How to Create an Invoice for Rent Template

When managing property leases, one of the most important aspects is ensuring clear and accurate documentation of payments. A well-structured document that outlines the amount due, payment terms, and contact details is essential for both landlords and tenants. This tool helps avoid confusion, provides transparency, and simplifies financial record-keeping for all parties involved.

Having a standardized document not only saves time but also improves professionalism in property management. It ensures that all necessary details are consistently included, reducing the likelihood of errors or disputes. This approach is especially beneficial when managing multiple tenants or properties, streamlining administrative tasks, and maintaining smooth financial operations.

In this guide, we will explore how to create and customize these payment request forms, offering practical examples and tips for tailoring them to suit various lease agreements. Whether you’re a seasoned landlord or just starting out, this resource will help you stay organized and compliant with your rental agreements.

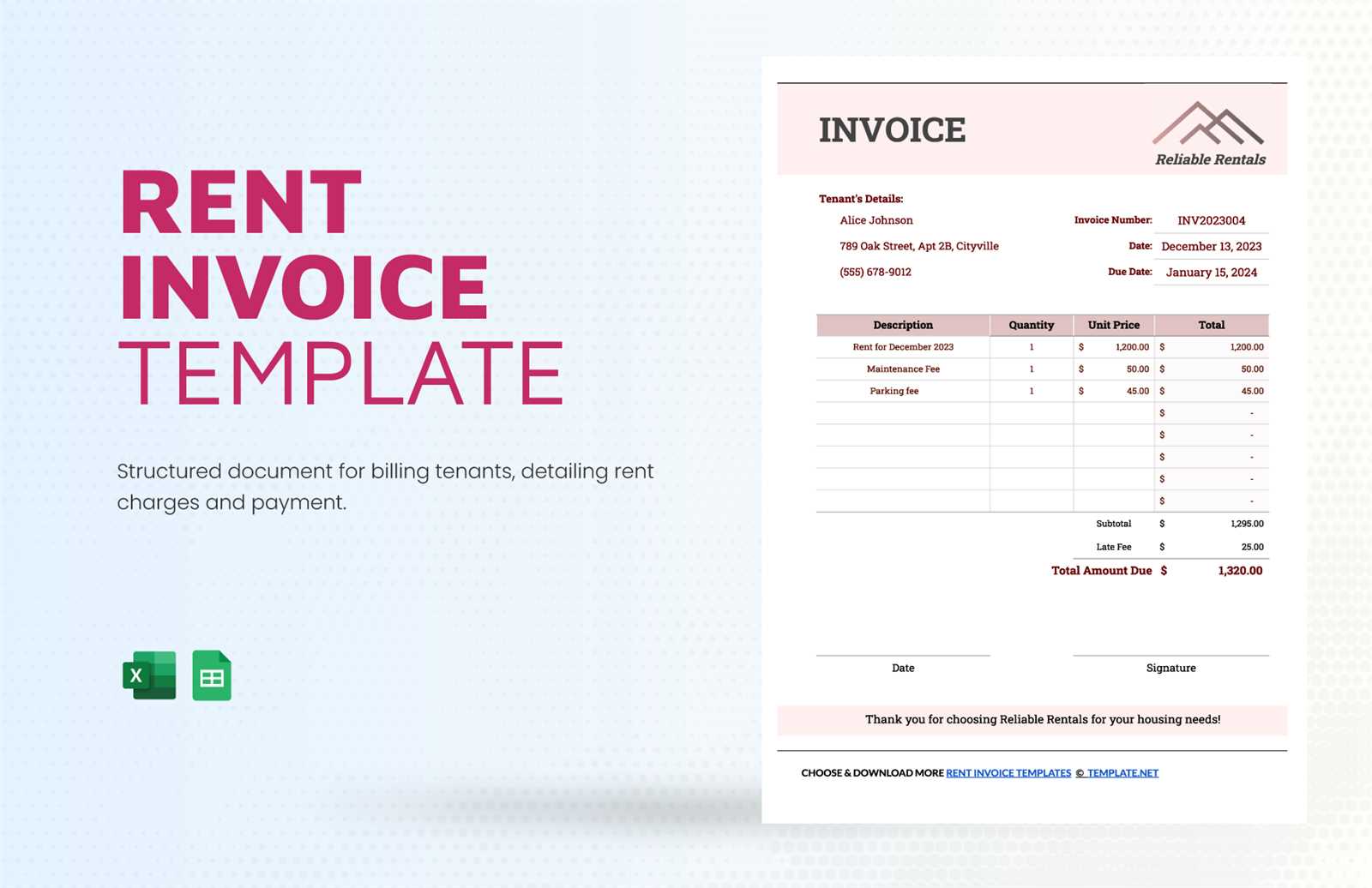

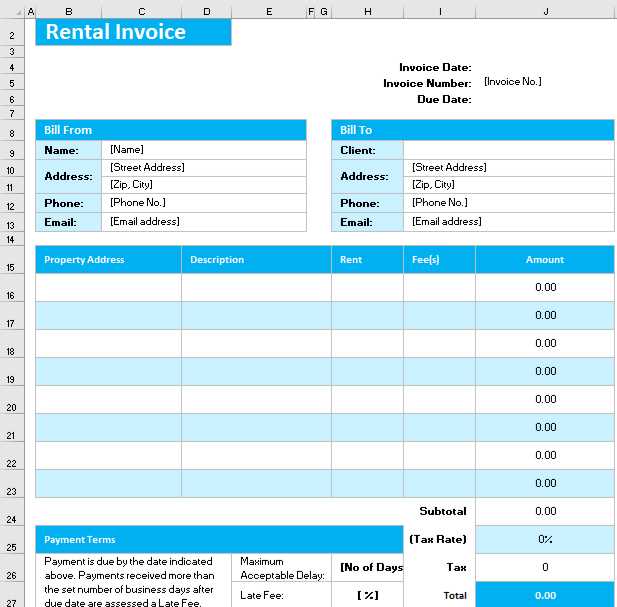

Invoice for Rent Template

In property management, providing tenants with clear and professional payment requests is key to maintaining smooth financial operations. A well-designed document outlining payment details helps ensure both parties are on the same page and reduces the potential for confusion or disputes. Creating a customizable form allows landlords to quickly adjust information for each tenant while maintaining consistency across multiple agreements.

Essential Components of the Document

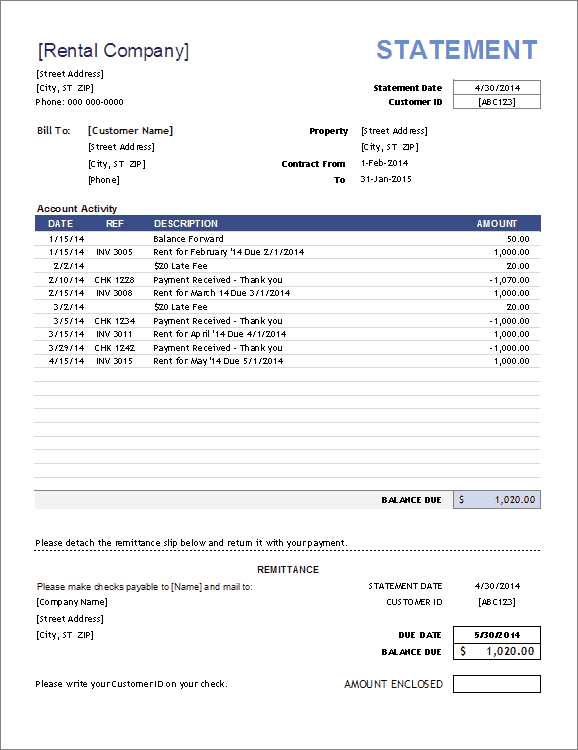

Each payment request should include several key elements. These include the tenant’s name and address, the payment amount, due date, and details about any late fees or additional charges. It’s also important to specify the payment methods available and any relevant contact information. By incorporating these elements into a standardized document, landlords can ensure transparency and clarity for all involved parties.

