How to Use an Invoice Creation Template for Professional Billing

Managing financial transactions efficiently is essential for any business, and having a structured method to document payments is key to maintaining clarity and professionalism. By using ready-made formats designed to organize critical details, businesses can ensure accuracy and consistency in their records. These documents are versatile, helping to save time while reducing the risk of errors.

With a well-designed document, companies can easily input necessary information such as amounts, due dates, and contact details. Whether you’re a small business or a large corporation, utilizing such formats simplifies the process, allowing you to focus on growth and customer relationships. Tailoring these documents to meet specific needs is possible without sacrificing ease of use.

Efficiency and simplicity are the cornerstones of these solutions, empowering businesses to handle transactions smoothly and keep their financial processes transparent. With the right system in place, billing becomes a seamless part of daily operations.

Invoice Creation Template Overview

In any business, having a standardized document to record transactions is crucial for maintaining organization and professionalism. These documents help ensure that all necessary details are clearly presented, making it easier for both parties to understand the terms of a deal. By using pre-designed formats, businesses can streamline the process, saving time and reducing the chance of errors.

Key Features of a Well-Designed Document

- Consistency: A uniform structure ensures that every entry is presented in the same manner, making it easier to track and manage.

- Clarity: Clearly defined sections for pricing, dates, and contact information help avoid confusion and miscommunication.

- Customization: Many formats can be tailored to meet specific business needs, such as adding logos or adjusting terms and conditions.

Benefits of Using a Standardized Format

- Time-saving: With a ready-made structure, businesses can fill in the necessary details without starting from scratch.

- Improved Accuracy: Pre-defined fields minimize the risk of missing critical information.

- Professionalism: Presenting a well-organized document strengthens a company’s image and builds trust with clients.

Whether you’re working with a small or large scale operation, adopting a structured approach to recording financial transactions enhances efficiency and organization. These formats help businesses focus on growth and client relationships, while ensuring transparency in all dealings.

Why Use an Invoice Template

Having a consistent document structure to manage financial exchanges is essential for any business. It helps maintain organization, ensures accuracy, and creates a professional appearance. By relying on predefined formats, businesses can avoid mistakes and reduce the amount of time spent on administrative tasks, allowing more focus on important activities like client interactions and service improvements.

Here are some reasons why adopting a structured format can be beneficial:

| Benefit | Description |

|---|---|

| Time Efficiency | Predefined fields allow for faster data entry, reducing the time needed to prepare documents. |

| Accuracy | A fixed format minimizes the chances of omitting important details or making errors during entry. |

| Professional Appearance | A well-organized document presents a professional image, which can improve client trust and relationships. |

| Consistency | Using the same format for every transaction ensures uniformity, making it easier to track and compare records. |

| Customization | Many formats can be tailored to fit the specific needs of the business, such as adding logos or specific terms. |

By incorporating these formats into your workflow, you can simplify the process of documenting financial transactions while maintaining a high level of professionalism and accuracy.

