Ultimate Invoice Creator Template for Quick and Professional Invoices

Creating accurate and professional billing documents is a crucial part of managing any business. Having a structured method for generating these documents ensures that payments are received on time and reflects the professionalism of your company. The right tools can simplify this process, allowing you to focus more on your core business operations.

Whether you are a freelancer or run a small business, having a reliable way to generate clear and concise payment requests can save time and reduce errors. By using an organized system, you can ensure consistency and avoid confusion with clients or customers.

In this guide, we’ll explore various options for setting up billing documents quickly, efficiently, and with minimal hassle. You’ll learn how to customize the layout to suit your specific needs, integrate with accounting software, and avoid common mistakes that can delay payments.

Invoice Creator Template Guide

Having a structured approach to generating payment documents is essential for any business. With the right tools, this process becomes easier and more efficient, saving you time and ensuring accuracy. By using a systematic method, you can create professional records that streamline communication with clients and guarantee smooth transactions.

In this guide, we’ll walk through the steps to set up an organized system for generating payment documents. From choosing the right format to understanding what details are necessary, we’ll cover everything you need to know to ensure clarity and consistency in every document you send.

| Step | Description |

|---|---|

| Step 1 | Select the appropriate document structure that suits your business needs. |

| Step 2 | Customize the layout with your company details, payment terms, and other essential information. |

| Step 3 | Ensure all calculations are correct and the document is easy to read. |

| Step 4 | Review and save the file in a format ready for distribution to clients. |

Why Use an Invoice Template

Having a consistent structure for creating payment requests offers numerous advantages for businesses of all sizes. By standardizing the process, you can ensure clarity and professionalism in every transaction, which can lead to improved customer satisfaction and faster payments.

Key Benefits of Using a Structured Approach

- Efficiency: Streamlining the document creation process saves valuable time and resources.

- Accuracy: A pre-designed format ensures that you never forget important details, reducing the risk of errors.

- Consistency: Using a consistent layout strengthens your brand and presents a unified image to clients.

- Customization: You can easily adjust the layout to match your specific business needs, adding or removing fields as necessary.

How It Helps Your Business

- Improves communication by presenting clear and concise information.

- Enhances professionalism, showing clients that you take your business seriously.

- Reduces administrative overhead, making it easier to manage financial documents.

