Effective Invoice Collection Letter Template for Prompt Payment Recovery

Managing overdue payments is an essential aspect of maintaining a healthy cash flow for any business. Delays in payments can disrupt operations, cause financial stress, and even affect long-term growth. To ensure timely recovery, it is crucial to have a clear and professional approach when requesting payment from clients who have missed their due dates.

One of the most effective ways to address outstanding balances is through a formal written request. A well-crafted communication can encourage customers to settle their debts while preserving the professional relationship. The key is to balance firmness with courtesy, making sure your tone conveys the urgency of the situation without coming across as aggressive.

In this guide, we will explore how to create a compelling request for payment, focusing on essential components, timing, and best practices. With the right approach, you can significantly improve your chances of receiving payment promptly, all while maintaining a positive rapport with your clients.

Invoice Collection Letter Template Guide

When payments are overdue, businesses need an effective strategy to recover outstanding funds. A formal communication that clearly outlines payment expectations is crucial for ensuring timely settlements. In this section, we will explore how to structure such a message to ensure it is both polite and firm, while maximizing the chances of receiving prompt payment.

Key Elements of a Payment Request

The core of a successful payment request lies in its structure. First, it’s essential to include specific details such as the amount owed, the due date, and any agreed-upon terms. Additionally, including a clear call to action, such as a request for payment within a set period, helps ensure the recipient knows exactly what is expected of them.

Maintaining Professionalism and Clarity

While it’s important to convey urgency, the tone of the message should always remain professional. A well-worded request demonstrates respect for the recipient, encouraging them to take prompt action without feeling pressured. Being clear about the consequences of continued non-payment–such as late fees or potential legal action–can also motivate timely resolution.

By following these guidelines, businesses can craft a message that not only prompts payment but also maintains strong customer relationships.

Why Use an Invoice Collection Letter

Requesting payment through formal written communication is an essential part of managing overdue balances in business. This method provides a structured way to remind clients about outstanding amounts while maintaining professionalism. It ensures that the business has a documented record of the request, which can be important for both internal records and potential future disputes.

One of the primary reasons for using this approach is that it sets clear expectations. A written request outlines the amount due, the payment terms, and any consequences for non-payment, reducing misunderstandings between the business and the client. By addressing the situation directly and professionally, businesses can encourage customers to act promptly, minimizing the chances of prolonged delays.

Additionally, formal requests convey a sense of urgency and importance, which is often more effective than verbal reminders. They demonstrate that the issue is being taken seriously, while still maintaining a tone of respect and professionalism. This can help preserve relationships with clients, encouraging timely payment while avoiding any potential conflicts.

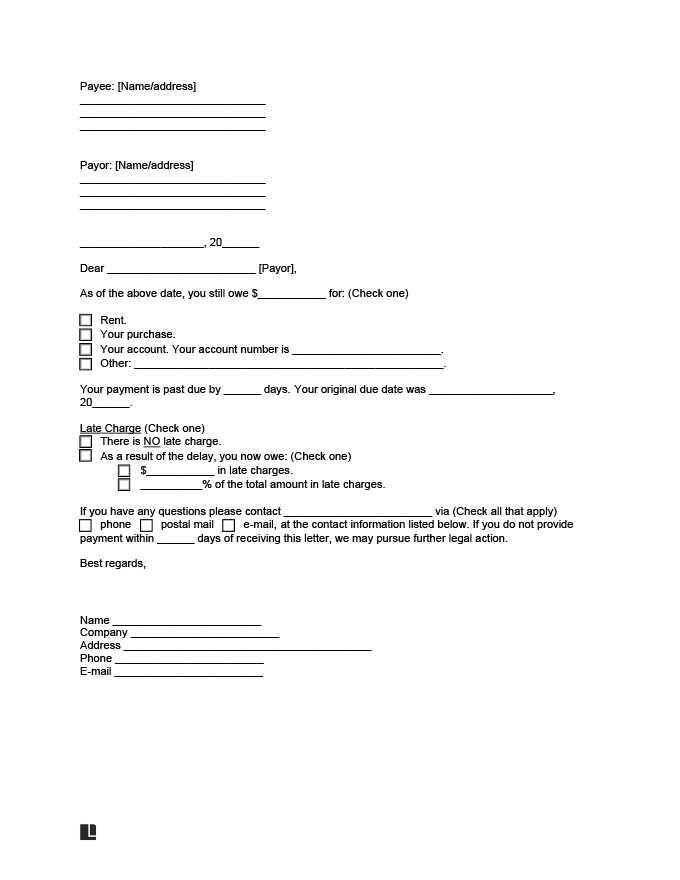

Key Elements of a Collection Letter

When requesting payment from a client, the structure and content of the communication play a vital role in achieving the desired result. A well-crafted message should include essential details that clearly outline the purpose and expectations. This ensures that the recipient understands their obligations and the necessary steps to resolve the matter efficiently.

First, the communication must include a clear statement of the outstanding amount. This should include both the principal sum owed and any applicable late fees or interest. Including an itemized breakdown, if necessary, helps the recipient understand exactly what is being requested.

Second, it is crucial to provide the due date and any terms of payment. This gives the recipient a clear timeframe for when the payment must be made. Setting a specific deadline can prompt quicker action and reinforce the urgency of the situation.

Finally, a professional and polite tone is key to maintaining a positive relationship with the client. Even when addressing overdue payments, it is important to avoid aggressive language. Instead, focus on being respectful, firm, and solution-oriented. This helps ensure that the communication is well-received and the issue can be resolved amicably.

