Invoice for Performance Template Free Download and Customization

Creating accurate and clear billing documents is essential for any business providing services to clients. These documents serve as formal requests for payment, outlining the work completed and the amount due. Whether you’re a freelancer, consultant, or agency, using a well-structured format helps maintain professionalism and ensures smooth transactions with clients.

Designing the right kind of billing form can save you time and effort while also preventing misunderstandings. By incorporating essential details such as work descriptions, due dates, and payment instructions, you set clear expectations for both parties. A properly formatted billing record is not only a tool for financial tracking but also an important aspect of maintaining strong client relationships.

In this guide, we will explore how to create an effective and customizable billing record that suits different business needs. From setting up basic sections to including advanced features, this resource will help you tailor documents to fit various industries and service types. Using the correct structure can also help streamline the process of managing payments and keeping your financial records in order.

Invoice for Performance Template Overview

When providing services to clients, it’s essential to clearly document the work completed and the payment due. A structured billing document helps outline the details of the service, payment terms, and expectations in a professional manner. This overview will guide you through the key components of such a document and explain why it’s crucial for maintaining smooth business operations.

The goal is to create a clear, concise, and easily understandable request for payment that both parties can reference. It should include all relevant information about the work carried out, the amount owed, and how the payment should be made. A well-organized record ensures that your clients have all the necessary details, which reduces confusion and helps to maintain positive relationships.

Here are some key benefits of using a structured billing record:

- Professionalism: A clean, consistent format reinforces your credibility with clients.

- Clarity: By detailing every aspect of the service, both you and your client know exactly what to expect.

- Organization: Helps you keep track of payments, deadlines, and financial records with ease.

- Efficiency: Saves time by using a customizable and reusable format.

Understanding the different elements that should be included in such a document is essential to ensuring it serves its purpose effectively. From work descriptions and fees to payment instructions and due dates, a comprehensive approach will provide a smooth experience for both service providers and clients.

Why You Need a Performance Invoice

In any service-oriented business, documenting the work completed and specifying the amount due is essential for smooth transactions. Without a clear written request, misunderstandings can arise, potentially delaying payments or even damaging client relationships. Having a structured document that outlines the details of your work ensures both you and your client are on the same page regarding expectations and obligations.

One of the key reasons to use such a document is to create transparency in the payment process. By breaking down the tasks performed, the time spent, and the total cost, you eliminate any confusion about the agreed-upon price or terms. This not only helps to avoid disputes but also fosters trust and professionalism in your business dealings.

Additionally, using a detailed record helps you stay organized. It serves as a reference point for both you and your client, allowing you to track payment schedules and past work. This documentation is also important for tax purposes, as it provides a clear record of income and expenses.

Another key benefit is efficiency. When you use a consistent and easy-to-understand format, you can streamline the billing process. Instead of creating a new format for every transaction, you can customize a pre-made document that suits your specific needs, saving you time and effort.

Key Elements of a Performance Invoice

When creating a document to request payment for services rendered, it is important to include several critical components to ensure clarity and accuracy. A well-structured billing document should outline essential details to avoid confusion and streamline the payment process. Below are the key elements you should always include when drafting such a document.

Basic Information

Start by including basic details about both the service provider and the client. This establishes who is involved in the transaction and sets the tone for a professional agreement.

- Service Provider’s Name and Contact Info: Include your business name, address, phone number, and email.

- Client’s Information: Clearly list the client’s name, address, and any relevant contact details.

- Date of Issue: The date the document is generated should be clearly stated for reference.

- Unique Reference Number: A unique identifier (such as an invoice number) for easier tracking and future reference.

Details of Work Performed

In the main body of the document, outline the services or tasks completed in detail. This section should be as specific as possible to prevent any ambiguity regarding what has been delivered.

- Service Descriptions: Provide a brief but clear description of the tasks or services provided.

- Quantity and Hours Worked: Specify how much time or resources were spent on the work, including hourly rates if applicable.

- Cost Breakdown: Include the cost for each task or service, as well as the total amount owed.

Payment Terms and Conditions

Clearly state the payment terms to ensure both parties know when and how the payment should be made. This section helps set expectations and avoids delays.

- Due Date: Specify when the payment is due. Common terms include “Net 30” or “Due on receipt.”

- Payment Methods: List the accepted payment methods (e.g., bank transfer, credit card, PayPal).

- Late Payment Fees: If applicable, include any penalties for late payments, such as interest charges or additional fees.

How to Create a Professional Invoice

Creating a professional billing document is crucial to maintaining a strong, reputable image in any service-oriented business. A well-designed record not only helps you get paid on time but also reinforces your credibility and professionalism. The process of crafting such a document is straightforward, but attention to detail ensures that your request is clear, accurate, and easily understood by your clients.

Step 1: Include Essential Information

The first step in creating a polished document is to ensure that all necessary information is included. This allows both parties to easily identify and reference the transaction, avoiding confusion down the line.

- Your Contact Information: Include your full name or business name, address, phone number, and email address.

- Client’s Details: List your client’s name, business name, address, and contact information.

- Date and Reference Number: Clearly state the date the document was created and assign a unique reference number for tracking purposes.

Step 2: Detail the Services Provided

Next, provide a clear breakdown of the work completed. This section should be detailed enough to avoid misunderstandings and leave no room for ambiguity.

- Description of Work: Be specific about the tasks or services you completed, breaking them down into understandable terms.

- Hours or Quantity: Indicate the number of hours worked or the quantity of services provided, if relevant.

- Pricing Structure: List the cost for each item or service, including hourly rates or flat fees as appropriate.

