How to Create an Invoice for Graphic Design Template

When working in the creative industry, ensuring smooth financial transactions is as important as delivering quality work. Clear and well-structured billing documents not only reflect professionalism but also help streamline the payment process. Whether you are a freelancer or part of a larger studio, having an organized system for invoicing clients is crucial for maintaining healthy cash flow.

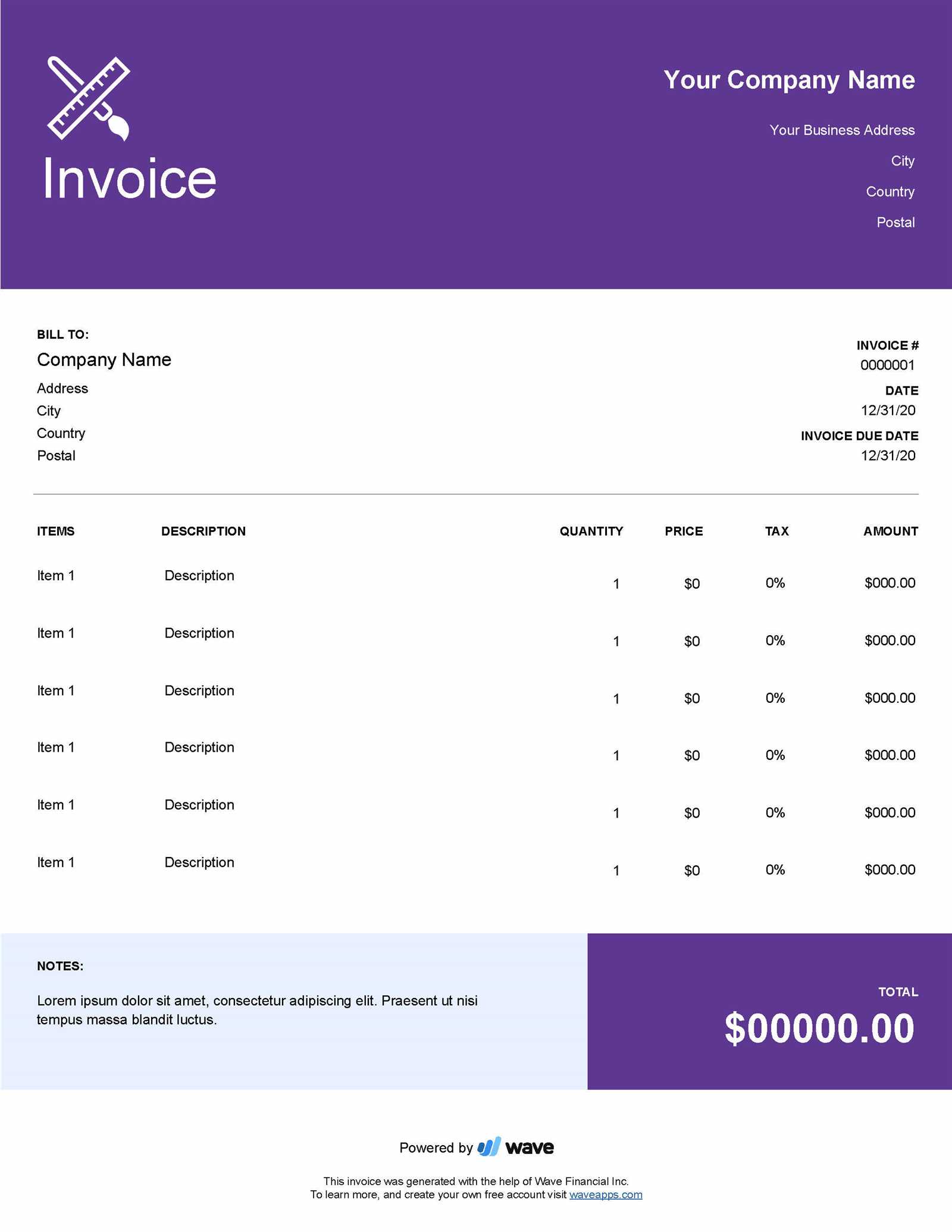

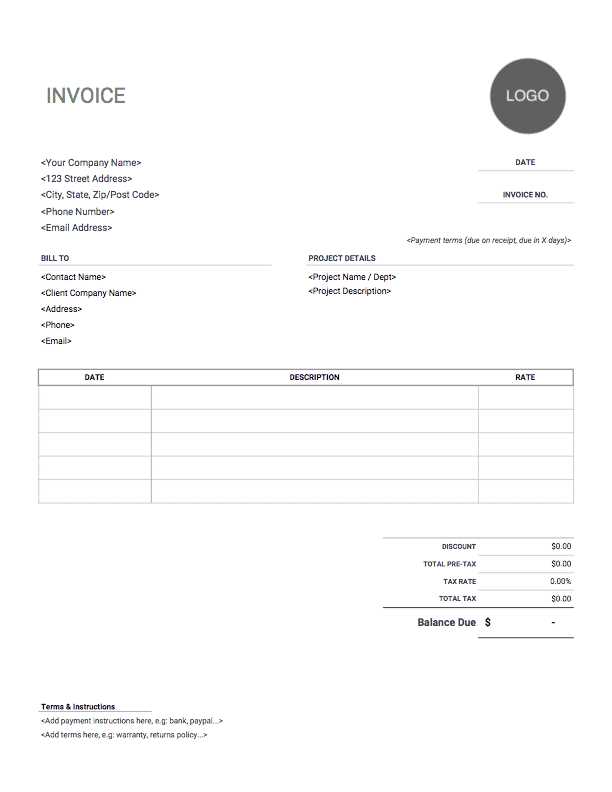

Utilizing customizable templates can save time and eliminate errors, allowing you to focus more on your craft. These ready-made forms can be tailored to fit your specific needs, whether you are charging per hour, project, or on a retainer basis. By following best practices and including all necessary details, you can avoid misunderstandings and ensure both parties are satisfied with the terms of payment.

In this guide, we’ll explore the key elements to include in these essential documents and how you can create a smooth billing process that supports your creative business. From calculating fees to handling payment terms, we’ll help you craft documents that convey professionalism and clarity.

