Download Free Invoice Templates for Easy Billing

Managing payments and keeping track of financial transactions can often be a time-consuming task for small business owners. Finding a simple yet effective way to handle these processes is essential to maintaining smooth operations and ensuring accurate records. A well-structured document can help you present all necessary details clearly and professionally, saving both time and effort.

Customizable solutions allow you to generate such documents quickly and without hassle, ensuring that every payment request is clear, easy to understand, and well-organized. Whether you’re sending them electronically or in print, having a reliable format ensures you stay on top of your financial management.

Various resources available online offer tools that assist in creating these documents without the need for advanced software or design skills. By utilizing simple yet functional layouts, you can create accurate and professional-looking statements that enhance your business image while keeping your billing process efficient and error-free.

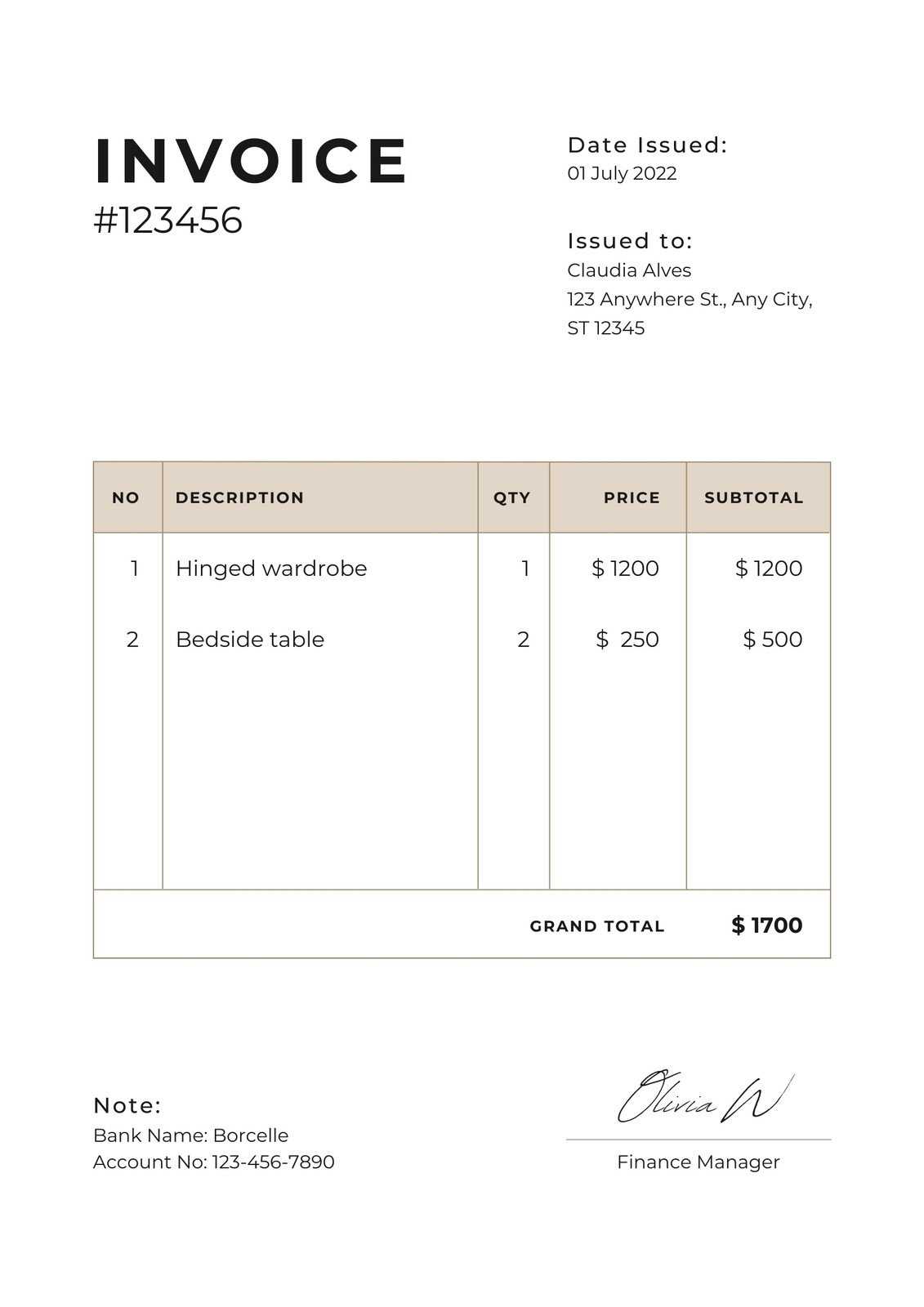

Free Invoice Templates for Your Business

For any business, having an organized method to track payments and manage financial transactions is crucial. There are several straightforward resources available online that allow business owners to create documents that suit their specific needs without starting from scratch. These solutions provide an easy way to ensure that every transaction is documented correctly and professionally, whether for clients or suppliers.

