Easy to Use Invoice Doc Template for Professional Invoicing

When it comes to managing business finances, having a structured approach to creating financial documents is essential. Whether you’re a freelancer, small business owner, or part of a larger enterprise, ensuring that your records are clear, accurate, and easy to understand can save time and reduce errors. The process of drafting formal requests for payment shouldn’t be complicated, and with the right tools, it can become much more efficient.

Using pre-designed formats to generate such documents can simplify the task. These ready-made structures provide an organized framework that guarantees consistency, professionalism, and compliance with common business practices. Instead of starting from scratch every time, you can rely on customizable options that meet your specific needs and maintain a polished appearance across all your records.

Whether you’re handling a handful of transactions or managing large-scale invoicing, having a reliable method for generating payment requests can streamline your workflow. This approach not only saves you valuable time but also ensures that all necessary details are captured, helping to avoid potential disputes or misunderstandings with clients. By implementing these efficient solutions, you can focus more on growing your business and less on administrative tasks.

Invoice Document Template: A Complete Guide

Creating professional payment requests is essential for any business. The process can be simplified by using structured formats that ensure all necessary information is included, reducing the risk of errors and misunderstandings. In this guide, we’ll explore how to create, customize, and use pre-designed formats that streamline the process of generating formal billing documents.

Why Use a Structured Format?

Having a consistent format for all payment-related documents not only saves time but also improves the clarity of communication with clients. These pre-designed formats can be tailored to suit various needs, whether you’re a freelancer, small business owner, or part of a larger organization. The use of a structured approach ensures that important details like contact information, payment terms, and itemized services are clearly presented.

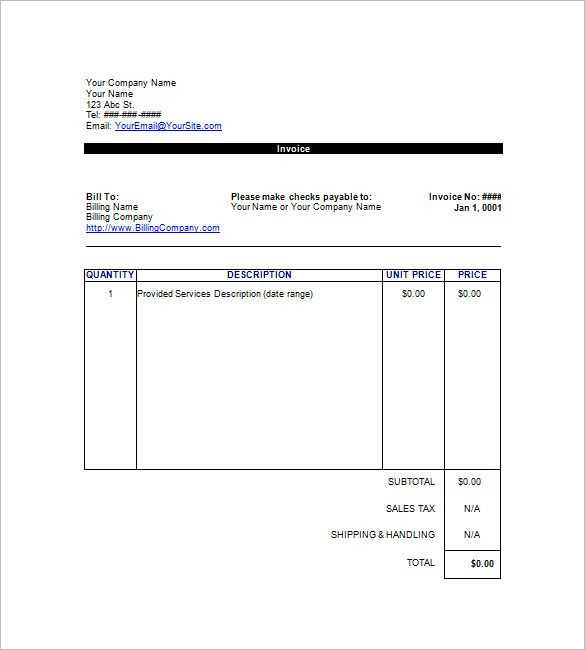

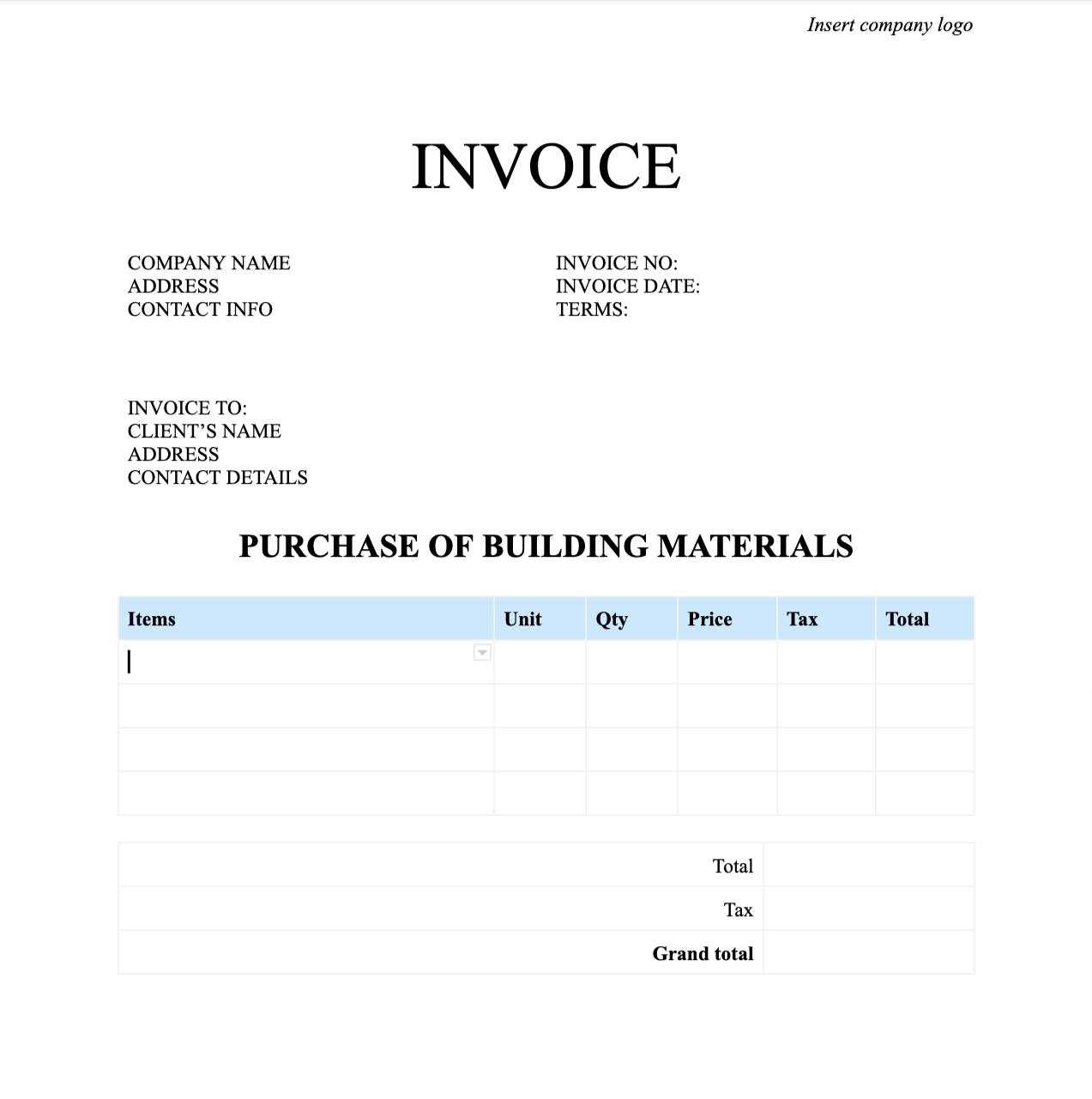

Steps to Create a Professional Billing Document

To create a polished and effective document, start by selecting a suitable structure that fits your business requirements. A well-designed document should include fields for the sender’s details, recipient’s information, a description of the products or services, the total amount due, and payment terms. Once you’ve selected the appropriate layout, customization becomes straightforward, allowing you to add or remove specific sections as needed.