Key Features of a Good Template

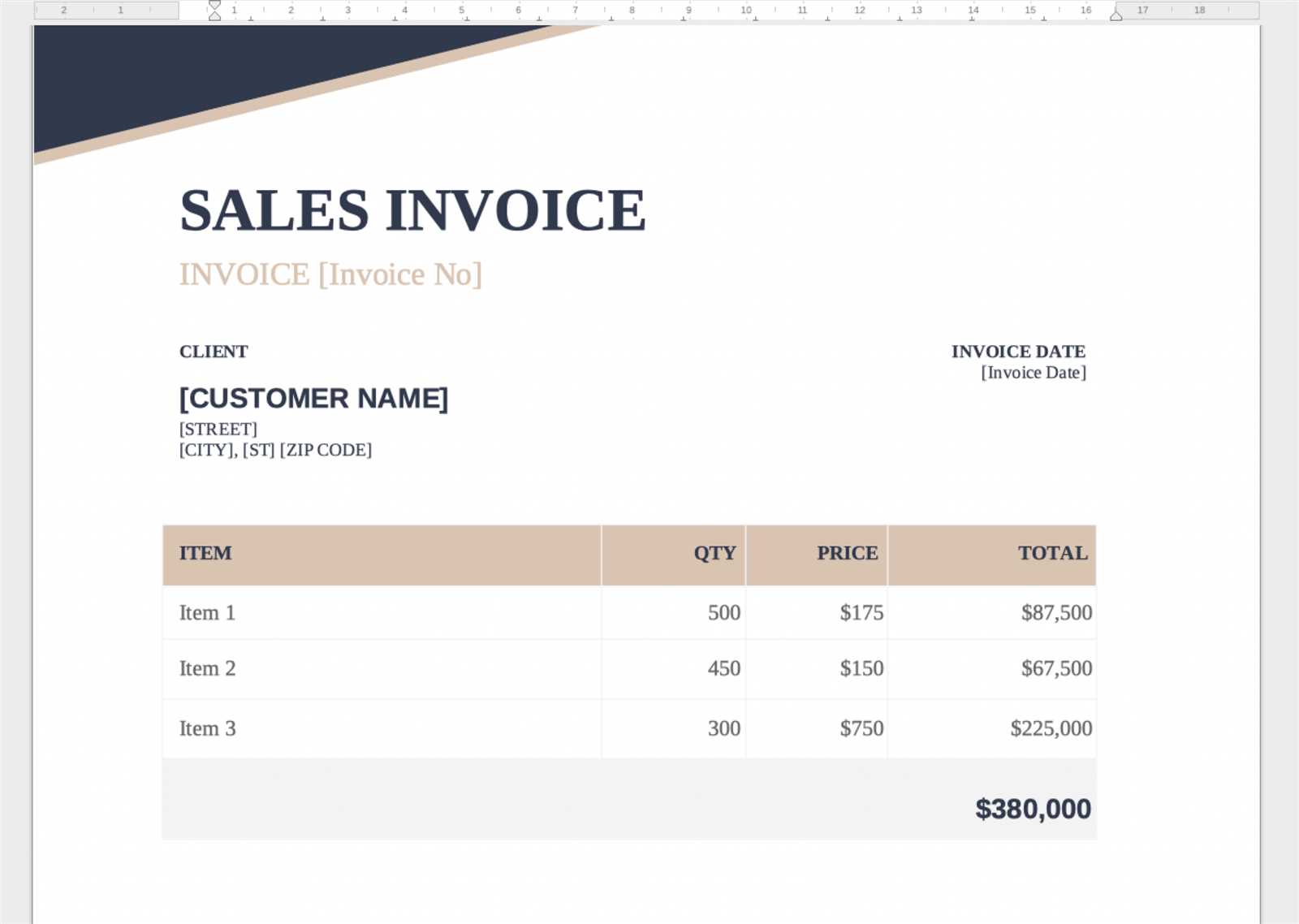

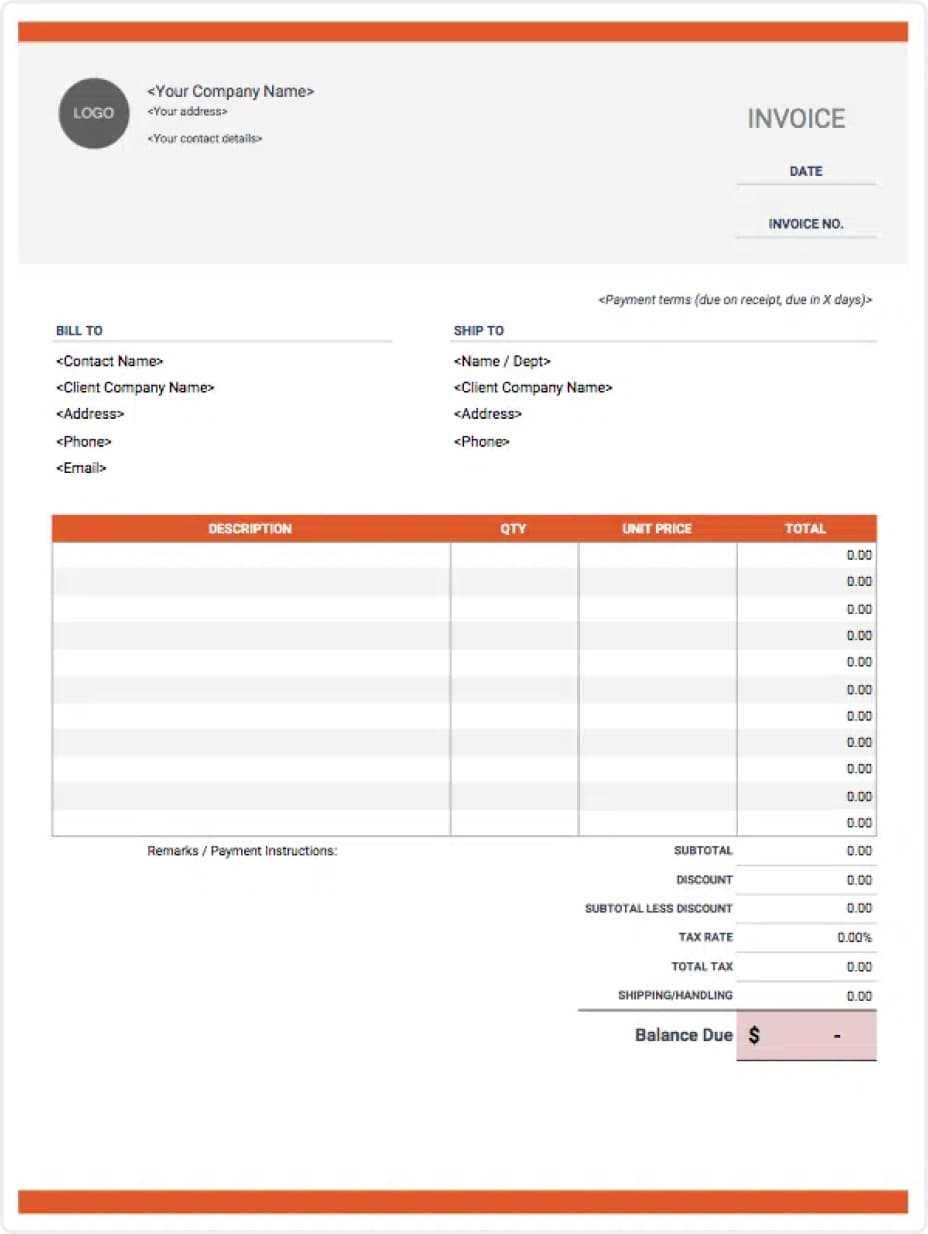

When designing a structured document for payment requests, there are several essential features that make the process smooth and effective. A well-organized format ensures all necessary details are included, while maintaining a professional and clean appearance. Here are the most important elements to look for when selecting or creating such a document.

Essential Elements of a High-Quality Document

- Clear Layout: A simple and easy-to-read structure that highlights key details, such as payment amounts and due dates.

- Predefined Fields: Sections for client details, itemized costs, payment terms, and other necessary information.

- Customizability: The ability to adjust sections based on the unique needs of your business or clients.

- Professional Design: A clean, polished look that reflects the professionalism of your brand.

- Legible Fonts: Easy-to-read typography that ensures clients can quickly understand the document.

Additional Features to Consider

- Option for adding logos or branding for personalized touch.

- Simple methods for calculating totals and taxes automatically.

- Ability to export or save in multiple formats, such as PDF or Excel.

- Clear payment instructions or bank details for easy processing.

Customizing Your Invoice Template

Adapting your payment request structure to meet your business needs is essential for clarity and professionalism. Customization allows you to highlight the most important details, adjust the design to reflect your brand, and ensure the document aligns with your specific requirements. Whether you are adding new fields or changing the layout, personalization enhances both functionality and appearance.

One of the key aspects of personalizing such a document is the ability to modify the layout, include custom fields, and ensure that the format supports your billing process. Customizing allows you to create a seamless experience for both your team and your clients, ensuring that all essential information is presented clearly and efficiently.

How to Download Invoice Templates

Finding and downloading the right document structure for your billing process is a straightforward task. There are various sources available where you can easily access pre-designed layouts that suit your needs. Whether you are looking for a free or premium option, understanding where and how to download these resources can save you time and effort in creating accurate and professional documents.

Here are a few methods to help you download the right billing document layout:

- Search Online: Many websites offer free and paid versions of these documents. A simple search can lead you to numerous options.

- Use Office Software: Tools like Microsoft Word or Google Docs often provide downloadable options within their templates section.

- Download from Trusted Providers: Many accounting software platforms offer specialized document layouts that integrate seamlessly with their tools.

Once you have located the layout that fits your needs, follow these steps to download it:

- Visit a trusted website or software provider.

- Browse through the available options and select the design that suits your business style.

- Click on the download button and save the file to your computer or cloud storage.

- Open the downloaded file in the appropriate software and begin customizing it as needed.

Choosing the Right Template for Your Business

Selecting the right layout for generating payment documents is crucial for creating a streamlined and professional billing process. The right design will not only enhance your company’s image but also make the entire transaction process smoother and more efficient. It is important to choose a format that aligns with your business needs, ensuring all essential details are clearly presented while maintaining a polished appearance.

