Top Invoice Dashboard Template for Excel to Improve Your Billing Workflow

Managing finances, especially keeping track of payments and outstanding amounts, is crucial for any business. With the right tools, organizing and monitoring financial data becomes much simpler, leading to improved efficiency and fewer errors. A streamlined system can save time and reduce the chances of missing important updates, making it easier to stay on top of income and expenditures.

By utilizing well-structured documents, professionals can quickly gain insights into their financial standing, track pending payments, and visualize trends. These systems allow for seamless updates and easy analysis, ensuring business owners can focus on growth rather than administrative tasks.

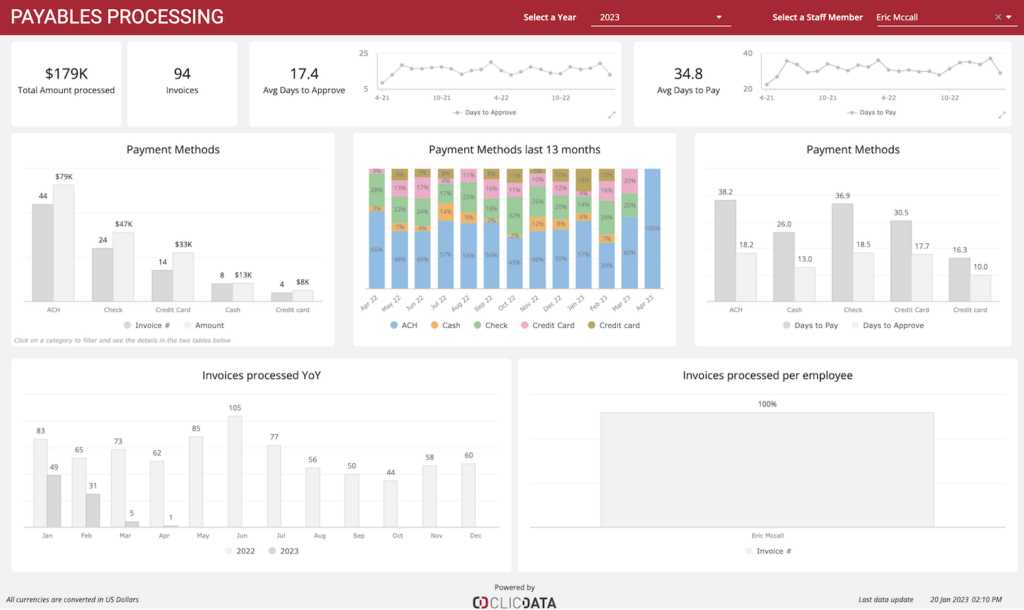

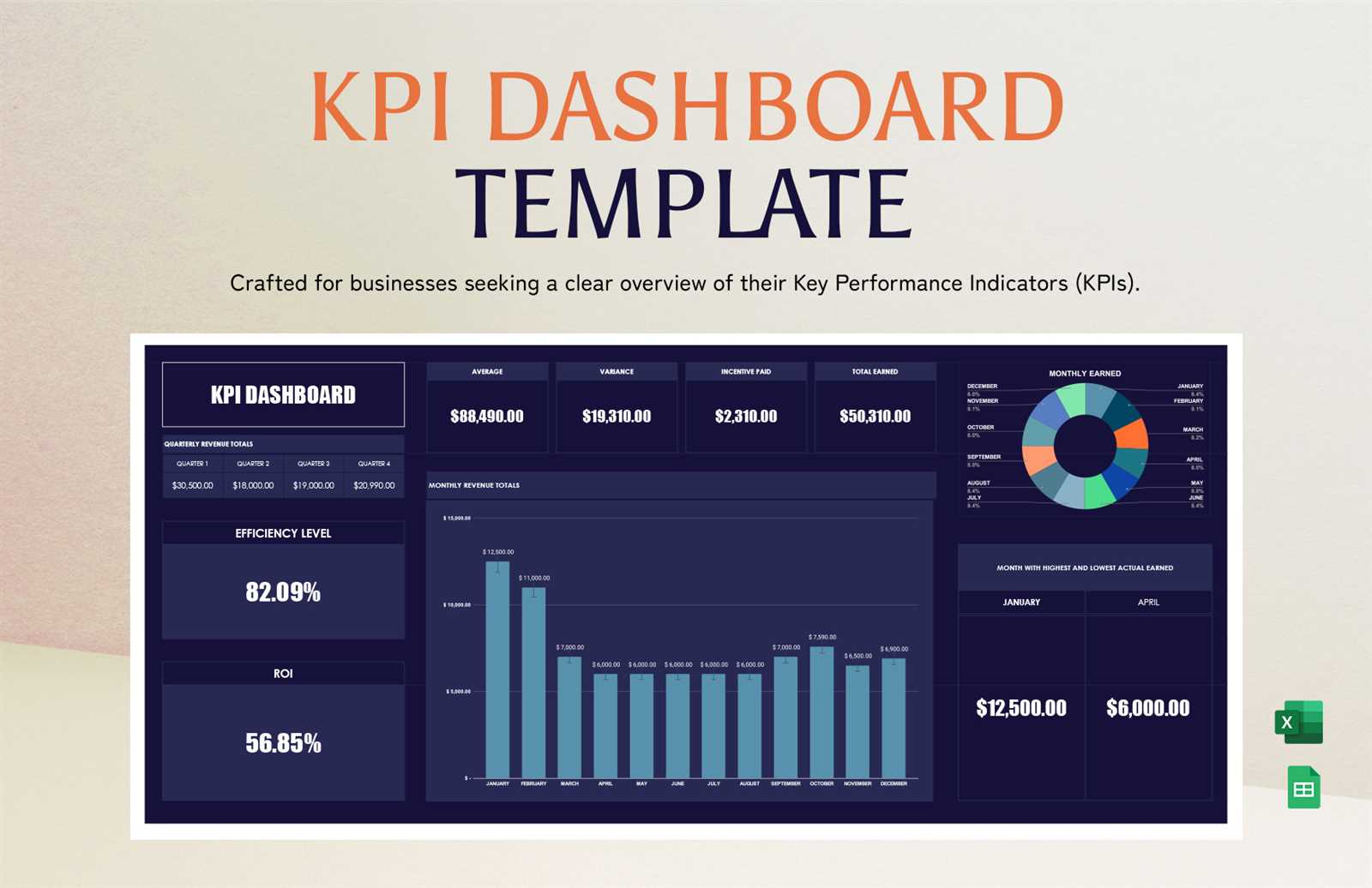

Data visualization plays a key role in transforming raw numbers into clear, actionable insights. With the right structure, users can quickly interpret information such as