Download Freelance Work Invoice Template for Easy Billing

When managing your business as an independent contractor, having a clear and organized method of requesting payment is essential. Whether you’re offering services on a per-project or hourly basis, streamlining your financial communication ensures both you and your clients stay on the same page. This is where proper documentation plays a vital role in fostering trust and maintaining professionalism.

Crafting a document that outlines the agreed-upon compensation and payment expectations can save time, reduce misunderstandings, and expedite the collection process. A well-designed record not only makes it easier for clients to process payments but also provides a useful reference for both parties. Knowing the best practices and structure for creating these documents can significantly improve your cash flow management.

Understanding how to create this important document and tailor it to suit different types of projects or agreements is crucial for professionals in various fields. The right approach ensures that you remain organized and efficient while delivering high-quality services to your clients.

Why Freelancers Need Invoice Templates

Independent professionals often juggle multiple projects and clients, making it difficult to keep track of financial transactions. Without a standardized method to request payments, there’s a greater chance for mistakes, missed details, or delays. A structured document that clearly lists the amount due, terms, and deadlines simplifies the process, ensuring smooth interactions and timely payments.

Benefits of Using a Standardized Document

Having a pre-designed structure saves valuable time, especially when you’re handling numerous clients. It helps maintain consistency and reduces the likelihood of missing important details like payment terms, service descriptions, or tax information. Moreover, a professional-looking document can enhance your credibility and encourage faster payment.

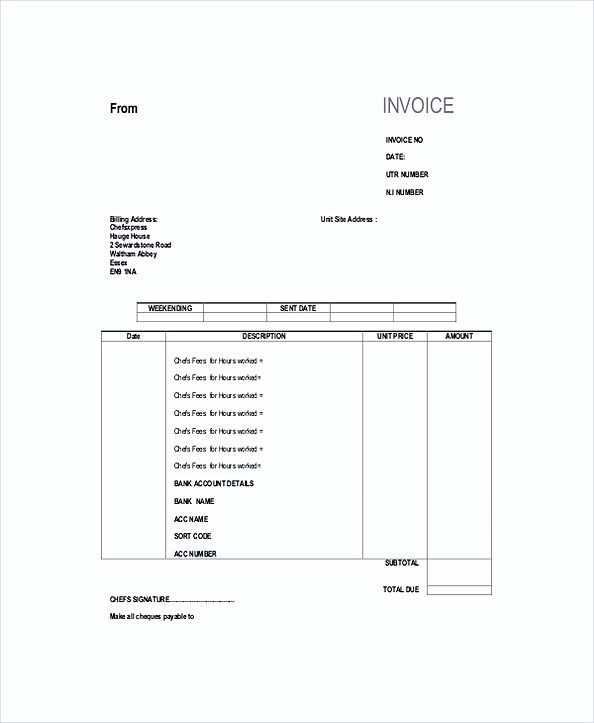

Essential Elements of a Well-Designed Document

A document meant for billing should always include certain key elements to ensure clarity and avoid confusion. Here is a simple breakdown of the important details to include:

| Element | Description |

|---|---|

| Client Information | Name, address, and contact details of the client. |

| Amount Due | Clearly specify the agreed sum for the services provided. |

| Due Date | The exact date when payment should be made. |

| Payment Terms | Details on the accepted payment methods and any late fees. |

Understanding the Basics of Invoice Creation

Creating a formal request for payment is an essential part of managing your finances as an independent professional. This document serves as a clear and concise communication tool between you and your client, outlining the amount due and the details of the services provided. A well-crafted request ensures transparency and can help avoid disputes or delays in payment.

At its core, the creation process involves organizing key details such as the amount to be paid, a breakdown of services, deadlines, and payment terms. This helps set expectations and fosters a professional relationship between you and your clients. Having a clear structure not only saves time but also makes it easier to track your earnings and maintain financial records.

By understanding the basic components and including the right information, you can create a document that is both functional and professional, ensuring smooth transactions every time you engage with a client.

