Invoice for Work Done Template to Simplify Your Billing Process

Effective documentation is crucial for ensuring clear communication between service providers and their clients. Having a structured format for outlining the details of services provided helps both parties stay organized and maintain a smooth financial relationship. Whether you are a freelancer, small business owner, or contractor, using a standardized approach for invoicing can simplify the payment process and enhance your professional image.

Crafting a clear and precise billing statement includes specifying the services rendered, the agreed-upon rates, and any applicable terms. A well-structured form can not only ensure transparency but also make it easier to track payments and outstanding balances. By using the right structure, you can minimize confusion, avoid errors, and improve your chances of getting paid on time.

In this guide, we explore how to create a document that meets your needs, helping you get paid efficiently and professionally. A well-organized layout can streamline your administrative tasks and save you time, letting you focus more on what you do best. Whether you’re starting fresh or looking for ways to improve your current methods, having a customizable form is essential for a smooth billing experience.

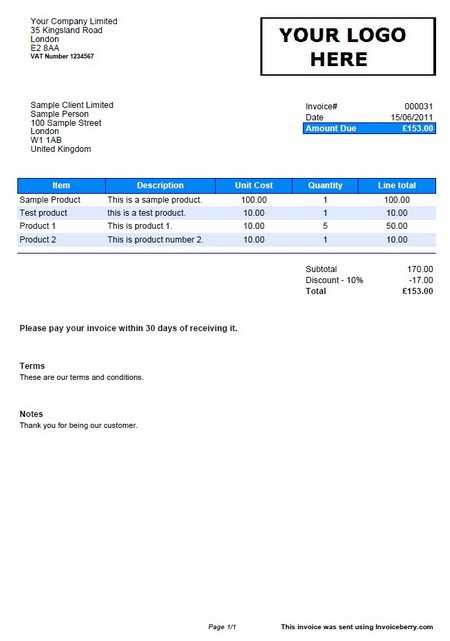

Invoice for Work Done Template Overview

Having a clear, organized method to document services rendered is essential for any business or freelancer. A well-structured document allows you to communicate the scope of the project, the agreed-upon compensation, and the terms of payment in a professional manner. This structured approach not only enhances your credibility but also ensures that both parties have a mutual understanding of expectations, reducing the potential for disputes.