How to Write a Professional Letter

Crafting a professional communication to request overdue payment requires careful attention to tone, clarity, and structure. The goal is to convey your message firmly but respectfully, encouraging the recipient to settle the outstanding balance while maintaining a positive relationship. Following a structured approach ensures that all necessary information is included and the message is clear.

1. Start with a Polite Greeting

- Use a formal greeting such as “Dear [Client’s Name],” or “Dear [Company Name].” Avoid casual language to maintain professionalism.

- If you have an ongoing relationship, ensure the tone reflects mutual respect. Avoid overly familiar phrases.

2. Be Clear About the Purpose

- State the purpose of your communication early on. Let the recipient know you’re addressing an outstanding payment, but do so politely.

- Provide the relevant details, such as the amount due, the original due date, and any payment terms that were agreed upon.

For example, you can write: “I am writing to follow up on the payment of $X, which was due on [date]. As of today, this payment remains outstanding.” Be concise but specific.

3. Maintain a Respectful and Firm Tone

- Use a respectful and professional tone throughout the communication. Even if the payment is overdue, avoid sounding accusatory or rude.

- Clearly state any consequences for further delays, but keep the language polite, such as, “If payment is not received by [new date], we will be forced to [action].”

4. Include a Call to Action

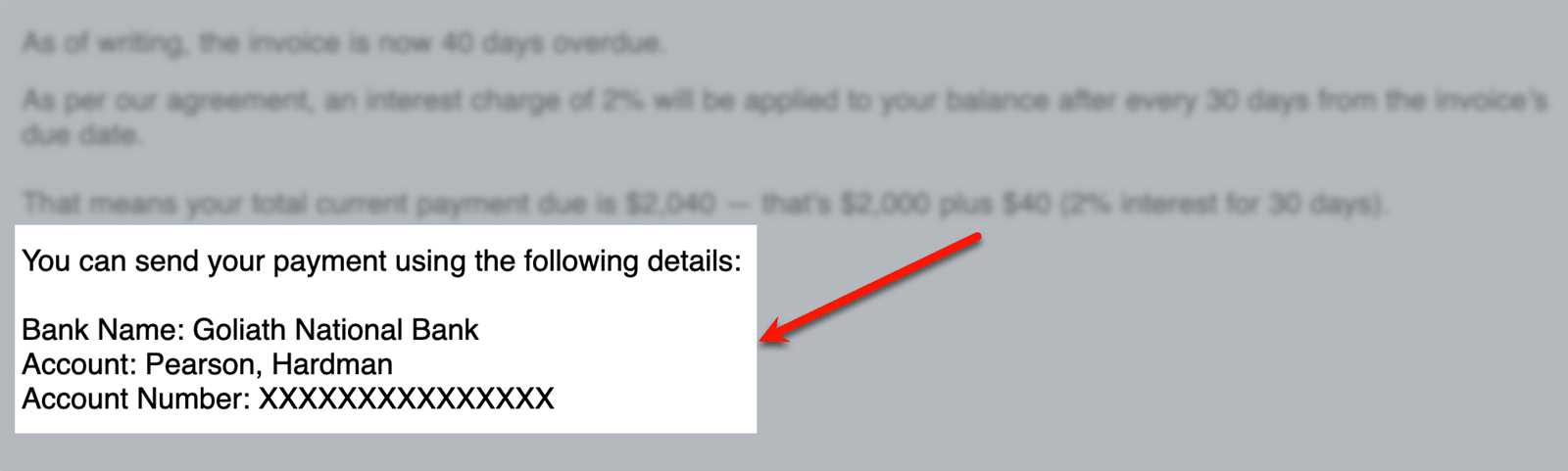

- Clearly state the next steps for the recipient, such as how they can make the payment and by when.

- Provide payment methods or account details to make it easier for the recipient to pay without confusion.

For example: “Please make payment by [new due date] to avoid further action. You can pay via [payment method] or directly to [account details].”

5. Close Professionally

- End the message on a positive and courteous note. Thank the recipient for their prompt attention and express hope for continued cooperation.

- Use a polite closing such as “Sincerely,” “Kind regards,” or “Best regards,” followed by your name and position.

By following these steps, you can write a professional and effective communication that encourages prompt payment while maintaining a respectful relationship with your clients.

Best Practices for Collecting Payments

Recovering outstanding payments is an essential task for any business, but the approach taken can make a significant difference in the outcome. A strategic and professional approach ensures that you maintain a positive relationship with your clients while encouraging timely payment. By following a few key best practices, businesses can increase their chances of successful payment recovery while avoiding unnecessary tension.

1. Send Timely and Clear Reminders

- Start by sending a polite reminder shortly after the due date passes. The sooner you address the issue, the less likely it is to escalate.

- Make your communication clear and direct. Include details such as the amount due, payment terms, and the expected date of payment.

- Consider sending reminders at regular intervals. A follow-up after the first reminder can be more effective in prompting action.

2. Offer Flexible Payment Options

- Provide multiple payment methods to make it easier for clients to settle their debts. This could include credit card payments, bank transfers, or online payment platforms.

- If possible, offer payment plans for larger balances. Breaking down the payment into smaller installments can make it more manageable for clients.

Tip: The more convenient you make the payment process, the higher the likelihood that clients will follow through.

3. Stay Professional and Courteous

- Always maintain a polite and respectful tone, even when following up on overdue payments. This shows professionalism and keeps the door open for future business.

- Focus on the facts, not the emotions. Instead of expressing frustration or disappointment, emphasize the importance of resolving the payment promptly.

By adopting these best practices, you not only improve your chances of recovering overdue payments but also foster long-term, positive relationships with your clients.

When to Send a Collection Letter

Knowing the right timing to send a formal payment request is crucial in managing overdue balances effectively. Waiting too long can result in further delays, while acting too quickly can strain your relationship with clients. It’s important to find the right balance and send your communication at the most strategic moment to maximize the chances of a successful outcome.

