Free Invoice Fillable Template for Easy Customization

Managing client payments can be time-consuming, especially when dealing with repetitive paperwork. Simplifying this process allows businesses to save valuable time and ensure accuracy in their financial transactions. With the right tools, invoicing can become a quick and efficient task that aligns with your brand’s needs.

Using a pre-designed, customizable document helps to eliminate errors and makes it easier to track transactions. These forms are not only practical but also allow you to present a professional appearance, enhancing your credibility with clients. Whether you are running a small business or freelancing, having a reliable and flexible document system is essential for smooth operations.

By adapting these documents to suit specific requirements, you can create an effective system that works for you. Integrating essential fields, payment terms, and customer information ensures that your paperwork is always in order. This approach minimizes delays and helps to avoid common mistakes that can occur when using generic forms.

Why Use a Fillable Invoice Template

Efficient financial management requires the right tools to handle client billing quickly and accurately. Using a customizable document allows for easier data entry and reduces the chance of errors, ensuring smooth business operations. The ability to modify essential fields makes this option particularly appealing for businesses with varying needs or frequent transactions.

By utilizing a pre-designed, editable form, you can maintain consistency in the way you present your charges. This eliminates the need for manual entry from scratch, saving you both time and effort. It also ensures all required information is included every time, making it easier to keep track of outstanding payments and reducing administrative overhead.

Another major benefit of this method is the ability to personalize the document to fit your brand. Customizing the layout, font, and color scheme helps you present a professional image to clients while maintaining an efficient and organized system. This flexibility provides a seamless way to manage finances without the hassle of manually creating documents each time.

