Effective Invoice Email Message Template for Professional Communication

When it comes to requesting payment for services or products, clear and professional communication is essential. Using a well-crafted written format ensures that the recipient understands the purpose of the communication and responds promptly. Proper structure, tone, and content can make a significant difference in how quickly payments are received and how clients perceive the professionalism of your business.

By mastering the art of formal correspondence, you can convey payment details, deadlines, and instructions in a manner that minimizes confusion. Whether you’re working with new or existing clients, creating a reliable method for this communication can streamline your operations and foster positive client relationships. A polished approach shows attention to detail and helps ensure that your financial transactions run smoothly.

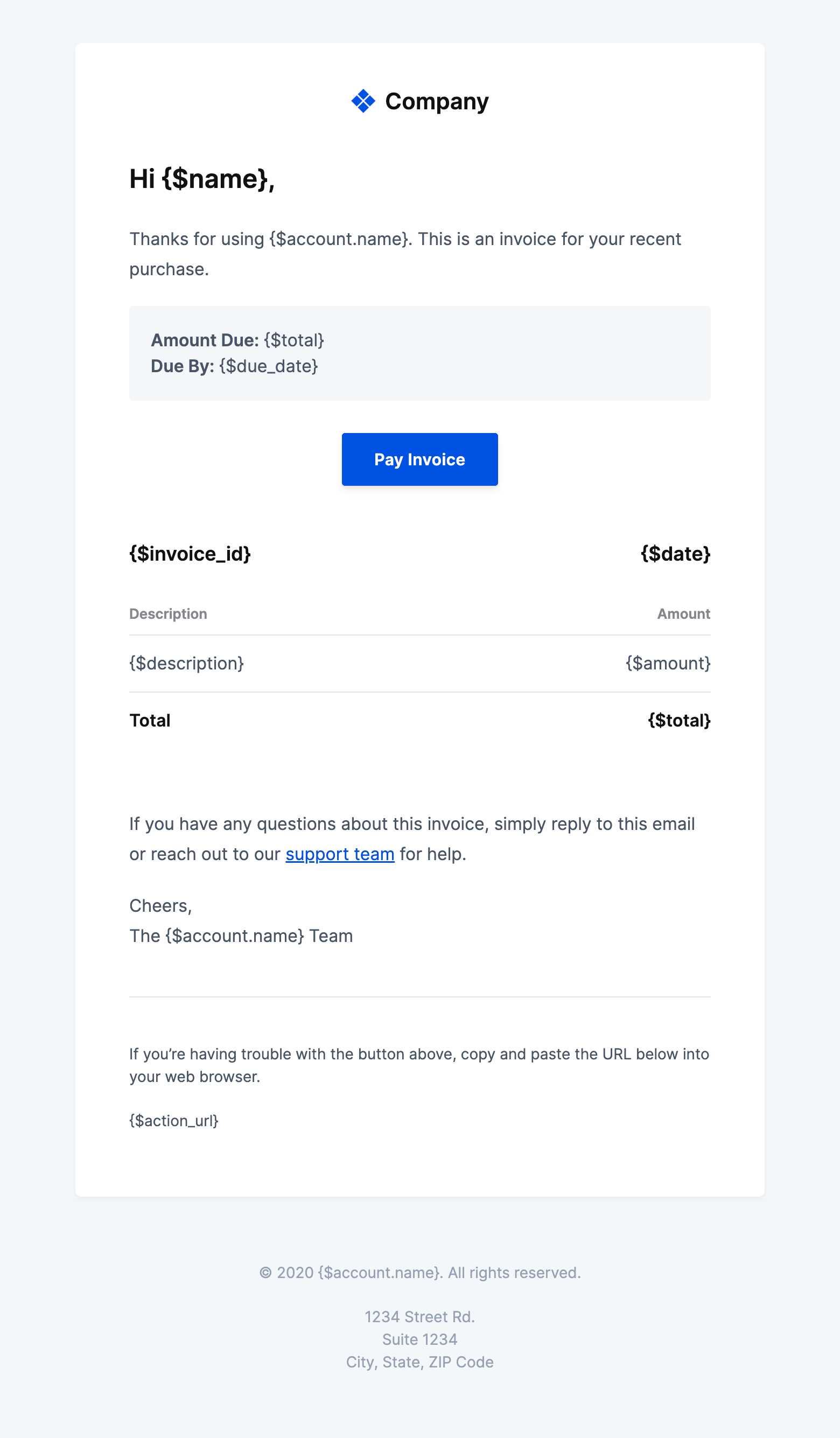

Invoice Email Message Template

When requesting payment from clients, having a standardized written format helps maintain consistency and professionalism in all communications. This format ensures that all necessary details are included, such as amounts, due dates, and payment instructions, while also conveying the right tone. A well-structured document can improve clarity, reduce misunderstandings, and speed up the payment process.

Creating a consistent structure for these communications allows businesses to save time, avoid errors, and build trust with clients. A carefully composed template can be easily customized for different situations, from a first-time reminder to a follow-up for overdue payments. Key components should include clear headings, a polite request for payment, and any relevant contact or payment information.

Key Elements: Make sure to include the recipient’s name, the amount owed

Why Use an Invoice Email Message Template

Having a predefined structure for requesting payments ensures that the process is smooth, professional, and consistent. Instead of composing each request from scratch, a ready-made format helps save time and reduce the chance of errors. With a standard approach, you can ensure that all important details are included, improving clarity and communication with clients.

Time Efficiency and Consistency

One of the key advantages of using a structured format is the time saved in drafting these communications. Instead of writing the same information over and over, a well-organized format allows you to quickly fill in the necessary details, maintaining uniformity across all transactions. Consistency also contributes to professionalism, making your business appear more reliable and organized.

Minimizing Mistakes and Improving Accuracy

By following a set structure, the chances of omitting critical information, such as payment amounts or due dates, are greatly reduced. Accuracy is key when requesting payments, and a reliable format ensures that all relevant details are clearly presented, minimizing the risk of confusion or delays in payment.

| Benefit | Explanation |

|---|---|

| Time Saving | Quickly generate requests by filling in the essential details without starting from scratch. |

| Consistency | Maintain a uniform and professional tone across all communications. |

| Accuracy | Ensure that all relevant information, such as due dates and amounts, are clearly stated. |

How to Structure Your Invoice Email

When crafting a formal payment request, organization and clarity are essential to ensure the recipient understands the purpose and details of the communication. A well-structured format makes the process straightforward, ensuring that all key information is included and easily accessible. A professional layout increases the likelihood of timely payment and enhances the credibility of your business.

