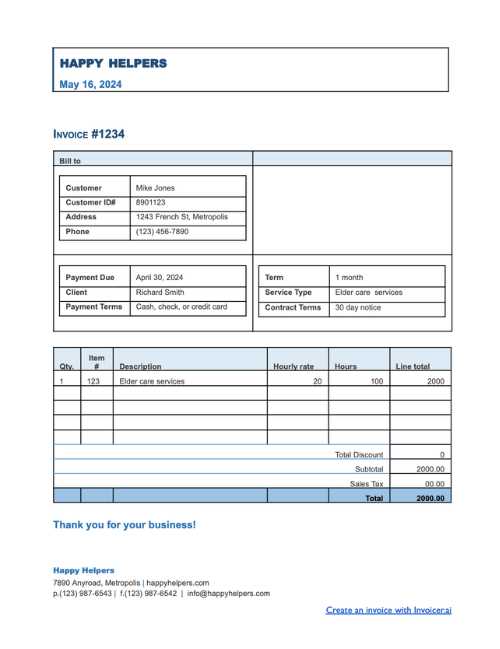

Easy to Use Invoice Database Template for Better Billing Management

Efficient record-keeping is essential for any business, ensuring that financial transactions are well-organized and easily accessible. With the right tools, tracking and managing financial data can become a streamlined and error-free process. This section focuses on solutions that simplify the process of organizing payment and billing information, enhancing both productivity and accuracy.

Customizable tools allow businesses to tailor their data management systems to their specific needs, providing a foundation for clear and effective financial tracking. By utilizing well-structured systems, users can easily keep track of payments, outstanding balances, and important dates.

Automating key functions within these tools helps to eliminate repetitive tasks, improving efficiency and reducing the chance for human error. With the proper setup, these systems ensure that every financial record is securely stored and effortlessly retrievable whenever needed.

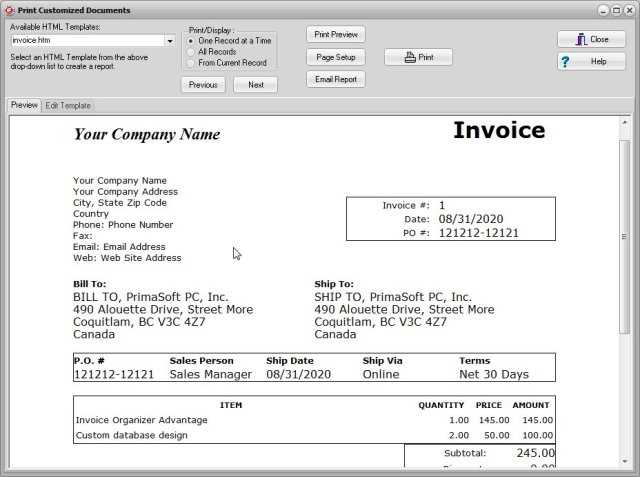

How to Create an Invoice Management System

Building an organized system for managing financial records requires a few key steps to ensure efficiency and accuracy. The goal is to create a structure that allows for easy input, retrieval, and tracking of payment-related information, helping you maintain a smooth workflow and avoid confusion.

To begin, it’s essential to choose the right platform that suits your needs. Whether you use a spreadsheet program, a cloud-based service, or custom software, ensure the tool is user-friendly and allows for flexibility in design. Here’s a general outline for setting up your system:

- Determine the Information to Track: Decide on the key details you need to store, such as client names, payment amounts, dates, and due dates.

- Choose a Structure: Organize the data in a way that makes sense for your business. Common options include a tabular structure or categorized sections for different clients or projects.

- Design Input Fields: Ensure that each piece of information has a dedicated space to be filled out. This helps prevent missing or inconsistent entries.

- Enable Sorting and Filtering: Make sure your system allows for easy sorting and filtering by different criteria like date, client, or amount. This feature can be very helpful when searching through records.

- Ensure Security and Backup: Protect sensitive data by using secure access protocols and regularly backing up your records to avoid data loss.

Once your system is set up, it’s important to consistently input data correctly and regularly update records as transactions occur. With time, you will create a streamlined process that improves efficiency and helps manage financial data effortlessly.