Customizing the Document for Specific Needs

Depending on the type of property or lease agreement, certain details may need to be adjusted. For example, if utilities are included in the agreement, those charges should be clearly outlined. Additionally, terms such as security deposits, maintenance fees, or any specific clauses can be added to the document as needed. Customizing these forms helps ensure they reflect the unique conditions of each rental agreement.

Why Use a Rent Invoice Template

Maintaining accurate and organized financial records is crucial for landlords and property managers. A standardized document that outlines payment details can streamline the entire process, ensuring that all transactions are clear and well-documented. Using a pre-designed form saves time and effort, helping landlords stay on top of their obligations while providing tenants with transparent, professional communication.

Consistency and Professionalism

By using a structured format, landlords can ensure that all essential information is consistently included, minimizing the chances of missing important details. This approach enhances professionalism, making it clear to tenants that their landlord takes financial matters seriously. A formal document also reinforces the legitimacy of the transaction, promoting trust and reducing potential misunderstandings.

Time and Effort Savings

Rather than creating a new document from scratch each time a payment is due, using a pre-made form significantly reduces the time spent on administrative tasks. Landlords can quickly update specific information, such as payment amounts or dates, and easily reuse the same layout for multiple tenants. This efficiency not only saves time but also ensures accuracy and consistency in the long term.

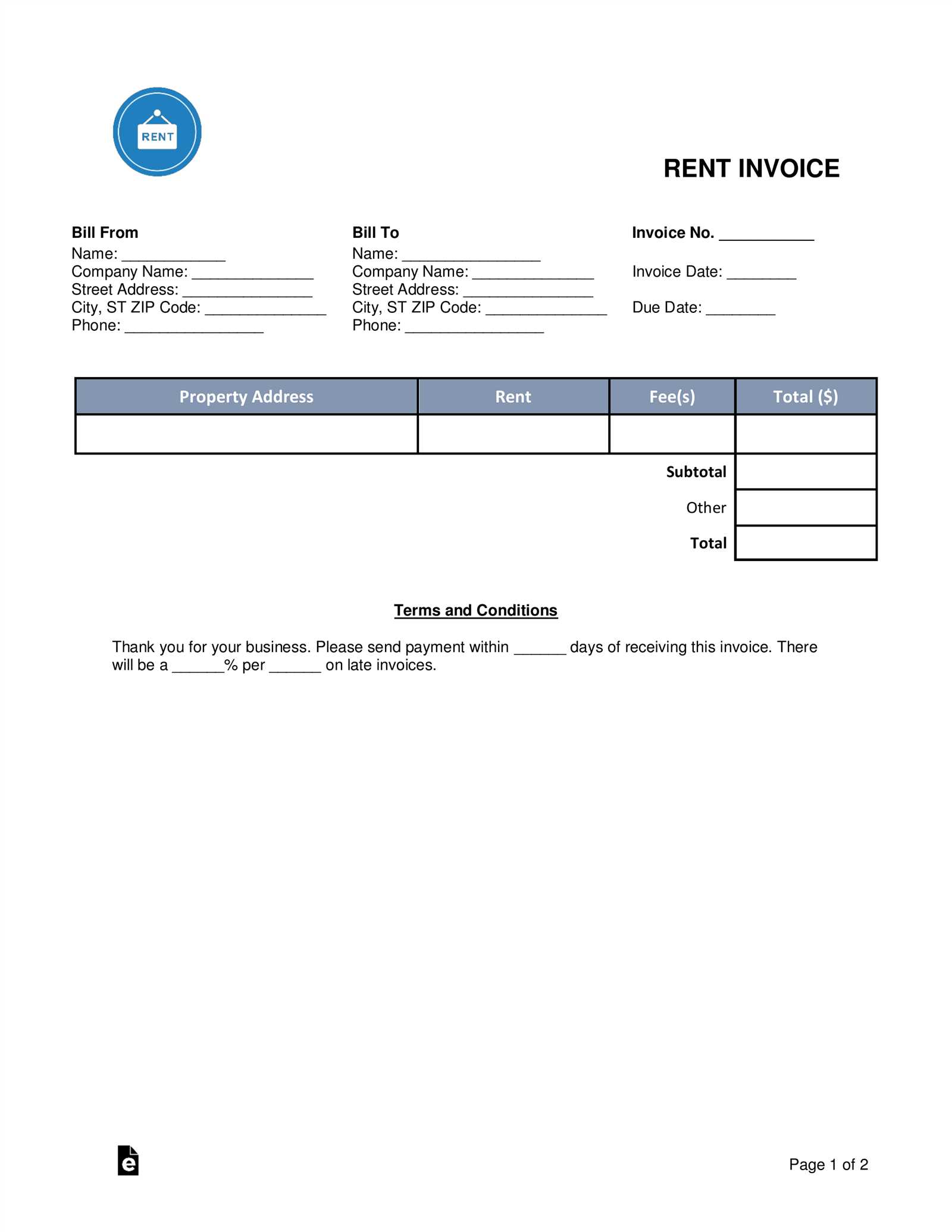

Key Elements of a Rent Invoice

To ensure clear communication and avoid misunderstandings, it is important to include certain key details in any payment request document. These elements help both landlords and tenants keep track of financial transactions and ensure that the expectations are set correctly. Below are the essential components that should be included in every payment request form:

- Tenant’s Information: Full name, address, and contact details of the tenant.

- Landlord’s Information: Full name, address, and contact details of the property owner or manager.

- Payment Amount: The total amount due, including any charges for utilities, maintenance, or additional fees.

- Due Date: The specific date by which payment must be made to avoid penalties or late fees.

- Payment Methods: Accepted methods for payment, such as bank transfer, check, or online payment platforms.

- Late Fees: Any additional charges that apply if payment is not received by the due date.

- Property Information: Address of the rental property being invoiced.

- Invoice Number: A unique reference number to track and identify each payment request.

- Description of Charges: A breakdown of the rent, including any additional fees for services like parking, repairs, or other utilities.

By including these key elements, landlords can ensure that their financial requests are clear, professional, and easy to understand, minimizing the chance for disputes and fostering positive relationships with tenants.

How to Create a Rent Invoice

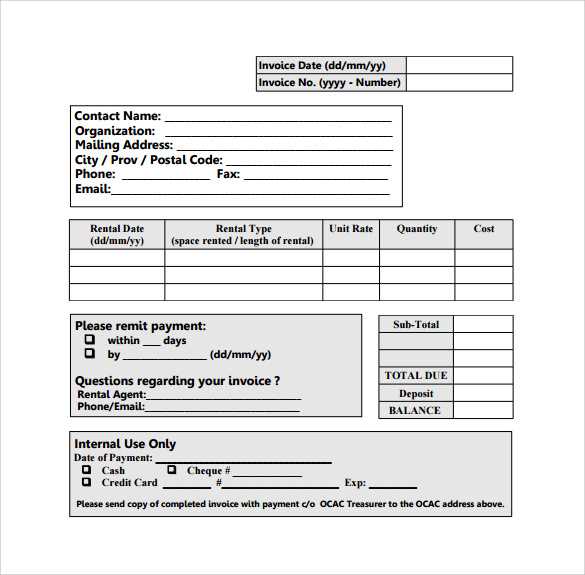

Creating a professional and accurate payment request document is essential for both landlords and tenants. A well-structured form helps ensure clarity and transparency in financial transactions, making it easier to track payments and avoid confusion. Here’s a step-by-step guide to help you prepare an effective document that clearly communicates the amount due and relevant payment details.