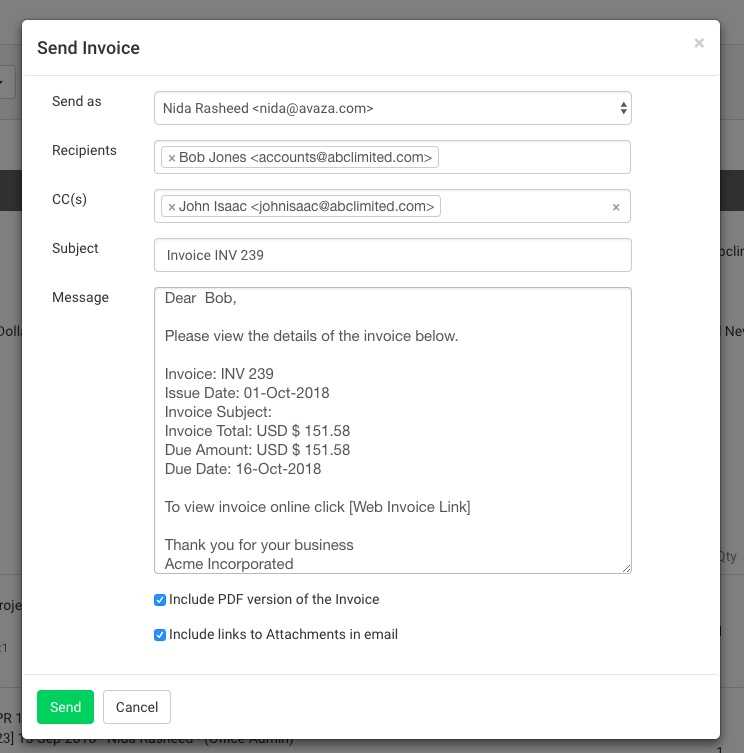

Start with a courteous greeting and ensure the recipient’s name is correct. Follow this with a clear statement of the amount due, the payment deadline, and any necessary instructions. Be sure to maintain a polite and professional tone throughout, while also offering assistance if there are any questions or concerns about the payment process.

Essential Elements: The subject line, greeting, payment details, due date, payment instructions, and closing should all be present in the communication. Keeping these components organized will help the recipient quickly understand the purpose of the message and take the necessary steps.

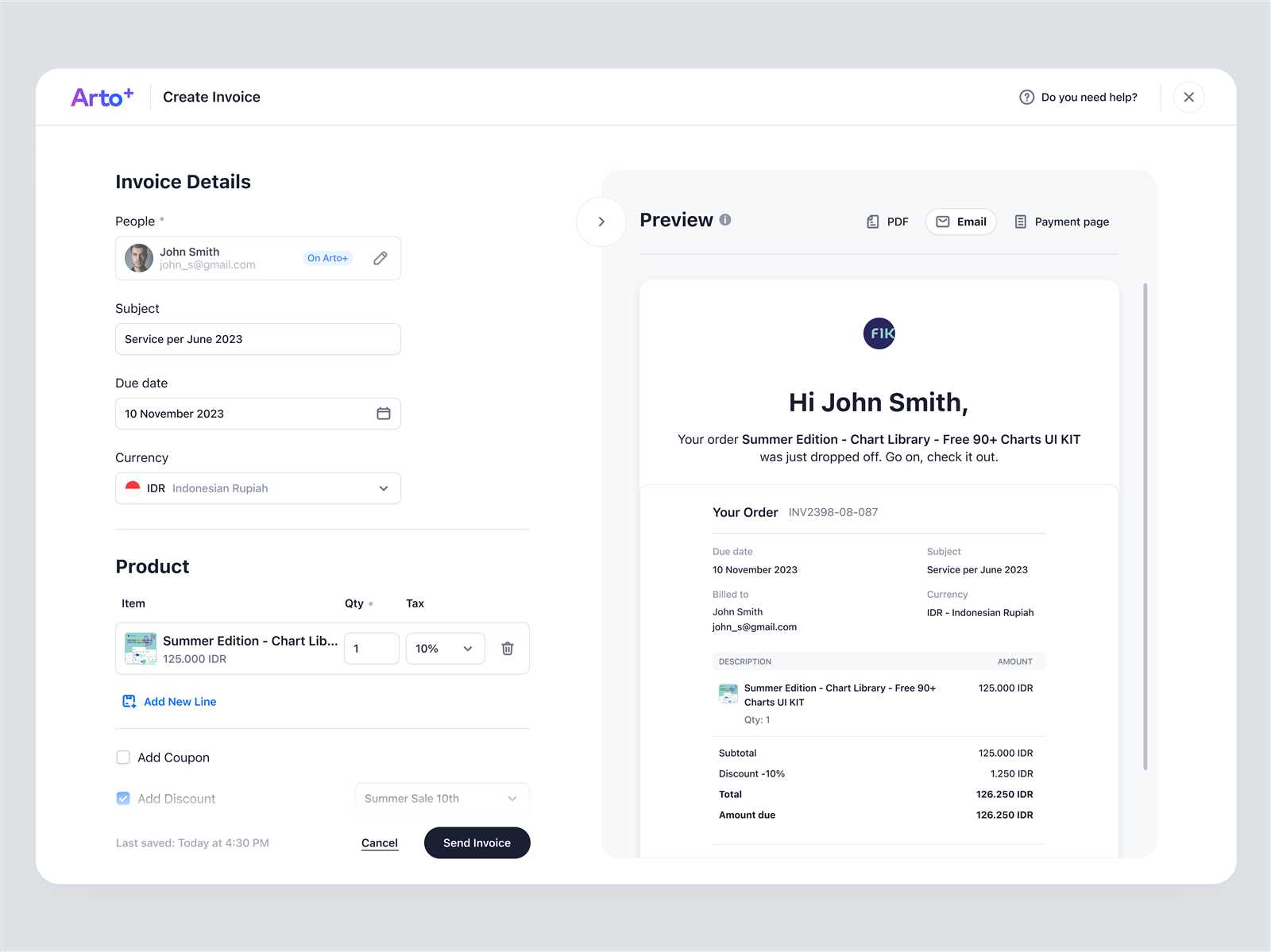

Customizing Your Invoice Email Message

Tailoring your payment request allows you to better connect with clients and address their specific needs. A personalized approach can enhance the relationship by making the communication feel more thoughtful and relevant. Whether adjusting the tone, content, or format, customization helps reflect your brand and ensure the recipient receives a message that is both clear and engaging.

Adjusting the Tone for Different Clients

Not all clients are the same, so adjusting the tone of your correspondence can be beneficial. For long-term clients with whom you have a strong relationship, you might use a friendlier, more conversational tone. For new clients or formal business transactions, a more professional and straightforward approach is recommended.

Personalizing Payment Details and Instructions

When communicating specific payment details, it’s important to ensure that the message is tailored to each client’s situation. This includes adding personal references such as project names, previous discussions, or any unique payment methods that apply to the recipient. By doing this, you not only make the payment request clearer but also show that you’ve taken the time to understand their particular needs.

| Customization Aspect | Explanation |

|---|---|

| Tone | Adjust the formality based on the client’s relationship with your business. |

| Personal References | Include details like project names, dates, or previous conversations to make the request more relevant. |

| Payment Instructions | Offer clear, specific instructions based on the client’s preferred payment method. |