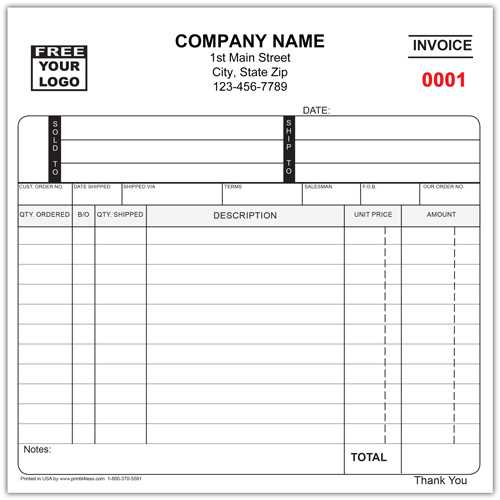

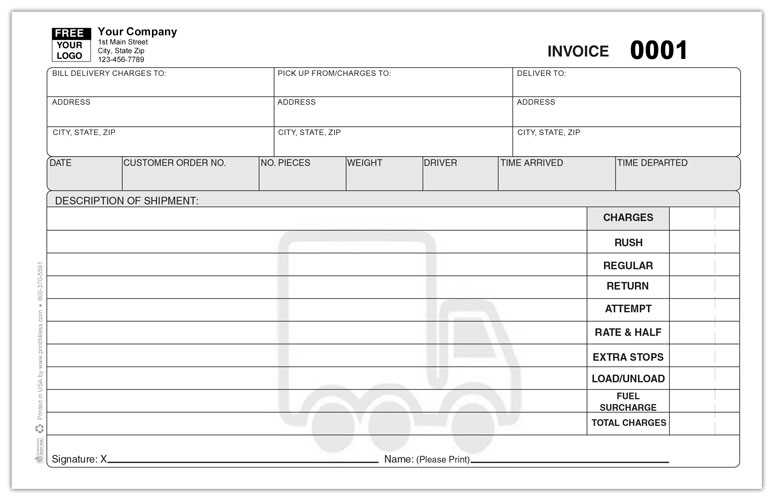

How to Create Custom Invoices Quickly

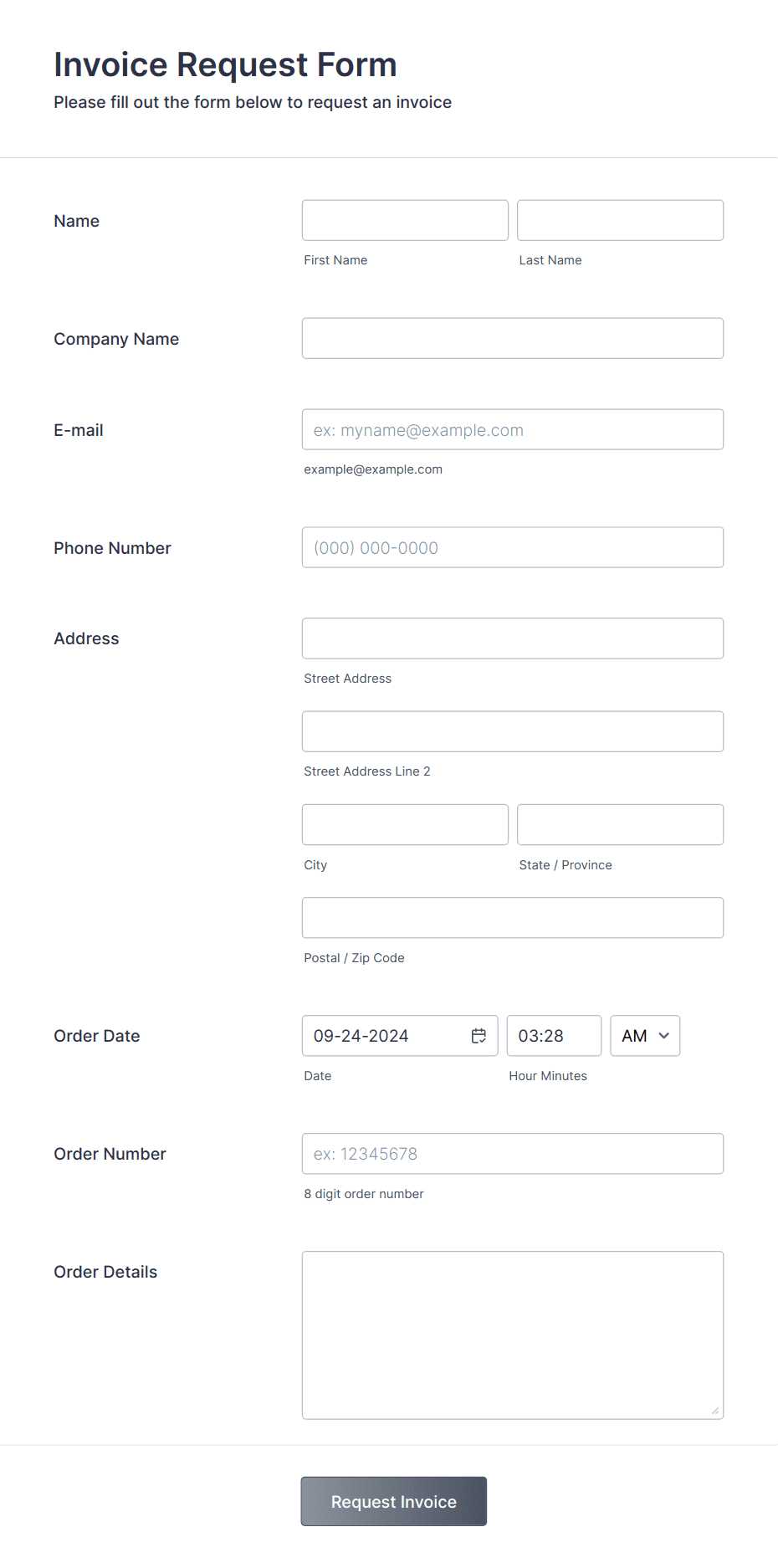

Creating personalized billing documents doesn’t have to be a time-consuming task. With the right approach, you can generate professional and accurate statements in a matter of minutes. The key is to have a streamlined system that allows you to easily input client details and payment information, while still offering flexibility for customization.

Choose the Right Tool for the Job

Start by selecting a software or platform that offers easy customization. Most modern tools provide editable fields, allowing you to quickly change the content and design to suit your needs. Here are some options to consider:

- Online billing platforms with pre-designed layouts

- Spreadsheet programs with customizable formulas

- PDF editors that allow text and data input

Customize Your Document Structure

Once you have the right tool, it’s time to personalize the layout and fields. Focus on including the essentials, such as client name, payment terms, service description, and total amount. You can also add your company logo and contact details for a more professional touch. A few simple steps can help ensure consistency in every document:

- Insert standardized headings for easy reading

- Use clear and concise language for item descriptions

- Include automated fields for dates and totals

By following these steps, you’ll be able to create customized and professional documents efficiently, saving time while maintaining accuracy and clarity.

Benefits of Using a Digital Invoice

In today’s fast-paced world, businesses need solutions that streamline processes and reduce the likelihood of errors. Digital billing offers numerous advantages over traditional methods, especially in terms of efficiency, accessibility, and environmental impact. By shifting from paper-based documents to electronic formats, companies can improve their operations and offer a more convenient experience for both themselves and their clients.

Speed and Efficiency

One of the primary benefits of switching to digital billing is the speed at which documents can be created, edited, and sent. Instead of manually writing out or printing forms, you can quickly generate an accurate statement with just a few clicks. This not only saves time but also reduces the administrative burden, allowing you to focus on other important tasks.

Improved Accuracy and Organization

Digital documents automatically update totals, calculations, and other relevant information, ensuring that everything is accurate and up to date. Furthermore, with proper storage and categorization, it’s much easier to track payments and manage records, eliminating the need for manual filing and reducing the risk of losing important documents.

