Invoice Down Payment Template for Easy Payment Management

In business transactions, securing an initial sum before completing a project or delivering goods is a common practice. This approach ensures that both parties are committed and that the supplier receives financial assurance. A well-structured document outlining this initial charge can provide clarity and avoid misunderstandings between businesses and their clients.

Creating a clear and professional record for upfront fees is essential for maintaining transparency. It sets clear expectations regarding the amount due, the services or products covered, and the timing of the remaining balance. With a properly formatted agreement, businesses can streamline their financial operations and ensure smoother transactions.

Utilizing a flexible and easy-to-edit model for this document allows businesses to adapt to various client needs while keeping records consistent and professional. Whether you’re a freelancer, contractor, or company offering complex services, this tool can simplify financial interactions and help manage the flow of funds effectively.

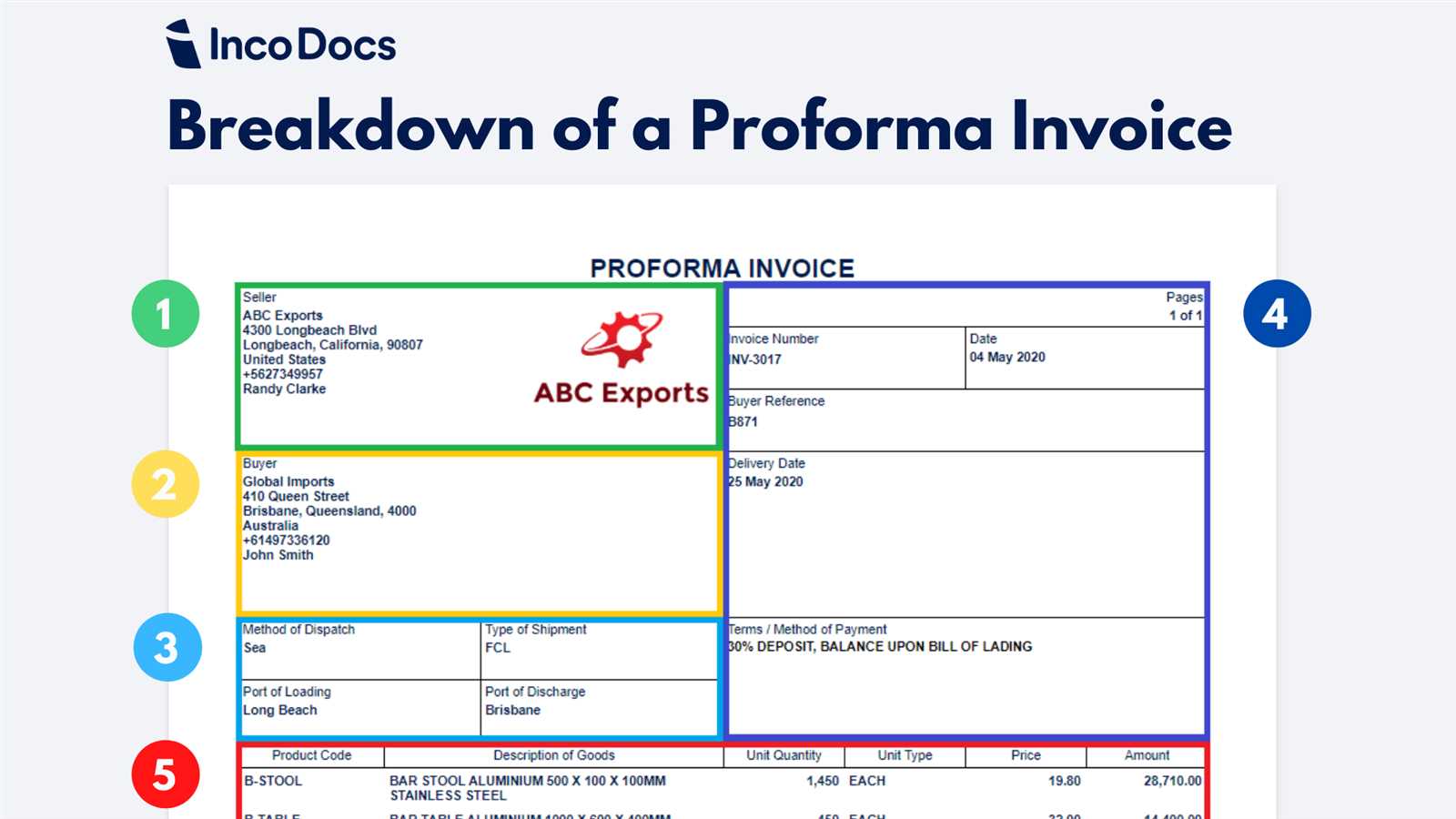

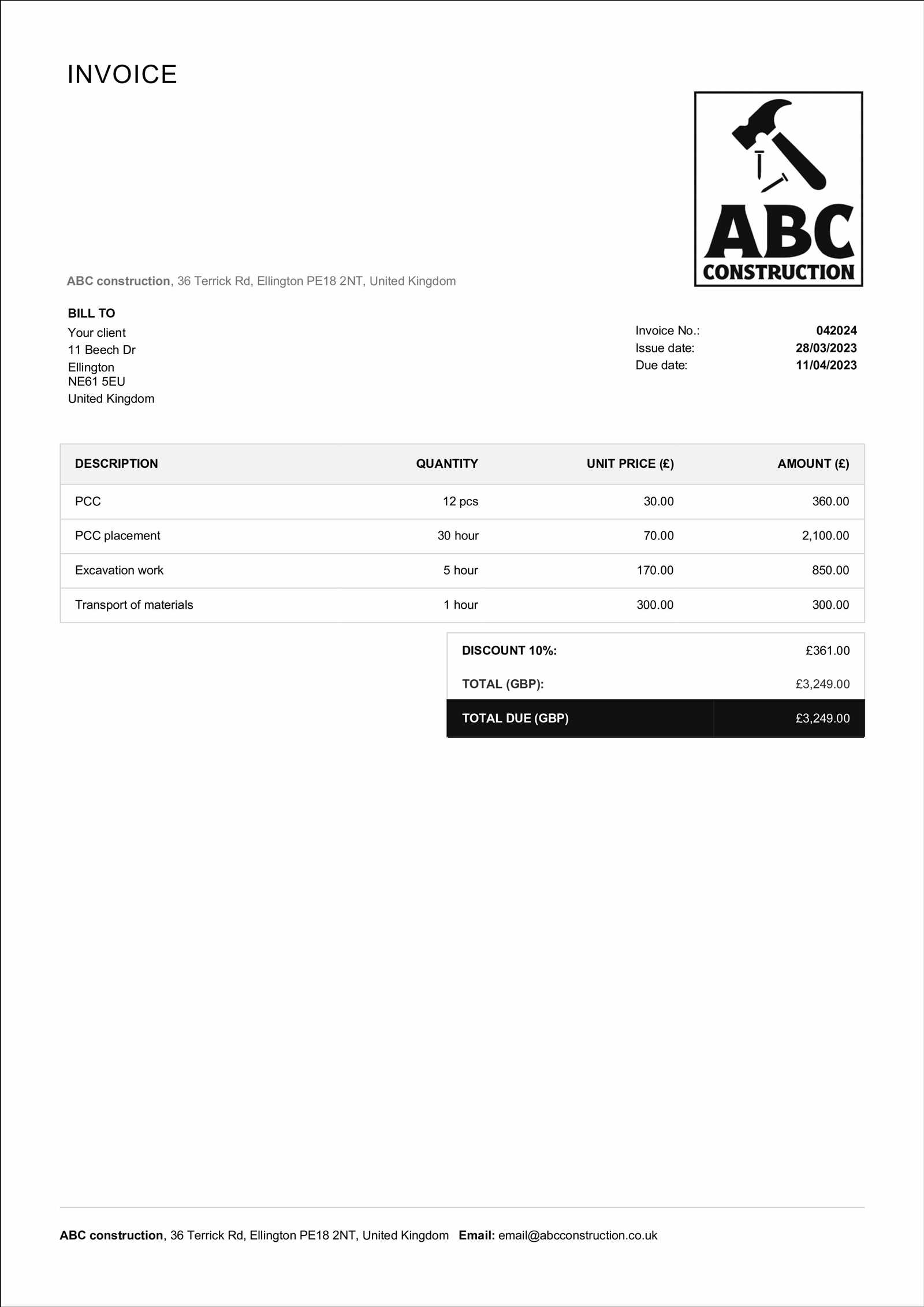

Invoice Down Payment Template Overview

When engaging in business transactions that require an upfront commitment from a client, having a well-organized record outlining the initial amount due is crucial. This document serves as a formal agreement between both parties, ensuring that the supplier is compensated in advance for a portion of the total cost while establishing clear terms for the remaining balance. Such a record helps prevent misunderstandings and ensures smoother financial interactions.

Why a Clear Record Matters

Providing an upfront sum can be a critical step in securing long-term projects or large orders. A properly structured document ensures that both the service provider and the client are on the same page regarding expectations and obligations. By clearly listing the amount received, the products or services covered, and the remaining balance, businesses can maintain professionalism and transparency throughout the transaction.