Advantages of Using Ready-to-Use Documents

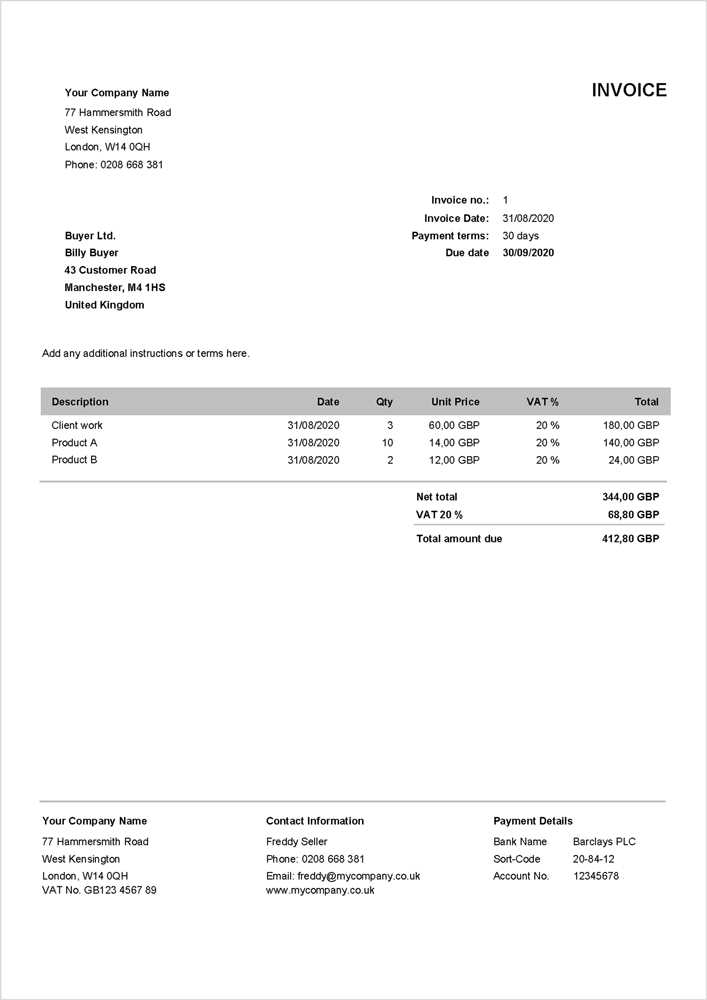

Ready-made solutions can save valuable time and reduce the stress of creating these materials manually. They typically include all the necessary fields and sections, such as contact information, service details, and payment terms, ensuring completeness. With these pre-designed formats, you can maintain consistency in your communications and avoid errors that could lead to confusion or delayed payments.

Customization and Flexibility

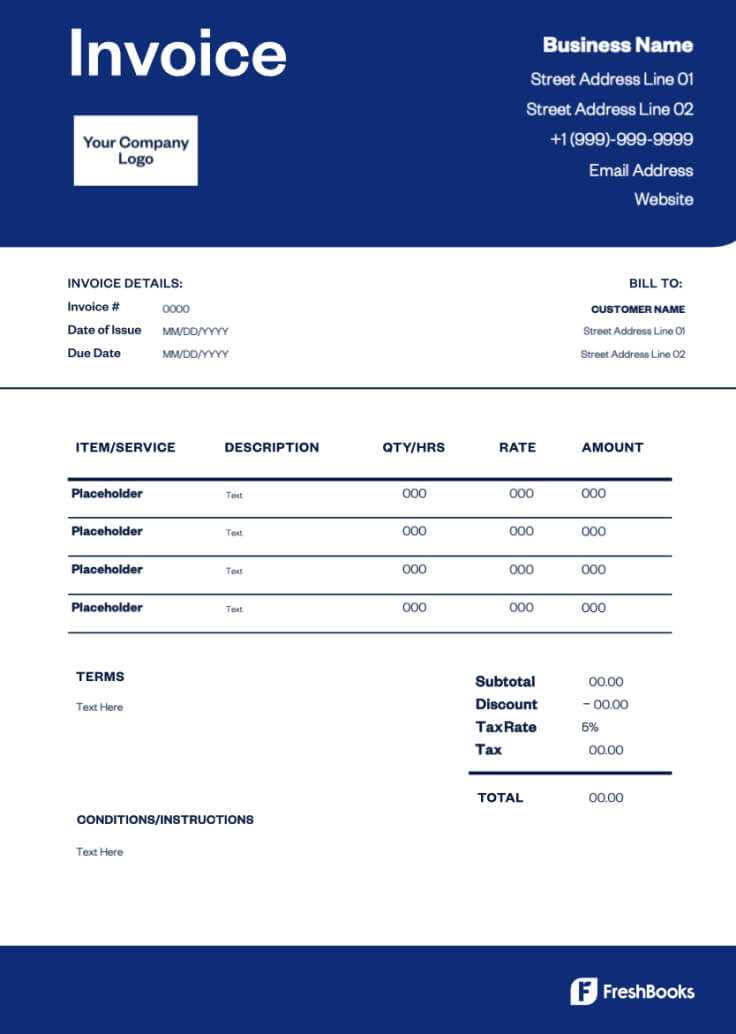

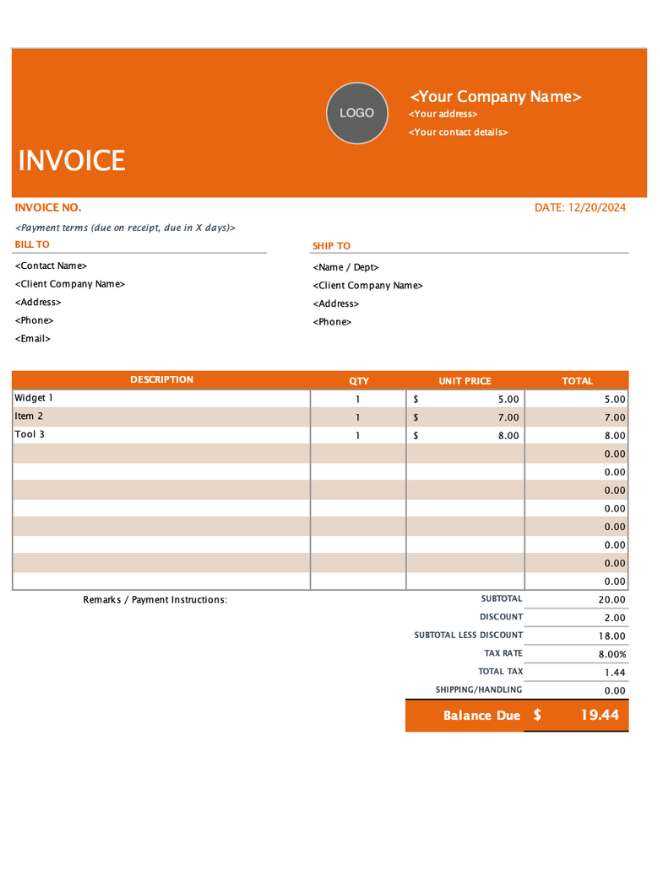

These resources also offer customization options, allowing you to adjust the layout and content to match your business style. Adding your company logo, adjusting color schemes, or modifying payment terms are simple tasks. This flexibility ensures that the documents not only meet your practical needs but also reflect your brand identity.

How to Choose the Right Template

Selecting the appropriate format for your business documents is a crucial step in maintaining professionalism and clarity in your financial communications. It’s important to find a layout that meets your specific needs while ensuring that all necessary information is clearly presented. The right choice can help streamline your workflow and leave a positive impression on your clients.

