Invoice Example Template for Easy Billing and Payment Management

Managing financial transactions efficiently is crucial for any business, regardless of size. A well-structured billing document not only helps maintain clear communication with clients but also ensures timely payments and professional service. When it comes to crafting these important records, having a reliable structure can save you time and prevent errors.

By using a standard format for your invoices, you can streamline the process of documenting and tracking payments. Customizing these records according to your business needs enhances clarity and ensures all necessary details are included. From contact information to payment terms, every component plays a role in facilitating smooth transactions.

Whether you are a freelancer, small business owner, or part of a large company, the right approach to creating these documents can lead to more efficient operations. In this guide, we will delve into the essential features of an effective billing record, and how you can craft one that meets your business requirements.

What is an Invoice Example Template

When running a business, it is essential to have a reliable structure for documenting financial transactions. A standardized document format provides consistency and clarity, ensuring that both you and your clients are on the same page regarding services, amounts, and payment expectations. These documents help facilitate smooth communication and are an important part of your overall accounting process.

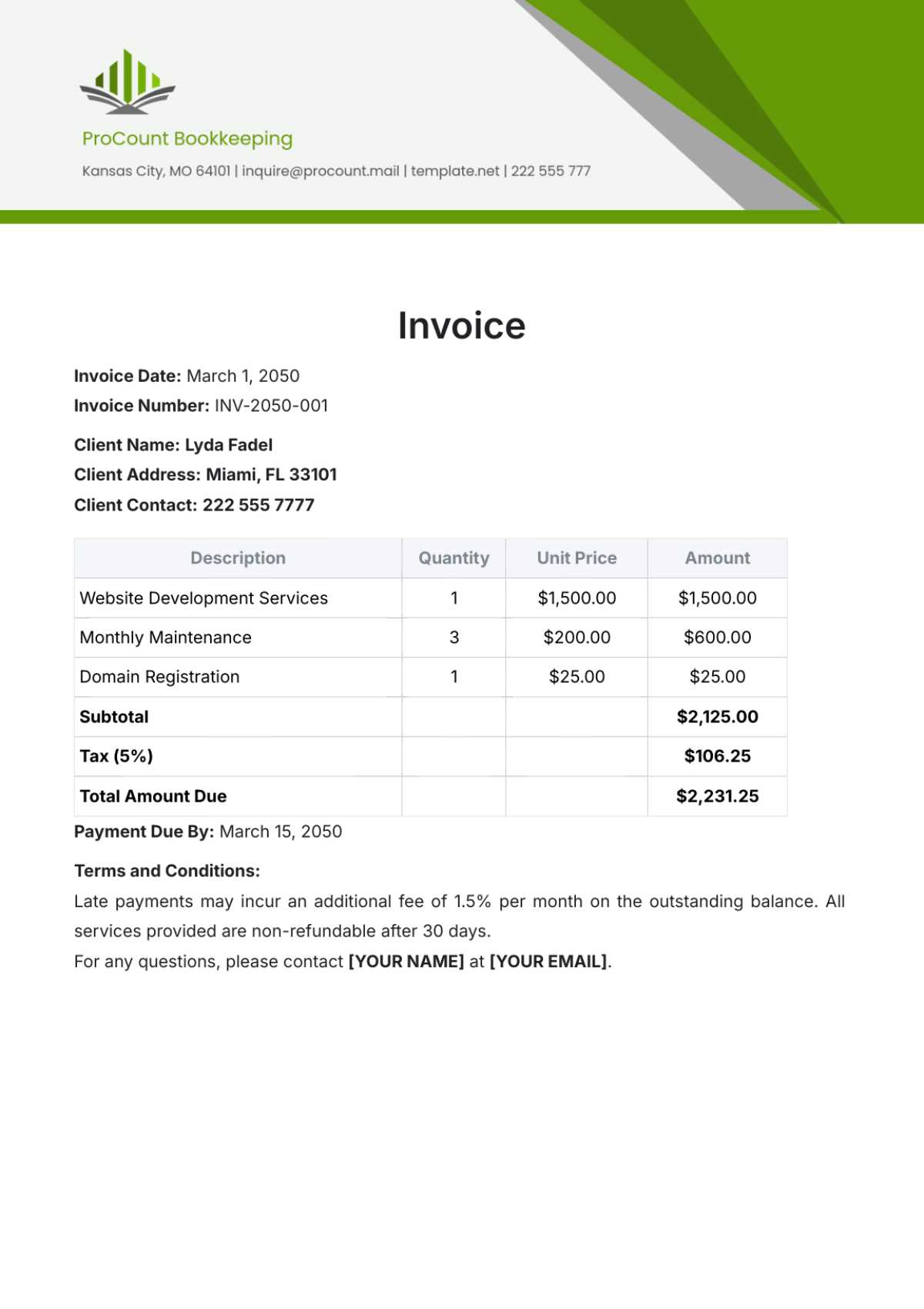

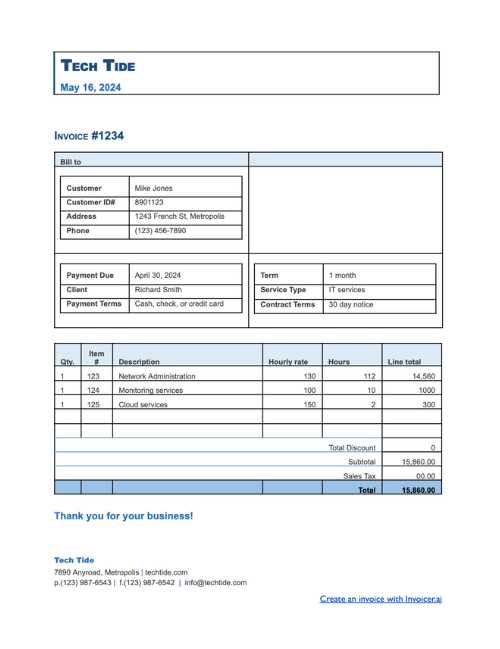

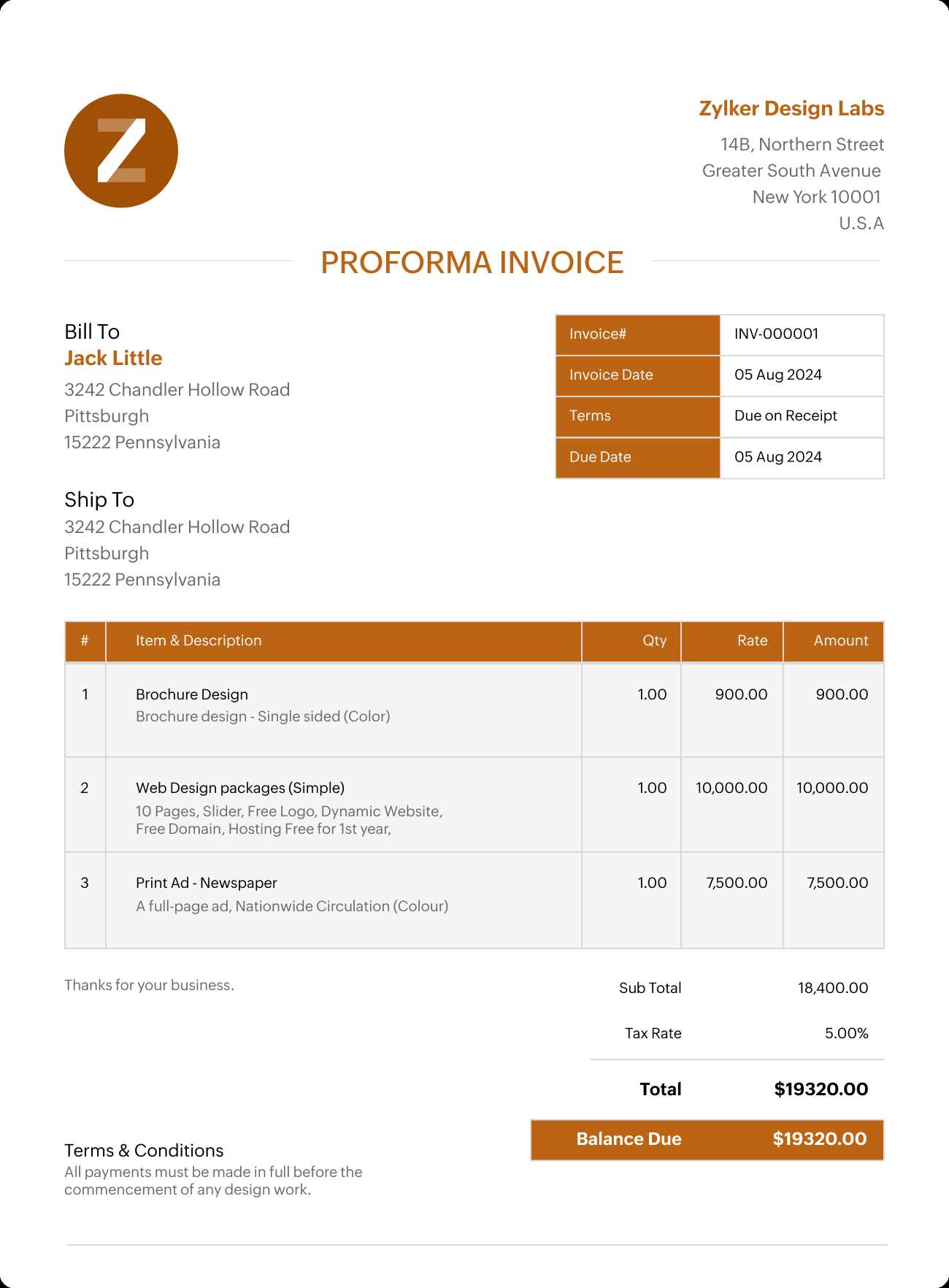

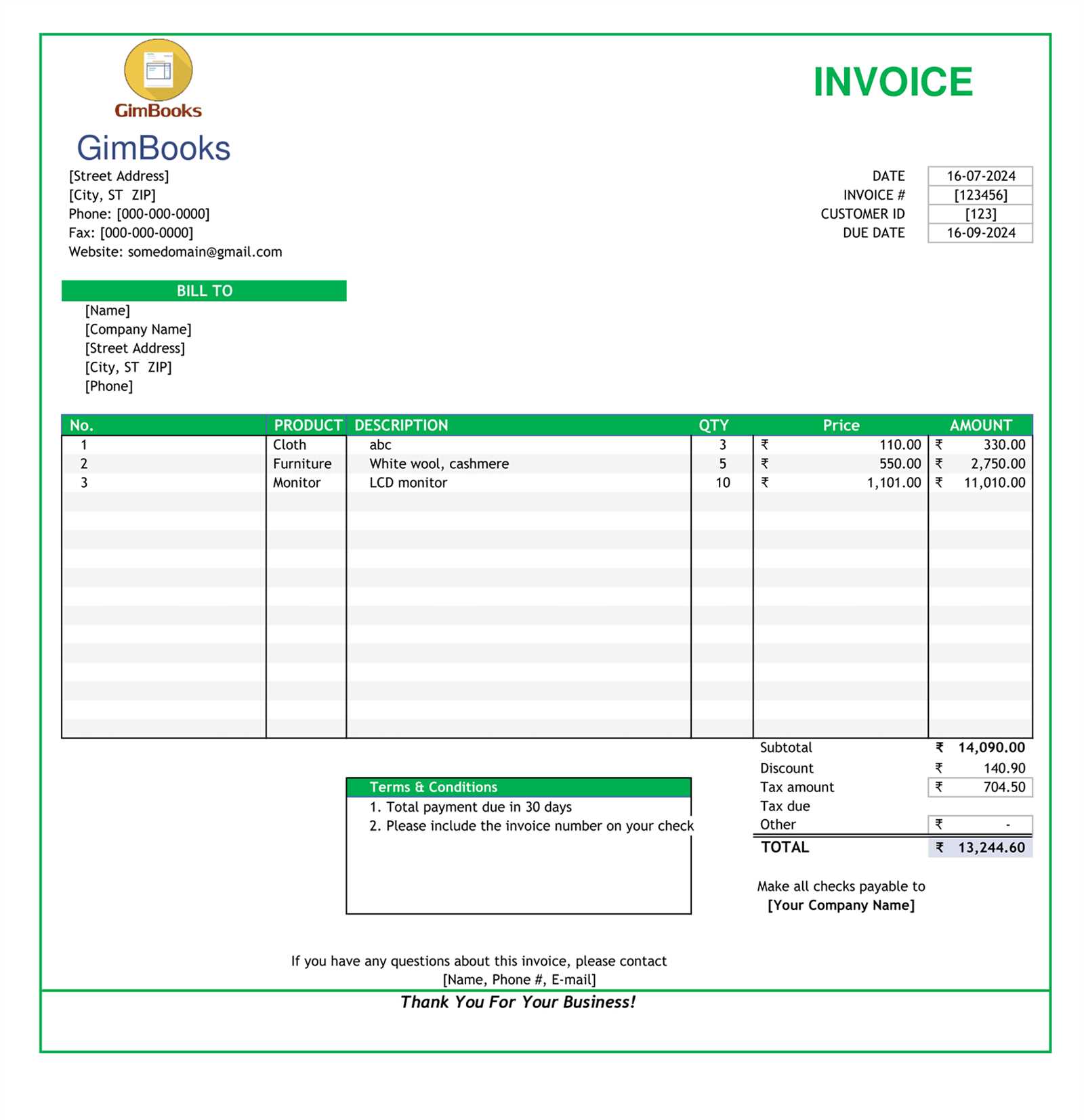

Such a format typically includes key details such as the names of the parties involved, a breakdown of the services provided, pricing, and payment terms. Using a consistent structure for these records not only saves time but also reduces the likelihood of errors and misunderstandings. It serves as a record of agreement between parties, helping to maintain professionalism and accuracy.

