Invoice Mechanic Template for Simplified Billing and Payment Tracking

Managing financial transactions efficiently is crucial for any business that provides services. Clear documentation of services rendered and payments due helps ensure smooth operations and maintains professionalism. A well-organized system for billing can save time, reduce errors, and enhance client relationships.

Having a structured format for detailing charges, terms, and payment methods is essential in providing clarity to clients. A system that simplifies the creation of such documents not only boosts productivity but also ensures consistency across all interactions. Customizable formats can adapt to various business needs, making them an invaluable tool for service providers.

By using the right approach, businesses can easily track outstanding payments and keep records for future reference. The flexibility of digital tools allows for quicker adjustments, helping to avoid common mistakes and delays. Implementing an efficient strategy for generating financial documents ensures that the billing process is both professional and hassle-free.

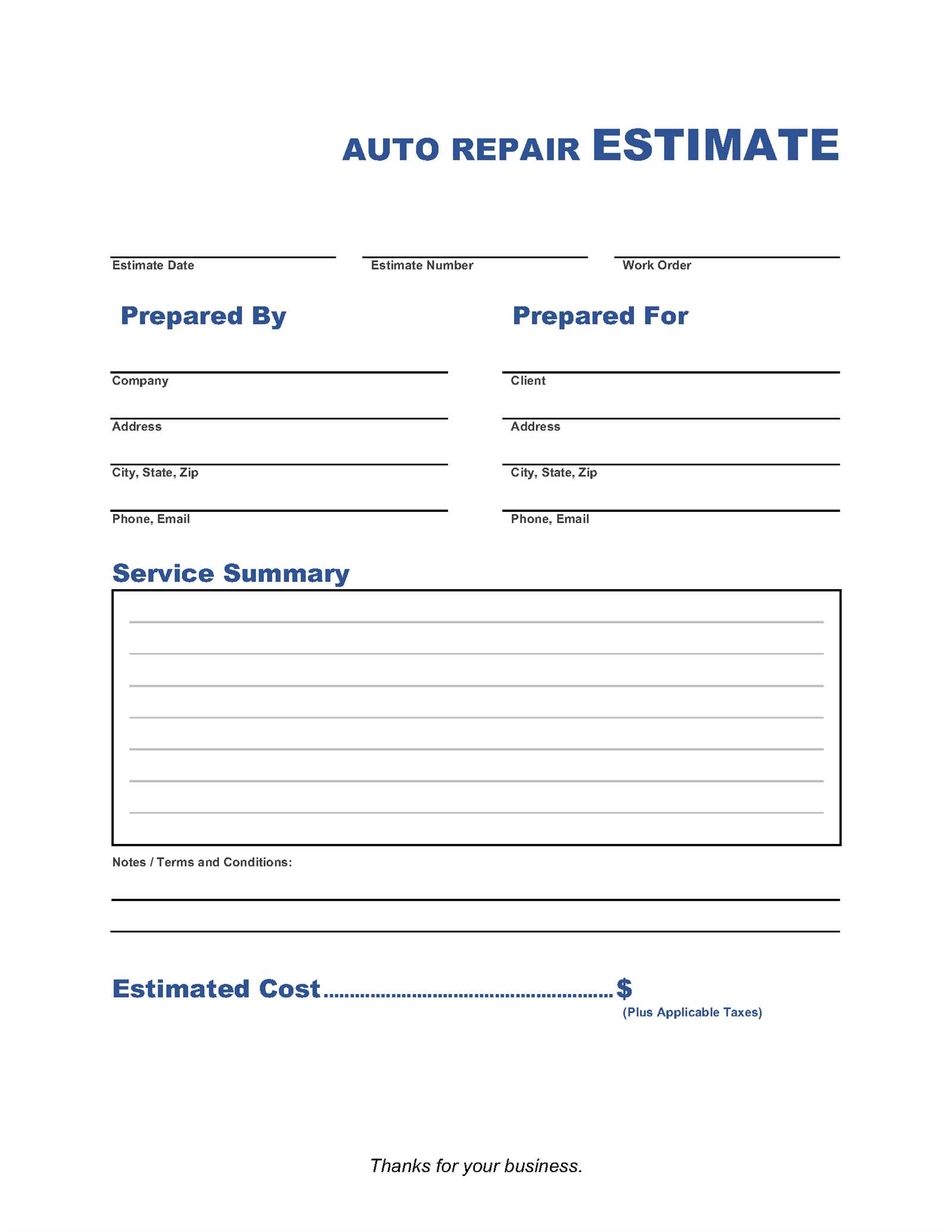

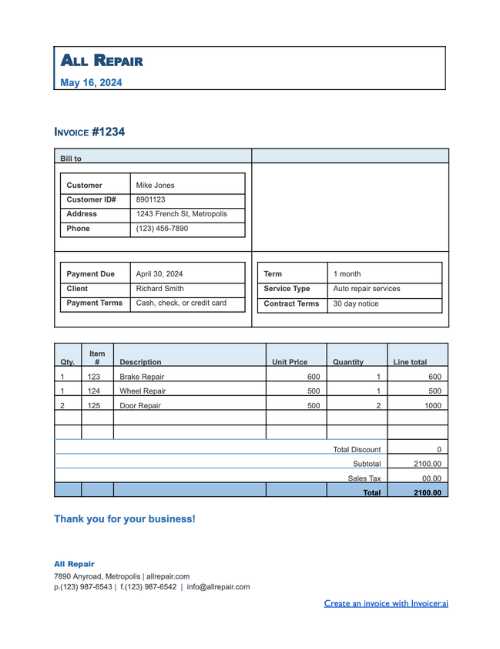

Invoice Template Overview

For any business, especially those offering technical services, creating detailed records of transactions is essential for maintaining accurate financial documentation. Using a structured system to outline services, fees, and payment details allows for greater organization and reduces the chance of errors. This approach not only enhances business efficiency but also improves client trust and satisfaction.

