Invoice Ireland Template for Easy and Professional Billing

For any business, managing financial transactions accurately is essential for smooth operations. Having a streamlined process to create and send billing documents helps maintain professionalism and ensures compliance with legal requirements. A standardized approach to creating these documents can save time and reduce errors, making it easier to manage accounts and payments.

In today’s digital age, there are numerous tools available that allow businesses to generate customized billing documents quickly. By utilizing pre-designed formats, companies can easily input the necessary details, ensuring they meet industry standards. Whether you are just starting your business or looking to improve your existing process, adopting an effective solution can make all the difference in maintaining organized records and smooth cash flow.

Customizable and user-friendly solutions give businesses the flexibility to adapt their documents to specific needs, offering clear and concise layouts. With the right system in place, financial transactions can be tracked, payments can be monitored, and compliance with local tax laws is guaranteed. This approach not only improves efficiency but also enhances customer trust by providing them with transparent and professional statements.

Invoice Solution for Small Businesses

For small businesses, managing financial documentation efficiently is crucial to staying organized and ensuring smooth transactions. Having a ready-to-use, customizable document for recording sales, services rendered, or goods provided can help save time and reduce errors. Instead of manually crafting a new document for every transaction, small companies can rely on a standardized format that meets their needs and complies with local regulations.

Why Small Businesses Need a Standardized Approach

Using a structured document helps small business owners track payments, manage taxes, and maintain professional relationships with clients. Key benefits include:

- Time-saving: Ready-made formats allow quick generation without repetitive data entry.

- Consistency: Ensures each document follows the same layout and includes all essential information.

- Compliance: Helps businesses meet local tax regulations and reporting standards.

- Professionalism: Well-structured documents help present a polished image to clients and customers.