When selecting a design, consider the specific requirements of your business. Different industries and client needs may demand unique features or layouts. By understanding what works best for your company, you can ensure that every document you send reflects professionalism and accuracy.

Top Benefits of Using Invoice Templates

Utilizing a structured format for generating payment documents brings numerous advantages to your business. By implementing a consistent approach, you can streamline your billing process, reduce errors, and save time. These benefits not only improve internal efficiency but also enhance your professionalism in the eyes of your clients, ensuring smoother financial transactions.

Here are some of the key advantages of using a pre-designed document layout:

| Benefit | Description |

|---|---|

| Time-Saving: | Pre-built structures allow you to generate documents quickly without the need for designing from scratch each time. |

| Accuracy: | Predefined fields ensure that no important information is overlooked, minimizing the risk of mistakes. |

| Professional Appearance: | A polished, uniform look across all documents strengthens your brand and gives clients confidence in your business. |

| Customization: | Adjust the layout and sections according to your needs, making it easier to tailor each document to the specific job or client. |

| Consistency: | Using the same format for all documents creates consistency, which is important for maintaining a professional image. |

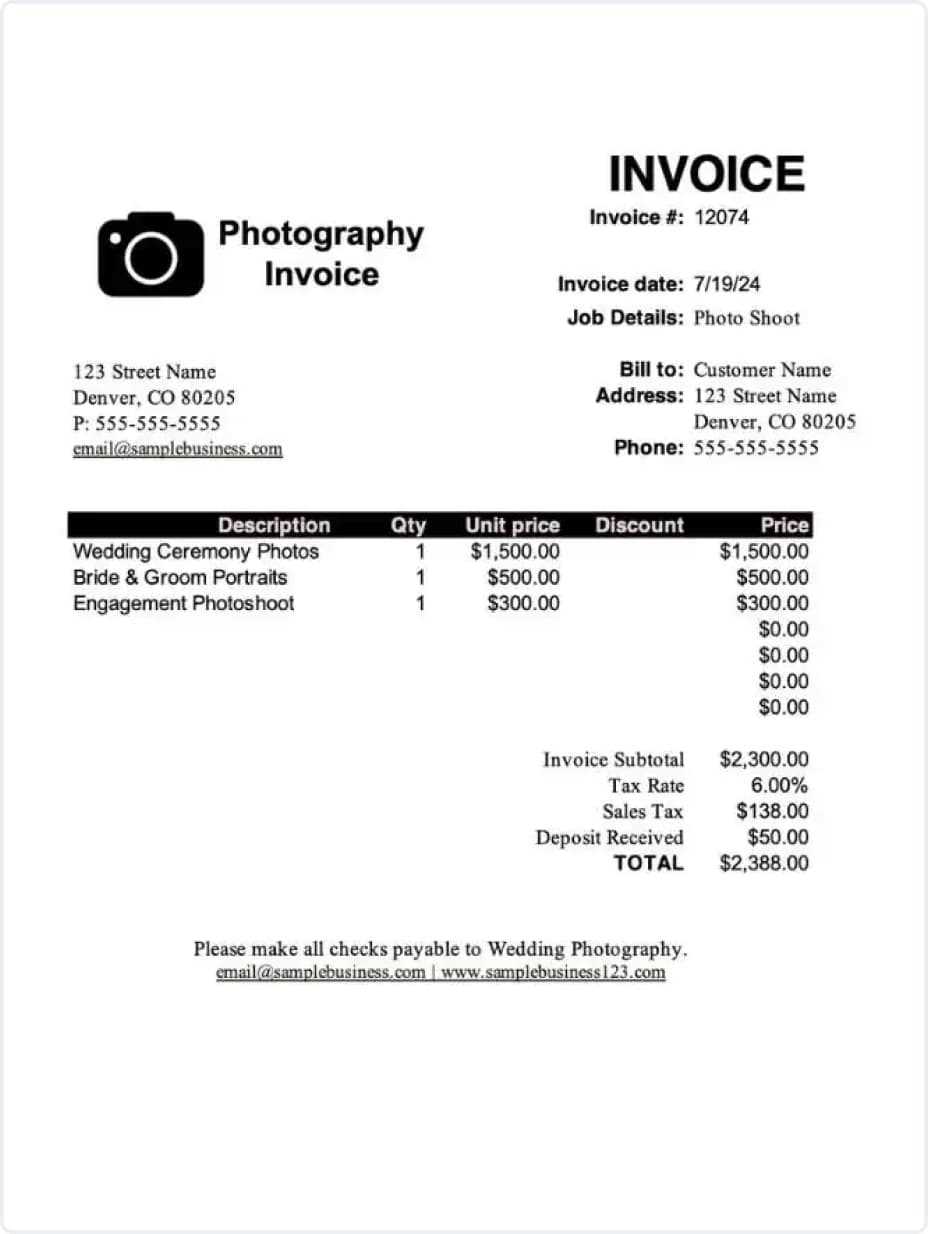

Invoice Templates for Different Industries

Every industry has its unique requirements when it comes to generating payment documents. Whether you are in construction, consulting, or retail, customizing your billing format to meet the needs of your specific field is crucial. Certain elements, such as itemized descriptions, project milestones, or hourly rates, may need to be highlighted differently based on the industry you are operating in.

