Ultimate Guide to Invoice Builder Templates

In today’s fast-paced business environment, efficient financial management is crucial for success. Streamlining the process of generating bills not only saves time but also enhances professionalism in your operations. A well-designed invoicing system can simplify transactions, improve cash flow, and foster better relationships with clients.

By utilizing advanced solutions for generating financial documents, businesses can customize layouts to fit their unique branding and service offerings. This adaptability allows for a more tailored approach, ensuring that each bill accurately reflects the company’s identity while providing essential information to customers.

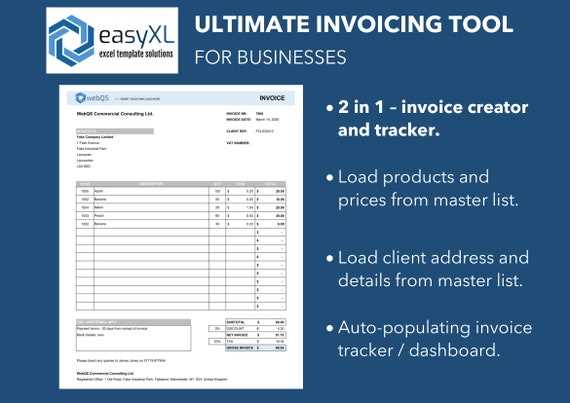

Furthermore, integrating technology into the billing process can lead to significant improvements in accuracy and organization. Automation tools can help manage client data efficiently, track payments, and minimize errors, making the overall experience seamless for both service providers and clients. Embracing these innovative practices can elevate your financial processes and contribute to sustained growth.

Understanding Invoice Builder Templates

In the realm of financial documentation, the ability to create well-structured billing statements is essential for any business. The tools designed for generating these documents offer various features that streamline the process, allowing users to produce professional-looking records efficiently. By simplifying the task of creating these essential materials, businesses can focus more on their core operations while ensuring that their financial transactions are accurately recorded.

Features of Document Creation Tools

Advanced solutions for crafting billing statements typically come with a range of functionalities. Users can customize layouts, add logos, and incorporate specific details relevant to each transaction. This level of personalization not only enhances the visual appeal but also helps maintain brand consistency across all financial communications.

Benefits of Using These Solutions

Employing efficient methods for generating financial documents can significantly improve overall business performance. Automating the process reduces the likelihood of human error, ensuring accuracy in every transaction. Moreover, these tools often include tracking features, allowing businesses to monitor outstanding payments and manage client relationships effectively. By utilizing such innovative solutions, companies can elevate their financial management practices and foster trust with their clientele.

Benefits of Using Invoice Templates

Utilizing structured formats for generating financial documents provides numerous advantages that can enhance the efficiency and effectiveness of business operations. These convenient tools simplify the billing process, allowing organizations to maintain professionalism while reducing the time spent on administrative tasks.

Here are some key benefits of employing such solutions:

- Time-Saving: Streamlined processes significantly cut down the time required to create billing statements, enabling staff to focus on more critical tasks.

- Consistency: Pre-designed layouts ensure uniformity across all financial documents, reinforcing brand identity and enhancing client trust.

- Accuracy: Reducing manual entry minimizes the risk of errors, leading to more reliable and precise financial records.

- Customization: Many tools allow for personalization, enabling businesses to include specific details such as logos, colors, and service descriptions.

- Tracking: Built-in features can help monitor outstanding payments and manage customer accounts effectively.

By leveraging these advantages, organizations can improve their financial management processes and foster positive relationships with clients through clear and professional communications.

Key Features of Invoice Builders

Effective solutions for creating financial documentation come equipped with various features that enhance user experience and streamline processes. These functionalities are designed to simplify the creation and management of billing statements, making it easier for businesses to maintain accuracy and professionalism.

Customization Options

One of the most significant advantages of these tools is the ability to customize documents according to specific business needs. Users can modify layouts, select color schemes, and add branding elements, such as logos and taglines. This personalization ensures that each document not only conveys important financial information but also reflects the company’s identity.

Automation and Efficiency

Automation features play a crucial role in enhancing productivity. Many solutions allow users to set recurring transactions, which can significantly reduce the time spent on repetitive tasks. Additionally, automatic calculations minimize the chances of errors, ensuring that all figures are accurate and up-to-date. This efficiency allows businesses to focus more on growth and less on administrative burdens.

