How to Use an Editable Invoice Template for Your Business

In today’s fast-paced business world, having a streamlined and efficient way to manage financial documents is crucial. Businesses of all sizes rely on professional-looking, accurate records to ensure smooth transactions and maintain strong relationships with clients. Customizing your own documents can save both time and resources, providing flexibility and control over your financial reporting.

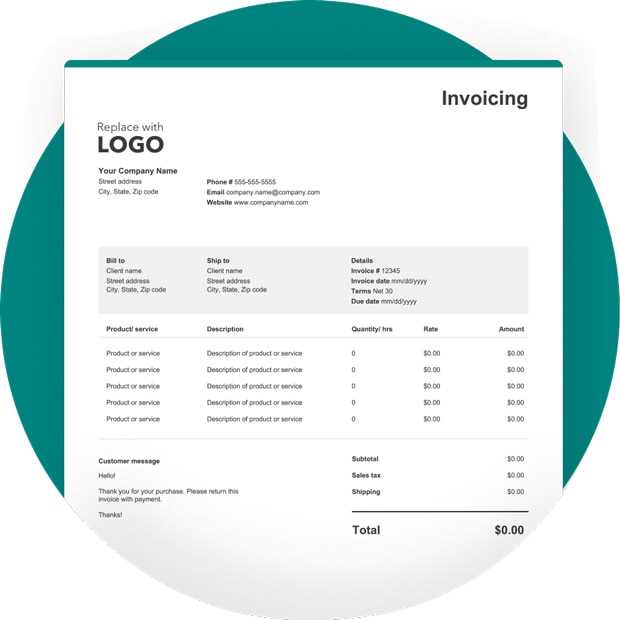

Customizable forms offer an easy solution to meet your unique needs. Whether you’re a freelancer, small business owner, or part of a larger enterprise, being able to adjust details quickly can improve your workflow. These forms can be easily modified to include specific items, payment terms, or branding, helping you present a polished image and maintain consistency across your records.

With the right tools, you can quickly create professional documents that reflect your business’s identity. The ability to personalize content means you’re not limited to rigid, generic designs, giving you more freedom to adjust for each client or project. This not only enhances efficiency but also improves accuracy, ensuring that all necessary information is always included and up to date.

What is an Editable Invoice Template

In the business world, having a flexible document that can be quickly adjusted to suit specific needs is essential. Such documents allow users to input and update necessary information with ease, ensuring that each transaction or service provided is properly recorded. These customizable forms are designed to save time and reduce the risk of errors by providing a structured format while offering the freedom to modify key details.

