Free Invoice Template Excel Download

Managing finances efficiently is crucial for any business. Having a structured way to create and track charges is essential to ensure smooth transactions and accurate record-keeping. With the right tools, you can save time, reduce errors, and streamline your financial processes. The goal is to make the process as simple and effective as possible.

There are several options available to create professional documents for financial purposes. The key is to use a method that allows easy customization, simple calculations, and clear formatting. These solutions can help ensure that all necessary details are included, making it easy for clients to understand and process the information provided.

By utilizing accessible software, businesses can create customized billing documents in a matter of minutes. Whether you’re a freelancer, a small business owner, or managing a larger team, having a reliable tool that fits your needs is essential for maintaining good client relationships and keeping finances in order.

Invoice Free Template Excel Guide

Creating professional financial documents is an essential task for any business. These records help ensure transparency, maintain accurate accounts, and streamline communication with clients. Using a reliable system for generating these documents can save time and reduce human error. A well-structured document should be easy to read, clear, and allow for quick modifications when needed.

How to Set Up Your Document

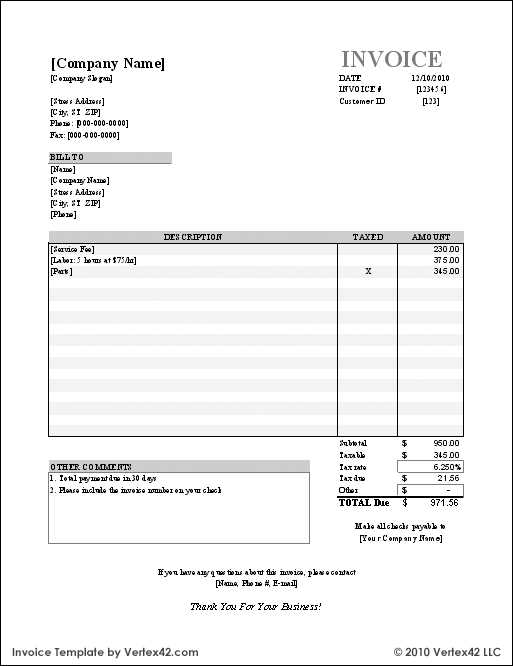

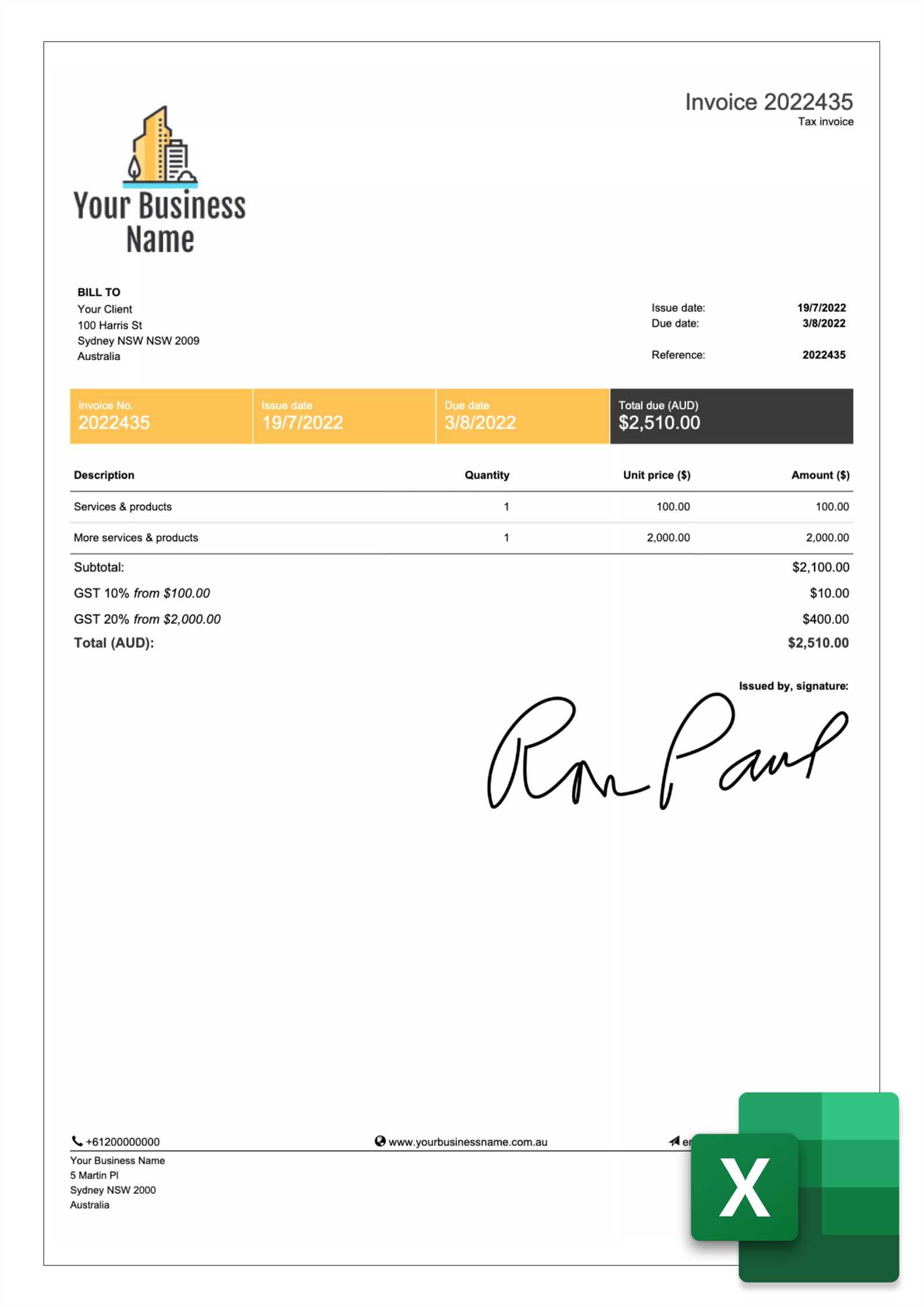

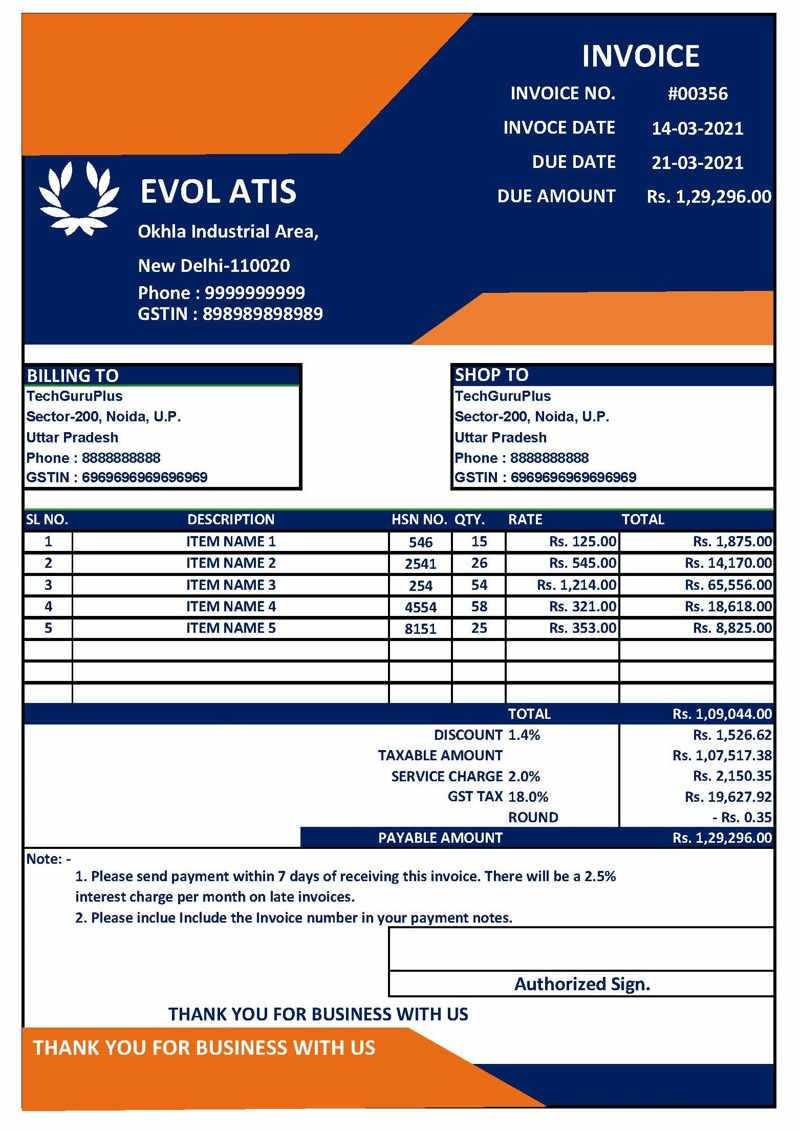

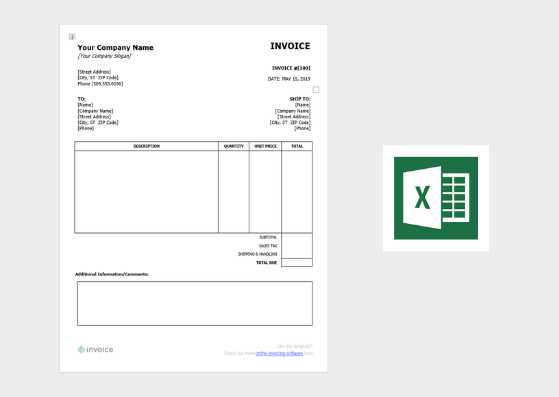

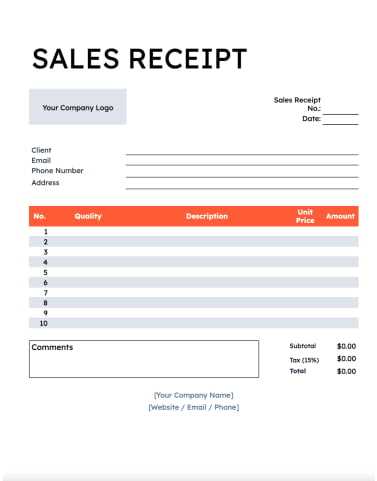

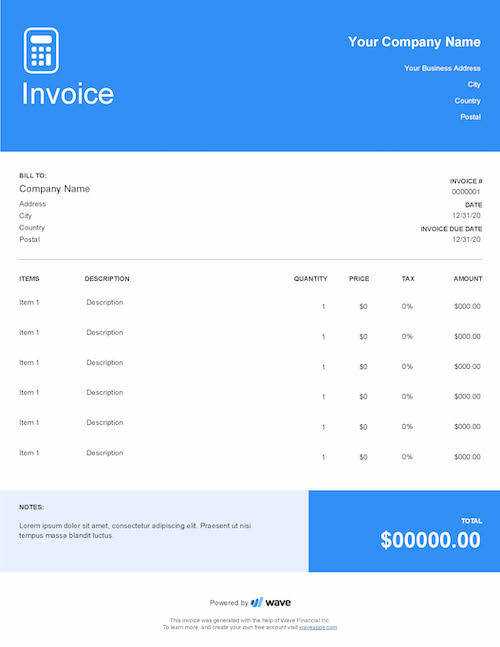

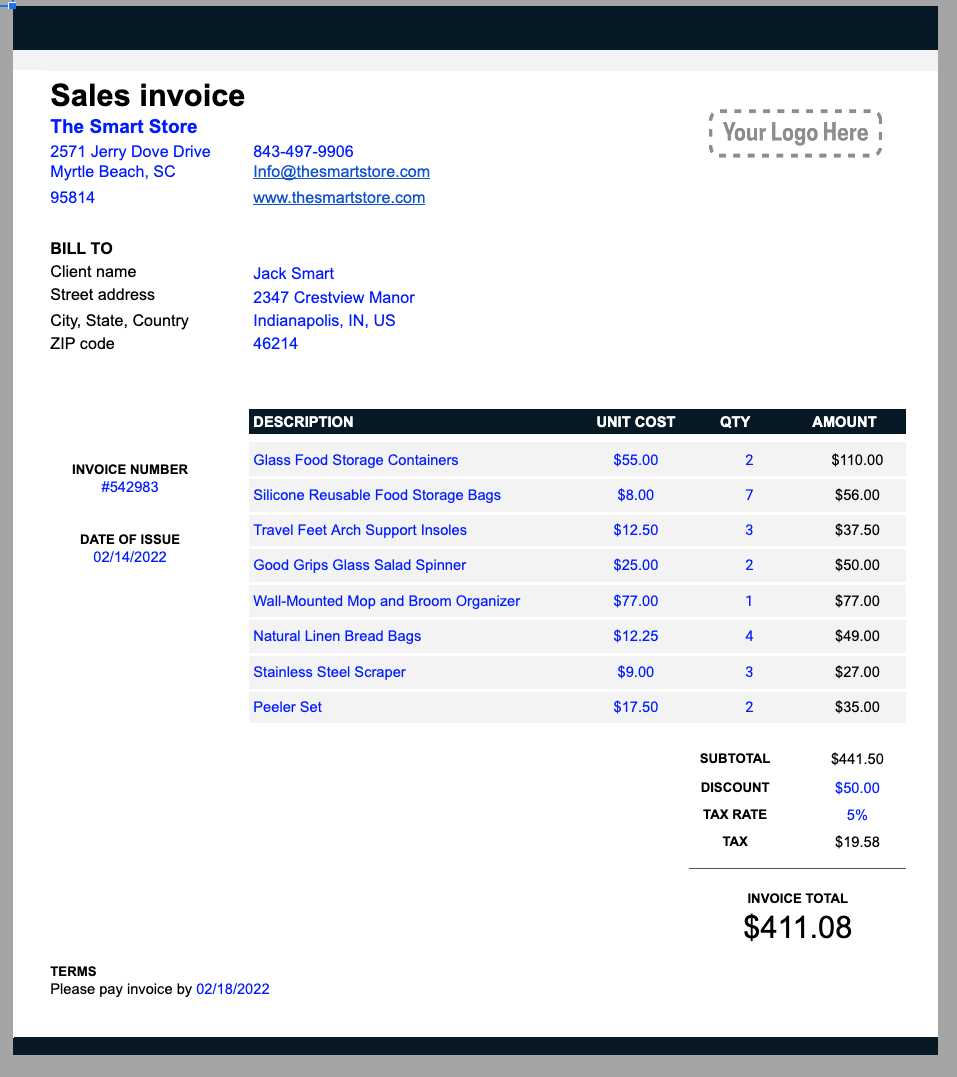

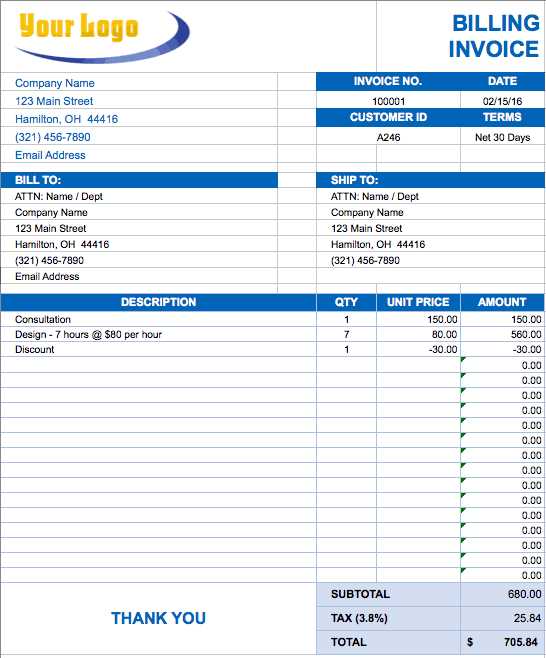

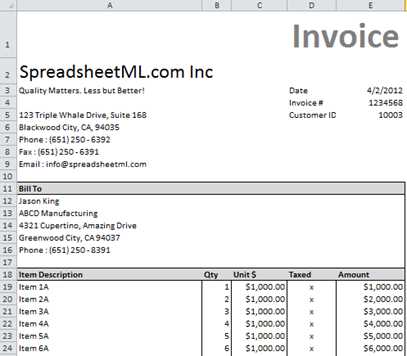