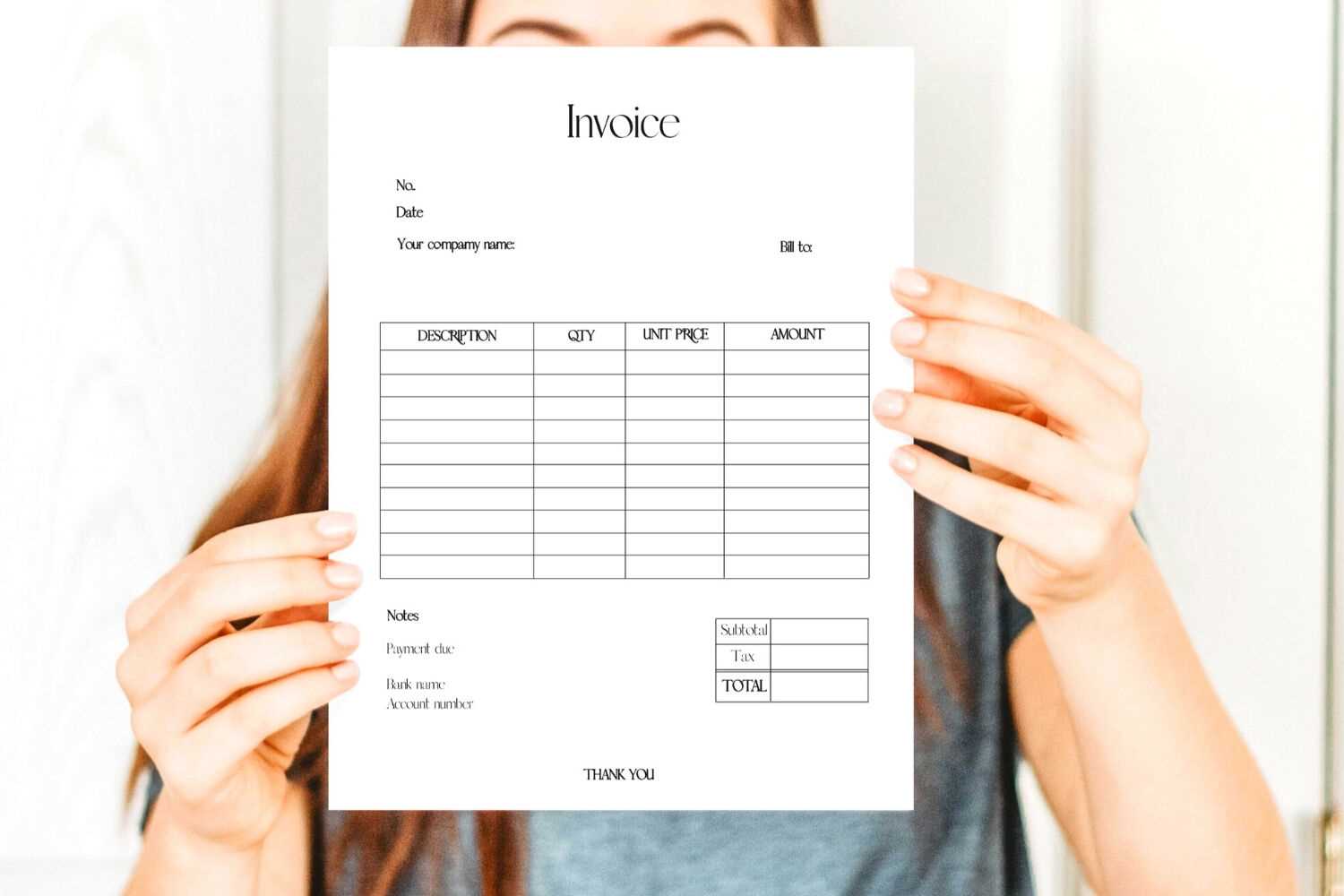

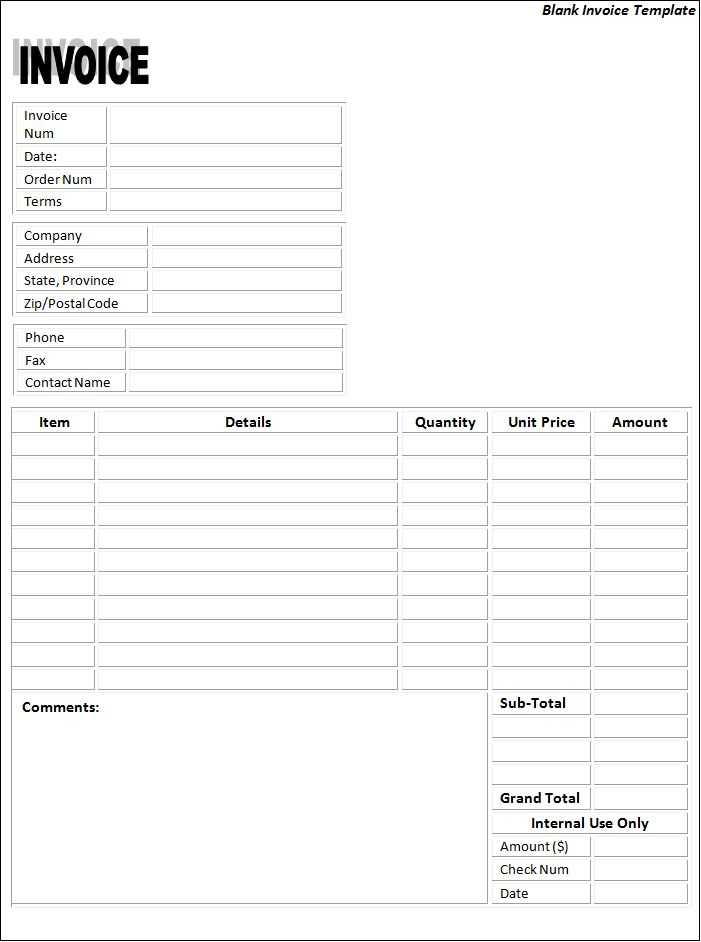

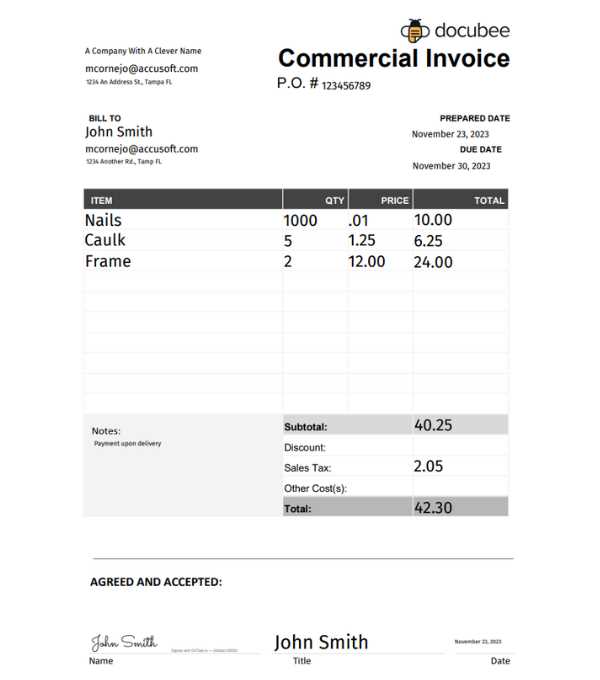

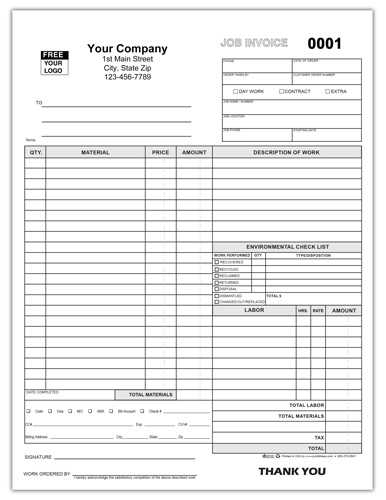

Key Elements of an Invoice Template

Creating a well-structured billing document is essential for clarity and professionalism. A properly designed form includes specific fields that allow both businesses and clients to quickly understand the transaction details. By ensuring that the right information is included, you can reduce confusion and maintain a smooth flow of communication regarding payments.

Essential Information to Include

Each document should contain several key elements to ensure it serves its purpose effectively. These components allow for easy identification, accurate record-keeping, and seamless transaction tracking:

- Business Details: Company name, address, and contact information.

- Client Information: Customer name, address, and contact details.

- Unique Reference Number: A number to track the document easily.

- Payment Terms: Due date and any late fees associated with overdue payments.

- Itemized List: Description of goods or services provided along with their prices.

- Total Amount: The overall cost, including taxes and discounts if applicable.

Formatting for Clarity

While the content is crucial, how the information is presented also matters. Use clear headings, bullet points, and easily distinguishable sections to organize the data. This makes the document easy to read and ensures that both you and your clients can quickly locate the necessary information when needed.

Top Tools for Customizing Invoice Templates

To create personalized billing documents quickly and efficiently, the right tools are essential. Various platforms and software can help you customize your forms to fit your business needs. These tools offer flexibility, allowing you to easily edit fields, add your branding, and automate calculations, ultimately saving you time and reducing the risk of errors.

Online Platforms for Easy Customization

Online tools offer user-friendly interfaces, making it easy for anyone to design and edit professional documents. These platforms typically come with a range of pre-designed layouts that you can modify to include your unique information. Some top options include:

- Canva: Known for its intuitive design options, Canva allows you to create visually appealing documents with custom logos and layouts.

- Zoho Invoice: An all-in-one solution for creating, sending, and managing billing statements, with options for customization and automation.

- FreshBooks: Provides customizable billing forms with integrated payment options and easy-to-use tools for small businesses.

Spreadsheet Software for Flexibility

If you prefer working with spreadsheets, programs like Microsoft Excel or Google Sheets offer great flexibility. These tools allow you to create detailed, itemized billing statements with the added benefit of built-in calculation functions:

- Excel: Offers full control over your document’s layout, calculations, and design elements.

- Google Sheets: Free and accessible online, Google Sheets offers collaborative features and custom templates to tailor your documents.