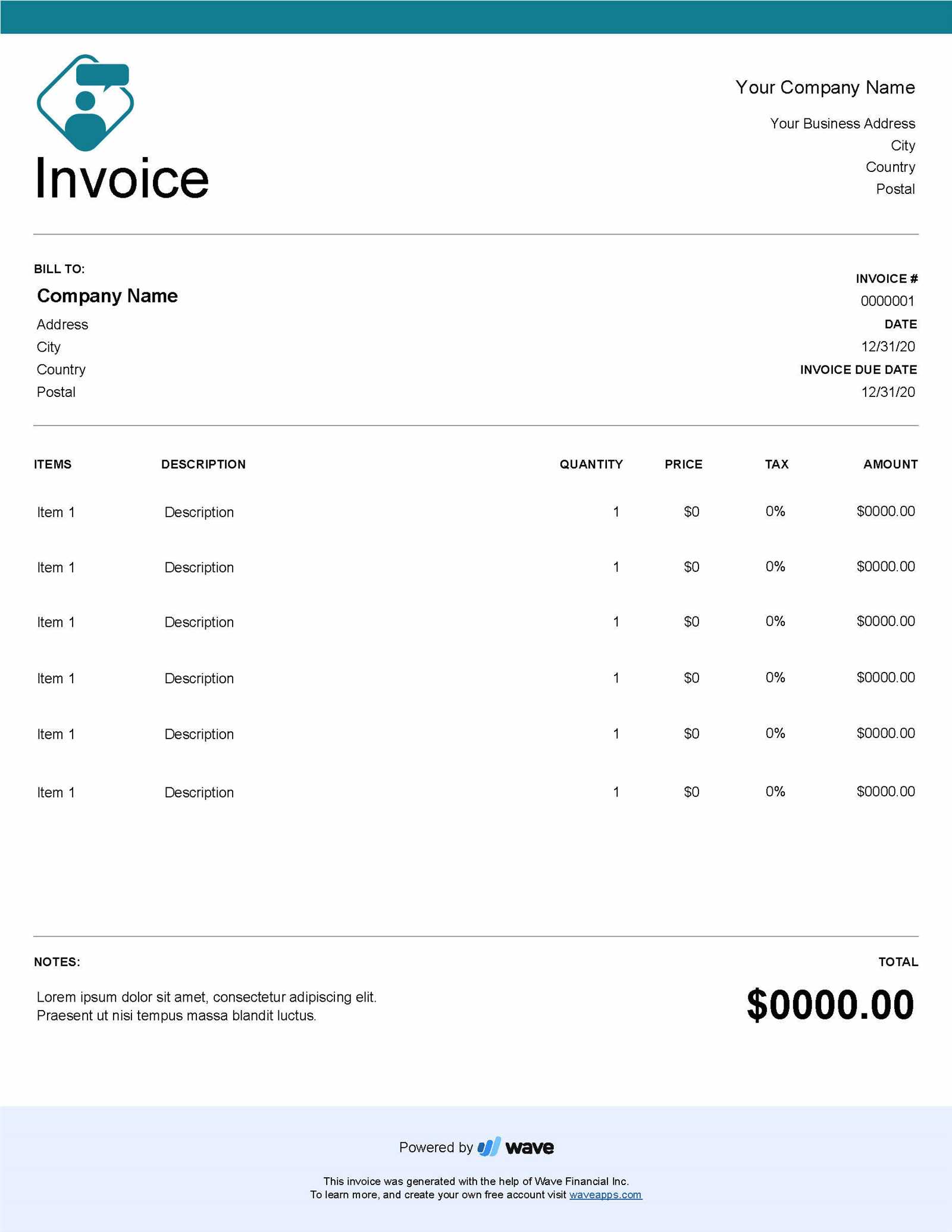

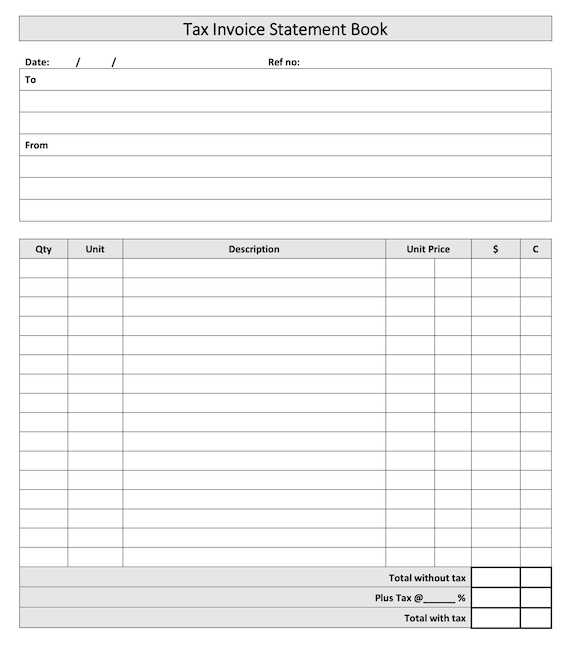

With the right layout, you can easily include essential details such as client information, itemized services, payment deadlines, and applicable taxes. This kind of document also helps in maintaining a proper record of transactions, which can be essential for future reference or tax purposes. The ability to customize such a document according to different types of services ensures that it fits a wide range of needs, whether for one-time projects or ongoing engagements.

By using an easy-to-adapt format, you save time and effort in creating new records each time you need to bill a client. Moreover, consistency in your billing process makes it easier to manage finances and maintain professionalism throughout your interactions with clients. This method is especially useful for small businesses or independent contractors looking for a straightforward way to handle transactions effectively.

Why You Need an Invoice Template

Having a standardized method to document and request payment is essential for ensuring that both you and your clients stay on the same page. It streamlines communication, making it clear what services were provided, the corresponding costs, and the payment terms. Without a consistent format, there is a higher chance of confusion or missed payments, which can affect your cash flow and business operations.

Using a predefined structure saves time and effort by eliminating the need to create a new record from scratch each time. It also ensures that all necessary details, such as contact information, service descriptions, rates, and deadlines, are included, which helps avoid oversight. This clarity can prevent misunderstandings and help establish a more professional relationship with your clients.

Additionally, a well-organized document can serve as a record for both parties, providing a reference point in case of any future disputes or questions regarding the transaction. By using an easy-to-customize structure, you can maintain consistency across all of your client interactions, improving your workflow and making your business look more polished and reliable.

Key Features of a Work Invoice

A professional document requesting payment should contain several essential components to ensure clarity and accuracy. These elements help both the service provider and the client understand the terms of the transaction, reducing the likelihood of disputes and ensuring prompt payment. Here are the key features that should be included in every document of this nature:

- Contact Information: The full names, addresses, and contact details of both the service provider and the client.

- Unique Reference Number: A unique number or code to identify the document for record-keeping purposes.

- Description of Services: A detailed list of the services provided, including dates and any specific tasks completed.

- Payment Amount: The agreed-upon fee for the services, clearly itemized to show individual charges if applicable.

- Payment Terms: A section outlining when payment is due, accepted payment methods, and any late fees if applicable.

- Taxes: Any applicable tax rates and amounts clearly stated, ensuring both parties are aware of their obligations.

- Due Date: The date by which payment should be made to avoid penalties or delays.

By including these features, you create a well-organized and clear document that ensures both parties understand their responsibilities, reducing confusion and streamlining the payment process. These elements can be customized to fit different types of services or client needs, offering flexibility while maintaining professionalism.