Consider Your Business Needs

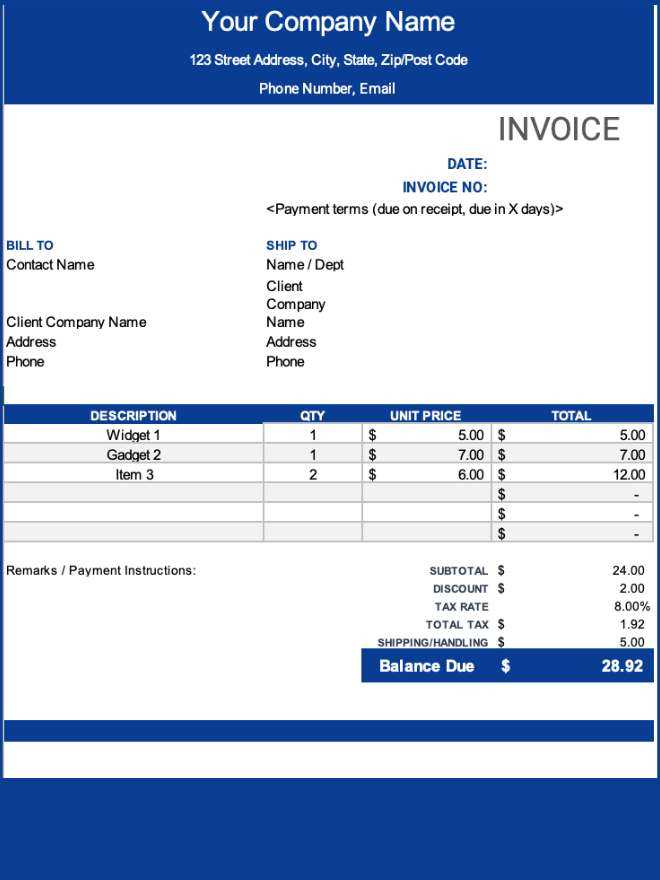

Before choosing a format, think about the type of services or products you provide and the level of detail required for your documents. Some businesses may need a simple structure with just the essential details, while others might require more complex fields to account for varying pricing, taxes, or multiple items. Ensure that the format you select can accommodate your requirements without overcomplicating things.

Look for Customization Options

Flexibility is another important factor. The ideal solution should allow you to customize key elements such as fonts, colors, and logos. This enables you to maintain a consistent brand image and create documents that reflect your business’s identity. Additionally, check if the format allows you to easily update or adjust fields based on your changing needs.

Benefits of Using Free Templates

Utilizing ready-made formats for business documentation can offer numerous advantages, especially for small businesses looking to save time and resources. These accessible solutions simplify the process of creating important documents, allowing you to focus on other critical aspects of your business. They offer both efficiency and professionalism without the need for specialized software or skills.

Cost Efficiency

One of the most significant benefits of using these resources is the cost-saving aspect. By opting for readily available formats, businesses avoid spending money on expensive software or professional services for document creation. These tools are often accessible at no cost, making them ideal for entrepreneurs or startups with limited budgets.

Time-Saving and Convenience

Ready-made documents can be created in just a few clicks, significantly reducing the time spent on drafting and formatting. This means you can focus on more important tasks like customer service, product development, or marketing. The convenience of having pre-organized structures allows you to instantly produce consistent and high-quality materials.

Table of Key Advantages

| Benefit | Explanation |

|---|---|

| Cost-effective | No need for expensive software or professional services. |

| Quick and easy | Ready-to-use structures can be filled in quickly. |

| Professional appearance | Well-designed formats ensure consistency and clarity. |