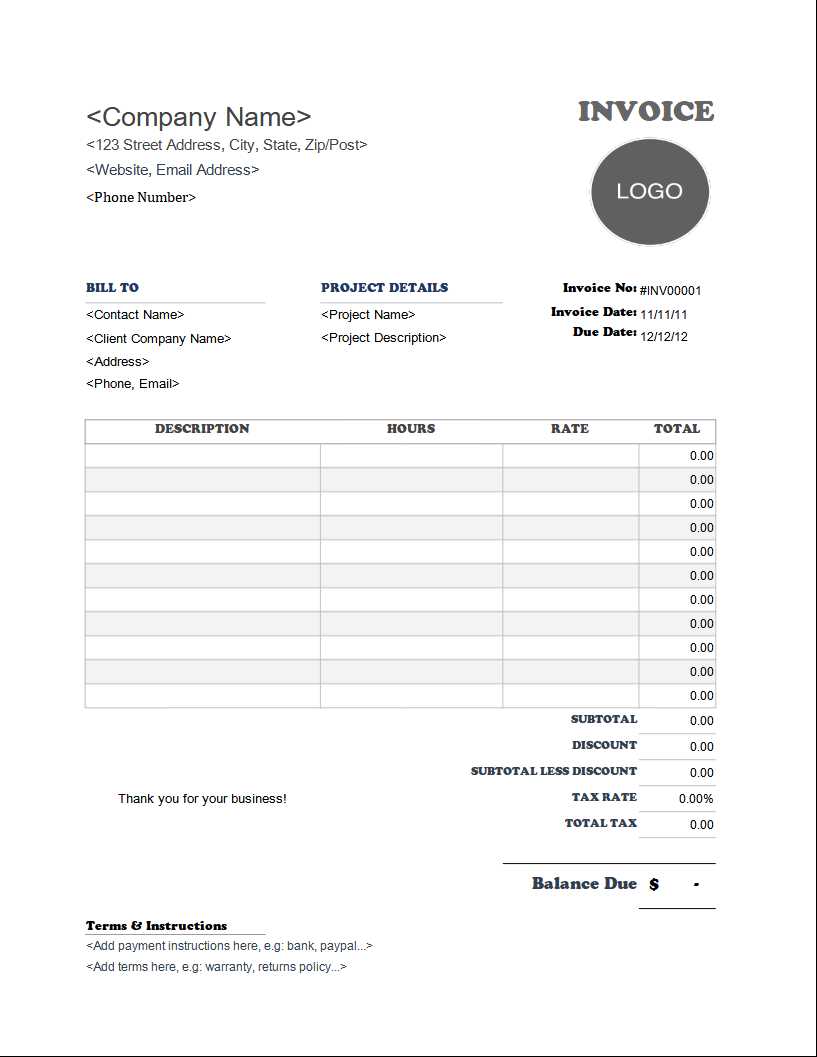

How to Customize Your Invoice Template

Customizing your payment request document allows you to tailor it to your specific needs, enhancing professionalism and ensuring that all relevant information is included. By making small adjustments, you can create a document that reflects your brand and works for various types of projects and agreements. Customization can also ensure that clients have a clear understanding of what is being charged and when payments are due.

Here are a few steps to help you customize your billing document:

- Add Your Branding: Include your logo, business name, and contact information to give the document a personal touch and professional appearance.

- Adjust the Layout: Ensure that the sections are organized in a way that is easy to read. You can choose different formats depending on the type of project or the client’s preferences.

- Include Specific Service Details: Break down the services or products you are charging for in clear terms, adding descriptions and quantities as needed.

- Set Clear Payment Terms: Make sure your payment deadlines, methods, and any penalties for late payments are clearly stated.

Customizing your document not only makes it more functional but also helps you create a professional impression, ensuring both you and your clients stay on the same page throughout the billing process.

Key Elements Every Invoice Should Include

When requesting payment for services provided, certain details must be included to ensure that both you and your client are on the same page. These elements not only ensure clarity but also protect you legally by outlining the terms of the transaction. By carefully incorporating all necessary information, you can avoid confusion and delays in payment.

