Explore Invoice Ninja Templates for Efficient and Professional Invoicing

Managing financial documentation efficiently is essential for any business. With the right tools, creating polished, professional invoices becomes a seamless part of your workflow. Using customizable billing solutions can save time and reduce errors, ensuring that every transaction is recorded accurately and sent to clients in a timely manner.

These versatile tools offer a wide range of features designed to suit various business needs, from freelancers to large enterprises. By offering user-friendly interfaces and advanced customization options, they allow users to create personalized billing statements that reflect their brand and cater to different payment methods and currencies.

Whether you’re a small business owner, a freelancer, or part of a larger organization, leveraging these solutions can help you improve your invoicing process, enhance client interactions, and maintain clear financial records. By choosing the right approach, you can boost your professionalism while ensuring your clients receive clear and concise billing information every time.

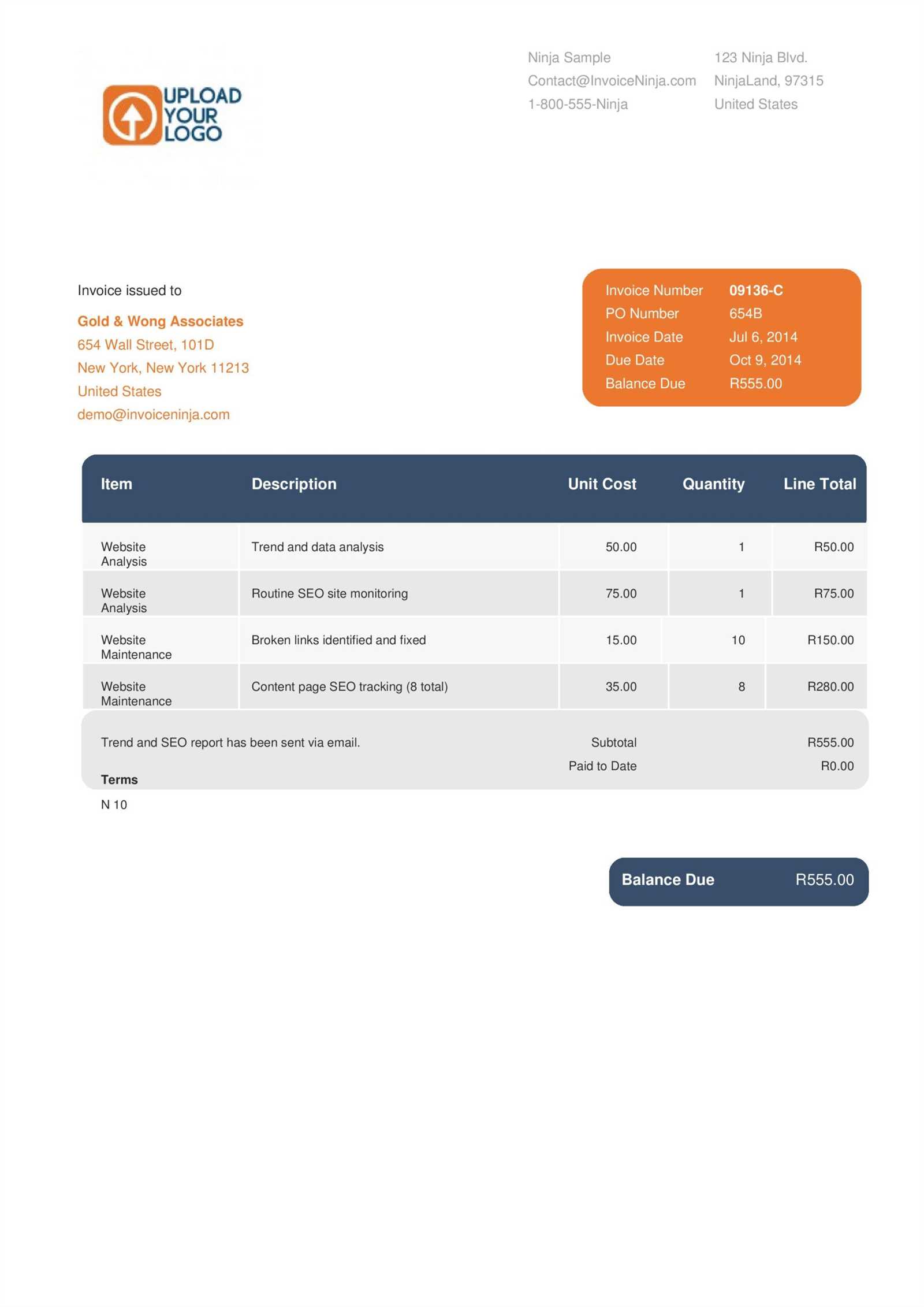

Invoice Ninja Template Overview

Efficient billing is a critical component of any business operation. Having the right tools to create clean, professional financial documents is essential for maintaining smooth client relationships and ensuring prompt payments. These tools provide a flexible and customizable approach to generating structured billing records that align with your specific needs.

By offering a variety of pre-designed layouts, users can quickly generate well-organized statements without the hassle of designing from scratch. The range of available designs ensures that businesses of all sizes can find an option that reflects their unique style while maintaining clarity and professionalism.

Moreover, these solutions are not just about aesthetics; they are also built with functionality in mind. They offer features like automatic calculations, payment tracking, and the ability to integrate with various payment gateways. This integration helps streamline the entire process, from creating a bill to receiving payments, saving time and reducing manual errors.

