Free Invoice Model Template for Easy Customization

Effective billing is a cornerstone of any successful business. Having a structured, professional way to present payment requests ensures smooth transactions and helps build trust with clients. Whether you’re a freelancer, a small business owner, or part of a larger company, having the right document format can save you time and improve the clarity of your communications.

Creating a standardized document for billing not only makes your business look more organized but also prevents errors that can delay payments. Customizable formats allow you to add all necessary details like item descriptions, costs, payment terms, and due dates, making the whole process straightforward for both parties involved.

In this guide, we’ll explore how you can choose, personalize, and use ready-made solutions to simplify your billing workflow. From basic layouts to more advanced designs, you’ll find options that fit your needs and help maintain professionalism in every transaction.

How to Create an Invoice Model

Designing a professional document to request payment is essential for maintaining clear and efficient business transactions. The key to a well-structured bill lies in including the right components, ensuring all necessary information is present, and presenting it in an organized and easy-to-read format. By following a few simple guidelines, you can craft a document that meets both legal requirements and your specific business needs.

Step 1: Choose a Clear Layout

The first step is to decide on the layout. A clean, minimal design with clear sections will make your document easy to navigate for both you and your clients. Ensure that it includes fields for essential information, such as your business name, the client’s details, the services or products provided, and the total amount due. A simple, logical structure will prevent any confusion when it’s time to review the document.

Step 2: Add Payment and Contact Details

It’s crucial to include both payment instructions and your contact information. List accepted payment methods, such as bank transfer, credit card, or online payment systems, as well as due dates and any applicable late fees. This transparency will prevent any misunderstandings. Additionally, ensure that both your business and the client’s contact details are clearly visible in case any questions arise after sending the document.

By following these steps, you can create a functional and professional document that helps facilitate timely payments and maintains a smooth business relationship with your clients.

Essential Elements of an Invoice Template

To ensure smooth transactions and avoid confusion, it’s vital to include all the necessary components when creating a document to request payment. These elements help clarify the details of the transaction and make it easier for both parties to understand what’s expected. Below are the key components that should be present in any professional billing document.

