Top Invoice Email Templates for Clear and Professional Billing

Clear and professional communication with clients is essential for ensuring smooth transactions, especially when it comes to financial matters. A well-structured message accompanying a billing request can significantly impact payment speed and client satisfaction. It’s not just about asking for payment, but also conveying professionalism and transparency throughout the process.

By using a pre-designed structure for your payment notifications, you can save time while maintaining a consistent tone. These ready-made formats help create a polished appearance and reduce the risk of errors, which can otherwise lead to confusion or delayed payments. The right approach to crafting such messages not only reflects your attention to detail but also builds trust with your clients.

In this guide, we’ll explore how to craft messages that are both clear and courteous, ensuring you get paid on time while keeping client relationships strong. With the right approach, you can streamline your billing process and make it easier for both you and your clients to manage financial transactions.

Essential Tips for Crafting Invoice Emails

When requesting payment, it’s crucial to ensure that the message you send is clear, professional, and effective. The tone, structure, and content of your correspondence can influence how quickly your clients process payments. Crafting these communications carefully can help maintain a positive relationship with your clients while ensuring timely compensation for your services or products.

Keep It Simple and Direct

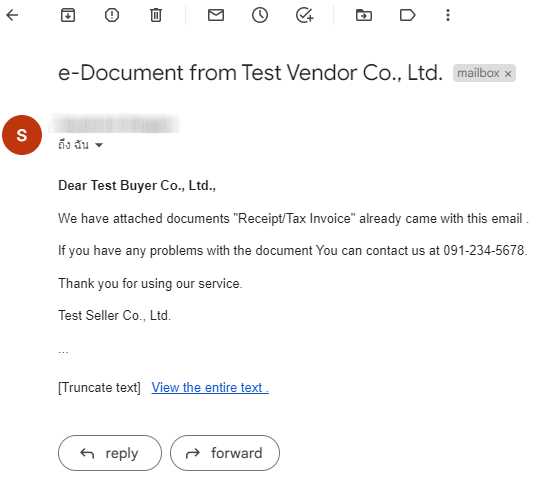

One of the key factors in an effective billing message is simplicity. Avoid long paragraphs and unnecessary details that may confuse your recipient. Focus on the most important information: the amount due, the due date, and how the client can make the payment. Use bullet points or short sentences for clarity, and always ensure that the key facts stand out. Directness will help avoid misunderstandings.

Personalize and Maintain a Professional Tone

While it’s important to keep the message concise, don’t overlook the value of personalization. Addressing your client by name and referencing the specific service or product they purchased shows attention to detail and builds rapport. At the same time, maintaining a professional tone ensures that your request is taken seriously. Strive for a balance between friendly and formal to create a message that feels personal yet respectful.

Why You Need an Invoice Email Template

Having a ready-made structure for your billing communications can save significant time and effort. It eliminates the need to write each message from scratch, reducing the chance of errors and ensuring consistency across all interactions. When your communication is clear and professional, it helps avoid confusion and maintains a positive relationship with clients.

Here are a few reasons why a standardized approach to these messages is essential:

- Efficiency: A pre-designed format allows you to quickly fill in the necessary details without worrying about formatting or tone each time.

- Consistency: Using the same structure ensures that every client receives a uniform experience, which helps build trust and professionalism.

- Accuracy: By reusing a proven structure, you reduce the risk of overlooking critical information, such as payment terms or amounts due.

- Branding: A well-crafted structure can reflect your brand’s voice and style, reinforcing your company’s identity in every interaction.

Having this consistent framework not only improves the efficiency of your billing process but also enhances your overall professionalism and client satisfaction.

How to Personalize Your Invoice Emails

Personalizing your billing messages is a great way to build a stronger connection with your clients. While it’s important to maintain professionalism, adding personal touches can show that you value the individual relationship, which can lead to better communication and faster payments. By tailoring your communication, you can make your clients feel more comfortable and appreciated while still conveying the necessary details.

Here are some strategies to personalize your payment requests effectively:

- Use the Client’s Name: Always address the recipient by their first name or company name, depending on your relationship. This simple addition creates a friendly, individualized tone.

- Reference Specific Projects or Services: Mention the exact work you completed or the products provided. This shows attention to detail and reminds the client of the value they received.

- Include Custom Payment Terms: If your client has unique payment arrangements, include those details in the message. This ensures clarity and demonstrates that you understand and respect their preferences.

- Thank Them for Their Business: A simple expression of gratitude can go a long way. Thanking your client for their trust in your services or products fosters a positive, lasting relationship.

Personalizing your billing messages, even in small ways, helps create a more engaging and respectful communication. By taking the extra step to make your message feel individual, you not only encourage prompt payment but also strengthen your professional rapport.

Common Mistakes in Invoice Emails to Avoid

While sending payment requests, it’s easy to overlook small details that can lead to confusion or even delayed payments. Certain errors in your communication can create misunderstandings or give the impression of unprofessionalism, which can affect your client relationships. Being mindful of these common mistakes can help you avoid unnecessary issues and maintain a smooth, efficient billing process.

Here are some common mistakes to watch out for when crafting your payment requests:

- Missing or Incorrect Payment Information: Always double-check the amount due, payment method, and due date before sending. Any discrepancies can cause delays or lead to questions from your client.

- Vague Subject Line: A vague or unclear subject line can confuse your recipient. Be specific, such as “Payment Request for [Service/Product] Due [Date]” to ensure the purpose of the message is immediately clear.

- Failure to Include Clear Instructions: Make it easy for your client to pay by providing clear instructions on how to proceed. Whether it’s a link to an online portal or specific bank details, ensure that all necessary information is easy to find.

- Overly Casual or Unprofessional Tone: While it’s important to be polite, maintaining a level of formality is essential in payment-related communication. An overly casual tone might not be taken seriously and could hurt your professional image.

- Not Following Up on Unpaid Requests: If a payment has not been received by the due date, don’t hesitate to send a gentle reminder. Failing to follow up can make it seem as though you don’t value your time or the transaction.