Essential Information to Include

Every document should feature specific data that helps identify the transaction, such as payment amounts, deadlines, and contact details. Here’s a breakdown of the most important elements to incorporate:

| Element | Description |

|---|---|

| Unique Identifier | A unique number or code for each request to ensure tracking and reference. |

| Client and Service Provider Details | Include names, addresses, and contact information of both parties involved. |

| Description of Services | Provide a clear breakdown of the services offered, including dates, hours worked, and specific tasks performed. |

| Total Amount Due | Clearly state the amount being charged and any applicable taxes or fees. |

| Payment Terms | Specify the due date, late fees (if applicable), and the accepted payment methods. |

Why These Elements Matter

By including all these details, you make the document clear, professional, and legally sound. These key pieces of information not only ensure the transaction is understood by both parties, but also make it easier to follow up in case of payment issues or discrepancies.

Choosing the Right Invoice Format

When preparing a document to request payment, selecting the appropriate format is crucial for ensuring clarity and efficiency. The right layout can make a big difference in how your client perceives the document and how easily they can process the payment. Choosing the best format helps avoid confusion and delays while maintaining a professional appearance.

There are various formats available, depending on the type of services provided and the preferences of your client. Some formats are more suited for quick, one-time projects, while others are designed for ongoing services. The key is to select one that fits the nature of the work and is easy for both you and your client to manage.

Considerations when choosing the format:

- Client preferences: Some clients may have specific requirements for how they wish to receive payment requests.

- Complexity of the project: More detailed breakdowns may require a more extensive format, while simple tasks may be suited to a minimalist approach.

- Payment method: Choose a format that aligns with the payment method, whether electronic or physical.

Ultimately, the right format ensures that your request is clear, professional, and easy to process, helping to expedite payments and maintain smooth business relations.

Top Tools for Creating Invoices

When it comes to preparing a document to request payment, using the right tools can save you time and ensure accuracy. Various software and online platforms are available to help you design, generate, and manage billing statements, making the process more efficient and less prone to errors. These tools often offer customizable features, which can make the process much easier, especially when handling multiple clients or projects.

Popular Software Solutions

Many professionals rely on specialized software to create billing statements. These tools offer a wide range of templates and automation features to simplify the process. Some popular options include:

- QuickBooks: Ideal for managing finances and generating detailed statements, QuickBooks also integrates with other financial tools.

- FreshBooks: A user-friendly platform that helps with time tracking, invoicing, and managing client payments.

- Zoho Invoice: A versatile tool offering a wide array of templates and customization options to match various business needs.

Online Platforms and Free Tools

If you’re looking for more accessible or budget-friendly options, several online platforms provide easy-to-use solutions:

- Wave: A free tool that offers unlimited billing, as well as bookkeeping and accounting features.

- PayPal: Great for quick payments and basic request documents, PayPal offers simple billing functionalities.

- Invoicely: An online platform with free and paid plans, featuring templates that are easy to modify for various needs.

Using the right tool can help streamline your payment requests, reduce the time spent on administrative tasks, and ensure that your documents are accurate and professional.

Common Mistakes in Freelance Invoices

Even though creating a payment request document may seem straightforward, there are several common mistakes that can lead to misunderstandings or delays in payments. These errors often stem from missing or incorrect information, which can create confusion for both you and your clients. Avoiding these pitfalls will help ensure smoother transactions and maintain professional relationships.

Common Errors to Watch Out For

Below are some of the most frequent mistakes that professionals make when preparing documents to request payments:

- Missing Client Details: Not including the client’s full name, address, and contact information can cause delays and make it difficult to identify the correct recipient of the payment.

- Unclear Payment Terms: Failing to clearly outline the payment due date, late fees, or accepted payment methods can lead to confusion and disputes.

- Inaccurate Payment Amounts: A common mistake is not thoroughly reviewing the total amount being charged, including taxes, discounts, or additional fees. This can result in incorrect amounts being requested.

- Omitting Service Descriptions: Not providing a detailed breakdown of the services provided can leave clients unclear about what they are paying for, increasing the chances of disagreements.

How to Avoid These Mistakes

By double-checking all the details before sending your payment request, you can avoid these errors. Ensure all client information is accurate, clearly state your payment terms, and always provide a detailed list of services rendered along with their respective charges. Taking these precautions helps streamline the payment process and establishes a professional reputation with your clients.