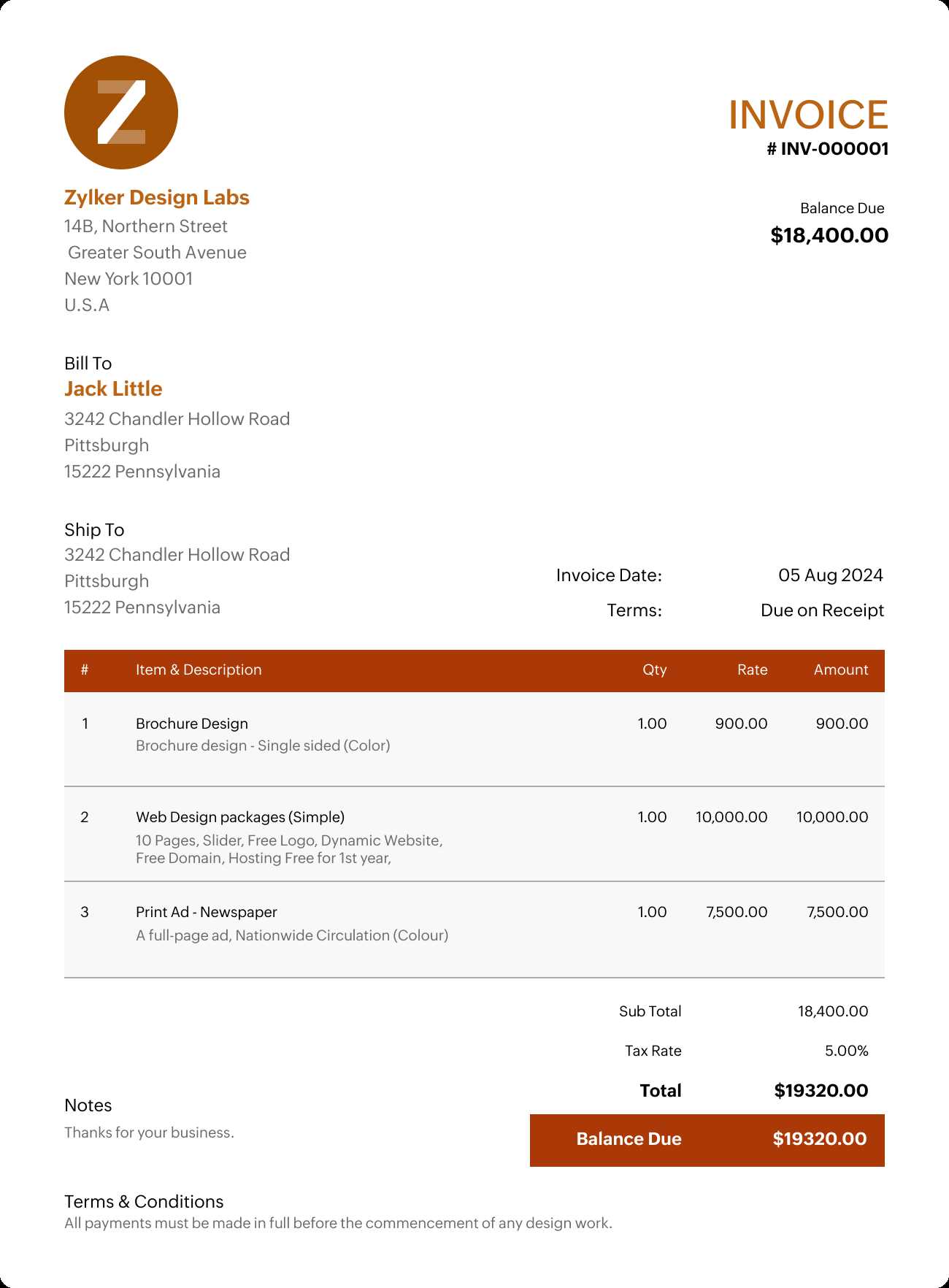

Customizing Your Invoice Template

Tailoring a financial document to meet the specific needs of your business can significantly enhance both its functionality and appearance. Customization allows you to align the structure with your brand identity, incorporate additional details, and ensure that all necessary information is clearly presented. This level of personalization not only improves usability but also helps reinforce professionalism in every transaction.

Here are key aspects to focus on when personalizing a financial document:

- Branding: Add your company logo, colors, and fonts to make the document reflect your business identity.

- Additional Fields: Customize the format to include specific sections such as discounts, taxes, or payment terms relevant to your operations.

- Payment Instructions: Provide clear instructions for how and where payments should be made to avoid confusion.

Consider these tips for effective customization:

- Consistency: Ensure that your changes follow a consistent style and layout, keeping the document professional and easy to navigate.

- Client Focus: Tailor the content to suit the preferences and requirements of your clients, such as adding a personalized message or notes.

- Clarity: Avoid cluttering the document with unnecessary information–focus on the essentials to keep it clean and readable.

By carefully customizing each aspect, you ensure that every financial record not only meets business standards but also enhances client trust and engagement.