payment statuses, due amounts, and overall financial health. This not only saves time but also provides a clear view of cash flow and upcoming obligations.

Customizable solutions are particularly beneficial, as they allow users to tailor the system to their specific needs. Whether for small businesses or large enterprises, personalized layouts can make the data more relevant and easier to navigate, ensuring all the important details are readily available at a glance.

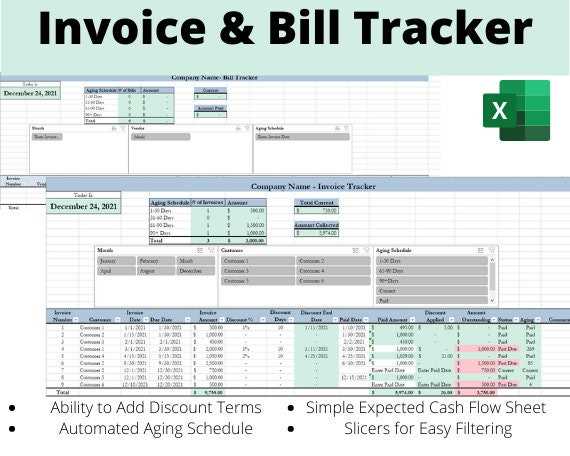

Invoice Dashboard Template for Excel

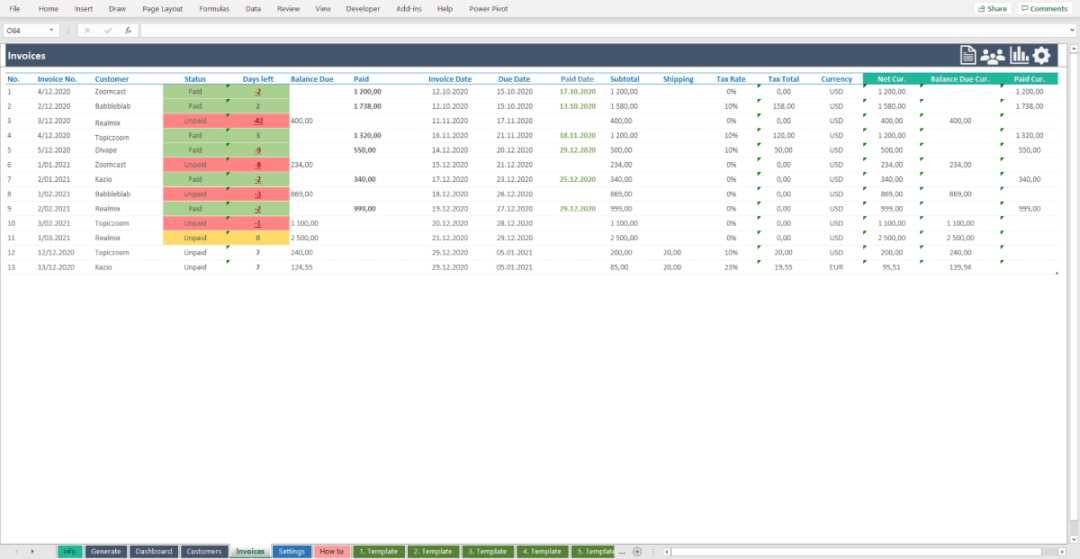

Efficient tracking of financial transactions is essential for smooth business operations. Having a well-organized document that consolidates all relevant information into a clear, easily accessible format can significantly enhance your ability to monitor and manage payments, income, and expenses. A customizable system allows users to input, update, and analyze data quickly, ensuring no crucial details are overlooked.

