Easy to Use Invoice Bill Template for Quick and Accurate Billing

Managing financial transactions efficiently is a crucial part of running any business. One of the most effective ways to ensure smooth and timely payments is by using a professional document for recording charges. These documents help provide clarity, transparency, and consistency between you and your clients.

There are various tools available that make creating these records easier and faster. With customizable formats, you can quickly adjust the details to suit your specific needs, whether for a one-time transaction or recurring billing. This approach not only saves time but also reduces the likelihood of errors that can complicate payments.

In this guide, we’ll explore the essential elements of such documents, offer tips on customization, and highlight the benefits of using these resources to maintain a well-organized billing system. Whether you’re a freelancer or running a larger operation, the right structure can greatly enhance both your professionalism and operational efficiency.

Invoice Bill Template Overview

When it comes to managing payments and client transactions, using a structured document to outline charges is essential for any business. These documents are vital for ensuring transparency and consistency in your financial dealings. They provide both the business owner and the client with a clear record of what has been agreed upon, making the entire payment process more streamlined and professional.

Modern solutions allow for easy customization, so you can adapt the layout and information according to your specific needs. With a well-organized format, these documents help avoid confusion, prevent errors, and ensure timely payments. Understanding the components and best practices of creating such records is key to maintaining smooth financial operations.

What Makes a Strong Billing Document?

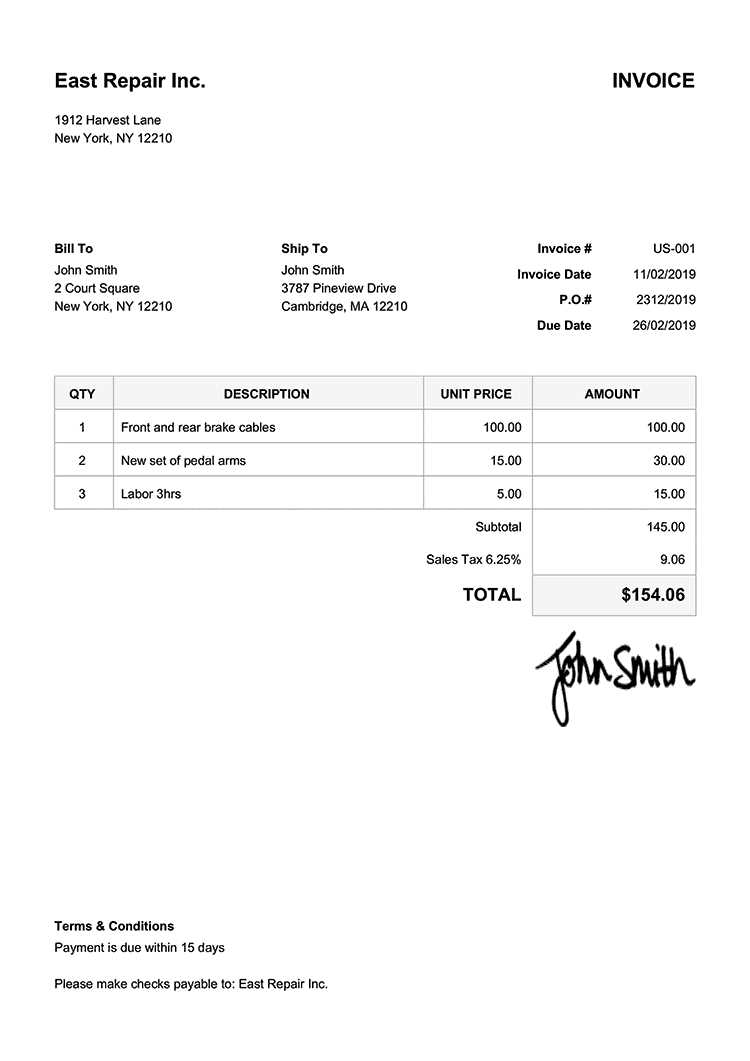

A solid document for recording charges includes essential fields such as client information, detailed descriptions of services provided, payment terms, and due dates. It ensures all necessary details are covered to prevent any miscommunication and foster trust between parties.

Benefits of Using a Structured Format

By utilizing a pre-made or customizable structure, businesses can save time on administrative tasks, reduce the chance of mistakes, and provide clients with professional-looking records. A clear and well-organized document helps create a positive impression, ensuring smoother transactions in the future.

Why You Need an Invoice Template

Having a standardized document for recording transactions is crucial for any business. Without a clear and organized method of documenting financial exchanges, misunderstandings can arise, leading to delayed payments or even disputes. A pre-designed structure ensures that all necessary details are included and formatted properly, saving you time and minimizing errors.

Using a well-structured form brings many advantages, from increasing professionalism to streamlining your workflow. It’s a simple yet effective tool that improves your overall efficiency, keeps your records consistent, and builds trust with clients.

Key Reasons to Use a Structured Document

- Consistency: A standard format ensures all important details are always included, reducing the chances of missing crucial information.

- Time-saving: Instead of manually writing out details for each transaction, you can quickly fill in the blanks in a pre-made structure.

- Professionalism: Presenting a polished, well-organized document reflects positively on your business and enhances credibility.

- Accuracy: By using a defined layout, the risk of errors is significantly lowered, which helps prevent misunderstandings with clients.

How It Helps With Payments

A clear and detailed document not only ensures that your clients understand exactly what they are paying for, but also encourages prompt payments. With all terms, amounts, and deadlines outlined, there is less room for confusion, making it more likely that payments will be made on time.