Why Choose Invoice Ninja Templates

When it comes to handling financial documentation, efficiency, accuracy, and professionalism are key. Using a well-designed solution can save time, reduce errors, and help businesses manage their billing process with ease. The right set of pre-configured designs not only simplifies the task of creating clean, readable documents but also allows for customization to suit individual brand identities.

Streamlined Process

One of the primary reasons businesses opt for these tools is the ability to streamline the billing workflow. Instead of manually creating statements from scratch, users can select from a variety of pre-made designs, customize details such as payment terms or client information, and instantly generate a document. This process minimizes the time spent on administrative tasks and allows businesses to focus more on their core activities.

Customization Options

Customization is another compelling feature of these tools. Whether you need to add your company logo, adjust colors to match your branding, or modify the layout to suit your needs, these solutions offer a high degree of flexibility. This ensures that every document sent to clients reflects a professional and cohesive brand image.

| Feature | Benefit |

|---|---|

| Pre-designed Layouts | Quick and easy document creation |

| Customizable Fields | Align documents with your brand identity |

| Automatic Calculations | Eliminate errors and save time |

| Payment Integration | Streamline payment processing |

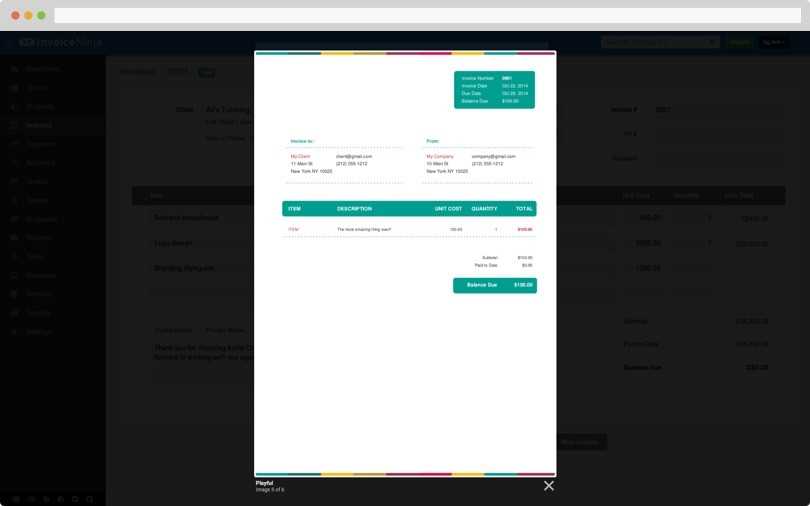

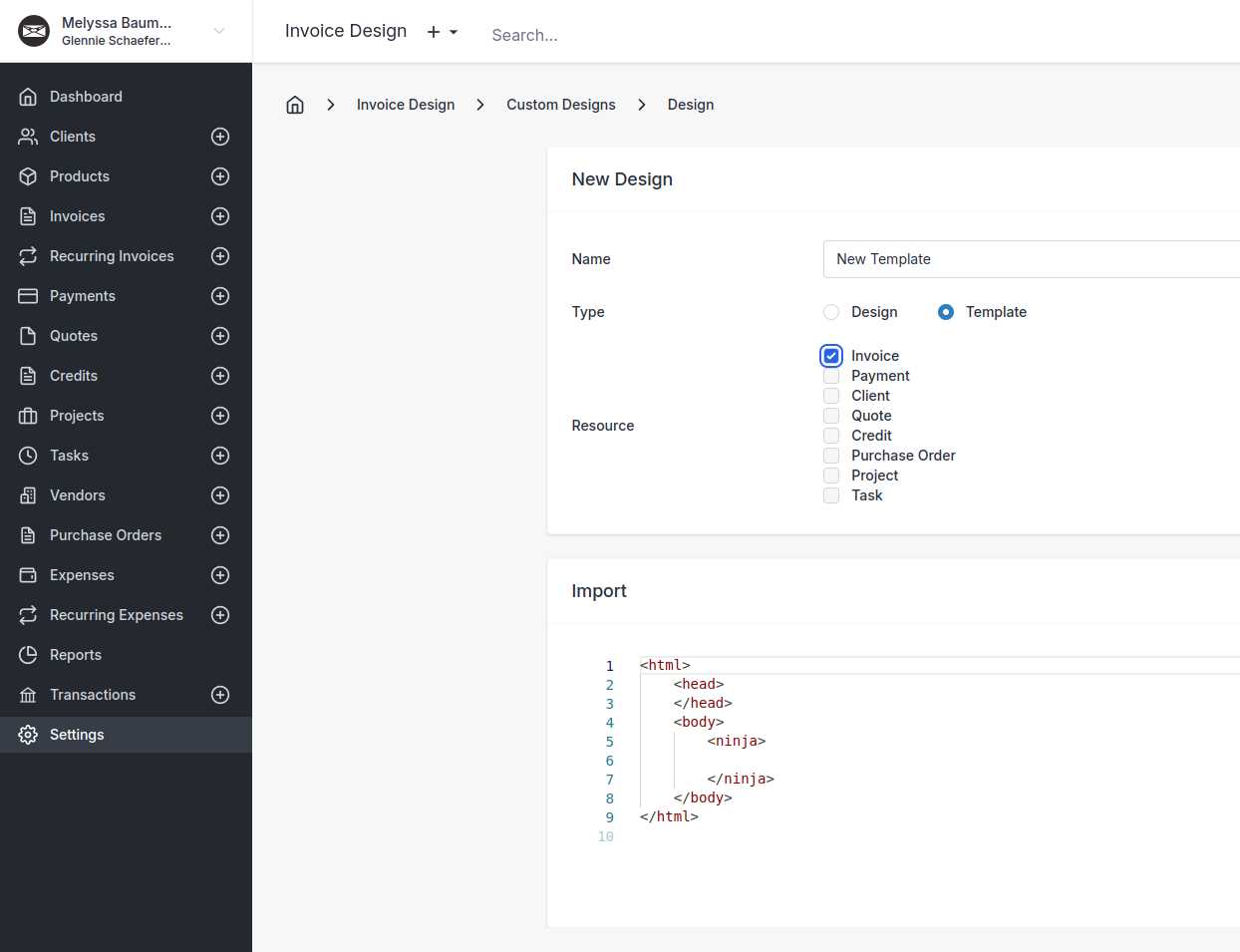

How to Customize Invoice Ninja Templates

Customizing your billing documents is a simple yet powerful way to ensure they reflect your brand and meet your specific needs. By adjusting various elements such as layout, colors, fonts, and information fields, you can create professional, personalized financial records that align with your business identity. The process is designed to be user-friendly, offering flexibility without requiring advanced technical skills.

Steps to Customize Your Billing Documents

To begin personalizing your financial records, you first need to access the customization settings. Most tools offer a straightforward interface where you can modify the structure, appearance, and content of the document. Start by choosing a design that closely matches your preferences, then proceed to adjust text fields, add logos, and update the color scheme.