Step 1: Gather Necessary Information

Before you begin, make sure you have all the required details on hand. This includes:

- Tenant’s Name and Contact Information: Include full name, address, and phone number.

- Landlord’s Information: Your name, address, and preferred contact methods.

- Payment Amount: Specify the amount due, including any additional fees such as utilities or late charges.

- Due Date: Clearly state when the payment is expected.

- Payment Method: Indicate accepted forms of payment (bank transfer, credit card, etc.).

Step 2: Organize the Document

Start with a professional header that includes both parties’ contact details and the document’s title. Below that, clearly itemize the charges, including any discounts, fees, or adjustments. The total amount due should be prominently displayed. Include a space for payment terms, such as late fees or penalties, to ensure that all conditions are transparent. Finally, include a unique reference number for easy tracking.

By following these steps, you’ll create a straightforward and professional document that keeps both you and your tenant informed about payment expectations.

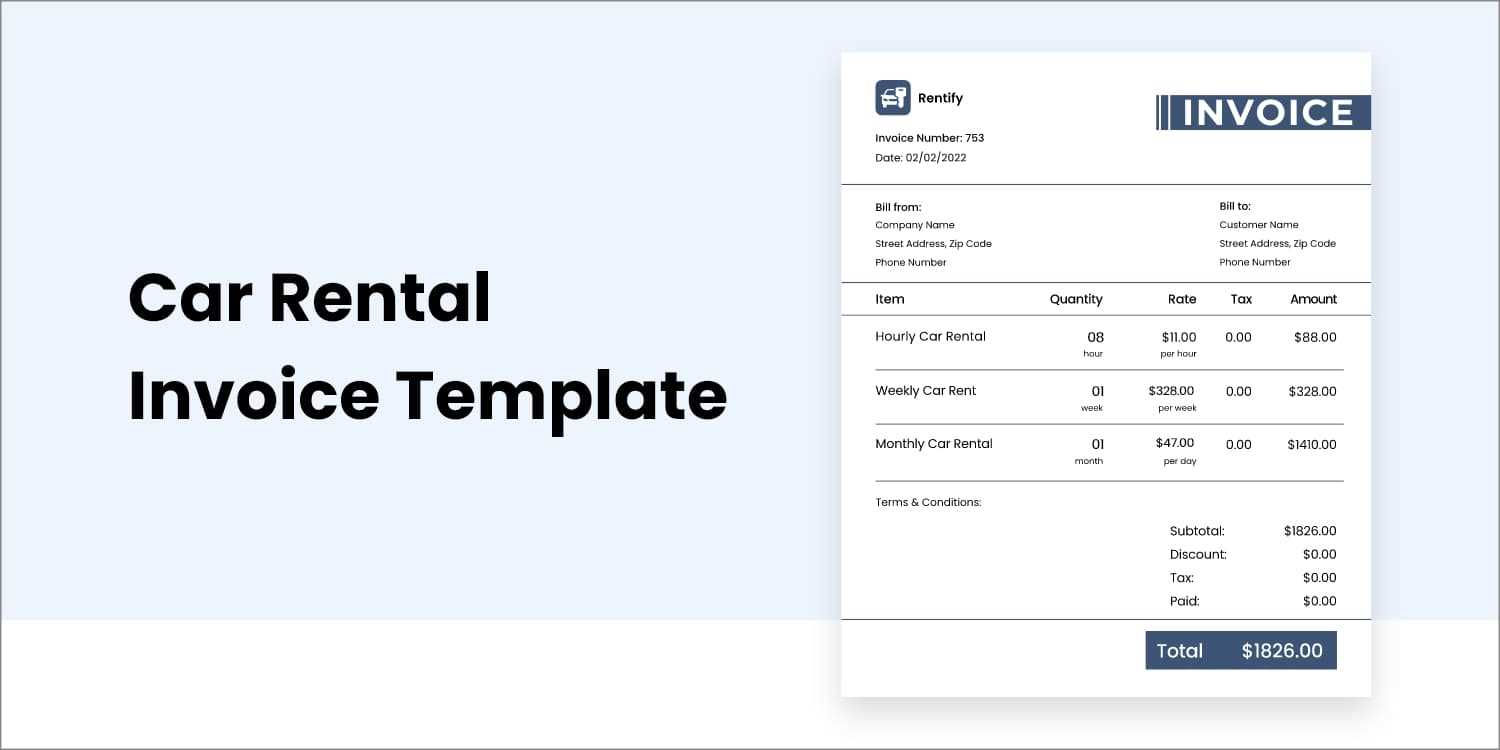

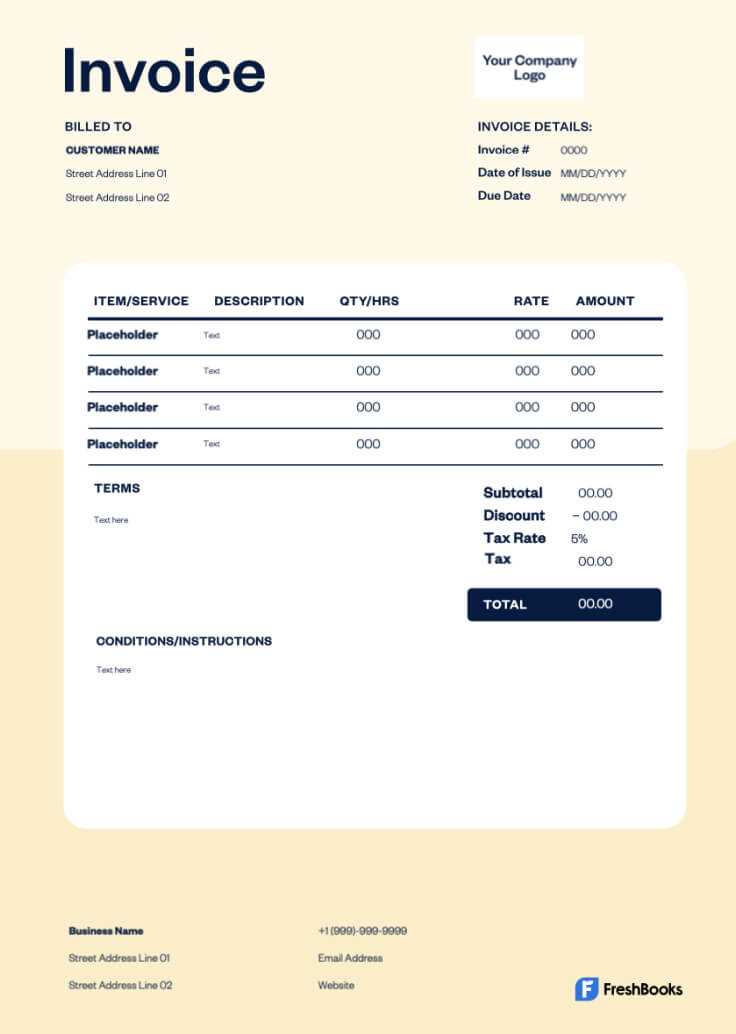

Best Tools for Rent Invoice Templates

When managing rental properties, using the right software or tools to create professional payment request forms can significantly streamline the process. These tools allow landlords to generate customized documents quickly, ensuring that all essential information is included and formatted correctly. Whether you prefer online platforms, software, or pre-designed forms, there are various options available to suit different needs.