Step 3: Set Clear Payment Terms

Establishing clear payment terms is essential for avoiding delays and ensuring that both you and your client understand the expectations. This will also help you manage your cash flow more effectively.

- Due Date: Specify when payment is expected, such as “Due upon receipt” or “Net 30 days.”

- Accepted Payment Methods: List all the ways your client can pay, such as bank transfers, credit cards, or online payment platforms.

- Late Payment Penalties: Include any penalties for overdue payments, such as interest rates or late fees, if applicable.

By following these steps, you’ll be able to create a professional and comprehensive document that ensures clarity and encourages timely payment. Keep your design simple, organized, and easy to navigate, and your clients will appreciate the professionalism you bring to every transaction.

Common Mistakes in Performance Invoices

When preparing a document to request payment for services provided, even small errors can cause confusion or delays. These mistakes can range from simple oversights to more significant issues that affect the clarity or professionalism of the request. Avoiding these common pitfalls will ensure smoother transactions and better client relationships.

1. Missing or Inaccurate Client Information

One of the most frequent mistakes is failing to include correct contact details for both the service provider and the client. If any of this information is missing or inaccurate, it can cause delays in communication and payment. Always double-check the following:

- Client’s Name and Address: Make sure the recipient’s details are accurate.

- Your Contact Information: Double-check your own business details to avoid any confusion.

- Reference Number: If used, ensure the reference number is unique and consistent with your records.

2. Vague Service Descriptions

Another common mistake is not clearly explaining the services provided. Clients need a detailed description of what they are being charged for, so they don’t question the cost or terms later. Ensure you include:

- Specific Tasks: List exactly what was done, whether it’s hours worked, specific projects, or tasks completed.

- Breakdown of Costs: Always include how much each item or service costs to prevent confusion.

3. Unclear Payment Terms

Failing to clearly state payment expectations can lead to misunderstandings or delayed payments. Ensure that your document includes:

- Due Date: Be specific about when payment is expected to be made.

- Accepted Payment Methods: Clearly outline how the client can pay, whether by check, bank transfer, or online payment system.

- Late Fees: If applicable, clearly define any penalties for late payment.

4. Overlooking Taxes and Additional Costs

Many service providers forget to account for taxes or additional fees that may apply. If you fail to include these details, it can result in payment discrepancies or compliance issues. Always ensure that:

- Sales Tax: Include the correct tax rate based on your location or the client’s location.

- Additional Charges: Add any extra fees or costs related to the services provided.

By avoiding these common mistakes, you can create a more accurate and professional document that helps ensure timely payments and maintains strong, transparent relationships with clients.

Best Practices for Invoice Formatting

Effective formatting is crucial when creating billing documents to ensure clarity and professionalism. A well-organized and easy-to-read document not only improves communication but also helps clients quickly understand the details of the charges. By following a few key formatting practices, you can make sure your document looks polished and facilitates smoother payment processing.

1. Keep It Clean and Simple

The layout of your document should be simple and uncluttered. A clean design with ample white space makes the information easier to digest. Avoid unnecessary colors or fonts that might distract from the content.

- Use Clear Fonts: Choose readable fonts like Arial, Helvetica, or Times New Roman, with a size between 10-12pt.

- Maintain Consistent Alignment: Ensure all text is aligned neatly, especially when listing services or costs.

2. Organize Information Logically

Make sure the document follows a logical flow, grouping similar pieces of information together. This helps your client easily navigate the details.

- Header Section: Place your business name, contact information, and document reference number at the top.

- Work Details: Include the description of services, hours, and pricing in a table format for clarity.

- Footer: Place payment instructions, due date, and terms at the bottom.

3. Use Tables for Clarity

Tables are an excellent way to present pricing information in a clean, easy-to-read format. Use tables to list services, quantities, rates, and total amounts.

- Separate Columns: Organize each piece of information (description, quantity, rate, total) into distinct columns.

- Include Subtotals: Include a line for subtotaling individual items or services before the final amount.

4. Highlight Important Information

Make sure key details stand out. This can be achieved by using bold text or larger font sizes for critical information like the total amount due or due date.

- Bold Important Figures: Highlight the total cost and payment due date in bold or a larger font.

- Use Lines or Borders: Separate sections with horizontal lines or borders for added organization.

By following these formatting guidelines, you ensure your billing document is not only professional but also clear and easy to understand, leading to more efficient transactions and stronger client relationships.