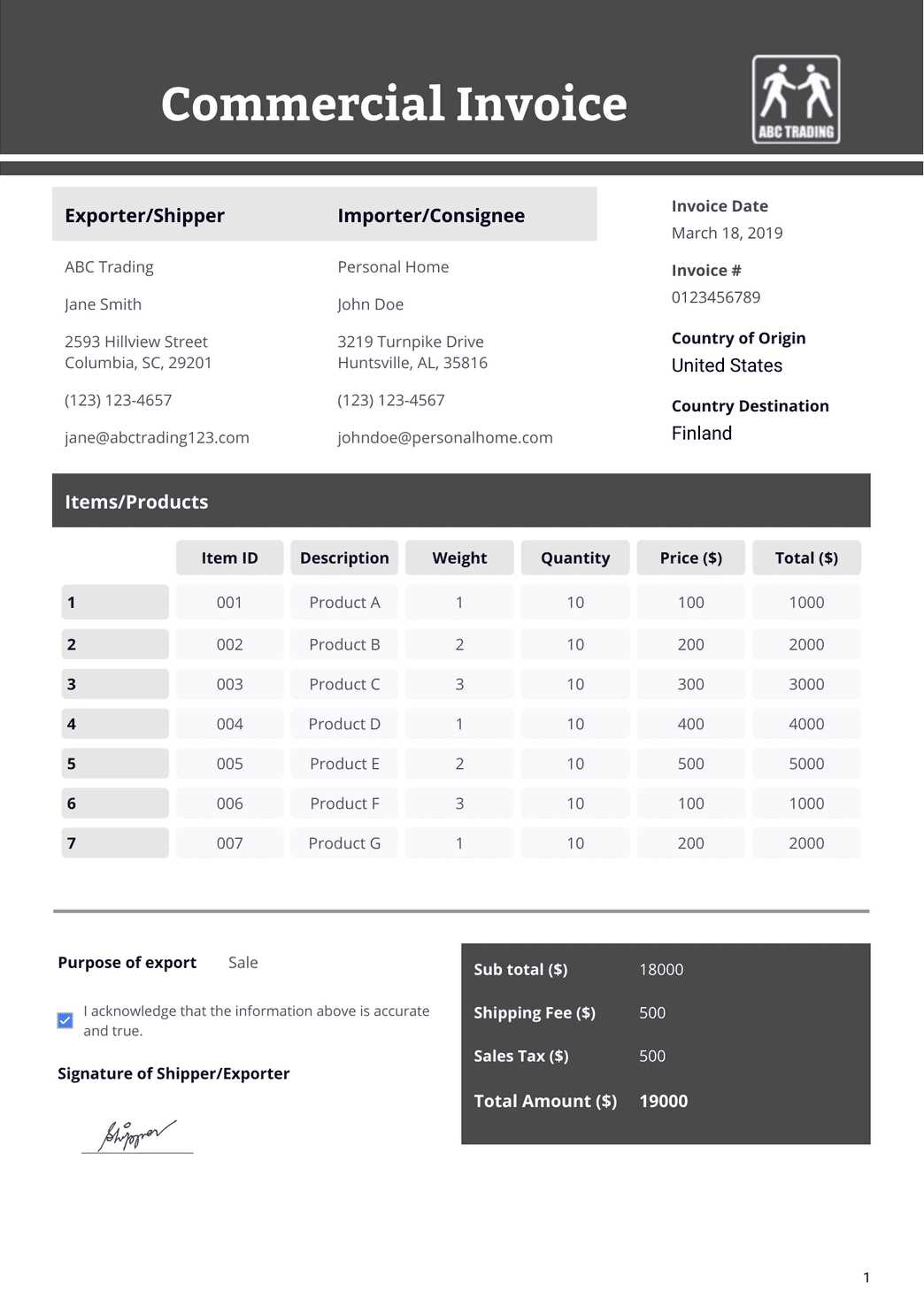

- Header Section: Your business name, logo, and contact details should be placed at the top for clear identification. This establishes professionalism and ensures your client knows where to direct any questions.

- Client Information: Include the client’s name, address, and contact details. This ensures that the document is personalized and easily traceable to the correct person or company.

- Unique Identifier: Every billing document should have a unique reference number or ID. This is important for record-keeping, tracking, and avoiding confusion with other transactions.

- Itemized List of Products or Services: Clearly detail the items or services provided, including descriptions, quantities, unit prices, and any applicable taxes. This transparency prevents any disputes or misunderstandings.

- Total Amount Due: Include a clear breakdown of the total, showing the cost of individual items, taxes, discounts, and the final amount owed. This helps the client see exactly what they are paying for.

- Payment Terms: Specify due dates, late fees, and accepted payment methods. This helps set clear expectations and encourages timely payment.

- Notes and Additional Information: If necessary, include space for any additional information such as special instructions, terms, or personal messages to the client.

By incorporating these essential elements, you ensure that your document is complete, professional, and easy to understand, helping to prevent delays and ensuring smooth financial transactions.

Why Use an Invoice Model

Using a standardized document for billing is essential for streamlining your financial processes and ensuring clarity in every transaction. A well-structured format reduces errors, saves time, and helps maintain a professional appearance. By adopting a consistent approach to creating payment requests, businesses can avoid confusion and establish trust with their clients.

Efficiency and Time-Saving: A pre-designed layout allows you to quickly generate billing documents without having to start from scratch each time. You can focus on adding specific details rather than worrying about formatting or structure, making the entire process faster and more efficient.

Consistency and Professionalism: Using a standard format ensures that all of your payment requests look consistent. This professional presentation reflects positively on your business and helps you build credibility. Clients are more likely to take your payment request seriously when it’s well-organized and easy to understand.

Accuracy and Clarity: A pre-built structure ensures that you include all the necessary details, such as client information, payment terms, and itemized costs. This reduces the chance of missing crucial data and helps prevent misunderstandings, leading to timely payments and fewer disputes.

