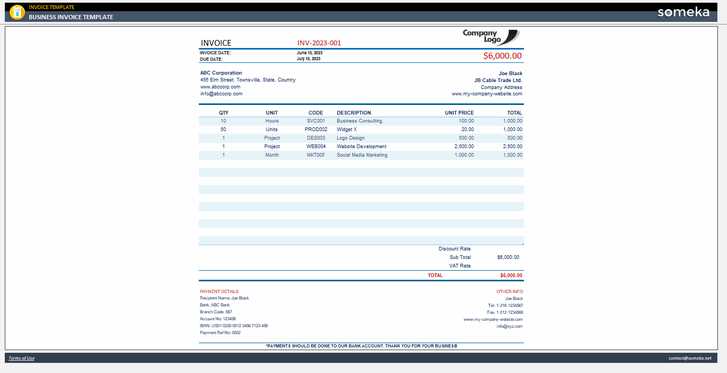

Download a Professional Invoice for Business Template

Managing payments and maintaining financial records is a crucial aspect of any operation. Having a structured system in place for generating requests for payment helps streamline the process, ensuring professionalism and accuracy. With the right tools, preparing clear and consistent documentation becomes a straightforward task that can save time and reduce errors.

Streamlining payment procedures through well-designed forms enhances communication with clients and partners. Customizable formats offer flexibility, allowing businesses to adapt their documents to different needs while maintaining a standardized approach. Whether it’s for one-time services or ongoing projects, organizing requests in a professional manner leaves a lasting impression.

Having the ability to quickly create and send customized payment requests not only improves workflow efficiency but also facilitates faster transactions. This is where digital solutions come into play, providing accessible options that meet diverse operational needs. By choosing the right tools and formats, businesses can elevate their financial practices to a new level of organization.

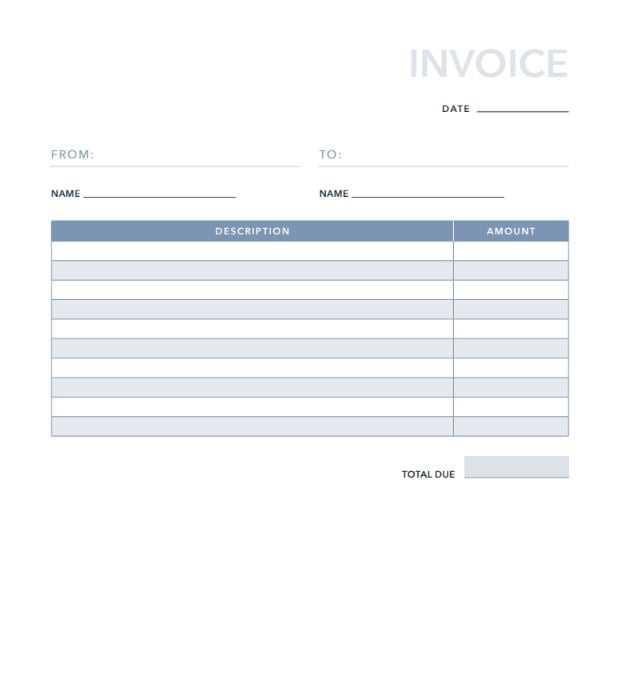

Invoice for Business Template

Creating clear and professional payment requests is essential for any operation. A well-organized document helps ensure that transactions are processed smoothly and both parties understand the terms. The ability to quickly generate these documents with a consistent format can significantly improve financial management and streamline operations.

By using ready-made forms, individuals and companies can focus on their core tasks without worrying about formatting or missing important details. These solutions offer flexibility, allowing for customization while maintaining a professional structure. Consistency in design and content ensures that every request aligns with industry standards and enhances credibility.