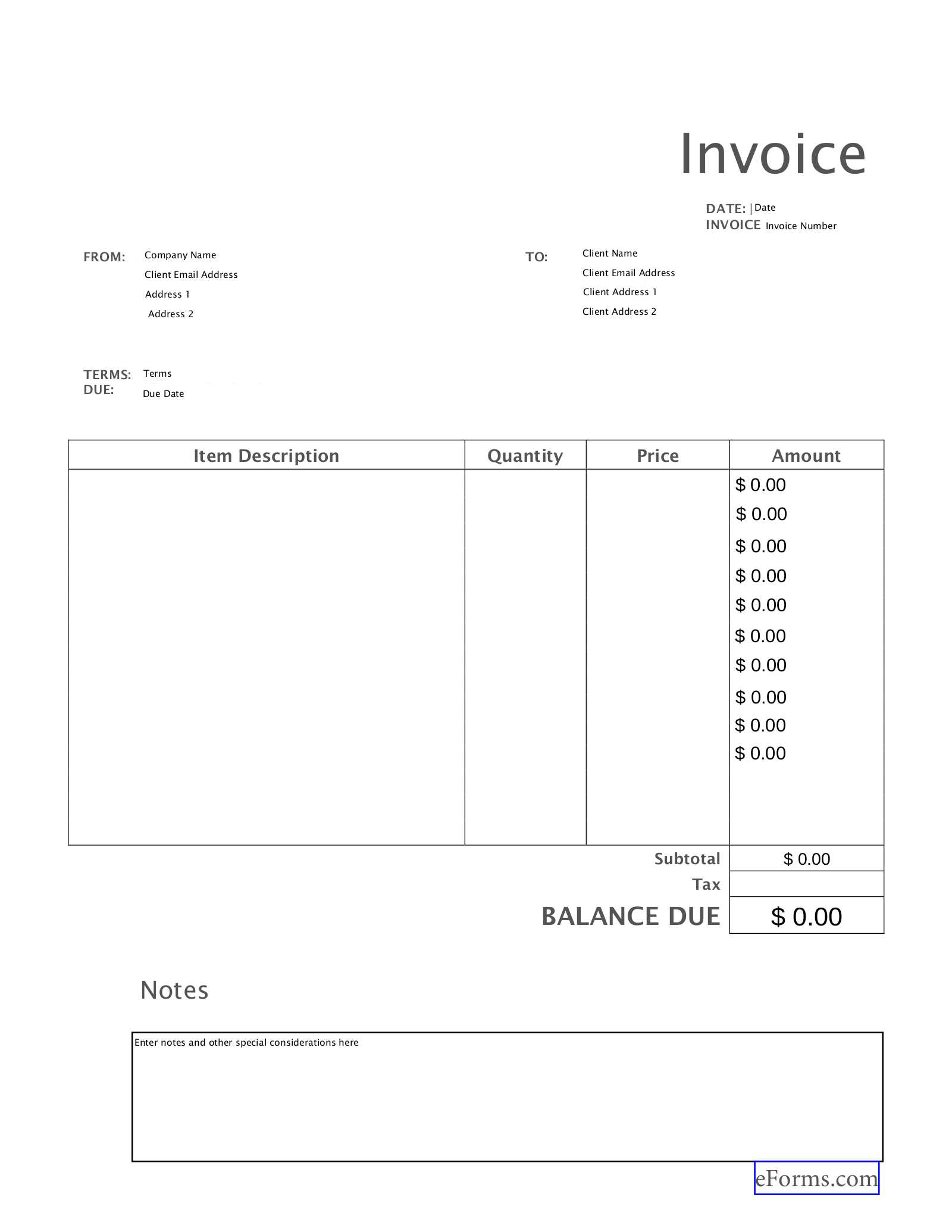

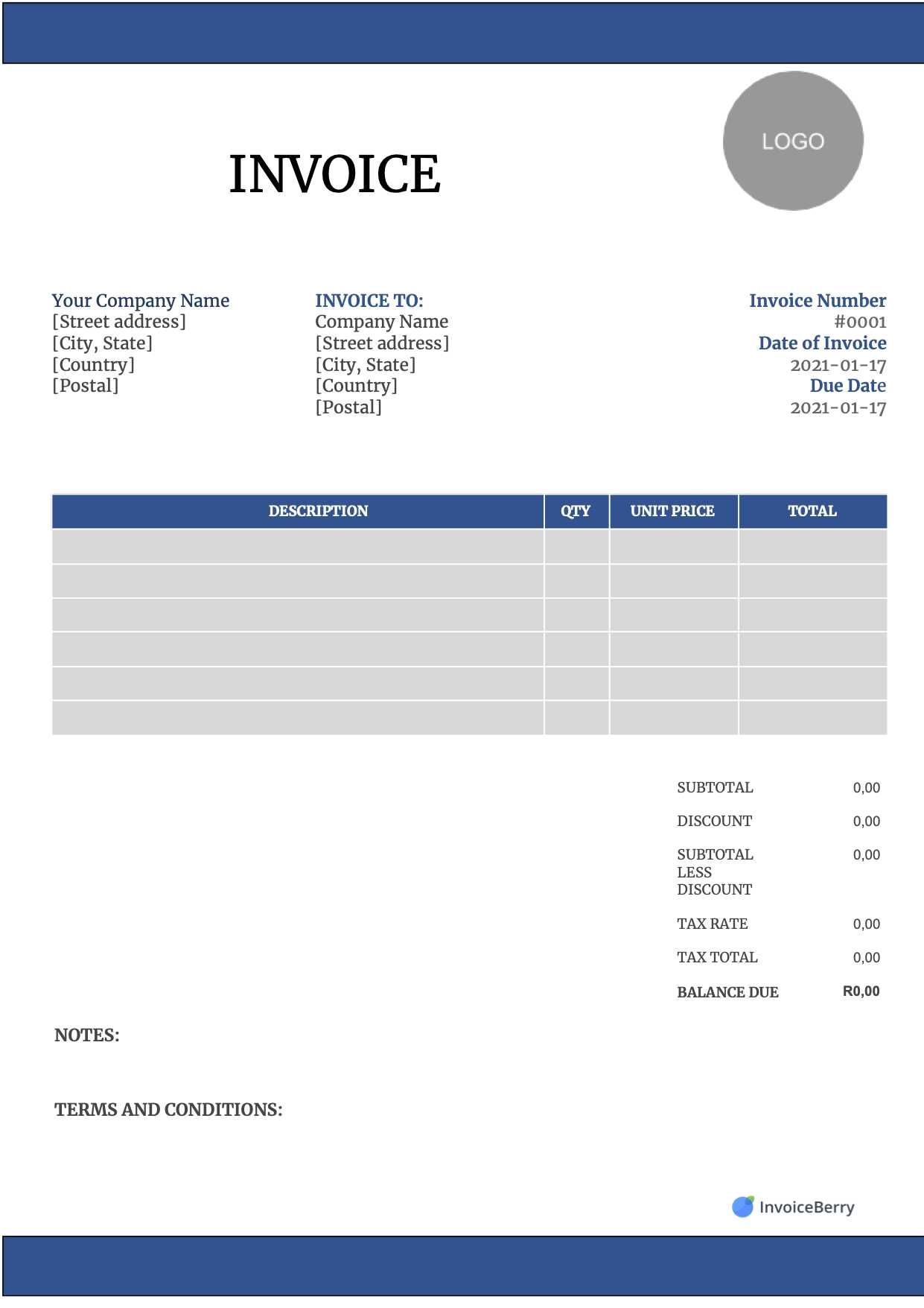

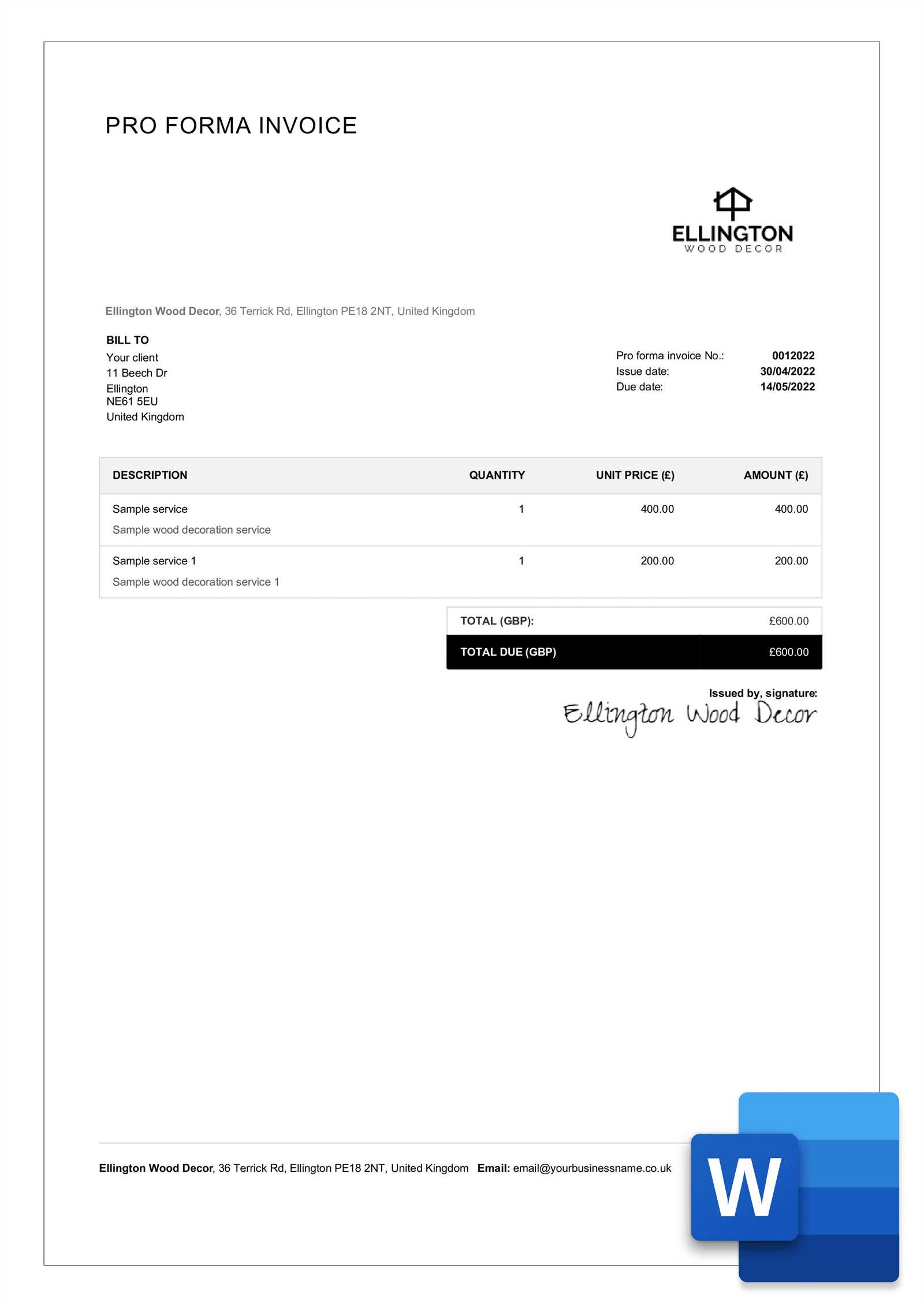

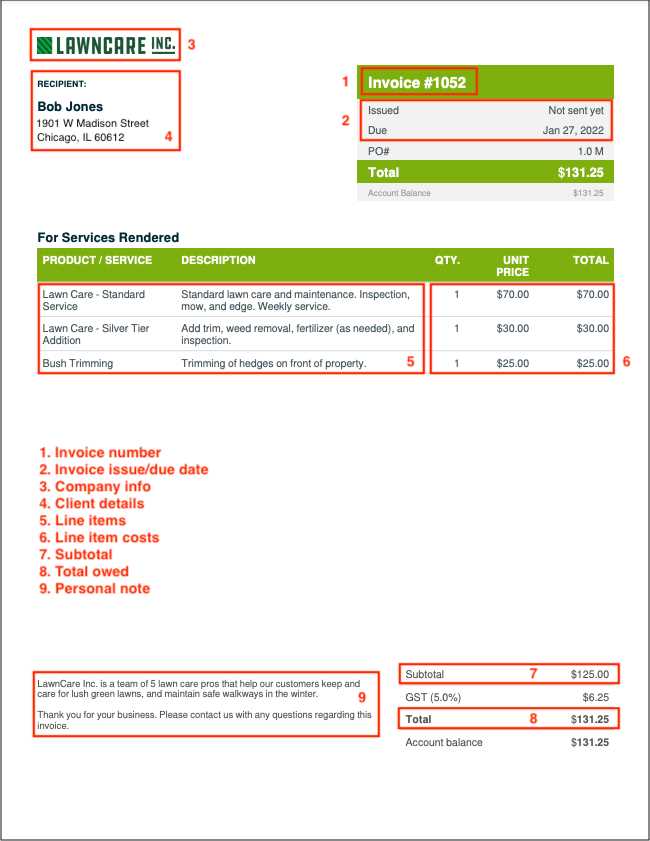

A customizable financial form typically includes fields for essential details such as the client’s name, items or services rendered, payment terms, and total amount due. With the ability to modify these fields, users can tailor the document to reflect each unique situation. The primary benefit of using such a system is its adaptability, as it allows businesses to create professional records without starting from scratch each time.

Customizable financial documents are especially useful for businesses that deal with a variety of clients and projects. Whether you need to change the pricing, add discounts, or update contact information, this flexibility ensures that each document is always accurate and relevant. The convenience of being able to quickly modify content makes managing accounts and transactions easier, more efficient, and consistent.

Benefits of Using Customizable Invoices

Customizable financial documents offer a range of advantages for businesses looking to streamline their billing processes. The ability to adjust the format and content ensures that each record is tailored to meet specific requirements, improving both accuracy and efficiency. By using flexible forms, businesses can better manage client relationships and ensure consistency in their documentation.