Avoiding these mistakes ensures that your messages are clear, professional, and effective. By being careful with the details and maintaining a strong communication strategy, you can prevent misunderstandings and encourage timely payments.

Best Practices for Professional Invoice Communication

Clear and professional communication is key when requesting payments. It ensures that your client understands the details of the transaction, knows how to make the payment, and feels confident in your business practices. By following best practices, you can streamline your billing process, reduce confusion, and foster a positive, professional relationship with your clients.

Here are some best practices to follow for effective payment communications:

- Be Clear and Concise: Keep your message straightforward and to the point. Highlight the amount due, due date, and any relevant payment instructions. Avoid unnecessary information that could distract from the main message.

- Use a Professional Tone: Maintain a polite, formal tone in your communication. Even if you have an ongoing friendly relationship with the client, a professional approach ensures that the transaction is taken seriously.

- Provide Detailed Payment Instructions: Clearly outline the steps your client needs to follow to complete the payment. Whether it’s via bank transfer, online payment platform, or another method, make the process as simple as possible.

- Always Include Relevant Dates: Clearly state the date the payment is due, and make sure it’s easily noticeable. If necessary, remind clients of any applicable late fees or penalties.

- Follow Up When Needed: If the payment is overdue, don’t hesitate to send a polite reminder. Be courteous yet firm, and reiterate the payment details to ensure the client has all the information they need to complete the transaction.

- Express Gratitude: Always thank your client for their business. A simple expression of gratitude can go a long way in maintaining a positive working relationship.

By adhering to these best practices, you ensure that your communications are not only effective but also help you maintain your professionalism and credibility. Clients will appreciate the clarity and attention to detail, which can contribute to more timely payments and stronger business relationships.

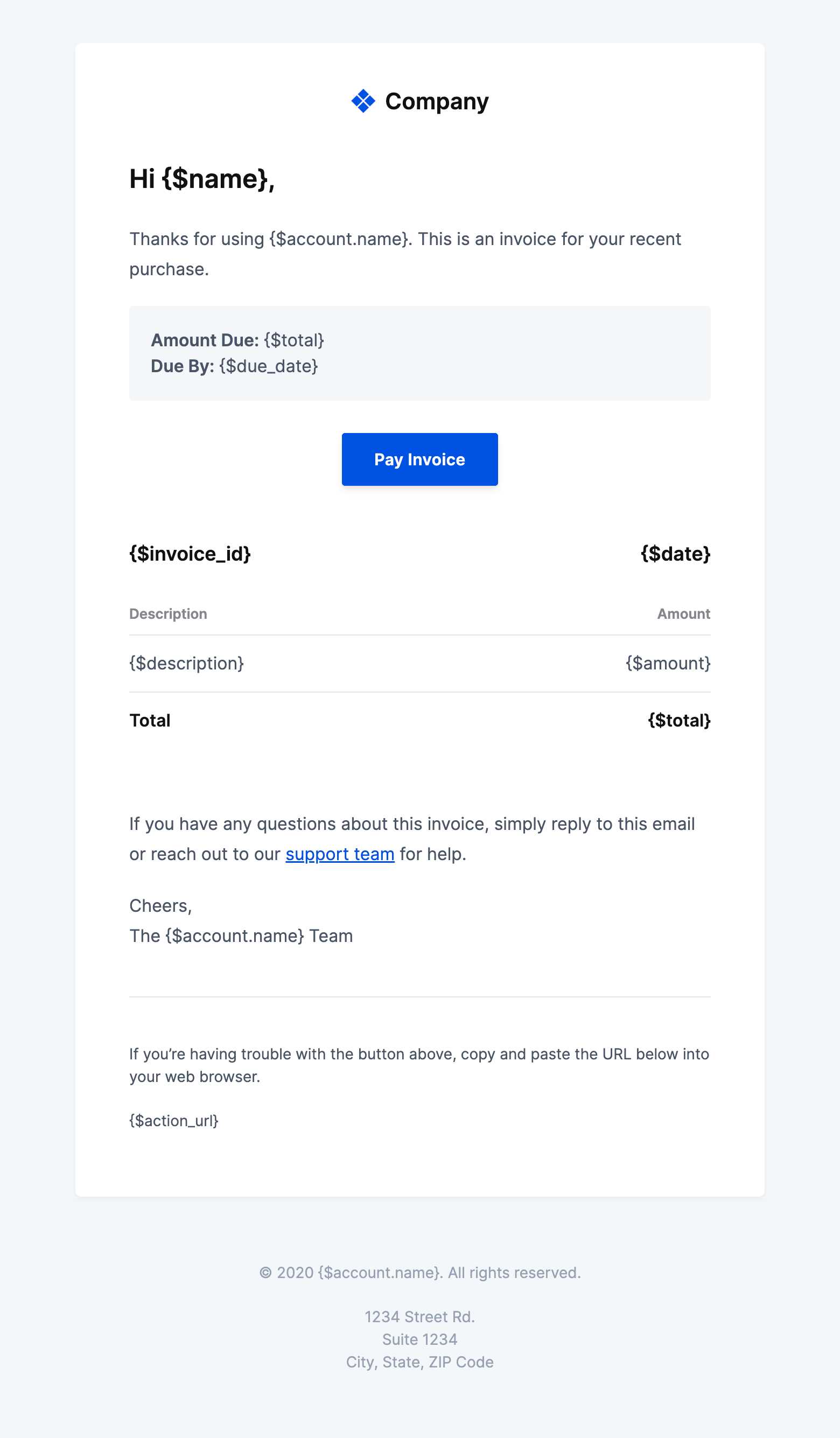

Key Elements of an Effective Invoice Email

For a payment request to be effective, it needs to contain several key elements that ensure clarity, professionalism, and ease of understanding. Each part of the communication should serve a specific purpose, whether it’s outlining the amount due, providing payment instructions, or reinforcing the due date. A well-organized message makes it easier for clients to act quickly and accurately, reducing any chances of confusion or delays.

