Professional Invoice Letter Template for Clear Billing Communication

In any business, maintaining clear and professional communication is essential, especially when it comes to requesting payments. Properly drafted financial documents not only ensure smooth transactions but also reflect the professionalism of your company. The right approach to preparing these documents can help you establish trust with clients and ensure timely payments.

Effective financial communication includes providing all necessary details in a straightforward and organized manner. This allows the recipient to understand the request quickly and take action without confusion. With the right format, you can avoid misunderstandings and reduce the chances of disputes over amounts or terms.

Whether you’re running a small business or managing larger projects, having a consistent and customizable structure for your payment requests can save time and effort. Personalizing these documents to fit your specific needs while adhering to standard practices ensures both professionalism and efficiency in your financial dealings.

Invoice Letter Template Overview

When it comes to managing payment requests, having a standardized format is essential for maintaining consistency and professionalism. A well-structured document can streamline the billing process, ensuring that all relevant details are included clearly and concisely. This not only improves communication with clients but also reduces the chances of errors or misunderstandings regarding amounts or payment terms.

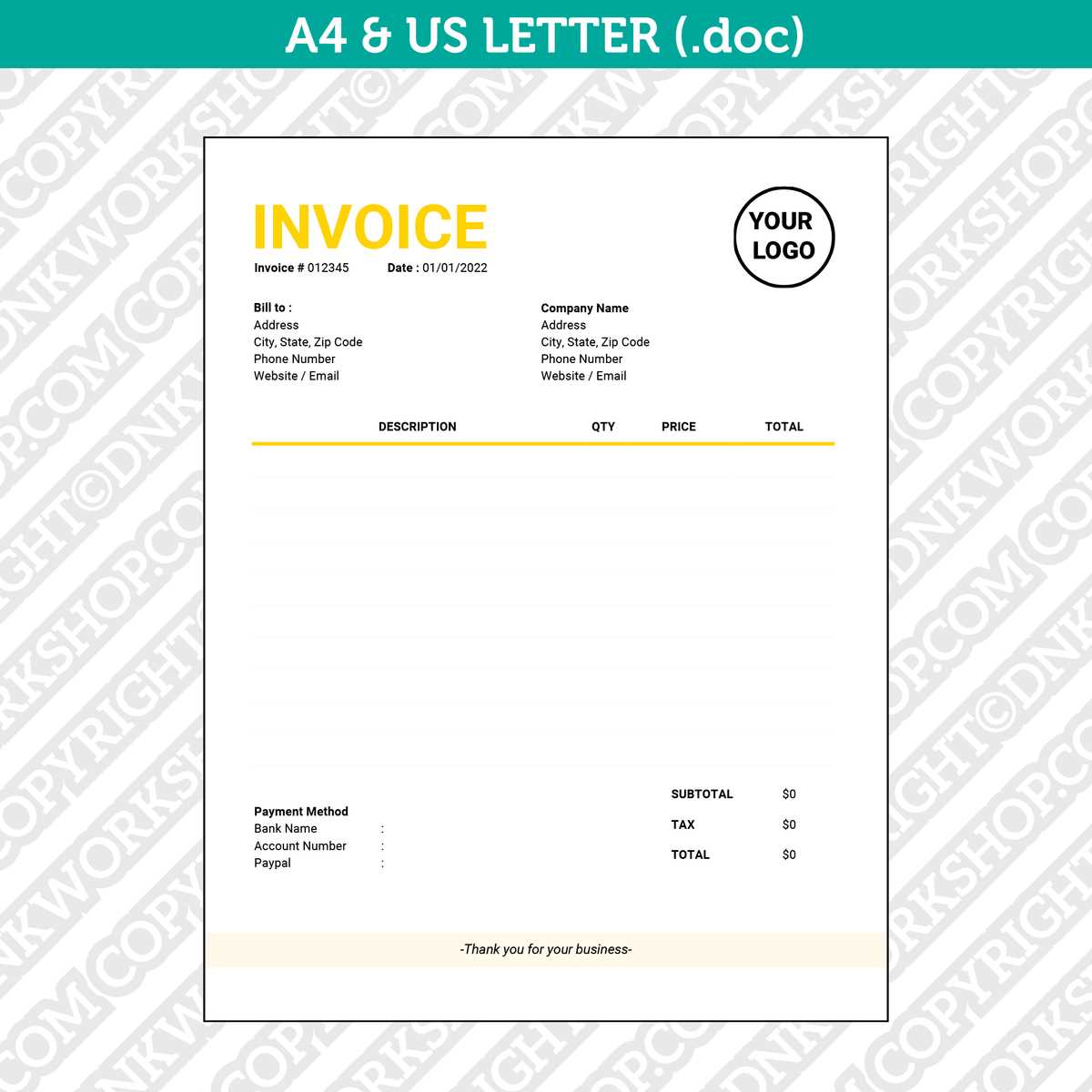

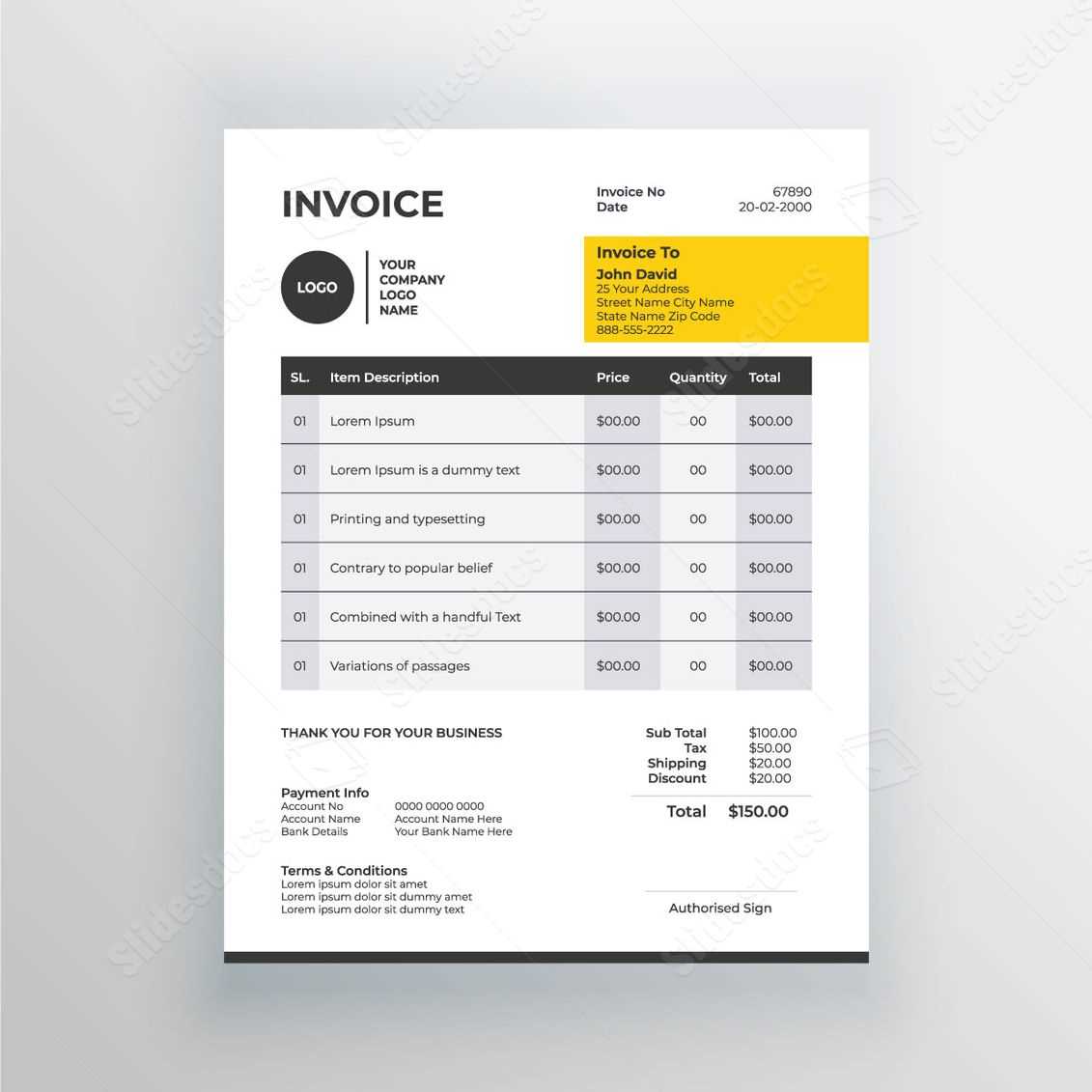

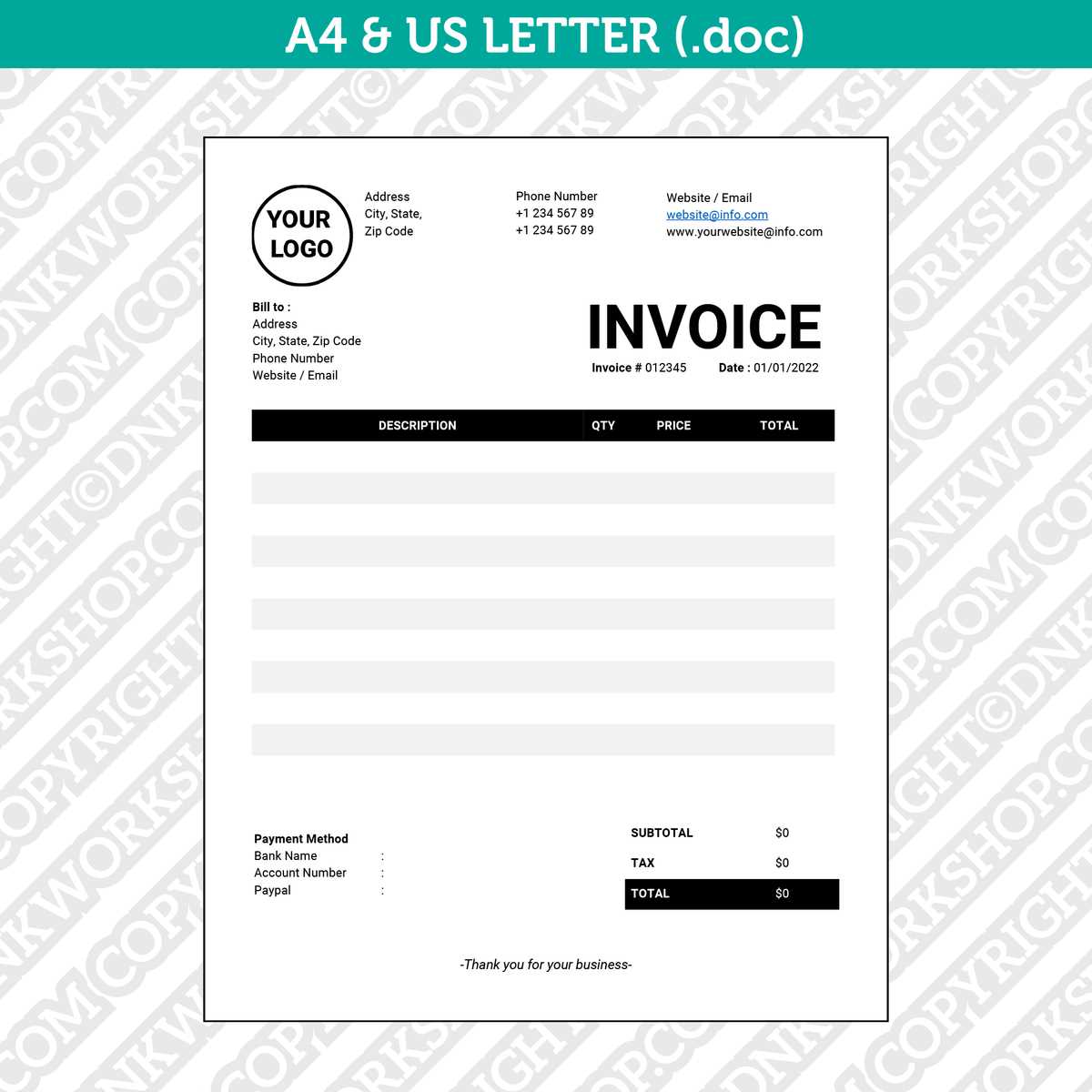

These documents typically follow a specific format, containing key elements such as sender and recipient information, itemized charges, payment instructions, and due dates. By adopting a uniform approach, businesses can ensure that their requests are always clear, precise, and easy to understand. Below is an overview of the essential sections commonly found in a payment request document.

| Section | Description |

|---|---|

| Header | Includes the name, address, and contact details of the sender and recipient. |

| Payment Details | Itemizes the products or services provided, including quantities, prices, and any applicable taxes. |

| Payment Terms | Outlines the due date, payment methods, and any penalties for late payments. |

| Footer | Contains additional contact information, legal disclaimers, or notes to the recipient. |

Using this structure helps maintain a professional tone while ensuring that clients have all the necessary information to complete the payment process smoothly.