Essential Fields in an Invoice

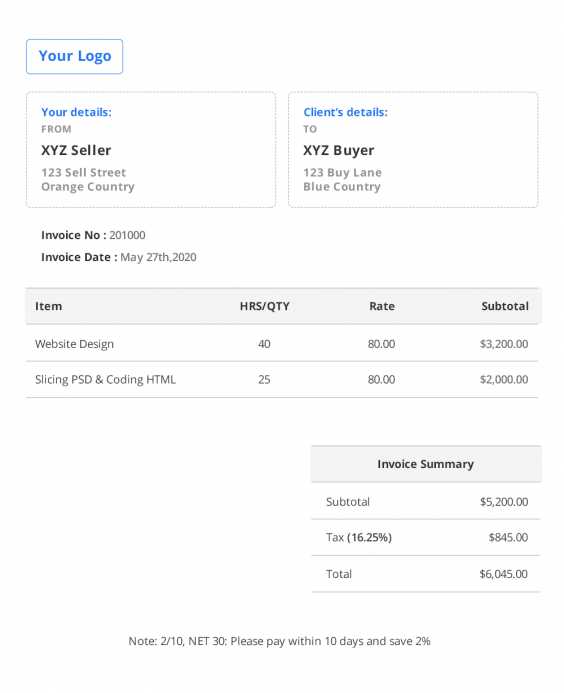

For any business to keep track of transactions efficiently, it is important to include the right elements in every financial document. These elements ensure that all the necessary information is captured accurately, making it easy for both the sender and recipient to understand the terms of the agreement. Including these essential details also helps to maintain clarity and avoid confusion in the future.

Key Information to Include

- Contact Information: Always include your business name, address, and contact details, as well as those of the client. This establishes who is involved in the transaction.

- Unique Identifier: Assign a unique reference number or code for easy tracking of each record.

- Transaction Date: Clearly indicate the date when the transaction took place or when the document is being issued.

- Description of Goods or Services: List the products or services provided, including quantity and detailed descriptions to ensure both parties are on the same page.

Additional Important Details

- Amount Due: Clearly specify the amount owed, along with any taxes or additional fees, so the recipient knows the exact payment expected.

- Payment Terms: State the payment due date, available methods, and any late fees that may apply if payments are not received on time.

- Notes: Include any extra information such as terms and conditions or a personalized message to the recipient, if necessary.

By ensuring that these essential fields are present in every document, businesses can streamline their financial processes and foster transparent communication with clients.

How to Format Your Invoice

Proper formatting of a financial document is essential for clarity and ease of use. A well-structured document not only enhances professionalism but also ensures that all necessary details are presented in an organized manner. By using a clean layout and logical arrangement, businesses can avoid confusion and make it easier for clients to process and pay their bills on time.

Here’s how to structure your document effectively:

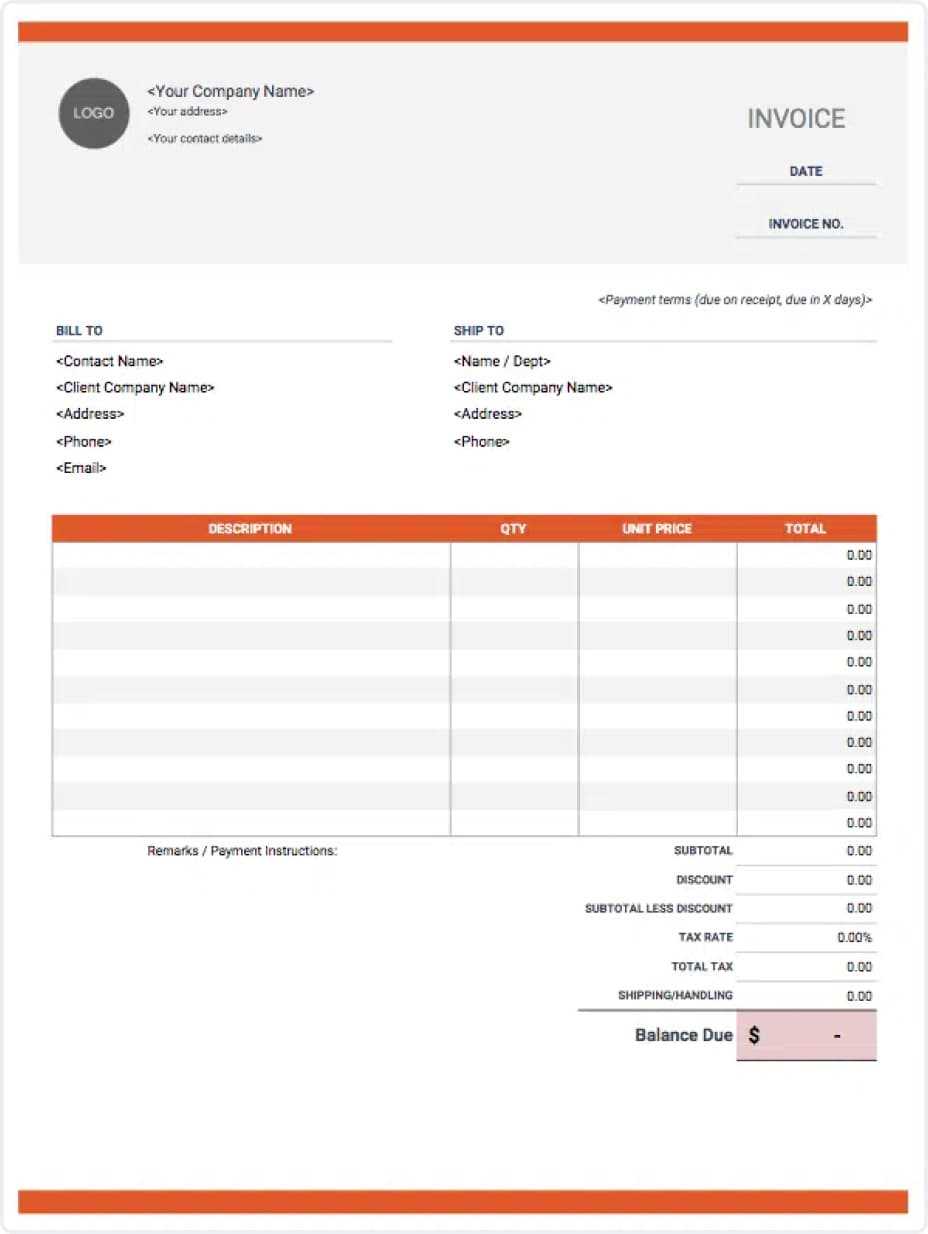

| Section | Details to Include |

|---|---|

| Header | Include your business name, logo, and contact details along with the client’s information for quick reference. |

| Transaction Information | Provide a unique reference number, the date of the transaction, and any relevant terms of sale or agreement. |

| Line Items | List each product or service provided, with clear descriptions, quantities, and individual prices for transparency. |

| Amount Due | Sum up the total amount due, including applicable taxes, discounts, and any other charges. |

| Payment Terms | Specify the due date for payment, acceptable payment methods, and any late fees that may apply. |

| Footer | Include additional notes, terms and conditions, or thank-you messages to reinforce customer relationships. |

A simple and logical structure will ensure that your document is easy to read, helping to facilitate faster processing and minimizing misunderstandings. By adhering to a clear format, you demonstrate professionalism and ensure transparency in all business transactions.

Choosing the Right Template for Your Business

When selecting a structured format to manage financial documentation, it’s important to choose one that aligns with your business needs and industry standards. A well-suited design not only saves time but also ensures that your documents reflect your business’s professionalism and meet regulatory requirements. Tailoring the format to your specific processes can help streamline administrative tasks and improve customer communication.

Here are key factors to consider when selecting a format:

- Business Type: Different industries may require specific details, such as additional service descriptions or product codes. Ensure the structure you choose accommodates your unique requirements.

- Customization Options: Look for formats that allow you to add personalized elements, such as your logo, business colors, or custom fields like discounts or additional fees.

- User-Friendliness: Choose a format that is easy to fill out and understand, both for you and your clients. This minimizes errors and confusion.

- Legal Compliance: Ensure the format includes all legally required elements, such as tax details or payment terms, which may vary by region or industry.

Consider these tips for selecting the best format for your business:

- Assess Your Needs: Evaluate the size of your business and the volume of transactions you handle. Smaller businesses may prefer simpler designs, while larger companies might require more detailed formats.

- Look for Flexibility: Choose a format that can adapt as your business grows, such as one that allows you to easily add or remove fields as your needs change.

- Test and Review: Before fully adopting any format, test it with real data to ensure it works efficiently and provides all necessary information in a clear and organized manner.

By selecting the right structured format, you can streamline your business processes, ensure accuracy, and present a professional image to your clients, ultimately improving both efficiency and customer satisfaction.

Invoice Design Tips for Professionals

For any business, presenting a well-structured and aesthetically pleasing financial document is crucial. A clean, professional design not only enhances the perception of your brand but also ensures that all necessary information is conveyed clearly and efficiently. By focusing on certain design elements, you can make your documents more effective, easy to read, and visually appealing.

Here are some key design tips to consider:

- Simplicity is Key: Avoid cluttering the document with unnecessary details. A minimalist approach helps ensure that important information stands out and is easy to find.

- Consistent Branding: Incorporate your company’s logo, colors, and fonts to make the document easily identifiable and reflective of your brand’s identity.

