Download Free Invoice Excel Template XLS for Simple and Professional Invoicing

Benefits of Excel for Invoicing

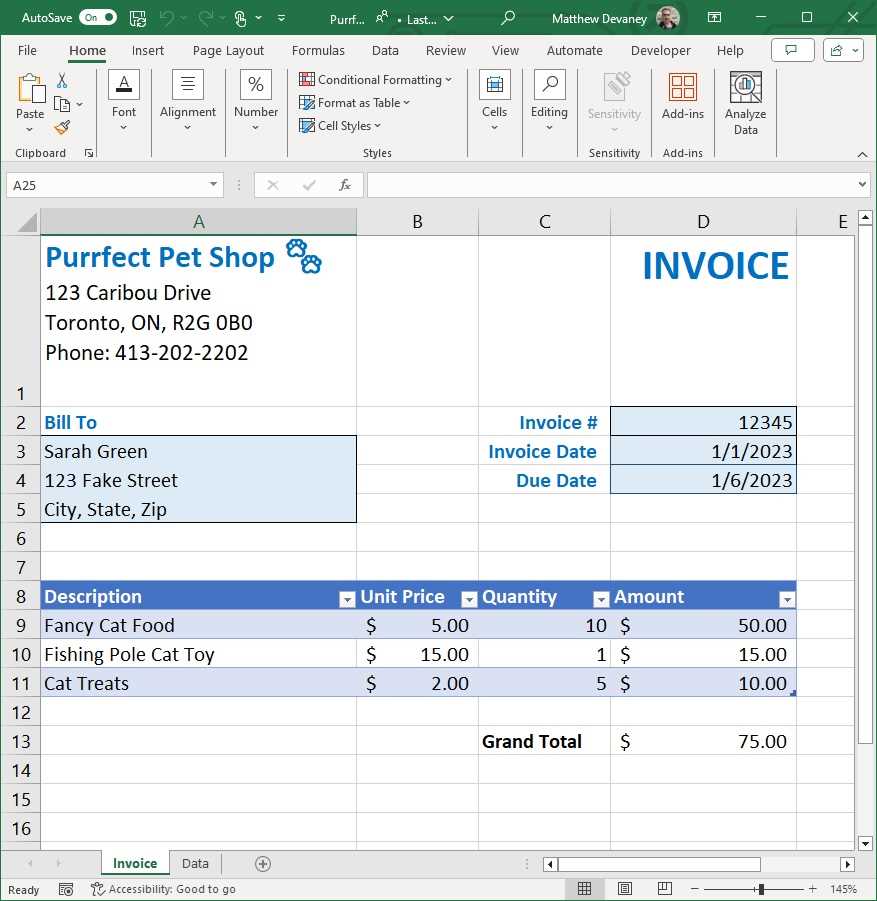

How to Create an Invoice in Excel

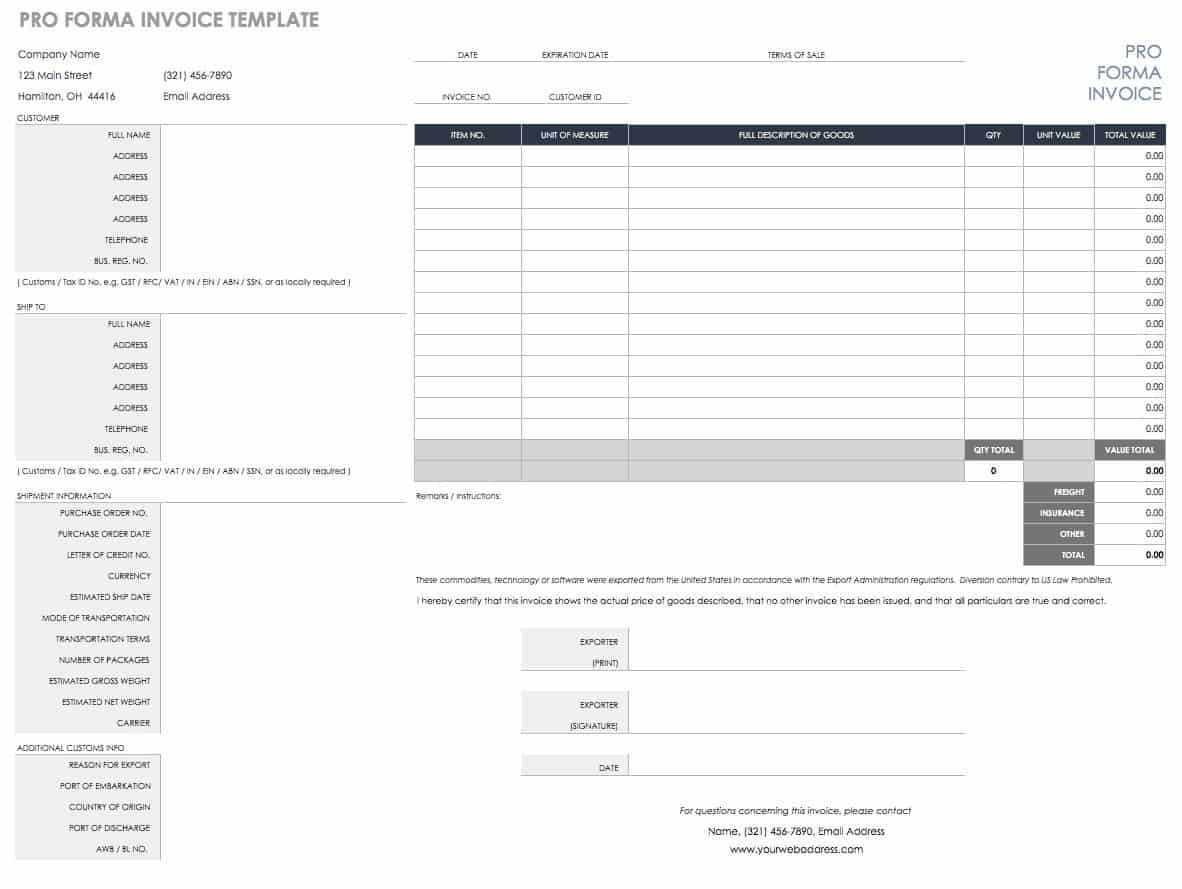

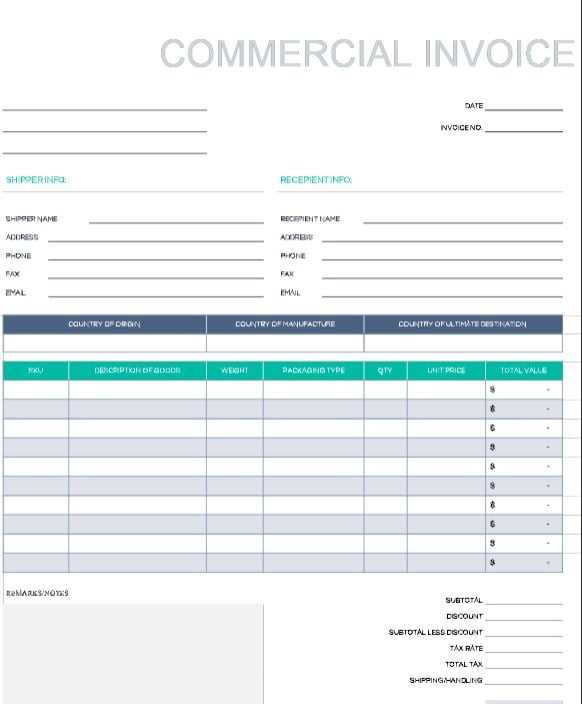