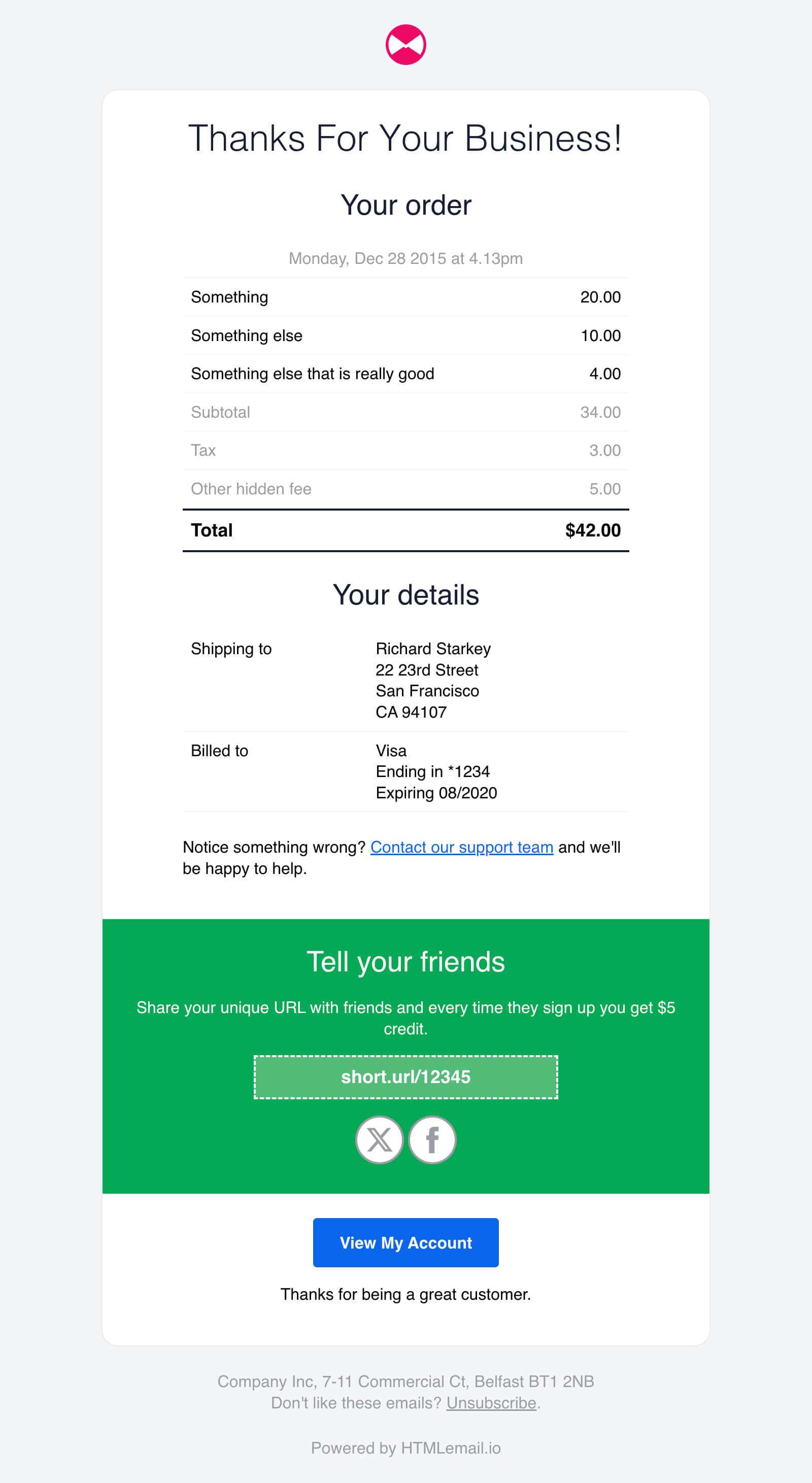

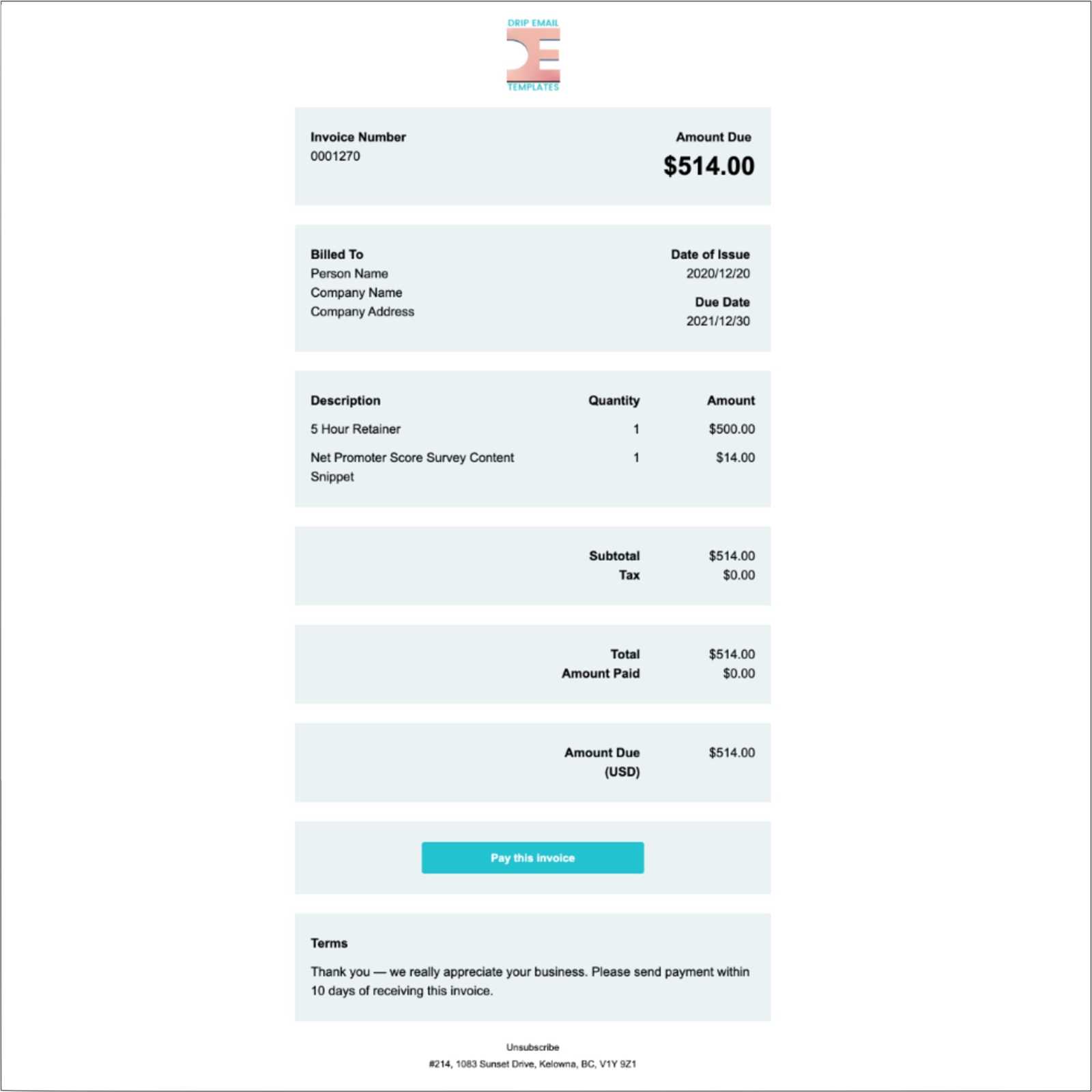

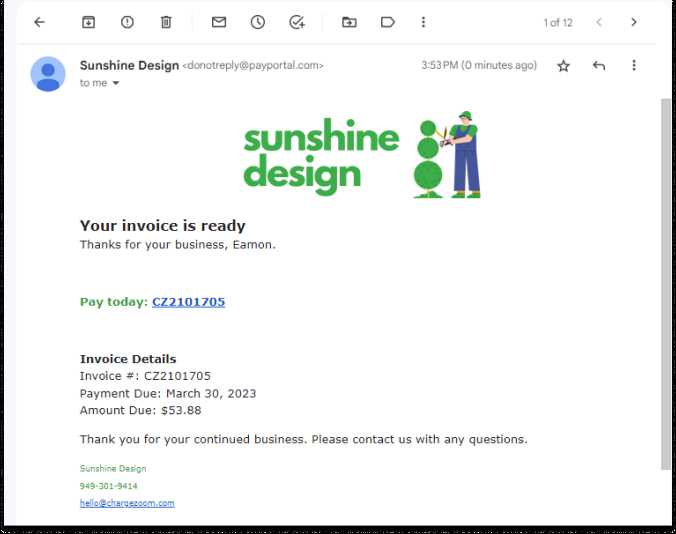

Essential Elements of an Invoice Email

When sending a formal payment request, certain components are critical to ensure clarity and professionalism. Including the right details helps the recipient understand the purpose of the communication and makes the payment process smooth. A well-structured request should provide all necessary information while maintaining a polite and direct tone.

To create a comprehensive and effective payment request, consider including the following elements:

- Clear Subject Line: Ensure the recipient knows immediately that the purpose is related to a payment request.

- Recipient’s Name: Address the person or company directly to create a personalized touch.

- Amount Due: Clearly state the amount that is expected to be paid.

- Due Date: Include the exact date by which payment is expected.

- Payment Instructions: Provide clear instructions on how the recipient can make the payment.

- Contact Information: Include your contact details in case the recipient has questions or needs assistance.

- Polite Closing: End the message with a courteous note to maintain a professional tone.

By ensuring these elements are present, you help the recipient easily understand the details of the transaction and increase the likelihood of a prompt response.

Professional Tone in Invoice Emails

Maintaining a professional tone when requesting payments is crucial for fostering positive business relationships and ensuring clear communication. A well-crafted payment request should convey respect and professionalism while remaining polite and direct. The tone sets the stage for how your business is perceived and can influence how promptly and willingly clients fulfill their financial obligations.

When composing your request, it is important to strike a balance between formality and friendliness. A formal tone ensures that your communication is taken seriously, while a touch of warmth can help maintain a positive relationship with clients. Avoid overly casual language, which could undermine the professionalism of your business, but also steer clear of being too stern or rigid, as this could make clients feel uncomfortable or pressured.

Key Aspects of a Professional Tone:

- Polite and Respectful Language: Always address clients courteously and express gratitude for their business.

- Clear and Direct Communication: Be specific about the payment details without being overly wordy.

- Neutral and Positive Phrasing: Avoid using demanding or negative language; instead, frame requests in a constructive way.

By keeping your tone professional yet approachable, you create a positive impression that encourages timely and efficient payments while preserving your client relationships.

Common Mistakes to Avoid in Invoices

Even small errors in a payment request can lead to confusion, delays, or misunderstandings. It is essential to pay close attention to the details when crafting these communications. Avoiding common mistakes ensures that the recipient can easily process the request and make the payment without issues. These errors, while often minor, can negatively affect your business’s credibility and cash flow.

Some frequent mistakes include failing to include clear payment instructions, overlooking important details like due dates, or using unclear language. Additionally, incorrect or missing amounts can cause unnecessary back-and-forth between you and the recipient, delaying the process. Double-checking all elements before sending out any payment requests can save time and prevent frustration for both parties.

Common Errors to Avoid:

- Leaving out the payment due date or making it unclear.

- Not providing accurate payment details, such as the total amount owed.

- Using vague or overly complex language that confuses the recipient.

- Forgetting to include important contact details for follow-up questions.

- Failing to proofread for typos or grammatical errors that may undermine professionalism.