Top Software Solutions

There are several software options available that can simplify the creation of payment documents. Below is a table comparing some of the best tools for creating customizable forms:

| Tool | Features | Pricing | Best For |

|---|---|---|---|

| QuickBooks | Customizable forms, easy tracking, invoicing, and financial reports | Subscription-based, starting from $15/month | Landlords with multiple properties |

| Zoho Invoice | Free plan, invoice customization, automatic payment reminders | Free for basic use, paid plans start at $9/month | Small landlords or property managers |

| FreshBooks | Automated invoicing, time tracking, and expense management | Starting at $15/month | Landlords needing detailed expense tracking |

| Wave | Free invoicing tool with basic features | Free | Landlords on a budget or those with few tenants |

Online Platforms and Services

If you’re looking for a more hands-off approach or need a quick solution, several online platforms offer pre-made forms that you can easily fill out and send to tenants. These platforms typically offer basic templates that can be customized with your information and sent directly via email. Some popular options include:

- Invoice Simple: A straightforward tool for creating and sending basic payment requests.

- PayPal: Offers customizable forms with built-in payment options.

- Invoice Ninja: Allows for easy customization of forms with free and premium features available.

Each of these tools offe

Benefits of Digital Rent Invoices

Digital payment requests offer numerous advantages over traditional paper-based methods. They not only streamline the process but also provide a range of benefits in terms of efficiency, accuracy, and environmental impact. By switching to digital formats, landlords can simplify their operations while ensuring that all transactions are recorded and managed more effectively.

| Benefit | Description |

|---|---|

| Time Savings | Creating and sending digital forms is quick and easy, allowing landlords to manage multiple tenants without wasting time on manual paperwork. |

| Increased Accuracy | Automated tools reduce the risk of human error in calculations, ensuring that payment amounts, due dates, and other details are correct. |

| Instant Delivery | Digital forms can be sent instantly via email or online platforms, ensuring that tenants receive their payment requests promptly. |

| Reduced Paper Waste | Switching to digital formats helps reduce the use of paper, contributing to a more eco-friendly business practice. |

| Better Tracking | Digital records are easily stored and tracked, making it easier to monitor payments, identify overdue balances, and manage financial reports. |

| Payment Integration | Many digital tools allow landlords to integrate payment systems directly, enabling tenants to pay quickly through secure online methods. |

Overall, adopting digital formats for payment requests improves efficiency, enhances record-keeping, and offers better flexibility for both landlords and tenants. With these tools, property managers can stay organized and provide a more convenient experience for everyone involved.

Customizing Your Rent Invoice Template

Personalizing your payment request document can help ensure that it aligns with the unique terms and conditions of each lease agreement. Customization allows you to tailor the form to reflect specific charges, payment terms, and any other details that are relevant to your property or tenant. By adjusting the layout and content, you can create a more professional and efficient way to manage financial transactions.

Here are a few key elements to consider when customizing your payment request document:

- Tenant-Specific Information: Include the tenant’s full name, address, and contact details. This makes the document more personal and ensures clarity about who the payment request is intended for.

- Additional Charges: If there are any extra costs like maintenance, utilities, or late fees, these should be clearly broken down in the document. A detailed breakdown helps avoid misunderstandings and ensures transparency.

- Payment Terms: Specify due dates, acceptable payment methods, and any applicable late fees. Being clear about expectations and penalties can help encourage timely payments.

- Branding and Aesthetics: Adding your company’s logo or using a consistent color scheme and font can make the document look more professional and recognizable.

- Legal Clauses: If your rental agreement includes specific legal clauses or instructions regarding payment, these should be added to ensure that both you and your tenant are on the same page.

By taking the time to customize the payment request form, you can create a clear, professional document that meets the needs of both you and your tenant, ensuring smooth financial transactions and fostering trust.

Common Mistakes in Rent Invoices

Even small mistakes in a payment request document can lead to confusion, delayed payments, or disputes between landlords and tenants. It is crucial to ensure that every detail is accurate and clearly communicated to avoid misunderstandings. Below are some of the most common mistakes that landlords should be aware of when creating payment requests.

Missing or Incorrect Details

One of the most common mistakes is failing to include complete and accurate information. Omitting the tenant’s name, payment amount, or due date can result in confusion and delays. Be sure to double-check the following:

- Tenant’s full name and address

- The total amount due, including any extra fees or adjustments

- Clear payment instructions and methods

- Correct due date

Unclear Payment Terms

Payment terms, such as due dates, late fees, and penalties, must be explicitly stated to avoid any ambiguity. If tenants are unsure about when or how much to pay, it may lead to late payments or disputes. Always ensure that the payment deadline is highlighted and any additional charges are detailed and easy to understand.

By paying attention to these common mistakes, landlords can ensure that their payment requests are clear, professional, and free from errors that could cause unnecessary complications.

How to Add Payment Terms on Invoices

Clearly outlining payment terms is essential to ensure both landlords and tenants understand the expectations and obligations tied to the financial agreement. Payment terms should specify when payment is due, any penalties for late payments, and the accepted methods for submitting funds. By making these terms clear in the document, you can avoid misunderstandings and improve cash flow management.

Key Payment Terms to Include

When crafting your payment request document, it’s important to include the following key terms:

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which payment should be made to avoid penalties or disruptions in the agreement. |

| Late Fees | Include any additional charges that apply if payment is not received by the due date. Be specific about the amount or percentage that will be added for late payments. |

| Early Payment Discounts | If applicable, offer discounts for tenants who pay before the due date. This encourages timely payments and fosters positive relationships. |

| Accepted Payment Methods | Clearly list the payment methods that are acceptable, such as bank transfer, credit card, or online payment platforms. |

| Grace Period | Define any grace period allowed after the due date before penalties begin to apply. This gives tenants a buffer to make payments without facing immediate consequences. |

Formatting Payment Terms Clearly

Once you’ve defined the terms, ensure they are presented clearly within the document. Use bold text or bullet points to highlight these key details, making them easy to find and understand. The clearer the payment terms, the less likely there will be confusion or missed payments.

By properly defining and clearly stating payment terms in your forms, you can set the right expectations from the start, minimizing payment delays and improving financial transparency.