To begin, it is important to choose the right structure for your financial document. This should include spaces for essential details such as your business name, client information, date of issue, and an itemized list of services or products provided. Having these elements in place ensures that all required information is included, making the document both functional and professional.

Customizing for Your Needs

Once the basic structure is in place, you can further customize the layout to suit your specific business needs. Add or remove sections as necessary, such as payment terms, discounts, or tax calculations. Customizing the document allows you to align it with your branding, giving it a more personalized touch while ensuring it meets your operational requirements.

Why Use Excel for Invoices

Using a versatile software tool to manage financial records and generate professional documents is a smart choice for many businesses. This tool provides a simple yet effective way to organize key details and automate calculations. Its accessibility, ease of use, and wide range of features make it an excellent choice for businesses of all sizes looking to streamline their financial operations.

Benefits of Using a Spreadsheet for Financial Records

Spreadsheet software offers several advantages for those looking to create clear and accurate billing documents:

- Customization: Easily modify the structure to fit your needs.

- Automatic Calculations: Built-in functions for adding totals, taxes, and discounts.

- Accessibility: Accessible on multiple devices, allowing for easy updates and sharing.

- Cost-Effective: Often included with office software suites or available for low cost.

Efficiency and Time-Saving Features

Using a well-established tool offers practical features that save time and reduce errors, such as:

- Predefined Fields: Simplified fields for entering basic details.