| Customizable | Easy to adjust for individual needs or branding. |

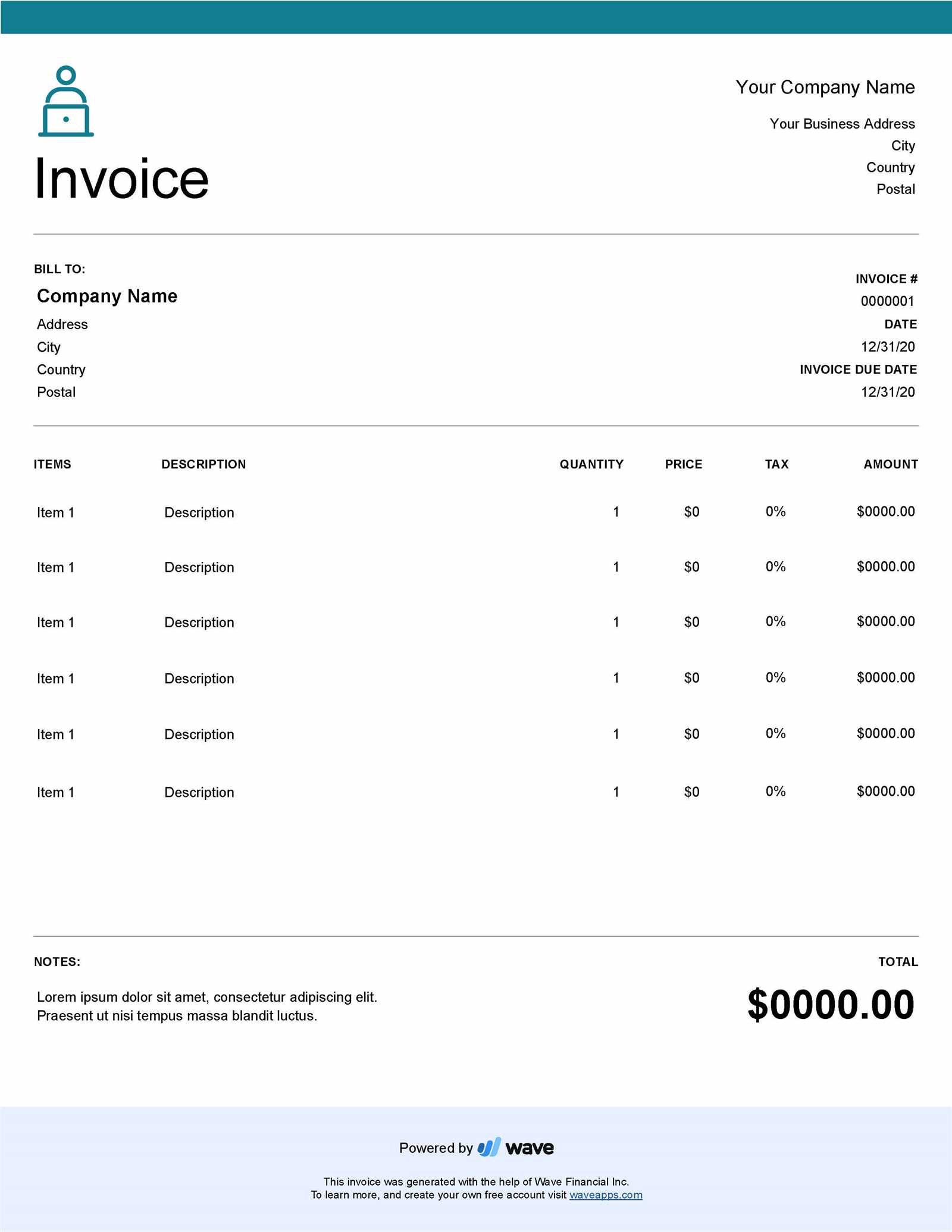

Where to Find Invoice Templates Online

There are many reliable sources available online where business owners can access ready-to-use formats for generating important business documents. These platforms offer various styles and designs, allowing you to choose one that fits your specific needs. Whether you need a simple layout or something more complex, there is likely an option that suits your requirements.

Online Document Generators

Numerous websites provide online document creation tools that let you build, customize, and save your business paperwork quickly. These platforms often have a wide selection of ready-made structures to choose from, which you can personalize with your details. Some even allow you to fill out and send documents directly from the website, streamlining your workflow further.

Business Resource Websites

Many websites focused on business solutions offer these documents as part of their service. These platforms may feature a collection of various business resources, including accounting forms, contracts, and payment receipts. Searching for business resource websites or accounting platforms can lead you to comprehensive libraries of useful materials.

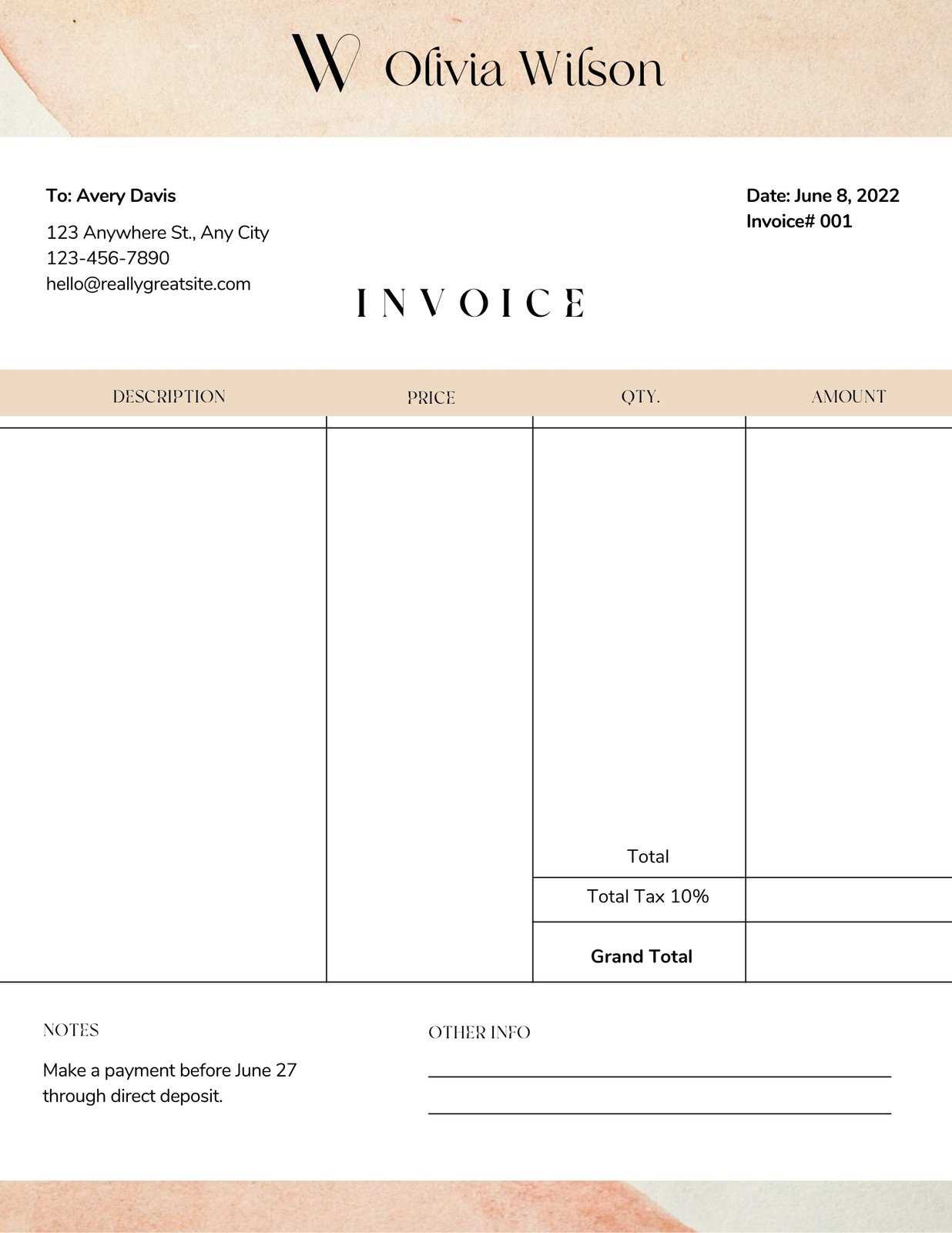

Customizing Your Invoice Template

Personalizing the layout for your business documents allows you to better reflect your brand and ensure all necessary details are clearly visible. Customization options enable you to adjust the structure, colors, and fields to suit the specific needs of your business while maintaining a professional appearance. By making these changes, you can create a more engaging and functional tool for managing transactions.

Key Customization Options

When tailoring your document, consider what elements need to be emphasized. Customizing sections such as the header, footer, or payment terms allows you to highlight important details such as your business logo, contact information, or due dates. Personalization can also include adjusting fonts and colors to align with your brand identity.

