

By incorporating these key details, your reminder document will be both functional and clear, making it easier for clients to take prompt action on their outstanding payments.

Why You Need an Invoice Reminder

Maintaining effective communication with clients is crucial for ensuring timely payments and a steady cash flow. Sending reminders about pending balances helps reduce confusion and reminds customers of their obligations. Without a clear and professional system in place, late payments can become a frequent issue, potentially affecting your business operations.

Timely reminders serve as a gentle yet firm prompt for clients to settle their debts. They help to avoid misunderstandings and ensure that both parties are aligned on the terms of payment. Without them, businesses risk losing revenue or facing cash flow issues that can hinder growth.

Professionalism in all financial communications is key. A well-structured reminder letter enhances the credibility of your business while maintaining positive customer relationships. By having a standardized process, you avoid the need for constant follow-ups, which can be time-consuming and stressful.

In addition, reminders can be an important legal safeguard. In the event of disputes, having a clear record of communication helps protect your interests. Ensuring that every transaction is documented thoroughly is essential for maintaining transparency and trust with clients.

Key Elements of an Invoice Reminder

Creating an effective payment reminder requires careful attention to detail. A well-crafted document not only informs the client of their outstanding balance but also provides all the necessary information to facilitate easy and timely payment. The goal is to ensure that there is no ambiguity about what is owed, how to pay, and by when.

The structure of the reminder is critical to its effectiveness. It must be clear, professional, and easy to follow. Below are the essential components that should be included to ensure that the reminder fulfills its purpose:

- Client Information: Include the recipient’s full name, address, and contact details to ensure clarity and avoid any mix-ups.

- Outstanding Amount: Clearly state the amount due, including any applicable taxes, fees, or discounts. This helps to avoid confusion over the final balance.

- Due Date: Specify the exact date by which payment should be made. This establishes urgency and helps clients stay on track.

- Payment Methods: Provide the necessary details for how payments can be made, such as bank account numbers, online payment links, or other methods available.

- Late Fees: If applicable, mention any penalties or interest for overdue payments. This encourages prompt action and discourages delays.

- Clear Instructions: Offer clear, step-by-step instructions on how to proceed with the payment, ensuring no confusion in the process.

Incorporating these elements ensures that the reminder serves its purpose without causing any misunderstandings. By providing all relevant details in a professional and organized manner, you increase the chances of receiving payment on time and maintaining a good relationship with your client.

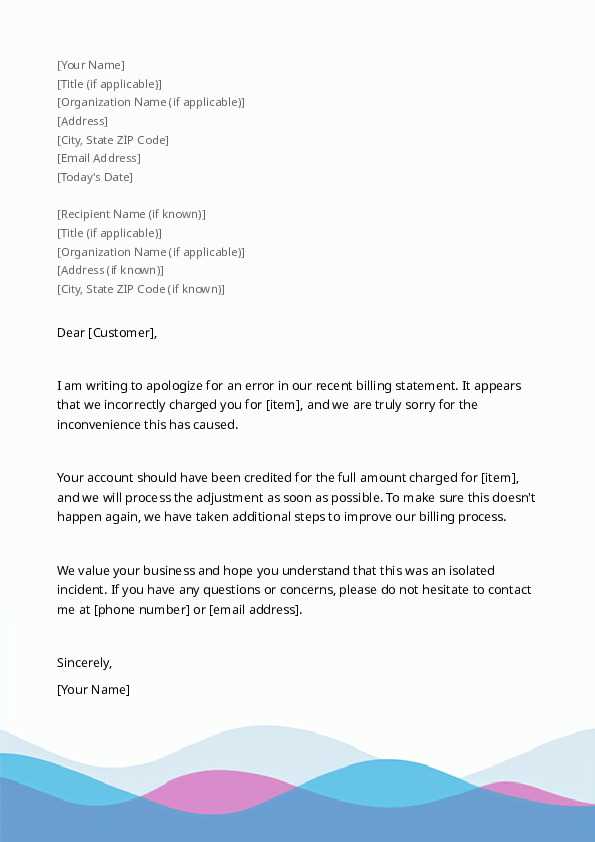

How to Customize Your Payment Reminder

Personalizing your payment reminder document ensures that it reflects your brand identity and meets the specific needs of your clients. Customization allows you to adapt the content, design, and tone to create a more engaging and effective communication tool. A well-tailored reminder not only looks professional but also enhances the likelihood of prompt payment.

Personalizing the Content

Begin by adjusting the core details of the reminder. Include your business logo, contact information, and a professional sign-off to give the document a polished appearance. Additionally, make sure to tailor the language based on your relationship with the client. For example, you may opt for a more formal tone for corporate clients and a friendly, approachable tone for smaller businesses or long-term customers.

Adapting Design Elements

The layout and design of the reminder should be clear and easy to read. Use your company’s branding colors and fonts to make the document visually consistent with other business materials. Ensure there is ample white space to make the information easy to navigate. Avoid overcrowding the document with unnecessary text or design elements, as a cluttered layout can lead to confusion.

By customizing both the content and design, your payment reminders will appear more personal and professional, helping to strengthen relationships with your clients while improving the chances of timely payment.