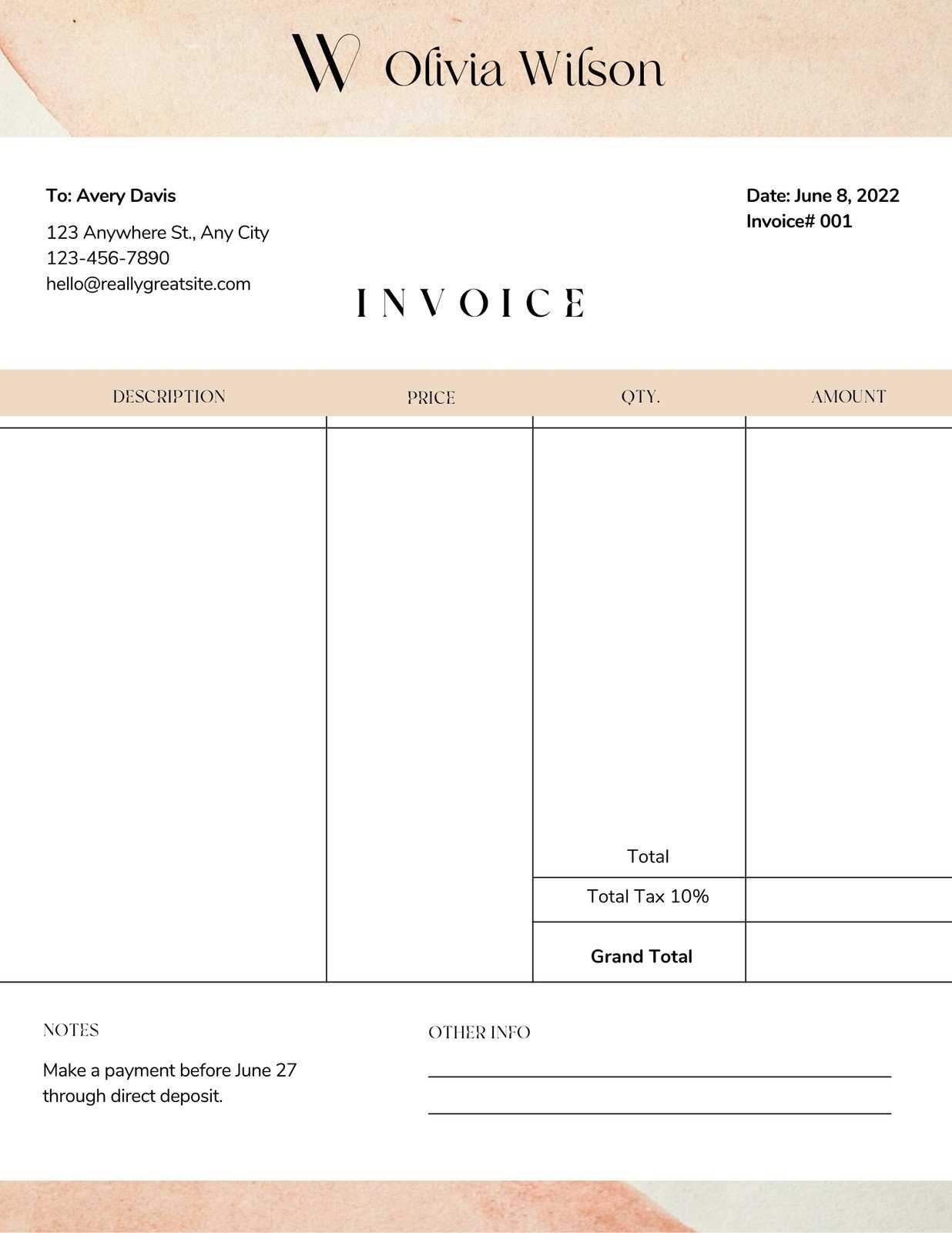

How to Customize Your Invoice Template

Personalizing your financial documentation is essential for tailoring it to your specific needs. A flexible structure allows you to adapt the content and layout to match your branding, industry requirements, or the type of services you offer. Customization ensures that the document not only serves its functional purpose but also aligns with your business identity.

There are several key elements you can modify to create a more effective and professional document. Whether it’s adjusting the design, adding or removing sections, or changing the content, these adjustments can make the document more relevant and efficient for both you and your clients.

Essential Elements to Customize

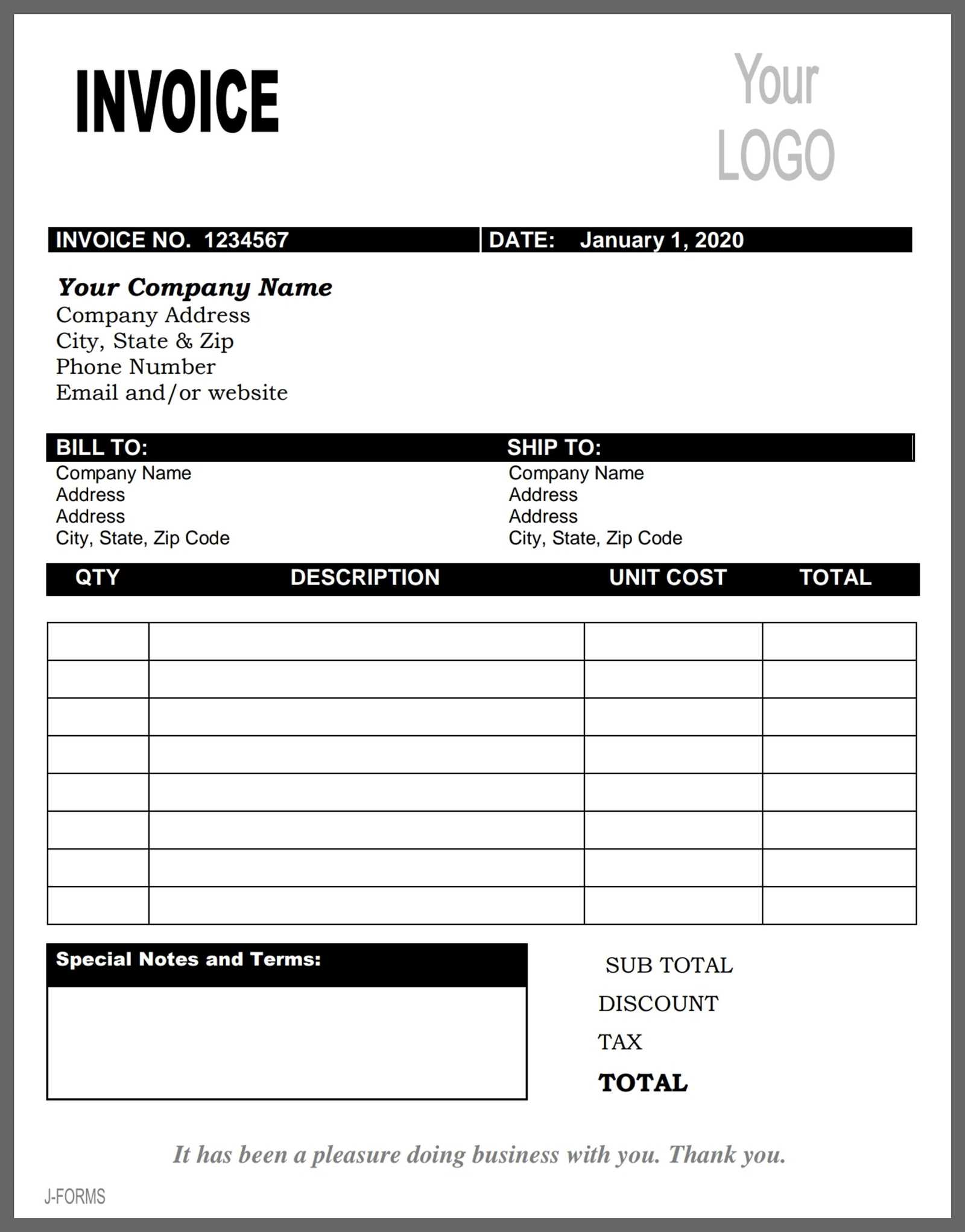

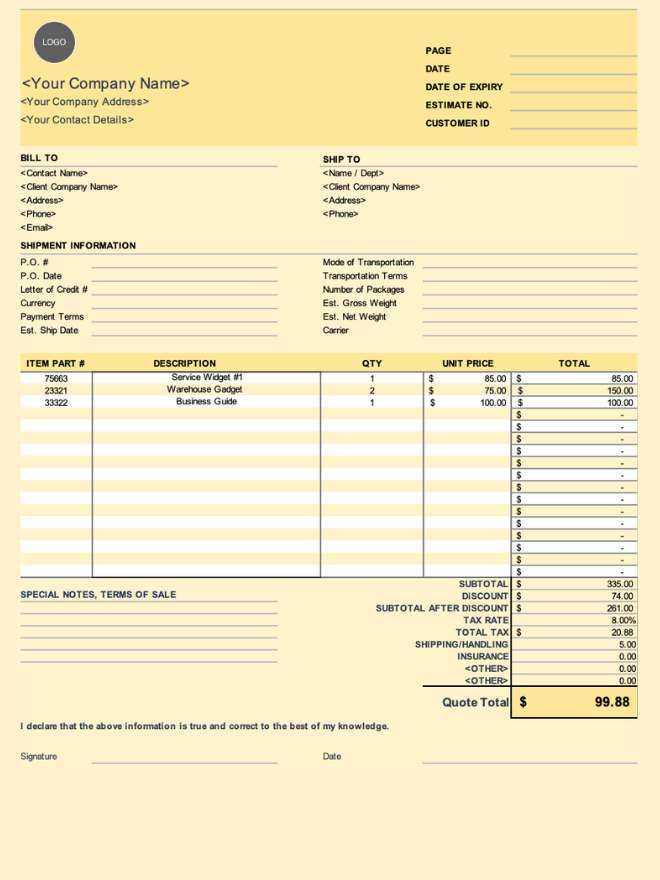

- Header and Branding: Include your company logo, name, and contact information to make the document easily recognizable and professional.