By utilizing a well-organized structure, you ensure that every essential detail is accounted for, enhancing your business’s credibility and improving the client experience. These formats help you maintain professionalism while simplifying the billing process, allowing you to focus on what matters most – delivering quality services.

Why You Need an Invoice Template

For any business or freelancer, keeping financial records clear and well-organized is crucial. Having a ready-made structure for billing documents offers several advantages, making the process smoother and more efficient. Instead of creating new documents from scratch every time, using pre-designed formats ensures consistency, reduces errors, and saves valuable time.

Here are some key reasons why using a structured billing format is beneficial:

- Time-saving: A pre-designed structure eliminates the need to start from scratch, allowing you to create documents quickly and easily.

- Consistency: Using a standard layout ensures that all your billing documents follow the same professional format, making them easier for clients to understand.

- Reduced Errors: Structured formats help ensure all necessary fields are filled in correctly, minimizing mistakes and omissions.

- Professionalism: A polished document reinforces your business’s credibility and creates a positive impression with clients.

- Legal Compliance: Many regions require certain details in billing documents for tax and legal reasons. A structured format helps you meet these requirements.

With a reliable structure in place, you can focus on delivering quality services while streamlining your financial processes. A well-organized format not only benefits your business but also improves the experience for your clients, making them more likely to trust and return for future work.

How to Create a Billing Document

Creating a professional payment request document is essential for clear communication and smooth business transactions. By following a structured approach, you can ensure that all necessary details are included, reducing the risk of errors and disputes. Here’s a step-by-step guide to creating an effective billing document.

The key components to include are the following:

| Section | Description |

|---|---|

| Sender’s Details | Include your business name, address, phone number, and email address. |

| Recipient’s Information | Provide the client’s name, address, and contact details. |

| Document Date | Indicate the date the document is created to track payment deadlines. |

| Description of Goods/Services | List the items or services provided, including quantity, rate, and description. |

| Amount Due | State the total amount owed, including taxes and additional fees, if applicable. |

| Payment Terms | Specify the payment due date and any late fees or penalties for overdue payments. |

| Payment Methods | List accepted payment options, such as bank transfer, PayPal, or credit card. |

Once all the details are included, review the document for accuracy and clarity. Customizing

Benefits of Using Billing Document Templates

Utilizing pre-designed structures for creating financial documents brings numerous advantages to any business. Instead of manually creating payment requests from scratch, having a set format streamlines the entire process, saving both time and effort. This approach not only enhances the efficiency of your operations but also ensures that all necessary information is consistently included, reducing the chance of mistakes.

Here are some of the key benefits:

- Time Efficiency: With a ready-made structure, creating a document becomes a quick task. You no longer need to worry about formatting or organizing content, allowing you to focus on other important aspects of your business.

- Consistency: Using the same layout for all financial documents ensures that they look professional and consistent. This makes it easier for clients to understand and track their payments, contributing to smoother business interactions.

- Accuracy: A predefined format helps eliminate errors by including all the necessary fields. By reducing the chance of omissions, you can be confident that all critical details–such as amounts, due dates, and services–are clearly presented.

- Professional Appearance: A well-designed document adds credibility to your business. Clients are more likely to trust your brand and take payment requests seriously when they are presented in a polished, organized manner.

- Compliance: Certain legal requirements must be met when creating financial documents. Using a structured format ensures that you include all the necessary information to comply with tax laws and other regulations.

By adopting pre-made structures, you can make the process of creating formal payment documents seamless, professional, and error-free, enhancing both your workflow and client relationships.

Common Features of Billing Documents

Regardless of the industry or type of business, there are certain key elements that should be included in every formal payment request. These essential features help ensure clarity, accuracy, and smooth transactions between businesses and clients. By incorporating these common components into your financial documents, you can create a professional and consistent experience for both parties.

Some of the most important features found in well-structured payment documents include:

- Sender’s Information: This section typically includes the name, address, phone number, and email of the business or individual requesting payment. It establishes clear identification and allows clients to contact you if needed.

- Recipient’s Details: The client’s information should be listed here, including their name, company (if applicable), and address. This ensures that the document is directed to the correct party and avoids confusion.

- Document Date: The date the document is issued is crucial for tracking payment deadlines. This date is typically used to calculate when payment is due.

- Itemized List: A clear breakdown of the products or services provided, including a brief description, quantity, unit price, and total cost. This section helps the client understand exactly what they are paying for.

- Total Amount Due: The final amount owed, which should be clearly displayed, including any taxes, fees, or additional charges. This number must be accurate to prevent misunderstandings.

- Payment Terms: The terms specify when payment is due, any late fees or penalties for overdue payments, and accepted payment methods. This section helps set expectations and provides clear guidelines for the client.

- Unique Reference Number: Including a reference or invoice number helps with tracking and organizing records, making it easier to identify specific payments if needed in the future.

By ensuring that these features are consistently included, you can create documents that are not only easy for clients to understand but also legally sound and professionally presented. This makes it easier for businesses to manage their financial transactions and maintain positive client relationships.