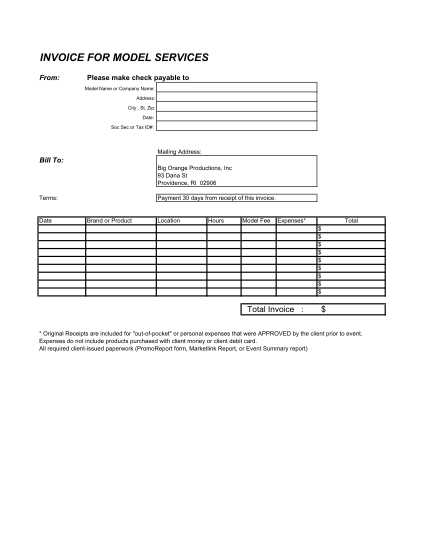

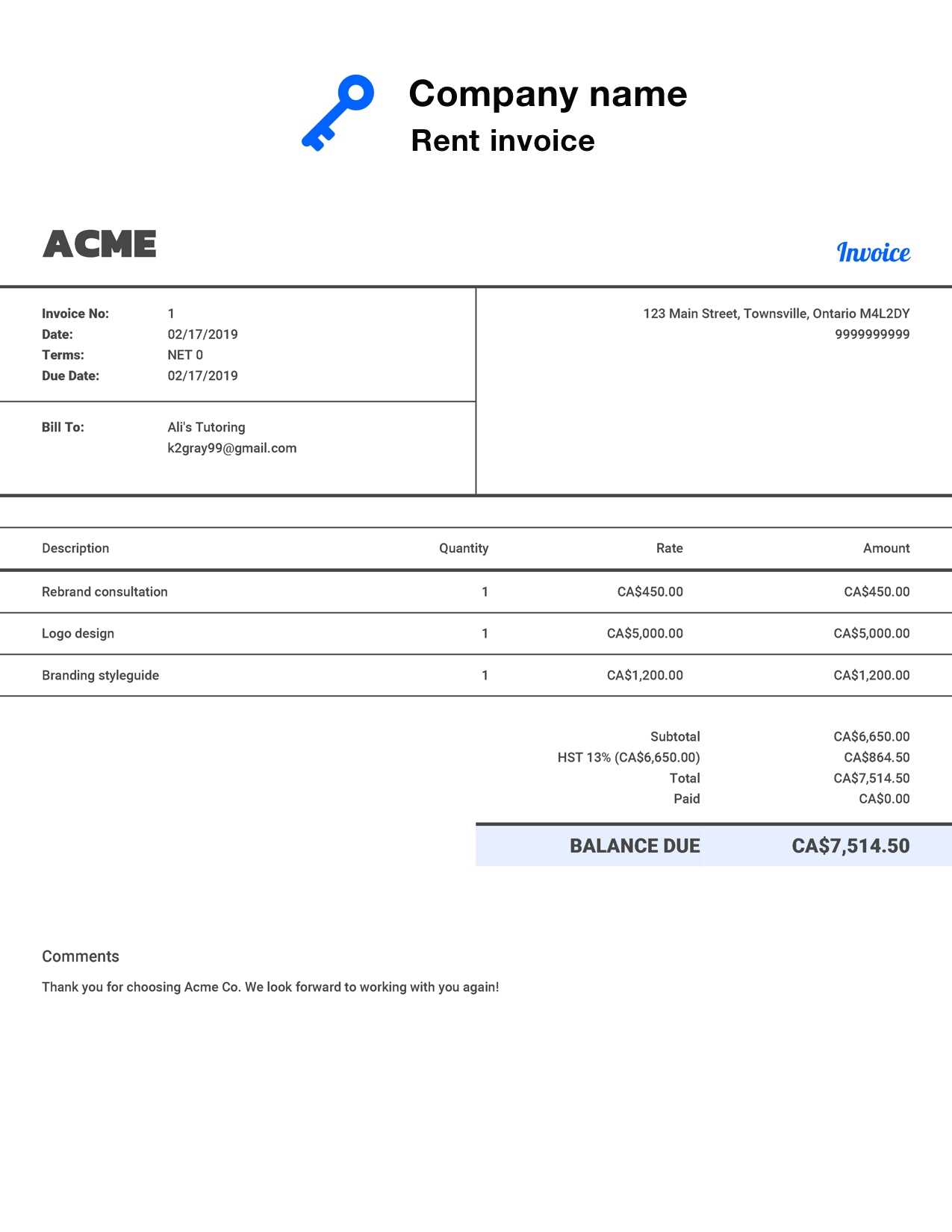

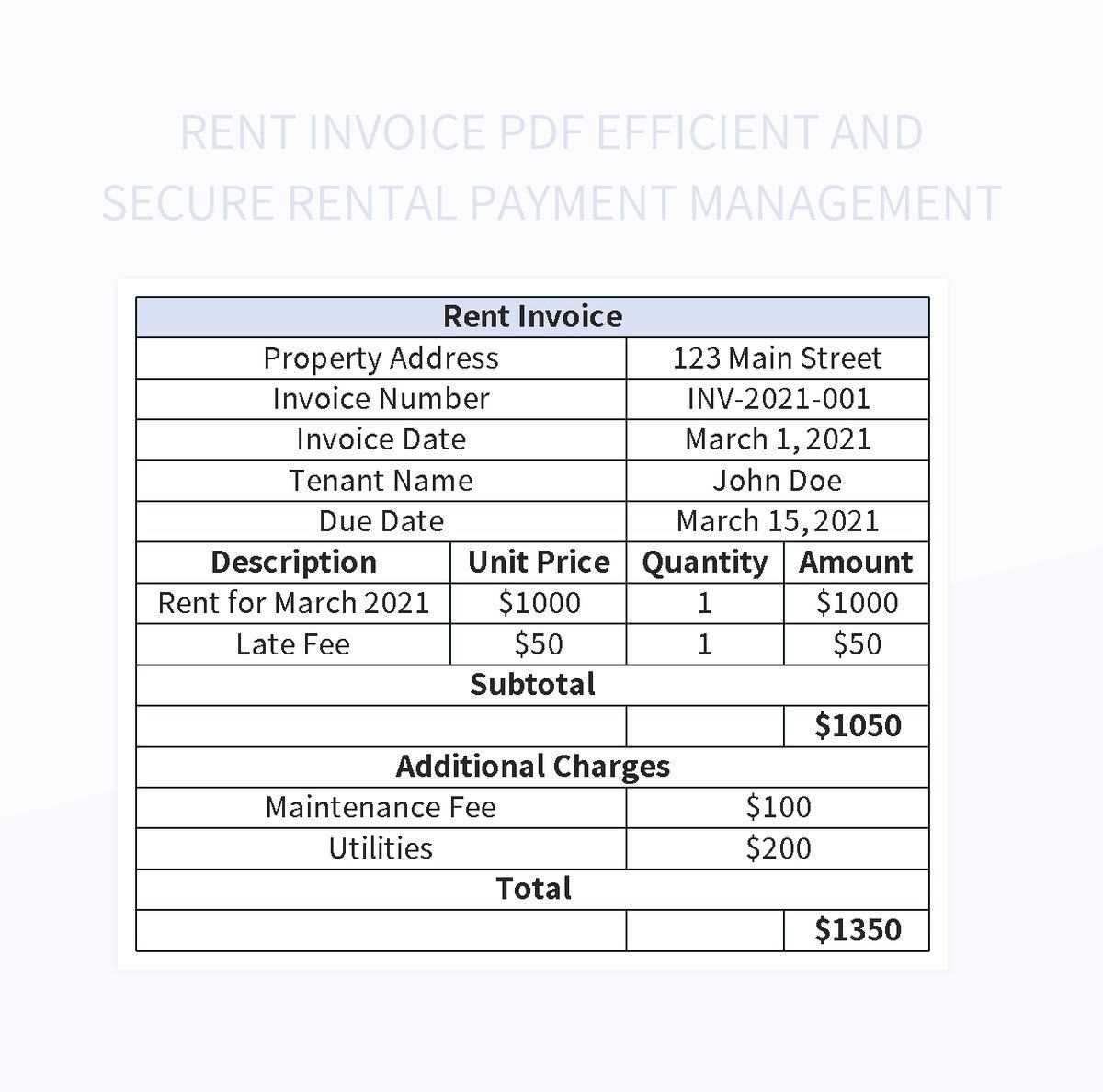

Rent Invoice Examples for Landlords

Providing tenants with clear and professional payment requests is essential to maintaining a smooth rental process. Examples of effective payment forms can help landlords craft documents that are both comprehensive and easy for tenants to understand. Below are two sample formats for property owners to use, ensuring that they include all the necessary information while remaining professional and easy to follow.