By being mindful of these common pitfalls, you can ensure your requests are processed smoothly and professionally, reducing the chances of delays or misunderstandings.

Creating a Clear Payment Request

A well-constructed payment request is crucial for ensuring that clients understand exactly what is owed and how to proceed. Clear communication helps prevent misunderstandings and reduces the chance of delays. A simple, straightforward approach that highlights the key details can make it easier for the recipient to take action promptly.

To craft a payment request that is easy to understand, ensure that all the essential information is presented in a logical order and free of any ambiguity. The language should be direct but courteous, and all instructions for making the payment should be clear and concise. Including all relevant details from the start helps avoid unnecessary follow-up questions and delays.

Key Elements for a Clear Request:

- Amount Due: Specify the exact amount the recipient is expected to pay.

- Due Date: Clearly state when the payment is due to avoid confusion.

- Payment Instructions: Provide straightforward steps or options for making the payment.

- Contact Information: Ensure the recipient knows how to reach you in case of questions.

By presenting the information in an organized and easy-to-read manner, you increase the likelihood of timely payment while maintaining a professional image.

Adding Personalization to Your Invoice Email

Personalizing a payment request not only makes it more engaging, but it also strengthens your relationship with the client. By including tailored details, you show that you value the client and have taken the time to customize the communication. Personalization can enhance the clarity of the request and improve the chances of timely payment.

How Personalization Builds Trust

Addressing the recipient by name and referencing specific details about the project or transaction helps create a connection. Clients are more likely to respond positively to requests that feel personal rather than generic. A personalized tone demonstrates professionalism and can set your business apart from others that use one-size-fits-all approaches.

Personalization Ideas to Consider

Here are a few ways to customize your payment request:

- Client’s Name: Always address the recipient by name rather than using a generic greeting.

- Project/Service Details: Mention the specific work or product provided to make the request more relevant.

- Special Offers or Discounts: If applicable, reference any discounts or special terms that apply to the recipient.

- Friendly Closing: End the request with a warm note or appreciation for the client’s business.

By adding these personal touches, you ensure that your payment requests are not only clear but also thoughtful, which helps to maintain strong and professional client relationships.

How to Handle Late Payments in Emails

Dealing with late payments can be a delicate situation, requiring a balance of professionalism and firmness. When a payment is overdue, it’s essential to follow up with clear, polite reminders, while also maintaining the client relationship. A well-crafted request can encourage timely payment without damaging rapport or sounding confrontational.

Steps to Effectively Address Late Payments

When following up on overdue payments, it is important to stay courteous and respectful. Begin by reviewing the original terms to ensure there’s no misunderstanding about the due date. In your follow-up, be firm but polite, restating the due amount and payment terms while providing any necessary payment instructions. Offering assistance or clarifying any possible confusion may help resolve the situation quickly.

Key Elements for Late Payment Follow-Ups

Here are some essential components to include in a late payment follow-up:

- Clear Reference to the Original Agreement: Politely remind the client of the agreed-upon payment terms.

- Restatement of the Amount Due: Include the exact amount owed, as well as any late fees if applicable.

- Payment Methods: Provide easy-to-follow instructions for making the payment.

- Polite Yet Firm Tone: Be professional and courteous, but express the urgency of receiving payment.