How to Design a Graphic Invoice

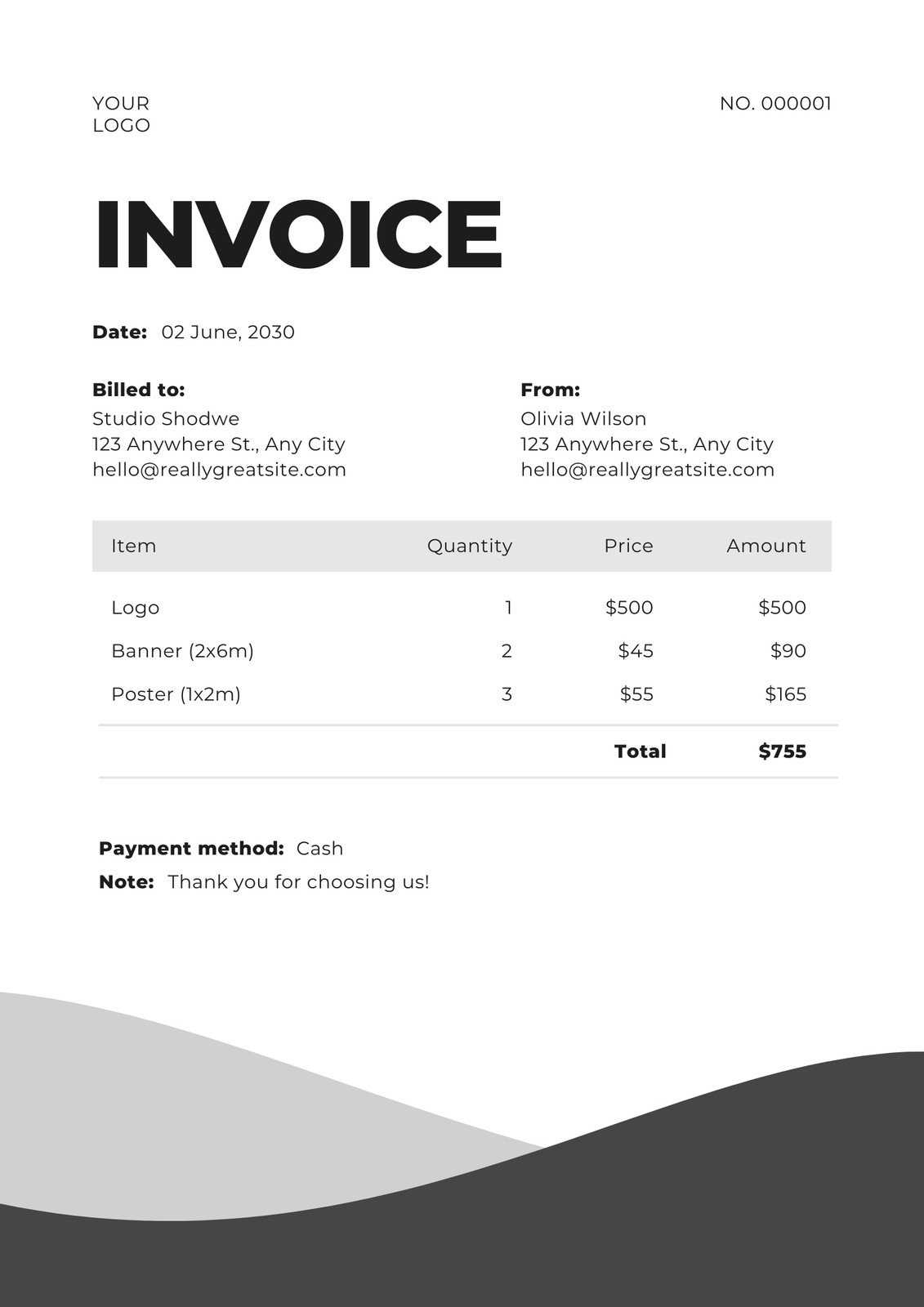

Creating a professional billing document goes beyond simply listing services and costs. The appearance and structure of the document are key elements that help establish credibility and make a positive impression on clients. A well-designed form not only ensures clarity but also reflects the quality of the work provided. It is essential that your billing document looks clean, organized, and visually appealing to reinforce your brand’s professionalism.