Customizing Your Performance Invoice Template

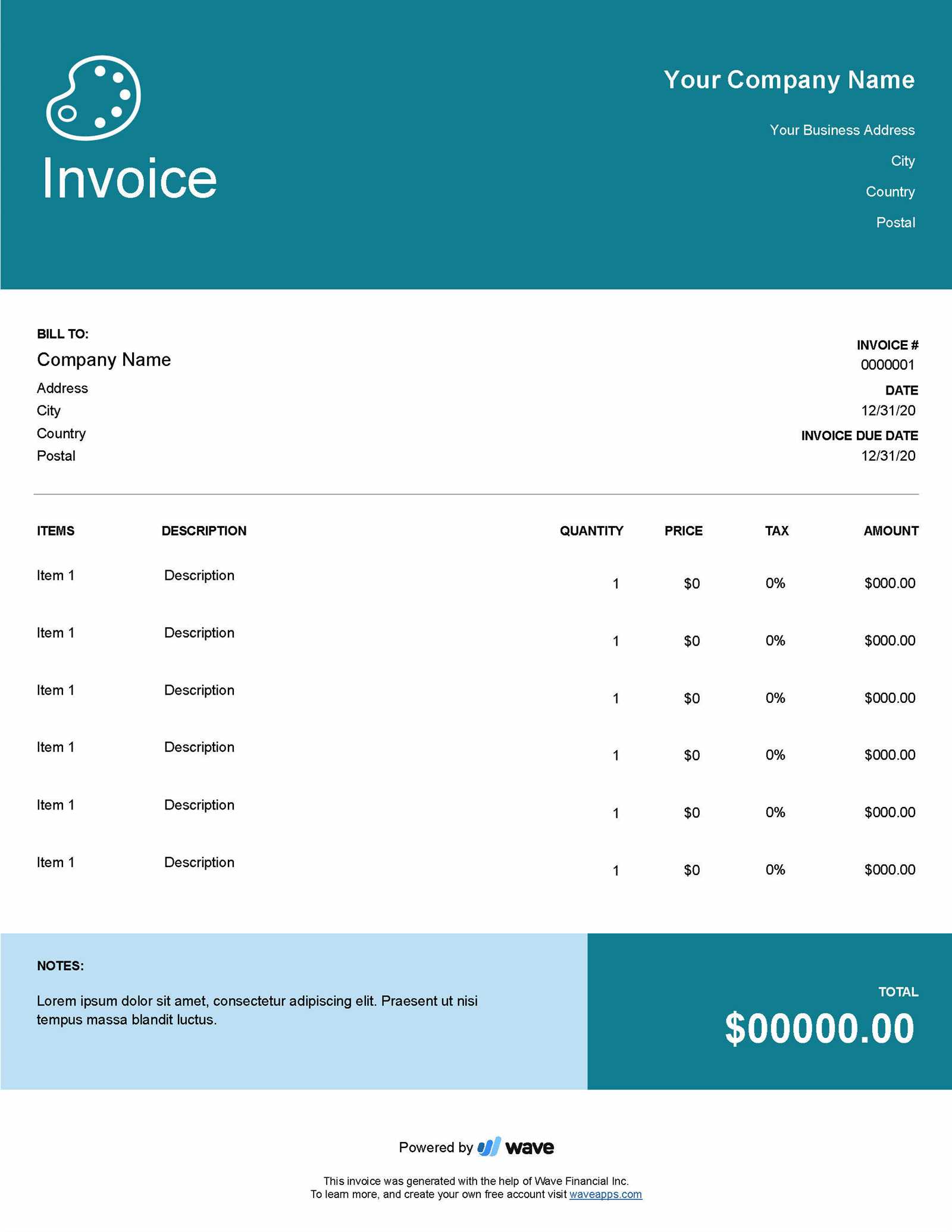

Tailoring your billing document to suit your business needs and client preferences can significantly enhance the professionalism and clarity of your requests for payment. Customization allows you to include specific branding elements, payment instructions, and other unique details that reflect your services and business identity. In this section, we will explore how to adjust key sections to create a personalized and effective payment request.

1. Adjust the Layout and Design

The design of your document should align with your brand identity. This includes using your company logo, colors, and fonts to maintain consistency across all your business communications.

- Branding: Incorporate your logo at the top and select colors that reflect your business’s visual identity.

- Fonts: Choose professional fonts that are easy to read, and ensure consistency with other company documents.

- Headers: Customize headers to include your business name, address, and contact information in a clear and visually appealing way.