Below are examples of how different industries can benefit from specialized document layouts:

| Industry | Key Features |

|---|---|

| Freelancers | Simple, clear layouts with sections for hourly rates or project fees, along with space for additional services. |

| Construction | Detailed descriptions of work performed, material costs, labor hours, and project milestones for better transparency. |

| Consulting | Breakdown of hourly or daily rates, consultation time, and specific deliverables related to the service provided. |

| Retail | Itemized lists of goods or services with unit prices, quantities, taxes, and shipping details. |

| Software Development | Sections for hourly rates, fixed-price contracts, milestones, and project-specific terms such as licenses and maintenance. |

How to Create Professional Invoices Fast

Generating polished and accurate billing documents quickly is an essential skill for maintaining smooth cash flow in any business. The key is having a clear and efficient process in place. With the right tools and approach, you can produce professional requests for payment in no time, ensuring that all the necessary details are included while presenting your business in the best light.

Streamline the Process

To create documents quickly, it’s important to streamline the process. Start by using a pre-designed layout that suits your business needs, where you can easily input the required details such as client name, services provided, payment terms, and amounts due. This eliminates the need to build each document from scratch and saves valuable time.

Automate Where Possible

Many software solutions allow for automation of key elements such as tax calculation and subtotaling. By incorporating automation, you reduce human error and speed up the process, enabling you to focus on other important tasks while ensuring accuracy in your financial records.

