Free Invoice Template for Services

Managing payments and ensuring smooth transactions with clients can be a time-consuming task, especially when you don’t have the right tools. Whether you’re a freelancer, a contractor, or a small business owner, having a structured and organized approach to billing is essential. With the right tools, you can save time, reduce errors, and create a professional image for your business.

Downloadable documents offer a quick and efficient way to streamline your invoicing process. These ready-made documents are designed to be easy to use and customize, allowing you to input your details and client information without hassle. By using these ready-to-go forms, you can ensure that your billing is clear, accurate, and delivered on time.

Access to these resources can make a significant difference in how you handle financial transactions. Instead of starting from scratch each time, you can focus on providing your expertise while leaving the paperwork to an automated solution that suits your business needs.

Free Invoice Templates for Service Providers

Efficient billing is a cornerstone of running a successful business, especially when working with clients on a project or hourly basis. Professionals in various fields often need a structured document that outlines the scope of work completed and the payment due. These documents help avoid confusion and ensure clarity between both parties, which ultimately leads to smooth financial transactions.

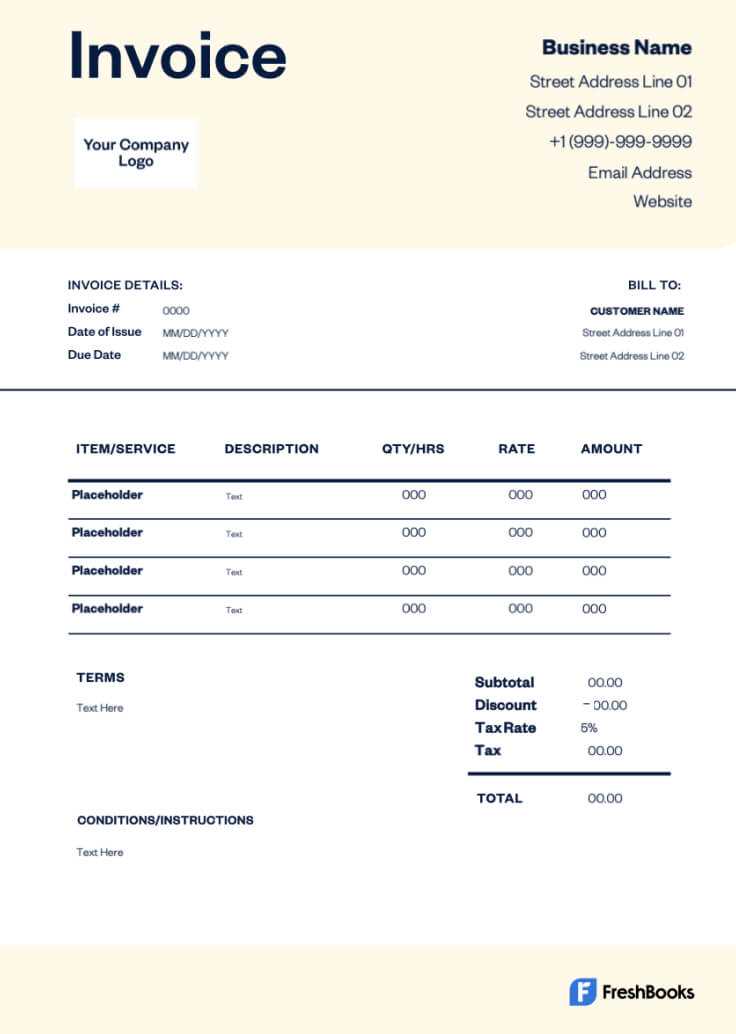

One of the easiest ways to manage billing is by using downloadable forms that are customizable to fit your business needs. These forms provide a ready-made structure where you can input the necessary details, such as client information, job descriptions, payment terms, and amounts due. The ability to quickly generate accurate documents not only saves time but also enhances your professionalism in the eyes of your clients.