Table of Late Payment Follow-Up Example

| Follow-Up Step | Action |

|---|---|

| Initial Reminder | Send a friendly reminder soon after the due date has passed, offering assistance and clarifying terms. |

| Second Reminder | Reiterate the original terms and gently highlight the overdue amount, stressing the importance of timely payment. |

| Final Reminder | If payment is still not received, send a firm yet polite final notice, emphasizing potential late fees or consequences. |

By following these steps and maintaining a professional tone, you can handle late payments effectively while preserving positive business relationships.

Including Payment Instructions in Invoices

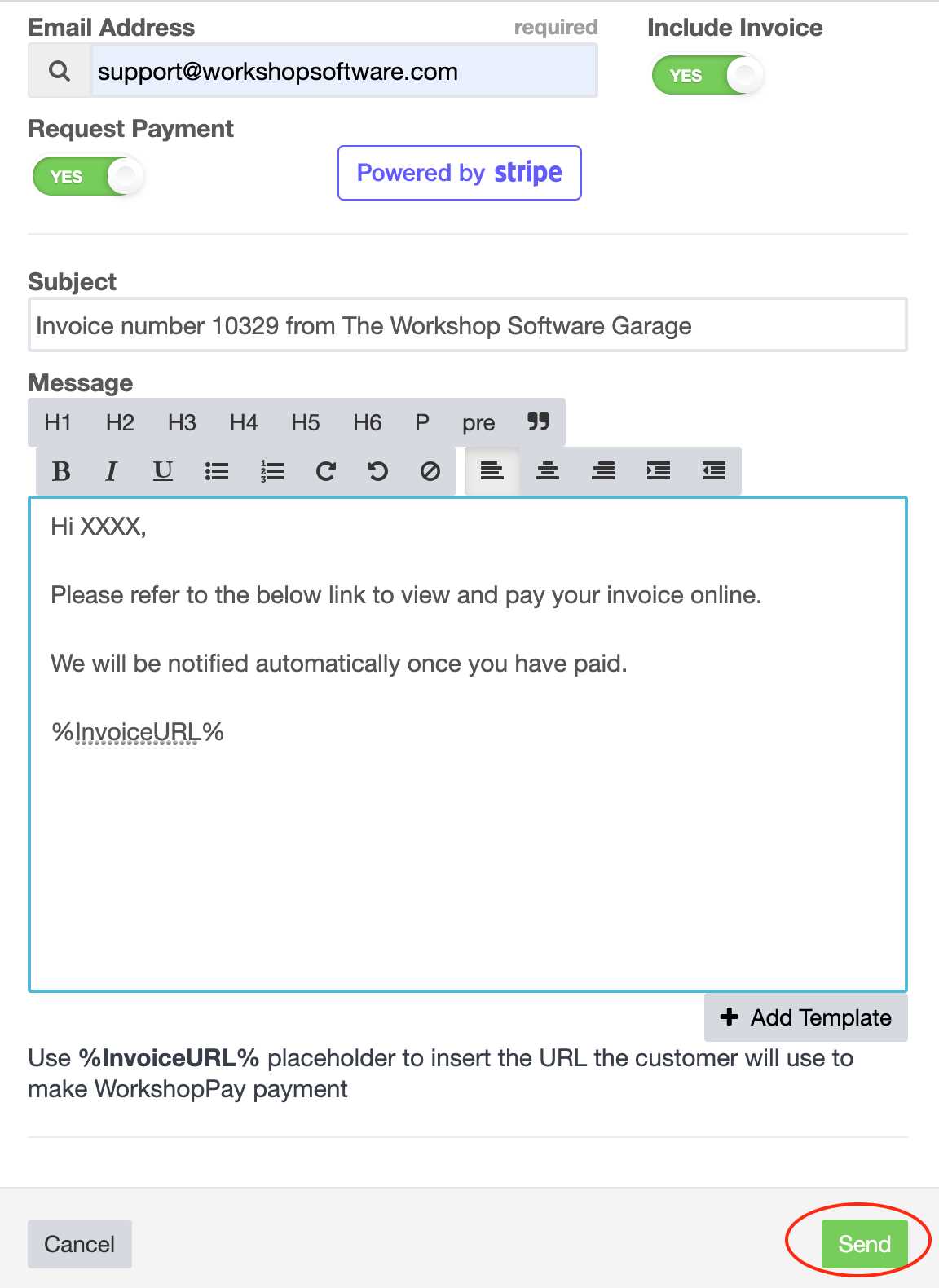

Clear and detailed payment instructions are essential for ensuring a smooth transaction process. When clients receive a payment request, they need straightforward guidance on how to proceed with settling the amount due. By outlining the steps or options for payment, you reduce the chances of confusion or delays, making the payment process as simple as possible for the recipient.

Providing easy-to-follow instructions not only helps ensure prompt payment but also demonstrates professionalism and transparency. Clients should have all the information they need to complete the transaction successfully, whether it involves bank transfers, online payment systems, or other methods. Including clear instructions can save time and avoid unnecessary follow-up communication.

| Payment Method | Details to Include |

|---|---|

| Bank Transfer | Provide bank name, account number, sort code, and any reference details required for the transfer. |

| Online Payment Portal | Include a link to the payment portal and detailed instructions on how to make the payment online. |

| Credit/Debit Card | Explain how to pay by card, including a secure payment link or necessary card information fields. |

| Checks | Specify the recipient’s name, address, and any necessary instructions for mailing the check. |

By incorporating clear and specific payment instructions, you help the recipient make the payment without confusion or unnecessary delays. This creates a more efficient payment process and enhances client satisfaction.

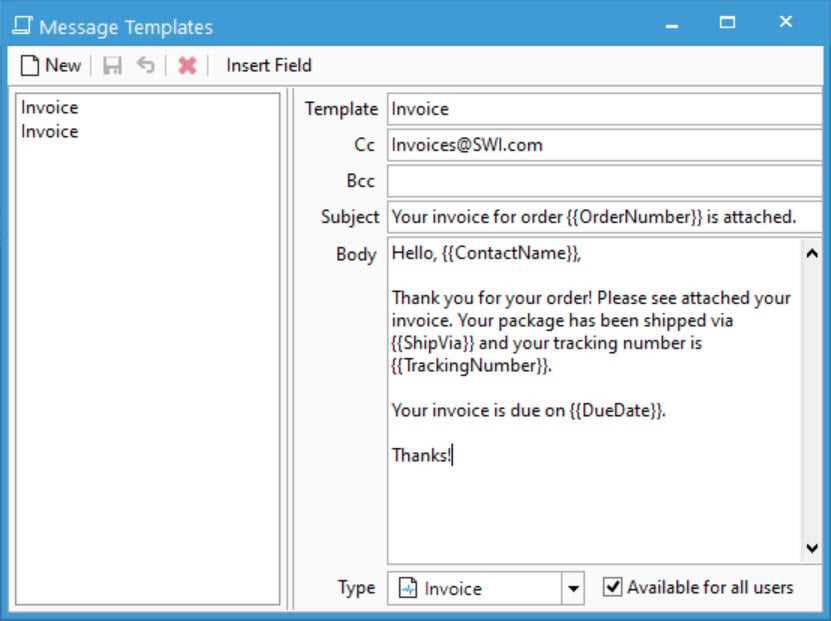

Best Practices for Invoice Email Formatting

Properly formatting a payment request is key to ensuring it is professional, clear, and easy to understand. The way the request is structured influences how quickly and accurately the recipient can process the payment. A well-organized layout helps the recipient quickly locate essential details such as the amount due, due date, and payment instructions, which increases the likelihood of timely payment.