- Reusable Formats: Save and reuse custom layouts for future documents.

- Data Organization: Easily track payments and balances.

Benefits of Free Invoice Templates

Using a pre-designed document format for creating financial records can offer several advantages, especially for businesses that need a quick and easy way to manage payments and transactions. These documents save time, reduce the need for design work, and ensure that important details are included in each record. The simplicity of ready-to-use formats allows businesses to focus more on their core activities rather than spending time on document creation.

Key Advantages of Pre-Designed Formats

There are many benefits to adopting ready-made document designs, such as:

- Time-Saving: No need to start from scratch, allowing for faster document creation.

- Consistency: Ensures a uniform format for all records, which is essential for professional communication.

- Customization: Easily adjust the layout to meet specific business needs without complex software.

- Cost-Effective: Many options are available at no cost, reducing expenses for businesses.

Improved Accuracy and Professionalism

Using established formats can also help enhance the accuracy and overall professionalism of your financial records:

- Built-in Fields: Pre-designed sections help avoid missing essential information.

- Automated Calculations: Many formats offer functions that automatically calculate totals, taxes, and discounts, reducing human errors.

- Clarity: Clean and simple designs make documents easier for clients to read and understand.

How to Download an Invoice Template

Getting started with creating professional financial records is simple when you know where to find reliable resources. Downloading a suitable file is the first step toward building accurate and well-organized billing documents. Many platforms offer easy access to a variety of document formats that you can quickly download and begin using.

Steps to Download a Billing Document

To download a well-structured document for business use, follow these straightforward steps:

- Search for a trusted website that offers customizable billing forms.

- Choose the file format that works best for your needs, such as .xlsx or .csv.

- Click on the download button and save the file to your device.

- Open the file and begin customizing the fields with your business and client details.

Choosing the Right Platform

When selecting a source for your document, consider the following factors:

| Factor | Why It Matters |

|---|---|

| File Compatibility | Ensure the format is compatible with your software to avoid issues when opening the document. |

| Customization Options | Choose a format that allows you to adjust fields according to your business needs. |

| Support & Updates | Look for reliable sources that offer support and occasional updates to keep the documents current. |

Customizing Your Excel Invoice

Once you have your document set up, personalizing it to suit your business needs is the next step. Customizing your billing records allows you to make sure all relevant details are included, ensuring clarity and professionalism. Tailoring the layout and content can help align it with your branding and operational requirements, making it a more effective tool for your financial processes.

Key Elements to Customize

Here are the most important aspects to adjust in your document:

- Business Information: Include your company name, logo, address, and contact details at the top.

- Client Details: Make sure to enter the client’s name, address, and other relevant contact information.

- Service/Product Descriptions: Clearly list the services or products provided, including quantities and unit prices.

- Payment Terms: Add any important payment details, such as due dates and accepted methods of payment.

Additional Customization Tips

For even greater flexibility and professionalism, consider these additional customizations:

- Colors and Fonts: Adjust the colors and fonts to match your business’s branding guidelines.

- Tax and Discount Calculations: Add columns for tax rates or discounts that automatically calculate totals.

- Itemized Breakdown: Use multiple rows or tables to separate different products or services for clarity.

- Notes Section: Include a section for additional comments or special instructions to clients.

Simple Steps to Create Invoices

Creating a professional billing document doesn’t have to be complex. With the right tools, the process can be quick and straightforward. By following a few simple steps, you can ensure that each document is clear, accurate, and meets the requirements of both your business and your clients.

Start by collecting the necessary information. This includes your business details, client information, and a list of services or products provided. Next, decide on the format and structure, ensuring there’s a logical flow to the document that’s easy for clients to follow. Once the structure is set, enter the required information, and make sure to check that all calculations, such as totals and taxes, are correct.

After the basic details are in place, focus on the design and presentation. Use clean formatting to enhance readability, and ensure the document looks professional. Adding your company logo or adjusting the font to match your branding can help reinforce a consistent image.

Finally, save and review the document before sending it to the client. Double-check all fields, especially payment terms and amounts. Once everything looks good, you’re ready to deliver the document, whether electronically or in print.

Tracking Payments with Excel Templates

Keeping track of payments is essential for maintaining clear financial records. Having an organized system in place to monitor received and outstanding payments can help you stay on top of your business’s cash flow. A well-designed document allows you to record each transaction, track payment dates, and easily identify any overdue amounts.

How to Set Up Payment Tracking

To effectively track payments, create a document with columns that include key details such as:

- Client Name: Identify the customer or business making the payment.