Choose a Clean Layout

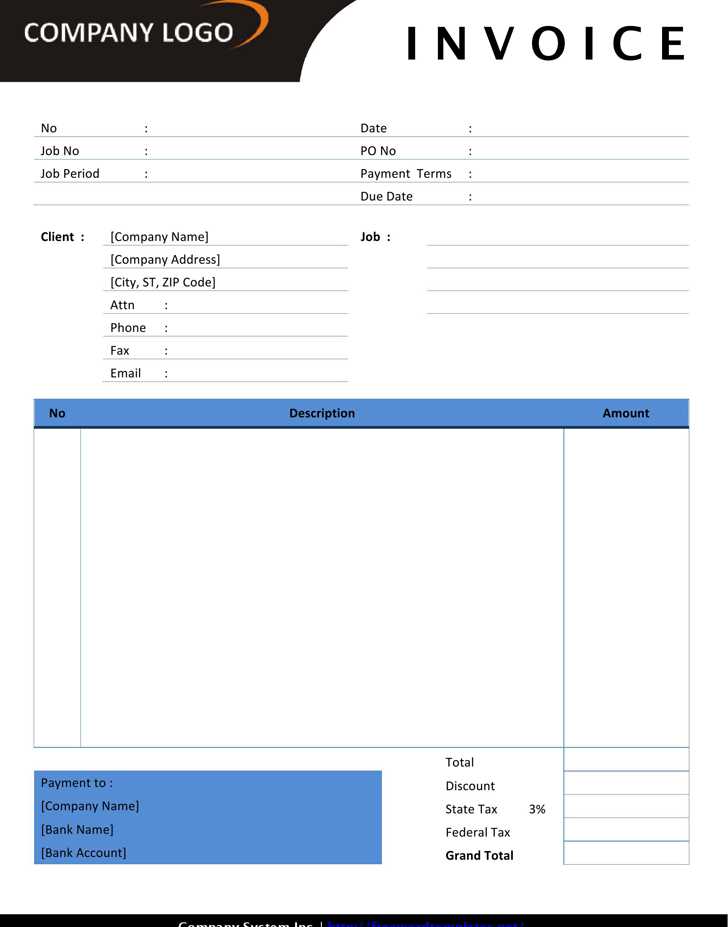

A simple and uncluttered layout is the foundation of a good billing document. Avoid overwhelming the reader with too many elements. Focus on making the most important information, such as the amount due, payment terms, and services rendered, easy to find. Use clear sections and headings to guide the reader’s eye naturally through the content.