By implementing a reliable system for creating payment documents, you simplify your workflow, minimize errors, and create a more efficient process for both you and your clients.

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing documents is crucial to ensure clarity and professionalism in every transaction. The right format helps present all the necessary details in a straightforward and organized manner, which not only speeds up the process but also minimizes the risk of confusion. A well-chosen structure sets the tone for how your business communicates financial information.

Consider the Type of Business: The format you choose should align with the nature of your business. For instance, a freelancer might prefer a simple, clean design with a focus on services provided, while a company selling physical products may require a more detailed layout with item descriptions, quantities, and pricing. Identifying your business needs first will guide you in selecting the best format.

Keep It Simple and Clear: A cluttered layout can overwhelm clients and lead to confusion. A clean, minimalist design with distinct sections and clear headings makes the document easy to read and understand. Focus on functionality rather than unnecessary design elements, ensuring that important details like payment terms, due dates, and total amounts are easy to locate.

Adaptability for Various Situations: Choose a format that can easily be customized for different types of transactions. Whether you’re billing for a one-time service, recurring payments, or multiple products, your document format should be flexible enough to accommodate these variations without losing clarity or professionalism.

By carefully considering these factors, you can select a structure that meets your business needs while enhancing communication and promoting timely payments.

Customizing Your Invoice Template

Personalizing your billing document is key to creating a consistent and professional experience for your clients. Customization allows you to reflect your business identity while ensuring that all necessary details are included. A tailored format not only strengthens your brand but also makes it easier to communicate important transaction information in a clear and efficient manner.

Add Your Branding: One of the first steps in customization is incorporating your business logo, color scheme, and fonts. This makes the document instantly recognizable and ensures that it aligns with your overall brand identity. A branded design helps reinforce your professionalism and trustworthiness in the eyes of your clients.

Include Unique Information: Customizing the layout allows you to add specific fields that are relevant to your business. For example, if you offer multiple payment methods, you might include a section for payment instructions. If your services include ongoing support or warranties, space for those details can be added. Adjusting the content to fit your needs ensures that your document is both informative and relevant.

Tailor to Client Needs: In addition to business-related information, your document should be easily adaptable to the specific details of each client. You can add or remove sections depending on the complexity of the transaction. For instance, larger projects may require more extensive itemization, while a simpler service can benefit from a more streamlined approach.

By customizing your billing documents, you ensure they are both functional and aligned with your business’s unique needs. A personalized format enhances your brand presence and fosters better communication with your clients.

Common Invoice Template Mistakes to Avoid

Creating a well-organized payment document is crucial for maintaining professionalism and ensuring timely payments. However, even small mistakes in the structure or content can lead to confusion, delayed payments, and damaged client relationships. Being aware of common errors will help you create clearer, more efficient documents that reflect well on your business.

Omitting Key Information

One of the most common mistakes is leaving out important details such as payment terms, due dates, or itemized lists of goods or services. Failing to include these elements can lead to misunderstandings and disputes, as your client may not be clear on the total amount owed or the expected payment timeline. Always double-check that all necessary information is present before sending your document.

Using Inconsistent Formatting

Inconsistent fonts, colors, or spacing can make your document look unprofessional and harder to read. Using a uniform design throughout helps ensure that the document is visually appealing and easy to follow. Consistency also makes it easier for both you and your clients to find important details quickly. A cluttered or mismatched layout can detract from the message you’re trying to convey.

By avoiding these common mistakes, you can create a well-organized and professional document that enhances your business’s image and encourages timely payments.

Free Invoice Templates for Businesses

For businesses looking to streamline their billing process without incurring additional costs, free options are available that offer all the essential features needed to create professional payment requests. These free solutions are an excellent starting point for entrepreneurs, freelancers, and small businesses who want to maintain a polished and efficient system without having to design everything from scratch.

Where to Find Free Templates

Many websites offer a wide range of no-cost formats for generating billing documents. Popular sources include business management platforms, accounting software providers, and freelance resource websites. These tools often come in various styles and can be easily downloaded and customized to suit your specific needs.