Advantages of Using Ready-Made Billing Forms

By choosing ready-to-use billing forms, you gain several advantages that can improve the efficiency and accuracy of your business operations:

- Quick setup and customization for different projects

- Standardized format ensures consistency across documents

- Eliminates common errors in manual calculations

- Helps maintain a professional image when dealing with clients

How to Customize Your Document

Customizing your document to reflect the specifics of each job is essential. Below is an example of the key fields you can easily modify to suit different situations:

| Field | Description |

|---|---|

| Client Name | Enter the full name or company name of the client |

| Work Description | Provide a detailed description of the work completed or services rendered |

| Payment Due | Indicate the amount due for the work completed |

| Payment Terms | Specify when the payment is due (e.g., net 30 days) |

| Contact Details | Include your contact information in case the client needs to reach you |

By using c

How to Create an Invoice for Services

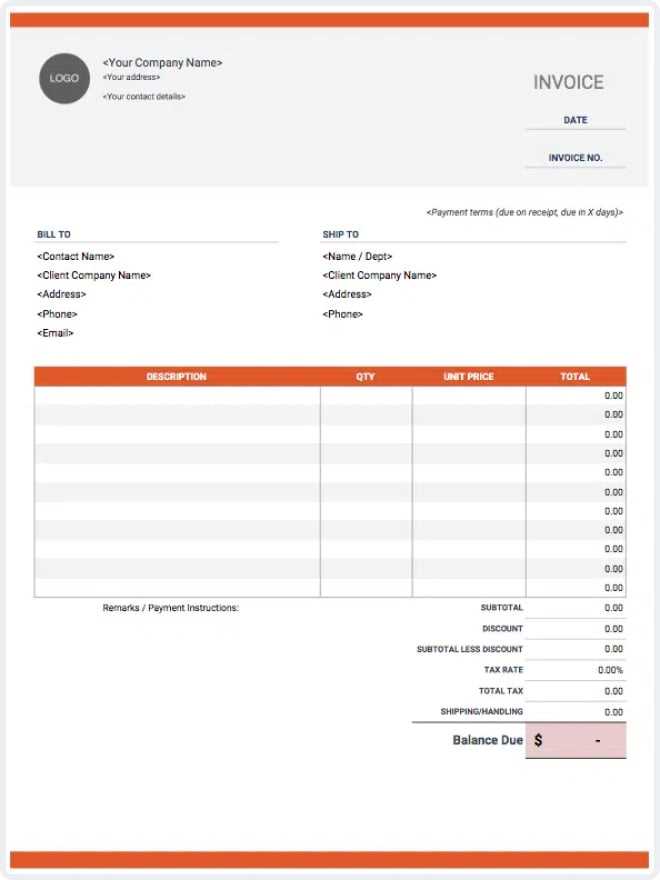

Creating a billing document that clearly outlines the work completed and the amount due is an essential part of doing business. A well-structured bill not only helps ensure you get paid on time but also maintains a professional image in the eyes of your clients. To craft a proper document, you need to include key details that help both parties understand the terms and expectations.

The first step is to gather all the necessary information, including client contact details, a description of the work, and the agreed-upon payment terms. Once these are in place, you can move on to formatting your document in a clear, easy-to-read way. It’s crucial to ensure that all numbers are accurate and that the document is well-organized to avoid confusion.

Key Components to Include

Below are the essential elements that should be included in your billing document:

| Section | Details |

|---|---|

| Client Information | Include the client’s name, company name (if applicable), and contact details |

| Work Description | Provide a brief yet clear description of the tasks completed or work delivered |

| Amount Due | Clearly state the total payment due for the completed work |

| Payment Terms | Specify the deadline for payment (e.g., due upon receipt, net 30 days) |

| Contact Information | Include your contact details for questions or payment issues |

Once you have entered all of this information, it’s important to review the document carefully. Double-check the figures, confirm the correct client details, and ensure that the payment terms are clear. A professional, detailed bill will help you maintain a positive relationship with your clients and get paid promptly.

Why Use Free Invoice Templates

Efficiently managing your billing process can significantly improve the overall experience for both you and your clients. Whether you are a freelancer or a small business owner, using pre-designed documents can streamline your workflow, reduce errors, and save time. These resources are designed to be simple and flexible, allowing you to quickly generate a professional-looking bill without having to start from scratch each time.

Many people choose ready-to-use options because they eliminate the need for complex formatting and calculations. Instead of worrying about design or structure, you can focus on adding the necessary details, knowing that the document is already organized to meet business standards. These ready-made solutions offer a straightforward way to maintain consistency and professionalism in your financial dealings.