- Client Information: Customize fields to accommodate specific client details such as name, address, and contact information.

- Services or Products: Adjust descriptions and quantities to match the specific offerings of your business, ensuring clarity for the client.

- Payment Terms: Clearly define payment deadlines, late fees, or any special conditions relevant to the transaction.

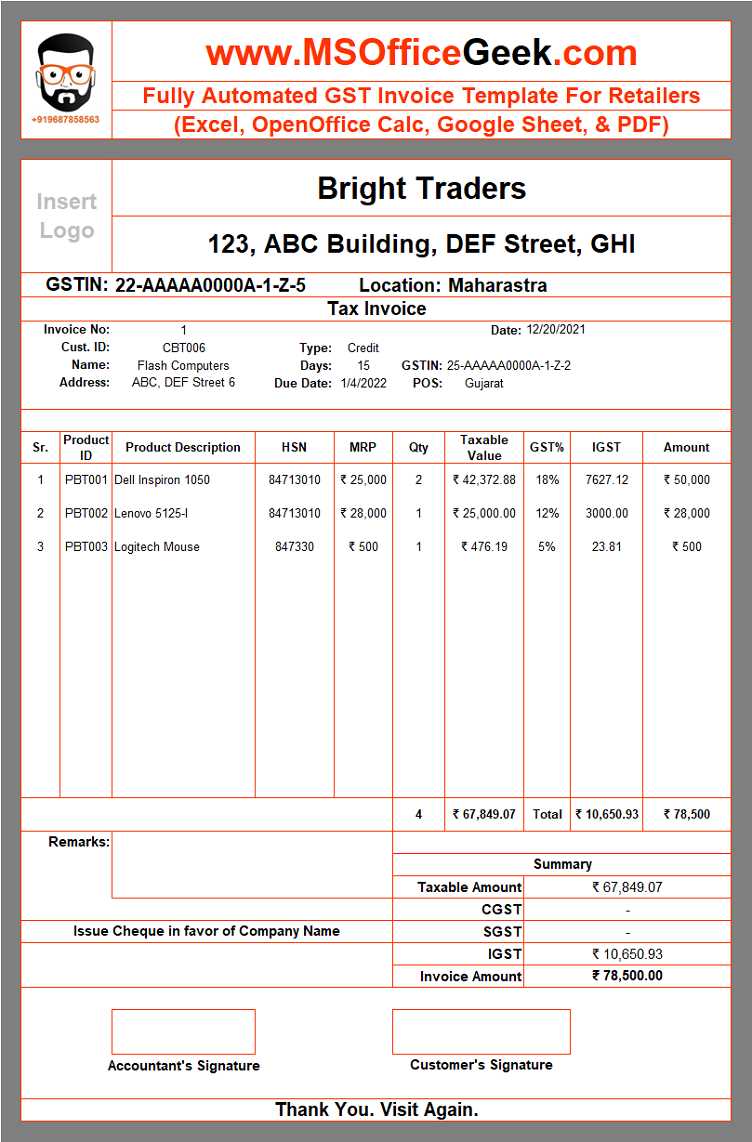

- Currency and Tax Information: Ensure the document reflects the correct currency and includes any applicable tax rates or exemptions.

