Invoice Attached Email Template for Clear Communication

In professional correspondence, sending financial documents requires a clear and polite approach to ensure smooth transactions. When sharing important payment details, it’s crucial to maintain a formal yet friendly tone, making sure that your message is understood and that your expectations are clear.

Clear communication is key when requesting payments. A well-crafted message not only provides the necessary details but also conveys professionalism. By structuring your correspondence in a way that is both informative and approachable, you can facilitate quicker responses and avoid misunderstandings.

For many businesses, the way financial documents are sent can reflect their commitment to professionalism. A thoughtful approach, including the right language and format, can help build trust with clients and encourage timely action on their part. Investing time into perfecting this communication style can pay off in both efficiency and client relationships.

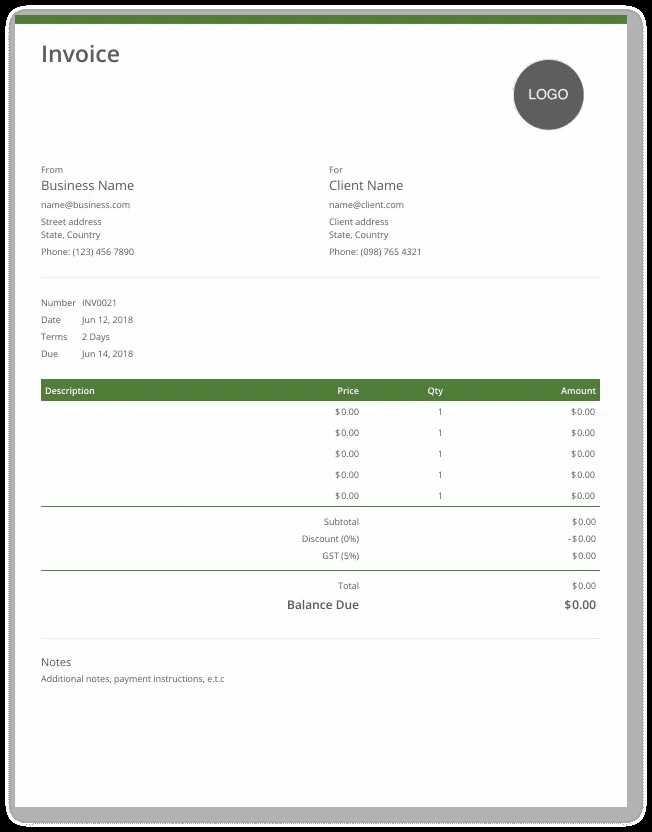

Invoice Email Template Basics

When sending payment-related documents, it’s important to create a message that is both professional and easy to understand. This section covers the basic components necessary for crafting a communication that serves its purpose effectively, ensuring that the recipient has all the details needed to proceed with the transaction.

The key to an effective message is clarity. By including all the relevant information in a structured and concise manner, you can avoid confusion and improve the chances of a timely response. A well-organized communication also helps maintain a professional image for your business.

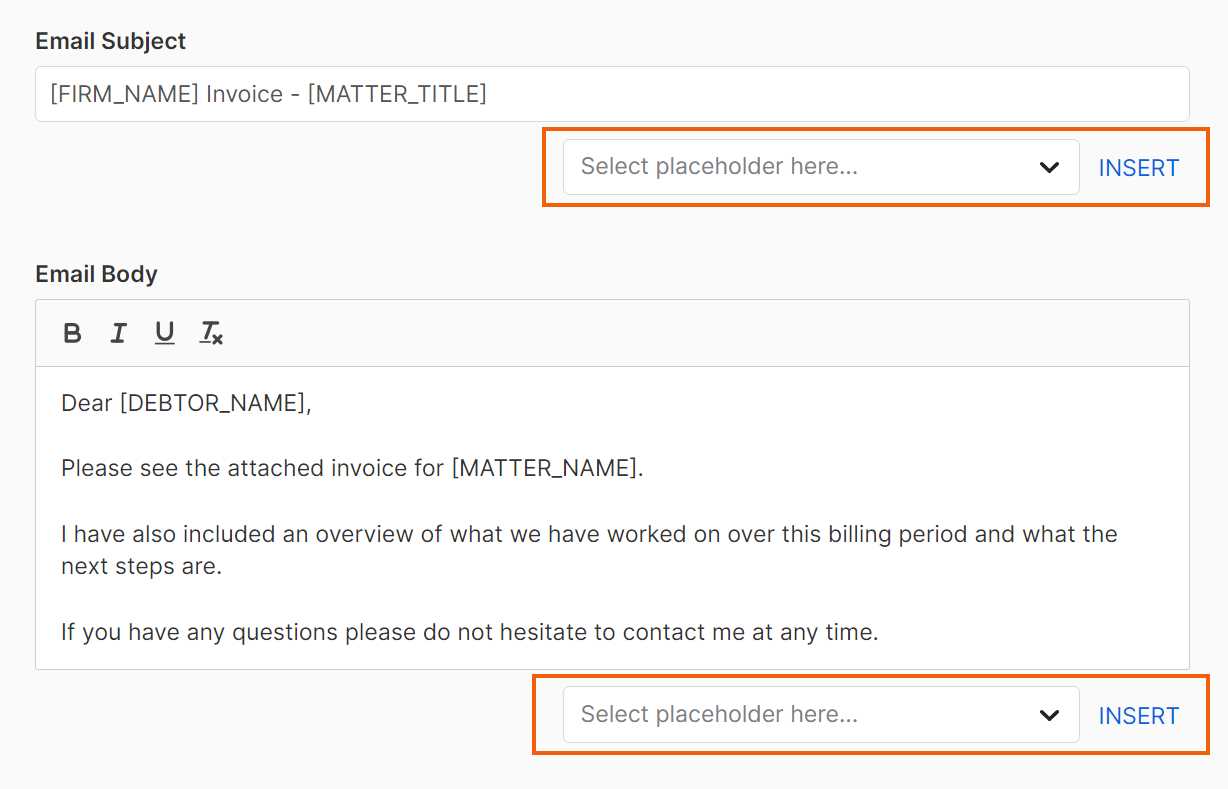

- Subject Line: Keep it simple and to the point. Ensure the subject clearly reflects the purpose of the message, making it easy for the recipient to identify its importance.

- Greeting: Always use a formal greeting, addressing the recipient by their name if possible. This sets a respectful tone for the message.

- Message Body: Clearly explain the purpose of the document, specifying the amount due, due date, and any other important details. Avoid long paragraphs; use bullet points if necessary to break down the information.

- Call to Action: Encourage the recipient to take action by clearly stating the next steps, such as making a payment or confirming receipt of the document.

- Closing: End the message politely with a thank you and a professional sign-off.

By following these basic guidelines, you can ensure that your communication is not only professional but also effective in encouraging prompt payment. A clear and straightforward message is essential for maintaining smooth business operations.