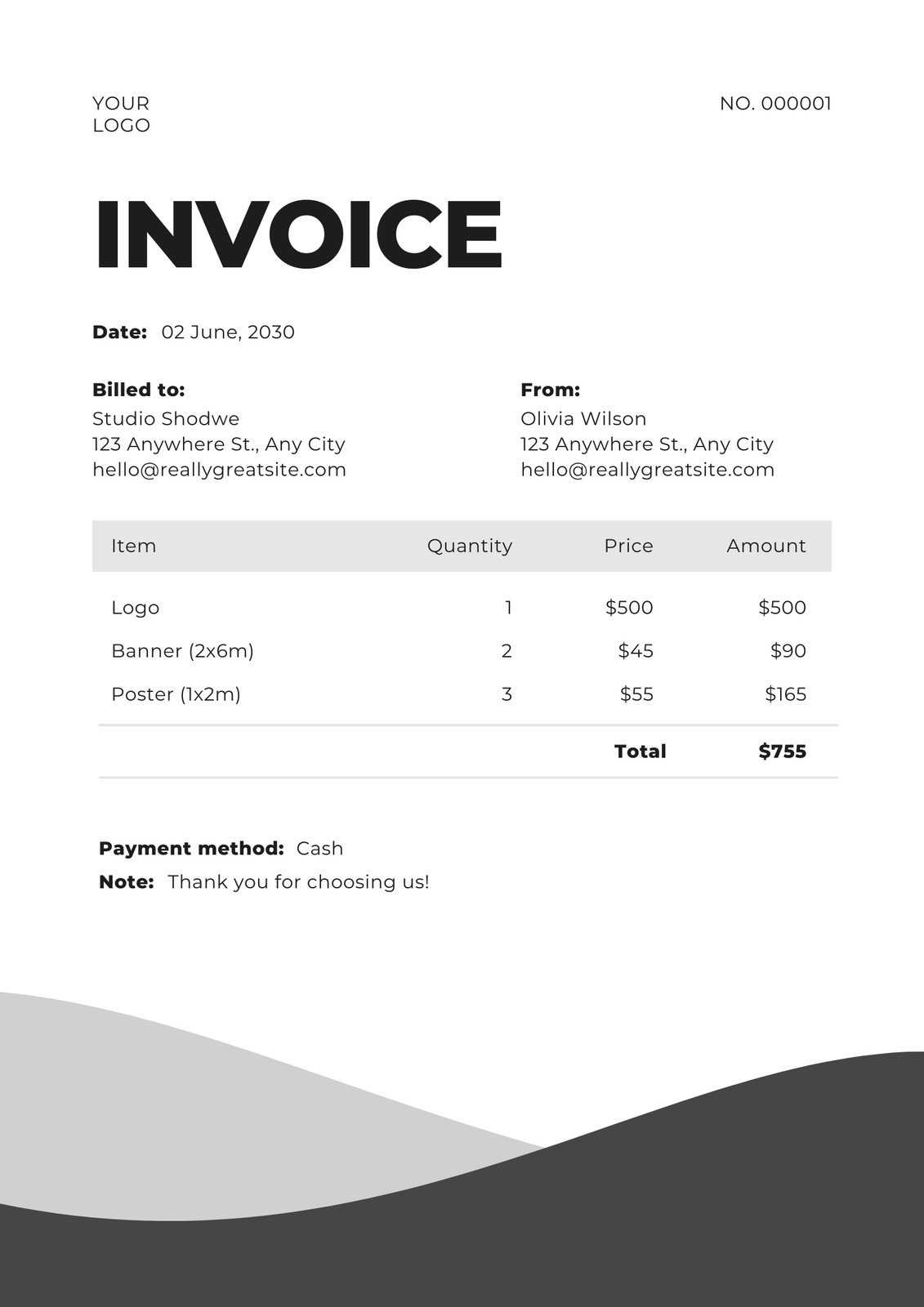

What Information to Include in Invoices

When preparing a payment document, it’s essential to ensure that all relevant details are included. A well-structured document not only ensures clarity for both parties but also helps in avoiding disputes and delays in payment. Each section of the document should serve a specific purpose, outlining the nature of the transaction and the terms of payment.

Here are the key elements to include in your document:

- Business Information: Your business name, address, and contact details, as well as your tax identification number, if applicable.

- Client Information: The name, address, and contact details of the customer or company receiving the services or goods.

- Document Date: The date when the payment request was generated.

- Unique Reference Number: A unique identifier for the document, such as an invoice number, to help track payments.

- Description of Services or Products: A detailed list of the services provided or products sold, including quantities, rates, and itemized prices.

- Payment Terms: Clear terms for payment, such as the due date, accepted payment methods, and any penalties for late payments.

- Total Amount Due: The full amount that the client is required to pay, including taxes and any additional fees.

Understanding Invoice Numbering Systems

Having a clear and systematic way of numbering your payment documents is essential for keeping track of transactions, maintaining organization, and ensuring compliance with accounting standards. A well-structured numbering system allows both you and your clients to easily reference and organize documents for future use. It also helps avoid confusion and mismanagement, especially when dealing with multiple clients or large volumes of transactions.

Benefits of a Numbering System

A consistent numbering system offers several advantages, including:

- Easy Tracking: Each document has a unique identifier, making it simple to locate or reference past transactions.

- Improved Organization: Numbering documents in sequence helps keep your files and records neat and manageable.

- Legal and Tax Compliance: Many jurisdictions require businesses to maintain a chronological record of all transactions for tax and auditing purposes.

Common Numbering Formats

There are several ways to structure your numbering system depending on your business needs:

- Sequential Numbers: A simple, consecutive numbering system starting from 001 and increasing by one for each new document.

- Year-Based Numbers: You can include the year in the numbering system (e.g., 2024-001) to help identify when a transaction took place.

- Client-Specific Numbers: Including client or project identifiers (e.g., CL001-2024) makes it easier to track documents by client or specific job.