Customizing Your Billing Document Structure

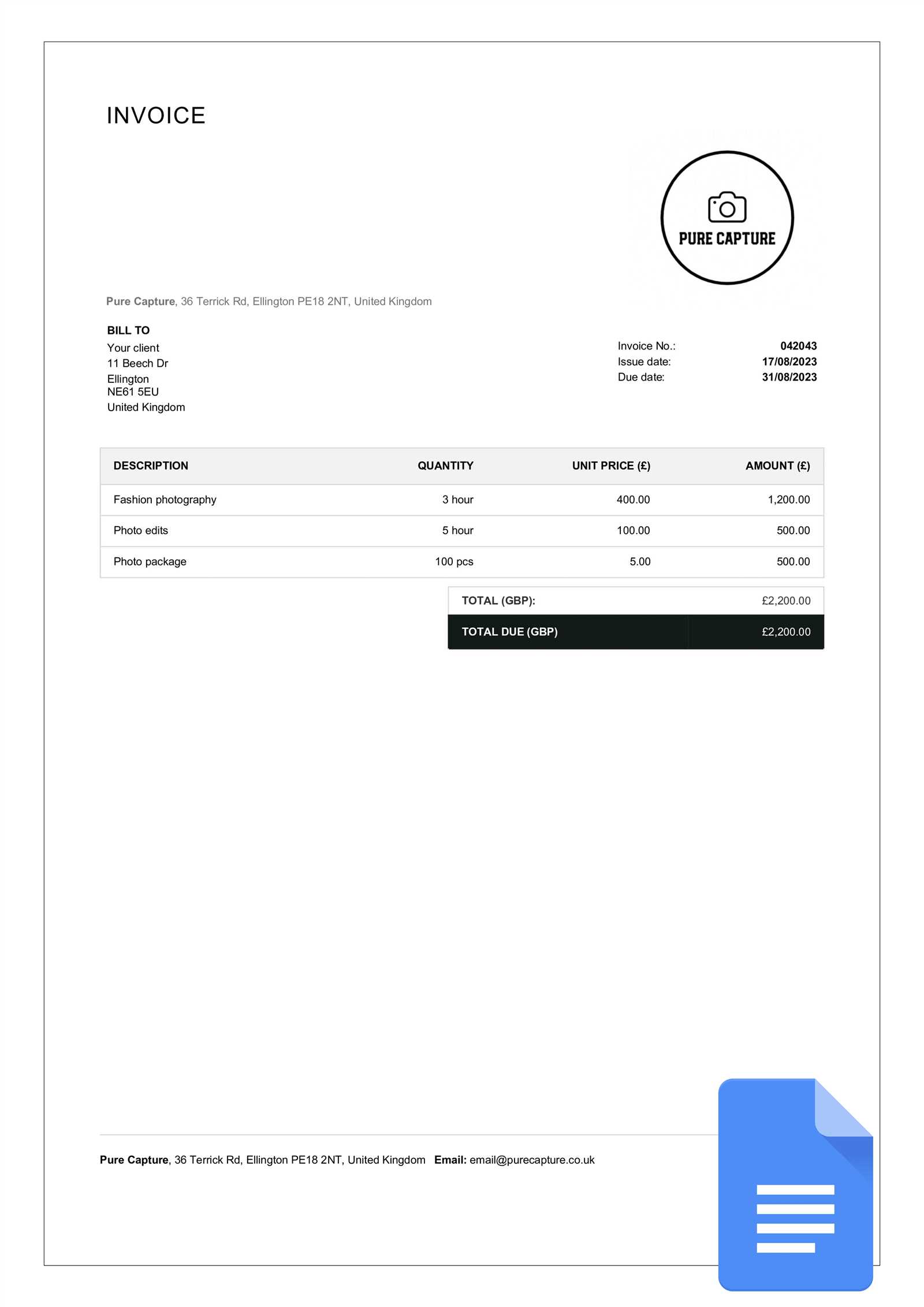

Personalizing your payment request documents ensures that they reflect your unique business needs and branding. Customization allows you to adapt the format to suit different types of transactions and industries, while maintaining consistency in the look and feel of your documents. By adjusting the layout, design, and content, you can create a tailored experience for your clients that reinforces your professionalism.

Key Customization Options

When modifying your billing documents, several key elements can be adjusted to better suit your business or personal preferences:

- Business Branding: Include your logo, business name, and color scheme to make your documents align with your overall brand identity.

- Font Style and Size: Choose a readable font style and adjust the size for different sections to enhance clarity and visual appeal.

- Payment Terms: Customize the terms of payment, such as the due date, late fees, and available payment methods, to match your business policies.

- Field Customization: Add or remove specific fields depending on the nature of the transaction. For example, you can include a field for project milestones, discounts, or additional notes.

- Tax Information: Include applicable taxes or tax identification numbers to comply with local tax laws and ensure transparency in pricing.

Designing for Clarity and Professionalism

When customizing, always prioritize clarity and professionalism. Ensure that all important information is easy to find and clearly labeled. Simple and clean designs help clients quickly locate the details they need, from payment deadlines to itemized costs. Additionally, a consistent layout reinforces your business’s professionalism and helps foster trust with clients.

By tailoring the design and content to your specific needs, you create a document that not only meets your business requirements but also reflects your unique brand and strengthens your relationship with clients.

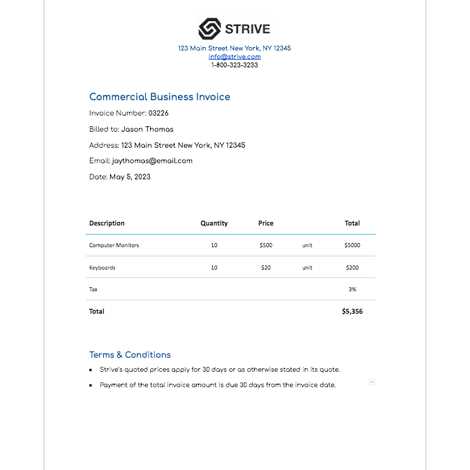

Best Billing Document Formats Explained

Choosing the right structure for your payment request can make a significant difference in how your business is perceived and how smoothly your transactions proceed. Different formats offer various advantages depending on the complexity of the services or products you’re offering. By understanding the strengths of each format, you can select the one that best suits your needs, ensuring both clarity and professionalism in every communication.