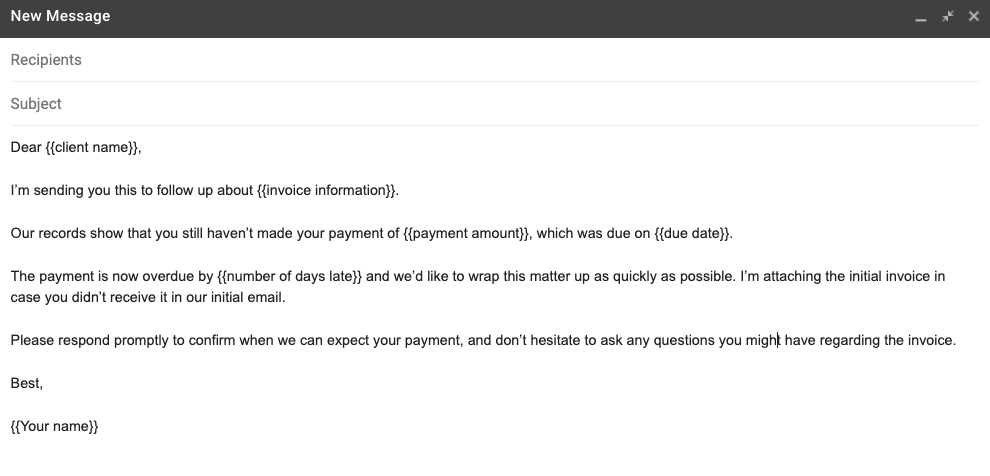

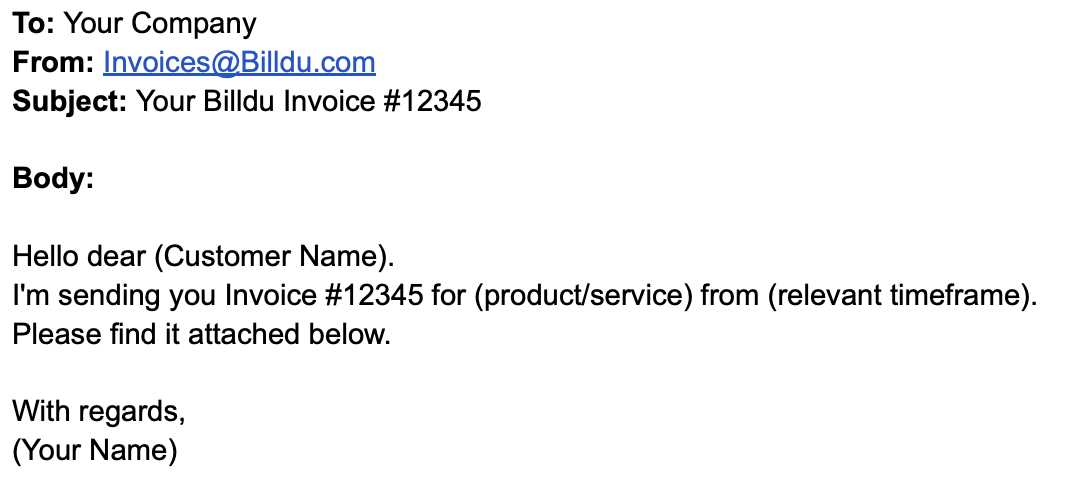

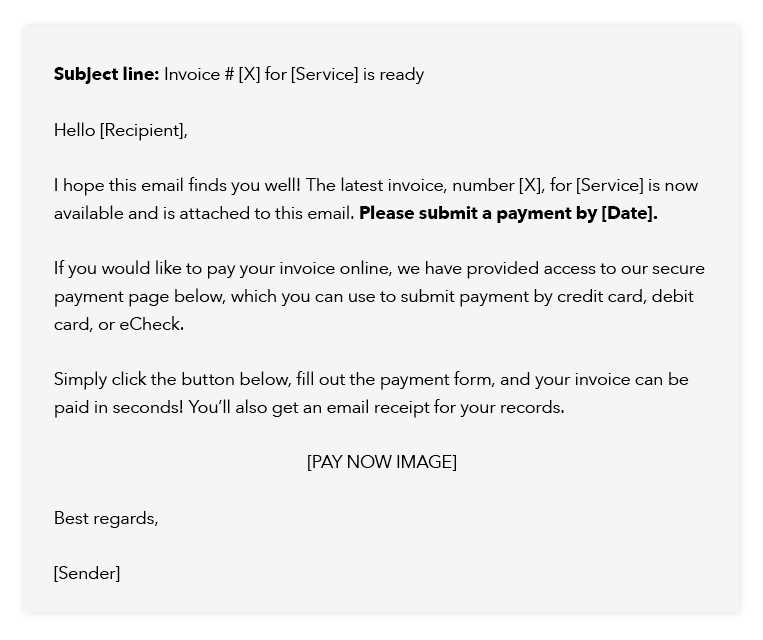

How to Craft a Professional Message

Creating a polished and professional message requires attention to tone, clarity, and structure. When composing correspondence related to financial matters, it’s essential to convey the necessary details in a way that is both respectful and clear, ensuring the recipient understands what is required from them.

To start, use a clear subject line that immediately communicates the purpose of the message. A straightforward and concise subject helps the recipient prioritize the communication. For example, instead of a vague subject, opt for something like “Payment Details for Upcoming Due Date”.

Next, begin the message with a respectful greeting such as “Dear [Name],” or “Hello [Name],”. Personalizing the greeting adds a touch of professionalism and warmth to the message. This small gesture can make the recipient feel valued.

Ensure that the main content of the message is structured logically and without ambiguity. Include key details like the amount due, the due date, and any other necessary instructions. Keeping the language simple and to the point ensures that your message is easy to follow. Avoid long, complicated sentences that may confuse the recipient.

Finally, close with a courteous sign-off such as “Best regards” or “Sincerely,” followed by your name and business details. This creates a professional and respectful conclusion to the correspondence.

Key Elements in Invoice Emails

When sending financial documents through formal communication, it’s essential to include specific details that ensure the recipient has all the necessary information. A well-crafted message helps avoid confusion and ensures the prompt handling of the matter at hand.

Clear Identification: The subject line should immediately reflect the content of the message. A straightforward and descriptive subject allows the recipient to easily recognize the purpose of the communication and prioritize it accordingly.

Precise Payment Information: Include important details such as the amount due, the due date, and any relevant reference numbers. This makes it clear what is expected and helps the recipient quickly understand the financial requirement.

Payment Instructions: Make it easy for the recipient to know how to proceed by outlining the payment methods and steps clearly. Whether you prefer bank transfers, online payments, or other methods, providing simple instructions helps reduce delays and misunderstandings.

Polite Tone: Maintaining a courteous and professional tone throughout the message fosters positive communication. A simple “Thank you for your business” or “We appreciate your prompt attention” can enhance the relationship between both parties.

Contact Information: Always include your contact details in case the recipient has any questions or needs clarification. Offering a way to easily get in touch builds trust and ensures a smoother process.

