Essential Invoice Email Body Template for Clear and Professional Billing

Sending payment requests in a professional and clear manner is essential for maintaining smooth business relationships. A well-written message helps avoid confusion and ensures timely settlements. It serves as a formal reminder, reinforcing the terms of the transaction while maintaining a courteous tone.

When drafting such messages, the right structure and tone are key. You want to communicate all necessary details, such as amounts and due dates, without overwhelming the recipient. A clear, concise approach fosters trust and shows professionalism, helping to improve the efficiency of your billing process.

In this guide, we will explore how to craft effective communication that not only serves as a reminder but also encourages prompt payments. By customizing your approach, you can tailor your communication to different clients and situations, ensuring it always aligns with your business needs.

Invoice Email Body Template Guide

Creating a clear and professional message for requesting payment is essential to ensure that your clients understand the terms and are motivated to settle their dues promptly. A well-crafted message should convey all the necessary details in a straightforward manner while maintaining a polite and formal tone. The key is to strike a balance between being informative and concise, ensuring that the recipient doesn’t feel overwhelmed while still having all the information they need at hand.

To help you write effective payment reminders, it’s important to follow a few simple guidelines. These will allow you to tailor each message to fit the specific needs of your business, while also fostering positive relationships with your clients. Below are some key elements to include in your communication:

Key Elements to Include

When composing your payment reminder, make sure to include the following essential components:

| Element | Description |

|---|---|

| Subject Line | Clear and concise subject lines grab the recipient’s attention and let them know the purpose of the message. |

| Introduction | Begin with a polite greeting, followed by a brief introduction that references the transaction and the amount due. |

| Details of the Payment | Provide a breakdown of the amount due, including any applicable taxes or discounts, and the payment deadline. |

| Call to Action | Include a clear and direct request for payment, along with any instructions on how to proceed with the payment. |

| Closing | End with a polite closing statement, thanking the recipient for their business and offering assistance if needed. |

Customizing Your Request

While the basic structure remains the same, you should always customize the content based on the specifics of each client and transaction. Whether it’s a first-time customer or a long-term partner, adjusting the tone or adding personalized details can make a big difference in how the message is received. A thoughtful, individualized approach shows that you value the client and their business, and can help maintain strong professional relationships in the long term.

Why Professional Emails Matter in Billing

Clear and well-structured communication is essential when it comes to managing payments in any business. A professional approach not only ensures that the recipient understands the payment expectations, but also builds trust and strengthens business relationships. The way a company communicates about financial matters can impact the perception of its reliability and professionalism.

Effective communication can make a significant difference in how promptly and smoothly payments are processed. By maintaining a formal tone, being clear about payment terms, and showing appreciation for the client’s business, you are more likely to receive timely responses and prevent misunderstandings that could delay transactions.

Building Trust and Credibility

Professional messages create a sense of credibility and respect. Clients are more likely to trust a business that demonstrates attention to detail and courtesy in its financial communications. A well-crafted message ensures that the client knows exactly what is expected and when, reducing the chance of late payments or disputes.

Encouraging Timely Payments

A well-constructed message can motivate clients to settle their accounts promptly. By clearly stating due dates, amounts, and payment methods, you make it easier for clients to understand their obligations. A professional tone conveys urgency without being demanding, which can lead to faster payments.

In summary, maintaining professionalism in all aspects of your billing communications not only improves your payment collection process but also enhances your reputation and fosters stronger business relationships.

How to Write an Effective Invoice Email

When requesting payment from clients, the clarity and tone of your message play a crucial role in ensuring a smooth transaction. A well-crafted communication can facilitate prompt payments, maintain professionalism, and reduce the likelihood of misunderstandings. The key to an effective payment request is providing all necessary details in a straightforward manner, while keeping the tone courteous and respectful.

By following a structured approach and including essential elements, you can create a message that not only communicates your needs clearly but also fosters a positive relationship with the recipient. Below are some important guidelines to consider when writing your payment request.

Essential Components of a Payment Request

To ensure your message is complete and easily understood, be sure to include the following elements:

| Component | Description |

|---|---|

| Subject Line | Ensure the subject is clear and straightforward, letting the recipient know the purpose of the message. |

| Greeting | Begin with a polite greeting that addresses the recipient by name, if possible. |

| Transaction Details | Include key information such as the amount due, the service or product provided, and the payment due date. |

| Payment Instructions | Provide clear instructions on how the payment should be made, including methods and any necessary account details. |

| Friendly Reminder | Politely remind the recipient of the due date and express appreciation for their timely payment. |

| Closing | Conclude with a courteous sign-off, offering assistance if necessary and expressing thanks for their business. |

Best Practices for Crafting a Payment Request

While the components listed above are essential, the tone and formatting of your message can also impact its effectiveness. Keep the language professional but friendly, and avoid sounding overly aggressive or too casual. A positive and respectful approach encourages clients to pay on time and fosters a sense of goodwill.

In conclusion, writing an effective request requires careful attention to detail and a balance of professionalism and courtesy. By following these guidelines, you can ensure your messages are clear, respectful, and more likely to result in timely payments.

Key Elements of an Invoice Email

When crafting a request for payment, it’s essential to ensure that the communication includes all necessary details in a clear, organized manner. A well-structured message makes it easier for the recipient to understand their financial obligations and take action promptly. Including the right elements can streamline the process, reduce confusion, and help maintain a positive relationship with the client.

Below are the crucial components that should be included in every payment request, ensuring clarity and professionalism in your communication.