Benefits of Using Ready-Made Billing Documents

Using downloadable billing forms offers several advantages, especially for those with limited time or design skills:

- Quick setup, allowing you to focus on your work rather than paperwork

- Consistent design that enhances your professional image

- Customizable fields that let you adapt the document to various needs

- Simple to use, even for those without design experience

How It Saves Time and Reduces Errors

One of the primary reasons to rely on pre-designed forms is the time saved in the creation process. Instead of starting from a blank page, you simply need to enter the details of your recent work, and the document is ready to be sent. Furthermore, these resources often come with built-in calculations, reducing the risk of making mathematical errors.

| Feature | Advantage |

|---|---|

| Pre-Formatted Design | Eliminates the need for manual formatting, saving time |

| Customizable Fields | Adapt the document to various types of work and clients |

| Built-in Calculations | Reduces the risk of mistakes in billing amounts |

By using these ready-made solutions, you ensure that your documents are both professional and accurate, allowing you to focus more on your business and less on administrative tasks.

Customizing Your Billing Document

Customizing your billing document ensures that it accurately reflects the details of the work completed and meets both your and your client’s expectations. A personalized approach not only makes the document look professional but also helps in maintaining clarity and transparency regarding payment terms, amounts, and services rendered. Tailoring each document to specific projects and clients creates a more organized and streamlined process.

When you have a standard structure in place, you can easily adjust fields like client information, work descriptions, and pricing. Customization allows you to highlight important details, include necessary legal terms, and adjust payment timelines based on the nature of each job. Whether you are working with a one-time client or a long-term partner, modifying your documents to suit the situation adds a layer of professionalism and organization to your business operations.

Common customizations include changing fonts, adding company logos, adjusting layout options, and defining specific terms for payment. You can also modify the structure to suit the frequency of your work (e.g., hourly, project-based, or retainer) to ensure that all details are clear and aligned with the agreement you’ve made with your client.

Top Features of an Invoice Template

When creating a billing document, certain features are essential to ensure that it is clear, professional, and effective. A well-designed document should provide all necessary information in an organized manner, leaving no room for confusion. Key elements help ensure that your client understands the payment terms, the scope of work, and the total amount due, all while maintaining a polished image for your business.

Clarity and simplicity are paramount. The structure should allow both you and the client to quickly identify key details such as work completed, pricing, and deadlines. A professional-looking document enhances the likelihood of prompt payment and helps in fostering trust between you and your clients.

Some important features to look for in a quality billing document include:

- Customizable fields – The ability to modify client details, project descriptions, and pricing allows you to tailor the document to each specific job.

- Payment terms section – Clearly outlining payment deadlines and conditions (e.g., due upon receipt or net 30) prevents misunderstandings and ensures both parties are on the same page.

- Automatic calculations – Built-in math functions can automatically calculate totals, taxes, and discounts, minimizing errors and saving time.

- Professional layout – A clean, well-organized layout that highlights important details like the total amount due, contact information, and payment instructions can make your document look polished and easy to read.

- Branding options – Customizable sections that allow you to add your logo or brand colors give the document a personalized touch, reinforcing your brand identity.

- Tax and discount fields – Flexibility in entering taxes or applying discounts ensures that you can easily account for any adjustments or special pricing terms.

These key features ensure that your billing documents are not only functional but also serve as a tool to maintain a professional image and streamline the payment process.

Benefits of Using Digital Invoice Templates

Managing payments and tracking financial transactions is a critical aspect of running any business. Using digital documents for this purpose offers numerous advantages over traditional paper methods. With digital solutions, you can streamline the billing process, enhance accuracy, and save time, all while keeping your business operations efficient and professional.

One of the primary benefits of digital documents is their convenience. With just a few clicks, you can generate and send a professional-looking bill to your client without the need for printing, mailing, or manually filling out forms. This reduces administrative work and helps you stay focused on the core aspects of your business.

Time Efficiency

Digital documents allow you to quickly customize and send bills to multiple clients without needing to redo the same tasks every time. Many digital solutions also come with automatic calculation features, which minimize errors and save you valuable time spent on manual number crunching.

Environmentally Friendly

By opting for digital documentation, you reduce your reliance on paper, contributing to a more sustainable business practice. This is not only good for the environment but also eliminates the costs associated with paper, ink, and mailing services.

In addition to saving time and costs, using digital billing documents also offers the advantage of easy access and storage. You can quickly retrieve past records and track payment histories, making it easier to manage finances and avoid potential errors in your records.