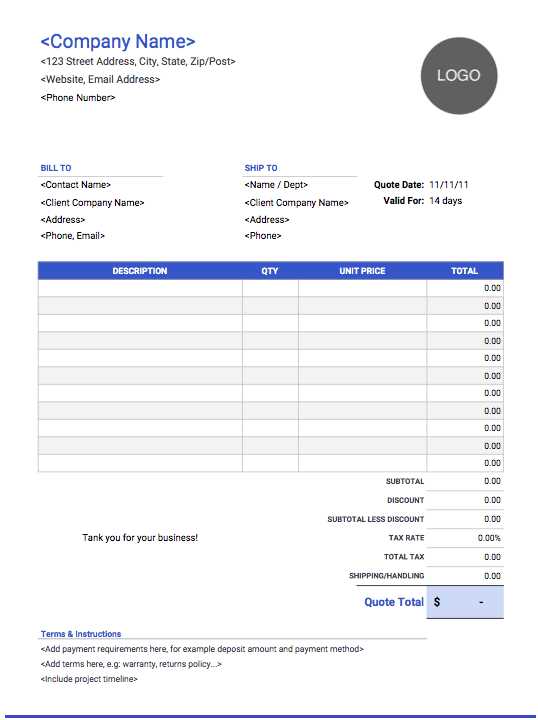

Choosing the Right Template

Selecting the appropriate design for generating financial documents is crucial for ensuring clarity and professionalism. The right format not only enhances the aesthetic appeal but also improves functionality, making it easier for clients to understand and process the information provided.

Here are some factors to consider when choosing an effective layout:

- Industry Relevance: Different industries may have specific requirements. Select a format that aligns with your field to meet client expectations.

- Customization Capabilities: Ensure that the chosen design allows for personalization. This flexibility is important for including your branding elements.

- Clarity and Readability: Opt for layouts that prioritize clear presentation of information. A straightforward structure helps avoid confusion and enhances comprehension.

- Functionality: Look for designs that incorporate necessary features such as itemized lists, tax calculations, and total amounts for ease of use.

- Mobile Compatibility: As more clients use mobile devices, select a format that displays well on various screen sizes to ensure accessibility.

By taking these factors into account, businesses can select a design that not only looks professional but also facilitates efficient communication with clients.

Customizing Your Invoice Design

Personalizing the appearance of financial documents is essential for creating a lasting impression on clients. A unique design not only reflects your brand identity but also enhances the professionalism of your communications. Tailoring layouts allows businesses to convey important information effectively while maintaining an engaging visual style.

Incorporating Branding Elements

One of the primary aspects of customization is the integration of branding elements. Including your logo, business colors, and fonts can help create a cohesive look that reinforces your identity. This attention to detail enhances recognition and fosters trust with your clientele.

Structuring Information Clearly

Another critical component of design customization is organizing information in a clear and logical manner. Utilize headings, bullet points, and sections to present data succinctly. This not only aids in readability but also ensures that clients can easily navigate the document and locate essential details. Additionally, consider using white space effectively to avoid clutter, making the overall appearance more appealing.

Popular Invoice Builder Tools

In today’s digital landscape, a variety of tools are available to assist businesses in creating effective billing documents. These solutions cater to different needs and preferences, offering unique features that streamline the process of generating professional statements. Selecting the right tool can significantly enhance productivity and ensure that all financial communications are clear and visually appealing.

Some of the most popular options include:

1. FreshBooks – Known for its user-friendly interface, this tool offers extensive features for invoicing, expense tracking, and reporting, making it ideal for small businesses.

2. QuickBooks – A comprehensive accounting software that includes powerful invoicing capabilities, allowing users to manage finances seamlessly.

3. Zoho Invoice – This cloud-based solution provides customizable billing formats, automation features, and integration with other Zoho products for enhanced efficiency.

4. Square Invoices – Perfect for businesses that already use Square for payments, it offers easy integration and a straightforward way to create and send professional bills.

5. Bill.com – A robust platform designed for managing accounts payable and receivable, this tool simplifies the entire billing process while ensuring timely payments.