Key Features of a Well-Structured Billing Document

A well-designed financial record will contain several essential components. Here are the most important features:

| Component | Description |

|---|---|

| Contact Information | Details of the seller and buyer, including names, addresses, and contact numbers. |

| Services Rendered | A clear description of the goods or services provided, including quantities and dates. |

| Price and Taxes | Itemized list of charges, including any applicable taxes or discounts. |

| Payment Terms | Information about due dates, late fees, and acceptable payment methods. |

| Unique Identifier | A unique reference number to help track the document for future reference. |

Why Standardizing Billing Documents Matters

Having a pre-designed structure for financial records ensures that all critical information is included, reducing the chances of omissions or mistakes. It also allows businesses to maintain a uniform approach for all clients, which contributes to smoother operations and improved efficiency. Whether you’re managing multiple transactions a day or just a few, a consistent format helps streamline the entire invoicing process.

How to Create an Invoice Template

Creating a structured document for billing purposes is a simple yet essential task for any business. A well-organized document ensures that all the necessary details are captured and communicated clearly to clients. It helps maintain professionalism, prevents errors, and streamlines the payment process. Whether you’re a freelancer, small business owner, or part of a larger organization, setting up a format tailored to your needs is key to efficient financial management.

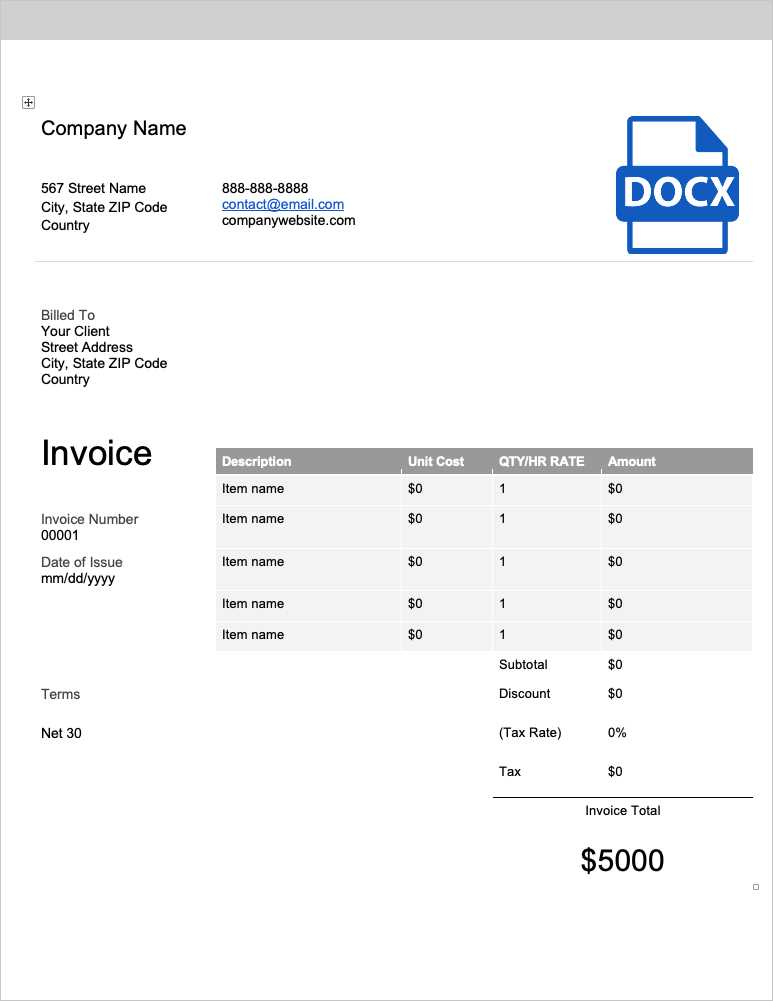

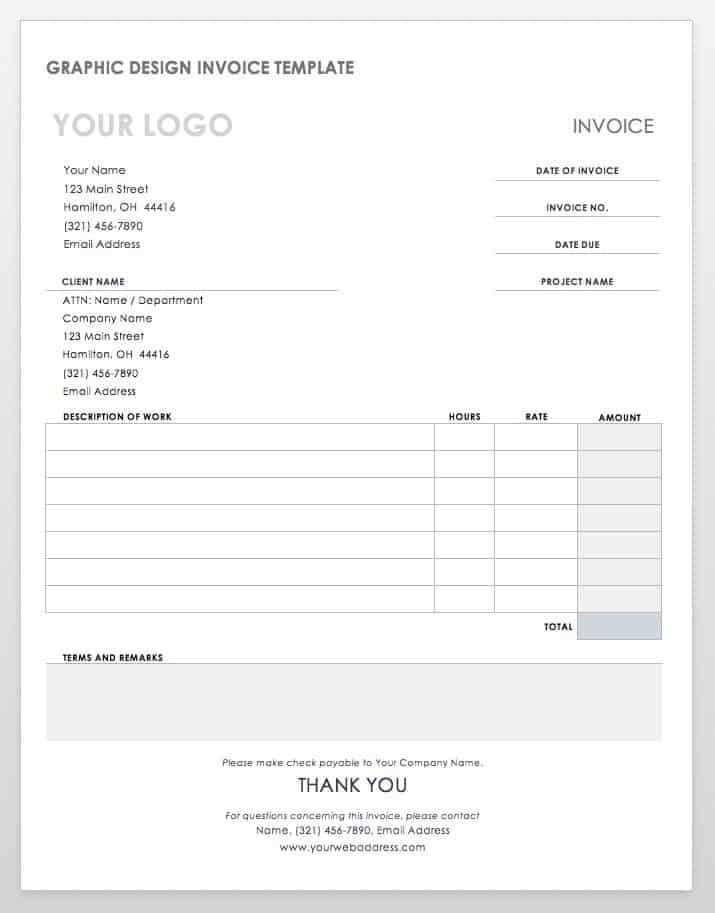

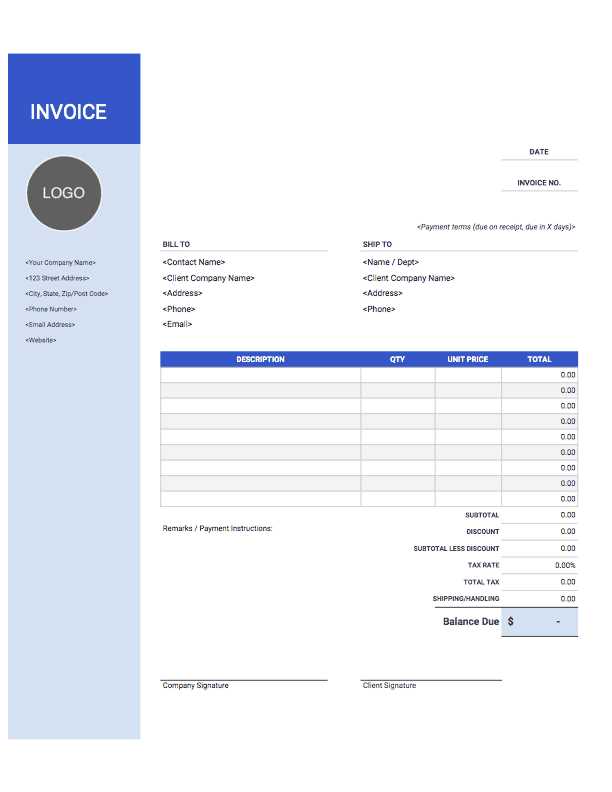

Step 1: Choose a Layout

The first step in creating a billing record is deciding on its layout. You can opt for a clean, minimalist design or a more detailed format, depending on the nature of your business. Key considerations include clear section headings, easily readable fonts, and ample space for essential details. A simple layout usually works best to avoid clutter, allowing clients to easily review the necessary information.

Step 2: Add Essential Information

Each document should contain several important pieces of information to be complete and legally binding. These typically include:

- Seller’s and buyer’s details: Names, addresses, and contact information.

- Description of services: A breakdown of the products or services provided, with dates and quantities.

- Price breakdown: The cost for each service or product, including any taxes or discounts.

- Payment terms: When the payment is due, accepted methods, and any late fees if applicable.

- Unique reference number: A unique identifier to track the document and prevent confusion.

Each of these sections plays a crucial role in ensuring that the transaction is clearly documented, both for your own records and the client’s understanding.

Step 3: Customize the Document

Once you’ve set up the basic structure, you can further personalize it to reflect your business’s branding and style. This can include adding your logo, choosing your brand colors, and adjusting the layout to suit your specific needs. Customizing your documents makes them more professional and reinforces your brand identity, adding a personal touch for your clients.

By following these steps, you can easily create a document that is both functional and professional, ensuring smooth transactions and clear communication with your clients.

Key Elements of a Professional Invoice