Key Formatting Principles

To ensure your payment request is easy to read and understand, use simple formatting techniques that enhance readability. Consistent use of headings, bullet points, and tables makes it easier for the recipient to digest the information. Avoid cluttering the communication with too much text, and instead focus on clear, concise details. Professional fonts, proper spacing, and organized sections contribute to a polished, business-like appearance.

Effective Layout Tips

Here are some best practices for structuring a payment request:

- Clear Subject Line: A subject line should immediately convey the purpose of the request.

- Consistent Formatting: Use consistent fonts, sizes, and colors for a clean, professional look.

- Easy-to-Read Font: Stick to fonts like Arial or Times New Roman to ensure legibility.

- Organized Sections: Break down the information into clearly labeled sections for easy navigation.

Example Table Layout

| Section | Details |

|---|---|

| Payment Amount | Clearly state the total amount due. |

| Due Date | Make sure the payment deadline is highlighted and easy to spot. |

| Payment Instructions | Provide clear, step-by-step instructions on how to make the payment. |

By following these formatting practices, you ensure your payment request is easy to understand, visually appealing, and professional, encouraging prompt payment and positive client relationships.

How to Follow Up on Unpaid Invoices

Following up on overdue payments is an essential part of maintaining cash flow and ensuring your business remains financially healthy. While it’s important to approach the situation professionally, being persistent and clear about the payment terms can help resolve the issue without damaging the client relationship. A well-crafted follow-up strategy can ensure that payments are processed without unnecessary delays.

When to Send a Follow-Up

Timing is key when following up on overdue payments. It’s important to send a gentle reminder shortly after the due date has passed. If the payment is not received after the first reminder, a more firm follow-up may be necessary. However, always remain polite and professional, regardless of how overdue the payment is. This helps maintain a positive relationship with the client while also conveying the seriousness of the situation.

Steps for Effectively Following Up

Here are some important steps to take when following up on unpaid payments:

- Send a Friendly Reminder: A polite reminder soon after the due date can often resolve the issue before it escalates.

- Restate the Due Amount and Deadline: Be clear about the amount owed and the original payment terms.

- Offer Payment Assistance: If the client is facing difficulties, offer to discuss payment options or a payment plan.

- Be Clear About Consequences: If the payment is not received after multiple follow-ups, inform the client of the next steps or potential late fees.

By following these steps and maintaining professionalism, you can effectively follow up on overdue payments and minimize disruption to your business operations.

Importance of a Strong Email Subject Line

The subject line of a payment request is the first thing the recipient sees, and it plays a crucial role in determining whether your communication is opened, read, and acted upon promptly. A well-crafted subject line can grab the recipient’s attention, convey the urgency of the request, and set the tone for the entire communication. It’s your first opportunity to make a positive impression and encourage swift action.

Why a Strong Subject Line Matters

When clients receive numerous messages daily, a strong subject line helps your request stand out in their inbox. An effective subject line provides clarity, sparks interest, and motivates the recipient to open the message without hesitation. It helps ensure that your request isn’t overlooked or lost among other less urgent emails.

Tips for Crafting an Effective Subject Line

Here are some key strategies for creating a compelling subject line:

- Be Clear and Direct: Ensure the recipient knows exactly what the message is about. Phrases like “Payment Due” or “Action Required: Outstanding Balance” make it clear.

- Include Key Information: Mention the due date or the amount owed to increase the urgency of the request.

- Keep It Concise: Aim for brevity while still conveying the necessary details. Long subject lines may get cut off, especially on mobile devices.

- Avoid Being Too Pushy: Use polite language to remain professional and avoid sounding too aggressive. For example, “Reminder: Payment Due” is more effective than “Final Notice” or “Immediate Action Required.”

By taking the time to create an effective subject line, you increase the likelihood that your request will be noticed and acted upon quickly. A strong subject line can boost your payment collection process and help you maintain positive client relationships.

Legal Considerations for Invoice Emails

When sending payment requests, it is essential to be aware of the legal requirements and best practices to ensure that your communications are compliant with relevant laws. Incorrectly phrased or poorly formatted requests could lead to misunderstandings, disputes, or even legal consequences. Understanding the legal framework helps protect both your business and your client relationships, ensuring that all transactions are conducted fairly and transparently.

Key Legal Elements to Include

There are several critical elements that must be included in payment requests to ensure legal compliance. These elements help provide clarity and protect both parties involved in the transaction.

- Clear Terms and Conditions: Always specify payment terms, including the due date, the amount owed, and any penalties or fees for late payments. This helps avoid ambiguity and potential disputes.

- Accurate Business Information: Include your business name, contact details, and relevant registration numbers. This ensures the recipient knows who they are dealing with and can verify your legitimacy.

- Payment Methods and Instructions: Clearly outline the available payment methods and any associated instructions, making it easy for the recipient to complete the transaction.

- Late Payment Fees: If applicable, mention any late payment fees or interest that will apply if the payment is not received on time. Ensure these fees are in line with the law and previously agreed upon.

Legal Pitfalls to Avoid

While it’s important to include the necessary legal details, it’s equally important to avoid certain mistakes that could put you at risk.

- Ambiguous Language: Vague or unclear language can lead to misunderstandings and make it difficult to enforce payment terms. Be specific and precise in your requests.

- Failure to Provide Payment Options: If the payment methods are not clearly communicated, it can cause delays or confusion. Always include clear instructions on how the payment can be made.

- Unclear Payment Due Dates: Failing to specify an exact due date or not stating it clearly can lead to unnecessary disputes and late payments.

By following these legal considerations, you ensure that your payment requests are clear, professional, and legally sound. Being transparent about payment terms, methods, and any penalties for late payments protects your business and fosters positive relationships with clients.