Important Components of a Payment Request

Each payment request should contain the following elements to ensure that the recipient has all the information they need:

| Component | Description |

|---|---|

| Subject Line | Start with a subject that clearly indicates the purpose of the communication, such as the amount due or the payment deadline. |

| Salutation | Greet the recipient politely, addressing them by name or title to add a personal touch to the message. |

| Payment Details | Provide a breakdown of the amount due, including any applicable taxes, discounts, and the total amount owed. |

| Due Date | Clearly state when the payment is due, providing enough time for the recipient to process the transaction. |

| Payment Instructions | Specify how the recipient can make the payment, including the payment method and any necessary account details. |

| Friendly Reminder | A polite reminder about the due date and the importance of making the payment on time. |

| Closing | End with a courteous thank you, offering assistance or clarification if needed, and expressing appreciation for the business. |

Best Practices for Crafting Payment Requests

While these components are essential, the way they are presented can make a big difference in how your message is received. Keep the tone professional yet friendly, and ensure that the layout is easy to read. Organize the information logically, using bullet points or tables if necessary, to enhance clarity and readability.

In conclusion, including the right elements in your payment request can significantly improve the chances of receiving prompt payment. A well-structured message not only conveys professionalism but also fosters good communication and stronger business relationships.

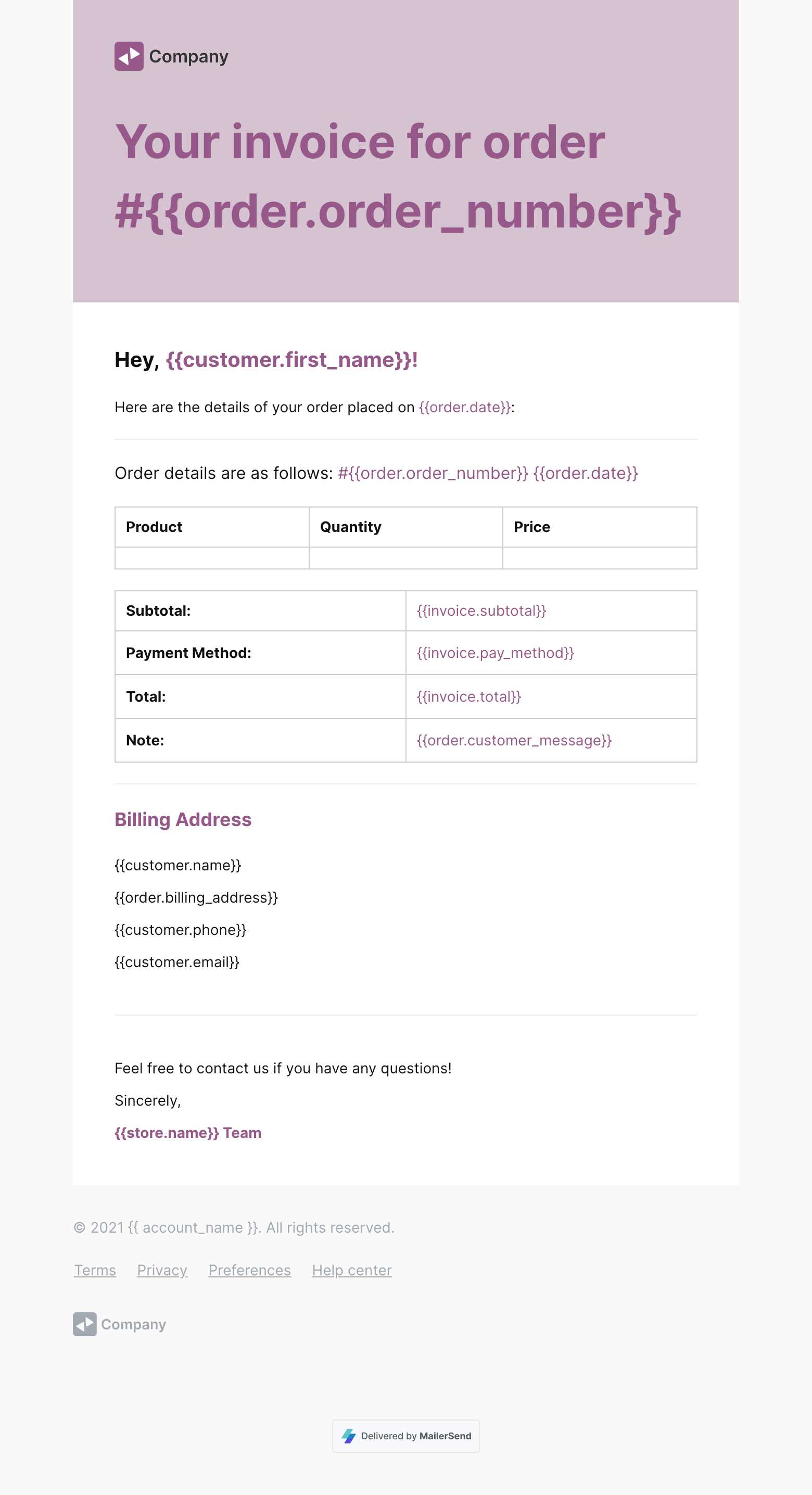