Example 1: Simple Payment Request

This format is ideal for landlords who need to send straightforward payment requests for basic lease agreements. It includes the essential details without overwhelming the tenant with unnecessary information:

Landlord’s Name: John Doe

Tenant’s Name: Jane Smith

Property Address: 123 Maple Street, Apartment 4B

Payment Due Date: May 1, 2024

Total Due: $1,200 (includes $1,000 lease + $200 utilities)

Late Fee: $50 if payment is received after May 5, 2024

Payment Methods: Bank transfer, PayPal, or check

Notes: Please ensure payment is made by the due date to avoid late fees.

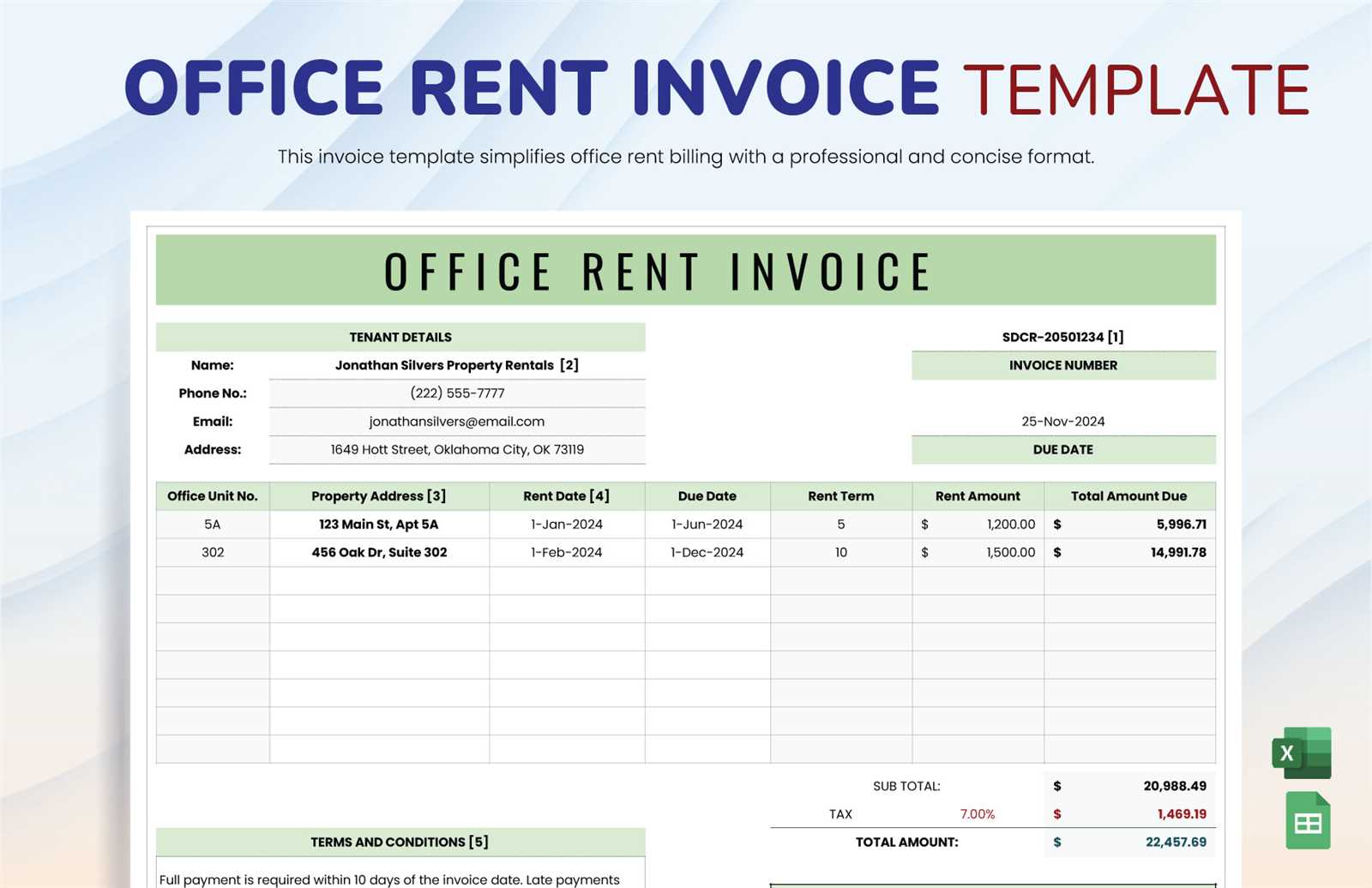

Example 2: Detailed Payment Request with Additional Charges

This format is more suitable for landlords who manage properties with additional services or complex terms. It allows for a more detailed breakdown of costs and charges:

Landlord’s Name: Sarah Williams

Tenant’s Name: Michael Johnson

Property Address: 456 Oak Road, Unit 3A

Payment Due Date: June 1, 2024

Breakdown of Charges:

- Monthly Lease: $1,500

- Parking Fee: $100

- Water and Sewerage: $50

- Internet Fee: $75

Total Due: $1,725

Late Fee: $75 if payment is received after June 5, 2024

Payment Methods: Bank transfer, credit card, or cash

Notes: Please ensure payment is made by the due date to avoid any interruptions in service.

By using these examples as a guide, landlords can ensure their payment requests are clear, professional, and complete, helping to avoid confusion and promote timely payments from tenants.

How to Send Rent Invoices to Tenants

Sending payment requests to tenants is a crucial part of managing rental properties. A clear and efficient process for distributing these documents ensures that tenants receive the necessary information on time and reduces the risk of missed or delayed payments. There are several ways to send these documents, depending on the preferences of both the landlord and the tenant.

Methods of Sending Payment Requests

Below are the most common methods landlords can use to send payment requests to tenants:

- Email: Sending payment requests via email is fast, reliable, and allows for easy tracking. Make sure to attach the document in PDF format to ensure the tenant can open and view it without issues. It’s also a good practice to include a clear subject line, such as “Monthly Payment Request – Due [Date].”

- Online Payment Platforms: If you use an online payment service (e.g., PayPal, Venmo, or a property management platform), you can send payment requests directly through these tools. Many of these services allow landlords to generate customized documents and send them directly to tenants via the platform’s messaging system.

- Printed Copies: For tenants who prefer paper documents or if the landlord does not have a reliable digital means of communication, sending a printed copy through postal mail is an option. Ensure the document is clearly printed and includes return instructions, such as payment via check or bank transfer.

Best Practices for Sending Payment Requests

To ensure that your payment requests are effective, consider the following best practices:

- Send Requests in Advance: Aim to send payment requests at least 5 to 7 days before the due date to allow tenants time to process and make payments.

- Use Clear and Professional Language: Ensure that the language used in the document is polite, clear, and free from ambiguity. Include details such as the due date, payment options, and any late fees if applicable.

- Track Deliveries: Whether you send documents via email or postal mail, keep track of deliveries. Use read receipts for emails or certified mail for physical documents to confirm that the tenant has received the payment request.

By choosing the right method and following best practices, landlords can efficiently send payment requests, helping to ensure that tenants receive the necessary information in a timely and professional manner.