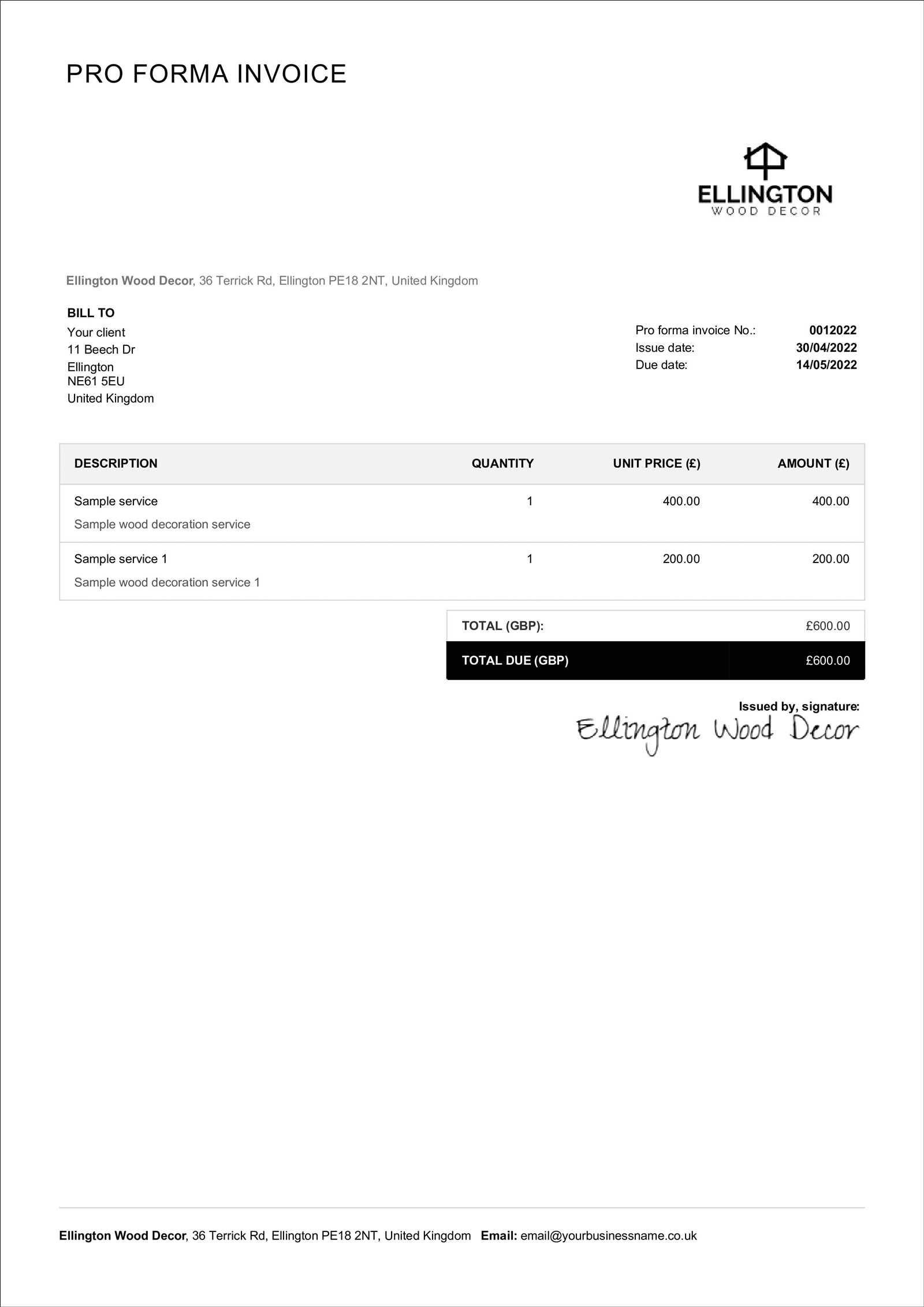

2. Modify Service Descriptions and Costs

Customizing the service details is key to making your document more accurate and relevant to each client. You may want to add additional lines for more services, adjust quantities, or provide specific notes related to the tasks completed.

| Service Description | Quantity | Rate | Total |

|---|---|---|---|

| Consulting Session | 5 hours | $50/hour | $250 |

| Project Management | 3 hours | $75/hour | $225 |

Ensure the descriptions clearly reflect the services rendered, and include any relevant terms such as hourly rates, flat fees, or custom packages for specific clients. You can also add extra lines for discounts or additional charges as needed.

3. Include Custom Payment Instructions

Customizing the payment section is essential to avoid confusion and provide clear directions for clients. Include details about accepted payment methods, late fees, and any other terms specific to the client or the type of service provided.

- Accepted Payment Methods: Specify whether clients can pay via bank transfer, PayPal, credit card, or other options.

- Late Payment Penalties: If you apply late fees, clearly state them in this section, including the rate and when they apply.

- Notes or Terms: Include any other special payment terms or discounts for early payment.

By customizing these elements, you can create a unique document that suits your specific needs and enhances the client experience, making it easier for them to understand and process your

Choosing the Right Invoice Software

Selecting the right software to manage your payment requests and financial records is essential for streamlining your business operations. The right tool can save you time, reduce errors, and ensure that all transactions are accurately tracked. With many options available, it’s important to choose a solution that fits your specific business needs, whether you’re a freelancer, small business owner, or part of a larger organization.

When evaluating software, consider features such as ease of use, customization options, integration with other tools, and scalability. A good program should make it easy to create and send requests, track payments, and maintain accurate financial records. In addition, it should offer flexibility to adapt to your specific requirements, whether that’s offering detailed reports, automatic reminders for late payments, or the ability to customize document designs.

Some software options offer additional features, such as tax calculations, multi-currency support, or the ability to manage recurring charges. Choose a platform that can grow with your business and meet your evolving needs.

How to Calculate Performance Fees

Calculating fees for services based on specific outcomes or results requires a methodical approach to ensure fairness and transparency. These fees can vary depending on the scope of work, the complexity of the project, and the agreed-upon terms between you and the client. Below, we will outline a few key steps and common methods used to calculate these fees effectively.

1. Determine the Basis for the Fee

The first step is to define the criteria that will determine how the fee is calculated. This can depend on various factors, including the value of work completed, the time spent, or the results achieved.

- Fixed Rate: A predetermined amount for specific tasks or services.

- Hourly Rate: An agreed-upon rate based on the number of hours worked.

- Percentage of Revenue: A percentage of the revenue or profit generated as a result of your services.

- Milestone Payments: Payments based on the completion of specific project milestones or results.

2. Include Additional Costs or Expenses

In many cases, the overall fee will include not just the cost of labor but also any out-of-pocket expenses that were incurred during the work. These should be carefully documented to ensure transparency and avoid confusion.

- Materials or Supplies: Include any costs for physical goods or supplies used in the service delivery.

- Travel or Shipping: If travel or shipping costs are involved, they should be clearly added to the total fee.

- Subcontractors or Third-Party Services: If you have hired subcontractors or used third-party services, these expenses should be factored in.

3. Account for Performance-Based Adjustments

In cases where the fee is tied directly to performance, you may need to make adjustments based on the results achieved. This can include bonuses for exceeding goals or discounts for failing to meet expectations.

- Bonus Structure: Offer a performance bonus for exceeding agreed-upon targets, such as completing a project ahead of schedule or generating higher-than-expected results.

- Penalty Clause: Consider including penalties for underperformance or failure to meet specific benchmarks.

4. Calculate the Total Amount

Once all components have been established, calculate the total fee by adding together the base charge, any additional costs, and any performance-related adjustments. Ensure that all fees are clearly itemized for the client’s understanding.

- Base Fee: The agreed-upon fee for the services or tasks completed.

- Additional Costs: Any out-of-pocket expenses or extra charges incurred.

- Performance Adjustments: Add any bonuses or penalties based on the final outcome.