Key Features of a Good System

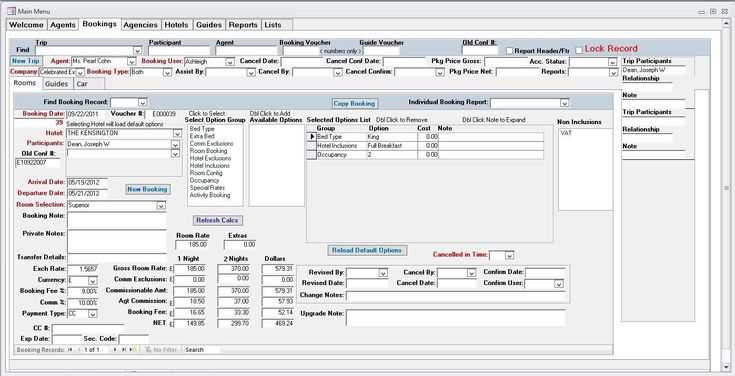

When selecting a system for managing financial records, there are several important qualities to look for that ensure efficiency and ease of use. A well-constructed system should allow users to enter, track, and manage data smoothly, with all necessary features for accurate record-keeping and quick access to information.

Usability and Flexibility

A good system should be user-friendly, with a simple and intuitive interface that makes it easy for anyone to input and retrieve data. The structure should also be flexible enough to adapt to different types of financial transactions and businesses, allowing customization as needed.

Organized and Structured Layout

Effective systems prioritize organization, grouping similar data together and making it easy to find specific information. This structured layout should allow for quick filtering and sorting, which can be crucial when managing a large volume of entries.

| Feature | Description |

|---|---|

| Ease of Use | The system should be simple to navigate, with a clean and intuitive interface that reduces the learning curve. |

| Customization | Allows adjustments to suit your specific needs, such as adding custom fields or changing the layout. |

| Data Sorting and Filtering | Enables easy organization and retrieval of information by sorting or filtering based on different criteria. |

| Security | Includes measures to protect sensitive financial data and ensure that access is granted only to authorized users. |

By focusing on these key features, you can build or select a system that not only organizes information effectively but also streamlines your processes, saving you time and reducing errors in your financial management tasks.

Benefits of Using an Organized Record System

Implementing an organized system for managing financial records offers numerous advantages that help businesses maintain control over their transactions. These systems not only simplify the management process but also enhance accuracy, reduce errors, and increase overall efficiency. Whether you’re a small business owner or part of a larger organization, leveraging such a system provides both immediate and long-term benefits.

Improved Efficiency and Time Savings

By automating various tasks such as tracking payments, issuing receipts, and organizing client information, businesses can save valuable time. Instead of manually processing each record, an efficient system enables quick data entry and retrieval, allowing staff to focus on more important tasks.

Accurate and Streamlined Financial Records

With a well-designed structure, the risk of errors is greatly reduced. The ability to store and organize all financial information in one place ensures that nothing is overlooked, and helps avoid costly mistakes, like missed payments or incorrect billing details.

| Benefit | Description |

|---|---|

| Time Efficiency | Reduces manual processes by automating tasks, allowing quicker and easier management of financial data. |

| Accuracy | Helps minimize errors by ensuring all relevant information is properly recorded and organized. |

| Data Security | Provides secure storage for sensitive information, protecting it from unauthorized access and potential loss. |

| Easy Reporting | Facilitates generating financial reports, making it easier to assess the overall financial health of a business. |

Overall, implementing such a system creates a more organized, reliable, and efficient approach to handling financial tasks, leading to better management and greater control over your business’s finances.

Choosing the Right Software for Financial Management Tools

Selecting the appropriate software to manage financial records is a crucial step in ensuring efficient and reliable tracking of transactions. The right solution should offer the features and flexibility needed to handle various types of financial data, while also being user-friendly and secure. When evaluating options, it’s important to consider factors such as ease of use, integration capabilities, and customization options to ensure that the software meets your business’s unique needs.

