How to Use an Invoice Blank Template for Efficient Billing

Managing payments and ensuring smooth financial transactions is crucial for any business. One of the most effective ways to simplify this process is by using structured documents that can be easily customized to fit your needs. These forms provide a clear and professional way to outline the details of a transaction, ensuring accuracy and reducing the chances of errors.

By utilizing a pre-designed document, you can save time and focus on more important tasks. Whether you’re a freelancer, small business owner, or part of a larger organization, having a reliable tool to record payment details can make all the difference in maintaining good relationships with clients and keeping your finances organized.

With a variety of options available, it’s important to choose the right solution that allows flexibility while maintaining professionalism. The right format not only helps you keep track of payments but also ensures you meet any legal or business standards that may apply to your industry.

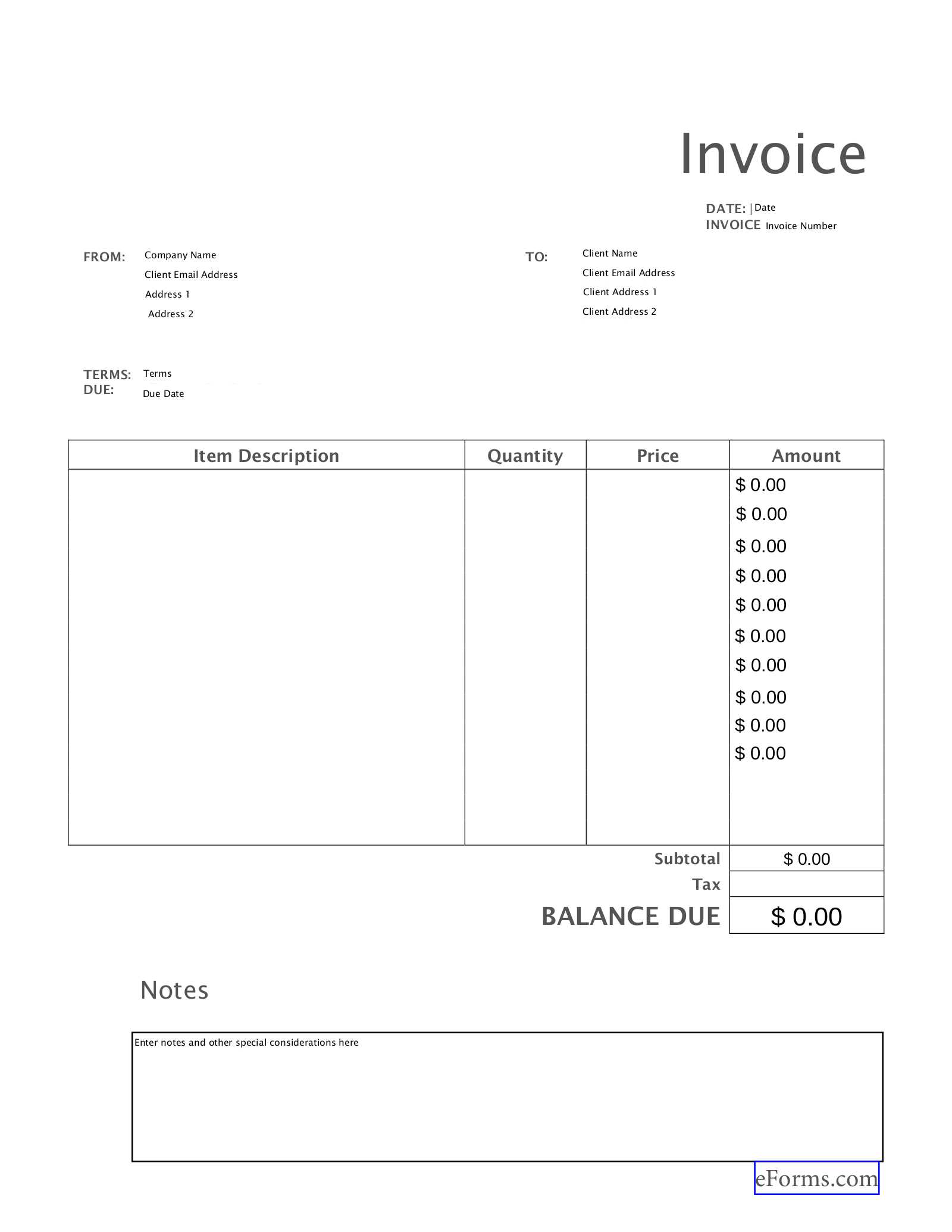

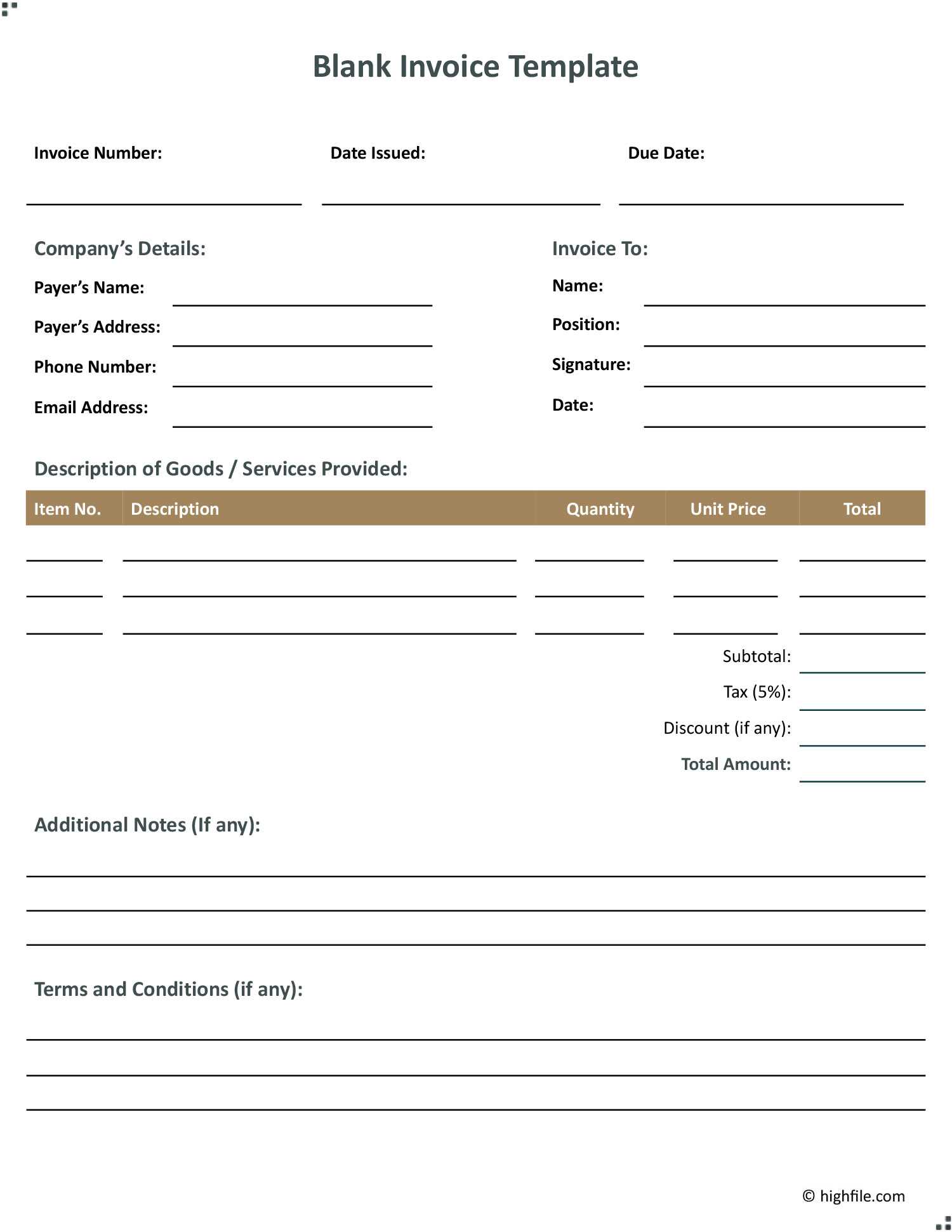

Invoice Blank Template Overview

Efficiently managing payment documentation is essential for businesses of all sizes. Having a ready-to-use form that can be quickly customized for each transaction helps streamline the entire billing process. These forms are designed to include all necessary details, ensuring that both the service provider and the client are clear on the terms of payment, amounts owed, and other important information.

These customizable documents offer flexibility and simplicity, allowing businesses to maintain a professional appearance while minimizing the time spent creating billing records. With key fields such as item descriptions, quantities, prices, and contact details, these forms ensure that everything needed for a complete transaction is included. Whether used in digital or printed formats, they are an indispensable tool for maintaining organized financial records.