Benefits of Using Free Options

Cost-Effective: Free solutions allow businesses to create professional documents without the need to purchase expensive software or hire a designer. You can access ready-made formats that fit your brand and business type.

Quick and Easy: Most free templates are designed for ease of use, with user-friendly features that allow you to quickly input details and generate billing documents. This saves time, especially for businesses with frequent billing needs.

By using free options, businesses can efficiently manage their financial transactions, reduce administrative burdens, and maintain a high level of professionalism without additional expenses.

How to Add Payment Terms to Invoices

Clearly stating payment terms in your billing documents is essential to avoid confusion and ensure timely payments. Payment terms specify the expectations for when and how clients should pay, including deadlines, accepted methods, and any applicable penalties for late payments. Including these terms upfront helps set clear boundaries and reduces the risk of payment delays.

Key Elements to Include

When adding payment terms, it’s important to cover several key points that make the terms clear to the client. These include the payment due date, available payment methods, and late payment penalties. Below is a simple example of how to present these details in a clear and organized manner:

| Term | Details |

|---|---|

| Due Date | Payment is due within 30 days of receipt. |

| Accepted Methods | Bank transfer, credit card, PayPal. |

| Late Fees | 2% interest per month after the due date. |

| Discounts | 5% discount for early payment within 7 days. |

Best Practices for Clear Payment Terms

To avoid confusion, make sure that payment terms are easily noticeable within your document. They should be placed in a section that stands out, typically at the bottom of the page or in a clearly marked area. Additionally, make the language simple and straightforward so that the client understands exactly what is expected. For example, avoid using ambiguous terms like “soon” or “asap.” Instead, opt for precise timeframes such as “within 15 days” or “due upon receipt.”

By clearly stating payment terms, you can prevent misunderstandings and ensure that both parties are aligned on when and how payments should be made.

Designing Professional Invoice Templates

Creating a well-designed billing document is essential for making a lasting impression on clients and ensuring smooth financial transactions. A clean, professional design not only enhances your brand image but also improves the clarity of important details, such as payment terms and itemized costs. The right layout helps clients easily understand their obligations and reduces the likelihood of disputes or payment delays.

Maintain a Clean and Simple Layout: A clutter-free design is crucial for readability. Use ample white space and a clear hierarchy of information to guide the reader’s eye. The most important details, such as the amount due and payment instructions, should be easy to find. Avoid overly complex graphics or decorative elements that could distract from the content.

Brand Consistency: Your billing document is a reflection of your business, so it’s important to incorporate your brand identity into the design. Include your company logo, use brand colors, and apply fonts that match your overall marketing materials. A consistent design helps clients recognize your business at a glance and reinforces your professional image.

Highlight Important Details: Ensure that key elements, such as the total amount due, due date, and payment methods, are prominently displayed. Using bold or larger fonts for these sections makes them stand out and reduces the chance of missed information. Clearly separate different sections, like service descriptions, payment terms, and client details, to improve navigation.

By focusing on clarity, brand consistency, and user-friendly design, you can create a professional billing document that not only communicates important details but also reinforces your business’s credibility and professionalism.

Best Software for Invoice Creation

Choosing the right software to create billing documents can significantly streamline your financial workflow, making it easier to generate and manage payment requests. The best tools not only offer ease of use but also provide customization options, helping you design professional and clear documents quickly. With many solutions available, it’s important to pick one that fits your business needs, whether you’re a freelancer, a small business owner, or part of a larger organization.

1. QuickBooks

QuickBooks is one of the most popular accounting software options for businesses of all sizes. It allows users to easily create customized billing documents, track payments, and integrate with other financial tools. QuickBooks is especially beneficial for businesses that need invoicing as part of a broader accounting system.

2. FreshBooks

FreshBooks is another excellent choice for small business owners and freelancers. This software offers an intuitive, user-friendly interface that makes it easy to generate professional-looking documents, track time, and handle recurring payments. It also includes features like client reminders and easy payment processing.