1. Immediately After the Due Date

- Once the payment due date has passed, sending a polite reminder within a few days is ideal. This serves as a gentle nudge and helps prevent the issue from escalating.

- A prompt reminder shows that you are serious about your payment terms, but it also allows the client some grace period to make the payment.

2. After a Grace Period Has Passed

- If no payment is received after the initial reminder, send a follow-up after about 7–14 days. This gives the client ample time to process the payment but still keeps the matter fresh.

- At this point, your message should be more direct and include any potential consequences for further delay, such as late fees or other actions.

3. Multiple Follow-Ups Over Time

- If the debt remains unpaid after several weeks, consider sending additional reminders. Space them out strategically, for example, every two weeks, to avoid overwhelming the client.

- Each reminder should be increasingly firm but still professional, reiterating the urgency of the matter without burning bridges.

By sending a payment request at the right time and in a structured way, you can encourage clients to settle their balances without harming your professional relationship.

Common Mistakes to Avoid in Letters

When drafting a formal payment request, it’s important to avoid certain missteps that could harm your chances of getting paid on time or jeopardize your relationship with the client. Small errors in wording, tone, or structure can undermine the effectiveness of your communication. Below are some of the most common mistakes businesses make when writing payment requests and how to avoid them.

| Mistake | Why It Should Be Avoided | How to Fix It |

|---|---|---|

| Using an Aggressive Tone | An overly harsh or demanding tone can alienate the client and harm the relationship. | Maintain a firm but polite tone, focusing on professionalism and clarity. |

| Vague Payment Details | Failure to provide specific information about the debt can confuse the recipient and delay the payment process. | Clearly outline the exact amount owed, the original due date, and any relevant terms or penalties. |

| Not Including a Deadline | Without a clear deadline, the recipient may not feel a sense of urgency to settle the debt. | Specify a reasonable payment date and indicate the consequences for late payments. |

| Being Too Passive | A weak or indirect message can lead to delays, as it lacks the necessary urgency. | Be clear and direct, while maintaining a respectful and professional tone. |

| Leaving Out Contact Information | If the recipient doesn’t have easy access to payment methods or your contact details, it can create unnecessary confusion. | Always include multiple payment options and clear contact information for follow-up questions. |

By avoiding these common mistakes and focusing on clarity, professionalism, and respect, you can improve the likelihood of receiving timely payment and maintaining positive business relationships.

How to Personalize Your Collection Letter

Personalizing your payment request can significantly improve its effectiveness. A generic message may come across as impersonal and fail to encourage the recipient to take prompt action. By tailoring the communication to the individual client or situation, you demonstrate that you value the relationship and are actively engaging with their specific circumstances. This can increase the likelihood of a positive response and timely payment.

1. Address the Recipient by Name

- Always use the client’s name in the greeting. This small gesture shows that the message is not a generic reminder but a direct communication.

- Example: “Dear Mr. Smith” or “Hello [Client’s Name],” rather than a generic “To whom it may concern.”

2. Reference Past Communication and Agreements

- Make sure to mention any previous discussions or agreements regarding the payment. This shows that you are aware of the context and are not sending a generic request.

- Example: “As per our agreement on [date], the payment of $X was due on [due date].”

3. Acknowledge the Client’s Business

- Take a moment to acknowledge the importance of the client’s business. This reinforces the professional nature of your relationship and emphasizes that you value their partnership.

- Example: “We’ve appreciated working with your company and look forward to continuing our successful partnership.”

4. Tailor the Tone to the Client

- If you have an ongoing positive relationship, adopt a more friendly and conversational tone. If the payment delay is significant, a firmer, more formal tone may be necessary.

- Example: “We hope this small delay hasn’t caused any inconvenience, and we trust that you will be able to resolve this promptly.”

By taking the time to personalize your request, you show your clients that you are committed to maintaining a good relationship while addressing the important matter of payment. This personalized approach can lead to quicker and more favorable outcomes for both parties.

Legal Considerations for Collection Letters

When requesting overdue payments, it is essential to be mindful of the legal implications of your communication. Although you want to be firm in encouraging payment, it is equally important to ensure that your approach complies with relevant laws and regulations. Unlawful or overly aggressive tactics could lead to disputes or legal consequences. Understanding the legal framework surrounding payment requests helps protect both your business and your client relationships.

One critical consideration is the Fair Debt Collection Practices Act (FDCPA), which applies in many jurisdictions. This law sets out clear guidelines on what can and cannot be said or done when requesting payment from individuals. For example, it prohibits harassment or threats, and mandates that communications be professional and respectful. Ensuring your message follows these rules helps avoid legal action and maintains your company’s reputation.

Another important aspect is confidentiality. Always ensure that you do not share any details of the outstanding debt with third parties, unless legally required to do so. Disclosing this information inappropriately could expose you to legal action for breach of privacy.

Finally, make sure your terms are clearly outlined. If you reference legal action, interest fees, or other consequences for non-payment, ensure they are supported by any prior agreements or contracts. This transparency helps avoid misunderstandings and ensures that your actions are legally justified.

By staying informed about these legal considerations and ensuring that your communication aligns with applicable laws, you can protect your business while effectively managing overdue payments.

How to Follow Up After a Letter

After sending a formal payment request, it’s important to follow up if the payment has not been received within the specified time frame. A timely follow-up ensures that the matter remains a priority for your client, while also reinforcing the importance of resolving the outstanding balance. Knowing when and how to follow up can make all the difference in maintaining professionalism while securing payment.