Adopting a digital solution for preparing such records simplifies the process, allowing service providers to focus more on their core work while ensuring that all financial details are clearly communicated. These systems typically feature customizable fields, making it easy to adjust the format to meet specific business needs.

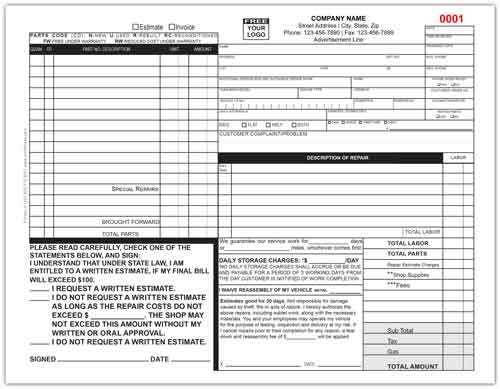

| Section | Description |

|---|---|

| Header | Company and customer information, service date, and unique reference number. |

| Services Rendered | Clear breakdown of each task performed with associated costs. |

| Payment Terms | Details about due dates, payment methods, and any penalties for late payments. |

| Total Amount | Summarized total cost, including taxes and any additional fees. |

| Footer | Business contact details and any legal disclaimers or payment instructions. |

This method offers a professional and systematic way to handle transactions, ensuring that all necessary information is communicated efficiently and accurately. The result is a smooth, transparent process that benefits both the service provider and their clients.

Benefits of Using a Template

Utilizing a pre-designed format for documenting financial transactions offers significant advantages for service providers. This approach streamlines the process, saving both time and effort while ensuring consistency across all records. By following a structured system, businesses can avoid mistakes and maintain a professional appearance in their financial communications.

One of the main benefits is efficiency. A ready-to-use format eliminates the need to start from scratch with every transaction, allowing for quick adjustments and updates. This can be particularly valuable for businesses that handle a large volume of client interactions or need to generate records frequently.

Another key advantage is accuracy. Templates ensure that all necessary details are included and correctly formatted, reducing the risk of missing important information. This minimizes errors and ensures that all clients receive the same clear, professional documents.

Additionally, using a standardized format promotes legal compliance by including all required sections, such as payment terms and service descriptions. It also enhances client trust, as customers are more likely to appreciate well-organized and transparent documentation.