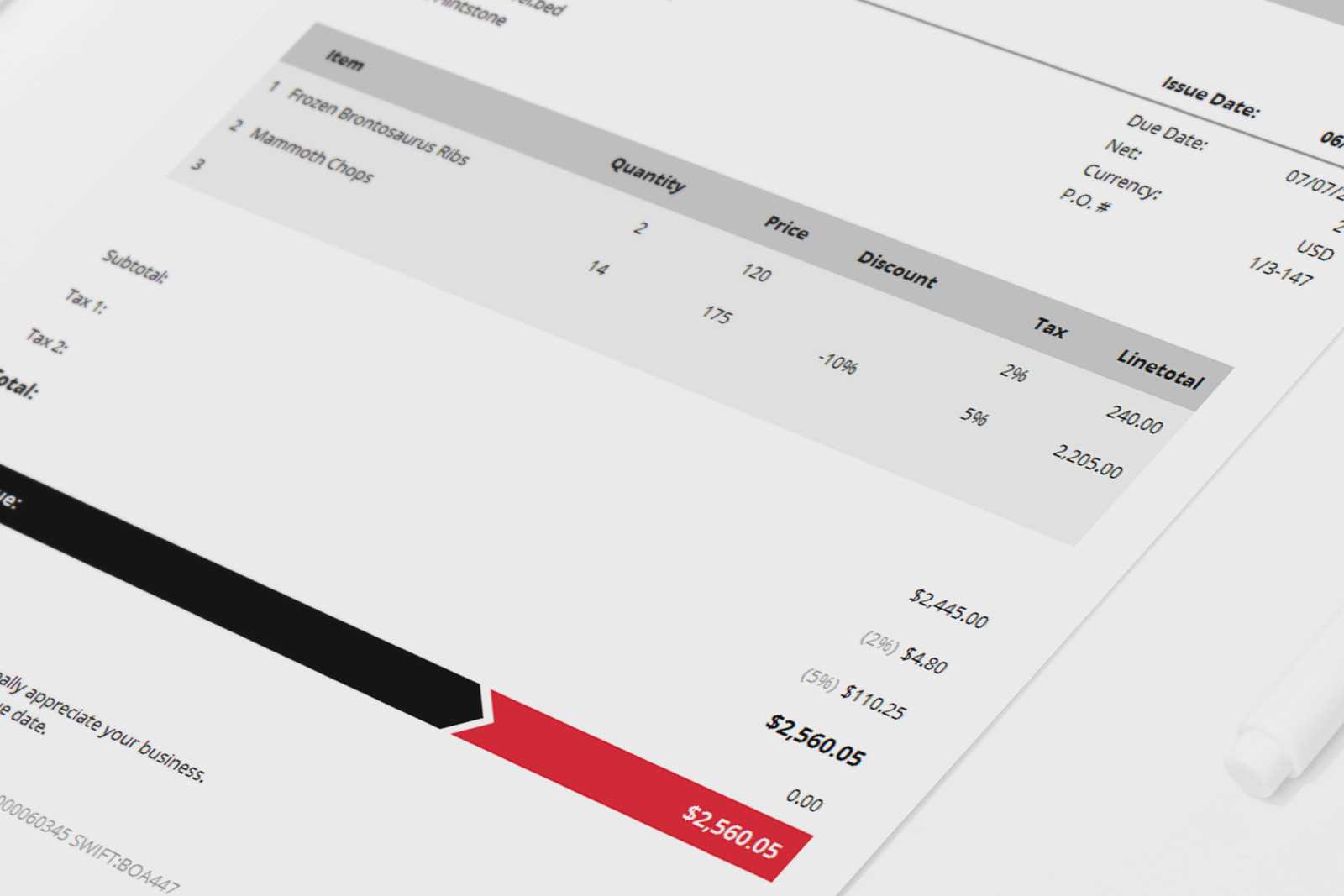

Customizable features allow users to adjust the details according to specific needs. Whether it’s adding specific payment terms, adjusting amounts, or incorporating taxes, these options make it easier to cater to various requirements. The result is a document that looks polished and delivers important information in a straightforward manner. Efficiency is maximized, and time is saved in the long run.

How to Create an Effective Invoice

Designing a functional and clear request for payment requires careful attention to detail. The goal is to ensure that the recipient understands the terms, amounts, and any other essential information at a glance. A well-structured document facilitates smooth transactions and minimizes the risk of confusion or disputes.

To achieve an effective result, it’s important to include key elements that clearly communicate the necessary details. Here are some critical components:

- Contact Information: Always include your details and the recipient’s, such as names, addresses, and contact numbers.

- Unique Identification Number: Assigning a unique reference number helps both parties track the document.

- Clear Payment Terms: Specify when payment is due, including any late fees or discounts for early payment.

- Itemized List of Services or Products: Break down the charges to avoid any confusion regarding the amount due.

- Payment Methods: Provide clear instructions on how payments can be made, including bank account details or online payment options.

In addition to these essentials, it’s also important to maintain a professional design. A clean, readable layout with logical sections ensures that important information is easily accessible. A consistent format helps reinforce your credibility and ensures the document serves its intended purpose efficiently.

Benefits of Using a Template for Billing

Utilizing pre-designed forms for payment requests can greatly improve the efficiency and professionalism of your financial processes. By eliminating the need to create new documents from scratch each time, you save time and reduce the risk of errors. These ready-made solutions help maintain consistency and ensure that important details are never overlooked.

Time-Saving and Efficiency

One of the primary advantages of using a pre-made document structure is the significant amount of time saved. With all the essential fields and formatting already in place, you can focus on the content rather than layout. This allows you to generate accurate payment requests in minutes, making the process more efficient.