Essential Information

Every payment request should include the following basic components:

- Amount Due: Clearly state the total amount the client owes, ensuring it’s easy to spot and understand.

- Due Date: Be explicit about when the payment is expected, and highlight any late fees if applicable.

- Payment Instructions: Provide clear instructions on how the client can make the payment, including payment methods and relevant details like bank account numbers or links to online payment portals.

Professional Tone and Structure

The structure and tone of your message are just as important as the content. The message should be polite and formal but also approachable. Here are some additional elements to consider:

- Subject Line: The subject should be clear and relevant, such as “Payment Request for [Service/Product] Due [Date].”

- Personalization: Use the client’s name and reference the specific service or product they received to make the message feel more personalized and engaging.

- Polite Closing: Finish with a courteous closing, such as “Thank you for your prompt attention to this matter,” to reinforce a professional tone.

Including all of these key elements ensures that your payment request is not only professional but also complete and easy for your client to process. The more organized and clear your communication, the more likely it is that you’ll receive timely payments.

How to Design Simple Invoice Emails

When requesting payment, simplicity is key. A clear and uncomplicated message helps ensure that your client understands exactly what is required of them, without distractions or confusion. A well-designed, simple layout can enhance the professionalism of your communication, making it easy for your client to process the payment quickly and efficiently.

Here are a few tips to design straightforward and effective payment messages:

- Limit the Amount of Text: Keep your message short and to the point. Focus on the key details–amount due, due date, and payment instructions. Avoid unnecessary information that could clutter the message.

- Use Clear Headings: Organize your message with headings to make it easy to scan. Sections like “Amount Due,” “Payment Instructions,” and “Due Date” should be easily distinguishable.

- Highlight Key Information: Make the important details stand out by using bold text or separating them with spacing. This makes it easier for your client to find the most critical points at a glance.

- Minimal Design Elements: Avoid using too many fonts or colors, as these can distract from the message. A clean, simple design with one or two colors will keep the focus on the content.

- Clear Call to Action: If you need the client to take immediate action, be clear about what they need to do next. For example, include a prominent “Pay Now” button or a direct link to the payment portal.

A simple, straightforward approach not only makes the process smoother for your client, but it also reflects well on your professionalism. By focusing on the essentials and keeping the design clean, you’ll increase the likelihood of timely payment and maintain a positive client relationship.

Using Invoice Email Templates for Efficiency

Creating a consistent and professional approach to your payment requests doesn’t have to be time-consuming. By utilizing pre-designed structures, you can quickly send out payment notices without worrying about formatting or missing important details. These ready-made formats save you time, reduce errors, and help ensure that every communication maintains a high standard of professionalism.

Here’s how using a standardized structure improves your efficiency:

| Benefit | Description |

|---|---|

| Time Savings | With a predefined structure, you don’t need to write every message from scratch. Simply fill in the specific details and send, reducing preparation time. |

| Consistency | Using the same format for every communication ensures that your messaging is always consistent, helping to reinforce your brand’s professionalism. |

| Reduced Errors | By reusing a proven structure, you minimize the risk of missing essential information such as payment instructions or amounts, which could lead to misunderstandings. |

| Scalability | As your client base grows, you can easily send multiple payment requests with the same structure, making it easier to manage large volumes of transactions. |

By incorporating a reusable structure into your workflow, you not only save time but also create a more streamlined and efficient process. Whether you’re a freelancer, small business owner, or part of a larger team, adopting this method will enhance both your productivity and your professionalism.