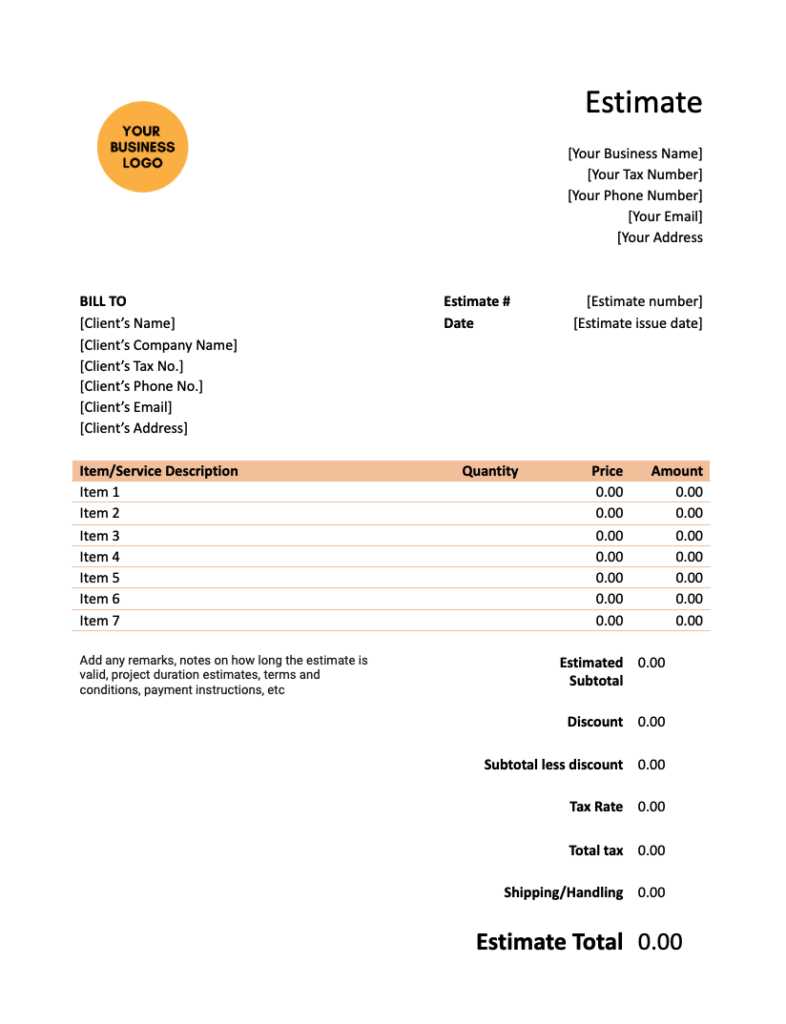

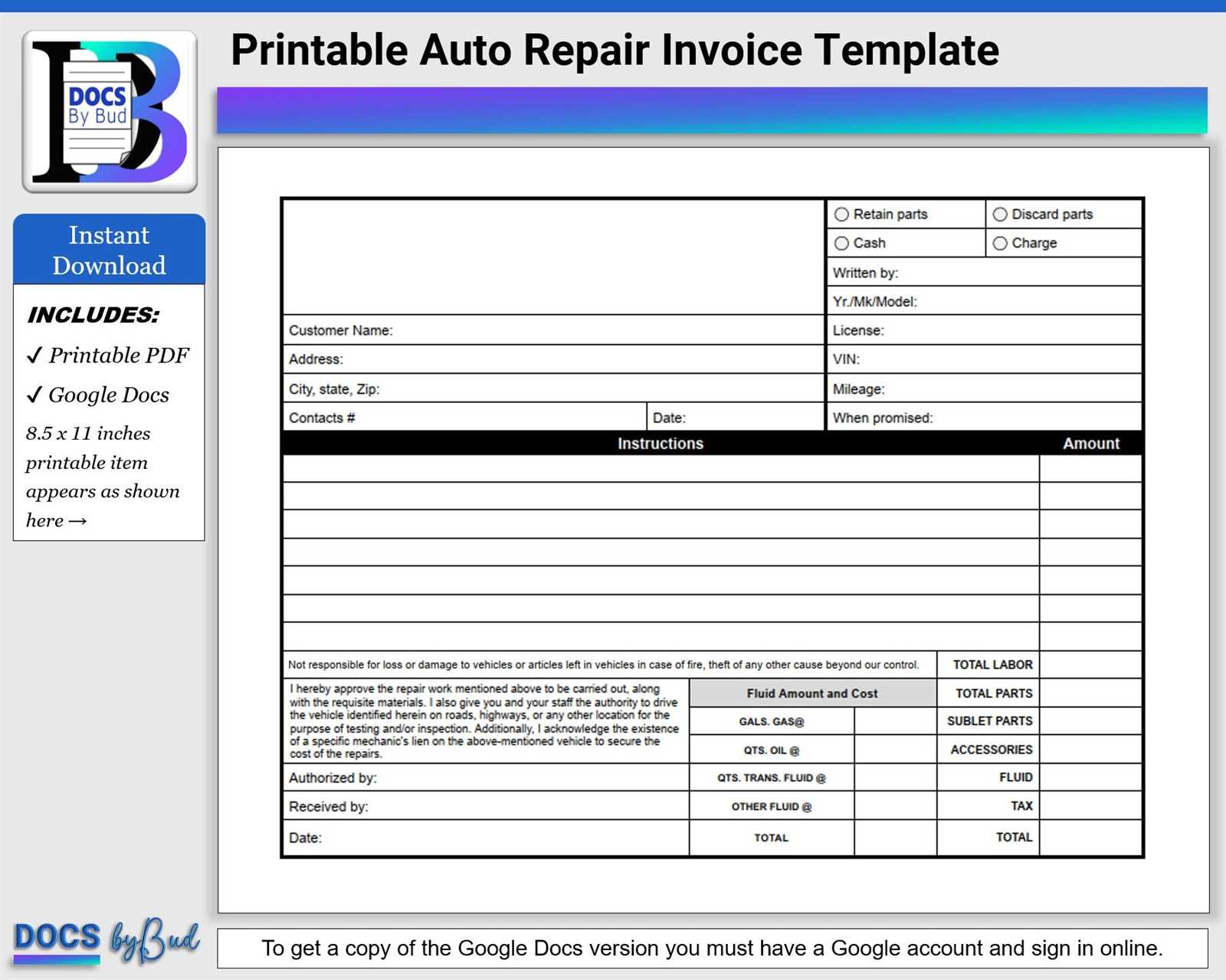

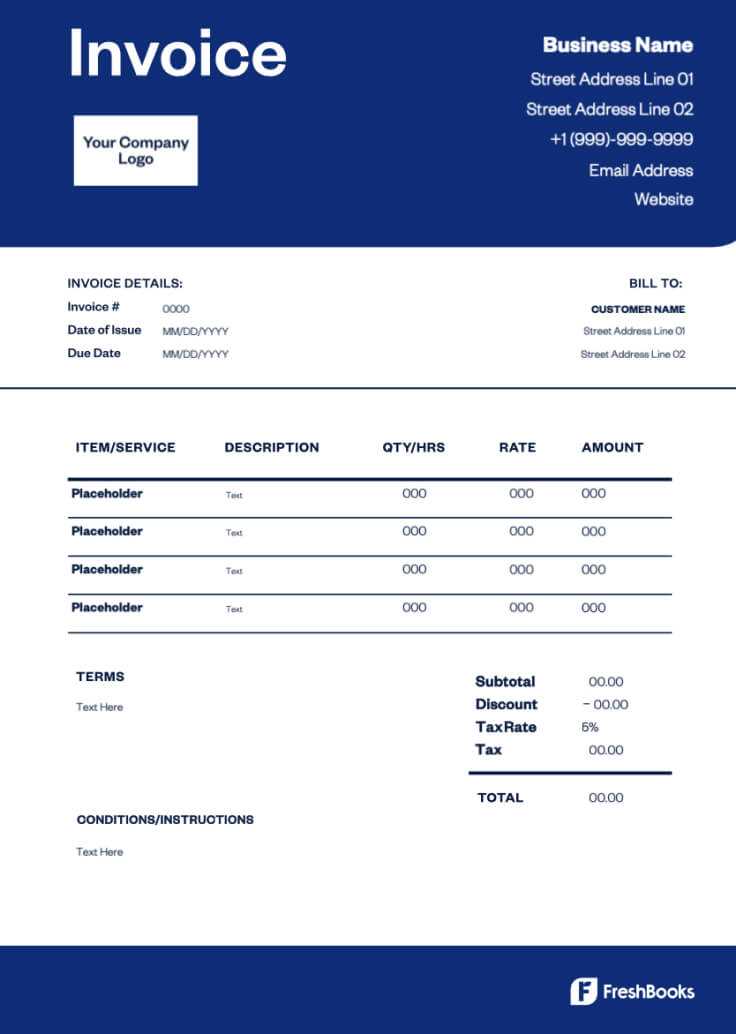

How to Customize Your Template

Personalizing your financial document layout is essential to ensure it reflects your business style and meets your specific needs. Customization allows you to adjust the format, design, and details to suit your services and enhance professionalism. By tailoring the structure, you can make the document both functional and visually appealing for your clients.

The first step in customization is defining the key sections. These might include customer information, a breakdown of services, payment terms, and any additional instructions. You can adjust the layout of each section to prioritize the most important details, ensuring that the document is both easy to understand and comprehensive.

Next, you can modify the appearance. Choose colors, fonts, and logos that align with your brand identity. Adding your business logo or customizing the font style can enhance the document’s visual appeal and make it instantly recognizable to clients. Keep the design professional and simple, ensuring clarity and readability.