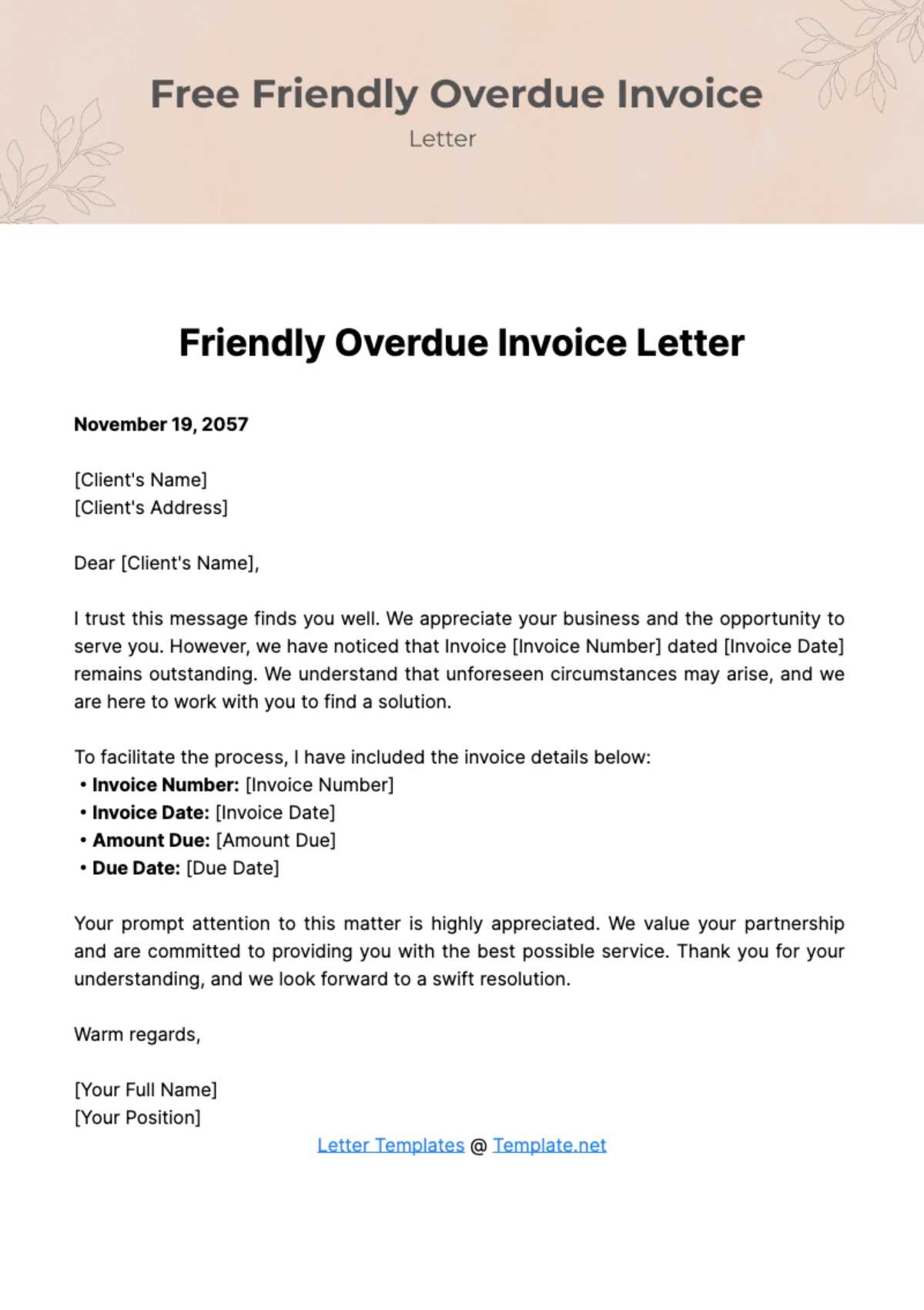

Types of Payment Reminders for Businesses

There are various types of payment reminders that businesses can use to inform clients about outstanding balances. Each type serves a different purpose and can be customized based on the specific situation or stage of the payment cycle. Understanding these different types allows businesses to choose the most appropriate approach to ensure timely payments while maintaining a professional relationship with their clients.

Generally, payment reminders can be categorized based on the timing, formality, and urgency of the request. Here are the most common types used by businesses:

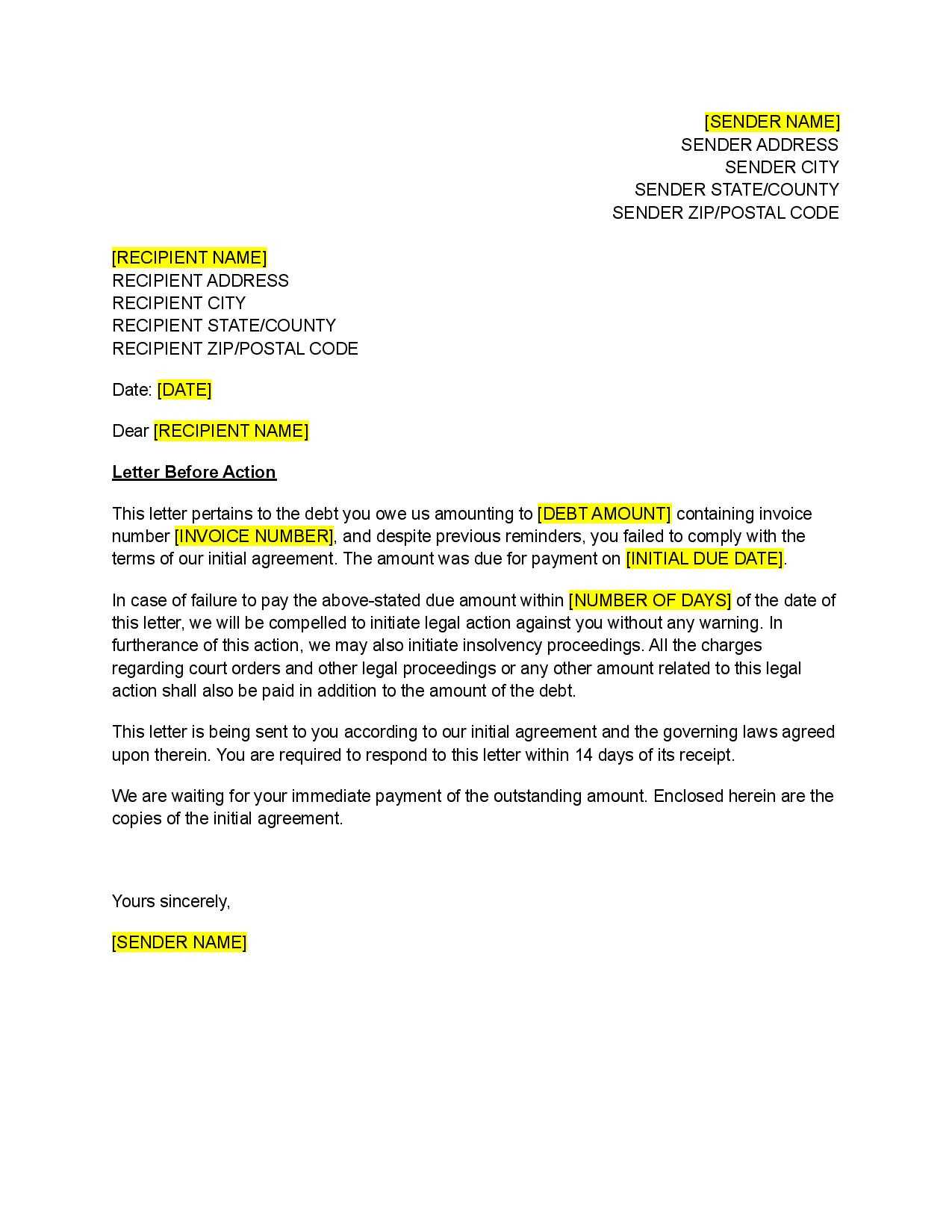

- Initial Reminder: This is the first communication sent shortly after the due date has passed. It serves as a polite reminder that the payment is overdue, without sounding too harsh.

- Second Reminder: If payment has still not been made after the first reminder, a second notice may be sent. This message is more assertive, stressing the importance of settling the balance soon to avoid further action.

- Final Reminder: This is a more urgent communication, often including a mention of penalties or late fees. It is sent when the payment is significantly overdue, and it often warns the client about the possibility of additional legal or financial consequences if the matter is not addressed immediately.

- Friendly Reminder: A less formal reminder sent before the due date. It is used to inform the client of an approaching deadline, providing them with the necessary details to make a timely payment.

- Payment Confirmation: After a payment has been received, a confirmation notice is sent to acknowledge the transaction. This is not technically a “reminder,” but it is an important part of the payment process, helping both parties keep accurate records.

By using the right type of reminder at the appropriate time, businesses can increase the chances of receiving payment without damaging customer relationships.

Creating Professional Payment Reminders Easily

Crafting a professional payment reminder doesn’t have to be a complicated or time-consuming task. With the right tools and a clear structure, businesses can quickly generate documents that are both effective and polished. A well-designed reminder not only improves communication with clients but also enhances the business’s credibility.

To create a professional reminder, follow these simple steps:

- Choose a Clear Layout: Ensure the document is easy to read and follow. Use sections for different types of information, such as the payment amount, due date, and payment instructions. A clean layout will make it more likely that the client will read and act on the reminder.

- Use Professional Language: The tone of your message should be polite yet firm. Avoid overly casual language, but also ensure the tone remains customer-friendly to maintain a positive relationship.

- Include Essential Information: Make sure to add all necessary details such as client information, the outstanding amount, payment due date, and available payment methods. The more complete the information, the easier it is for the client to make the payment without confusion.

- Personalize the Message: Whenever possible, address the client by name and reference specific details related to their account or service. Personalization makes the reminder feel more tailored and thoughtful.

- Offer Multiple Payment Options: Provide various payment methods to make it easier for the client to settle the balance. Whether it’s through a bank transfer, online payment platform, or another method, offering flexibility encourages faster payments.

By following these guidelines, businesses can create professional and efficient payment reminders in a matter of minutes. With the right approach, you can save time and improve your payment collection process without sacrificing professionalism.

Common Mistakes in Payment Reminders

When creating a reminder for outstanding payments, even small errors can lead to confusion or delays in payment. Businesses that fail to pay attention to detail in their communications risk damaging client relationships or prolonging the collection process. Understanding common mistakes can help prevent these issues and ensure that your reminders are both clear and effective.