Each of these solutions offers unique benefits, enabling businesses to find the right match for their specific requirements and enhance their financial management practices.

How to Create Invoices Easily

Generating billing documents efficiently can streamline the financial operations of any business. By following a few straightforward steps, you can create professional-looking statements that not only convey essential information but also enhance your brand image. Understanding the process and utilizing available tools can make this task quick and uncomplicated.

Here’s a simple approach to crafting effective financial documents:

| Step | Description |

|---|---|

| 1 | Choose a Suitable Tool: Select an online solution or software that fits your needs for generating billing statements. |

| 2 | Pick a Design: Decide on a layout that reflects your brand identity and is easy for clients to understand. |

| 3 | Enter Client Information: Include details such as the client’s name, contact information, and billing address for clarity. |

| 4 | List Products or Services: Clearly outline what was provided, including quantities and prices to ensure transparency. |

| 5 | Include Payment Terms: Specify due dates, acceptable payment methods, and any applicable fees for late payments. |

| 6 | Review and Send: Double-check all information for accuracy before sending it to the client to maintain professionalism. |

By following these steps, you can efficiently produce billing documents that are both clear and visually appealing, ultimately improving your financial interactions with clients.

Integrating Invoicing with Accounting Software

Seamlessly connecting billing processes with accounting software can greatly enhance a business’s financial management. This integration allows for a more streamlined workflow, reduces errors, and saves time by automating various tasks. By utilizing technology effectively, companies can ensure accurate financial tracking and reporting.

Here are some key benefits of integrating invoicing with accounting software:

- Automated Data Entry: Eliminates the need for manual input, reducing the likelihood of errors and saving time.

- Real-Time Updates: Changes made in one system reflect in the other instantly, ensuring that all financial information is up-to-date.

- Improved Cash Flow Management: Enables better tracking of receivables and payables, helping to maintain a healthy cash flow.

- Enhanced Reporting: Facilitates the generation of comprehensive financial reports that provide insights into business performance.

- Streamlined Processes: Simplifies the workflow by allowing users to create, send, and track documents from a single platform.

To achieve successful integration, consider the following steps:

- Choose compatible software solutions that can easily work together.

- Follow the setup instructions provided by both applications to ensure proper connectivity.

- Train your team on using the integrated systems to maximize efficiency and productivity.

- Regularly review and update the integration settings to maintain optimal performance.

By effectively integrating billing functions with accounting systems, businesses can enhance their overall financial operations and improve accuracy, ultimately leading to better decision-making and growth.

Common Mistakes in Invoice Creation

Creating financial documents is a crucial task for any business, but it often comes with its share of pitfalls. Errors in these documents can lead to payment delays, misunderstandings, and a negative impact on client relationships. Recognizing and avoiding common mistakes is essential for ensuring accuracy and professionalism.

Frequent Errors to Avoid

Here are some typical mistakes made during the preparation of financial documents:

- Missing Information: Failing to include essential details such as contact information, service descriptions, and due dates can create confusion.

- Incorrect Calculations: Math errors can lead to discrepancies in amounts owed, affecting cash flow and client trust.

- Inconsistent Formatting: A lack of uniformity in layout and design may appear unprofessional and disorganized.

- Delayed Sending: Waiting too long to send these documents can hinder prompt payments and disrupt financial planning.

- Neglecting Follow-Up: Failing to follow up on unpaid documents can result in lost revenue and strained client relations.

Best Practices for Accuracy

To minimize errors and enhance the quality of financial documents, consider the following best practices:

- Double-Check Details: Review all information for accuracy before sending.

- Use Software Tools: Leverage technology to automate calculations and maintain consistency.

- Set Reminders: Implement reminders for sending and following up on these documents to maintain a steady cash flow.

- Seek Feedback: Encourage team members to review documents for clarity and correctness before distribution.

Avoiding these common mistakes not only enhances the quality of financial documents but also helps build trust with clients, ultimately contributing to the success of the business.

Best Practices for Invoicing

Creating effective financial documents is essential for maintaining healthy cash flow and fostering strong client relationships. By adhering to established best practices, businesses can enhance their efficiency and ensure timely payments. These practices encompass everything from document design to communication strategies.