Increased Flexibility and Accuracy

One of the most significant benefits of these flexible forms is the ability to quickly update key details. Whether it’s adjusting prices, changing service descriptions, or including specific payment terms, the customization options make it easy to keep everything accurate and up to date. This reduces the likelihood of errors and ensures that each document reflects the exact nature of the transaction.

Time and Cost Savings

Using a customizable document also saves valuable time. Rather than creating a new record from scratch for each client or project, businesses can simply modify an existing form. This process is much faster, freeing up time for other important tasks. Additionally, reducing the need for manual input or complex paperwork helps minimize the risk of costly mistakes, which can result in delayed payments or misunderstandings.

Professional Appearance

When you can adjust the layout and include your branding, the finished product presents a polished and professional image to clients. This attention to detail can improve customer trust and strengthen business relationships. A well-organized, customized document reflects the quality of service you provide, leaving a lasting impression.

How to Create Your Own Invoice

Creating a professional billing document for your business doesn’t have to be complicated. With the right approach, you can design a custom record that meets your needs and reflects your brand. The process involves determining the key elements that should be included, ensuring clarity and accuracy in each field. Whether you’re a freelancer or a small business owner, having control over your billing documents helps maintain a consistent and professional appearance.

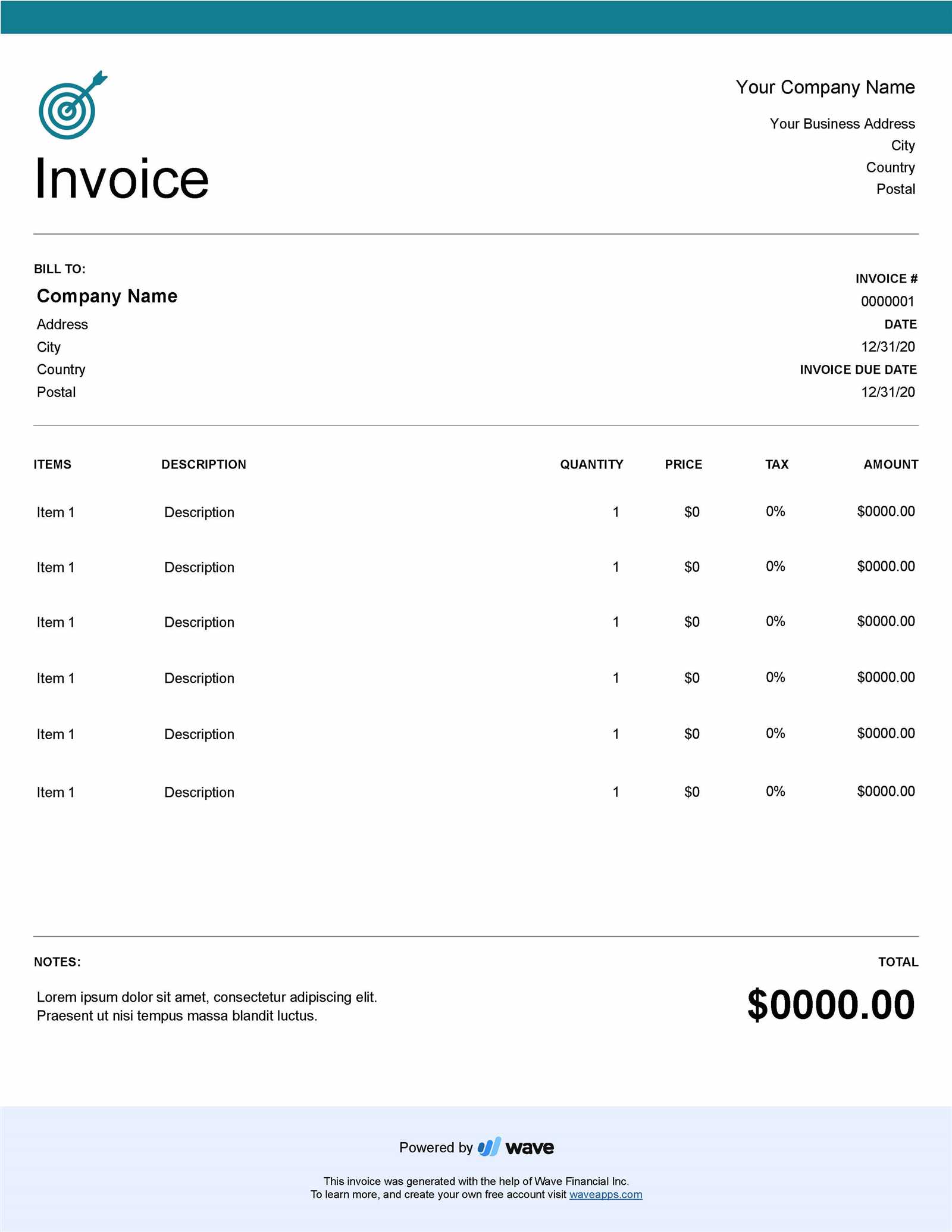

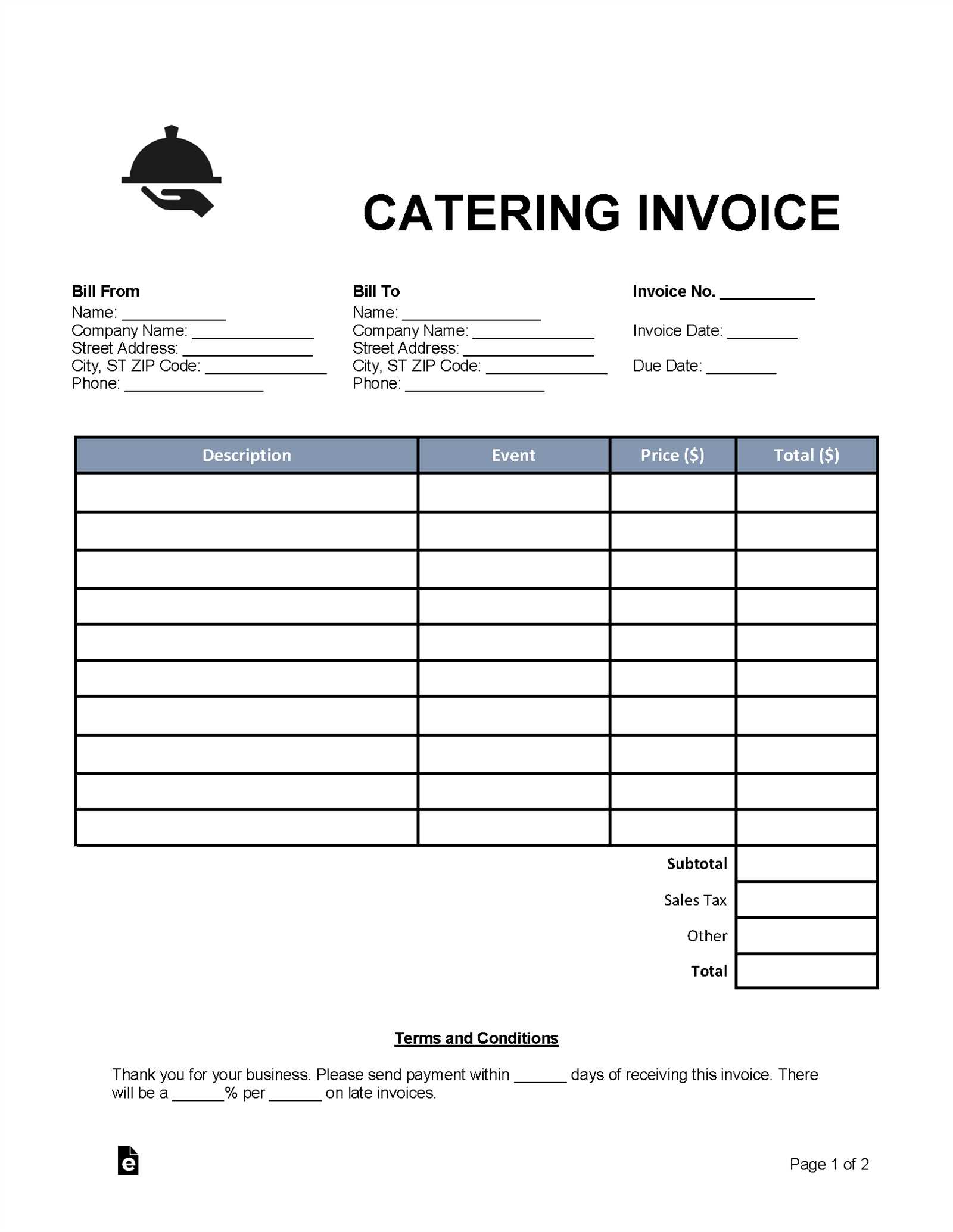

Step 1: Choose the Right Layout

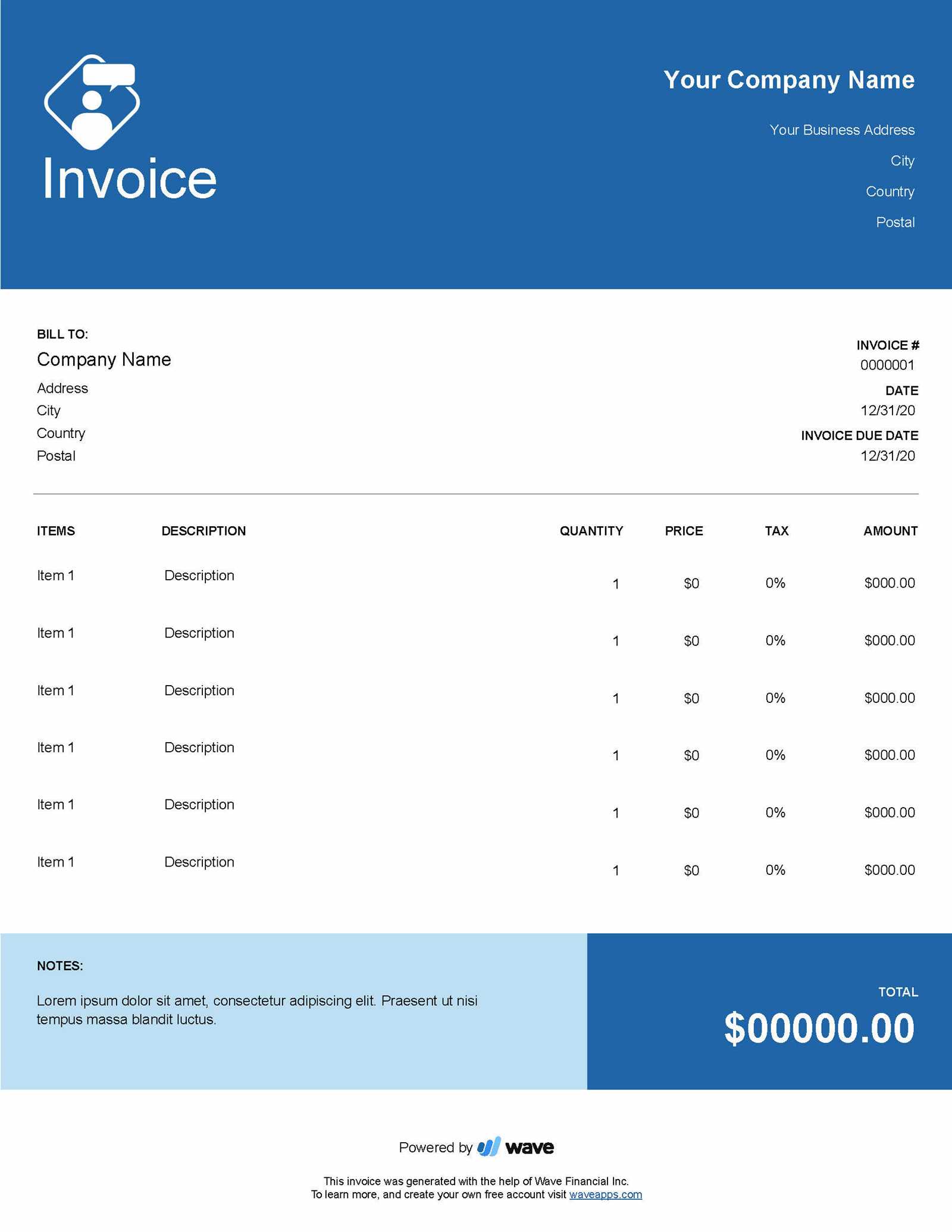

The first step in designing your billing document is to choose a clean and easy-to-read layout. A well-organized structure will make it simple for your clients to understand the charges and payment terms. Typically, the document should include sections for your business information, client details, a breakdown of services or products, and the total amount due. Make sure there’s enough space for you to add specific details relevant to each transaction.

Step 2: Add Essential Information

Once the layout is chosen, you can begin adding the necessary information. This includes your contact details, the client’s name, a description of services provided, and the payment due date. It’s important to be thorough but concise, as clarity is key. Additionally, make sure to include any relevant terms, such as late fees or discounts, to avoid any misunderstandings later on. A clear, comprehensive document helps maintain transparency with clients.

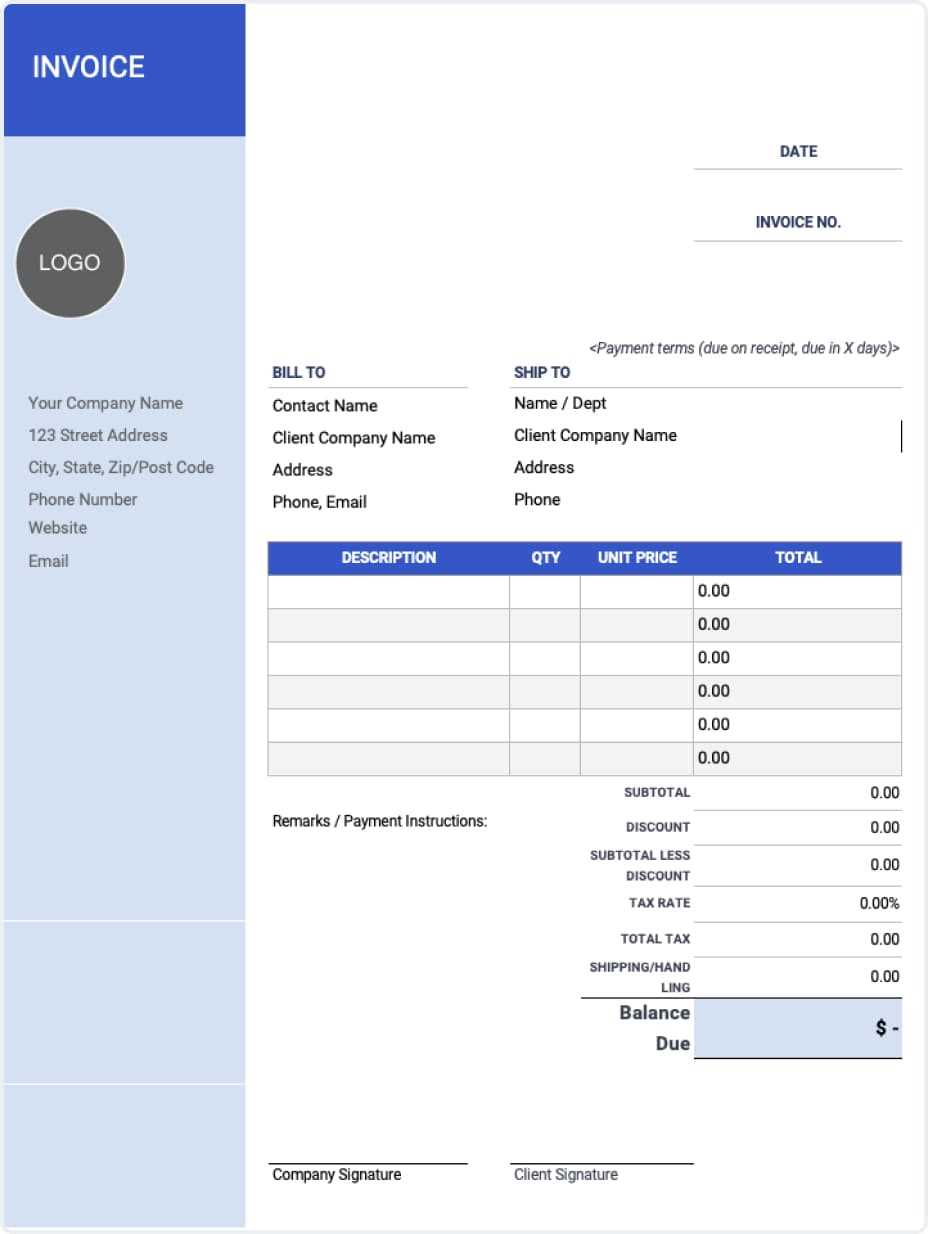

Customizing the Design

Many platforms and tools allow you to further personalize the document by adding your company logo, adjusting colors, or modifying fonts. This helps give your billing record a unique touch and reinforces your business’s branding. A personalized, professional document not only looks good but also adds a sense of trust and reliability to your transactions.