Incorporate Your Branding

Incorporating your unique branding elements into your billing form helps maintain consistency across all client communications. Use your logo, brand colors, and typography to make the document feel cohesive with the rest of your professional materials. By doing so, you not only create a polished, professional image but also reinforce your identity with every interaction.

Why Use a Template for Invoices

Having a pre-made format for billing is an efficient way to save time and avoid mistakes. Instead of starting from scratch each time, a structured document allows you to focus on the details while maintaining consistency. It ensures that no essential information is left out and minimizes the chances of errors in calculations or formatting.

Using a ready-made form also streamlines your workflow, especially when working with multiple clients. You can easily customize the template to fit each project’s specific requirements, from pricing to services provided, without having to redesign the entire layout. Consistency across all your documents not only boosts professionalism but also helps with quicker processing and easier tracking of payments.

Furthermore, these customizable forms often come with features that assist in automating repetitive tasks, such as calculating totals or including taxes, which can save valuable time. With a template, you can focus more on your work while ensuring that your billing process is seamless and efficient.

Essential Elements of a Billing Document

To ensure a smooth transaction and avoid confusion, it is important to include certain key components in any professional billing document. These elements not only help to clarify the details of the payment but also create a sense of professionalism and trust with your clients. Whether you are providing a service or a product, the right structure ensures both you and your client are on the same page.

Key Information to Include

Each billing document should contain specific information to facilitate clarity and make the payment process seamless. Here are some of the most important details:

- Your business details: Include your company name, address, email, and phone number. This ensures the client knows who they are dealing with.

- Client’s information: Clearly state the client’s name, company, and contact details.

- Unique reference number: A unique number or code for tracking purposes that helps to identify the document in your records.

- Services or products provided: A detailed list of what was delivered, along with any relevant descriptions to avoid confusion.

- Total amount due: The final amount owed, broken down by individual services or units if necessary.

- Payment terms: Specify the payment due date, accepted payment methods, and any late fees if applicable.

Additional Optional Elements

While the above elements are essential, there are some optional components that can enhance your document further:

- Terms and conditions: Including any applicable terms can help prevent disputes and clarify your working arrangements.

- Notes or special instructions: Adding a personal note or important instructions can make the document feel more customized and professional.

- Discounts or promotions: If applicable, state any discounts given or special pricing arrangements made with the client.

By incorporating these essential elements, you create a comprehensive and professional billing document that promotes transparency and ensures a smoother payment process.

Free Templates for Creative Professionals

For freelancers and professionals in the creative industry, having access to well-structured forms can significantly simplify the billing process. Free customizable documents can save time and effort, allowing you to focus on your work rather than worrying about formatting and organization. These pre-made options provide a professional appearance while ensuring that all necessary details are included, making it easier to manage client transactions efficiently.

Many platforms offer free, high-quality formats tailored specifically for creative services. These resources are often easy to edit, enabling you to adjust the layout and content to suit your specific needs. With these ready-made forms, you can quickly generate the documents you need to ensure a smooth and professional payment process every time you complete a project.

Utilizing such free forms not only saves money but also guarantees that your documents meet industry standards, helping you maintain a professional reputation while staying organized. Whether you’re just starting or have years of experience, these resources can enhance your workflow and improve client communication.