Key Customization Options

Once you have selected your preferred layout, several elements can be adjusted to fit your business style:

| Customizable Element | How It Helps |

|---|---|

| Brand Logo | Incorporates your company’s identity |

| Color Scheme | Aligns the document with your branding |

| Text Fields | Modify fields such as client name, dates, or payment terms |

| Font Styles | Enhances readability and professionalism |

| Additional Sections | Include custom information such as notes or discounts |

By adjusting these elements, you ensure that every document is tailored to your specific business needs and reflects your professional image. Customizing these settings allows for consistent communication with clients, making your financial documents both functional and visually appealing.

Best Features of Invoice Ninja Templates

When it comes to creating professional billing statements, the right set of features can make a significant difference in terms of efficiency and user experience. The best billing tools offer an array of functionalities that not only streamline the process but also enhance the quality of the documents generated. From automatic calculations to integration with payment systems, these solutions provide everything you need to handle billing seamlessly.

Key Features to Look For

The following features make these billing tools stand out and help businesses improve their invoicing workflow:

| Feature | Benefit |

|---|---|

| Customizable Layouts | Adjust document structure to match your brand and preferences |

| Automated Calculations | Reduces manual errors and saves time |

| Payment Gateway Integration | Accept payments directly from the document |

| Multi-currency Support | Handle international clients with ease |

| Recurring Billing | Automatically generate invoices for repeat clients |

Additional Advantages

Beyond the core features, these tools often offer additional benefits that help optimize your workflow. For example, automatic reminders for overdue payments and the ability to track invoice statuses make it easy to stay on top of outstanding balances. The user-friendly interface ensures that even those without advanced technical skills can create and manage documents with ease, further enhancing overall efficiency.