How to Avoid Invoice Errors

Errors in payment requests can lead to confusion, delayed payments, and even damage to professional relationships. To avoid such issues, it is essential to follow a careful process when creating these documents. Paying attention to detail and ensuring that all necessary information is included will minimize mistakes and streamline the billing process.

Here are some key strategies to help you avoid common errors:

- Double-Check Client Information: Ensure that you have the correct name, address, and contact details for your client. A simple mistake in this area can lead to payments being sent to the wrong address.

- Review Payment Amounts Thoroughly: Always double-check the total amount being charged. Ensure that all services, taxes, and any additional fees are accurately reflected in the total sum.

- Clarify Payment Terms: Be explicit about when the payment is due, the methods of payment you accept, and any penalties for late payments. This will help your client understand your expectations and avoid misunderstandings.

- Provide Detailed Descriptions: Always include a breakdown of the services you are billing for, along with the relevant hours worked or units delivered. A vague description can lead to questions or disputes about the charges.

- Use a Standardized Format: If you create these documents regularly, using a consistent format can help you avoid forgetting critical information. A template or software tool can ensure that no important detail is overlooked.

By following these simple steps, you can reduce the chances of making costly mistakes and improve your overall billing efficiency. Maintaining accuracy in your payment requests will not only speed up the payment process but also project a more professional image to your clients.

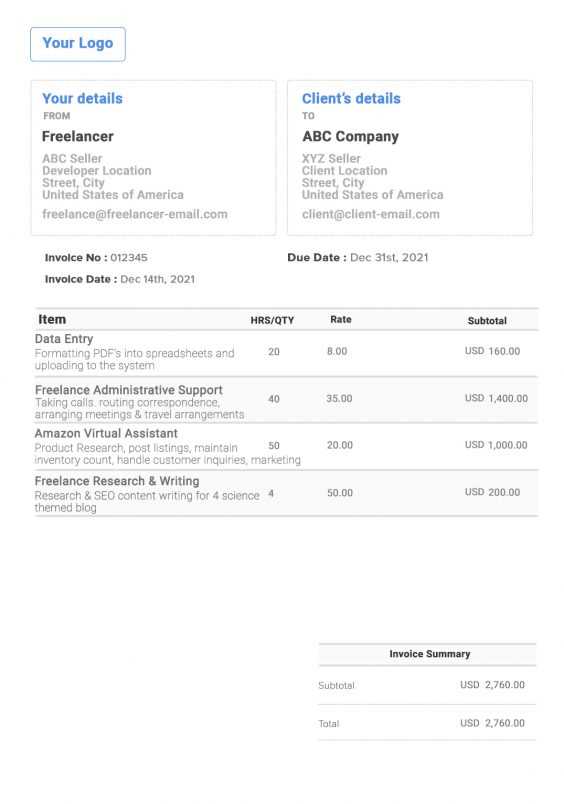

How to Invoice for Hourly Work

When charging based on time spent on a project, it is important to clearly communicate the number of hours worked and the agreed-upon rate. Properly tracking your hours and providing a detailed breakdown will ensure that you are paid fairly and that the client understands the cost of your time. This method requires precision to avoid disputes over billing amounts.

Steps to Create an Hourly Billing Statement

Follow these simple steps to ensure that your payment request reflects accurate information:

- Track Your Hours: Keep a log of the time you spend on each task. Use a time-tracking tool or spreadsheet to record your hours accurately.

- Clearly State Your Rate: Make sure that your hourly rate is clearly stated, either as a flat fee or broken down by task or service.

- Provide a Time Breakdown: Include a detailed list of the tasks performed and the amount of time spent on each. This helps the client understand how their money is being spent.

- Include Additional Costs: If there are any additional costs or expenses related to the project, make sure to outline them separately so there is no confusion.

Best Practices for Hourly Billing

To ensure smooth transactions, follow these best practices:

- Be Transparent: Keep the client updated on how many hours have been worked, especially if the project is ongoing or if you have agreed on an estimate.