Here are some of the most popular and effective formats:

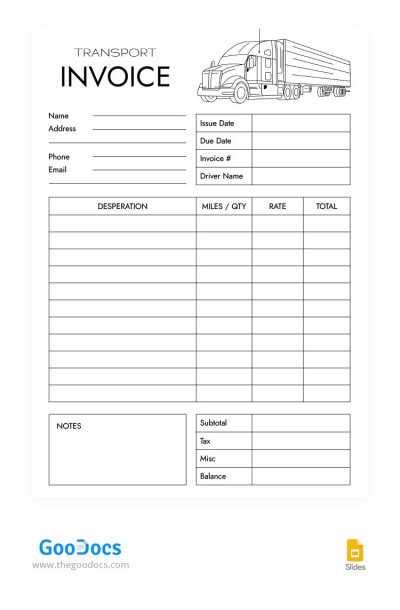

- Basic Layout: This is the most common format, ideal for simple transactions. It includes essential information like sender and recipient details, itemized services, and the total amount due. This straightforward structure is perfect for small businesses or freelancers with limited billing needs.

- Detailed Breakdown: For businesses offering complex services or products, this format provides an in-depth breakdown of costs. It includes sections for multiple services, detailed descriptions, hourly rates, and taxes. This format is particularly useful for consultants, contractors, or those with varied offerings.

- Recurring Billing Format: This format is designed for businesses that charge clients on a regular basis, such as subscription services or membership fees. It includes a schedule of payments, recurring dates, and clear terms regarding automatic renewals or changes in rates over time.

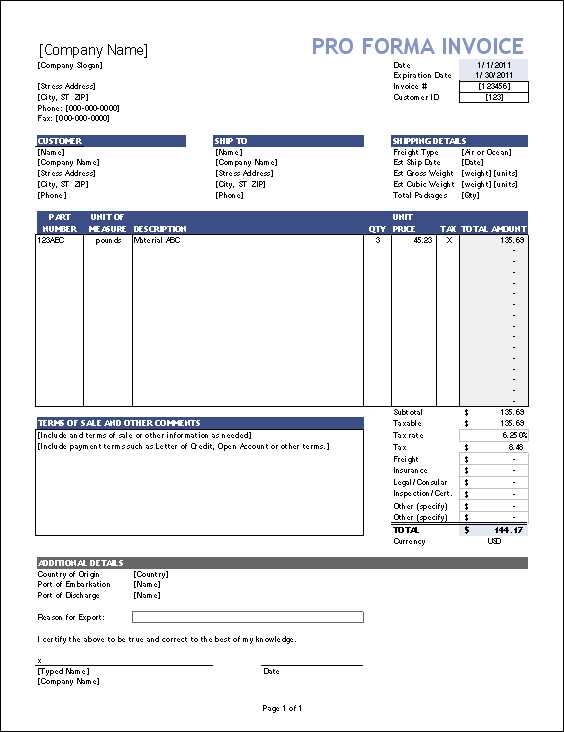

- Proforma Format: A proforma format is typically used when the final price is not yet confirmed, or when an estimate is required before actual billing. It offers a preliminary overview of expected charges, with clear notations that the document is an estimate rather than a final bill.

- Commercial Format: A more formal structure typically used for large transactions, commercial formats are suited for business-to-business (B2B) interactions. This format often includes terms of sale, shipping information, and purchase order references, offering a comprehensive look at both financial and logistical details.

The right format for your business will depend on the nature of your work and the needs of your clients. By selecting a structure that matches your workflow and communication style, you ensure a smooth process for both you and your customers, making it easier to maintain positive, ongoing business relationships.