Key Strategies for Effective Documentation

Implementing the following strategies can significantly improve the quality of your financial documents:

- Clear Structure: Organize your documents logically, including sections for services rendered, payment terms, and contact details to ensure clarity.

- Professional Design: Utilize a clean and professional layout that reflects your brand identity and promotes trustworthiness.

- Detailed Descriptions: Provide thorough descriptions of services or products to prevent misunderstandings and disputes.

- Timely Distribution: Send documents promptly after services are rendered to facilitate faster payment cycles.

- Flexible Payment Options: Offer various payment methods to accommodate client preferences, making it easier for them to settle their accounts.

Maintaining Communication and Follow-Up

Effective communication is crucial for successful financial transactions. Consider these tips:

- Personalized Communication: Address clients by name and tailor messages to create a more engaging experience.

- Set Payment Reminders: Utilize automated reminders for upcoming due dates to encourage timely payments.

- Follow-Up on Late Payments: Reach out diplomatically to clients with overdue balances, reinforcing the importance of timely settlement.

- Request Feedback: Encourage clients to provide feedback on the documentation process, helping you refine and improve future interactions.

By implementing these best practices, businesses can streamline their financial documentation processes, resulting in improved cash flow and stronger relationships with clients.

Automating Your Invoice Process

Streamlining financial documentation is vital for businesses seeking efficiency and accuracy in their operations. By implementing automation in the documentation process, organizations can reduce manual errors, save time, and enhance overall productivity. Automation not only simplifies the creation and distribution of documents but also facilitates better tracking and management of financial transactions.

Benefits of Automation

Integrating automated solutions offers numerous advantages for managing financial documentation:

- Time Savings: Automation significantly reduces the time spent on manual tasks, allowing staff to focus on more strategic activities.

- Reduced Errors: Automated systems minimize the likelihood of human error, leading to more accurate financial records.

- Improved Tracking: Digital systems provide better tracking of documents, ensuring that nothing falls through the cracks.

- Faster Payments: With automated reminders and notifications, clients are prompted to make payments on time, improving cash flow.

Key Features of Automation Tools

When selecting automation solutions, consider the following features:

| Feature | Description |

|---|---|

| Automated Reminders | Set up reminders for clients about upcoming payments or overdue balances. |

| Template Creation | Easily create standardized documents using customizable templates for consistency. |

| Integration with Accounting Software | Seamlessly connect with accounting systems to synchronize financial data. |

| Analytics and Reporting | Generate reports to analyze cash flow and payment patterns for better decision-making. |

By adopting automation for your financial documentation process, you can enhance operational efficiency, reduce costs, and foster better relationships with clients through timely and accurate transactions.

Managing Client Information Effectively

Efficient management of client data is essential for fostering strong relationships and ensuring seamless interactions. By organizing and maintaining accurate information, businesses can provide personalized services, enhance communication, and improve overall customer satisfaction. This section explores strategies for effectively managing client details in a systematic manner.

Importance of Centralized Data

Centralizing client information allows for easy access and organization. Key benefits include:

- Streamlined Communication: With all client details in one place, team members can quickly reference important information, leading to more efficient interactions.

- Personalized Service: Having access to client preferences and history enables businesses to tailor their offerings, enhancing customer experiences.

- Accurate Record Keeping: Maintaining a single source of truth reduces the risk of discrepancies and ensures that all team members are working with the most current data.

Strategies for Effective Management

Implementing the following strategies can enhance the management of client information:

- Use of CRM Systems: Customer relationship management software can help organize and track client interactions, preferences, and transactions.

- Regular Updates: Periodically review and update client records to reflect any changes in contact information or preferences.

- Data Security: Ensure that client information is stored securely and that access is restricted to authorized personnel only.

By adopting these practices, businesses can maintain an organized system for client data, leading to improved relationships and enhanced operational efficiency.