Customizing Your Billing Document

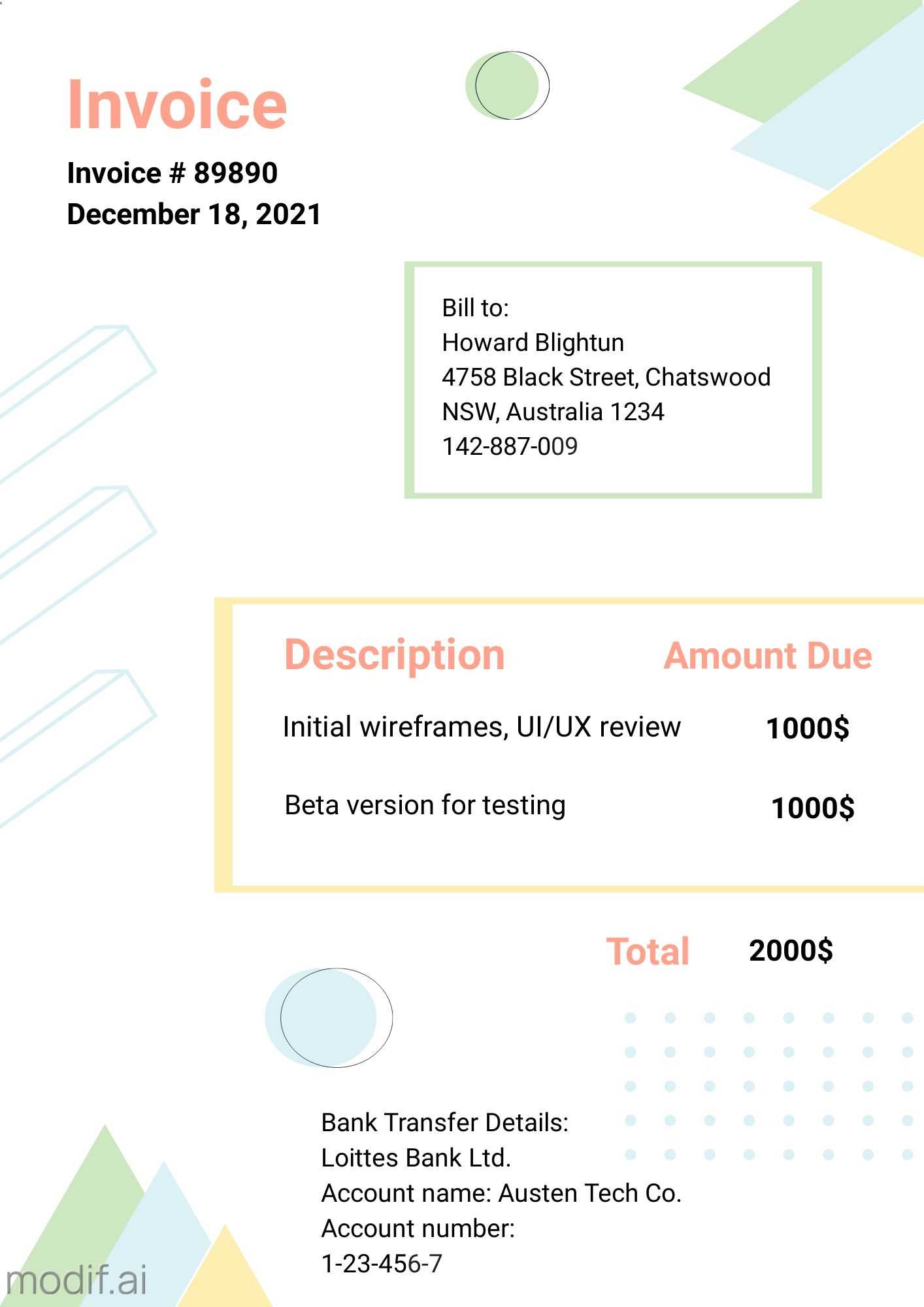

Customizing your billing document is essential to reflect your unique style and meet specific client needs. By tailoring the layout and content, you can create a professional, personalized document that represents your business while ensuring that all important details are clearly communicated. Customization also helps streamline your workflow and saves time on repetitive tasks.

Adjusting Layout and Design

One of the first steps in customization is adjusting the layout to suit your preferences and business needs. You can modify sections such as client information, services provided, and total amount due to ensure clarity and simplicity. Use clean lines, ample white space, and bold headings to separate different parts of the document, making it easy for your clients to navigate through. Customizing the layout to reflect your brand’s style can help create a cohesive professional image that aligns with the rest of your materials.

Personalizing with Client-Specific Details

Personalization goes beyond the visual elements. You can also customize the document with client-specific information such as payment terms, special discounts, or project-specific notes. Including any relevant details about the nature of the work or specific agreements you made can help avoid misunderstandings and make the process more transparent for both you and your client.