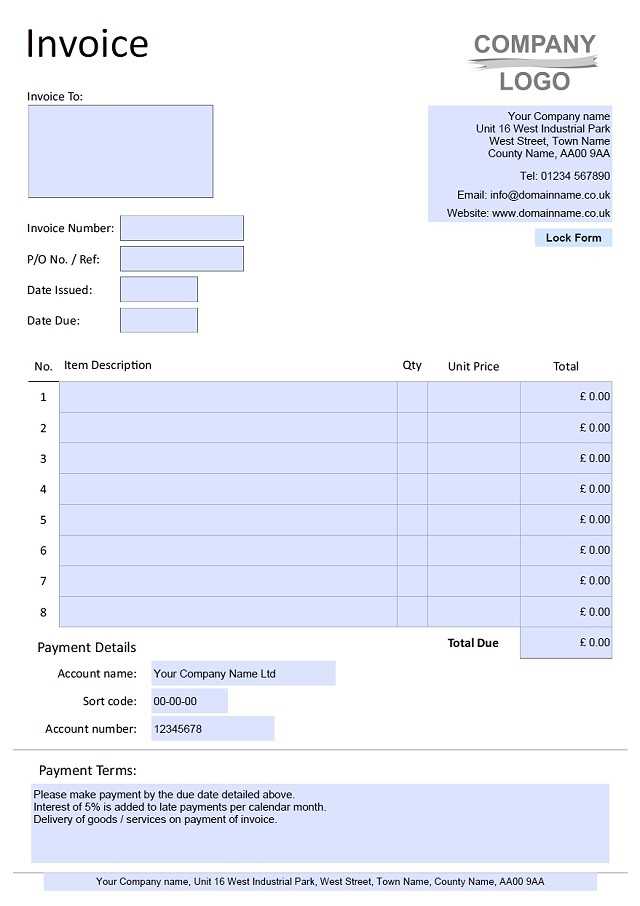

Choosing the Right Document for Your Business

When it comes to managing payments and keeping track of transactions, selecting the right document is crucial to maintaining professionalism and ensuring smooth operations. The right form can help you organize important details, stay consistent with your client communications, and make the process of receiving payments much more efficient. Choosing a suitable structure that reflects your business needs and industry requirements will set the foundation for successful financial management.

Different businesses have different billing requirements, and finding a solution that caters to your specific needs is key. Whether you’re running a freelance operation, a consulting business, or a small enterprise, it’s important to choose a document format that aligns with your pricing model, payment terms, and the services you offer. Customizability, clarity, and ease of use should be your top priorities when making your selection.

Factors to Consider When Selecting a Document

Before settling on a specific format, you should take several factors into account:

- Business type – Your document should be designed to suit the nature of your work, whether it’s project-based, hourly, or retainer-based.

- Client needs – Consider whether your clients require a simple breakdown of tasks or a more detailed statement with itemized sections.

- Customization options – Choose a format that allows you to personalize fields such as client details, payment terms, and job descriptions.

Choosing the Best Fit

Here’s a quick comparison of different formats that may work best depending on your business model:

| Business Type | Recommended Document Features |

|---|---|

| Freelancers | Simple layout, customizable fields for hourly rates or flat fees |

| Consultants | Detailed breakdown of tasks, payment terms, and project milestones |

| Small Businesses | Multiple line items, tax and discount fields, payment history tracking |

By understanding your business requirements and evaluating the specific features that will streamline your billing process, you can make an informed choice that supports both your needs and the expectations of your clients.

How to Download a Free Billing Document

Accessing ready-made, customizable forms for managing client payments can simplify the billing process and save you time. Whether you’re a freelancer, a contractor, or a small business owner, downloading a pre-designed document that suits your needs can be a valuable tool. Many websites offer easy-to-use, downloadable options that you can tailor to your specific requirements without any additional cost.

Once you’ve identified a document that fits your business needs, the next step is to download and customize it. This is typically a quick process that involves selecting a format, entering your business information, and adapting it to your client’s specific details. The beauty of these resources is that they are ready to go with minimal effort on your part, leaving you more time to focus on your core work.

Where to Find the Best Resources

There are numerous websites that offer downloadable documents for businesses, often with several options to choose from. When selecting a source, consider the following criteria:

- Customization options – Ensure the document is flexible enough to allow changes to the layout and fields based on your needs.