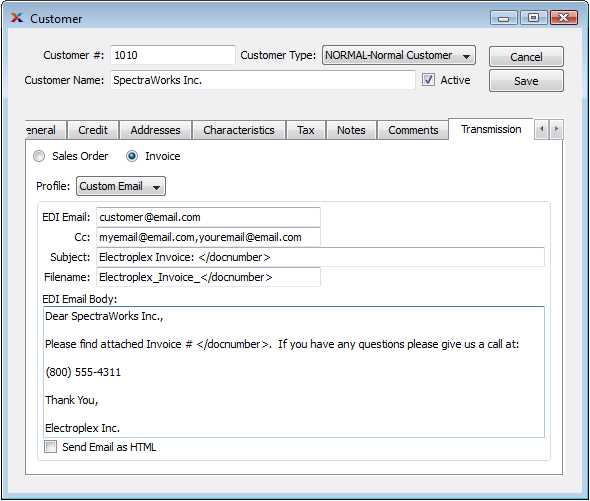

Personalizing Your Invoice Email

Personalization plays a crucial role in ensuring that your message feels tailored and professional. By addressing the recipient in a way that acknowledges their relationship with your business, you can strengthen the communication and foster a more positive response. This approach can improve engagement and make the process more efficient for both parties.

Addressing the Recipient by Name

Start by using the recipient’s name in the greeting. A simple “Dear [Name]” or “Hello [Name]” immediately creates a more personal tone, showing that you’ve taken the time to address them individually. This small gesture can help to build trust and make the communication feel less transactional.

Customizing the Content

Tailor the message to reflect the specific nature of the transaction. For instance, you can reference prior conversations or agreements, and acknowledge any special terms. Mentioning details such as the services provided or specific items purchased makes the message more relevant to the recipient, enhancing the overall experience.

Best Practices for Invoice Attachments

When sending important documents related to payments, it’s essential to follow best practices to ensure the recipient receives the information clearly and securely. Proper handling of these files not only maintains professionalism but also helps prevent any issues related to accessibility or confusion.

Ensure File Format Compatibility

One of the most important aspects of sharing documents is choosing a file format that is accessible to the recipient. PDFs are widely preferred due to their universal compatibility and ability to preserve the document’s layout. Ensure that the file is easy to open, even for recipients who may not be familiar with specific software.

Clearly Label Files

Give the document a clear and descriptive name. Avoid generic file names like “document1” or “file123”. Instead, use a label that identifies the content and includes relevant details such as the due date or the recipient’s name. For example, “Payment-Details-John-Doe-October2024” will make it easier for the recipient to locate and organize the file.

Keep File Size Manageable. Large files can cause problems for recipients with slower internet connections or email size limits. If the document is large, consider compressing the file or using a cloud-sharing service to provide a link instead.

By following these best practices, you ensure that the documents are not only accessible but also professional, making the transaction process smoother and more efficient for all parties involved.

Why a Polite Tone Matters

Maintaining a respectful and courteous tone in professional correspondence is crucial, especially when discussing financial matters. A polite approach helps foster positive relationships, encourages timely responses, and reduces misunderstandings. Whether you are reminding someone about a payment or providing important details, how you communicate can impact the outcome of the interaction.

Building Trust and Rapport

A polite tone helps build trust between you and the recipient. When financial details are involved, recipients are more likely to engage positively when they feel respected. Some key benefits of using a courteous tone include:

- Encouraging cooperation: A respectful message sets a cooperative tone, making the recipient more willing to act promptly.

- Reducing tension: Financial matters can sometimes be sensitive, so maintaining politeness avoids any potential conflict or discomfort.

- Strengthening relationships: Consistently polite communication builds stronger, more lasting professional relationships.

Setting a Professional Standard

By keeping a polite tone, you set a professional standard for your business. The recipient is more likely to perceive your brand as trustworthy and professional, which can enhance your reputation in the long term. This approach is not only good for resolving immediate matters but also for establishing a positive image in the industry.

Choosing the Right File Format

When sharing important documents, selecting the right file format is crucial for ensuring that the recipient can easily access and view the content. The chosen format can impact the document’s readability, accessibility, and security. Therefore, understanding the options and their benefits can help you make an informed decision.

Popular File Formats for Documents

There are several common file formats that are widely used for business documents. Each format offers different advantages depending on the type of content and how it needs to be viewed or edited:

- PDF: This format is the most universally accepted and ideal for preserving the original layout and design. It ensures that the document looks the same regardless of the device or software used by the recipient.

- Word Documents (DOCX): If the document requires editing or collaboration, this format allows the recipient to make changes easily while maintaining text formatting.

- Excel (XLSX): For spreadsheets or documents containing tables and financial data, Excel is the best choice. It allows for data manipulation and calculation while maintaining an organized structure.

Considerations for File Selection

When choosing a file format, consider factors such as:

- Compatibility: Ensure that the recipient can easily open and view the file on their device.

- Security: Some formats, like PDF, offer better security options, such as password protection, to safeguard sensitive information.

- File Size: Keep in mind that larger files can be difficult to send via email. Consider compressing files or using cloud-sharing services if necessary.

By selecting the right format, you make it easier for the recipient to engage with the document while maintaining professionalism and clarity in communication.

How to Include Payment Instructions

Clearly stating how payment should be made is an essential part of professional communication, especially when it involves financial transactions. Providing explicit instructions helps avoid confusion and ensures that the recipient knows exactly how to proceed. Whether you’re requesting payment via bank transfer, credit card, or another method, it’s important to present the details in a concise and organized manner.

Key Steps for Including Payment Details

To make the payment process as straightforward as possible, follow these steps when providing instructions:

- Specify the Payment Method: Clearly indicate which methods of payment are accepted. For example, bank transfer, online payment gateways, or checks.

- Provide Relevant Information: Include all necessary details like bank account numbers, routing codes, online payment links, or mailing addresses for checks.

- State the Payment Deadline: Be explicit about the due date for the payment to ensure prompt processing and avoid any late fees.

- Include Reference Numbers: If applicable, provide any unique reference numbers that should be mentioned when making the payment for easier tracking.

Formatting the Instructions

Present the payment details in a clear, easy-to-read format. Use bullet points, numbered lists, or short paragraphs to break down the information. This makes it more likely that the recipient will follow the instructions correctly and avoid errors.

- Example Payment Methods:

- Bank Transfer: Account Number 123456, Sort Code 654321

- Credit Card: Visit [payment link]

- Cheque: Payable to [Business Name], Send to [Address]

By providing detailed, easy-to-follow payment instructions, you increase the chances of timely and accurate payments.

Timing Your Invoice Email Effectively

Sending a request for payment at the right time is crucial for ensuring that the recipient has enough time to process it without feeling rushed. The timing of your communication not only affects how promptly the recipient responds, but it can also reflect the professionalism of your business. Understanding when to send such requests can contribute to smoother transactions and better cash flow management.

Strategically timing your message involves considering the recipient’s schedule and the typical response time required for their payment process. It’s important to balance being proactive with being considerate of their time.

