Complete Guide to Using an Invoice Factoring Template

Managing cash flow effectively is crucial for any business, especially when dealing with delayed payments from clients. Streamlining this process with well-organized documentation can significantly reduce financial strain. By using a clear, standardized approach, companies can ensure they maintain liquidity and focus on growth without the distraction of unpaid invoices.

One effective way to achieve this is by using a structured document that facilitates the rapid transfer of outstanding receivables to a third party for immediate cash. This method is increasingly popular among small and medium-sized businesses looking for a reliable alternative to traditional loans. With the right documentation in place, businesses can take control of their finances and improve cash flow management, even in times of uncertainty.

In this guide, we’ll explore how to create and utilize such a document, highlighting the essential elements needed for success. By the end, you’ll have a better understanding of how this tool can make your financial operations more efficient and less stressful.

Understanding Structured Financial Documents

In any business, maintaining consistent cash flow is essential for growth and stability. One common solution to managing delayed payments is leveraging a financial instrument that allows businesses to receive immediate funds by selling outstanding receivables to a third party. The process is simplified with the use of a well-organized document that outlines key details, ensuring both parties are clear on terms and expectations.

This document serves as a formal record, providing clarity and structure to the transaction. It includes all the necessary fields to ensure smooth processing and prevent any potential misunderstandings. By using such a document, businesses can not only speed up their financial operations but also reduce the risk associated with delayed payments.

Key Features of a Structured Financial Document

- Clear Identification of Parties: This includes the business selling receivables and the buyer or financing company.

- Details of Outstanding Receivables: The document must clearly list the outstanding invoices or debts to be sold.

- Payment Terms: A detailed outline of how and when funds will be exchanged.

- Fees and Interest: It’s crucial to define any applicable fees or interest rates that will affect the overall transaction.

- Legal Conditions: Terms outlining legal obligations and rights for both parties involved.

How This Document Facilitates Smooth Transactions

Having a clear, structured approach helps streamline the entire process. The parties involved have a mutual understanding of what is being agreed upon, which reduces the likelihood of disputes. Moreover, it provides a framework for tracking the transfer of funds, ensuring that payments are processed efficiently and on time.

By using a standardized document, businesses are able to speed up their cash flow, thus enabling them to focus more on growth and operational needs instead of financial bottlenecks.

What is Invoice Financing?

In business, maintaining a steady cash flow is often a challenge, particularly when clients delay payments. A common solution to this issue involves a process that allows businesses to quickly access funds by selling their unpaid invoices to a third party. This process helps bridge the gap between completing work and receiving payment, providing immediate financial support.

Essentially, it allows companies to unlock the value of their outstanding receivables, turning them into cash that can be used to cover operational expenses, pay suppliers, or invest in growth. This option is particularly valuable for small and medium-sized businesses that might not have access to traditional forms of financing, such as loans or lines of credit.