Steps for Customization

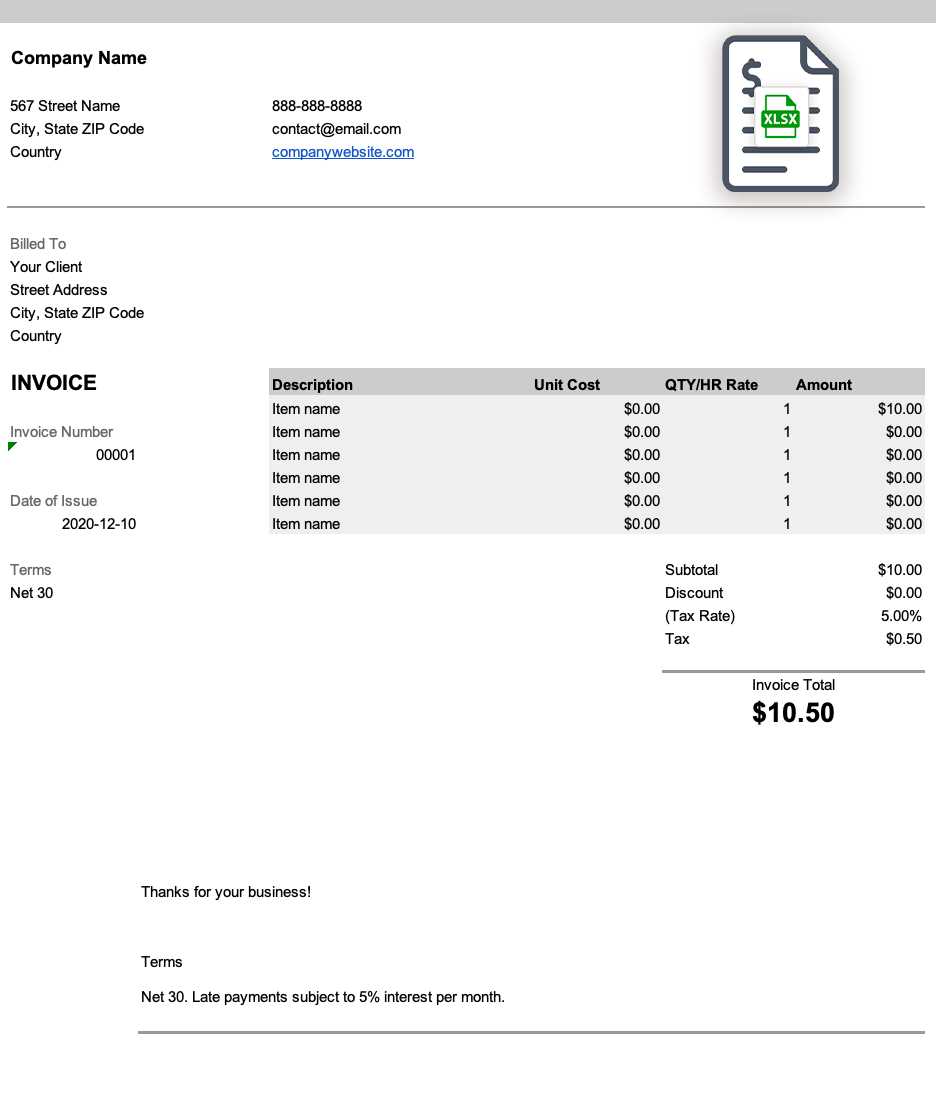

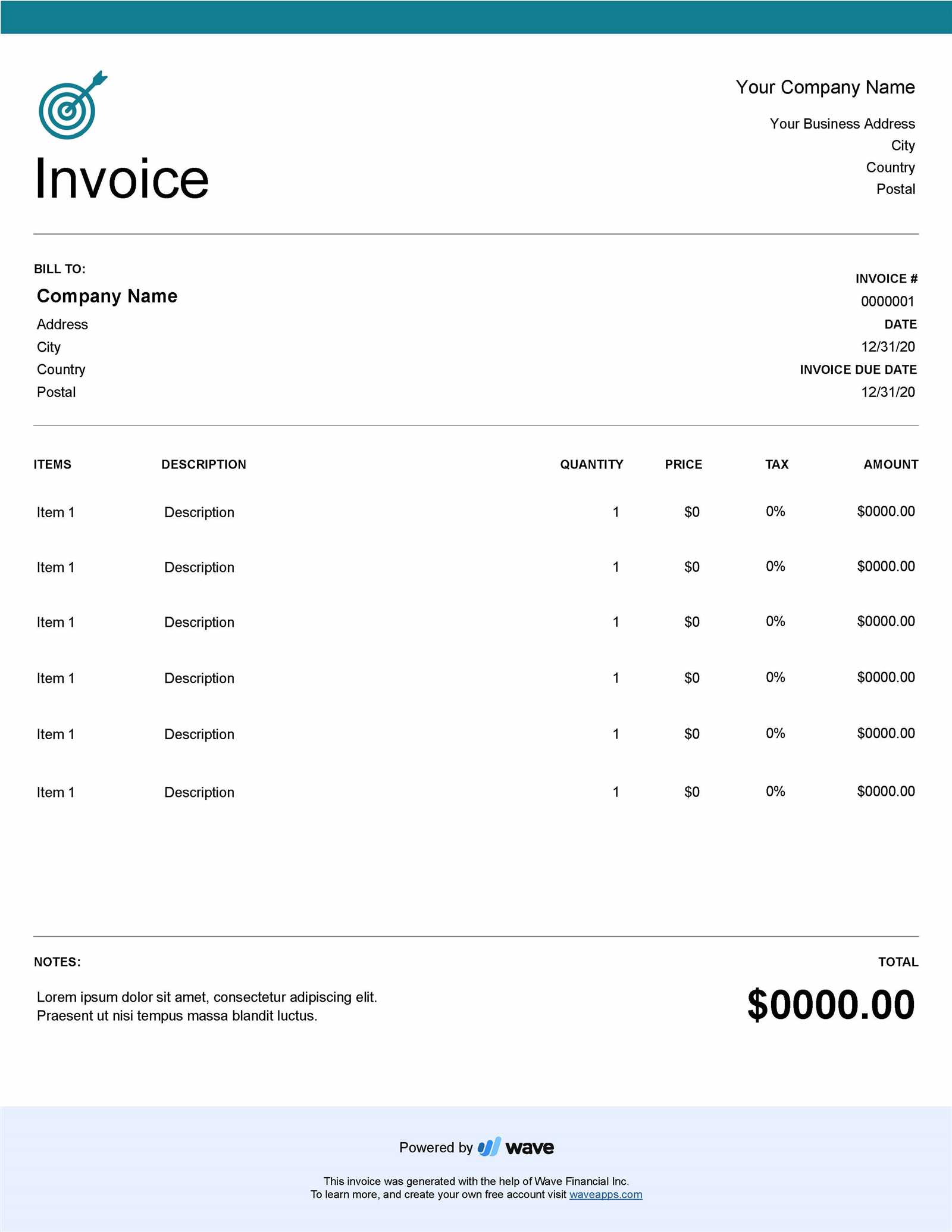

- Choose a layout: Select a clean and easy-to-read design that aligns with your business style.

- Insert your brand elements: Add your logo, colors, and business details to create a consistent brand identity.

- Fill in necessary information: Enter client details, services provided, and pricing information as per each transaction.

- Review for accuracy: Double-check all fields to ensure no errors, as mistakes can delay payments and cause confusion.

- Save for future use: Once customized, save the document as a reusable template for future transactions.

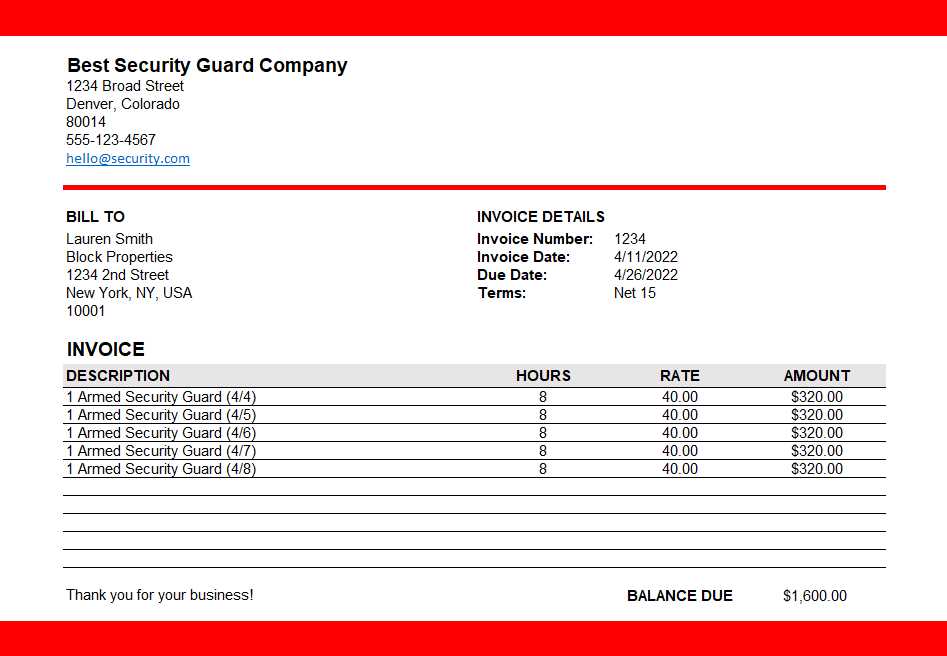

Key Elements of an Invoice Bill

To ensure smooth financial transactions, certain elements must be included in any document used for recording charges. These components not only make the document more professional but also ensure that both parties clearly understand the terms of the agreement. A well-structured document will facilitate accurate processing and payment, while minimizing confusion or errors.

Each part of the document plays a specific role, from detailing the items or services provided to specifying payment terms. Let’s explore the core elements you need to include to create a comprehensive and effective record of a transaction.