Different software solutions offer different functionalities, so understanding what is most important for your workflow will help guide your decision. Whether you’re looking for basic features or a comprehensive suite, you must balance ease of use with the ability to scale as your business grows.

| Criteria | Description |

|---|---|

| Usability | The software should be easy to navigate and intuitive, allowing users to input and manage data without a steep learning curve. |

| Customization | Look for software that allows customization to fit your specific needs, such as adding custom fields or adjusting layouts. |

| Integration | Choose a solution that integrates well with other tools your business uses, such as accounting software or CRM systems. |

| Security | Ensure the software provides robust data protection features, including encryption and secure user access. |

| Scalability | Opt for software that can grow with your business, offering the ability to handle increasing amounts of data over time. |

By focusing on these key factors, you can select the right software that not only meets your current requirements but also offers long-term value as your business evolves.

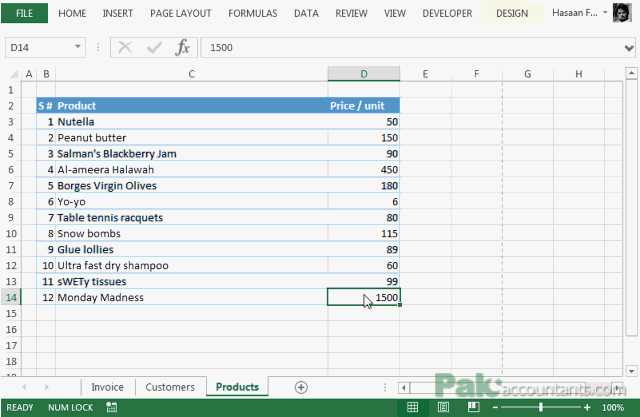

Customizing Your Financial Management System

Tailoring your financial tracking system to suit the specific needs of your business is essential for maximizing its effectiveness. Customization allows you to adapt the structure and features of the tool to better align with the types of transactions you handle, the way you track data, and the reporting requirements that are most relevant to your operations.

By modifying various components, you can ensure the system is not only efficient but also intuitive for your team. Customization options may include adjusting data fields, setting up automated functions, or reconfiguring the layout to make certain information more accessible.

Here are some aspects you can customize in your financial management system:

- Data Fields: Modify or add fields to capture specific information relevant to your business, such as project codes or payment methods.

- Layout: Adjust the visual structure to highlight the most important data, making it easier to read and navigate.

- Automation: Set up automatic notifications for due payments or create recurring entries to streamline routine tasks.

- Reports: Design customized reports to meet your needs, whether for internal analysis or client-facing documentation.

Customizing your system ensures that you have full control over how your financial records are organized, making it a more powerful tool that fits seamlessly into your daily business operations.

Steps to Organize Financial Data Efficiently

Properly organizing financial records is essential for maintaining accuracy and ensuring smooth operations within any business. With a well-structured approach, you can easily track transactions, retrieve important details when needed, and minimize the risk of errors. By following a few strategic steps, you can establish an efficient system that meets your specific business needs.

1. Categorize and Group Your Data

The first step in efficient data organization is to categorize your records based on relevant criteria, such as clients, payment statuses, or transaction types. Grouping data into logical categories ensures that you can quickly find specific information when needed. For example, you could organize by:

- Client names or project names

- Payment status, such as paid, pending, or overdue

- Date, with separate sections for different months or years

2. Implement Consistent Naming Conventions

Using consistent naming conventions for your entries will further streamline the process. This consistency allows for easier sorting and searching. For example, ensure that all client names, project titles, or payment terms are spelled the same way each time. This small step can save a lot of time when you need to pull reports or review past transactions.

Tip: Make sure that your naming system is clear and standardized across all records. This will prevent confusion when multiple people are accessing the data.

By following these steps, you can create an organized structure that simplifies tracking, reduces errors, and makes financial management more efficient overall.

How to Track Payments in a System

Effectively tracking payments is crucial for maintaining financial control and ensuring that all transactions are properly accounted for. A well-structured system allows you to monitor payments in real-time, check the status of outstanding amounts, and quickly identify any discrepancies. By following the right process and using the right tools, you can easily manage your financial records and stay on top of incoming payments.

One of the first steps is to record each payment promptly, ensuring that all relevant details, such as the payer’s information, payment amount, and the date, are included. This data should be consistently updated to reflect the current status of each transaction. Regular tracking helps to avoid missed payments and allows for quick follow-ups when needed.

To track payments efficiently, you can implement the following steps:

- Record Payment Details: For each transaction, ensure that details such as the payer’s name, payment amount, and date of payment are clearly entered into the system.