Choosing the Right Format for Billing Documents

Selecting the appropriate format for your billing document is crucial to ensure both you and your clients have a seamless experience. A well-organized and easy-to-read layout can help prevent errors, improve understanding, and facilitate faster payments. The format should be flexible enough to accommodate your specific needs while maintaining a professional and consistent appearance.

There are several options to choose from, including digital formats like PDFs and spreadsheets, as well as traditional paper versions. The right choice depends on your business style, the preferences of your clients, and the level of customization you require. Digital formats are often more convenient for tracking and storing records, while paper versions can still be useful in certain industries or for clients who prefer hard copies.

Additionally, consider the level of detail and customization you need. Simple forms might suffice for smaller projects, while larger or ongoing contracts may require more elaborate layouts with additional sections and calculations. Ultimately, your choice should make the process more efficient, professional, and aligned with the type of service you provide.

Benefits of Digital Billing Documents for Designers

Switching to digital formats for billing can offer a variety of advantages, especially for professionals in creative industries. Digital documents are more efficient, easier to manage, and help streamline the financial aspects of a business. With the right tools, they can simplify the entire payment process, from creating and sending to tracking and storing records.

Speed and Convenience

Digital files can be created, edited, and sent quickly, eliminating the need for physical paperwork. This means faster communication with clients and quicker payment processing. You can easily attach documents to emails or share them through secure online platforms, making transactions smoother and more efficient.

Better Organization and Tracking

Keeping digital records of billing documents allows for better organization and more accessible tracking. Unlike paper records, which can easily be lost or disorganized, digital files can be stored in cloud-based systems or file management tools. This makes it easier to reference past transactions, keep track of unpaid amounts, and generate reports.

| Benefits | Details |

|---|---|

| Speed | Quick creation, editing, and delivery of documents. |

| Convenience | Shareable through email or online platforms for faster transactions. |

| Organization | Easy to store and organize in digital folders, preventing lost documents. |

| Tracking | Allows for real-time tracking of payments, due dates, and outstanding amounts. |

Ultimately, digital billing documents can save time, reduce errors, and make it easier to manage your finances, allowing you to focus more on your creative work.

Common Mistakes in Billing Documents

When creating billing documents, it’s easy to overlook certain details, especially when juggling multiple clients or projects. However, small mistakes can lead to confusion, delays in payment, and even disputes. Identifying and avoiding common errors can help ensure that your documents are professional, clear, and facilitate smooth transactions.

Missing or Incorrect Client Information

One of the most common errors is providing incomplete or incorrect client details. Failing to include the correct name, company, or contact information can lead to confusion and delays in communication. Always double-check that you have the right details, especially when working with new clients or on a new project. Accuracy in this area is crucial for a professional image and smooth payment processing.

Unclear Payment Terms and Conditions

Another frequent mistake is not clearly outlining payment terms. If payment deadlines, methods, or late fees are not explicitly stated, it can create misunderstandings with the client. Always ensure that your payment terms are clearly defined, specifying the due date, accepted methods, and any penalties for late payments. This helps avoid confusion and ensures both parties are on the same page.

How to Calculate Fees in Billing Documents

Calculating accurate fees for services is essential for ensuring both you and your clients are satisfied with the financial arrangement. Whether you charge hourly rates, project-based fees, or a flat rate, it’s important to outline how these costs are derived clearly. This transparency helps avoid misunderstandings and ensures that both parties agree on the amount to be paid.

Hourly Rate Calculation

If you charge by the hour, start by determining your hourly rate. This rate should reflect your expertise, time commitment, and market value. Multiply your hourly rate by the number of hours worked to calculate the total amount owed. Always track the hours spent on each task, as it provides a clear breakdown of your work and justifies your fees.

Project-Based or Flat Rate Fees

When working on a fixed-price project, determine the total cost upfront based on the scope of work. Break down the project into manageable phases or milestones, and assign a cost to each phase. This method is especially useful for larger projects with multiple components. Clarity in outlining what is included in the flat rate helps prevent any surprises for the client.

Best Practices for Professional Billing Documents

Creating professional billing documents is essential for maintaining credibility and ensuring smooth financial transactions. A well-structured document not only communicates the necessary details but also reflects the professionalism of your business. Adhering to best practices when crafting these documents can help build trust with clients and minimize confusion during the payment process.

