How to Create an Effective Invoice Claim Template

Dealing with unpaid invoices is an inevitable part of running a business. When payments are delayed or not received at all, it’s essential to address the issue quickly and professionally. One of the most effective ways to communicate with clients in such situations is through a well-structured written notice. This letter serves as a formal request for payment, outlining the details of the outstanding balance and setting expectations for resolution.

Creating a clear and concise letter is crucial for maintaining positive business relationships while ensuring that your financial interests are protected. A professional approach not only helps in resolving the matter but also improves your chances of receiving the payment in a timely manner. Knowing how to draft such letters is an essential skill for business owners, freelancers, and anyone involved in invoicing and collections.

In this guide, we will explore the essential components of a well-crafted letter, tips for customization, and strategies for effective communication with clients who have overdue balances. With the right approach, you can simplify the process and increase the likelihood of a swift resolution.

Invoice Claim Template Overview

When a business encounters delayed or missing payments, it is essential to have a formal method for addressing these issues. A well-crafted written request is an important tool for communicating with clients and ensuring that outstanding amounts are paid. This type of document provides a structured approach to handling payment disputes, offering a professional way to remind clients of their financial obligations.

The purpose of such a communication is not just to request payment but also to maintain a positive relationship with the client. By outlining clear details about the payment owed, including any agreed-upon terms, it ensures that both parties understand the situation. A carefully written letter can encourage prompt action and help avoid misunderstandings or further delays.

In this section, we will explore the key components of an effective payment request, including essential information that should be included and how to structure the message. Whether you are a small business owner or a freelancer, understanding how to draft these documents will help you manage financial matters efficiently.

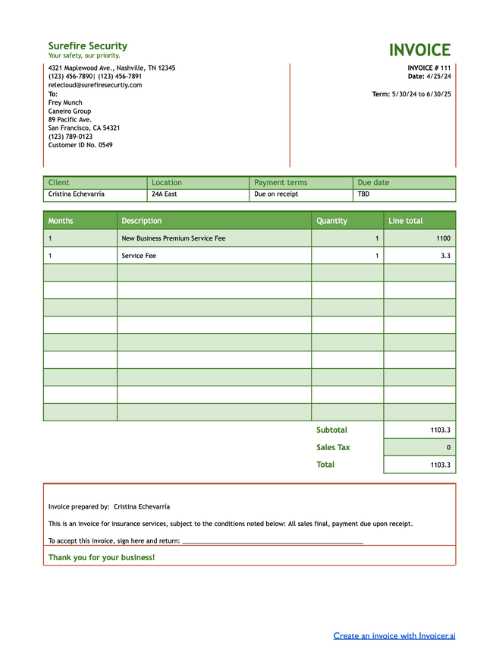

What is an Invoice Claim?

A payment request document is used when a business needs to formally remind a client of an outstanding balance. It serves as an official reminder that a specific amount remains unpaid, and it often includes important details such as the total amount due, due date, and a request for prompt resolution. This type of written communication is designed to encourage the recipient to take action and settle the debt in a timely manner.

Such documents are commonly used when payment terms have been violated, or when an expected payment has not been made. By clearly outlining the debt and the necessary next steps, this communication helps businesses protect their cash flow while maintaining professionalism in their dealings with clients.

| Component | Description |

|---|---|

| Amount Due | The total sum of money that has not been paid |

| Due Date | The agreed-upon date by which payment should have been made |

| Details of Services or Goods | A breakdown of what the payment covers, such as services rendered or products delivered |

| Action Requested | A formal request for payment, including instructions on how the debt should be settled |

By providing a clear overview of the outstanding balance and emphasizing the need for resolution, this document helps businesses resolve payment disputes and ensure that financial obligations are met.

Why Use an Invoice Claim Template?

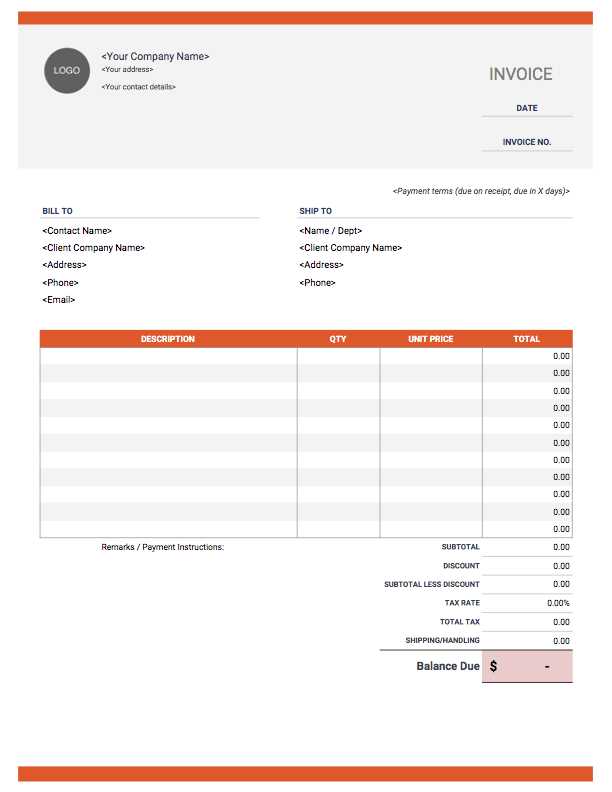

Having a standardized document for addressing overdue payments is essential for any business. It provides a structured approach to requesting funds while ensuring consistency in communication. By using a pre-designed format, businesses can avoid making common errors and maintain a professional tone in all interactions. A well-organized letter helps clarify the payment details, reduces confusion, and facilitates a quicker resolution to financial disputes.

Consistency and Professionalism

One of the main advantages of using a ready-made format is the ability to present a consistent and professional message every time. This ensures that each customer receives the same clear information, regardless of the specific situation, and shows that the business takes its financial matters seriously. It also ensures that important details are not overlooked, such as payment deadlines and necessary actions.