1. Wait for the Appropriate Time

- Before sending a follow-up, give your client enough time to process the payment. Typically, a period of 7 to 14 days is reasonable, depending on the original terms of the request.

- If the payment was due on a specific date, give a brief grace period before initiating a reminder.

2. Maintain Professionalism in Your Follow-Up

- When following up, remain polite but firm. Acknowledge the possibility of an oversight or misunderstanding while stressing the importance of timely payment.

- Example: “I’m reaching out to kindly remind you about the outstanding balance of $X, which was due on [date]. If you’ve already made the payment, please disregard this message. If not, we kindly request that you arrange payment as soon as possible.”

By approaching the follow-up with a professional and respectful tone, you reinforce your position while maintaining a positive relationship with your client. This approach is more likely to result in a timely resolution and continued collaboration.

Tone and Language in Collection Letters

The tone and language used in payment requests are critical to ensuring the message is received appropriately. While it’s important to convey urgency and professionalism, it’s equally essential to maintain a respectful and considerate tone. The way you phrase your request can significantly impact the response rate and your relationship with the client, so careful attention to wording is necessary.

1. Maintain a Professional Yet Friendly Tone

- A professional tone establishes authority and trust, while a friendly approach helps keep the client comfortable. Striking a balance between the two is key to making the request clear without sounding overly harsh.

- Example: “We hope everything is going well. We’d like to remind you of the outstanding balance of $X, due on [date]. We kindly ask for payment by [new date].”

2. Be Firm but Respectful

- While it’s important to be direct about the amount due and the payment timeline, it’s equally essential to avoid sounding threatening or aggressive. Always aim for firmness, not forcefulness.

- Example: “We understand that sometimes delays happen, but we ask that the outstanding balance be cleared by [date]. Thank you for your prompt attention to this matter.”

Using the right language and tone helps to ensure that your message is professional, clear, and effective. It also minimizes the chance of straining client relationships, fostering a smoother resolution to payment issues.

Using Email for Invoice Collection

Email has become a widely-used and efficient tool for sending payment requests. It offers convenience, speed, and the ability to reach clients instantly, making it an ideal communication method for addressing overdue balances. However, when using email to request payment, it’s important to ensure your message is clear, professional, and effective to achieve the desired outcome.

1. Craft a Clear and Direct Subject Line

- The subject line is the first thing your recipient sees. Make sure it’s clear and directly related to the content of the email.

- Example: “Friendly Reminder: Payment Due for [Service/Product]” or “Action Required: Outstanding Balance on Your Account.”

2. Keep the Email Professional and Concise

- While email is a more informal medium than a printed letter, it’s still important to maintain professionalism in your tone and language.

- Keep the message short and to the point. Avoid lengthy paragraphs that may overwhelm the reader. Use bullet points if needed to organize the information.

3. Include Relevant Payment Details

- Ensure that your email contains all necessary details for the recipient to make the payment, such as the amount due, the due date, and available payment methods.

- Example: “The outstanding amount of $X is due for payment by [date]. Please submit payment via [payment method] to [account details].”

4. Set a Clear Deadline and Next Steps

- State the exact date you expect the payment to be made and outline any potential consequences for non-payment, if applicable. Be firm but courteous in your request.

- Example: “We kindly request payment by [date]. If payment is not received by this time, a late fee of $X may apply.”

5. Follow Up with Reminders

- If the payment is still overdue after the first email, don’t hesitate to send a follow-up. Be respectful in your reminder, but also emphasize the importance of prompt payment.

- Example: “This is a friendly reminder that payment for your account is still pending. We kindly ask that you settle the amount of $X as soon as possible.”

Email offers a quick, professional, and trackable way to manage overdue balances. By following these best practices, you can increase the likelihood of receiving timely payments while maintaining strong relationships with your clients.

Handling Disputes and Customer Concerns

Dealing with disputes or concerns related to unpaid balances can be a delicate matter. When clients question charges or raise concerns about a payment, it’s important to handle the situation professionally and diplomatically. Addressing these issues promptly and respectfully not only helps resolve conflicts but also ensures a continued positive relationship with your clients.

1. Listen and Acknowledge the Client’s Concerns

- Start by acknowledging the client’s concerns without making assumptions. Listening actively helps build trust and shows that you value their perspective.

- Example: “Thank you for bringing this to our attention. We understand your concern and are happy to review the situation together.”

2. Investigate the Issue Thoroughly

- Before responding, make sure to carefully review all the details related to the payment or service in question. Double-check records and any agreements made with the client.

- Example: “We have reviewed your account and the records related to this payment. According to our records, the payment was due on [date] as agreed. However, we are happy to discuss any discrepancies further.”

3. Provide a Clear and Transparent Explanation

- If there was a misunderstanding or error, be honest and transparent about it. If everything is correct on your end, explain the situation clearly and offer evidence if necessary.

- Example: “Upon reviewing the situation, we can confirm that the charges are accurate based on the terms outlined in our contract. Please let us know if you need any further clarification on this.”

4. Offer a Solution or Compromise

- If the client’s concerns are valid, offer a resolution, such as adjusting the amount due or providing a payment plan. If no error has occurred, calmly explain the next steps for resolving the situation.

- Example: “To resolve this, we can offer an extended payment period or break down the charges further for better clarity. We want to ensure we are aligned moving forward.”

5. Keep Communication Professional and Respectful

- Even if the situation becomes tense, always maintain a calm and professional tone. Avoid escalating the situation and aim for a solution that satisfies both parties.

- Example: “We truly value your business and hope to find a resolution that works for both sides. Thank you for your understanding and cooperation.”

Handling disputes and customer concerns with care can turn a potentially negative experience into an opportunity for strengthening the business relationship. By being responsive, transparent, and flexible, you demonstrate professionalism and commitment to customer satisfaction.