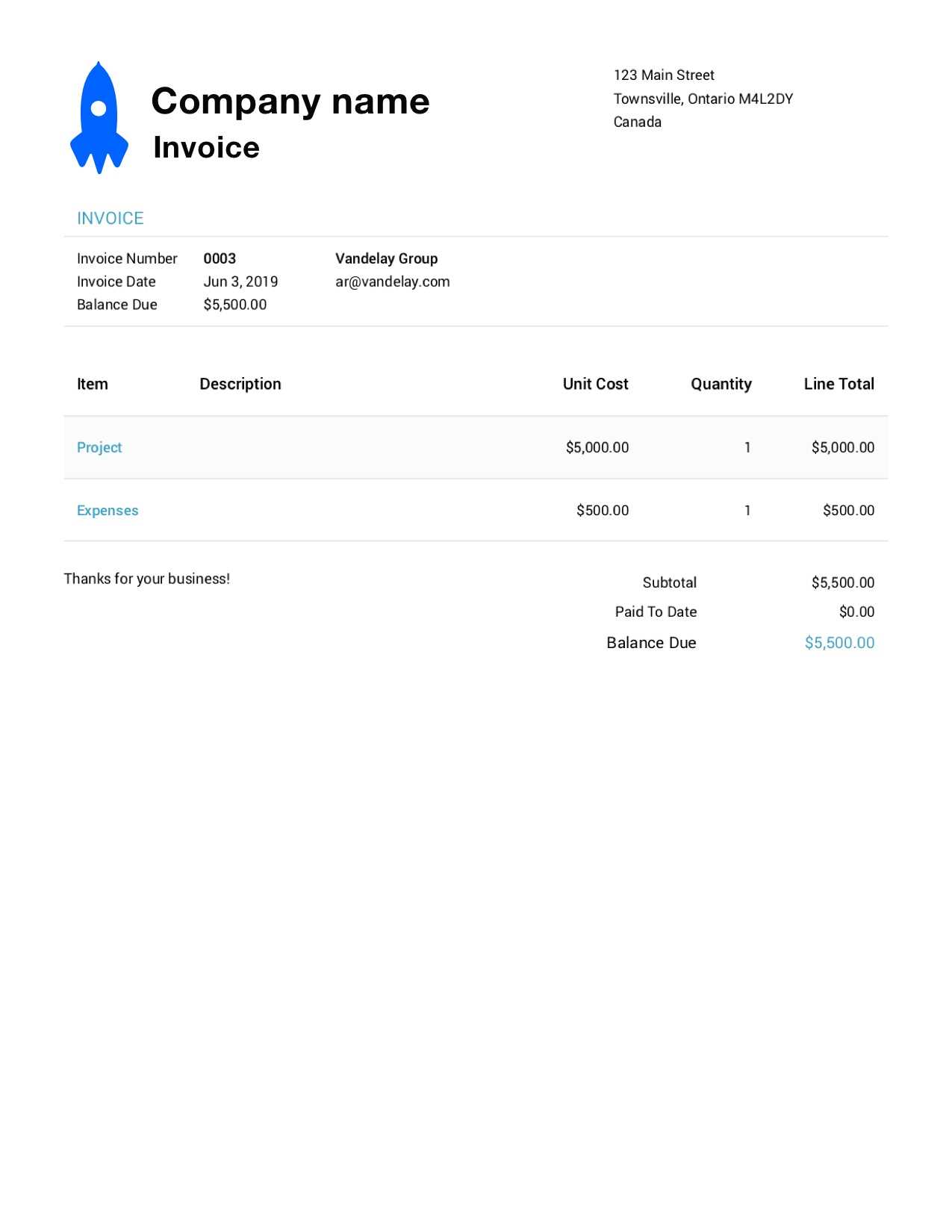

Designing Professional Invoices with Templates

Creating well-designed financial documents is essential for businesses that want to project a professional image. A polished, clear, and easy-to-read statement not only ensures that clients can understand the details but also reinforces trust and credibility. By utilizing pre-built designs, users can easily craft visually appealing records while maintaining accuracy and consistency across all documents.

Importance of Professional Design

The design of your financial statements plays a key role in how your business is perceived. A cluttered or confusing layout can lead to misunderstandings or delays in payment, while a clean, well-organized layout reflects professionalism. By using carefully crafted designs, businesses can convey a sense of reliability and attention to detail, making clients more likely to trust and engage with your services.

Steps to Create a Professional Design

To ensure your financial records meet the highest standards, follow these steps:

| Step | Action |

|---|---|

| 1 | Choose a simple and clean layout |

| 2 | Add your company logo and contact details |

| 3 | Ensure clear section headers and readable fonts |

| 4 | Incorporate your business colors for consistency |

| 5 | Double-check alignment and spacing for clarity |

By following these steps, businesses can create visually appealing and professional-looking statements that will help establish trust with clients and improve overall communication.

Invoice Ninja Templates for Small Businesses

For small businesses, managing billing can be time-consuming and often overwhelming. Having the right tools to create professional, consistent financial documents is crucial, especially when resources are limited. Pre-designed solutions offer a cost-effective way to maintain accuracy and professionalism, allowing small business owners to streamline their processes and focus on growing their business.

Why Small Businesses Benefit from Pre-Designed Billing Solutions

Small businesses face unique challenges when it comes to managing finances. Tight budgets and limited staff can make it difficult to dedicate time to administrative tasks like creating financial records. By utilizing easy-to-use, customizable tools, small business owners can generate clear and professional documents without the need for extensive design skills or hiring additional help. These tools help improve cash flow management and present a polished image to clients.

Features Ideal for Small Businesses

When selecting a tool for creating financial documents, small businesses should look for specific features that address their needs:

| Feature | Benefit |

|---|---|

| Ease of Use | No technical expertise required to create documents |

| Customizable Layouts | Match your business’s branding and style |

| Recurring Billing | Automate regular transactions to save time |

| Payment Gateway Integration | Accept payments directly from the document |

| Cost-Effective | Affordable solution for businesses with limited budgets |

By choosing the right solution, small business owners can optimize their billing process, improve client satisfaction, and ensure financial records are always accurate and up to date.

Integrating Payment Options with Templates

Integrating payment methods directly into your billing documents makes the payment process more efficient for both businesses and clients. By offering multiple payment options within your financial records, you can simplify transactions and encourage timely payments. This integration eliminates the need for separate payment instructions and creates a seamless experience for clients, enhancing cash flow and reducing the chances of delayed payments.

Most modern billing tools support various payment gateways that can be linked directly to your documents. These options allow clients to pay with their preferred methods, whether via credit card, bank transfer, or online payment platforms. By embedding these options directly into the document, businesses can offer a smoother, more professional experience for their clients.

Furthermore, integrating payment features allows businesses to track payment statuses automatically, reducing administrative effort. Once a payment is made, the system can update the status of the transaction, sending notifications to both the business and the client, ensuring everyone stays informed throughout the process.

Free vs Paid Invoice Ninja Templates

When choosing a billing solution, businesses often face the decision between using free or paid options. Both have their advantages, but the choice depends on the specific needs and scale of the business. Free tools provide a cost-effective way to get started, while paid options often offer advanced features and greater customization. Understanding the key differences can help businesses make the best decision for their situation.