How to Customize Your Invoice

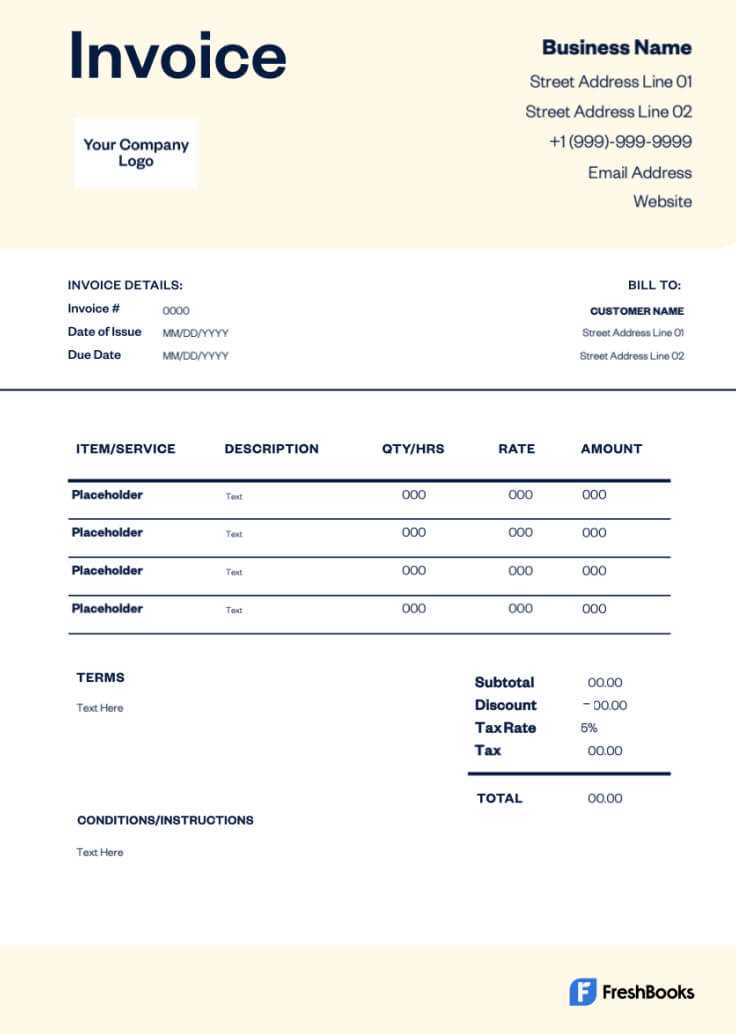

Customizing a billing document allows you to tailor it to the specific needs of your business and clients. Whether you’re offering a one-time service or managing ongoing projects, a personalized format ensures that all relevant details are clearly presented. The process of customizing can involve adjusting the layout, adding or removing sections, and including unique information that reflects your services and client relationships.

Start by modifying the layout to fit your branding, such as including your company logo, color scheme, and fonts. This helps create a professional and cohesive look. Next, adjust the fields to reflect the type of services provided, whether it’s hourly rates, project-based fees, or a combination of both. Ensure that the description section is clear and detailed to avoid confusion about what the charges represent.

Additionally, you can include special notes, payment instructions, or discount offers tailored to specific clients. This level of customization adds a personal touch and can make your billing process feel more professional and thoughtful. By keeping the document adaptable, you ensure it remains flexible for various types of transactions and client preferences.

Free vs Paid Invoice Templates

When it comes to creating a billing document, there are two main options: using free resources or investing in a paid service. Each choice has its advantages and disadvantages, and the right one depends on your business needs, budget, and the level of customization required. Below is a comparison to help you decide which option best suits your needs.

| Feature | Free Option | Paid Option |

|---|---|---|

| Cost | No charge | Subscription or one-time fee |

| Customization | Limited, often template-based | Highly customizable, advanced features |

| Ease of Use | Simple, minimal design | User-friendly, with more professional designs |

| Features | Basic fields, limited functionality | Advanced options like tax calculations, reporting, automatic reminders |

| Support | Community-based or none | Dedicated customer support |

Free options are often simple and straightforward, suitable for freelancers or small businesses with basic billing needs. However, paid options provide more advanced features, such as automatic calculations, branding customization, and integration with accounting software, making them ideal for larger operations or those who require more flexibility and support.

How to Add Payment Terms

Clearly defining payment terms is crucial for ensuring that both you and your client are on the same page regarding expectations for payment. This section outlines the key elements that should be included to make payment terms clear and enforceable. It is important to specify the timeline, methods, and any penalties associated with late payments.

- Due Date: Clearly state the date by which payment is expected. For example, “Payment is due within 30 days of receipt.” This sets clear expectations for both parties.

- Accepted Payment Methods: Specify which payment methods are acceptable, such as bank transfer, credit card, or online payment platforms like PayPal.

- Late Fees: If applicable, outline any fees for late payments. For example, “A 2% late fee will be applied for every 10 days past the due date.”

- Early Payment Discounts: If you offer discounts for early payments, make sure to include the details, such as “5% discount for payments made within 7 days.”

- Payment Installments: If payments are to be made in installments, outline the schedule and amounts due at each stage of the project or service delivery.

By including these details, you provide your client with a clear understanding of when and how payments should be made, which can reduce confusion and ensure timely transactions. Adjusting these terms to fit the nature of the services provided can also improve the efficiency of your billing process and maintain a positive relationship with your clients.

Essential Elements of a Professional Invoice

To create a professional billing document, there are several key elements that should always be included to ensure clarity, accuracy, and professionalism. These elements help both you and your client to fully understand the details of the transaction, reducing the potential for misunderstandings or disputes. Below is a list of the most essential parts to include in every document of this nature.

Key Information to Include

- Contact Details: Both the service provider and the client should be clearly listed with full names, addresses, and contact numbers.

- Unique Identifier: A reference number is necessary for easy tracking and record-keeping. This helps both parties quickly locate the document in the future.

- Description of Services: A detailed breakdown of what was provided, including dates and any specific tasks completed. This ensures transparency and avoids confusion.

- Total Amount Due: The total amount owed should be clearly stated, including any taxes or additional charges.

- Payment Instructions: Provide information on how the client can make the payment, such as bank account details or payment links.

Additional Features for Clarity

- Due Date: Clearly outline the expected payment date to set the right expectations and avoid delays.

- Late Fees: If applicable, mention any additional fees for overdue payments, such as a fixed percentage for each day past the due date.