How to Save Time with Templates

Using pre-designed documents can significantly reduce the time spent on routine tasks, allowing businesses to streamline their operations. Instead of starting from scratch each time you need to create a new record, you can rely on customizable formats that can be quickly filled out. This approach ensures that all necessary fields are completed accurately, eliminating the need for manual adjustments.

By setting up reusable structures, you can focus on the details rather than creating documents from the ground up. Automated calculations and pre-set fields further enhance efficiency, ensuring you save time on repetitive tasks.

| Task | Time Saved |

|---|---|

| Creating a New Document from Scratch | 10-15 minutes |

| Using a Pre-Designed Layout | 2-3 minutes |

| Updating Client Information | 1-2 minutes |

| Adding Payment Details | 2 minutes |

As seen in the table, switching to a ready-made form can save you a significant amount of time, enabling you to focus on other aspects of your business while maintaining accuracy and consistency in your records.

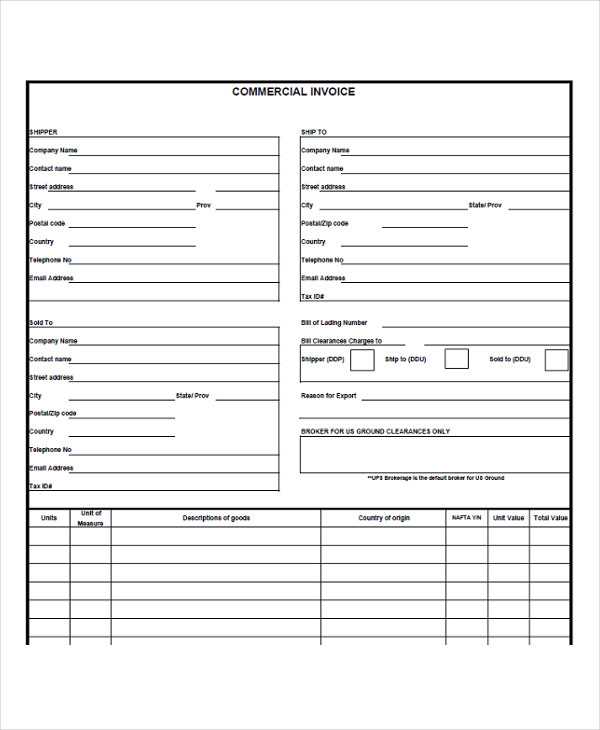

Legal Considerations When Using Invoices

When creating and sending billing documents, it is essential to consider legal requirements to ensure compliance with regulations. Properly structured forms help protect both businesses and clients by outlining payment terms clearly and reducing the risk of disputes. Understanding the key legal aspects can prevent issues related to tax reporting, contractual agreements, and payment enforcement.

One of the most important factors to consider is ensuring that all necessary details, such as payment deadlines, tax rates, and client information, are included. These elements are not only essential for transparency but are also often required by law for accurate financial reporting. Failure to include these details can lead to penalties or complications with tax authorities.

Another legal consideration is ensuring that your documents adhere to industry-specific standards. Depending on your location and business type, there may be specific regulations regarding invoicing that must be followed. For instance, some jurisdictions may require specific wording, such as “due upon receipt” or the inclusion of VAT identification numbers for international transactions.

How to Add Payment Terms to Invoices

Clearly stating payment conditions in business documents helps prevent misunderstandings and ensures timely transactions. By specifying when and how payments should be made, you set expectations for both parties and protect your business from delayed or missed payments. Including these terms ensures transparency and creates a legal framework for payment enforcement.

To add payment conditions to your documents, start by clearly stating the due date. This can either be a fixed date or a time frame from the issue date, such as “Due within 30 days.” If there are any early payment discounts or late fees, make sure to highlight them. For example, you could write, “A 5% discount will apply if paid within 10 days” or “Late payments will incur a 2% monthly fee”.

Additionally, consider including preferred payment methods, such as bank transfers, checks, or online payment platforms, to provide convenience for your clients. You can also specify the necessary details for making payments, such as your bank account information or online payment links, to further simplify the process.