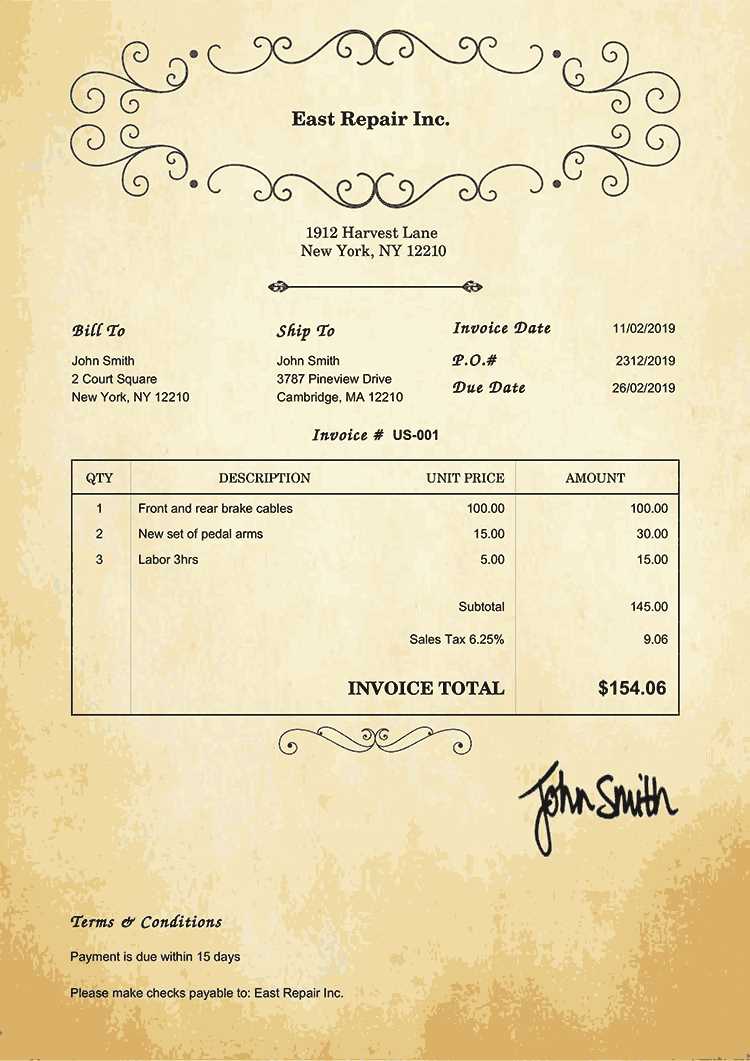

Tracking Payments with Invoice Templates

Monitoring financial transactions is crucial for maintaining a healthy cash flow and ensuring the stability of a business. An organized approach to managing payment records enables companies to track outstanding amounts, manage due dates, and follow up with clients effectively. This section delves into the benefits of using structured documents to facilitate payment tracking.

Enhanced Visibility: Utilizing well-designed documents allows businesses to clearly outline payment details, making it easier to see which transactions have been completed and which remain unpaid. This visibility is essential for managing accounts receivable efficiently.

Automated Reminders: Incorporating reminders within the document can help prompt clients about upcoming or overdue payments. This proactive communication strategy can significantly reduce the chances of late payments and improve cash flow.

Comprehensive Reporting: By keeping detailed records through structured documents, businesses can generate reports that provide insights into payment patterns. Analyzing this data helps identify trends and potential issues, enabling more informed decision-making.

Streamlined Reconciliation: Having all payment information organized simplifies the reconciliation process. When the time comes to match transactions against bank statements or accounting records, having accurate documents ensures that discrepancies can be easily identified and addressed.

In conclusion, implementing structured documentation for tracking payments not only improves organization but also enhances communication with clients, ultimately contributing to better financial health for the business.

Legal Considerations for Invoices

Understanding the legal implications of financial documents is essential for any business. Properly drafted paperwork not only ensures compliance with regulations but also protects the interests of both the service provider and the client. This section highlights key legal aspects that should be considered when creating and managing financial records.

Key Legal Elements

When preparing financial documents, consider the following essential elements:

- Identification Details: Clearly include the names, addresses, and contact information of both parties involved in the transaction.

- Date of Issue: Always specify the date on which the document is issued to establish the timeline for payment and compliance.

- Unique Reference Number: Assign a distinct identifier to each document to facilitate tracking and prevent duplication.

- Payment Terms: Clearly outline the payment terms, including due dates, accepted payment methods, and any penalties for late payments.

- Legal Compliance: Ensure that the document complies with relevant local laws and regulations concerning financial transactions and record-keeping.

Consequences of Non-Compliance

Failure to adhere to legal requirements can result in various consequences, including:

- Disputes with clients regarding payment obligations.