Lastly, consider adding any additional fields or custom information that may be specific to your services. Whether it’s including special discount terms, unique billing instructions, or project-specific notes, the flexibility of your system allows for full personalization to meet every client’s needs.

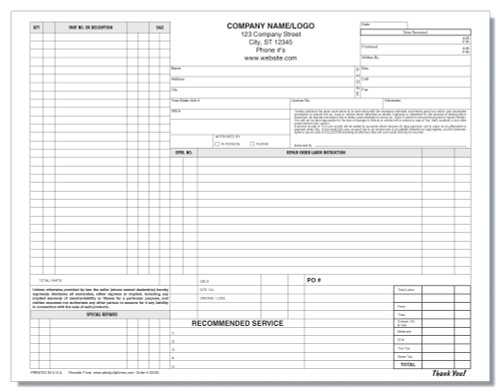

Choosing the Right Format for Your Document

Selecting the right format for creating financial records is crucial to ensure that all necessary information is presented clearly and professionally. The format you choose can impact the efficiency of your workflow and how easily clients can understand the charges. It is important to consider the type of services provided, the complexity of the billing, and the preferences of your clients when deciding on the most suitable structure.

Factors to Consider

- Clarity: Choose a format that presents all relevant details in an easy-to-understand manner. Avoid cluttering the document with unnecessary information.

- Customization: Make sure the format allows for customization so that you can adjust the layout and fields as needed.

- Compatibility: Ensure the format works well with the software or tools you are using for business management, such as accounting or project management platforms.

Types of Formats to Consider

- Simple List Format: Ideal for straightforward billing with minimal details, where each item or service is listed with its corresponding cost.

- Itemized Breakdown: Best for detailed charges, where multiple services are broken down with specific descriptions, quantities, and rates.

- Professional Design Layout: Suitable for businesses that want a more formal, branded appearance, including logos, custom headers, and footer sections.

Ultimately, the best format will depend on your business needs and client expectations. By choosing a format that is both functional and visually appealing, you can enhance communication and ensure a smooth billing process for both you and your clients.

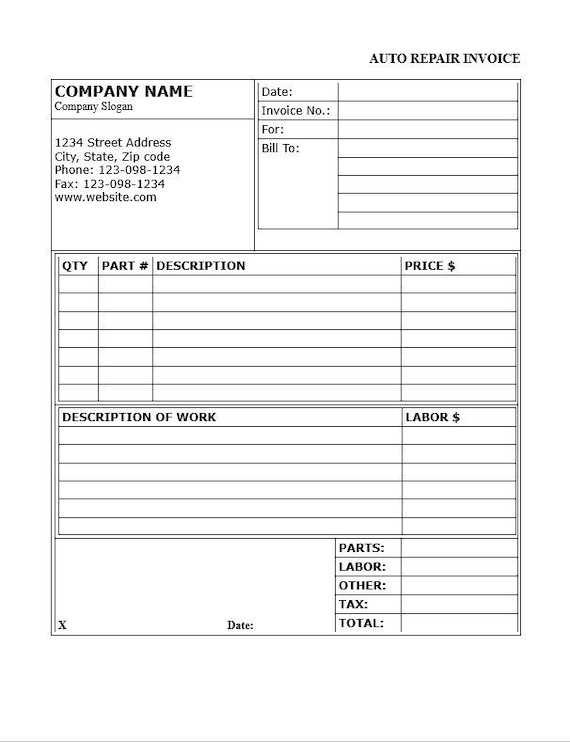

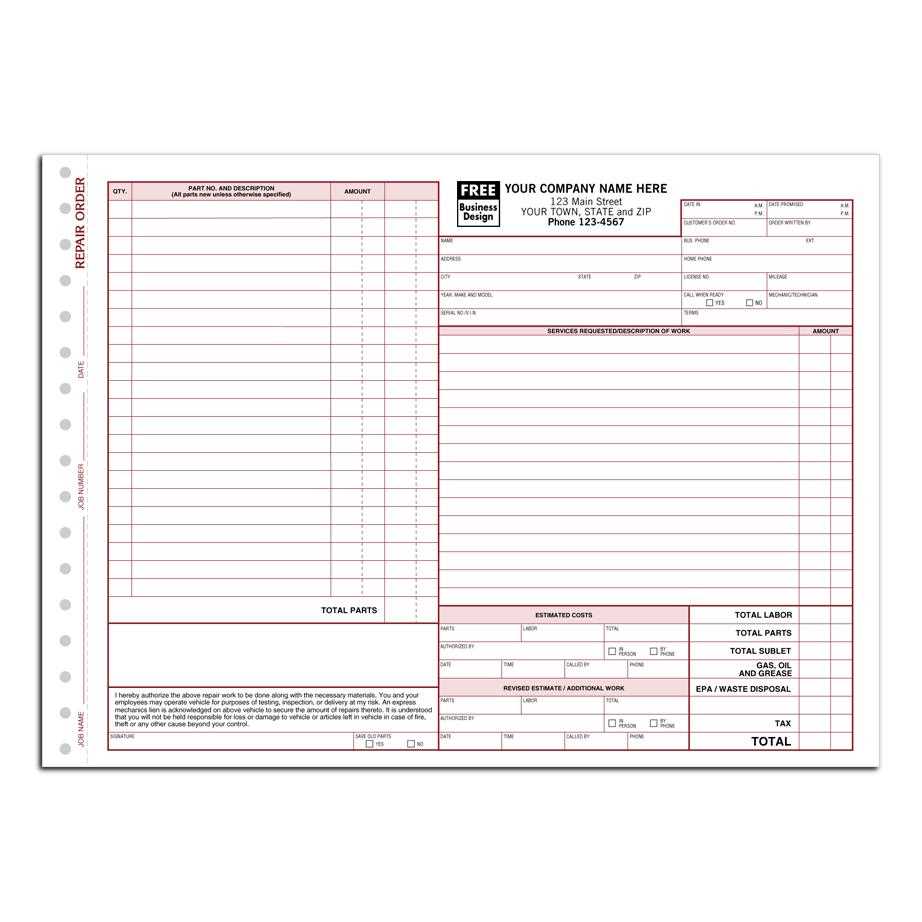

Essential Elements for Service Billing Documents

Creating clear and comprehensive financial documents is key to ensuring smooth transactions between service providers and clients. The right structure helps prevent misunderstandings and ensures both parties are on the same page regarding services, charges, and payment expectations. Certain key components should always be included to maintain transparency and professionalism.