What to Include in This Record

A comprehensive record should include essential details such as the client’s information, the service or product description, the agreed-upon amount, and the due date for the remaining balance. It may also specify payment methods, terms of completion, and any additional conditions that could affect the transaction. This helps both parties avoid potential disputes and ensures a seamless flow of work.

Why Use a Down Payment Invoice

Securing a partial amount before beginning a project or providing goods is a common practice that offers significant benefits to both the service provider and the client. By requesting a prepayment, businesses ensure financial security and commitment, which helps in managing cash flow and mitigating potential risks associated with non-payment or delayed payments. A clear and formal document outlining these initial terms is essential for maintaining trust and avoiding misunderstandings.

Key Benefits for Businesses

- Cash Flow Management: Collecting a portion upfront ensures businesses can cover initial costs and continue operations without financial strain.

- Reduced Risk: Pre-commitment from clients decreases the likelihood of no-shows or delayed payments, offering peace of mind for the supplier.

- Clear Expectations: By clearly outlining terms, both parties know what to expect, which helps prevent confusion or disputes during or after the project.

- Increased Professionalism: A formal, well-structured agreement demonstrates credibility and enhances the supplier’s reputation.

Advantages for Clients

- Financial Transparency: Clients can see the breakdown of costs and understand exactly what they are paying for upfront.

- Commitment Assurance: Making an initial payment shows the client’s serious intent, often leading to prioritized service or discounts.

- Flexibility: Clear payment terms can provide clients with a structured plan, reducing the stress of having to pay the entire amount at once.