- Compatibility – Check that the format is compatible with your preferred software (e.g., Word, Excel, PDF).

- Ease of use – The document should be simple to navigate, even if you have no design experience.

Step-by-Step Process to Download

Follow these simple steps to access and download your document:

| Step | Action |

|---|---|

| 1 | Visit a trusted website offering downloadable billing forms |

| 2 | Select a format that fits your business needs (e.g., basic, detailed, hourly) |

| 3 | Download the document to your computer or cloud storage |

| 4 | Open the file in your preferred software and begin customizing the details |

| 5 | Save and send it to your client |

Downloading and using a ready-made billing form is an easy way to

Common Mistakes in Service Invoices

When preparing a document to request payment from clients, it’s easy to make simple mistakes that can lead to confusion or delays in receiving payments. Whether you are a freelancer, a contractor, or a small business owner, understanding the common pitfalls and how to avoid them can ensure your financial transactions run smoothly. Accurate and clear records are vital for building trust and maintaining good client relationships.

One of the most frequent issues is failing to include complete information, such as missing client details or omitting important dates. Another common mistake is unclear payment terms, which can lead to misunderstandings about when and how payments should be made. These oversights may result in delays or even disputes, affecting your cash flow and professional reputation.

Key Errors to Avoid

Here are some of the most common mistakes made in billing documents:

- Missing or incorrect client details – Ensure the correct name, contact information, and address of the client are included.

- Unclear work descriptions – Always provide a detailed breakdown of the work completed or the tasks performed to avoid any confusion about what was delivered.

- Not specifying payment terms – Make sure you include clear instructions on how and when payment is due, as well as acceptable methods of payment.

- Omitting taxes or additional fees – If applicable, include taxes, discounts, or extra charges to prevent any surprises for your client.

- Incorrect amounts – Double-check all calculations to ensure accuracy before sending the document.

How to Prevent Mistakes

The best way to avoid these common errors is by using a structured, standardized format that ensures all critical information is included every time. Additionally, reviewing the document before sending it out, and possibly having a second person look it over, can help catch any mistakes that might have been overlooked.

By taking the time to create precise, clear, and accurate billing records, you can avoid complications and make the payment process smoother for both you and your clients.

Invoice Formats You Can Use

When it comes to billing clients, there are various formats available that can help you organize your requests for payment. The format you choose can greatly influence the clarity and professionalism of your document. Depending on your business needs, you may want a simple structure or a more detailed layout with multiple sections. Understanding the different styles available ensures that you select the most suitable one for your situation.

Choosing the right structure will not only make the payment process more transparent but also contribute to a positive client experience. A well-organized document makes it easier for clients to understand what they’re paying for, which in turn increases the likelihood of timely payments. Let’s explore some of the most commonly used formats that can be adapted to fit your needs.

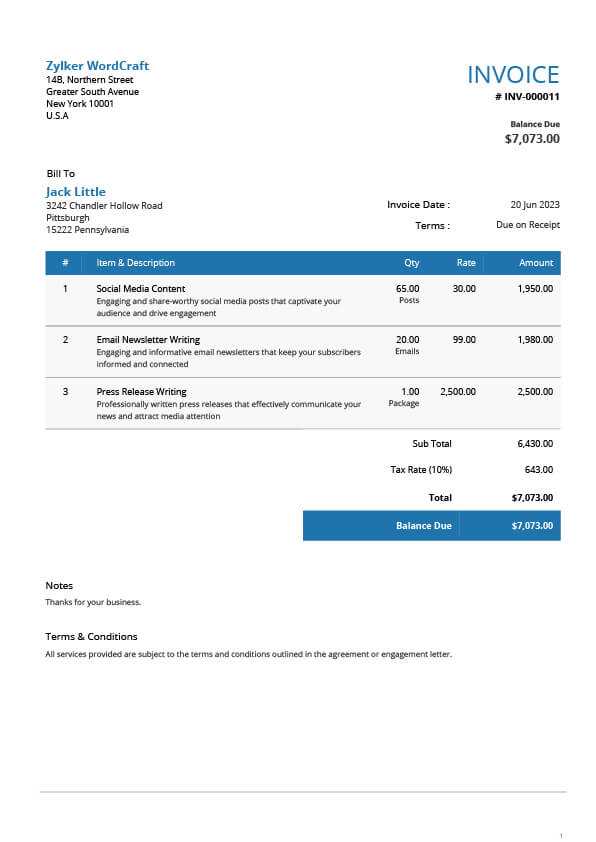

Basic Layout

The basic format is ideal for smaller businesses or freelancers who perform simple tasks or projects. It’s straightforward, typically including sections for client information, task description, payment terms, and the total amount due. This format is efficient and easy to understand, making it a popular choice for many professionals.