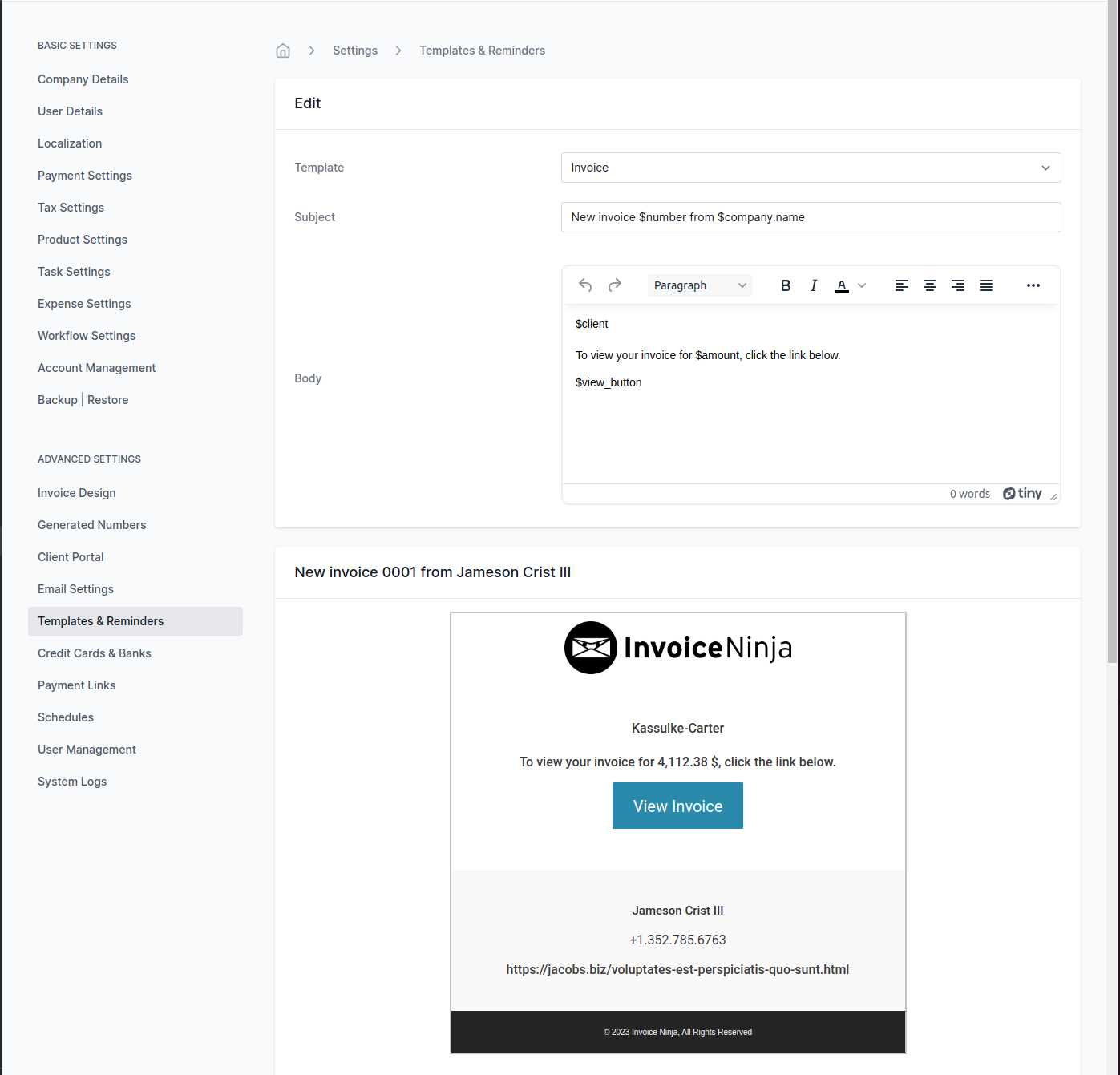

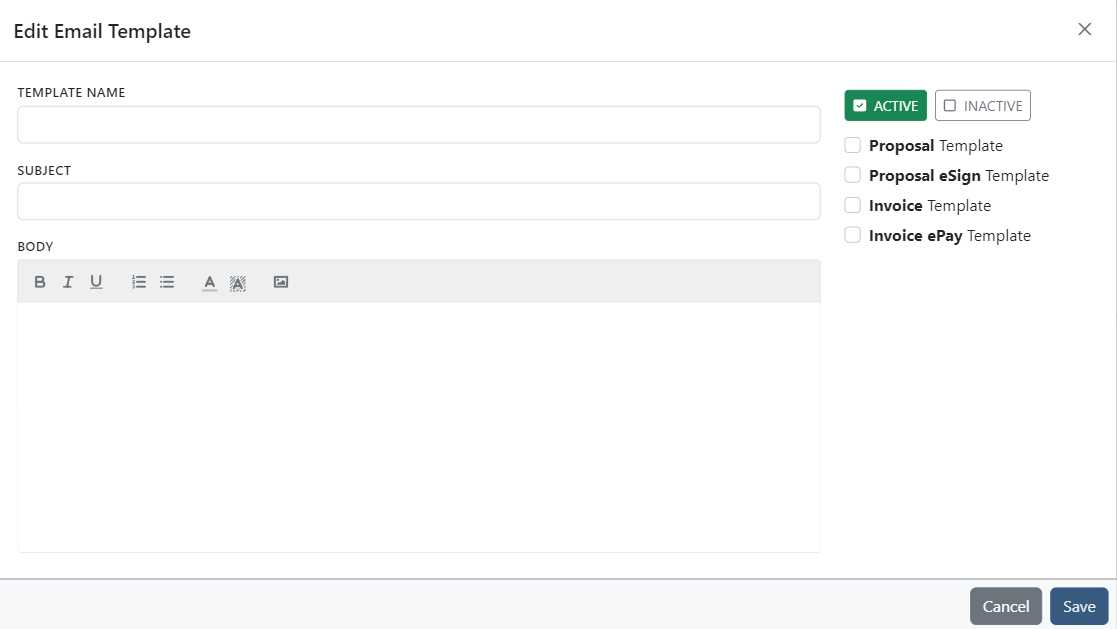

Customizing Your Invoice Email Template

Tailoring your payment request to suit the unique needs of each client is an essential aspect of maintaining professional and effective communication. Personalizing your message ensures that the recipient feels valued and helps create a positive experience. Customization allows you to adjust the tone, details, and format of the message to better align with your business style and the specific circumstances of each transaction.

Here are some ways you can customize your payment request message to make it more relevant and impactful:

Personalizing the Content

Personalizing the content of your communication can help strengthen your client relationships. Consider the following tips:

- Addressing the Recipient by Name: Start with a personalized greeting using the client’s name or title to create a more personal connection.

- Referencing Previous Communications: Mention previous interactions, agreements, or purchases to show that you are aware of the client’s history with your business.

- Adjusting the Tone: Tailor the level of formality based on your relationship with the client–more formal for corporate clients, and a friendlier tone for long-term partners.

Including Relevant Details

Customization also involves including specific details that make the request more transparent and client-focused:

- Special Payment Instructions: If the client prefers a specific payment method or requires special instructions, make sure these are clearly outlined in the message.

- Discounts or Offers: If applicable, mention any discounts or offers that apply to the payment, such as early payment discounts or loyalty rewards.