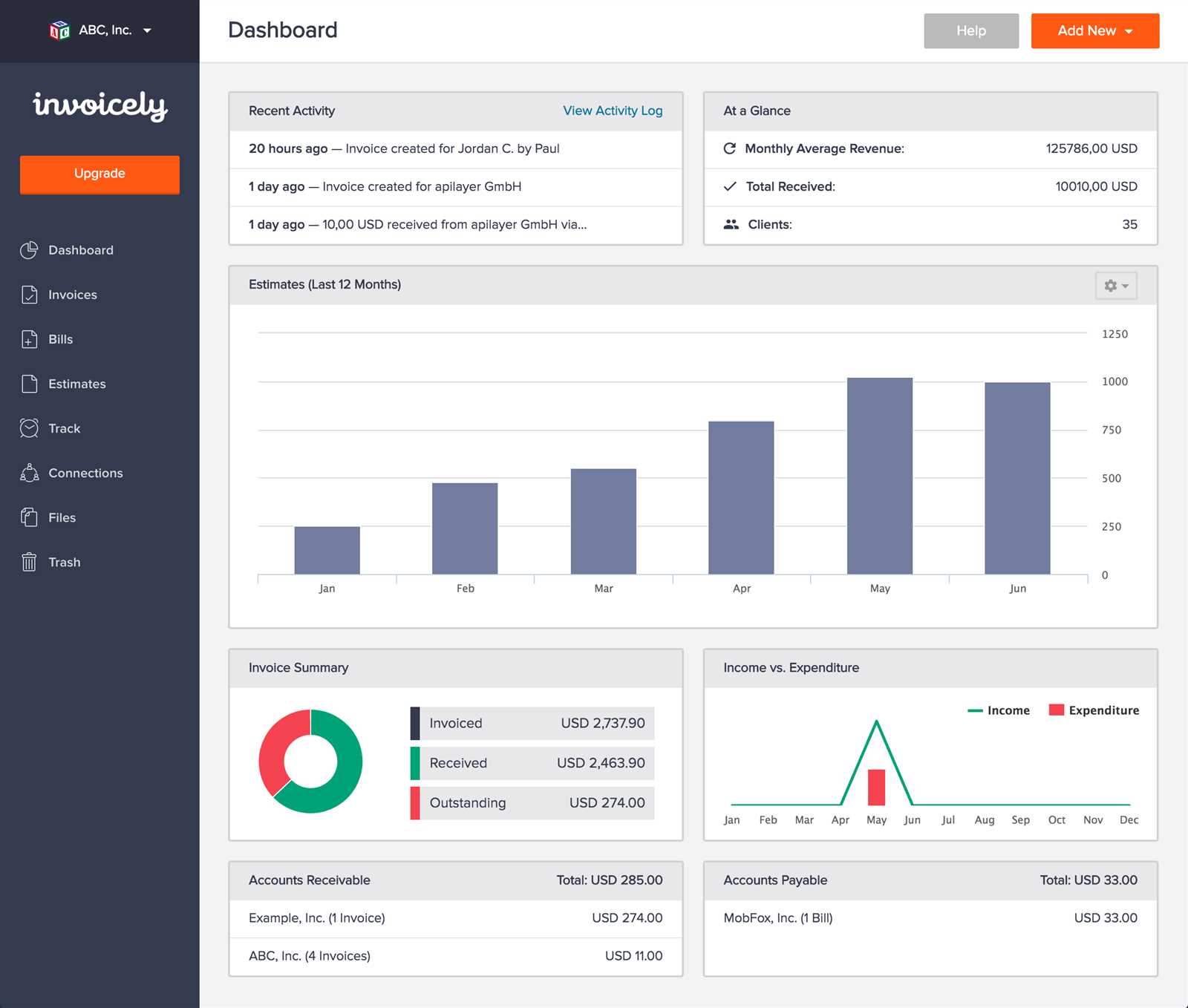

By utilizing a structured system, business owners can effortlessly visualize key metrics such as outstanding balances, payment histories, and upcoming deadlines. The tool provides a snapshot of financial health, helping to prioritize actions and ensure timely follow-ups with clients. This approach reduces administrative burden and improves overall workflow efficiency.

Customizable features play a critical role in making the system adaptable to specific business needs. Whether tracking payments for a small project or managing the finances of a large corporation, having the flexibility to adjust the layout and data points makes the tool more effective. Users can modify columns, add custom formulas, and integrate various data sources, all without the need for specialized software.

Automation is another major advantage. With the right setup, users can automate certain tasks, such as calculating totals, categorizing transactions, or updating payment statuses. This not only speeds up the process but also minimizes the risk of human error, ensuring data accuracy across all entries.

What Is an Invoice Dashboard?

A financial tracking system is a tool designed to help businesses monitor and manage various payment-related activities. It brings together key information in a single place, making it easier to analyze financial data and monitor trends. This centralized view allows users to track the status of payments, record transactions, and make data-driven decisions with greater efficiency.

Core Functions of a Financial Tracking System

These systems are typically designed to offer several core functions that help streamline business processes:

- Payment Tracking: Keep an eye on amounts due, amounts paid, and the status of pending payments.

- Data Visualization: Present important financial metrics in easy-to-read charts and graphs for quick understanding.

- Transaction Organization: Sort and categorize payments based on criteria like due date, client, or amount.

- Financial Insights: Identify trends, analyze cash flow, and make predictions based on historical data.