Advantages of Free Solutions

Free billing solutions can be an excellent option for small businesses or startups that have limited budgets. These tools typically offer basic features that are sufficient for generating standard financial documents. Here are some benefits:

- Zero upfront costs

- Easy to use with minimal setup

- Great for small businesses or freelancers

- Provides essential features like basic customization and invoicing

However, free options often come with limitations that may hinder long-term growth or customization needs.

Benefits of Paid Solutions

Paid billing solutions typically offer a wider range of features, providing greater flexibility and functionality. These advanced options are suitable for businesses looking to scale or those that require more control over their financial documents. Key advantages of paid solutions include:

- Access to advanced customization options (e.g., custom branding, advanced formatting)

- Integration with multiple payment gateways and accounting systems

- Support for recurring billing and automated reminders

- Premium customer support and troubleshooting assistance

- More robust reporting and analytics features

While paid solutions come with an upfront cost, they offer a comprehensive set of tools that can save time and improve overall business operations in the long run.

How to Automate Invoicing Using Templates

Automating the creation and delivery of financial documents can significantly streamline your workflow, saving both time and effort. By using automated solutions, businesses can reduce manual data entry, ensure consistent document formatting, and ensure timely delivery to clients without the need for constant intervention. Setting up automation with pre-designed solutions is a powerful way to manage recurring tasks more efficiently and ensure that all clients receive their statements on schedule.

The process typically involves setting up the automation feature within your chosen solution, selecting the frequency of billing cycles, and configuring the necessary client details. Once automated, the system can generate and send statements on your behalf without needing to recreate documents each time.

Steps to Set Up Automation

To get started with automating your billing workflow, follow these steps:

- Choose your frequency: Select how often you want documents to be generated (e.g., daily, weekly, monthly).

- Input client information: Add client details, payment terms, and any other relevant data that will appear in each document.

- Link payment options: Ensure that payment methods are integrated directly into the document for easy transaction processing.

- Set up reminders: Enable automatic reminders for clients when a payment is due or overdue.

- Test the system: Run a test to ensure everything functions as expected before enabling full automation.

Benefits of Automation

Once automated, invoicing becomes a seamless part of your business operations, offering several benefits:

- Time savings: No need to manually create each document, freeing up time for other important tasks.

- Reduced errors: Automation ensures accuracy, minimizing the risk of mistakes in client information or billing details.

- Consistency: Every document follows the same format, maintaining a professional appearance and improving brand consistency.

- Faster payments: Timely and accurate billing leads to faster payments, helping improve cash flow.

Automating your billing process with pre-designed solutions makes it easier to manage your financial documents and ensures that clients receive their statements exactly when they need them.

Improving Client Relationships with Templates

Building strong relationships with clients goes beyond delivering quality products or services; it also involves clear, professional communication throughout your business interactions. By utilizing well-designed and personalized documents, businesses can make a positive impression and show clients that they value their partnership. Customized, easy-to-read documents can enhance the overall client experience, fostering trust and satisfaction.

Personalization plays a key role in strengthening these relationships. By customizing the content and appearance of your financial documents, you make them more relevant to each client, which can improve their perception of your business and encourage timely payments. A professional-looking, consistent document also reinforces your brand identity, making clients feel more secure in their dealings with you.

How Personalized Documents Benefit Client Relationships

Customizing your documents offers several advantages that directly impact client relationships:

- Clear communication: Well-organized documents help clients understand the terms of the transaction without confusion, reducing the risk of misunderstandings.

- Professional image: Consistently polished documents convey reliability and attention to detail, which strengthens client trust.

- Timely updates: Automated features like payment reminders or status updates show clients that you are attentive to their needs, creating a more responsive experience.

- Brand recognition: Including your branding and logo creates a memorable experience and reinforces your company’s identity.

Building Trust with Consistency

Another critical factor in maintaining positive client relationships is consistency. Sending regular, well-structured documents that adhere to the same professional standards helps clients feel confident in your services. Whether it’s the clarity of payment instructions, the professionalism of your layout, or the timeliness of your updates, consistency is key to establishing long-term trust and credibility with your clients.

By using personalized, reliable, and clear financial records, businesses not only improve client interactions but also cultivate lasting, positive relationships that can drive repeat business and referrals.