- Customizable Reminders: Depending on the payment timeline, include gentle reminders if the payment is approaching its due date, or if a delay has already occurred.

Formatting and Layout

How your message looks can also impact how it is received. Customizing the layout can make the request easier to read and more visually appealing:

- Clear and Concise Layout: Use short paragraphs, bullet points, and headers to make the content scannable and easy to digest.

- Incorporating Your Branding: Ensure that your logo, colors, and business contact information are included to maintain consistency with your brand identity.

- Professional Sign-Off: Always end the message with a professional closing, such as “Best regards” or “Sincerely,” followed by your name or business name.

In conclusion, customizing your payment request ensures that each client feels personally attended to, and helps foster stronger relationships. A tailored approach can also improve the chances of timely payments, making your communication more effective and efficient.

Best Practices for Invoice Email Formatting

Proper formatting is key when crafting a payment request message. A clean, well-organized layout ensures that the recipient can easily read and understand the necessary details. The right formatting not only improves the readability of your communication but also conveys professionalism, making it more likely that the recipient will act promptly on the request.

Here are some best practices to follow when formatting your payment requests to make them both visually appealing and easy to follow:

Maintain a Clear Structure

A well-structured message makes it easier for the recipient to find important details quickly. Consider the following tips for creating a clear layout:

- Use Short Paragraphs: Break your message into short, digestible paragraphs to avoid overwhelming the reader.

- Include Headers: Use headings to segment different sections of the message, such as “Payment Details” or “Due Date.” This makes it easier for the reader to scan the content.

- Use Bullet Points or Tables: Lists and tables help organize important details, like amounts owed or payment instructions, in a way that’s easy to follow.

- Avoid Overloading with Information: Provide just enough detail to be clear, but avoid cluttering the message with excessive information.

Use Professional and Readable Fonts

The choice of font plays an important role in how your message is perceived. Make sure the text is easy to read and reflects your business professionalism:

- Choose Simple Fonts: Use clean, easy-to-read fonts like Arial, Helvetica, or Times New Roman, which are standard and professional.

- Maintain Font Size Consistency: Ensure the font size is uniform throughout the message. Avoid using excessive bolding or italics that could distract from the content.

- Use Sufficient Line Spacing: Adequate spacing between lines and sections ensures that the content doesn’t look cramped and is easy to read.

Keep the Message Visually Balanced

Proper alignment and spacing create a visually appealing layout that enhances readability:

- Align Text Left: Left-aligning your text improves readability and prevents awkward line breaks.

- Use White Space: Ensure there is plenty of white space around text blocks and between sections to avoid a cluttered appearance.

- Consistent Margins: Set uniform margins around the edges of the message to give it a polished, neat look.

In conclusion, following these formatting best practices will help you craft professional and easy-to-read payment requests. A well-organized, visually balanced message not only makes the content more accessible to the recipient but also reinforces your business’s professionalism and attention to detail.

Tips for Clear Invoice Email Communication

Clear communication is essential when requesting payments from clients. Ensuring that your message is easy to understand, free from ambiguity, and provides all necessary information is key to avoiding delays and misunderstandings. A well-written request helps the recipient quickly grasp what is expected and reduces the likelihood of disputes over payment terms.

Here are some effective tips to improve clarity in your payment requests:

Be Direct and Concise

A clear message is a direct message. Avoid unnecessary jargon or overly complex language. Focus on the essential details, and present them in a way that is easy for the recipient to understand.

- State the Purpose Upfront: Begin by clearly explaining the reason for your communication, such as “This is a reminder regarding your outstanding balance.” This sets the tone for the rest of the message.

- Use Simple Language: Avoid technical terms or ambiguous words that could confuse the recipient. Opt for straightforward language that anyone can understand.

- Get to the Point Quickly: Keep your message focused on the most important aspects – the amount due, payment methods, and due dates.

Provide Complete and Accurate Details

For the recipient to act swiftly, make sure all necessary details are included and easy to locate within the message.

- Include the Amount Due: Clearly state the total amount that is owed, including any applicable fees or taxes, if necessary.

- Specify Payment Methods: Outline how the payment can be made, including any account details or links for online payments.

- State the Deadline: Clearly indicate the due date for the payment to avoid confusion and ensure prompt action.

- Breakdown of Charges: If the payment involves multiple charges, provide a detailed breakdown, either in a table or a bullet-point list, to avoid any confusion.

Maintain a Professional and Friendly Tone

While it’s important to be clear, the tone of your communication also plays a role in how it’s received. A professional yet friendly tone encourages prompt payment while maintaining a positive relationship.

- Use Polite Language: Always use courteous language, such as “Please” and “Thank you,” even when reminding the client of overdue payments.

- Avoid Harsh or Aggressive Language: Keep the tone respectful, even if the payment is late. A calm, polite reminder is far more effective than an aggressive approach.

- Express Appreciation: Thank the client for their business and express your appreciation for their prompt attention to the matter.

Double-Check for Errors

Before sending your message, double-check for any spelling, grammar, or factual errors. A well-proofread request reflects your attention to detail and enhances your professional image.

- Proofread the Message: Ensure that there are no typos, spelling mistakes, or unclear phrases that could confuse the recipient.

- Verify Payment Details: Double-check that all payment details, such as account numbers or links, are

Common Mistakes to Avoid in Invoice Emails

When sending a request for payment, it’s crucial to avoid common errors that can lead to confusion, delays, or even strained relationships with clients. Small mistakes in communication can have a big impact on how professional your business appears, as well as how quickly your payments are processed. Recognizing and correcting these mistakes can help ensure smoother transactions and maintain a positive rapport with your clients.

Here are some common mistakes to avoid when drafting your payment requests:

Missing or Incorrect Information

Omitting important details or providing inaccurate information is one of the most common mistakes and can cause unnecessary delays in payment processing.

- Incomplete Payment Details: Failing to provide the full breakdown of charges, payment methods, or necessary account information can confuse the recipient.