- Amount Due: List the total amount that needs to be paid for each transaction.

- Amount Paid: Record how much has been paid by the client.

- Payment Date: Include the date when the payment was received.

- Balance Due: Automatically calculate the outstanding balance after each payment.

Using Built-in Functions for Automation

Most spreadsheet programs offer built-in functions that can automate calculations and help you save time. For example, you can use simple formulas to calculate the balance due by subtracting the amount paid from the total amount owed. Additionally, conditional formatting can highlight overdue payments, helping you quickly identify which clients still need to pay.

Formatting Tips for Invoice Clarity

Clear and professional presentation of your billing documents is essential for effective communication with clients. Well-organized records not only help prevent misunderstandings but also reflect positively on your business. By following some simple formatting tips, you can ensure that your documents are easy to read and understand, making the entire payment process smoother for both you and your clients.

Essential Formatting Tips

Here are some key tips to help improve the clarity and overall appearance of your financial documents:

- Use Clear Headings: Make sure each section is clearly labeled, such as “Client Information”, “Payment Details”, and “Total Due”. This helps readers quickly find the information they need.

- Keep It Simple: Avoid clutter by using clean, simple fonts and spacing. Leave enough space between sections to enhance readability.

- Highlight Key Information: Use bold or underlined text for important details, like payment amounts or due dates, to make them stand out.

- Use Consistent Alignment: Align text and numbers consistently. For example, align all numbers to the right for easy comparison, and use left alignment for text fields.

Additional Design Enhancements

Beyond basic formatting, consider these enhancements to further improve your document’s clarity:

- Gridlines and Borders: Use gridlines or borders around columns and rows to visually separate different pieces of information.

- Color Coding: Consider using soft background colors to differentiate sections, such as payment details or contact information, but avoid overly bright colors that could distract from the content.

- Consistent Font Usage: Stick to one or two fonts throughout the document for a polished, cohesive look.

Invoice Template Features to Look For

When choosing a document for billing purposes, it’s important to select one with the right features that will streamline your workflow. A well-designed billing document should make the process of recording and calculating payments easier and more efficient. By looking for specific elements, you can ensure that the document fits your business needs and helps maintain accuracy in your financial records.

Essential Features for a Billing Document

Here are some important features to consider when selecting a billing document format:

- Customizable Fields: Ensure that the format allows you to easily modify fields to include your business name, client details, and itemized services or products.

- Automatic Calculations: Look for a format that includes built-in formulas to automatically calculate totals, taxes, and discounts, reducing the chance of errors.

- Clear Layout: Choose a design with a clean, logical structure. Sections should be clearly defined, and the information should be easy to follow.

- Professional Appearance: The document should have a polished, business-like appearance, including space for a company logo, contact details, and a well-organized summary of the transaction.

Additional Features to Consider

Beyond the basics, there are other useful features that can improve the functionality of your billing document:

- Multiple Currency Support: If you deal with international clients, look for a format that allows you to switch between currencies easily.

- Tax Rate Adjustments: A flexible document should let you customize tax rates, especially if you operate in different regions or with varying products.

- Due Date Reminders: Some formats include automatic reminders for due dates, helping you track payments and avoid delays.

How to Add Taxes to Your Invoice

When creating billing documents, it’s important to accurately calculate and display taxes. Adding taxes ensures that your clients are aware of the total amount due, including any necessary tax charges. By incorporating tax calculations properly, you ensure compliance with local regulations and maintain transparent financial records.

Steps to Add Taxes

Follow these steps to accurately include taxes in your billing documents:

- Identify the Tax Rate: Determine the appropriate tax rate for your products or services. This may vary based on your location, product type, or service category.

- Calculate the Tax Amount: Multiply the subtotal (the total amount before tax) by the tax rate. For example, if your subtotal is $100 and the tax rate is 10%, the tax amount would be $10.

- Add the Tax to the Total: Once you’ve calculated the tax, add it to the subtotal to get the total amount due. In our example, the total would be $110.

Tax Calculation Tips

To make the process easier, here are a few tips:

- Use Formulas: Many digital formats offer built-in formulas that automatically calculate taxes for you based on the entered rate and subtotal.

- Include Tax Breakdown: Clearly label the tax amount separately on the document so clients can see how it was calculated.

- Check for Tax Exemptions: Ensure that any tax-exempt items or clients are properly noted to avoid applying incorrect taxes.