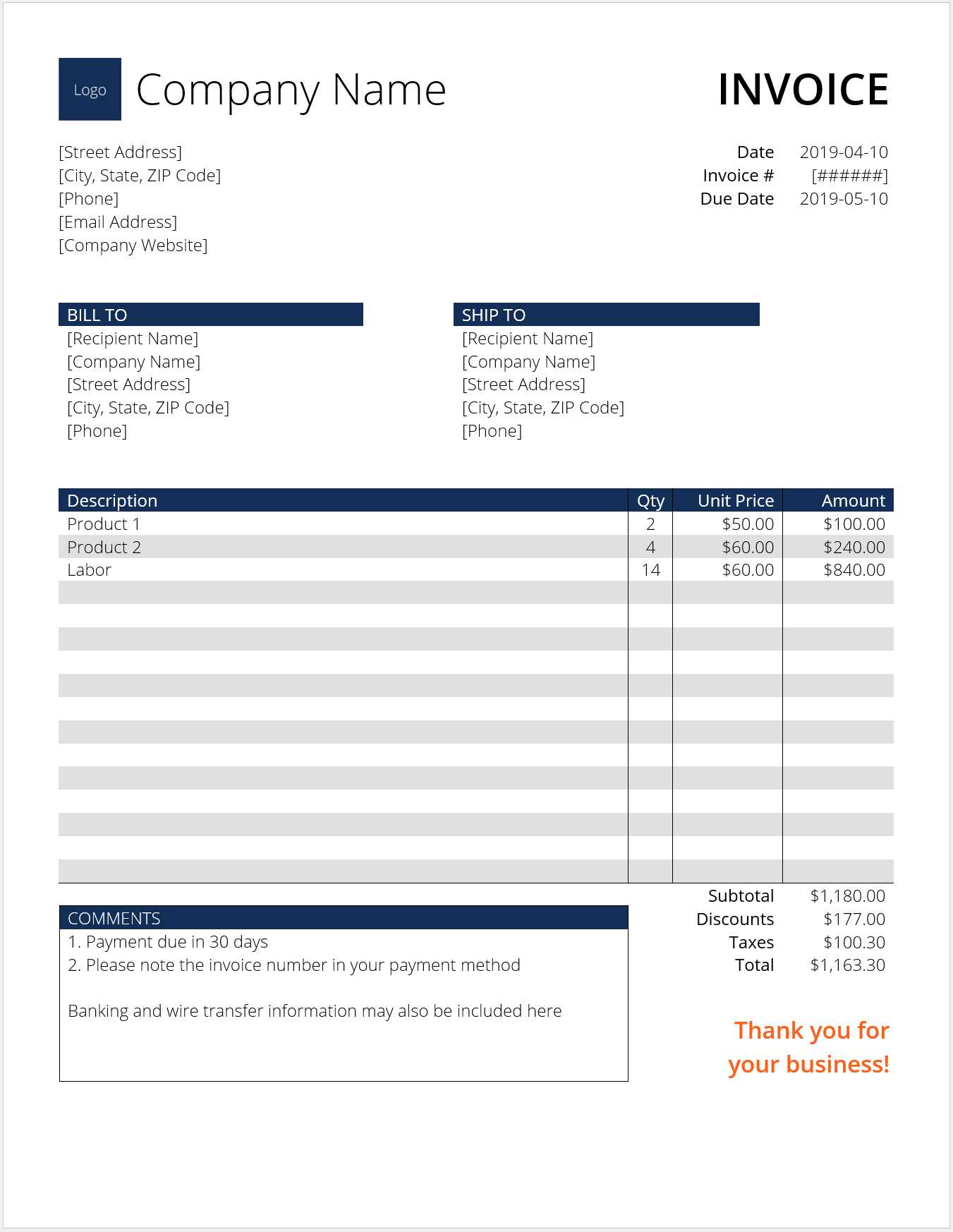

Key Elements of a Down Payment Invoice

For a clear and professional record of the initial amount due, it’s important to include specific details that ensure transparency and prevent confusion. These key components help both the client and the business understand the agreed terms, providing a foundation for a smooth transaction and successful completion of the project or delivery of goods.

Essential Details to Include

- Client Information: Always include the client’s full name or company name, along with contact details such as address, phone number, and email. This ensures both parties can be easily reached if needed.

- Service or Product Description: A clear breakdown of what is being provided or sold. This section helps avoid ambiguity and ensures both parties agree on the scope of work or items involved.

- Initial Amount: Clearly state the agreed-upon sum that is required upfront. This amount should be precise and unambiguous, so both parties understand what is expected at the outset.

- Remaining Balance: Indicate the total cost of the project or goods, and clearly show the remaining amount to be paid after the initial sum is received.

- Due Dates and Deadlines: Specify the timeline for the final balance payment and any important milestones in the project or delivery process that might influence the remaining charges.

Additional Information for Clarity

- Payment Methods: Outline the methods by which the initial sum can be paid (e.g., credit card, bank transfer, PayPal), as well as any fees or charges associated with these options.

- Terms and Conditions: Include any special terms related to refunds, cancellations, or additional charges. This helps manage expectations and ensures that both parties are aware of their rights and responsibilities.

- Reference Numbers or Codes: If applicable, include any reference numbers related to the order or project, which can help both parties track the transaction more easily.