- Monitor Payment Status: Keep track of whether payments are pending, completed, or overdue to stay on top of outstanding balances.

- Set Up Automated Alerts: Configure automatic reminders for upcoming payments or overdue amounts to ensure timely follow-up.

- Generate Regular Reports: Regularly generate reports to analyze payment patterns, track outstanding amounts, and identify any issues that need attention.

By organizing your payment records in this way, you will have better visibility into your financial situation and improve the accuracy of your reports. This method not only saves time but also helps reduce the likelihood of errors and ensures that your business operations run smoothly.

Automating Financial Document Creation with Tools

Automating the creation of financial documents can significantly improve the efficiency of your business operations. By using pre-designed structures, you can generate standardized documents without manually inputting the same information each time. Automation reduces errors, saves time, and ensures consistency in all your financial records.

Benefits of Automation

Automating the generation of financial documents offers several advantages, particularly for businesses that handle a high volume of transactions. Some key benefits include:

- Time Efficiency: Automation eliminates repetitive tasks, allowing you to generate documents with minimal effort and in less time.

- Consistency: Pre-set formats and fields ensure that each document follows the same structure, reducing the risk of errors or omissions.

- Reduced Errors: Automation helps minimize human mistakes, such as incorrect dates or missing information.

- Better Tracking: Automatically generated documents can be linked to other systems, enabling easier tracking and management.

How to Set Up Automated Document Creation

To successfully automate the creation of your financial records, follow these steps:

- Select an Automation Tool: Choose software that supports automated document generation and integrates with your existing systems.

- Customize Document Layouts: Set up predefined structures that include all necessary fields, such as client details, amounts, and dates.

- Define Automation Triggers: Decide when documents should be created automatically, such as when a payment is received or a transaction is completed.

- Test the System: Run tests to ensure that the automated generation process works smoothly and accurately.

By automating your document creation process, you can improve efficiency, reduce manual labor, and ensure that all financial documentation is created accurately and on time.

Improving Accuracy in Financial Records

Ensuring the accuracy of financial records is essential for maintaining the integrity of your business operations. Small errors in data entry or tracking can lead to significant issues, including incorrect reporting and financial discrepancies. By implementing systematic approaches and using reliable tools, you can significantly enhance the precision of your financial documentation and reduce the risk of mistakes.

The key to improving accuracy lies in consistency and thoroughness. By adopting a few best practices, you can minimize human error and ensure that all records are properly maintained. Regularly reviewing and updating your processes also helps in identifying areas where mistakes are more likely to occur, allowing you to take corrective action before they become problems.

Here are several strategies to improve the accuracy of your financial records:

- Automate Data Entry: Reduce human error by using automated systems for data collection and entry. This ensures that information is input correctly and consistently.

- Use Validation Tools: Implement checks and validations in your system to ensure that all required fields are filled out correctly and that the data entered meets the necessary criteria.

- Double-Check Entries: Establish a routine for reviewing all entries before finalizing them, especially when handling large volumes of transactions.

- Integrate Systems: Ensure that your financial tracking system integrates with other tools, such as accounting software, to reduce the chance of discrepancies between different platforms.

- Train Your Team: Proper training for everyone involved in managing financial data helps ensure that they follow best practices and are aware of the importance of accuracy.

By focusing on these strategies, you can significantly reduce errors, enhance the reliability of your financial data, and improve the overall efficiency of your business operations.

Integrating Your System with Other Platforms

Connecting your system with other platforms and tools is a crucial step in streamlining your business operations. Integration allows for seamless data flow between different systems, reducing the need for manual entry and minimizing the risk of errors. By linking your financial record-keeping system with accounting, CRM, or payment processing tools, you can ensure that all data remains consistent and up-to-date across platforms.

Key Benefits of Integration

Integrating your financial system with other business tools offers several advantages, including:

- Time Savings: Automation of data transfer between systems reduces the time spent on manual data entry and reconciliation.

- Consistency: Synchronizing data ensures consistency across all systems, preventing discrepancies between platforms.

- Improved Accuracy: Reducing manual input decreases the likelihood of errors that can arise from duplicated or inconsistent data.

- Better Insights: Integration allows for the aggregation of data from multiple sources, giving you a clearer and more accurate picture of your business’s financial health.