Best Times to Send Payment Requests

Consider the following timing strategies to ensure your request is received and processed effectively:

| Time Frame | Reason |

|---|---|

| At the Beginning of the Month | Many clients process payments at the start of the month, so sending your message early allows them to budget accordingly. |

| Mid-Month Reminders | Sending a polite reminder midway through the month gives clients time to respond before the deadline. |

| A Few Days Before the Due Date | A reminder just before the payment deadline can help prevent any last-minute issues and ensure timely payment. |

| Post-Due Date (if applicable) | If the deadline has passed, sending a courteous follow-up will prompt the recipient to take action without feeling pressured. |

By carefully considering when to send your request, you increase the chances of receiving payments on time while maintaining good relationships with your clients.

Handling Invoice Disputes via Email

Disputes related to payments can arise due to various reasons, such as discrepancies in amounts, services rendered, or misunderstandings about the terms. Handling such disputes professionally is essential for maintaining positive business relationships while ensuring that both parties are treated fairly. Proper communication is key to resolving these issues efficiently and amicably.

When addressing a dispute, it’s important to remain calm and understanding. Clear, polite, and concise communication will help prevent the situation from escalating and allow both parties to come to a resolution. Below are some key strategies for managing such issues via written correspondence.

Steps for Handling Payment Disputes

Follow these guidelines to ensure a smooth and respectful resolution:

| Step | Action |

|---|---|

| 1. Acknowledge the Dispute | Recognize the issue raised by the client without making immediate judgments. Acknowledge their concerns and reassure them that you’re committed to resolving the matter. |

| 2. Gather Documentation | Ensure you have all relevant documents, such as contracts, receipts, or previous communications, to verify the situation before responding. |

| 3. Respond Politely | Craft a response that is respectful and neutral, outlining your position and offering possible solutions. Avoid using aggressive language that could escalate the issue. |

| 4. Propose a Solution | Offer a reasonable resolution, whether it’s a correction, partial refund, or another form of compensation. Be open to negotiation while maintaining fairness. |

| 5. Follow Up | After the dispute is addressed, follow up to ensure that the solution was satisfactory and that both parties are content with the outcome. |

By approaching disputes with professionalism and understanding, you can resolve payment issues efficiently and maintain a positive working relationship with your clients.

Common Mistakes to Avoid in Emails

In written communication, especially when dealing with professional matters, the tone, clarity, and structure of your message can significantly impact the recipient’s perception. It’s crucial to avoid certain errors that may lead to confusion, misunderstandings, or even a breakdown in communication. Below are common mistakes that can diminish the effectiveness of your written messages.

Key Mistakes to Watch Out For

- Lack of Clear Subject Lines: A vague or missing subject line can confuse the recipient and result in your message being overlooked. Always ensure the subject is clear and relevant to the content of your message.

- Overuse of Jargon or Complex Language: Using overly technical language or jargon can alienate the reader. Aim for clarity and simplicity to ensure the message is understood by all recipients.

- Unprofessional Tone: Being too casual or too formal can give the wrong impression. Striking the right balance is key to maintaining professionalism.

- Grammatical Errors: Spelling and grammar mistakes can undermine your professionalism. Always proofread your messages before sending them.

- Failure to Personalize: Generic, impersonal messages can feel robotic and less engaging. Including the recipient’s name or referencing past interactions can make the communication feel more genuine.

Additional Tips for Effective Communication

- Be Concise: Avoid lengthy paragraphs and get to the point quickly. Respect the recipient’s time and make it easy for them to understand your main message.

- Check Attachments: Double-check that any necessary documents are included, and mention them in the body of your message to ensure nothing is overlooked.

- Failing to Follow Up: If a response is expected, don’t forget to follow up if necessary. A lack of follow-up can be perceived as neglectful.

By avoiding these common mistakes, you can ensure that your written communication remains effective, professional, and clear, ultimately leading to better outcomes in your interactions.

Tips for Clear and Concise Emails

When sending written messages, brevity and clarity are essential. A well-structured message saves time, reduces the risk of misunderstandings, and ensures that the recipient grasps your main points quickly. Below are effective strategies to help you craft clear and direct communications.

Important Guidelines for Crafting Clear Messages

- Use Simple Language: Avoid complicated phrases or technical jargon. Clear and simple language ensures that your message is easily understood by a wider audience.

- Keep it Short: Stick to the essential information. Eliminate unnecessary details to maintain focus and prevent information overload.

- Organize Your Thoughts: Structure your message logically. Break it into paragraphs, use bullet points or numbered lists, and focus on one idea per section.

- Stay on Point: Don’t wander off-topic. Focus on your main message to avoid confusion and make it easier for the reader to follow.

Practical Tips for Better Communication

| Tip | Explanation |

|---|---|

| Use Clear Subject Lines | Subject lines should summarize the purpose of your message. This helps recipients quickly determine the importance and relevance of the content. |

| Prioritize Information | Place the most important information at the beginning of the message, followed by supporting details. |

| Use Actionable Language | If action is required, be direct. Use phrases like “Please confirm,” “Let me know,” or “Kindly review” to indicate expected actions clearly. |

| Proofread Before Sending | Read through your message to catch errors or unnecessary phrases. This ensures accuracy and clarity. |

By following these simple yet effective guidelines, you can improve the clarity and impact of your written communications, ensuring they are both efficient and professional.