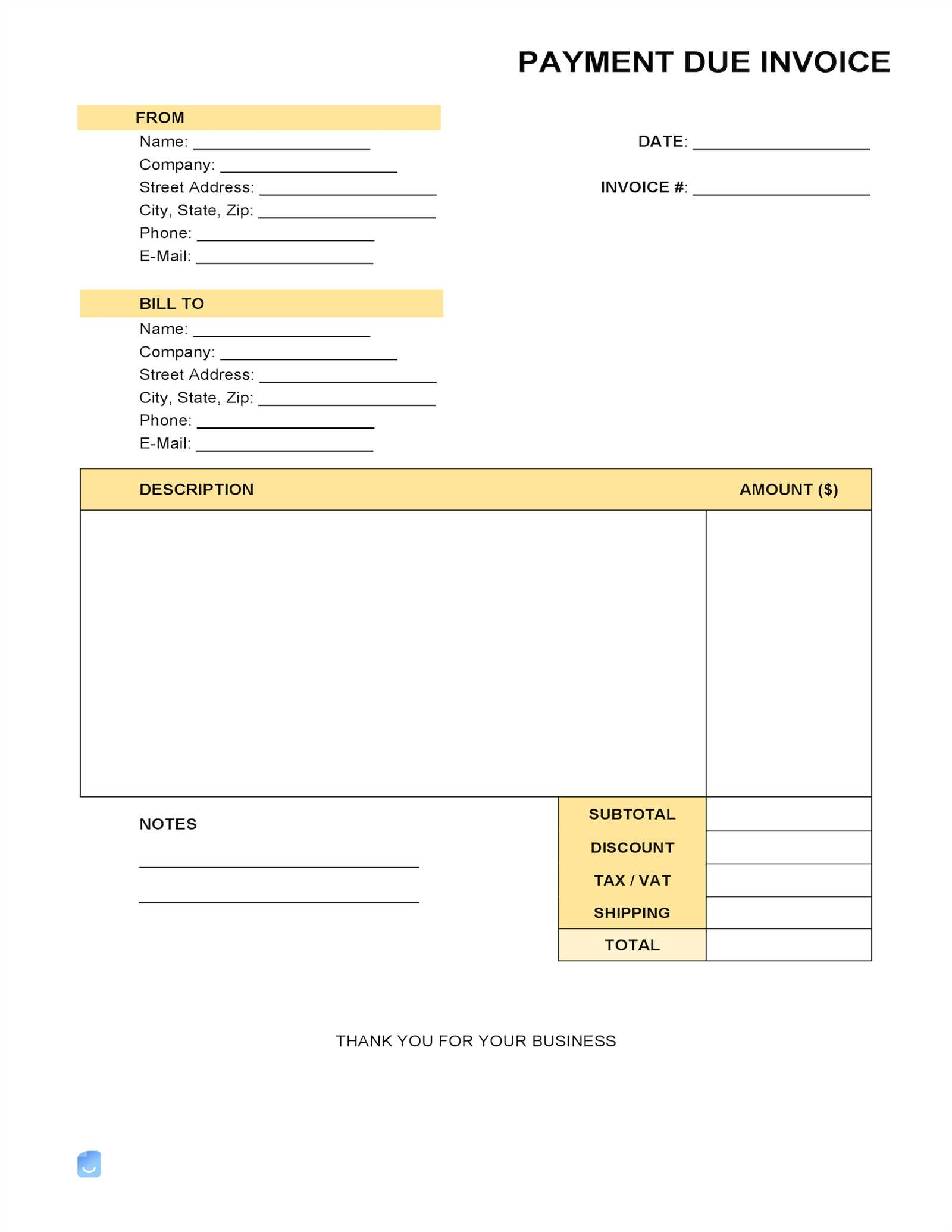

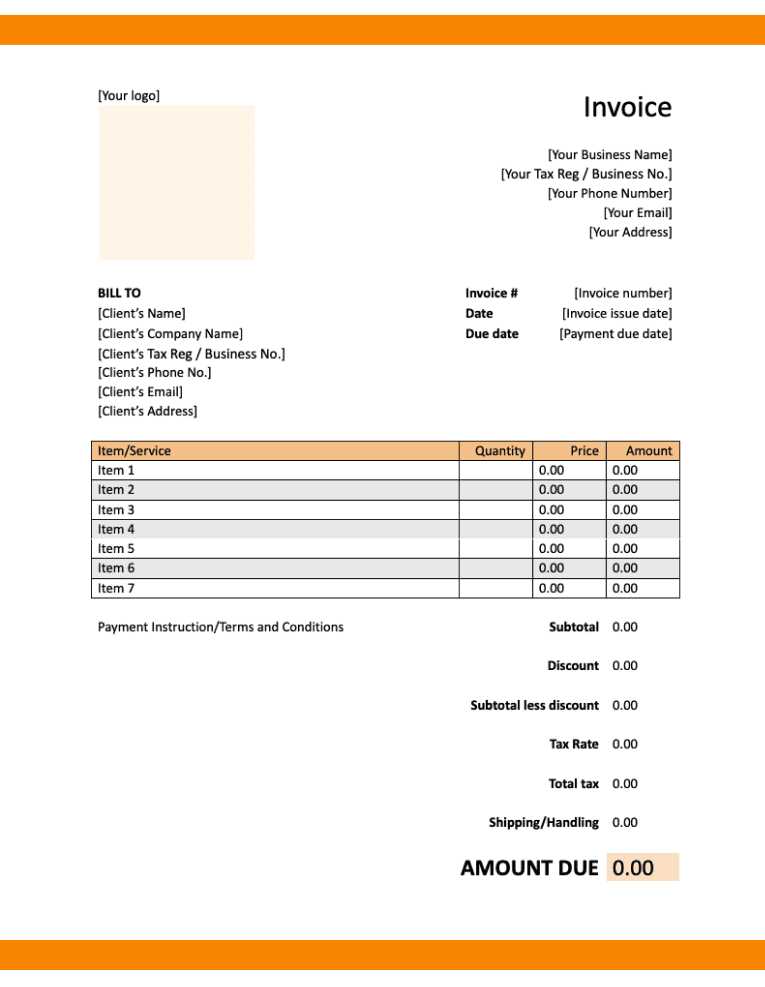

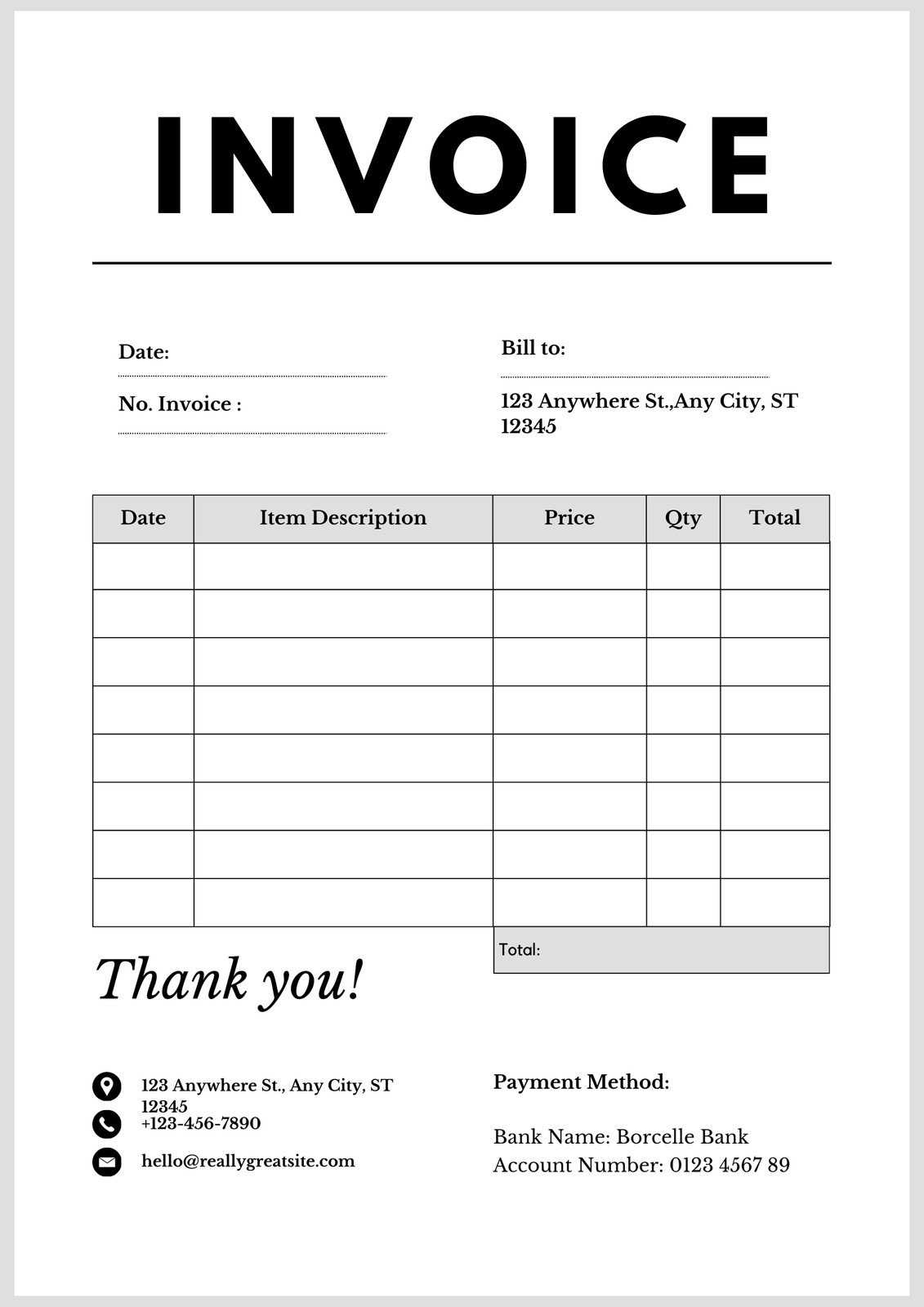

How to Customize Your Invoice Template

Adapting a document for initial charges to fit your business needs is a straightforward process that can save time and ensure accuracy. By personalizing this document, you can reflect your brand, define terms clearly, and accommodate specific client needs. Customization allows for flexibility, whether you’re working on a one-time project or establishing an ongoing relationship with a client.

Steps to Personalize Your Document

- Choose a Clear Layout: Select a format that is easy to read and understand. Avoid clutter by organizing information logically, with clear headings for each section.

- Add Branding: Include your business logo, colors, and font styles. This not only makes the document look professional but also reinforces your brand identity.

- Customize Client Information: Ensure that your client’s details, including their name, address, and contact information, are accurately entered. This avoids errors and helps maintain good communication.

- Define the Scope of Work: Be specific about the products or services being offered. The more detail you provide here, the less room there is for confusion later on.

Additional Customization Tips

- Adjust Payment Terms: Include specific terms that reflect the payment structure, such as when the full balance is due or if there are any late fees.

- Include Special Conditions: If there are unique conditions for the current transaction–like discounts, deposits, or milestones–be sure to note them clearly to avoid misunderstandings.

- Automate Repetitive Sections: For businesses with frequent clients, consider creating a reusable document that automatically fills in standard information, such as payment methods or general terms, to streamline the process.

Benefits of Using an Invoice Template

Utilizing pre-designed forms for billing can greatly enhance efficiency and organization for businesses. These ready-made documents help streamline the invoicing process, ensuring consistency and accuracy in financial transactions. Instead of creating new records from scratch, having a structured format reduces errors, saves time, and maintains a professional appearance. This is particularly helpful for small businesses or freelancers who need to manage multiple requests and transactions without complicated software solutions.

Here are some key advantages of adopting such structured formats:

| Advantage | Description |

|---|---|

| Time Efficiency | Ready-made documents allow for quick updates and data input, reducing the time spent on each transaction. |