Designing a Visually Appealing Letter

The visual design of a payment request plays a crucial role in conveying professionalism and clarity. A well-organized, visually appealing document not only makes the content easier to read but also leaves a positive impression on the recipient. Proper design can help ensure that your message stands out and encourages timely action.

1. Use a Clean, Professional Layout

- Ensure that the document is well-structured, with clear headings, subheadings, and bullet points for easy navigation. A cluttered design can make the message feel overwhelming and may distract from the main content.

- Example: Divide the document into distinct sections such as “Payment Details,” “Outstanding Amount,” and “Due Date” for a logical flow of information.

2. Choose Readable Fonts and Proper Formatting

- Choose simple, easy-to-read fonts such as Arial, Times New Roman, or Helvetica. Avoid overly decorative fonts, as they may reduce readability and appear unprofessional.

- Ensure proper font sizes. The body text should typically be around 10-12pt, while headings can be larger to highlight important sections.

- Example: Use bold for section headings and important dates or figures to make them stand out without overwhelming the page.

3. Incorporate Your Branding Elements

- Including your company’s logo and using your brand colors helps reinforce your professional identity. However, be sure to keep these elements subtle and consistent with your business’s image.

- Example: Add your company logo at the top of the document, followed by your contact information and business name. This gives a personal touch without making the document feel too informal.

4. Use Ample White Space

- White space helps to make the document more readable and less overwhelming. Avoid overloading the page with too much text or too many graphics.

- Leave appropriate margins and space between paragraphs to create a sense of balance and ensure the document is easy on the eyes.

By focusing on these design principles, you can create a visually appealing payment request that not only communicates the necessary information clearly but also reflects your professionalism. A well-designed document can increase the chances of a positive and prompt response.

How to Track Payment Progress

Monitoring the progress of outstanding payments is a vital part of managing finances and ensuring the timely receipt of funds. It allows businesses to stay organized and take proactive steps if payments are delayed. Proper tracking helps prevent confusion and ensures that every payment is accounted for accurately.

1. Use a Payment Tracking System

- Implement a reliable system, such as accounting software or a spreadsheet, to track all payments, including the amounts, due dates, and statuses.

- Ensure the system allows you to easily filter by overdue payments, partial payments, or completed transactions to get a clear view of the current financial situation.

- Example: “QuickBooks” and “Xero” are examples of accounting tools that can automate and track payment progress effectively.

2. Set Reminders and Alerts

- Automated reminders and alerts can help you stay on top of approaching payment due dates. Set notifications to remind you when payments are overdue or when a follow-up is needed.

- These reminders can be set for specific dates or based on the payment terms agreed upon with the client, ensuring that you take timely action.

- Example: Use tools like Google Calendar or integrated CRM systems to set reminders for follow-ups.

3. Regularly Communicate with Clients

- Keep clients informed about the status of their payment. Regular communication helps ensure that both parties are aware of any issues and can address them promptly.

- Example: If a payment is delayed, send polite reminders or offer assistance in case there are any issues with the payment method.

4. Monitor Partial Payments and Adjust Records

- If a client makes a partial payment, update your records immediately to reflect the remaining balance. Keep an eye on payment progress and send updated reminders if necessary.

- Example: Keep a column in your payment tracker for partial payments so you can quickly see how much is still owed and when it is due.

By actively tracking payment progress, businesses can ensure that outstanding balances are addressed in a timely manner, minimize the risk of overdue accounts, and maintain smoother cash flow. Staying organized and consistent in tracking payments is key to managing finances effectively.

How to Maintain Professionalism

Maintaining professionalism during the process of requesting payment is essential for upholding business relationships and ensuring the timely resolution of any outstanding balances. A respectful, clear, and consistent approach not only helps convey the seriousness of the matter but also demonstrates that you value the client and their business.

1. Be Clear and Concise

- Make sure that your message is straightforward and easy to understand. Avoid overly complex language that might confuse the recipient or make the situation seem more complicated than it is.

- Example: “This is a reminder regarding the outstanding balance of $X, which was due on [date]. We kindly request that payment be made by [new date].”

2. Use Polite and Respectful Language

- Always use polite language, even when dealing with overdue payments. Maintaining a courteous tone helps prevent alienating the client while still asserting the importance of the matter.

- Example: “We understand that circumstances may arise, and we appreciate your prompt attention to this matter. Please let us know if there are any issues regarding the payment.”

3. Avoid Aggressive or Threatening Language

- While it’s important to be firm in your request, avoid using any language that could be perceived as threatening or aggressive. Focus on resolving the issue without escalating the situation unnecessarily.

- Example: Instead of saying “If payment is not received by [date], legal action will be taken,” try saying “If payment is not received by [date], we will need to explore alternative options for resolving the balance.”

4. Maintain Consistency in Communication

- Ensure that all communication is consistent, whether it’s an email, a phone call, or written correspondence. Using the same tone and format across all touchpoints builds trust and reduces the risk of misunderstandings.

- Example: If you’ve used a formal tone in initial communications, maintain that tone in follow-up messages as well.

5. Keep Records of Communication

- Always document your communications with clients regarding outstanding payments. This helps create a transparent record in case of any future disputes and ensures that all interactions are professional.

- Example: Keep a log of emails sent, dates, and any notes from phone conversations for reference.

By consistently applying these strategies, you can maintain professionalism throughout the process, ensuring that payment requests are handled in a way that is respectful, clear, and effective. This approach helps preserve client relationships while facilitating timely payment resolution.