Invoice Templates for Freelancers

Freelancers often face the challenge of managing their own administrative tasks, and one of the most important aspects of running a freelance business is issuing clear and professional payment documents. These documents not only serve as a record of services rendered but also ensure that clients understand exactly what they are being charged for. Using a well-structured layout can help make this process more efficient and reliable.

Key Elements for Freelance Billing

When creating billing statements as a freelancer, it’s important to include several key components that are tailored to your unique business model:

- Hourly or Project Rates: Include a breakdown of your rate, whether it is based on time worked or a flat fee for a project.

- Clear Itemization: List all services rendered with detailed descriptions to avoid any misunderstandings.

- Payment Terms: Clearly state the payment due date and any penalties for late payments.

- Contact Information: Ensure your contact details, as well as those of your client, are easily visible for easy communication.

Customizing Your Freelance Documents

As a freelancer, personalizing your payment documents can set you apart from others in your field. Consider adding your logo or adjusting the layout to reflect your brand. This simple step not only makes your documents look more professional but also reinforces your personal brand in the eyes of your clients.

How to Personalize Your Invoices

Personalizing your billing documents is an excellent way to make a strong impression on your clients. A personalized document not only reflects your professionalism but also helps establish a connection with your clients. Customizing your documents can include visual elements as well as specific details that make the payment process smoother and more memorable.

Here are some effective ways to personalize your billing statements:

- Branding: Add your company logo, business name, and a consistent color scheme to match your brand identity.

- Custom Message: Include a brief thank-you note or a personalized message to your clients, showing appreciation for their business.

- Client-Specific Information: Use your client’s name and project details to tailor the document and make it feel more personal and relevant.

- Professional Design: Choose a clean and attractive layout that enhances readability, with sections clearly defined for easy navigation.

- Payment Instructions: Provide personalized payment methods, including relevant bank account information, PayPal links, or other digital payment options you accept.

By incorporating these personalized touches, you can make your documents stand out while also reinforcing a professional image. These small adjustments create a positive impact and encourage timely payments from clients.

Common Mistakes in Invoice Creation

When preparing billing documents, it’s easy to make small errors that can cause confusion, delays in payments, or even disputes with clients. These mistakes can lead to frustrations on both sides and potentially harm your professional reputation. Understanding the common pitfalls can help ensure your documents are clear, accurate, and professional every time.

Typical Errors to Avoid

Here are some of the most common mistakes businesses make when preparing payment requests:

- Missing or Incorrect Contact Information: Failing to include accurate details such as your name, address, or payment methods can delay processing.

- Unclear Payment Terms: Not specifying the due date or payment method can lead to misunderstandings about when and how payments should be made.

- Lack of Itemization: Failing to break down the services provided or the charges can leave clients unsure about the costs and lead to disputes.

- Not Including a Unique Reference Number: Without a unique identifier, tracking or referring to specific transactions can become difficult, especially when dealing with multiple clients.

- Overlooking Discounts or Tax Information: Neglecting to include discounts, tax rates, or any other adjustments can result in confusion and miscalculations.

How to Prevent These Mistakes

Ensuring that all the necessary details are included and presented clearly can help you avoid these mistakes. Double-checking for accuracy and clarity before sending out documents can help prevent issues later. Implementing a standard template or checklist can also streamline the process and reduce the chances of errors.

How to Send Invoices Efficiently

Sending billing documents promptly and efficiently is crucial for maintaining cash flow and professionalism. The way you send these documents can affect how quickly payments are processed and how clients perceive your business. Using the right methods and tools can streamline the process and reduce errors, ensuring timely transactions.

Effective Methods for Sending Documents

Here are some best practices for sending your payment requests quickly and accurately:

- Use Digital Formats: Sending documents electronically is faster and more reliable than traditional mail. Formats like PDF are widely accepted and easily readable.

- Leverage Automated Tools: Use invoicing software or online platforms to generate and send documents automatically, reducing the time spent on manual entry.

- Set Up Payment Reminders: Automated reminders or due date alerts can ensure your clients don’t forget to make a payment, helping maintain a steady cash flow.

- Send via Secure Channels: Ensure that the method you use to send documents (e.g., email or secure portals) is reliable and keeps the information safe from unauthorized access.

- Track Sent Documents: Keep records of what has been sent, when, and to whom. Tracking this can help you follow up efficiently if necessary.

