How to Choose the Best Invoice Home Template for Your Business

Designing professional billing documents is essential for businesses of all sizes. These documents help streamline the financial process, ensuring both clarity and consistency in your transactions. Whether you’re a freelancer or running a larger operation, having a reliable and customizable solution can save you valuable time and effort.

Using a well-structured layout allows you to provide clients with clear, easy-to-read records that detail the services or products provided. The format of these records should be simple, yet comprehensive enough to cover all necessary information. Having a system in place can improve your overall workflow and reduce the risk of mistakes.

Fortunately, modern tools and software offer a variety of options to create and personalize these documents. With the right resources, you can create a custom solution that meets your specific business needs while maintaining a professional appearance. Whether you choose a free or premium option, the key is to find one that helps you stay organized and on top of payments.

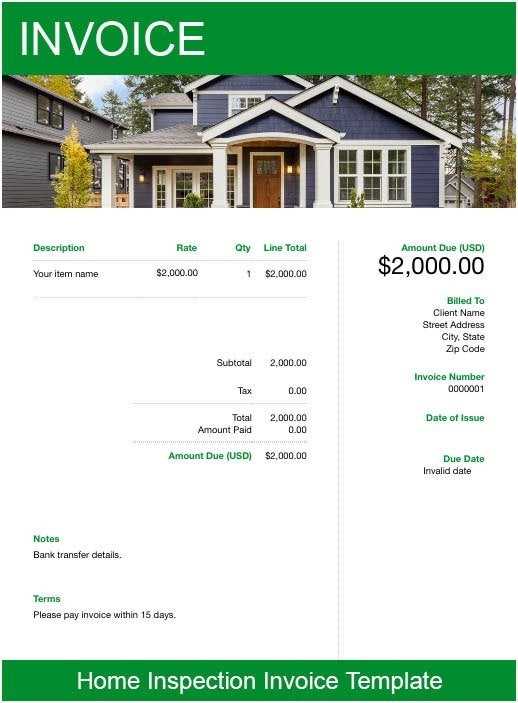

Invoice Home Template Overview

Creating consistent, well-organized billing documents is crucial for any business. These documents serve as formal records of transactions and ensure that both the provider and client have clear expectations regarding payment terms. A properly structured document can simplify communication, avoid misunderstandings, and streamline financial processes.

Key Features of an Effective Layout

An ideal billing structure typically includes essential information such as the service description, pricing, client details, and payment terms. The design of these documents should be professional and easy to follow, ensuring that no detail is overlooked. Customization options are also important, as they allow businesses to tailor the layout to their specific needs, creating a more personalized experience for clients.

Benefits of Using a Pre-designed Structure

Using a pre-made design or layout can save time and effort, especially for small businesses or freelancers who may not have the resources to create documents from scratch. These pre-built solutions are often flexible, allowing for easy adjustments without the need for advanced design skills. In addition, they ensure consistency across all your financial communications, maintaining a professional image for your brand.

Why You Need an Invoice Template

Maintaining a consistent, organized approach to billing is essential for any business, large or small. Without a clear and structured way to communicate payment expectations, misunderstandings and delays can occur. A ready-made design for financial documents not only streamlines this process but also ensures professionalism in every transaction.

Efficiency and Time Savings

Creating billing documents from scratch can be time-consuming and prone to errors. With a ready-made structure, you can significantly reduce the time spent on drafting and formatting these records. Key benefits include:

- Faster generation of documents: Pre-set fields and formats make it easy to input necessary details quickly.

- Consistent style: Every document follows the same design, ensuring uniformity across all communications.

- Reduced chances of errors: With a defined structure, you’re less likely to overlook important details.

Professional Appearance

A well-designed document reinforces your brand’s credibility. Having a polished, cohesive appearance in all financial communications creates a positive impression and promotes trust with clients. By using an established format, you show clients that your business is organized, reliable, and serious about its financial dealings.

Benefits of Using Invoice Templates

Utilizing a structured design for financial records brings numerous advantages to businesses. Whether you’re a freelancer or managing a larger team, adopting a pre-designed format can enhance both efficiency and professionalism. These formats help standardize your documents, improve accuracy, and save time, ultimately benefiting your business operations.