Key Components to Include

- Service Provider Information: Always include the business name, contact details, and legal registration information. This ensures the client can easily reach you for questions or further communication.

- Client Details: Accurate client information, including their name, address, and contact information, ensures that the document is personalized and correctly attributed.

- Service Description: Clearly detail the work performed, including a brief description of each task, service date, and the agreed-upon rate. This helps the client understand exactly what they are being charged for.

- Terms of Payment: Specify payment due dates, accepted methods, and any applicable late fees or discounts. Setting these expectations upfront ensures there is no confusion about when and how to pay.

- Total Amount: Summarize the total cost at the end of the document, including taxes, service charges, and any additional fees, ensuring full transparency.

- Unique Reference Number: Assign a unique identifier to each document for easy tracking and future reference. This can be a simple serial number or code specific to the transaction.

Optional Elements to Enhance Clarity

- Payment Instructions: Provide any special instructions for how payments should be made, especially if you use non-traditional methods like bank transfers or online payments.

- Discounts or Adjustments: If applicable, include any discounts or adjustments to the total amount for returning customers or special offers.

- Legal Disclaimers: Add any necessary terms, such as warranty details or disclaimers, that may apply to the services provided.

Including these elements ensures that your documents are not only clear and accurate but also legally sound and easy for clients to understand. A well-structured financial record promotes trust and enhances client relationships, leading to smoother business operations overall.

Creating Clear Payment Terms

Clear and concise payment terms are crucial to maintaining smooth business transactions. By clearly outlining when and how payments are expected, both the service provider and the client have a mutual understanding of their financial obligations. Setting transparent expectations upfront helps prevent confusion and ensures timely payments, avoiding potential disputes.

The payment terms should be specific and unambiguous. Include key details such as the due date, payment methods accepted, and any penalties for late payments. This information gives the client a clear idea of their responsibilities and reduces the chance of misunderstandings.

Due Date: Clearly specify when the payment is expected, whether it’s within a certain number of days after the service is completed, or on a specific calendar date. This helps clients plan their payments accordingly.

Accepted Payment Methods: List all the payment options available, such as bank transfers, credit card payments, checks, or digital platforms like PayPal or Venmo. This ensures that the client knows how to make the payment easily and without delay.

Late Payment Fees: It is advisable to include any applicable late fees or interest charges if payments are not made on time. This can act as an incentive for clients to settle their balances promptly, while also protecting the business from delayed cash flow.

Discounts for Early Payments: Offering discounts for early settlement can encourage prompt payment. Clearly state any such incentives, along with the conditions, to motivate clients to pay ahead of time.

When your payment terms are clear and well-defined, you build a strong foundation for trust and accountability, leading to more positive client relationships and a more efficient financial process.