Itemized Format

For more complex projects, the itemized format is often the best option. This structure breaks down the work into individual tasks or hours worked, listing the cost for each. This format is particularly useful for clients who prefer a detailed explanation of charges or when dealing with hourly rates. It provides full transparency and helps both you and your clients keep track of every aspect of the work completed.

Key Features of an Itemized Layout:

- Task description: A clear description of each task or deliverable.

- Rate breakdown: The cost for each task, including hourly rates or flat fees.

- Total: The sum of al

How to Add Payment Terms in an Invoice

Clearly outlining payment terms in your billing document is essential for ensuring both you and your clients are on the same page when it comes to payment expectations. Payment terms specify when and how you expect to be paid, and can include important details such as deadlines, late fees, and accepted payment methods. These terms help avoid misunderstandings and ensure a smooth transaction process.

When you include payment terms in your document, it helps manage your cash flow effectively and reduces the likelihood of delayed payments. Clearly defined terms set expectations upfront, making it easier for clients to follow through on their commitments. Let’s explore how you can include these terms and the key elements to consider when doing so.

Key Elements to Include in Payment Terms

When drafting your payment terms, there are several important details to cover:

- Payment Due Date: Specify the exact date when payment is expected. Common terms include “due upon receipt” or “net 30” (payment due within 30 days).

- Late Fees: Outline any penalties for overdue payments. For example, a fee of 1.5% per month for late payments.

- Accepted Payment Methods: Indicate which payment methods are acceptable, such as bank transfers, credit card payments, or checks.

- Discounts for Early Payment: Some businesses offer discounts (e.g., 2% off if paid within 10 days), which should be clearly stated if applicable.

Example of Payment Terms in a Document

Here’s a sample structure for how payment terms could appear in your document:

Payment Terms Description Payment Due Payment is due within 30 days from the date of issue. Late Fee A 1.5% monthly interest charge will apply for overdue payments. Accepted Payments Bank transfer, credit card, and PayPal are accepted. Early Payment Discount A 2% discount will apply if payment is made within 10 days of receipt. By clearly stating these terms, you set the foundation for a professional and organized transaction, ensuring your clients understand their obligations and reducing the chance of payment delays.

Including Tax Information in Your Invoice

When creating a billing document, it’s important to clearly indicate any applicable taxes to avoid confusion and ensure compliance with local tax laws. Including tax details not only ensures that your client knows the exact amount due but also protects your business in the event of an audit. Depending on your location and the nature of the work, different types of taxes may apply, and it’s crucial to display them correctly on your document.

By providing clear and accurate tax information, you create transparency in your financial transactions and help maintain a professional relationship with your clients. Let’s explore how to properly include tax details in your document and the key elements to consider.

Key Tax Information to Include

Here are the main tax-related details you should include in your document:

- Tax Rate: Specify the applicable rate, whether it’s a sales tax, VAT, or any other relevant tax. This should be listed as a percentage.

- Tax Amount: Clearly state the total tax amount being charged based on the rate and the value of the transaction.

- Tax Identification Number (TIN): Include your business’s tax ID number if required by local regulations.

- Tax Exemption: If your business or client is exempt from certain taxes, make sure to indicate this clearly.

Example of Tax Information Layout

Here’s how you can structure the tax details in your billing document:

- Subtotal (Before Tax)

- Applicable Tax Rate (e.g., 7%)

- Calculated Tax Amount (e.g., $15)

- Total (Including Tax)

In some regions, you may need to break down multiple types of taxes separately, such as state tax, federal tax, or environmental tax. Make sure to check local regulations to ensure compliance.

By carefully including tax information, you ens

How to Properly Number Your Invoices

Properly numbering your billing documents is essential for maintaining organization and ensuring that your records are clear and easy to manage. A unique numbering system helps you track transactions, maintain a logical order, and prevent confusion with clients. It’s also important for your financial records, especially when it comes to filing taxes or handling disputes.