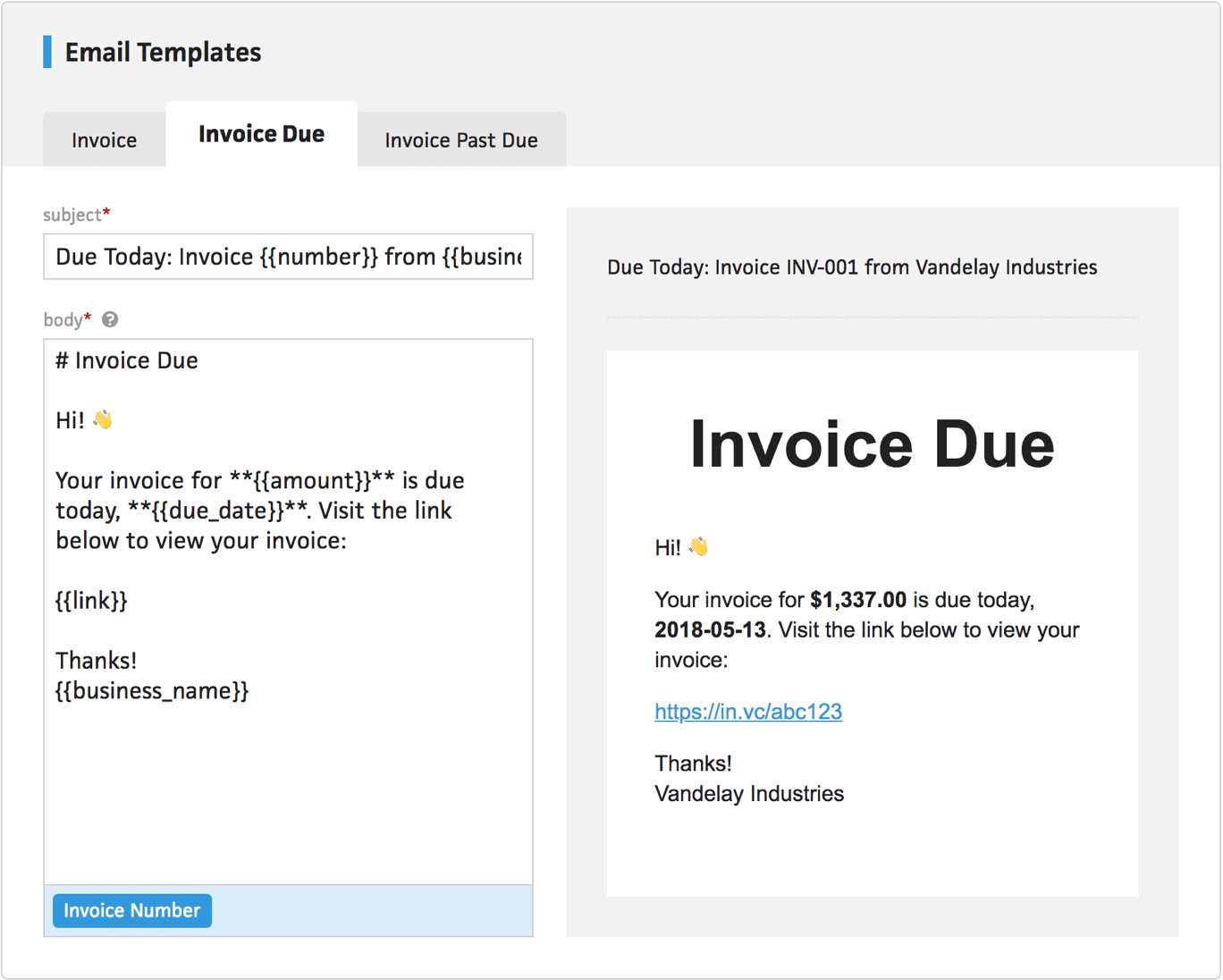

Creating Customizable Invoice Email Templates

Having the ability to personalize your payment requests while maintaining a consistent structure can significantly enhance your efficiency and client relationships. By designing adaptable formats, you can easily adjust the content to suit each client’s needs, whether it’s adding custom payment terms or referencing specific services. Customizable structures give you the flexibility to tailor your communication while still saving time with a pre-designed framework.

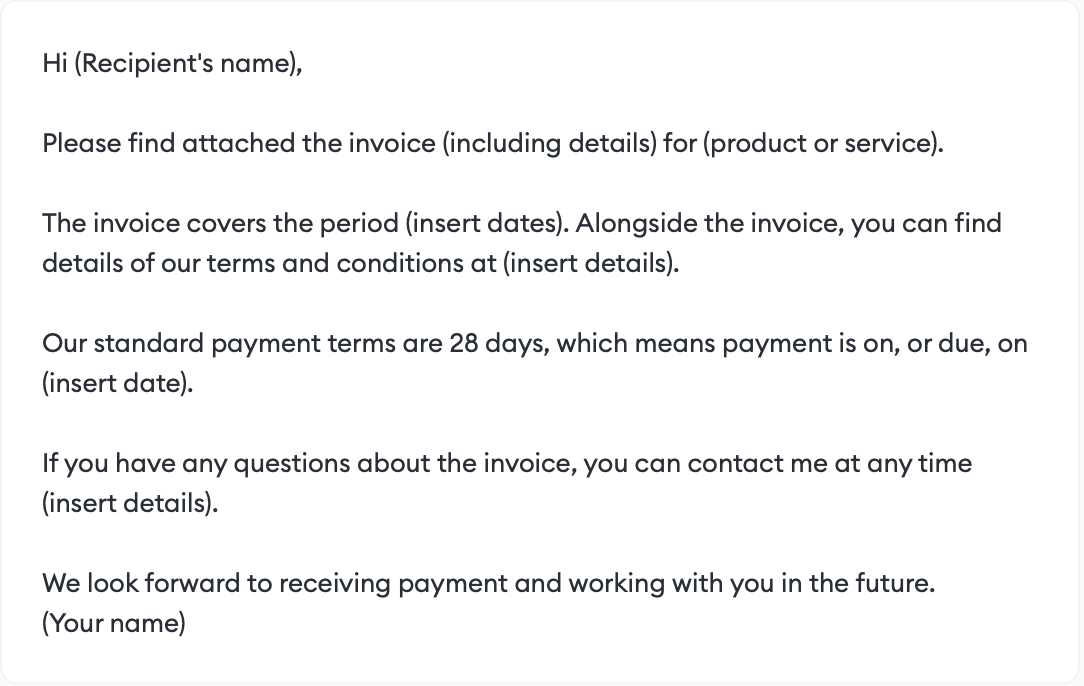

Here’s how to create a flexible payment request format that you can modify for different clients and situations:

- Incorporate Placeholders: Use placeholders for client names, amounts, due dates, and services rendered. This allows you to quickly fill in the details for each unique transaction.

- Adjustable Payment Terms: Include sections that can be customized with specific payment conditions or methods. For instance, you might want to include a special discount for early payments or adjust the due date for repeat clients.

- Professional Tone with Personal Touches: Keep the overall tone formal but allow space for personalization. A brief thank you or a reference to the specific project can add a personal touch without losing professionalism.

- Clear Formatting Options: Ensure your layout is easily adjustable. For example, consider different text alignments or bullet points to highlight critical details, such as payment methods and amounts.

By creating a format that can be easily customized, you can save time on each communication while ensuring that every message is appropriate and client-specific. Customizable structures allow you to streamline your process while maintaining a personal, professional approach.

How to Include Payment Terms in Emails

Clearly stating payment terms in your billing communication is essential to avoid confusion and ensure timely transactions. It provides your clients with the necessary information regarding the expectations for when and how payments should be made. Including these details in a clear and straightforward manner not only prevents misunderstandings but also helps build trust and professionalism.

Here are some key elements to consider when including payment terms in your communication:

- Specify the Due Date: Always include the exact date by which the payment is expected. If there are specific timeframes, such as “net 30” or “due upon receipt,” make sure these are clearly stated.

- Outline Payment Methods: Be explicit about the acceptable payment methods, whether it’s a bank transfer, online payment system, check, or any other option. Providing payment instructions, such as bank account details or links to online platforms, can make the process smoother for your clients.