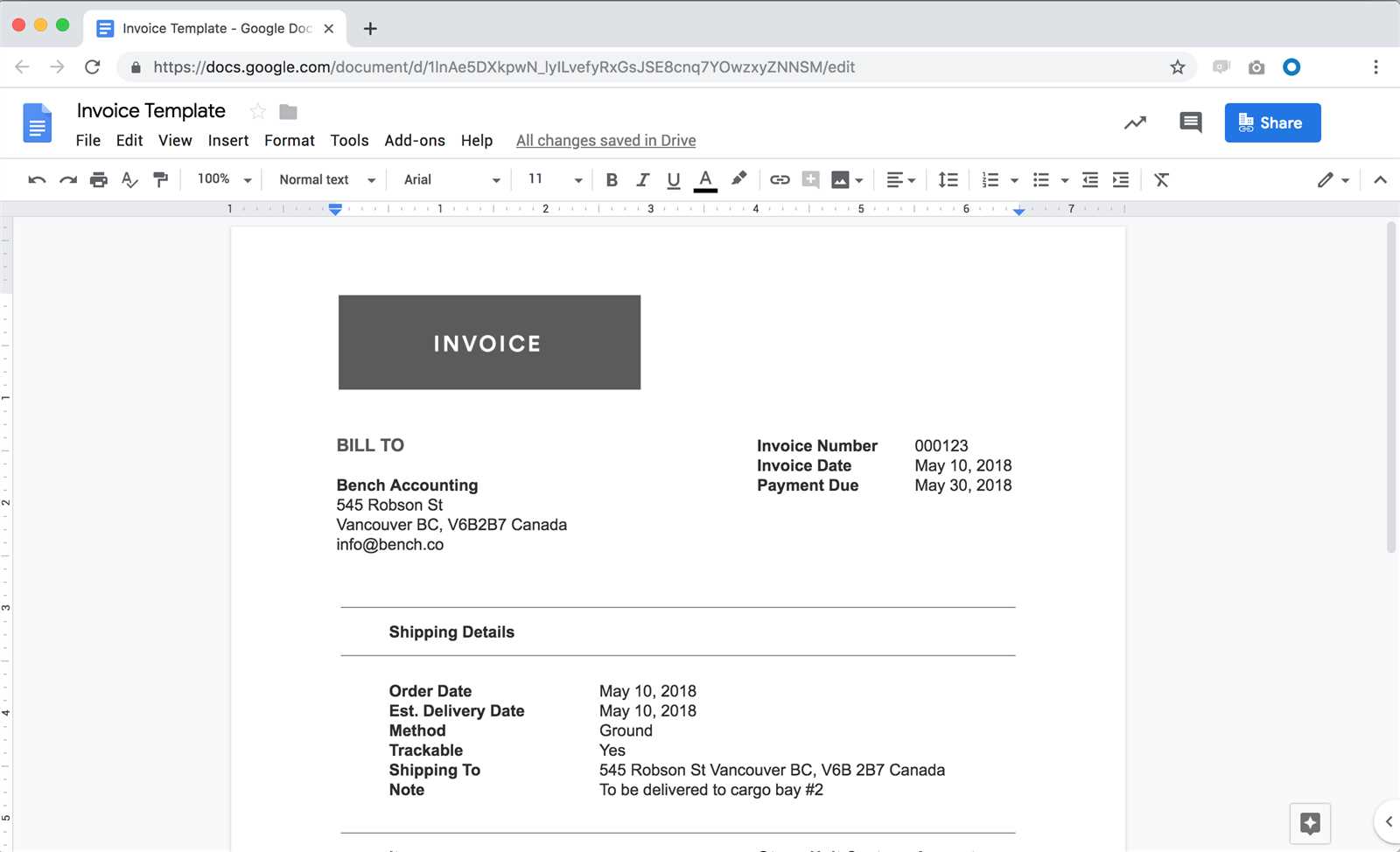

Where to Find Free Billing Document Templates

Many businesses and freelancers look for simple and accessible solutions when creating formal payment documents. Fortunately, there are numerous platforms offering free, ready-to-use formats that can be customized to fit your specific needs. These resources allow you to save time and ensure your documents meet professional standards, all without the cost of purchasing specialized software.

Here are some of the best places to find free, customizable billing document structures:

| Resource | Description |

|---|---|

| Microsoft Office | Microsoft offers a variety of free downloadable billing structures within Word and Excel. These formats are fully customizable, and the Excel templates allow for easy calculations. |

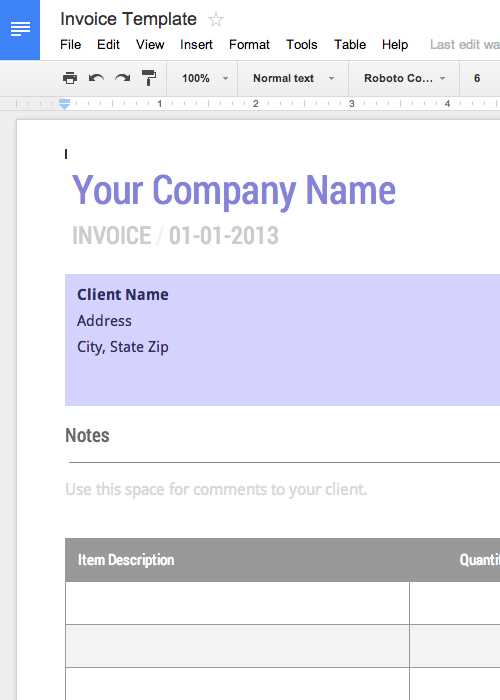

| Google Docs | Google Docs provides free templates that can be accessed directly in Google Drive. These templates are cloud-based, allowing for easy sharing and collaboration in real-time. |

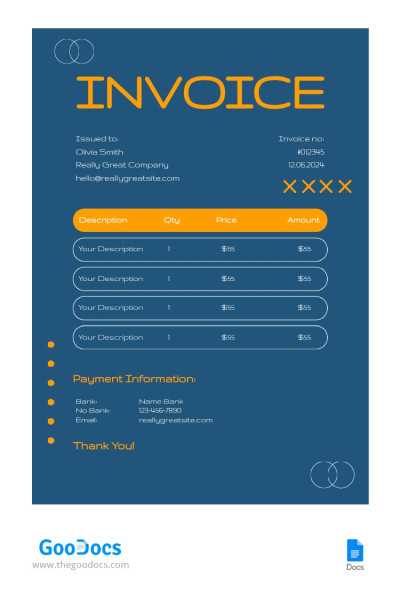

| Canva | Canva offers visually appealing billing structures that can be customized with their easy-to-use design tools. These templates are ideal for businesses that want to maintain a unique and branded look. |

| FreshBooks | FreshBooks provides a free and user-friendly invoicing platform that includes customizable billing document layouts. Their service is often free for small businesses with minimal billing needs. |

| Zoho | Zoho offers free billing formats with additional features for small businesses. It’s a great option for those looking for more integrated solutions for tracking payments and managing clients. |

By exploring these free resources, you can quickly find the right structure that suits your business, helping you streamline your billing process and maintain a professional image without the need for costly software solutions.

Top Tools for Creating Billing Documents

Creating professional payment requests has never been easier, thanks to the variety of online tools and software available today. Whether you’re a freelancer, small business owner, or part of a larger organization, these platforms offer intuitive interfaces that allow you to generate customized documents quickly and efficiently. Many tools come with additional features, such as automatic calculations, payment tracking, and integration with accounting software, to streamline your financial management.

Here are some of the best tools for creating payment requests:

- QuickBooks: Known for its accounting capabilities, QuickBooks also offers an easy-to-use billing platform. It allows you to create and send custom payment requests, track payments, and integrate with your overall accounting system. It’s a great choice for small businesses looking for an all-in-one solution.

- Wave: Wave is a free, cloud-based tool that simplifies the process of creating and managing billing documents. It includes features such as customizable layouts, automatic tax calculations, and recurring billing options. Wave is ideal for freelancers and small businesses on a budget.

- FreshBooks: FreshBooks is a user-friendly tool that focuses on simplifying billing for service-based businesses. It offers customizable formats, automatic reminders for overdue payments, and detailed reporting features to help you stay on top of your finances.

- Zoho Invoice: Zoho Invoice offers a robust set of tools for creating and managing payment requests. It includes features like multi-currency support, time tracking, and customizable branding, making it a strong choice for businesses with international clients or complex billing needs.

- Canva: Canva provides an easy way to design visually appealing billing documents. While it’s primarily a graphic design tool, Canva offers customizable billing layouts that can be downloaded and used for transactions. It’s perfect for businesses that want to create unique and branded documents.

These tools offer a range of features to help you create professional, customized billing documents quickly and easily. By selecting the right platform for your needs, you can streamline your payment process and focus more on growing your business.

How to Save Time with Billing Document Templates

Generating formal payment requests can often be a time-consuming task, especially when creating them from scratch each time. By using pre-designed structures, businesses can drastically reduce the time spent on preparing these documents. With the right layout in place, you can quickly input the necessary details and generate a professional request without having to start from zero every time.