Top Features to Look for in Templates

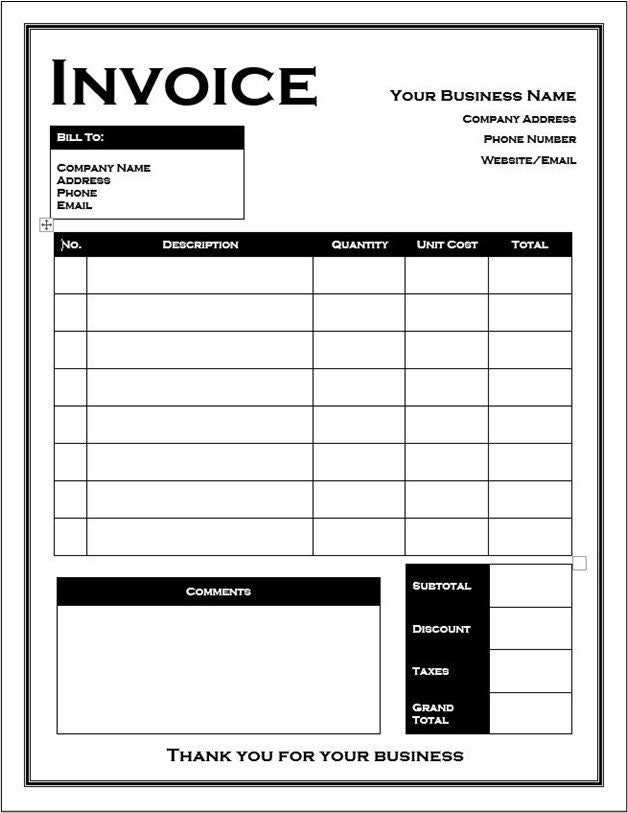

When choosing a document design for your billing needs, it’s important to consider several key features that will make the process easier and more efficient. The right form should not only be easy to customize but also contain essential elements that ensure clarity and professionalism. Below are some of the most important features to look for when selecting a solution for your business.

| Feature | Description |

|---|---|

| Customizable Fields | The ability to adjust key information, such as service descriptions, pricing, and client details, ensures that the document suits each individual transaction. |

| Clear Layout | A clean and organized design that makes it easy for both you and your client to read and understand the contents at a glance. |

| Branding Options | The ability to add your company logo, colors, and fonts helps maintain a consistent visual identity, reinforcing your brand image. |

| Payment Terms Section | A section that clearly outlines payment instructions, due dates, and any late fees or discounts, which helps avoid confusion later on. |

| Automatic Calculations | Built-in functions to automatically calculate totals, taxes, and discounts, ensuring accuracy and saving time on manual calculations. |

| Multiple File Formats | Support for various file formats (such as PDF, Word, Excel) so you can easily send the document via email, print it, or save it for future use. |

Choosing a form with these key features will help you create a more professional, efficient, and reliable system for managing your transactions. By considering your specific business needs and looking for these qualities, you’ll be able to streamline your workflow and maintain consistency across your documents.

Choosing the Right Template for Your Business

Selecting the right document format for your business is a crucial step in ensuring smooth and professional interactions with your clients. A well-chosen design can help streamline your workflow, improve accuracy, and create a consistent brand image. However, it’s important to consider various factors, such as the type of services you offer, your branding needs, and how you intend to use the document. Below are some key aspects to consider when choosing the ideal solution for your business.