How Customization Enhances Efficiency

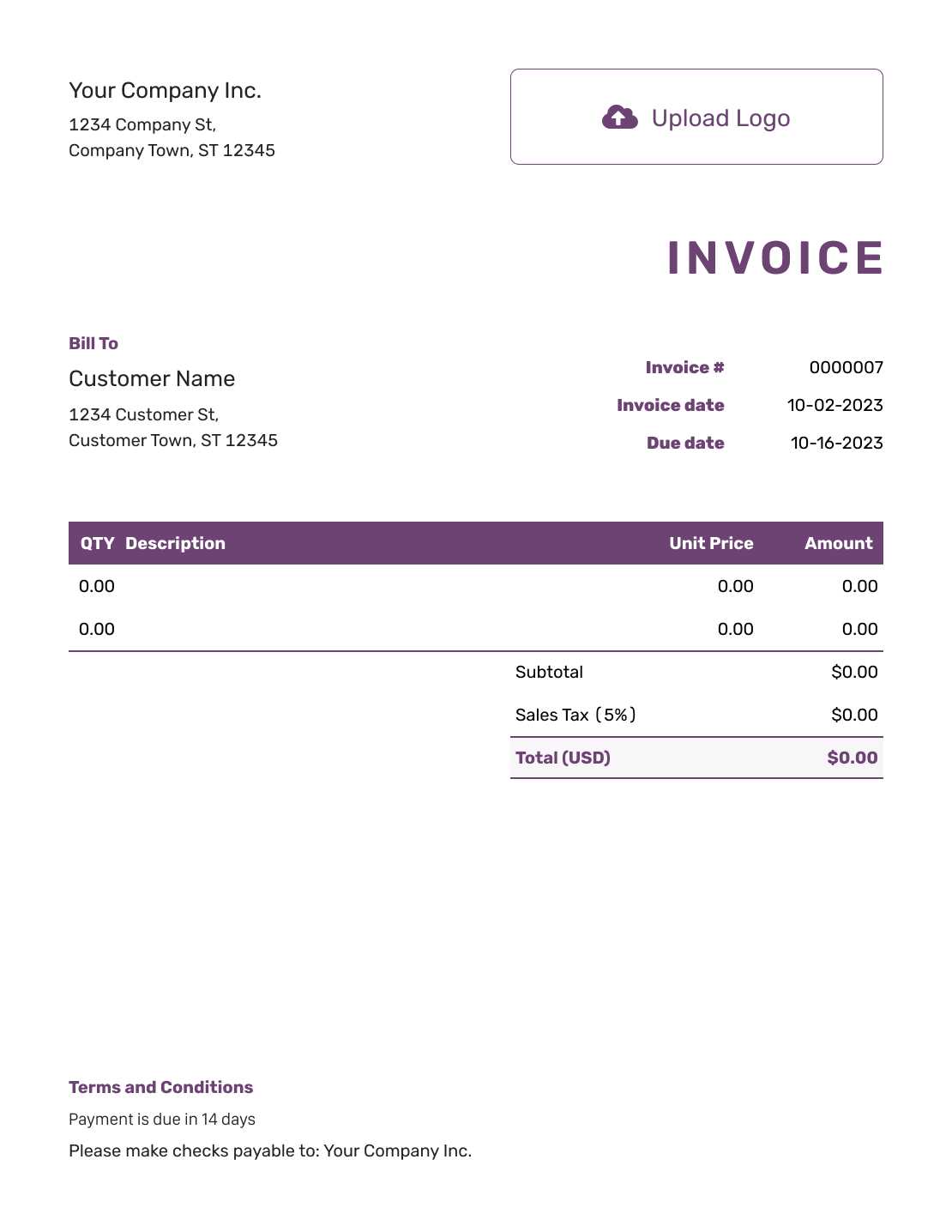

Being able to easily modify these documents based on specific client needs or project details adds significant value to the billing process. Customization ensures that only relevant information is displayed, preventing confusion or mistakes. Many forms allow businesses to add their logos, adjust payment terms, or incorporate additional notes, creating a personalized experience for clients while maintaining consistency in documentation.

Why Consistency Matters

Uniformity in billing documents not only enhances the professional image of your business but also helps ensure that all legal and business requirements are met. By using the same format for each transaction, it becomes easier to track payments, reconcile accounts, and resolve disputes quickly. A standardized approach also simplifies the process of sharing and archiving records for future reference or audit purposes.

Why Use a Blank Invoice Template

Utilizing a ready-made document for billing purposes can significantly improve efficiency in managing financial transactions. These pre-structured forms help ensure that all necessary details are included without the need for starting from scratch every time. By relying on these documents, businesses can save time, reduce errors, and maintain a professional image in their dealings with clients.

Having a consistent format for each transaction also enhances organization, making it easier to track payments, manage records, and avoid any misunderstandings. Whether for small businesses or large organizations, using a standardized document ensures all crucial fields are captured and that the information remains clear and concise.

Benefits of Using Pre-Structured Forms

Some of the key advantages of using these ready-made solutions include:

| Benefit | Description |

|---|---|

| Time Efficiency | No need to create a new document from scratch for each transaction. |

| Professional Appearance | Consistent format gives a polished and reliable impression to clients. |

| Accuracy | Reduces the chance of missing important information and errors. |

| Customizability | Easily adapt the form to suit specific client or project needs. |

Streamlined Financial Record Keeping

Maintaining clear and accurate financial records is critical for managing a business effectively. A standardized form helps organize transactions, making it easier to track payments, resolve discrepancies, and prepare for tax season or audits. It ensures all details are included, such as payment terms, dates, amounts, and client information, all in one place.