Clear and Concise Information

One of the most important aspects of a professional document is clarity. Avoid unnecessary jargon or complicated language. Include only the essential details, such as the services provided, amounts owed, payment terms, and contact information. This allows clients to quickly understand what is being billed and reduces the likelihood of disputes or confusion.

Consistent Formatting and Structure

Consistent formatting is crucial for readability and professionalism. Use a clean, organized layout with clearly defined sections for each important piece of information. Group related details together (such as payment terms and total amount) and use headings or bullet points for easy navigation. Consistency in fonts, colors, and spacing ensures your document appears polished and easy to follow.

| Best Practice | Why It Matters |

|---|---|

| Clear Breakdown of Services | Ensures transparency and helps avoid misunderstandings about what was delivered. |

| Accurate Dates and Deadlines | Prevents confusion regarding payment timelines and project completion. |

| Professional Language and Tone | Builds trust and enhances your reputation with clients. |

| Proper Formatting | Improves readability and ensures that all critical information is easy to find. |

By following these best practices, you can create a polished and professional document that not only simplifies the payment process but also strengthens your brand’s reputation.

Billing Software for Creative Professionals

For creative professionals, managing payments and keeping track of transactions can be time-consuming without the right tools. Using specialized software can streamline this process, making it easier to generate accurate documents, track payments, and maintain a professional workflow. With the right software, you can automate many aspects of billing and focus more on your work.

There are several billing solutions available that cater specifically to the needs of creative professionals. These tools offer various features that simplify the process, from customizable templates to integrated payment processing. Below are some key features to look for when choosing the right billing software:

- Customizable Formats: The ability to personalize layouts and include project-specific details helps maintain a professional appearance.

- Automated Calculations: Built-in tools to automatically calculate totals, taxes, and discounts save time and reduce errors.

- Payment Integration: Direct integration with payment platforms such as PayPal, Stripe, or bank transfers makes receiving payments easier.

- Client Management: Track your clients’ information, previous projects, and outstanding payments in one place for better organization.

- Recurring Billing: Ideal for ongoing projects or retainer agreements, this feature allows you to set up automatic, repeat billing.

By leveraging the right software, you can automate much of the manual work involved in billing, reducing the chances of errors while ensuring a professional and consistent process for your clients.

Tips for Streamlining Your Billing Process

Efficiently managing payments and financial documentation is key to keeping your business running smoothly. Streamlining your billing process not only saves time but also reduces the risk of errors, improves cash flow, and enhances your overall professionalism. With the right strategies in place, you can simplify the administrative side of your business and focus more on your creative work.

Here are some practical tips to help make your payment processing quicker and more organized:

- Automate Recurring Payments: For clients on retainer or long-term contracts, setting up automatic payments or billing schedules can eliminate the need for manual invoicing each time.

- Use Digital Solutions: Switching to online platforms allows for faster processing, easy access to records, and better tracking of paid and unpaid amounts.

- Set Clear Payment Terms: Define payment expectations upfront, including deadlines, late fees, and preferred payment methods to avoid confusion later on.

- Track Hours and Projects Efficiently: Use time-tracking tools or project management software to log hours worked or milestones completed, so you can easily translate this into an accurate final amount.

- Use Pre-designed Formats: Having a standardized, customizable document ready to go for each client helps speed up the process and ensures consistency across all transactions.

By implementing these strategies, you can streamline your financial operations, reduce stress, and ensure that your payment process is as smooth and professional as possible.

How to Avoid Billing Disputes

Disputes over payments can create unnecessary tension and delays, damaging both your client relationships and cash flow. Clear communication and proper documentation are key to minimizing misunderstandings and ensuring that both you and your clients are on the same page throughout the payment process. By taking a proactive approach, you can reduce the likelihood of conflicts and ensure smoother transactions.

Here are some effective strategies to avoid payment disputes:

- Define Expectations Clearly: Set clear terms from the beginning. Outline deadlines, payment methods, and amounts in writing to ensure both parties understand what is expected.

- Provide Detailed Descriptions: Include a comprehensive breakdown of the services provided. Specify what was completed, the hours worked, and any additional costs, so there are no questions about what the client is being billed for.

- Set Payment Deadlines: Agree on specific dates for payments and make sure these deadlines are clearly communicated. This avoids confusion and ensures both you and your client are on the same timeline.