- Logical Layout: Organize the sections logically, starting with contact information, followed by the details of the transaction, and then the payment instructions. This makes the document easy to navigate.

- Clear Fonts and Readable Text: Use fonts that are easy to read. Avoid overly decorative styles, and ensure that the font size is large enough for easy legibility.

- Use of Space: Adequate spacing between sections and items makes the document look more organized and allows the reader to easily distinguish between different types of information.

- Highlight Important Information: Use bold or colored text to highlight essential details such as total amounts, payment due dates, and terms. This draws attention to critical data without overwhelming the reader.

By following these design principles, you ensure that your financial records not only look professional but also provide a smooth experience for your clients, making the payment process straightforward and hassle-free.

Incorporating Your Brand into Invoices

Integrating your brand into every business document is a strategic way to reinforce your company’s identity and build a stronger connection with your clients. By customizing financial documents with elements that represent your business, you not only add a professional touch but also enhance brand recognition. This makes the document feel more personalized and aligned with the values and image of your company.

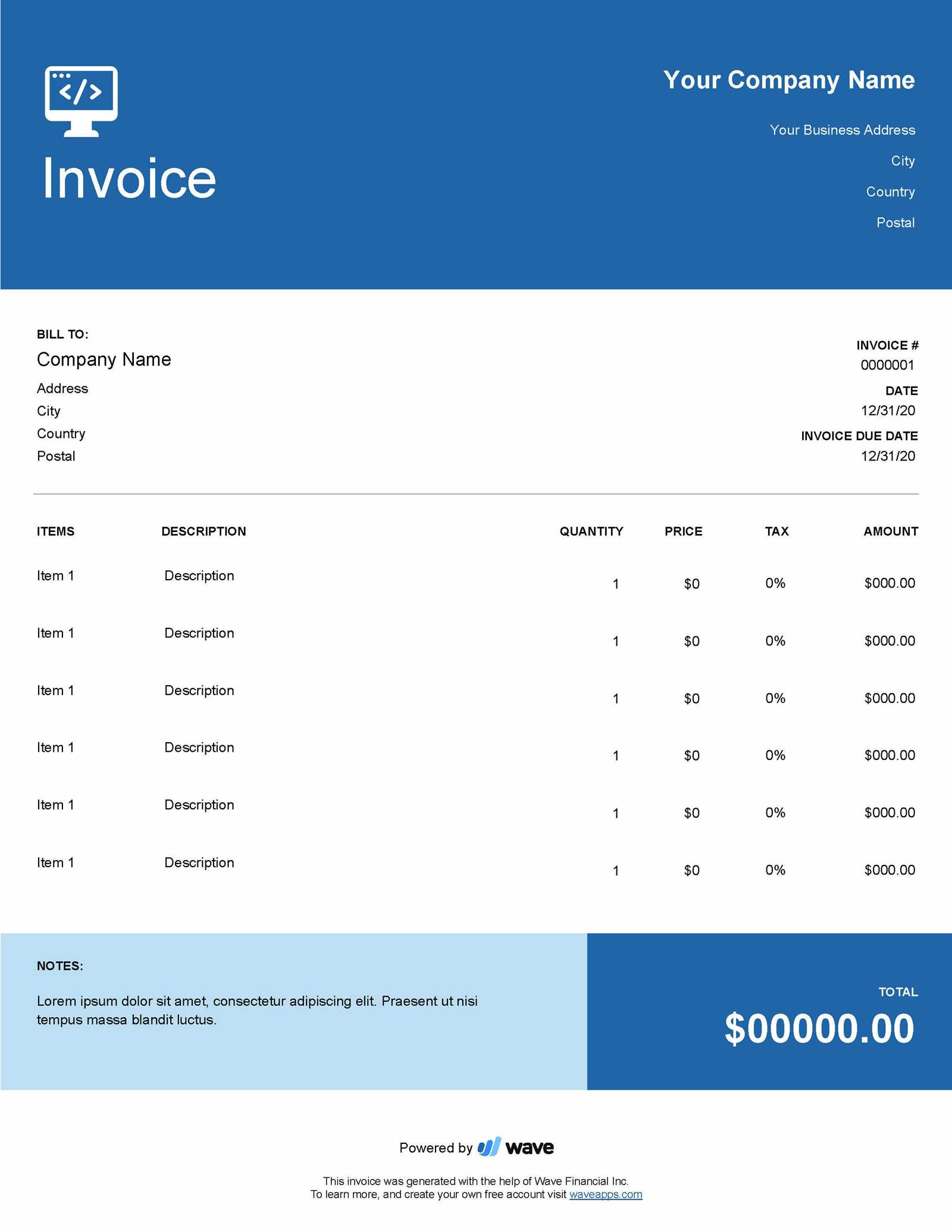

Key Elements to Add for Brand Consistency

- Logo: Include your company logo at the top of the document to immediately communicate your brand’s presence and identity.