Invoice Template Compatibility with Devices

When selecting a document for managing billing and financial records, it’s important to consider its compatibility across different devices. Ensuring that your document can be easily opened, edited, and shared across a variety of devices will improve flexibility and accessibility. Whether you’re working from a desktop, tablet, or smartphone, having a solution that functions seamlessly on all devices helps streamline your business processes.

Choosing a device-compatible document format can make it easier to track payments, update client details, and share your records without worrying about technical limitations. It’s essential to select a format that works well across platforms, from office computers to mobile devices, so you can manage your financial records anytime, anywhere.

Using Excel for Multiple Invoice Templates

Managing different types of billing documents can become cumbersome without an efficient solution. One way to streamline this process is by utilizing a single tool to create and manage multiple document formats for various clients, services, or projects. By leveraging advanced functionalities, you can customize and maintain several document layouts within a single program, saving time and reducing the risk of errors.

Benefits of Using One Tool

Using a versatile tool for managing multiple formats offers several advantages:

- Time Efficiency: By organizing multiple document formats within one program, you can easily switch between different layouts without the need to open and manage separate files.

- Consistency: Keeping all your documents in one place ensures uniformity in formatting, design, and structure, making your records look professional and cohesive.

- Easy Updates: Modifying your layout or adding new elements, like fields or calculations, can be done quickly across all formats simultaneously, keeping your records up to date.

How to Manage Multiple Document Formats

Here are some tips for efficiently managing several formats within a single tool:

- Use Sheets for Different Layouts: Each layout can be stored on a separate sheet within a single file. This allows for easy navigation between formats while keeping everything in one place.

- Employ Consistent Formulas: Ensure that formulas for calculations, such as totals and taxes, are applied consistently across all layouts to minimize mistakes.

- Customizable Fields: Design each format with customizable fields to accommodate different billing structures, ensuring that each layout serves your unique business needs.

Common Mistakes When Using Templates

While utilizing pre-designed formats for creating documents can save time and effort, it’s easy to overlook certain details that can lead to errors or inconsistencies. Common mistakes often arise from not fully understanding how the format functions or failing to customize it to suit specific needs. These errors can affect the accuracy and professionalism of your records, leading to confusion or delays in processing.

Being aware of these potential pitfalls allows you to avoid costly mistakes and ensure that your records are as accurate and effective as possible. Below are some of the most frequent issues users encounter when working with document formats.

- Leaving Fields Incomplete: One of the most common mistakes is forgetting to fill in all necessary fields. Whether it’s client information, item descriptions, or payment terms, missing details can lead to confusion and incorrect records.

- Using Incorrect Formulas: Another issue arises when users accidentally break formulas or fail to update them for new documents. This can lead to incorrect totals, tax calculations, or other financial errors that may go unnoticed until it’s too late.

- Not Customizing for Specific Needs: Many users fail to adjust the layout or structure to suit their particular business requirements. Failing to personalize the design can make documents harder to read or less effective for clients and accounting teams.

- Overcomplicating the Layout: While customization is important, adding unnecessary complexity can overwhelm the document and make it harder to understand. Keep the layout simple and easy to follow.

- Neglecting to Update for Changes: Another common mistake is not updating the format after changes in business policies or tax rates. Regularly review your documents to ensure they reflect the latest information.

How to Save and Send Invoices

Once you have created your billing documents, it’s essential to know how to store and share them efficiently. Properly saving and sending your documents ensures that your records are secure, accessible, and easily shareable with clients or colleagues. Whether you’re sending them electronically or printing them out, understanding the best practices for both saving and sharing your documents is key to smooth operations.

Saving Your Documents

Here are some important tips for storing your documents safely and ensuring easy access when needed:

- Choose the Right Format: Save your documents in formats that are widely accessible, such as PDF or a digital format that preserves the layout and data. This makes it easier for clients to open and review the document on any device.

- Organize Files Efficiently: Create a folder system that makes it easy to locate documents later. Consider organizing files by client, date, or project for better structure and easier searching.

- Backup Your Documents: Always keep a backup of important files, either in the cloud or on an external drive, to protect against accidental loss.

Sending Your Documents

Once your document is saved, it’s time to send it. Here’s how to do it effectively:

- Use Secure Delivery Methods: For sensitive or confidential documents, consider using encrypted email services or secure document-sharing platforms to ensure privacy and data protection.

- Check the Format: Before sending, make sure the document is in a format that can be easily opened and viewed by the recipient. PDFs are often the best choice for this.

- Include a Clear Subject Line: When sending via email, use a clear and professional subject line so the recipient can easily identify the purpose of the message.