Enhanced Organization and Consistency

A pre-set structure ensures that every document includes the same key information in the same layout. This consistency not only saves time but also enhances organization across your business. Clients will appreciate receiving documents that are neat and follow a familiar, easy-to-read format, which can reduce confusion and errors.

Time and Cost Efficiency

Instead of spending time designing each document from scratch, using a ready-made format allows for quick creation and updates. This is particularly valuable for businesses that need to generate a large volume of financial documents regularly. The cost-effectiveness of using these tools is clear when compared to hiring a designer or investing in specialized software.

| Benefit | Explanation |

|---|---|

| Speed | Documents can be generated quickly without the need to format or design each time. |

| Professionalism | Using a structured layout reinforces a professional image for your business. |

| Consistency | Every document follows the same format, ensuring uniformity across all communications. |

| Accuracy | Pre-set fields reduce the chances of missing important details or making errors. |

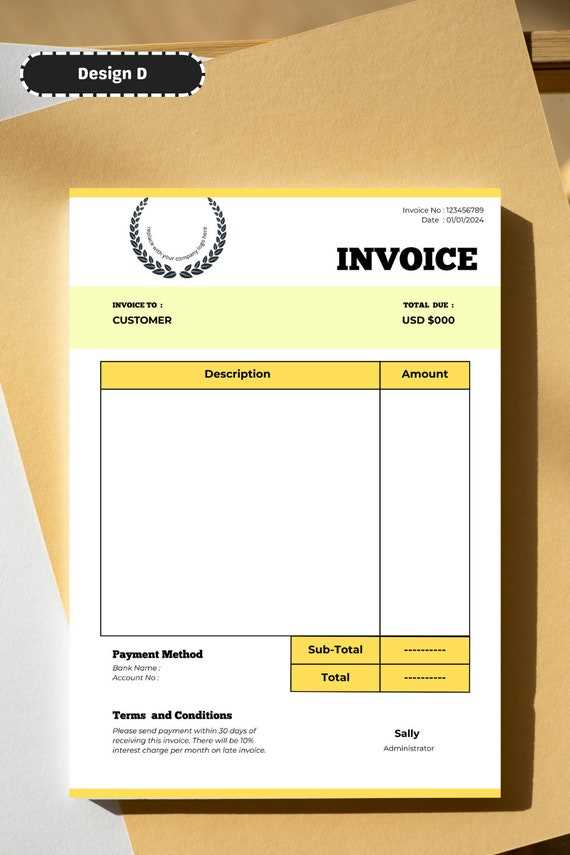

Customizing Your Invoice Template

Personalizing your financial documents allows you to create a more tailored experience for both you and your clients. Customization options let you adjust layouts, add specific branding elements, and include relevant details, all of which help reflect the unique identity of your business. The more you customize your records, the more professional and consistent they will appear.

Key Areas for Personalization

When adapting a standard format, there are several key areas you can focus on to better suit your needs:

- Branding: Add your business logo, colors, and contact information to create a cohesive visual identity.

- Fields and Sections: Modify the fields to include any specific details required for your industry, such as project milestones or specific service descriptions.

- Payment Terms: Customize payment instructions, including due dates, late fees, or preferred payment methods.

- Layout: Adjust the layout to ensure the document is clear, concise, and easy to navigate for clients.

Tips for Effective Customization

While customizing, it’s important to balance personalization with functionality. Here are a few tips to ensure your documents remain professional and efficient:

- Keep it simple: Avoid overloading the document with excessive design elements that can distract from the essential information.

- Maintain readability: Use clear fonts, logical spacing, and an easy-to-follow structure.

- Ensure flexibility: Choose a design that allows you to make quick adjustments as your business grows or changes.

Top Features in an Invoice Template

When creating billing documents, certain features are essential to ensure clarity, accuracy, and ease of use. A well-structured financial record should include everything needed for both parties to understand the transaction without confusion. These features enhance the professional appearance and functionality of the document, making the payment process smoother.

Essential Information Fields

The core of any effective billing record is the inclusion of key information that helps identify the transaction details. Some of the most important elements include:

- Client and business details: Clearly list the names, addresses, and contact information for both parties.

- Unique reference number: Assign a distinct number to each document for easy tracking and reference.

- Description of goods or services: Provide detailed descriptions to ensure both parties understand what is being billed.

- Payment terms: Specify due dates, payment methods, and any late fee policies.