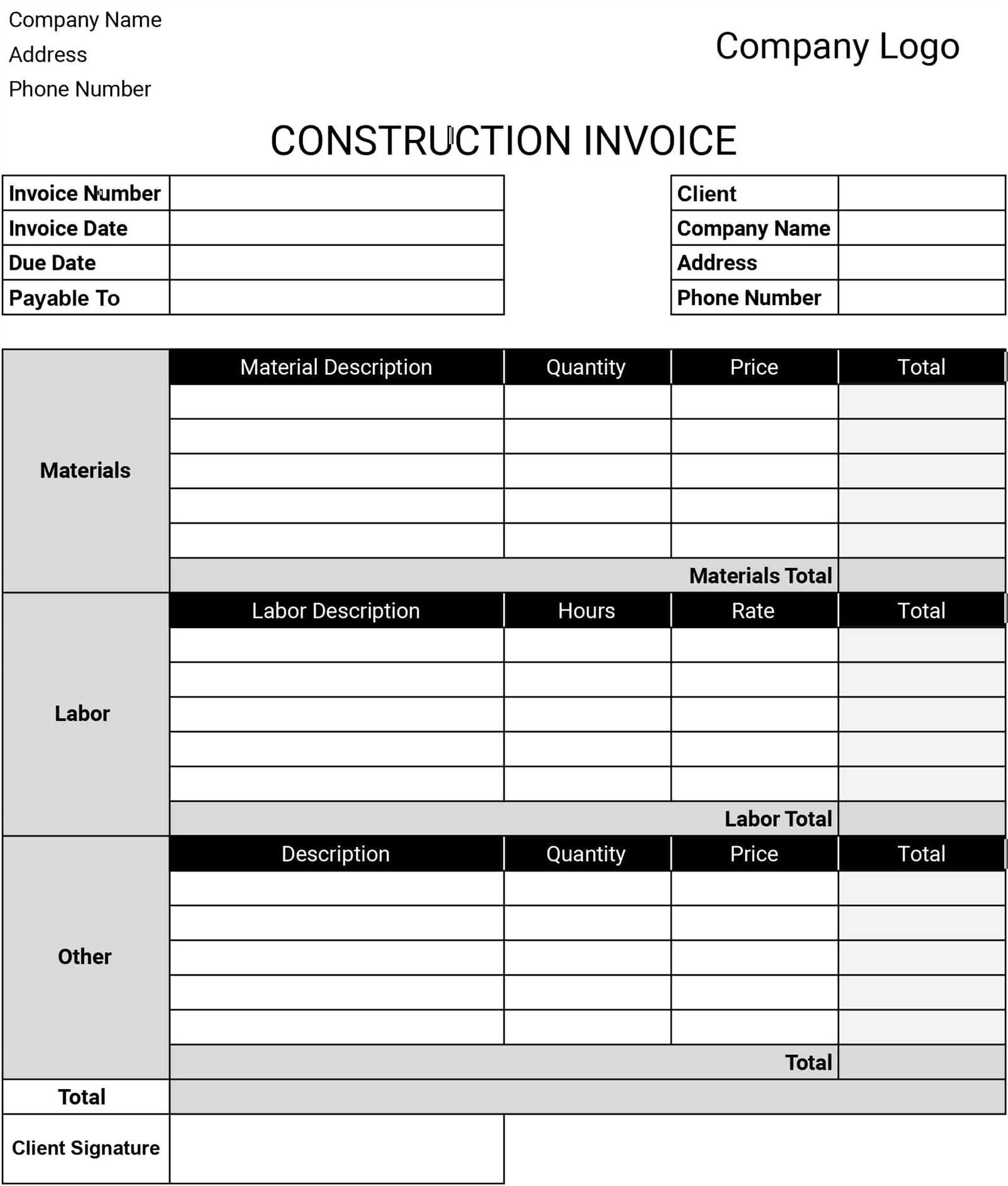

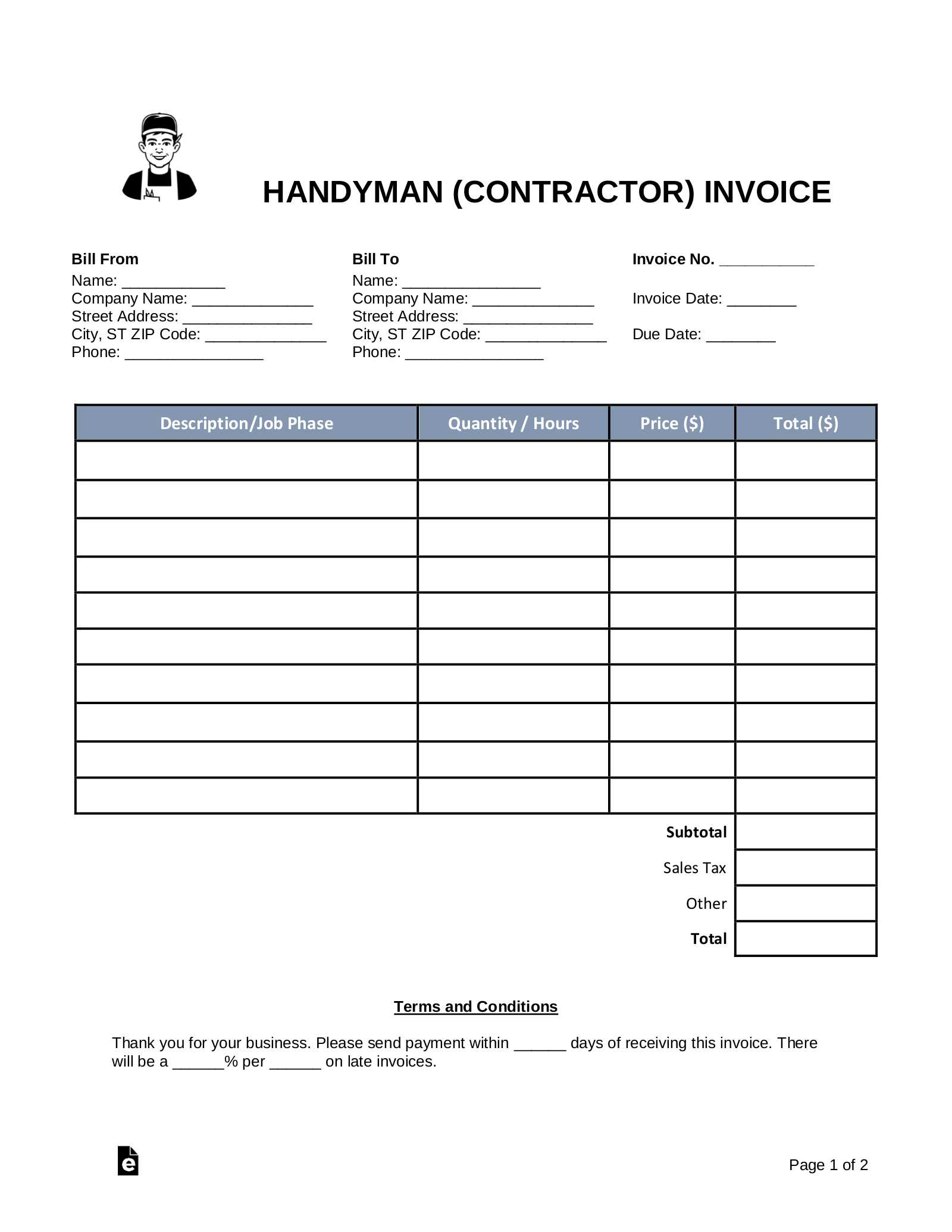

1. Consider the Nature of Your Business

Different types of businesses have varying needs when it comes to financial documents. For example, a freelance consultant may only need a simple, straightforward form, while a service-based company might require more detailed breakdowns of items or services provided. Consider the level of detail you need to include, such as hourly rates, product descriptions, or shipping costs, and choose a design that supports those needs without overwhelming your client.

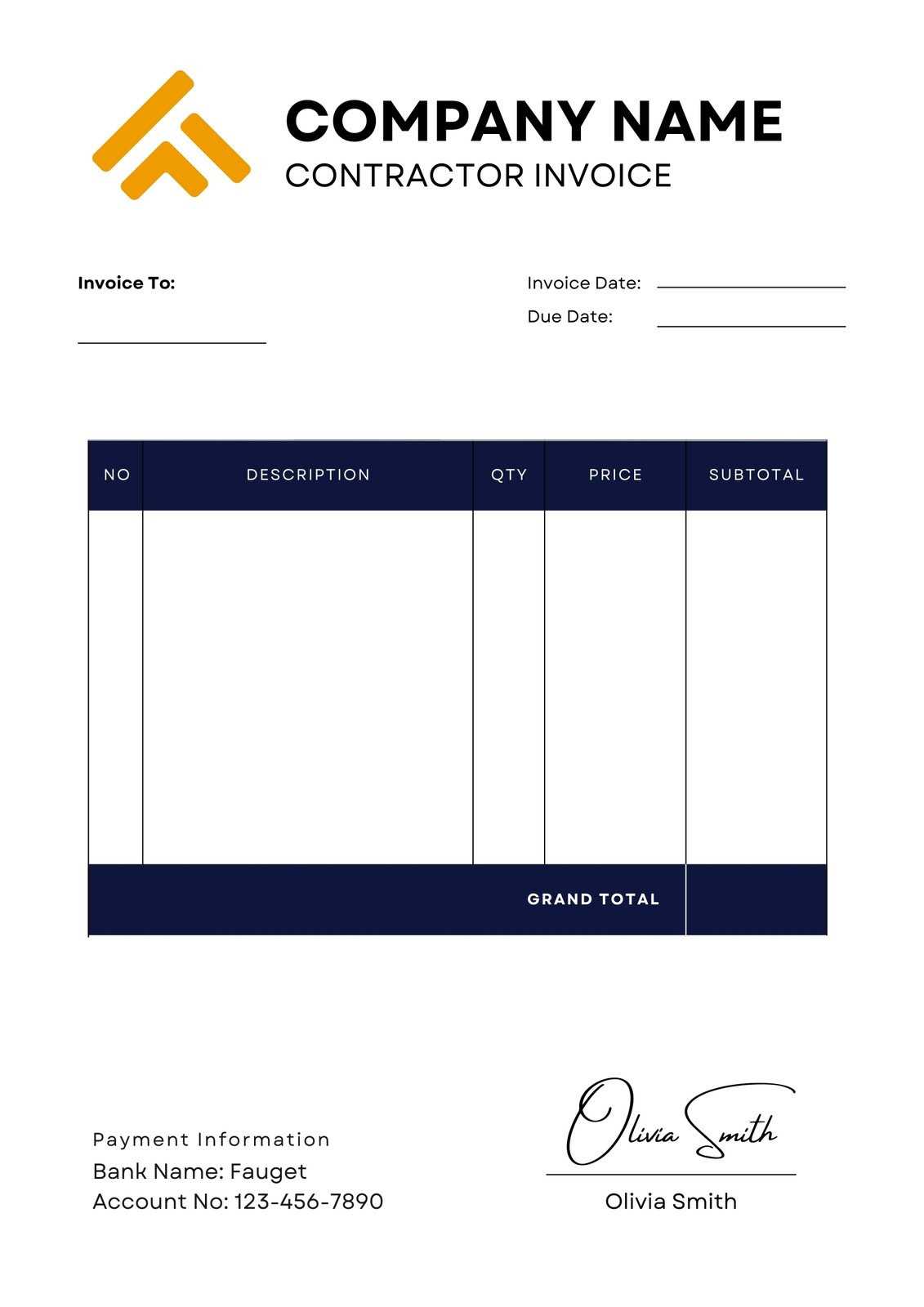

2. Align with Your Branding

Consistency in design is key to reinforcing your brand identity. Choose a format that allows you to incorporate your logo, color scheme, and fonts to create a cohesive and professional look. This not only helps your business stand out but also enhances client trust and recognition. A well-branded document can leave a positive impression and show that you pay attention to detail in all aspects of your business.

By evaluating the specific needs of your business and choosing a format that reflects your style and professionalism, you can ensure that every document you send adds value to your client relationships and enhances your overall brand image.

Editable Invoice Templates vs Paper Invoices

When it comes to managing billing records, businesses often face a choice between digital and traditional paper-based solutions. While both methods serve the same purpose, the digital approach offers several advantages in terms of efficiency, flexibility, and accuracy. In this section, we’ll compare the two methods to help you understand the key differences and decide which option best suits your business needs.

1. Flexibility and Customization

Digital forms offer a level of flexibility that paper-based records simply cannot match. With digital solutions, you can easily modify content, update pricing, adjust terms, or add custom notes with just a few clicks. This adaptability allows businesses to tailor each document to specific transactions, saving time and reducing the risk of errors. On the other hand, paper records are static and require manual rewriting for any changes, which is both time-consuming and prone to mistakes.