Why You Need an Invoice Letter

When conducting business transactions, it’s crucial to have a clear and formal way to request payments. This ensures that both parties are on the same page regarding the details of the agreement and the amount due. Without proper documentation, misunderstandings can occur, potentially leading to delayed payments or disputes. A well-constructed payment request serves as both a record and a reminder, making it essential for maintaining healthy financial operations.

Benefits of Using a Payment Request Document

- Clear Communication: Ensures that both the buyer and seller understand the terms of the payment, including the amount, due date, and method.

- Legal Protection: Provides a formal record of the transaction, which can be useful in case of disputes or legal issues.

- Professionalism: Demonstrates that your business operates with organization and transparency, helping to build trust with clients.

- Efficiency: Streamlines the billing process, saving time and reducing errors by having a standard format for all transactions.

When to Send a Payment Request

- At the completion of a service or delivery of goods.

- When a customer has agreed to a payment schedule, to remind them of the due date.

- To follow up on any outstanding balances after a specific period has passed.

In any case, having a clear and professional approach to requesting payments can help you manage your finances more effectively and ensure timely compensation for your work or products.

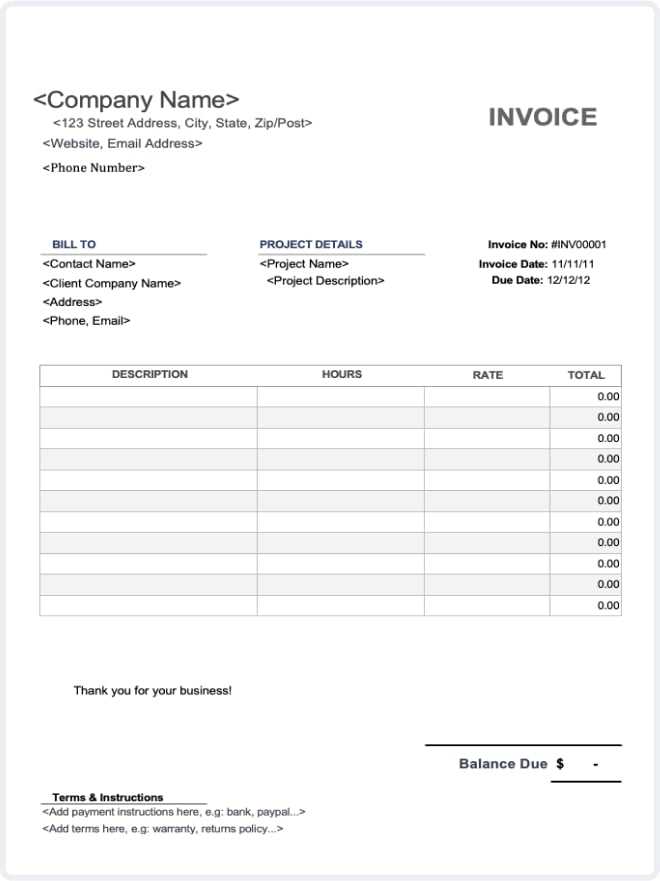

Key Elements of an Invoice Letter

For any payment request document to be effective, it must include certain critical details that ensure clarity and prevent any confusion. Each component of the document plays a unique role in communicating essential information, from the transaction specifics to payment terms. By including these key elements, you can guarantee that the recipient has all the necessary information to process the payment promptly and accurately.

Essential Components of a Payment Request

- Sender and Recipient Information: Clearly state the contact details of both the party issuing the request and the one responsible for payment. This includes full names, addresses, phone numbers, and email addresses.

- Document Number: A unique identifier for the document, often referred to as a reference number or ID. This helps both parties track the transaction and maintain records.

- Itemized Charges: A detailed list of products or services provided, including quantities, individual prices, and any applicable taxes. This ensures transparency and prevents confusion about the billed amount.

- Payment Amount: The total amount due, clearly separated from other details. This should match the sum of the itemized charges.

- Payment Terms: Include clear instructions on how the payment should be made, accepted methods, any applicable deadlines, and penalties for late payments.

- Due Date: A specific date by which payment is expected. This helps ensure timely processing and avoids unnecessary delays.

- Footer with Additional Notes: Optional section for including any additional information, such as bank account details, legal disclaimers, or a thank you note for the business relationship.

Why These Elements Matter

- Clarity: Ensures that both parties understand exactly what is owed and how to proceed with the payment.

- Professionalism: Demonstrates a well-organized approach, making it easier for clients to process payments on time.

- Prevention of Disputes: Reduces the likelihood of conflicts by providing transparent and comprehensive information upfront.

By including these essential components, you ensure that your payment request is both functional and professional, helping to maintain smooth financial operations and positive client relationships.

How to Write an Effective Invoice

Creating a clear and professional payment request is essential for smooth business transactions. An effective document not only provides all necessary details but also sets the right tone for your client relationship. The goal is to make sure the recipient understands the charges, payment instructions, and deadlines, reducing the likelihood of confusion or delayed payments.