Benefits of Using a Financial Tracking Tool

By using such a system, businesses can achieve greater accuracy, efficiency, and control over their financial activities. The ability to see a full overview of all transactions in one place reduces the likelihood of errors and missed deadlines. It also allows for quicker responses to financial issues that may arise.

Why Use Excel for Invoice Management?

Managing financial data efficiently is crucial for any business, and using a familiar tool like a spreadsheet program can greatly simplify the process. These programs offer a flexible and customizable environment where users can organize, track, and analyze payment-related information. With the ability to handle large volumes of data and apply complex calculations, this type of software is an ideal solution for maintaining accurate financial records without the need for expensive software or advanced technical skills.

Cost-effectiveness is one of the primary reasons businesses opt for this tool. Unlike specialized accounting software, spreadsheet programs are often already available or inexpensive to obtain. This makes them an accessible solution for businesses of all sizes, whether a small startup or a larger corporation.

Customizability also plays a key role in why many choose this method. Users can design their own layouts, modify columns, and incorporate formulas tailored to their specific needs. This adaptability allows businesses to create a system that works best for them, whether tracking payments, monitoring budgets, or analyzing trends in spending.

Automation features further enhance the tool’s usefulness. With built-in functions and the ability to use formulas, tasks such as totaling amounts, calculating taxes, or categorizing transactions can be completed automatically, saving both time and reducing the likelihood of human error.

Key Features of an Invoice Dashboard

An effective financial tracking system provides several essential features that help users manage payment information with ease. These features allow businesses to organize their financial data, track progress, and make informed decisions based on real-time insights. A well-designed tool should offer functionality that supports accurate data entry, analysis, and reporting, while being easy to customize to meet specific needs.

| Feature | Description |

|---|---|

| Real-Time Data Updates | Automatically refreshes to reflect the most up-to-date payment statuses, reducing manual data entry. |

| Data Visualization | Transforms raw figures into visual graphs or charts, making it easier to track trends and spot patterns. |

| Payment Tracking | Tracks amounts due, paid, and overdue, ensuring no payments are missed or delayed. |

| Customizable Layout | Allows users to adjust the design, add or remove columns, and tailor the system to their business needs. |

| Automated Calculations | Performs complex calculations, such as totals and taxes, without requiring manual input, saving time and reducing errors. |

| Data Filtering | Enables users to sort and filter data by different criteria (e.g., client, due date, payment status), streamlining analysis. |

These features combine to create a powerful tool that supports both day-to-day financial management and long-term business strategy. Whether for a small team or a large organization, this system helps ensure greater accuracy, efficiency, and visibility into financial health.