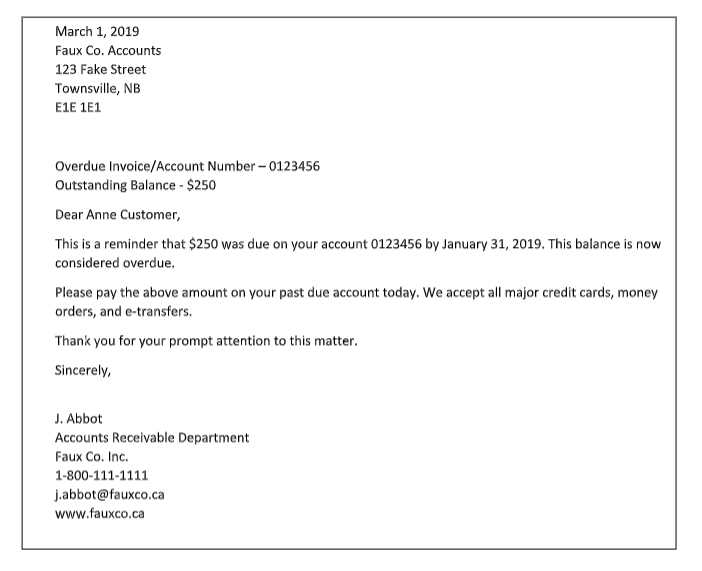

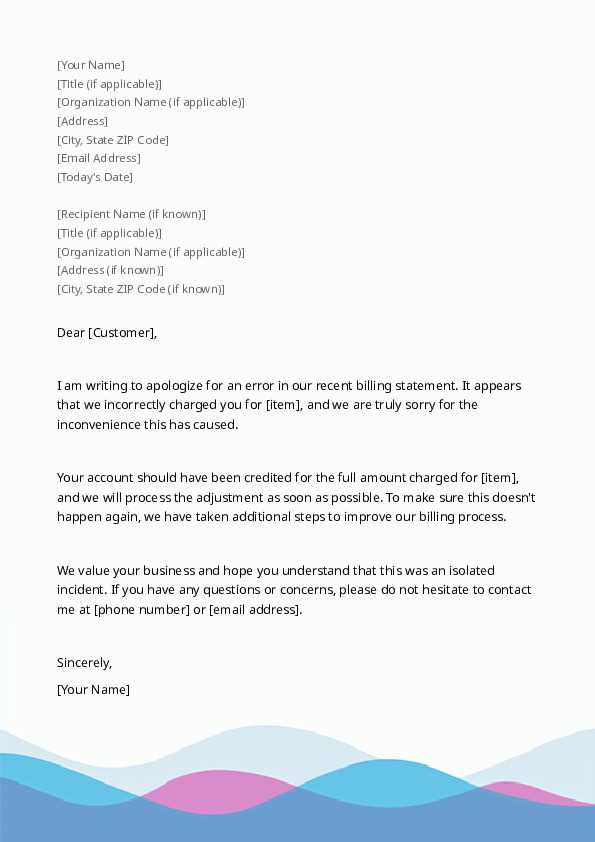

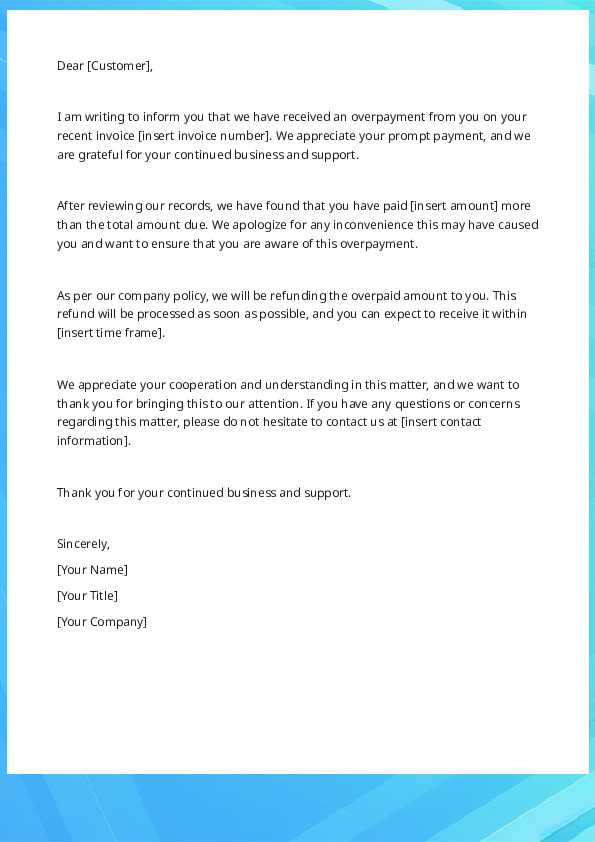

Sample Invoice Collection Letters

Providing examples of payment reminders can help businesses craft effective communication when seeking overdue payments. Below are sample templates to guide you in composing professional, respectful, and clear payment reminders tailored to different situations. These samples can be adjusted to suit your business tone and client relationships.

1. First Reminder for Payment

This sample is for an initial reminder, where the payment is overdue, but the situation is still friendly and professional.

- Subject: Friendly Reminder: Payment Due

- Dear [Client Name],

- We hope you are doing well. We are writing to kindly remind you that the payment of $[amount] was due on [date]. According to our records, we have not yet received payment.

- If there are any issues or concerns regarding the payment, please don’t hesitate to reach out. We would be happy to assist in resolving any questions.

- We appreciate your attention to this matter and look forward to receiving the payment soon. Thank you for your continued business.