Time and Efficiency Savings

Using a prepared document saves significant time. Rather than starting from scratch each time a payment issue arises, you can simply fill in the relevant details and send it quickly. This efficiency allows businesses to focus on their core activities rather than spending time drafting letters, while still ensuring that all the essential components are included.

| Benefit | Description |

|---|---|

| Consistency | Ensures that every client receives the same clear and professional message |

| Time Savings | Reduces the time spent on drafting payment reminders by using a pre-designed format |

| Accuracy | Minimizes the risk of missing important information, such as due dates or amounts owed |

| Professional Appearance | Conveys seriousness and professionalism in communication, helping maintain positive client relationships |

Incorporating a standardized document into your business practices is a smart way to streamline the payment recovery process while ensuring clarity, consistency, and professionalism at all times.

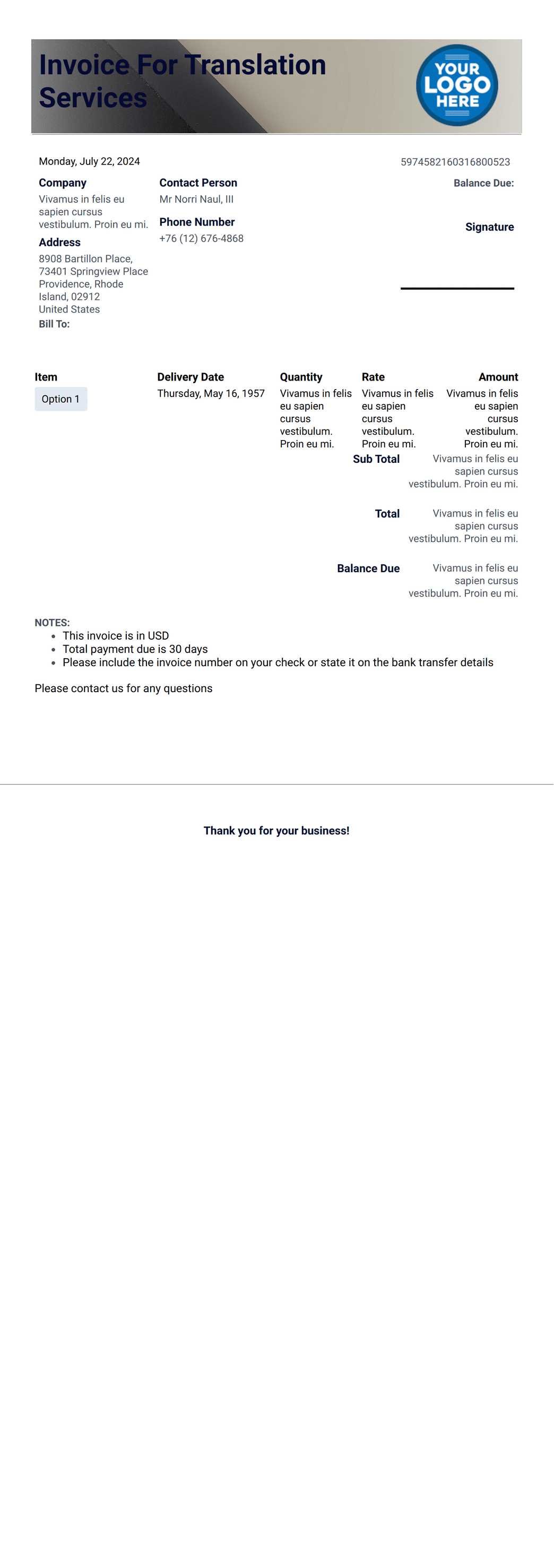

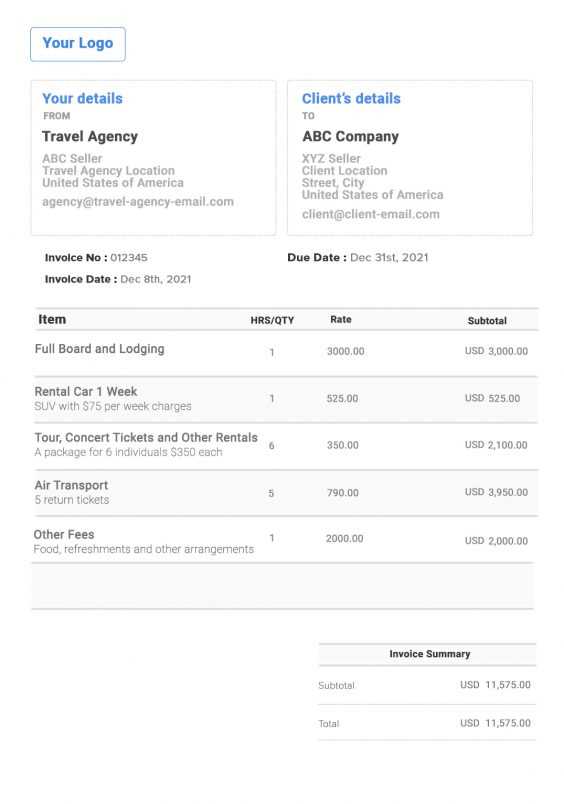

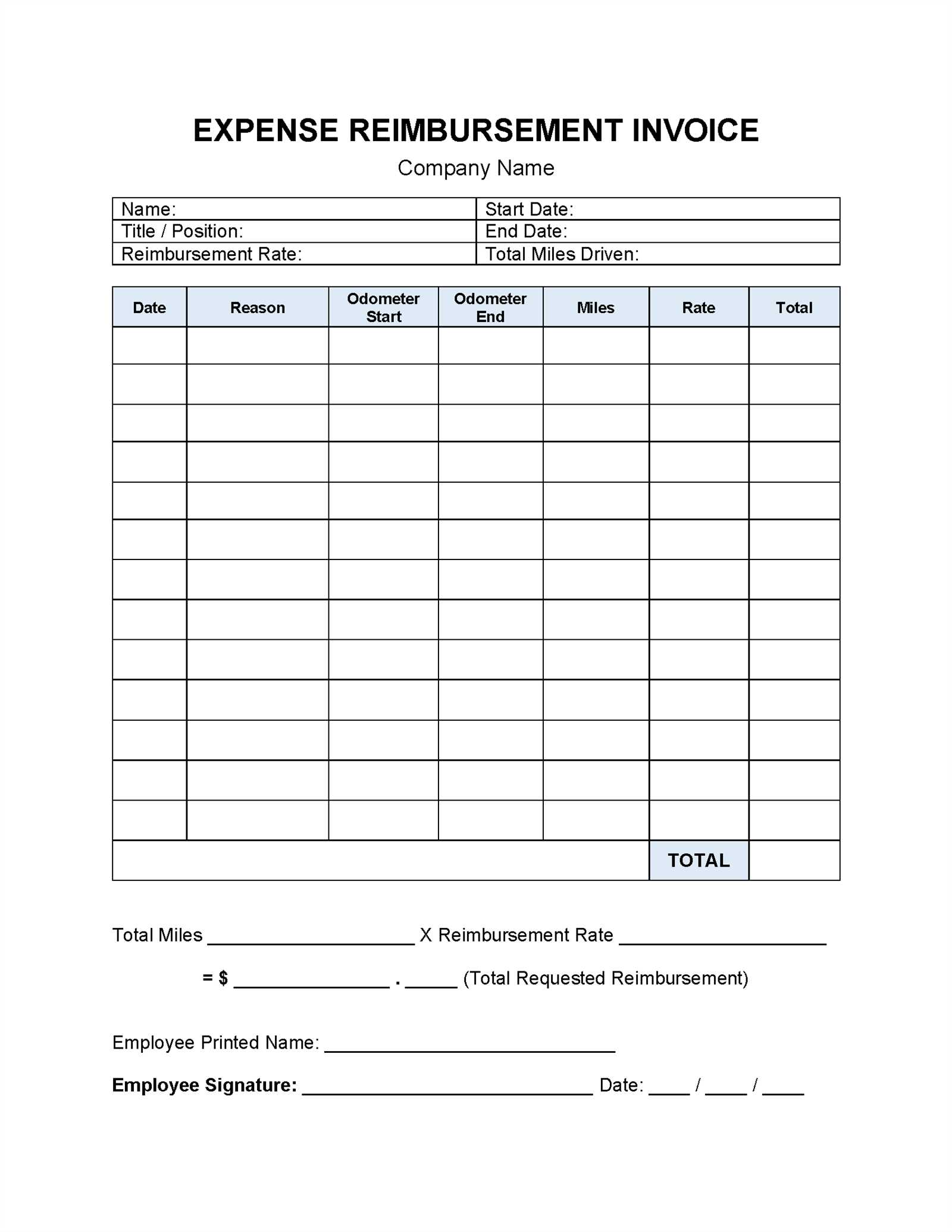

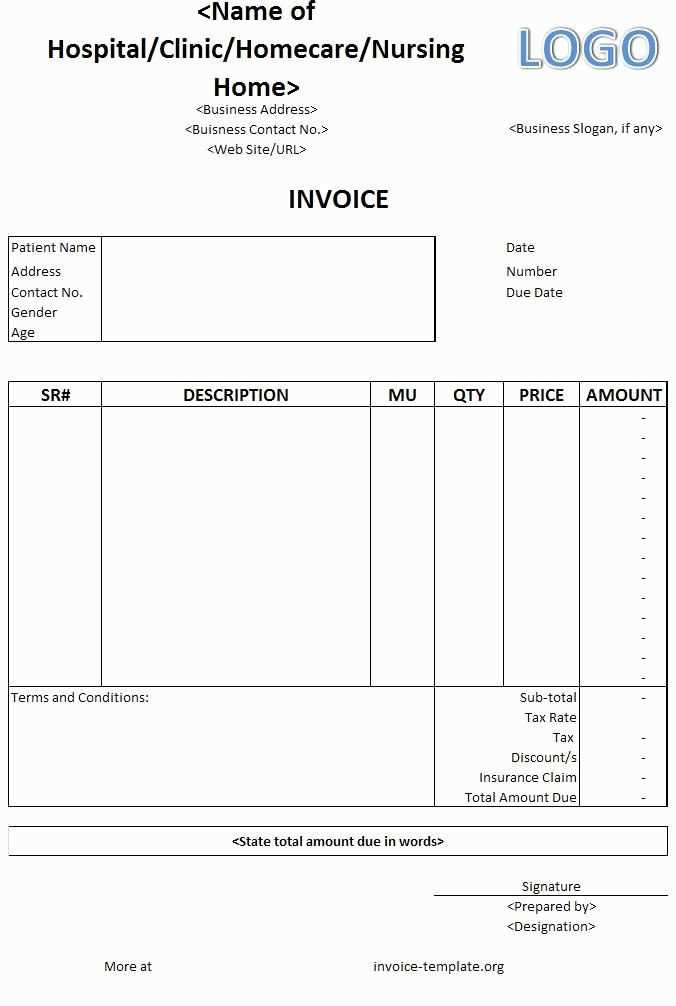

Key Elements of an Invoice Claim

When requesting payment for an outstanding balance, it is important to include specific details that ensure the recipient understands the situation clearly and can take prompt action. A well-structured payment reminder should cover all necessary information, such as the amount due, the reason for the debt, and any terms related to the payment. Each element of the document plays a crucial role in facilitating a smooth resolution of the issue.

The following are the essential components that should be included in every payment reminder:

| Element | Description |

|---|---|

| Payment Amount | The total sum that is owed, including any overdue fees or charges if applicable |

| Due Date | The original date by which the payment was expected to be received |

| Details of Goods or Services | A breakdown of what was provided or delivered, including dates and quantities if necessary |

| Contact Information | The recipient’s contact details, allowing the client to reach out for clarification or to resolve the issue |

| Action Requested | A clear instruction on what steps need to be taken, such as making payment or contacting the business |

| Payment Instructions | Details on how the payment should be made, including accepted methods and any required account information |

Including these key elements ensures that the recipient has all the necessary information to address the overdue balance efficiently. A clear, well-structured communication will help prevent confusion and promote timely resolution of the outstanding payment.