| Consistency | Using a standard format ensures that all records follow the same structure, preventing discrepancies and confusion. |

| Professionalism | Well-organized records make businesses appear more credible and reliable to clients and partners. |

| Accuracy | Predefined fields help avoid common mistakes in the calculation of totals, taxes, and other details. |

| Customization | Most forms allow for easy personalization to include company logos, contact information, or specific terms. |

Common Mistakes to Avoid in Invoices

Inaccuracies in billing can lead to confusion, delayed transactions, and strained relationships with clients. It’s essential to avoid common pitfalls that can undermine the professionalism of your business. Ensuring that every detail is correct not only promotes trust but also simplifies the process for both parties. Below are some common errors that can occur when preparing financial documents and how to avoid them.

- Missing or Incorrect Contact Information: Failing to include accurate details such as your company name, address, or phone number can lead to delayed communications and payments.

- Omitting Clear Terms: Lack of clarity regarding deadlines, fees, or other essential conditions can cause confusion. Be specific about payment due dates and other key terms.

- Errors in Amounts: Simple calculation mistakes or forgetting to include taxes or discounts can result in discrepancies that are hard to correct later.

- Not Including Unique Identifiers: Without reference numbers or codes, tracking and reconciling payments can become challenging, especially for long-term clients.

- Failure to Proofread: Spelling errors, incorrect figures, or missing details can create a negative impression. Always double-check your document before sending it out.

By paying attention to these common issues, you can ensure that your financial records are both accurate and professional, leading to smoother transactions and better client relationships.

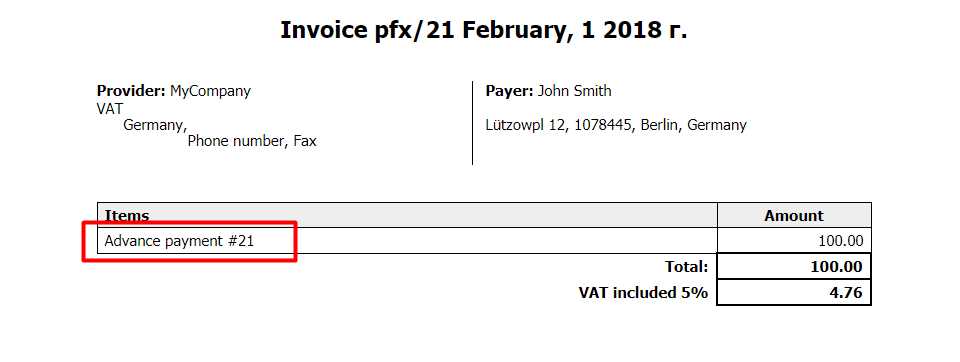

How to Calculate a Down Payment Amount

Determining the initial contribution required for a transaction is an essential part of financial planning, whether for large purchases, services, or agreements. The amount is typically a percentage of the total cost, and calculating it correctly ensures that both parties are aligned on the financial expectations. Understanding how to derive this amount involves straightforward steps based on the total value and the agreed percentage.

Here’s how to calculate the initial amount:

- Identify the Total Amount: Start by determining the full value of the goods or services being provided. This can include any taxes, additional fees, or discounts that apply to the final cost.