Professional Appearance and Accuracy

Using a standardized design gives your documents a polished, professional appearance that builds trust with clients and partners. In addition, these forms often come with built-in checks to ensure that key information, such as dates, amounts, and contact details, are included and correctly formatted. Consistency in layout and design also reduces the chances of making mistakes, which can be costly.

By using such solutions, you can improve your financial operations and maintain a high level of professionalism with minimal effort. This simple step can lead to faster payments and a better overall experience for both you and your clients.

Customizing Your Invoice for Different Needs

Tailoring your payment request documents to meet various requirements is essential for maintaining accuracy and ensuring the needs of both parties are met. Customization allows you to modify key elements based on the specific context, whether it’s a one-time service, a recurring project, or a large-scale transaction.

Key Customization Options

Here are some aspects you can adjust to suit your specific requirements:

- Design and Layout: Adjust the visual style to match your brand or the nature of the transaction, ensuring the document aligns with your overall professional image.

- Payment Terms: Modify the payment due dates, late fees, or discounts based on the agreement with your client.

- Item Descriptions: Provide detailed descriptions for each product or service, especially when dealing with complex transactions.

- Tax Calculation: Include applicable taxes or exemptions depending on your location or the client’s status.

Adapting to Various Scenarios

Different situations may call for unique modifications to the structure. For example, for one-time services, you might focus more on clear, simple breakdowns of costs. For long-term projects or ongoing agreements, including payment schedules or milestones is often necessary. The ability to adjust the content ensures that the document suits the specific transaction.

Customization is a powerful tool that not only ensures accuracy but also improves communication and transparency with clients. By tailoring each request to its unique context, you demonstrate professionalism and adaptability, which can foster stronger business relationships.

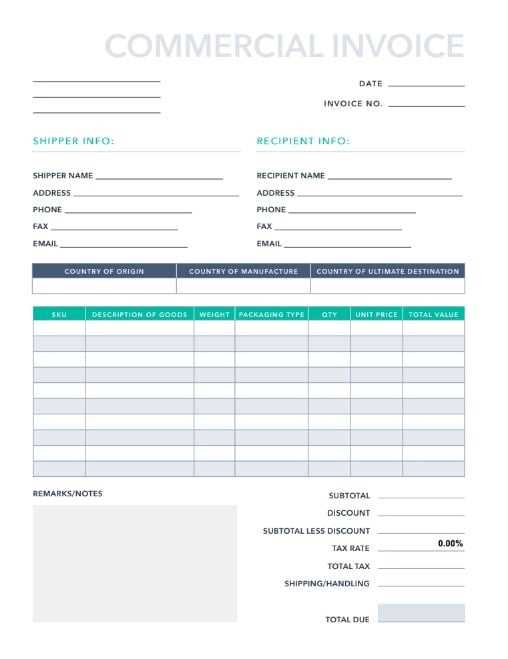

Key Information to Include in an Invoice

To ensure clarity and prevent misunderstandings, it’s important to include all necessary details when preparing a payment request. By covering all the essential information, you help both parties stay aligned regarding the terms and conditions of the transaction, reducing the risk of disputes or delays.

Here are the most critical elements to include in your request for payment:

- Your Contact Details: Include your full name or company name, address, and contact number for easy communication.

- Recipient’s Information: Ensure that the recipient’s details, such as their name, address, and contact information, are clearly stated.

- Unique Reference Number: Assign a unique identification number to each document for easier tracking and record-keeping.

- Detailed List of Products or Services: Clearly describe each item or service provided, including quantities, unit prices, and total amounts.

- Payment Terms: Specify when payment is due, including any penalties for late payments or discounts for early settlement.

- Taxes and Fees: If applicable, outline any taxes, additional fees, or discounts that apply to the transaction.

- Payment Instructions: Provide clear instructions on how the recipient can make a payment, including preferred methods like bank transfer or online payment links.

Including all of these elements in your payment request will not only make the process smoother but also demonstrate professionalism. A well-structured document that covers all aspects of the agreement ensures that both parties are fully informed and helps facilitate quicker payment processing.