Essential Information to Include

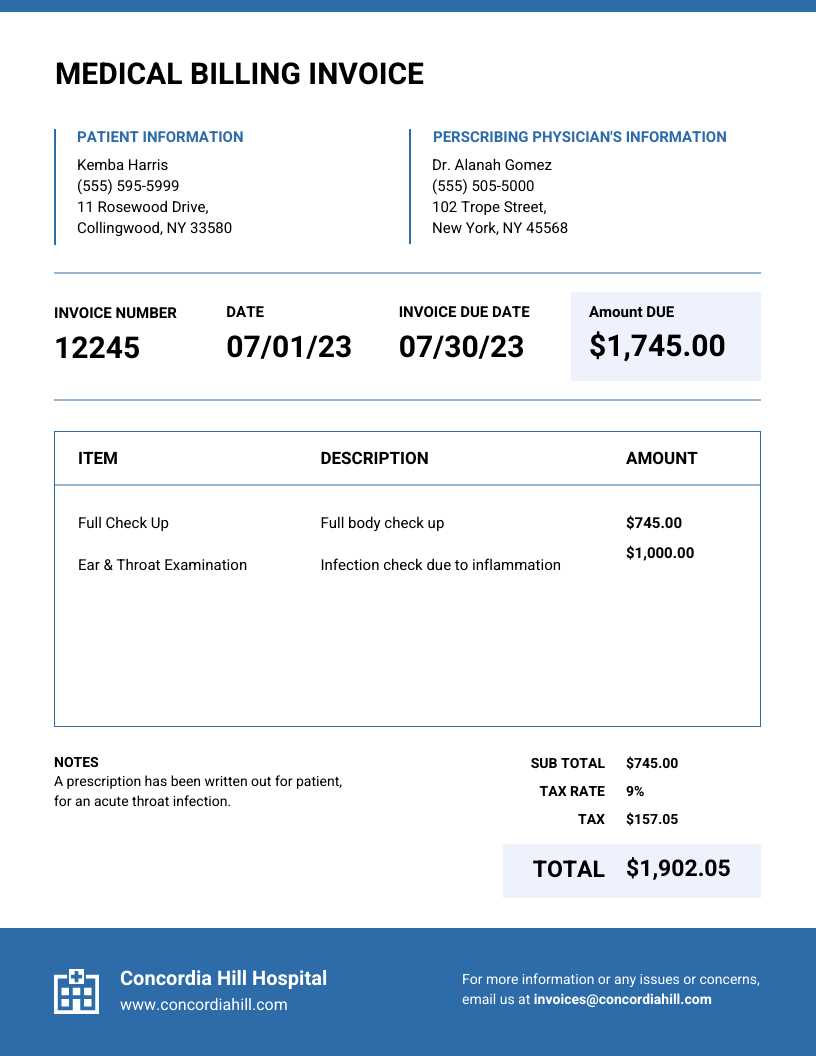

- Business and Client Details: Clearly state the name, address, and contact information for both parties involved in the transaction.

- Document Number: Assign a unique reference number to each document for easy tracking and organization.

- Description of Goods or Services: Provide detailed descriptions of the items or services provided, including quantities, unit prices, and any applicable discounts.

- Total Amount Due: Clearly state the total amount owed, including any taxes, shipping fees, or additional charges.

- Payment Terms and Due Date: Specify the payment deadlines, accepted payment methods, and any late fees or interest charges that may apply.

- Tax Information: Include the applicable tax rate and the amount charged, if required by local laws or business practices.

Optional but Useful Additions

- Notes or Special Instructions: Include any additional comments or special instructions that might be relevant to the transaction.

- Discounts or Promotions: If applicable, highlight any discounts applied to the total amount, as well as the reason for them.

- Payment Instructions: Provide clear instructions for how and where to make the payment, including bank account details or online payment links.

Choosing the Right Template for Your Business

Selecting the right format for recording financial transactions is essential for ensuring efficiency and professionalism in your operations. The right design should not only meet the needs of your business but also reflect your brand identity. Whether you are a freelancer or a large company, having a well-organized and adaptable document can help streamline your accounting process and improve client relations.

When choosing the right structure for your needs, there are several factors to consider, such as the type of business you run, the volume of transactions, and whether you need additional features like tax calculations or payment reminders. Below is a comparison of key factors to keep in mind when making your choice:

| Factor | Freelancers | Small Businesses | Larger Enterprises |

|---|---|---|---|

| Customization | Basic customization for services | Need for more sections like taxes, discounts | Highly customizable with integrated accounting systems |

| Design | Simple, clean layout | Professional design with brand elements | Advanced design with logo, complex details |

| Frequency of Use | Infrequent, ad-hoc | Regular, often recurring | Frequent, automated with accounting tools |

| Required Features | Basic fields: client, services, amount | Additional fields for tax, payment terms | Automated calculations, multi-currency support |

By understanding your business needs, you can select the most appropriate design that not only ensures clarity and professionalism but also supports your specific financial processes. Whether you opt for a simple, straightforward format or a more complex, feature-rich one, the right choice will ultimately help you manage your financial operations more efficiently.

Free vs Paid Invoice Templates

When choosing a format for documenting financial transactions, businesses often face the decision of whether to use a free or paid option. Both types offer distinct advantages and limitations, depending on the specific needs of your business. While free options may seem appealing due to their cost-effectiveness, paid solutions often provide additional features and customization that can save time and improve professionalism.

In this section, we’ll compare the key differences between free and paid solutions, helping you decide which one best suits your requirements. Consider factors like ease of use, customization options, and long-term value when making your choice.

| Factor | Free Options | Paid Options |

|---|---|---|

| Cost | Free, no upfront cost | Requires a one-time payment or subscription |

| Customization | Limited customization and features | Highly customizable with advanced features |

| Professional Design | Basic or generic designs | Premium, polished designs with branding options |

| Automation | Manual input, no automation | Automation of calculations, reminders, and recurring payments |

| Support | Minimal or no support | Customer support and regular updates |

Ultimately, the decision between free and paid options depends on your business’s specific needs and budget. Free options are ideal for small businesses or freelancers who need simple, straightforward documents. On the other hand, paid solutions may be more beneficial for larger operations or those requiring advanced features and frequent customization.

How to Use an Invoice Template Effectively

To make the most of a pre-designed document for recording charges, it’s essential to use it in a way that enhances efficiency and accuracy. A well-structured document is only as useful as the way it’s filled out and managed. By following some simple guidelines, you can ensure that your records are clear, professional, and reliable every time.

One of the key factors in using such a document effectively is consistency. By consistently applying the same format for every transaction, you create a predictable structure that both you and your clients can easily follow. This also helps avoid mistakes and ensures that all necessary details are captured each time.

Steps for Effective Use

- Choose the Right Format: Select a structure that fits the specific needs of your business and clients. Whether you require a basic layout or a more complex design, ensure it covers all essential details such as services provided, payment terms, and client information.

- Keep Information Consistent: Use the same fields and structure across all documents. This ensures that you don’t miss important details and provides a cohesive experience for your clients.

- Fill Out Details Accurately: Double-check the information you input, especially pricing, quantities, and payment dates. Small errors can cause confusion or payment delays.

- Stay Professional: Keep the design clean and easy to read. Avoid cluttering the document with unnecessary information or excessive graphics. A simple, well-organized layout enhances professionalism.

- Save Time with Automation: If your document solution allows for it, automate calculations and recurring fields to reduce manual work and increase accuracy.

Common Mistakes to Avoid

- Leaving Fields Empty: Always fill in all relevant sections, including client information, payment terms, and item descriptions. Missing details can cause confusion and delay payments.

- Using Unclear Terminology: Avoid ambiguous language. Be clear and specific about the products or services provided to ensure there are no misunderstandings.

- Time Efficiency: Pre-made structures save you time by eliminating the need to create a new document from scratch for every transaction.

- Consistency: Using the same format for each transaction ensures uniformity, making your financial records easier to track and manage.

- Professional Appearance: A polished, organized document makes a positive impression on clients, helping to establish your business as credible and reliable.

- Minimized Errors: By using a predefined structure, you reduce the chances of missing critical information or making mistakes in pricing and calculations.

- Ease of Customization: You can easily tailor the document to suit specif

Best Tools for Creating Invoice Templates

Choosing the right software to create your financial transaction documents can significantly enhance your workflow. The best tools allow for easy customization, accurate calculations, and professional design, helping you produce high-quality records every time. Whether you need a simple layout or a more advanced solution with automation, the right tool will streamline the process and ensure consistency across your records.

There are several options available, each offering unique features to cater to different business needs. From free online platforms to advanced paid software, the right tool depends on the complexity of your requirements and the frequency of document creation. Let’s explore some of the best tools for creating efficient and professional financial documents.

Top Free Tools

- Google Docs: A simple yet effective solution for creating custom documents. You can use existing templates or create your own from scratch, with easy sharing and collaboration features.

- Wave: An online tool offering free templates with basic customization options. It’s ideal for freelancers and small businesses looking for a straightforward solution without extra features.

- Zoho Invoice: A free tool with a clean, user-friendly interface, perfect for small businesses and freelancers. It allows for easy creation and management of professional records, with several customization options.