A well-structured numbering system makes it easier to refer back to previous transactions, and it can help you avoid mistakes when creating new documents. Let’s explore some effective practices for numbering your documents to keep everything organized and professional.

Best Practices for Numbering

When deciding how to number your documents, consider the following tips:

- Sequential Numbering: Always use a continuous sequence for your numbers. This helps avoid any gaps or duplication. For example, after document #001, the next should be #002, and so on.

- Incorporate the Year: Including the year in the number (e.g., 2024-001) can make it easier to track documents by year, especially if you issue a large number of them annually.

- Include a Prefix or Suffix: If you have different types of transactions, consider adding a letter or code to differentiate between them. For instance, “S-001” could be used for service-related documents, and “P-001” for product-related transactions.

- Avoid Reusing Numbers: Once a number has been used, never reuse it. This prevents any confusion or issues with duplicate records.

Example of Numbering System

Here is a simple example of how a numbering system could be structured:

2024-001 (First document of the year) 2024-002 (Second document of the year) 2024-003 (Third document of the year)

This structure is clear, easy to understand, and allows for efficient tracking. You can modify it further to suit your business model or transaction volume.

By properly numbering your documents, you create an organized system that ensures accuracy in your records and helps avoid any confusion with your clients. This practice also contributes to a professional appearance, making it easier to reference or retrieve past documents when needed.

When to Send an Invoice for Services

Timing is crucial when requesting payment for work completed. Sending a request for payment at the right moment ensures that your cash flow remains steady and that you maintain a professional relationship with your clients. Whether you’re billing upon completion of a project or at specific milestones, knowing when to issue a payment request can significantly impact the efficiency of your business operations.

Understanding the ideal time to send a payment request depends on the nature of your work, the agreement with your client, and the payment terms you’ve established. It’s important to strike a balance between ensuring timely payment and maintaining goodwill with your clients. Below are some general guidelines to help you determine the best time to send a request for payment.

When to Send the Request

The timing of your request largely depends on the arrangement you’ve made with the client. Here are some common scenarios:

- Upon Completion: Once the project or task is finished, sending the request promptly allows the client to review and pay for the completed work without delay.

- Milestone Billing: For longer-term projects, consider sending a request after reaching specific milestones or phases. This keeps the payment process ongoing and ensures you’re compensated for your work in stages.

- Monthly or Recurring Billing: If you’re offering ongoing work or subscriptions, sending a request on a set schedule (e.g., the first of the month) ensures predictability for both you and the client.

- Advance Payment: For some projects, you may require an upfront payment or deposit before starting the work. This ensures commitment and helps cover initial costs.

How Soon After Completion Should You Send It?

Once the work is complete, it’s best to send the request as soon as possible–ideally within a few days. This helps avoid delays in payment and keeps everything fresh in the client’s mind. Waiting too long may result in forgotten details, which could delay processing on their end.

By carefully considering the timing of your payment requests, you can improve your cash flow and reduce the likelihood of payment delays, all while maintaining positive client relationships.

Tracking Payments with Billing Documents

Efficiently managing payments is essential for maintaining smooth financial operations in any business. Keeping track of which payments have been made, which are still pending, and which are overdue ensures that you can stay on top of your cash flow. Using a structured document to track these payments allows you to maintain an organized record, making it easier to follow up with clients and manage your finances effectively.

By utilizing a well-organized system to monitor transactions, you reduce the risk of overlooking payments or failing to follow up with clients in a timely manner. Below, we’ll explore how to track payments accurately and the tools you can use to stay organized throughout the process.

How to Track Payments Effectively

There are several key methods and practices you can adopt to ensure that your payment records are accurate and up to date:

- Payment Status Indicators: Clearly mark each request as “Paid,” “Pending,” or “Overdue” in your document. This gives you a quick visual reference to identify which payments need follow-up.

- Payment Date: Always record the date when the payment was received. This helps you track how long it took for the payment to come through and ensures that you can easily reference the date for future inquiries.

- Amount Paid: Clearly specify the exact amount that has been received versus the total amount due. This is especially important if partial payments have been made.

- Notes Section: Include a space for additional details, such as payment method or any discrepancies. This helps you keep track of special instructions or circumstances related to each transaction.

Tools for Tracking Payments

In addition to a well-structured document, there are digital tools and software that can help you automate and streamline payment tracking:

- Accounting Software: Platforms like QuickBooks, Xero, or FreshBooks allow you to create and manage payment records automatically. These tools can track outstanding amounts, send reminders, and generate reports on your payments.