- Late Payment Penalties: If applicable, include any penalties or interest charges that will be applied in case of a late payment. For example, you can mention “A late fee of 1.5% per month will be applied to overdue balances.” This encourages prompt payment and sets clear expectations.

- Discounts for Early Payments: If you offer any discounts for early payment, make sure to mention these as well. For instance, “A 5% discount is available if paid within 7 days.” This gives your clients an incentive to pay sooner, benefiting both parties.

- Provide Clear Contact Information: Include contact details in case your client has any questions or concerns regarding the payment process. Providing a point of contact for billing issues can make the process feel more personalized and accessible.

By including these key elements, you can ensure that your payment terms are communicated effectively and professionally, reducing the risk of delays or disputes. Clear terms not only help streamline the billing process but also strengthen client relationships by setting mutual expectations.

Choosing the Right Tone for Your Invoice Emails

The tone of your payment request can significantly impact how your client perceives your professionalism and how they respond to your request. Striking the right balance between formality and friendliness is key to maintaining a positive relationship while ensuring your message is taken seriously. Whether your client is new or a long-term partner, the tone should reflect your business’s values while also making the transaction process smooth and clear.

Here are some considerations when choosing the right tone for your payment requests:

- Professional but Friendly: It’s important to maintain professionalism, but an overly formal tone can seem impersonal. A friendly yet respectful approach can make your client feel comfortable and valued while also emphasizing the importance of the payment.

- Clear and Direct: Be straightforward about the amount due, due date, and any other important details. While politeness is crucial, your client should have no confusion about the expectations you’re setting.

- Use Polite Language: Even if the payment is overdue, maintaining politeness in your tone helps to preserve goodwill. Phrases like “we kindly ask for your prompt attention” or “we appreciate your cooperation” convey respect while remaining firm about the need for payment.

- Adapt Based on the Relationship: For long-term clients or repeat business, you might adopt a slightly more casual tone, especially if you have a friendly working relationship. For new clients or formal business settings, lean towards a more structured and respectful tone.

- Express Gratitude: Regardless of the tone, always thank your client for their business. Gratitude fosters positive relations and ensures your message doesn’t come across as demanding or one-sided.

By adjusting the tone appropriately for each situation, you ensure that your payment requests remain respectful, professional, and effective. The right tone encourages timely payment while strengthening your ongoing client relationships.

How to Follow Up on Unpaid Invoices

Following up on overdue payments is a delicate but necessary part of maintaining a healthy cash flow. When a payment has not been received by the due date, a well-timed and polite follow-up can help ensure the outstanding balance is paid without damaging your relationship with the client. It’s essential to approach this task with professionalism, patience, and clarity to achieve the best results.

Here are some key steps to effectively follow up on unpaid balances:

- Send a Friendly Reminder: If the payment is just a few days late, start with a gentle reminder. Be polite and assume that the client may have simply overlooked the due date. A message such as “Just a quick reminder that payment was due on [Date], and we would appreciate your prompt attention to this matter” can work well.

- Reconfirm Payment Details: Sometimes, clients forget the payment instructions or need a reminder on how to make the payment. Reconfirming the amount, payment method, and due date can help eliminate any confusion and speed up the process.

- Use a Clear Subject Line: When following up, ensure your subject line is specific and to the point. For example, “Payment Due for [Service/Product] – Action Required.” A clear subject line helps the recipient prioritize the message.

- Be Firm but Courteous: If the payment remains overdue, a firmer tone may be required, but always remain courteous. Politely reiterate the original terms and express your expectation for the payment to be made within a specified timeframe. For example, “We kindly ask that the balance of [Amount] be settled by [New Due Date] to avoid any further delays.”

- Offer Payment Options: In some cases, clients may be struggling with cash flow issues. Offering alternative payment methods or discussing a payment plan could facilitate the transaction and demonstrate flexibility on your part.

- Send a Final Notice: If all previous attempts have failed, it may be time to send a final reminder. Make it clear that you intend to take further action if the payment is not received by a specific date, but still maintain professionalism and courtesy.

By following these steps, you can improve your chances of receiving timely payments while maintaining positive relationships with your clients. A well-handled follow-up shows that you take your business seriously, but also that you value your clients and are willing to work with them when issues arise.

Invoice Email Templates for Freelancers

For freelancers, effective communication with clients is crucial, especially when it comes to requesting payments. Using a well-structured, professional format for your payment requests helps ensure clarity, promotes timely payments, and strengthens your relationships with clients. Having a set format for payment messages can also save you valuable time, allowing you to focus more on your work and less on administrative tasks.

Here are some practical examples of how freelancers can create and use customizable formats to streamline their payment process:

Simple Payment Request

This format is ideal for sending an initial payment request right after completing a project or task:

- Subject Line: “Payment Request for [Project Name] – Due [Date]”

- Greeting: Start with a personal greeting, such as “Dear [Client Name],”

- Body: Clearly state the service provided, the total amount due, and the payment deadline. Example: “Thank you for the opportunity to work on [Project Name]. The total amount due is [Amount], and the payment is due by [Due Date].”

- Payment Details: Include all necessary payment instructions, such as bank details or online payment links. Example: “Please transfer the payment to [Bank Account Details] or use [Payment Portal Link].”

- Closing: End with a polite and professional note. Example: “I look forward to your prompt payment. If you have any questions, feel free to contact me.”