By following these steps and calculating the total amount methodically, you can ensure a transparent, fair, and accurate fee structure for your clients. This will help in maintaining trust and fostering long

Including Taxes on Your Invoice

When requesting payment for services, it’s essential to include the appropriate taxes to ensure compliance with local tax laws. Failing to account for taxes can lead to complications for both you and your client, as well as potential legal issues. Accurately including taxes not only protects you but also helps your client understand the full cost of the transaction. In this section, we’ll discuss how to properly calculate and display taxes on your billing document.

1. Identify Applicable Taxes

Before you can apply taxes, it’s crucial to determine which types of taxes apply to your services or goods. Tax rates vary depending on your location, the client’s location, and the nature of the service provided.

- Sales Tax: Typically applies to goods and some services, depending on local tax regulations.

- Value Added Tax (VAT): A consumption tax common in many countries, applied at each stage of production or distribution.

- Service Tax: Some regions may impose a specific tax on services rather than goods.

2. Calculate the Tax Amount

Once you know which taxes apply, the next step is to calculate the tax amount to be added. This will depend on the agreed-upon pricing and the tax rate for the specific service or product.

- Sales Tax: Multiply the total amount for services or goods by the sales tax rate. For example, if the service costs $500 and the sales tax rate is 8%, the tax would be $40.

- VAT: For VAT, calculate the tax based on the total price, including VAT, to find the tax amount separately. In some cases, this may be included in the total price already.

Be sure to clarify whether the tax is included in the price or added as a separate line item. This will prevent confusion and make the document easier to understand.

3. Displaying Taxes Clearly

It’s important to present tax details clearly and transparently to avoid misunderstandings. Include a breakdown of the tax rate and the amount charged in an easily visible format.

- Separate Line for Taxes: Create a separate line item for taxes, clearly showing the percentage applied and the tax amount.

- Include Tax Identification Number: If required by local regulations, include your tax ID number on the document.

- Total Amount with Taxes: Display the total amount, including taxes, at the bottom of the document for easy reference.

By correctly including and displaying taxes, you not only stay compliant with legal requirements but also maintain clarity and professionalism in your financial dealings.

Setting Payment Terms for Your Invoice

Establishing clear payment terms is essential to ensure that both you and your client understand the expectations regarding when and how payments should be made. Well-defined terms prevent confusion and delays and help maintain a professional relationship. In this section, we will explore how to set effective payment terms that protect both parties and encourage timely payments.

1. Define the Payment Due Date

One of the most important aspects of payment terms is specifying when the payment is due. The due date sets clear expectations and helps avoid misunderstandings or late payments.

- Standard Payment Terms: Commonly used terms include “Net 30” (payment due within 30 days), “Net 15,” or “Net 60,” depending on your agreement with the client.

- Fixed Due Date: Alternatively, you can specify a fixed due date, such as “Payment due by the 15th of each month.”

- Payment Upon Completion: If the work is project-based, you may set payment due immediately after the project is completed.

2. Include Accepted Payment Methods

Clearly listing the methods of payment you accept helps clients understand how they can fulfill their financial obligations. Be sure to include multiple options to accommodate client preferences and make the process as smooth as possible.

- Bank Transfer: Provide your bank account details for direct payments.

- Credit Card: Indicate whether you accept credit card payments through a secure payment processor.

- Online Payment Systems: If you use services like PayPal or Stripe, include the relevant payment details.

- Checks: If you accept checks, specify the mailing address or the name to make them payable to.

3. Specify Late Payment Fees

To encourage timely payments, it’s a good idea to outline any late payment fees or penalties in advance. This section helps mitigate delays and ensures that clients are aware of the consequences of not meeting the payment deadline.

| Late Fee Type | Fee Amount | Conditions |

|---|---|---|

| Fixed Fee | $25 | Applied if payment is not received within 10 days of the due date. |

| Percentage Fee | 2% of the total | Applied monthly on any overdue balance after the due date. |

By outlining late fees clearly, you provide an incentive for clients to make payments on time, thus reducing the likelihood of delayed payments.

4. Offer Early P

How to Send and Track Invoices

Sending and tracking payment requests is an essential part of managing your business finances. It ensures you receive payment on time and keeps you organized when dealing with multiple clients. By choosing the right tools and processes, you can streamline your billing system and avoid missed payments or confusion. This section will guide you through the steps of sending out payment requests and keeping track of their status.

1. Sending Payment Requests

Once your payment document is ready, you need to send it to your client in a clear and professional manner. This ensures that all relevant information is received and reviewed promptly.

- Email: The most common method of sending payment requests. Attach the document as a PDF for easy access and secure delivery.

- Online Payment Platforms: If you’re using an online platform like PayPal or Stripe, you can send the request directly through their interface, which also allows for easy payment tracking.

- Postal Mail: If a client prefers physical copies, mail the request along with a return envelope for payment.

- Client Portal: Some businesses offer client portals where payment requests can be uploaded and managed. This option is convenient for clients who prefer online access to their billing documents.

2. Tracking Payment Status

Once the payment request has been sent, it’s crucial to track its status to ensure timely payment. This helps you stay on top of any overdue balances and follow up if necessary.

- Manual Tracking: Keep a detailed record of sent requests and their due dates. Mark when a payment is received and note any outstanding amounts.

- Automated Tracking: Many accounting software programs automatically track payments. These tools often provide reminders for overdue payments and offer real-time updates when a payment is received.

- Payment Confirmation: After sending the payment request, confirm with the client that they have received it. You can ask for a receipt or acknowledgment of the payment due date.

- Follow-Up Process: Set a system for following up on overdue payments. This could include sending reminders at regular intervals (e.g., 7 days, 14 days) and establishing a protocol for escalating collection efforts if needed.