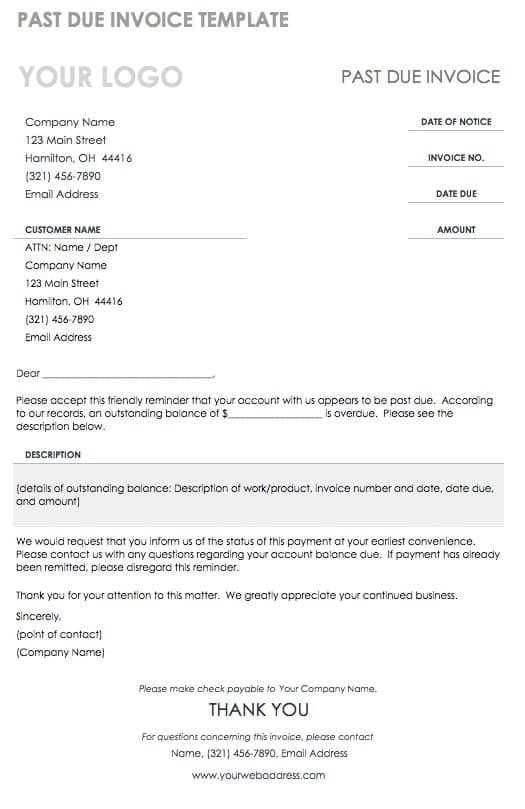

How to Start Your Claim Letter

When beginning a formal letter to request payment, it is important to approach the matter with professionalism and clarity. The first impression sets the tone for the rest of the communication, and starting your letter correctly helps ensure a positive and efficient outcome. You want to provide the recipient with all the necessary information upfront, while maintaining a respectful and courteous tone.

Here are some steps to follow when drafting the opening of your letter:

- Begin with a polite salutation: Address the recipient by name, using a formal greeting such as “Dear [Client’s Name],” or “To Whom It May Concern” if you are unsure of the specific contact.

- State the purpose of your letter immediately: Be clear from the outset that this communication is about an overdue payment, but do so without being confrontational. For example, “I am writing to follow up on an outstanding balance for services rendered.”

- Provide relevant details: Include the date the service was completed or the product was delivered and any previously agreed-upon terms. This provides context and reminds the recipient of their obligations.

Here’s an example of how to start:

- “Dear [Client’s Name],”

- “I hope this message finds you well. I am writing to remind you of an outstanding payment of [amount] that was due on [date].”

- “As per our agreement, the payment was to be made by [due date], but it appears that it has not been processed yet.”

Starting your letter with clear, polite, and direct language will set the foundation for a smooth and professional exchange. Once you’ve established the purpose and context, you can move on to providing further details and outlining the requested action.

Common Mistakes in Invoice Claims

When requesting payment for overdue balances, even small errors in your communication can lead to confusion, delays, or even the loss of a potential payment. It’s crucial to ensure that your message is clear, concise, and professional. Common mistakes can undermine the effectiveness of your request and negatively impact your business relationships. Identifying and avoiding these pitfalls will improve your chances of resolving payment issues efficiently.

The following table highlights some of the most frequent mistakes businesses make when drafting payment reminders:

| Mistake | Explanation |

|---|---|

| Vague Language | Being unclear about the amount due, the services provided, or the timeline can lead to confusion and delay in payment. |

| Not Including Payment Details | Failing to provide clear instructions on how to make the payment, such as account numbers or accepted methods, can prevent timely resolution. |

| Too Harsh a Tone | Using aggressive or overly demanding language can alienate the client and damage the business relationship. |

| Missing Deadlines | Not specifying the due date or failing to mention that the payment is overdue can cause confusion about when payment is expected. |

| Lack of Supporting Documentation | Not attaching or referencing relevant documents, such as contracts or original agreements, can make it harder for the recipient to verify the claim. |

Avoiding these mistakes will help ensure that your request is clear and professional, improving the chances of a prompt resolution to any outstanding payments. Keep your communication straightforward, provide all the necessary details, and always maintain a polite, respectful tone to foster positive outcomes.

How to Address Payment Disputes

Handling payment disputes in a timely and professional manner is essential for maintaining healthy business relationships and protecting your cash flow. When a client raises an issue about a pending payment, it’s crucial to address the situation calmly, gather all necessary facts, and communicate clearly. A well-structured approach can help resolve the disagreement quickly and prevent further complications.

Step 1: Review the Terms and Details

Before reaching out to the client, ensure that you thoroughly understand the terms of the original agreement. Review the services or products delivered, payment schedules, and any prior communication regarding payment deadlines. This will allow you to present the facts in an objective manner and avoid misunderstandings.

Step 2: Communicate Clearly and Professionally

Once you have reviewed the details, reach out to the client with a clear and concise message. Explain the situation calmly, reiterating the agreed terms and highlighting any discrepancies. Avoid using an accusatory tone and instead focus on finding a mutually beneficial solution. Providing all relevant documents, such as contracts, invoices, or correspondence, can help clarify the situation and provide proof of your position.

Example of how to address the situation:

- “Dear [Client’s Name],”

- “I hope you are doing well. I wanted to follow up on the outstanding balance of [amount] that was due on [date]. According to our agreement, the payment was to be made by [due date]. I understand that there may be some confusion regarding this.”

- “Please let me know if there are any issues or concerns that we can address to resolve this matter. I’ve attached the relevant documents for your reference.”

By approaching the situation with understanding and offering solutions, you increase the likelihood of a swift and amicable resolution.