Steps to Write a Clear Payment Request

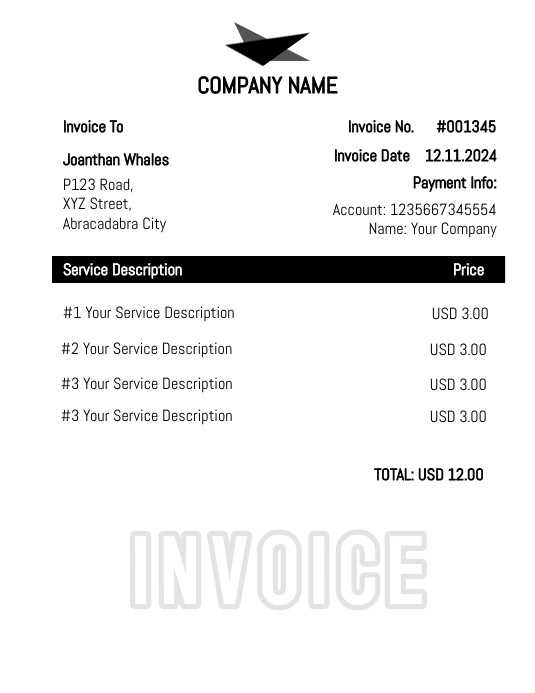

- Start with Your Business Information: Include your company’s name, address, contact details, and logo. This helps the recipient easily identify the source of the request.

- Include the Recipient’s Information: Clearly state the client’s name, address, and contact details to avoid any confusion on who the payment is intended for.

- Provide a Unique Reference Number: This serves as an identifier for the transaction and helps both parties track the payment record in case of future correspondence.

- Itemize the Charges: List each product or service with a description, quantity, unit price, and the total amount. This transparency prevents misunderstandings regarding what is being billed.

- Clearly State the Total Due: The final amount owed should be prominently displayed, separating it from other information to avoid any mistakes.

- Set Payment Terms: Clearly outline the due date, acceptable payment methods, and any penalties for late payments. This helps manage expectations and encourages timely payment.

Tips for Making Your Payment Request Professional

- Use a Formal Tone: Keep the language respectful and professional. This fosters trust and ensures a positive client relationship.

- Keep It Simple: Avoid unnecessary complexity. Use clear, straightforward language and structure so that the recipient can easily understand what is required.

- Check for Accuracy: Double-check all amounts, dates, and contact information to avoid costly errors that may cause confusion or delays.

By following these steps, you can ensure that your payment requests are both professional and efficient, increasing the likelihood of prompt and accurate payments.

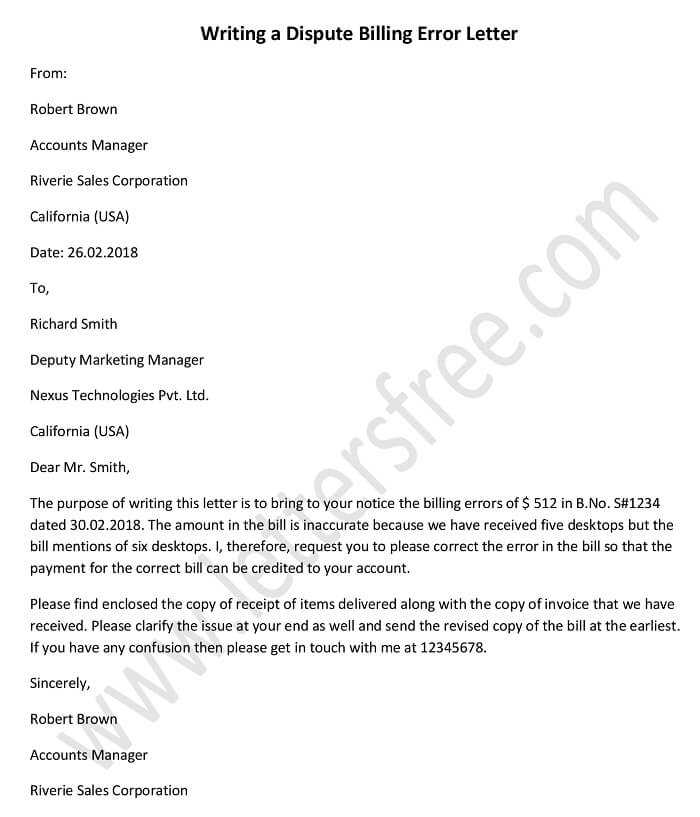

Common Mistakes to Avoid in Invoices

While creating payment requests is a routine task, it’s easy to make errors that can lead to confusion, delays, or even disputes. Small mistakes in the document can have a big impact on your cash flow and client relationships. To ensure your billing process runs smoothly, it’s essential to avoid common pitfalls that could complicate the payment process.

Frequent Errors in Billing Documents

- Incorrect or Missing Contact Information: Failing to include accurate details for both your business and the recipient can delay communication and payment processing.

- Unclear Payment Terms: Vague or missing terms regarding the payment deadline, methods, or penalties for late payments can lead to confusion and delayed payments.

- Omitting a Unique Reference Number: Without a unique identifier, tracking the transaction becomes difficult, especially when handling multiple clients or large volumes of requests.

- Failure to Itemize Charges: Not breaking down products or services into individual line items can make it difficult for the recipient to understand what they are paying for, increasing the risk of disputes.

- Inaccurate Totals: Simple math errors or mismatched totals can raise doubts about the accuracy of the request, leading to delays in payment while clients wait for clarification.

- Missing Payment Deadline: Leaving out a clear due date for payment can result in late or forgotten payments. Always specify when the payment is expected.

How to Avoid These Mistakes

- Double-Check Information: Always verify contact details, payment amounts, and other critical data before sending the request.

- Use Clear Language: Be as straightforward as possible with your terms, making sure the recipient knows exactly what is expected of them.

- Include All Relevant Information: Ensure all necessary details, like payment methods, late fees, and transaction references, are included to avoid misunderstandings.

By being vigilant about these common mistakes, you can avoid unnecessary delays and ensure that your payment requests are processed quickly and accurately.