2. Efficiency and Time Savings

Managing documents digitally significantly streamlines workflows. Sending an electronic document via email is quick and efficient, eliminating the need for printing, mailing, or storing physical copies. This not only saves time but also reduces costs related to paper, ink, and postage. In contrast, paper records require manual handling at each step, from printing to filing, which can slow down processes and increase administrative workload.

While paper documents still have their place in certain industries, the benefits of digital solutions make them the preferred choice for businesses looking to optimize their operations. The ability to quickly create, modify, and send documents without the constraints of physical paperwork offers a clear advantage in today’s fast-paced business environment.

How Editable Invoices Save Time

Time is a valuable resource for any business, and reducing the amount of time spent on administrative tasks can make a significant difference in overall productivity. Digital billing documents are designed to streamline the creation and management process, making it faster to generate accurate records. By automating and simplifying repetitive tasks, businesses can save time on manual entries, corrections, and formatting.

1. Quick Customization and Updates

One of the most time-saving features of digital documents is the ability to make quick adjustments. Instead of starting from scratch or manually rewriting every document, you can simply modify the existing format to fit each unique transaction. This includes:

- Changing client details

- Updating product or service descriptions

- Adjusting pricing or applying discounts

- Modifying payment terms or due dates

These changes can be done in seconds, drastically reducing the time spent on each individual record.

2. Automatic Calculations

Digital systems often include built-in functions to automatically calculate totals, taxes, and discounts. This eliminates the need for manual calculations, reducing the chances of errors and speeding up the entire process. The time saved by automating this aspect of document creation can be used for more important tasks, such as client communication or business development.

By using digital solutions, businesses can create and send records faster, reduce the risk of errors, and focus more on growing the business rather than spending time on repetitive administrative tasks. Time saved on billing can be better spent on improving service quality, engaging with customers, and expanding operations.

Easy Steps to Edit Your Invoice

Making adjustments to your business records is a straightforward process, especially when using flexible digital documents. Whether you need to update a client’s details, modify pricing, or add additional services, the process is simple and quick. Here are the easy steps to follow when modifying your document to ensure accuracy and consistency in your billing process.

1. Open the Document

The first step in editing your business record is opening the file in the appropriate software or platform. Depending on the format you’re using, this could be a word processor, spreadsheet program, or a dedicated business tool. Make sure the file is in an editable format, allowing you to make changes easily.

2. Make Necessary Changes

Once the document is open, follow these steps to modify the content:

- Update Client Information: Replace old contact details, including the client’s name, address, or email.

- Modify Service Descriptions: Adjust the list of services or products if there were any changes to the scope of work or deliverables.

- Adjust Pricing: Edit unit prices, add discounts, or adjust quantities to reflect the agreed terms.

- Edit Payment Terms: If necessary, update payment due dates or include new payment methods and instructions.

3. Review and Save the Document

After making all the necessary changes, thoroughly review the document to ensure all information is correct. Double-check the calculations and verify that the updated content is accurate. Once everything is in order, save the modified file in your preferred format, ready to be sent or printed.

Editing your business documents is a fast and simple process that can be done in just a few steps. By following these easy guidelines, you can ensure that all records are up-to-date and reflect the most accurate information for each client or transaction.

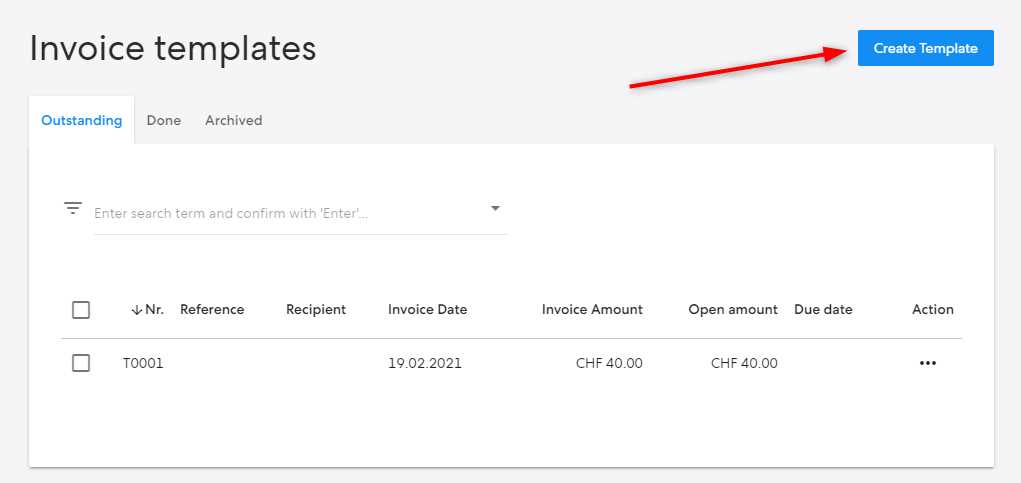

Integrating Invoice Templates with Accounting Software

Integrating billing documents with accounting software can significantly enhance efficiency and accuracy in managing financial records. By automating the flow of data between your billing system and accounting software, you can reduce manual entry errors, streamline your processes, and maintain consistency across all your financial documents. This integration simplifies tasks such as tracking payments, generating reports, and managing tax information.

1. Benefits of Integration

When you connect your digital forms with accounting tools, you gain several advantages:

- Efficiency: Automatically populate key information in your accounting software without re-entering data, saving time and reducing the risk of mistakes.

- Real-Time Updates: Any changes made to a financial record are instantly reflected in your accounting software, ensuring accurate and up-to-date information.

- Seamless Reporting: Integrated systems make it easier to generate financial reports and track the overall health of your business.

2. Key Integration Features

Here are some essential features to look for when choosing an accounting software solution that integrates well with your billing system:

| Feature | Description |

|---|---|

| Automatic Data Sync | Ensures that all details from your billing documents are directly transferred into the accounting system for accurate record-keeping. |

| Tax Calculations | Automates the calculation of taxes based on your location and business needs, minimizing errors and saving time during tax season. |

| Client Management | Allows you to track client information, payment history, and balances, ensuring smooth and organized communication. |

| Customizable Reports | Generates reports based on integrated data, providing insights into sales, expenses, and profits with just a few clicks. |

Integrating your financial records with accounting software not only reduces the time spent on manual tasks but also ensures that your data is accurate and easily accessible. By choosing the right tools for integration, you can streamline your business operations and focus on growth rather than administrative work.

Best Tools for Customizing Invoice Templates

Customizing your business records is essential for creating professional and consistent documents that reflect your brand. Fortunately, there are a variety of online tools and software available that make the process quick and easy. These tools allow you to adjust layout, content, and design with just a few clicks, enabling you to create personalized and accurate documents that meet your specific needs.

Here are some of the best tools for customizing your financial documents:

- Canva: A popular design tool that provides customizable templates for all types of business documents. With drag-and-drop functionality, Canva allows you to personalize your forms with ease by adding logos, adjusting fonts, and modifying colors.

- Zoho Invoice: An online platform that offers a wide range of customizable formats for creating professional billing records. Zoho Invoice allows you to add your company branding, integrate payment gateways, and automate recurring invoices.

- Microsoft Word/Excel: Traditional but effective, these tools offer complete control over design and structure. With built-in templates and formatting options, Word and Excel are simple options for businesses looking to create or modify their records without using online services.

- FreshBooks: A cloud-based accounting software that comes with customizable billing documents. FreshBooks allows you to personalize fields, adjust layouts, and automate the creation of records based on client information.

- Invoice Ninja: A free online tool that offers a variety of customizable invoice formats. With Invoice Ninja, users can edit client details, modify pricing, and include discounts, all while maintaining a professional and clean layout.

Each of these tools offers unique features to help businesses streamline their documentation process while maintaining flexibility and customization. Whether you’re looking for a simple, no-fuss solution or a fully integrated tool, the right platform can make all the difference in creating accurate and polished documents for your clients.

How to Format an Editable Invoice

Creating a well-organized and easy-to-read billing document is essential for maintaining professionalism and ensuring accuracy in transactions. Proper formatting ensures that the document is clear, logically structured, and easy for your clients to understand. Whether you’re preparing a record for a one-time client or setting up a standard format for ongoing use, here are the key steps to format a professional document.

1. Organize the Document Layout

Start by setting up a clear, structured layout that includes all the necessary sections. Common elements to include are:

- Header Section: Include your company name, logo, and contact details (address, phone number, email).