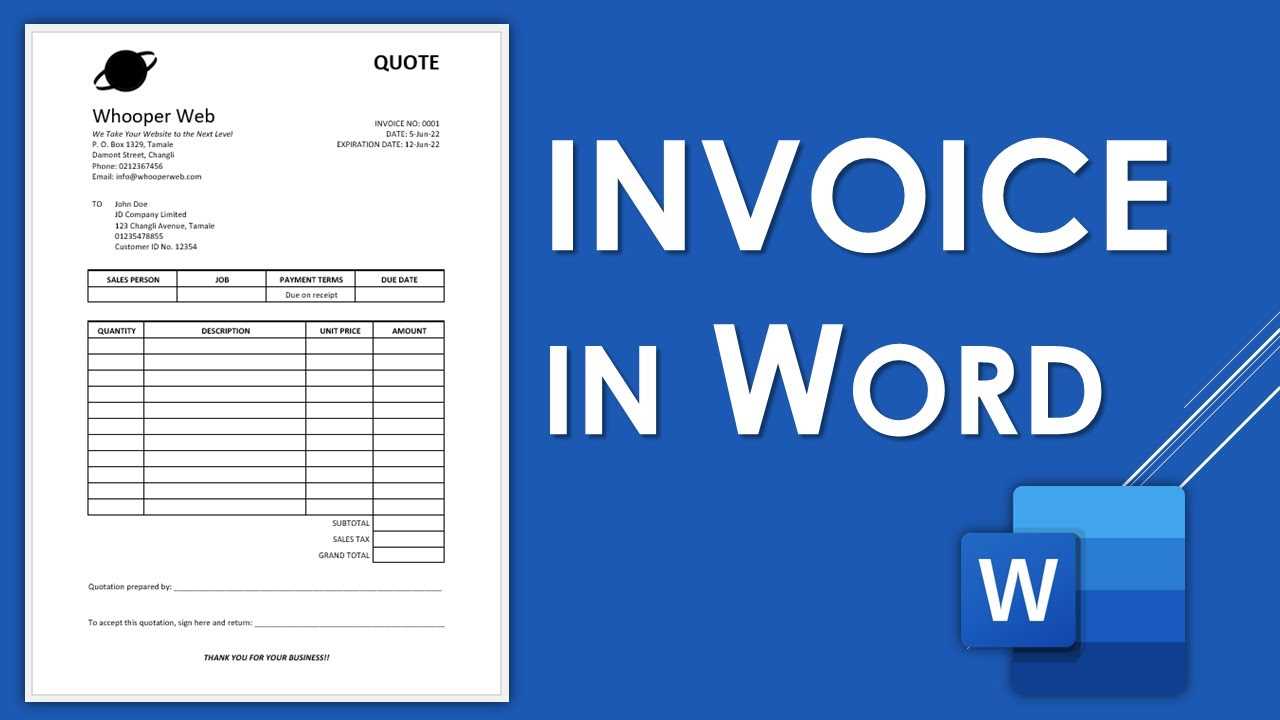

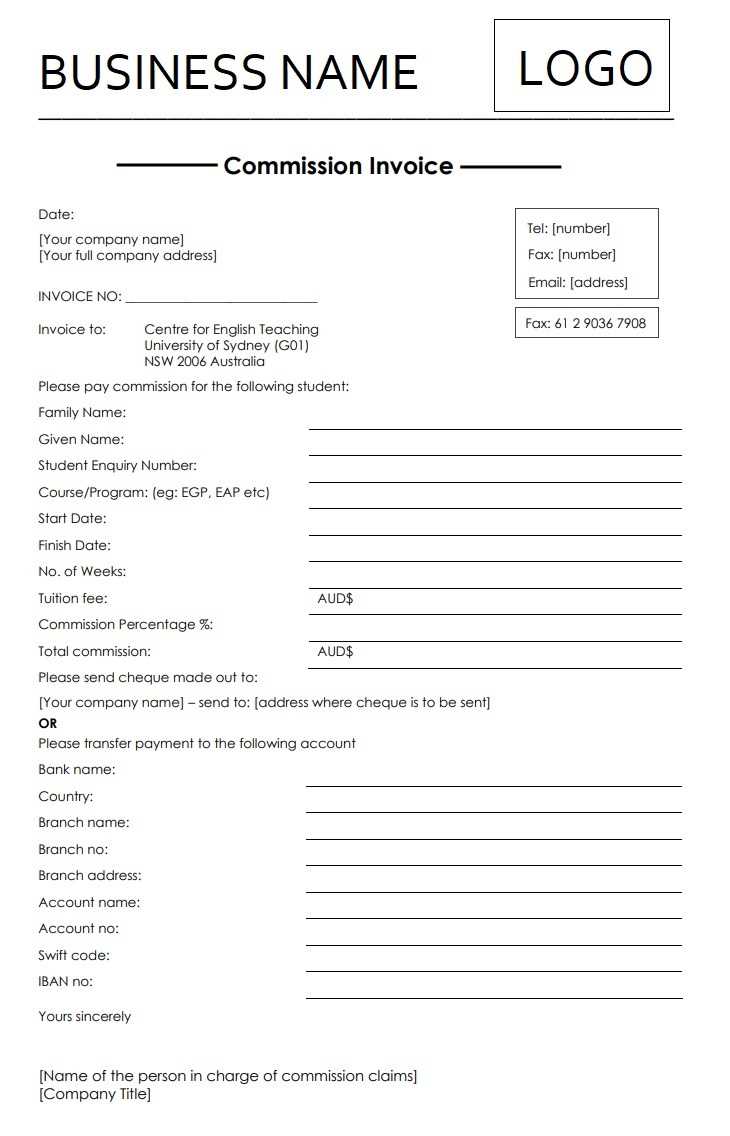

Steps for Creating a Claim Template

Creating a structured document for requesting overdue payments is a key step in ensuring efficient financial management. Having a ready-to-use format can streamline the process and save time when addressing payment issues. A well-crafted request helps maintain professionalism while ensuring that all necessary information is included. Below are the essential steps for designing an effective payment request document.