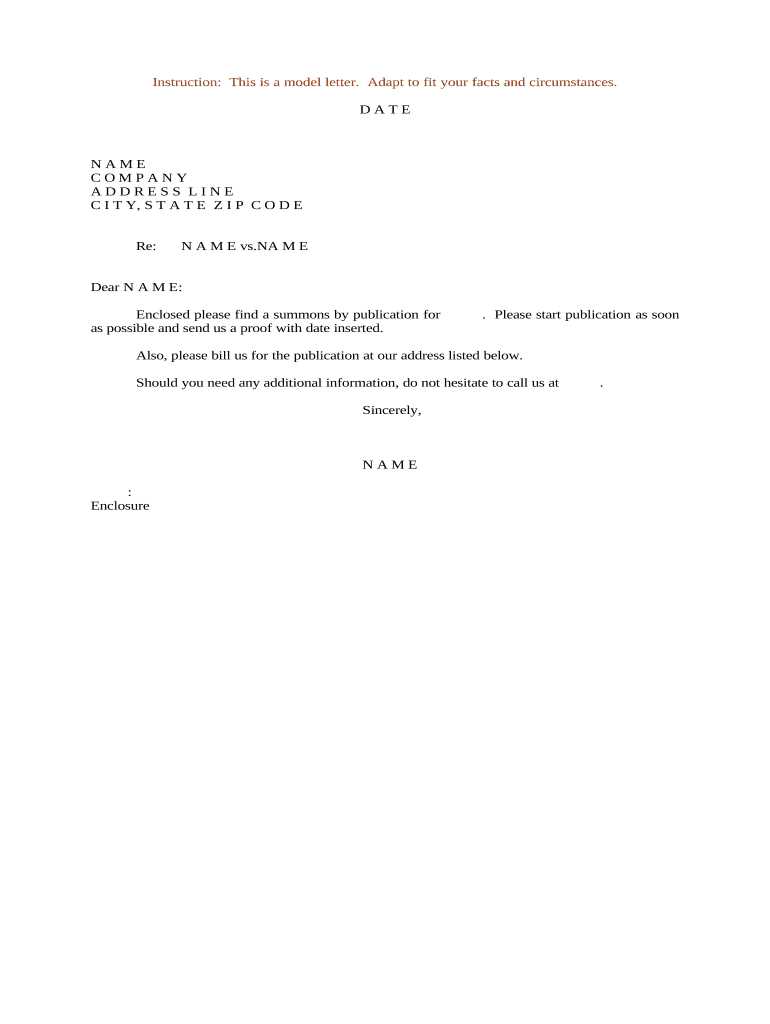

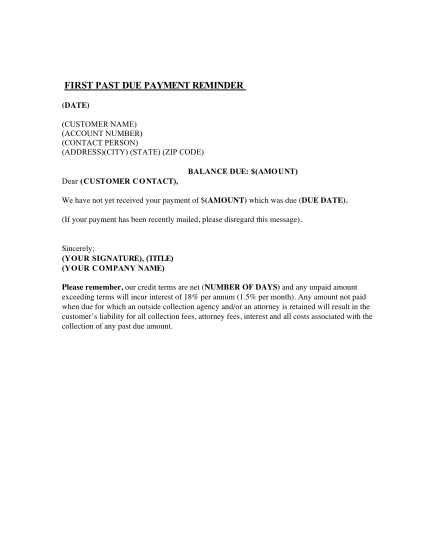

Different Types of Invoice Letters

Not all payment requests are created equal. Depending on the nature of the transaction, the relationship with the client, and the payment schedule, there are various types of documents you can use to request payment. Each type is designed to address specific needs and circumstances, helping to ensure that your communication is clear and appropriate for the situation.

Common Types of Payment Requests

- Standard Billing Request: The most common form, used for regular transactions where products or services are delivered, and payment is expected by a specified due date.

- Proforma Payment Request: Issued before the delivery of goods or services, typically used for advance payments or when outlining the estimated cost of a project or service.

- Past Due Request: Sent when a payment deadline has passed. This type typically includes a polite reminder and may outline any late fees or penalties for delayed payments.

- Partial Payment Request: Used when a customer has agreed to pay in installments, breaking down the amounts due at different stages of a project or service delivery.

- Credit Invoice: Issued when a client has overpaid or when there is an adjustment to be made, such as a refund or discount for a previous payment.

- Recurring Billing Request: Common for subscription-based businesses, this request is sent at regular intervals, often monthly or annually, for ongoing services or memberships.

- Final Payment Request: Sent when a service or project is completed, requesting the last payment to close the transaction.

When to Use Each Type

- Standard Billing Request: Use for routine transactions with clear payment deadlines and no special conditions.

- Proforma Payment Request: Ideal for when you need an upfront payment or need to secure financial commitment before work begins.

- Past Due Request: Necessary for chasing overdue payments and reminding clients of their obligations.

- Partial Payment Request: When working on large projects with payment milestones, use this to break down the total amount into manageable parts.

- Credit Invoice: Issue when adjustments need to be made to a client’s previous payments or a refund is necessary.

- Recurring Billing Request: Best for businesses with long-term clients who have ongoing services or subscriptions.

Invoice Letter Format and Structure

When creating a document to request payment, following a clear and consistent format is essential for ensuring that all the necessary details are easily understood. A well-organized structure not only makes the document professional but also helps the recipient quickly find the relevant information. This clarity can lead to faster processing and fewer misunderstandings, benefiting both the sender and the client.

Essential Sections to Include

- Header Section: This should include your business name, logo, and contact information, along with the recipient’s name and contact details. It helps the client quickly identify who the request is from and where to send payment.

- Unique Reference Number: Every document should have a unique number or identifier to make it easy to track. This is especially useful for future reference or if the client needs to ask questions about the request.

- Details of Goods or Services: Include a breakdown of what is being billed, with descriptions, quantities, individual prices, and the total amount. This allows the client to see exactly what they are paying for.

- Amount Due: The total amount owed should be clearly stated, ensuring there is no confusion. This figure should be easy to locate and prominently displayed.

- Payment Instructions: Provide clear details on how and when the payment should be made. Specify the due date and any penalties for late payments to ensure timely action from the recipient.

- Footer Section: Often, the footer contains additional contact information, terms and conditions, or a polite note thanking the client for their business.

Formatting Tips for a Professional Appearance

- Use Consistent Fonts: Choose a clean and professional font, such as Arial or Times New Roman, and keep it consistent throughout the document.

- Organize Information Clearly: Use headings, bullet points, or tables to break down the details into easy-to-read sections.

- Maintain a Professional Tone: The language should be clear, polite, and formal, reflecting the professionalism of your business.

- Keep It Simple: Avoid cluttering the document with unnecessary information. Stick to the essentials to make it easy for the recipient to understand and process.