- Agree on the Percentage: Usually, a fixed percentage (e.g., 20%, 30%) of the total amount is specified as the required advance. This is typically negotiated or predefined in the terms of the agreement.

- Perform the Calculation: Multiply the total amount by the agreed percentage (expressed as a decimal). For example, if the total is $1,000 and the required percentage is 25%, the calculation would be: 1,000 x 0.25 = 250.

- Confirm the Amount: Ensure that the calculated value aligns with the expectations and agreements between both parties. This is the amount that will be required upfront.

By following these steps, you can easily calculate the necessary contribution for any agreement, ensuring that all terms are clear and well-understood by both sides.

Legal Considerations for Down Payment Invoices

When requesting an upfront contribution for goods or services, it is crucial to ensure that the terms and conditions are legally sound. Properly drafted agreements and documentation protect both the service provider and the client, helping to avoid disputes and misunderstandings. There are several legal factors to consider when setting up the terms for an initial contribution, ranging from clear contract language to compliance with applicable laws.

Key Legal Elements to Include

- Clear Terms and Conditions: Specify the amount to be paid in advance, the due date, and any conditions for refunds or adjustments. Ambiguity can lead to confusion and legal disputes.

- Refund Policy: Outline the circumstances under which a refund may be issued, as well as any penalties or restrictions that may apply. This protects both parties in the event of cancellations or delays.

- Agreement on Delivery or Services: Be sure that the document clearly defines when and how the remaining balance will be paid and what happens if the full amount is not paid by the due date.

- Compliance with Local Regulations: Ensure the agreement complies with local consumer protection laws, such as those governing deposits, refund rights, and transaction cancellations.

- Signatures and Acknowledgments: Have both parties sign the agreement to confirm mutual understanding and acceptance of the terms. This provides legal protection in case of disputes.

Potential Legal Issues to Watch Out For

- Non-refundable Deposits: While non-refundable fees are sometimes permissible, they must be clearly stated and justifiable under the law. Without proper explanation, they could be challenged.

- Unclear Refund Policies: If the refund terms are not transparent, clients may feel misled, potentially leading to legal complaints or claims.

- Failure to Meet Deadlines: If the provider does not fulfill the contract as agreed, clients may be entitled to a refund or compensation, depending on the agreement’s terms.

By carefully addressing these legal aspects, businesses can safeguard their interests while maintaining transparent and professional relationships with clients.

Best Practices for Clear Payment Terms

Establishing well-defined financial conditions at the outset of any agreement is essential to avoid confusion and ensure smooth transactions. Clear terms set expectations for both parties, reducing the potential for misunderstandings and disputes. By outlining specifics such as due dates, amounts, and penalties for late contributions, businesses can create a transparent framework that builds trust with clients while securing their own financial interests.

Key Elements of Clear Financial Terms

| Element | Description |

|---|---|

| Amount and Structure | Clearly define the total amount due and whether the sum is to be paid in full or in installments, including any upfront contributions. |

| Due Date | State the exact date by which payment is expected. If flexibility is necessary, provide a grace period and outline penalties for delays. |

| Accepted Payment Methods | Specify which payment methods are acceptable (e.g., bank transfer, credit card, online platforms) to avoid confusion. |

| Late Fees | Indicate any fees or interest charges that apply in case of delayed payments, and explain when these charges begin to accrue. |

| Refund Policy | Clarify the conditions under which refunds may be issued, including the process for requesting one and any applicable time limits. |

Best Practices for Drafting Financial Terms

- Be Specific: Avoid vague language. Use clear, straightforward terms to prevent misinterpretation.

- Use Simple Language: Legal jargon can confuse clients. Keep the language simple and easy to understand.

- Ensure Mutual Understanding: Confirm that both parties acknowledge and agree to the terms in writing, ideally through signed agreements.

- Stay Transparent: Outline all potential charges, penalties, and conditions so that there are no hidden costs.

- Review Regularly: Periodically review and update your payment terms to ensure they remain aligned with your business practices and relevant laws.

By following these best practices, businesses can establish clear financial conditions that foster trust, improve cash flow, and avoid disputes with clients.

How to Format Your Down Payment Invoice

Proper formatting is key when creating a document requesting an initial contribution for goods or services. A well-structured document not only ensures clarity but also enhances professionalism and reduces the chances of errors. The right format should be easy to read, organized, and include all necessary details to avoid confusion between the parties involved. Below are the key elements to consider when formatting such a document.

| Section | Description |

|---|---|

| Header | Include your business name, logo, and contact information at the top of the document. This establishes your brand identity and provides the client with a quick way to contact you. |

| Date | Clearly mark the date the document is issued. This helps track deadlines and serves as a reference for both parties. |

| Client Information | List the client’s name, address, and contact details to ensure the document is directed to the correct party. |

| Itemized List | Break down the services or goods being provided with a description, quantity, unit cost, and total for each item. This transparency helps prevent misunderstandings. |

| Initial Contribution Amount | Clearly state the amount being requested upfront, along with any applicable taxes or discounts. Specify the percentage of the total cost it represents. |

| Payment Terms | Outline the terms for the remainder of the balance, including the due date and acceptable payment methods. Also, indicate any late fees or penalties for overdue amounts. |

| Terms and Conditions | Provide a summary of the agreement’s terms, including cancellation policies, refund conditions, and other relevant legal points. |

| Signature Line | Include a space for signatures from both parties, confirming that the terms are agreed upon. This adds a layer of formality and security to the transaction. |

By adhering to these formatting guidelines, you can create a clear and professional document that sets expectations and protects both your business and your client.