Follow these steps to create a clear and professional letter:

| Step | Description |

|---|---|

| 1. Include Header Information | Start by including your business name, contact details, and the recipient’s information. This makes it easy for the recipient to identify the sender and respond promptly. |

| 2. Address the Recipient Properly | Use a polite and formal greeting, addressing the recipient by their full name or company name. This sets a professional tone right from the beginning. |

| 3. State the Purpose Clearly | In the opening lines, state the reason for your letter. Specify the outstanding balance and any relevant details to avoid confusion. |

| 4. Provide a Detailed Breakdown | List the services or products provided, the original payment terms, and the amount due. This clarity helps the recipient understand the situation without ambiguity. |

| 5. Set a Clear Deadline | Provide a clear deadline for when the payment should be made. Mention any late fees or consequences of not meeting the deadline if applicable. |

| 6. Include Payment Instructions | Clearly state how the payment should be made, including payment methods and any necessary account details or links for online payments. |

| 7. Close Politely | End your letter with a courteous closing, expressing your hope for swift resolution and offering to discuss any concerns. This helps maintain a positive relationship. |

By following these steps, you can create a standardized, effective document that addresses payment issues professionally and efficiently. This structured approach increases the likelihood of a timely resolution and reinforces positive communication with clients.

Tips for Writing Clear Invoice Claims

When requesting overdue payments, clarity and professionalism are key. A well-written communication helps to avoid misunderstandings and ensures that the recipient fully understands the situation. By presenting the details clearly and concisely, you increase the chances of a quick resolution. Here are some tips to ensure your payment request is clear and effective:

- Be Direct and Specific: State the reason for the letter and the amount owed right from the beginning. Avoid unnecessary details or vague language that might confuse the recipient.

- Provide Complete Information: Include all relevant facts, such as the payment due date, terms of the agreement, and the services or products provided. Ensure that the recipient can quickly verify the details of the transaction.

- Use Simple and Professional Language: Keep the tone polite but firm. Avoid overly complex language or jargon. The goal is to communicate the necessary information in an easily understandable way.

- Clearly State the Next Steps: Outline what you expect from the recipient, whether it’s payment by a specific date or further communication to resolve the issue. Clearly state any late fees or actions that may be taken if payment is not received.

- Double-Check for Accuracy: Before sending the letter, ensure all details are correct, including amounts, dates, and payment instructions. Mistakes can lead to confusion or delays in payment.

- Keep It Concise: Avoid including unnecessary information that may distract from the main issue. A concise letter is more likely to be read carefully and acted upon promptly.

- Provide Contact Information: Make it easy for the recipient to get in touch with you for any clarification. Include your phone number, email address, or any other method of contact.

By following these tips, you can ensure your payment requests are clear, professional, and effective in resolving any outstanding balances quickly and efficiently.

When to Send an Invoice Claim

Timing is crucial when addressing overdue payments. Sending a reminder too early or too late can result in confusion or lost opportunities. Knowing the right moment to send a formal payment request ensures that you maintain professionalism while also encouraging timely action. It’s important to consider factors like agreed-upon payment terms, the relationship with the client, and your business’s cash flow needs when deciding when to send a request.

1. Review Payment Terms

The first step in determining when to send a payment request is to review the terms outlined in your original agreement. If the payment is due on a specific date, sending a reminder too soon may seem premature, while waiting too long could lead to unnecessary delays. A good rule of thumb is to send a reminder once the due date has passed, giving the client a reasonable amount of time to fulfill their obligations.

2. Consider Grace Periods and Client Relations

Some businesses offer a grace period after the due date to accommodate clients who may be facing temporary financial difficulties. If you have a long-term relationship with the client or if the payment is only slightly overdue, it may be beneficial to wait a few extra days before sending a formal letter. However, it’s essential to balance understanding with the need for cash flow management.

| Timing | Action |

|---|---|

| Before Due Date | Do not send a reminder, as this may come across as unnecessary or presumptive. |

| 1-3 Days After Due Date | Send a polite, non-confrontational reminder. This gives the client a short window to address any issues before escalating. |

| 1 Week After Due Date | If no action is taken, send a more formal reminder with clear instructions on how to resolve the situation. |

| 2 Weeks After Due Date | By this time, you may need to send a stronger message. Reiterate the overdue amount and any penalties or interest that may apply. |

| 1 Month or More After Due Date | If payment has not been made, consider escalating the issue further or seeking legal assistance, depending on your policy. |

By understanding the best time to send a formal payment reminder and following these steps, you can encourage prompt payment while maintaining a positive business relationship.

Importance of Professional Tone

Maintaining a professional tone in any form of business communication is essential, especially when addressing payment matters. A respectful and clear approach not only ensures that the recipient understands the issue but also helps preserve the business relationship. Using polite language, staying calm, and expressing your concerns without aggression are key to ensuring that the situation is handled efficiently and amicably.

When requesting payment for overdue balances or addressing any financial issue, your tone can significantly influence the outcome. A professional tone shows that you are serious about resolving the matter while also being understanding of the other party’s circumstances. This helps to prevent misunderstandings and encourages the recipient to act promptly.

Why a Professional Tone Matters:

- Prevents Conflict: A polite and neutral tone reduces the risk of confrontation and negative reactions from the recipient, who may feel offended or antagonized by aggressive language.

- Encourages Timely Action: When the message is delivered in a courteous and respectful manner, the recipient is more likely to take the necessary steps to address the overdue payment.

- Maintains Business Relationships: Even when a payment issue arises, maintaining professionalism ensures that the relationship with your client remains intact for future business opportunities.

- Enhances Credibility: A well-crafted, polite message enhances your company’s reputation as one that handles all matters with professionalism and respect.

Ultimately, using a professional tone ensures that your request is taken seriously while fostering an environment of mutual respect and understanding. By taking the time to communicate effectively and thoughtfully, you increase the likelihood of a positive resolution, even in challenging situations.

Customizing Your Invoice Claim Template

Adapting your payment request letter to suit different situations or clients can significantly enhance its effectiveness. A one-size-fits-all approach might not always convey the necessary level of detail or formality, and customizing the document can make it more personal and relevant. By tailoring the structure, language, and tone of the communication, you can address specific issues more effectively and improve your chances of receiving prompt payment.