Choosing the Right Layout

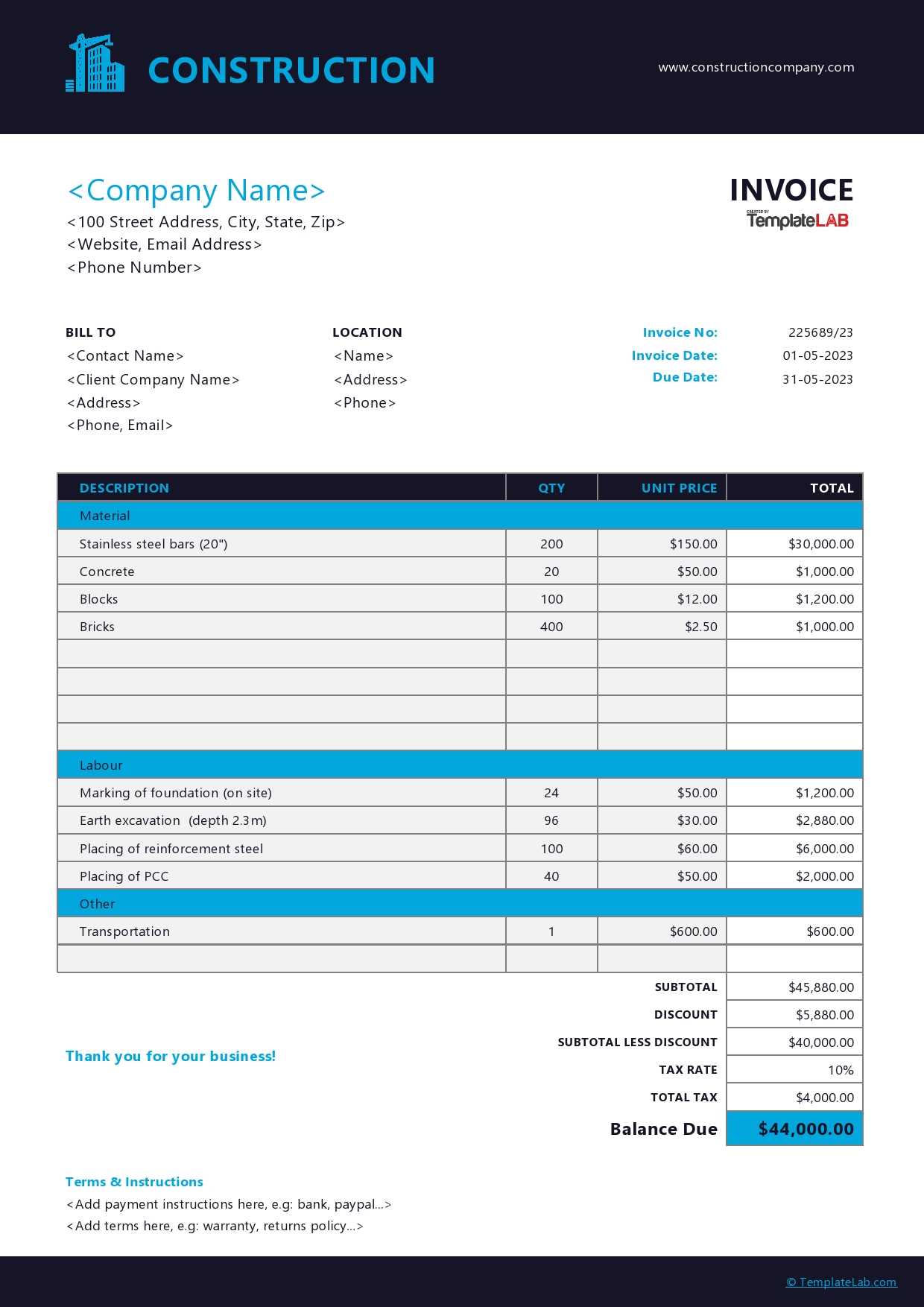

The layout of your document should be clear and intuitive. Depending on your needs, you may want to opt for a simple, minimalist design or a more detailed one that includes extra fields for taxes, discounts, or multiple items. Flexibility is key, as different businesses have different requirements for presenting their financial information.

Table of Customization Features

| Customization Feature | Benefit |

|---|---|

| Header | Includes your logo and business information for clear identification. |

| Footer | Can include payment terms, additional notes, or contact details. |

| Colors and Fonts | Aligns with your brand’s visual identity, creating consistency. |

| Sections and Fields | Allows inclusion of necessary details like taxes, discounts, or due dates. |

Essential Elements of an Invoice

When creating a document to request payment, it’s important to include certain key details that ensure clarity and professionalism. A well-structured layout provides all necessary information, making it easy for both parties to understand the terms and prevent confusion. These fundamental elements contribute to a smooth transaction process and foster positive business relationships.