- Set Expectations Early: Clearly define your hourly rate and any expectations about billing frequency (e.g., weekly, bi-weekly) at the start of the project.

- Use Time-Tracking Software: Utilizing tools like Toggl, Harvest, or Clockify can help ensure you track every minute spent on a project and generate reports easily.

By following these steps and best practices, you can ensure that clients are billed fairly for the time spent on each project, reducing the chance of errors and disputes.

Billing for Project-Based Freelance Jobs

When working on a project with a defined scope and deliverables, billing becomes a bit different than hourly-based work. Instead of charging for time spent, you charge a flat fee for completing the entire project. This method requires careful planning and clear communication with your client about expectations, deliverables, and deadlines. It’s essential to agree on a price upfront to ensure that both parties understand the terms of the agreement.

Steps for Billing on a Project Basis

Here are the key steps to ensure that your billing process runs smoothly for project-based jobs:

- Agree on a Fixed Price: Discuss the total cost with your client before starting the project. Be sure to consider the full scope of work, including any revisions or additional tasks that may arise.

- Break Down Deliverables: Clearly outline the deliverables in your agreement. This way, both you and your client will know what to expect and when.

- Set Milestones: If the project is large, consider breaking it into stages with specific milestones. This way, you can invoice for completed portions of the project, ensuring steady cash flow.

- Determine Payment Terms: Agree on when payments will be made, whether it’s a single payment upon completion, or divided into installments based on milestones.

Best Practices for Project-Based Billing

Follow these best practices to ensure a smooth billing process and avoid disputes:

- Provide a Detailed Contract: A clear contract or agreement can prevent misunderstandings later on. Be sure to include deadlines, the agreed fee, and payment terms.

- Communicate Regularly: Keep your client updated on the progress of the project. This builds trust and ensures that both of you are aligned on expectations throughout the process.

- Consider a Retainer for Ongoing Projects: For long-term or ongoing projects, you might want to agree on a retainer fee to secure a regular income stream and ensure commitment from both parties.

By clearly defining the scope, deliverables, and payment terms from the start, you can avoid confusion and create a professional framework that benefits both you and your client. This approach is especially effective for projects with a fixed budget and well-defined goals.

Incorporating Taxes in Your Invoice

When charging for services, it’s important to factor in taxes to ensure that you comply with local tax laws and avoid unexpected expenses. Including taxes in your payment request document is not just a matter of following the law but also maintaining transparency with your clients. It’s essential to understand how to calculate and present taxes to avoid confusion and ensure you are compensated correctly for the work you’ve done.

How to Calculate and Add Taxes

Taxes can vary depending on your location and the type of services you provide. Here are some key steps to help you incorporate taxes accurately:

- Know Your Tax Rate: Research the applicable sales tax or VAT rate in your jurisdiction. The tax rate may differ based on the region or the specific service you are offering.

- Determine Taxable Services: Some services may be exempt from taxes, while others may be fully taxable. Be sure to confirm which of your services fall under taxable categories.

- Calculate the Tax Amount: Multiply the total amount for your services by the applicable tax rate to determine the tax amount due. For example, if the total cost is $500 and the tax rate is 10%, the tax amount will be $50.

- Add the Tax to the Total: Once you have the tax amount, add it to the total due to your client. Ensure that the tax is clearly listed and separated from the original cost for clarity.

Best Practices for Displaying Taxes

To avoid confusion and maintain professionalism, follow these best practices when presenting taxes in your payment request:

- Be Transparent: Always show the exact tax rate and the amount being charged. It’s important that your client knows how the tax is calculated.

- Separate Taxes from Service Costs: Clearly separate the service cost and taxes in your document. This helps avoid confusion and ensures clients know exactly what they are being charged for.

- Include Your Tax Identification Number: In many regions, you are required to provide your tax ID number on official documents. Check the local regulations to ensure you are compliant.

- Double-Check Local Regulations: Tax laws can vary greatly depending on where you and your client are based. Make sure you stay updated on local tax laws and requirements to ensure compliance.