Benefits of Customizable Invoice Templates

The ability to modify billing forms to meet specific needs offers a wide range of benefits for businesses. Customizable documents allow you to tailor the layout and content, ensuring they align with your brand, industry requirements, and client preferences. This flexibility helps improve efficiency, accuracy, and professionalism in managing transactions.

By adapting the format to suit particular situations, businesses can easily address unique client requests, include specific services, or adjust payment terms. This approach not only saves time but also reduces the likelihood of mistakes, which can lead to misunderstandings or delays in payments.

Key Advantages of Customization

- Brand Consistency: Add your company logo, colors, and fonts to ensure all documents reflect your business identity.

- Flexibility: Modify fields and sections to accommodate different client needs or specific project details.

- Professional Appearance: A customized design enhances the overall look, making the form more polished and easier for clients to understand.

- Improved Accuracy: Customizable forms reduce the chances of omitting important information, ensuring clarity for both parties.

- Time Efficiency: Having a pre-designed but adjustable format saves time and effort in creating new records for each transaction.

Adapting Forms to Business Needs

Every business has unique requirements, whether it’s the inclusion of tax rates, project milestones, or payment deadlines. Customizable billing records let you adjust the content without creating a new structure each time. By incorporating specific fields and details, you can avoid confusion, streamline communication with clients, and ensure all necessary data is included with each transaction.

Key Elements of an Invoice Template

A well-structured billing document should include all essential components that clearly communicate the terms of the transaction. These elements not only help ensure that both parties understand the details of the payment but also contribute to the professional presentation of the document. Including the right sections minimizes confusion and improves the overall efficiency of the process.

The key to creating a comprehensive and effective form lies in capturing all the necessary information while keeping the layout clean and easy to understand. Below are the critical components that should always be included in a payment record.

- Contact Information: The document should display the names, addresses, and contact details of both the service provider and the client. This ensures clarity and provides a point of reference in case of any questions or issues.

- Unique Reference Number: Each record should have a distinct identifier or number. This allows for easy tracking and referencing, both for clients and businesses.

- Date of Issue: The date when the record is created is crucial for establishing payment terms and deadlines.

- Detailed Breakdown of Goods/Services: A clear list of the items or services provided, along with their quantities, prices, and descriptions, makes the document more transparent and ensures that all charges are understood.

- Payment Terms: It’s important to specify payment deadlines, accepted methods, and any applicable late fees or discounts for early payment. This section helps avoid any misunderstandings about due dates or penalties.

- Subtotal and Total: Calculating the total amount due, including taxes and any additional charges, is essential for clarity. Ensure that the subtotal and final amount are clearly visible to prevent confusion.

- Payment Instructions: Provide specific details on how to make the payment, such as bank account information, online payment portals, or mailing instructions for checks.

By including these critical elements, the payment document not only fulfills its functional purpose but also reflects professionalism and helps ensure smooth transactions. Well-structured documents can enhance communication and build trust with clients, leading to stronger business relationships.

How to Choose the Right Template

Selecting the most suitable document format for your billing needs can have a significant impact on how efficiently and professionally you manage transactions. With so many options available, it’s essential to consider various factors before making a choice. The right design will not only simplify your workflow but also ensure your clients receive clear, consistent, and accurate records.

When choosing the appropriate structure, consider the nature of your business, the level of customization required, and the preferred method of communication with your clients. Below are key factors to keep in mind when making your decision.

Consider Your Business Type

Different businesses have varying needs when it comes to payment documentation. For example, a freelancer may need a simple, easy-to-understand design, while a larger business might require a more detailed and comprehensive format. Consider the following:

- Small Businesses: Choose a straightforward, clean design with essential fields that don’t overwhelm your clients.

- Freelancers: A minimalist approach might be best, focusing on services rendered and payment terms.

- Large Enterprises: Opt for a more complex structure that accommodates multiple items, services, tax details, and specific terms.

Level of Customization

Another important consideration is how much customization you need. If you want to add your company logo, adjust payment terms, or include specific tax information, choose a design that allows you to modify these aspects easily. Some documents offer more flexibility in adjusting fields, while others provide a fixed structure that may not accommodate your needs fully.

Think about:

- Flexibility: Do you need to frequently change details or add custom notes for clients?

- Simplicity: If your needs are basic, a simple, ready-to-use structure might be the best option.

By carefully considering these factors, you’ll be able to select the most effective solution for your business, ensuring efficient, accurate, and professional transacti

Where to Find Free Invoice Templates

Finding a free, ready-to-use document for billing purposes is easier than ever, thanks to numerous online resources. Many platforms offer a wide variety of customizable forms that can be downloaded and used for different types of transactions. These options allow businesses of all sizes to access high-quality billing solutions without having to create one from scratch.

Whether you’re looking for a basic structure or something more complex, there are multiple places where you can find free formats tailored to your needs. Below are some of the best sources for downloading and customizing your payment documents.