Design and Layout Features

The layout of the document is just as important as the content. A clear, organized structure helps clients navigate the information without difficulty. Key design features include:

- Logical flow: Arrange information in a way that is easy to read, typically starting with the most important details at the top.

- Branding options: Include your logo, color scheme, and any other elements that reflect your business identity.

- Easy-to-read fonts: Use fonts that are clear and legible to ensure the document is accessible and professional.

How to Choose the Right Template

Choosing the right design for your financial documents can significantly impact how professional and efficient your business appears. Selecting a layout that aligns with your business needs and client expectations ensures a smooth workflow and positive client relationships. Consider key factors such as industry requirements, design flexibility, and ease of use when making your decision.

Consider Your Business Needs

Different businesses have unique requirements when it comes to billing records. Think about the specific information you need to include and how often you create these documents. Some factors to consider:

- Complexity of services: If you offer detailed services, choose a layout that allows for multiple line items and detailed descriptions.

- Volume of transactions: For businesses with frequent transactions, choose a simple design that is easy to generate quickly.

- Customization options: Make sure the design allows for enough flexibility to add or remove information as needed.

Ease of Use and Flexibility

Choose a layout that is not only easy to navigate but also flexible enough to adapt as your business grows. Features such as automatic calculations, reusable fields, and simple editing options can save time and reduce errors. Also, consider compatibility with your preferred software or tools for seamless integration into your workflow.