By properly including taxes in your payment requests, you not only stay compliant with the law but also maintain a professional relationship with your clients by being tra

Freelancer Payment Terms Explained

When establishing an agreement with a client, it’s crucial to set clear payment terms to avoid any misunderstandings or delays in receiving compensation. These terms define how and when you will be paid for your services, ensuring that both you and the client are aligned on expectations. Whether it’s payment schedules, rates, or conditions for late fees, clearly defined payment terms are essential for maintaining a smooth and professional relationship.

Payment terms typically cover several key aspects that should be agreed upon before beginning any project:

- Payment Schedule: This specifies when payments are due. It can be based on milestones, specific project phases, or a set number of days after the service is rendered.

- Payment Methods: Different clients may prefer different methods of payment, whether it’s bank transfer, PayPal, or another payment platform. Make sure to clarify which methods you accept.

- Late Payment Penalties: Setting up a penalty for late payments ensures clients are motivated to pay on time. It could be a percentage of the total amount due for every day or week a payment is delayed.

- Deposit or Upfront Payment: In many cases, it’s a good idea to request a portion of the total fee upfront, especially for larger projects. This protects you in case the client defaults on payment later.

- Discounts for Early Payment: Some professionals offer discounts if the client pays ahead of the agreed deadline. This can be an incentive for clients to settle faster.

By setting clear and realistic payment terms at the outset, you can reduce the potential for disputes and ensure that both you and your client understand the expectations surrounding compensation. A well-defined agreement also helps maintain your professional integrity and ensures that both parties are comfortable throughout the process.

Why You Should Use Professional Invoices

Using a polished, formal document to request payment is essential for any professional service provider. A well-designed payment request does more than just outline what you are owed–it also communicates your credibility, improves your client relationships, and ensures smooth financial transactions. By using a professional format, you demonstrate that you are organized, serious, and committed to the quality of your service.

Here are some reasons why using a professional document is important:

- Establishes Credibility: A professionally crafted document signals to your clients that you are a legitimate business. It can help build trust, especially with new clients who may be unfamiliar with your work.

- Prevents Payment Delays: A clear and professional document can help prevent misunderstandings about payment terms, thus reducing the risk of delays.

- Improves Payment Accuracy: Including all relevant details in a structured format ensures that there is no confusion about the amount, due date, and services provided, making it easier for clients to process payments correctly.

- Helps With Tax Documentation: A proper document can simplify record-keeping and make it easier to prepare for taxes. It ensures that all the necessary information is available for both you and the tax authorities.

Example of a Professional Payment Request

A professional document typically includes several key components, each serving a specific purpose. Here’s an example layout:

| Section | Details |

|---|---|

| Client Information | Client’s name, address, and contact details |

| Your Information | Your business name, address, and contact information |

| Services Provided | A detailed list of services rendered with dates and quantities |

| Amount Due | The total amount owed, including any applicable taxes or fees |

| Due Date | The payment deadline and accepted payment methods |

| Payment Terms | Any late fees or early payment discounts, if applicable |

Using a professional format ensures that both you and your client are on the same page regarding expectations and responsibilities. It helps facilitate prompt and accurate payments, while also reinforcing your professionalism.

How to Track Payments and Due Dates

Maintaining accurate records of payments and deadlines is crucial for managing your finances effectively. By tracking the amounts you’ve billed, when payments are due, and when they’ve been received, you can ensure timely payment and avoid unnecessary delays or confusion. Proper tracking not only helps you stay organized but also ensures that clients are held accountable for their payments.

Steps to Effectively Track Payments

Here are some essential steps to help you keep track of payments and due dates:

- Keep a Record of All Transactions: Create a system to log each payment request along with its due date. This can be done using a simple spreadsheet, accounting software, or a digital payment management tool.

- Set Clear Due Dates: Include specific payment due dates for each request. Make sure that the client knows exactly when the payment is expected, and confirm this during the initial agreement.

- Monitor Payment Status: Regularly check whether clients have made the necessary payments by the agreed-upon due dates. Mark off paid amounts and keep an eye on outstanding balances.

- Send Payment Reminders: If a payment has not been received by the due date, it’s essential to follow up. Send a polite reminder with details about the amount due and the original payment terms.