- Track Sent Documents: Keep a record of all sent files, including the date and recipient. This helps with follow-ups and ensures you can confirm when the document was sent.

Best Practices for Invoice Design

Creating a well-designed document for billing purposes not only ensures clarity but also promotes professionalism. The structure and layout of your records can influence how they are perceived by your clients, making it essential to pay attention to design details. A clean, easy-to-read format helps avoid confusion and ensures that all necessary information is readily accessible.

Here are some key design principles to follow when crafting your billing documents:

- Keep It Simple and Clear: Avoid clutter by focusing on essential information. Use a clean layout with adequate spacing to make the document easy to read and navigate.

- Use Professional Fonts: Select fonts that are legible and professional. Avoid decorative fonts that may distract from the content, opting for simple, standard fonts like Arial or Helvetica.

- Highlight Key Information: Make sure important details such as totals, payment terms, and due dates are easily visible. You can use bold or larger font sizes for these elements to draw attention.

- Include Consistent Branding: If you have a business logo or specific color scheme, incorporate these elements to maintain consistency with your brand identity. This adds a level of professionalism and makes your documents easily recognizable.

- Group Information Logically: Organize your content into clear sections such as client details, itemized costs, and payment instructions. This ensures that the document is intuitive and easy to follow.

- Use Tables for Itemized Lists: Tables can help structure itemized lists of services or products, making it easier for the recipient to review each charge. Ensure that columns are well-aligned and information is formatted neatly.

Updating Your Template for Business Growth

As your business expands, the tools you use for managing financial transactions need to evolve as well. Whether you’re adding new services, reaching new customer segments, or improving internal processes, it’s important to update your billing documents to reflect these changes. Regular updates ensure that your records remain efficient, accurate, and professional as your business scales.

Here are some strategies to keep your financial documentation up-to-date as your business grows:

1. Reflect New Products and Services

As you introduce new offerings or modify existing ones, make sure your billing documents capture these updates. Clearly list all new items, including descriptions, pricing, and applicable taxes. This not only improves clarity but also reduces the chance of errors when processing payments.

2. Adapt to Changing Business Needs

Your company’s structure and needs may change over time, and your financial documents should adapt accordingly. This could involve adding new sections for discounts, advanced payment options, or more complex pricing structures. Ensure that your document layout is flexible enough to accommodate these changes without becoming overly complicated.

- Review Business Information: Ensure that all company contact details, tax identification numbers, and bank account information are current and accurate.

- Incorporate Branding Updates: As your brand evolves, update your logo, color scheme, and fonts to match your latest identity, maintaining consistency across all communication channels.

- Integrate Advanced Features: As your business grows, consider integrating automated features like automatic tax calculations or currency conversion, which can save time and reduce the likelihood of errors.

By keeping your financial documentation aligned with your business growth, you ensure that your clients have a smooth and professional experience, while streamlining your internal processes for increased efficiency.

Alternatives to Excel Invoice Templates

While spreadsheets are a popular option for creating financial documents, there are various other tools and solutions available that can offer greater efficiency and customization. Depending on your business needs, some alternatives may provide additional features like automated calculations, cloud storage, and easier integration with other business systems. Exploring these options can help you save time, reduce errors, and improve your overall workflow.

Here are a few alternatives you can consider for creating and managing your billing documentation:

1. Online Billing Software

Cloud-based platforms offer robust tools for generating and tracking payment records. These systems often come with built-in templates, real-time updates, and the ability to send invoices directly from the platform. Additionally, many online solutions integrate with other business management tools, like accounting and customer relationship software, to streamline your operations.

2. Accounting Software

Many accounting platforms, such as QuickBooks or FreshBooks, provide specialized features for creating and managing financial documents. These tools allow you to automate the creation of statements, track expenses, and generate financial reports, making them ideal for businesses that need more than just basic invoicing capabilities.

- Real-Time Updates: Accounting software allows for immediate updates to billing records, ensuring that data is always current.

- Automated Calculations: Many platforms automatically calculate taxes, discounts, and totals, reducing the potential for manual errors.

- Customizable Options: Customize templates and designs to suit your business’s unique requirements.

3. PDF Templates

If you prefer a more straightforward solution, using downloadable PDF forms might be the right choice. These ready-made documents are typically easy to fill out and can be customized with your branding. They offer the advantage of being professional and easy to share, particularly when email correspondence is required.

Choosing the right tool depends on your business’s size, complexity, and specific needs. If your operations require frequent updates, integration with other systems, or higher-level automation, a dedicated solution might be more suitable than traditional spreadsheet options.