Key Errors to Avoid

Below are some of the most common mistakes businesses make when drafting payment reminders:

| Error | Impact |

|---|---|

| Missing or Incorrect Client Details | Can lead to confusion or miscommunication, and potentially result in payments being delayed or sent to the wrong address. |

| Vague Payment Instructions | Without clear guidance, clients may struggle to complete the payment, leading to frustration and further delays. |

| Unclear Payment Amount | When the total due is not specified or breaks down incorrectly, clients may question the amount or overlook partial payments. |

| Overly Aggressive Tone | A harsh or confrontational tone can damage the client relationship and discourage timely payments. |

| Missing Payment Due Date | Without a clear due date, the client may not prioritize the payment, resulting in unnecessary delays. |

How to Avoid These Mistakes

To ensure your payment reminders are effective, always double-check the details before sending. Take the time to verify client information, make sure payment instructions are clear, and be polite yet firm in your language. Clear communication not only reduces mistakes but also fosters trust between you and your clients, making it easier to manage timely payments.

Best Practices for Sending Payment Reminders

Sending payment reminders effectively is essential to ensuring timely payments while maintaining strong client relationships. A well-timed, professional reminder can make all the difference in receiving payments on time, without creating friction. By following best practices, businesses can streamline their collection process and reduce the risk of late payments or misunderstandings.

Timing and Frequency

Timing is crucial when sending payment reminders. Sending reminders too early or too late can have negative effects. Ideally, send the first reminder soon after the due date, but not too soon that it comes across as a mistake. Follow up with a second reminder if necessary, giving clients enough time to resolve the payment without feeling pressured.

- First Reminder: Send within 1-3 days after the due date to give the client a gentle nudge.

- Second Reminder: Send 7-10 days later if no payment has been received, stressing the importance of immediate action.

- Final Reminder: Send at least 15-30 days after the due date, warning of potential penalties or further action.

Crafting the Message

When creating a payment reminder, ensure that the message is clear, polite, and professional. Always provide complete details, including the outstanding amount, due date, and payment instructions. While it’s important to remain firm, be sure to avoid aggressive language that could harm the client relationship.

- Be Clear: Make sure all necessary information is included–such as payment amount, due date, and available methods of payment.

- Be Professional: Use formal language, especially when dealing with larger clients. Personalize the message when possible to maintain a friendly tone.

- Offer Solutions: If there are any issues with payment (such as a delay), offer potential solutions or options for clients to resolve the matter easily.

By following these practices, businesses can improve their chances of receiving payments on time, while keeping client relations intact.