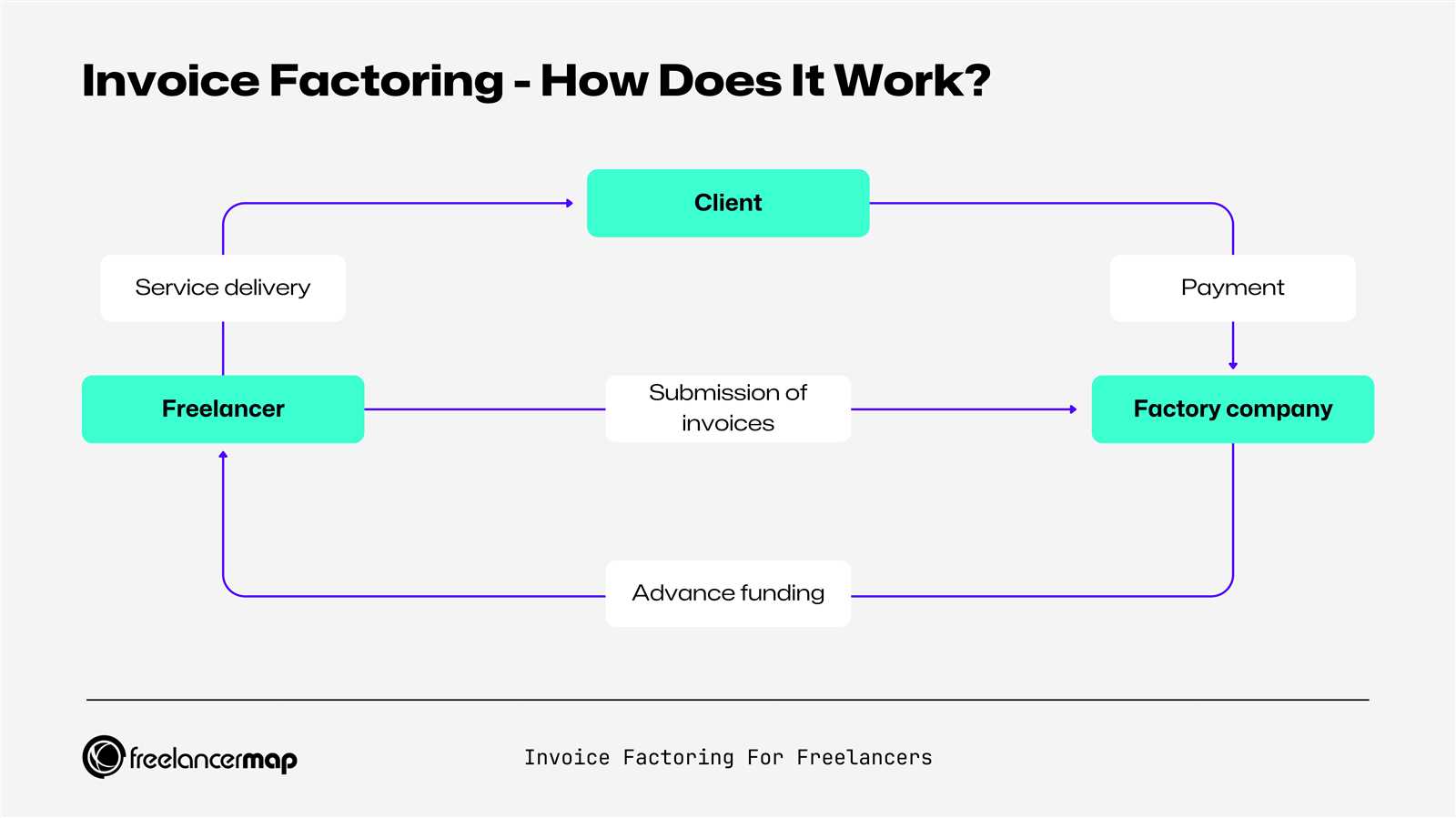

How Does the Process Work?

- Agreement with a Financing Company: The business enters into an agreement with a third-party lender or financing company.

- Sale of Receivables: The business sells its unpaid invoices to the financing company, often at a discounted rate.

- Advance Payment: The financing company provides an immediate payment (usually a percentage of the total invoice value).

- Collection of Payments: The financing company collects the full payment from the client once the invoices are due.

- Final Settlement: After the client pays, the financing company returns the remaining balance, minus any fees or interest.

Why Do Businesses Use This Method?

- Improved Cash Flow: Immediate access to funds helps businesses cover their expenses without waiting for client payments.

- Reduced Financial Stress: It allows businesses to avoid the strain of overdue accounts receivable.

- Less Risk: Companies can transfer the risk of delayed payments to a third party, freeing them from the burden of chasing unpaid invoices.

- Growth Opportunities: With better cash flow, businesses can seize new opportunities and continue operations without disruption.

How Invoice Financing Helps Cash Flow

For many businesses, managing cash flow can be a constant challenge, particularly when payments from clients are delayed. Without a consistent inflow of cash, covering operational expenses, paying employees, or investing in growth becomes difficult. One effective way to improve cash flow is by turning outstanding receivables into immediate funds, thus bridging the gap between providing services and getting paid.

By leveraging this financial solution, businesses can avoid waiting for clients to settle their accounts and gain access to cash much sooner. This not only helps maintain day-to-day operations but also provides the flexibility needed to seize new opportunities, pay suppliers on time, and manage unexpected expenses without disruption.

Here’s how this process directly benefits cash flow:

- Quick Access to Capital: Instead of waiting 30, 60, or 90 days for payment, businesses can access a portion of the owed amount right away.