By following this format, you can create a payment request that is both functional and professional, ensuring that all necessary information is easy to find and understand. A clear and organized document helps improve communication and expedites the payment process.

Personalizing Your Invoice Letter Template

Customizing your payment request documents helps create a more personalized experience for your clients. A personalized approach not only reflects professionalism but also fosters stronger client relationships. By tailoring the content to suit each client, you demonstrate attention to detail, which can improve your chances of timely payments and repeat business.

Ways to Personalize Your Payment Request

- Use Client’s Name: Addressing the recipient by name in both the greeting and throughout the document adds a personal touch, showing that the request is specifically meant for them.

- Include Custom Payment Terms: If your client has unique payment preferences or a customized payment schedule, ensure those terms are reflected clearly in the document.

- Tailor the Tone: Adjust the tone based on your relationship with the client. For long-term clients, a more friendly and conversational tone may be appropriate, while a more formal approach works for newer or corporate clients.

- Reference Specific Projects or Services: Include specific details about the work completed or products delivered. This not only personalizes the request but also ensures the client understands exactly what they are paying for.

- Offer Discounts or Special Terms: If applicable, customize the request by including any discounts, promotions, or special terms you’ve agreed upon with the client. This can help maintain goodwill and encourage future business.

Why Personalization Matters

- Builds Stronger Relationships: Personalizing your requests helps to create a connection, making the client feel valued and respected.

- Enhances Professionalism: Customizing the document shows that you take your work seriously and are committed to providing tailored services to your clients.

- Improves Payment Accuracy: By referencing specific details about the work or products, clients are less likely to dispute the charges or delay payments.

By taking the time to personalize each payment request, you demonstrate a level of care and professionalism that can positively impact your business relationships and payment cycles.

How to Customize Your Invoice Template

Customizing your payment request document can make a significant difference in how clients perceive your professionalism and attention to detail. Personalization allows you to tailor each request to the specific needs of the client or project, ensuring clarity and improving the chances of timely payments. Whether you’re adjusting design elements, content, or payment terms, customizing the document helps you maintain a consistent and professional image while accommodating the unique aspects of each transaction.

Steps to Customize Your Payment Request Document

- Adjust the Design: Modify the layout, font style, and colors to match your business branding. Consistency in design reflects professionalism and makes your document visually appealing.

- Add Your Business Logo: Including your company logo at the top of the document reinforces your brand identity and gives the document a formal, branded appearance.

- Include Client-Specific Information: Always customize the recipient’s name, address, and contact details to make the request more personal and accurate.

- Customize Payment Terms: If your client has specific payment arrangements, reflect those terms in the document. Include agreed-upon due dates, discounts, or installment payment options.

- Personalize Descriptions of Goods or Services: Include specific details for each product or service provided. This helps the client understand exactly what they are being billed for and prevents confusion.

- Set Appropriate Due Dates: Adjust the due date based on the agreed-upon payment schedule. For example, clients on a monthly retainer may have a different due date than one-time projects.

Additional Customization Tips

- Include Special Instructions: If you have specific requests or need the payment to be made through a particular method, be sure to mention this in a polite and clear manner.

- Offer Multiple Payment Methods: Tailor the payment instructions to your client’s preferences, such as bank transfer, credit card, or online payment platforms.

- Make Use of Automated Features: If you’re using invoicing software, customize automated fields like transaction numbers, dates, and amounts to minimize errors and save time.

By following these customization tips, you can create a payment request that is both functional and professional, enhancing client relations and ensuring smooth transactions. A personalized approach will help you stand out and make a lasting impression on your clients.

Tips for Professional Invoice Writing

Writing a payment request document that is clear, professional, and easy to understand is essential for maintaining a good relationship with your clients. A well-written request not only ensures that you are paid promptly but also reflects positively on your business. Whether you are new to creating these documents or want to improve your current approach, there are several key strategies to follow to ensure that your requests are both effective and professional.

Key Tips for Writing a Professional Payment Request

- Be Clear and Concise: Use simple, straightforward language to ensure the recipient understands the details of the request. Avoid jargon and complicated terms that may confuse the reader.

- Use a Polite and Professional Tone: The tone should be formal and respectful, even if you are reminding the client about a late payment. A polite approach fosters positive business relationships.

- Proofread for Accuracy: Before sending your request, review it carefully to ensure all details are accurate, including dates, amounts, and contact information. Mistakes can lead to delays in payment and damage your credibility.

- Be Specific About Payment Terms: Clearly outline the due date, acceptable payment methods, and any late fees or penalties. Transparency about terms reduces confusion and helps set expectations.

- Provide Detailed Descriptions: Break down the products or services provided with enough detail for the recipient to understand exactly what they are being charged for. This clarity can prevent disputes and speed up the payment process.

Example of a Professional Payment Request Format

Section Description Header Include your business name, logo, and contact details, as well as the recipient’s information for a clear identification. Unique Reference Number Assign a unique identifier for tracking purposes and future reference. Itemized Breakdown Provide a detailed list of goods or services delivered, including quantities, rates, and total amounts. Amount Due Clearly state the total sum due, including applicable taxes or fees. Payment Terms Specify due dates, accepted payment methods, and any late payment penalties. Footer Include any additional notes, thank-you messages, or reminders for your client. By following these tips and structuring your document correctly, you ensure that your payment request is professional, easy to understand, and free of errors. This not only improves the chances of prompt payment but also helps to establish trust and credibility wit

How to Handle Late Payments in Invoices

Late payments are a common challenge for businesses, and they can disrupt your cash flow if not managed properly. When clients fail to pay on time, it is essential to approach the situation with professionalism and clear communication. Handling late payments effectively can help maintain positive client relationships while ensuring that you get paid for the work or products provided.

Steps to Take When Payments Are Late

- Send a Friendly Reminder: After the payment due date passes, send a polite reminder to the client. This could be a simple email or message reiterating the terms of payment and gently reminding them of the outstanding amount.

- Provide Clear Payment Terms: When first setting up your payment requests, ensure the terms are crystal clear. If late fees are applicable, specify them upfront. This will help set the right expectations for your clients and reduce confusion.

- Offer Payment Solutions: If your client is facing financial difficulties, consider offering flexible payment options, such as installment payments or an extended deadline. Being understanding can help build loyalty and maintain a good business relationship.