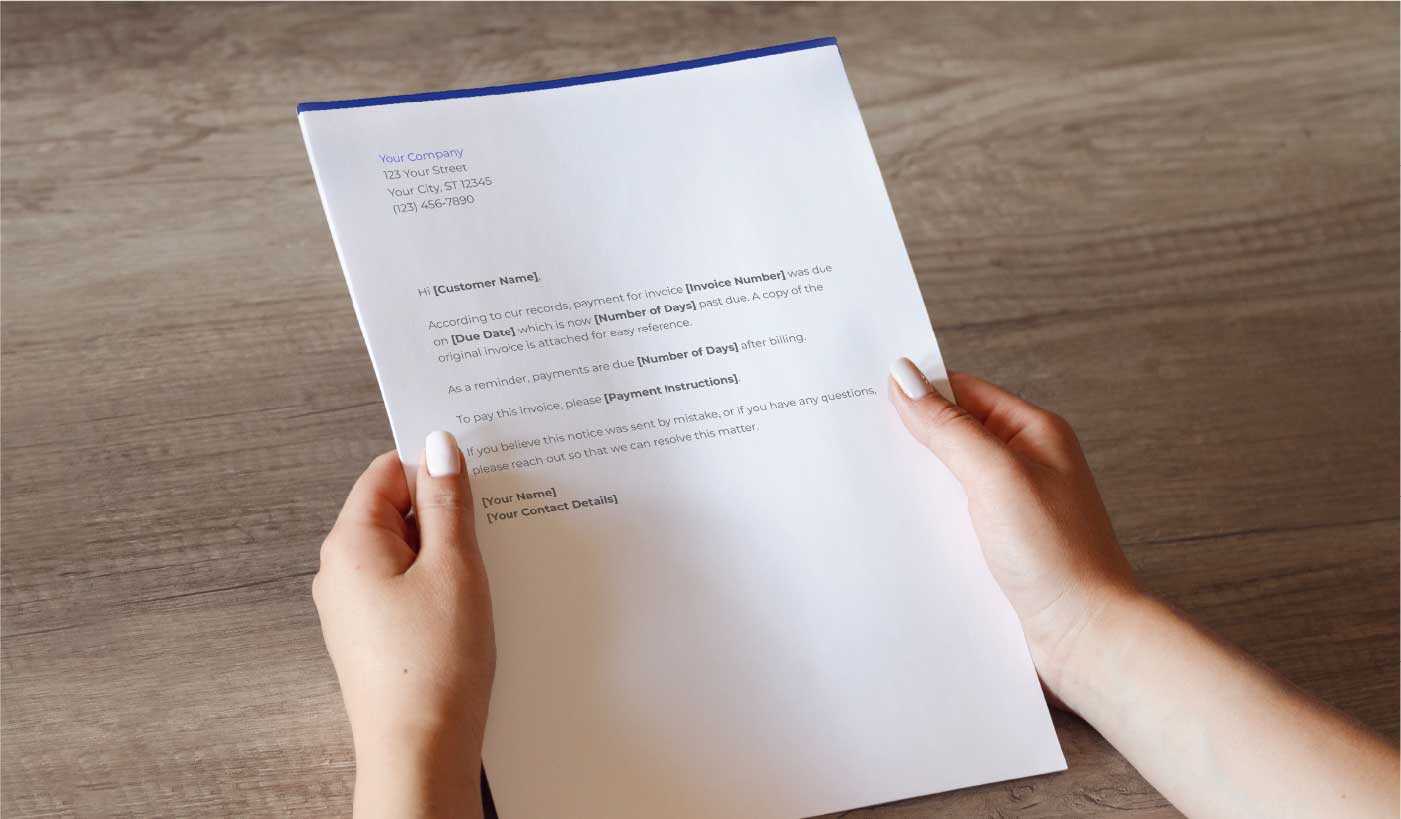

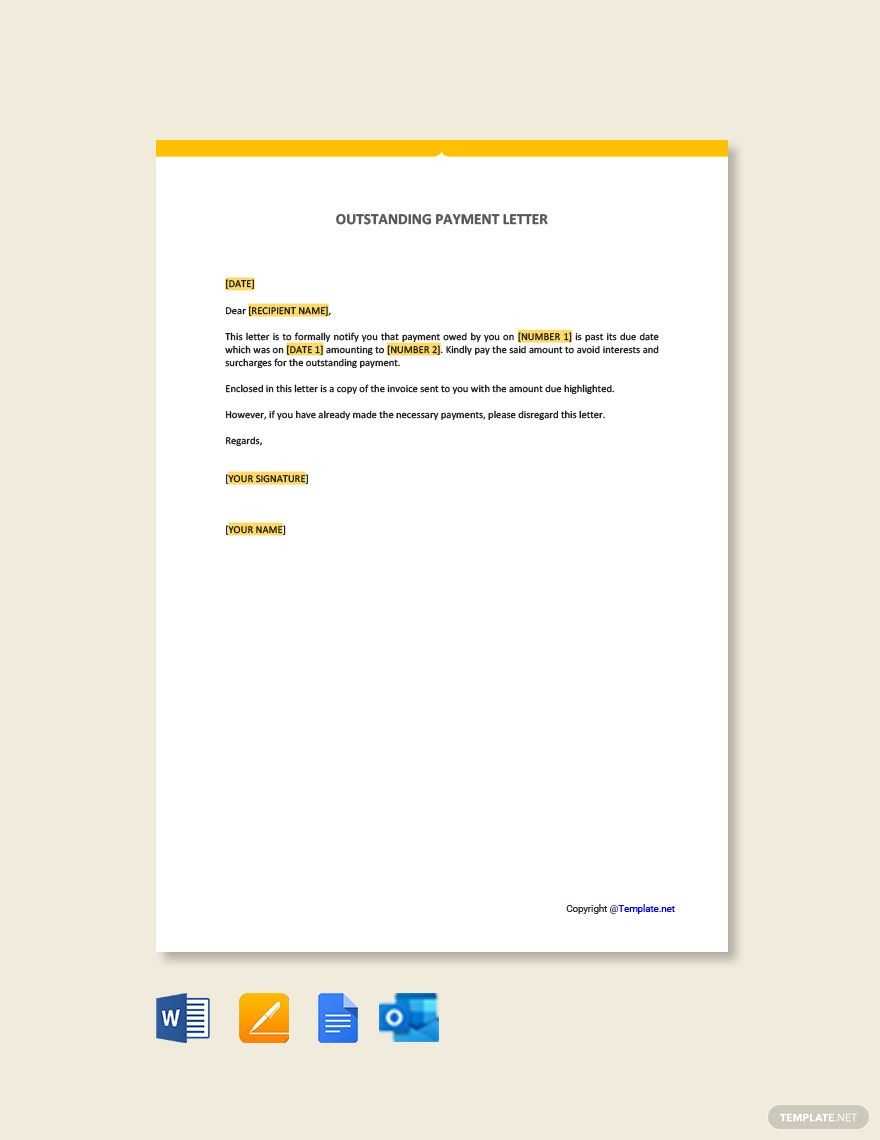

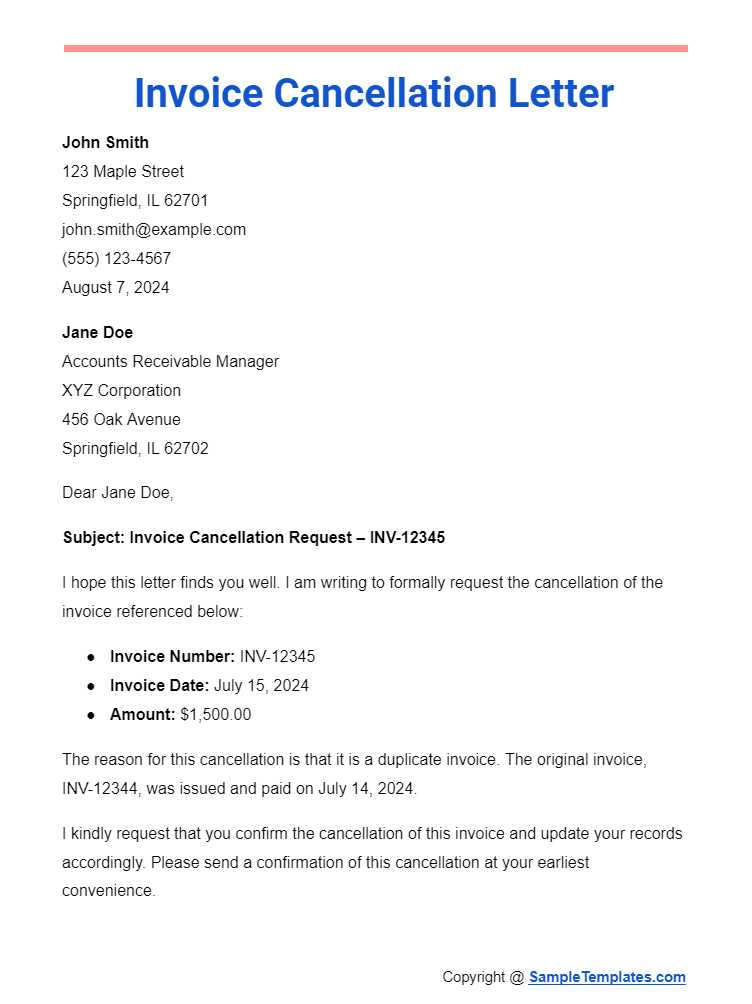

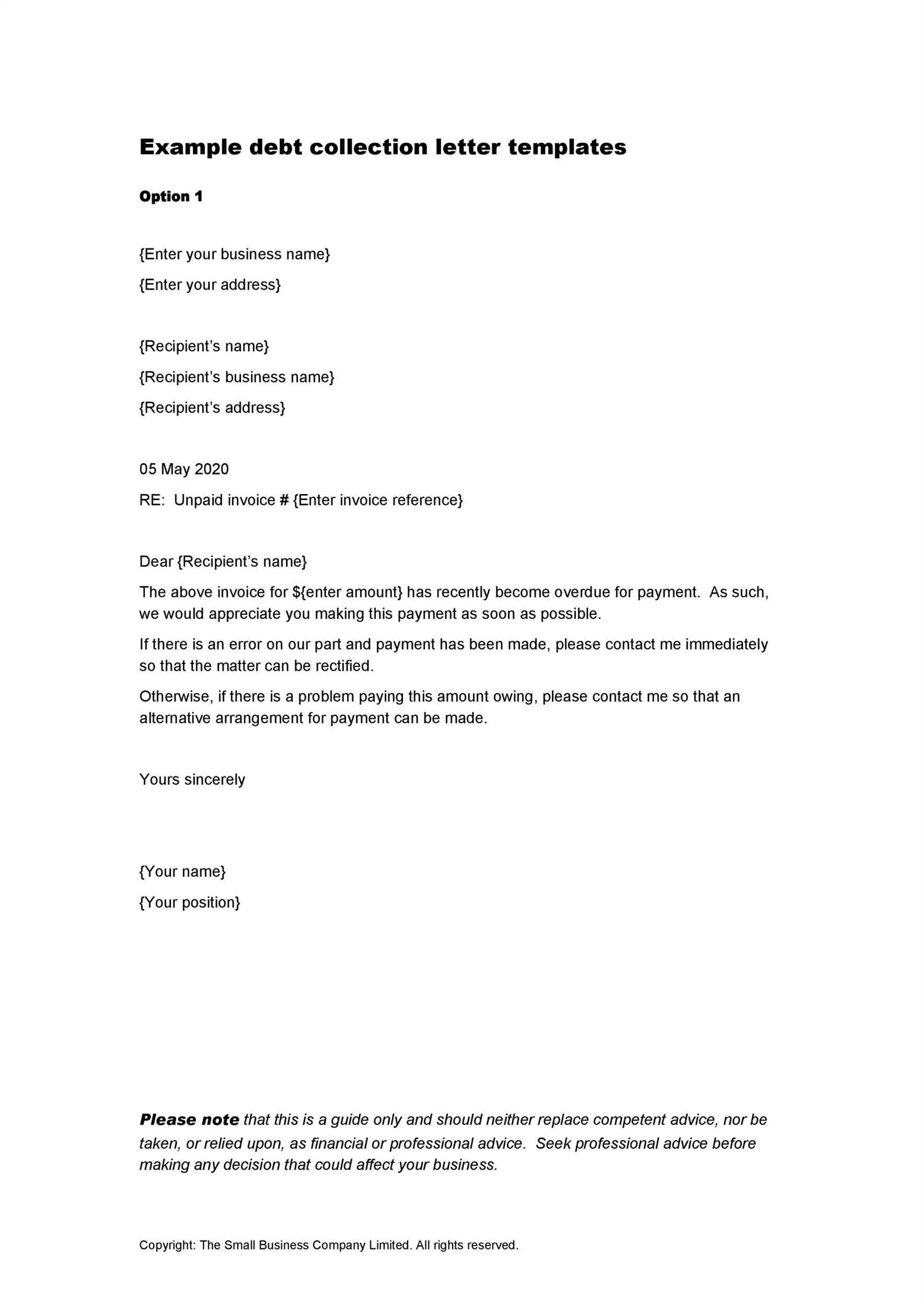

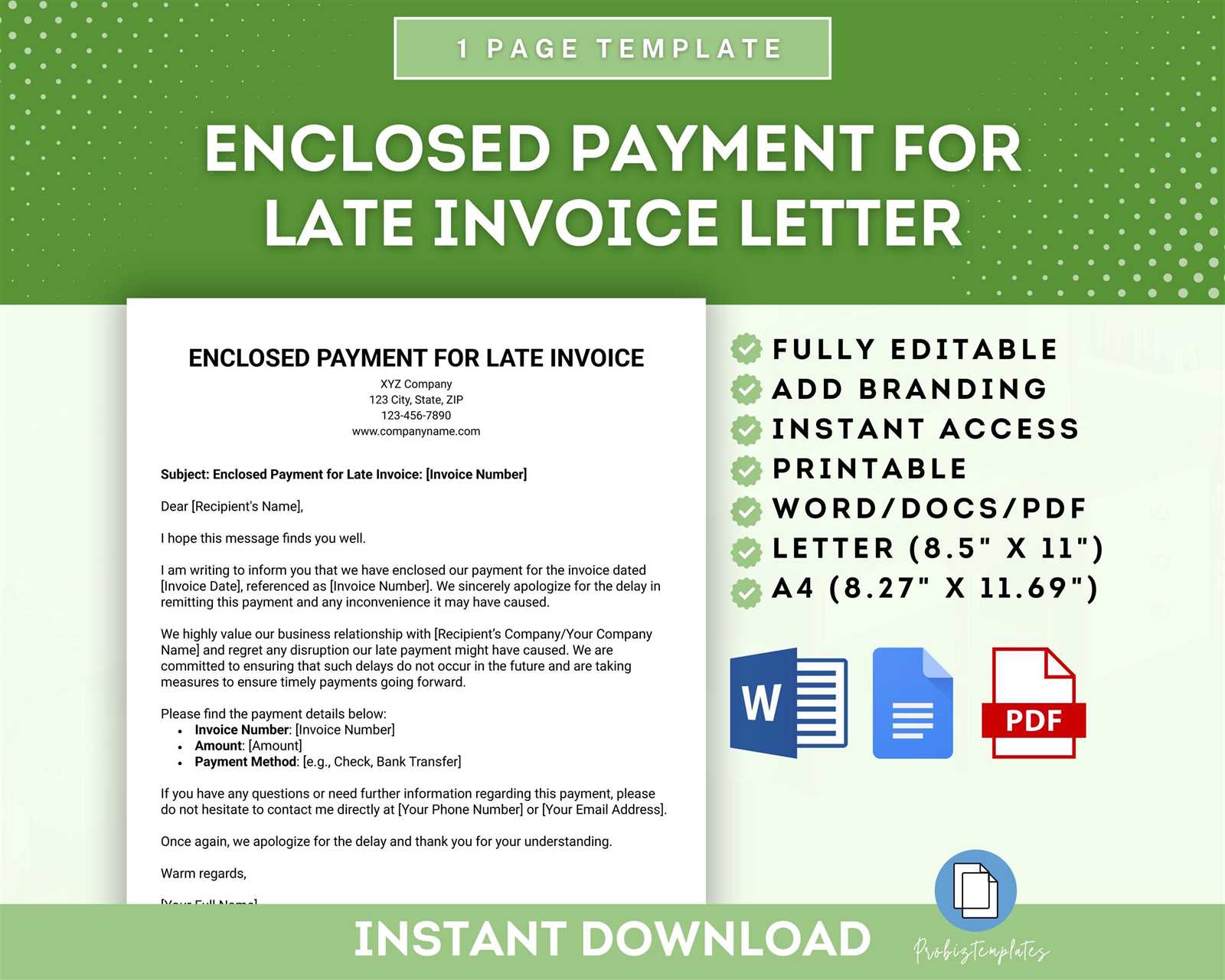

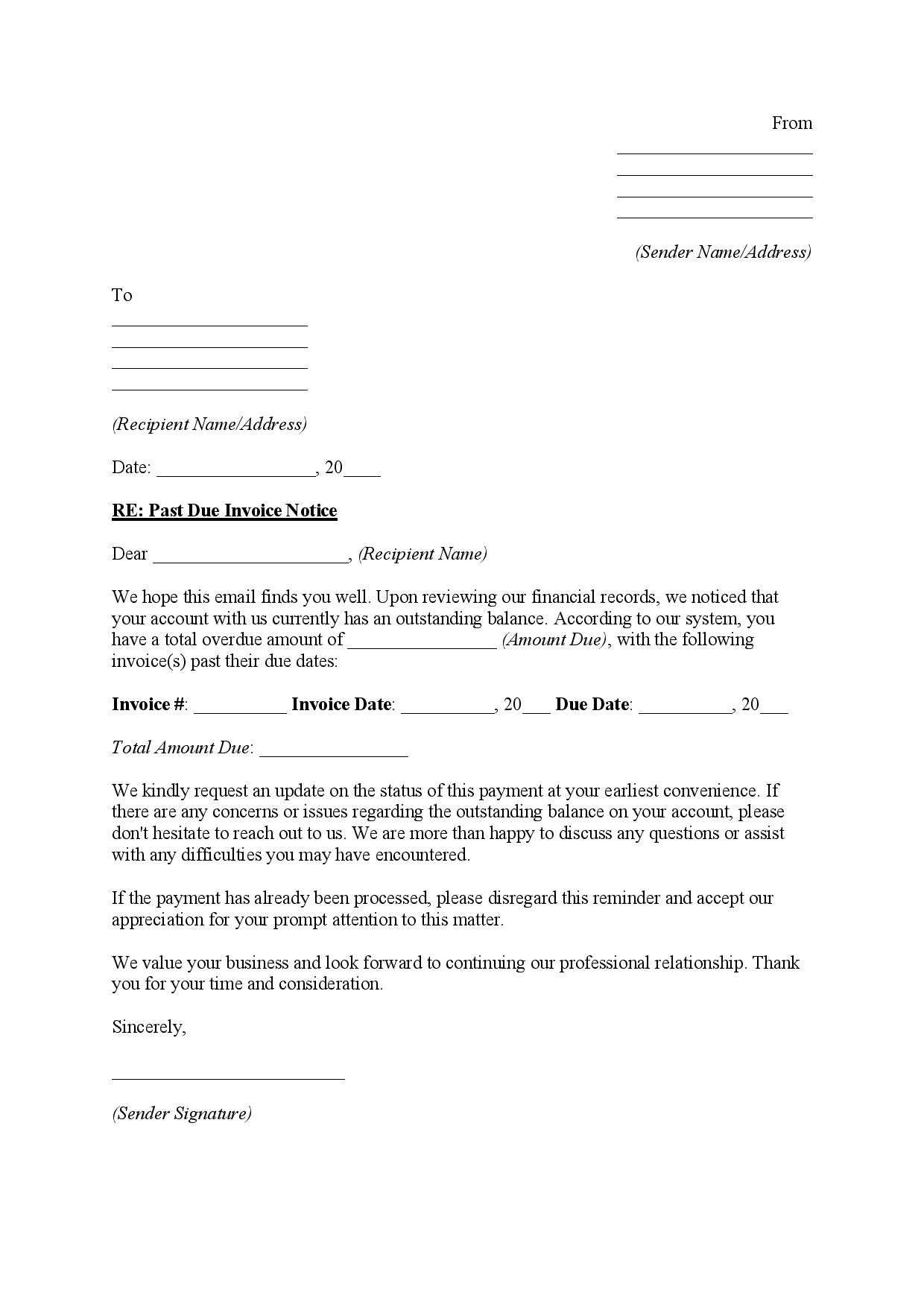

Free Payment Reminder Templates Available

For businesses looking to streamline their payment collection process, having access to ready-made reminder documents can save both time and effort. Free templates offer a quick and easy way to send professional payment reminders without having to design one from scratch. These pre-built formats are customizable, allowing businesses to personalize them according to their specific needs and branding.