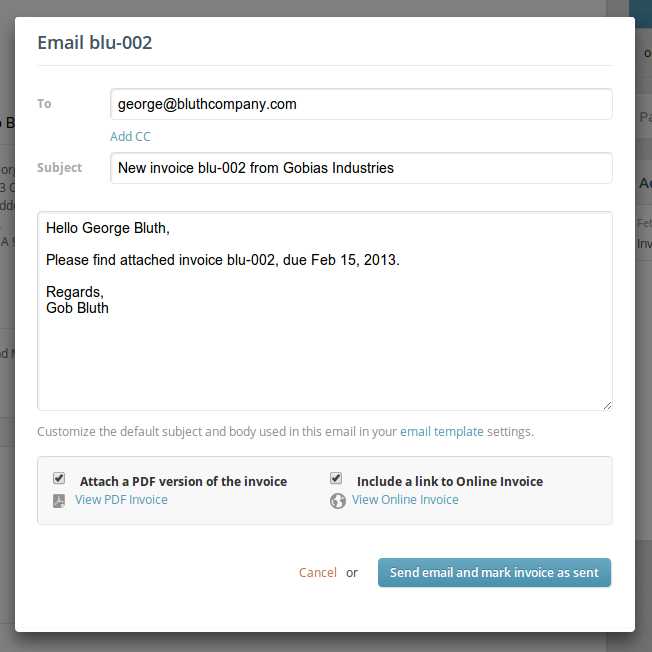

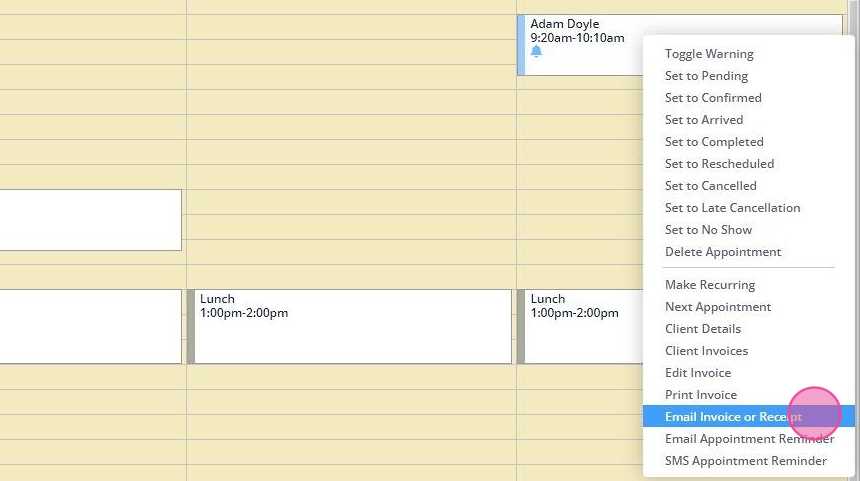

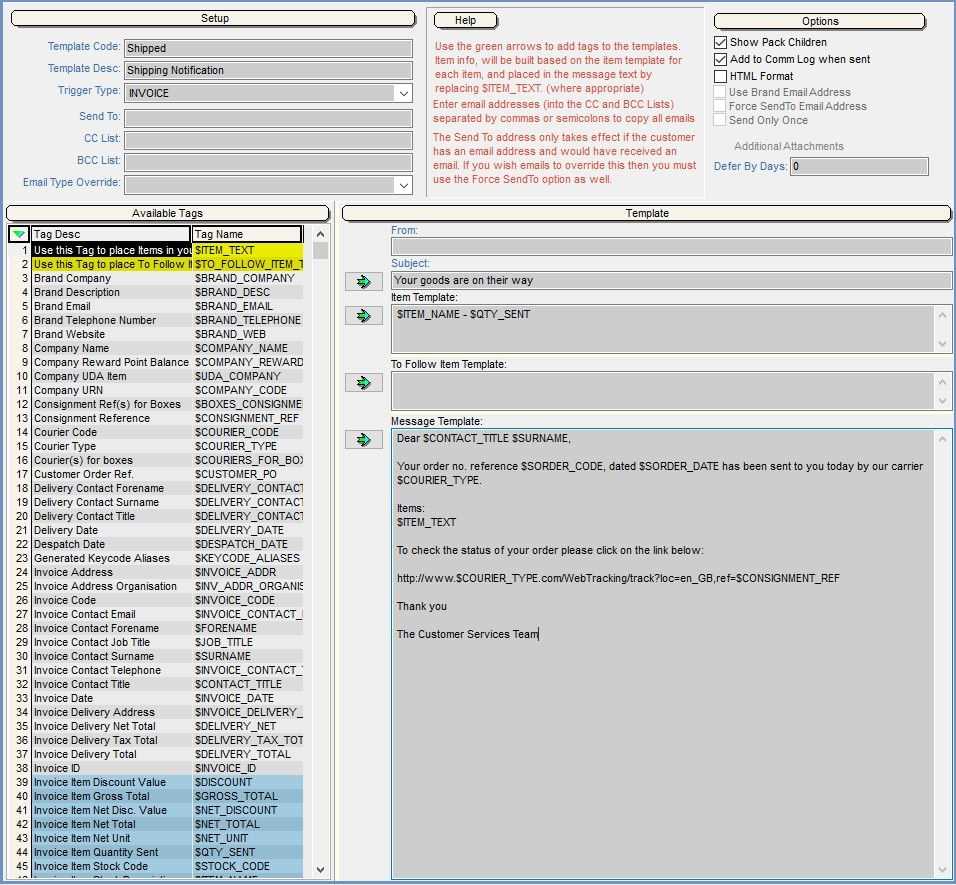

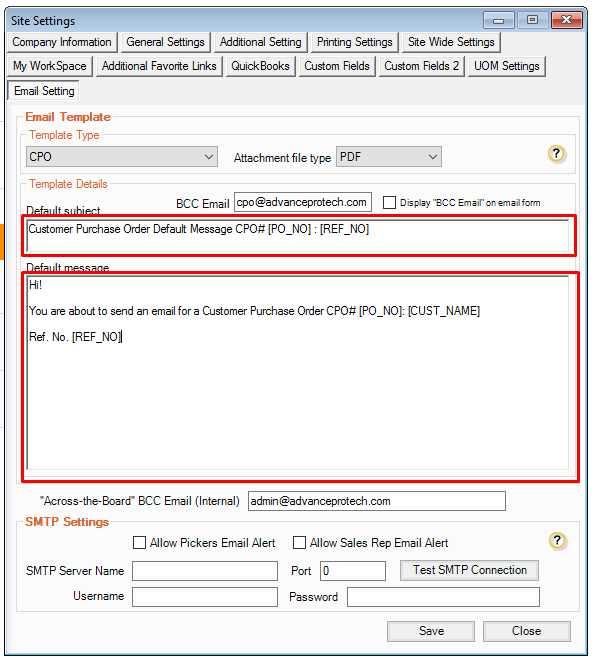

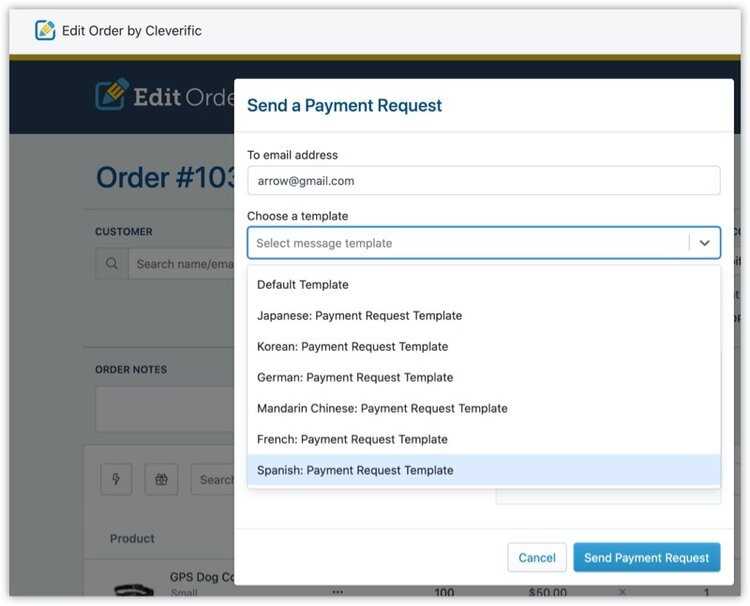

Automating Invoice Email Sending

Automating the process of sending payment requests can significantly streamline business operations, save time, and reduce human error. By using automated systems, businesses can ensure that clients receive timely, consistent, and professional communications without the need for manual input for each transaction. This not only improves efficiency but also ensures that reminders and payment requests are sent promptly, helping to maintain cash flow and avoid overdue accounts.