- Implement Late Fees: If the payment is significantly delayed, you may want to implement late fees as outlined in your original terms. Clearly communicate this penalty to the client as a way to encourage timely payment in the future.

- Use Professional Collection Methods: If reminders and flexible terms do not lead to payment, consider using a professional collections service. This should be a last resort, as it may strain the relationship with the client.

Best Practices to Prevent Late Payments

- Set Clear Payment Deadlines: Make sure your payment terms are stated upfront in all communications. Specify exact dates and acceptable payment methods to avoid confusion.

- Send Early Payment Requests: Don’t wait until the due date to send your request. Sending payment reminders a few days before the deadline increases the likelihood of timely payment.

- Invoice Promptly: Send your payment request as soon as the work or delivery is completed. The sooner you send it, the sooner the client can arrange payment.

- Follow Up Regularly: If payment is not received on time, follow up quickly with reminders. The earlier you address the issue, the more likely it is to be resolved quickly.

By approaching late payments with patience and professionalism, you can ensure a smoother payment process for both you and your clients. Clear communication, flexibility when appropriate, and consistent follow-up will help maintain a healthy cash flow and positive business relationships.

Using Invoice Letters for Business Growth

Properly crafted payment requests are more than just tools for collecting funds; they can also serve as a strategic asset for growing your business. By designing and managing these documents effectively, you can enhance your professional image, improve customer satisfaction, and foster stronger business relationships. These documents can also help streamline operations, ensuring faster payments, better tracking, and the ability to scale your business without losing financial control.

How Payment Requests Contribute to Business Growth

- Strengthen Client Relationships: A well-written payment request reflects professionalism and reinforces the image of a reliable business. When clients feel valued through clear and polite communication, they are more likely to continue working with you in the future.

- Improve Cash Flow: Timely, organized requests can help speed up payment processing. When clients know exactly what is expected of them, and payments are easier to make, you reduce the risk of late payments, ensuring a consistent flow of revenue.

- Increase Brand Visibility: Payment documents are a great opportunity to showcase your brand. Including your logo, business details, and a personal touch in these requests can help reinforce your brand identity every time a client receives one.

- Track Financial Performance: By creating and managing clear, consistent payment requests, you can easily track income, understand which clients are paying on time, and identify trends in your business’s financial health.

Best Practices for Leveraging Payment Requests for Growth

- Customize for Different Clients: Personalizing each request, whether through specific payment terms or tailored discounts, helps you cater to individual client needs, building trust and loyalty over time.

- Be Transparent About Terms: Set clear expectations for due dates, late fees, and payment methods upfront. Transparency ensures clients understand their obligations, which helps avoid delays and misunderstandings.

- Automate for Efficiency: Use invoicing software or automated systems to streamline the process, making it easier to send out payment requests, track payments, and maintain records. This saves time and reduces human error.

- Regular Follow-Ups: Create a system for sending reminders and follow-up messages. A polite reminder a few days before the payment due date can reduce late payments and keep your revenue flowing.

Example of How Effective Payment Requests Can Boost Growth

Strategy Outcome Customized Requests Clients feel more valued, leading to higher client retention and repeat business. Clear Payment Terms Fewer payment delays, improving cash flow and financial planning. Branding and Personalization Stronger brand recognition and professionalism that can attract new clients. Automated Reminders Reduced administrative b Legal Considerations for Invoice Letters

When creating payment requests, it’s crucial to ensure that the document complies with legal requirements and protects your rights as a business owner. An accurate, legally sound request not only facilitates prompt payments but also helps you avoid potential disputes. Understanding the essential legal aspects involved can save you time, money, and unnecessary complications in the future. There are several important factors to keep in mind when drafting payment-related communications to ensure that they are enforceable and legally compliant.

Key Legal Aspects to Include in Your Payment Request

- Clear Payment Terms: Specify the exact due date for payment, the amount owed, and the agreed-upon payment method. Clearly outline any interest charges or late fees that will apply if the payment is not made on time. This protects both you and your client and sets clear expectations.

- Accurate Contact Information: Ensure that all parties’ contact information, including names, addresses, and phone numbers, are correctly listed on the document. This is vital in case you need to follow up or take legal action for non-payment.

- Legal Entity and Business Information: Include your legal business name, registration number, and any other relevant identifiers. In many jurisdictions, this information is legally required and adds credibility to the document.

- Tax Identification Information: Depending on your location, you may be required to include your tax ID number or VAT number on payment requests. This ensures compliance with tax laws and provides proof that you are operating as a legitimate business.

- Clear Description of Goods/Services: A detailed breakdown of the goods or services provided, including quantities and prices, can help avoid disputes and protect your business in the event of legal action. This clarity ensures that both parties are in agreement about what is being paid for.

Legal Protections for Non-Payment

- Late Payment Fees: In many jurisdictions, businesses can charge interest on overdue payments. Make sure your document outlines these charges clearly, as they can help motivate clients to pay promptly.

- Contractual Agreement: If you have a formal contract with the client, refer to it in your payment request. This strengthens your position in case of non-payment or disputes and ensures that the terms you’ve agreed upon are legally enforceable.

- Dispute Resolution Clauses: If you anticipate potential issues with a client, consider adding a dispute resolution clause to your payment request. This could specify that any disagreements should be resolved through mediation or arbitration, potentially avoiding costly court proceedings.

- Legal Action for Non-Payment: If t

How to Send Your Invoice Letter

Sending a payment request effectively is just as important as creating one. The method of delivery, timing, and the way you communicate can all impact the speed and success of payment collection. Whether you choose email, physical mail, or an online platform, it’s crucial to make sure your client receives the request promptly and that it’s easy for them to process. In this section, we’ll discuss the best practices for sending your payment requests to ensure smooth and timely transactions.

Best Methods for Sending Payment Requests

- Email: Sending payment requests via email is one of the most common and efficient methods. It’s quick, cost-effective, and allows you to track the delivery of your request. Ensure that your email is professional, clear, and includes all necessary attachments or links.

- Postal Mail: If your client prefers paper communication, mailing a hard copy can be a more personal approach. Use professional-looking stationery and include all relevant details in a well-organized format. This method is especially effective for clients who may not be tech-savvy or who have specific requirements for physical copies.