- Brand Colors: Use your company’s primary colors in headings, borders, and accents. This creates visual continuity across all materials.

- Font Style: Apply your business’s standard fonts to maintain a consistent look across all documents, from emails to printed forms.

- Tagline or Slogan: Adding a brief slogan or tagline under your business name can help reinforce your company’s mission or values.

Benefits of Customizing Documents with Your Brand

- Professionalism: Customized documents present a polished and cohesive image, reflecting your attention to detail and commitment to quality.

- Client Recognition: When clients see familiar branding elements, it builds trust and makes your business stand out in a competitive market.

- Brand Loyalty: Consistently using your brand on every communication reinforces your identity, fostering a stronger connection with customers.

By incorporating these branding elements, your financial documents will serve as more than just a transactional tool; they will be an extension of your business identity, helping to create a lasting impression on clients.

Managing Multiple Invoices Effectively

Handling a large volume of financial documents can quickly become overwhelming without proper organization and systematic tracking. To maintain accuracy and ensure timely payments, businesses need a structured approach that allows them to manage multiple records with ease. By implementing efficient processes, you can streamline workflows and avoid errors that may arise from managing too many documents at once.

Key Strategies for Managing Multiple Records

- Organize by Categories: Group similar documents together by client, project, or transaction type. This allows you to quickly locate specific records when needed.

- Use Unique Reference Numbers: Assign a unique identifier to each document to reduce confusion and ensure clear tracking for both you and your clients.

- Set Up a System for Due Dates: Implement a scheduling system to track payment deadlines. This can help you follow up on overdue payments promptly and efficiently.

- Digital Solutions: Consider using cloud-based software or invoicing tools that automate the process and provide easy access to all your records in one place.

- Track Status: Maintain a system for tracking the status of each document (e.g., paid, pending, overdue) to avoid confusion and ensure timely follow-up.

Tools and Tips for Efficient Management

- Cloud-Based Platforms: Utilize digital tools that allow you to access records from anywhere, collaborate with your team, and keep everything synchronized.

- Automated Reminders: Set automated reminders for payment deadlines, ensuring that nothing slips through the cracks.

- Reporting Features: Many digital solutions offer built-in reporting functions, allowing you to quickly assess outstanding balances and overdue documents.

By organizing and automating your processes, you can handle multiple documents with greater efficiency and ensur

Common Mistakes in Invoice Creation

Inaccuracies in financial documentation can lead to delays in payments, confusion, and even disputes with clients. Many businesses, especially small enterprises, may overlook key details when preparing their records, which can result in costly mistakes. Understanding the most common errors can help you ensure that all documents are accurate and complete, minimizing potential issues down the road.

Common Errors to Avoid

| Error | Consequence | Solution |

|---|---|---|

| Missing or Incorrect Contact Information | Delays in communication, payment processing issues | Double-check client details before sending any documents |

| Unclear Payment Terms | Confusion and delayed payments | Ensure payment terms, including deadlines and late fees, are clearly stated |

| Omitting Necessary Details | Questions from clients, potential non-payment | Always include service descriptions, amounts, taxes, and any additional fees |

| Incorrect Calculations | Loss of revenue, client distrust | Double-check all figures and consider using automated tools for calculations |

| Failure to Include a Unique Identifier | Difficulty in tracking payments and reconciling records | Assign a unique reference number to each document for easy identification |

Best Practices to Ensure Accuracy

- Use Standardized Formats: Adopting a consistent structure for all documents helps reduce mistakes and ensures all necessary information is included.

- Review Before Sending: Always proofread before finalizing and sending documents. This can help catch small mistakes before they become bigger issues.