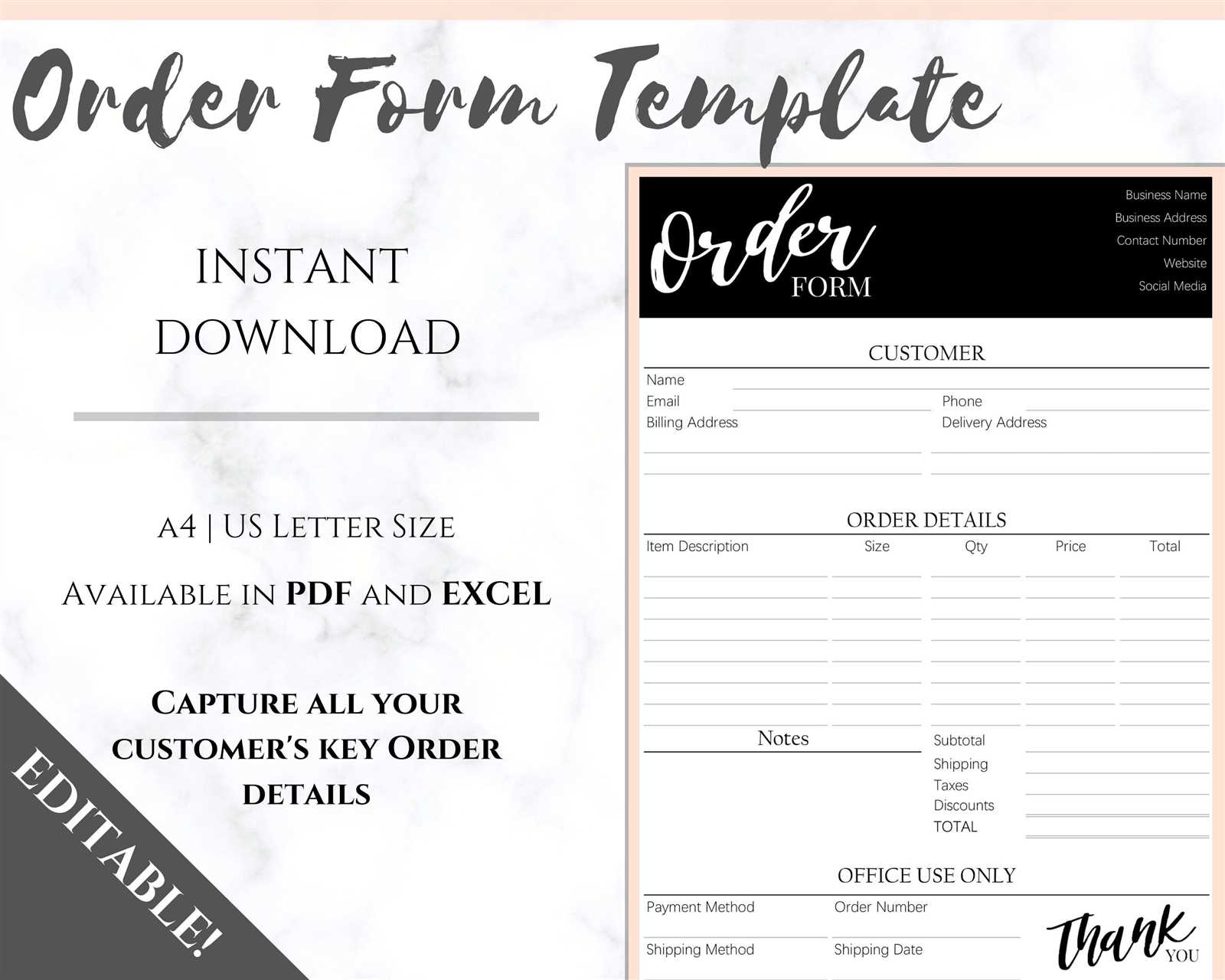

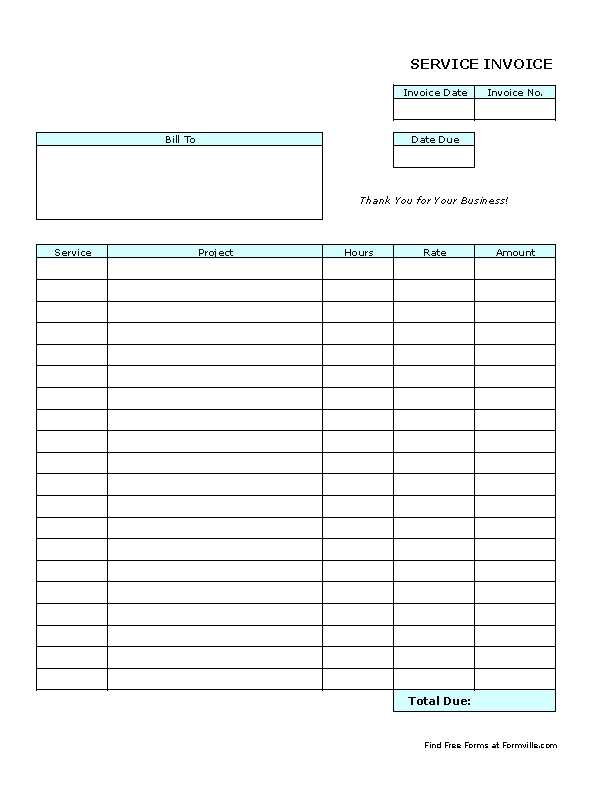

Best Practices for Invoice Design

Designing a clear and professional document is essential for effective communication with clients. A well-structured layout not only enhances readability but also reinforces your brand’s credibility. By focusing on simplicity, consistency, and essential information, you can ensure that your forms are both functional and aesthetically pleasing.

When creating your document, aim for a clean design with clearly defined sections. Use headings and bullet points to break down information, and make sure that all necessary details are easy to find. A clutter-free format prevents confusion and ensures that clients can quickly access payment details, due dates, and other essential information.

| Design Element | Best Practice |

|---|---|

| Layout | Keep it organized with clear sections for client info, services, and totals. |

| Fonts | Choose legible fonts with consistent sizing for easy readability. |

| Colors | Use your brand colors, but avoid using too many to keep it professional. |

| Branding | Include your company logo and contact information for easy recognition. |

By following these best practices, you can create a streamlined document that enhances your professionalism and ensures that all necessary information is clear and easily accessible to your clients.

How to Automate Invoice Generation

Automating the creation of billing statements can save you time and reduce the risk of errors. By setting up an automated system, you can ensure that all necessary information is included correctly and consistently, while freeing up valuable time for other tasks. Automation tools can streamline the entire process, from creating records to sending them to clients.

Choose the Right Software

The first step in automation is selecting the appropriate software or platform. Many accounting tools and platforms offer built-in automation features that can generate documents based on preset criteria. Look for software that allows you to input customer details, payment terms, and product or service descriptions, which can then be automatically filled into your forms.

- QuickBooks: Offers automated billing and customizable templates that can generate documents with minimal effort.

- FreshBooks: This cloud-based solution allows for automatic recurring billing and tracks payments with ease.

- Zoho Invoice: An excellent option for small businesses, this tool offers automated billing, reminders, and payment tracking.

Set Up Recurring Billing

If you provide subscription-based services or have long-term contracts, recurring billing is essential for automation. Most software allows you to set up recurring cycles for customers, so their documents are automatically generated and sent on a schedule. This not only saves time but also ensures that you never miss a payment deadline.

- Set your preferred frequency (weekly, monthly, yearly).

- Include all relevant client information (e.g., payment details, subscription levels).

- Enable automated reminders for unpaid or upcoming payments.

By automating the generation of these documents, you can focus more on growing your business while ensuring that all clients receive accurate and timely records of their transactions.

How to Protect Your Invoice Data

Ensuring the security of your financial records is crucial for maintaining confidentiality and avoiding fraud. As these documents often contain sensitive client information, payment details, and business transactions, taking proactive steps to protect them is essential. Implementing strong security measures can help safeguard your data from unauthorized access and potential breaches.

Use Strong Encryption

One of the most effective ways to secure your documents is by using encryption technology. This ensures that even if your files are intercepted, they cannot be read without the decryption key. Many accounting software solutions offer built-in encryption for both stored and transmitted documents, making it easier to protect sensitive data.

- File Encryption: Encrypt your documents before storing or sending them online to prevent unauthorized access.

- End-to-End Encryption: Use services that offer end-to-end encryption for added protection during online transactions and file sharing.

Limit Access and Set Permissions

Another way to protect your records is by restricting access to authorized individuals only. Set up user accounts with specific roles and permissions to ensure that only those who need access to the data can view or modify it. This minimizes the risk of accidental or intentional data leaks.

- Role-based Access: Assign roles to employees based on their responsibilities, limiting their access to certain parts of the system.

- Audit Logs: Enable audit logging to track any changes or access to your documents, helping you monitor any suspicious activities.

By using encryption and restricting access, you can significantly reduce the risk of unauthorized individuals gaining access to your sensitive financial information, ensuring that your records remain secure and confidential.