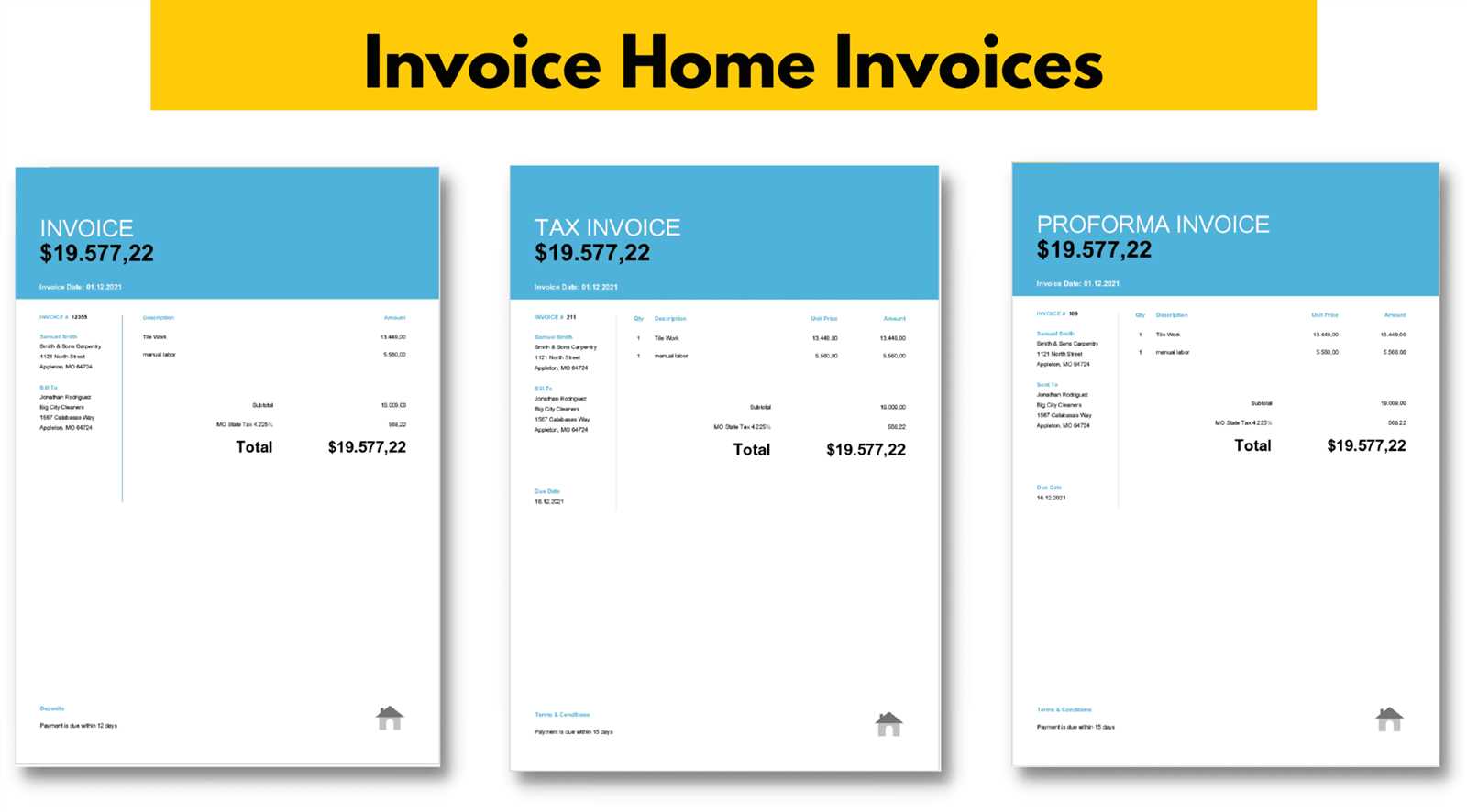

Free vs Paid Invoice Templates

When selecting a design for your billing documents, you’ll encounter both free and paid options. Each has its own set of advantages and limitations, making it important to evaluate which type best suits your business needs. While free solutions are often sufficient for basic needs, paid options tend to offer additional features and customization that can help businesses looking for more advanced or specific functionality.

Advantages of Free Solutions

Free designs are ideal for small businesses or individuals with straightforward requirements. They offer a low-cost way to get started without any upfront investment. Some key benefits of free options include:

- No cost: Free designs don’t require any financial commitment, making them a perfect starting point for new businesses or freelancers.

- Basic functionality: Free options often include essential fields and formatting, allowing you to create functional documents quickly.

- Simple design: These layouts tend to be minimalist, which can work well for businesses that don’t need complex structures.

Benefits of Paid Solutions

Paid layouts, on the other hand, offer more advanced features and customization. For businesses that require a professional, scalable solution, investing in a paid option may be worthwhile. Here’s why:

- Customization: Paid designs often allow for more detailed personalization, letting you align the documents with your brand and business style.

- Advanced features: These layouts may come with automated calculations, integrated payment gateways, and other sophisticated tools that save time and reduce errors.

- Support and updates: With paid options, you’re more likely to receive customer support and regular updates, ensuring that your documents stay current with changing business or tax requirements.

How to Personalize Your Invoices

Customizing your financial documents allows you to create a unique and professional impression for your clients. Personalization helps reflect your brand identity, ensures consistency across your communications, and makes your documents more user-friendly. With a few simple adjustments, you can tailor these records to better suit your business style and client expectations.

Key Areas for Customization

There are several areas you can focus on when personalizing your billing records. Here are some of the most important:

- Branding: Include your business logo, color scheme, and contact information to make your documents instantly recognizable and aligned with your brand identity.

- Fonts and Style: Choose fonts that reflect your business personality while maintaining clarity. A professional style can help convey a trustworthy image.

- Payment Instructions: Add specific payment terms, such as due dates, late fees, or preferred payment methods, to ensure clients know how to process payments easily.

- Additional Notes: Include custom fields for notes or special messages, such as a thank-you message or a reminder about upcoming projects.

Design and Layout Adjustments

Beyond textual elements, the overall structure and design of your financial documents play a crucial role in personalization:

- Column adjustments: Arrange the sections based on your priorities. For instance, make sure the amount due is prominent and easy to locate.

- Spacing and alignment: Adjust the margins, padding, and alignment to create a balanced and visually appealing layout.

- Colors and borders: Use color coding or subtle borders to visually separate different sections, making the document easier to navigate.

Common Mistakes to Avoid

When creating financial documents, even small errors can lead to confusion, delayed payments, or a lack of professionalism. It’s important to be aware of common pitfalls that can negatively impact the clarity and effectiveness of your records. Avoiding these mistakes will help you maintain a smooth workflow and create reliable, trustworthy documents every time.

Here are some of the most frequent issues businesses face when generating billing records:

- Missing or incorrect client details: Ensure that all contact information is accurate and up-to-date. Incorrect names or addresses can lead to payment delays or misunderstandings.

- Omitting key payment information: Always include clear payment terms, such as due dates, payment methods, and any late fees, to avoid confusion later on.

- Not using unique document numbers: Each document should have a unique reference number for easy tracking and to prevent mix-ups with past transactions.