- Incorrect Due Dates: Ensure the due date is clearly stated and accurate. Misleading or vague deadlines can cause misunderstandings.

- Typos and Errors: Small mistakes, such as incorrect amounts or account numbers, can lead to mistakes in payments and damage your credibility.

Unprofessional Tone or Language

While it’s important to be clear, the tone of your communication should remain polite and professional. An overly casual or harsh tone can make the recipient feel uncomfortable or defensive.

- Being Too Aggressive: Demanding payment or using threatening language can harm your client relationships and may even delay payment further.

- Overuse of Informal Language: Using overly casual language may seem unprofessional, especially when dealing with clients in a business context.

- Lack of Politeness: Always maintain a respectful and courteous tone, even when following up on overdue payments.

In conclusion, paying attention to the details and ensuring your communication is professional and complete can help avoid mistakes that hinder timely payments and affect your business reputation. By steering clear of these common errors, you ensure smoother transactions and stronger relationships with your clients.

How to Personalize Your Invoice Email

Personalizing your payment request not only makes your communication more engaging but also helps build stronger relationships with your clients. A personalized message shows that you are attentive to the specific needs of the recipient, rather than sending a generic, impersonal request. Tailoring your message can make a significant difference in how the client perceives the request and may encourage prompt action.

Here are some effective ways to personalize your payment communication:

1. Address the Recipient by Name

Start your message by addressing the recipient by their full name or title. This simple gesture can make the interaction feel more personal and less like a generic transaction.

- Use the Client’s Name: For example, “Dear Mr. Smith” or “Hello Sarah.” This makes the message feel more customized and less automated.

- Acknowledge Their Relationship with You: If applicable, mention any recent projects, orders, or collaborations to add a personal touch.

2. Tailor the Content Based on Previous Interactions

Referring to past business interactions can show the client that you value their relationship and are aware of their specific needs.

- Reference Previous Agreements: If you have an ongoing contract or arrangement, mention this to provide context for the payment request.

- Include Custom Payment Terms: If you’ve discussed or agreed on specific payment conditions, ensure these are included in the message to reflect your understanding of their preferences.

In conclusion, personalizing your payment request can help foster a stronger client relationship and improve the likelihood of prompt payment. By adding small touches, such as using the client’s name or referencing previous engagements, you create a message that is more engaging and less transactional.

Maintaining a Professional Tone in Emails

When requesting payments, it’s essential to maintain a tone that is both respectful and professional. How you communicate directly impacts how your message is received and can influence the likelihood of timely payments. Striking the right balance between being courteous and clear ensures that the recipient understands the importance of the request without feeling pressured or alienated.

Here are some strategies to help you maintain a professional tone in your payment communications:

- Be Polite and Courteous: Use polite language such as “please” and “thank you” to maintain a respectful tone throughout the message. Even when reminding the recipient about overdue payments, avoid harsh language.

- Stay Neutral and Objective: Keep your language neutral and avoid expressing frustration or anger, even if payments are delayed. A calm and collected approach is always more effective than an emotional one.

- Use Formal Greetings and Closures: Start with a formal greeting like “Dear [Client’s Name]” and end with a respectful closing such as “Best regards” or “Sincerely.” These small touches contribute to the professional nature of the message.

In conclusion, maintaining a professional tone in your payment requests ensures that the recipient feels respected and valued while making it clear that the matter is important. By remaining courteous and neutral, you create an atmosphere that fosters positive interactions and encourages prompt payment without risking any misunderstandings or strained relationships.

When to Send Invoice Emails to Clients

Timing is crucial when it comes to sending payment requests. Knowing the right moment to reach out can help ensure prompt responses and minimize delays. Sending a request at the wrong time may result in the client overlooking it or delaying payment, whereas sending it at the right time can improve your cash flow and maintain a good relationship with the client.

Here are some key moments when you should consider sending a payment request to your clients:

1. After a Completed Transaction

One of the most common times to send a payment request is immediately after completing a transaction or service. This helps establish clarity about what is due and ensures that both parties are on the same page.

- Prompt Delivery: Send the request as soon as the service is provided or the product is delivered to avoid confusion or forgetting the details.

- Clear Payment Terms: Specify when the payment is due, ensuring that the client is aware of the timeline from the very beginning.

2. Before the Due Date

Sending a reminder before the payment is due can help ensure that your client doesn’t forget or overlook the payment. It also demonstrates professionalism and foresight.

- Early Reminder: Sending a gentle reminder a few days before the due date can prompt the client to prepare the payment on time.

- Clarity on Deadline: Make sure the client knows exactly when the payment is due to avoid any miscommunication.

3. After the Due Date

If the payment is late, it’s important to follow up promptly. A polite but firm reminder after the due date can help maintain a healthy cash flow without damaging the relationship.

- Polite Follow-Up: Send a follow-up request as soon as the payment is overdue, but ensure the tone remains respectful and professional.

- Provide Clear Instructions: If necessary, remind the client of the payment method or offer any assistance they might need to process the payment.

In conclusion, knowing when to send a payment request is vital for ensuring timely payments and smooth transactions. By sending requests promptly after a service is completed, providing reminders before the due date, and following up respectfully after the due date, you can keep your cash flow healthy and maintain professional relationships with your clients.