Top Paid Tools

- QuickBooks: A comprehensive accounting solution that includes automated record creation, tax calculations, and integration with other business management tools. Ideal for larger businesses or those needing advanced features.

- FreshBooks: A highly-rated tool that offers customizable documents, recurring billing, and time tracking. It’s designed for freelancers and small businesses looking to streamline their financial processes.

- Invoicely: A versatile, cloud-based tool with both free and paid plans. The premium versions offer additional customization options, integrations, and advanced features like recurring invoicing and multi-currency support.

Each of these tools offers a unique set of features that can help you generate accurate and professional documents with ease. The choice between free and paid options will depend on your specific needs, but any of these solutions can improve the efficiency of your billing and payment process.

How to Add Payment Terms in Invoices

Clearly stating payment terms in financial documents is essential for ensuring that both parties are on the same page regarding the timing and method of payment. These terms help set expectations, reduce misunderstandings, and ensure timely payments. By defining when and how payments should be made, you protect your business and foster trust with your clients.

Payment terms typically include details about the due date, acceptable payment methods, and any consequences for late payments. This section is crucial for avoiding confusion and ensuring smooth transactions. Below, we’ll walk through the steps to effectively include payment terms in your documents.

Key Payment Terms to Include

- Due Date: Clearly specify the date by which payment should be made. Common options include “net 30” (due 30 days after the issue date) or “due upon receipt” (payment expected immediately upon receiving the document).

- Accepted Payment Methods: Indicate the methods through which payment can be made, such as bank transfer, credit card, PayPal, or other online payment systems.

- Late Fees or Penalties: To encourage timely payments, outline any late fees or interest charges that will apply if the payment is not received by the specified due date.

- Discounts for Early Payments: If applicable, offer discounts for clients who pay early, such as a 2% discount if payment is made within 10 days.

- Partial Payments: Clarify whether partial payments are acceptable, and if so, how they will be applied toward the total amount due.

Steps to Add Payment Terms

- Locate the Payment Section: In your document, create a dedicated section for payment terms, typically placed near the total amount due or at the end of the record.

- Be Specific: Avoid vague language. Use precise dates and clear terms to ensure there is no confusion abo

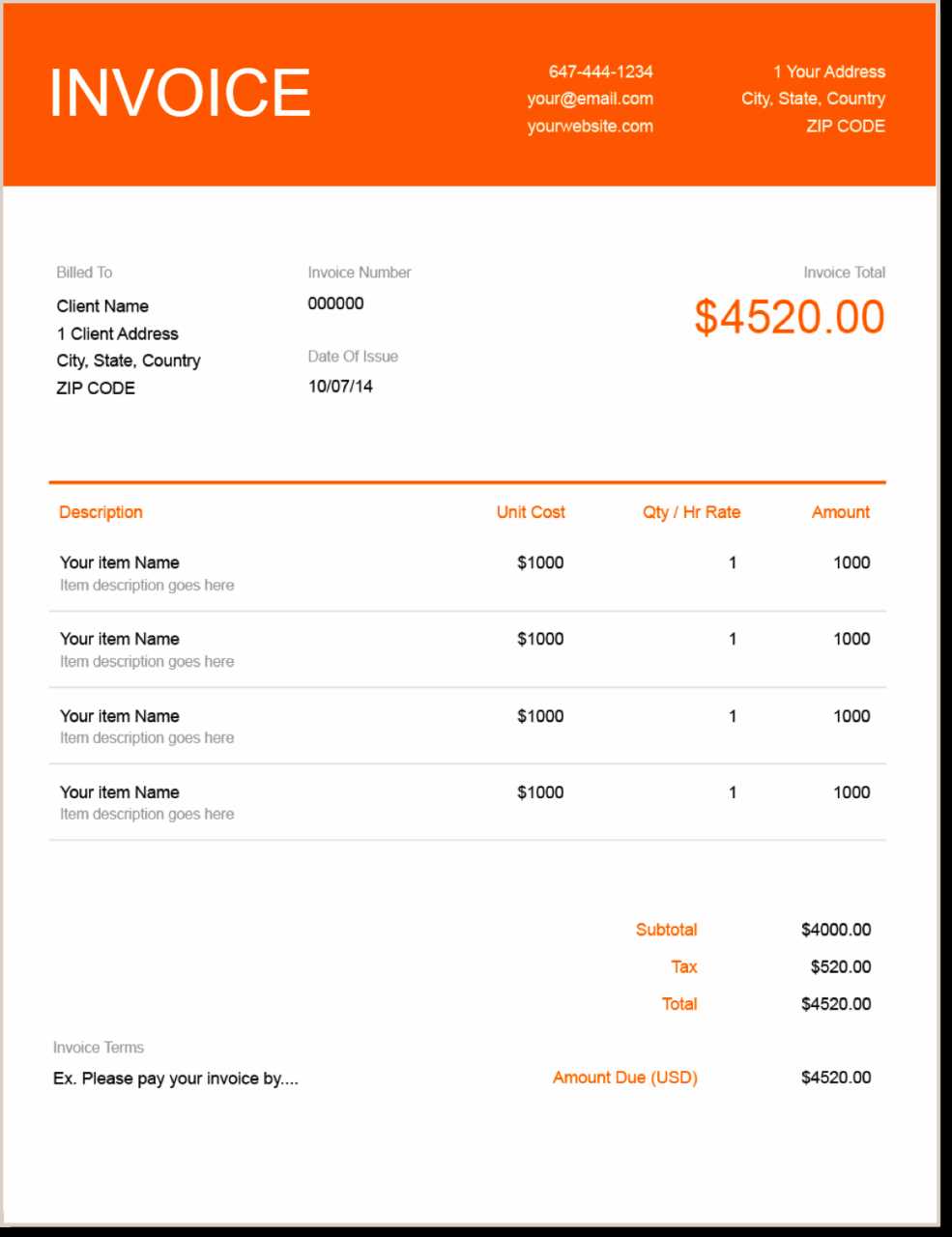

Formatting Your Invoice Template for Clarity

A well-organized and clear document is key to ensuring that both you and your clients understand the details of a transaction. Proper formatting not only makes the content easier to read but also helps to present the information in a logical and professional manner. By following a few simple guidelines, you can create a visually appealing and effective document that leaves no room for confusion.

Effective formatting involves arranging the key information in a way that guides the reader’s eye through the document. This means using headings, bullet points, and a clean design to separate important sections. Below are some best practices for formatting that can help you achieve clarity and professionalism in your financial records.

Best Practices for Formatting

- Use Clear Headings: Break down the document into sections with easy-to-read headings, such as “Client Information,” “Itemized List,” and “Total Amount Due.” This helps readers navigate the document with ease.

- Prioritize Important Information: Ensure that the most critical details, like payment amounts and due dates, are prominently displayed. You can use bold text or larger fonts to make this information stand out.

- Align Text Properly: Align headings and data in a consistent manner. For example, center-align the document title and client information, while left-align numerical data like item prices and totals for easier reading.

- Use Bullet Points for Lists: When listing products, services, or other key details, use bullet points or numbered lists to make the information easier to follow.

- Maintain Ample White Space: Avoid clutter by leaving sufficient space between sections. This improves readability and makes the document look more organized.

- Highlight Key Dates: Use a different font style or color to highlight important dates, such as the due date or payment date, so they stand out clearly.

Additional Tips for Visual Appeal

- Use Professional Fonts: Stick to clean, professional fonts like Arial or Times New Roman. Avoid using too many font styles, as this can make the document look unorganized.