Online Platforms and Websites

Many websites specialize in providing free business resources, including professional billing forms. These sites often offer a wide range of styles and formats, making it easy to find one that suits your needs. Here are a few places to check:

- Microsoft Office Templates: The official Microsoft website offers a variety of free forms compatible with Word and Excel, which can be customized to suit your requirements.

- Google Docs: Google’s free document editor also has several pre-made structures that you can easily modify and store online.

- Canva: Known for its design flexibility, Canva allows users to create visually appealing, professional documents with customizable fields.

- FreshBooks: Although primarily a paid service, FreshBooks offers free downloadable samples of payment records that can be edited for personal use.

Freelance and Business Websites

For freelancers and small business owners, websites dedicated to entrepreneurial resources often provide free downloadable solutions as well. These platforms cater to a variety of industries and business types, ensuring that you find a format that is industry-specific and functional.

- Upwork: Freelance marketplaces like Upwork often provide free billing forms for freelancers working with clients on the platform.

- QuickBooks: While primarily offering paid accounting services, QuickBooks offers a few free resources for small business owners looking for simple billing solutions.

- HubSpot: HubSpot provides a selection of free downloadable forms designed to meet the needs of various industries, from consulting to digital services.

These free resources provide an excellent starting point for any business, helping you maintain accurate records while saving time and money. By exploring the options available, you can easily find a solution that works for your business needs.

Creating a Professional Invoice Quickly

Creating a polished and professional payment record doesn’t have to be time-consuming. With the right tools and a clear structure, you can generate accurate billing documents in minutes, ensuring timely payments and a professional image for your business. The key is to focus on the essential details while maintaining a clean, easy-to-read format that aligns with your brand.

Here are some steps to help you create a professional document without delay:

Steps for Quickly Generating a Billing Document

- Choose a Reliable Format: Select a pre-designed document that fits your business type. This eliminates the need to start from scratch while ensuring that all critical elements are included.

- Personalize with Your Brand: Add your company name, logo, and contact details to make the document unique to your business. Personalizing the form adds a professional touch and reinforces your brand.

- Include Essential Information: Ensure you have all necessary fields, such as client information, transaction details, payment terms, and amounts. This helps avoid confusion and ensures clarity for both parties.

- Specify Payment Terms: Be clear about the payment due date, accepted methods, and any penalties for late payments. Providing this upfront can prevent misunderstandings later.

- Review for Accuracy: Double-check all amounts, descriptions, and contact details. A mistake can lead to delays, so it’s essential to ensure everything is correct before sending it out.

Tools for Fast Creation

- Online Generators: Use online tools like Canva or FreshBooks that provide easy-to-fill-in forms with drag-and-drop features, allowing you to quickly customize and download the final document.

- Spreadsheet Software: Applications like Google Sheets or Excel offer customizable options, allowing you to create simple yet effective billing documents in no time.

- Accounting Software: If you use accounting software, such as QuickBooks or Zoho, these platforms can automatically generate professional payment records based on the data you’ve entered.

By following these simple steps and using the right tools, you can create a professional, error-free payment record in no time, ensuring a smooth and efficient transaction process.

Common Mistakes in Invoice Creation

When preparing payment records, even small errors can lead to confusion, delayed payments, or strained business relationships. Ensuring accuracy and clarity is essential, as a well-organized document reflects professionalism and helps avoid misunderstandings. Below are some common mistakes businesses make when creating these documents and how to prevent them.

Being aware of these pitfalls can help streamline your billing process, ensure timely payments, and maintain a positive relationship with clients.

- Missing or Incorrect Contact Information: Failing to include accurate names, addresses, and contact details can delay payments or cause confusion. Always double-check client and business information.

- Unclear Payment Terms: If payment deadlines, methods, or late fees are not clearly stated, clients may delay payments. Clearly outline due dates, accepted payment methods, and penalties for late payments.

- Omitting Important Details: Failing to list all services or products provided, quantities, and prices can cause confusion. Ensure every charge is itemized and described in detail.

- Wrong Amounts or Calculations: Simple math errors or incorrect totals can lead to disputes and delays. Always double-check your calculations and use automated tools where possible.

- Failure to Include Unique Reference Number: Without a reference number, both you and your client may have difficulty tracking the payment. Make sure each document has a unique identifier for easy reference.

By avoiding these common mistakes, you ensure a smoother billing process, reduce the chance of disputes, and maintain professional relationships with your clients.

How to Customize Your Invoice Template

Customizing a billing document is a great way to align it with your business needs and brand identity. By tailoring the structure and content, you can ensure that the document not only provides all necessary information but also reflects your company’s professionalism. Customization allows you to include specific details like your logo, payment terms, or services that are unique to your business.

Below are some simple steps you can follow to adjust the document format according to your needs.