A well-crafted billing document should include all the essential details needed for a smooth transaction between parties. These elements not only ensure clarity and transparency but also help maintain a professional appearance. Properly organized information can reduce misunderstandings and lead to faster payments. Below are the critical components that should always be included in a business transaction document.

1. Contact Information

Clear communication begins with accurate contact details. Both the seller’s and the buyer’s names, addresses, and phone numbers should be clearly visible at the top of the document. This ensures that there is no confusion about who is involved in the transaction.

- Seller’s Information: Name, company name, address, phone number, email.

- Buyer’s Information: Name, company name, address, phone number, email.

2. Description of Products or Services

A clear and detailed description of what is being billed is crucial. This section should list the services or goods provided, along with quantities, unit prices, and any relevant dates. This ensures that the client understands exactly what they are paying for.

- Service/Product Name: A brief title of the service or product provided.

- Quantity: The number of items or hours worked.

- Unit Price: The cost per item or service unit.

- Total Cost: The total amount due for each service or product.

3. Payment Details

Including payment information makes it clear how and when the amount is due. Specify the payment methods accepted, due date, and any applicable late fees. This ensures that clients understand the terms and avoid delays.

- Due Date: The date by which payment must be made.

- Payment Methods: Bank transfer, PayPal, credit card, or any other preferred payment options.

- Late Fees: Any penalties for delayed payments, if applicable.

4. Unique Reference Number

Each document should have a unique identifier to easily track the transaction. A reference number helps both parties locate and refer to the document in case of queries or discrepancies. This also plays a role in accounting and record-keeping.

- Unique Number: A sequential number or custom code for each transaction.

5. Terms and Conditions

Clarify any specific conditions relate

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing documents is a crucial step in ensuring smooth financial transactions. The format you choose affects the ease of use for both you and your clients, as well as how professional your records appear. An effective layout not only makes it easier to track payments but also helps avoid confusion by clearly presenting key details. It’s essential to pick a style that suits your business needs, whether you’re dealing with simple or complex transactions.

Factors to Consider When Choosing a Format

When selecting a structure for your billing records, consider the following aspects:

- Business Size: Smaller businesses or freelancers might benefit from a more minimalist design, while larger companies may require a more detailed format to accommodate additional information.

- Client Needs: Consider your client’s preferences and the level of detail they require. Some clients may prefer a straightforward document, while others may need a more comprehensive breakdown of services or products.

- Branding: Customization options like adding a logo or adjusting colors can help reflect your business’s identity. A branded document can improve the professionalism of your communication.

- Complexity of Transactions: If you’re handling multiple products, services, or varying tax rates, you’ll need a format that can clearly display all the necessary information without becoming cluttered.