How to Integrate Your System

To successfully integrate your system with other tools, follow these steps:

- Identify Compatible Platforms: Choose systems that can be easily integrated with your existing software. Look for platforms with open APIs or integration capabilities.

- Map Data Flows: Understand the data flow between the systems to ensure that data is transferred accurately and consistently. Define which fields should be synced between systems.

- Automate Data Syncing: Set up automated data syncing to eliminate the need for manual transfers. This helps ensure that all systems are always up-to-date.

- Monitor and Test: Regularly test the integration to identify any issues, and monitor the data flow to ensure that no critical information is lost or duplicated.

By integrating your financial management system with other essential business tools, you can save time, improve efficiency, and ensure the accuracy and consistency of your data across the board.

Common Mistakes to Avoid with Tools

When working with pre-designed systems, it’s easy to overlook certain aspects that can affect the efficiency and accuracy of your records. While these tools are intended to streamline processes, errors in setup or usage can lead to complications that may impact the overall workflow. Being aware of common mistakes and taking preventive measures can help you get the most out of your systems.

Frequent Errors to Watch Out For

Here are some of the most common mistakes users make when utilizing automated systems:

- Neglecting Customization: Failing to adjust the tool to suit your specific needs can lead to inefficiencies. Always ensure that the layout and structure match your requirements.

- Ignoring Regular Updates: Outdated software or systems may not work as efficiently and could lead to errors in data handling. Make it a point to regularly check for updates or improvements.

- Inconsistent Data Entry: Inaccurate or inconsistent input can result in discrepancies. Always verify that data is entered correctly and uniformly across all systems.

- Lack of Backup Systems: Relying on one system without backups can lead to data loss in case of a technical failure. Ensure that you have backup options to protect critical information.

- Overlooking Security Features: Many tools contain security settings to protect sensitive data. Failing to configure these can expose you to risks. Always enable and regularly review security measures.

Preventive Measures

To avoid these pitfalls and ensure that you are getting the most from your system, consider the following practices:

- Customize the Tool: Tailor the tool to your business’s needs, ensuring it is set up to work efficiently with your workflow and processes.

- Stay Up-to-Date: Keep your system updated to take advantage of new features, bug fixes, and security improvements.

- Standardize Data Entry: Implement guidelines for consistent data entry to avoid errors and ensure accuracy across all records.

- Backup Regularly: Set up automatic backups to avoid losing important information in the event of technical issues.

- Review Security Settings: Always configure and monitor your system’s security features to protect your data from potential threats.

By being mindful of these common mistakes, you can ensure that your system remains effective and reliable, leading to smoother operations and more accurate financial management.

Ensuring Data Security in Your System

Protecting sensitive business information is a crucial aspect of managing any system. Without proper security measures, your records and transactions can be vulnerable to breaches, theft, or unauthorized access. Implementing robust security protocols is essential to safeguard your data and ensure the integrity of your operations. By adopting best practices and using advanced tools, you can enhance the protection of your records and mitigate potential risks.

Data security involves multiple layers, ranging from secure access controls to encryption methods. A comprehensive approach includes setting up strong user authentication, regularly updating security systems, and monitoring for potential threats. It’s essential to stay vigilant and proactive in securing the information to avoid the costly consequences of data breaches.

To ensure your data remains secure, consider the following strategies:

- Encryption: Use encryption to protect sensitive information both in transit and at rest. This ensures that even if unauthorized access occurs, the data will remain unreadable without the proper decryption key.

- Access Controls: Limit access to your system based on roles and responsibilities. Implement strong user authentication methods, such as multi-factor authentication, to ensure that only authorized personnel can access sensitive information.

- Regular Backups: Regularly back up your data to protect it from loss due to system failures or security breaches. Store backups in a secure location and test recovery procedures periodically.

- Firewalls and Anti-Malware: Implement firewalls and anti-malware software to detect and block potential threats from entering your system. Keep these tools up to date to respond to evolving security risks.

- Security Audits: Conduct regular security audits to identify vulnerabilities within your system. Address any weaknesses promptly to prevent exploitation by cybercriminals.