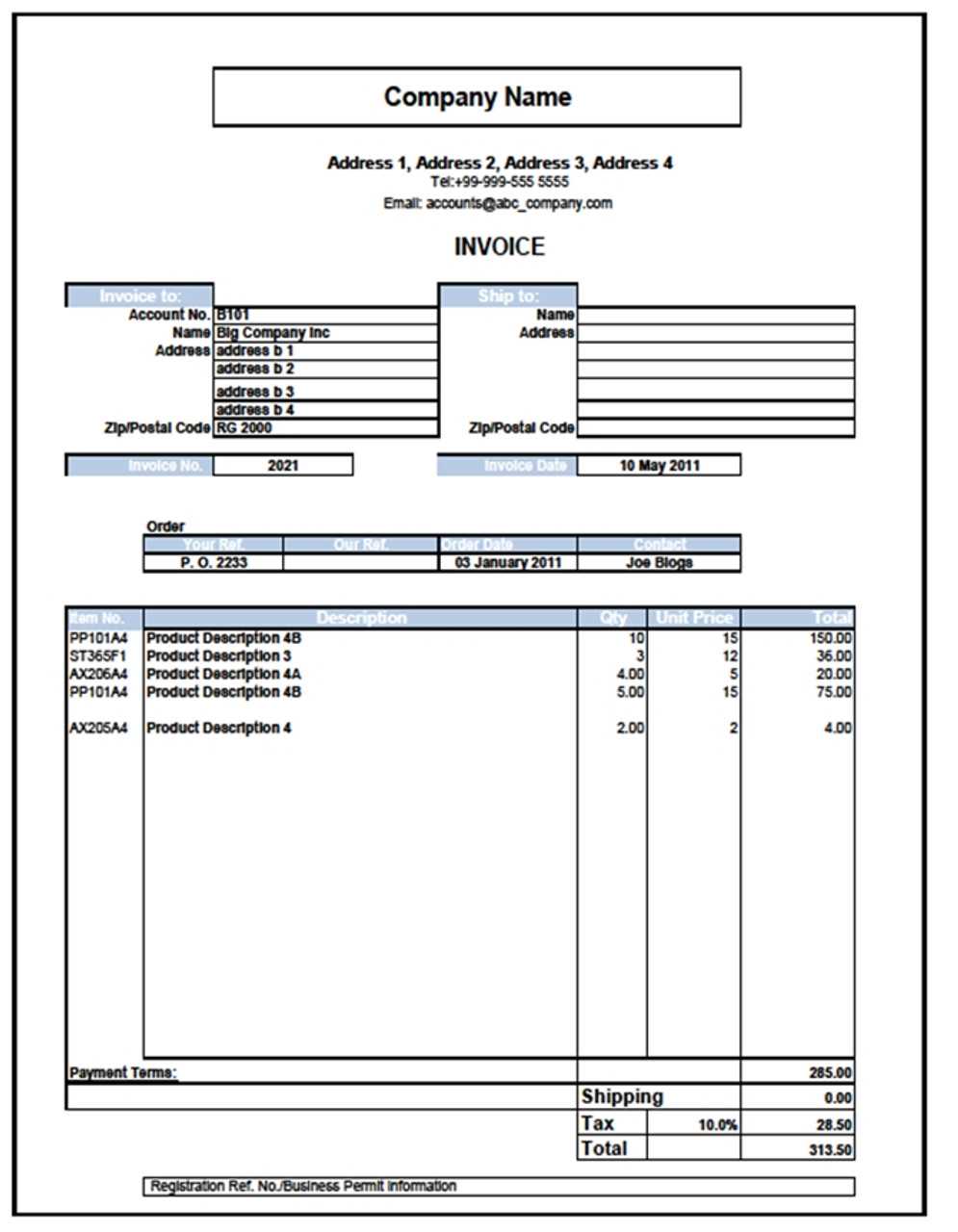

Essential Features for Small Business Documents

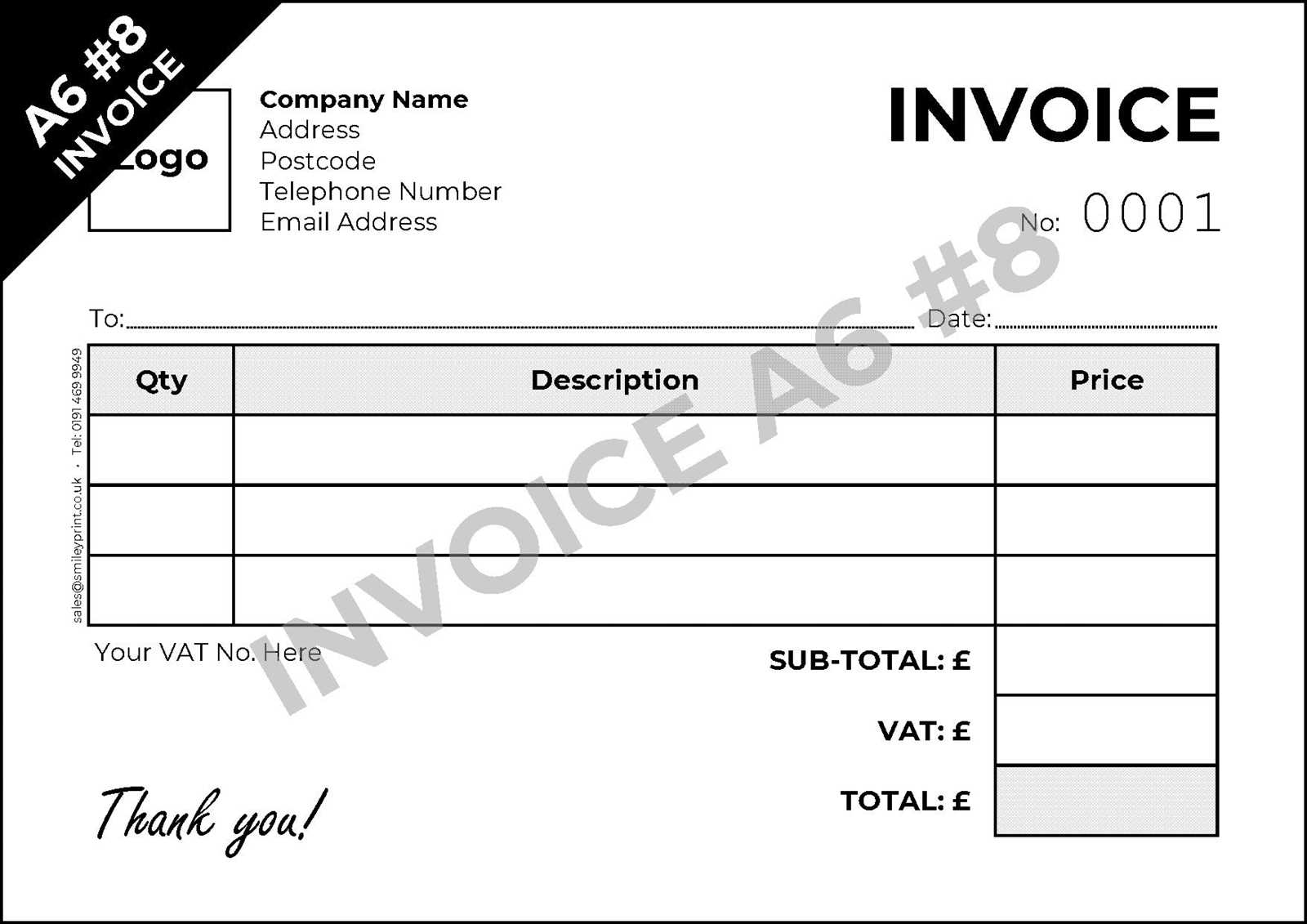

When creating financial documents for your business, it’s important to ensure they contain all necessary details. Here are some of the key elements to include:

- Business Name and Contact Information: Clearly list your company’s name, address, phone number, and email.

- Client Information: Include your customer’s name, address, and contact details.

- Unique Reference Number: Assign a unique identifier to each document for tracking purposes.

- Detailed Description of Goods/Services: Specify what was sold or provided, including quantity, price, and any applicable terms.

- Payment Terms: Include details about the payment due date and accepted methods.

- Tax Information: Ensure all required tax rates and totals are included.

By incorporating these elements into your business documents, you can ensure that every transaction is properly recorded and easy to follow for both you and your clients.

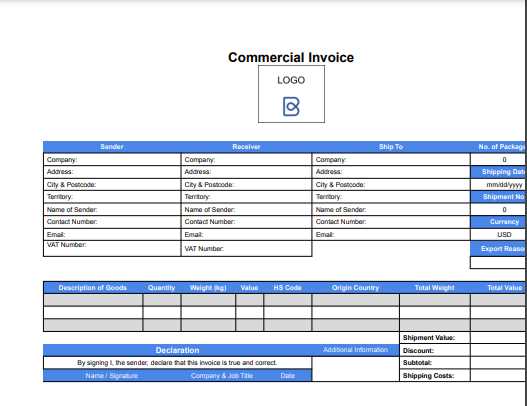

How to Create an Invoice in Ireland

Creating a billing document for your business involves providing clear and precise details that outline the goods or services provided, payment terms, and any applicable taxes. It is essential to ensure that your documents are accurate, professional, and compliant with local regulations. This process typically involves several key steps that will make your financial transactions transparent and easily traceable.

The first step is to include your business information, such as the company name, address, and contact details. This helps the recipient know exactly who the payment is due to. Next, you will need to include the recipient’s details, such as their name and address, to make sure the document is correctly attributed to them.

In the document, you should clearly outline the goods or services rendered, including descriptions, quantities, unit prices, and the total amount due. Any applicable taxes, such as VAT, should be calculated and included in the document. It is also important to list payment terms, including the due date and any late payment penalties if applicable.

Finally, assigning a unique reference number to each billing document is essential for tracking purposes. This number will help both you and your customer keep a record of the transaction. Once all of these details are in place, your document will be complete and ready to be sent out for payment.