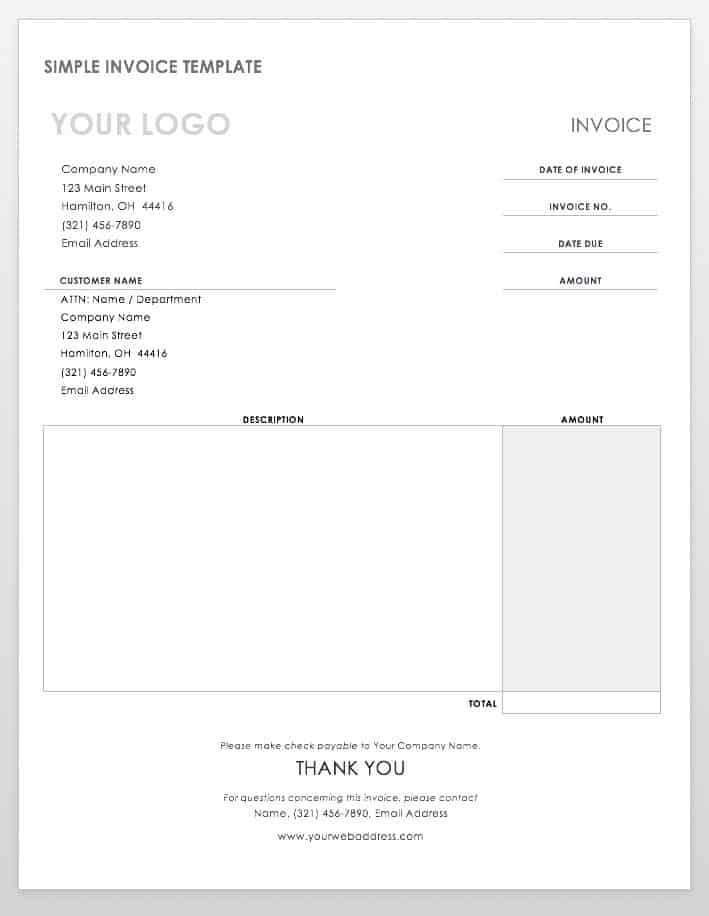

How to Choose the Right Template

Selecting the appropriate format for your payment request documents is crucial to ensure both functionality and professionalism. The right design helps you present information clearly while accommodating specific needs, whether you’re managing large transactions or simple agreements. The key is to find a balance between simplicity and detail, depending on the complexity of the transaction.

Factors to Consider

When deciding on a format, consider the following factors:

- Level of Detail: Choose a layout that allows you to list items or services in detail if necessary, or one that keeps it simple for smaller transactions.

- Customization Options: Look for formats that are flexible enough to adapt to your unique needs, such as adding taxes, discounts, or terms.

- Professional Design: Ensure the design reflects your professional image. A clean, organized layout builds trust with clients.

- Ease of Use: Opt for a design that is intuitive and easy to fill out, even for first-time users.

Comparing Different Options

Here’s a table that compares some of the features to look for in different formats:

| Feature | Simple Layout | Detailed Layout | Fully Customizable |

|---|---|---|---|

| Ease of Use | High | Medium | Low |

| Customization | Low | Medium | High |

| Professional Look | Medium | High | High |

| Best For | Small Transactions | Ongoing Projects | Large or Complex Transactions |

By considering these factors and comparing the available options, you can select the most suitable format for your needs. A well-chosen design will make the process more efficient, clear, and professional.

Invoice Template Options for Small Businesses

Small enterprises often require streamlined solutions for managing payments and maintaining professional records. Choosing the right structure for payment requests is essential to ensure clarity, accuracy, and ease of use. The best format depends on the specific needs of the business, whether it’s a service provider, a retail shop, or a freelancer. Selecting the right format can make a big difference in saving time and ensuring that payments are processed smoothly.

Key Features for Small Enterprises

When selecting a payment request format, consider the following features to make sure the layout suits the size and complexity of your transactions:

- Simplicity: Opt for a straightforward design with only essential fields to avoid unnecessary clutter.

- Cost-Effectiveness: Many free or low-cost options are available, ideal for small businesses with tight budgets.

- Customization: Choose a layout that allows for easy modification to fit specific client needs or project details.

- Professional Design: A clean, professional-looking document adds credibility and helps foster client trust.

Comparing Available Layouts

Here’s a table to help you compare different layout options suitable for small enterprises:

| Feature | Simple Layout | Comprehensive Layout | Free Options |

|---|---|---|---|

| Ease of Use | Very High | Medium | High |

| Customization Flexibility | Low | High | Medium |

| Professional Appearance | Medium | High | Medium |

| Best For | Quick, Simple Payments | Long-Term or Complex Deals | Budget-Conscious Small Businesses |

By evaluating the key features and comparing different layout options, small businesses can choose the most effective solution to manage payments. A well-chosen structure can not only save time but also improve communication with clients a

Digital vs Printed Invoices for Businesses

When choosing how to send payment requests, companies must decide whether to use digital or printed formats. Both options have their advantages and drawbacks, depending on factors such as speed, cost, and the nature of the relationship with the client. Understanding the differences between these two methods helps businesses make an informed decision based on their specific needs.