By setting up a reliable system for both sending and tracking payment requests, you can minimize the chances of late payments and improve your cash flow management.

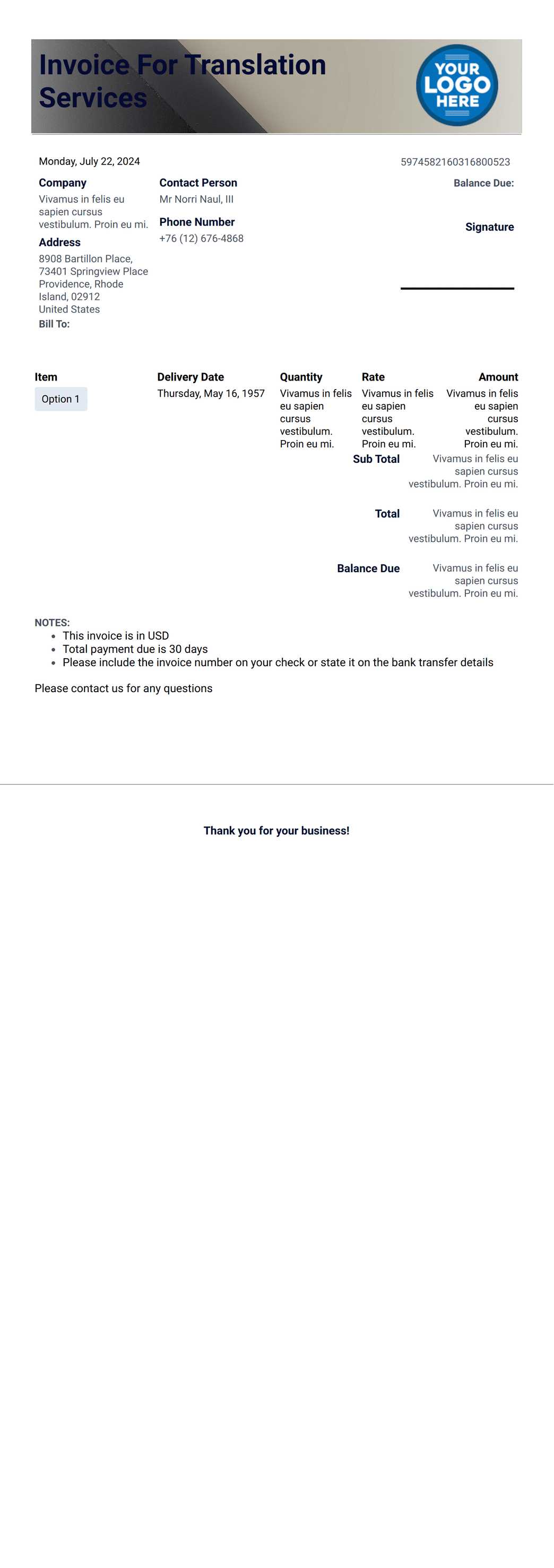

Invoice Templates for Different Industries

Different industries have specific needs when it comes to billing clients. The structure and content of the payment request may vary based on the type of service or product offered. Understanding the unique requirements for each sector can help you create the most appropriate and professional document for your business. Below, we explore how various industries typically structure their payment requests.

1. Creative and Freelance Services

Freelancers and creatives, such as writers, designers, and photographers, often have different requirements compared to other industries. Their payment requests typically need to be simple yet detailed, capturing the nature of the service provided, hours worked, and agreed-upon fees.

- Hourly or Project-Based Fees: Clearly state whether the fees are hourly or based on the scope of a specific project.

- Milestones: Break down the payments into stages based on work completed, such as 50% upfront and 50% upon completion.

- Licensing and Usage Rights: Include terms regarding the transfer of intellectual property or licensing rights for any creative work.