- Potential legal actions that may arise from non-compliance with contract laws.

- Financial penalties or fines imposed by regulatory authorities.

- Negative impacts on business reputation and trustworthiness.

By being aware of these legal considerations, businesses can create secure and compliant financial records that foster transparency and build trust with their clients.

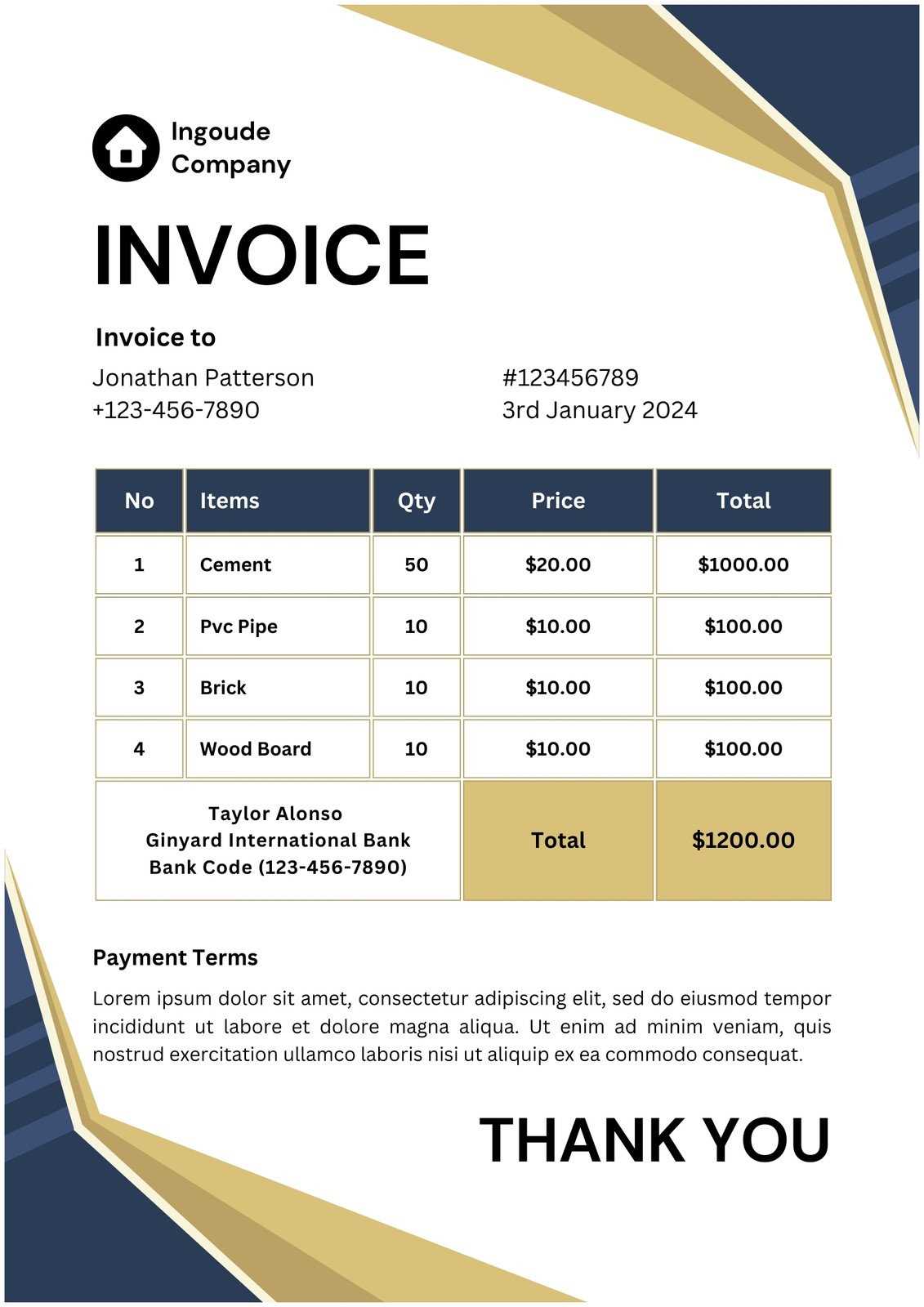

Enhancing Professionalism with Invoices

Presenting well-crafted financial documents can significantly elevate a business’s professional image. The design and content of these records reflect the quality of services rendered and the overall reliability of the company. This section explores how thoughtful documentation can contribute to a more professional appearance in the eyes of clients and partners.