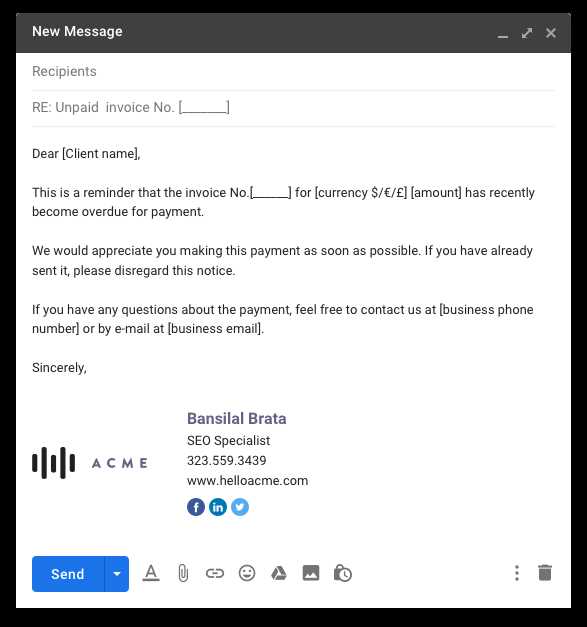

Reminder for Overdue Payment

If payment has not been made by the agreed-upon date, a friendly yet firm reminder is necessary:

- Subject Line: “Friendly Reminder: Payment Due for [Project Name]”

- Greeting: Address the client respectfully, e.g., “Dear [Client Name],”

- Body: Politely remind them that the payment is overdue. Example: “I hope everything is going well. I wanted to gently remind you that the payment for [Project Name] was due on [Due Date] and has not been received yet. The total outstanding amount is [Amount].”

- Action Request: Include a clear call to action. Example: “Kindly make the payment by [New Due Date] to avoid any further delays.”

- Closing: Offer assistance or clarification if needed. Example: “Please don’t hesitate to reach out if you have any questions regarding the payment details.”

By using these simple yet effective formats, freelancers can maintain a professional image while ensuring they are paid promptly for their work. Customizing these structures as needed allows you to quickly adapt to different clients and projects while keeping the process efficient and clear.