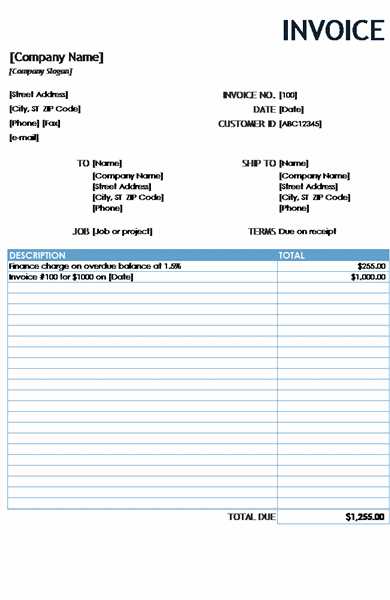

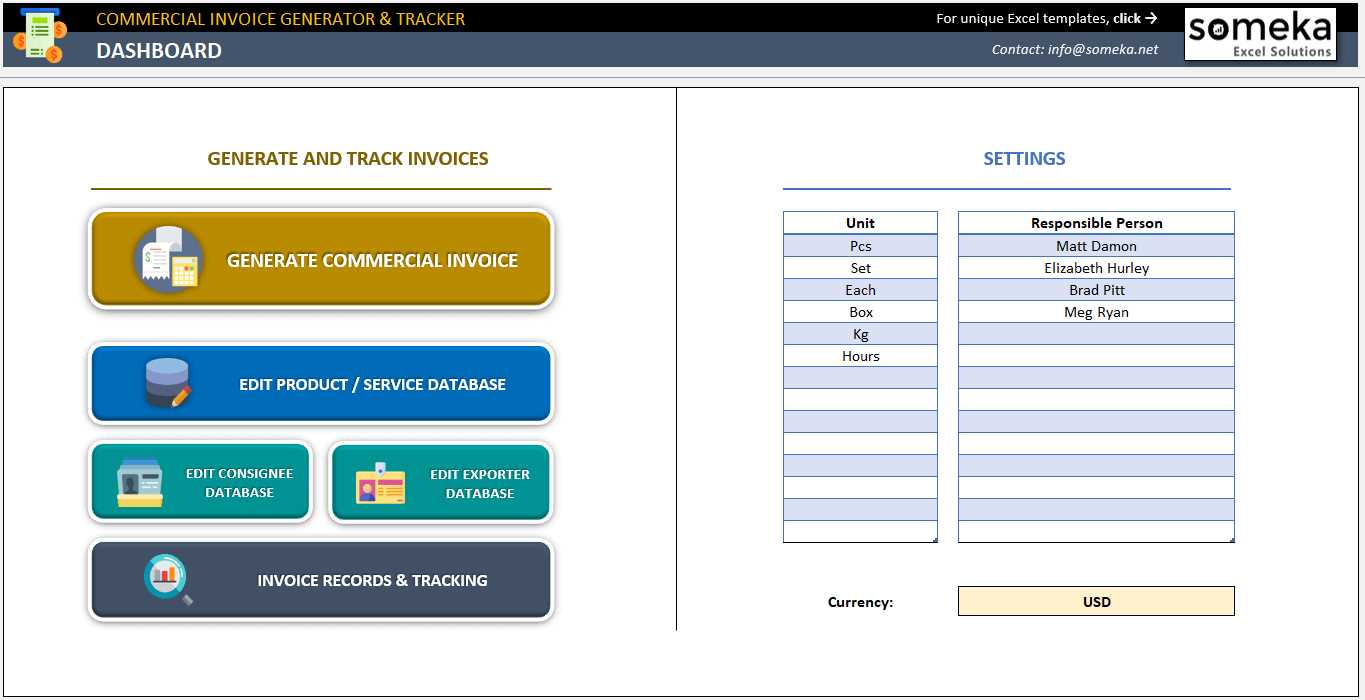

How to Create an Invoice Dashboard in Excel

Creating an effective financial tracking system requires a combination of clear organization, automation, and customization. By following a few simple steps, you can build a tool that organizes payment records, visualizes trends, and helps you stay on top of your business finances. Whether you’re tracking overdue payments or analyzing cash flow, a well-structured document can save time and enhance accuracy.

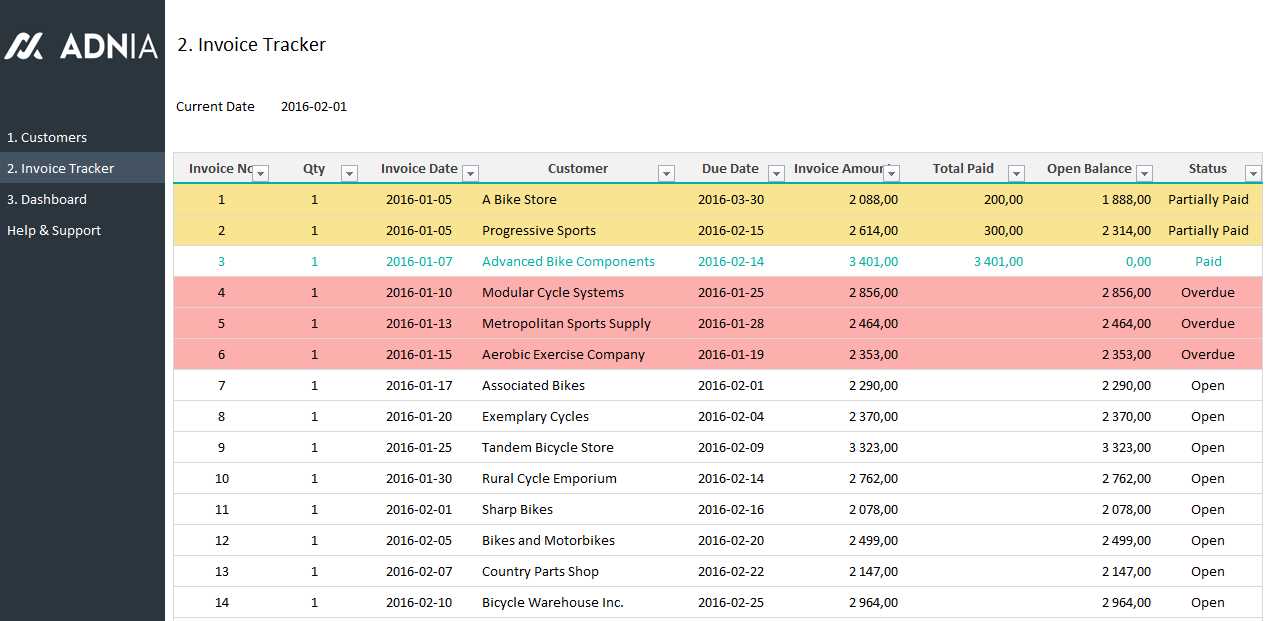

Step 1: Set Up Your Spreadsheet Structure

Begin by organizing your data into a clear structure. Start with columns for essential information such as client name, amount due, payment date, and status. This basic framework will serve as the foundation for your system, allowing you to input and track the most important details. Make sure to use clear headers for each column to avoid confusion later.

Step 2: Incorporate Formulas for Automation

Automation is key to saving time and reducing errors. Use built-in functions to perform calculations like totals, tax calculations, or outstanding balances. For example, you can use the SUM function to calculate the total amount owed, or the IF function to automatically categorize entries based on payment status. These formulas will update automatically as new data is entered, keeping your financial records accurate and up to date.

Step 3: Add Data Visualization

Once your basic structure is in place and your data is being tracked, enhance the system with visual elements. You can use charts and graphs to represent trends in payments, overdue amounts, or income growth. Visual representation helps you spot patterns more easily and makes it simpler to communicate the data to others. Excel offers a variety of built-in chart options that you can customize to suit your needs.