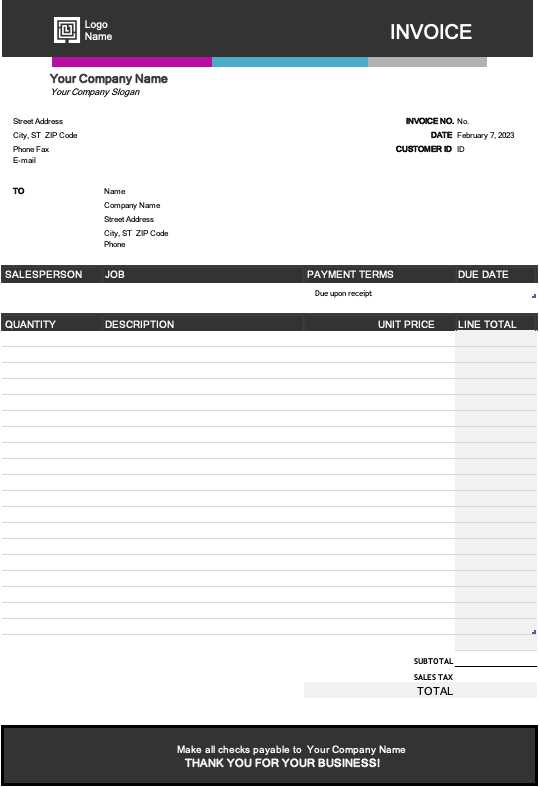

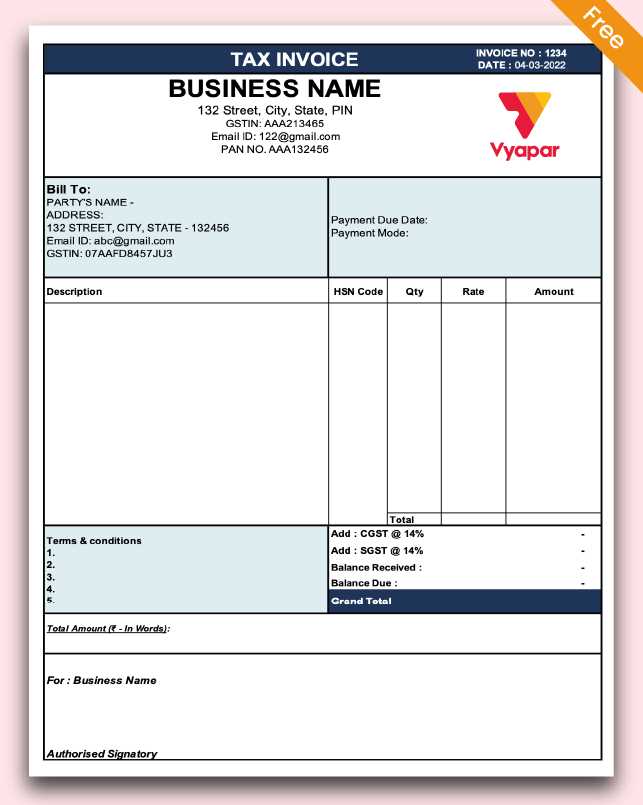

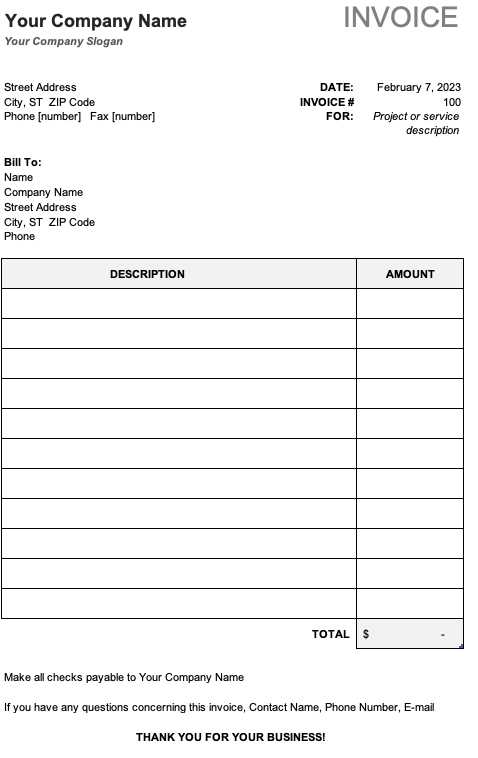

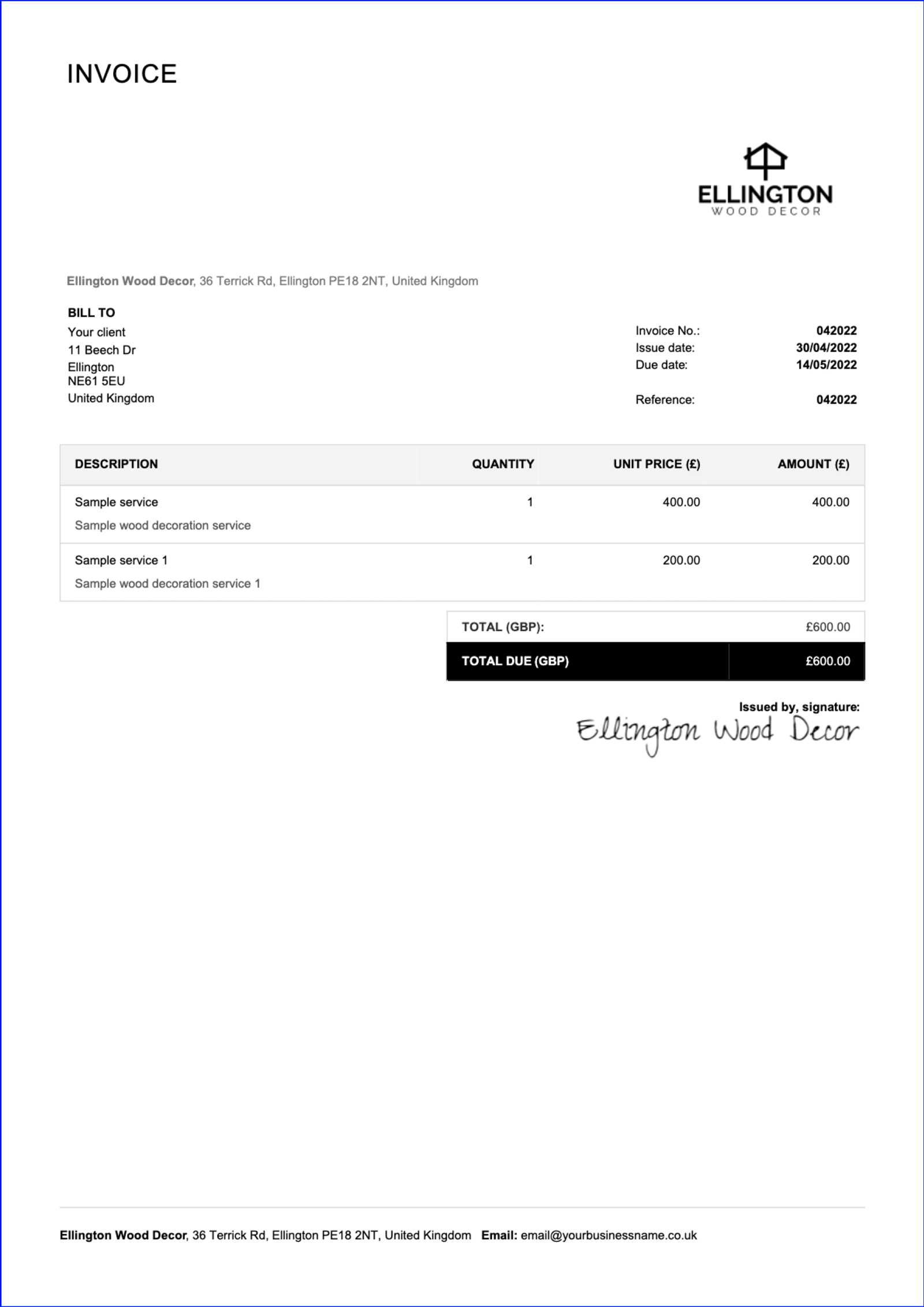

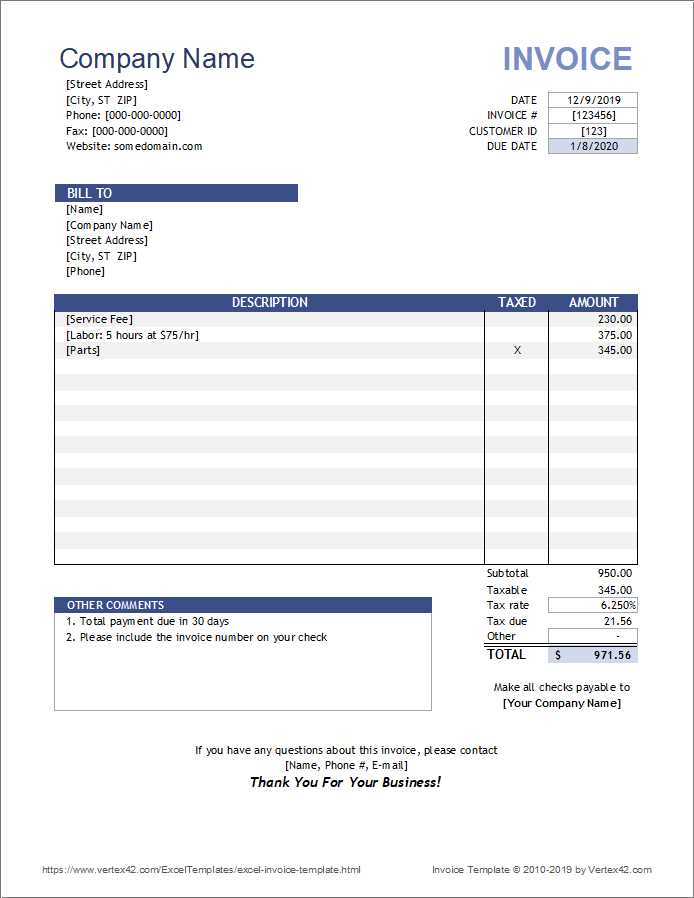

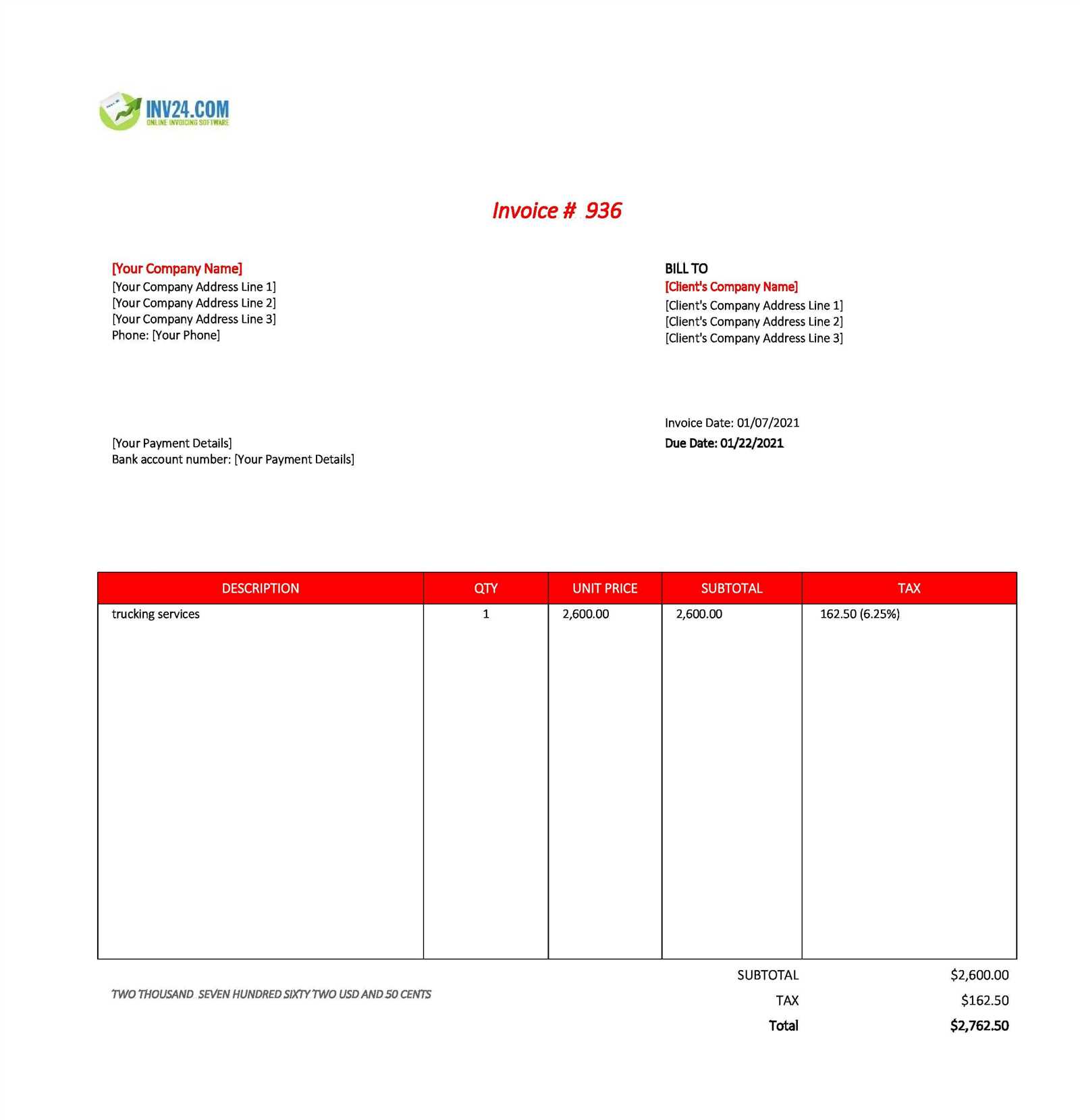

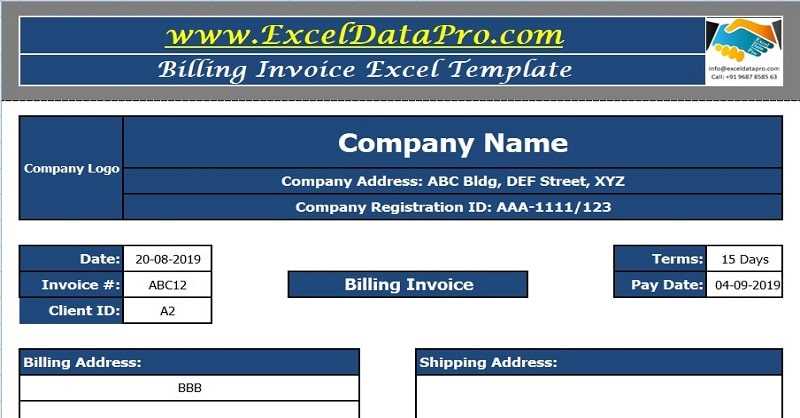