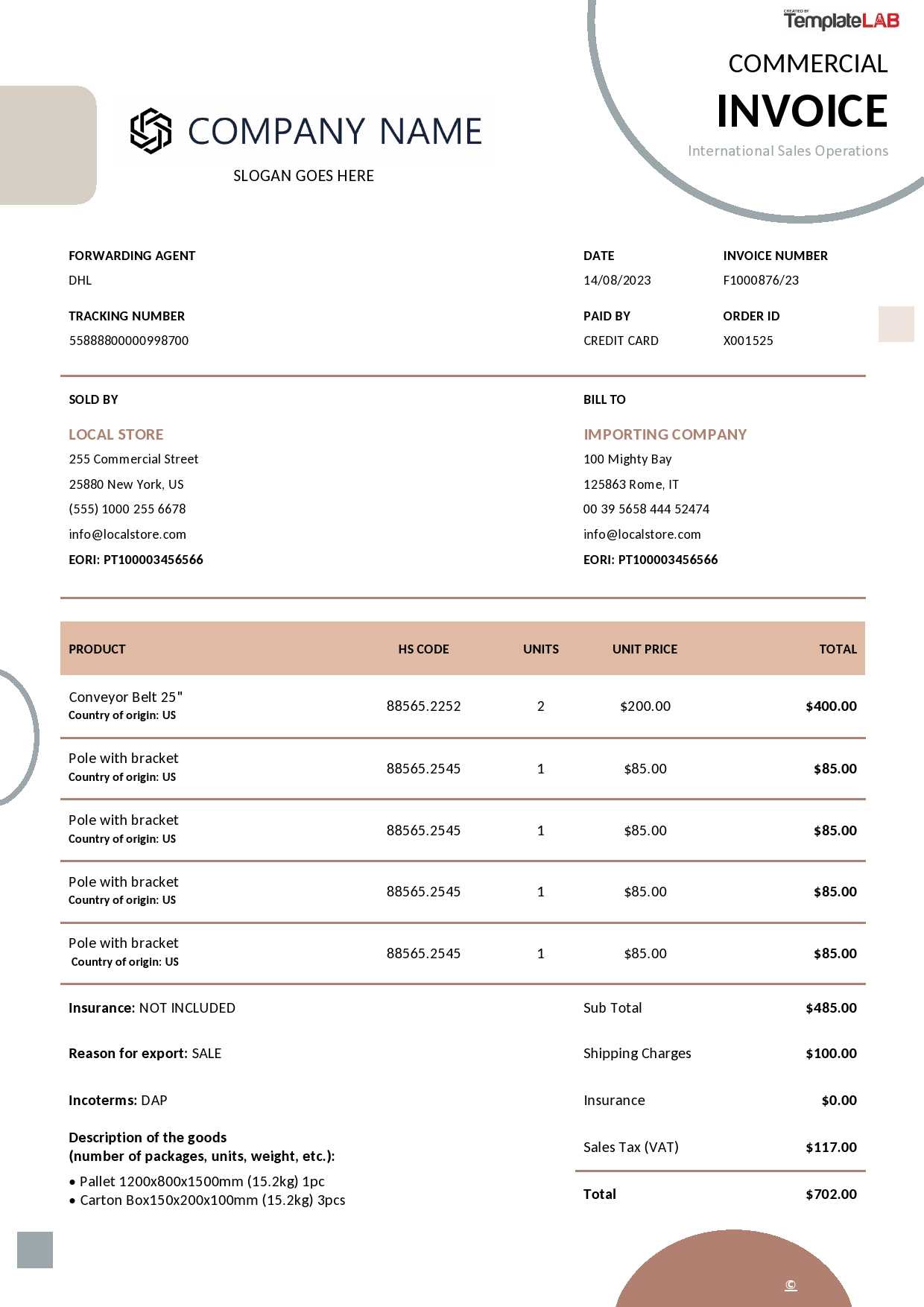

Types of Formats to Choose From

There are various formats available, depending on how you wish to structure the document. Some common types include:

- Basic Format: Ideal for freelancers and small businesses, this layout includes essential details like service description, total amount, and payment terms, presented in a simple and easy-to-read format.

- Itemized Format: Best for businesses offering multiple products or services. This layout allows for detailed descriptions and individual pricing, making it easy to track individual items.

- Professional Format: A more formal and branded design, which includes a logo, custom fonts, and advanced sections for terms, conditions, and detailed breakdowns.

- Online/Invoicing Software Formats: Many businesses now use digital invoicing platforms, which offer pre-designed formats that are customizable and easy to manage. These often include features like automatic numbering and payment reminders.

Benefits of Choosing the Right Format

By selecting the correct structure for your billing records, you not only save time but also create a more professional experience for your clients. A clear and organized document makes it easier for clients to understand the charges and prevents payment delays. Additionally, a properly chosen layout helps with record-keeping and ensures consistency across all your transactions.

In summary, carefully selecting the right format ensures that your financial documents are efficient, easy to understand, and aligned with your business needs. Whether you go with a simple or a more detailed design, consistency and clarity are key to

Customizing Your Invoice Template

Personalizing your billing documents is an important step in establishing your brand and ensuring consistency across your business operations. Customization allows you to adapt the structure to your specific needs, making the document more efficient and relevant for your business model. Tailoring the format not only adds professionalism but also makes it easier for both you and your clients to manage financial transactions.

Adding Brand Elements

Incorporating your brand’s identity into the document makes it more recognizable and helps maintain a consistent professional image. Here are some ways to personalize the layout:

- Logo: Adding your company logo at the top of the document instantly communicates professionalism and reinforces brand recognition.

- Color Scheme: Using your business’s colors can help create a cohesive look. Choose colors that are easy on the eyes and don’t overpower the essential details.

- Font Style and Size: Select fonts that reflect your brand’s character, but ensure they are legible. Avoid overly stylized fonts that might make the document harder to read.

Personalizing the Content

Once the visual elements are in place, you can adjust the content to fit your specific needs. Here are a few ways to tailor the document:

- Terms and Conditions: Customize payment terms to reflect your specific policies. Include any late fees, discounts, or other conditions that apply to your transactions.

- Item Descriptions: Tailor the descriptions to clearly reflect the services or products you provide. Make sure the client understands exactly what they are being charged for.

- Contact Information: Ensure that your contact details, including phone numbers, emails, and physical addresses, are always up to date. You may also include links to your website or social media profiles if necessary.

Personalizing your document makes it not only functional but also aligned with your brand, giving your clients a clear impression of your professionalism. These small adjustments ensure that your financial records are both practical and a reflection of your business’s values.

Benefits of Using an Invoice Template

Having a pre-designed structure for your billing documents can save you time, reduce errors, and enhance your professional image. Whether you’re managing a few transactions or handling numerous clients daily, a standardized format ensures consistency and simplifies the process. By relying on a customizable document layout, you streamline your workflow and make it easier to track payments and manage your business finances.

1. Time Efficiency

One of the main advantages of using a pre-designed document is the significant amount of time it saves. Instead of creating a new layout from scratch for each transaction, you can simply update the relevant details and send it off. This reduces the need for repetitive tasks and allows you to focus on other important aspects of your business.

- Quick Customization: With a pre-set format, you only need to input client details, service descriptions, and payment terms. This ensures that each document is ready to send within minutes.

- Reduced Errors: By using a consistent layout, the chances of forgetting key information or making formatting mistakes are minimized.

2. Professional Appearance

Using a professional, consistent layout for all your financial documents enhances your business’s credibility. When clients receive clear, well-structured records, they are more likely to view your services as trustworthy and reliable. The format helps you present your business in a polished way, leaving a positive impression on clients and partners.

- Brand Consistency: A consistent layout reflects your business’s branding and reinforces your identity with every interaction.

- Clarity: A clean and structured format makes it easier for clients to review and understand the charges, which can lead to quicker payments and fewer disputes.

3. Improved Financial Tracking

When you use a structured format for your billing documents, it becomes easier to track payments, manage outstanding amounts, and maintain accurate financial records. Each document can be stored and referenced systematically, simplifying accounting tasks and making tax season much easier to handle.

- Easy Record Keeping: A consistent structure allows for easy sorting and retrieval of past transactions.

- Better Organization: By numbering and categorizing documents, you can easily track paid and unpaid accounts, helping to ensure nothing is overlooked.