- Limit Color Usage:

Common Mistakes to Avoid in Invoices

When preparing documents to request payment, accuracy is critical to avoid misunderstandings or payment delays. Even small errors can lead to confusion and potentially harm your business relationships. By being aware of common mistakes, you can ensure that your documents are always clear, professional, and effective in facilitating timely payments.

Below are some frequent mistakes that businesses make when preparing payment requests. Recognizing and correcting these issues will help you maintain smooth and efficient financial transactions.

Frequent Errors to Watch For

- Missing or Incorrect Client Information: Failing to include the correct client name, address, or contact information can cause delays in payment and potential confusion. Always double-check client details before sending.

- Unclear Payment Terms: Not specifying clear payment terms, such as due dates or late fees, can lead to misunderstandings. Make sure payment expectations are explicitly stated, including payment methods and deadlines.

- Calculation Errors: Mistakes in totaling amounts, taxes, or discounts can result in disputes or delayed payments. Double-check all figures, especially when adding multiple items or services.

- Failure to Include a Unique Reference Number: Without a unique reference number or code, it can be difficult to track payments, particularly for repeat clients. Ensure each document is uniquely identifiable for your records and your client’s.

- Omitting the Date of Issue: The absence of an issue date can confuse payment timelines. Always include the date the document was created or sent to ensure clarity about when payment is expected.

How to Avoid These Mistakes

- Review Every Detail: Before sending the document, take a few moments to carefully review all details, from client information to the payment amounts and due dates.

- Use Automated Calculations: Many software solutions offer automated totals and tax calculations, which can significantly reduce the risk of errors.

- Be Consistent: Ensure that your formatting, terminology, and document structure remain consistent across all transactions. This will help you avoid confusion and keep things organized.

- Include a Clear Payment Section: Always make sure that the payment terms are highlighted and easy to find, and include a clear breakdown of the amount due, payment methods, and any other necessary details.

By avoiding these common mistakes and being mindful of the details, you can ensure that your payment requests are clear, professional, and effective in securing timely payments.

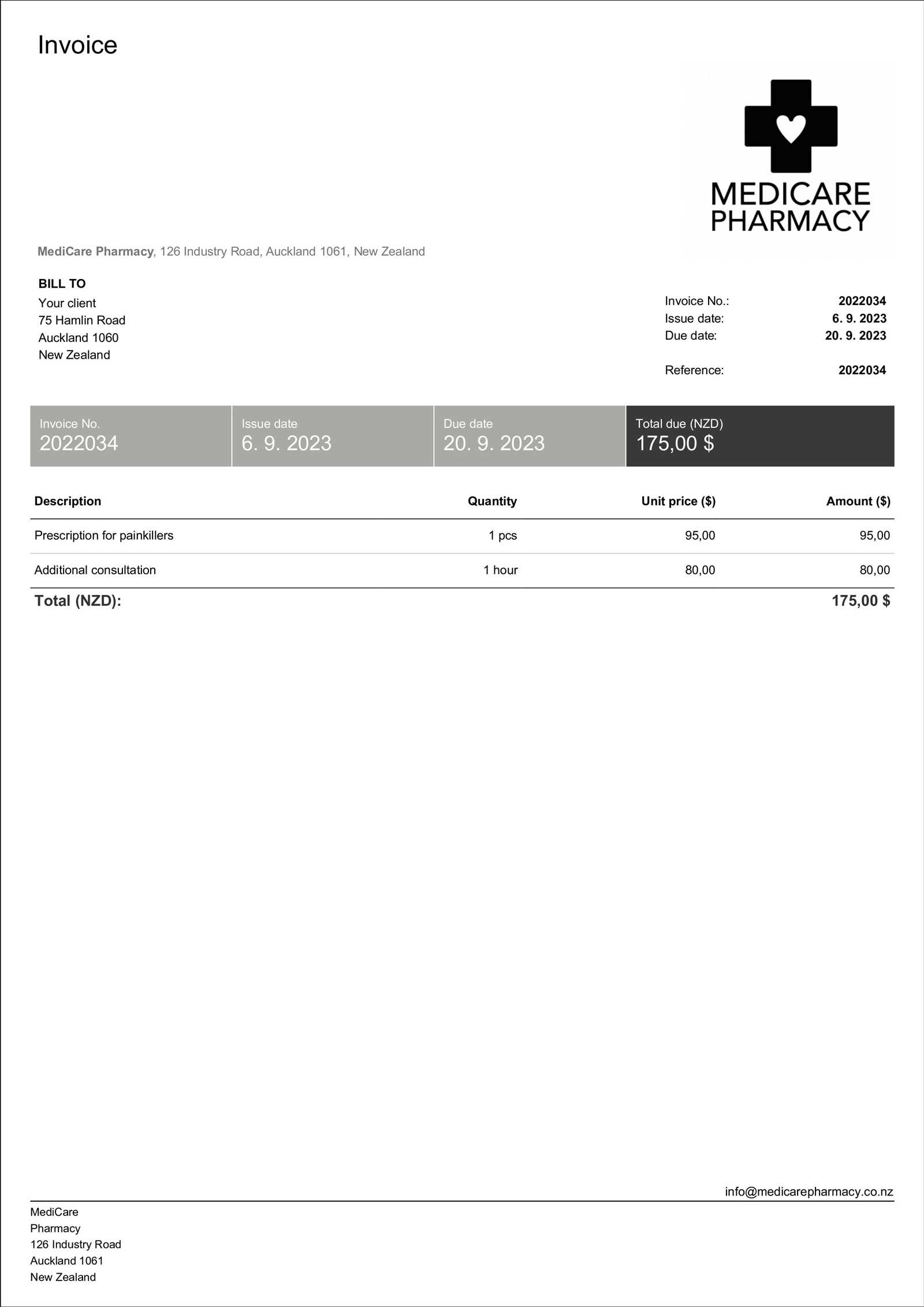

How to Include Taxes in Invoice Templates

Including taxes in financial documents is crucial for ensuring compliance with local regulations and providing clients with a clear understanding of the total cost. Whether you’re charging sales tax, VAT, or another type of tax, it’s important to show these details transparently. Properly incorporating taxes into your documents not only helps avoid legal issues but also ensures that clients know exactly what they are paying for.

In this section, we will guide you through the process of adding taxes to your financial documents, ensuring that all the necessary information is accurately displayed and easily understood by your clients.

Steps to Include Taxes Correctly

- Determine the Tax Rate: Before adding taxes, make sure you know the applicable tax rate based on your location or the client’s location. Different regions may have different rates depending on the nature of the product or service being provided.

- Specify the Tax Type: Clearly label the tax type you are charging, such as sales tax, VAT, or GST. This helps your clients understand exactly what they are being charged for and why.

- Include a Tax Breakdown: Provide a separate line for the tax amount on the document, distinct from the product or service charges. This allows clients to see the cost before and after taxes are applied.

- Show the Total Amount: Ensure the total amount due includes both the pre-tax charges and the tax amount. It’s important that the tax is added to the final total so your client knows exactly how much they need to pay.

- Keep It Clear and Transparent: Avoid confusion by formatting the tax information clearly. Use simple language, and ensure that both the tax rate and the tax amount are easy to find on the document.

Example Breakdown of Taxes in a Financial Document

Description Amount Product A $100.00 Generating Invoices from Templates Automatically

Automating the creation of payment requests is an efficient way to save time and ensure consistency in your business processes. By using automation tools, you can generate detailed financial documents quickly, reducing the risk of human error and streamlining your workflow. Whether you’re a freelancer or a large enterprise, automation allows you to focus on your core tasks while handling the administrative side of things effortlessly.

This process typically involves using software that pulls information from your database or accounting system, filling in the necessary fields, and creating a professional-looking document without any manual input. Here’s how automation can benefit your business and the steps to set it up effectively.