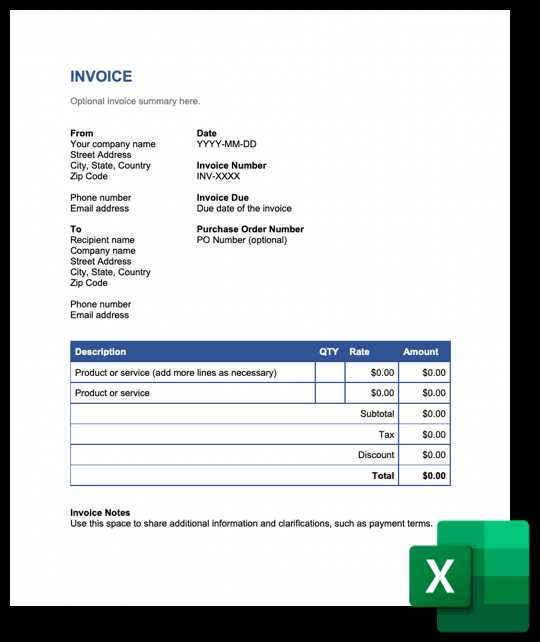

Free Invoice Templates for Small Businesses

Customizing Your Invoice Excel Template

Top Features of Excel Invoice Templates

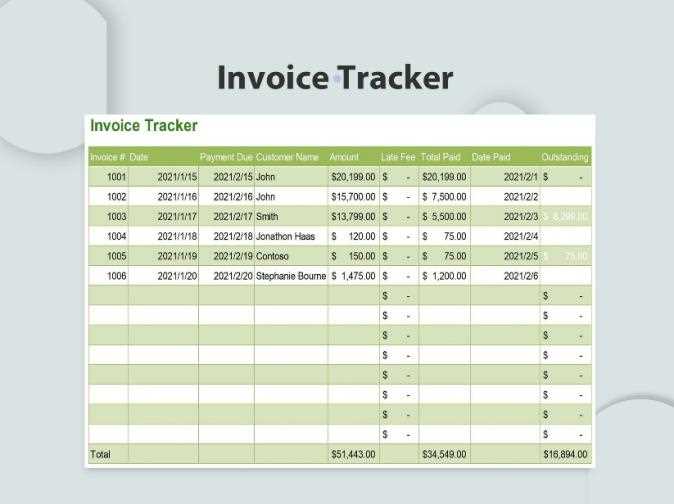

How to Track Payments with Excel

Automating Invoices with Excel Formulas