Tips for Improving Speed and Accuracy

Efficiency isn’t just about speed; it’s also about accuracy. Double-check the details before sending, and make sure all information is complete and correct. Use pre-built structures or software tools that automatically fill in details like client information and payment terms to save time and avoid mistakes.

How Invoice Templates Save Time

Creating billing documents from scratch every time can be time-consuming and inefficient. By using pre-designed structures or forms, businesses can streamline their billing process, reducing manual input and minimizing errors. This method not only saves time but also ensures consistency and accuracy in every document sent.

Time-Saving Benefits of Pre-Designed Structures

Here’s how using pre-set structures can help you save valuable time:

- Faster Document Creation: With a pre-built format, all you need to do is fill in the necessary details, eliminating the need to start from a blank page every time.

- Consistency Across Documents: Using a set format ensures that all your documents are uniform, reducing the chances of forgetting key information.

- Automatic Calculations: Many structures include automatic calculations for totals, taxes, and discounts, which can save you time and reduce the risk of manual errors.

- Easy Customization: Most pre-designed formats can be customized with your business logo and payment details, allowing you to maintain a professional appearance with minimal effort.

- Quick Client Communication: Once set up, you can generate and send your documents in just a few clicks, improving response time and client satisfaction.

Optimizing Your Workflow

By integrating pre-designed structures into your regular workflow, you can significantly cut down on administrative time. This leaves more space for other important tasks while ensuring your clients receive clear, professional documents every time.

Integrating Invoice Templates with Accounting Tools

By combining pre-designed billing forms with accounting software, businesses can enhance the accuracy and efficiency of their financial processes. This integration allows for seamless data transfer, automating repetitive tasks and minimizing manual entry errors. It creates a more streamlined workflow, saving time and ensuring consistency in financial records.

Advantages of Integration

- Automatic Data Syncing: Connecting your billing forms with accounting tools ensures that details like payment amounts, dates, and customer information are automatically updated in both systems, reducing the need for duplicate entries.

- Improved Accuracy: By eliminating manual data entry, you lower the risk of errors and discrepancies between the two platforms.

- Faster Financial Reporting: With real-time data synchronization, you can generate financial reports more quickly, giving you up-to-date insights into your business’s performance.

- Efficient Tax Calculation: Integrated systems often automatically calculate applicable taxes and deductions, ensuring compliance and accurate financial documentation.

- Increased Productivity: With less time spent on repetitive administrative tasks, you can focus on growing your business or managing other critical operations.

How to Set Up Integration

To link your pre-built forms with accounting tools, follow these steps:

- Select Compatible Tools: Choose accounting software that allows for easy integration with your billing forms. Popular platforms such as QuickBooks, Xero, or FreshBooks offer such capabilities.

- Configure Integration Settings: Set up the connection by entering API keys or linking accounts between the two systems, following the provided instructions.

- Test the Integration: Perform a test transaction to ensure that data flows correctly between your billing system and accounting platform.

- Monitor and Update: Regularly check the integration settings to ensure everything is working smoothly and make adjustments if needed.

By integrating billing systems with accounting tools, businesses can simplify their financial management and ensure a higher level of accuracy and efficiency in their operations.

Free vs Paid Invoice Templates

When choosing a billing form, businesses often face the decision between free and paid options. While free solutions may seem appealing due to their no-cost nature, they may lack the advanced features or customization options that a paid version offers. On the other hand, premium options can provide more flexibility, additional functionalities, and better support, but come at a cost. Understanding the key differences between these two types of options is crucial when selecting the best one for your business needs.

Free versions typically offer basic designs and limited features, which may be sufficient for small businesses or freelancers with simple billing needs. However, these options may lack customization, support, or the ability to integrate with other business tools, potentially leading to extra work down the line.

Paid solutions, in contrast, provide access to premium features, such as more advanced customization options, integration with accounting software, and enhanced customer support. These tools can save time and improve efficiency for larger businesses or those that require more sophisticated invoicing systems.

Ultimately, the decision comes down to your specific needs, budget, and the level of complexity required for your billing process. If your business requires simple forms and doesn’t need advanced functionality, a free option may be sufficient. However, if you need more flexibility, automation, or integration, a paid option might be the better choice for your long-term success.