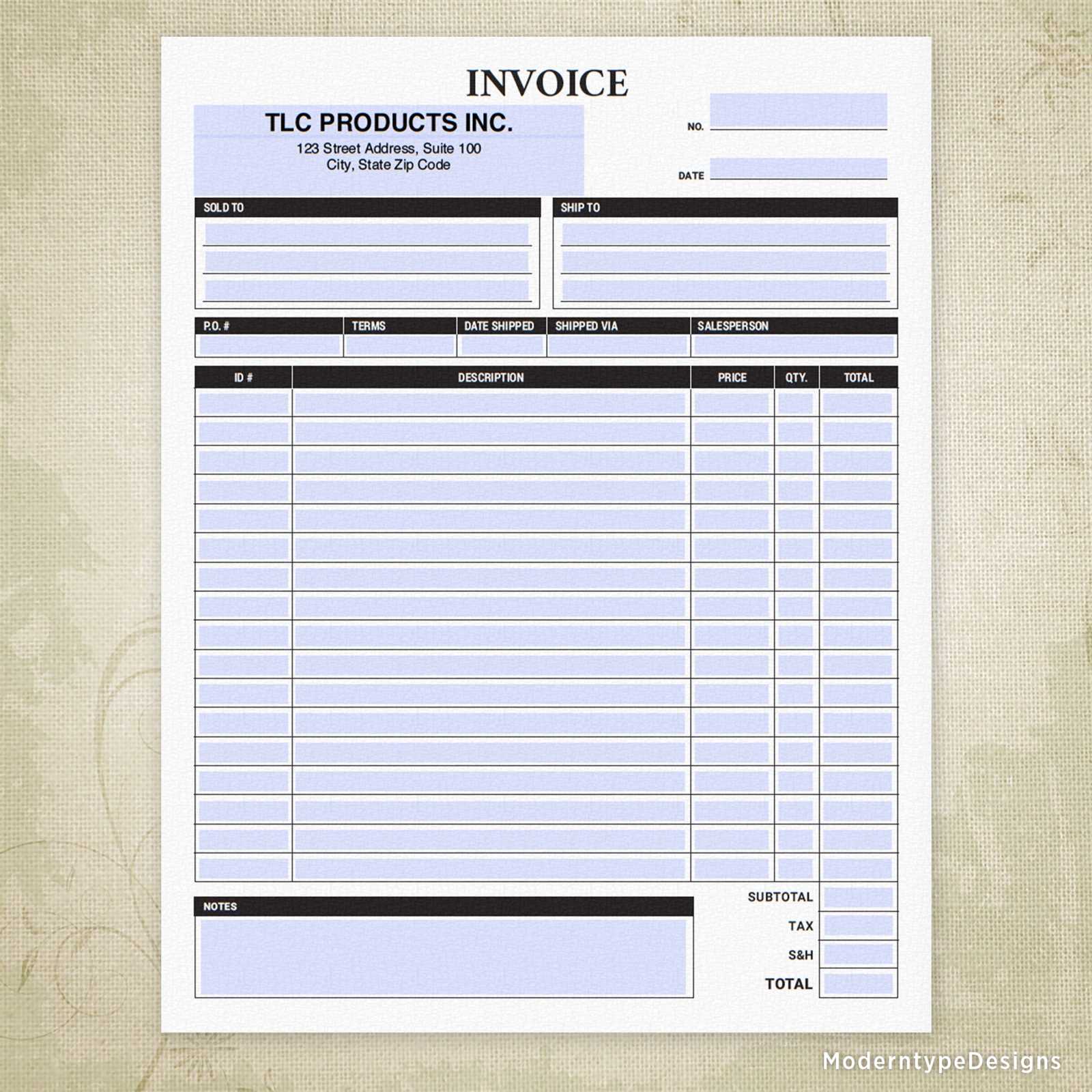

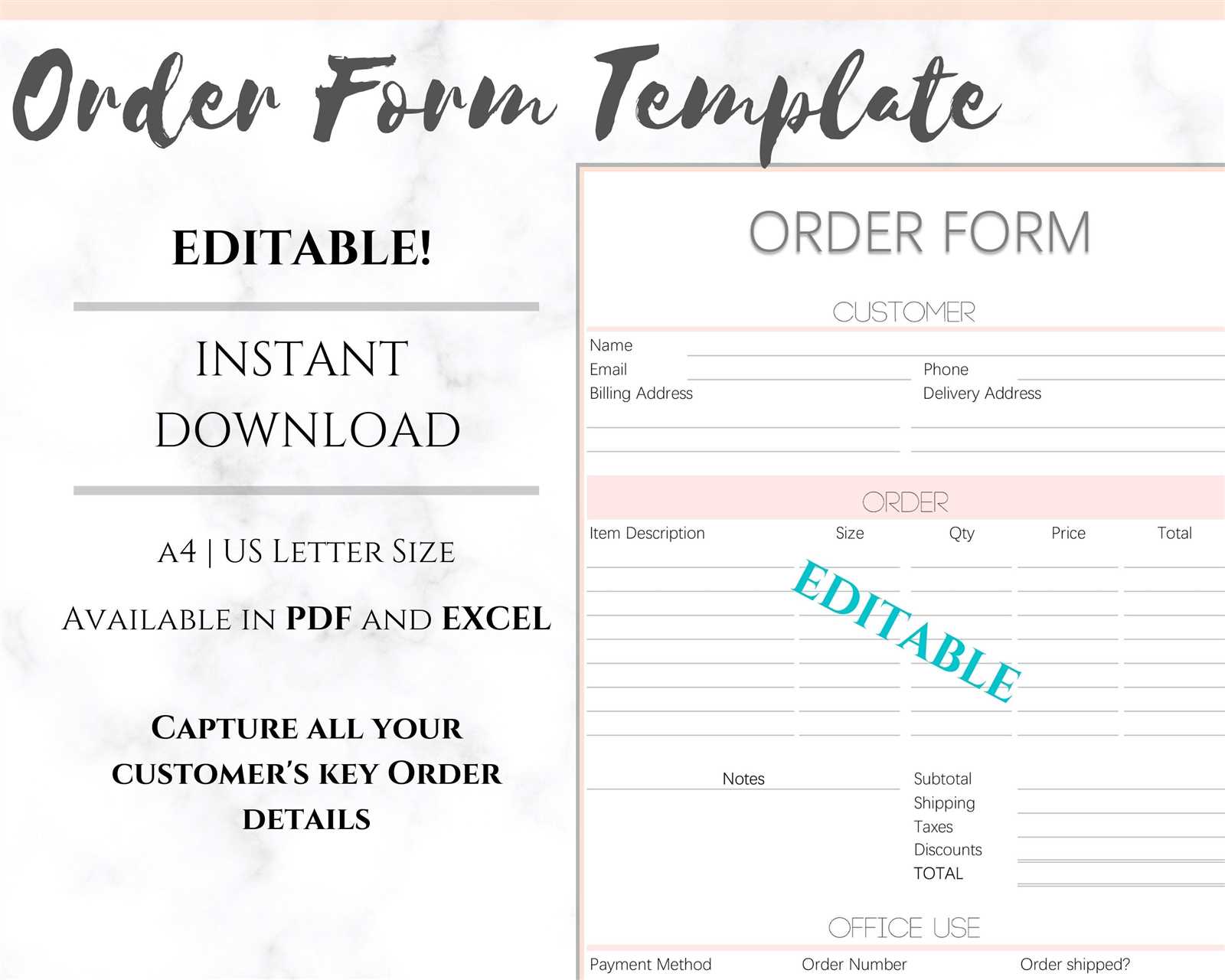

Managing Multiple Clients with Templates

Efficiently handling numerous clients can be a challenging task, especially when it comes to managing individual details, payment records, and customized documents. By using standardized forms for each client, you can streamline the process and ensure consistency across all your transactions. A well-organized approach helps you save time and reduces the risk of errors, especially when working with a large number of clients.

Organize Client Information

One of the first steps in managing multiple clients is organizing their details. This includes contact information, service agreements, and payment terms. By keeping all this data in one place, you can quickly generate accurate records without having to search for information each time. Using a digital management system can help store and retrieve this data efficiently.

- Centralized Database: Keep client information in a single system that can be accessed easily when needed.

- Pre-filled Fields: Use systems that allow you to pre-fill client data, reducing manual entry each time you create a new record.

Customizing for Each Client

While standardization is key, personalization is still important when dealing with different clients. Customizing specific details for each client ensures that all documents reflect their unique needs and agreements. This can be done by setting up distinct profiles or customizing fields that change from client to client, such as pricing, services, and due dates.