- Reduced Financial Stress: Immediate funds allow businesses to manage cash requirements without scrambling to find short-term financing.

- Improved Budgeting: Knowing that a portion of outstanding debts has already been converted into cash makes it easier to forecast expenses and plan for the future.

- Greater Flexibility: With more available cash, businesses can invest in growth initiatives, increase inventory, or expand their operations without financial constraints.

- Less Reliance on Credit: By using this method, businesses can reduce their dependence on traditional loans or credit lines to cover gaps in cash flow.

By implementing this solution, companies can stabilize their financial situation and ensure they have the resources needed to keep moving forward, even when client payments are delayed.

Key Elements of an Invoice Financing Document

When using a structured document to sell outstanding receivables, it is essential to include all necessary details to ensure both parties are clear on the terms and conditions. A well-crafted document serves as the foundation for a smooth transaction, preventing misunderstandings and ensuring that all relevant information is captured. By incorporating the right components, businesses can streamline the process and reduce the risk of complications.

The following elements are crucial for creating a clear and effective document for transferring receivables:

- Parties Involved: Clearly identify the business selling the receivables and the financial institution or third party purchasing them. This ensures both sides understand their roles and responsibilities in the transaction.

- Receivables Details: A comprehensive list of the outstanding invoices or debts to be sold. This should include the original amounts, due dates, and any relevant information regarding the clients involved.

- Advance Amount: Specify the percentage of the total receivable value that will be advanced to the business immediately. This is typically a significant portion of the outstanding debt.

- Fees and Interest: Outline any applicable fees or interest charges that will be deducted from the total amount once the client pays. Clear disclosure of these costs is vital to avoid surprises later on.

- Payment Terms: Define the terms under which the financial institution will collect the payment. This should include when and how the remaining balance, after deductions, will be paid to the business.

- Legal Clauses: Include any legal terms and conditions that govern the agreement, such as dispute resolution processes, responsibilities for any defaults, and any applicable jurisdiction or governing law.

Incorporating these key components into the document helps ensure that the transaction runs smoothly, both from a financial and a legal perspective. It provides clarity for both the business and the third-party purchaser, minimizing potential risks and maximizing the benefits of the arrangement.

Step-by-Step Guide to Using a Financing Document

When utilizing a structured document for selling receivables, it’s important to follow a clear process to ensure all the necessary details are included and the transaction proceeds smoothly. This step-by-step guide will walk you through how to use a financial document from start to finish, ensuring you cover every aspect needed for a successful agreement.

Step 1: Gather Necessary Information

The first step is to gather all the relevant details about the receivables and the parties involved. This includes the outstanding debts, client information, and any terms related to the sale of those debts.

Step 2: Fill Out the Document

Once you have all the necessary information, start filling out the document. This includes entering details about the business, the purchaser, the receivables, and any financial terms such as advance percentages, fees, and payment schedules.

| Field | Required Information |

|---|---|

| Business Name | Name of the company selling receivables |

| Purchaser Details | Name of the third-party company buying the receivables |

| Receivable Amount | Total value of the outstanding debts being sold |

| Advance Percentage | Percentage of the receivable value that will be paid upfront |

| Fees and Interest | Any applicable fees or interest that will be deducted |

| Payment Terms | Details on when and how remaining payments will be made |

Step 3: Review and Finalize

After filling in all the fields, it’s essential to review the document carefully. Double-check that all information is correct, including amounts, dates, and terms. Any mistakes or omissions can lead to misunderstandings or delays in the process.

Once everything is confirmed, sign the document, and ensure that the purchasing party does the same. After both parties have agreed to the terms, the document is officially in place, and the transaction can proceed.

Step 4: Monitor the Process

After the document is completed and payments are processed, it’s important to track the progress. Stay in communication with the purchaser to ensure they collect payments from the clients and return the remaining balance as agreed.

Following these steps will ensure that you efficiently use the financial document to manage receivables and improve cash flow. It provides clarity, structure, and legal protection throughout the process.