Where to Find Free Templates

There are several online platforms offering free payment reminder templates, including both simple and more advanced designs. These platforms allow users to download documents in various formats, such as Word, PDF, or Excel, making it easy to integrate them into existing systems. Some popular sources include:

- Online Business Websites: Many business-focused websites offer free downloadable files that can be quickly customized for your specific needs.

- Document Sharing Platforms: Websites like Google Docs and Microsoft Office Templates offer a range of professional reminder formats, which are simple to adapt and use.

- Specialized Accounting Sites: Some accounting and financial management websites provide tailored reminder documents that align with industry standards.

Advantages of Using Free Templates

Free templates provide several benefits for businesses, especially for those that may not have the resources to create custom documents. Some of the key advantages include:

- Time-Saving: Templates eliminate the need to design reminders from scratch, allowing businesses to quickly generate documents and focus on other priorities.

- Consistency: Pre-designed documents ensure a consistent look and feel across all reminders, maintaining a professional image for the business.

- Customization: Most free templates are easily customizable, allowing businesses to add their own branding, client-specific details, and payment terms.

By using these free resources, businesses can improve their payment reminder process and ensure that they are sending clear, professional communication to clients every time.

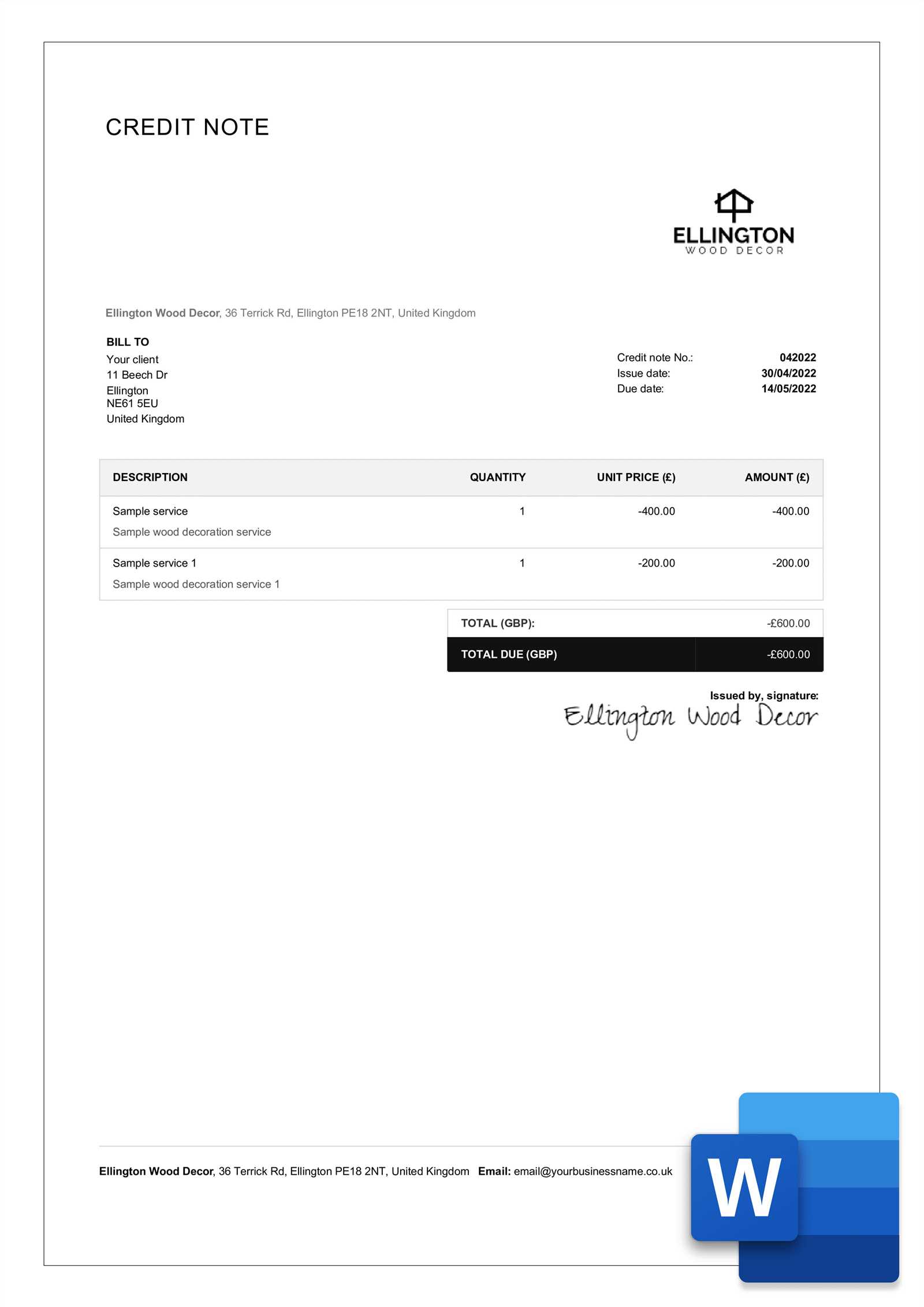

How to Format Your Payment Reminder

Formatting a payment reminder effectively is crucial for ensuring clarity and professionalism. The right layout not only makes the document easier to read but also helps convey important details in a structured way. A well-formatted reminder ensures that your client understands the due amount, payment terms, and necessary steps to complete the transaction, reducing the chances of confusion or delays.

When formatting your payment reminder, follow these key guidelines to ensure the document is both visually appealing and functional:

- Use Clear Headings: Start with a bold and easily identifiable header, such as “Payment Reminder” or “Outstanding Balance.” This immediately informs the recipient of the purpose of the document.

- Include Company Information: Place your business name, address, and contact information at the top, along with any relevant reference or invoice number. This ensures the client knows who the reminder is from and can refer to the appropriate details.

- Client Details: Include the client’s name, address, and any relevant account number or reference. This helps ensure there are no misunderstandings about who the reminder is for.

- Use Clear Payment Details: Clearly break down the outstanding amount, including the total balance, any applicable taxes, and any discounts. Ensure these numbers are easy to read and calculate.

- Provide Payment Instructions: Be specific about how the client can make the payment. Include payment options, such as bank account details or online links, and any instructions for each method.

- Specify Payment Due Date: Clearly highlight the due date so there is no confusion about when payment is expected. You may want to use bold or colored text to make this date stand out.

- State Consequences of Late Payment: If there are late fees or interest penalties, make sure these are clearly stated in the document, ideally near the bottom or as part of the payment instructions.

- Professional Tone: Use formal, polite language throughout the reminder. Even if the payment is overdue, keep the tone courteous and professional to maintain a positive business relationship.

By following these formatting guidelines, your payment reminder will be both clear and professional, helping to ensure a smooth and timely transaction while maintaining your business’s reputation.