- Automated Fields: Use software that allows fields such as client name, service descriptions, and amounts to be automatically filled based on the client profile.

- Personalized Documents: Include client-specific information like custom payment terms or discounts to make each document more tailored.

By utilizing these strategies, you can handle multiple clients effectively, ensure accuracy, and save valuable time in the process.

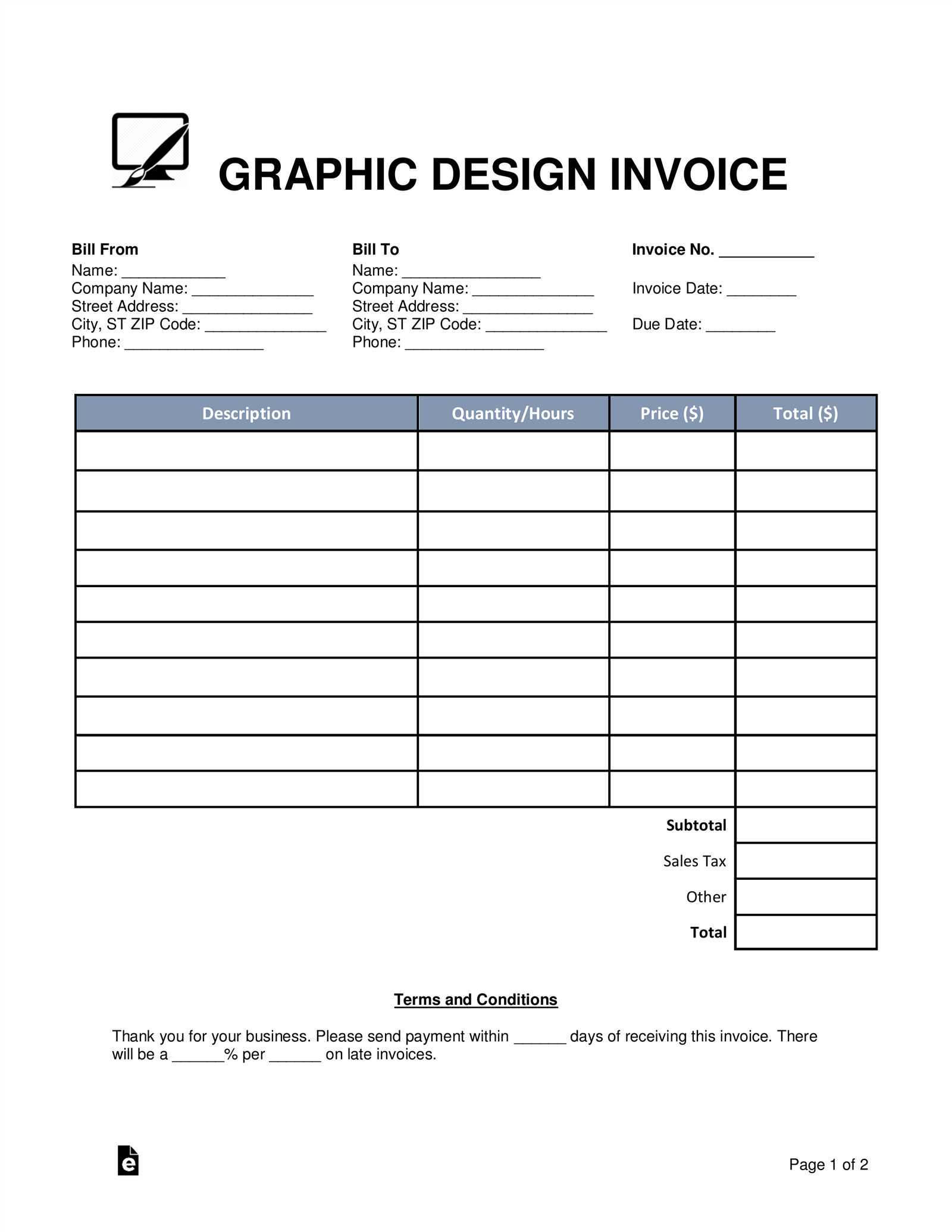

How to Personalize Invoice Templates

Customizing your billing documents is an essential step in creating a professional and tailored experience for your clients. Personalization goes beyond just including basic contact information–it’s about reflecting your brand identity and adapting the document to fit your unique business needs. By modifying key elements, you can make your financial records stand out and enhance client relationships.

Branding Your Documents

One of the first steps in personalization is adding your business logo, colors, and fonts. This not only improves the visual appeal of your records but also strengthens your brand identity. Consistent branding across all your documents creates a professional image that clients will recognize and trust.