Key Elements of an Irish Invoice

To ensure clarity and compliance, it is crucial that every financial document contains all the necessary information. A well-structured record of the transaction allows both the business and the customer to easily understand the details of the sale or service provided. Below are the key components that should be included in every document used to request payment for goods or services.

| Element | Description |

|---|---|

| Business Information | Include your company’s name, address, phone number, and email for easy contact. |

| Customer Details | List the name, address, and contact information of the recipient. |

| Unique Reference Number | A unique number for each transaction to track and reference the document. |

| Description of Goods/Services | Provide a clear description, quantity, and unit price of the items or services provided. |

| Amount Due | The total amount payable, including any discounts or additional charges. |

| Tax Details | Include any applicable taxes, such as VAT, with the rate and total tax amount. |

| Payment Terms | Specify the due date, accepted payment methods, and any late payment penalties. |

These elements help to ensure that all necessary details are included, minimizing the risk of confusion or errors in the transaction. When creating such documents, make sure to pay close attention to accuracy and completeness to foster trust and ensure timely payment.

Benefits of Using a Template in Ireland

Utilizing a pre-designed format for creating billing documents can bring a wide range of advantages to any business. Whether you are just starting or already managing a growing company, adopting a structured approach helps streamline your operations and maintain consistency across all financial records. By relying on a ready-made solution, businesses can save time, reduce errors, and improve overall professionalism.

- Time Efficiency: Using a pre-set format allows you to generate documents quickly without having to start from scratch each time. This can save significant time, especially for businesses with high transaction volumes.

- Accuracy: A well-structured document ensures that all necessary fields are included, reducing the risk of missing key information such as payment terms, client details, or tax calculations.

- Professionalism: A consistent format helps create a polished, professional appearance for your business, boosting trust and confidence with clients and customers.

- Compliance: Many pre-made solutions are designed to comply with local tax laws and regulations, ensuring your documents meet the necessary legal requirements.

- Customization: While standardized, many formats are easily customizable, allowing you to adapt them to your specific needs or branding.

- Tracking and Organization: Having a consistent structure for all documents makes it easier to track payments and organize records, helping with audits or financial reviews.

By using a ready-made solution, businesses can ensure that every document is clear, consistent, and legally sound. This not only makes daily operations smoother but also enhances client relations and supports financial organization.

Customizing Your Document for Irish Taxation

When creating financial documents for transactions, it is essential to ensure that they align with the local tax laws and requirements. In the case of businesses operating in Ireland, understanding how to apply tax rates and present tax-related information correctly is key to maintaining compliance. Proper customization of your documents will ensure that you meet legal standards while also making the process easier for both you and your customers.

There are several key tax-related elements that should be included in every financial document to comply with Irish taxation rules:

| Element | Description |

|---|---|

| VAT Registration Number | Ensure your business’s VAT registration number is clearly displayed on each document if applicable. |

| VAT Rate | Specify the correct VAT rate for each item or service, as the rate may differ based on the type of goods or services provided. |

| Breakdown of Tax | Clearly show the tax amount separately from the total cost to make it easier for customers to understand the charges. |

| Tax Inclusive or Exclusive | Indicate whether the total amount shown includes or excludes tax, to avoid confusion regarding the final payable amount. |

| Tax Period | State the tax period for which the transaction is relevant if necessary, especially in the case of ongoing services. |

Customizing your document to include the correct tax information will help avoid legal complications and make your business operations smoother. Ensuring that all required tax details are presented clearly also enhances the professionalism of your documents and builds trust with your clients.

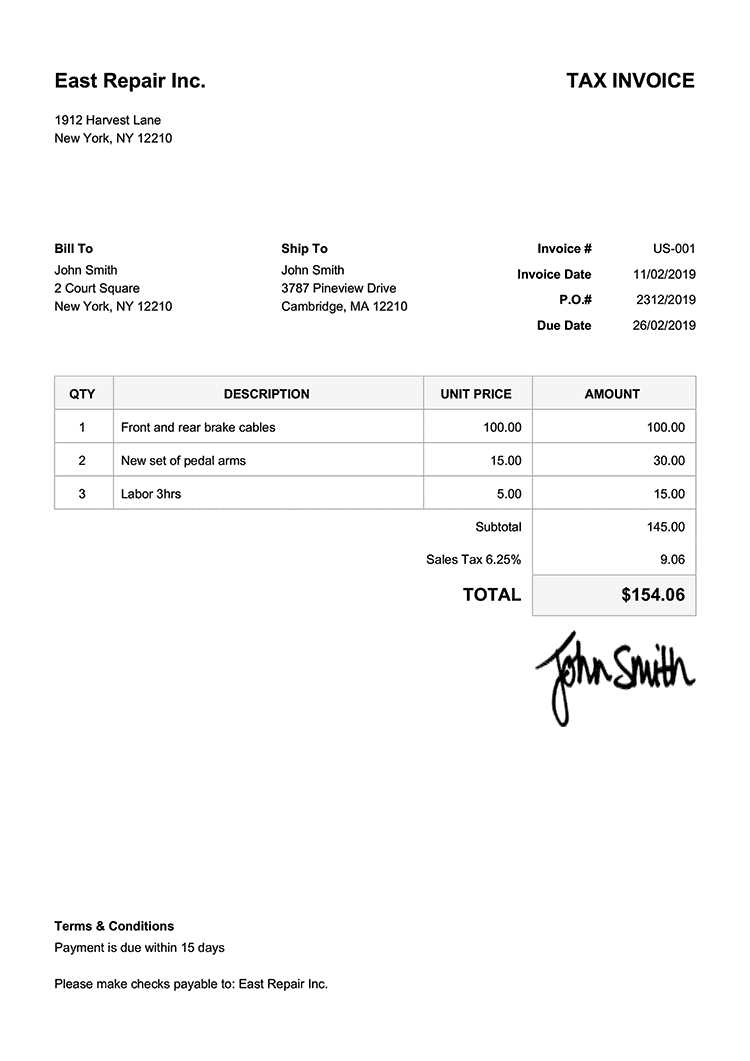

Free Billing Formats for Irish Companies

For businesses in need of a quick and efficient way to create billing documents, free pre-designed formats can be a valuable resource. These ready-made solutions can simplify the process of generating clear and professional documents without requiring any advanced design skills. Whether you are a small start-up or an established company, free formats offer a practical way to maintain consistency and stay organized while ensuring compliance with local regulations.

Free options are widely available online, allowing businesses to choose a format that suits their needs. These solutions typically offer flexibility for customization, ensuring that each document can reflect the business’s branding and include all necessary details, such as client information, payment terms, tax rates, and itemized costs.