- Stay Transparent About Additional Costs: If extra charges arise during the course of a project, inform your client immediately. Always get approval before proceeding with additional work that would affect the overall cost.

- Maintain Clear Communication: Throughout the project, keep your client informed of progress, any changes, and any issues that may arise. Regular communication helps build trust and prevents surprises when the time comes to settle the bill.

By taking these precautions, you can significantly reduce the chance of disputes and maintain a positive working relationship with your clients. Clear terms and transparency will help keep the payment process smooth and professional, allowing you to focus on your work without unnecessary interruptions.

Legal Considerations in Billing Documents

When creating billing documents, it’s important to ensure that they not only look professional but also comply with legal requirements. Understanding the legal aspects of payment requests can protect both you and your clients, reduce the risk of disputes, and help you avoid potential legal issues. These considerations are especially crucial for service-based businesses, where contracts, terms, and conditions are part of the overall financial transaction.

Key Legal Elements to Include

Certain elements must be included in your payment documents to ensure they are legally sound. Below are the essential details that should always be present:

- Clear Terms of Service: Outline the nature of the services provided, including any specific agreements or deliverables. This helps clarify expectations on both sides and serves as evidence in case of a dispute.

- Payment Deadlines: Specify clear payment deadlines to avoid any confusion about when payments are due. This will also give you legal leverage in case you need to charge late fees.

- Applicable Taxes: Depending on your location and the nature of the service, you may be required to charge taxes. Make sure to include any tax rates or VAT applicable to the total amount owed.

- Late Payment Terms: Include any penalties for late payments, such as interest charges or additional fees. This encourages timely payments and protects your financial interests.

- Legal Jurisdiction: Specify the jurisdiction or legal venue that will govern any disputes. This is particularly important in case of a legal issue where both parties reside in different regions or countries.

Contracts and Agreements

While payment documents are essential for requesting payment, it’s also important to have a signed contract or agreement in place before beginning any work. A contract establishes the terms of the project, including the scope of work, deadlines, and payment structure. Without a signed agreement, you may face challenges in enforcing payment terms, especially in cases of delayed or disputed payments.

- Written Agreements: Always have a contract that defines the scope, deadlines, and payment terms before starting any project. Written agreements offer legal protection in case of any misunderstandings.

- Signatures: Ensure that both you and your client sign the agreement to make it legally binding.

- Project Deliverables: Clearly outline what is expected at the end of the project, including any revisions or additional work that may be charged separately.

By including these legal elements and establishing clear agreements upfront, you can ensure a smoother process and minimize the risk of disputes. A well-structured billing process, backed by solid contracts and terms, is a key part of maintaining a professional and legally sound business.

How to Track Payments and Due Dates

Managing payment schedules and keeping track of when payments are due is crucial for maintaining a healthy cash flow and ensuring that you are compensated promptly. Without an organized system, it’s easy to lose track of outstanding balances, late payments, or missed deadlines. Implementing a streamlined approach to track payments will not only improve your financial management but also enhance your professionalism and client relationships.

Here are some effective strategies to keep track of payments and due dates:

- Use a Payment Tracking System: Leverage accounting or billing software to automatically track due dates, outstanding payments, and payment status. These tools often send automated reminders to both you and your clients when payments are approaching or overdue.

- Set Clear Payment Deadlines: Always specify the due date clearly in your documentation and communicate it to your clients. Setting explicit deadlines helps ensure that both parties understand when the payment is expected and reduces delays.

- Keep a Payment Log: Maintain a detailed log of all payments received, including the date, amount, and client information. This allows you to track your income easily and stay on top of any pending payments.

- Send Timely Reminders: If the payment due date passes without receiving the amount owed, don’t hesitate to send a polite reminder to the client. Automated reminder emails or messages can help you follow up without having to manually track each one.

- Offer Multiple Payment Methods: Make it easier for clients to pay on time by offering multiple payment methods, such as bank transfers, credit cards, or digital payment platforms. The more convenient you make it for clients to pay, the more likely they will do so on time.

By using these strategies, you can ensure that payments are received promptly and that overdue amounts are tracked and addressed efficiently. A clear and organized approach to tracking payments will help you avoid cash flow issues and maintain better financial control.