In summary, using a pre-designed structure for your billing documents brings multiple benefits that enhance both efficiency and professionalism. It helps you stay organized, maintain a polished appearance, and avoid unnecessary mistakes–all crucial elements for smooth business operations.

Free Invoice Templates Available Online

For businesses looking to streamline their billing process, there are a variety of free resources available online that offer pre-designed documents. These ready-made layouts allow you to quickly generate professional records without having to start from scratch. Whether you’re a freelancer, small business owner, or managing a larger operation, free options can help save time and effort, allowing you to focus on what truly matters–your business operations.

Benefits of Using Free Templates

Utilizing a free layout for your financial documents comes with several advantages:

- Cost-Effective: Free options allow businesses to create professional documents without any upfront costs, which is ideal for startups or small businesses on a budget.

- Time-Saving: Pre-designed formats require minimal input from you, helping to reduce the time spent on document creation. Simply fill in the necessary details and send it off.

- Ease of Use: Most free options are user-friendly and easy to navigate, with simple fields that can be filled in with your specific transaction details.

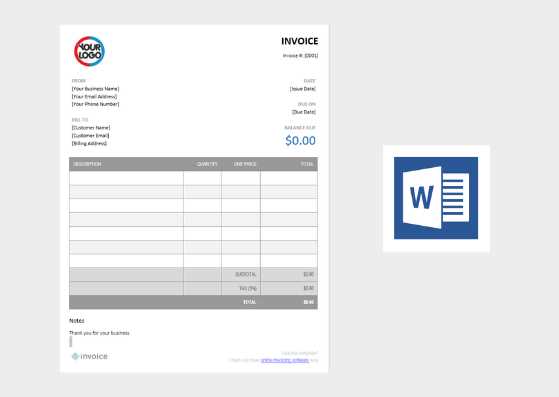

Where to Find Free Templates

There are many websites that offer customizable layouts, often in a variety of formats, such as PDF, Excel, Word, or even directly within invoicing software. Some of the most popular sources include:

- Google Docs: Offers a range of free customizable options that you can easily access and modify online.

- Microsoft Office Templates: Free downloadable documents available through Microsoft’s template library, compatible with both Word and Excel.

- Invoicing Software Providers: Many online invoicing platforms, like Wave or Zoho, offer free basic layouts that can be personalized and managed within their systems.

- Template Websites: Websites such as Template.net or Invoice Simple offer free downloads for different document formats, which are ready for customization.

By using free resources, businesses can easily adapt a professional-looking format to su

Common Invoice Mistakes to Avoid

When it comes to billing, even small errors can lead to confusion, delays in payment, or disputes with clients. Ensuring that all necessary details are accurately presented is essential for maintaining professional relationships and streamlining the financial process. In this section, we’ll explore some common mistakes that businesses make when creating billing records and offer tips on how to avoid them.

1. Incorrect or Missing Contact Information

One of the most common mistakes is not providing complete or accurate contact details for both the service provider and the client. This can cause delays in payment or confusion if the client has questions about the charges. Always double-check that the names, addresses, and phone numbers are correct and up-to-date.

- Double-check contact details: Verify that all phone numbers, email addresses, and physical addresses are accurate.

- Include all relevant parties: If there are multiple contacts within the client’s company, ensure the correct person is listed to avoid confusion.

2. Failure to Include a Clear Breakdown of Charges

Omitting detailed descriptions or an itemized list of charges can lead to misunderstandings or disputes. Clients need to understand exactly what they are paying for, especially when dealing with multiple services or products. Always provide a clear and concise breakdown of each item or service, along with the corresponding costs.

- Be specific: List each service or product separately with a detailed description.

- Include quantities and unit prices: This ensures the client knows exactly how the total was calculated.

3. Missing or Inaccurate Payment Terms

Another frequent mistake is not clearly outlining payment terms, including the due date, payment methods, and late fees (if applicable). This can result in delayed payments or confusion about when and how payment is expected. Clearly stating the terms upfront helps set expectations and encourages timely payment.

- Specify the due date:

How to Add Payment Terms in an Invoice

Clearly outlining payment terms in your billing documents is essential to ensure smooth transactions and prevent misunderstandings. Payment terms define the conditions under which payment is expected and provide a framework for both parties on how and when the payment should be made. Including this information helps establish clear expectations and can even encourage timely payments.

Key Elements to Include in Payment Terms

When adding payment conditions to your document, it’s important to be both clear and comprehensive. Here are the main components to include:

- Payment Due Date: Specify the exact date by which payment should be made. If you offer different terms for early or late payments, be sure to outline them.

- Accepted Payment Methods: List all the ways your clients can pay, such as bank transfers, credit cards, checks, or online payment platforms like PayPal or Stripe.

- Late Fees or Penalties: Clearly indicate if there are any additional charges for overdue payments. For example, you may charge a fixed fee or a percentage of the total amount due after a certain number of days.

- Discounts for Early Payment: If you offer discounts for early settlement, mention the specific percentage and the timeframe in which the payment must be made to qualify for the discount.

- Currency: Indicate the currency in which payment should be made, especially if dealing with international clients. This helps avoid confusion about the amount due.

How to Format Payment Terms for Clarity

Ensuring that your payment terms are easy to understand is crucial for avoiding any confusion. Here are some tips for formatting them effectively:

- Use Simple, Direct Language: Avoid complicated or ambiguous language that could be mi

Including Taxes in Your Invoice Template

When conducting business transactions, accurately calculating and displaying taxes is essential to ensure compliance with legal requirements and avoid disputes with clients. Properly incorporating taxes into your billing documents not only reflects the correct total amount owed but also helps maintain transparency and professionalism. Whether you are adding sales tax, VAT, or other types of tax, it’s important to present this information clearly and consistently.

How to Calculate Taxes

Before including taxes in your document, ensure that you are correctly calculating the applicable tax rate for your products or services. Here’s how to approach this:

- Determine the Tax Rate: Research the current tax rate for your region or industry. Tax rates may vary depending on the product type or location, so it’s important to stay updated.

- Apply the Tax Rate: Multiply the taxable amount (the cost of goods or services) by the tax rate to determine the tax amount. For example, if the tax rate is 10% and the total cost is $100, the tax would be $10.

- Check for Exemptions: Some products or services may be exempt from certain taxes. Ensure that you only apply taxes to items that require them and exclude exempt items.

How to Display Taxes Clearly

Once you’ve calculated the correct tax amount, make sure it is clearly displayed on your document so that your clients can easily identify it. Here are some tips for formatting tax information:

- Label the Tax Line: Clearly label the tax amount as “Tax” or specify the type of tax (e.g., “Sales Tax” or “VAT”) to avoid confusion.

- Show the Tax Rate: In addition to the tax amount, it’s often helpful to display the applicable tax rate. This helps your client understand how the tax was calculated.

- Itemize Taxes Separately: If you are charging multiple taxes (e.g., federal and state tax), list each one separately, including the rate and the amount for each.