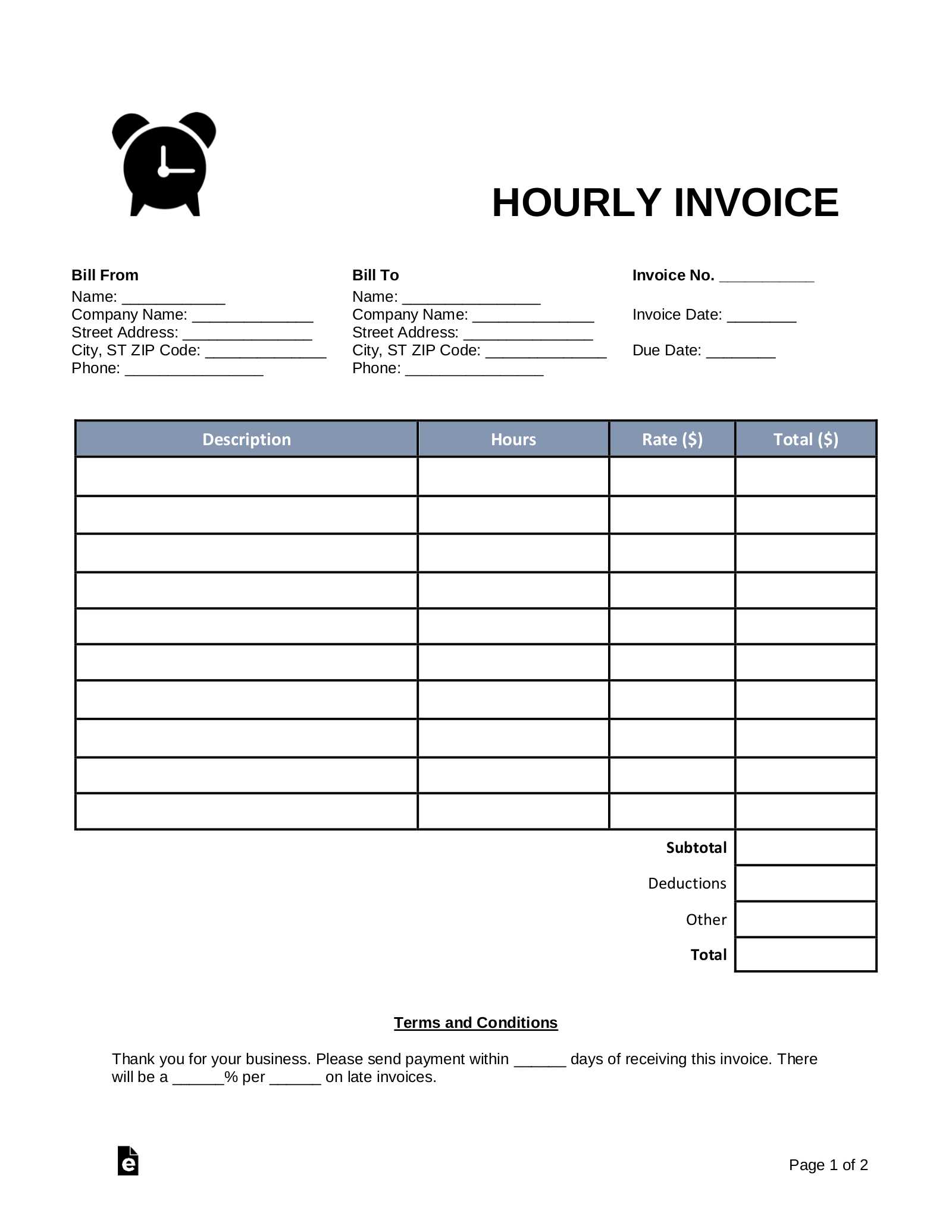

Incorporating Payment Schedules into Invoices

When dealing with larger projects or agreements requiring multiple contributions over time, including a clear payment schedule in your billing documents is essential. This provides both the business and the client with a clear roadmap of when and how payments should be made. A well-defined payment schedule helps manage cash flow, ensures timely compensation, and prevents misunderstandings regarding payment deadlines.

Here are some key steps for incorporating a payment plan into your billing documents:

- Specify Payment Milestones: Break down the total amount into stages or milestones. Each milestone represents a specific portion of the work or deliverable. This makes it clear when each installment is due.

- Set Clear Dates: Clearly outline the due dates for each installment. If necessary, include grace periods and penalties for overdue amounts to encourage timely payments.

- Define the Amounts: Include the specific amount due for each stage of the project. This helps the client understand exactly what they owe at each point, avoiding confusion over totals.

- Include Payment Methods: State the methods by which payments can be made (e.g., bank transfer, credit card, online payment system). Provide your payment details for ease of processing.

- Explain Terms of Completion: Outline what will be delivered or completed for each installment. This ties the payments to specific outcomes, reinforcing the value of each contribution.

- Clarify Consequences for Non-Payment: Define the actions that will be taken if payments are missed or delayed, such as suspension of services or interest charges on overdue amounts.

By clearly outlining a payment schedule, both parties can avoid confusion and ensure that the financial side of the project progresses smoothly. It also provides a reference point in case of disputes or misunderstandings down the line.

Templates vs Custom Invoices: Which is Better?

When it comes to preparing billing documents, businesses often face a choice between using pre-designed forms or creating completely custom records for each transaction. Both options have their advantages, but the best choice depends on the specific needs of the business and the type of service being offered. Understanding the pros and cons of each can help determine which approach suits your business processes and client relationships best.

Advantages of Using Pre-Designed Forms

- Time Efficiency: Pre-designed forms allow for quick customization, which is ideal for businesses with a high volume of transactions.

- Consistency: Using a standardized format ensures all documents look the same, maintaining professionalism and reducing the chance of errors.

- Ease of Use: Many pre-designed options are user-friendly, with fields already laid out for key information, making them easy to fill out even for those with minimal experience.

- Cost-Effective: Pre-made forms are typically available at little to no cost, making them a budget-friendly option for smaller businesses or startups.

Advantages of Custom Billing Records

- Personalization: Custom documents can be tailored to reflect the unique needs of each client or project, ensuring that every detail is specific to the transaction.

- Flexibility: With a custom approach, you have the freedom to include any specific terms or conditions that a pre-designed form might not accommodate.

- Branding Opportunities: Custom records allow for better integration of branding elements like logos, colors, and personalized messages, helping to enhance your business identity.

- Adaptability: As your business grows, custom documents can evolve alongside your changing processes and service offerings, allowing for continuous improvements.

Ultimately, the choice between pre-designed forms and custom records depends on the nature of your business, the volume of transactions, and how much time and effort you’re willing to invest in the process. For businesses that need efficiency and consistency, pre-designed forms may be the best option. However, if your business requires flexibility, personalization, or a unique brand image, creating custom documents could be the better choice.