When to Issue a Rent Invoice

Knowing when to send a payment request is vital for maintaining smooth financial operations and ensuring timely payments. Timing can vary depending on the terms of the lease agreement and the payment schedule. It’s essential to issue the document at the right moment to allow tenants enough time to make their payments while avoiding unnecessary delays.

Timing Based on Payment Frequency

Here are some general guidelines on when to issue a payment request based on the frequency of payments:

- Monthly Payments: A payment request should be sent at least 5 to 7 days before the due date. This gives tenants enough time to review the details and arrange payment before the deadline.

- Weekly or Bi-Weekly Payments: If payments are due more frequently, issue the payment request a few days in advance of the due date to ensure tenants can meet their obligations.

- Annual or Quarterly Payments: For longer payment cycles, it’s a good idea to send the request 10 to 14 days before the due date. This helps tenants plan their finances in advance, especially if they need to make a larger payment.

Special Situations for Issuing Payment Requests

In addition to regular payment schedules, there are specific situations where payment requests should be issued at different times:

- Late Payments: If the tenant has missed a payment or is overdue, it’s important to send a reminder promptly. Typically, a reminder should be sent within 2-3 days after the due date to avoid further delays.

- Additional Charges or Adjustments: If there are any extra charges–such as maintenance costs or utility adjustments–these should be included in the payment request as soon as the charge is applied. Make sure to notify the tenant of these changes well in advance of the payment due date.

By following these guidelines, landlords can ensure they issue payment requests at the right time, minimizing delays and improving cash flow management.

How to Track Rent Payments Effectively

Properly tracking payments from tenants is essential for managing your property efficiently and maintaining a steady cash flow. Effective tracking helps ensure that all payments are received on time, reduces the risk of missed payments, and enables landlords to quickly address any discrepancies or late fees. There are several methods and tools available that can make this process much more organized and accurate.

Manual Tracking Methods

For landlords with only a few properties or tenants, manual tracking may be sufficient. This can be done using spreadsheets or written records. However, it requires a consistent system and regular updates to avoid confusion. Key components to track include:

- Tenant Details: Maintain a list of all tenants with their contact information, lease terms, and due dates for payments.

- Payment Dates: Mark the dates when payments are received, and ensure that any late payments are flagged with applicable fees.

- Payment Amounts: Keep a record of the exact amounts paid by each tenant to ensure that they are paying the correct amount.

- Outstanding Balances: Track any unpaid amounts to stay on top of overdue payments and address them promptly.

Automated Tracking Tools

For larger property portfolios or landlords who prefer a more streamlined approach, using property management software or accounting tools can make tracking payments much easier. These tools typically offer the following benefits:

- Automated Reminders: Set up automatic reminders to notify tenants of upcoming or overdue payments, helping them stay on top of their obligations.

- Integrated Payment Systems: Many platforms allow tenants to pay directly through the software, automatically updating your records when payments are made.

- Financial Reports: Software often generates detailed reports that show payment history, balances, and any late fees, helping landlords monitor their cash flow at a glance.

- Cloud Storage: Securely store payment records in the cloud, making it easy to access historical data and share information if needed.

By utilizing either manual or automated methods, landlords can effectively track payments, reduce errors, and ensure timely transactions, leading to smoother property management operations.

Legal Considerations for Rent Invoices

When preparing payment requests for tenants, it is important to be aware of the legal requirements and regulations that govern these documents. Understanding the legal aspects ensures that both landlords and tenants are protected and that any disputes are minimized. From proper documentation to adhering to tenant rights, there are several key considerations to keep in mind.

Essential Legal Elements to Include

When creating payment requests, there are specific legal elements that must be included to ensure compliance with local regulations:

| Legal Element | Description |

|---|---|

| Landlord’s Full Contact Information | Include the full name, address, and contact details of the property owner or management company to ensure transparency and easy communication. |

| Tenant’s Details | List the tenant’s full name and the address of the rental property. This is essential for identifying the recipient of the payment request. |

| Payment Due Date | The document must clearly specify when payment is due to avoid confusion. This should align with the terms of the lease agreement. |

| Late Payment Fees | If applicable, late fees must be clearly stated, including the percentage or fixed amount that will be added to overdue payments. |

| Clear Payment Instructions | List the acceptable payment methods (e.g., bank transfer, credit card, cash) and any relevant details to facilitate payment. |

Legal Compliance and Tenant Rights

It is also crucial to ensure that payment requests comply with tenant protection laws and avoid any actions that could be seen as harassment or unlawful. Key considerations include:

- Compliance with Local Laws: Different jurisdictions may have specific laws governing how and when payment requests can be issued. Be sure to review local landlord-tenant laws to ensure compliance.

- Respecting Privacy: Do not include personal details or confidential information that could violate privacy laws.

- Prohibition of Retaliation: Landlords are not allowed to penalize tenants or issue requests in retaliation for tenant complaints or the exercise of legal rights.

- Written Agreement: Payment terms and expectations should be outlined in the lease agreement. Ensure that the document aligns with any clauses agreed upon in the rental contract.

By ensuring these legal elements are present and compliant, landlords can create transparent, enforceable payment documents that protect both parties and reduce the risk of disputes.

Free Rent Invoice Templates for Landlords

Landlords often look for simple, efficient ways to request payments from tenants without having to create documents from scratch each time. Free resources are available that allow landlords to easily generate professional and clear payment requests. These customizable documents help save time, ensure accuracy, and make managing finances easier.

Benefits of Using Free Payment Request Formats

Using a pre-designed format offers several advantages, especially for landlords managing multiple properties:

- Time-saving: Pre-made formats eliminate the need to create documents from scratch, saving landlords valuable time.

- Professional Appearance: These resources are designed to give a polished look to payment requests, which can help improve tenant relations.

- Customizable: Most free formats are fully customizable, allowing landlords to adjust terms, payment methods, and other details to fit their specific needs.

- Consistency: Using a standard format ensures consistency across all payment requests, which helps avoid errors or confusion.

Where to Find Free Resources

Landlords can find a wide variety of free formats online, from simple documents to more advanced options with additional features. Some of the most popular sources include:

- Online Template Websites: Many websites offer free, downloadable payment request formats specifically designed for property owners. These can be customized in programs like Microsoft Word or Google Docs.

- Property Management Software: Some software platforms offer free access to payment request creation tools. These platforms may include additional features such as payment tracking and automated reminders.

- Word Processors: Free formats can often be found within word processing programs like Microsoft Word or Google Docs, which include easy-to-use templates that can be customized to fit individual needs.

- PDF Editors: Free online PDF editing tools often offer customizable payment forms that can be filled out and saved digitally, ensuring a professional appearance with minimal effort.

With these free resources, landlords can easily create and send professional payment requests, ensuring that all necessary information is included while saving time and effort in the process.

How to Manage Multiple Rent Invoices

Managing payments from multiple tenants can quickly become overwhelming, especially if you own or manage several rental properties. Effective management requires an organized system to track payments, ensure timely collection, and minimize errors. Using the right tools and techniques can streamline the process and make it more efficient, whether you handle a handful of units or a large portfolio.