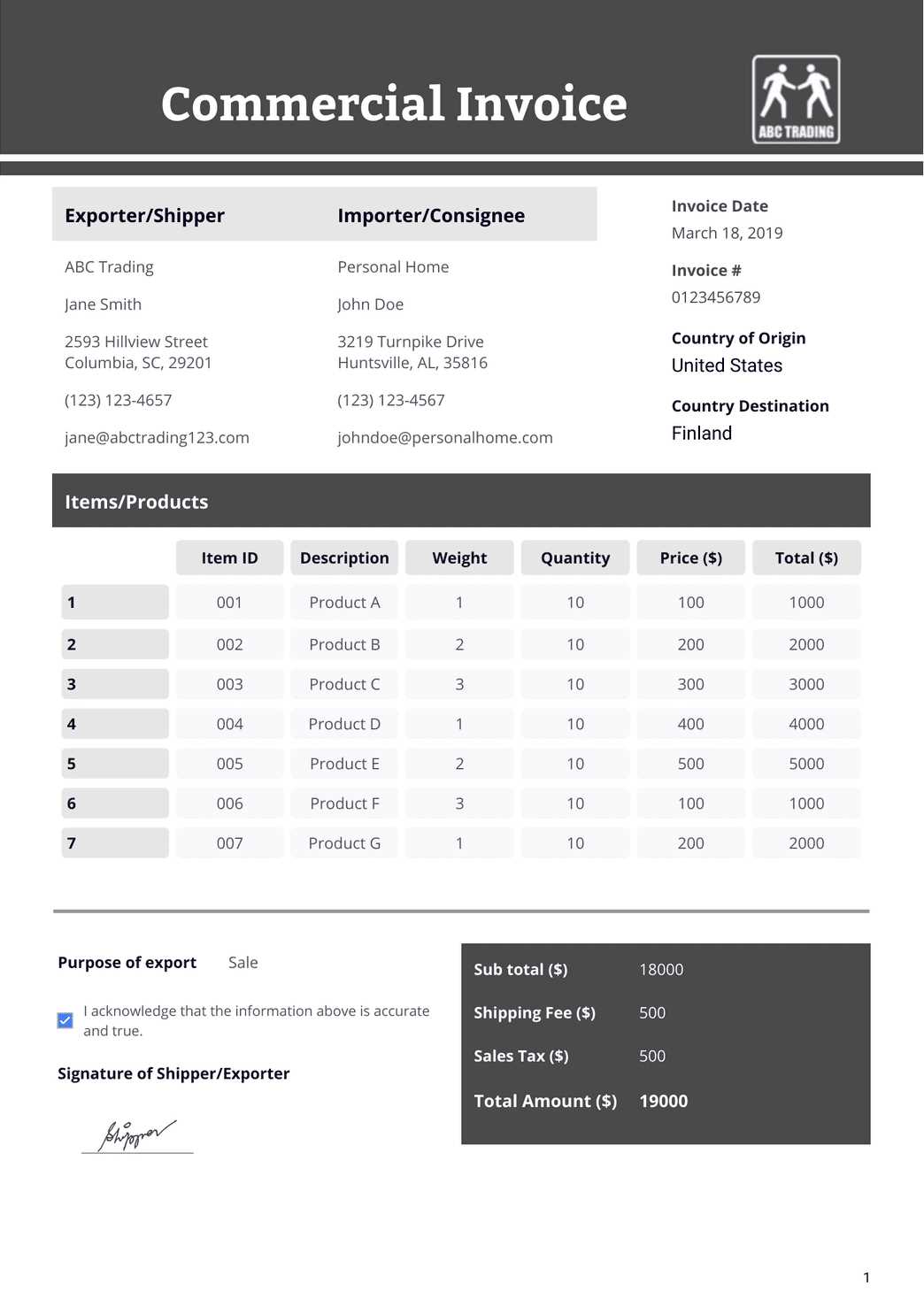

Key Information to Include

Each document should contain the following details to be complete and legally valid. These are the essentials that provide a clear record of the transaction and ensure proper documentation for both the sender and receiver:

- Business Information: Include your company name, address, phone number, and email for easy contact.

- Client Details: Make sure to add the client’s name, address, and contact information.

- Date and Number: Every document should have a unique identification number and the date it was issued.

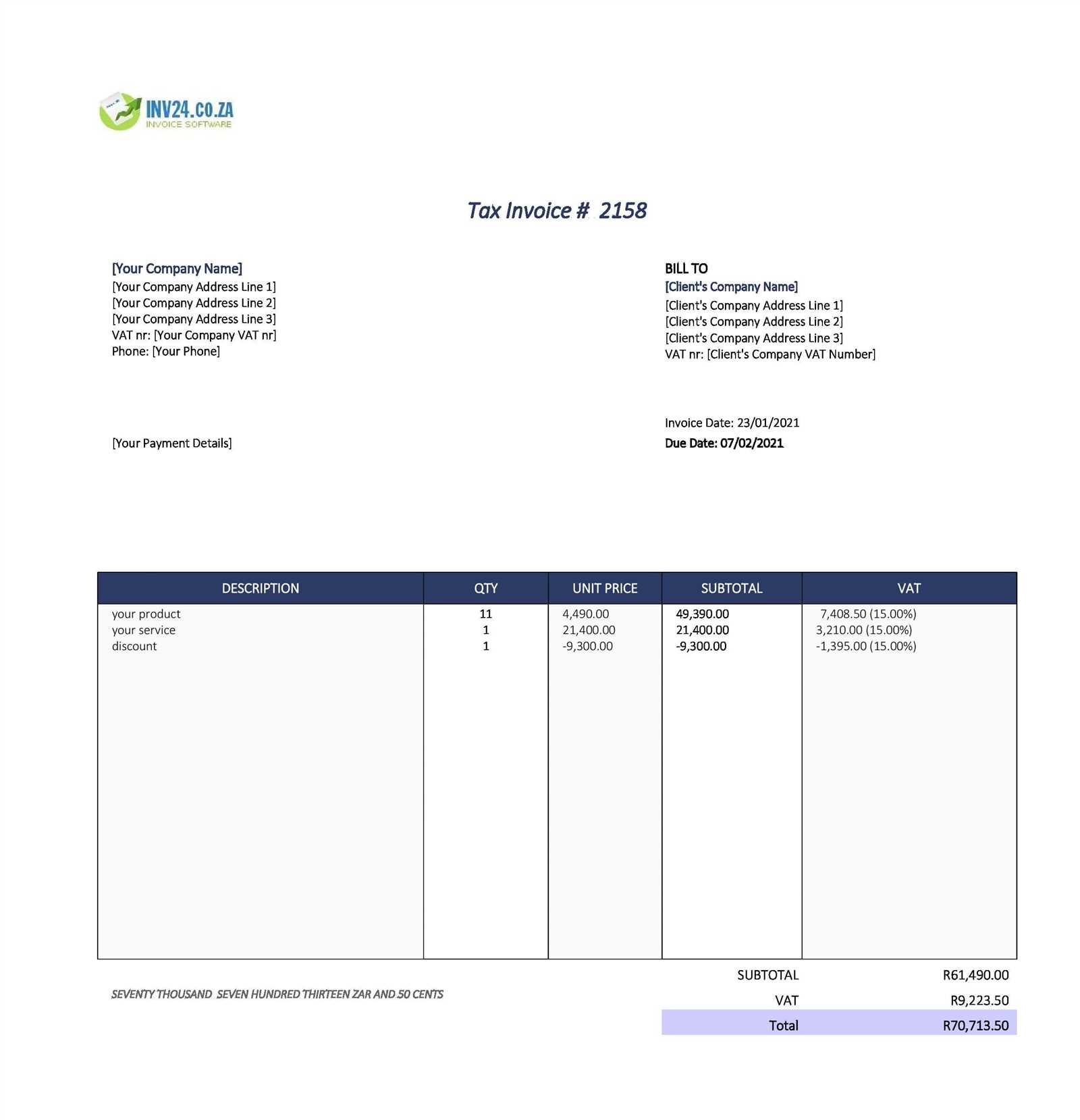

- Description of Goods or Services: A clear breakdown of what is being billed for, including quantities, prices, and any relevant details.