Step 4: Customize for Your Needs

Every business has different financial tracking needs. Adjust the layout, add custom categories, and design the sheet to fit your workflow. You might want to include additional columns for notes or custom labels that help with organization. The flexibility of this tool allows you to tailor it to your unique requirements, making it more efficient and user-friendly.

By following these steps, you can create a simple yet powerful tool to manage your financial records effectively. The combination of structure, automation, and customization will give you greater control over your business finances while saving valuable time.

Best Practices for Designing Dashboards

Creating an effective financial management system requires more than just organizing data; it also involves designing a user-friendly interface that allows you to access, analyze, and interpret key information quickly. By following a few best practices, you can ensure that your system is both functional and visually intuitive, making it easier to track payments, monitor financial health, and identify trends.

| Best Practice | Description | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Keep It Simple | Avoid cluttering your system with unnecessary information. Focus on the most important metrics and ensure that the layout is clean and easy to navigate. | |||||||||||||||||||||||

| Use Clear Labels | Label columns and rows clearly so users can quickly identify the data they need. Consistent naming conventions help avoid confusion and make data entry more efficient. | |||||||||||||||||||||||

| Visualize Key Metrics | Use charts and graphs to represent important figures, such as totals, outstanding amounts, or trends over time. This makes it easier to spot patterns

Customizing Your Excel Invoice TemplateOne of the greatest advantages of using a flexible financial tracking tool is the ability to customize it to fit your business’s specific needs. Whether you’re managing a small number of transactions or handling a large volume, the ability to modify the layout, add new fields, or adjust calculations can greatly improve the efficiency and relevance of the system. Customization ensures that the tool works in harmony with your workflow and captures the data that matters most to you. Step 1: Adjusting the LayoutThe first step in customization is organizing the structure to align with your unique requirements. You can rearrange columns and rows to suit your needs, add new sections for specific information, or remove unnecessary categories. This flexibility ensures that only relevant details are displayed, reducing clutter and improving readability.