When customizing a payment request letter, consider the following aspects:

- Client Information: Include the recipient’s name, company details, and any reference numbers relevant to the transaction. Personalized information helps clarify the communication and makes it easier for the recipient to identify the issue.

- Payment Terms: Adjust the wording to reflect the specific terms of your agreement with the client. For example, if there was a special discount, extended payment period, or agreed-upon interest for overdue payments, be sure to highlight these points.

- Level of Formality: Depending on the nature of your relationship with the client, you may want to adjust the tone. For a long-term client, a friendly, yet firm reminder may be appropriate, while a new or less familiar client may require a more formal, direct approach.

- Supporting Documents: Depending on the situation, you may want to attach or reference specific documents, such as contracts, receipts, or previous correspondence, to support your request and clarify the situation.

- Payment Methods: Include the relevant payment details or methods that apply to that specific client. Some clients may prefer bank transfers, while others may be more comfortable with online payments or credit cards.

Customizing your payment request letters ensures that your communication is clear, professional, and specific to each client. By tailoring the details, you not only increase the chances of a swift resolution but also reinforce positive relationships with your clients.

How to Follow Up on Claims

Following up on a payment request is an essential part of ensuring that outstanding balances are settled in a timely manner. After sending your initial communication, it’s important to track responses and, if necessary, send a follow-up message to keep the process moving forward. A well-timed and polite follow-up can help maintain a professional relationship with your client while reinforcing the urgency of the situation.

When following up on payment requests, it’s crucial to maintain professionalism and clarity. Here are some tips for effectively following up:

- Be Timely: Wait an appropriate amount of time before following up. Typically, 3 to 5 days after the initial request is a good timeframe. If you’ve set a specific deadline for payment, consider following up a few days after that deadline passes.

- Be Polite but Firm: When sending a follow-up message, ensure that your tone remains respectful yet firm. Reiterate the key details, such as the amount due and the original payment terms, while also showing understanding of any possible delays.

- Provide Clear Instructions: Make sure the client understands what steps they need to take to resolve the issue. Include payment details, any additional actions required, and an updated deadline if necessary.

- Keep it Short and Professional: Avoid writing long, emotional messages. Stick to the facts and make your message easy to read by keeping it concise and to the point. A simple reminder with all the relevant information is often enough.

- Offer Assistance: Sometimes payments are delayed due to technical issues or misunderstandings. Offer to help the client with the payment process or answer any questions they might have regarding the outstanding balance.

Example of a follow-up message:

“Dear [Client’s Name],

Following up on our previous correspondence, I wanted to kindly remind you of the outstanding balance of [amount], which was due on [date]. If you’ve already processed the payment, please disregard this message. Otherwise, I would appreciate it if you could make arrangements for payment at your earliest convenience.

If there are any issues or concerns regarding the payment, feel free to reach out, and I’d be happy to assist you.

Thank you for your prompt attention to this matter.”

By following these steps and maintaining a respectful tone, you can increase the likelihood of resolving outstanding payments while preserving positive client relationships.

Legal Considerations for Invoice Claims

When addressing overdue payments or seeking resolution for financial disputes, it’s essential to understand the legal implications involved. Certain laws and regulations govern how businesses can collect debts, and these must be followed to avoid legal complications. Whether you’re drafting a formal payment request or pursuing further action, knowing the legal framework ensures that your actions are compliant and fair, protecting both your business interests and the rights of your clients.

Key Legal Aspects to Keep in Mind:

- Contractual Agreements: Always refer to the terms outlined in your original agreement or contract with the client. Any payment terms, deadlines, and penalties for late payments should be clearly defined to avoid confusion or disputes down the line. If your contract specifies a grace period or late fees, these clauses must be adhered to when requesting payment.

- Fair Debt Collection Practices: It’s important to follow legal guidelines for debt collection in your jurisdiction. Many countries have laws that protect consumers from harassment or unfair practices. These laws govern how and when you can contact clients about overdue balances and set limits on the language and frequency of reminders.

- Documenting Communication: Keeping a record of all communications regarding overdue payments is crucial. This can be valuable if you need to escalate the matter or involve legal authorities. Keep copies of letters, emails, and any other written communication in case further legal action is required.

- Interest and Late Fees: If your agreement includes provisions for charging interest or late fees, make sure that these are in line with local laws. Some regions have caps on how much interest can be charged, and these limits must be respected to avoid legal issues.

- Dispute Resolution: Consider including a dispute resolution clause in your contracts, specifying how disputes will be resolved–whether through mediation, arbitration, or legal proceedings. This provides a clear path for addressing payment issues without resorting to unnecessary litigation.

- Legal Action: If the issue persists and the payment remains unpaid, you may need to consider taking legal action. However, this should only be a last resort. Before pursuing litigation, it’s important to consult with a legal professional to understand your options and the potential costs involved.

By being aware of these legal considerations, you can approach payment issues with a well-informed strategy. This helps ensure that your actions are within the law, protects your business rights, and allows you to handle disputes efficiently and fairly.

How to Handle Non-Responsive Clients

Dealing with clients who do not respond to payment requests or communications can be frustrating, especially when there is an outstanding balance that needs to be addressed. However, maintaining professionalism throughout the process is crucial to avoid escalating tensions and damaging business relationships. A strategic, calm approach can help encourage the client to take action and resolve the matter without unnecessary conflict.

Here are some steps to take when handling clients who are not responding to payment reminders:

- Send a Friendly Reminder: If the client has not responded to the first request, send a gentle follow-up. Be polite, reminding them of the due payment, and provide clear instructions for how they can resolve the issue. Sometimes, clients simply forget or overlook the matter, and a friendly reminder can prompt action.

- Reiterate the Agreement: Politely reference the terms of the original agreement or contract to reinforce the understanding of the payment terms. This can serve as a reminder of the mutual obligations both parties agreed upon, helping clarify expectations.

- Offer Flexibility: If possible, offer a reasonable extension or alternative payment plan. Sometimes, clients may be facing cash flow issues, and a little flexibility can go a long way in maintaining the relationship while also ensuring you get paid.