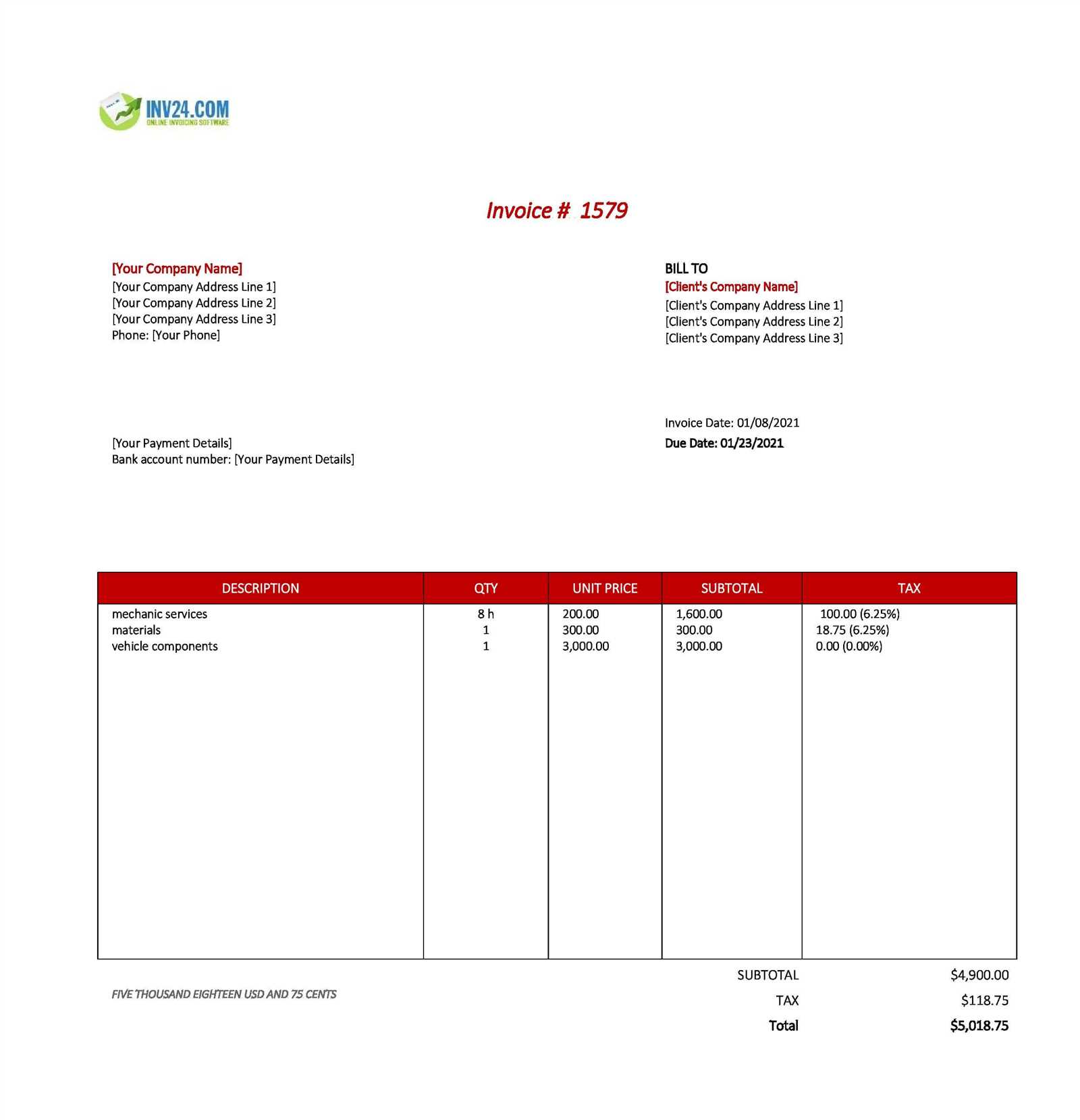

How to Include Service Descriptions

Including clear and detailed descriptions of the work provided is an essential part of any financial document. A well-written service description ensures that the client understands exactly what they are paying for, and it helps avoid potential disputes or confusion. It also demonstrates professionalism and transparency, fostering trust between the service provider and the client.

What to Include in Service Descriptions

- Specific Tasks: Break down each service or task performed with a brief but clear explanation. For example, instead of just saying “Repair,” specify “Replaced alternator belt” or “Fixed brake system issues.” This provides clarity on what was done.

- Service Duration: Indicate how long each task took or the estimated time spent on the work. This is particularly helpful for clients who may want to understand the time investment required for each service.

- Materials Used: If any specific parts or materials were used, list them in the description. This gives the client transparency regarding the cost of materials and justifies the overall pricing.

- Additional Notes: Include any relevant comments or information, such as additional tasks completed that were outside of the initial scope or any recommendations for future work.

Best Practices for Writing Service Descriptions

- Be Clear and Concise: Avoid jargon or overly technical language. Write in a way that the client can easily understand, even if they aren’t familiar with the specifics of the work.

- Use Bullet Points: For multiple services, consider using bullet points to make the description more readable and organized.

- Stay Objective: Focus on what was done rather than subjective opinions. Stick to the facts to ensure the description is professional and accurate.

By following these guidelines, you can create service descriptions that are both informative and easy to understand, ensuring that clients are well-informed and confident in the services provided.

Using Billing Documents for Efficiency

Using pre-designed layouts for financial documents can significantly streamline the billing process, saving both time and effort. These ready-to-use structures allow for quick customization, reducing the need to create each document from scratch. By utilizing standardized formats, service providers can ensure consistency, reduce errors, and enhance professionalism in their financial communications.

By employing a structured layout, you can quickly input the necessary details for each client and job, ensuring that all required information is included without missing important elements. This not only improves accuracy but also boosts productivity, as you won’t have to rethink the design and structure each time.

Key Benefits of Using Pre-Designed Formats:

| Benefit | Explanation |

|---|---|

| Time Efficiency | Using a set structure eliminates the need to manually organize every section, allowing you to quickly fill in the details and focus on the core tasks. |

| Consistency | Pre-designed documents ensure that all your financial records follow a uniform format, making them more professional and easier for clients to understand. |

| Reduced Errors | By using an established format, you minimize the risk of forgetting key details or including incorrect information. |

| Customization | While standardized, these formats can be easily tailored to suit specific business needs or client requirements, ensuring flexibility. |

With these benefits in mind, using a pre-designed structure for billing tasks can help you optimize your workflow, maintain professionalism, and ensure that all essential information is included without delay or confusion.

How to Automate Your Billing Process

Automating the billing process can save time, reduce errors, and improve cash flow. By streamlining routine tasks, such as generating and sending payment requests, businesses can focus more on core activities. With the right tools and setup, you can automate many aspects of the financial documentation process, ensuring consistency and efficiency in your operations.

Steps to Automate Your Billing Process

- Choose an Automated System: Select a software or platform that allows for automatic generation and delivery of payment requests. Many platforms provide features like recurring billing, custom fields, and easy integration with payment processors.

- Integrate with Your Client Database: Link your system to your client records so that relevant information such as contact details, payment terms, and past transactions are automatically populated into each document.

- Set Up Recurring Billing: For clients with ongoing services, set up recurring billing cycles to automatically generate and send financial documents at specified intervals (e.g., weekly, monthly). This reduces the administrative burden and ensures timely payments.

- Customize Payment Reminders: Automate payment reminders that notify clients of upcoming due dates or overdue balances. This helps ensure that payments are made on time and reduces manual follow-up efforts.

Benefits of Automation

- Reduced Human Error: Automating the process minimizes the risk of data entry mistakes, ensuring that all client details and charges are accurate.

- Faster Processing: Automatically generated documents save time, allowing you to focus on other tasks while ensuring that your financial operations run smoothly.

- Improved Client Experience: Automation ensures consistency and timeliness, providing clients with professional, on-time billing and payment notifications.

- Better Cash Flow Management: Automated reminders and recurring billing ensure that payments are collected promptly, improving cash flow and reducing late payments.

By automating your billing processes, you can streamline your workflow, reduce the chances of errors, and create a more efficient and professional payment experience for both your business and clients.

Saving Time with Pre-made Templates

Using pre-designed formats can significantly reduce the time spent on preparing financial documents. By adopting ready-made structures, businesses can avoid the repetitive task of manually creating each new document from scratch. These pre-structured designs allow for quick customization and ensure that all essential information is included, making the process more efficient and less time-consuming.

Rather than worrying about layout and formatting, you can focus on the content and specifics of the work performed. This streamlining of the process frees up valuable time, allowing you to allocate your efforts to other important tasks. Additionally, with consistent formats, you eliminate the need to recheck each document for accuracy or completeness.