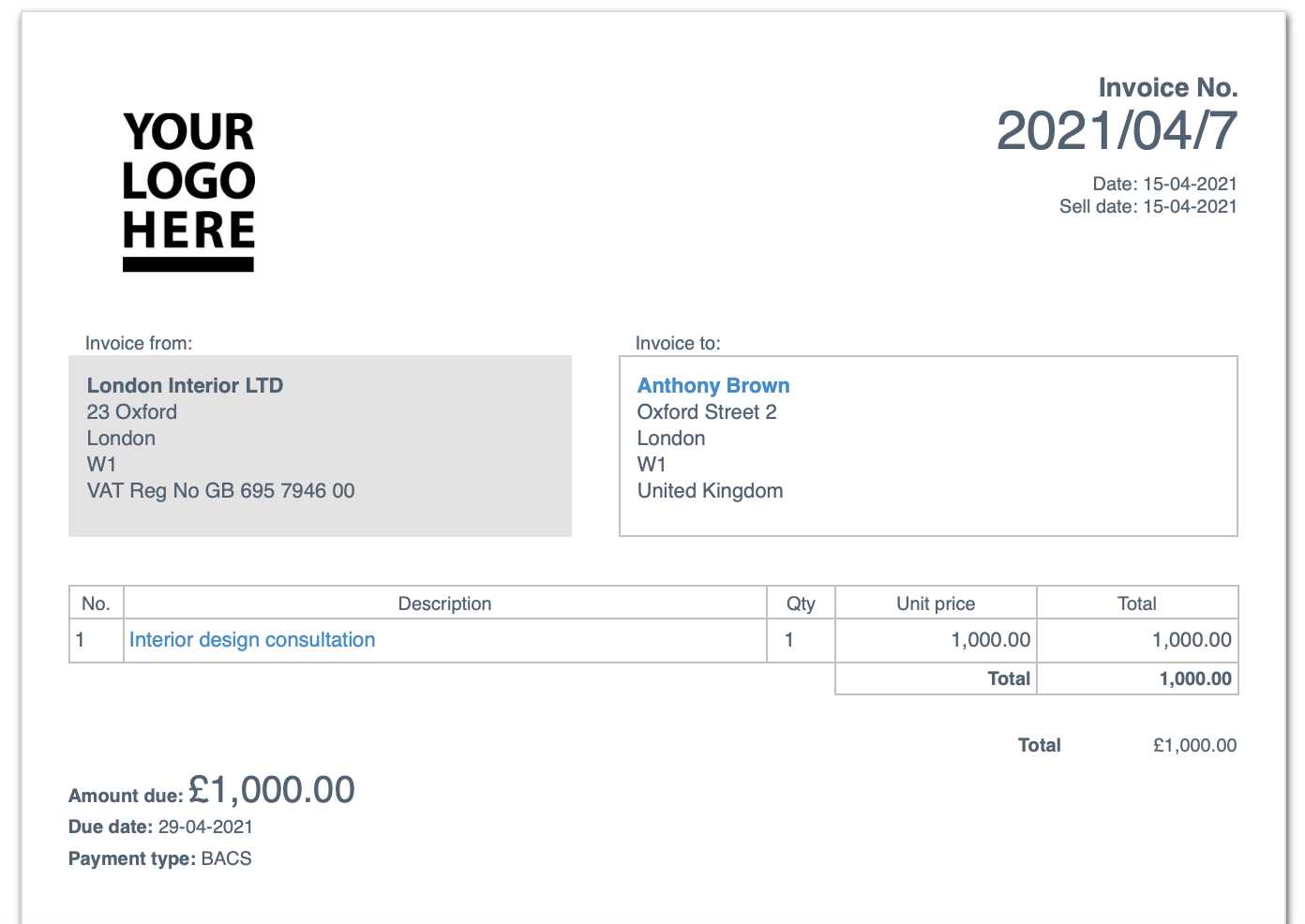

2. Consulting and Professional Services

Consultants and other professionals, such as lawyers or accountants, may charge for their expertise, typically on an hourly or flat-rate basis. It’s important to outline the exact services provided and specify any terms regarding additional charges for meetings, travel, or expenses.

- Hourly Rate or Flat Rate: Be specific about how fees are calculated–whether it’s per hour or a flat rate for a defined service.

- Retainers: If the client is on a retainer, clearly outline the agreed-upon retainer fee and the services included under this agreement.

- Expenses: If the service involves additional costs like travel or research, itemize these separately for transparency.

3. Retail and E-commerce

Retail and e-commerce businesses typically deal with tangible products and will need to provide clear pricing, shipping fees, and tax details. Billing documents for this industry should provide itemized lists of products sold, along with any applicable shipping charges.

- Product Details: Include item names, quantities, unit prices, and total prices for each product sold.

- Shipping and Handling: Include any additional charges for shipping, packaging, or handling, if applicable.

- Sales Tax: Clearly list applicable taxes, based on local tax laws.

4. Construction and Contracting

In the construction industry, payments are often based on work completed, materials used, and milestones achieved. Payment documents need to reflect the scope of work, detailed estimates, and any costs for materials or subcontractors.

- Progress Billing: Provide clear breakdowns of work completed and payments due bas

Legal Requirements for Performance Invoices

When creating a request for payment, it’s essential to understand the legal obligations that govern how such documents should be structured. Compliance with local, state, and international laws ensures that both parties in a transaction are protected, and the process remains transparent. Legal requirements can vary by country or industry, but certain elements must be included to meet general regulatory standards.

1. Mandatory Information to Include

To ensure your billing document is legally sound, certain information must be included. Omitting key details could lead to disputes or even legal challenges. Below are the critical elements that are generally required:

- Business Identification: Include your business name, address, and contact information. For sole proprietors, include your personal name as well.

- Client Information: Ensure that the client’s name, company name (if applicable), and address are correct and clearly displayed.

- Unique Identifier: Each document should have a unique reference number (e.g., a bill or reference number), which makes it easy to track and refer to.

- Date of Issue: Clearly state the date the payment request is issued to establish the timeline for payment.

- Detailed Description of Goods or Services: Include a description of the work completed, services provided, or products sold, with corresponding prices.

- Tax Information: In many regions, it’s necessary to display the relevant tax identification numbers (e.g., VAT or sales tax number), as well as the applicable tax rates and amounts.

2. Payment Terms and Deadlines

Establishing clear terms and payment deadlines is crucial for both legal and financial clarity. Without these details, clients may refuse payment or delay payment beyond the agreed-upon time frame, leading to financial instability.

- Due Date: Specify the payment due date or the time frame within which payment should be made (e.g., “Net 30,” “within 10 days,” etc.).

- Late Fees: If applicable, outline any penalties or interest for late payments. These should be clearly stated and compliant with local laws regarding maximum allowable rates.

- Accepted Payment Methods: Clearly state how payment can be made (e.g., bank transfer, online payment platforms, checks, etc.).

- Payment Schedule: If the payment is due in stages (e.g., deposits, installment payments), this should be explicitly outlined, including due dates for each stage.

3. Regional and International Compliance

Depending on your location or the location of your client, there may be additional legal requirements related to the type of transaction or industry you are operating in. Understanding and adhering to these regulations is key to avoiding legal issues.

- Tax Laws: Different regions have different tax rates and rules for how sales or services are taxed. Ensure compliance with your local tax authority, whether it’s VAT, GST, or sales tax.