Here are a few ways in which using a ready-made structure can help save time:

- Consistency: A standardized format allows you to fill in key details quickly, as all sections are predefined. This reduces the chances of missing important information and minimizes time spent on layout adjustments.

- Pre-filled Information: Many platforms allow you to save client information, such as name, address, and payment preferences. This means you can reuse the same details without re-entering them for every document, cutting down on repetitive tasks.

- Automated Calculations: Some tools and formats automatically calculate totals, taxes, and discounts, saving you time on manual math and ensuring accuracy.

- Recurring Billing: For businesses with regular clients or subscription services, using a structured format allows you to set up recurring payment requests. This can be automated to send out on specific dates, saving time and reducing administrative work.

- Customization Options: Ready-made structures can be customized to suit different services or clients. Once you set up a few variations based on your needs, you can quickly select the right one for each transaction and make minimal adjustments.

By implementing a well-organized system and utilizing pre-made formats, businesses can improve efficiency, reduce errors, and streamline their payment request process–leaving more time to focus on what truly matters: serving clients and growing your business.

Essential Information in a Billing Document

When creating formal payment requests, it is crucial to include all the necessary details that clearly communicate the transaction terms. The goal is to provide the recipient with everything they need to understand what is being billed, how much is due, and when payment is expected. Missing or unclear information can lead to misunderstandings, delayed payments, and frustration for both parties.

The following components are essential for creating a complete and professional payment request:

- Sender’s Information: This section should include the business or individual issuing the payment request. It typically consists of the name, address, contact number, and email address, making it easy for the recipient to reach out if needed.

- Recipient’s Details: Just as important as the sender’s information, this section lists the name, address, and contact information of the person or company being billed. Correctly addressing the recipient ensures the document reaches the right person and can be processed promptly.

- Unique Reference Number: A reference or identification number is essential for tracking and organizing documents. This helps both the sender and recipient easily locate and reference the specific payment request, especially in case of disputes or follow-ups.

- Itemized List of Services or Products: Clearly detail the services provided or products sold, including quantities, descriptions, unit prices, and any applicable taxes. This breakdown helps avoid confusion and clarifies what the recipient is paying for.

- Total Amount Due: Clearly display the final amount to be paid, including any discounts, taxes, or additional fees. This ensures the recipient understands the exact amount owed and helps prevent payment errors.

- Payment Terms: Outline the payment due date, any late fees, and the available methods of payment. This section sets expectations for when and how payment should be made, reducing the likelihood of delays.

- Payment Instructions: If specific payment methods are preferred (e.g., bank transfer, PayPal, credit card), be sure to include all relevant details to guide the recipient through the payment process.

By ensuring these elements are present in your billing document, you provide clear communication, help facilitate timely payments, and create a professional impression that can build trust with clients and partners.

How to Organize Your Billing Documents

Proper organization of your payment records is essential for managing your business’s finances efficiently. Whether you’re a freelancer, a small business owner, or part of a larger organization, keeping track of your financial transactions in an orderly way ensures that you can easily access the information you need when it’s time to follow up with clients, file taxes, or review your cash flow. A well-structured system can also save you time and help avoid errors that might affect your business operations.

Here are some key strategies for organizing your payment records:

| Method | Description |

|---|---|

| Use a Consistent Naming Convention | Choose a naming system that works for you and stick with it. For example, you can include the client name and the date (e.g., “ClientName_2024-10”). This makes it easy to identify documents at a glance and prevents confusion when searching for a specific record. |

| Digital Folder System | Create a well-organized folder structure on your computer or in the cloud. You can organize records by client, project, or month. This allows you to quickly find and manage multiple records while keeping everything secure and backed up. |

| Automated Tracking Tools | Use accounting or invoicing software to track and manage your payment requests. These tools often offer features that help categorize and store records, making it easy to generate reports and search for specific transactions. |

| Keep Clear Documentation of Payments | When payments are received, mark the corresponding record as paid and store it accordingly. Keeping a clear record of payment dates, amounts, and methods can help you stay on top of outstanding balances and avoid confusion with clients. |

| Use Color Coding or Labels | For physical records or digital files, consider using color-coding or labels to mark the status of each payment request. For example, you could use green for paid, yellow for pending, and red for overdue documents. This provides a quick visual reference and helps prioritize follow-ups. |

By implementing a clear organizational system, you not only stay on top of your financial records but also ensure that your business operations run smoothly. A well-organized system makes it easier to manage payments, avoid overdue issues, and keep your workflow efficient.

Billing Documents for Small Businesses

For small businesses, managing billing and payment requests efficiently is crucial to maintaining a steady cash flow. With limited resources, it’s important to streamline administrative tasks like creating payment requests to save time and avoid errors. By using pre-designed formats, small business owners can easily generate professional, clear, and accurate documents that reflect their brand and meet their clients’ needs.

Why Small Businesses Need Professional Billing Documents

For small business owners, presenting a professional image is essential. A well-structured payment request can help establish credibility with clients and ensure a smooth payment process. Additionally, using a consistent format across all transactions helps maintain order and reduces the risk of mistakes or miscommunications.

Best Formats for Small Business Billing

- Simple and Clear Layout: A clean and straightforward design is ideal for small businesses that want to quickly generate and send payment requests without unnecessary complexity. It typically includes the most important details like business name, recipient’s information, services or products, and total amount.

- Customizable Branding: Customizing the document to match your business’s brand–such as adding your logo and using your brand’s colors–helps reinforce your company’s professional image and makes your documents stand out.

- Itemized Breakdown: Small businesses offering multiple products or services should consider using a layout that allows for detailed breakdowns. An itemized format makes it clear to clients what they are paying for, which is especially important for transparency and avoiding disputes.

- Recurring Billing Format: For businesses that provide ongoing services (like subscriptions or maintenance), using a recurring billing format can save time by automating the process of sending out regular payment requests.

By selecting the right format, small business owners can improve the efficiency of their billing process, reduce administrative burdens, and ensure that clients receive clear and professional documents every time.