By using these free formats, companies can:

- Save Time: Pre-made formats allow for quick document creation, reducing the time spent on administrative tasks.

- Ensure Accuracy: Using a standardized format reduces the likelihood of missing crucial details or making errors in calculations.

- Stay Professional: Clean, well-structured documents improve your business’s image and help build trust with clients.

- Remain Compliant: Many free formats are designed to meet local regulations, ensuring your documents are legally sound.

Choosing a free billing solution can greatly benefit businesses looking to streamline their processes while maintaining accuracy and professionalism in their transactions.

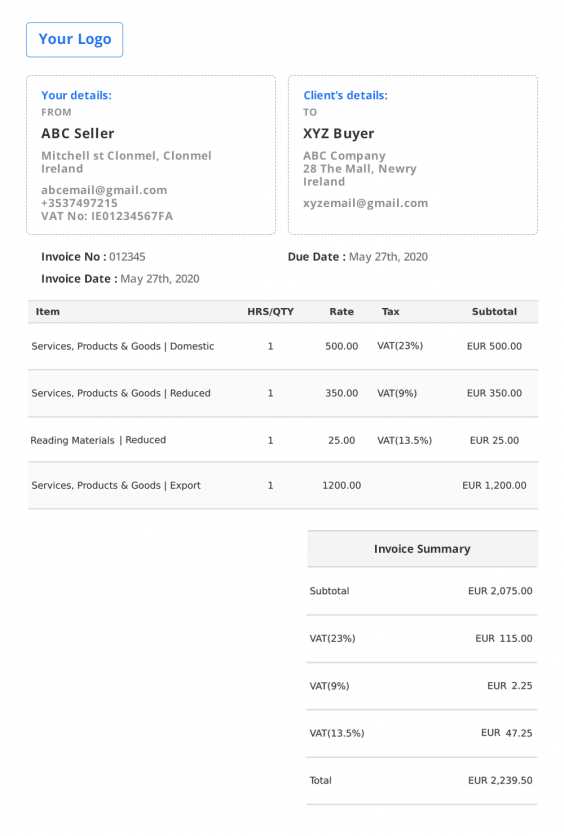

How to Add VAT to Your Document

When creating a billing document for your business, including the correct tax information is essential for compliance and transparency. In many cases, this means adding Value-Added Tax (VAT) to the final amount due. Understanding how to correctly apply VAT ensures that your business follows local tax laws while providing clear and accurate information to your clients. Below are some essential steps for properly including VAT in your documents.

First, determine the applicable VAT rate for the goods or services you are providing. The VAT rate can vary depending on the type of item or service, so it’s important to know the current rates based on local regulations. Once the rate is established, you can proceed to calculate the tax amount.

To add VAT, follow these steps:

- Step 1: Identify the net amount for the goods or services before tax.

- Step 2: Apply the VAT rate to this amount. For example, if your rate is 23%, multiply the net amount by 0.23.

- Step 3: Add the calculated VAT to the net amount to find the total amount due.

- Step 4: Ensure the VAT amount is listed separately on the document, along with the net amount and the final total, to maintain clarity for the customer.

Example: If you are charging €100 for a service, the VAT at a 23% rate would be €23. The total amount payable would then be €123. This clear breakdown of VAT ensures that your client understands exactly how much tax is being added to the total cost.

By accurately calculating and presenting VAT, you not only comply with tax regulations but also provide your customers with the necessary transparency in their transactions.

Common Mistakes to Avoid in Irish Billing Documents

When creating billing records for your business, it’s important to be mindful of common errors that could lead to confusion or even legal issues. Small mistakes can have a big impact, affecting not only your relationship with clients but also your compliance with local regulations. Below are some of the most frequent mistakes businesses make when preparing financial documents, along with tips on how to avoid them.

- Missing Contact Information: One of the most basic but often overlooked mistakes is failing to include your company’s complete contact details, including your business name, address, phone number, and email. Ensure that both you and your customer’s information is clearly visible.

- Incorrect VAT Application: Failing to apply the correct VAT rate or miscalculating tax amounts is a common error. Always double-check the current rates for the specific goods or services you provide and ensure you calculate tax accurately to avoid discrepancies.

- Unclear Payment Terms: Not specifying clear payment terms or failing to mention the due date is a common issue. Make sure your customers know when the payment is due, whether there are late fees, and what payment methods are accepted.

- Omitting a Unique Reference Number: A unique reference number helps track payments and reduces confusion. Always assign a distinct identifier to each document to facilitate better record-keeping and tracking.

- Not Including a Clear Breakdown of Charges: Failing to list individual charges, such as service fees or product costs, can lead to misunderstandings. Ensure all items are listed with their respective prices, including the tax breakdown, so customers can easily see how the final total is calculated.

- Not Updating Information Regularly: If your business address, VAT registration number, or other important details change, ensure that these updates are reflected in your financial documents promptly to maintain accuracy and compliance.

By avoiding these common mistakes, you can ensure that your billing records are clear, accurate, and legally compliant, ultimately building trust with your clients and streamlining your financial processes.