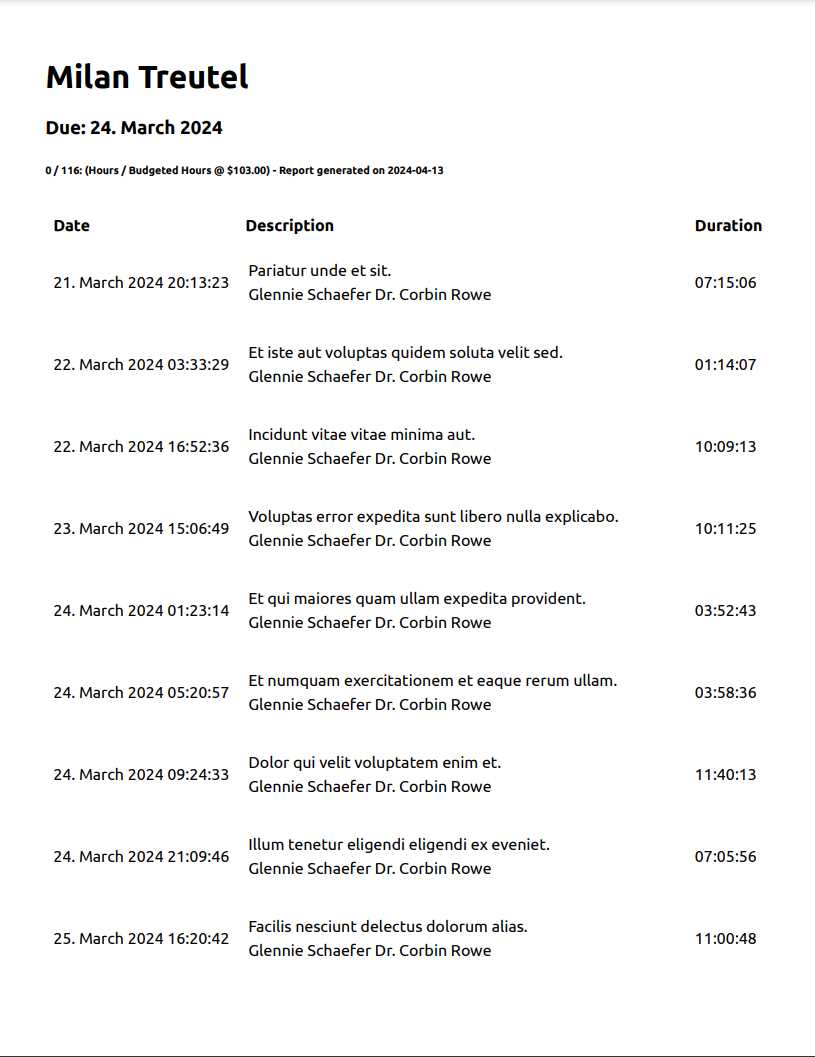

Managing Recurring Invoices in Invoice Ninja

For businesses with ongoing services or subscriptions, managing repetitive billing can be time-consuming. Setting up an automated system to handle these recurring transactions can simplify the process, ensuring that clients are billed on time and reducing the risk of human error. By automating the creation and delivery of regular statements, businesses can free up time for more critical tasks while maintaining consistent cash flow.

Recurring billing functionality allows businesses to set up a schedule for automatic generation and delivery of financial documents. Once configured, the system handles the process of sending invoices based on the agreed-upon frequency–whether it’s weekly, monthly, or annually. This not only ensures that clients are billed consistently but also helps businesses maintain a reliable revenue stream.

Setting Up Recurring Transactions

To set up recurring billing, follow these steps:

- Choose a plan: Select the service or product being billed regularly.

- Set frequency: Determine the interval at which the client will be billed (e.g., monthly, quarterly, etc.).

- Client details: Enter the client’s information, including payment preferences and billing address.

- Payment methods: Link the payment methods that clients can use to complete transactions automatically.

- Review and activate: Confirm the details and activate the recurring billing setup.

Benefits of Recurring Billing

Implementing automated recurring transactions offers several advantages for both businesses and clients:

- Time-saving: No need to manually create and send each document, allowing you to focus on other tasks.

- Improved cash flow: Consistent billing cycles lead to predictable income.

- Reduced errors: Automation eliminates mistakes associated with manual data entry or forgetting to send statements.

- Better client experience: Clients appreciate the convenience of automatic billing and timely reminders.

By automating recurring billing processes, businesses can enhance operational efficiency, improve cash flow, and foster stronger relationships with clients through timely and accurate transactions.