- Spreadsheet Tools: If you prefer a manual approach, spreadsheets like Google Sheets or Microsoft Excel can be customized to track payments. You can create columns for payment dates, amounts, and status indicators.

By carefully tracking payments and keeping detailed records, you’ll be able to maintain a clear overview of your financial status, avoid late payments, and ensure smoother operations for your business.

Why Service Providers Need Professional Invoices

For those offering specialized work, it is essential to present a polished and professional request for payment to clients. A well-crafted billing document not only outlines the financial details clearly but also enhances the credibility of your business. It demonstrates that you take your work seriously and that you understand the importance of organization and professionalism in financial transactions.

When clients receive a formal, well-structured payment request, it establishes trust and reflects your attention to detail. Additionally, using a professional format ensures you include all necessary information, reducing the chance of misunderstandings or delays. Let’s look at why using a professional document is essential and how it benefits both you and your clients.

Benefits of Using Professional Payment Requests

Here are several reasons why a professional document is important for those offering expert work:

- Enhances Credibility: A well-designed document makes your business appear more reliable and established, which can help attract more clients and establish long-term relationships.

- Reduces Payment Delays: When clients clearly understand the payment amount, deadlines, and terms, they are more likely to pay on time. A professional document reduces confusion and helps avoid delays.

- Provides Legal Protection: A detailed request ensures that both parties understand the agreed-upon terms. In case of a dispute, a professional document serves as a legal reference point.

- Improves Financial Management: Consistently using the same format makes it easier to track payments and organize your finances. You can quickly reference previous transactions for budgeting or reporting purposes.

Key Elements in a Professional Payment Request

To ensure your document is professional and comprehensive, be sure to include the following elements:

Element Description Business Details Include your business name, contact information, and tax identification number (if required). Client Information List the client’s name, address, and any relevant contact details. Transaction Summary Provide a clear breakdown of what was provided, including the agreed-upon price, payment terms, and any applicable taxes or discounts. Payment Terms Clearly state the amount due, payment method, and due date to prevent confusion. By including these key elements in your request for payment, you present a professional image, promote timely payments, and streamline your financial processes. It’s an important step toward managing your business effectively and fostering trust with your clients.

Best Practices for Invoice Management

Efficiently managing billing records is crucial to ensure that all payments are tracked, clients are satisfied, and cash flow remains steady. Proper management not only helps maintain financial accuracy but also ensures timely collection of payments and reduces the chances of overlooking important transactions. Implementing effective practices in managing payment requests allows businesses to stay organized and avoid common mistakes that could lead to delayed payments or disputes.

Establishing a systematic approach to handling payment requests, keeping accurate records, and following up in a timely manner is essential. Below are some best practices to streamline your billing process and improve overall efficiency.

Key Practices for Effective Billing Management

To ensure smooth and organized handling of all billing-related tasks, consider the following strategies:

- Consistent Formatting: Use a standardized format for all payment requests to ensure consistency. This makes it easier for clients to understand and for you to track. A well-structured document can include your branding, payment details, and clear instructions.

- Set Clear Payment Terms: Always outline clear payment terms, including due dates, late fees, and accepted payment methods. This prevents confusion and sets expectations from the beginning.

- Track Payments: Keep a record of all payments received, including amounts, dates, and payment methods. This helps you stay on top of what has been paid and what is outstanding. Implementing a digital tool or accounting software can assist with this process.

- Send Reminders: If a payment is overdue, don’t hesitate to send polite reminders. Often, clients simply forget, and a reminder can prompt them to pay without damaging the relationship.

Tools for Streamlined Management

In addition to adopting the best practices, using the right tools can significantly enhance your efficiency. Here are some options:

- Accounting Software: Programs like QuickBooks, FreshBooks, and Xero offer automated billing and payment tracking features. These tools can generate reports, send reminders, and help with record-keeping.

- Spreadsheets: For those who prefer a more manual approach, using spreadsheets like Microsoft Excel or Google Sheets is an affordable and effective way to track payments. You can create custom fields for client names, due dates, and amounts paid.

- Online Payment Platforms: Platforms like PayPal, Stripe, or Square allow clients to pay online easily and instantly. These platforms also help track payments and provide you with