Advantages of Using Pre-made Formats

- Faster Document Creation: Pre-set formats allow you to quickly input job details, payment terms, and other information, speeding up the overall process.

- Consistent Structure: With a standard design, every document will maintain the same layout and structure, making it easier for clients to understand and for you to manage.

- Reduced Decision Fatigue: Since the format is already decided, you don’t have to spend time deciding on the design or layout each time, freeing your focus for other tasks.

- Easy Customization: Pre-made designs are often flexible, allowing you to adjust content as needed without changing the entire layout or structure.

How Pre-made Formats Save You Time

- Streamlined Information Entry: With templates, all necessary fields are preset, and you only need to fill in the job-specific details, eliminating the need to recreate each document.

- Improved Accuracy: By using a standardized format, you are less likely to miss key information or make errors that might require additional time to correct.

- Time Savings Across Clients: Whether you’re working with new clients or returning ones, a pre-made structure ensures you can process multiple documents quickly without losing quality or professionalism.

By implementing pre-made designs, businesses can significantly increase efficiency, reduce the time spent on each task, and maintain consistency across all financial documentation.

Ensuring Legal Compliance with Billing Documents

When creating billing documents, it’s crucial to ensure they meet all legal requirements. Proper documentation not only facilitates smooth business operations but also protects your company from potential legal issues. By following the required standards, businesses can avoid fines, disputes, or complications that may arise due to non-compliance.

Legal compliance involves ensuring that all necessary information is included in each financial document, such as correct tax rates, payment terms, and client details. Failing to include these elements can result in financial penalties or loss of credibility. Furthermore, adhering to local regulations helps maintain transparency and trust with your clients.

Key Elements for Legal Compliance:

- Correct Tax Information: Ensure that all applicable taxes are clearly stated, with accurate tax rates and amounts. This helps both parties understand their financial obligations and meet government regulations.

- Clear Payment Terms: Clearly outline the payment deadlines, accepted payment methods, and any penalties for late payments. This protects your business from delayed payments and sets expectations with clients.

- Accurate Client Information: Include up-to-date contact details, company names, and addresses. This ensures that the document is valid and can be traced back to the correct entity if necessary.

- Proper Formatting: Many jurisdictions have specific formatting rules for business documents. Adhering to these standards will ensure that your documents are recognized as legitimate and legally binding.

How to Stay Compliant:

- Regularly update your billing documents to reflect any changes in tax laws or business regulations.

- Use accounting software or automated systems that incorporate legal standards to ensure that every document meets the required criteria.

- Consult with a legal or financial professional to ensure that all aspects of your billing documents adhere to the latest laws in your jurisdiction.

By integrating legal compliance into your billing process, you ensure that your financial transactions are secure, transparent, and free from legal complications.

How to Track Payments and Expenses

Effectively tracking payments and expenses is essential for maintaining a healthy cash flow and ensuring that your financial records are accurate. Monitoring transactions helps you stay on top of incoming payments, outstanding debts, and ongoing costs, providing valuable insights into the financial health of your business. By keeping detailed records, you can better manage your budget, forecast future expenses, and make informed decisions.

Proper tracking can also help prevent financial discrepancies and ensure you meet tax obligations. Whether you use digital tools or manual methods, it’s important to stay organized and consistent with how payments and expenses are recorded. Below are some effective ways to manage these financial records.

Best Practices for Tracking Payments

- Use Accounting Software: Accounting tools can automate the tracking process, allowing you to easily monitor incoming payments and categorize them by client or project.

- Record Payments Immediately: Ensure that each payment is recorded as soon as it’s received to avoid missing any transactions and to maintain an up-to-date cash flow overview.

- Set Up Payment Alerts: Set reminders for due payments or upcoming deadlines to stay on top of outstanding invoices and ensure timely follow-ups.

- Integrate Payment Methods: Link your payment systems, such as credit card processors or bank accounts, with your tracking system to automatically update your records with each transaction.

Tracking Expenses Effectively

- Categorize Expenses: Group your expenses into categories like supplies, overhead, or operational costs. This makes it easier to review and analyze spending patterns over time.

- Use a Spreadsheet: For those who prefer manual tracking, maintaining a well-organized spreadsheet is an effective way to log every expense and assign it to the appropriate category.

- Monitor Regular and One-time Expenses: Track both recurring and one-off costs to get a full picture of your financial obligations and manage cash flow more effectively.

- Keep Digital or Physical Receipts: Always store receipts for any purchases, whether digital or paper. This will ensure you have proof of expenses if required for audits or tax filings.

Tools for Tracking Payments and Expenses

| Tool | Features | Best For |

|---|---|---|

| QuickBooks | Automated payment tracking, expense categorization, and tax reports | Small to medium businesses |

| FreshBooks | Time tracking, invoicing, and expense management | Freelancers and small business owners |

| Xero | Comprehensive accounting software with easy reporting features | Growing businesses with complex financial needs |

| Wave | Free invoicing, payment tracking, and expense management | Small businesses or startups with limited budgets |

By adopting the right tools and methods for tracking payments and expenses, you can ensure that your financial management is organized, transparent, and efficient, ultimately leading to better decision-ma

Incorporating Discounts and Fees

In any financial document, it’s essential to accurately reflect any discounts or additional charges that may apply. Offering discounts can encourage prompt payment or reward loyal customers, while adding fees can cover the costs of extra services or delays. Clear communication about these adjustments ensures transparency and avoids misunderstandings between businesses and their clients.

When incorporating discounts and fees, the calculation should be straightforward and easy to understand. It’s important to clearly outline how these adjustments are applied, whether as a percentage of the total or a fixed amount. Additionally, both parties should be aware of the terms associated with any discounts or fees to prevent confusion.

How to Apply Discounts

- Percentage Discount: A discount based on a percentage of the total amount, typically offered as an incentive for early payments or bulk purchases.

- Flat Rate Discount: A fixed amount deducted from the total, often used in promotions or special offers.