Key Customization Options

Here are the most common elements that you can modify to better suit your business:

| Customization Area | Description |

|---|---|

| Logo and Branding | Include your business logo, colors, and fonts to make the document visually consistent with your brand. |

| Payment Terms | Adjust the payment due date, accepted methods, and any discounts or late fees to suit your preferences. |

| Service or Product Details | Clearly list all items or services provided, including descriptions, quantities, and unit prices. |

| Client Information | Ensure accurate client contact details are included for smooth communication and follow-ups. |

| Taxes and Discounts | Modify tax rates or include special discounts, if applicable, to match the specific transaction. |

Practical Tips for Effective Customization

While customization can help create a more tailored document, it’s important to maintain a balance between personalization and clarity. Here are a few additional tips:

- Keep it Professional: Ensure the document maintains a clean and organized layout. Avoid cluttering it with too many colors or images.

- Use Clear Language: Make sure all terms, product descriptions, and amounts are easy to understand to prevent confusion.

- Double-Check

Printable Invoice Templates for Easy Use

Having a ready-to-print billing document can save you time and effort when you need to send payment requests quickly. Printable versions allow you to easily fill in the details and provide a professional, hard copy of your billing record. These documents are especially helpful for businesses that deal with physical transactions or clients who prefer paper records over digital ones.

With the right printable design, you can ensure your document is clean, easy to read, and includes all the necessary information for prompt payment. Whether you need a simple structure or something more detailed, printable forms can be tailored to fit your specific needs.

Advantages of Printable Billing Records

- Easy to Use: Simply fill in the required fields, print, and send. No complicated software or formats are needed.

- Professional Appearance: A well-designed printable form can enhance the perception of your business and improve client relations.

- Physical Recordkeeping: Providing a hard copy allows clients to keep a physical record of the transaction for their own documentation.

- Quick Delivery: For clients who prefer physical copies, printed forms can be mailed immediately after completion.

Where to Find Printable Forms

Many platforms offer free or paid versions of printable billing documents that can be easily customized to suit your needs:

- Microsoft Word or Google Docs: Both offer simple, customizable forms that you can download and print directly.

- Canva: This design platform allows you to create visually appealing documents that can be printed in high quality.

- Online Tools: Websites like Invoice Generator or FreshBooks provide pre-made forms that you can quickly download and print.

With these resources, you can easily create and print professional, error-free documents that are ready to be sent to clients. Whether you’re in a fast-paced industry or simply need a quick way to issue payment requests, printable forms offer an efficient solution.

Digital Invoices and Template Benefits

In today’s fast-paced digital world, transitioning from traditional paper records to electronic payment documents offers numerous advantages. Digital formats provide greater convenience, speed, and flexibility, allowing businesses to streamline their billing process. With a digital structure, you can easily create, send, and store payment records without the need for physical paperwork.

By using electronic formats, businesses can also automate many aspects of their billing system, from calculating totals to sending reminders, reducing human error and saving valuable time. Below are some key benefits of adopting digital payment documents for your business.

Key Benefits of Digital Billing Systems

- Efficiency and Speed: Creating and sending a digital payment document takes only a few minutes, enabling faster transactions and quicker processing times.

- Cost-Effective: Reduces costs related to paper, printing, and postage. No physical copies are needed, and distribution can be done instantly via email or through online platforms.

- Easy Customization: With digital forms, customization is simple. You can easily add your company logo, adjust payment terms, or modify the document for different clients.

- Automation: You can automate calculations, tax rates, and even follow-up reminders for overdue payments, ensuring that nothing is overlooked.

- Environmental Impact: Digital formats eliminate paper waste, making them an eco-friendly option for businesses looking to reduce their environmental footprint.

Integration with Accounting Software

One of the major advantages of using digital billing solutions is the ability to integrate them with accounting and finance software. This integration streamlines the entire financial management process, allowing businesses to track income, expenses, and profits more effectively. The automation helps maintain accurate records, which is especially useful for tax filing and financial reporting.

By choosing to use digital payment documents, businesses can save time, reduce errors, and enhance their overall workflow. The ease of use, coupled with the benefits of automation and integration, makes digital solutions a valuable tool for modern business operations.