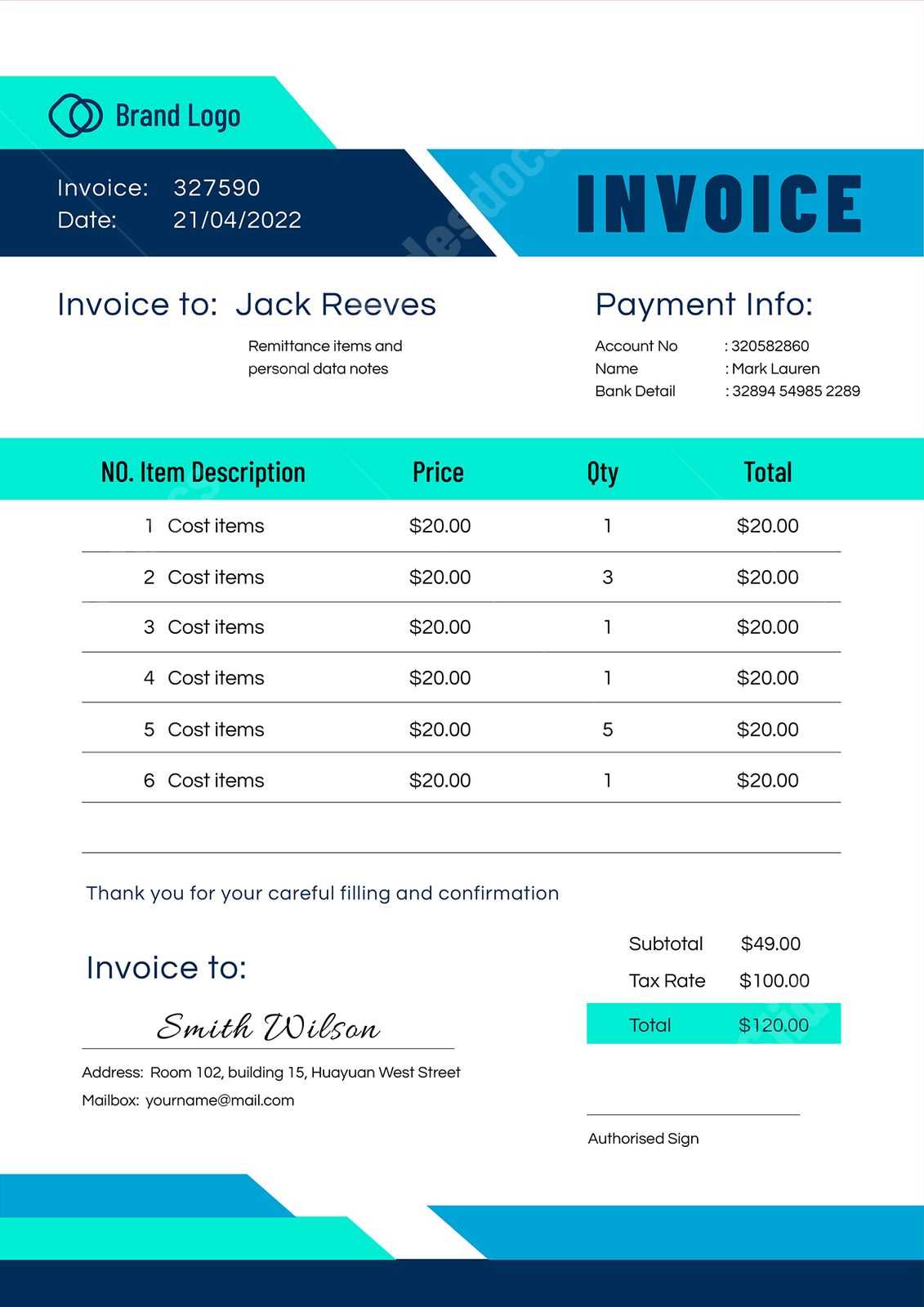

What Makes a Professional Billing Document

A professional payment request is more than just a document; it serves as an essential communication tool between a business and its clients. It not only provides clients with clear payment instructions but also reflects the professionalism and credibility of the business. Whether you’re a freelancer or a small business owner, ensuring your payment requests are well-designed, clear, and accurate is critical for building trust and facilitating timely payments.

Key Elements of a Professional Payment Request

A well-structured payment document includes several essential elements that make it both functional and professional. These elements ensure that clients understand what they are being charged for, how to make payments, and when payment is due.

- Clear Branding: Including your business logo, contact information, and any other brand elements helps personalize the document and reinforces your company’s identity.

- Detailed Breakdown: A professional billing document should clearly list the products or services provided, including quantities, unit prices, and any taxes. This transparency ensures that there are no misunderstandings between the sender and recipient.

- Precise Payment Terms: Clearly stating when the payment is due, as well as any late fees or discounts for early payment, sets expectations and helps avoid confusion.

- Accurate Totals: Double-checking that all calculations are correct is essential to maintaining professionalism. Ensure that totals, taxes, and discounts are accurately reflected.

- Simple Layout: A clean, easy-to-read format is key to creating a document that’s both professional and functional. Avoid clutter and use sections or tables to organize the information in a visually appealing way.

How a Professional Payment Request Builds Trust

When clients receive clear and organized billing documents, they feel more confident in their dealings with your business. This not only improves the likelihood of timely payments but also enhances your reputation as a reliable and trustworthy business partner. By maintaining consistency in your payment requests, you build a professional image that clients can rely on.

Incorporating these elements into your payment documents ensures that you project a professional image and foster stronger business relationships, while also making the payment process smoother for both parties.

Billing Documents for Freelancers

Freelancers face unique challenges when it comes to managing their finances, especially when it comes to creating clear, professional payment requests. Unlike traditional employees, freelancers often work with multiple clients and need a straightforward, efficient way to bill for their services. Using a structured document ensures that payment terms are clear, that the client knows exactly what they are paying for, and that all necessary information is included for smooth transactions.

Here are some key features that freelancers should look for in their payment requests:

- Personalized Branding: Freelancers should customize their documents with their name, logo, or personal brand elements to give the document a professional look and feel. This helps create a sense of consistency and trust with clients.

- Clear Breakdown of Services: Whether it’s hourly rates or project-based fees, clearly outlining the services provided–along with a description, quantity, and rate–ensures there is no confusion on what the client is paying for.