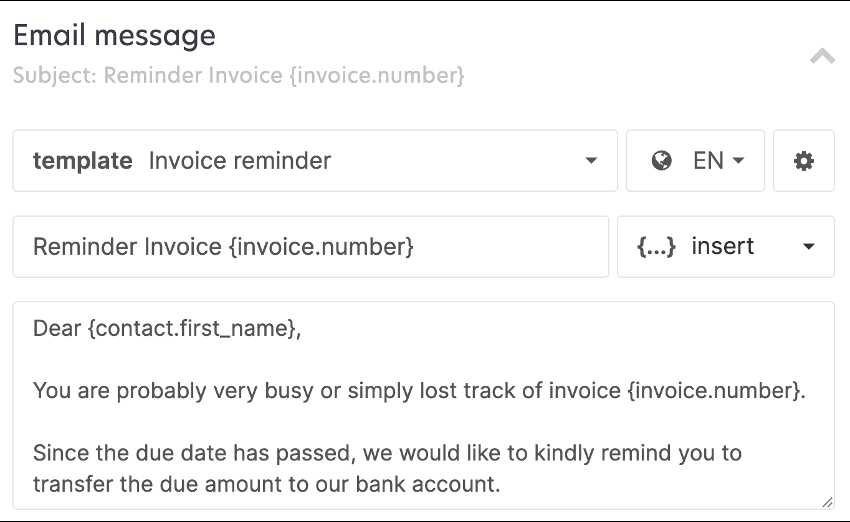

How to Follow Up on Unpaid Invoices

When payments are overdue, following up with clients in a professional and respectful manner is essential to maintaining cash flow and preserving business relationships. A well-crafted follow-up request ensures that the client understands the outstanding balance while also reinforcing your professionalism. It’s important to balance firmness with courtesy to encourage timely payment without damaging the working relationship.

Here are some key steps to effectively follow up on unpaid balances:

1. Send a Friendly Reminder

If the payment is only slightly overdue, begin with a gentle reminder. A polite, non-confrontational message can often be enough to prompt action without causing tension.

- Express Understanding: Acknowledge that the client may have overlooked the payment or had other priorities, showing empathy for their situation.

- Include Clear Payment Details: Make sure to clearly state the amount due, the due date, and any applicable payment methods to avoid any confusion.

- Set a New Deadline: If necessary, provide a new deadline for payment to create urgency.

2. Be Firm but Professional After a Few Days

If the payment remains unpaid after the initial reminder, you may need to be more direct. However, it’s essential to maintain a professional and calm tone to avoid damaging your relationship.

- State the Consequences: Politely but firmly outline any late fees, penalties, or interruptions to services that might result from further delays.

- Offer Payment Assistance: If appropriate, provide payment options or clarify any issues the client might be facing in processing the payment.

- Reaffirm Your Professionalism: Reiterate your commitment to working with the client and resolving the matter quickly and amicably.

3. Escalate If Necessary

If the payment is significantly overdue and the client has not responded to earlier reminders, you may need to escalate the situation. This might involve sending a final notice or involving a collections agency, depending on your business policies.

- Final Notice: A final reminder should clearly state that this is the last communication before more serious actions are taken. Be firm but polite.

- Consider Legal Action: If the amount is substantial and all attempts to reach an agreement have failed, you may need to consider legal options. Always consult with a professional before pursuing this route.

In conclusion, following up on unpaid balances is a delicate process that requires patience, professionalism, and persistence. By approaching the situation with a clear, polite, and firm strategy, you can increase the chances of timely payment while maintaining good client relationships.

Invoice Email Template for Freelancers

As a freelancer, sending a professional payment request is crucial for maintaining a positive relationship with clients while ensuring timely payments. A well-crafted message not only conveys the amount due but also reinforces your professionalism and attention to detail. Below is an example of how a freelancer might structure a payment request to ensure clarity and professionalism.

Here’s a simple, customizable payment request structure:

Section Example Subject Line Payment Request for Recent Project Completion Greeting Dear [Client’s Name], Opening Line I hope this message finds you well. I am writing to follow up on the payment for the recent work completed. Details of Work Done As per our agreement, the project titled [Project Name] was completed on [Completion Date]. Amount Due The total amount due is [Amount], as outlined in the project contract. Payment Instructions Kindly make the payment via [Payment Method]. Here are the payment details: [Include Payment Information]. Due Date The payment is due on [Due Date]. Please let me know if you need any additional information to process this. Closing Statement If you have any questions or concerns, feel free to reach out. I appreciate your prompt attention to this matter. Sign-Off Best regards,

[Your Name]

[Your Contact Information]In conclusion, customizing your payment request ensures professionalism and sets clear expectations with your clients. By maintaining transparency and politeness, you foster positive relationships that lead to repeat business and timely payments.