Tools and Methods for Tracking Payments

There are several methods to help organize and manage multiple payment requests for tenants. Depending on your preferences and the scale of your operations, you can choose the system that works best for you:

| Method | Description |

|---|---|

| Spreadsheets | Spreadsheets like Excel or Google Sheets are simple yet effective tools for tracking payments. They allow you to list tenants, payment dates, amounts due, and status, and can easily be updated as payments are made. |

| Property Management Software | Many software platforms designed for property management offer built-in tools to track payments, send reminders, and generate financial reports. These systems help automate much of the tracking and make the process more streamlined. |

| Accounting Software | Accounting tools like QuickBooks or FreshBooks can be used to track and manage all rental payments, including automatic reminders for overdue balances and the generation of financial statements. |

| Manual Records | If you prefer a more traditional approach, you can keep a physical ledger or manual records for each tenant, although this requires more time and effort to maintain and track. |

Best Practices for Managing Multiple Payment Requests

To effectively manage multiple payment requests, consider the following best practices:

- Set Clear Deadlines: Clearly communicate payment due dates in the lease agreement and on each document sent to the tenant. Consistent deadlines help tenants stay on track with their payments.

- Automate Reminders: Use automated reminder systems, whether through property management software or accounting tools, to alert tenants of upcoming or overdue payments.

- Track Each Payment: Keep a record of each payment as it’s made, noting the amount, date, and method of payment. This helps prevent confusion or errors later.

- Organize Payments by Tenant:

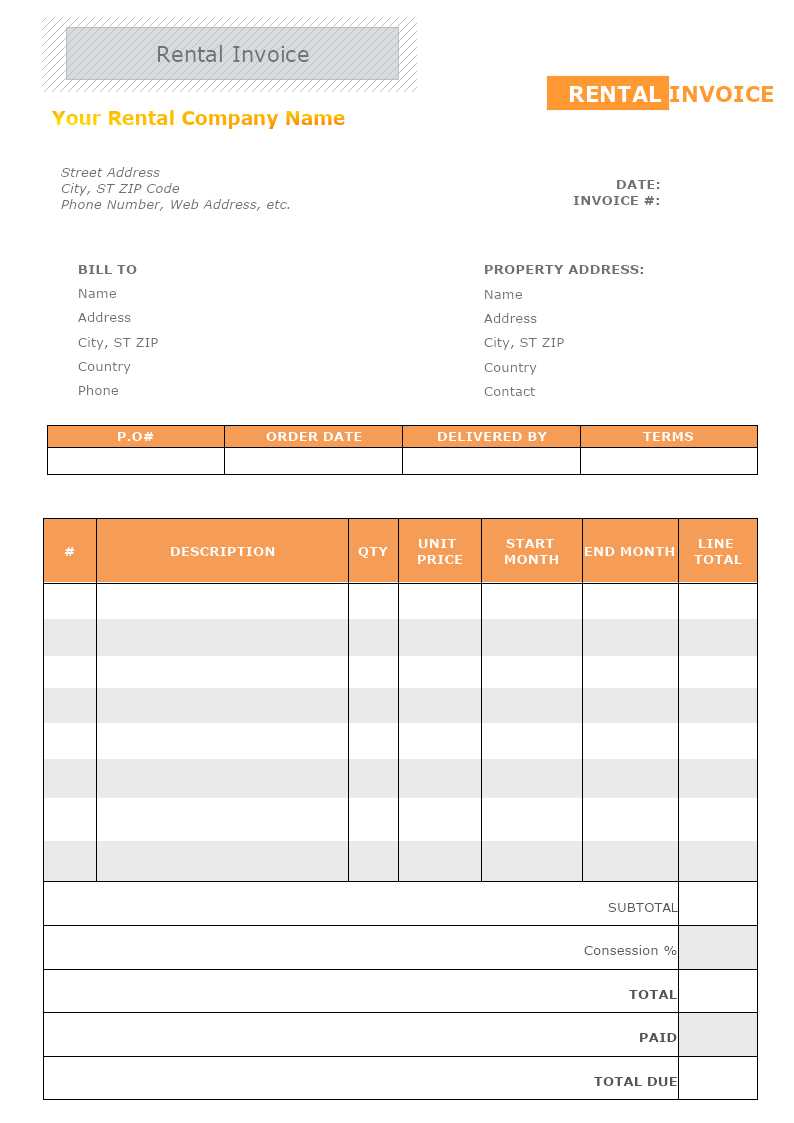

Creating Rent Invoices for Different Properties

Managing multiple properties with different tenants requires a tailored approach when preparing payment requests. Each property may have unique terms, rates, and billing cycles, so it’s important to create clear and accurate documents that reflect the specific details of each unit. Organizing payment requests for multiple properties efficiently helps landlords avoid confusion and ensure timely payments.

Important Factors to Consider

When preparing payment requests for different units, there are several important factors to keep in mind to ensure accuracy and consistency:

- Property Address: Clearly state the address of the property on each document to avoid any confusion between tenants or properties.

- Lease Terms: Each property may have different lease terms, such as rent amounts, due dates, and payment schedules. Make sure to reflect these details on each payment request.

- Payment Frequency: Some properties may have monthly payments, while others may require payments quarterly or yearly. Be sure to adjust the billing cycle according to the specific agreement for each property.

- Additional Charges: If any properties have additional charges, such as maintenance fees, utilities, or parking fees, include these in the payment request as separate line items.

- Tenant Information: Ensure that the correct tenant’s name and contact details are included for each property to avoid sending the wrong payment request to the wrong person.

Methods for Streamlining the Process

Handling multiple properties can be time-consuming, but there are methods and tools that can help streamline the process:

- Property Management Software: Use software that allows you to track multiple properties, create customized documents, and manage different billing cycles. These platforms often allow for quick adjustments and provide templates for each property type.

- Spreadsheets: Create a separate sheet for each property, listing the payment terms, due dates, and outstanding balances. This can be an effective way to keep track of each unit’s payment history.

- Automated Tools: Some tools can automate the process of generating payment requests for different properties, adjusting the details according to the specific terms for each tenant or unit.

By considering the unique details of each property and utilizing effective tools for manageme

How to Use Rent Invoices for Tax Purposes

When it comes to managing rental properties, keeping accurate records is crucial, especially when it comes time to file taxes. Properly documented payment requests not only help ensure timely payments from tenants, but they can also be valuable during tax season. These records can serve as proof of income, expenses, and other deductible costs associated with maintaining and managing rental properties.

Tracking Income and Expenses

One of the main uses of payment requests is to document rental income. By keeping a detailed record of payments made by tenants, property owners can accurately track their earnings. Additionally, these documents can be used to record various expenses related to the property, which may be tax-deductible. Some of the key information to track includes:

- Rental Income: Each payment request should list the amount due and the payment made, allowing landlords to track total earnings for the year.

- Expenses: Maintenance costs, property repairs, and other operational expenses should also be documented. These can often be deducted from taxable income, reducing overall tax liability.

- Depreciation: Rental properties can be depreciated over time, and having detailed records of income and expenses helps calculate depreciation for tax reporting purposes.

How to Organize and Store Records

To make tax filing easier, landlords should organize their payment requests in a systematic way. This includes keeping both digital and physical records for reference. Some best practices for organizing payment records include:

- Digital Filing Systems: Use cloud storage services or property management software to store electronic copies of all payment requests and related documents. This makes it easier to access and reference them during tax season.

- Monthly Summaries: Keep monthly summaries of income and expenses. This can be a simple spreadsheet or report that compiles all the payment requests and costs incurred for the property.

- Separate Property Records: If you manage multiple properties, make sure to separate records by property to avoid confusion and simplify the tax filing process.

- Backup Documentation: Keep supporting documents such as receipts, invoices from contractors, or bank statements to validate deductions and expenses related to the property.

Using accurate and organized payment records not only makes it easier to file taxes but also ensures compliance with tax laws and maximizes potential deductions. By incorporating these records into your tax planning process, you can reduce your overall tax burden and ensure you are taking full advantage of all available benefits.