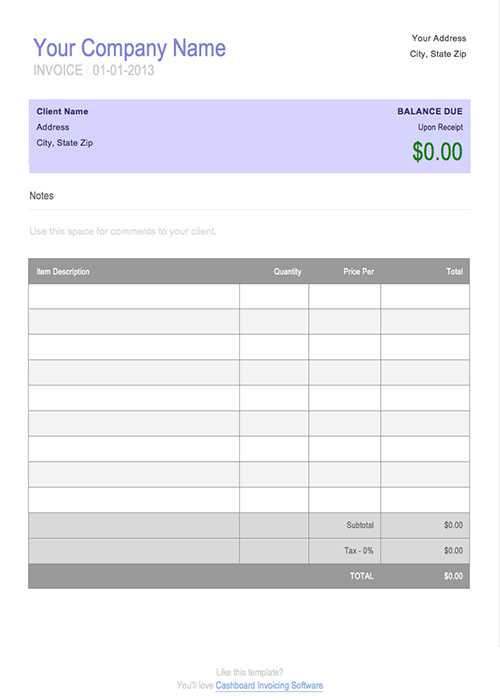

Invoice Template for Small Businesses

For small business owners, having an organized and efficient method to track payments and transactions is crucial. A well-structured document for payment requests not only helps maintain clear financial records but also establishes a professional image. Whether you are providing services or selling products, using a standardized format for billing ensures that both you and your clients are on the same page regarding payment terms and expectations.

Small businesses, in particular, benefit from using a customizable format that can be tailored to suit different types of transactions. A good structure allows you to quickly add or adjust details, such as item descriptions, costs, and tax rates, making the process more streamlined and efficient.

Key Features for Small Business Billing Documents

When choosing or creating a document for payment requests, it’s important to ensure that it includes all necessary information to avoid confusion or payment delays:

- Business Information: Include your business name, address, contact details, and logo. This reinforces your brand identity and makes it easier for clients to get in touch if needed.

- Client Details: Clearly list the client’s name, address, and contact information to ensure accuracy when sending payment requests.

- Itemized List of Products or Services: Break down the items or services provided, along with their prices and quantities. This transparency helps clients understand exactly what they are paying for.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or discounts, if applicable. This ensures clarity and can help avoid future disputes.

- Unique Invoice Number: Assign a unique reference number to each document for tracking and record-keeping purposes.

Benefits of a Customized Format for Small Businesses

Using a flexible and personalized payment document format can help small businesses save time and stay organized. Some advantages include:

- Professionalism: A clean and well-organized document portrays a professional image, increasing the likelihood of timely payments.

- Time-Saving: A reusable structure that can be quickly customized reduces the time spent creating new billing documents for each transaction.

- Accuracy: Standardizing the format ensures that all necessary fields are included, reducing the risk of missing crucial information and preventing mistakes.

By using a well-designed and customizable billing document, small businesses can simplify their accounting process, maintain a professional appearance, and improve cash flow management.

How to Track Payments Using Templates

Effectively managing payments is essential for maintaining healthy cash flow in any business. Using a consistent format to record and track transactions ensures that you can easily monitor outstanding payments, follow up with clients, and maintain accurate financial records. By organizing payment details in a clear and systematic manner, you can reduce the chances of errors and make it easier to track overdue amounts.

Here’s how you can use a standardized format to track payments effectively:

Steps to Track Payments

- Create a Detailed Record: Use a structured layout where each transaction has its own entry. Include essential details such as the client’s name, amount due, due date, and any specific terms regarding payment.

- Update Payment Status: For every payment received, mark the status of the transaction as “Paid” and enter the date of payment. This helps distinguish between pending and completed payments.

- Set Reminders for Overdue Payments: If a payment has not been received by the due date, use the document to create a reminder. Note the overdue amount and any applicable late fees, if specified in your payment terms.

- Track Multiple Payments: For recurring clients or long-term projects, use a section to note partial payments and track the balance left. This helps in monitoring progress and ensuring all payments are eventually settled.

Essential Features for Payment Tracking

When setting up a system to track payments, it’s important to ensure the following features are included in your structure:

- Unique Reference Number: Each transaction should have a unique identifier to help you quickly locate and cross-reference payment records.

- Payment Method: Record how the payment was made (e.g., bank transfer, check, cash, etc.) for future reference and potential follow-up.

- Due Date and Payment Date: Include both the original due date and the actual payment date to track delays and ensure timely follow-up on overdue amounts.

- Notes Section: Add a space for additional comments, such as reasons for delays or agreements made with the client regarding payment terms.

By consistently using a structured format, you can streamline your payment tracking process, stay organized, and ensure no payment is overlooked. This approach also helps improve client relations, as you can easily access the status of each payment and follow up when necessary.

Invoice Templates for Freelancers

Freelancers often manage their own billing and payments, making it essential to have an efficient way to track and present their work. Using a consistent structure for documenting services and payments ensures professionalism and clarity in every transaction. A well-organized payment document not only helps in tracking earnings but also fosters trust with clients by clearly outlining terms, prices, and services rendered.

For freelancers, a customizable format can save time and streamline the billing process. With a standardized structure, freelancers can quickly generate and send accurate records of their work, helping to avoid errors and delays in payment.

Below are some key benefits and features to consider when choosing or creating a payment document format for your freelance work:

- Time-Saving: Having a reusable structure allows freelancers to quickly fill in the details for each new client or project, avoiding the need to start from scratch each time.

- Professional Appearance: A consistent and clear format makes a freelancer’s communication with clients appear more professional and reliable.