- Terms and Conditions: Include any other contract

Common Mistakes to Avoid in Invoices

When creating a billing document, small errors can lead to confusion, delayed payments, or even damaged professional relationships. Understanding common mistakes and how to avoid them can ensure a smoother process for both you and your clients. By being mindful of these issues, you can maintain professionalism and ensure that all transactions are clear and efficient.

Typical Errors to Watch For

- Missing or Incorrect Client Information: Failing to include the correct contact details or using outdated information can cause delays in payment or confusion. Always double-check the client’s name, address, and other essential details before finalizing the document.

- Unclear Service Descriptions: Providing vague descriptions can lead to misunderstandings. Clearly list all services, including dates and specific tasks, to avoid disputes later on.

- Incorrect Payment Amounts: Ensure that the total is correct and all discounts, taxes, or additional fees are accurately included. Small discrepancies in the amount due can delay payment or cause frustration.

- Lack of Due Date: Omitting a due date can create confusion about when payment is expected, leading to delays. Always specify the exact date or a specific number of days from the issue date.

Additional Issues to Avoid

- Inconsistent Formatting: A disorganized document can be hard to read and may not convey professionalism. Consistent fonts, clear headings, and organized sections help maintain clarity.

- Failure to Include Payment Terms: Be sure to specify payment methods, due dates, and any penalties for late payments. Not including these details can cause delays and disputes over how and when to settle the bill.

Avoiding these mistakes ensures that your billing process is clear, efficient, and professional. By paying attention to these common

Tips for Writing Clear Descriptions

Clear and precise descriptions are crucial when detailing services or products in any billing document. A well-written description ensures that both you and your client have a mutual understanding of what is being charged and prevents potential confusion. Here are some helpful tips for writing effective descriptions that convey the necessary information clearly and professionally.

Key Guidelines for Effective Descriptions

- Be Specific: Avoid vague terms. Instead of simply saying “consultation,” provide more detail like “Initial consultation to assess project scope” or “Two-hour strategy session on digital marketing.” The more specific you are, the clearer the scope of services becomes.

- Use Simple Language: Keep your language straightforward and easy to understand. Avoid jargon or overly technical terms unless the client is familiar with them. The goal is to make it easy for anyone reading the document to understand the service provided.

- Include Time Frames: If applicable, mention the duration of the service, such as “10 hours of website development” or “3 days of project management.” This helps set clear expectations regarding the effort involved.

- Clarify Quantity and Rate: If your pricing is based on time or quantity, make sure to specify the rate and quantity involved. For example, “5 hours at $50/hour” or “10 units at $10 each.”

Additional Tips for Clarity

- Avoid Over-Complicating the Description: While details are important, don’t overwhelm the client with excessive information. Focus on the essentials–what was provided, how much time it took, and the agreed-upon terms.

- Be Consistent: Ensure that your descriptions follow a consistent structure across all documents. This makes it easier for clients to understand the layout and en

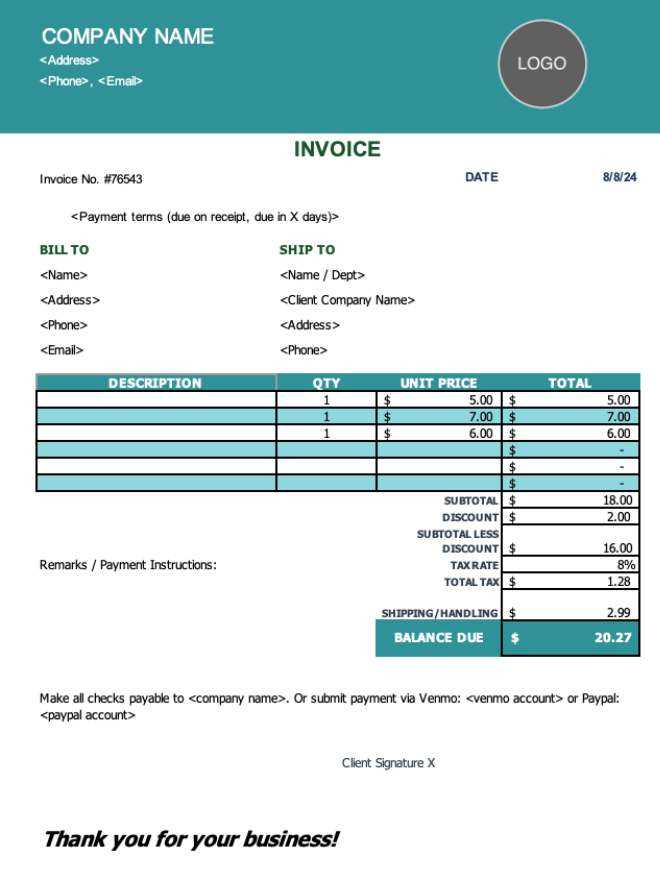

How to Calculate Taxes on Invoices

Accurately calculating taxes is a crucial part of any financial document. Taxes ensure compliance with local and national regulations, while also providing clarity for both the business and the client. Understanding how to apply the correct tax rates, calculate the total amount due, and ensure proper reporting can help streamline the process and avoid errors.

Steps to Calculate Taxes

- Determine the Tax Rate: The first step is to identify the applicable tax rate for your product or service. This rate will vary based on location, type of service, or product, and whether it’s subject to state or local taxes.