Managing Client Expectations with Invoices

Clear and transparent documentation is crucial for managing client expectations in any business transaction. When both parties understand the financial terms and obligations, it reduces the risk of misunderstandings and disputes. A well-structured billing record ensures that clients are fully aware of the amounts due, timelines, and any specific conditions tied to the agreement. By setting clear financial expectations from the start, businesses can foster trust and maintain positive relationships with their clients.

Here are some ways to effectively manage client expectations through billing documentation:

- Provide Detailed Descriptions: Ensure that every service or product is clearly described with corresponding costs. Clients should be able to easily understand what they are being charged for.

- Set Clear Deadlines: Include specific due dates for each installment or the total amount. This helps clients understand when their financial obligations must be met and prevents delays.

- Clarify Terms and Conditions: Clearly outline any terms regarding late fees, refunds, or cancellations. Being upfront about these policies helps clients understand the consequences of not adhering to the terms.

- Communicate Progress: If the billing is tied to milestones or project stages, keep clients updated on progress. This can reassure them that their payments are being applied according to the agreed-upon terms.

- Offer Flexibility Where Possible: If your business model allows for it, consider offering flexible options such as installment plans or different payment methods, which can make it easier for clients to manage their finances.

By providing clear, organized financial records and maintaining open communication throughout the process, businesses can manage client expectations effectively, ensuring a smooth and successful transaction.

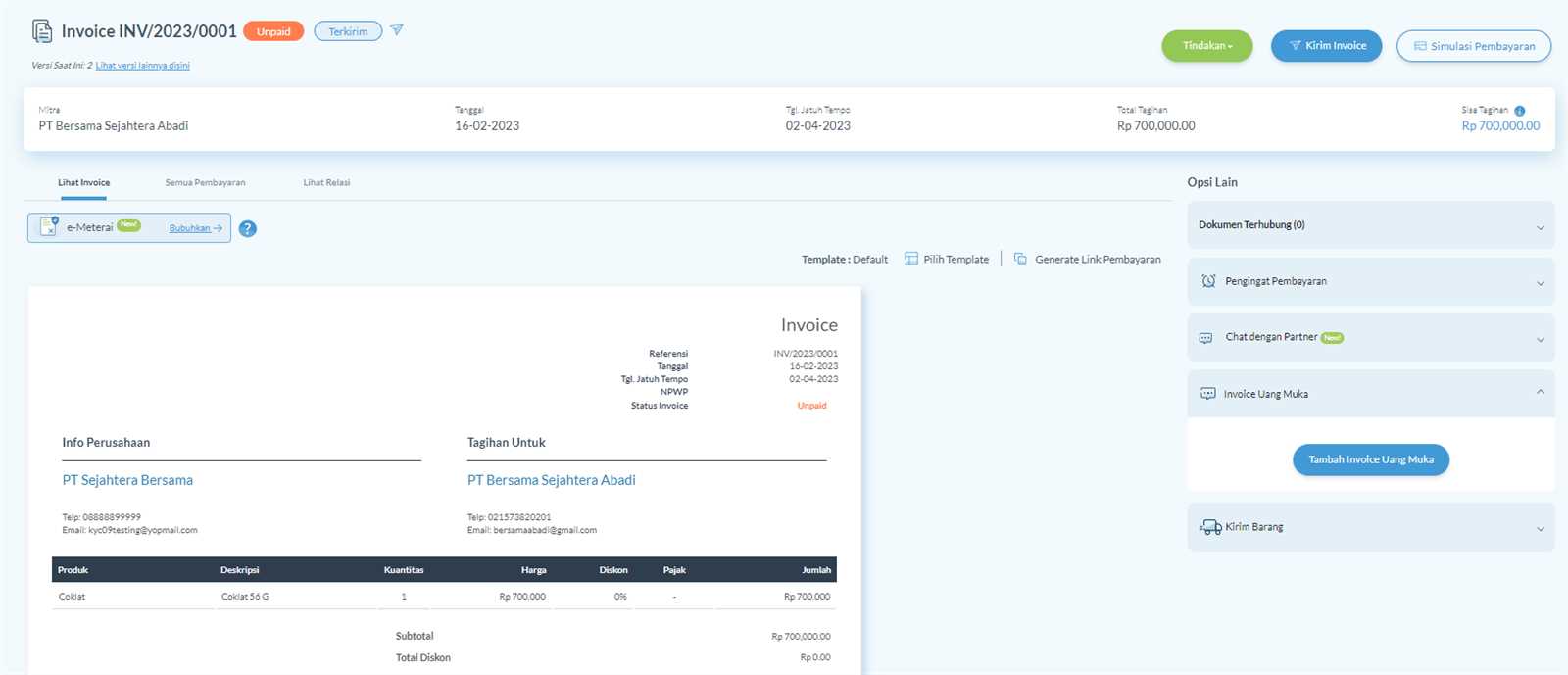

Automating Down Payment Invoice Creation

Creating financial documents for initial project contributions can be streamlined through automated systems. These tools allow businesses to efficiently prepare structured records, ensuring accuracy and saving valuable time for other operations. Automation also minimizes human errors, providing consistency across all documents.

- Improved Speed: Automated solutions reduce manual entry time, enabling faster generation of each document.

- Enhanced Accuracy: Automation helps eliminate calculation errors, ensuring each record matches client expectations.

- Consistent Format: Standardized templates keep all files uniform, facilitating a more professional presentation.

- Data Integration: Many automation tools integrate with existing databases, pulling client and project information directly into each document.

Implementing automation in this process enhances reliability, allowing businesses to maintain high standards and reduce processing times significantly.

Tracking Payments with Invoice Templates

Monitoring financial contributions throughout a project’s lifecycle is essential for effective cash flow management. Structured documentation tools allow businesses to keep detailed records of each transaction, providing transparency and helping track client contributions over time. Organized forms support quick access to financial history, making financial oversight straightforward.

Benefits of Using Structured Forms

Well-organized formats offer several advantages for tracking client transactions. They ensure consistency in record-keeping, reduce the likelihood of errors, and make financial follow-ups simpler. Here are some common details tracked for each contribution:

| Item | Description | Amount | Date |

|---|---|---|---|

| Service/Product | Details of the item provided | Amount credited | Transaction date |

| Taxes/Fees | Any additional charges applied | Amount calculated |