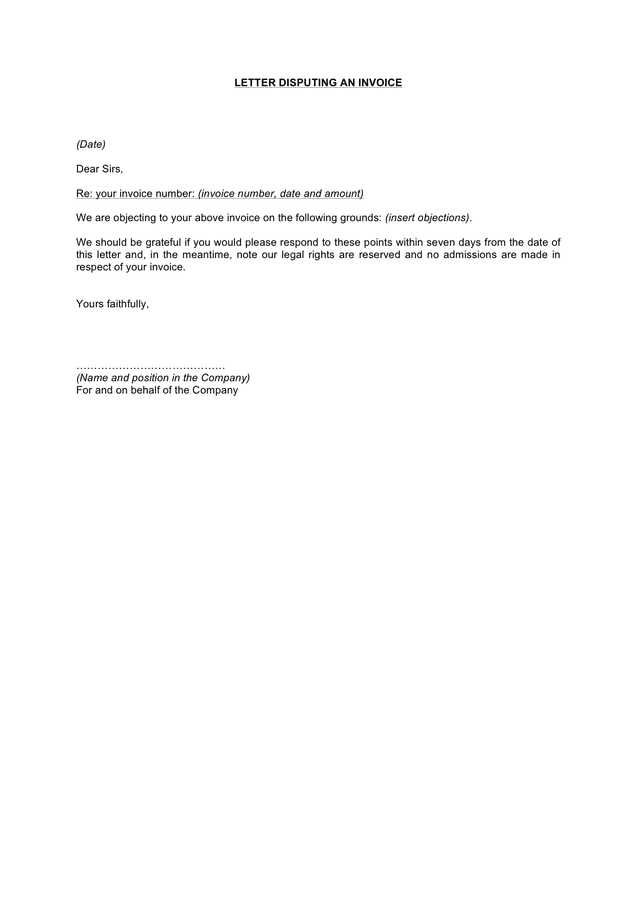

Legal Requirements for Payment Reminders

When sending payment reminders, businesses must adhere to certain legal requirements to ensure compliance and avoid potential disputes. These regulations ensure that communications are fair, transparent, and respectful of the rights of both parties involved. Understanding these requirements is essential to avoid legal issues while still maintaining professionalism in your payment follow-ups.

Key Legal Considerations

There are several legal aspects to consider when crafting payment reminders, including the following:

- Clear and Transparent Terms: Your payment reminder should include clear information about the amount due, payment terms, and due date. This is essential for protecting both your business and the client from misunderstandings or misinterpretations.

- No Harassment or Threats: While it is important to follow up on overdue payments, it’s critical to avoid language that could be perceived as harassment or coercion. Threatening language or excessive follow-ups may violate consumer protection laws, especially in regions with strict rules about debt collection practices.

- Compliance with Local Laws: The legal requirements for debt collection and payment reminders can vary significantly by country or state. It’s important to be aware of the specific rules governing collection practices in your jurisdiction, such as limitations on late fees, interest charges, and collection efforts.

- Data Protection: When sending payment reminders, ensure that any personal information used (such as contact details or account information) is handled according to data protection laws, like GDPR in Europe or CCPA in California. This includes secure handling of client data and offering clients the ability to opt-out of marketing or promotional communications.

- Clear Deadlines and Late Fees: If your business imposes late fees or interest charges on overdue payments, these should be clearly outlined in both the initial agreement and in the reminder. Such charges should be fair, transparent, and in accordance with applicable regulations.

When to Seek Legal Advice

If you’re unsure about the legal aspects of your payment reminders, it’s always best to consult with a legal professional. This is especially important if you encounter clients who are repeatedly late with payments, as a legal professional can help guide you on best practices for handling these situations and ensuring compliance with relevant laws.

By following legal guidelines and ensuring your payment reminders are clear, transparent, and respectful, you protect both your business interests and the rights of your clients, fostering positive and professional relationships.

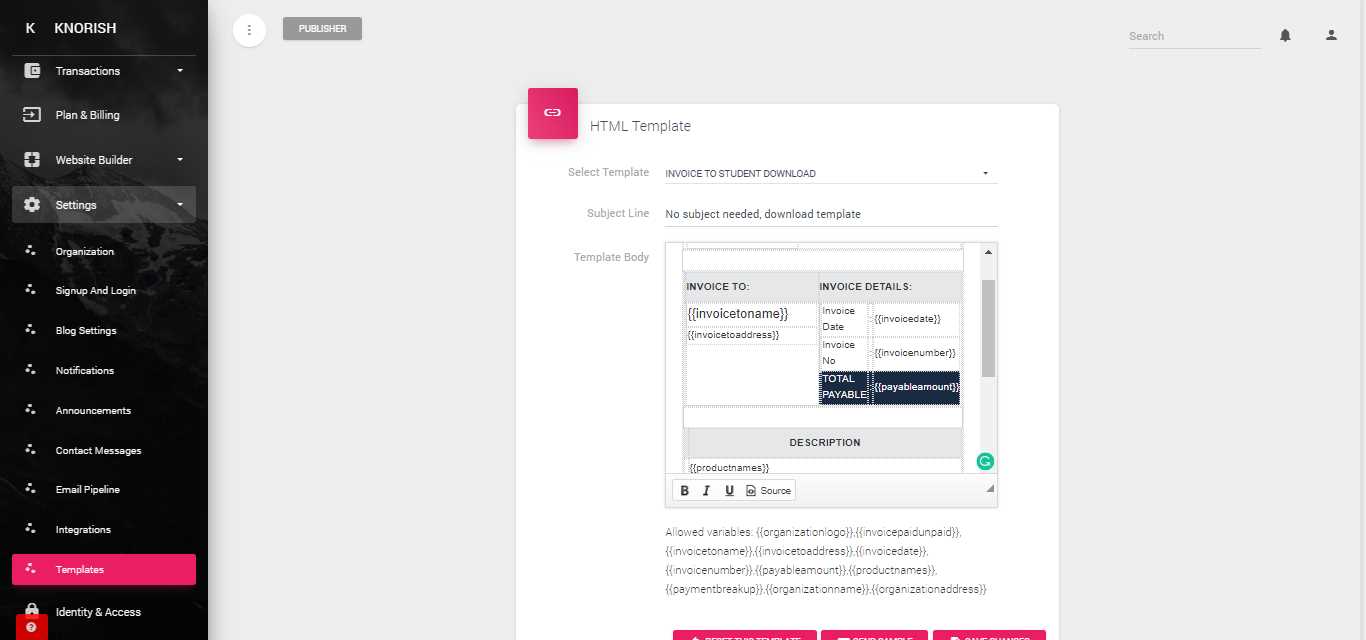

Automating Your Payment Reminder Process

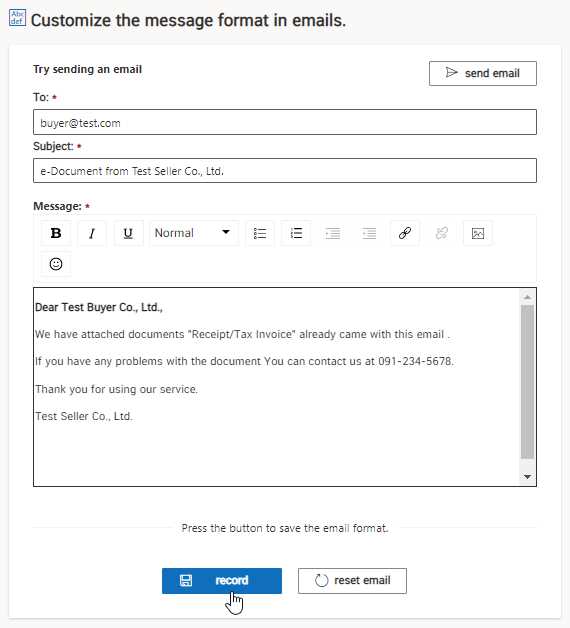

Automating the process of sending payment reminders can save businesses valuable time and reduce the risk of human error. By leveraging software and tools, businesses can streamline their payment follow-ups, ensuring timely communication with clients and consistent follow-through. Automation not only improves efficiency but also allows businesses to maintain a professional image by sending reminders at the right time and in the right format.

Here are some key steps to automate your payment reminder process:

- Choose the Right Software: Select a tool or platform that offers automation features, such as automatic scheduling of payment reminders, integration with your accounting system, and customizable templates. Many accounting software programs include these features out of the box.

- Set Up Payment Reminders: Configure your system to automatically send reminders at specific intervals, such as a few days after the due date, a week after, and a final reminder before late fees are applied. This ensures that clients receive timely follow-ups without you having to manually track due dates.