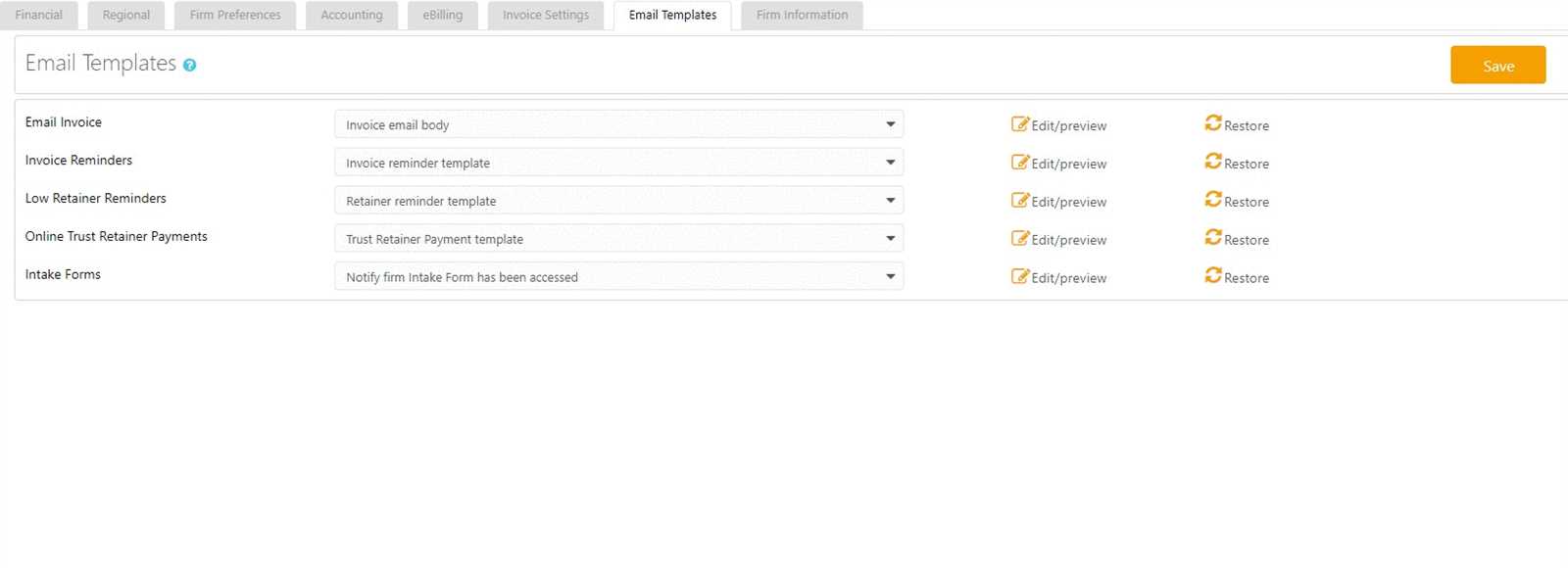

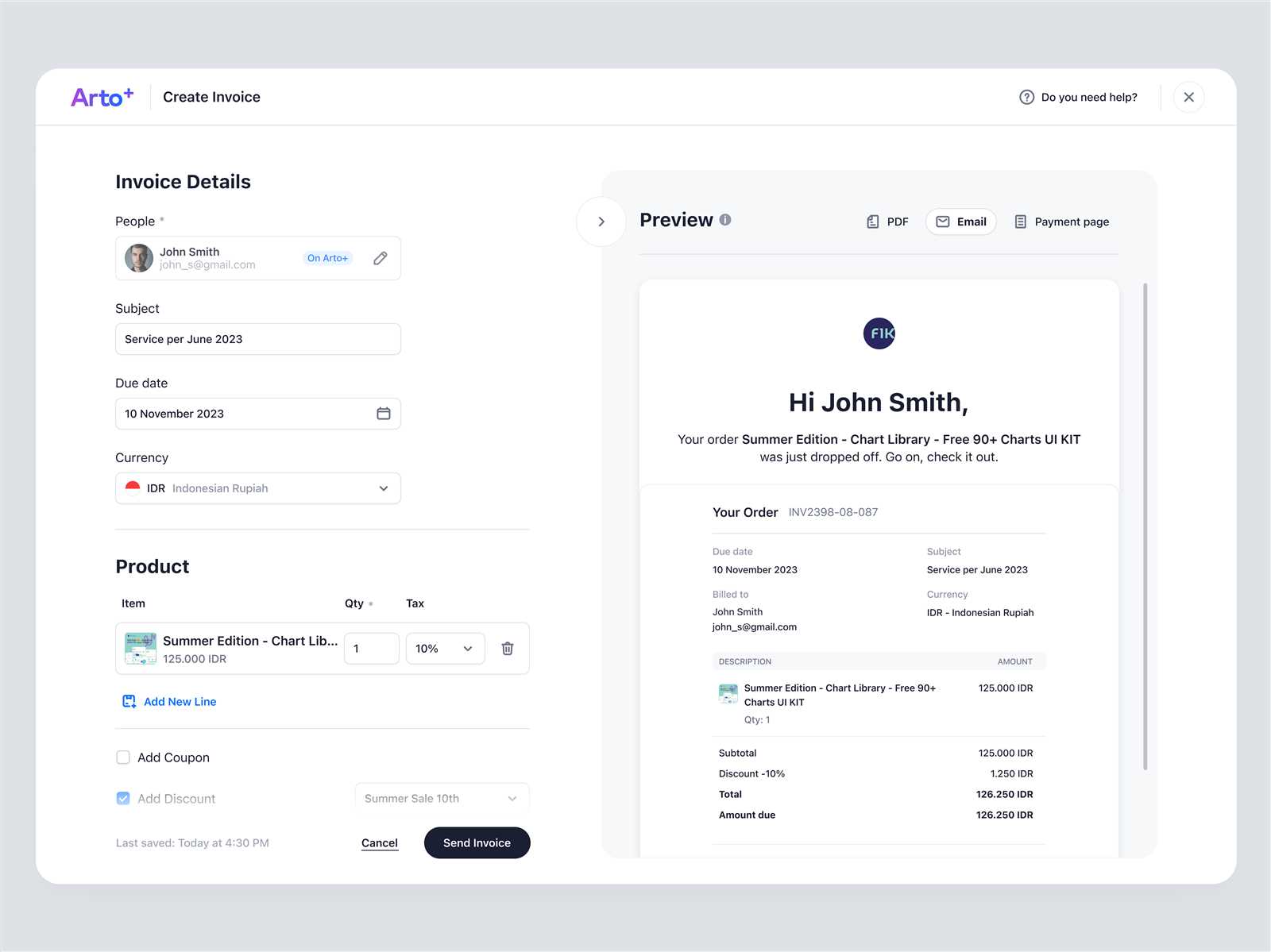

Automating Invoice Email Process

For businesses looking to streamline their billing process, automation can significantly improve efficiency and reduce the risk of human error. By automating the process of sending payment requests, you can ensure that clients receive timely reminders, reducing the chances of missed payments and freeing up valuable time for other tasks. Automation tools allow you to set up recurring schedules, customize messages, and track payment statuses without the need for manual intervention.

Here’s how automation can be applied to the payment request process:

Step Description Choose an Automation Tool Select a reliable invoicing or billing platform that supports automated payment requests. Popular tools include [Tool Name], [Tool Name], and [Tool Name]. Set Up Payment Schedules Configure recurring payment schedules based on your client contracts, whether it’s weekly, monthly, or per project. Customize Messages Personalize the content of the payment requests, ensuring that each message is appropriate to the specific client or project. Most platforms allow for dynamic fields like the client’s name, due amount, and payment instructions. Automated Reminders Set up reminders to be sent before the due date and again after the payment deadline has passed. This can help ensure that payments are not delayed. Track Payment Status Utilize the tool’s tracking features to monitor which payments have been made, which are overdue, and which are still pending. In conclusion, automating the process of sending payment requests not only saves you time but also reduces the chances of missed or delayed payments. With the right tools in place, you can ensure consistency, accuracy, and professionalism in your billing process while focusing on growing your business.