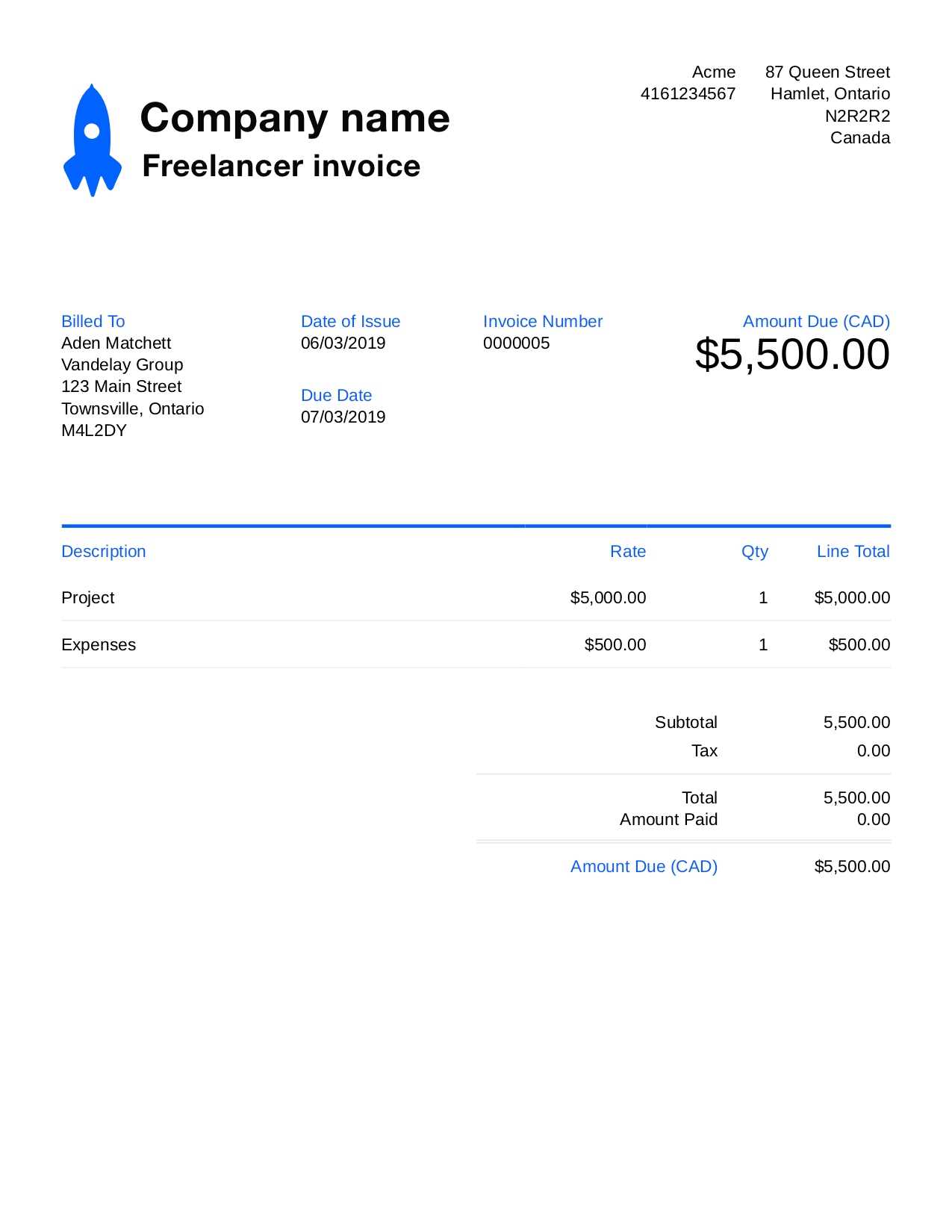

Invoice Ninja Templates for Freelancers

Freelancers often juggle multiple projects and clients, which can make managing billing a complex and time-consuming task. Having the right tools to generate professional financial documents can help streamline the process, ensuring that payments are received on time and that all details are accurate. Using pre-designed solutions allows freelancers to create customized, polished documents in minutes, leaving more time to focus on their craft.

For freelancers, simplicity and efficiency are key when it comes to billing. Customizable documents provide the flexibility to adjust client information, services rendered, and payment terms with ease. Whether it’s a one-off project or an ongoing collaboration, a well-structured billing document helps maintain clear communication and sets the right expectations with clients.

Why Freelancers Should Use Pre-Designed Solutions

Freelancers can benefit from using ready-made billing solutions for several reasons:

- Time-saving: Quickly generate professional documents without the need for designing each one from scratch.

- Customization: Personalize your documents with your branding, client details, and payment terms.

- Consistency: Ensure all billing documents follow a uniform format, helping clients feel confident and comfortable in the transaction.

- Efficiency: With features like automatic calculations and recurring billing, freelancers can automate much of the administrative work, reducing the chances of error and missed deadlines.

Key Features for Freelancers

When choosing a billing solution, freelancers should look for tools that offer features tailored to their needs, such as:

- Customizable fields: Adjust each document to reflect specific project details, deadlines, and payment schedules.

- Simple payment integration: Accept payments directly from the document, making it easy for clients to pay immediately.

- Multi-currency support: Ideal for freelancers working with international clients.

- Easy tracking: Keep track of unpaid invoices and get notifications for overdue payments.

By leveraging these features, freelancers can not only simplify their administrative tasks but also present a professional image that encourages prompt payments and fosters stronger client relationships.

How to Import and Export Templates

For businesses looking to streamline their billing process, the ability to import and export pre-designed solutions is essential. Importing allows you to bring in external documents or designs, while exporting lets you save and share your customized files with others. This flexibility ensures that businesses can work with different systems, share documents across teams, or even migrate their data between platforms with ease.

Whether you’re moving between different software or need to reuse a document format for multiple clients, importing and exporting solutions ensures that the process remains smooth and efficient. It’s a convenient way to preserve your design preferences and settings, making it easier to create consistent documents without starting from scratch every time.

Importing Documents

Importing allows you to bring existing files into your system for further customization or re-use. To import a document:

- Select your format: Choose the file type you wish to import, such as a custom design or a document from another platform.

- Upload the file: Locate the file on your computer or cloud storage, and upload it into your billing solution.

- Map necessary fields: Ensure that all relevant data fields, such as client details and payment terms, are mapped correctly to your system.

- Save and customize: Once imported, you can make any necessary adjustments to fit your business needs.

Exporting Documents

Exporting documents allows you to save them in a specific format for sharing or future use. To export your custom designs:

- Choose export format: Select the desired format for exporting, such as PDF, Excel, or CSV.

- Configure settings: Adjust settings such as layout, currency, and client details to match your requirements.

- Download the file: Click on the export option and save the document to your computer or cloud storage.

- Share or transfer: Share the exported document with clients, colleagues, or other systems as needed.

By mastering the import and export features, businesses can ensure they are working efficiently and consistently while having the flexibility to adapt to different needs or systems. These tools make it easier to manage large volumes of financial documents, customize them for various clients, and keep everything organized across multiple platforms.

Enhancing Brand Identity with Custom Templates

Customizing your billing documents is not just about adding your business information–it’s an opportunity to reinforce your brand’s identity and create a memorable impression with every interaction. By designing financial documents that reflect your company’s values, color scheme, and logo, you communicate professionalism and attention to detail, which can strengthen your relationship with clients and set you apart from competitors.