Benefits of Using a Financing Document

Using a structured document to manage the sale of outstanding receivables provides several advantages for businesses looking to improve cash flow and streamline their financial operations. By adopting this approach, companies can ensure that the process is efficient, transparent, and legally sound. This document serves as a key tool in managing financial transactions, offering both immediate and long-term benefits.

Here are some of the primary benefits of using such a document:

- Improved Cash Flow: By turning unpaid debts into immediate cash, businesses can quickly access funds to cover operational costs, invest in growth, and meet other financial obligations.

- Faster Processing: A clear, standardized document simplifies the process, allowing businesses to quickly complete transactions without the delays typically associated with traditional financing methods.

- Reduced Risk: This method transfers the responsibility of collecting payments from clients to a third party, minimizing the risk of non-payment or overdue accounts.

- Enhanced Financial Flexibility: With quicker access to cash, businesses can make more informed decisions, whether it’s increasing inventory, hiring new staff, or taking advantage of new opportunities.

- Less Administrative Burden: A well-structured document reduces the need for constant follow-up with clients and simplifies the management of accounts receivable.

- Legal Protection: The document serves as a legally binding agreement that outlines the terms and conditions of the transaction, providing both parties with clear expectations and reducing the potential for disputes.

By using this approach, businesses can not only improve their immediate cash flow but also create a more predictable financial environment, making it easier to plan for the future and grow without the stress of delayed payments.

Common Mistakes When Using Financing Documents

When businesses use structured documents to manage the sale of receivables, it’s essential to ensure that all details are correctly filled out and that the terms are clear. Mistakes in this process can lead to delays, misunderstandings, and even legal complications. While the use of such a document simplifies transactions, it’s important to be aware of some common pitfalls to avoid.

1. Inaccurate or Incomplete Information

One of the most common mistakes is failing to accurately fill out all the required details. Missing or incorrect information, such as the amounts of receivables or the names of involved parties, can lead to confusion and delays in processing. Additionally, any discrepancies in the financial terms can result in disputes or misunderstandings between the business and the third-party purchaser.

2. Overlooking Fees and Costs

Another frequent mistake is not clearly outlining the fees, interest rates, or any other costs associated with the transaction. These should be fully disclosed and agreed upon in the document to avoid surprises later. If these elements are left vague or unmentioned, businesses may find themselves paying more than anticipated, or the third-party purchaser might face confusion over payment terms.

To avoid these issues, always double-check the accuracy of the information and ensure that all financial terms, fees, and payment schedules are transparent and clearly documented. This helps prevent costly misunderstandings and ensures a smooth transaction for both parties involved.

Choosing the Right Financial Document

Selecting the right document for transferring receivables is crucial for ensuring a smooth and efficient transaction. The right structure can streamline the process, provide clarity, and protect both parties involved. With various options available, it’s important to understand the key features and factors that should influence your decision when choosing the best document for your business needs.

Key Considerations When Choosing a Document

- Clarity of Terms: The document should clearly outline all terms, including advance amounts, fees, and payment schedules. Any ambiguity can lead to confusion or disputes.

- Customization Options: Ensure the document can be tailored to your specific business needs. Different industries may have unique requirements, and flexibility is important.

- Legal Compliance: Verify that the document complies with all relevant laws and regulations. This is especially important when dealing with cross-border transactions or varying legal jurisdictions.

- Ease of Use: A user-friendly design and layout are essential. The document should be easy to understand and fill out, minimizing the time spent on administrative tasks.

- Reputation of the Provider: Consider the reputation of the entity offering the document. It’s important to choose a reliable and reputable provider to ensure the document is legitimate and widely accepted.

Steps to Find the Best Fit for Your Business

- Evaluate Your Needs: Determine the specific features your business requires, such as the types of receivables you typically sell, and any particular terms you prefer.

- Research Available Options: Compare different options available in the market, considering factors like customization, ease of use, and legal compliance.

- Consult a Professional: If needed, seek advice from a legal or financial expert to ensure the document aligns with your business objectives and legal requirements.

- Test the Document: Before fully committing, test the document with a small transaction to ensure it functions as expected and meets your needs.

Choosing the right document can significantly impact the efficiency of your financial operations. By focusing on clarity, flexibility, and legal compliance, you can ensure that your business is well-positioned for success when managing receivables.