- Payment Terms: Specify the payment due date, accepted methods, and any late fees or discounts for early payment.

- Total Amount: Clearly state the total amount due, including taxes and any additional fees.

Additional Helpful Details

While the basic elements are critical, you can also include extra details that improve communication and provide further clarity:

- Purchase Order Number: If applicable, include this to link the payment request to a specific order.

- Notes or Special Instructions: Add any additional comments, such as delivery information or special terms.

- Tax Identification Number: For businesses that require it, including a tax ID can be important for legal purposes.

How to Save Time with Templates

Using pre-designed formats can significantly streamline your workflow, especially when managing repetitive tasks like generating business documents. These ready-made structures save time by eliminating the need to create each document from scratch, allowing you to focus on other important tasks in your business. With just a few adjustments, you can quickly produce professional documents that are both consistent and accurate.

Efficiency in Document Creation

By utilizing structured layouts, you can save a great deal of time on formatting and organizing content. Instead of deciding where to place each section or worrying about proper alignment, you simply input the necessary information into a pre-designed framework. This efficiency leads to faster processing times, enabling you to handle more transactions in less time.

Consistency Across Documents

Another time-saving advantage is maintaining consistency across all your business documents. When you use the same layout each time, you ensure that all essential details are included and correctly formatted. This not only reduces the chance of errors but also ensures that your communications appear professional and polished every time you create a new document.

Free vs Paid Invoice Templates

When selecting a format for your business documentation, it’s important to weigh the pros and cons of different options. Some solutions are available at no cost, while others require a financial investment. While both types can serve the same purpose, the quality, customization options, and features can differ, influencing the choice for your business’s needs.

Advantages of Free Formats

Free solutions are often accessible and quick to implement. They provide basic structures that can be used immediately without the need for additional investment. For small businesses or startups with tight budgets, these options offer a practical way to handle transactions without incurring extra expenses. However, they might be limited in terms of design or customization.

Benefits of Paid Formats

Paid solutions, on the other hand, typically offer a greater range of features, including advanced customization, professional designs, and additional functionalities such as integrated payment tracking or reporting tools. For businesses looking to present a polished, branded image, investing in a premium format can provide long-term value and save time in the long run by offering more tailored options.

Best Formats for Invoice Templates

Choosing the right document structure is crucial for presenting clear and professional business records. Depending on your needs, different formats offer varying levels of customization and functionality. Selecting the ideal layout will ensure your documents are easy to understand and align with your business practices.

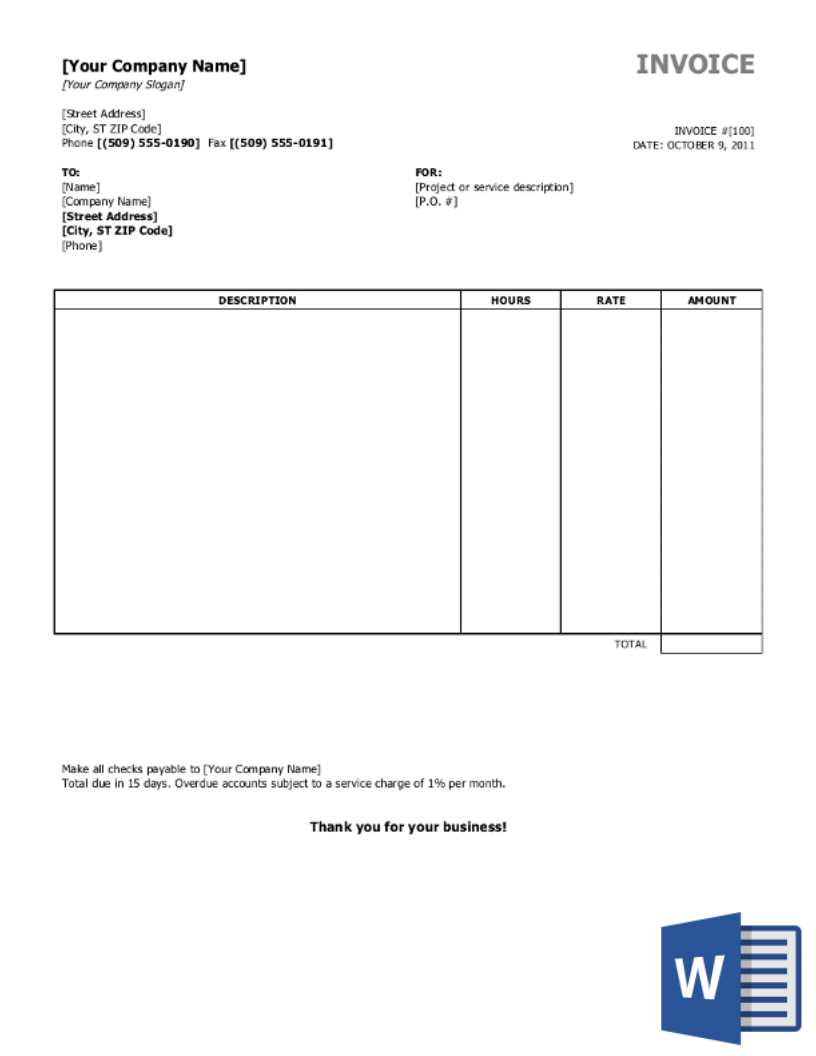

Some of the most commonly used formats for business records include editable Word documents, spreadsheets, and PDF files. Each format has its unique benefits, from flexibility and easy edits in Word, to the data management capabilities in spreadsheets, and the consistency of a finalized, uneditable PDF. Depending on how you manage your business transactions, one format may be more suitable than the others.

Creating Professional Invoices Quickly

Generating polished and accurate business documents doesn’t have to be a time-consuming task. With the right tools and a well-organized process, you can create professional records efficiently, without sacrificing quality. By utilizing pre-established structures and understanding the key elements required, you can streamline the process and ensure your documents are always consistent and reliable.