When clients receive documents that are well-branded, it not only boosts their confidence in your business but also ensures that your company remains top of mind. Consistency across all communication materials–whether digital or printed–helps create a unified experience, enhancing brand recognition and trust.

Key Branding Elements to Include

Here are several important elements to consider when customizing your documents to enhance your brand identity:

| Element | Description |

|---|---|

| Logo | Your logo should be prominently displayed to ensure your business is instantly recognizable. |

| Color scheme | Use the same colors as your website, marketing materials, and other branding assets to create a cohesive look. |

| Font style | Choose fonts that align with your brand’s personality–whether it’s modern, traditional, or playful–ensuring easy readability. |

| Tagline or slogan | If you have a company tagline, including it on your documents can help reinforce your brand’s message. |

Benefits of Customization for Brand Identity

By customizing your documents, you not only present a polished and professional image but also enjoy several benefits that contribute to brand growth:

- Increased brand recognition: Consistent visual identity helps clients immediately associate the document with your business.

- Improved professionalism: A well-branded document conveys attention to detail, enhancing your reputation as a professional service provider.

- Enhanced customer experience: A personalized touch improves client satisfaction, making them feel valued and increasing the likelihood of repeat business.

- Stronger trust and loyalty: Clients are more likely to trust a business that consistently presents itself in a professional and cohesive manner.

Incorporating your brand elements into your documents doesn’t just enhance the look and feel–it helps foster lasting client relationships, ensuring your business stands out in a competitive market.

Using Invoice Ninja for Multiple Currencies

For businesses with an international client base, handling multiple currencies efficiently is crucial. Offering clients the option to pay in their preferred currency not only enhances their experience but also increases the likelihood of timely payments. By using tools that support multi-currency functionality, businesses can simplify cross-border transactions, reduce confusion, and ensure that both parties are on the same page when it comes to pricing.

When managing transactions in different currencies, it’s important to ensure that all relevant details–such as exchange rates, payment methods, and local tax regulations–are correctly accounted for. Using an automated system that integrates multi-currency support makes it easier to manage these details without the need for manual calculations or adjustments.

Setting Up Multiple Currencies

To use multi-currency options, follow these steps:

- Select Currency Preferences: In the settings, choose the currencies you want to accept from your clients. This could include USD, EUR, GBP, or any other international currency.

- Define Default Currency: Set the default currency for your business, which will be used for most transactions unless otherwise specified.

- Assign Currency to Clients: For each client, select the currency they prefer for billing. This ensures that the amounts are automatically converted based on the latest exchange rates.

- Monitor Exchange Rates: Ensure that the system is updated with current exchange rates to provide accurate pricing in each currency. Many tools allow you to set up automatic updates for these rates.

- Review and Confirm: Before sending out any billing documents, verify that the correct currency has been applied and that the amounts are correct.

Benefits of Multi-Currency Support

Supporting multiple currencies offers several key advantages for businesses that operate internationally:

- Global Reach: You can easily cater to clients from different countries, increasing your business’s reach and potential for growth.

- Simplified Transactions: Clients appreciate the convenience of paying in their own currency, reducing confusion and making the transaction process smoother.

- Accurate Billing: Automated currency conversion ensures that the amounts displayed on invoices are always up-to-date, preventing issues with overcharging or undercharging.

- Efficient Payment Processing: Accepting multiple currencies enables faster payments and avoids the complications of dealing with currency conversion manually.

By offering the flexibility to manage multiple currencies, businesses can provide a more seamless experience for their global clients, ensuring that billing is simple, transparent, and hassle-free.

Tracking Invoice Status with Templates

For businesses, keeping track of the status of financial documents is essential for ensuring timely payments and maintaining a smooth workflow. By using automated solutions, it becomes easier to monitor the progress of each document, from creation to payment. This helps businesses stay on top of unpaid or overdue amounts, improving cash flow management and reducing the administrative burden associated with manual follow-ups.

Tracking the status of financial documents not only ensures that clients are invoiced correctly but also gives businesses a clear overview of their accounts receivable. With automatic updates, businesses can receive alerts when a document is viewed, paid, or overdue, allowing for quick action when needed. This reduces the likelihood of errors and delays, fostering better relationships with clients and improving operational efficiency.

How to Track the Status of Your Financial Documents

To effectively track the status of your documents, follow these steps:

- Enable notifications: Set up automatic alerts to notify you when a document is viewed, paid, or overdue.

- Monitor payment status: Keep track of whether the payment has been processed or is pending. Most solutions offer real-time status updates.

- Send reminders: Set up automated reminders for clients with overdue payments, reducing the need for manual follow-up.

- View transaction history: Access a full history of payments made and outstanding balances to stay organized and informed.

Benefits of Tracking Financial Documents

There are several key advantages to tracking the status of your financial documents:

- Improved cash flow: Timely tracking and reminders ensure that payments are collected on time, improving overall cash flow.

- Reduced administrative work: Automating the tracking process saves time and effort spent on manual follow-ups and record-keeping.

- Better client relationships: By staying on top of payment statuses, you can maintain transparency with clients and avoid any misunderstandings.

- Faster resolution of issues: If a payment issue arises, you can quickly identify the problem and address it without delays.

By using automated tools to track the status of your financial documents, you can ensure smoother operations, faster payments, and stronger client relationships. This leads to a more efficient and professional approach to business financial management.