- Volume Discounts: Discounts applied when a customer purchases a large quantity of goods or services, incentivizing larger orders.

How to Include Fees

- Late Payment Fee: A charge applied when a payment is overdue. This helps encourage timely payments and covers any administrative costs.

- Service Fees: Additional charges for specialized services, such as rush orders or premium support, that go beyond the standard offering.

- Shipping or Delivery Fee: A fee for the cost of shipping goods, often added to the final amount based on the delivery method or destination.

Best Practices for Clear Communication:

- Clearly state the terms of discounts and fees upfront to avoid confusion. Specify how long discounts are valid and under what conditions they apply.

- Make sure fees are justified and transparent, explaining why they are necessary and how they are calculated.

- Ensure all adjustments are itemized separately in the financial document, so clients can easily identify and understand the breakdown of charges.

By effectively incorporating discounts and fees, businesses can maintain positive relationships with customers while ensuring their financial documentation remains accurate and professional.

Using Digital Tools for Invoice Management

In today’s fast-paced business environment, digital tools play a crucial role in streamlining financial record-keeping and improving overall efficiency. These tools not only simplify the creation of financial documents but also enhance tracking, organization, and payment processing, ensuring that businesses can manage their finances effectively and with minimal errors.

By utilizing specialized software or online platforms, businesses can automate many aspects of the billing process, such as creating customized documents, tracking payments, and generating reports. This reduces manual labor and helps to avoid common mistakes that can lead to discrepancies or delays in payments. Digital tools can also offer additional features like reminders for overdue payments or automatic calculations for taxes and discounts.

Benefits of Digital Tools for Management

- Efficiency: Automated processes save time by eliminating manual tasks such as data entry and calculations.

- Accuracy: Reduces human error in calculations and entries, ensuring that all figures are correct.

- Accessibility: Cloud-based tools allow easy access to records from anywhere, providing flexibility for remote teams and business owners.

- Customization: Many tools allow for full customization of document layouts, fields, and branding, ensuring that all materials align with a business’s image.

Popular Digital Tools for Efficient Financial Management

| Tool | Features | Pros |

|---|---|---|

| QuickBooks | Invoicing, expense tracking, financial reports, tax calculations | Comprehensive solution, user-friendly, widely used |

| FreshBooks | Time tracking, invoicing, project management, client communication | Good for freelancers, easy-to-use interface, mobile app |

| Zoho Invoice | Invoice creation, online payments, client management, reports | Affordable, customizable templates, multi-currency support |

These tools allow businesses to take advantage of cloud

Preventing Common Invoice Errors

Ensuring accuracy in financial documents is crucial for maintaining smooth operations and positive client relationships. Mistakes, even small ones, can lead to misunderstandings, delayed payments, or a damaged reputation. The key to avoiding such errors lies in attention to detail, consistency, and using reliable tools to streamline the process.

Common mistakes can occur at various stages, from data entry to calculation errors. These errors often stem from a lack of standardization or reliance on manual processes. By implementing clear procedures and using digital solutions, businesses can reduce the risk of such mistakes and ensure that all transactions are accurately recorded and processed.

Common Errors to Watch Out For

- Incorrect Client Details: Always double-check the client’s contact information and billing address to avoid sending documents to the wrong person.

- Calculation Mistakes: Ensure all amounts are accurately calculated, including taxes, discounts, and total charges.

- Missing Payment Terms: Clearly specify the payment deadlines and methods to avoid confusion or late payments.

- Inconsistent Formatting: Use a standardized format for all financial documents to make them professional and easy to read.

- Failure to Track Payments: Make sure to update payment statuses regularly to avoid sending reminders for already settled bills.

Tips for Reducing Errors

- Automate Calculations: Use software that automatically calculates totals, taxes, and discounts to prevent manual calculation mistakes.

- Standardize Your Process: Develop a consistent process for creating and sending financial documents, including a checklist to ensure all necessary information is included.

- Review Before Sending: Always review the document before finalizing and sending it to ensure there are no errors in details, amounts, or payment terms.

- Use Templates: Pre-designed layouts can help maintain consistency and reduce the risk of missing essential details or misplacing key information.

By taking proactive steps to prevent common errors, businesses can enhance their financial management processes, maintain professionalism, and build trust with their clients. This leads to better communication, smoother transactions, and ultimately, a stronger reputation in the marketplace.

Best Practices for Sending Invoices

Sending financial documents efficiently and professionally is essential for ensuring timely payments and maintaining strong client relationships. By following a few key practices, businesses can streamline their billing process, reduce confusion, and avoid delays. Properly handling these communications helps reinforce trust and promotes smooth transactions.

From the moment you create a document until it’s received by your client, every step matters. Setting clear expectations, choosing the right method of delivery, and following up when necessary can all contribute to a more effective process. Below are some best practices for sending documents that ensure clarity and efficiency in your billing system.

Key Considerations When Sending Financial Documents

- Ensure Accurate Information: Double-check all details before sending, such as client name, billing address, services rendered, and payment terms.

- Choose the Right Delivery Method: Opt for a method that suits both you and your client. Email is convenient, but some clients may prefer physical mail or secure portals.

- Send Promptly: Avoid delays by sending documents as soon as the work is complete. This helps maintain a professional image and ensures quicker payment cycles.

- Use a Clear Subject Line: When emailing, ensure the subject line is descriptive and easy to understand, such as “Payment Request for [Service Name] – Due [Date].”

Follow-Up Strategies

- Set Reminders: If payment is not received within the specified time, send a polite reminder after a few days, clearly stating the outstanding amount.

- Offer Flexible Payment Options: Sometimes clients need time or additional methods to complete a payment. Offer options to accommodate their needs without compromising your own timelines.

- Maintain Professionalism: Always keep the tone of your communications polite and professional, even when following up on overdue payments.

By implementing these best practices, businesses can foster positive relationships with clients while ensuring that payments are processed efficiently and promptly. Streamlining the sending process not only minimizes administrative work but also maximizes the chances of receiving payments on time.