How to Customize Your Document

Customizing a financial document for transferring receivables is essential to meet the specific needs of your business and ensure smooth transactions. A standardized document can be adjusted to reflect your company’s unique terms, client requirements, and legal considerations. By tailoring the document, you can streamline the process, avoid misunderstandings, and make the transaction more efficient.

Here are the steps to help you customize the document effectively:

1. Define the Key Terms

Before customizing, clearly outline the terms that are most relevant to your business. These terms should be tailored to your specific needs and business practices, and may include the following:

- Receivable Amount: Adjust the amounts and descriptions to match the specific debts being sold.

- Advance Percentage: Specify the percentage of the total receivable that will be paid upfront.

- Payment Schedule: Include specific dates and methods for payment, such as a lump sum or installments.

- Fees and Charges: Clearly state any applicable fees, interest rates, or additional costs.

- Legal Terms: Add any industry-specific regulations or legal clauses that apply to your business.

2. Adjust the Layout for Clarity

The layout and structure of the document should be organized to ensure ease of use and understanding. Make sure it is visually appealing and easy to navigate, especially for clients who may not be familiar with financial transactions.

- Headers and Subheadings: Use clear headings to separate each section of the document (e.g., Terms, Fees, Payment Schedule).

- Bold Key Information: Highlight important details like amounts, dates, and percentages to make them stand out.

- Tables: Use tables to organize financial details, such as the total amount, advance payment, and outstanding balance.

3. Ensure Legal Compliance

Make sure the document complies with local laws and regulations, especially if you are dealing with international transactions. If necessary, consult a legal professional to ensure your customizations meet legal requirements in your jurisdiction.

4. Test the Customization

Before finalizing the customized document, test it in a real or simulated scenario. This will allow you to identify any issues with the structure or wording, ensuring the document functions as intended. It also gives you a chance to make further adjustments if needed.

By following these steps, you can create a customized financial document that aligns with your business needs, simplifies the process, and minimizes potential misunderstandings or legal issues.

Legal Aspects of Receivables Financing

When businesses choose to sell outstanding debts to a third party, it’s essential to understand the legal framework surrounding the transaction. The sale of receivables involves several legal considerations that ensure both the business and the third-party purchaser are protected. These agreements are legally binding, and any mistake or oversight in the terms can lead to disputes, financial loss, or regulatory issues.

Understanding the legal aspects of such agreements is crucial for minimizing risks and ensuring compliance with local and international laws. Properly structuring the agreement can help prevent conflicts and establish clear expectations for all parties involved.

Key Legal Considerations

- Ownership of Receivables: The business must have full ownership of the debts being sold, and the receivables should be free of any existing liens or claims. If the debts are disputed or have been previously pledged as collateral, this can complicate the transaction.

- Contractual Terms: The agreement must specify the terms clearly, including the amount being sold, the advance rate, the repayment schedule, and the fees charged. These terms should also outline any conditions under which the agreement can be terminated or amended.

- Client Notification: In some jurisdictions, clients must be notified that their debt has been sold to a third party. Without proper notification, businesses may face legal challenges or complications when collecting payments from clients.

- Confidentiality and Data Protection: The agreement should address confidentiality, particularly if sensitive client information is being shared with the purchaser. Compliance with data protection laws such as GDPR (General Data Protection Regulation) is essential for businesses operating in specific regions.

- Dispute Resolution: It is important to include a clear process for resolving any disputes that may arise. This could involve mediation, arbitration, or legal action, and should specify the jurisdiction and legal venue where any disputes would be handled.

Compliance with Local and International Laws

It is essential for businesses to ensure that their agreements comply with the laws of the jurisdiction in which they operate. Different regions may have varying regulations regarding the sale of receivables, such as laws governing secured transactions, collection practices, and debtor rights. International transactions may be subject to even more complex legal requirements.

Before proceeding with the sale of receivables, businesses should consult legal experts to ensure that their agreements adhere to all relevant regulations and that they are fully protected from legal risks. This helps safeguard the business’s interests and prevents potential legal challenges down the line.

By addressing these legal aspects properly, businesses can ensure that their receivables sales are smooth, compliant, and free from unnecessary risks.