- Use Multiple Communication Channels: If emails or phone calls are not getting responses, try reaching out via other methods, such as text messages or social media. Sometimes clients are more responsive to certain communication channels, and diversifying your approach may lead to better results.

- Set a Deadline: After sending a reminder, be clear about the timeline for resolution. Set a specific date by which the payment should be received, and make it known that failure to meet this deadline will result in further actions. Be firm but still professional in your tone.

If these approaches do not lead to a response or payment, consider more formal steps, such as involving a collections agency or seeking legal advice. Below is an example of a communication strategy:

| Action | Timeline | Purpose |

|---|---|---|

| Initial Friendly Reminder | 0-3 days after due date | To gently remind the client of the overdue payment. |

| Second Reminder | 5-7 days after due date | To reiterate the terms and request prompt payment. |

| Final Notice | 10-14 days after due date | To set a clear deadline for payment and inform the client of further actions. |

| Escalation to Legal or Collections | After 14-30 days | To involve legal or professional debt recovery services if payment is still not received. |

By following these steps, you can handle non-responsive clients with professionalism and persistence. Taking timely action increases the chances of a positive outcome while maintaining your business’s reputation and relationships.

Improving Cash Flow with Claims

Maintaining healthy cash flow is crucial for the sustainability of any business, and addressing overdue payments is one of the most effective ways to improve it. When clients delay payments, it can severely impact your financial stability, making it difficult to meet operational costs and reinvest in growth. Taking proactive measures to address these outstanding balances not only ensures you receive the payments you’re owed but also helps strengthen your financial position for the future.

Effective communication and a structured approach to addressing overdue balances can accelerate payments and improve cash flow. By promptly following up on unpaid amounts, offering clear terms, and taking the necessary steps to ensure collection, businesses can prevent cash flow gaps that can otherwise lead to unnecessary debt or financial strain.

Here are a few strategies to improve cash flow through proactive follow-ups and payment requests:

- Prompt Follow-Up: The earlier you address overdue balances, the better. A timely reminder or request ensures that clients are aware of their outstanding payments and have a clear deadline for settling them.

- Clear Payment Terms: Make sure that payment terms are clearly outlined from the beginning. If clients understand the payment schedule, late fees, or penalties for delays,

Examples of Effective Invoice Claims

Sending a well-crafted payment request is an essential part of maintaining a positive business relationship while ensuring that overdue balances are addressed efficiently. An effective request should be clear, professional, and respectful while including all the necessary details to prompt prompt payment. Below are some examples of how to structure your payment requests, ensuring they are clear and actionable for your clients.

Example 1: Polite Reminder

Subject: Friendly Payment Reminder – [Amount Due]

Dear [Client’s Name],

We hope this message finds you well. We wanted to kindly remind you that the payment for [product/service] in the amount of [amount] was due on [due date]. We understand that oversights happen, and we would appreciate it if you could process the payment at your earliest convenience.

If you have already made the payment, please disregard this message. If not, we kindly request that the payment be made by [new deadline], as per the terms of our agreement. You can make the payment using the following details: [payment details].

Thank you for your attention to this matter, and please feel free to reach out if you have any questions or need assistance with the payment process.

Best regards,

[Your Name]

[Your Business Name]

Example 2: Firm Follow-Up

Subject: Urgent: Outstanding Balance – [Amount Due]

Dear [Client’s Name],

This is a follow-up regarding the outstanding balance of [amount], which was due on [due date]. As of today, we have not yet received payment, and we would appreciate it if this matter could be resolved promptly.

To avoid any disruptions or late fees, we kindly ask that you make the payment by [new deadline]. Please see below for the payment instructions: [payment details]. If there are any issues or concerns preventing payment, please contact us immediately so we can work together to resolve the matter.

If payment is not received by [new deadline], we may need to pursue further action. We trust that we can resolve this matter quickly and amicably.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

[Your Business Name]

Both examples offer a clear structure and tone–one is a gentle reminder, while the other is more firm. Tailoring the message depending on the situation can help maintain professionalism while ensuring that the necessary steps are taken to resolve outstanding payments.

Automating the Invoice Claim Process

Managing overdue payments and payment requests manually can be time-consuming and prone to errors, especially for businesses handling multiple clients. Automating the payment follow-up process can save time, reduce human error, and help ensure that no outstanding balances are overlooked. By leveraging modern tools and software, businesses can streamline communication, track overdue payments, and even automatically send reminders, making the entire process more efficient and less stressful.

Automating this process not only improves efficiency but also helps maintain consistent communication with clients. Automation ensures that reminders are sent out at the right intervals, reducing the risk of delays and increasing the likelihood of timely payments. Here are some ways to automate the payment request process:

- Automated Reminders: Set up automatic reminders to be sent at specific intervals–such as 7, 14, and 30 days after a payment is due. These reminders can be customized to include relevant payment details and polite requests for settlement, ensuring that clients are always informed.

- Payment Tracking Software: Use software that allows you to track payment statuses in real time. This way, you can quickly identify overdue accounts and prioritize follow-up actions accordingly.

- Online Payment Portals: Integrate payment portals into your system, allowing clients to make payments quickly and easily online. Automated invoicing platforms often include built-in payment links, which can reduce delays and offer convenience for both parties.

- Auto-Generated Documents: Use tools that generate and send personalized payment requests automatically based on the due dates and the client’s specific information. This helps maintain consistency in messaging and ensures that every client receives a professional, accurate request.

- Scheduled Reports: Set up automated reports to monitor outstanding payments. These reports can be generated daily, weekly, or monthly, providing you with a snapshot of your accounts receivable, allowing you to stay on top of overdue balances.

By automating key aspects of the payment request process, you not only improve the speed of your follow-ups but also enhance the overall client experience. Clients appreciate timely and professional reminders, which can help build trust and ensure that payments are processed smoothly. Ultimately, automation frees up valuable time for your team to focus on other important tasks, while still maintaining control over the financial health of your business.