- Calculate the Tax Amount: Once you have the tax rate, multiply it by the pre-tax total of the goods or services provided. For example, if the total is $500 and the tax rate is 8%, the tax would be $40 (500 x 0.08).

- Add the Tax to the Total: After calculating the tax amount, add it to the subtotal to get the final amount due. For example, if the subtotal is $500 and the tax is $40, the total due would be $540.

Considerations When Calculating Taxes

- Exemptions: Some goods or services may be tax-exempt or have special tax rates. Be sure to check local tax laws to ensure compliance with any exemptions that may apply to your services or products.

- International Taxes: If you’re dealing with international clients, different countries have different tax rates. It’s essential to be aware of the specific tax laws in the client’s location.

- Keep Records: Always keep detailed records of the taxes you charge, as this will help in the event of an audit or if you need to provide tax-related documentation later.

By

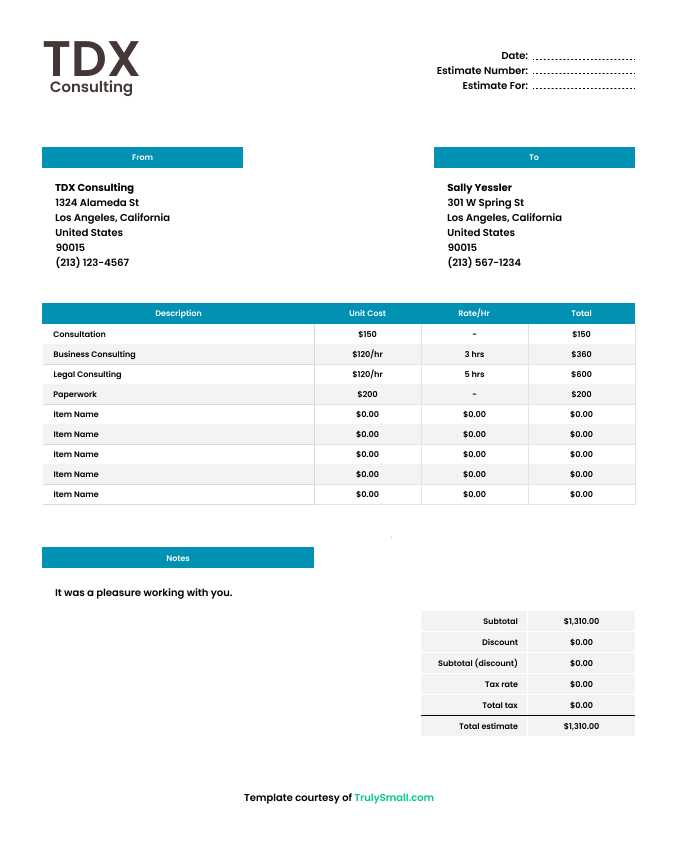

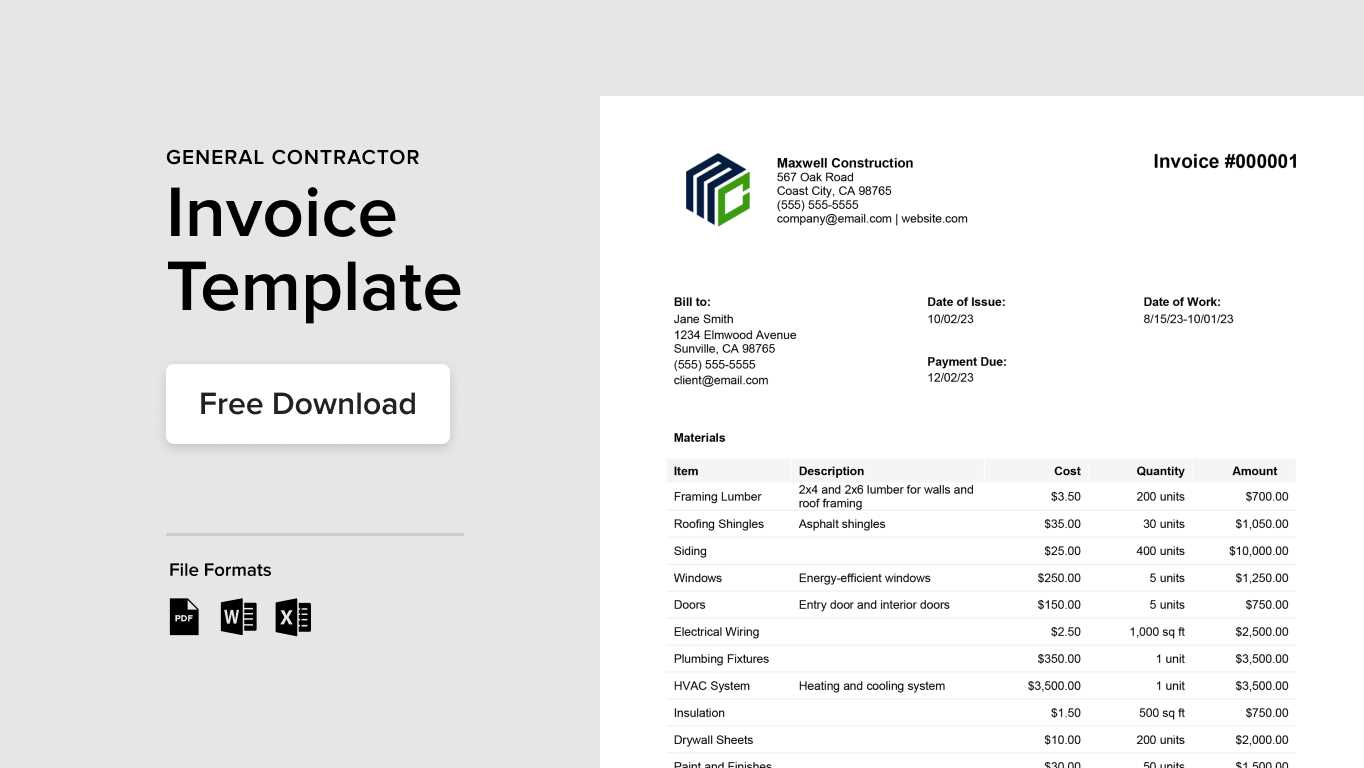

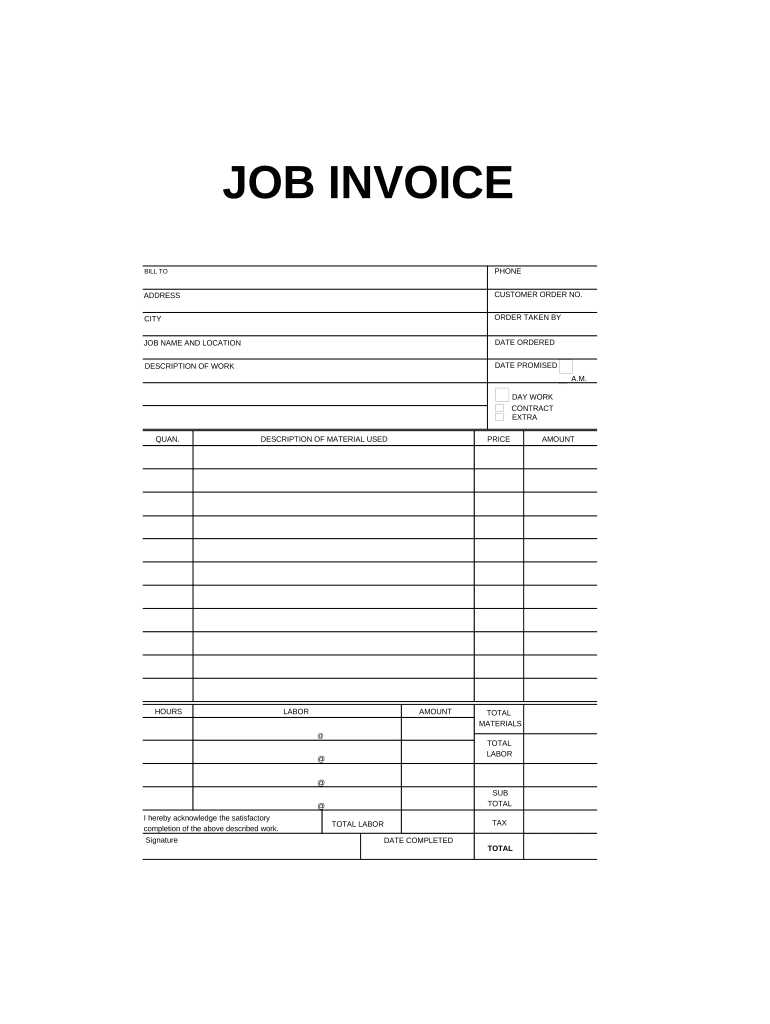

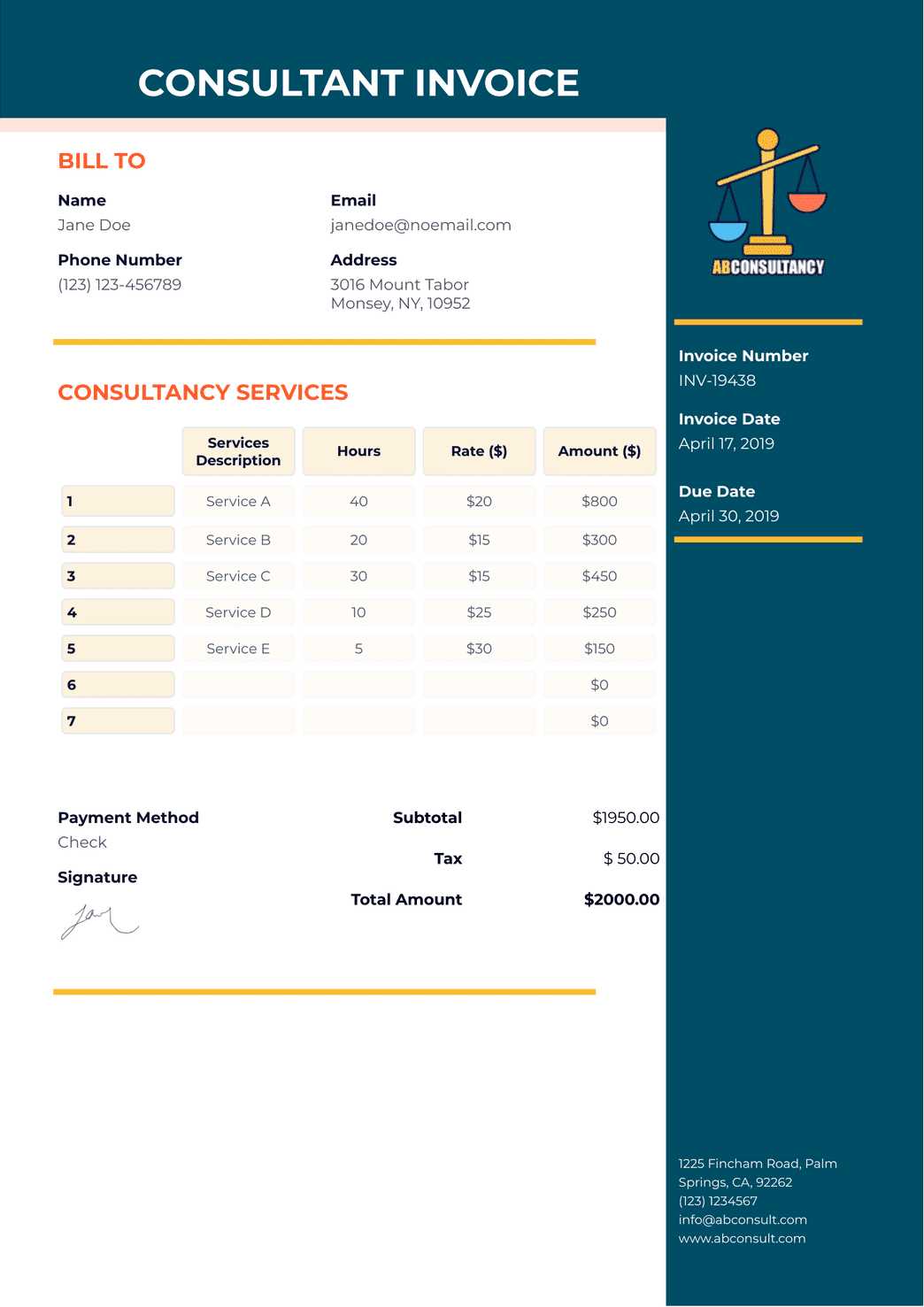

Creating Invoices for Different Services

Every service is unique, and tailoring your billing document to reflect the specific nature of each service ensures clarity and professionalism. Whether you are offering consulting, design, or maintenance, the way you present your charges and details will vary. Understanding how to adapt your document for each scenario is key to ensuring both parties are on the same page regarding the terms and expectations.

When preparing a billing document for various types of services, you should consider several factors that may differ from one service to another. For example, consulting services may require billing by the hour, while design work might be charged by project completion. These distinctions need to be clearly communicated to avoid any confusion. Additionally, some services might involve recurring charges or milestones, which should be reflected accordingly.