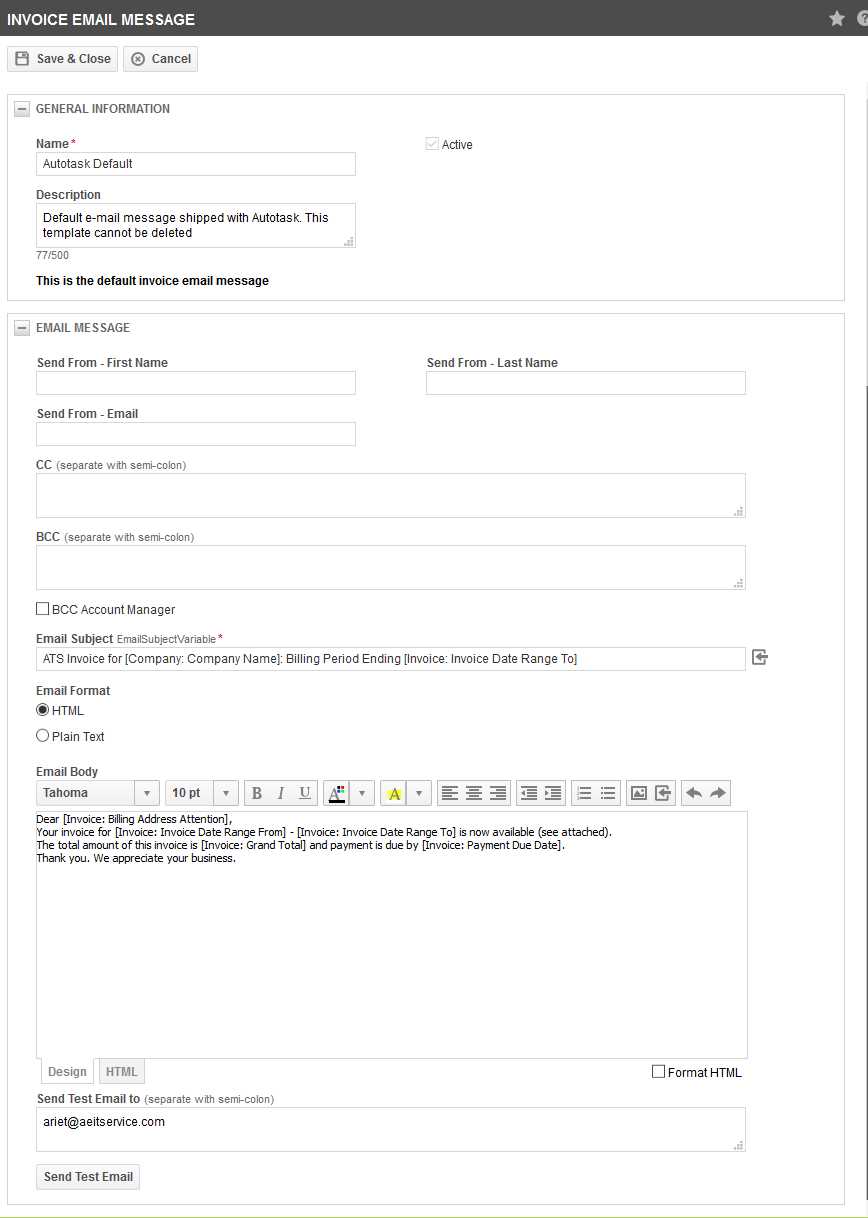

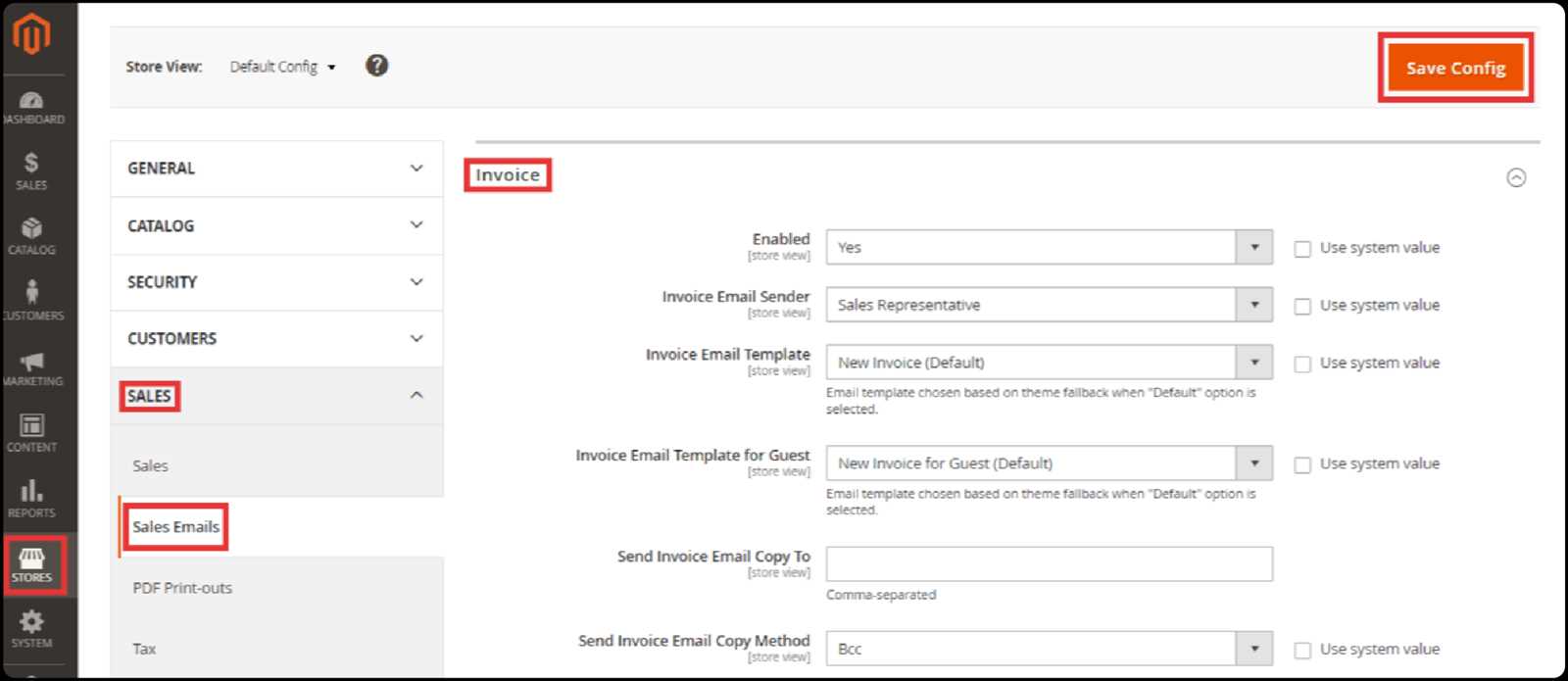

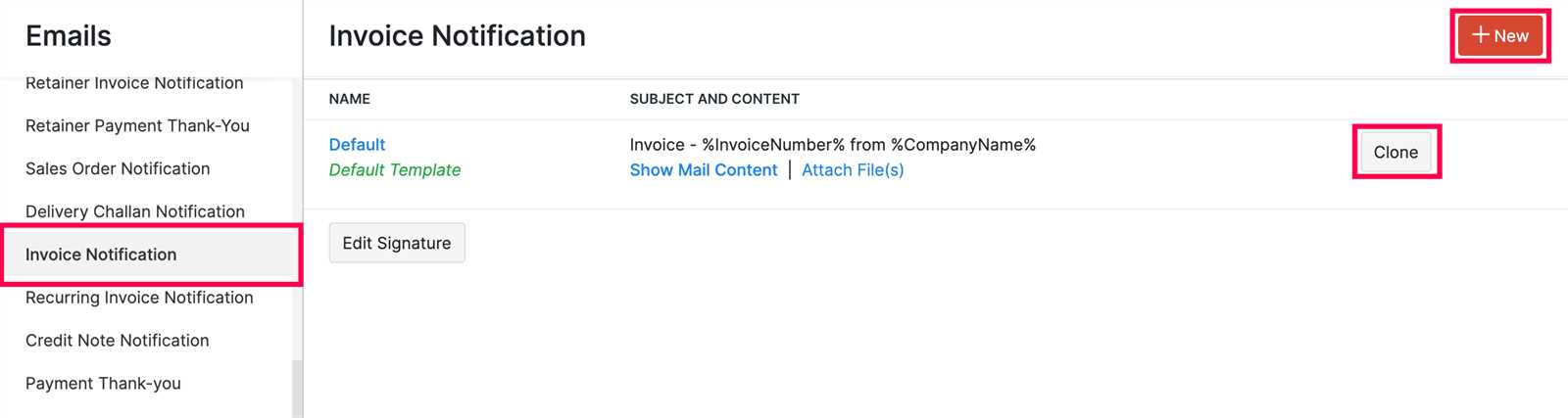

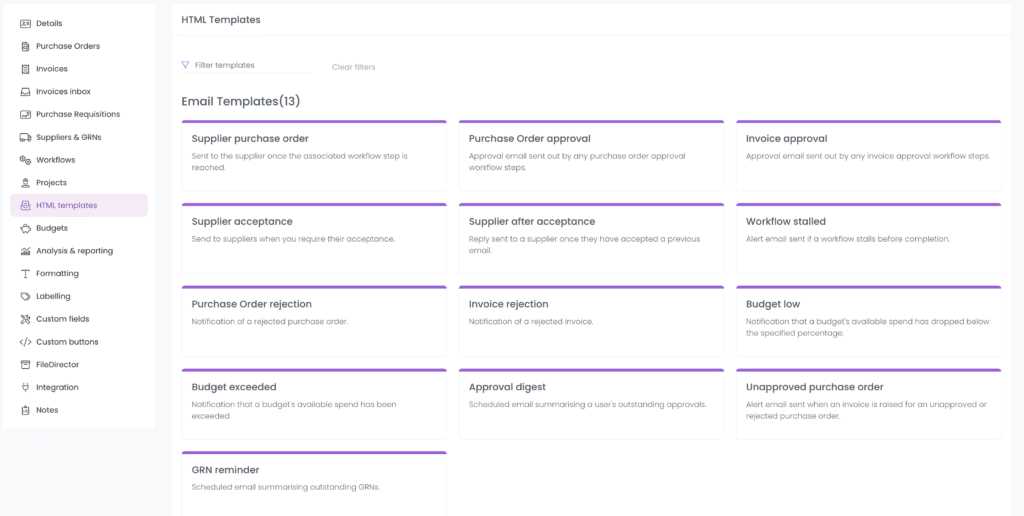

How to Automate Invoice Email Sending

Automating the process of sending payment requests can significantly improve efficiency and ensure that nothing is overlooked. By setting up automated systems, you can save time, reduce human error, and ensure that clients receive timely reminders without you having to send them manually. Automating this task allows you to focus on other aspects of your business while maintaining professionalism and consistency in your communications.