Consistency in Design: Utilizing a uniform design across all financial documents not only fosters brand recognition but also demonstrates attention to detail. Incorporating company logos, consistent color schemes, and well-structured layouts conveys a sense of organization and professionalism.

Clarity of Information: Clear and concise presentation of relevant details is crucial. Ensuring that essential information such as amounts, services provided, and payment terms are easy to understand minimizes the chances of miscommunication and reflects professionalism.

Timeliness: Sending documents promptly after the completion of services illustrates respect for the client’s time and promotes efficient financial management. This practice can enhance trust and encourage timely payments.

Personalization: Tailoring documents to the specific needs and preferences of clients can foster a more personalized relationship. Including a thank-you note or a brief message adds a human touch that clients appreciate, enhancing their overall experience.

By focusing on these aspects, businesses can enhance their professionalism, build stronger relationships with clients, and ultimately contribute to long-term success.

Invoice Templates for Different Industries

Various sectors have unique requirements when it comes to financial documentation. Customizing records to suit specific industry standards not only facilitates clarity but also enhances professionalism. This section discusses tailored formats for distinct fields and how they address unique needs.

1. Creative Services

In industries such as graphic design and marketing, creativity is paramount. Documentation in these fields often features:

- Visual elements that reflect the brand’s identity.

- Detailed descriptions of services provided.

- Clear breakdowns of project phases and corresponding costs.