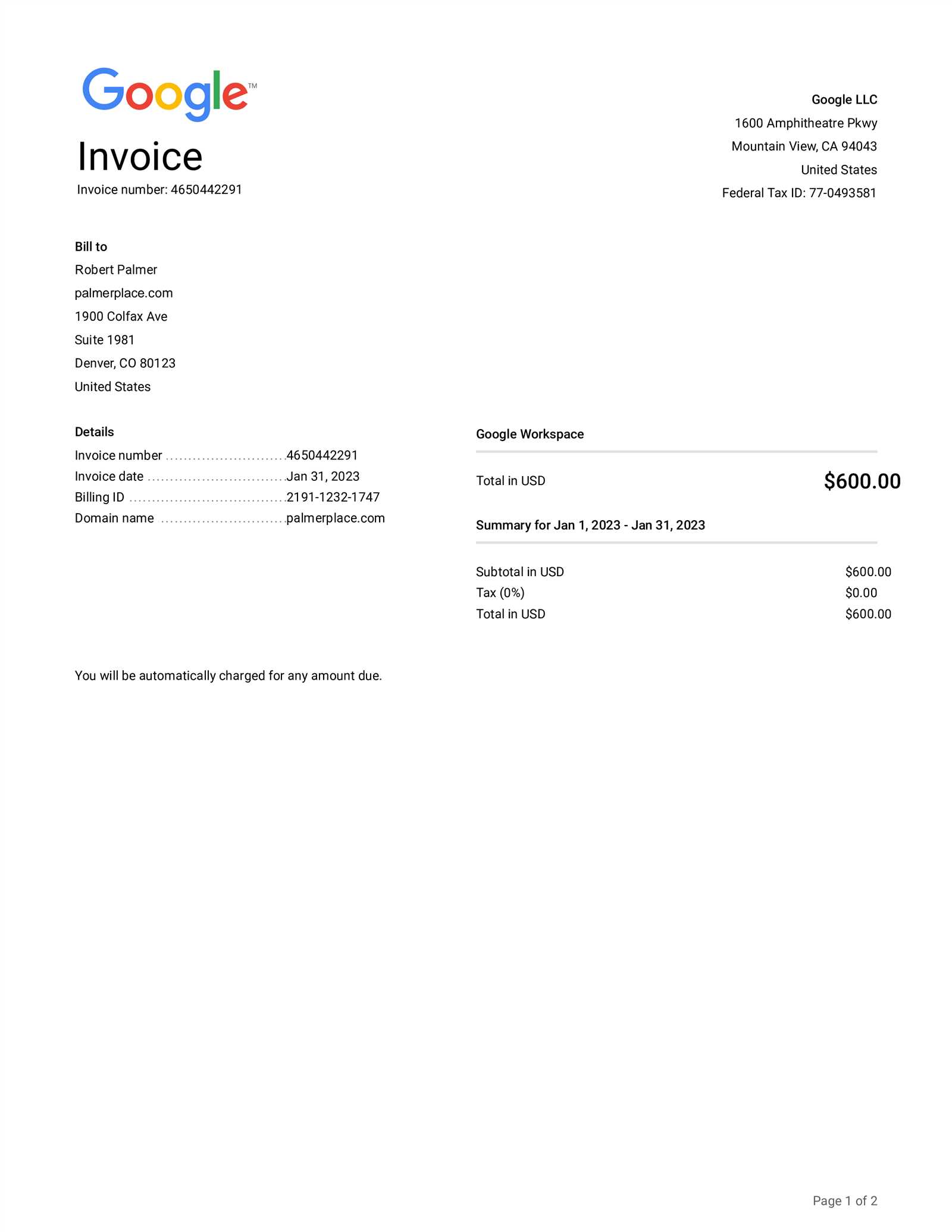

Legal Requirements for Billing Documents in Ireland

When creating billing records for your business, it is essential to ensure that they comply with local legal standards. In Ireland, businesses must adhere to specific regulations when preparing financial documents, especially for taxation purposes. Meeting these legal requirements not only helps you avoid potential fines but also ensures transparency and trust in your transactions.

Here are some of the key legal elements that must be included in your documents:

- Business Details: Your company’s name, address, and VAT registration number must be clearly listed. This ensures that both parties can identify the business involved in the transaction.

- Customer Information: The customer’s name and address should be included to identify the recipient of the goods or services. This helps establish accountability and provides clear documentation for both sides.

- Unique Reference Number: Each document must have a unique reference number for tracking and auditing purposes. This is important for record-keeping and ensuring that all transactions are properly documented.

- Detailed Description of Goods/Services: You must provide a detailed breakdown of the goods or services provided, including quantities, unit prices, and total amounts. This level of detail is necessary for clarity and to avoid any confusion between the business and the customer.

- VAT Information: If applicable, your document should clearly show the VAT rate applied to the transaction, the amount of tax charged, and the total cost. This is important for both tax reporting and ensuring that customers understand the tax applied to their purchases.

- Payment Terms: Clearly state the due date for payment and any penalties for late payments. This helps manage expectations and ensures that both parties understand the payment conditions.

Failure to include these essential elements can result in penalties or legal issues, especially during tax audits. By ensuring that your documents comply with these legal requirements, you protect both your business and your customers while maintaining transparency and professionalism.

Why Pre-designed Formats Save Time and Money

Using pre-designed documents for business transactions offers significant time and cost savings. By relying on standardized layouts, companies can streamline administrative tasks, reduce errors, and maintain a high level of consistency across all financial records. This approach simplifies day-to-day operations and allows businesses to focus on what matters most–growing and serving customers.

Time Efficiency

Creating documents from scratch every time a new transaction occurs can be time-consuming. Pre-designed formats eliminate the need to start from zero, allowing businesses to quickly generate new records with minimal effort. This time-saving aspect is especially important for businesses with high transaction volumes or tight deadlines.

Cost Savings

By using pre-made solutions, businesses can avoid the costs associated with custom document creation or hiring a professional to design each record. Many pre-designed formats are available for free or at a low cost, making them an affordable option for small to medium-sized businesses.

| Benefit | Explanation |

|---|---|

| Speed | Pre-designed formats reduce the time spent on administrative tasks, allowing for faster document creation. |

| Consistency | Using a standard format ensures uniformity across all records, reducing the chances of missing important details. |

| Reduced Errors | A well-structured format helps minimize human error, leading to more accurate records and fewer revisions. |

| Cost-Effective | Pre-made solutions eliminate the need for expensive custom design or professional services, saving businesses money. |

By adopting pre-designed formats, businesses can significantly cut down on both time and expenses, allowing for more efficient operations and a more professional appearance with less effort.

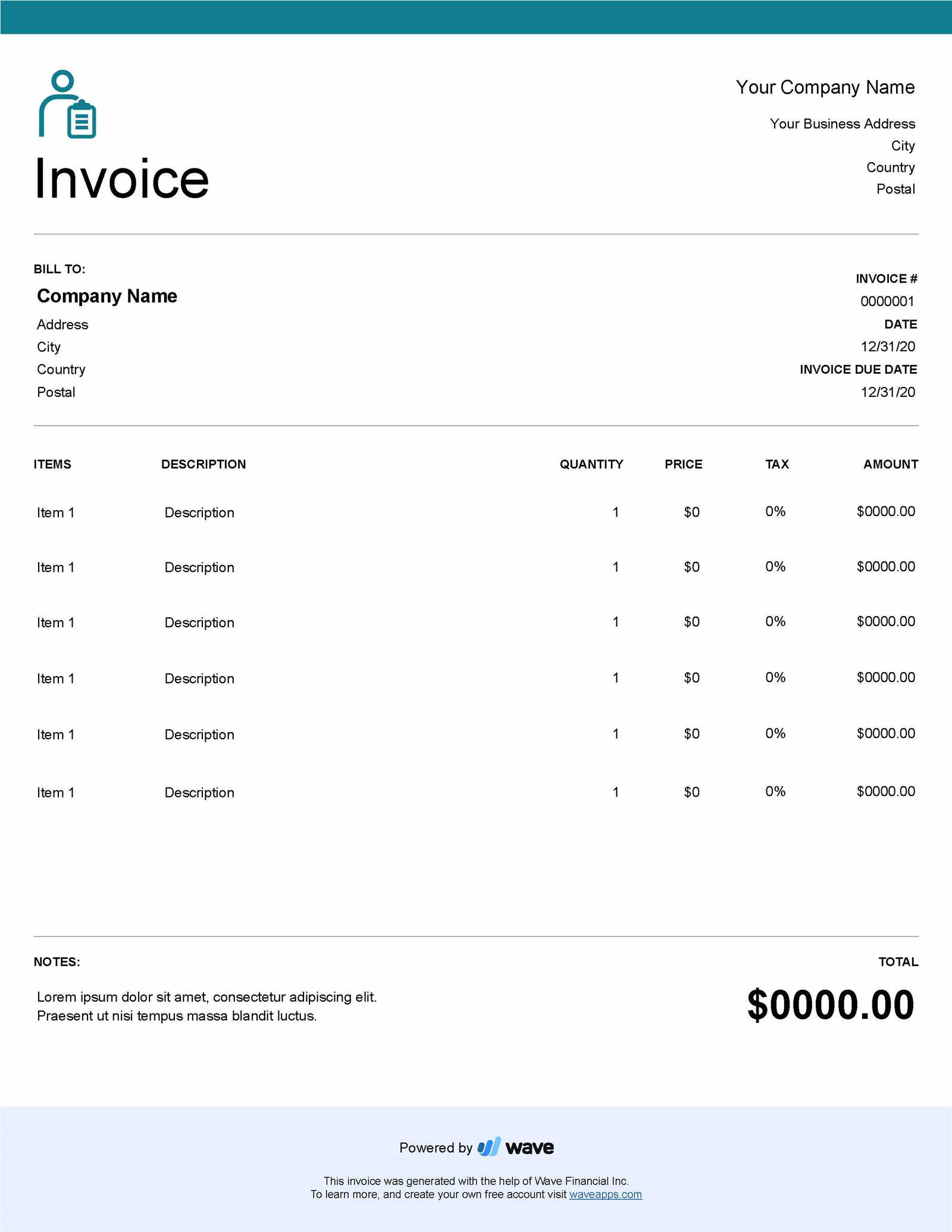

Best Software for Generating Billing Documents in Ireland

Choosing the right software for creating and managing financial records is essential for businesses aiming to streamline their processes and maintain accuracy. The right tool can simplify the entire procedure, from creating professional records to tracking payments and managing tax information. Below are some of the best software options available for generating billing documents, with features designed to save time and reduce errors.

Top Features to Look for

When evaluating software for generating financial documents, it’s important to consider several key features that can help ensure smooth operations:

- Ease of Use: Look for user-friendly software with intuitive interfaces that allow you to create documents quickly without a steep learning curve.

- Customization Options: The ability to personalize the document layout, add your business logo, and adjust details like payment terms is crucial for branding and consistency.

- Compliance Tools: The software should assist with local tax calculations, ensuring compliance with tax rates and regulations specific to your region.

- Automation: Automated features such as recurring billing or auto-generating unique reference numbers save time and reduce manual effort.

- Integration: Ensure the software integrates with your accounting and payment systems for seamless data syncing.

Recommended Software Solutions

Here are a few of the top software tools for creating financial documents:

- QuickBooks: A well-known solution that offers comprehensive accounting features, including easy document creation, tax calculations, and integration with other financial tools.

- FreshBooks: Ideal for small businesses and freelancers, FreshBooks offers customizable billing documents, automated reminders, and built-in payment processing options.

- Zoho Invoice: A highly rated tool that provides professional templates, multi-currency support, and tax rate management, making it a great choice for businesses with international clients.

- Wave: A free, cloud-based solution that covers everything from document creation to accounting and payment tracking, perfect for small businesses with limited budgets.

- Xero: Xero offers robust accounting features and allows for easy document creation and management with a focus on accuracy and financial oversight.

Choosing the best software for generating your billing documents depends on the specific needs of your business. Whether you’re looking for simplicity, advanced features, or affordability, there’s a solution to help streamline your financial processes and keep your business running smoothly.

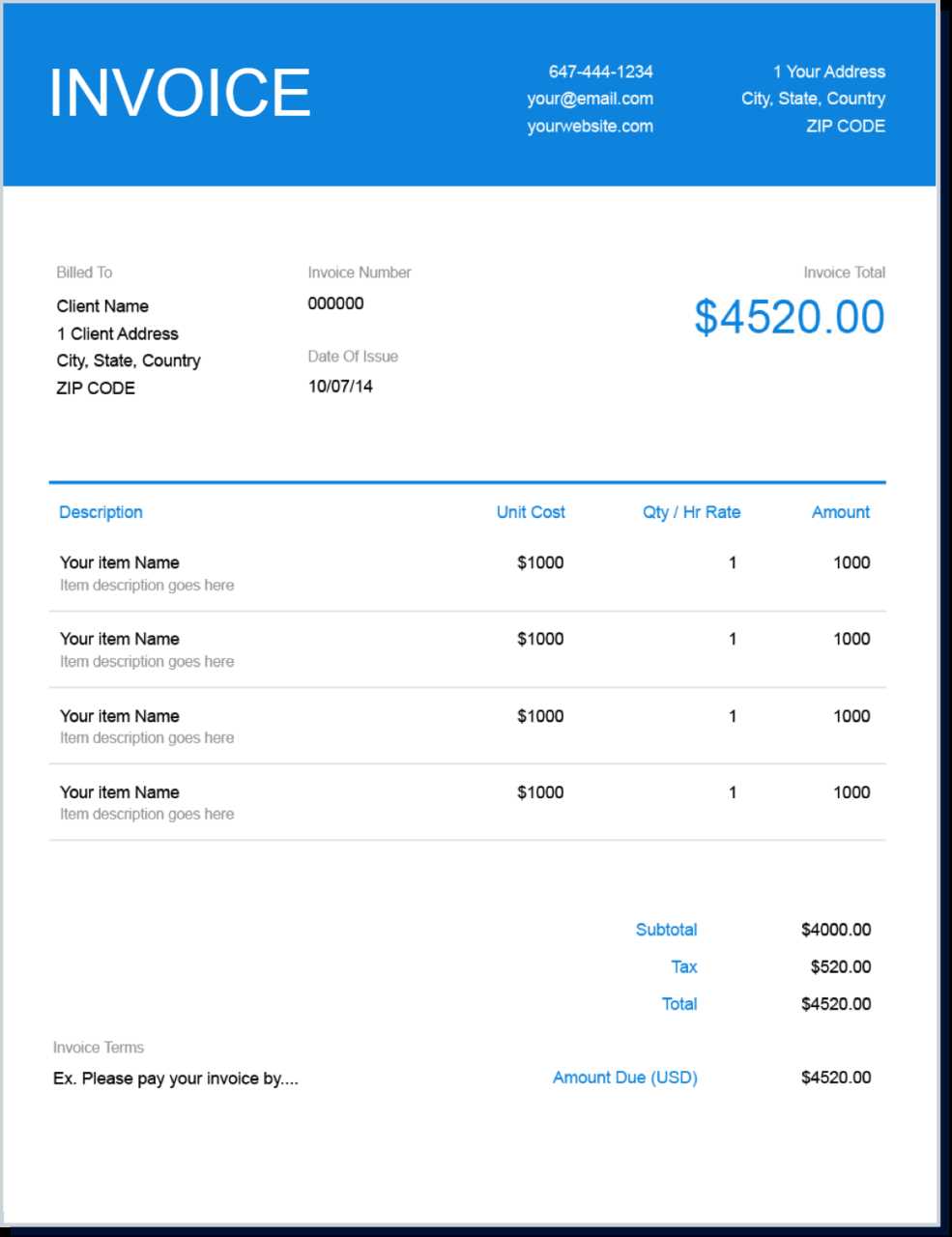

Understanding the Irish Billing Document Format

Creating clear and professional billing records is essential for any business, especially when dealing with transactions that require compliance with local laws. In Ireland, certain elements must be included in every billing document to ensure clarity, accuracy, and legal compliance. Understanding the required format will help businesses avoid mistakes, facilitate smoother transactions, and build trust with customers.

Below are the key components typically found in a standard business document in Ireland:

- Business Information: Include your company name, address, and VAT number (if applicable). This helps identify the business and ensures the document meets legal requirements.

- Customer Information: The recipient’s name, address, and any relevant contact details must be clearly stated for easy reference.

- Unique Reference Number: Each document must have a distinct reference number for tracking purposes. This ensures proper record-keeping and prevents confusion in your accounting system.

- Date of Issue: The date the document is issued should be clearly stated, as this is crucial for payment terms and tax reporting.

- Description of Goods or Services: List the products or services provided in detail, including quantities, unit prices, and any applicable discounts or additional fees. This breakdown ensures transparency and allows both parties to understand the charges.

- Tax Information: If applicable, indicate the VAT rate applied to the transaction and calculate the tax amount separately. This ensures that customers can clearly see the total amount of tax being paid.

- Total Amount Due: The final total, including the cost of goods/services and tax, should be listed prominently. Be sure to specify whether this total is inclusive or exclusive of tax.

- Payment Terms: Clearly state the payment due date, any late fees, and accepted payment methods. This ensures that both parties understand when and how payment should be made.

Following this format not only helps ensure compliance with local regulations but also enhances the professionalism of your business communications. By including all the necessary details and structuring your documents correctly, you create a clear record that benefits both your business and your customers.

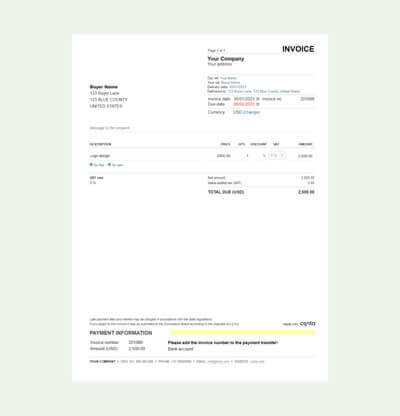

Choosing the Right Format for Your Business

Selecting the correct format for creating billing documents is crucial for any business. The right layout ensures that all the necessary information is presented clearly, professionally, and in compliance with local standards. A well-chosen document format can enhance your business’s image, reduce errors, and help streamline the financial side of your operations.

Factors to Consider When Choosing a Format

Before settling on a specific document format, consider the following factors to ensure it meets your needs:

- Business Type: Different industries may require different types of records. For example, service-based businesses may need more detailed descriptions of work completed, while product-based companies might focus more on quantities and prices.

- Customer Expectations: If you deal with high-profile clients or large corporations, it’s important to choose a format that reflects professionalism and consistency. Simpler formats may be appropriate for smaller businesses or individual clients.

- Customization Needs: Make sure the format you choose allows for customization. Your document should be able to reflect your branding, such as adding your logo, company colors, and specific terms that suit your business.

- Compliance Requirements: Depending on your location and the type of business you run, there may be legal requirements for what must be included in your financial records. Ensure the chosen format supports the inclusion of essential elements like tax rates, payment terms, and business registration details.

- Ease of Use: Opt for a format that is easy to use and helps streamline the creation of documents. A user-friendly design saves time, reduces mistakes, and minimizes the need for constant manual adjustments.

Types of Formats to Consider

Here are some common options to explore when choosing the right format for your business:

- Pre-Designed Digital Formats: These are often the most convenient choice. They come with standard fields and a clear structure that can be quickly customized for your business.

- Customizable Software Solutions: Many accounting and billing software packages offer highly customizable formats. These tools allow you to tweak the layout and ensure compliance with your specific needs.

- Manual Templates: For those who prefer more control, manually created formats can be designed from scratch. While this option provides flexibility, it requires more time and attention to ensure accuracy.

- Cloud-Based Platforms: These formats are accessible online and can be used by multiple users, making them ideal for businesses with remote teams or those requiring regular u

How to Track Payments Using Billing Records

Effectively tracking payments is essential for maintaining accurate financial records and ensuring smooth cash flow in any business. By utilizing well-structured billing records, you can monitor outstanding payments, identify overdue amounts, and easily reconcile accounts. This practice not only helps keep your business financially organized but also improves your relationship with clients by providing clarity on payment statuses.

Here are some practical tips on how to track payments using billing documents:

- Assign Unique Reference Numbers: Each billing record should have a unique reference number to ensure easy identification and tracking. This allows you to cross-reference payments with the corresponding document and ensures there is no confusion with multiple transactions.

- Set Clear Payment Terms: Always include the payment due date on each document. Clear terms make it easier to track whether payments are on time and avoid disputes. If applicable, include any penalties for late payments to encourage timely payments.

- Indicate Payment Status: Keep track of the payment status directly on the billing document. You can mark whether the payment is pending, completed, or overdue. This helps both you and your client stay updated on the status of each transaction.

- Record Payments as They Come In: As soon as a payment is received, update your records to reflect this. Recording payments promptly ensures that your accounts are always up to date and helps avoid missing any transactions.

- Use Payment Tracking Software: To simplify the process, consider using payment tracking software that integrates with your accounting system. These tools can automatically update your records when a payment is received, reducing the chances of human error and saving time.

- Provide Detailed Statements: After a payment is made, send your clients a detailed statement or receipt confirming the amount paid and any remaining balance. This helps both parties track financial progress and ensures transparency.

By using these practices, you can effectively track payments, manage cash flow, and ensure that your financial records are both accurate and up-to-date. Proper tracking not only keeps your business running smoothly but also fosters trust and professionalism with your clients.

Digital vs. Paper Billing Records

When managing business transactions, choosing between digital and paper records can significantly impact your workflow, efficiency, and environmental footprint. Both methods have their advantages and drawbacks, and understanding these can help businesses decide which format suits their needs best. As businesses increasingly embrace technology, the debate between digital and paper documentation remains relevant in terms of cost, ease of use, and legal considerations.

Below is a comparison of the key aspects of using digital versus paper records:

Aspect Digital Records Paper Records Convenience Easy to create, store, and send. Can be accessed from anywhere. Requires physical storage space and can be cumbersome to transport. Cost Typically lower costs for creation and distribution (e.g., no printing or postage fees). Higher costs due to printing, paper, and postage expenses. Environmental Impact More eco-friendly due to the reduction in paper use and physical waste. Less environmentally friendly as it involves paper production, printing, and waste. Security Can be securely stored and encrypted in cloud-based systems, but at risk of cyber threats. More vulnerable to physical loss or damage but can be stored in secure locations. Compliance Generally meets legal requirements, especially if encrypted and properly backed up. Accepted by authorities but can be harder to manage for compliance and retrieval in case of audits. Searchability Easy to search and retrieve, saving time when reviewing past transactions. Manual searching required, which can be time-consuming, especially with large volumes. Both methods offer distinct advantages depending on your business model. Digital formats are generally more efficient, cost-effective, and environmentally friendly, while paper records may still hold a place in more traditional or localized businesses. The decision will ultimately depend on your business needs, resources, and how you wish to manage and store your financial documentation.

How to Automate Billing Document Creation

Automating the generation of billing documents can save your business a significant amount of time and reduce human errors. By leveraging automation tools, businesses can streamline their financial processes, ensuring that records are created quickly, consistently, and accurately. Automating these tasks frees up resources, allowing you to focus more on your core operations while maintaining professional and compliant financial documentation.

Here are some steps to help you automate the process of creating and managing billing documents:

Steps to Automate Billing Creation

- Choose the Right Software: Invest in billing software that offers automation features. Look for solutions that integrate with your accounting system, track client information, and can automatically generate documents based on predefined criteria.

- Set Up Client Profiles: Ensure that client details, such as billing addresses, payment terms, and preferred payment methods, are stored within the system. This will allow the software to automatically fill in these fields when creating new documents.

- Customize Document Layout: Customize the layout and content of your documents. Pre-define fields like service descriptions, quantities, and pricing, as well as apply any applicable taxes or discounts. This ensures consistency across all generated records.

- Automate Recurring Billings: For clients with recurring payments, set up automated billing cycles. The software will generate and send the required documents on the specified schedule without manual intervention.

- Integrate Payment Systems: Automate the payment tracking process by linking your document creation tool to your payment system. This allows the software to update the payment status and mark documents as paid once the payment is received.

- Set Up Automatic Reminders: Automation tools can send reminders to clients about upcoming or overdue payments, ensuring timely payment and reducing the need for manual follow-ups.

Benefits of Automating Billing

- Efficiency: Automation speeds up the document generation process, reducing the time spent manually creating records.

- Accuracy: Automated systems reduce the risk of human error, ensuring that billing documents are created with the correct information every time.

- Cost Savings: By automating repetitive tasks, you reduce the need for manual labor, helping your business save on operational costs.

- Improved Cash Flow: Automation ensures timely and accurate billings, helping businesses receive payments faster and manage cash flow more effectively.

- Compliance: Many automated systems are designed to comply with local tax regulations, ensuring that your documents meet legal requirements without extra effort on your part.

By automating the creation of billing documents, you can significantly enhance the efficiency and accuracy of your financial processes. This not only saves time but also improves overall business productivity and cash flow management.