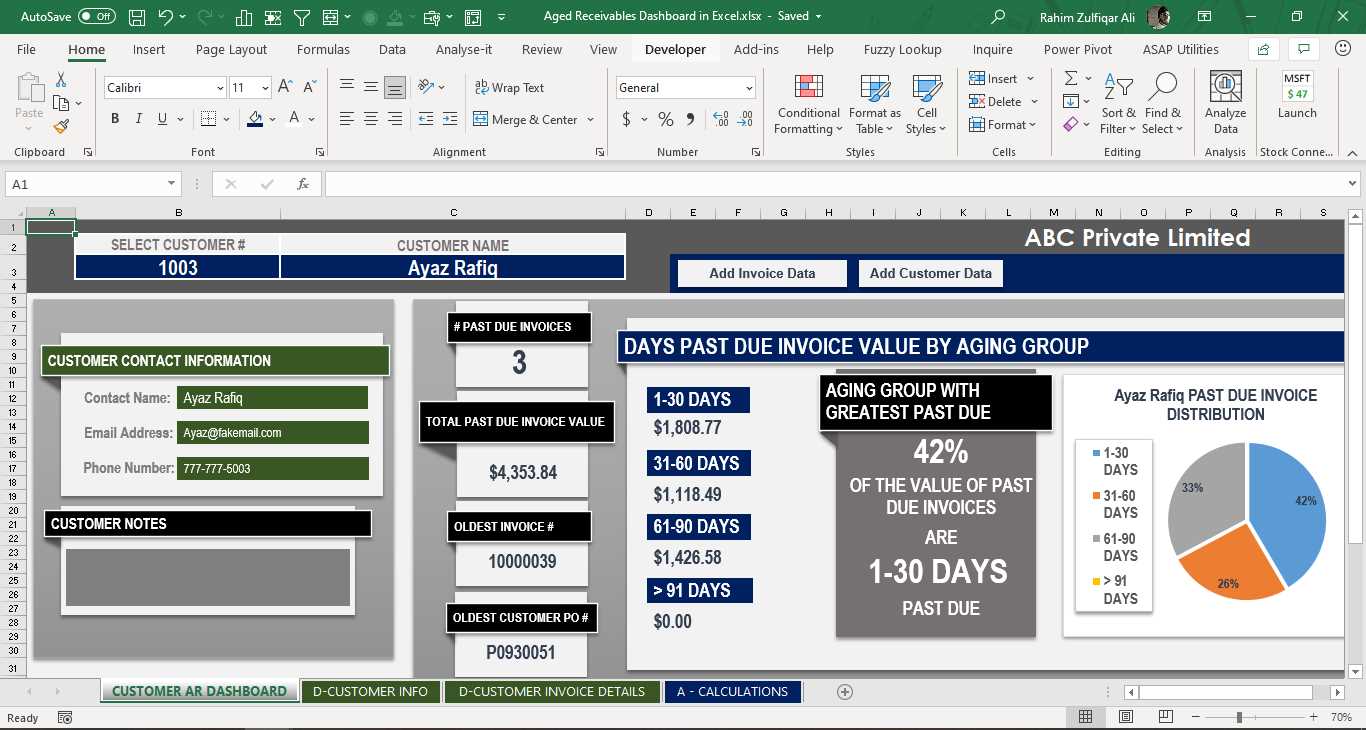

Step 2: Automating CalculationsCustom formulas allow you to automate calculations for more accuracy and speed. For example, you can set up automatic summing of amounts or apply percentage formulas to calculate taxes or discounts. Custom formulas can also help categorize payment statuses based on certain criteria, saving time and reducing the potential for human error. Using Conditional Formatting can also enhance the system’s functionality. You can highlight specific rows or columns based on conditions, such as overdue payments or amounts that exceed a certain threshold. This makes it easier to spot potential issues at a glance. By customizing your financial tracking system, you ensure that it is perfectly tailored to your business operations, improving your ability to manage financ Automating Invoice Tracking in ExcelAutomating the process of tracking financial transactions can significantly reduce manual effort, increase accuracy, and improve overall efficiency. By leveraging the built-in features of spreadsheet programs, businesses can streamline data entry, updates, and calculations. Automation allows for quicker and more accurate reporting, freeing up time for analysis and decision-making. One of the most powerful aspects of automation is its ability to handle repetitive tasks, such as summing totals, categorizing payments, and identifying overdue amounts. With the right setup, you can ensure that all updates happen automatically without the need for constant manual input. Key Automation Features to Use