For example, a breakdown could look like this:

- Subtotal: $100.00

- Sales Tax (10%): $10.00

- Total A

What Information Should Be on an Invoice

Creating a clear and accurate billing document is essential for maintaining transparency and ensuring timely payments. Whether you’re billing a client for services rendered or products delivered, certain key details must be included to avoid confusion and ensure both parties are on the same page. This section outlines the necessary information to include in a well-organized billing record.

Essential Information to Include

There are several critical elements that should always be present in your billing records to ensure completeness and accuracy:

- Business and Client Information: Both your business name and contact details should be prominently displayed, as well as the client’s information (name, address, phone number, and email). This ensures the document is easily traceable.

- Unique Reference Number: A unique identification number or code should be included for easy reference in case of future communication or disputes.

- Date of Issuance: Clearly indicate the date the document was issued to establish the timeframe for payment.

- Detailed Description of Goods or Services: Provide an itemized list of all products or services provided, with a brief description of each, quantities, and unit prices.

- Payment Terms: Include the agreed-upon payment methods, deadlines, and any penalties for late payments, ensuring the client knows how and when to pay.

- Taxes and Additional Charges: Specify any applicable taxes, such as sales tax or VAT, as well as any additional charges (e.g., shipping fees), with clear breakdowns.

- Total Amount Due: The final amount owed should be clearly displayed, including all taxes, discounts, and any additional charges.

Sample Layout of Billing Information

Here is an example of how the information should be organized on your billing document:

Item Description Quantity Unit Price Total Consultation Service 1 $150.00 $150.00 Web Design 1 $500.00 $500.00 How to Save Time with Invoice Templates

Efficient billing is crucial for any business, but creating financial documents from scratch for each transaction can be time-consuming. By using pre-designed layouts, you can streamline the process, reduce errors, and save valuable time. These ready-to-use formats allow you to input details quickly, ensuring you can focus more on your core business activities instead of administrative tasks.

Benefits of Using Pre-Formatted Documents

There are several key advantages to using pre-made formats for your financial documentation:

- Consistency: With a pre-designed layout, every document will look professional and consistent, reinforcing your brand image.

- Time Efficiency: Once the format is set up, you only need to input the specifics of each transaction, drastically reducing the time spent on creating new documents.

- Reduced Errors: Pre-filled fields and automatic calculations can minimize human errors in data entry, ensuring accurate totals, tax rates, and payment deadlines.

- Customization: You can customize the layout to fit your business needs and update it as required, while still maintaining efficiency.

How to Maximize Efficiency with Pre-Made Formats

Here’s how you can make the most of ready-to-use financial documents:

- Save Client Information: Store your clients’ contact details in a reusable document so you don’t need to enter them manually each time.

- Use Templates with Built-In Calculations: Choose formats that automatically calculate totals, taxes, and discounts based on the information you enter. This eliminates the need for manual math.

- Create Recurring Profiles: For regular clients, you can save common charges, payment terms, and other repeated details, reducing the effort for each billing cycle.

Example of a Pre-Formatted Billing Document

Here is an example of how a pre-designed format can save time by automatically calculating totals, taxes, and subtotals:

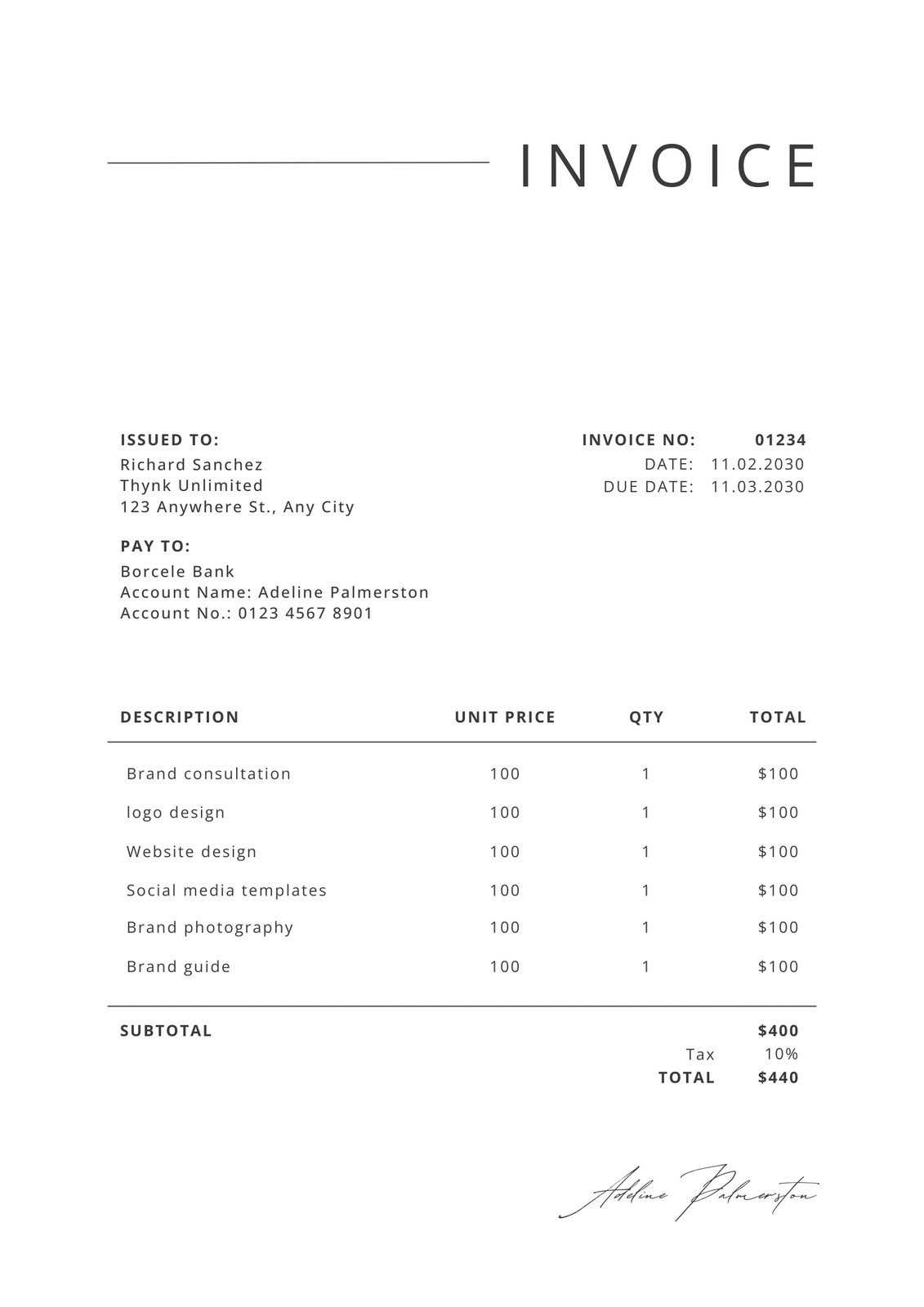

Item Description Quantity Unit Price Total Consulting Service 2 $100.00 $200.00 Design Tips for an Attractive Invoice

The appearance of your billing document plays an important role in leaving a lasting impression on clients. A well-designed, clean, and professional layout not only ensures clarity but also enhances your brand image. When clients receive a polished and easy-to-read document, it conveys trustworthiness and attention to detail, which can improve payment timelines and overall client satisfaction.