Here are a few considerations when customizing billing for different types of services:

- Hourly vs. Flat Rates: If your services are billed by the hour, be sure to include the time spent and the hourly rate. For fixed-price services, clearly state the project cost and any specific deliverables.

- Milestones and Phases: For larger projects or ongoing services, it may be necessary to break down payments into phases. Define what will be delivered at each stage and specify the payment due upon completion of each phase.

- Additional Expenses: In some cases, services might involve extra costs, such as materials or travel. Ensure that these additional fees are clearly outlined and justified in the document.

By considering the unique aspects of each service you provide, you can cre

How to Track Paid and Unpaid Invoices

Efficiently managing financial transactions is vital for maintaining smooth cash flow in any business. By keeping track of which payments have been made and which are still pending, you can avoid confusion and ensure that all amounts due are collected promptly. A clear system for tracking payments will help you stay organized and on top of your finances, preventing missed payments and potential misunderstandings with clients.

To successfully track both settled and outstanding balances, it is essential to implement a straightforward system. This includes maintaining a detailed record of each document issued, noting the amount due, the payment date, and any outstanding balances. Here are a few methods to help you stay organized:

- Use a Spreadsheet: A simple spreadsheet can serve as a comprehensive tool to track paid and unpaid balances. You can create columns for document numbers, amounts, due dates, payment statuses, and dates of payment.

- Set Up Payment Reminders: Automate reminders for outstanding payments by setting up alerts based on due dates. This ensures you follow up promptly on unpaid amounts without overlooking them.