- Overcomplicating the design: A cluttered or overly complex layout can confuse your clients. Keep the design clean and straightforward for easy navigation.

- Ignoring tax details: Ensure that taxes are calculated correctly and clearly displayed, especially if your business operates in regions with varying tax rates.

- Not reviewing before sending: Always double-check the document for any mistakes before sending it to a client. Typos, incorrect totals, or missing information can undermine your professionalism.

Best Software for Invoice Templates

Choosing the right software to create and manage your billing documents can save you time, reduce errors, and improve the overall professionalism of your business communications. The best tools offer a combination of user-friendly design, customizable options, and advanced features to streamline your financial workflows. Whether you’re looking for simplicity or more robust functionality, there are various software options available to suit your needs.

Here are some of the most popular and reliable tools for designing and managing your billing records:

- QuickBooks: A widely-used solution that offers customizable layouts, automated calculations, and integration with accounting software. Ideal for businesses that need comprehensive financial management tools.

- FreshBooks: Known for its easy-to-use interface, FreshBooks offers customizable billing records, time tracking, and expense management. Great for freelancers and small businesses.

- Zoho Invoice: A cloud-based platform that provides customizable designs, automated reminders, and integration with other Zoho tools. Suitable for businesses of all sizes looking for a simple yet powerful solution.

- Wave: A free solution that allows users to create professional-looking financial records with customizable options. Perfect for freelancers and small businesses on a budget.

- Invoicely: Offers both free and paid plans with customizable designs, multi-currency support, and advanced reporting. Best for businesses that need a flexible solution for invoicing across different regions.

Each of these tools has its own strengths and can be tailored to fit various business needs. Whether you prioritize cost, simplicity, or advanced features, choosing the right software can streamline your billing process and improve your overall efficiency.

Setting Up Invoice Templates for Clients

When preparing billing records for clients, it’s essential to ensure that each document is tailored to meet their specific needs while maintaining consistency and professionalism. Setting up a structured design can help streamline the process and provide clarity, making it easier for both you and your clients to manage payments. Customizing these records allows you to ensure that all the relevant details are presented in an organized and easy-to-understand format.

Steps to Set Up Client-Specific Billing Records

To create an effective billing system for your clients, there are several steps you can follow to set up these documents properly:

- Understand Client Preferences: Before creating a record, understand if your client has any specific requirements for how they like to receive financial documents, including formatting or additional details they may want.

- Customize Fields: Tailor the fields to include client-specific information, such as custom references, project names, or agreed-upon payment terms.

- Automate Recurring Information: If you have regular clients, consider automating recurring details such as tax rates, discounts, or service descriptions to save time and reduce errors.

- Include Client Branding: Personalize the document by including client logos or specific design elements to maintain consistency with their brand.

Client Information Table Example

To ensure all necessary client details are included and formatted properly, you can create a table for quick reference:

| Field | Details |

|---|---|

| Client Name | John Doe Enterprises |

| Contact Information | [email protected] |

| Payment Terms | Net 30 days |

| Services Provided | Web Development, Design, and Hosting |

| Discounts | 10% on next project |

Having a table like this ensures all critical details are included and easy to access when creating each document, making the billing process more efficient and reducing the likeli

Invoice Template Design Tips

Creating well-designed billing records is essential for professionalism and clarity. A clean, organized layout ensures that both you and your clients can quickly locate important information. By focusing on simplicity and structure, you can create a document that communicates effectively while enhancing the overall client experience. Here are some tips to help you design the perfect billing layout for your business.

Keep It Simple and Clear

Clarity is key when designing financial documents. A complicated layout can confuse clients and make it harder for them to find critical information. Focus on a clean, straightforward structure with easy-to-read fonts, logical spacing, and well-defined sections. Some design strategies to ensure simplicity include:

- Minimalist approach: Avoid clutter. Keep only the essential information visible, such as transaction details, payment terms, and contact information.

- Legible fonts: Use fonts that are easy to read. Stick to standard sans-serif fonts for a modern, clean look.

- Consistent spacing: Ensure there’s enough white space between sections to help separate content and make the document easier to scan.

Highlight Key Information

To ensure important details stand out, consider using design elements that draw attention to the most critical sections. This will help your clients quickly find the necessary information without having to search through the entire document. Some techniques include:

- Bold headings: Make section titles bold and slightly larger to make them easy to spot at a glance.