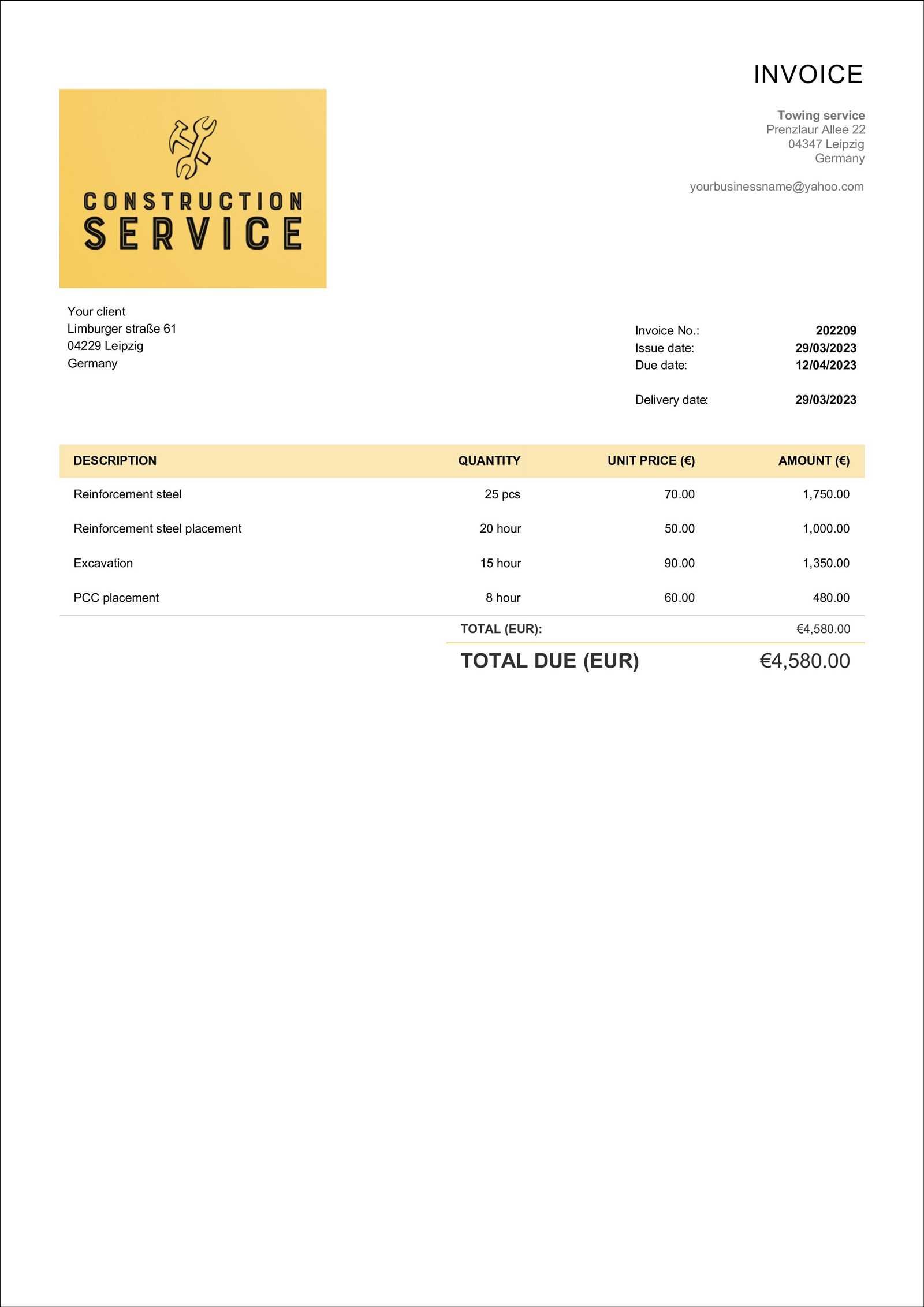

2. Construction and Contracting

In construction, accurate record-keeping is essential. Key features for this sector include:

- Itemized lists of materials and labor costs.

- Clear timelines and payment milestones.

- Compliance with local regulations and requirements.

By adapting documents to meet the specific demands of each industry, businesses can enhance clarity, foster trust, and improve communication with their clients.

Comparing Free and Paid Options

When selecting a solution for generating financial documents, users often face the choice between free and paid offerings. Each option presents distinct advantages and disadvantages, making it essential to evaluate which best fits individual needs and budgets. This section explores the key differences to help users make informed decisions.

Advantages of Free Solutions

Free options can be highly appealing, especially for startups and small businesses. Some benefits include:

- No initial investment: Users can access basic functionalities without financial commitment.

- Accessibility: Many free tools are easy to use and can be accessed online without installation.

- Variety of choices: A wide range of free options are available, catering to diverse preferences.

Benefits of Paid Solutions

On the other hand, premium offerings often provide enhanced features and support. Key advantages include:

- Advanced features: Paid options typically include more customization, automation, and reporting tools.

- Customer support: Users often receive dedicated assistance, ensuring a smoother experience.

- Increased security: Paid services usually offer better data protection and compliance with regulations.

Ultimately, the choice between free and paid solutions should be guided by the specific needs of the business, the complexity of required features, and budget considerations.

Future Trends in Invoicing Solutions

As businesses evolve in an increasingly digital landscape, the tools and methods for creating financial documents are also advancing. The future of these solutions promises to be shaped by several key trends that enhance efficiency, user experience, and integration capabilities. Understanding these trends can help organizations stay ahead of the curve.

1. Automation and AI Integration

Automation is set to revolutionize how financial documents are generated and managed. Key aspects include:

- Time-saving processes: Automated systems can handle repetitive tasks, reducing manual input and errors.

- Intelligent data analysis: Artificial intelligence can analyze client behavior, helping tailor documents for better engagement.

- Seamless integration: Enhanced compatibility with other software can streamline workflows and data sharing.

2. Enhanced User Experience

Future solutions will prioritize user experience to facilitate ease of use and accessibility:

- Intuitive interfaces: Simplified navigation and design will allow users to create documents more efficiently.

- Mobile compatibility: With the rise of remote work, mobile-friendly options will enable users to manage documents on the go.

- Customization: More personalized options will help businesses maintain branding and professional appearance.

3. Increased Focus on Security

As cyber threats become more sophisticated, security will remain a top priority:

- Data encryption: Enhanced encryption methods will protect sensitive information from unauthorized access.

- Compliance with regulations: Solutions will increasingly align with financial and data protection regulations to safeguard user trust.

- Regular updates: Frequent software updates will address vulnerabilities and improve overall security.

These trends indicate a shift toward smarter, more secure, and user-friendly solutions that can adapt to the changing needs of businesses and their clients.