- Utilize Automation: Leverage software that automates calculations and ensures accuracy,

Digital vs. Paper Invoices

Businesses today have the option of choosing between digital and physical methods for sending financial documents to clients. Each approach comes with its own set of advantages and challenges. While traditional paper-based methods have been in use for centuries, modern technology has made digital formats increasingly popular due to their convenience and speed. Understanding the key differences between these two formats can help businesses make an informed decision on which method works best for their needs.

Digital records offer several benefits such as faster delivery, the ability to store information securely, and ease of access from anywhere. On the other hand, physical documents might still appeal to some clients who prefer tangible records or lack the technology to manage digital formats effectively. Evaluating both options based on your business needs and client preferences can help you decide which is more suitable for your workflow.

Automating Your Invoice Process

Streamlining financial documentation workflows can significantly improve efficiency, reduce errors, and save valuable time. Automating routine tasks such as document creation, delivery, and follow-up can help businesses focus on more strategic activities. By integrating automation tools into your business processes, you can ensure that each document is generated, tracked, and sent promptly without manual intervention. This approach not only reduces administrative burden but also enhances overall productivity.

Benefits of Automation

Benefit Description Time Efficiency Automation speeds up repetitive tasks, reducing the need for manual input and allowing more focus on core business operations. Accuracy Automated systems reduce the chances of human error in calculations, dates, and details, ensuring consistency and reliability. Cost-Effective By automating processes, businesses can reduce overhead costs related to paperwork, postage, and manual labor. Improved Cash Flow Automation helps track payments and send timely reminders, improving cash flow by reducing delays in receiving payments. How to Implement Automation

- Choose the Right Software: Invest in cloud-based tools that offer automated billing and tracking features to streamline your workflow.

- Set Up Recurring Tasks: For regular services or subscriptions, configure automated invoicing to eliminate the need for manual entry.

- Integrate with Other Systems: Link your accounting software or CRM with your automation tools to ensure seamless data transfer and accurate record-keeping.

- Monitor and Adjust: Regularly review the automated processes to ensure they are working as expected and make adjustments as needed.

By automating the document management process, businesses can not only save time and reduce errors but also create a more streamlined e

Integrating Payment Methods on Invoices

Including clear payment options on your financial documents is crucial for ensuring smooth transactions and timely payments. By offering various payment methods, you make it easier for clients to settle their dues in the way that is most convenient for them. The more accessible and flexible the payment options, the more likely clients are to pay on time, which can positively impact your cash flow.

When designing your financial records, it’s important to provide a variety of payment methods such as bank transfers, credit card payments, online payment gateways, and checks. You should also include relevant details like account numbers, payment links, or instructions to ensure clients know exactly how to proceed. Providing multiple options not only improves convenience but can also strengthen customer relationships by showing you accommodate their preferences.

Key Elements to Include:

- Bank Account Information: Include clear details like account numbers and routing codes for clients who prefer bank transfers.

- Payment Portal Links: If you use online payment systems like PayPal, Stripe, or others, make sure to include direct links for easy access.

- Accepted Cards: Specify which credit or debit cards are accepted to ensure transparency.

- Check Payment Instructions: For clients paying via checks, include the necessary mailing address and other important details.

By providing multiple payment methods and clear instructions, you reduce the chances of delayed payments, enhance customer satisfaction, and streamline your payment process.

Ensuring Accuracy in Your Invoices

Maintaining precision in your financial documentation is essential for building trust with clients and avoiding potential disputes. Mistakes, whether in pricing, dates, or calculations, can lead to confusion and delays in payment. Therefore, it’s crucial to implement a systematic approach that guarantees accuracy in every aspect of the document.

Key Areas to Focus on

- Correct Client Information: Always double-check that the client’s name, address, and contact details are accurate.

- Accurate Item Descriptions: Ensure that each product or service is clearly described with correct quantities and rates to avoid misunderstandings.

- Proper Tax Calculations: Verify that all taxes are applied correctly based on local laws and that they are clearly stated.

- Clear Payment Terms: Include precise payment due dates, accepted methods, and any late fees to avoid confusion.

Best Practices for Double-Checking

- Review All Entries: Before sending the document, review all fields for consistency and correctness.

- Use Accounting Software: Utilize automated tools that reduce human error by automatically calculating totals, taxes, and discounts.

- Have a Second Set of Eyes: A colleague or team member should review the document to catch any errors you may have overlooked.

By ensuring the accuracy of every detail in your financial documentation, you reduce the likelihood of confusion and ensure a smooth transaction process, fostering stronger client relationships.