- Use color wisely: Highlight key information, such as the amount due or payment terms, with a subtle color that stands out but doesn’t overwhelm the document.

- Separate sections: Use borders or lines to separate different parts of the document, such as the client’s information, service descriptions, and payment instructions.

How to Automate Invoice Creation

Automating the creation of billing documents can save time, reduce human error, and ensure consistency in your financial records. By setting up an automated system, you can streamline your processes, from generating bills to sending them out to clients, making the overall workflow more efficient. With the right tools, you can eliminate the manual work involved in creating and tracking each document.

Here are a few steps to help you automate your billing process:

1. Use Online Tools or Software

Several software platforms and online tools offer automated document generation, allowing you to quickly create and send invoices without manual input each time. These tools typically allow you to:

- Set up client profiles: Store client information (e.g., contact details, payment terms) for quick access and automatic population of fields in each new record.

- Automate recurring billing: Set up regular billing cycles (e.g., monthly, quarterly) and have the system automatically generate and send out records on schedule.

- Integrate with accounting systems: Sync with your accounting software for seamless tracking and reporting.

2. Create Reusable Templates

Many automated systems allow you to design and save reusable document layouts. With pre-set designs, you can avoid recreating the structure each time. The software will then fill in the variable fields (e.g., service descriptions, amounts) based on the data you provide. Some platforms even allow you to:

- Customize fields: Tailor the content that appears in your documents (e.g., discounts, tax rates) based on the client or project.

- Set up payment reminders: Automatically send reminders to clients about upcoming or overdue payments, saving you time on follow-up tasks.

3. Leverage API Integrations

If you have a more complex workflow, you can integrate your billing system with other software applications via API (Application Programming Interface). This allows you to automatically import transaction data, generate billing documents, and even send them out, all without manual intervention. By automating data transfer between systems, you can ensure accuracy and save considerable time.

Legal Considerations for Invoices

When creating financial documents for transactions, it’s important to be aware of the legal requirements to ensure compliance with local, state, and international laws. These records are not only used for payment processing but also serve as official documentation in case of audits, disputes, or legal proceedings. Ensuring that your billing documents meet legal standards helps protect your business and maintain trust with your clients.

Here are key legal considerations to keep in mind when preparing these documents:

1. Include Essential Information

For your records to be legally valid, they must contain specific details that are required by law. Commonly required information includes:

- Business Identification: The name, address, and tax identification number (TIN) or VAT number of your business.

- Client Information: The name and address of the client or company you are billing.

- Unique Reference Number: A unique document number for tracking and record-keeping purposes.

- Transaction Date: The date of the service or product delivery, as well as the date the document is created.

- Detailed Description: A clear description of the services or goods provided, including quantities and unit prices.

- Tax Information: Any applicable taxes, such as sales tax or VAT, should be clearly outlined.

2. Payment Terms and Conditions

Clearly state the payment terms and conditions in your documents to avoid confusion and ensure both parties are aware of their obligations. Commonly included payment-related terms are:

- Due Date: The exact date by which payment should be made.

- Late Fees: Specify any penalties or fees that will be charged for late payments.

- Accepted Payment Methods: List the types of payment methods you accept (e.g., bank transfer, credit card, check).

- Refund Policy: If applicable, include the terms under which refunds are provided.

3. Retain Documentation

Legally, it’s important to retain copies of all your financial documents for a certain period of time. This ensures that you can provide proof of transactions in case of any disputes or audits. The retention period may vary depending on the jurisdiction, but typically, businesses should keep records for:

- 3 to 7 years, depending on local laws and the nature of the transaction.

- Longer retention periods may be required for certain industries or if the transaction involves long-term contracts.

Being mindful of these legal requirements not only helps you stay compliant but also protects your business interests and builds credibility with your clients.

Ensuring Accuracy in Invoice Details

Accuracy is critical when preparing financial documents, as even small errors can lead to confusion, delayed payments, and potential disputes. Ensuring that all the information on your records is correct and consistent not only helps maintain professionalism but also improves the overall efficiency of your billing process. Careful attention to detail is necessary to avoid costly mistakes and to build trust with clients.

1. Double-Check Client Information

One of the most common sources of errors comes from incorrect client details. Ensure that your client’s name, address, contact information, and any other personal details are accurate. Mistakes here can result in sending documents to the wrong address or misidentifying the client. Steps to ensure accuracy include:

- Use updated contact details: Always verify and update client information regularly.