Best Tools for Payment and Due Date Tracking

There are several tools that can make the tracking process easier and more efficient:

- Spreadsheets: A simple and customizable tool like Google Sheets or Excel can be used to track due dates, amounts, and payment status.

- Accounting Software: Software like QuickBooks or FreshBooks is designed specifically for managing billing, payments, and due dates. These tools also generate reports, making it easy to track financial progress.

- Payment Management Tools: Platforms like PayPal or Stripe provide tracking capabilities for payments made online, automatically updating when payments are received.

By staying on top of payment tracking, you can ensure smooth financial operations, reduce overdue payments, and maintain strong relationships with clients. An organized system not only prevents potential misunderstandings but also helps with tax filings and future budgeting.

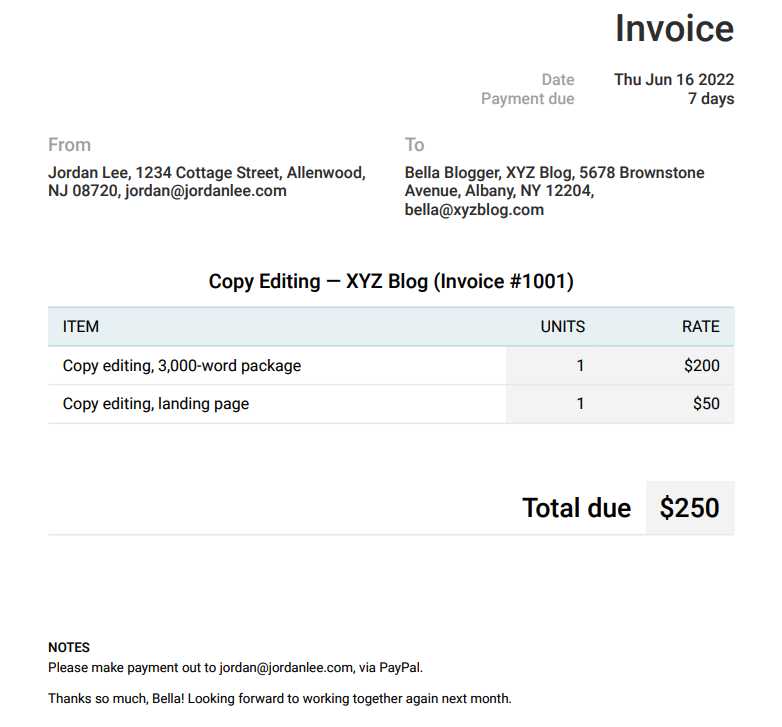

How to Send an Invoice Effectively

Sending a payment request to a client may seem simple, but how you deliver it can impact your payment timing and client satisfaction. The goal is to ensure that the process is clear, professional, and efficient. By paying attention to how and when you send your request, you can increase the chances of receiving timely payments and maintaining positive client relationships.

Here are some key strategies to send your payment requests effectively:

- Choose the Right Delivery Method: Whether it’s via email, postal mail, or a payment platform, choose the method that works best for both you and your client. Email is the most common and efficient method, but some clients may prefer a physical document or a system like PayPal.

- Attach the Document Properly: Always send your payment request as an attachment, either in PDF format (preferred for its professional appearance) or another easy-to-read format. Avoid sending it as a text document or image, as these can seem less formal.

- Include a Clear Subject Line: Make it easy for your client to recognize the purpose of your email right away. A simple subject line like “Payment Request for [Project Name]” helps your client know exactly what to expect when opening your message.

- Be Clear and Concise in the Message: Keep the body of your email short and to the point. Include a polite note with the document, stating the amount due, the due date, and any additional instructions. Don’t over-explain or repeat details that are already in the attached document.

- Follow Up if Necessary: If you don’t receive a response by the due date, send a polite reminder. Ensure your follow-up message is professional and courteous, reiterating the details and confirming if there are any issues with the payment.

By being organized and professional in your communication, you reduce the chances of confusion or delays. Sending a well-prepared request with all the necessary information, in the right format, ensures a smoother process for both you and your client.