3. Zoho Invoice

Zoho Invoice is a flexible and cost-effective option that’s perfect for small businesses and startups. It offers highly customizable formats, multiple currency options, and automated reminders. Zoho also integrates well with other Zoho products, making it ideal for companies that use the Zoho ecosystem.

4. Wave

Wave is a free software that provides basic but powerful invoicing and accounting features. It’s perfect for freelancers and entrepreneurs who need a simple, no-cost solution for managing their finances. Wave allows you to create professional invoices, track expenses, and accept payments online, all in one place.

5. Invoicely

Invoicely offers both free and paid plans and provides an easy way to generate professional invoices. With features such as time tracking, multiple users, and integration with PayPal, this software is well-suited for small to medium-sized businesses.

By choosing the right tool, you can automate and simplify the billing process, leaving more time to focus on growing your business while ensuring that payment requests are clear, professional, and timely.

Incorporating Branding in Invoices

Incorporating your brand identity into your billing documents is a powerful way to reinforce your business’s professional image and ensure consistency across all client touchpoints. By reflecting your logo, colors, and style within the design, you create a cohesive experience that enhances your brand recognition and communicates trustworthiness to your clients.

Start by including your business logo at the top of the document. This immediately helps clients identify your company and sets the tone for the entire document. Along with your logo, consider using your brand’s color scheme for headings, borders, and other design elements to maintain visual consistency. A strong, recognizable color palette enhances your business’s identity and makes your documents look polished and professional.

Typography is another key aspect of branding. Choose fonts that align with your overall brand style–whether it’s modern, traditional, or playful–so that your billing documents reflect the personality of your business. Ensure that the fonts are easy to read and maintain clarity throughout the document.

Additionally, consider adding a brief tagline or slogan that encapsulates your business’s values or mission. This small touch can reinforce your brand message while maintaining a professional appearance.

By thoughtfully incorporating branding elements into your billing documents, you ensure that every interaction with your clients strengthens your business identity, making your documents not only functional but also a reflection of your brand’s values and professionalism.

Handling Taxes on Invoice Templates

When creating payment documents, accurately calculating and displaying taxes is crucial for both legal compliance and transparency. Including the correct tax information ensures that clients are aware of their total costs and helps businesses avoid potential legal issues. It’s important to not only apply the right tax rates but also clearly break down these charges for the client to see.

Types of Taxes to Include

The type of taxes you need to apply will depend on your location, industry, and the nature of the product or service provided. Common taxes that may need to be included are sales tax, value-added tax (VAT), and service tax. Understanding local tax laws is essential to ensure you are charging the right amount and meeting legal requirements.

How to Present Tax Information

It’s essential to display tax calculations in a clear and transparent manner on your billing document. Typically, taxes are broken down into their own line items, showing the applicable tax rate and the amount being charged. The total amount due should reflect the sum of the goods or services and the taxes applied. Below is an example of how tax information can be clearly presented:

| Item Description | Price | Tax Rate | Tax Amount |

|---|---|---|---|

| Product A | $100.00 | 10% | $10.00 |

| Product B | $50.00 | 10% | $5.00 |

| Total | $150.00 | $15.00 |

In this example, the tax amount is clearly calculated and displayed, ensuring the client understands both the original cost and the added tax. This transparent approach not only helps in reducing confusion but also enhances the professional image of your business.

By correctly handling taxes in your billing documents, you demonstrate attention to detail and professionalism while ensuring compliance with tax regulations.

How to Include Discounts in Invoices

Offering discounts can be a great way to encourage timely payments or reward loyal clients. However, it’s essential to clearly communicate any discounts on your billing documents to avoid confusion and ensure that both you and your clients are on the same page. By including discounts in a transparent and organized manner, you maintain professionalism while showcasing your willingness to work with clients on pricing.

When incorporating discounts into your payment request, it’s important to follow a few best practices to make the process smooth and clear:

- Clearly State the Discount Amount: Always specify the exact discount amount applied, whether it’s a percentage or a fixed sum. This helps avoid misunderstandings and shows clients exactly how much they’re saving.