Excel vs Other Invoice Software

How to Save Time with Invoice Templates

Tracking Client Information in Excel

Managing Multiple Invoices in Excel

Tips for Professional-Looking Invoices

How to Adjust Taxes in Excel Templates

Ensuring Accuracy in Your Invoices

Using Excel for Recurring Invoices

Exporting and Printing Excel Invoices

Benefits of Excel for Invoicing

How to Create an Invoice in Excel

Free Invoice Templates for Small Businesses

Customizing Your Invoice Excel Template

Top Features of Excel Invoice Templates

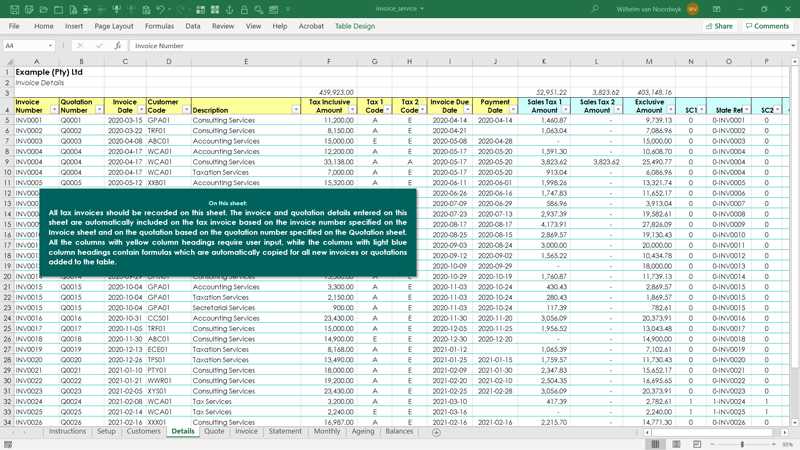

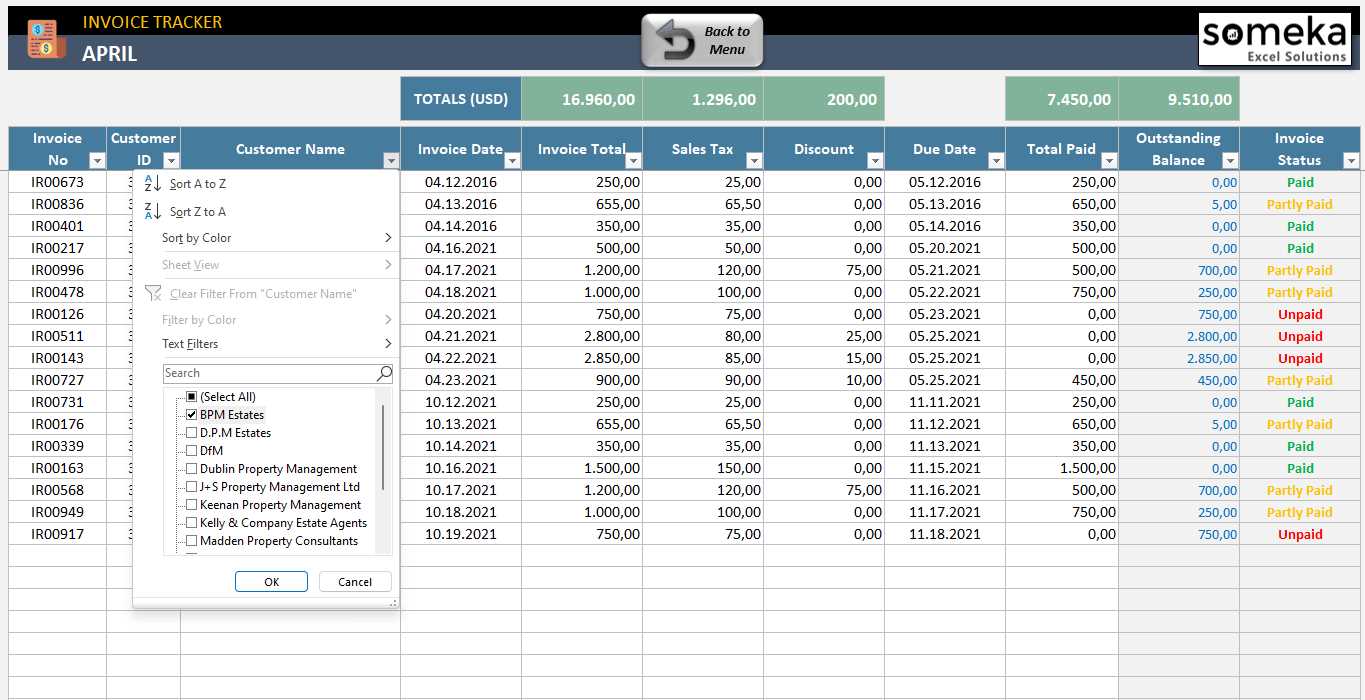

How to Track Payments with Excel

Automating Invoices with Excel Formulas

Excel vs Other Invoice Software

How to Save Time with Invoice Templates

Tracking Client Information in Excel

Managing Multiple Invoices in Excel

Tips for Professional-Looking Invoices

How to Adjust Taxes in Excel Templates

Ensuring Accuracy in Your Invoices

Using Excel for Recurring Invoices

Exporting and Printing Excel Invoices

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Benefits of Excel for Invoicing