By prioritizing data security and continuously improving your protection measures, you can reduce the likelihood of data breaches and ensure that your system remains s

How to Update and Maintain Systems

Keeping your system up-to-date is essential to ensure that it continues to function efficiently and meets your evolving needs. Regular updates allow you to improve features, fix issues, and maintain compatibility with other tools. A well-maintained system enhances productivity, reduces errors, and ensures that your operations run smoothly. This section outlines key strategies for maintaining and updating your system regularly.

Steps to Keep Your System Updated

To keep your system functioning at its best, consider following these essential steps:

- Regularly Review Features: Assess whether your current setup meets your requirements. Check if there are new features or improvements that could enhance the system’s effectiveness.

- Perform Software Updates: Ensure that all components of your system, including any software or plugins, are updated to their latest versions. This helps patch security vulnerabilities and ensure optimal performance.

- Test for Compatibility: Before updating, test new features or updates in a controlled environment to verify that they are compatible with existing systems and workflows.

- Fix Bugs and Errors: Promptly address any bugs or errors that arise. Keeping a log of issues and resolutions will help you identify recurring problems and improve the overall system.

Best Practices for Maintaining Your System

To ensure the long-term functionality of your system, integrate these best practices into your routine maintenance:

- Document Changes: Keep detailed records of any updates, configurations, or customizations. This documentation will be helpful in troubleshooting and ensuring consistency across different versions.

- Monitor Performance: Regularly evaluate the performance of your system. Monitoring key metrics will help you detect issues early and optimize for better efficiency.

- Back Up Your Data: Always create backups before making significant updates or changes. This ensures that you can recover your information in case anything goes wrong.

- Provide User Training: Ensure that all users are familiar with updates and new features. Offering training sessions will help them adapt to changes and maximize the system’s potential.

By following these steps, you can ensure that your system remain

Exporting Data from Record Systems

Exporting information from a system is an essential task for organizations that need to share, analyze, or backup critical records. It allows you to extract data in a format that can be used in other tools, such as spreadsheets, accounting software, or external applications. Proper export functionality ensures that you can move and store information efficiently while maintaining its integrity and accuracy.

Key Methods for Data Export

There are several ways to export data from a system, and the method you choose depends on the tools and the specific requirements of your business. Below are some common ways to export data:

- CSV (Comma-Separated Values): One of the most popular methods for data export. CSV files can be opened in spreadsheet programs like Microsoft Excel or Google Sheets. This format is simple and widely supported.

- Excel (XLSX): Exporting data directly to an Excel file provides better structure and allows for additional formatting. It is ideal for users who need to work with the data immediately in a familiar format.

- PDF: If you need to share information in a non-editable format, exporting as a PDF can be useful. This ensures that the formatting remains consistent across devices, although it limits further manipulation of the data.

- XML or JSON: These formats are ideal for integrating with other systems, allowing easy transfer of data between applications. They are often used when automating data exchange or syncing information with external platforms.

Steps for Exporting Data

To ensure a smooth and accurate export process, follow these steps:

- Step 1: Select the Data: Choose the specific records you wish to export. Depending on your system, you may be able to filter the data by date range, category, or other criteria.

- Step 2: Choose Export Format: Select the format that best fits your needs. Consider what program or system the exported data will be used in and choose the most compatible format.

- Step 3: Review and Confirm:

Tips for Managing Multiple Clients

Effectively managing several clients can be a challenging yet rewarding task. To ensure smooth operations and maintain strong relationships, it is important to stay organized, communicate clearly, and deliver consistent service. By applying key strategies, you can efficiently handle multiple clients without sacrificing quality or attention to detail.

Stay Organized with a System

Having a structured approach to tracking your clients’ projects, communications, and deadlines is essential. A well-organized system will help you keep everything in order and reduce the chances of overlooking important details. Here are some tips:

- Use a CRM Tool: Customer Relationship Management (CRM) software is a powerful tool for keeping track of client interactions, project status, and contact details. It can help you manage multiple clients at once by providing a centralized location for all important information.

- Maintain Detailed Records: For each client, maintain detailed records of their preferences, past communications, and project history. This will help you stay informed and provide personalized service.

- Set Reminders: Deadlines and follow-up tasks should never be missed. Utilize reminders in your CRM or calendar apps to stay on top of important dates.