Example Automation Setup

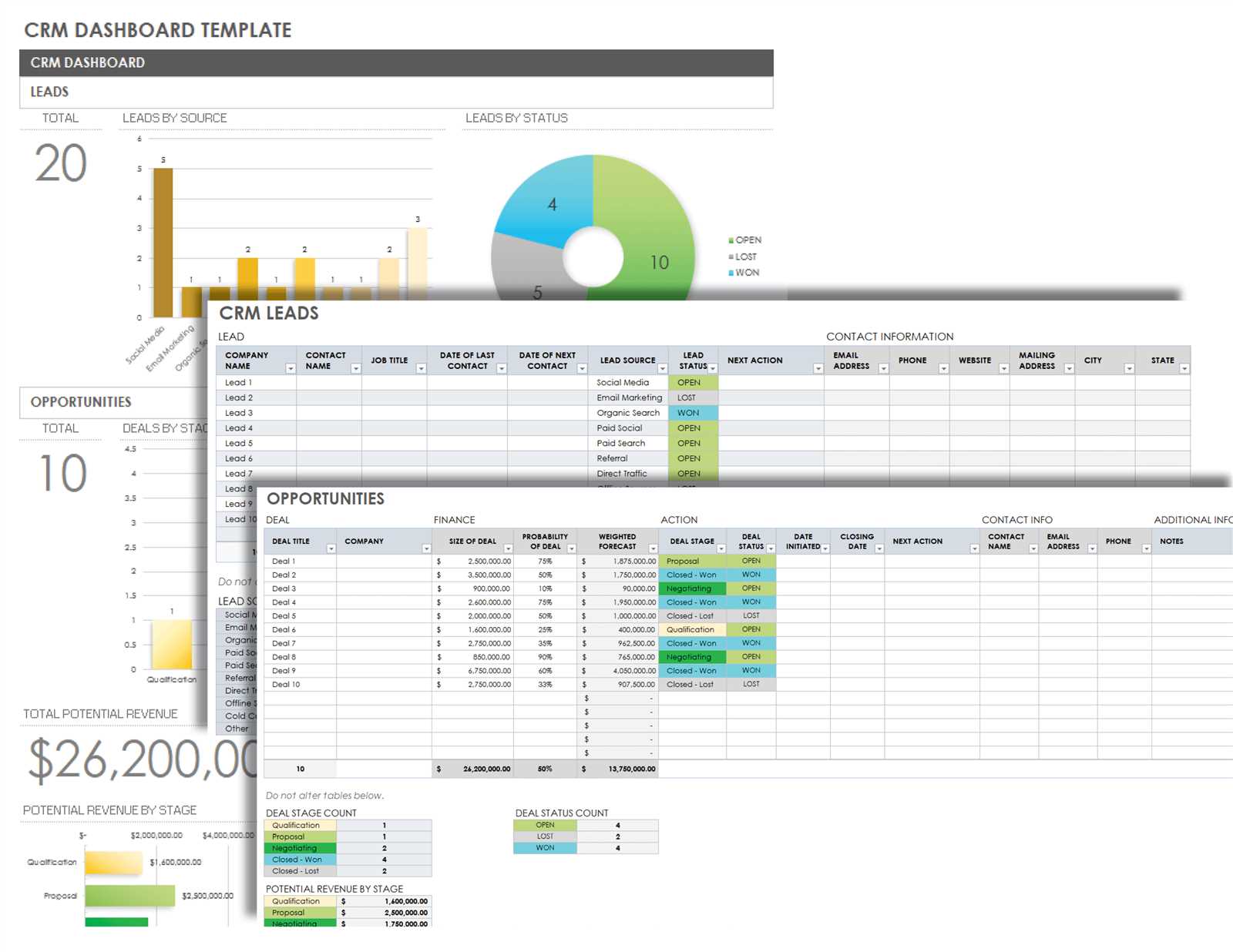

For example, to automatically update payment statuses, you can use an IF function that checks if the payment date is later than the due date. If the payment is overdue, the status will automatically update to “Overdue.” Similarly, you can set up a formula that sums all unpaid amounts, so you always know your outstanding balance without needing to manually total the amounts. By implementing these automated processes, you can reduce the time spent on data entry and ensure that your records remain accurate and up to date with minimal effort. Automation is a key step towards more efficient and effective financial management. Tracking Payment Status with DashboardsTracking payment status is a critical aspect of financial management. Having a clear and organized view of whether payments have been made, are pending, or are overdue helps businesses stay on top of their cash flow and ensures that no payments slip through the cracks. By using visual tools, you can easily monitor and manage the status of payments across multiple clients or projects, simplifying follow-ups and improving overall financial control. Organizing Payment Status InformationTo effectively track payment statuses, start by organizing key information such as the payment amount, due date, client name, and status. This allows you to quickly identify which payments are still pending, which are overdue, and which have been completed. A well-structured system provides a clear overview of the current financial situation and highlights areas that require attention. For instance, you can set up a column for “Payment Status” that includes categories like “Paid,” “Pending,” and “Overdue.” This way, you can easily filter through records to see which transactions need immediate follow-up and which ones are on track. Visualizing Payment StatusOnce you have organized the data, visualizing the payment status can greatly enhance your ability to manage payments. Use color coding or conditional formatting to automatically highlight overdue or pending payments. For example, you can set up the system to color overdue payments in red and paid ones in green, making it easy to spot issues at a glance. Another useful approach is to implement charts or graphs that show the proportion of paid, pending, and overdue payments. These visual tools provide a quick summary of your financial situation, allowing you to focus your efforts on the most urgent tasks. You can also use these visuals for reports, providing stakeholders with a clear and concise view of the payment status. By tracking payment status with such tools, businesses can reduce the likelihood of late payments, ensure timely follow-ups, and maintain a healthier cash flow. Visualizing Financial Data EffectivelyEffective visualization of financial data transforms raw numbers into actionable insights. By presenting key metrics in a visually appealing and easy-to-understand format, businesses can quickly identify trends, track performance, and make informed decisions. Whether you’re analyzing cash flow, sales figures, or outstanding balances, using visual tools such as charts and graphs simplifies complex data, allowing for a more intuitive understanding of financial health. Clear and concise visuals enable decision-makers to see patterns, compare results, and spot potential issues in real time. For example, a pie chart can show the proportion of different payment statuses, while a bar graph can highlight the amounts due each month. These visuals not only make the data more digestible but also enhance communication with stakeholders who may not be familiar with detailed financial reports. Choosing the Right Visualization

Different types of visual tools are best suited to different types of data. Here are a few examples of how to choose the right format:

Improving Insights with Interactive FeaturesInteractivity further enhances the value of financial visuals. By incorporating filters or drop-down menus, users can interact with the data to drill down into specific periods, clients, or payment statuses. This interactivity allows for deeper analysis without overwhelming the user with too much information at once. Additionally, it provides flexibility, as users can easily customize the data view based on their specific needs. By visualizing financial data effectively, businesses gain a clearer picture of their financial landscape, enabling quicker responses to challenges and more strategic decision-making. Integrating Multiple Data Sources in ExcelManaging data from various sources can be challenging, especially when trying to combine them into a cohesive system for analysis and reporting. By integrating information from different platforms or files, businesses can create a centralized overview that streamlines decision-making and improves accuracy. Combining multiple data sets allows for a more comprehensive view of financial performance and reduces the risk of missing important details. Data integration enables users to pull together information from disparate systems, such as payment records, sales reports, or client details. By consolidating these data sources into one place, you can easily cross-reference information and perform more detailed analyses without having to manually merge multiple files. This approach enhances efficiency and ensures that all data points are considered when making business decisions. Methods for Integrating Data

There are several methods for bringing data from different sources into a single system, depending on the type of data and the tools available:

Benefits of Data Integration

Integrating data not only saves time but also provides greater accuracy and completeness in financial tracking. For example, by combining payment records from multiple clients or projects, you can see overall revenue trends and identify patterns in payment behavior. Integration also improves reporting capabilities by allowing you to create comprehensive reports based on data from various sources without having to update each file separately. By seamlessly connecting multiple data sources, businesses can create a more dynamic, real-time financial management system that drives better decision-making and provides deeper insights into performance. Using Pivot Tables for Financial Insights

Pivot tables are powerful tools that allow users to summarize and analyze large datasets efficiently. By transforming raw data into organized, concise reports, pivot tables enable quick insights into key financial metrics. Whether you’re tracking revenues, costs, or payment trends, pivot tables help you identify patterns, perform deeper analyses, and generate comprehensive reports with ease. Through the dynamic grouping of data, pivot tables allow you to analyze information from multiple perspectives. For example, you can quickly summarize sales by client, payment status by date, or expenses by category. This flexibility makes pivot tables a valuable asset in managing and interpreting financial data. How Pivot Tables WorkTo create a pivot table, you’ll first need to arrange your data into columns and rows. Once your data is structured, you can drag and drop specific fields into the pivot table areas: rows, columns, values, and filters. This will allow you to dynamically manipulate the data and gain new insights based on different criteria. Here is a simple structure of a pivot table:

Key Benefits of Using Pivot Tables for Financial Analysis

|