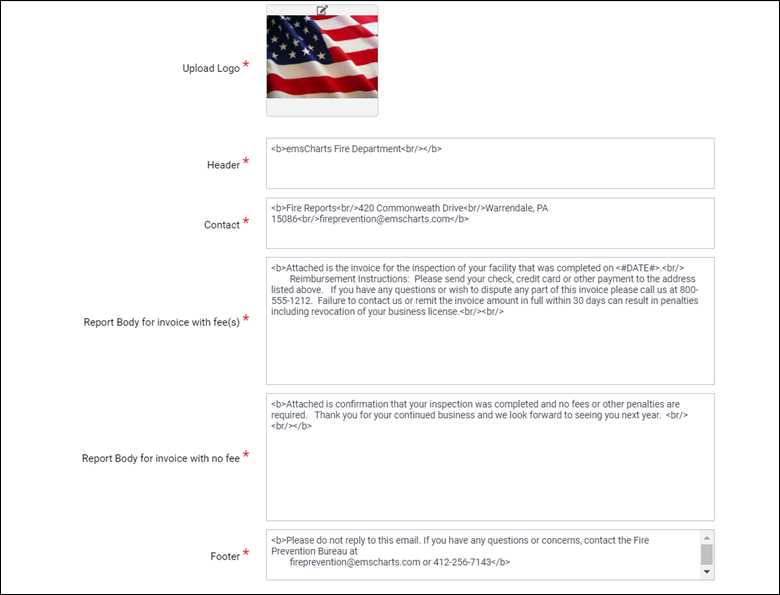

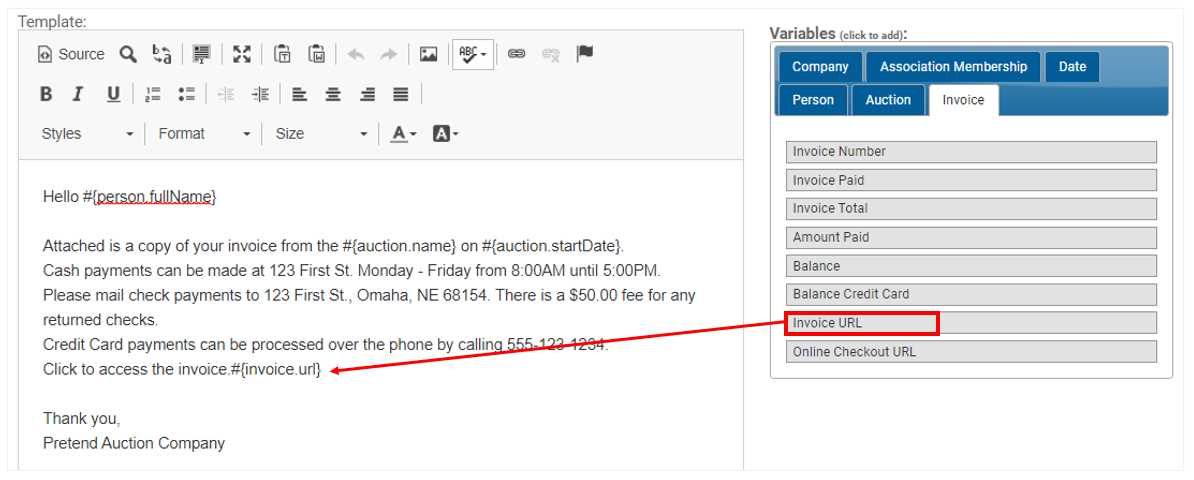

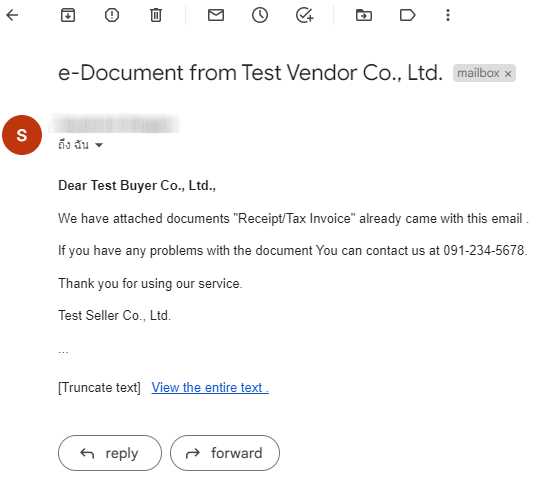

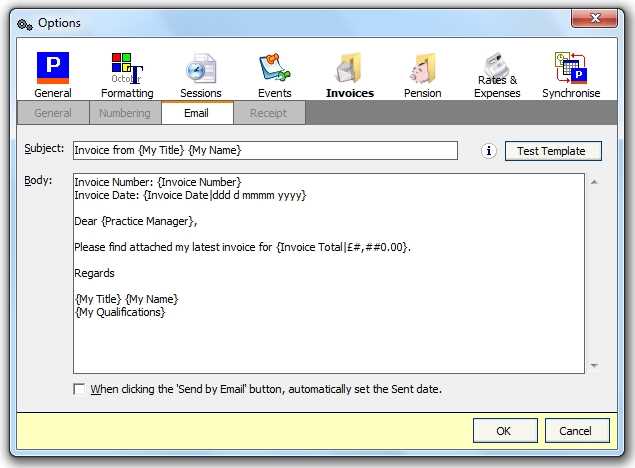

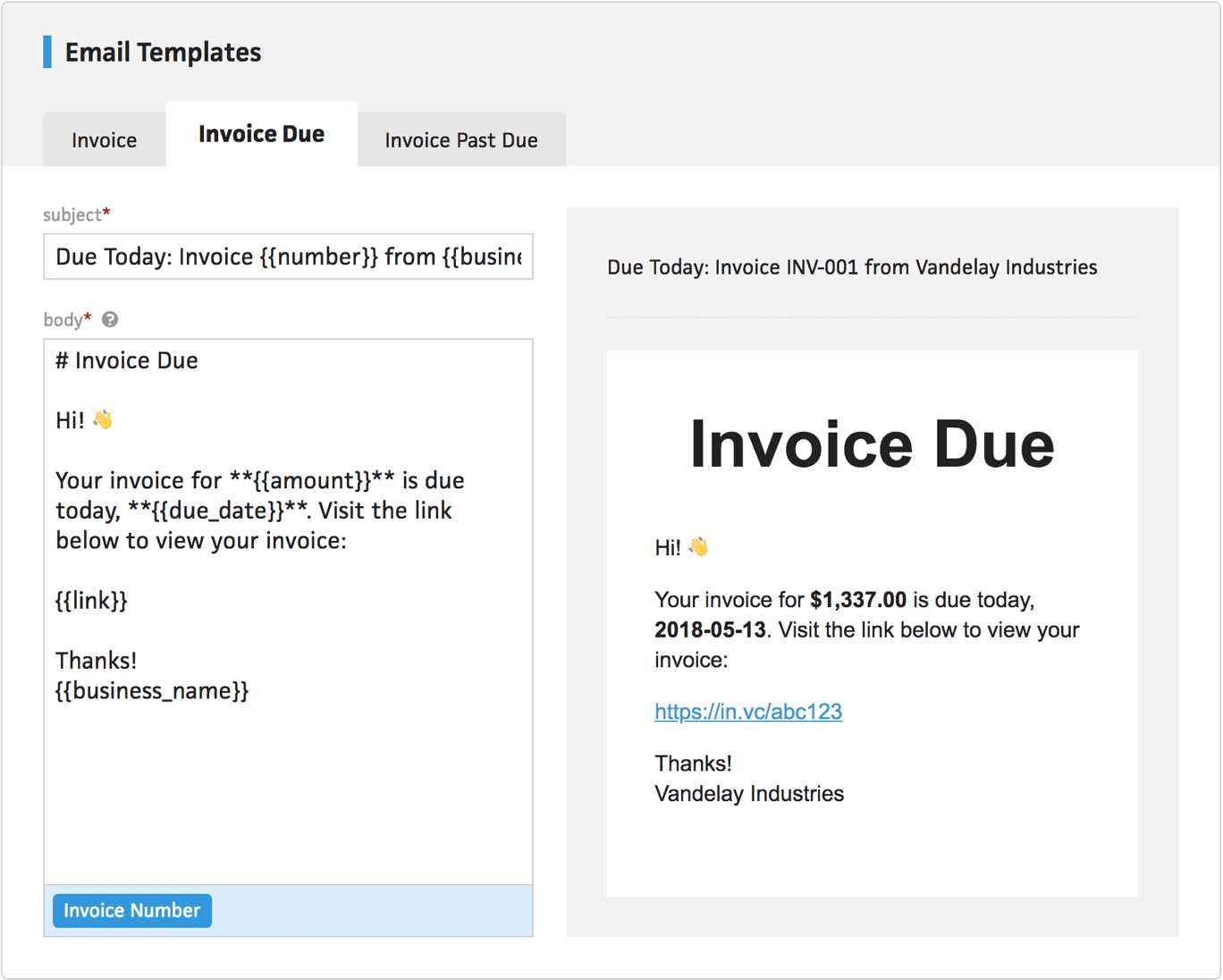

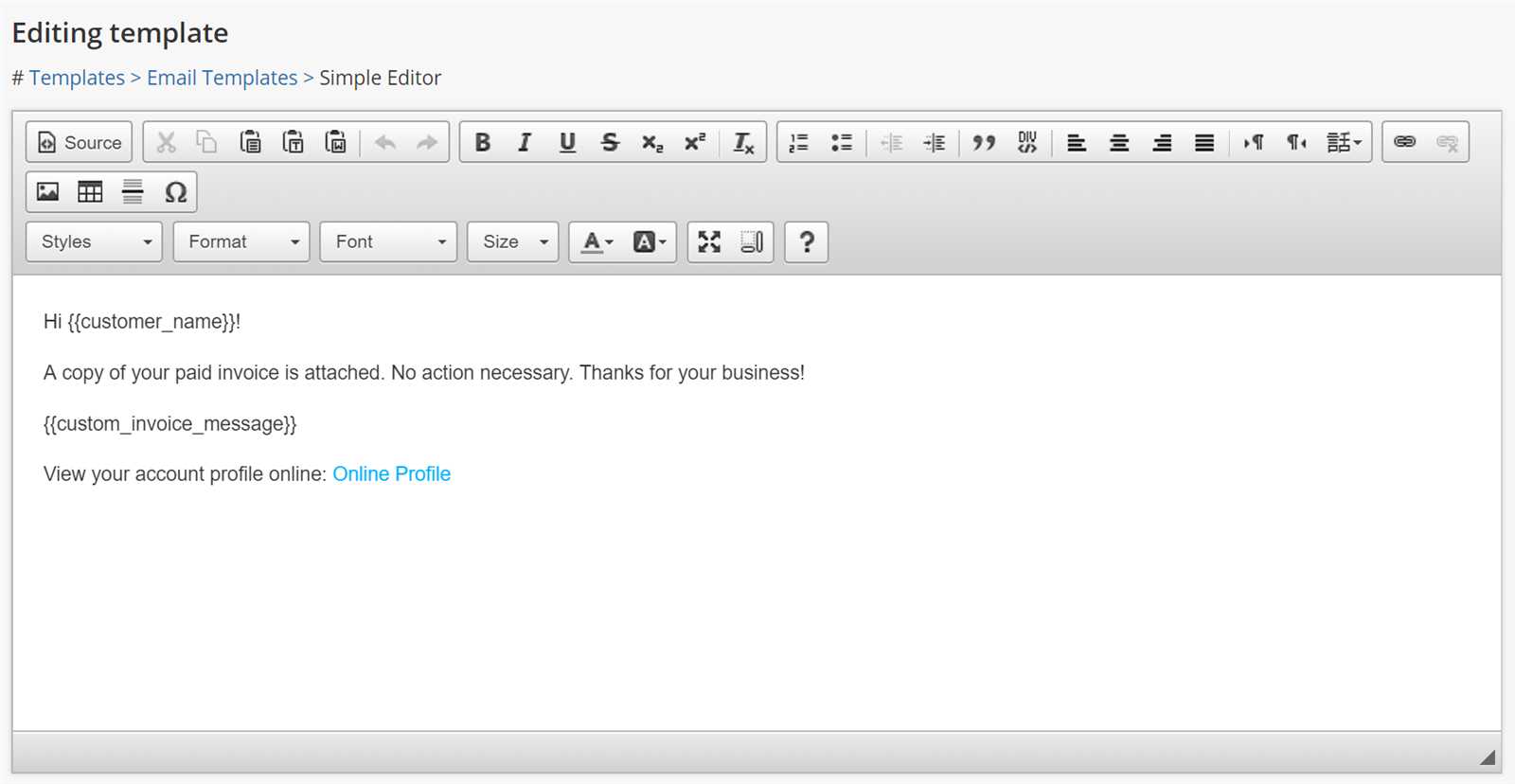

Automating Invoice Email Sending

Automating the process of sending billing statements or reminders can save time, reduce human error, and improve overall efficiency. By setting up automatic workflows, businesses can ensure that messages are sent on time, every time, without manual intervention. This approach allows for streamlined operations and enhances customer satisfaction.

Benefits of Automating the Process

- Efficiency: Automation reduces the need for repetitive tasks, freeing up valuable time for other business activities.

- Accuracy: Automated systems reduce the risk of mistakes, ensuring that the correct details are included in each message.

- Timeliness: Automated tools allow you to set precise schedules, ensuring that reminders or statements are sent at the most appropriate times.

- Cost Savings: By eliminating manual processes, businesses can reduce administrative costs and allocate resources more effectively.

How to Set Up Automation

To successfully implement automation for sending billing statements, follow these steps:

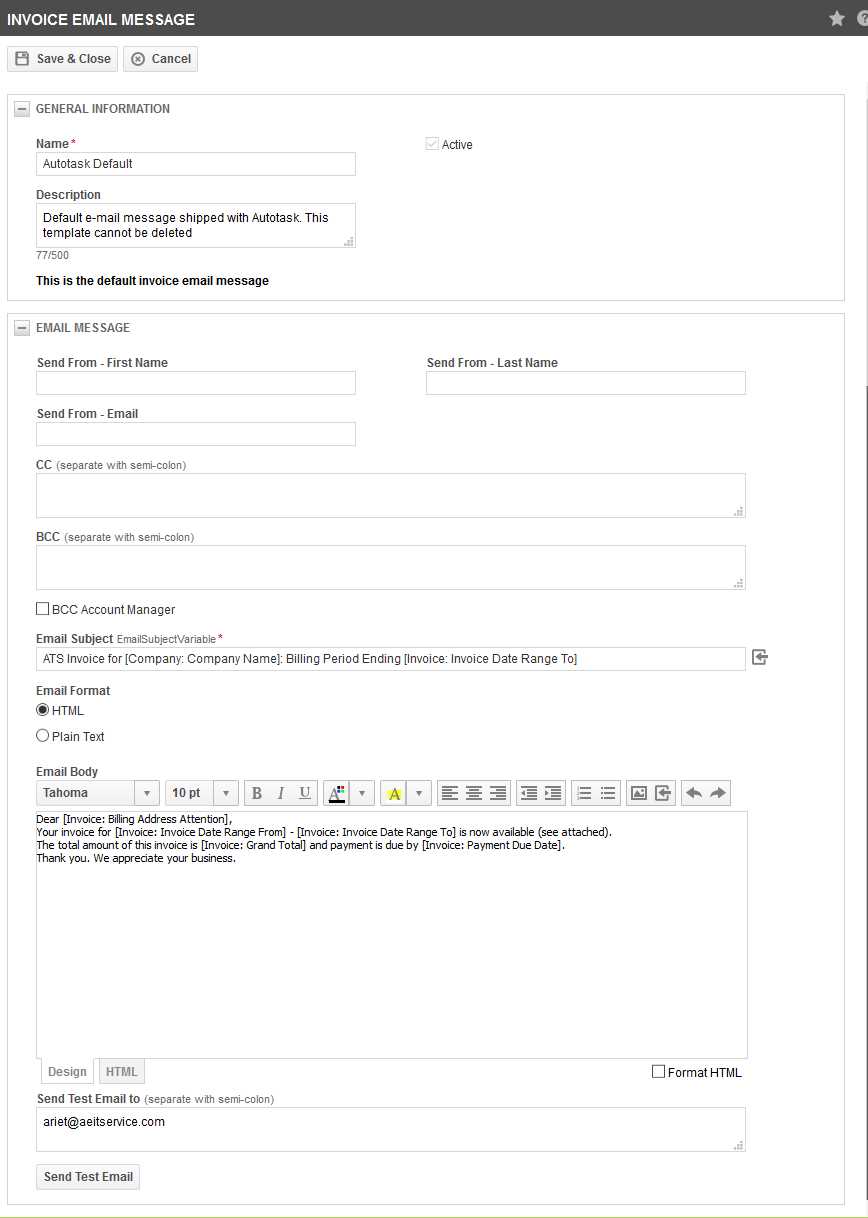

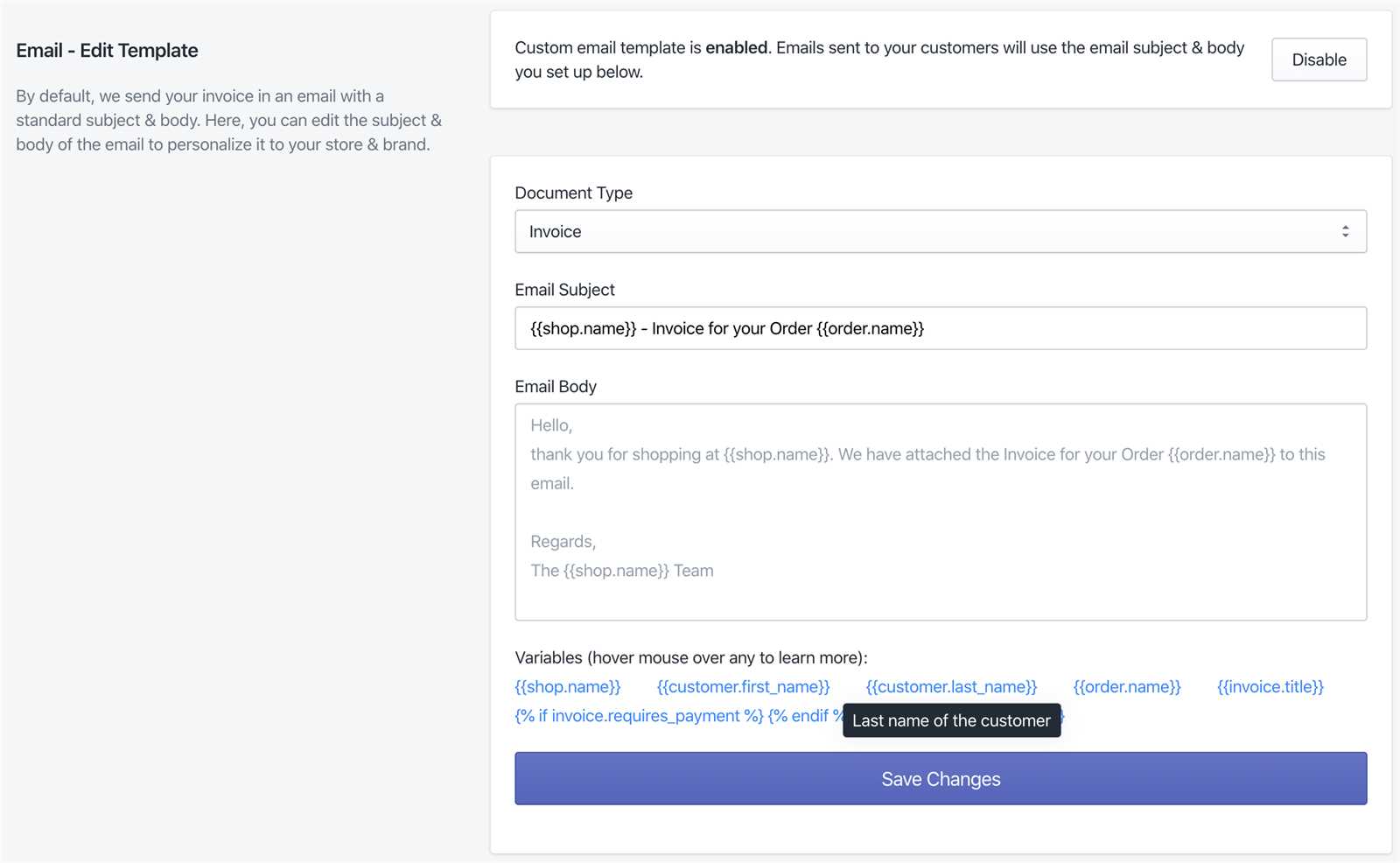

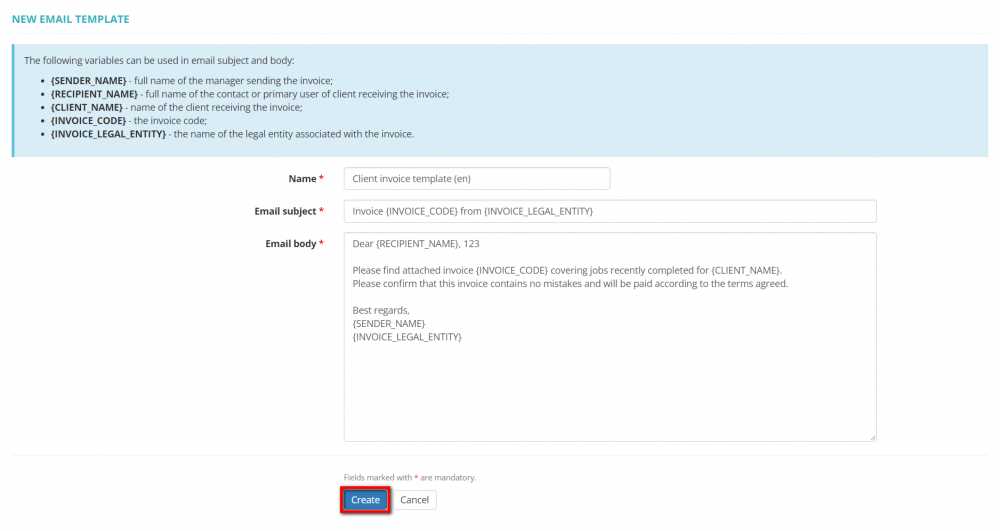

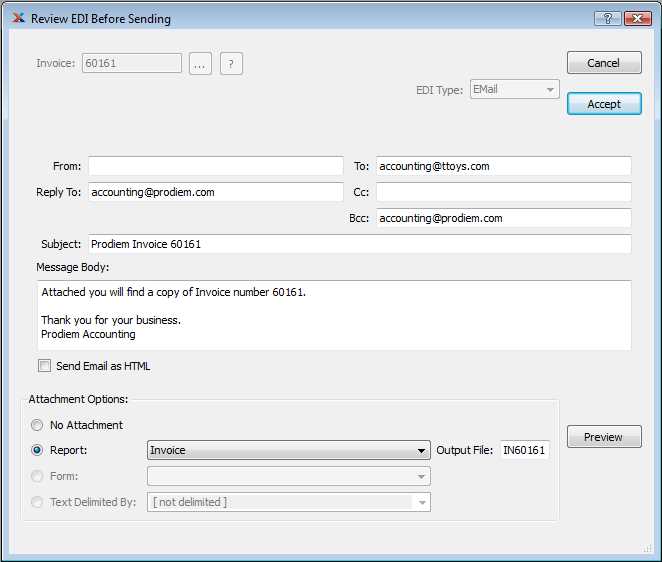

- Choose the Right Software: Select an automation platform that integrates well with your current systems and allows for easy customization.

- Set Up Templates: Create pre-written messages that can be personalized with customer-specific details, such as due dates and amounts.

- Define Triggers: Establish clear conditions for when messages should be sent, such as specific dates or actions taken by the customer.

- Test the System: Before going live, run test scenarios to ensure that everything works smoothly and as expected.

By automating this process, businesses can maintain a consistent and professional approach to handling transactions, improving both internal efficiency and customer relationships.

Ensuring Email Security for Attachments

Securing sensitive files sent via digital correspondence is essential to protect both the sender and the recipient. As digital communication becomes more prevalent, the risk of data breaches, malware, and phishing attacks increases. It is important to follow best practices to ensure that shared documents remain safe and confidential throughout the transmission process.

Use Encryption

Encrypting files before sending them is one of the most effective ways to safeguard sensitive information. This prevents unauthorized access to the contents of the file during transmission. Consider using encryption tools or secure platforms that offer end-to-end encryption for an added layer of security.

Verify Recipient Details

Before sending any important documents, always double-check the recipient’s contact information to avoid accidental sharing with unauthorized individuals. Confirm the correct recipient’s email address, especially when dealing with large groups or companies.

Limit the Size of Attachments

Sending large files may pose security risks, as they could potentially bypass certain security filters. Compress files to a reasonable size or, better yet, use a secure file-sharing platform that offers controlled access for larger documents.

Apply Password Protection

Another useful strategy is to password-protect sensitive documents. This adds an additional layer of security, ensuring that even if the file is intercepted, it cannot be opened without the correct password.

Utilize Secure Platforms

Whenever possible, opt for secure file-sharing services that specialize in protecting digital content. These platforms often offer features such as access control, file expiration, and encryption, ensuring better protection for shared documents.

By implementing these security measures, you reduce the risk of unauthorized access to confidential materials, helping maintain a high level of trust and professionalism in digital communications.

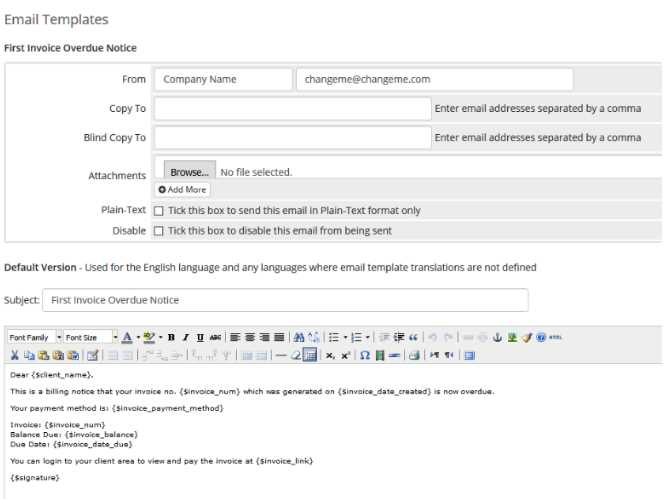

Following Up on Unpaid Invoices