How Automated Generation Works

- Integrating with Your System: The first step is to link your financial system or CRM software with the tool you’re using to automate document generation. This integration allows the software to pull client details, payment terms, and itemized lists directly from your records.

- Template Customization: Choose or create a customizable layout that suits your business needs. These tools offer a variety of designs and options to personalize your documents, ensuring they are professional and aligned with your brand.

- Data Population: Once the system is set up, the software will automatically populate the fields based on your pre-existing client and transaction data. You can also set recurring billing schedules for clients with regular transactions.

- Automatic Sending: Some tools allow for automatic delivery via email or through client portals, ensuring that your clients receive the document promptly without manual intervention.

Benefits of Automatic Generation

- Time Savings: Automation eliminates the need to manually enter client details, item prices, and other data. This allows you to generate documents in seconds instead of hours.

- Consistency: Automated systems reduce the risk of errors in formatting or calculations, ensuring that each document is generated accurately every time.

- Increased Professionalism: Automation tools allow you to produce documents with a clean and polished layout, making your business appear more organized and professional.

- Improved Cash Flow: With automation, you can set up reminders and recurring billing cycles, ensuring that payments are requested in a timely manner and reducing the chances of missed or late payments.

Example of Automatic Data Population

Description Amount Invoice Template Best Practices for Small Businesses

For small businesses, creating clear, professional, and consistent payment requests is essential for maintaining good client relationships and ensuring prompt payments. Whether you’re just starting out or looking to streamline your invoicing process, adopting best practices can significantly improve your business’s cash flow and operational efficiency. Following a structured approach will help avoid common mistakes and present your business in the best light.

In this section, we will outline the key best practices that small businesses should follow when creating payment documents, ensuring that all essential details are included and that your clients have a smooth experience when receiving and processing payments.

Key Practices for Effective Payment Documents

- Use a Consistent Format: Establish a standard layout for all your documents. This ensures that your clients can quickly understand the details each time. A consistent format also reinforces your brand’s identity and professionalism.

- Clearly State Payment Terms: Always specify the payment due date, accepted methods, and any late fees. This sets clear expectations and reduces the chances of disputes or delayed payments.

- Break Down Charges: Clearly itemize the products or services provided. Clients should be able to see exactly what they are being charged for, including quantities, rates, and any applicable taxes or discounts.

- Include Contact Information: Make sure your contact details are easy to find on the document. This includes your business name, address, phone number, and email address, in case your client has any questions or needs clarification.

- Include a Unique Identifier: Each document should have a unique reference number to make tracking easier. This is especially important when you have multiple clients or frequent transactions.

Additional Tips for Small Business Success

- Ensure Clarity and Simplicity: Keep the language simple and direct. Avoid complex terms or jargon, as this may confuse clients. The goal is for them to understand the document quickly and easily.

- Leverage Automation Tools: Consider using invoicing software or online tools to generate your documents. These tools help ensure that all fields are filled correctly and automatically, saving you time and reducing human error.

- Track Payments Effectively: Always track the payment status of your clients. This helps you identify overdue payments and send reminders if necessary, keeping your cash flow steady.

By following these best practices, small businesses can enhance their invoicing processes, reduce errors, and present a professional image to clients. With clear and consistent payment requests, you’re more likely to build trust with clients and ensure timely payments for your services.

How to Send Invoices Efficiently

Sending payment requests in a timely and organized manner is crucial for maintaining a steady cash flow. The process of sending these documents should be streamlined to reduce administrative work and ensure that clients receive the information they need promptly. By adopting efficient practices, you can ensure that your clients pay on time and that your business runs smoothly.

In this section, we will explore effective strategies for sending payment requests, including the tools and methods that can help you save time, reduce errors, and track payments with ease.

Methods for Sending Payment Requests

- Email Delivery: One of the quickest and most common methods is sending payment documents via email. This is cost-effective and allows for easy tracking. Make sure the email contains all relevant details, such as the document itself and payment instructions.

- Use of Online Portals: If your business uses a customer portal, you can upload payment documents directly to the portal, making it easy for clients to access and make payments at their convenience.

- Automated Sending: Many invoicing tools allow for automated scheduling, ensuring that payment requests are sent at the right time without manual input. This method helps avoid delays and ensures that your client receives the request when it’s due.

- Physical Mail: While less common, some businesses may still choose to send physical copies of payment requests. If doing so, ensure that your documents are sent via a reliable service to avoid delays.

Best Practices for Efficient Sending

- Double-Check All Details: Before sending a document, verify that all information–such as client name, payment terms, and itemized charges–are correct. This minimizes the risk of disputes later on.

- Keep it Professional: Use a professional email template or letterhead when se

Legal Considerations for Invoice Templates

When creating payment documents, it’s essential to ensure that they comply with relevant legal regulations. Properly formatted records not only help maintain a professional image but also protect your business from potential legal disputes. There are several key elements that should be included in these documents to make them legally binding and enforceable in case of non-payment or disputes.

This section will highlight important legal considerations that small businesses should keep in mind when preparing payment requests to ensure that they adhere to local laws and regulations. From payment terms to required information, understanding these factors can save you from costly mistakes.

Essential Legal Information to Include

- Business Details: Always include your business name, address, phone number, and any relevant registration numbers (such as a tax ID or business registration number). This ensures that the recipient knows who issued the document and how to contact you if necessary.

- Payment Terms: Clearly outline the agreed-upon payment terms, including the due date and any penalties for late payments. This helps avoid misunderstandings and can protect you legally if the terms are not met.

- Clear Itemization: Include a detailed breakdown of services or products provided, including quantities, rates, and discounts. This transparency is crucial for avoiding disputes over pricing and ensuring that clients understand exactly what they are being charged for.

- Legal Language: Use clear, concise language that describes the terms of the payment and any actions that will be taken in the event of non-payment. For example, include statements such as “Payments not received by the due date will incur a late fee of X%.” This can serve as an enforceable agreement in case of late payments.

- Jurisdiction and Dispute Resolution: It is often advisable to include a clause specifying the jurisdiction under which disputes will be resolved. This is particularly important for businesses that operate across multiple regions or countries.

Common Legal Pitfalls to Avoid

- Failure to Specify Due Dates: Not including a specific due date can lead to confusion and delays in payment. Always include an exact date when the payment is due.

- Vague Terms of Service: Avoid using vague or ambiguous language in your payment terms. Be as specific as possible regarding discounts, penalties, or any additional charges that may apply.

- Non-compliance with Local Laws: Ensure that your documents comply with local tax laws, including any applicable taxes that must be included in the total amount. Failure to do so could result in penalties or legal issues with authorities.

- Not Providing Proper Documentation: Some businesses may be required by law to issue receipts or provide specific documentation for tax purposes. Be sure that your documents meet these requirements to avoid potential issues.

By including all the necessary legal elements and avoiding common mistakes, you ensure that your payment documents not only facilitate smooth business transactions but also protect your interests in the event of disputes. Being diligent about legal compliance can make a significant difference in how your business is perceived and help prevent costly legal issues down the road.

Benefits of Using an Invoice Template

Utilizing a pre-designed structure for recording financial transactions offers numerous advantages that can streamline your workflow and enhance professionalism. Such a resource not only saves time but also ensures that your documents are consistently clear, accurate, and complete. When you use a well-organized format, both you and your clients benefit from a more efficient and transparent billing process.

These ready-made documents help you maintain a standard across all transactions, reducing the risk of errors and confusion. By automating certain elements and ensuring that all relevant details are included, you can focus more on growing your business and less on administrative tasks.