- Sincerely, [Your Name] [Your Company]

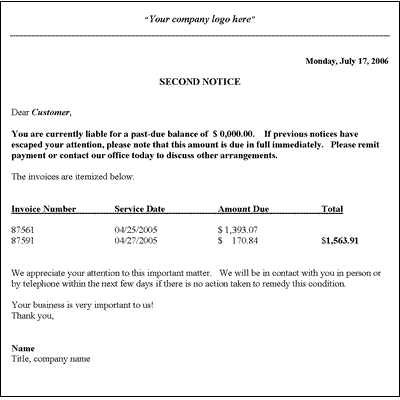

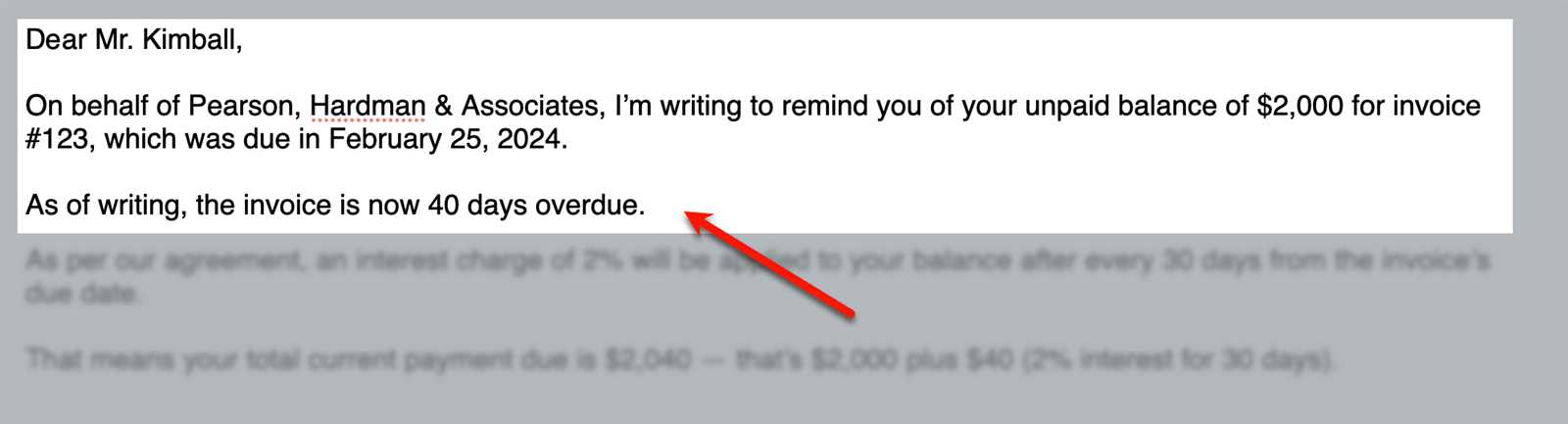

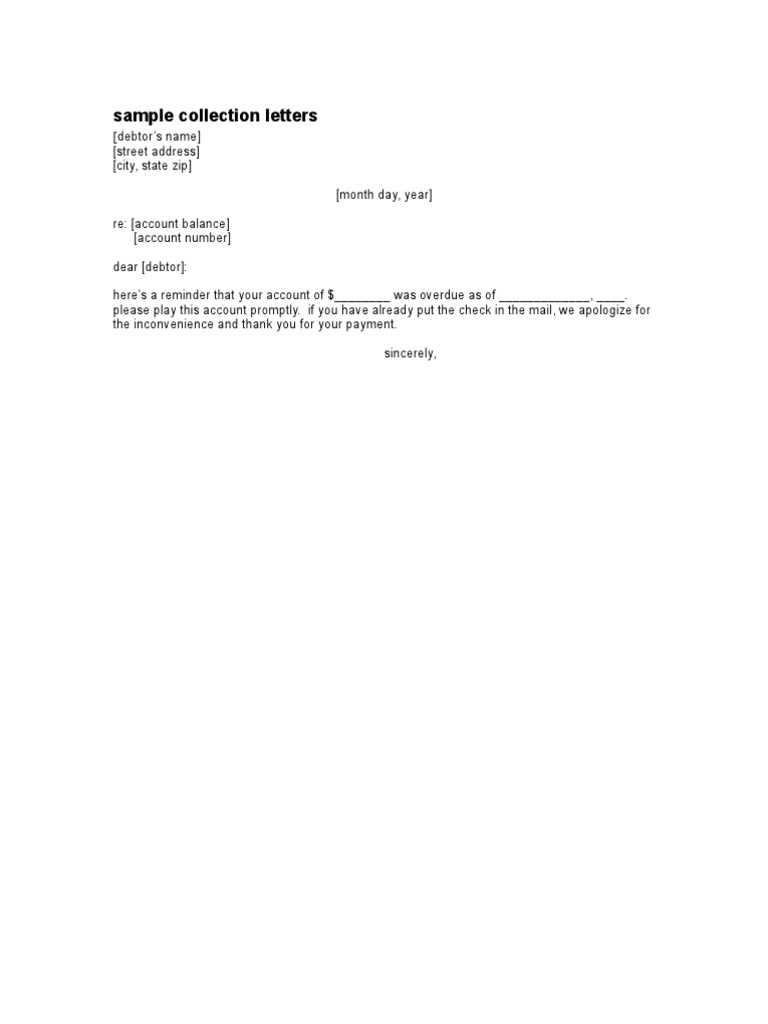

2. Second Reminder for Payment

This is a second reminder, for when the payment is still overdue, but the tone remains professional, polite, and firm.

- Subject: Second Reminder: Outstanding Payment

- Dear [Client Name],

- This is a follow-up regarding our previous correspondence about the overdue payment of $[amount], which was due on [date]. As of today, we have not yet received the payment.

- We kindly ask that the payment be made as soon as possible. Please let us know if there are any issues preventing the payment from being processed. We are more than happy to discuss any concerns you may have.