- Cross-check client details: Before generating documents, ensure all previously entered data is correct.

2. Verify Financial Data

Accurate financial information is essential for maintaining transparency and ensuring timely payments. Verify that the amounts, tax rates, and any discounts are calculated correctly before sending the document. Key points to focus on include:

- Correct amounts: Double-check the total amount due, ensuring that the sums match the agreed prices and quantities.

- Accurate tax calculations: Make sure taxes are applied correctly based on the region and type of service or product.

- Clear payment terms: Double-check the payment due dates, methods, and any applicable late fees.

By thoroughly reviewing all details before sending documents, you can prevent errors and maintain smooth financial operations.

How to Track Payments with Templates

Efficiently tracking payments is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. With the right structure in place, you can easily monitor which transactions have been completed, which are pending, and which may require follow-up. By incorporating payment tracking elements into your financial documents, you can automate and streamline the process of managing payments.

1. Use Payment Status Fields

One of the most effective ways to track payments is by clearly marking the payment status directly on each document. This provides an at-a-glance overview of the payment progress and helps you easily identify outstanding balances. Key status options include:

- Paid: Marked when the full amount has been received.

- Pending: Indicating that the payment is due but hasn’t been received yet.

- Overdue: Used when the payment date has passed, but no payment has been made.

- Partially Paid: Used when only a portion of the total amount has been received.

2. Integrate Payment Tracking with Accounting Software

Many software tools offer the ability to integrate payment tracking features with your financial records. By syncing your documents with accounting software, you can automatically update payment statuses and avoid manually entering payment information. Some benefits include:

- Automatic status updates: As payments are received, the status of the document is automatically updated in your system.

- Real-time reporting: Get instant access to reports showing which payments are outstanding and which have been paid.

- Reduced errors: Syncing directly with your bank or payment platform minimizes the risk of human errors when entering payment data.

3. Create Payment Reminders

Timely reminders can help you follow up on outstanding payments and improve cash flow. Set up automated reminders to be sent to clients as their due dates approach or if payments become overdue. Some features to consider are:

- Automated reminders: Send email notifications automatically to clients at scheduled intervals (e.g., a week before the due date or a few days after the payment becomes overdue).

- Customizable messages: Personalize the reminder messages to maintain professionalism and encourage prompt payment.

By incorporating these strategies into your workflow, you can streamline payment tracking, reduce late payments, and enhance the overall efficiency of your financial manag

Updating Your Invoice Template Regularly

Regularly updating your financial documents is essential to ensure they remain accurate, professional, and compliant with any changes in laws or business requirements. As your business evolves or as regulations shift, keeping your billing records up to date helps prevent errors and ensures smooth financial operations. Updating these records can also reflect changes in your branding, payment terms, and any other business processes that may affect your invoicing procedures.

1. Stay Compliant with Legal Changes

Tax laws, financial regulations, and industry-specific rules can change over time. Keeping your documents updated ensures that they comply with the latest standards. Some legal aspects to monitor include:

- Tax rates: Regularly check and update tax rates for the regions where you do business.

- Mandatory details: Ensure that all required information, such as tax identification numbers or terms of service, is included.

- Currency updates: If your business deals internationally, make sure currency formats and exchange rates are accurate.

2. Reflect Changes in Business Operations

As your business grows or changes its processes, your billing structure may need to adapt as well. Here are a few common updates to consider:

- Service or product descriptions: Update item descriptions to reflect new offerings or changes in your products and services.

- Contact information: Always ensure that your business address, phone number, and email are correct.

- Branding: Update the logo, color scheme, and fonts to match your current branding and create a more professional look.

3. Improve Efficiency and Accuracy

Over time, you may discover more efficient ways to structure your documents to reduce errors or improve the customer experience. Consider these updates:

- Payment terms: Update payment terms to reflect changes in your policies or in response to customer feedback.

- Automation options: If you haven’t already, consider integrating automated fields for client information, payment amounts, or due dates to reduce manual entry and the risk of mistakes.

- Design improvements: As you learn more about what works best for clients, adjust the layout to make documents easier to read and understand.

By periodically reviewing and updating your financial documents, you ensure that they remain effective, accurate, and aligned with your current business needs and legal requirements.