To speed up the creation process, use systems that allow for easy customization and automatic calculations. This eliminates the need to manually format and total amounts each time. Below is a simple guide for organizing the content to create well-structured documents quickly:

| Step | Action |

|---|---|

| Step 1 | Choose a suitable layout or framework for your document. |

| Step 2 | Input the necessary client and transaction information into the predefined fields. |

| Step 3 | Review the details for accuracy and make any necessary adjustments. |

| Step 4 | Save or send the document as needed, ensuring all elements are aligned correctly. |

By following these steps and using accessible tools, creating high-quality documents can be a quick and hassle-free task.

How to Download Invoice Templates Safely

When obtaining business documents from the internet, it’s essential to ensure the sources are reliable and secure. Downloading files from untrusted websites can expose your business to unnecessary risks, such as malware or corrupted files. To protect your data and maintain the integrity of your operations, it’s important to take steps to ensure that the materials you access are from reputable platforms.

Choose Trusted Sources

Before downloading any document structure, verify that the website or service provider is trustworthy. Look for established platforms that offer reliable customer support and have positive user reviews. Reputable websites usually provide secure connections (indicated by “https://” in the URL) and offer clear terms of use. Avoid sites that seem suspicious or lack proper contact information.

Use Security Measures

Always ensure your antivirus software is up to date before accessing online files. This will help prevent any malicious software from being installed on your device. Additionally, avoid downloading documents from unsolicited emails or unfamiliar sources, as these could contain harmful content. By following these precautions, you can safely obtain the documents you need without compromising your data security.

Tips for Effective Invoicing

Properly managing your business’s documentation is essential for smooth financial operations. A well-organized system not only ensures that payments are received on time but also helps maintain professional relationships with clients. Below are some best practices to enhance the effectiveness of your business records and streamline your billing process.

Be Clear and Detailed

One of the most important aspects of creating accurate business records is to ensure all the necessary details are included. Make sure that the document clearly outlines services rendered, payment amounts, and any applicable terms. This transparency helps avoid confusion and reduces the chance of disputes later on. Always double-check for accuracy before sending out any document to clients.

Set Clear Payment Terms

Setting clear payment terms is key to ensuring timely payments. Specify due dates, late fees, and accepted payment methods upfront. This not only helps clients know when and how to pay but also establishes your expectations, minimizing delays in receiving funds. Using consistent payment terms helps clients understand your policies and reduces follow-up reminders.

Keep It Professional

Maintain a consistent and professional tone in your documents. Use formal language and ensure the layout is clean and easy to read. This gives your business a polished appearance and builds trust with clients. A well-structured document reflects the seriousness and reliability of your business, ensuring that you come across as organized and competent.

Common Invoice Mistakes to Avoid

When managing business records, small errors can lead to bigger issues, such as delayed payments or misunderstandings with clients. Even minor mistakes in document preparation can cause confusion, potentially affecting your cash flow and professional reputation. By being aware of common pitfalls, you can avoid unnecessary complications and maintain a smoother financial process.

One of the most frequent mistakes is failing to include all necessary details, such as correct client information, accurate amounts, and clear descriptions of the services provided. Incomplete or unclear records can cause delays as clients may need clarification or dispute the amounts. Always ensure everything is detailed and precise before finalizing any document.

Another common error is neglecting to specify clear payment terms. Without a clear due date or instructions on how to make the payment, clients may not understand your expectations, leading to delayed or missed payments. Always include payment deadlines and preferred payment methods to avoid confusion.

Additionally, some businesses overlook the importance of consistency. Using different formats or layouts for your records can confuse clients and make your operations appear unorganized. Stick to a consistent structure to help build trust and make your billing process more efficient.

How Templates Improve Payment Accuracy

Maintaining precise records is essential for ensuring timely and accurate payments. Using structured formats can significantly reduce errors and streamline the billing process. By following a consistent layout, you can ensure that all necessary details are included, which ultimately helps clients understand exactly what they owe and when they need to pay.

When a standard format is used for every transaction, it minimizes the risk of forgetting critical information such as payment amounts, service descriptions, or due dates. This consistency leads to fewer disputes and misunderstandings, ensuring that clients have all the information they need at a glance, reducing the likelihood of delayed payments.

Additionally, pre-defined layouts often include fields that help businesses stay organized. Automatically calculating totals or adding applicable taxes can prevent human errors and ensure that the amounts provided are correct. This attention to detail increases accuracy and fosters a smoother financial process.

Using Templates for International Billing

When dealing with clients from different countries, it’s essential to maintain clarity and consistency in your financial documentation. A standardized approach can help you overcome language barriers, currency differences, and varying tax regulations. By using structured formats, you ensure that all required information is clearly presented, no matter where your clients are located.

International transactions often involve additional complexities, such as foreign exchange rates, cross-border taxes, and multiple currencies. A well-organized document can easily accommodate these factors by including necessary fields for currency conversions, tax codes, and international payment options. This ensures that clients fully understand the details of the transaction and how much they owe, reducing the chances of errors or delays in payment.

Furthermore, consistent formatting makes it easier to adapt your billing practices to various countries’ legal and financial requirements. By having a template designed to be flexible and customizable, businesses can ensure they comply with local regulations while still maintaining a professional, uniform approach to invoicing.

How to Print and Share Your Invoice

Once you have completed your financial document, it’s important to share it with your client in a professional and efficient manner. Whether you prefer to send it digitally or provide a physical copy, ensuring that the document is clear and accessible is essential for smooth transactions. Knowing how to properly print and distribute your records can prevent misunderstandings and delays in payment.

For those opting to send a hard copy, ensure that the document is printed in a high-quality format, free of any errors or smudges. Check that all details, such as amounts, dates, and client information, are easily readable. It’s a good practice to include clear instructions on how the client can make their payment. If you’re printing multiple copies, consider using carbonless paper for a professional touch.

When sharing digitally, ensure that the file is in a widely accessible format, such as PDF, which preserves the layout and content. You can send it via email or through a secure online portal. Be sure to check that the file size isn’t too large, and the document remains legible on different devices. Below is an example of key components you might want to include in the digital version:

| Component | Description |

|---|---|

| Client Information | Full name, address, and contact details |

| Itemized List | Details of services or products provided |

| Due Date | Clear statement of when payment is expected |

| Payment Methods | Instructions for making payments, including options |

By following these guidelines, you can ensure that your document is both professional and easy for your clients to review, leading to more efficient and timely transactions.