- We appreciate your prompt attention to this matter and look forward to settling this issue. Please make the payment by [new due date] to avoid any further action.

- Best regards, [Your Name] [Your Company]

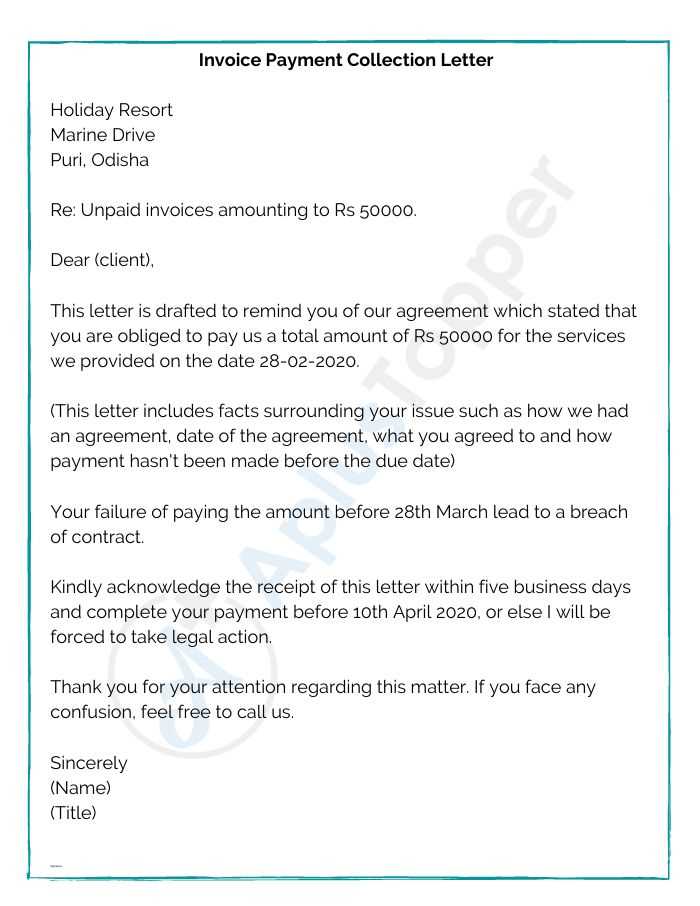

3. Final Reminder and Request for Immediate Payment

For a final reminder, where payment is significantly overdue, this sample is firm and requests immediate payment while maintaining professionalism.

- Subject: Final Notice: Payment Due

- Dear [Client Name],

- This is a final reminder regarding the payment of $[amount], which was due on [date]. Despite previous reminders, we have not yet received payment for the outstanding balance.

- If payment is not made by [final due date], we may need to consider other options, including involving a collections agency. We would prefer to resolve this matter promptly and amicably.

- Please contact us immediately to arrange payment or discuss any issues you may be experiencing.

- We appreciate your immediate attention to this matter and hope to hear from you soon.

- Sincerely, [Your Name] [Your Company]

These sample payment reminders can be tailored to suit your business’s specific needs, ensuring that your communication remains professional, respectful, and effective at encouraging timely payments.

Alternative Methods for Collecting Payments

While traditional methods like written reminders or phone calls remain effective, there are other ways to encourage timely payment. Leveraging digital tools, payment platforms, and alternative strategies can simplify the process and offer more flexibility to both businesses and clients. These methods can be more convenient, quicker, and often provide better tracking and transparency.

1. Online Payment Platforms

- Online payment solutions like PayPal, Stripe, and Square offer businesses the ability to accept payments quickly and securely. Clients can pay instantly using a variety of methods, such as credit cards, debit cards, or bank transfers.

- These platforms often provide invoicing tools that automatically remind clients of their payment due dates, making the process more streamlined and efficient.

- Additionally, using such platforms can make it easier to track payments in real-time and provide receipts immediately upon payment.

2. Payment Plans or Installments

- Offering clients the option to pay in installments can reduce the burden of large payments and increase the likelihood of payment completion. It’s a helpful method for clients who may not be able to pay the full amount at once.

- By establishing clear terms for the payment schedule and communicating these terms up front, businesses can ensure that both parties are on the same page.

- Many payment systems allow businesses to set up automated recurring payments, making it easier to manage long-term agreements without the need for constant reminders.

3. Credit Card Payments

- Encouraging clients to pay via credit cards offers another simple way to receive payment quickly. With the rise of digital wallets, many businesses now accept payments through mobile apps like Apple Pay or Google Pay.

- Credit card payments are often immediate, reducing delays associated with bank transfers and checks. Additionally, clients who prefer to use credit cards may appreciate the added convenience of making payments through this method.

- While businesses must be aware of transaction fees, the benefits of instant payment may outweigh the costs, especially for businesses looking to reduce outstanding balances quickly.

4. Automated Reminders via Email or SMS

- Using automated reminder systems can help you stay on top of outstanding payments without needing to manually send messages. Email or SMS reminders can be scheduled to notify clients of overdue balances.

- These reminders can include direct links to payment platforms, making it easier for clients to pay on the spot and reducing friction in the payment process.

- Automated systems can be set to escalate the frequency or tone of reminders depending on how long the payment is overdue, ensuring that clients are consistently reminded without having to involve staff resources.

5. Offering Discounts for Early Payments

- Providing incentives for early payment can motivate clients to pay before the due date. Discounts or special offers for early settlement help to reduce overdue payments and improve cash flow.

- Clearly communicating the terms of the discount – such as a percentage off the total balance for payments made within a certain timeframe – encourages clients to take action sooner rather than later.

By diversifying payment methods and incorporating modern techn