Tracking and Organizing Sent Invoices

Efficiently managing the documents you send to clients is critical for maintaining a smooth workflow and ensuring timely payments. A structured system for tracking and organizing these records helps avoid missed deadlines, lost documents, and confusion about which clients have settled their accounts. Proper organization also ensures easy retrieval of information when needed, such as for accounting purposes or resolving disputes.

Effective Organization Methods

- Digital Filing System: Use folders or cloud storage to categorize your records by client, date, or project for quick access.

- Unique Identifiers: Assign a unique reference number to each document to make tracking easier and to avoid duplicates.

- Automated Reminders: Set up reminders for upcoming payments or overdue accounts to follow up on time.

Tracking Tools and Best Practices

- Accounting Software: Leverage software that automatically tracks sent records and updates their status when payments are made.

- Manual Logs: Maintain a spreadsheet or logbook to record key details such as the date sent, payment due date, and payment status.

- Regular Audits: Periodically review your system to ensure that all documents are up-to-date and that no payment records are missing.

By using these strategies, you can enhance your ability to track and manage sent records, ensuring a more efficient and organized process for both you and your clients.

Legal Considerations for Invoice Templates

When preparing documents for financial transactions, it’s crucial to ensure they comply with local laws and regulations. Certain legal requirements must be met to ensure that these documents are valid, enforceable, and acceptable for both tax purposes and legal disputes. By understanding and implementing these requirements, you can protect your business and maintain professional standards.

Key Legal Requirements to Include

- Business Information: Always include your legal business name, address, and contact details. This is necessary for identification and legal purposes.

- Clear Payment Terms: Clearly outline payment due dates, methods of payment, and any late fees to avoid confusion or legal issues later.

- Tax Information: Ensure that any applicable taxes, such as sales tax or VAT, are clearly stated and calculated according to the relevant laws.

- Unique Document Number: Assign a unique identifier or reference number to each record for tracking and auditing purposes.

Protecting Your Business Legally

- Terms and Conditions: Include a section that outlines your terms of service, return policies, and any legal disclaimers to protect your business.

- Invoice Retention: Keep records of all issued documents for the required duration as stipulated by tax and accounting regulations in your region.

- Dispute Resolution: Indicate the process for resolving any payment disputes, including the legal steps to take if a payment remains overdue.

By ensuring that all legal aspects are covered, you minimize the risk of disputes and ensure that your documents are both legitimate and effective in securing payments.

Creating Recurring Invoices

For businesses that offer subscription-based services or ongoing projects, the ability to automate and streamline regular billing is essential. Setting up documents that can be issued on a recurring basis ensures consistent revenue and reduces administrative effort. By structuring these records efficiently, businesses can save time while keeping clients informed of regular charges.

Essential Elements of Recurring Billing

To effectively create recurring payments, certain components need to be included consistently. These ensure that both the business and the client have a clear understanding of the terms:

Component Description Billing Cycle Define the frequency (e.g., weekly, monthly, annually) at which payments will be processed. Service Period Indicate the exact period covered by the payment (e.g., for services rendered from January 1 to January 31). Amount Clearly state the amount due for each cycle, including taxes or discounts if applicable. Payment Methods List the available payment options (e.g., credit card, bank transfer, online payment gateways). Renewal Date Include the date when the next cycle of charges will occur, to help clients plan accordingly. Automating the Process

Setting up an automated system for generating recurring documents eliminates manual effort and ensures that no payment is missed. Many accounting software programs offer features for automating this process, allowing businesses to schedule and send documents without any additional input once the initial setup is complete. This process is especially useful for subscription models, membership services, or any scenario where clients are billed regularly.

Free vs. Paid Invoice Templates

When choosing a solution for creating business documents, one of the key decisions involves selecting between free and paid options. Both types offer distinct advantages, but the right choice depends on factors like business needs, volume of transactions, and desired level of customization. Each option has its own set of benefits and limitations that can significantly impact the efficiency and professionalism of your billing process.

Free options often provide basic functionalities, with standard layouts that suit smaller businesses or those with limited needs. While they are accessible and easy to use, free designs might lack advanced features or customization options that can give your documents a more polished look.

On the other hand, paid versions tend to offer more flexibility and a greater range of features. These may include enhanced design elements, automatic calculations, and integration with accounting software. For businesses that require more specialized features or wish to establish a unique brand identity, opting for a paid service can be a worthwhile investment.