- Leverage Accounting Software: Many accounting programs allow you to track payments automatically, providing a more streamlined and accurate way to manage your finances.

- Communicate with Clients: Regular communication is key to resolving outstanding balances. Send polite reminders and update your clients on the status of their payments.

By implementing these strategies, you can stay organized and ensure that all payments are received on time, helping you maintain a healthy financial flow and avoid disruptions in your business operations.

Invoice Templates for Small Businesses

Small businesses often need streamlined ways to manage their financial transactions. Having a reliable document to request payment is essential for maintaining smooth operations. By utilizing ready-made formats tailored to small business needs, entrepreneurs can save time and avoid the hassle of creating documents from scratch. These formats typically include all the necessary sections for clear communication and timely payment collection.

When choosing a format for your business, it’s important to consider the specific needs of your industry. A service-based company may require a detailed breakdown of hours worked, while a product-based business might need a list of items sold. Regardless of the business type, certain key elements should be included in every financial request to ensure clarity and professionalism.

- Simple and Clear Layout: A straightforward, easy-to-read layout helps ensure that clients understand the charges and the due date without confusion.

- Customizable Fields: Formats that allow you to easily adjust sections such as item descriptions, pricing, and payment terms are valuable, especially for businesses with varying needs.

- Professional Branding: Including your business logo and contact details adds a level of professionalism that clients appreciate.

- Compliance with Local Laws: Make sure your document adheres to any relevant tax or regulatory requirements to avoid legal issues.