- Currency and Language: When working with international clients, make sure to specify the currency and language of the payment request. Some countries have legal requirements for providing documents in the local language or in a specific currency.

- Consumer Protection Laws: Certain regions, especially within the EU, have strict consumer protection laws that govern payment agreements. These laws may require specific disclosures or terms in your payment documents.

By following these legal guidelines, you help safeguard your business from potential legal compl

How to Handle Late Payments

Dealing with late payments is a challenge that many businesses face. When clients or customers fail to make payments on time, it can disrupt cash flow and cause unnecessary stress. However, addressing overdue balances in a professional manner can help you maintain a positive relationship with clients while ensuring that your financial health remains intact. This section will explore effective strategies for handling delayed payments and minimizing their impact on your business.

1. Communicate Early and Clearly

Clear communication is key when addressing late payments. It’s essential to remind your client about the overdue balance in a polite and professional manner. Often, clients may forget or overlook their payment deadlines, and a gentle reminder can resolve the issue quickly.

- Send a Reminder: Reach out with a friendly reminder a few days after the payment is due. This can be done via email, phone call, or even a formal letter, depending on your preferred communication method.

- State the Details: Include the amount due, the original due date, and any terms that apply (e.g., late fees, penalties). Be clear but polite.

- Offer Assistance: If the client is facing financial issues, offer to discuss a payment plan or extended deadline, which can help maintain goodwill and preserve the relationship.

2. Implement Late Fees and Penalties

If late payments continue to be an issue, it’s important to have a policy in place for charging fees or penalties. These measures encourage timely payments and compensate for any inconvenience or financial strain caused by delayed transactions.

- Set Clear Terms in Advance: When starting a new project or contract, clearly define the consequences of late payments in your terms and conditions, such as adding interest or flat fees after a certain number of days.

- Apply Late Fees Consistently: If the terms specify late fees, apply them consistently to all clients. This ensures fairness and reduces the likelihood of delays in the future.

- Consider Offering Discounts: As an alternative to penalties, consider offering discounts for early payments. This can incentivize clients to pay on time while rewarding promptness.

3. Explore Payment Plan Options

If a client is unable to pay the full amount at once, it may be beneficial to offer a payment plan. This can help you receive at least a portion of the amount due while providing your client with some flexibility.

- Negotiate Terms: Work with your client to establish a reasonable payment schedule. This could include monthly or bi-weekly payments, depending on the amount owed.

- Formalize the Agreement: Make sure any payment plan is documented in writing, including the agreed-upon dates and amounts. This ensures that both parties are on the same page and legally protected.

- Monitor Payments: Keep track of payments according to the schedule. If payments are missed, follow up promptly to avoid the plan from falling apart.

By implementing these strategies, you can manage late payments effectively and protect your business’s cash flow. Timely communication, clear terms, and the use of penalties or payment plans can prevent overdue balances from becoming a long-term problem.

Benefits of Digital Invoices

As businesses increasingly embrace technology, the shift towards electronic billing documents has become more prominent. Using digital payment requests offers several advantages over traditional paper-based methods, enhancing efficiency, accuracy, and convenience for both business owners and clients. Here, we explore the main benefits of adopting electronic billing systems.

1. Improved Efficiency and Speed

One of the most significant benefits of using digital documents is the speed and efficiency they bring to the billing process. Electronic methods allow you to generate, send, and receive payment requests in a fraction of the time it takes to handle paper versions.

- Instant Delivery: Electronic documents can be sent immediately via email or online platforms, eliminating the delays associated with postal mail.

- Quick Processing: Clients can review and make payments faster, speeding up your cash flow and reducing the time spent waiting for funds.

- Automated Reminders: Automated systems can send reminders for overdue payments, saving you the time and effort of manually following up.

2. Reduced Errors and Improved Accuracy

Manual processes, such as handwritten billing, are prone to errors, whether from typos, incorrect calculations, or missed details. Digital payment requests help reduce these mistakes, improving accuracy across the board.

- Automatic Calculations: Most electronic systems have built-in calculation tools to ensure amounts and taxes are calculated correctly, minimizing human error.

- Standardized Formats: Digital platforms often offer standardized formats that help you include all necessary details in the correct order, ensuring that you don’t forget any important information.

- Data Validation: Many software solutions have data validation features that alert you if something is incorrect or missing before you send the document.

3. Cost and Resource Savings

Adopting electronic methods can save your business money in the long run. The costs associated with printing, mailing, and storing paper documents can add up quickly, especially for businesses that issue a high volume of payment requests.

- Reduced Paper Costs: By going digital, you can cut out the expense of paper, ink, and postage, leading to significant savings.

- Environmentally Friendly: Reducing paper usage is not only cost-effective but also better for the environment, helping you maintain a sustainable business model.

- Storage Efficiency: Digital records are easy to store, organize, and access, reducing the need for physical storage space and minimizing the risk of losing important documents.

4. Enhanced Security and Tracking

Digital systems offer better security than traditional paper-based methods. With electronic billing, sensitive financial information can be protected with encryption, and you can track the status of each document with ease.

- Secure Data Transmission: Most digital billing platforms use encryption to ensure that payment information remains confidential during transmission.

- Tracking and Audit Trails: You can easily track when a document was sent, received, viewed, and paid, providing a complete audit trail that enhances transparency and accountability.

- Reduced Risk of Loss: Unlike paper documents, digital files are not vulnerable to physical damage, theft, or misplacement, reducing the risk of losing important records.

Incorporating digital payment requests into your business operations offers a range of advantages, from streamlining your workflow to improving financial accuracy. By transitioning to electronic systems, businesses can enjoy faster transactions, reduced costs, and improved client satisfaction.