- Easy-to-Understand Payment Terms: Freelancers should state the payment due date, late fees (if applicable), and preferred payment methods. Being clear about when and how payments are expected helps avoid delays and misunderstandings.

- Flexible Format: Since freelancers work with various clients, having a versatile format that allows for quick customization is important. Whether it’s adjusting payment terms or adding new services, flexibility ensures you can adapt to different project needs.

- Client Contact Information: Including both your contact details and your client’s is critical for follow-ups or resolving payment-related issues. It should include phone numbers, email addresses, and business addresses where applicable.

By using well-organized billing documents, freelancers can not only save time but also create a more professional and reliable impression with their clients. These documents are an essential tool for managing cash flow, tracking payments, and maintaining smooth client relationships.

How to Avoid Billing Mistakes

Creating accurate and professional payment requests is essential for maintaining smooth business operations and building trust with clients. However, mistakes in these documents can lead to confusion, delayed payments, and even damage to your reputation. By following some simple best practices, you can avoid common errors and ensure your billing process remains efficient and error-free.

Here are some key strategies to help you avoid mistakes when preparing payment requests:

- Double-Check Client Information: Ensure that the recipient’s name, address, and contact details are correct before sending. Incorrect details can lead to delays or misdirected payments.

- Verify Service Details: Always provide an accurate and detailed breakdown of the services or products provided. Ensure quantities, descriptions, and unit prices are correct to avoid disputes.

- Check Your Math: One of the most common mistakes is incorrect calculations. Use automated tools or check your math manually to ensure totals, taxes, and discounts are accurate.

- Specify Payment Terms Clearly: Clearly define payment due dates, late fees, and accepted payment methods. This prevents confusion and sets expectations with the client.

- Use Consistent Formatting: Consistency in formatting helps make your documents easier to read and understand. Use the same structure for every billing document to avoid missing key elements.

- Review for Typos: Small errors, such as spelling mistakes or incorrect terms, can make your business appear unprofessional. Always proofread your documents before sending them out.

- Follow Up on Unpaid Bills: If a payment is overdue, send polite reminders or follow-up documents. This ensures that you keep track of outstanding balances and maintain good communication with clients.

By taking a few extra steps to review your billing documents, you can avoid costly mistakes, maintain a professional image, and ensure that your payments are processed smoothly and on time.

Billing Documents and Tax Filing

Properly managing your financial records is crucial when it comes to filing taxes. Accurate and well-organized billing statements play an important role in ensuring that your income and expenses are clearly documented, making the tax filing process smoother and more efficient. Whether you’re a freelancer, small business owner, or contractor, keeping track of your transactions can help you stay compliant and avoid costly mistakes during tax season.

How Billing Documents Help with Tax Filing

Having organized and detailed records of your payments and receipts not only makes it easier to track your business’s performance but also simplifies the preparation of your taxes. Here’s how these documents can assist:

- Income Tracking: Billing records provide clear proof of the income you’ve earned, which is essential for reporting your earnings to tax authorities.

- Expense Documentation: When you track the products or services you’ve purchased for your business, your payment records serve as supporting documentation for any deductible expenses.

- Tax Calculations: Billing documents help ensure you account for any applicable taxes, such as sales tax or VAT, making it easier to calculate your tax liability correctly.

- Audit Protection: Well-maintained records can protect you in case of an audit by providing a detailed history of your financial transactions.

Best Practices for Organizing Billing Records for Taxes

To make the most of your billing documents during tax season, it’s essential to follow some key practices:

- Keep Records for a Set Period: Tax authorities often require that you keep financial records for several years. Make sure to organize and store your payment requests securely for at least 3-7 years, depending on your local regulations.

- Organize by Year or Quarter: Sort your billing documents by year or quarter to make it easier to review your income and expenses when tax season arrives.

- Use Digital Tools: Leveraging accounting or invoicing software can help automate the process of organizing and categorizing transactions, saving you time and effort when preparing for tax filing.

By maintaining detailed and organized billing records, you not only stay compliant with tax laws but also streamline the tax filing process, reducing stress and minimizing errors. These practices help ensure that you can confidently report your income and expenses, making tax time much more manageable.

Ensuring Billing Compliance with Legal Standards

When creating payment documents for your business, it’s crucial to ensure they comply with legal and tax regulations. Failing to meet the necessary standards can lead to disputes, fines, or even legal action. Understanding the required components of a billing document and adhering to jurisdictional laws can protect your business and ensure smooth transactions with clients.

Key Legal Requirements for Billing Documents

There are several key elements that businesses must include in their billing records to remain compliant with legal standards. These details not only fulfill regulatory requirements but also help prevent misunderstandings with clients:

- Business Information: Your company’s full name, business address, and tax identification number are often required to verify the legitimacy of the document.

- Client Information: Including the client’s name, address, and contact details ensures that the payment document is associated with the correct party and facilitates easy communication if needed.

- Detailed Description of Goods or Services: Providing clear descriptions of the products or services delivered ensures that the client understands exactly what they are paying for. This also supports the proper classification of expenses and income for tax purposes.

- Amount Charged: Clearly stating the amount due, including any applicable taxes or discounts, is necessary for compliance with tax laws, especially in relation to VAT or sales tax.

- Payment Terms: Defining the due date, any penalties for late payment, and accepted payment methods is essential. Specific regulations may apply depending on the region, including maximum allowable payment periods.

- Unique Identification Number: Many jurisdictions require each payment document to have a unique invoice number for tracking purposes. This helps maintain a systematic record of transactions for both the business and the tax authorities.

Ensuring Compliance with Local Laws

Compliance standards for payment documents may vary depending on your location and the type of business you run. It is essential to stay informed about the legal requirements that apply to your industry and jurisdiction. Here are a few steps to ensure your billing documents meet legal standards:

- Research Local Regulations: Consult with a tax advisor or legal professional to ensure that your payment requests meet local tax and business law requirements.

- Keep Up with Changes in Tax Law: Tax laws and compliance requirements may change, so it’s important to regularly review your billing processes to ensure they stay current with any updates.

- Automate Compliance: Using invoicing software that automatically incorporates legal standards can help ensure compliance and reduce the risk of human error.

By following these guidelines and ensuring your payment documents are fully compliant with legal standards, you can avoid legal issues, improve your business’s credibility, and maintain a smooth relation