- Personalize Your Messages: Many automation tools allow you to personalize the content of your payment reminders, such as adding the client’s name, account details, and outstanding balance. Personalization makes the communication feel more tailored and increases the likelihood of a prompt response.

- Track Responses and Payments: Set up your system to track when reminders are sent and whether payments have been made. This will help you identify clients who may require additional follow-ups or further action. Some platforms also offer reminders if no response is received after a certain period.

- Set Up Late Fee Calculations: If your business charges late fees or interest for overdue payments, automating these calculations can save time and prevent mistakes. Your system can automatically add any late fees to the outstanding balance and reflect them in follow-up communications.

By automating your payment reminder process, you can improve your efficiency, reduce administrative workload, and ensure that your clients are consistently reminded of outstanding balances in a professional and timely manner. This approach not only benefits your business but also creates a more predictable cash flow and minimizes the chances of missing payments.

How Payment Reminders Improve Cash Flow

Effective payment reminders are essential for maintaining a healthy cash flow in any business. By regularly communicating with clients about outstanding balances, businesses can ensure that payments are made on time, reducing the risk of delayed or missed payments. This proactive approach helps businesses to maintain a consistent cash flow, which is critical for day-to-day operations and long-term growth.

Timely Follow-Ups Reduce Delays

Sending reminders at the right time helps prompt clients to settle their balances quickly, often before they forget or overlook the due date. Regular follow-ups prevent the accumulation of overdue payments, which can create a financial strain on your business. The sooner a reminder is sent, the quicker clients are likely to respond, thus preventing cash flow disruptions.

- First Reminder: Sent shortly after the due date, ensuring clients are aware of their overdue payment and encouraging prompt action.

- Second Reminder: A follow-up for those who haven’t paid after the first reminder, signaling a need for more immediate attention.

- Final Reminder: Sent when payment is significantly overdue, often including late fees or interest to encourage resolution.

Encourages Clients to Prioritize Payments

When clients receive consistent reminders, they are more likely to prioritize outstanding balances over time. Without reminders, payments can easily slip through the cracks, leaving businesses with unnecessary financial uncertainty. Regular communication about due dates and payment options keeps the issue at the forefront for clients, encouraging faster resolution and minimizing delays.

By improving the timeliness of payments, businesses ensure a steady influx of cash, which helps them meet operational expenses, invest in growth, and avoid financial instability. In the long run, effective payment reminders create a more predictable and reliable cash flow, helping businesses thrive even during uncertain times.

How to Follow Up on Unpaid Bills

When payments are overdue, timely and professional follow-ups are essential for maintaining healthy cash flow. Following up on unpaid bills can be a delicate process, as you want to ensure clients pay what they owe without damaging the business relationship. A well-planned follow-up strategy ensures you get paid promptly while preserving client trust.

Here’s a step-by-step guide to help you effectively follow up on unpaid bills:

- Send a Gentle Reminder: Once the payment due date has passed, send a polite reminder. This can be done via email or by phone. Be sure to keep the tone friendly and professional, as the client may simply have forgotten.

- Send a Second Reminder: If there is still no payment after the first follow-up, send a more formal second reminder. Include a clear request for payment, provide details of the outstanding amount, and reiterate the payment methods available.

- Offer Flexible Payment Options: In case the client is experiencing financial difficulty, offer alternative payment arrangements such as installment plans or extended payment deadlines. Flexibility can encourage clients to settle their debt in a way that works for both parties.

- Communicate the Consequences: If the payment is still overdue, make it clear that there will be consequences for non-payment. This could include late fees or interest charges. Ensure these terms were outlined in the initial agreement so that the client understands the penalties are part of the contract.

- Contact Them by Phone: If your written reminders have gone unanswered, try calling the client. A direct conversation can often be more effective in resolving the situation, as it allows you to discuss the issue in real time and address any concerns they may have.

- Final Written Notice: If payment is still not received, send a final, formal notice that outlines your intent to pursue legal action or collections if the debt remains unpaid. Be firm but polite, and make sure you keep a copy for your records.

By following these steps, you can increase the chances of getting paid promptly, while maintaining professional and respectful relationships with your clients. Effective follow-ups are key to preventing unpaid bills from affecting your business’s financial health.

Design Tips for Effective Payment Reminders

The design of your payment reminder plays a crucial role in how clearly the information is communicated and how quickly clients respond. A well-designed document not only ensures that the details are easy to understand but also gives a professional image that encourages timely action. In this section, we’ll explore key design tips to create reminders that are both visually appealing and effective in prompting payment.

Here are some design principles to consider when creating your payment reminders:

- Keep It Simple and Clean: Avoid clutter and keep the layout minimalistic. Use a simple font, clear headings, and enough white space to ensure that the most important information stands out. A clean design will make it easier for the recipient to read and understand the document.

- Highlight Key Information: Make sure the most important details, such as the amount due, due date, and payment instructions, are easy to find. You can use bold text or color to make these elements stand out, but avoid overusing them as it can cause visual clutter.

- Use Clear Headings and Sections: Organize the content into clearly defined sections such as “Payment Due,” “Amount Outstanding,” and “Payment Methods.” This helps the reader quickly find the information they need without having to read through dense paragraphs.

- Brand Consistency: Use your business’s branding, including logo, colors, and fonts, to create a professional and cohesive look. Consistent branding reinforces your company’s identity and adds a level of professionalism to the reminder.

- Incorporate a Call to Action: Make it clear what you expect from the recipient. Use strong but polite calls to action, such as “Pay Now” or “Settle Your Balance,” to encourage prompt action. Place these near the payment instructions or at the end of the reminder.

- Mobile-Friendly Design: Many recipients may view payment reminders on their mobile devices. Ensure that the layout is responsive and looks good on smaller screens. Text should be legible, and links or buttons should be easy to tap.

- Include Contact Information: Provide clear contact details in case the recipient has questions or needs assistance with payment. Make sure these are easily visible, ideally at the top or bottom of the document.

By following these design tips, you can create payment reminders that are both visually appealing and effective in prompting timely responses. A well-designed reminder not only increases the chances of receiving payment on time but also strengthens your business’s reputation for professionalism and attention to detail.

How Payment Reminders Benefit Small Businesses

For small businesses, managing cash flow is one of the most critical aspects of sustaining operations and supporting growth. Payment reminders provide a simple yet highly effective way to ensure timely payments, which is crucial for maintaining liquidity. By reminding clients of outstanding balances, small businesses can reduce the risk of late payments and avoid financial disruptions that could impact their ability to pay bills or invest in their business.

Improved Cash Flow Management

Payment reminders help businesses maintain a steady cash flow by encouraging clients to settle their accounts on time. A clear follow-up process ensures that clients are aware of what is due and when, minimizing the chances of overdue payments. With timely reminders, businesses can avoid unnecessary delays in cash inflow, allowing for more predictable financial planning and smoother day-to-day operations.

- Reduces Delayed Payments: Consistent follow-ups increase the likelihood that clients will pay on time, avoiding the need for extended payment terms or taking loans to cover shortfalls.

- Minimizes Payment Gaps: Frequent reminders reduce the occurrence of large gaps between payments, providing more reliable cash flow to cover expenses like payroll, supplies, and overhead.

Professionalism and Client Relationships

Sending payment reminders in a professional manner not only helps secure payments but also reinforces the business’s credibility. Regular reminders demonstrate that the business is organized and serious about its financial practices. This builds trust with clients, who are more likely to respect payment deadlines and continue working with the business in the future. A polite and professional approach can even strengthen the business-client relationship, as clients see that you are fair, transparent, and reliable.

For small businesses, timely payment reminders are an invaluable tool that promotes financial stability, strengthens client relationships, and ensures that operations continue smoothly without interruptions due to missed payments.