- Online Payment Platforms: Many businesses use online platforms such as PayPal, QuickBooks, or other invoicing services. These platforms often come with automated systems that can send payment reminders and allow clients to pay directly through the platform, making the process quicker and more streamlined.

- Fax: Although less common today, faxing is still an option for some industries, particularly in countries or regions where it remains a standard communication tool. Ensure the fax number is correct and that the document is legible.

Key Considerations When Sending a Payment Request

- Timing: Send the payment request as soon as possible after the goods or services have been delivered. Avoid unnecessary delays, as this can hinder the client’s ability to process the payment quickly.

- Clear Subject Line: When sending via email, the subject line should clearly state that the message is a payment request. For example, “Payment Due for [Product/Service Name] – [Invoice Number]”. This will ensure the recipient recognizes the urgency of the communication.

- Confirmation of Receipt: If possible, request a confirmation from the client acknowledging that they have received the payment request. This can be done through an email reply or via the invoicing platform’s tracking features.

- Follow-Up: If the payment request is not acknowledged or paid by the due date, send a polite follow-up reminder. A timely fol

Best Tools for Creating Invoice Letters

Creating professional payment requests is an essential part of running a successful business. To make the process easier and more efficient, various tools are available to help you craft well-structured and visually appealing documents. These tools can automate parts of the process, save time, and ensure accuracy, so you can focus more on growing your business and less on administrative tasks. Here are some of the best tools for creating payment requests that streamline the entire process.

Top Tools for Creating Payment Requests

- QuickBooks: QuickBooks is a comprehensive accounting software that includes features for generating customized payment requests. It allows you to track payments, manage due dates, and automate reminders, making it a popular choice for small and medium businesses.

- FreshBooks: Known for its user-friendly interface, FreshBooks helps you create professional documents, track expenses, and monitor payment statuses. It’s particularly useful for service-based businesses, offering customizable options to tailor the document to your needs.

- Zoho Invoice: Zoho Invoice is an easy-to-use invoicing software that offers customizable templates, automated reminders, and a range of payment options. It is ideal for businesses that need to send a large volume of payment requests regularly.

- Wave: Wave is a free accounting software that includes invoicing features. It allows you to create and send personalized payment requests, track payments, and generate reports. It’s especially great for freelancers and small businesses on a budget.

- PayPal Invoicing: PayPal’s invoicing tool is a simple and effective solution for creating and sending payment requests. You can easily customize the document, add taxes or discounts, and track payments directly through PayPal’s platform.

- Invoice Ninja: Invoice Ninja is an open-source invoicing tool that helps businesses generate invoices, track payments, and manage client relationships. It offers both free and paid plans with a variety of customization options.

- Microsoft Word/Excel: For those who prefer a more hands-on approach, Microsoft Word or Excel can be used to create payment requests from scratch. Excel is particularly useful for adding formulas to calculate totals or taxes automatically.

Features to Look for in Payment Request Tools

- Customization Options: Choose tools that allow you to personalize your payment requests with your business logo, colors, and other branding elements. This ensures a professional appearance.

- Automation: Automation features such as recurring payments, reminders, and due date tracking can save time and reduce the risk of errors.

- Integration with Payment Platforms: Tools that integrate with popular payment platforms like PayPal, Stripe, or bank accounts make it easier for clients to make payments directly from the request.

- Reporting and Tracking: Look for tools that allow you to track the status of your payment requests, view overdue balances, and generate reports for financial analysis.

- Security Features: Ensure that the tool you choose is secure and complies with industry standards for protecting sensitive client data, especially when processing payments online.

Using the right tool to create payment requests can significantly improve the efficien

How to Track Payments with Invoices

Effectively managing and tracking payments is a crucial part of running any business. Keeping track of who has paid and who hasn’t ensures that you maintain a healthy cash flow and can address overdue balances promptly. Fortunately, there are several strategies and tools that can help you stay on top of payments, ensuring you receive what you’re owed in a timely manner. This section will explore how to monitor and track payments associated with your requests efficiently.

Methods for Tracking Payments

- Manual Tracking: If you’re running a small business or handling a limited number of transactions, you may choose to track payments manually. This can be done using spreadsheets (such as Excel or Google Sheets) where you record the amount, due date, and payment status. You can mark payments as “Paid,” “Pending,” or “Overdue,” and use formulas to track outstanding balances.

- Accounting Software: Accounting platforms like QuickBooks, Xero, or FreshBooks offer comprehensive payment tracking features. These tools allow you to input payment details, track overdue balances, and automatically update payment statuses. Many also generate detailed reports that give you a clear picture of your outstanding invoices and overall cash flow.

- Online Payment Platforms: Services like PayPal, Stripe, and Square provide built-in features for tracking payments. When clients pay using these platforms, the payment status is updated automatically, and you can easily view the transaction history. Many of these platforms also allow you to set up automated reminders for overdue payments.

- Integrated Payment Solutions: For businesses that use invoicing platforms (like Zoho or Invoice Ninja), payments can be tracked directly within the same system. These solutions typically allow you to mark an invoice as “Paid” once the payment is received, and they often provide automatic email notifications when a payment is processed.

Tips for Effective Payment Tracking

- Set Clear Payment Terms: Always ensure that payment terms are clearly stated on your documents. This includes specifying the due date, accepted payment methods, and any late fees or interest charges for overdue balances. Clear terms make it easier for you to track payments and follow up when necessary.

- Use Payment Reminders: Automated reminders can save time and reduce the need for manual follow-ups. Many accounting and invoicing platforms allow you to set up reminders that will be sent to clients before, on, and after the due date, ensuring timely payment.

- Regularly Review Payment Status: Take the time to review your payment records regularly. A weekly or monthly check-up on your outstanding balances will help you identify overdue accounts quickly and prevent issues from escalating.

- Offer Multiple Payment Methods: Providing various payment options (such as credit card, bank transfer, or online payment portals) makes it easier for clients to pay on time and can improve the speed at which payments are received and tracked.

Tracking payments efficiently helps maintain cash flow and reduces the risk of overdue balances affecting your business operations. By using the right tools and strategies, you can stay organized, ensure timely payments, and focus more on growing your business rather than managing administrative tasks.