Advantages of Digital Payment Requests

Digital formats offer a variety of benefits, making them an attractive choice for many companies:

- Speed: Digital documents can be sent instantly, speeding up the payment process and reducing delays.

- Cost-Effective: There are no printing or postage costs associated with digital formats, making them more budget-friendly.

- Environmentally Friendly: By using digital documents, companies reduce paper waste and contribute to sustainability efforts.

- Easy Tracking: Digital formats are easier to organize, store, and retrieve, making record-keeping more efficient.

Advantages of Printed Payment Requests

Despite the rise of digital solutions, printed formats remain a viable option for some businesses:

- Personal Touch: Physical documents can feel more personal and professional to some clients, enhancing trust.

- No Technology Barriers: Printed formats can be useful for clients who are not comfortable with or do not have access to digital tools.

- Legal and Compliance Needs: In some regions, physical records may be required for legal or regulatory reasons.

- Branding Opportunities: Printed documents can be designed with high-quality materials, creating a stronger impression and reinforcing brand identity.

Both digital and printed options offer unique advantages, and the choice depends on the specific needs of the company and its clients. For businesses seeking efficiency and lower costs, digital formats may be the better choice. However, printed formats may still be preferred in situations where personal interaction or compliance requirements are important.

Tips for Making Professional Invoices

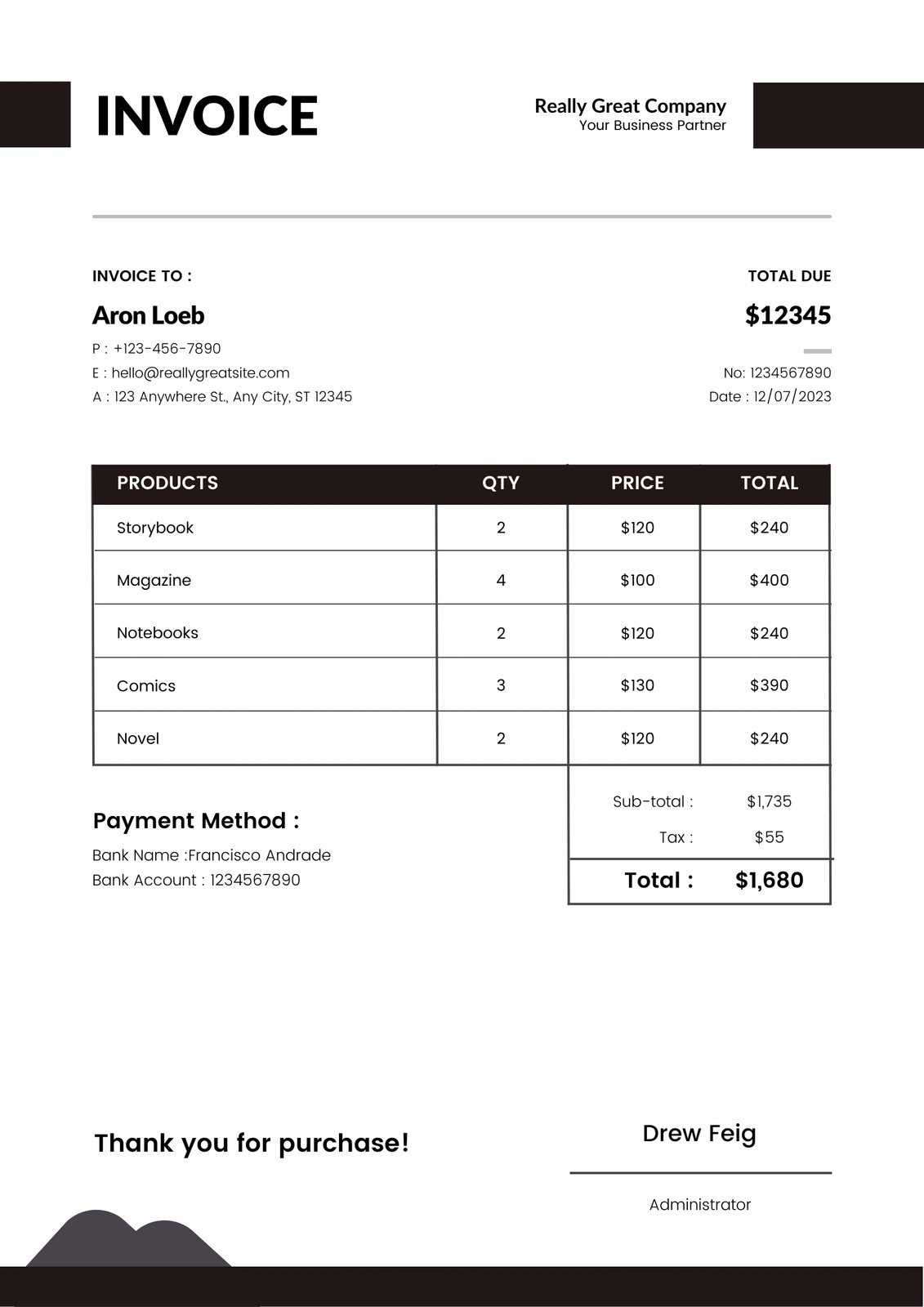

Creating a polished and well-organized payment request document is essential for maintaining a professional image and ensuring smooth transactions. Whether you’re working with clients on large projects or handling smaller orders, the way you present your billing documents can affect how you are perceived. A well-crafted payment request helps avoid confusion, promotes timely payments, and builds trust with clients.

Key Elements of a Professional Document

To make your billing documents stand out, focus on the following key elements:

- Clear Layout: A simple, organized design makes it easier for clients to understand the information at a glance.

- Accurate Information: Ensure all details such as amounts, dates, and descriptions are accurate to avoid disputes.

- Consistent Branding: Use your logo, color scheme, and font style to maintain a consistent brand identity.

- Legible Font: Choose a font that is easy to read, even on smaller screens or when printed.

Common Mistakes to Avoid

Avoid the following mistakes to ensure your payment requests remain professional and efficient:

- Missing Information: Ensure that key elements such as payment terms, contact information, and deadlines are included.

- Overly Complex Design: Avoid cluttering the document with too many graphics or unnecessary details that can distract from the main message.

- Unclear Payment Instructions: Make sure the payment process is straightforward and that clients know how and when to pay.

- Typos or Errors: Proofread carefully to avoid errors that can undermine your professionalism.

Template Comparison

Here’s a table that compares different document format

How to Automate Invoice Generation