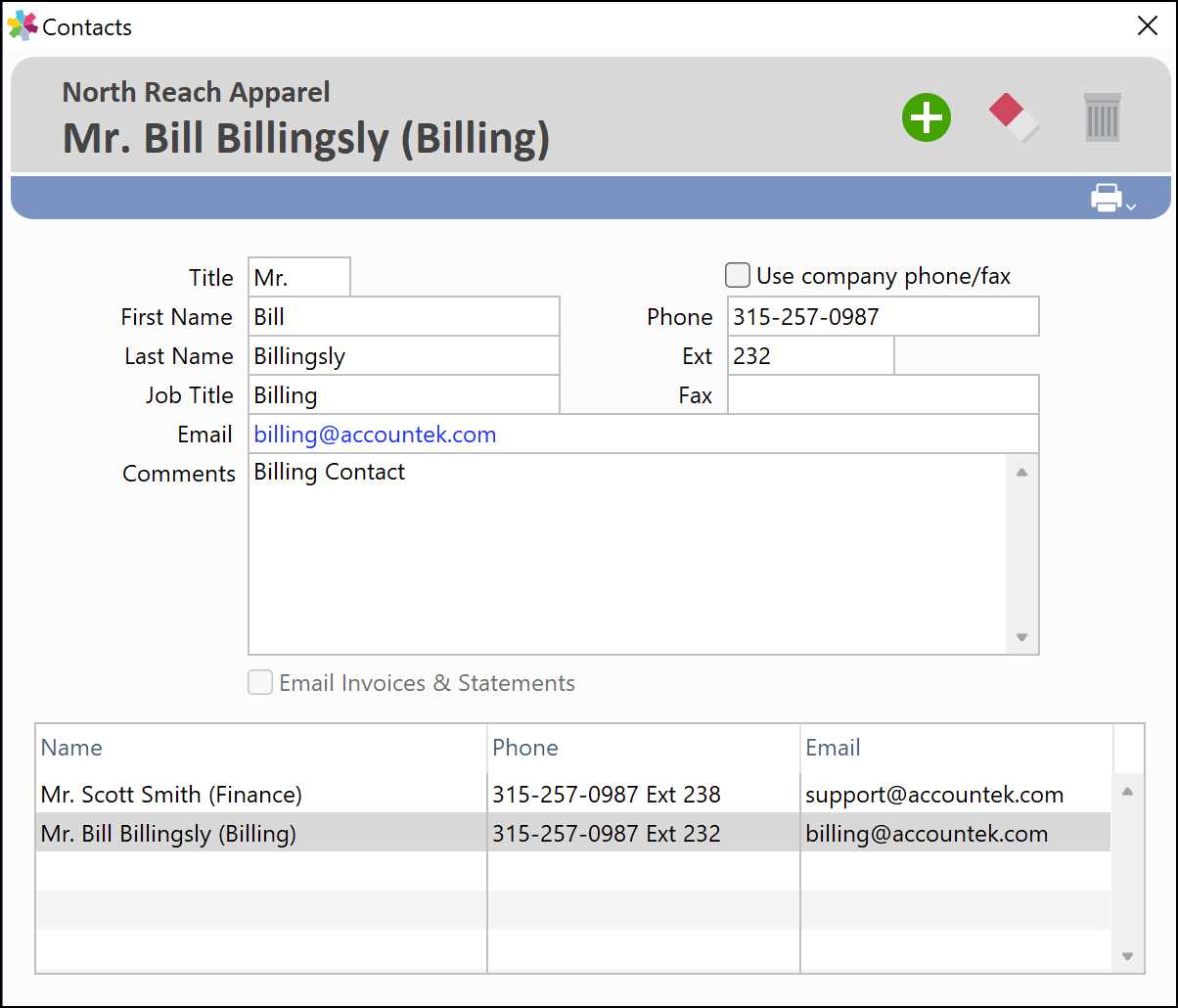

Automating this process can be done through various software solutions that integrate with your accounting or invoicing systems. These systems can schedule and send payment requests automatically based on the dates set in your financial records. Additionally, they can include client-specific details, ensuring that each communication is personalized without requiring manual adjustments.

Benefits of Automation

Here are some of the key advantages of automating payment request communication:

- Time Savings: Automation eliminates the need for repetitive manual tasks, allowing your team to focus on more important activities.

- Consistency: Automatic reminders and payment requests ensure that each client receives a communication at the right time, reducing the risk of late payments.

- Accuracy: With automation, there is a reduced risk of human error when entering payment details or client information.

- Professionalism: Automation systems can ensure that all communications maintain a high standard of professionalism, reinforcing your brand’s reputation.

How to Implement Automation

To get started with automating your payment requests, consider the following steps:

| Step | Action |

|---|---|

| Select Automation Software | Choose a solution that integrates with your current accounting system and fits your business size and needs. |

| Set Up Payment Schedules | Configure the system to automatically send requests based on the payment due dates in your records. |

| Customize Client Communications | Ensure the system is personalized to include client names, due amounts, and specific payment instructions. |

| Monitor and Adjust | Regularly review the automated process for accuracy and make adjustments as needed to ensure everything runs smoothly. |

By automating the sending of payment requests, you can increase operational efficiency, reduce errors, and improve your overall billing process. It frees up resources while ensuring that your clients receive timely and professional reminders to make payments on time.

Tracking Invoice Email Deliverability

Ensuring that your payment requests are successfully delivered to clients is a crucial aspect of managing timely payments. Monitoring the delivery of these communications helps you identify potential issues with email filters, spam classifications, or incorrect recipient addresses. By tracking deliverability, businesses can take proactive steps to address any obstacles that may prevent clients from receiving important payment reminders or requests.

Effective deliverability tracking allows businesses to measure the success rate of their communications, pinpoint delivery failures, and analyze open rates. These insights provide valuable feedback, enabling you to refine your approach and ensure that your communications are reaching the intended audience in a timely and reliable manner.

Why Deliverability Matters

Without proper monitoring, even the best-crafted payment request might never reach the recipient. Common issues like incorrect email addresses, poor sender reputation, or spam filters can prevent your communications from reaching your clients. If clients do not receive these important reminders, payments could be delayed, leading to cash flow issues for your business.

Best Practices for Monitoring Deliverability

Here are some key practices to help track and improve the deliverability of your payment requests:

- Use a Reliable Email Service Provider: Choose a provider with strong deliverability rates and reporting tools to track the status of sent messages.

- Monitor Bounce Rates: Regularly check for email bounces or failures to identify invalid addresses or server issues.

- Check Spam Filters: Ensure that your communication doesn’t get flagged as spam. Use best practices for subject lines and content to avoid being marked as unwanted.

- Track Open and Click Rates: Monitor how often recipients open your communication and follow through on payment links to gauge engagement.

By implementing these practices, you can ensure that your payment requests are successfully delivered to clients, improving your chances of receiving timely payments and avoiding any unnecessary payment delays.