- Logo Placement: Position your company logo prominently at the top of the document to make it easily recognizable.

- Color Scheme: Use your business’s brand colors in headings or background accents to maintain consistency across materials.

- Custom Fonts: Choose fonts that align with your brand style, ensuring readability and professionalism.

Adding Client-Specific Information

Another key aspect of personalization is including details that are specific to each client. This can include their name, address, service descriptions, pricing, and any special terms or discounts. By making these adjustments, you show clients that you’re paying attention to their needs and ensuring accuracy in your documents.

- Client Name and Address: Automatically populate these fields based on stored client data.

- Services Rendered: Customize the list of products or services for each client, ensuring that it’s relevant to them.

- Payment Terms: Include unique payment terms such as discounts, due dates, and methods of payment.

Personalizing your financial documents not only makes them more professional but also ensures that your clients feel valued and understood. With a few adjustments, you can create a more engaging and client-centric billing process.

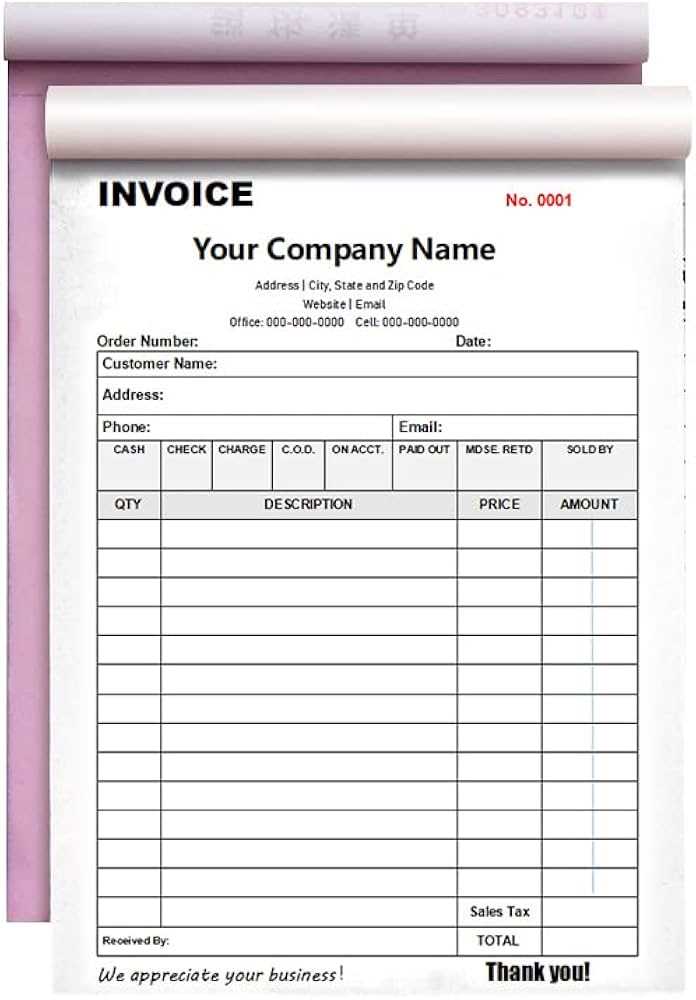

Where to Find Free Invoice Templates

Finding customizable billing documents that are free of charge can save both time and money for small businesses or freelancers. There are many online resources offering a variety of ready-to-use designs and formats to meet different business needs. These tools can be easily adapted to fit your brand and specific requirements, making them a great choice for creating professional documents without any cost.

Online Platforms Offering Free Templates

Several websites provide free access to a wide range of billing document designs, allowing you to download or customize them directly online. Many of these platforms also offer cloud storage options to manage your documents, making the process more convenient.

- Google Docs: Google offers free, editable options that can be easily customized and shared with clients.

- Microsoft Office Online: With Office Online, you can find free designs that can be customized and used directly within your browser.

- Canva: Canva provides a variety of free templates with drag-and-drop features, making customization easy for users without design experience.

- Zoho: Zoho offers a selection of free billing document templates that can be personalized and sent directly to clients.

Software with Free Options

If you’re looking for more robust features, several software tools also offer free versions or limited-use options for creating professional records. These platforms often come with additional tools to streamline your business processes.

- Wave: This accounting software provides free invoice creation tools, along with integrated payment tracking.

- FreshBooks: While FreshBooks primarily operates as a paid service, it offers free trials with access to its full suite of customizable billing tools.

- Invoicely: This platform offers a free plan that allows users to generate and send billing documents with ease.

With these free resources, you can find a solution that fits your business needs, whether you’re creating a one-time document or establishing an ongoing system for billing clients.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s essential to ensure accuracy and professionalism. Small errors in these records can lead to confusion, payment delays, and even lost revenue. By recognizing and avoiding common mistakes, you can streamline your billing process and maintain strong relationships with clients.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include or accurately display key contact information. If your details are incomplete or incorrect, clients may struggle to reach out for clarification, leading to delays in processing payments.

- Ensure accuracy: Double-check both your and your client’s contact details to avoid errors.

- Include all necessary info: Add your business name, address, phone number, and email address for easy communication.

2. Vague or Incomplete Descriptions of Services

Providing unclear or generalized descriptions of the products or services provided can cause confusion. It’s important that clients know exactly what they are paying for to avoid disputes later.

- Be specific: Include detailed descriptions of each service or product, including quantities and unit prices.

- Avoid ambiguity: Make sure there are no terms or phrases that can be misinterpreted.

3. Incorrect Dates or Payment Terms

Incorrect dates or payment terms can lead to misunderstanding and delayed payments. Be precise when indicating the issue date, due date, and any applicable payment terms to ensure everything is clear.

- Verify all dates: Double-check the issue and due dates to prevent confusion.

- Clarify terms: Include any payment deadlines, late fees, or discounts that apply to the transaction.

4. Not Including a Unique Reference Number

Without a unique reference number, it can become difficult to track and manage your billing documents. A reference number makes it easier to refer to specific records and helps with both internal and external organization.

- Assign a unique number: Each billing document should have its own reference number for easy identification.

- Use a consistent format: Develop a numbering system that is logical and easy to follow.

5. Failing to Include Payment Methods

Clients need to know how they can pay for services. Not including payment methods or offering insufficient payment options can lead to unnecessary delays.

- List all payment options: Include options such as bank transfer, credit card, or online payment platforms.

- Be clear about the process: Provide specific instructions on how to complete the payment if needed.

By avoiding these common mistakes, you can ensure that your billing documents are clear, accurate, and professional, leading to a smoother process for both you and your clients.