Automating the process of creating payment requests can save valuable time and reduce the chances of errors. With the right tools and strategies in place, generating professional billing documents can become a seamless and consistent part of your workflow. This automation not only improves efficiency but also ensures that clients receive accurate documents promptly, which can speed up payment cycles.

To begin automating the creation of payment documents, businesses can leverage a variety of software and online platforms designed for this purpose. These tools allow you to create predefined templates, track payments, and automatically fill in essential details, saving you from repetitive manual work. The process typically involves setting up the system to pull data from other platforms or databases, such as client information, transaction amounts, and due dates.

Key Steps in Setting Up Automation

Here’s how you can start automating your billing process:

- Choose Automation Software: Look for tools that offer features such as customizable templates, cloud integration, and real-time updates.

- Integrate with Your System: Set up the software to automatically pull client and transaction data from your CRM, accounting, or payment systems.

- Set Up Recurring Billing: For regular clients, automate recurring billing to reduce manual effort and ensure timely payments.

- Customize Document Formats: Customize templates to meet your branding needs and include all necessary details, such as payment terms, contact info, and item descriptions.

Benefits of Automating Billing

By automating the creation of payment requests, you gain several advantages:

- Consistency: Each document follows a consistent structure, reducing errors and ensuring professionalism.

- Time Savings: Automation eliminates repetitive tasks, allowing you to focus on other aspects of your operations.

- Faster Payments: With automated reminders and quicker document generation, payments are processed faster.

- Reduced Errors: Automatic data entry minimizes the risk of human error in the billing process.

Overall, automating payment request generation can enhance operational efficiency, improve accuracy, and streamline the financial processes of your company. Whether you are handling occasional transactions or managing a high volume of clients, automation can help you maintain a smooth and reliable payment process.

Managing Invoice Templates for Multiple Clients

Handling the creation of payment documents for various clients can quickly become overwhelming if each client requires different formats or specifications. However, with the right approach, managing multiple variations of payment requests can be streamlined. By organizing and customizing documents according to client needs, you can maintain a high level of professionalism while ensuring accuracy and efficiency in your billing process.

To manage multiple document formats effectively, it’s essential to have a system in place that allows easy customization and quick generation. This involves categorizing clients by their specific requirements, creating adaptable layouts, and using tools that facilitate template switching. Whether you work with freelancers, contractors, or long-term clients, each set of requirements can be met without losing consistency or compromising quality.

Organizing Client-Specific Formats

When dealing with multiple clients, it’s important to organize your files and payment document templates in a way that makes them easily accessible and adaptable. Here are some methods for managing these variations:

- Client Categorization: Group clients by the type of services or products they purchase, making it easier to apply the appropriate format to their documents.