Effective Communication is Key

Clear and proactive communication is vital when managing multiple clients. Keeping everyone informed will help build trust and ensure that expectations are met. Here are some suggestions:

- Establish Regular Updates: Schedule regular check-ins or updates with clients to inform them of progress and ask for feedback. This helps to keep the client engaged and ensures alignment on expectations.

- Be Transparent: If there are delays or issues, be open and honest about them. Clients will appreciate transparency, and it can help prevent misunderstandings down the line.

- Prioritize Responsiveness: Respond promptly to client queries and requests. The faster you address concerns, the more professional you will appear, and the stronger your relationship will be.

By implementing these strategies, you can effectively manage multiple clients while ensuring high levels of satisfaction and efficient workflow. Proper organization and communication will help you build lasting professional relationships and keep your business running smoothly.

How to Make Your Template Scalable

Creating a flexible and scalable structure is essential when designing tools for managing and organizing information. As your business or project grows, the need for adaptability becomes crucial. A well-designed structure should be able to expand and adjust to accommodate increased data, users, and complexity without sacrificing performance or usability.

Here are some strategies to ensure your system remains scalable as demands evolve:

Design with Flexibility in Mind

From the outset, consider how your system might need to grow in the future. Design for change by choosing a structure that can handle growth smoothly.

- Modular Design: Break down the structure into smaller, independent sections that can be updated or expanded without affecting the entire system. This allows for easy adjustments as new features or data requirements emerge.

- Use Scalable Tools: Choose software or frameworks that are known for their scalability. This can include database management systems, spreadsheets, or specialized tools that are designed to handle growth over time.

- Optimize for Performance: Ensure that your system can handle larger volumes of data or interactions efficiently. This means optimizing your code, reducing unnecessary complexity, and choosing technologies that can handle increased load.

Plan for Future Expansion

When creating your system, think ahead about potential future needs. This involves not just data but also user management and interface complexity.

- Ensure Data Flexibility: Design fields and structures that can easily accommodate new types of information as your requirements change. For example, allow for additional data fields or categories that can be added without disrupting the existing structure.

- Limit Hard-Coding: Avoid hard-coding data into the system. Instead, build flexibility into the design so that changes can be made easily as your needs evolve.

- Incorporate Automation: Integrating automation tools or processes can greatly improve scalability by reducing the need for manual updates and adjustments.

By following these strategies, you can ensure that your system remains functional and efficient as your business grows and your needs change. A scalable design enables you to adapt quickly to new challenges, making your operations more effective and sustainable in the long run.

Best Practices for Invoice Organization

Efficient management and organization of financial records are key to maintaining smooth operations. Properly organizing your financial documents can save time, reduce errors, and improve the accuracy of your business operations. Whether you’re managing receipts, transaction records, or payment details, having a clear structure in place is essential for ongoing success.

Here are some best practices to ensure your financial data is organized effectively:

1. Implement a Consistent Naming System

One of the first steps to organizing financial records is to create a consistent naming system for each document. This makes it easier to locate specific entries when needed. Ensure that your naming convention includes the key details, such as the date, client, and amount. A standard naming structure might look like this: “ClientName_Date_Amount” or “Date_TransactionNumber_Client”. This system not only simplifies sorting but also avoids confusion when reviewing records.

2. Use Categorization for Easy Access

Another vital aspect of organization is categorizing your records into clearly defined groups. Create separate folders or categories for different types of financial records. For example:

- Receipts and Payments: Keep a separate category for receipts and another for payment confirmations.

- Client-Specific Records: Group records based on individual clients or projects, which helps in quickly finding relevant details.

- Tax Documents: Maintain a dedicated folder for tax-related information such as invoices for tax reporting purposes.

Having these categories in place will enable you to quickly retrieve specific records, which is especially important during audits or when preparing financial reports.

3. Digitize and Backup Data Regularly

Moving away from paper-based records and digitizing your files can significantly improve organization and accessibility. Scanning or inputting records into digital systems allows for better storage, quicker retrieval, and less physical space needed. Additionally, ensure that you regularly back up your data to avoid loss in case of system failures. Cloud storage or external drives are excellent options for safeguarding your files.

By following these best practices, you can streamline your financial document management, ensuring that your business remains organized and efficient. Properly structured records are not only easier to track but also reduce the risk of costly mistakes and time-consuming searches.