Best Tools for Sending Invoice Emails

When managing payment requests, utilizing the right software can significantly enhance your efficiency, professionalism, and ability to stay organized. With the right tools, businesses can automate the process, ensuring that payment reminders and details are sent out promptly and accurately. These platforms not only simplify invoicing but also help in tracking payments, managing client information, and maintaining consistency in communication.

Below is a list of some of the best tools available to streamline your payment request process:

1. FreshBooks

FreshBooks is a popular invoicing and accounting tool that is well-suited for small businesses and freelancers. It allows you to easily create professional invoices, track payments, and send reminders to clients.

Feature Description Customizable Invoices Create and customize invoices with your branding, and easily adjust for different client requirements. Recurring Billing Set up automatic billing for clients on a regular schedule (weekly, monthly, etc.). Payment Tracking Monitor the status of your payments in real time and receive notifications for overdue payments. 2. QuickBooks

QuickBooks is another widely used accounting platform that offers a variety of features for creating and sending professional payment requests. It also provides a comprehensive suite of financial tools to help you manage all aspects of your business’s finances.

Feature Description Online Payments QuickBooks allows clients to pay directly through the invoices, streamlining the payment process. Automated Reminders Set up automatic reminders to be sent to clients before and after payment due dates. Expense Tracking In addition to sending payment requests, QuickBooks also allows you to track your business expenses and manage taxes efficiently. 3. Zoho Invoice

Zoho Invoice is a robust and user-friendly tool that simplifies the invoicing process for freelancers and small businesses. It allows for easy creation, customization, and management of invoices while also enabling automated payment reminders.

Feature Description Time Tracking How to Handle Client Queries via Email Effective communication with clients is a cornerstone of any successful business. When clients have questions or concerns regarding billing or services, it’s essential to address them promptly and professionally. The way you respond can greatly impact client satisfaction and retention. Below, we discuss best practices for handling client queries, ensuring your responses are clear, courteous, and efficient.

Here’s a guide on how to effectively respond to client inquiries:

Step Recommendation 1. Acknowledge the Query Begin by acknowledging the client’s concern. Let them know you’ve received their message and will address it promptly. This shows attentiveness and reassures the client. 2. Provide Clear and Accurate Information Respond with clear, concise, and accurate details. Ensure your response answers the client’s question completely, avoiding unnecessary jargon. 3. Be Courteous and Professional Maintain a polite and professional tone throughout. Even if the query is regarding an issue, a calm and respectful tone helps to prevent escalation. 4. Offer Solutions or Alternatives If the client is raising a concern or issue, offer potential solutions or alternatives. If something is wrong, explain what actions will be taken to rectify the situation. 5. Follow Up if Needed If the query requires additional time to resolve, let the client know you will follow up within a specific timeframe. Always stick to any promises you make regarding follow-ups. In conclusion, responding effectively to client queries is essential for building trust and maintaining strong professional relationships. By being clear, respectful, and timely in your responses, you not only resolve issues efficiently but also enhance your client’s experience with your business.

Designing Your Invoice Email for Clarity

When sending payment requests to clients, clear and well-structured communication is key to ensuring your message is easily understood. A cluttered or confusing message can lead to delays or misunderstandings. By designing your message with clarity in mind, you help clients quickly grasp important details, such as the amount due, payment terms, and the actions they need to take. A clean, organized layout and simple language can go a long way in making the payment process smooth for both parties.

Here are some tips for creating a clear and effective payment request:

- Use a Clear and Direct Subject Line: Make sure the subject of your message clearly indicates its purpose. For example, “Payment Request for [Project Name]” or “Reminder: Payment Due for [Service].”

- Structure Your Message with Bullet Points: Bullet points help break down key information, such as the amount owed, the due date, and payment methods, making it easier for the recipient to understand at a glance.

- Include Relevant Details: Provide all necessary information in one place, including the total amount due, any discounts, late fees, and instructions for how to make the payment.

- Keep Your Language Simple: Use plain language and avoid jargon or overly complex terms. Ensure the message is straightforward, with no room for ambiguity.

- Highlight Important Dates: Emphasize due dates or payment deadlines, ideally in bold or underlined text, so they stand out to the reader.

- Offer Multiple Payment Methods: If possible, give clients a few options for paying, such as bank transfer, online payment portals, or credit card payments, to make it easier for them to settle the bill.

In conclusion, designing your payment request with clarity and simplicity in mind will help reduce confusion and foster a professional and efficient exchange. A well-organized message not only makes it easier for clients to pay on time but also builds trust and enhances your reputation as a reliable business partner.

Creating a Simple Invoice Email Template

When crafting a message to request payment, simplicity and clarity are essential. A straightforward and professional structure not only helps in delivering the key information but also ensures your client can quickly understand the purpose and take the necessary actions. By using a well-structured layout, you can create an effective message without overwhelming the recipient.

Here’s a simple structure for crafting a payment request message that conveys all the necessary details while maintaining a clean and professional look:

1. Greeting and Introduction

Start with a polite greeting, followed by a brief introduction. State the purpose of the message without unnecessary elaboration.

- Example: “Dear [Client’s Name], I hope this message finds you well.”

- Example: “I am writing to remind you about the payment for [Service/Product].”

2. Payment Details

Include the key payment information such as the amount due, the due date, and any relevant details that the client needs to know. Use bullet points to make it easy to read.

- Amount Due: $[Amount]

- Due Date: [Due Date]

- Payment Method: [Payment Method Options]

3. Closing and Contact Information

End the message by expressing appreciation for the client’s business and providing a clear call to action. You can also offer assistance if needed.

- Example: “Thank you for your business. Please let me know if you have any questions or need further details.”

- Example: “I look forward to receiving your payment soon. Feel free to reach out with any concerns.”

In conclusion, creating a simple and effective payment request message involves a clean structure, polite language, and clear details. By following these basic steps, you can ensure your messages are professional and easy to understand, promoting timely payments and positive client relationships.