- Custom Fields: Use customizable fields within your document to include specific client information, such as contact details, payment terms, and project specifics.

- Template Variations: Create several versions of your document for different industries or types of transactions to reduce the time spent adapting a single layout.

Benefits of Efficient Management

Managing multiple document formats can offer several advantages when done correctly:

- Time Efficiency: Quickly generate accurate documents tailored to each client, reducing manual work.

- Improved Accuracy: With pre-built templates and automated fields, you minimize the risk of errors.

- Consistency: By maintaining a well-organized system, all documents adhere to your brand and professional standards, even with multiple variations.

By setting up a system to manage different variations and customizations for your clients, you ensure a smooth, professional billing process. This not only improves efficiency but also strengthens your relationships with clients by providing them with documents that meet their specific needs and expectations.

Common Mistakes to Avoid in Invoices

Creating payment requests might seem straightforward, but small errors can have significant consequences, leading to misunderstandings or delayed payments. Many common mistakes occur when key information is omitted or incorrect, which can cause frustration for both the sender and the recipient. By being aware of these frequent errors, you can ensure that your documents are professional, clear, and effective in facilitating timely transactions.

One of the most prevalent mistakes is not including essential details, such as clear payment terms, contact information, or proper itemization of services or products. Additionally, issues like incorrect calculations, missing dates, or not following agreed-upon terms can create confusion, potentially delaying the payment process or damaging client trust.

Here are some of the most common mistakes to avoid:

- Omitting Important Information: Ensure that all required details, such as payment deadlines, client information, and item descriptions, are clearly listed.

- Incorrect Calculations: Double-check all numbers, including totals, taxes, and discounts, to prevent discrepancies that could cause delays or disputes.

- Not Including a Clear Due Date: Always specify when payment is due to avoid confusion and late payments.

- Unprofessional Formatting: A disorganized or hard-to-read layout can make your documents appear less professional, which may affect how your clients perceive your services.

- Failure to Follow Agreed Terms: Be sure to follow the payment terms agreed upon with your clients to maintain trust and avoid conflicts.

By avoiding these common mistakes, you ensure that your documents are clear, accurate, and professional, helping to streamline your billing process and improve client relationships. Taking the time to review your payment requests carefully can save you from unnecessary complications and foster trust with your clients.

Best Tools for Designing Invoices

Creating professional and effective payment documents requires the right set of tools. Whether you are managing payments for clients or simply need a more streamlined way to produce accurate documents, choosing the right software can save you time and ensure your documents are consistent and professional. From simple online generators to advanced design platforms, there are various options available to suit your specific needs.

The best tools help automate the process of generating detailed and customized payment requests. They allow for the inclusion of personalized details such as company branding, payment terms, and a comprehensive breakdown of services or goods provided. Additionally, these tools often come with templates and pre-made formats that can speed up the process while still maintaining a high level of customization.

Popular Tools for Document Design

Here are some of the top tools widely used for creating payment requests:

- Canva: A versatile graphic design platform that offers customizable layouts, making it easy to create visually appealing and professional documents with ease.

- FreshBooks: A popular accounting software with built-in document creation features, allowing you to generate detailed, branded payment requests with a few clicks.

- Zoho Invoice: An online tool designed specifically for crafting professional payment documents, including options for automated calculations and customizable fields.

- Microsoft Word: While simple, Word remains a powerful tool with customizable features, including templates and design options suitable for crafting formal documents.

- Invoicely: This platform offers simple, efficient design tools and includes a range of customizable templates and automated invoicing features.

Choosing the Right Tool for Your Needs

When selecting the right tool, consider factors such as ease of use, customization options, and the ability to integrate with other software. If you are a freelancer or small business owner, a tool like Canva or FreshBooks might be ideal, providing both design flexibility and accounting functionality. Larger organizations may prefer advanced tools like Zoho Invoice for automation and scalability.

By leveraging these powerful tools, you can ensure that your payment documents look professional and are tailored to your specific requirements, streamlining the entire process and saving you valuable time.

Invoice Templates for Different Industries

Every industry has its own set of requirements when it comes to crafting payment documents. Whether you’re in consulting, retail, or the creative arts, the layout and content of your documents need to reflect the specific needs of your industry. Customizing these documents ensures they contain all relevant information, making it easier for clients to process payments and understand the terms.

In certain fields, you may need to include specialized information such as project milestones, service hours, or material costs. For example, a consultant might need to break down their hourly rates, while a construction contractor may need to list individual materials and labor separately. Understanding the unique needs of your industry will help you choose or create the most effective structure for your payment requests.