- Clarity for Clients: A detailed layout helps clients understand exactly what services were provided, the cost breakdown, and payment terms, which can prevent misunderstandings.

- Flexibility: A customizable structure can be adapted for different types of freelance work, whether you’re offering design services, writing, consulting, or any other type of freelance project.

By using a standardized structure for your payment documents, you can stay organized, save time, and ensure that you’re paid promptly and accurately for the work you do.

How to Add Taxes in Invoice Templates

In many cases, when you’re requesting payments from clients, taxes must be included to ensure that both you and your client are complying with legal requirements. Properly calculating and adding taxes to your billing document is essential for accuracy and transparency. A well-designed structure allows you to easily calculate tax amounts and display them in a clear way, helping both parties understand the total amount due.

Here’s how you can include taxes effectively in your payment documents:

Steps to Add Taxes

- Identify the Tax Rate: Determine the applicable tax rate for your region or business type. This can vary depending on the location and type of product or service provided.

- Calculate the Tax Amount: Multiply the subtotal (the total amount before tax) by the tax rate. For example, if the subtotal is $200 and the tax rate is 10%, the tax amount will be $20.

- Include the Tax in the Document: Add a section where you can clearly display the tax amount next to the subtotal. This helps to keep everything transparent and avoids any confusion for the client.

- Display Total Due: After adding the tax, include a final “Total Due” section that clearly shows the total amount the client must pay, including the cost of services or goods plus tax.

Things to Remember

- Be Transparent: Always break down the tax calculation clearly in the document. This helps build trust with clients and avoids disputes about the amount charged.

- Check Tax Regulations: Be sure you understand local tax laws and rates. Some regions may have different rates based on location or industry, so verify your rates to ensure compliance.

- Provide Tax Identification Number: Depending on your business type and local regulations, it might be necessary to include your tax identification number on your payment document.

By following these steps, you can easily incorporate taxes into your billing structure, ensuring that your records are accurate, legal, and clear for both you and your clients.

Ensuring Legal Compliance with Templates

When creating billing documents, it’s crucial to ensure that the format adheres to the relevant legal and tax regulations in your region or industry. Failing to include required information or miscalculating financial details can result in compliance issues, potential fines, or delays in payment. A well-structured document can help you avoid these issues by ensuring that all necessary details are clearly presented and in accordance with the law.

By utilizing a properly designed structure for your payment requests, you ensure that all the essential information is included. This not only protects your business from legal trouble but also builds trust with your clients, as they will see that you take your responsibilities seriously and follow the required standards.

Key elements to ensure legal compliance include:

- Clear Tax Information: Be sure to include the correct tax rates and your tax ID number if required. This ensures transparency and proper reporting for both you and your client.

- Proper Business Information: Include your full business name, address, and registration details. In many jurisdictions, this is a legal requirement for all payment documents.

- Accurate Payment Terms: Clearly state payment deadlines, accepted payment methods, and late fees. These details protect both you and your clients in case of disputes over payments.

- Legal Disclaimers: Depending on your industry, certain disclaimers or terms might be necessary, such as refund policies, liability clauses, or service-specific terms. Always check what legal disclaimers are required for your particular business.

By ensuring that your payment documentation follows these legal guidelines, you can protect your business from unnecessary risks and improve the professionalism of your financial dealings with clients.

Using Invoice Templates for Repeat Clients

For businesses with repeat clients, having a consistent, easily adaptable structure for payment requests can save valuable time and effort. Rather than creating new documents from scratch for every transaction, using a predefined format that can be quickly customized ensures that the billing process remains smooth, professional, and efficient. This approach also helps maintain consistency in communication, which is important for long-term client relationships.

By reusing a structured format for each new project or service, you can quickly add the necessary details while keeping the essential information consistent. This approach ensures that clients feel confident in the accuracy and professionalism of your billing, which can help foster trust and encourage timely payments.

Benefits for Repeat Clients

- Efficiency: With a predefined format, you only need to adjust client-specific information, saving time and reducing the chances of errors.

- Faster Turnaround: You can generate and send payment requests more quickly, ensuring clients receive their documents on time, which can lead to faster payments.

- Consistency: Reusing the same structure helps maintain consistency in your communication, reinforcing a professional image and setting clear expectations for both you and your clients.

Customization for Repeat Business

While using the same format for each client, it’s important to customize the details for each project or service. Here are some key areas to personalize:

- Project/Service Description: Clearly outline the work completed for the client, including any specific details or customizations related to their needs.

- Pricing and Discounts: Adjust the pricing for each client or offer discounts for repeat business, which can encourage loyalty and help build a strong relationship.

- Payment Terms: While the structure remains the same, ensure the payment terms are clear and updated based on your agreement with the client, including deadlines and any applicable late fees.

By using a consistent structure and tailoring the necessary details for each repeat client, you streamline your process and create a more efficient, professional billing experience that b