Here are the key steps to automate sending payment requests:

- Use an Invoicing Software: Many invoicing platforms offer automation features that allow you to schedule and send payment requests automatically. Choose a system that integrates with your workflow and automatically generates and sends payment reminders on specified dates.

- Set Up Recurring Payments: For clients with ongoing contracts, setting up recurring billing ensures that payment requests are sent out on a regular schedule without any manual input. These systems can also send reminders if a payment is missed or delayed.

- Automate Follow-Up Reminders: Once the payment deadline passes, automate follow-up reminders to clients who have not paid. These reminders can be customized based on the payment terms and can be sent at set intervals, such as a few days after the due date or weekly until the payment is received.

- Customize Email Content: While automation handles the timing and frequency, you can still personalize the content of your messages. Many invoicing platforms allow you to create custom templates that are automatically filled with the appropriate details, such as the amount due, the client’s name, and the due date.

- Integrate Payment Gateways: Automating payment collection by integrating online payment gateways into your system allows clients to make payments directly from the message they receive. This reduces friction and helps ensure faster payments.

- Monitor and Adjust Settings: After setting up the automation, monitor the process to ensure everything is working smoothly. Adjust the timing of reminders, the content of your messages, or the payment methods if necessary to improve the efficiency of your system.

By automating the sending of payment requests, you can streamline your business operations, reduce administrative workload, and improve cash flow. An automated system helps you stay organized and ensures timely communication, making it easier for your clients to pay on time and for you to maintain a smooth business operation.

When to Send Invoice Emails After Work Completion

Timing is critical when it comes to sending payment requests after completing a project. Sending your request too soon can appear rushed, while waiting too long may result in delays in payment. It’s essential to find the right balance to ensure your client has enough time to process the request while still encouraging prompt payment.

Here are some key considerations for determining the best time to send your payment request:

- Immediately After Project Completion: For shorter projects or tasks with a fixed deadline, it’s often best to send your payment request immediately upon completion. This ensures that the project is still fresh in the client’s mind, and they are more likely to prioritize your payment.

- Upon Client Approval: If the work requires client approval before moving forward, it’s wise to wait until you receive formal approval. Once the client confirms satisfaction, you can send the payment request with the assurance that they are fully on board with the completed work.

- Upon Milestone Completion: For larger projects with multiple phases, it’s beneficial to send payment requests after each milestone is achieved. This can help you maintain cash flow throughout the project and avoid having to wait until the entire project is finished before receiving payment.

- Agreed-Upon Payment Terms: Always align your request with the payment terms you’ve set with your client. For instance, if you’ve agreed to send a request upon completion, stick to that schedule. If payments are due upon receipt, send the request promptly after the work is completed.

- Timing Based on Client’s Process: Some clients may have a specific internal process for handling payments, such as requiring an internal review before sending payment. In this case, you may need to adjust the timing to accommodate their workflow, but be sure to communicate any expectations clearly.

By sending your payment request at the right time, you demonstrate professionalism and respect for your client’s process while helping to ensure timely payments. Whether it’s immediately after completion, upon approval, or after hitting specific milestones, aligning your request with your client’s expectations will help foster a smoother transaction.

Optimizing Your Invoice Email for Mobile Devices

With more people accessing their messages on mobile devices, it’s essential to ensure that your payment requests are mobile-friendly. A well-formatted, easy-to-read message increases the likelihood of timely payment, as clients can quickly view and act upon the request without needing to zoom in or navigate through complicated layouts. By optimizing your communication for mobile devices, you create a seamless and professional experience for your clients, encouraging prompt action.

Here are key considerations when optimizing your payment request for mobile viewing:

- Use a Simple and Clean Layout: Avoid clutter and excessive text. A clean, straightforward design with clear headings and short paragraphs makes it easier for clients to read your message on smaller screens. Keep the layout responsive, meaning it adjusts to different screen sizes automatically.

- Clear, Concise Subject Line: Mobile screens often cut off longer subject lines, so ensure your subject is short and to the point. For example, “Payment Due for [Service]” is concise and immediately communicates the message’s purpose.

- Use Large, Readable Fonts: On smaller screens, small fonts can be hard to read. Choose fonts that are easy to read on mobile devices, typically around 14-16px in size. Additionally, ensure adequate line spacing to improve readability.

- Shorten and Highlight Key Information: Place essential details, such as the amount due, due date, and payment instructions, at the top of your message. This makes it easy for clients to quickly identify what they need to act on. Bullet points or numbered lists can help organize the information clearly.

- Ensure Mobile-Friendly Links: If your payment instructions include links, ensure they are large enough to tap on and lead directly to a payment portal or instructions. Avoid using long URLs that might break or be hard to click on mobile.

- Avoid Heavy Attachments: Large attachments can be cumbersome to download or open on mobile devices. If you need to include a document, consider hosting it online and sharing a link to download rather than attaching it directly to the message.

- Test for Responsiveness: Before sending out payment requests, test how your message appears on different mobile devices. Check for readability, alignment, and any formatting issues. This helps ensure that your message will look professional on any device.

By optimizing your payment requests for mobile, you make it easier for clients to view and pay quickly, improving your chances of getting paid on time. A mobile-friendly message not only shows attention to detail but also reflects professionalism in how you communicate with clients.