Top Features to Include in a Financial Document

When creating a structured document for selling outstanding receivables, it is essential to include key elements that ensure clarity, transparency, and legal protection for all parties involved. A well-organized and detailed document minimizes misunderstandings and provides a solid foundation for the transaction. Including the right features in the document can make the entire process more efficient and secure.

Here are the top features that should be included in a financial document for transferring receivables:

- Parties Involved: Clearly identify the business selling the receivables and the purchaser (third-party institution). This establishes the roles and responsibilities of each party, ensuring transparency from the start.

- Receivable Details: A comprehensive description of the receivables being sold, including the amounts, due dates, and the names of the clients responsible for the debts. This provides a clear record of what is being transferred.

- Advance Payment Terms: Clearly outline the percentage of the total receivable that will be advanced to the business. This should also include any conditions for partial or full payment, as well as payment timelines.

- Fees and Deductions: Include details on any fees, interest, or other charges that will be applied to the transaction. Transparency in this area is critical to avoid disputes later on.

- Payment Process: Specify the terms under which the purchaser will collect the payments and how the remaining balance will be returned to the business. Define the timeline for payment settlement and any relevant processes.

- Legal Clauses: Include essential legal provisions that protect both parties, such as the dispute resolution process, governing law, and jurisdiction. This section should also cover any termination rights or penalties for non-compliance.

- Confidentiality Agreement: Ensure that the document addresses the confidentiality of sensitive information shared during the transaction. This may include client details or financial data that must remain secure.

By including these key features in the document, businesses can create a comprehensive and secure agreement that outlines all critical aspects of the receivables sale. These features provide clarity, protect both parties, and help avoid future misunderstandings or legal issues.

How to Calculate Financing Fees

When a business sells its outstanding receivables to a third-party purchaser, there are typically fees associated with the transaction. These fees are an important factor to consider, as they directly impact the total amount of funds the business receives upfront. Understanding how to calculate these fees is crucial for determining whether this financial solution is viable for the company.

Financing fees usually consist of a percentage of the total value of the receivables being sold, along with any additional charges based on the length of time the debt is outstanding. Here’s a breakdown of how to calculate the fees and what to keep in mind during the process:

1. Base Fee Percentage

The base fee is typically a percentage of the total receivables that are being sold. This percentage can vary depending on several factors, including the size of the transaction, the creditworthiness of the clients, and the terms of the agreement. The fee can range from 1% to 5% of the total receivable amount, though it may be higher for businesses with higher risk profiles.

- Example: If the total receivable amount is $50,000 and the base fee is 3%, the fee would be $1,500.

2. Additional Fees Based on Time

In some cases, the purchaser may also charge additional fees based on how long the receivables remain unpaid. This is commonly referred to as the “time fee” or “discount rate.” The longer the debt remains outstanding, the higher the additional fees can become. This is especially important for businesses looking for fast access to cash, as extended payment periods could result in higher overall costs.

- Example: If the payment is delayed for 30 days, the additional fee may be 0.5% for each 30-day period. This would add another $250 to the total fee on the original $50,000.

It’s important to factor in both the base fee and any time-related fees to calculate the full cost of the transaction. These costs should be weighed against the benefits of immediate cash access to determine if this option is financially advantageous for the business.

How Structured Documents Improve Efficiency

Utilizing standardized documents for managing the sale of receivables can significantly enhance business operations. These pre-designed structures provide a consistent framework that saves time, reduces errors, and streamlines the entire process. By using ready-made documents, businesses can avoid the need to recreate terms and conditions from scratch each time, allowing for faster and more accurate transactions.

Here are several ways that using a structured document can improve efficiency in business processes:

1. Time Savings

Standardized documents eliminate the need to manually draft each agreement, enabling businesses to complete transactions quickly and with minimal effort. The essential terms and conditions are already defined, reducing the time spent on drafting or reviewing each document.

- Faster Processing: With pre-defined fields and terms, the business can focus on completing specific details, like amounts and dates, rather than starting from scratch each time.

- Reduced Administrative Burden: Having a ready-made document means less time spent on administrative tasks, allowing staff to focus on other core areas of the business.

2. Reduced Risk of Errors

Structured documents help minimize human error. By using a consistent format, the likelihood of missing or misinterpreting key terms is greatly reduced. This can prevent costly mistakes and ensure that all parties are on the same page.