Using spreadsheet software for billing offers a range of advantages that streamline the process of generating and managing financial records. With its flexible structure and powerful calculation capabilities, this tool allows businesses to easily create, customize, and track all payment-related details in one place.

Cost-effective and Accessible: Unlike dedicated accounting software, this solution is often included in standard office software packages, making it a more affordable option for small businesses and freelancers. It’s also widely accessible, meaning users can quickly get started without the need for extensive training.

Customizable and Flexible: One of the key benefits is the ability to modify the layout, design, and functionality according to specific business needs. Whether you need to include extra fields, adjust for varying tax rates, or display different types of services, this platform can easily be tailored to fit any requirement.

Automatic Calculations: By using built-in formulas, users can automate repetitive calculations such as totals, taxes, and discounts. This reduces human error and saves time, ensuring that figures are always accurate and up to date.

Data Organization and Tracking: Spreadsheets provide powerful data management features that allow users to keep track of payment status, due dates, and customer information. This organization helps businesses stay on top of their finances and maintain a clear overview of their billing processes.

Easy Integration: This tool integrates seamlessly with other business management software, including accounting programs and payment platforms, providing an efficient workflow for keeping financial records synchronized.

Using Excel for Recurring Invoices

For businesses that deal with regular billing cycles, managing repeated charges can be time-consuming. A simple yet effective approach is utilizing a spreadsheet to automate and streamline the process of generating these charges. With the right setup, this method can save significant time and effort, ensuring that each cycle is accurately tracked and processed.

Setting Up Automatic Calculations

One of the most powerful features of a spreadsheet is the ability to automate calculations. By using formulas, you can set up the document to automatically adjust totals, taxes, and any recurring fees based on predetermined rates. This eliminates the need for manual adjustments each time a new payment cycle begins.

Tracking Payment Cycles and Due Dates

Spreadsheets also make it easy to track when payments are due and monitor their status. You can set up columns to display due dates, payment status, and any outstanding balances, ensuring that nothing is missed. This organization helps businesses stay on top of their billing and ensures timely follow-ups when necessary.

Customizing for Different Clients: Each client may have different billing terms or specific requirements. A spreadsheet allows you to create separate sections for each client, customizing the setup for their individual needs. Whether it’s adjusting the frequency of charges or modifying the description of services, customization is simple and efficient.

Saving Time and Reducing Errors: Automating recurring payments through a spreadsheet minimizes the risk of human error and cuts down on manual labor. Once the structure is set, you can quickly generate new records without needing to re-enter basic information each time.

Exporting and Printing Excel Invoices

Once financial records are created and updated, businesses often need to share or print them for clients and internal use. The ability to export and print these documents seamlessly is crucial for efficiency and professionalism. Spreadsheet software provides several options for converting and printing these documents in a way that maintains formatting and readability.

Exporting for Digital Use

For digital sharing, exporting the file into PDF format is a common choice. This format preserves all your customizations and ensures that the document appears the same on any device. To export, simply choose the “Save As” option and select the PDF format. This ensures easy distribution via email or cloud services, and it keeps the layout intact without needing additional software.

Printing for Physical Records

When printing is required, it’s important to ensure that the layout fits standard paper sizes like A4 or letter format. The software allows you to adjust print settings, such as margins and page orientation, to optimize the document for physical printing. Below is an example of how the information can be organized before printing:

| Client Name | Service Description | Amount | Due Date |

|---|---|---|---|

| John Doe | Consultation | $150 | 01/12/2024 |

| Jane Smith | Monthly Subscription | $50 | 01/12/2024 |

Adjusting Print Layout: Before printing, always check the preview to ensure that the document is well-organized and that no information is cut off. It may be necessary to adjust the scaling options to fit the entire table onto one page or to split it across multiple pages depending on the content size.