Key Design Principles to Follow

Here are some essential tips for designing a visually appealing and effective billing document:

- Keep It Simple and Clean: Avoid clutter by using a minimalist design. Ensure there is ample white space between sections to make the document easy to read.

- Use Your Brand’s Colors and Logo: Incorporate your company’s logo and color scheme to make the document instantly recognizable and consistent with your brand identity.

- Choose Readable Fonts: Stick to clear, professional fonts such as Arial or Helvetica. Avoid using too many different font styles, as it can make the document look chaotic.

- Highlight Key Information: Bold important details, such as the total amount due, payment due date, and any other critical data, to draw attention to them immediately.

- Organize Information Logically: Structure the document in a logical flow, with clearly separated sections. This makes it easy for the client to locate specific information quickly.

Additional Design Tips for Professional Appeal

- Use a Grid Layout: A grid system can help align the elements on the page neatly, creating a balanced and structured look.

- Add a Border or Divider: A subtle border or divider line can help separate sections (like itemized charges and totals), creating a visually organized document.

- Include Payment Details in a Prominent Spot: Make sure payment instructions, terms, and due dates are easy to find by placing them near the top or bottom of the document, or in a separate section that stands out.

By applying these design principles, you can create a billing document that not only looks professional but also facilitates easy understanding. A well-designed document makes a positive impression, encouraging prompt payments and reinforcing your brand’s professionalism.

How to Send an Invoice to Clients

Sending a billing document to clients is a crucial step in getting paid for the work or products you’ve delivered. The process should be efficient, professional, and clear, ensuring that the client has all the information needed to make payment. Whether you’re sending it by email, through a billing platform, or via traditional mail, there are best practices to follow to ensure your document reaches the client properly and that payments are processed smoothly.

Steps to Follow When Sending a Billing Document

- Choose the Right Delivery Method: Depending on your client’s preference, you may send the document via email, an online platform, or by post. Email is often the fastest and most reliable method.

- Attach the Document Correctly: When sending the document by email, attach it as a PDF file to ensure it retains its format and is easily accessible. Avoid sending it as a Word document, as this may look less professional.

- Include a Clear Subject Line: Use a subject line that clearly identifies the purpose of the email, such as “Billing Document for [Service/Product] – [Your Company Name]”. This helps the client recognize it quickly in their inbox.

- Write a Professional Email: Accompany the document with a brief, polite message summarizing the key details (amount due, payment due date, and any instructions). This adds a personal touch while maintaining professionalism.

- Set a Follow-Up Reminder: If payment is not received by the due date, set a reminder to follow up with the client to ensure they have received the document and to inquire about any issues.

Tips for Ensuring Smooth Delivery

- Double-Check the Contact Information: Ensure the client’s contact details, especially their email address, are correct to avoid delivery failures.

- Use Online Billing Platforms: Online platforms can automate much of the billing process, sending documents on your behalf and even reminding clients of pending payments.

- Keep Records of All Transactions: Always save a copy of the document and any related correspondence. This will help you track payments and resolve any potential issues.

By following these steps and tips, you can send billing documents that are clear, professional, and easy for clients to process, increasing the likelihood of timely payments and maintaining good business relationships.

Tracking Payments with Invoice Templates

Managing payments effectively is a vital aspect of maintaining smooth financial operations for any business. By using structured billing documents, you can easily track the status of payments, ensuring that no outstanding amounts are overlooked. This process helps you stay organized and on top of client accounts, improving cash flow and reducing the risk of missed payments.

How to Track Payment Status

Here are key steps to track payments when using pre-designed billing records:

- Record Payment Dates: Always note when a payment is received to keep an accurate record of transactions. This helps you monitor overdue payments and keep your cash flow in check.

- Use Payment Status Indicators: Clearly mark the status of each document, such as “Paid,” “Pending,” or “Overdue.” This makes it easy to identify which transactions need follow-up.

- Include Payment Terms and Due Dates: Make sure each document clearly lists the payment due date and any terms associated with late fees or discounts, so both you and your client are on the same page.

- Utilize Automated Tools: Many billing platforms can automatically update payment statuses once a payment is made, reducing the manual effort required to track each transaction.

Sample Payment Tracking Table

Here’s an example of how you can structure your payment tracking within your billing document to ensure everything is clear and organized:

Client Name Invoice Number Amount Due Payment Status Payment Date Balance John Doe #12345 $500.00 Paid 10/01/2024 $0.00 Jane Smith #12346 $750.00 Pending – $750.00 ABC Corp. Ensuring Legal Compliance with Invoices

When creating financial documents, it’s crucial to ensure that they meet legal requirements, which can vary depending on your location and the nature of the transaction. Properly formatted billing records not only protect your business but also help you avoid disputes and potential legal issues with clients or tax authorities. Adhering to these regulations can make your business operations smoother and more transparent.

Key Legal Requirements for Financial Documents

Here are some essential elements that must be included to ensure compliance with legal standards:

- Correct Identification: Both the buyer and seller’s full names or business names should be included, along with their contact information (address, phone number, email). This makes the document traceable and legally valid.

- Unique Reference Number: Each document must have a unique number for tracking purposes. This helps in maintaining records and provides a reference point in case of any legal disputes or audits.

- Date of Transaction: Including the issue date and due date is essential. It clarifies the timeline of the agreement and helps determine payment terms.

- Detailed Description of Goods or Services: Clearly list the products or services provided, including quantities, unit prices, and total amounts. This ensures transparency and reduces confusion in case of discrepancies.

- Applicable Taxes: If your country or state requires sales tax, VAT, or other taxes to be included, it’s important to show these amounts clearly on the document. Indicating tax rates and total tax charged ensures compliance with tax laws.

- Payment Terms and Conditions: Clearly stating payment terms, such as due dates, late fees, and acceptable payment methods, helps avoid misunderstandings and ensures both parties agree on the expectations.

Best Practices for Legal Compliance

- Consult Local Laws: Laws surrounding financial documents can differ depending on your location. Make sure to consult with legal experts or accountants to ensure your documents meet local regulations.

- Keep Accurate Records: Always store copies of your financial documents in an organized system, whether digital or physical. This can be critical in case of audits or legal disputes.