Examples of Industry-Specific Structures

Here are some examples of different fields and the key elements typically included in their payment requests:

| Industry | Key Elements |

|---|---|

| Consulting | Hourly rates, project phases, service breakdown |

| Construction | Materials, labor costs, project milestones |

| Retail | Itemized products, tax details, discounts |

| Freelance Writing | Word count, rate per word, deadlines |

| Design | Design hours, project revisions, deliverables |

Choosing the Right Structure for Your Field

When selecting a structure for your documents, consider the nature of the work and the expectations of your clients. A clear and easy-to-read format will help facilitate the payment process and reduce the risk of misunderstandings. Each industry has its own norms, so ensure that your document reflects these while maintaining clarity and professionalism.

By tailoring your documents to the specifics of your industry, you can make the billing process more efficient and foster a better relationship with clients by showing that you understand their unique requirements.

How to Track Invoice Payments Efficiently

Keeping track of payments is crucial for maintaining cash flow and managing your finances. An efficient tracking system ensures you can quickly identify which payments have been received, which are overdue, and which clients still owe money. This helps you stay organized and avoid confusion, reducing the chances of missing payments or sending duplicate requests.

To effectively track payments, you need a reliable system in place that allows you to monitor the status of each request. This system can range from simple manual methods to automated software tools, depending on the complexity and scale of your operations. Regardless of the method you choose, having a clear and structured approach will help you stay on top of your accounts and maintain good client relationships.

Methods for Payment Tracking

Here are some methods you can use to efficiently monitor payments:

- Manual Tracking: Using spreadsheets to track payments is a simple method that works well for small operations. You can record payment details, dates, and amounts received. However, this method can become time-consuming and prone to error as the volume of transactions increases.

- Automated Tools: Many software solutions allow you to track payments automatically. These tools can send reminders, generate reports, and even match payments to specific requests, saving you time and reducing human error.

- Payment Gateways: Using an integrated payment gateway provides real-time updates on payment status. Many platforms automatically update when payments are made, making it easy to track and reconcile funds.

- Cloud-Based Solutions: Cloud platforms allow you to access your payment records from anywhere, helping you stay on top of payments regardless of your location. These tools also facilitate collaboration with teams or clients, making it easier to communicate and share payment statuses.

Best Practices for Efficient Payment Tracking

Regardless of the method you choose, there are a few best practices that will help ensure efficient tracking:

- Consistent Follow-Ups: Regularly review your accounts to ensure that payments are processed on time. Automated reminders can be helpful, but personal follow-ups can strengthen client relationships.

- Clear Payment Terms: Clearly communicate your payment terms upfront to avoid misunderstandings. Include due dates, late fees, and payment methods in your payment requests.

- Organize Payment Data: Keep payment records organized and easily accessible. Categorizing by client or due date can help you quickly identify outstanding payments.

- Track Payment Methods: Be sure to

Legal Requirements for Business Invoices

When generating financial documents for clients, it’s important to adhere to local laws and regulations. Each country has specific legal obligations that must be met to ensure that payment requests are valid, transparent, and legally enforceable. These legal requirements help avoid disputes, provide proof of transactions, and ensure compliance with tax regulations.

One of the primary considerations in ensuring compliance is understanding the key details that must be included in every financial document. In addition to standard payment information, certain jurisdictions may require specific elements like tax identification numbers, payment terms, and detailed descriptions of goods or services provided.

Essential Legal Elements to Include

To ensure that your financial documents meet legal standards, be sure to include the following information:

- Company Details: Your full company name, address, and contact information should be clearly stated on the document. If applicable, include your business registration number or tax identification number.

- Client Details: Include the recipient’s name, address, and contact information. This ensures that the document is tied to the correct party.

- Unique Identifier: Each document should have a unique reference number for easy tracking. This helps both parties keep accurate records and facilitates dispute resolution.

- Detailed Description: Clearly list the goods or services provided, along with any applicable quantities, prices, and dates. This detail is vital for tax purposes and for client verification.

- Payment Terms: Include payment due dates and any late payment penalties. In some jurisdictions, payment terms are legally required to be specified, and failure to do so could result in penalties.

- Tax Information: If applicable, include tax rates, total tax charges, and your tax identification number. Many countries require businesses to detail taxes separately on financial documents for proper reporting and auditing.

Jurisdiction-Specific Considerations

Each country or region may have additional rules that affect the content and format of these documents. Some jurisdictions may require digital signatures or other forms of authentication for added security and verification. Researching local laws will ensure that you are fully compliant with the specific requirements in your area.

Understanding and complying with the legal requirements for financial documentation is crucial to protecting your business, avoiding penalties, and maintaining trust with clients. Keeping your documents clear, accurate, and compliant ensures smooth transactions and effici