- Client Information: Add the client’s name, address, and contact details, making it easy to identify the recipient of the document.

- Document Title and Number: Include a title that identifies the document (e.g., “Payment Receipt”) and a unique reference number for tracking purposes.

- Itemized List: Provide a detailed breakdown of the services or products provided, along with quantities, unit prices, and total amounts.

- Total Amount: Clearly highlight the total amount due, including taxes and any additional charges.

- Payment Terms: Clearly state the payment due date, methods accepted, and any relevant terms like late fees or early payment discounts.

2. Apply Consistent Styling

Once you’ve outlined the basic structure, it’s time to focus on formatting and design. Here are some tips for applying a consistent, professional style:

- Font Choice: Use clear, easy-to-read fonts like Arial or Times New Roman. Avoid overly decorative fonts that can distract from the content.

- Color Scheme: Stick to a minimal color palette that reflects your brand, but ensure there’s enough contrast for readability.

- Spacing: Use consistent spacing between sections to avoid a cluttered look. Adequate margins and line spacing make the document easier to read.

- Alignment: Ensure that text is properly aligned (left-aligned for most content, center-aligned for headings) to maintain structure.

By following these steps, you can create a polished, well-organized document that not only looks professional but also communicates all the necessary information clearly and effectively.

Why Consistency is Key in Invoices

Maintaining consistency in your financial documents is crucial for creating a professional image and ensuring that all necessary details are clear and easy to understand. Consistent formatting, structure, and terminology across all records help build trust with clients and reduce the likelihood of errors or misunderstandings. This section will highlight the importance of consistency and how it contributes to smoother business operations.

1. Builds Professionalism and Trust

A uniform style in your financial documents demonstrates attention to detail and professionalism. Clients will appreciate the clarity and reliability of your documents, which fosters trust. When they receive a consistent document each time, it becomes easier for them to quickly review and process the information. A well-organized, predictable document structure helps reinforce that your business is dependable and efficient.

2. Reduces Errors and Miscommunication

When all records follow the same structure and use the same terminology, there’s less chance of confusion. A consistent layout ensures that both your team and your clients know exactly where to find the necessary information, such as amounts, payment terms, or descriptions of services. This reduces the risk of missed details or errors during review, making financial transactions more accurate and easier to manage.

Consistency in your documentation process not only creates a cohesive brand image but also simplifies the billing process for both you and your clients. By ensuring that each document follows the same format, you enhance both the professionalism and efficiency of your business.

Security Considerations When Using Editable Invoices

When dealing with business records that contain sensitive information, security is a top priority. Digital documents, while convenient, are susceptible to a range of security risks, including unauthorized access, data breaches, and document manipulation. It is essential to take the necessary precautions to ensure that these documents remain secure and are only accessible to authorized individuals. Below are key security considerations to keep in mind when handling and using editable billing documents.

1. Protect Sensitive Information

Business records often contain sensitive data such as client names, payment details, and financial transactions. Protecting this information is critical to avoid identity theft or fraud. Here are some steps you can take:

- Encrypt Documents: Use encryption methods to protect files, especially when sharing them over email or online platforms.

- Remove Personal Data: Always ensure that personal client details are redacted or omitted if not necessary for the document’s purpose.

- Secure Storage: Store documents in secure, password-protected locations, whether on cloud services or physical systems.

2. Limit Access and Permissions

Controlling who can access and modify your documents is essential to prevent unauthorized changes or access to sensitive data:

- Assign User Roles: If using a cloud-based platform, ensure that only authorized personnel have the ability to modify or view records.

- Use Strong Passwords: Always use complex passwords for any system or software where billing records are stored. Implement two-factor authentication for an extra layer of security.

- Track Document History: Enable tracking features that monitor changes made to a document. This allows you to see who edited what and when.

3. Use Secure Sharing Methods

When sharing business documents with clients or vendors, it’s important to use secure communication channels to prevent interception:

- Encrypted Email: Always send sensitive documents via encrypted email or secure file-sharing platforms to protect data during transmission.

- Avoid Public Sharing: Avoid using unsecured methods like public cloud services or social media to share sensitive records.

- Password-Protect Documents: If possible, password-protect the documents before sending them, and provide the password through a separate communication method.

By taking these precautions, you can minimize the risk of exposing sensitive information and ensure the safe handling of business records. While digital documents offer convenience and flexibility, proper security measures are essential to protect your business and maintain client trust.

Common Mistakes to Avoid in Invoice Editing

When adjusting business records, accuracy and attention to detail are essential to ensure that the document is professional and error-free. Mistakes in editing can lead to confusion, payment delays, or even disputes with clients. Below are some of the most common errors that occur when modifying business documents, and how to avoid them to maintain a smooth and efficient process.

1. Incorrect Client Information

One of the most common mistakes when editing business documents is providing incorrect client details. Whether it’s the name, address, or contact information, errors in this section can lead to confusion or even misdirected payments. Always double-check that the client’s information is up-to-date and accurate.

2. Overlooking Payment Terms

Another frequent mistake is failing to update the payment terms. If the payment due date or accepted payment methods have changed, make sure these updates are reflected in the document. Missing or unclear payment terms can lead to late payments or disputes over when payment is expected.

3. Failing to Update Pricing

When the prices of products or services change, it’s critical to ensure that your documents are updated accordingly. Failing to revise unit prices or total amounts can lead to discrepancies in what the client is charged, causing frustration and possible loss of trust.

4. Not Checking for Typos

Even small typographical errors can give an unprofessional impression. Typos in the client’s name, item descriptions, or numbers can reduce credibility. Take the time to proofread the document carefully before finalizing it.

5. Using an Outdated Format

Using an old or outdated version of a record can lead to missing or incorrect sections. Always use the latest version that includes any recent updates or improvements. It’s essential that your document structure is aligned with current business practices and client expectations.

6. Neglecting to Include Necessary Details

Sometimes, in the process of editing, businesses may overlook important sections such as taxes, shipping fees, or itemized services. Omitting crucial details can result in confusion and questions from clients. Make sure every necessary item is included in the document before sending it out.

7. Forgetting to Save Changes

Finally, one of the simplest yet most frustrating mistakes is forgetting to save the document after making changes. Double-check that all edits have been saved and that the latest version is the one being sent to the client.

Table of Common Mistakes

| Feature | Benefit |

|---|---|

| Automatic Tax Calculation | Ensures tax amounts are correct and up-to-date with the latest rates |

| Customizable Fields | Incorporates all relevant tax details, such as rates and ID numbers |

| Tax Summaries | Generates reports to make tax filings faster and more accurate |

| Record Consistency | Ensures that tax records are uniform, reducing errors and omissions |

By using customizable documents, businesses can simplify the process of managing tax compliance and avoid potential errors. This not only saves time but also helps to ensure th

Free vs Paid Invoice Template Options

When creating business documents, one of the key decisions is whether to use a free or paid option. Both choices offer advantages, but they also come with distinct differences in terms of features, customization, and support. Understanding these differences can help you determine which option best meets your business needs and budget.

Free Options

Free business documents are an attractive option for small businesses or freelancers just starting out. They typically provide basic functionality without any cost. However, these options often come with limitations that may affect your ability to scale your business or add specific features as your needs grow.

- Basic Functionality: Free options usually offer simple structures with limited customization capabilities.

- Limited Features: Features like automated calculations, recurring billing, or integration with other software are often unavailable in free versions.

- Minimal Support: Most free options do not come with customer support or assistance if issues arise.

- Templates for Quick Use: Free options can be useful for short-term or one-time use, offering a simple way to create business records without needing much setup.

Paid Options

Paid options typically provide more advanced features and customization, making them ideal for businesses with more complex needs. These solutions often come with premium features, enhanced security, and dedicated customer support, ensuring that your business can grow and operate smoothly.

- Advanced Customization: Paid options allow you to fully customize the layout, design, and information fields, creating professional documents tailored to your brand.

- Enhanced Features: Features like automated tax calculations, payment tracking, and integration with accounting software are commonly included.

- Customer Support: Paid services usually offer customer support, providing assistance if you encounter technical issues or need help with customization.

- Better Security: With paid options, you often get enhanced security measures, such as encrypted document storage or secure payment processing.

While free options are great for businesses on a tight budget or those with minimal needs, paid services offer far more robust functionality and support, making them a better choice for businesses looking to streamline operations, enhance professionalism, and reduce errors.