Using the right format can help small business owners stay organized, improve cash flow, and avoid payment delays, all while providing a clear, professional way to request compensation for services rendered or goods sold.

Legal Considerations for Work Invoices

When creating financial documents to request payment, it is important to ensure that the format adheres to legal guidelines to avoid potential disputes or complications. Understanding the legal requirements surrounding these documents helps protect both the service provider and the client, ensuring that the terms of the agreement are clear, enforceable, and compliant with local laws.

One of the most crucial aspects of legally sound financial requests is accurately reflecting the agreed-upon terms, including the amount due, the scope of services, deadlines, and payment conditions. Additionally, being aware of any tax implications or industry-specific regulations is essential. Here are a few key legal factors to consider when creating such documents:

- Clear Payment Terms: Ensure that the due date, payment methods, and late fees are explicitly outlined to avoid confusion or delays.

- Accurate Descriptions: All services provided or products sold should be described in detail to prevent misunderstandings about the scope of the transaction.

- Compliance with Tax Regulations: Make sure to include any relevant tax information, such as sales tax or VAT, to comply with local tax laws.

- Proper Record Keeping: Retain copies of all documents for legal purposes, as they may be required for tax filings or in the case of disputes.

By paying attention to these key legal considerations, you can help ensure that your financial documents are legally valid and that both parties involved are protected throughout the transaction process.

How to Send and Follow Up on Invoices

Effectively managing the process of sending payment requests and following up on them is a critical part of maintaining healthy business cash flow. Sending a request is only the first step in the transaction process; ensuring that payments are received in a timely manner often requires follow-up communication. Being organized and polite in your follow-up efforts can help maintain good relationships with clients while securing timely payments.

Steps to Send Payment Requests

When sending a payment request, it’s important to make the process as clear and seamless as possible for your client. Here’s a simple approach:

- Use the Right Delivery Method: Send the payment request via email or a secure online platform. Make sure it is delivered to the right person at the right address.

- Include All Key Information: Ensure the request includes all relevant details such as the amount due, due date, services provided, and payment instructions.

- Maintain Professional Tone: While the request should be professional, it should also be polite and concise.

How to Follow Up

If a payment is overdue, it’s important to follow up in a timely manner. Here are some tips for following up effectively:

- Wait for the Grace Period: Give your clients a few days past the due date before sending a reminder.

- Be Polite but Firm: Send a friendly reminder, and if necessary, follow up with a firmer message stating the consequences of late payments.

- Offer Payment Plans if Needed: If your client is struggling to make the full payment, consider offering a flexible payment option to ensure you get paid in installments.

By following up professionally, you can help ensure timely payments while maintaining strong client relationships.

Step Action S Best Practices for Timely Payments

Ensuring that payments are made promptly is essential for maintaining a healthy cash flow in any business. Establishing clear guidelines, fostering positive client relationships, and using effective communication strategies can significantly reduce delays and improve your overall payment process. Following best practices in this area helps businesses maintain financial stability and build trust with clients.

Establish Clear Payment Terms

One of the most important steps in securing timely payments is to establish clear, concise payment terms from the outset. By defining expectations early, both parties understand what is required and when. Consider the following:

- Set a Specific Due Date: Avoid ambiguity by specifying exactly when payment is due, such as “Net 30” or “Due within 15 days of receipt”.

- Outline Late Fees: Include a clear policy for late fees, so clients are aware of the consequences of delayed payments.

- Payment Methods: Offer various payment options such as bank transfers, online payment systems, or checks, to make it easier for clients to pay on time.

Maintain Clear and Professional Communication

Effective communication is key to ensuring timely payments. Being proactive and courteous in your approach can encourage clients to meet their payment obligations without feeling pressured. Some helpful tips include:

- Send Reminders Before Due Dates: Remind clients of upcoming payments a few days before they are due. This simple step can help avoid any surprises.

- Follow Up Politely: If a payment is overdue, follow up with a polite and professional reminder. The tone should be firm but respectful.

- Address Disputes Quickly: If there is a payment dispute, address it promptly to prevent any delays in the process.

By incorporating these practices, businesses can minimize payment delays and maintain positive client relationships.

How to Use Digital Invoice Solutions

Embracing digital solutions for billing and payment processes can significantly streamline operations and improve efficiency. Digital tools allow businesses to create, send, and manage bills electronically, which not only saves time but also reduces the risk of errors and delays. These tools provide convenient ways to track transactions, automate reminders, and keep records organized for easy access and reference.

Choosing the Right Platform

When selecting a digital billing solution, it’s important to choose a platform that aligns with your business needs. Some key factors to consider include:

- User Interface: The platform should be intuitive and easy to navigate for both you and your clients.

- Customization Options: Look for solutions that allow you to customize the layout, terms, and branding to fit your business identity.

- Integration Capabilities: Choose a system that integrates with your accounting software and payment gateways to streamline your financial processes.

Benefits of Digital Billing Systems

Switching to a digital billing system offers numerous advantages over traditional paper-based methods:

- Efficiency: Generate and send documents instantly, reducing time spent on manual processes.

- Accessibility: Easily access and manage your records from anywhere, helping you stay organized and responsive.

- Security: Protect sensitive information with encrypted data storage and secure payment systems.

- Environmentally Friendly: Reduce paper waste and contribute to sustainability efforts by moving to a digital format.

By adopting a digital solution, businesses can enhance their billing process, reduce administrative costs, and provide a smoother experience for clients, all while ensuring timely and secure transactions.