- Consistency: A standardized document ensures that all necessary clauses are included, and none are overlooked, which can happen when drafting new agreements each time.

- Clarity and Accuracy: With clear and precise language, businesses can avoid ambiguity, reducing the chances of disputes later on.

3. Improved Compliance

When dealing with legal or regulatory requirements, it is essential to ensure that all documents are compliant with current laws. Using a pre-designed document helps ensure that the necessary legal clauses and protections are included, reducing the risk of non-compliance.

- Legal Protection: Standardized agreements are typically designed with legal compliance in mind, ensuring that all required elements are in place to protect the business.

- Up-to-Date Provisions: By using an established document, businesses can ensure that their terms reflect the latest legal and regulatory changes, preventing potential legal issues.

4. Greater Flexibility and Customization

While standardized documents are efficient, they can still be customized to fit specific business needs. Companies can adjust terms, amounts, or other details to suit their unique circumstances, providing flexibility while maintaining structure.

- Tailored Terms: Modify the agreement to reflect individual client relationships or specific transaction terms.

- Scalability: As the business grows or deals with a larger volume of transactions, structured documents can easily be adapted to accommodate changing needs.

In conclusion, using structured documents enhances operational efficiency by saving time, reducing errors, ensuring compli

Common Challenges with Receivables Financing

While selling outstanding debts can provide immediate cash flow and financial relief, it also comes with its own set of challenges. Businesses often face obstacles when managing the process, understanding the terms, and navigating the complexities involved in the transaction. These challenges can impact profitability and the overall effectiveness of this financing solution.

In this section, we explore some of the most common issues that businesses encounter when selling receivables, and provide guidance on how to address them.

1. High Fees and Costs

One of the most significant challenges associated with this type of financing is the cost. The fees charged by third-party purchasers can vary greatly and often depend on the size of the transaction, the creditworthiness of the clients, and the payment terms. These fees can add up quickly and reduce the amount of cash businesses receive upfront.

- Example: Businesses with higher-risk clients may face higher fees, which reduces the overall benefit of receiving immediate cash.

- Impact: Excessive fees can lead to businesses feeling that the cost of financing outweighs the benefits, particularly if the clients have a long payment history or the business operates on slim margins.

2. Client Relationships and Communication

When a business sells receivables, it often means that a third party will be responsible for collecting payments from the clients. This can create friction between the business and its clients, especially if the clients are not informed about the change. Poor communication or lack of transparency can harm business relationships and lead to confusion or resentment.

- Impact: Clients may feel uncomfortable with the idea of a third party collecting their payments, which can damage trust and lead to delayed payments or disputes.

- Solution: Properly notifying clients and establishing clear communication about the process can help minimize any misunderstandings and maintain strong relationships.

3. Potential Loss of Control Over Collections

When transferring receivables to a third-party purchaser, businesses often lose some degree of control over the collection process. This can be particularly concerning for businesses that have established strong relationships with their clients or who prefer a hands-on approach to managing their accounts receivable.

- Impact: The third-party purchaser may use aggressive collection tactics or make decisions that the business may not agree with, potentially harming client relationships.

- Solution: Carefully selecting a reputable purchaser with a track record of professional, client-focused collection practices can help mitigate this risk.

4. Limited Access to Funding for Long-Term Contracts

While selling receivables can provide quick access to cash, it may not be the best option for businesses with long-term contracts or clients with slow payment cycles. If the client takes too long to pay or if a large percentage of receivables are tied to long-term agreements,

Integrating Structured Documents into Your Business Workflow

Incorporating standardized documents into your business operations can enhance efficiency, reduce errors, and streamline processes. By using pre-designed formats for managing financial transactions, businesses can ensure consistency and accuracy in their dealings, while also minimizing time spent on administrative tasks. The challenge, however, lies in seamlessly integrating these structured documents into daily workflows.