- Include the Terms: Define the conditions of the discount, such as “10% off for early payment” or “discount valid for orders over $500.” This ensures clients know how to qualify for the discount.

- Show Discounted Price: List the original price before the discount and the final amount after the discount has been applied. This transparency helps clients see the benefit they are receiving.

Here’s an example of how you might include a discount on a payment document:

| Item Description | Original Price | Discount | Final Price |

|---|---|---|---|

| Product A | $100.00 | -10% | $90.00 |

| Product B | $150.00 | -10% | $135.00 |

| Total | $250.00 | -10% | $225.00 |

In this example, the discount is clearly applied to each item and the total, making it easy for the client to understand the savings. This approach builds trust and helps maintain clarity in your business dealings.

By following these practices, you can effectively integrate discounts into your payment documents while keeping everything transparent and professional.

Automating Invoice Generation for Efficiency

Automating the creation of billing documents can save valuable time and reduce the risk of human error. With automated systems, businesses can streamline the process, ensuring that payment requests are generated quickly and consistently. This approach not only improves efficiency but also helps maintain accuracy, which is essential for maintaining positive client relationships and ensuring timely payments.

Benefits of Automation

Automation offers several key advantages for businesses of all sizes:

- Time Savings: Automation reduces the need for manual data entry, freeing up time for other important tasks. With just a few clicks, you can generate multiple billing documents for clients.

- Consistency: Automated systems ensure that every document follows the same format and includes all required details, eliminating the risk of missing information or formatting inconsistencies.

- Error Reduction: By integrating automated systems with your accounting or customer relationship management (CRM) software, you reduce the chance of errors, such as incorrect amounts or missed payment terms.

How Automation Works

Automated systems typically allow users to set up recurring payment schedules, pre-filled client information, and predefined item lists. Here’s an example of how automation might work when generating a payment request:

| Client | Product/Service | Amount | Due Date |

|---|---|---|---|

| Client A | Consulting Service | $500.00 | 2024-11-15 |

| Client B | Product X | $300.00 | 2024-11-20 |

With automation, the system can pull data from your CRM and accounting software to quickly generate and send out these payment requests on schedule. Some platforms even allow for automated reminders and follow-ups, ensuring you get paid on time without needing to manage each request manually.

By automating your billing process, you can significantly improve your workflow, enhance client communication, and focus more on growing your business.

Printable vs Digital Invoice Models

When it comes to managing payment requests, businesses have the option to choose between traditional printed documents and more modern digital alternatives. Both options have their advantages and challenges, and the choice often depends on the specific needs of the business and its clients. Understanding the differences between these two methods is essential to making the right decision for your operations.

Advantages of Printable Payment Requests

Printed billing documents are still widely used, especially in industries where paper communication is a standard. Some of the main benefits include:

- Physical Record: Printed copies provide a tangible record of the transaction that can be stored for physical filing, which some businesses or clients may prefer for archiving purposes.

- Client Preference: Some clients may prefer receiving physical documents for various reasons, such as ease of use or company policy. In some cases, clients may not be comfortable with digital solutions.

- Professional Appearance: Well-designed, printed billing documents can have a polished, formal appearance, especially in industries where face-to-face interactions are common.

Advantages of Digital Payment Requests

Digital payment requests are becoming increasingly popular due to their convenience and efficiency. Here are some key advantages of using digital documents:

- Instant Delivery: Digital documents can be sent immediately to clients via email or online platforms, ensuring faster processing and reducing delays.

- Environmental Impact: Digital documents eliminate the need for paper, helping businesses reduce their environmental footprint. This can be an important consideration for companies aiming to be more eco-friendly.

- Automation and Integration: Digital payment systems can integrate with other business software, allowing for automated creation, tracking, and management of documents. This can save significant time and reduce errors.

Considerations for Choosing the Right Option

When deciding between printed and digital payment documents, businesses should consider several factors:

- Client Preferences: Some clients may require physical copies, while others may be more comfortable with digital versions. Understanding your client’s needs can help guide the decision.

- Cost and Resources: