Free Invoice Template for Easy Customization and Professional Invoicing

Managing financial transactions effectively is essential for any business, big or small. One of the most important tools in this process is a well-organized document that tracks payments, services rendered, and amounts due. This type of document helps ensure clarity and professionalism while providing a simple way to maintain accurate records.

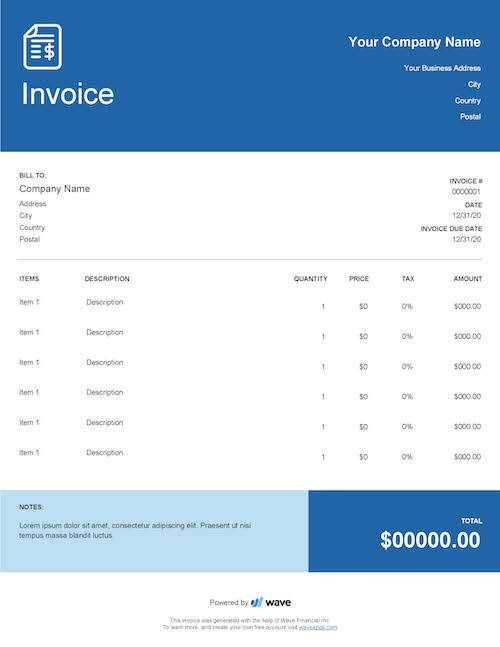

Using a customizable billing document can significantly reduce time spent on manual calculations and design. With the right layout, businesses can present a clean, professional appearance, while also incorporating all necessary details in a clear format. Many businesses turn to ready-made solutions that allow for quick setup, making invoicing smoother and more efficient.

Adopting the right approach to creating and managing these documents not only simplifies administrative tasks but also enhances the company’s reputation. Whether you are a freelancer, a small business owner, or part of a large corporation, streamlining this process is crucial for keeping track of finances and ensuring timely payments.

Invoice Template Benefits for Small Businesses

For small businesses, keeping financial matters organized is essential to maintaining smooth operations. Using a structured document to track payments and billing details offers numerous advantages. By simplifying the process, business owners can focus on other critical tasks while ensuring that financial transactions are handled efficiently.

Time and Cost Savings

One of the most significant benefits of using a ready-made document is the time saved on administrative tasks. Rather than creating a new bill from scratch every time, small businesses can use pre-designed formats that are quick to fill out. This can reduce the time spent on accounting and allow more focus on growing the business. Additionally, using a standardized format minimizes the risk of costly mistakes in calculations or missing details.

Professional Appearance

Professionally formatted billing statements create a positive impression on clients and customers. A clean, well-structured document demonstrates that the business is organized and trustworthy. This can lead to faster payments and long-term client relationships. When clients see that their transactions are being handled smoothly and professionally, they are more likely to engage in repeat business.

- Consistent branding across all financial documents.

- Clear presentation of amounts owed and due dates.

- Improved credibility with clients and partners.

Enhanced Record Keeping

Proper documentation of financial transactions is crucial for small businesses, especially for tax purposes or audits. Using a standardized document format makes it easier to maintain records in an organized and consistent way. With all relevant details in one place, business owners can quickly reference past transactions and track outstanding payments.

- Centralized record-keeping for easy access.

- Reduced risk of lost or incomplete information.

- Better preparation for tax season and audits.

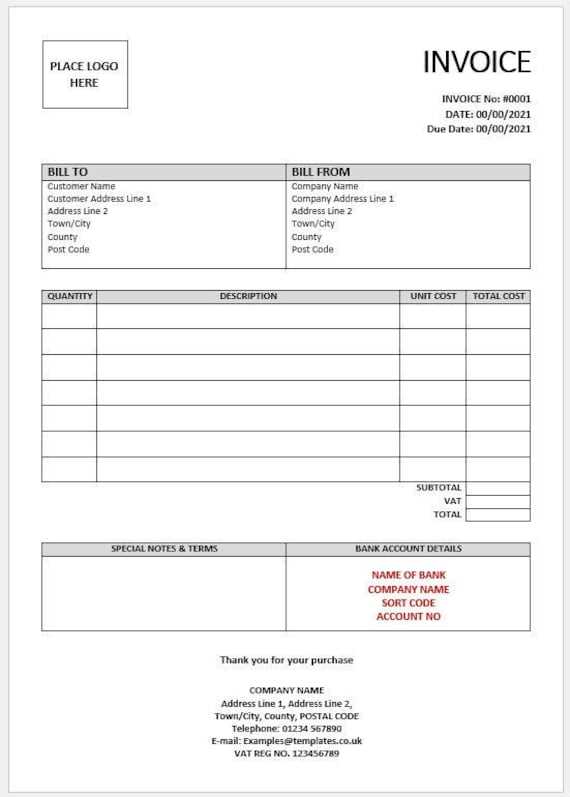

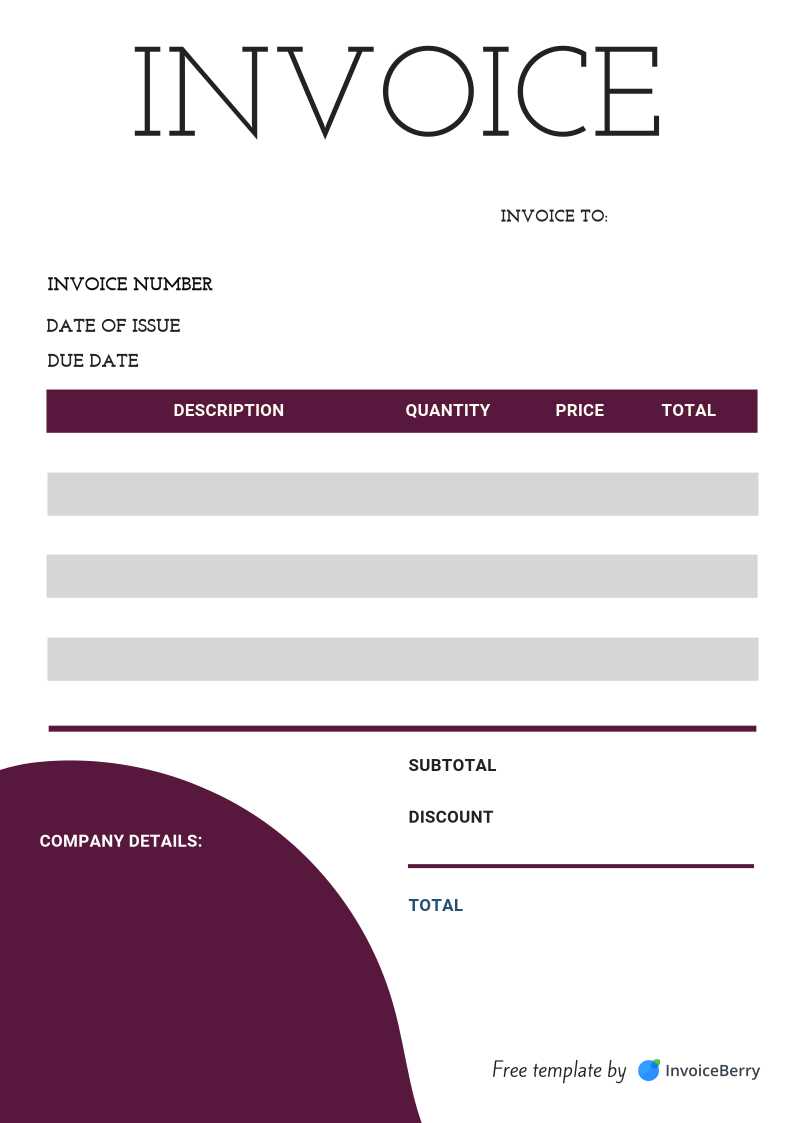

How to Customize an Invoice Template

Customizing a billing document is crucial for aligning it with your business needs. Personalizing the structure and layout not only enhances your brand’s identity but also ensures that all the necessary information is clearly presented to clients. The process of modification is simple and allows businesses to tailor the document to reflect their unique requirements.

The first step in customization is to include your company’s logo and contact details. This ensures that clients can easily recognize your brand and reach out if needed. Additionally, adjusting the layout to match your business style can help create a cohesive look across all your communications.

Adding Key Information

To ensure that your document is both functional and complete, it’s important to add key fields such as:

- Client details: Name, address, and contact information.

- Service description: A clear breakdown of what was provided.

- Payment terms: Include due dates and any applicable late fees.

- Tax details: If applicable, make sure to include any tax-related information clearly.

Formatting and Design Adjustments

Once the necessary information is added, focus on the design. It’s important that the document is easy to read and visually appealing. Choose a clean layout with a logical flow that guides the reader through the content without confusion. Adjust fonts, colors, and spacing to make sure that the document is professional and reflects your brand’s aesthetic.

- Use bold headings to separate sections clearly.

- Ensure enough white space to avoid clutter.

- Keep font styles consistent for better readability.

By customizing the layout and content, you create a unique and professional document that represents your business and ensures efficient communication with your clients.

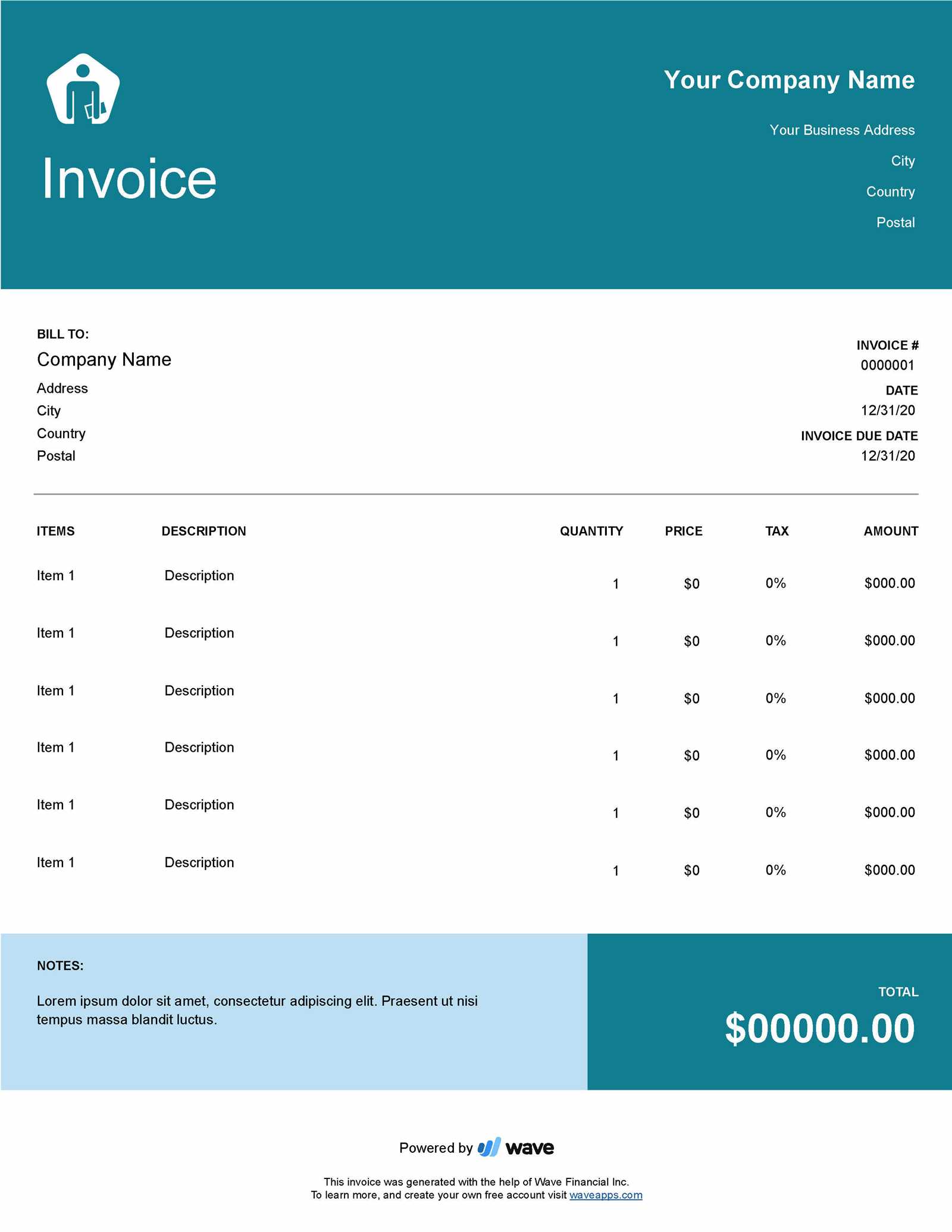

Choosing the Right Template for Your Business

Selecting the right document format for billing and payment tracking is essential for ensuring that your business operations run smoothly. The right design not only streamlines the process but also enhances your professional image. A well-suited structure can reflect your business’s unique needs and simplify client interactions.

Consider Your Business Type

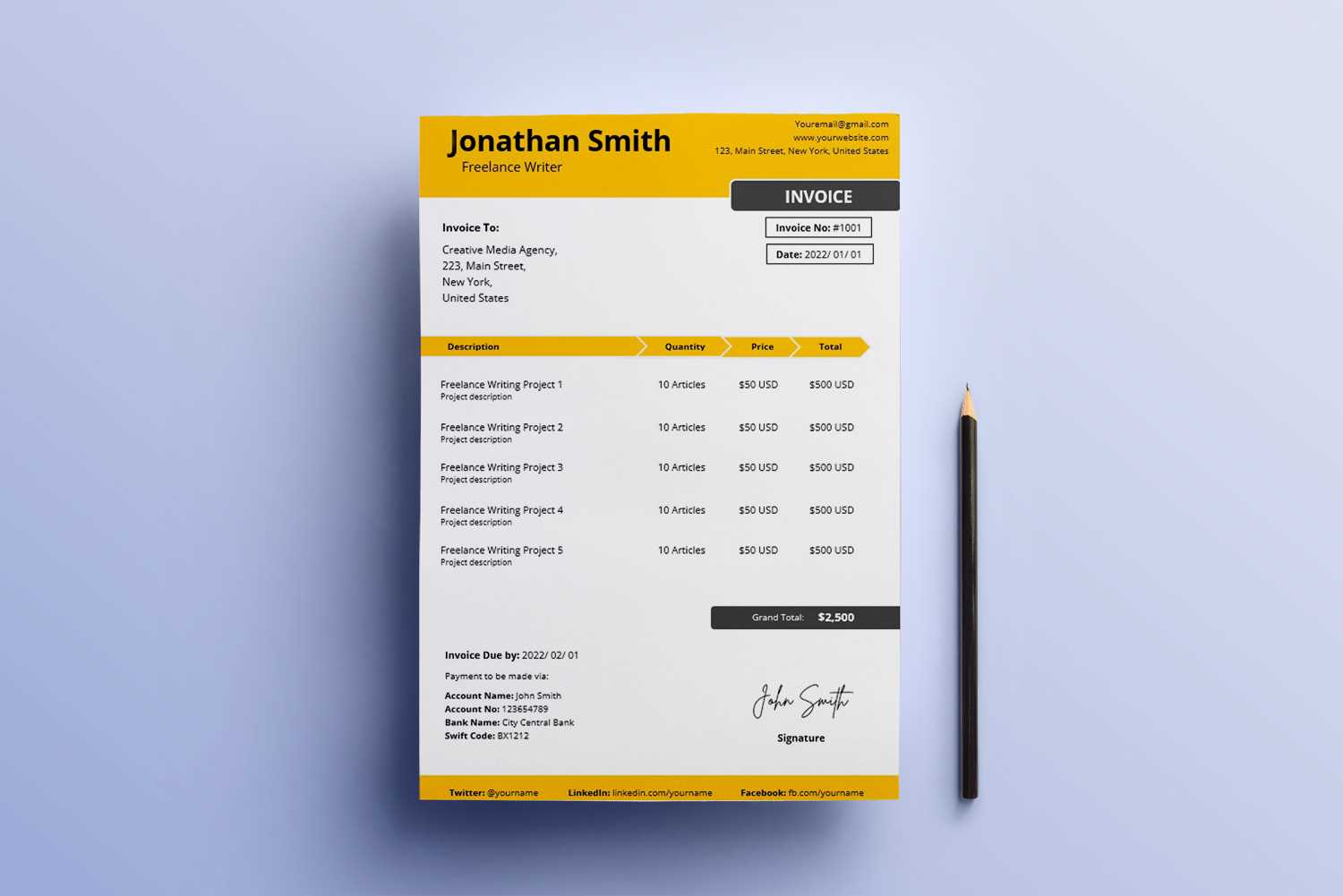

Different businesses have different requirements when it comes to tracking transactions. For instance, service-based businesses may need a simpler structure with fewer fields, while product-based companies might require more detailed descriptions and itemized lists. Understanding your business model helps in choosing a format that is both functional and efficient.

Features to Look For

When selecting a document design, make sure it includes essential elements such as:

- Client information: Fields for customer details like name and contact info.

- Payment terms: Clear payment deadlines and late fee policies.

- Customization options: The ability to modify the document for different services or products.

- Tax and discount fields: Essential for businesses that need to apply taxes or special offers.

By considering these factors and the specific needs of your business, you can choose a layout that fits both your operational needs and enhances the client experience.

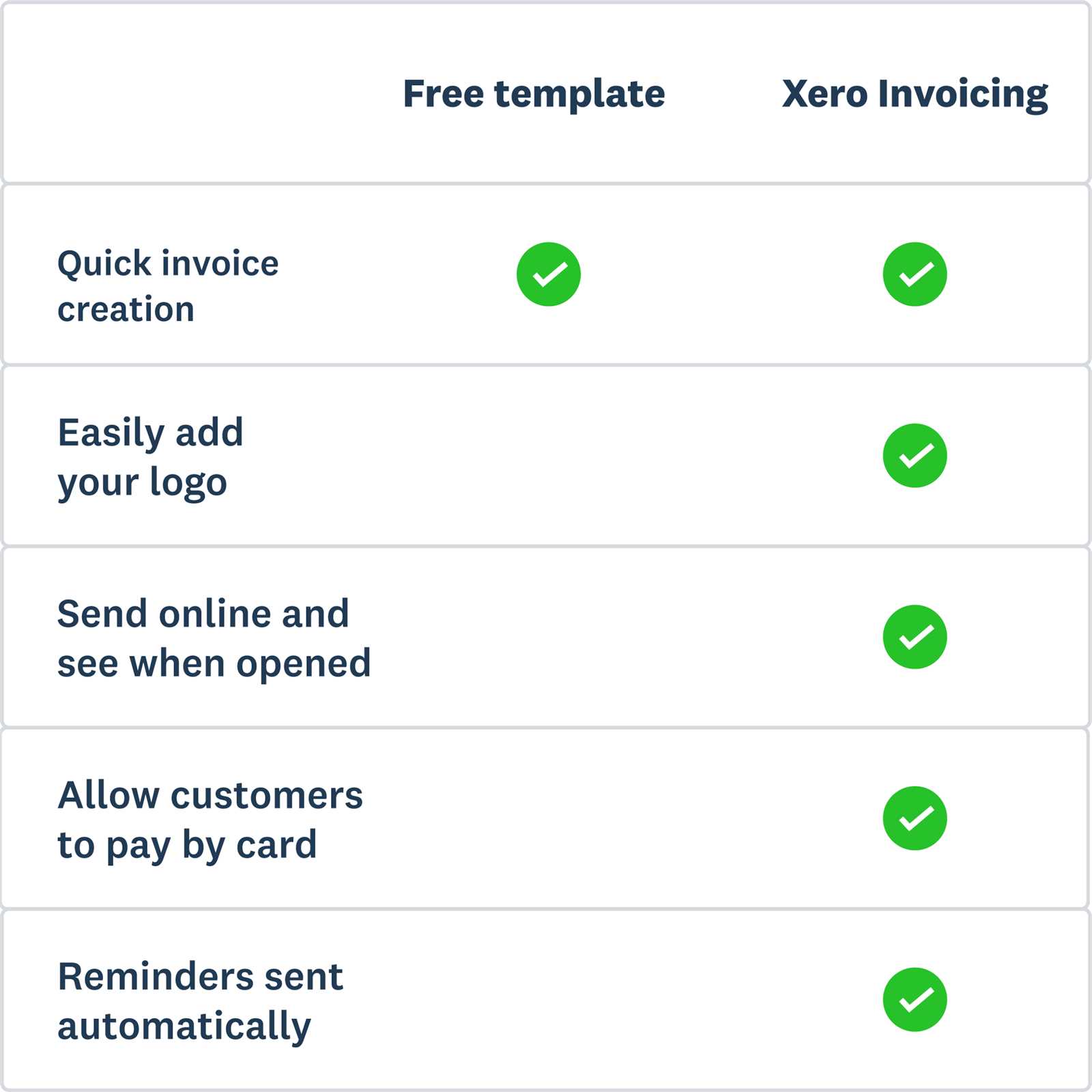

Free Invoice Templates vs Paid Options

When it comes to choosing a document for managing payments and billing details, businesses often face the decision of whether to opt for a free or paid solution. Both options have their advantages and drawbacks, and selecting the right one depends on the specific needs of the business. Understanding the key differences can help you make an informed choice.

Advantages of Free Options

Free document layouts can be a great choice for small businesses or freelancers who have minimal needs and want to save costs. These formats typically offer basic features, such as space for customer details, payment amounts, and descriptions of services. They can be downloaded quickly and used right away, providing a simple solution without any financial investment.

- Cost-effective: No financial commitment required.

- Easy to use: Simple layouts suitable for small-scale businesses.

- Quick access: Immediate download and use without additional setup.

Advantages of Paid Options

Paid document formats generally offer more customization, advanced features, and better overall support. For businesses with more complex billing needs, a paid layout might be worth the investment. These options often come with specialized functions like automated calculations, detailed customization, and integration with accounting systems, which can save time and reduce errors.

- Advanced features: Automation, calculations, and integrations with accounting software.

- Customization: Tailor every aspect of the design to fit your branding and needs.

- Customer support: Assistance when issues arise or features need modification.

Ultimately, the choice between free and paid formats depends on your business’s complexity and budget. Small businesses or startups with straightforward needs may find free options sufficient, while growing businesses with more sophisticated billing requirements might benefit from the additional features provided by paid solutions.

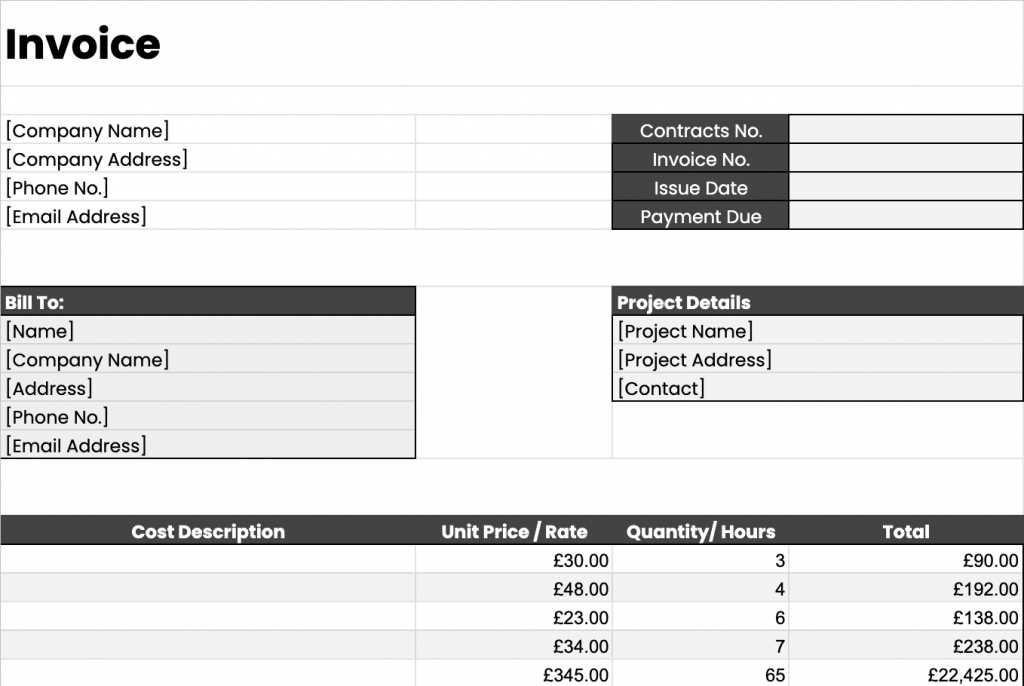

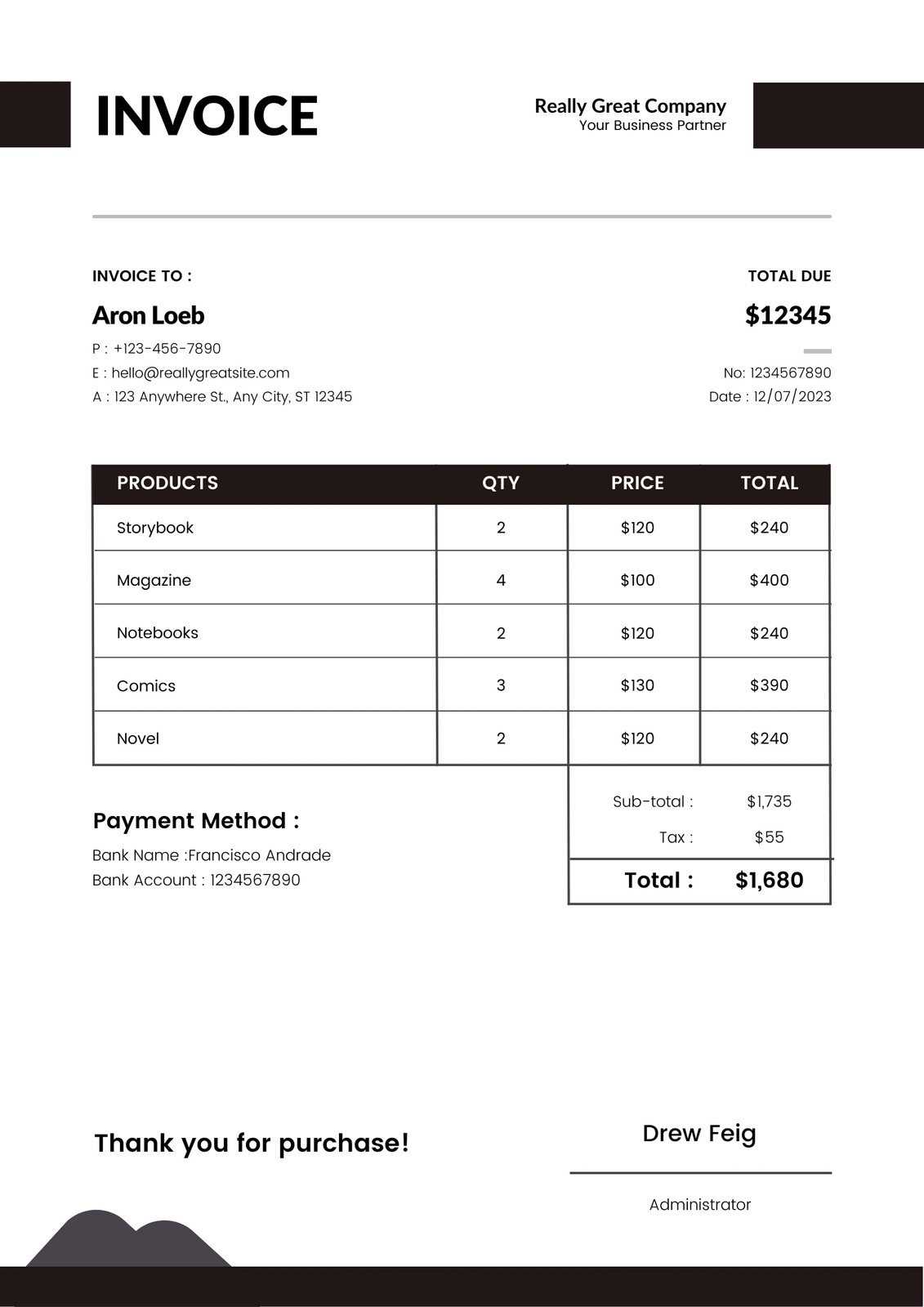

Common Features of Invoice Templates

When choosing a document to track transactions and payment details, it’s important to ensure that it includes the essential elements needed for clarity and efficiency. Well-designed formats are structured to highlight the most important information, making it easy for both businesses and clients to review details quickly and accurately.

Essential Information Fields

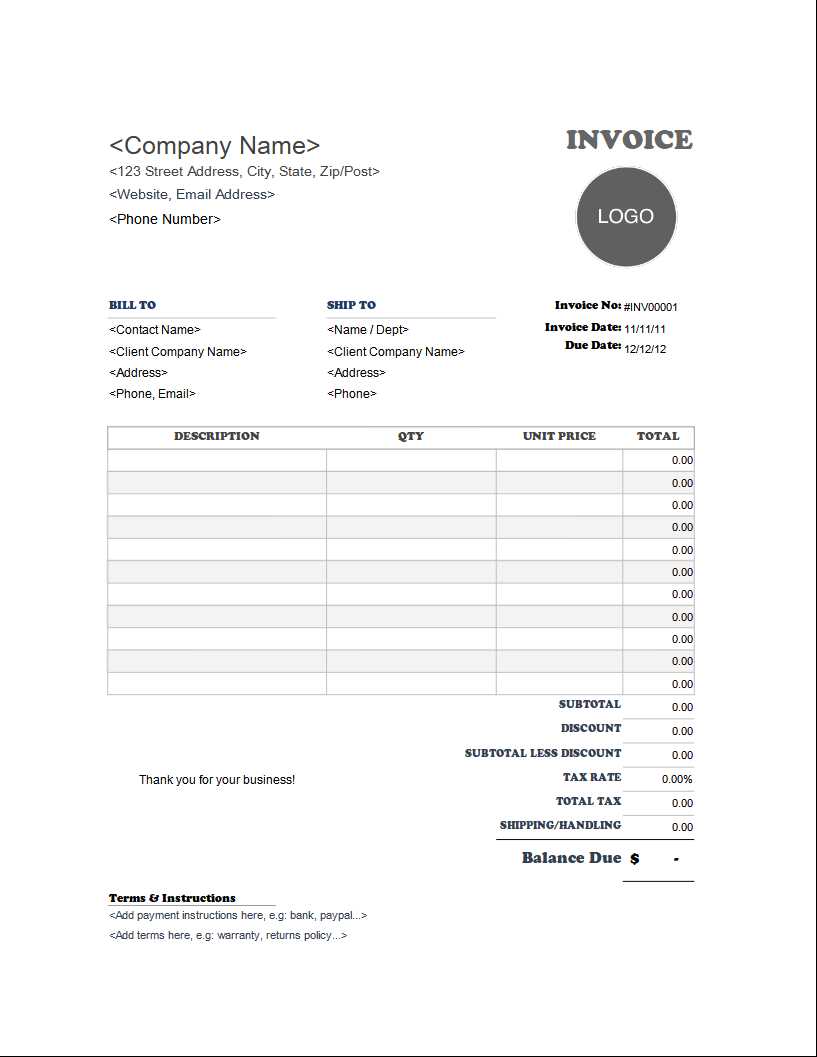

A standard layout typically includes several key sections to capture all relevant details. These sections ensure that both parties have all necessary information to complete the transaction smoothly and avoid confusion.

- Company and Client Details: This section includes names, addresses, and contact information for both the business and the client.

- Transaction Description: Clear descriptions of products or services provided, including quantities, unit prices, and total amounts.

- Payment Terms: This includes due dates, payment methods, and any additional terms such as late fees or early payment discounts.

- Unique Reference Number: Each document should have a unique identification number to help with tracking and record-keeping.

Design and Layout Features

The design of the document plays a key role in ensuring that it is not only functional but also visually appealing and easy to read. Here are some common design features:

- Clear Structure: Well-organized sections and bold headings make it easy to locate specific information.

- Logo and Branding: Customizable fields allow businesses to include their logos and brand colors for a professional look.

- Legible Fonts and Spacing: The use of readable fonts and appropriate spacing ensures that the content is not overwhelming and remains easy to understand.

These features combine to create a functional and professional-looking document that supports accurate record-keeping and promotes trust between businesses and clients.

Tips for Creating Professional Invoices

Creating clear, professional documents for billing is essential for maintaining positive client relationships and ensuring timely payments. A well-crafted document not only helps you keep track of financial transactions but also reflects your business’s professionalism. Here are some tips to ensure your billing documents are effective and polished.

Ensure Clear and Accurate Information

The accuracy of the information presented is crucial for avoiding misunderstandings and disputes. Make sure all details are correct and easy to read, especially important fields like client information, payment terms, and item descriptions. Using a consistent format helps clients quickly find the information they need.

Professional Layout and Design

A clean and organized design adds credibility to your business. Avoid clutter by using white space effectively and aligning elements properly. Make sure the most important details, such as amounts due, are clearly visible, and keep your layout simple yet attractive.

| Important Fields | Details to Include |

|---|---|

| Client Information | Full name, address, and contact details |

| Service or Product Description | Clear breakdown of what was provided, including quantity and pricing |

| Payment Terms | Due date, late fees, and acceptable payment methods |

| Reference Number | Unique document number for easy tracking and organization |

By following these tips, you ensure that your billing documents are not only professional but also user-friendly, fostering trust and clarity between you and your clients.

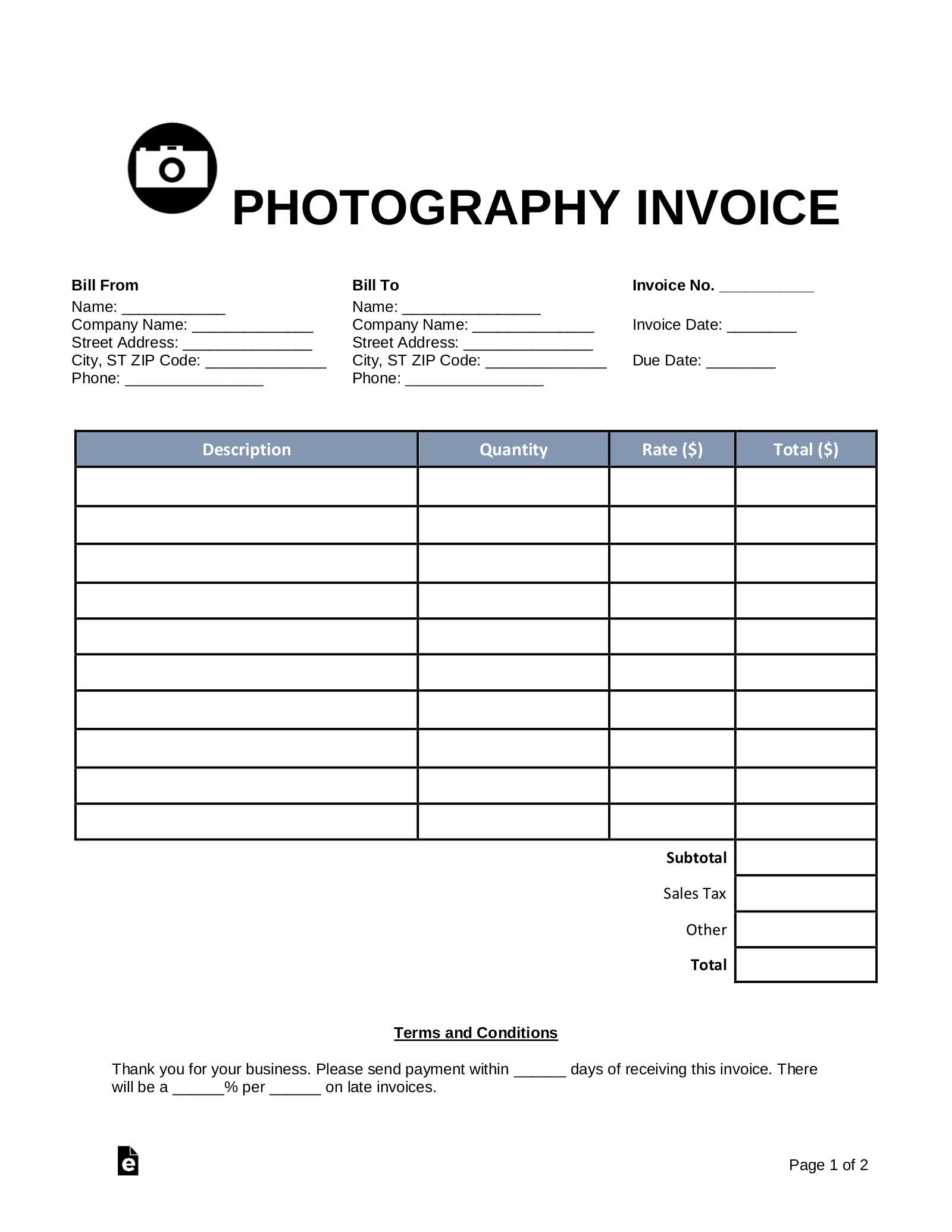

How to Add Company Information on Invoices

Including accurate and comprehensive company details on billing documents is essential for professionalism and effective communication with clients. Properly placed business information ensures that your clients can easily identify your company and contact you if necessary. This section explains how to effectively incorporate your company information into your documents.

Essential Company Details

Your business information should be clearly displayed at the top of the document, typically in the header section. The most important details include your company’s name, address, phone number, email, and website. These elements help your clients easily reach out to you for any inquiries or concerns.

| Company Detail | Information to Include |

|---|---|

| Company Name | The official registered name of your business |

| Business Address | Physical address of your company or a mailing address |

| Contact Information | Phone number, email, and possibly a contact person’s name |

| Website | Link to your official business website for easy access to more information |

Positioning Company Information

To maintain a professional and clean appearance, align your company’s information at the top or header section of the document. You can choose to center the information, or align it to the left for better readability. If your document is long or detailed, ensure the information is visible on the first page to avoid confusion.

Including this essential company information not only improves the clarity of your documents but also builds trust and transparency with your clients.

Managing Payments with Invoice Templates

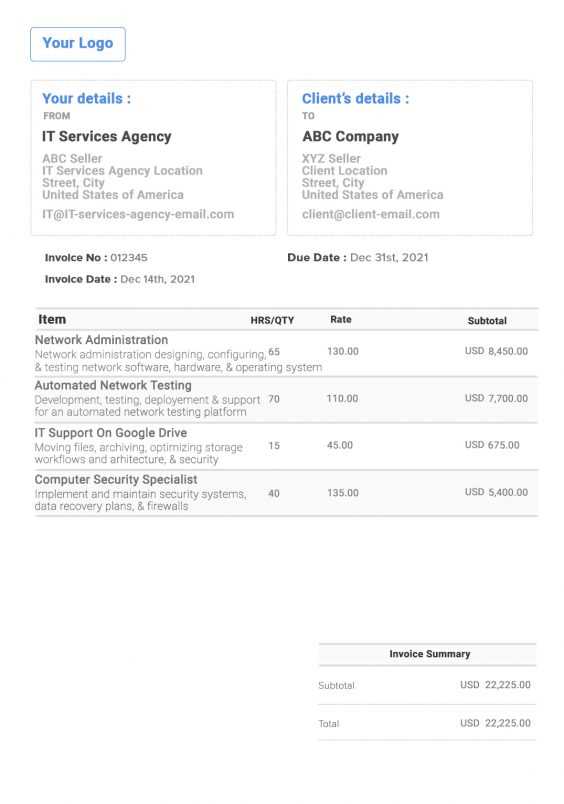

Efficient management of payments is crucial for any business, and a well-structured document plays an important role in ensuring smooth financial transactions. Using a properly formatted document helps you track payments, monitor overdue balances, and maintain a professional relationship with your clients. This section focuses on how to effectively manage payments through your billing documents.

Tracking Payment Status

One of the key features of a well-designed document is the ability to clearly mark the payment status. This can include whether the payment is pending, completed, or overdue. By having clear indicators on the document, both you and your clients can easily track outstanding balances and due dates.

- Payment Due Date: Clearly indicate the due date to avoid confusion.

- Paid Amount: Make sure to highlight payments that have been received and specify any remaining balance.

- Overdue Charges: Include any late fees if the payment is not made on time.

Methods of Payment

Including multiple payment methods in your document provides convenience for clients, increasing the likelihood of timely payments. Common options include bank transfers, credit card payments, or even online payment services. Make sure to clearly list all available methods, along with relevant account details or links.

- Bank Transfer Details: Include your bank account number and sort code.

- Online Payment Options: Provide links or QR codes to facilitate online payments through platforms like PayPal or Stripe.

- Payment Terms: Specify any discounts for early payments or penalties for overdue amounts.

By incorporating these features into your document, you create a clear and effective system for managing payments, ensuring both you and your clients are on the same page regarding financial transactions.

Legal Requirements for Invoices

When issuing billing documents, it is important to ensure that they comply with legal regulations to avoid any issues with tax authorities or clients. These documents must contain specific information to meet the requirements of local and international laws. Failing to include the necessary details could result in delays or disputes.

Mandatory Information for Compliance

Every official billing document should include certain key elements to be considered legally valid. These elements vary depending on the country or region but typically include the following:

- Business Identification: Include the name, address, and tax identification number of the business issuing the document.

- Client Information: Clearly state the name and address of the customer receiving the goods or services.

- Unique Reference Number: Each document should have a unique number for easy identification and tracking.

- Date of Issue: Specify the date when the document is generated.

- Transaction Details: List the goods or services provided, including quantities, unit prices, and total cost.

- Tax Information: Indicate the applicable tax rate(s) and total tax amount charged.

- Payment Terms: Specify the due date, payment method, and any applicable late fees or discounts.

Additional Legal Considerations

In addition to the mandatory information, businesses should be aware of any regional laws that require the inclusion of specific language or other disclosures. This may include:

- Consumer Rights: If applicable, include any rights that consumers may have under local law regarding refunds or warranties.

- Currency Information: In some cases, the currency in which the transaction is carried out must be clearly indicated.

- Legal Language: Certain jurisdictions require specific legal phrases or disclaimers to be included on documents for clarity or protection.

By ensuring your billing documents include all the necessary details, you protect your business from potential legal challenges and maintain transparency with your clients.

Integrating Invoice Templates with Accounting Software

Streamlining the billing process is essential for maintaining accurate financial records and improving operational efficiency. By integrating your billing documents with accounting software, you can automate various tasks, such as tracking payments, managing client data, and generating financial reports. This integration reduces manual entry and minimizes the risk of errors, ultimately saving time and improving the overall accuracy of your business operations.

Benefits of Integration

Connecting your billing system with accounting software offers several advantages that enhance business workflow:

- Automated Data Transfer: Directly importing billing details into your accounting system eliminates the need for manual entry, reducing the chance of errors.

- Real-Time Updates: As payments are made or invoices are created, your financial records are automatically updated, ensuring that all data is current.

- Improved Accuracy: With automated processes, you can reduce discrepancies in financial reporting, ensuring that both your invoicing and accounting are aligned.

- Faster Financial Reporting: Automated integration allows for quicker generation of financial reports, helping you make more informed decisions.

Steps to Integrate Billing Documents with Accounting Software

Successfully integrating your billing documents with accounting software typically involves the following steps:

- Select Compatible Software: Choose accounting software that supports integration with the specific billing system or document format you are using.

- Map Data Fields: Ensure that the fields on your billing documents (e.g., client name, total amount, due date) correspond correctly to the fields in your accounting software.

- Set Up Automated Syncing: Enable automatic syncing between your billing system and accounting software to ensure seamless data transfer whenever a document is created or updated.

- Test the Integration: Before fully implementing the system, conduct thorough testing to ensure that all data is being accurately imported and that the system is functioning as expected.

By integrating your billing system with accounting software, you not only simplify your financial management but also ensure greater accuracy, efficiency, and ease of use. The integration ultimately helps your business focus more on growth and less on manual data handling.

Best Practices for Invoice Design

Creating a well-designed billing document is essential for clear communication and professionalism. A clean, easy-to-read layout helps clients quickly understand the details of their charges, while also reflecting the quality of your business. The design should not only be functional but also align with your brand image and enhance the overall customer experience.

Essential Elements of a Well-Designed Billing Document

To ensure that your billing documents are effective, it’s important to include all necessary information in a way that is both organized and visually appealing. Here are some key components to consider:

- Clear Branding: Include your logo, company name, and contact information prominently at the top of the document to reinforce your brand identity.

- Readable Fonts: Use clear, legible fonts with appropriate sizes to make reading easy. Avoid using too many different fonts that can distract from the content.

- Logical Layout: Organize information in sections, such as item descriptions, totals, payment terms, and contact details, to guide the reader’s eye naturally through the document.

- Whitespace: Use sufficient whitespace to create a clean and uncluttered design. This helps prevent the document from feeling overwhelming and ensures important details stand out.

Design Tips for Enhancing User Experience

Beyond the basic requirements, a good design also aims to improve the overall user experience. Consider these tips for making your billing documents more user-friendly:

- Consistent Color Scheme: Use a consistent color palette that complements your branding and makes key elements, such as totals or due dates, stand out.

- Responsive Design: Ensure that your documents are easy to read and navigate, whether they are printed or viewed on a screen. Avoid overly complex layouts that may not render well on mobile devices.

- Highlight Important Information: Emphasize critical details such as payment deadlines and amounts due with bold or highlighted text to guide the reader’s focus.

- Use of Icons or Symbols: Simple icons can help make your document easier to navigate, especially for terms such as payment methods or services rendered.

By following these best practices, you can create professional, clear, and visually appealing billing documents that enhance both your brand image and the client experience. The right design will help ensure that your clients understand their charges and feel confident in their transactions with your business.

Tracking and Organizing Invoices Effectively

Efficiently managing billing documents is crucial for maintaining a smooth cash flow and ensuring timely payments. Keeping track of all issued bills, payments, and due dates can help avoid missed payments and improve financial planning. A structured system for organizing these documents allows businesses to stay on top of their finances, track outstanding amounts, and monitor payment histories with ease.

Benefits of Proper Organization

Implementing an effective tracking system for your billing documents offers several key benefits:

- Improved Cash Flow Management: By keeping an accurate record of outstanding amounts, you can ensure timely follow-ups and avoid delays in payments.

- Reduced Risk of Errors: A well-organized system minimizes the chances of duplicating or losing documents, ensuring accuracy in your financial records.

- Easy Reporting and Audits: Having a clear and accessible record of all transactions simplifies the process of generating financial reports and facilitates smoother audits.

- Better Client Relationships: When you are able to quickly reference past transactions, you are in a stronger position to resolve any disputes or answer client inquiries efficiently.

Strategies for Organizing Billing Documents

There are several strategies that can help businesses keep track of their billing documents and ensure everything is in order:

- Digital Systems: Utilize accounting or billing software to store and track all your documents. These platforms can automate many processes, such as generating reminders and creating reports.

- Use Unique Identifiers: Assign a unique reference number or code to each document to make tracking easier and reduce the chance of confusion.

- Categorize by Date and Status: Sort your documents by creation date or payment status (e.g., paid, pending, overdue) to quickly assess the current state of your finances.

- Regular Reconciliation: Set aside time regularly to review and reconcile your documents, ensuring that all payments have been received and all records are up to date.

By effectively tracking and organizing your billing documents, you can maintain better control over your finances, improve your cash flow, and reduce the likelihood of errors or disputes. Adopting a well-structured system will contribute to the overall success a

Ensuring Accurate Tax Calculations on Invoices

Accurate tax calculation is essential to maintain compliance with local tax regulations and ensure proper financial reporting. Whether you are providing products or services, correctly applying taxes to your billing documents ensures transparency and helps avoid any legal or financial issues. This section explores best practices for calculating taxes and the tools that can help you do so correctly.

Key Considerations for Correct Tax Calculations

To ensure tax amounts are calculated accurately, it’s important to consider the following points:

- Understanding Tax Rates: Different regions or products may have varying tax rates, so it’s essential to apply the correct rate for each item or service.

- Taxable vs. Non-Taxable Items: Not all products or services are subject to tax. Make sure to separate taxable from non-taxable items to avoid errors.

- Local and State Tax Regulations: Tax rules may vary depending on your location. Familiarize yourself with the tax requirements for both local and state governments.

- Exemptions and Discounts: If certain items are tax-exempt or if you’re applying discounts, be sure these are factored into your calculations properly.

Best Practices for Applying Taxes

Here are some best practices to follow when applying taxes to your documents:

- Use Accounting Software: Utilizing accounting or billing software that automatically calculates taxes based on your location and tax rates can save time and reduce errors.

- Clearly Display Tax Breakdown: Always break down the tax amount separately on the document so that the customer can easily see how the total was calculated.

- Stay Updated on Tax Changes: Tax rates and laws change over time, so regularly check for updates to ensure you are applying the correct rates.

- Consult a Tax Professional: For complex transactions, consider consulting with a tax expert to ensure you’re meeting all legal requirements and properly applying taxes.

By paying attention to these details and using the right tools, you can ensure that taxes are calculated correctly every time, helping you maintain good standing with tax authorities and providing clarity for your clients. Accurate tax calculations are a key element of your business’s financial health and professionalism.

Automating Invoice Generation for Efficiency

Automating the creation of billing documents can significantly improve efficiency and reduce errors in your business operations. By leveraging technology, you can eliminate the time-consuming process of manually creating and formatting these documents. Automation not only saves time but also ensures consistency and accuracy in every document you send out.

Benefits of Automation

Automating billing processes brings several key advantages:

- Time Savings: Automating document creation removes the need to manually enter details for each transaction, allowing you to focus on other important aspects of your business.

- Consistency and Accuracy: Automation ensures that the same format, calculations, and information are used for every document, reducing the risk of errors and discrepancies.

- Streamlined Workflow: Automated systems can integrate with other business tools, such as accounting software, CRM systems, and payment processors, creating a seamless workflow.

- Quick Turnaround: Automated generation speeds up the process, enabling you to send documents out faster, which helps accelerate payment collection.

How to Automate the Process

To implement automation in your business, consider the following steps:

- Choose the Right Software: Select accounting or billing software that offers automation features, such as recurring billing, template generation, and integration with payment systems.

- Set Up Recurring Billing: For clients with regular payments, configure recurring billing schedules so that documents are automatically generated and sent on time.

- Integrate with Other Tools: Connect your automated billing software with other business systems to streamline data flow and minimize manual data entry.

- Customize Automation Rules: Tailor the automation process to your business needs, such as applying specific discounts or tax rates, or including custom messages or payment terms.

By automating the generation of your billing documents, you can not only save time and resources but also enhance the professionalism of your operations. With fewer manual tasks, you can focus on growing your business and improving customer satisfaction, while ensuring accurate and timely financial transactions.

How to Handle Invoice Disputes

Disputes regarding billing documents are common in business transactions, but resolving them effectively is crucial for maintaining healthy client relationships. When a disagreement arises, it’s important to address the issue promptly, professionally, and fairly. This ensures that both parties feel heard and that the situation is resolved to mutual satisfaction.

Steps to Resolve Billing Disputes

Follow these best practices to manage and resolve any disputes that may arise:

- Review the Document Thoroughly: Before responding to a dispute, take time to carefully review the billing document in question. Ensure that all charges are correct and that the terms agreed upon have been followed.

- Communicate Clearly: Reach out to the client as soon as possible. Open and clear communication is key to understanding the nature of the dispute and finding a resolution. Ensure you remain professional and avoid becoming defensive.

- Understand the Client’s Concerns: Listen attentively to the client’s point of view. Understanding the root cause of the dispute–whether it’s a misunderstanding or an actual error–can help you identify the appropriate solution.

- Offer a Solution: Once the issue has been understood, offer a reasonable and fair solution. This could include issuing a corrected document, applying a discount, or providing further clarification if needed.

- Document the Resolution: Once the dispute has

How to Send and Follow Up on Invoices

Effectively sending and following up on billing documents is crucial for ensuring timely payments and maintaining positive client relationships. The process involves not only creating and sending clear and accurate documents but also managing communication afterward to ensure all dues are paid promptly. Establishing a structured approach can reduce delays and misunderstandings.

Steps for Sending Billing Documents

Follow these steps to ensure your billing documents are sent correctly and professionally:

- Ensure Accuracy: Double-check all details, such as client information, services provided, pricing, and payment terms. Mistakes can cause confusion and delays.

- Choose the Right Method: Decide on the most appropriate way to send the document. Email is the most common method, but some clients may prefer physical mail or an online payment portal.

- Use a Clear and Professional Subject Line: The subject line should clearly state the purpose of the email (e.g., “Payment Due for Services Rendered – [Your Company Name]”) to ensure the document is not overlooked.

- Attach the Document Properly: Make sure the billing document is attached in a commonly accepted file format, such as PDF, and ensure the attachment is not too large for email systems to handle.

- Include Payment Instructions: Clearly outline the payment methods accepted and include any necessary instructions or links for online payment.

How to Follow Up on Unpaid Documents

After sending the billing document, it’s important to follow up in a professional manner to ensure timely payment:

- Set Clear Deadlines: Clearly communicate when the payment is due. This helps set expectations from the start and serves as a reference when following up.

- Send a Reminder: If the due date passes without payment, send a polite reminder. It’s best to do this a few days after the due date to allow some grace period.

- Be Professional and Courteous: In all communication, maintain a friendly but firm tone. Remember that many reasons for delayed payments are not intentional, so approach the situation with understanding.

- Offer Flexible Payment Options: If the client is having trouble paying, offer flexible payment terms or alternative methods t