Successful integration involves aligning these documents with existing processes, automating where possible, and ensuring that all team members are properly trained on how to use them. Here’s how you can smoothly incorporate them into your business operations:

1. Mapping Documents to Business Processes

The first step in integration is understanding how these documents will fit into your current workflow. Identify the key stages where a structured document will be needed, from initial contract negotiation to final payment collection. This will ensure that the right document is used at the right time, reducing the risk of delays or miscommunications.

| Business Process | Document Usage |

|---|---|

| Initial Agreement | Use a standard agreement to outline terms with clients or financial institutions. |

| Payment Collection | Standardized forms for confirming payments received and outstanding amounts. |

| Dispute Resolution | Pre-designed documents to handle disputes, ensuring both parties follow agreed-upon procedures. |

2. Automating Document Generation

One of the most powerful benefits of structured documents is the ability to automate their generation. By using software that integrates with your business’s customer management or accounting systems, you can generate the required documents with minimal effort. Automation ensures that the documents are created accurately, reducing the chance for manual error and speeding up the process.

- Example: Link your accounting software with the document creation system so that when a sale is made or a payment is received, the necessary documents are automatically generated.

- Benefit: This reduces administrative time, allowing your team to focus on more strategic tasks.

3. Training Your Team

For any workflow integration to be effective, it is crucial that your team understands how to use the new system. Ensure that employees are trained on how to complete, customize, and manage the standardized documents. This can include setting up a system for document review and approval to ensure that all fields are completed correctly before the document is sent out.

Future Trends in Receivables Financing Documents

The landscape of financial management is evolving, and so are the tools businesses use to streamline operations and manage cash flow. As industries embrace digitalization and automation, the use of standardized documents in managing receivables will continue to undergo significant transformation. With new technologies and methodologies emerging, businesses can expect even more efficient, user-friendly, and secure ways to handle the sale of outstanding payments.

This section will explore the anticipated trends in the field of receivables management, focusing on how the evolution of these documents will shape business processes in the future.

1. Increased Automation and Integration

One of the most notable trends is the increased automation of financial processes, including the creation and management of standardized documents. With the rise of cloud-based platforms and AI-powered solutions, businesses can automate the generation, processing, and approval of these documents. This trend will make it easier for businesses to integrate receivables management into their existing workflows, minimizing manual input and reducing the likelihood of errors.

| Future Development | Impact on Businesses |

|---|---|

| Cloud-based Platforms | Allow businesses to access and update financial documents in real-time, from anywhere. |

| AI Integration | Automates the creation of documents based on transaction data, reducing human effort. |

| Smart Contracts | Facilitates automated execution of financial agreements without manual intervention. |

2. Enhanced Security and Data Protection

As businesses handle more sensitive financial information, data security will continue to be a critical concern. Future trends will see more secure, encrypted platforms for generating and storing receivables-related documents. Blockchain technology, in particular, has the potential to revolutionize the way these transactions are recorded and verified, ensuring that businesses can protect their financial data from fraud and unauthorized access.

- Blockchain Technology: Provides an immutable, transparent ledger for documenting transactions and ensuring compliance.

- Advanced Encryption: Secures sensitive financial data and prevents breaches during document transfer and storage.

3. Personalization and Customization

While standardized documents have long been the norm, future trends indicate a shift towards greater customization. Businesses will be able to easily tailor these documents to reflect their specific needs, whether it’s adjusting payment terms, fees, or other important conditions. This will allow companies to maintain a high level of flexibility while still benefiting from the efficiency of using pre-designed frameworks.

- Dynamic Document Fields: Allow businesses to modify terms, amounts, and other details based on specific client or transaction requirements.

- Client-Specific Customization: Enable businesses to create personalized agreements that align with each client’s preferences, ensuring better relationships.

4. Real-Time Data and Analytics

In the future, businesses will have access to real-time data and analytics that can inform the creation and use of receivables documents. This will include insights into payment histories, client creditworthiness, and more. By integrating these data points, businesses can make more informed decisions about which receivables to sell and how to structure the terms, improving both cash flow management and risk assessment.

- Data-Driven Decisions: Using historical data to guide decisions on which receivables to sell and at what terms.

- Predictive Analytics: Leveraging AI to predict payment behaviors, helping businesses optimize their receivables strategy.

As these trends continue to unfold, businesses will be able to streamline their financial operations even further, saving time and resources while maintaining greater flexibility and control over their transactions. The future of receivables management is one where technology, security, and data-driven insights create more efficient and effective solutions for businesses of all sizes.