When payments are delayed, it is crucial to address the situation promptly to maintain healthy cash flow. While following up on outstanding payments may seem uncomfortable, it is an essential part of ensuring that your business remains financially stable. The approach should be polite, professional, and clear to avoid any misunderstandings or strained relationships with clients.

When to Follow Up

Timing plays a significant role in follow-up communications. Ideally, reminders should be sent soon after a payment due date has passed. However, the tone and urgency of the reminder should vary depending on how overdue the payment is. Below is a table summarizing different follow-up strategies based on the length of the delay:

| Days Overdue | Action | Suggested Tone |

|---|---|---|

| 0-7 | Send a polite reminder | Friendly and understanding |

| 8-14 | Send a formal follow-up | Professional, firm but polite |

| 15+ | Escalate the matter | Urgent and assertive |

Crafting Your Follow-Up Message

It is essential to maintain a courteous tone even in cases of overdue payments. Here are some key points to include in your follow-up message:

- State the payment details clearly, including the amount and due date.

- Offer payment options if applicable to make the process easier for the client.

- Politely remind them of any late fees or penalties that might apply.

- Express understanding and willingness to work with the client, if necessary, on payment arrangements.

Being proactive and courteous with your reminders increases the likelihood of prompt payments while preserving a positive relationship with your clients.

Optimizing Your Message for Mobile

With an increasing number of users accessing content on their mobile devices, ensuring that your messages are easily readable on smaller screens has become essential. A mobile-optimized message provides a better user experience, increases engagement, and ensures that your communication is effective. To make sure your message reaches the recipient in the best possible format, it’s important to consider both layout and content accessibility.

Simple and Clear Layout

One of the most important aspects of a mobile-friendly message is its layout. On mobile devices, users typically scroll through content quickly, so your message should be concise and easy to navigate. Avoid large blocks of text and make sure that key information stands out. Use short paragraphs, clear headings, and bullet points to break up the content into digestible sections.

Responsive Design

Utilizing a responsive design ensures that your content automatically adjusts to different screen sizes. This allows your recipients to view the message clearly, whether they are using a smartphone, tablet, or computer. Test your design across multiple devices to ensure that it is displayed properly and that no important details are lost or hidden.

Actionable Content

When creating content for mobile, it is essential that all actionable items–such as links, buttons, or requests for payment–are easy to click on. Ensure that clickable elements are large enough for touch interaction and spaced out so they don’t overlap. If offering links, make sure they lead to mobile-optimized web pages that load quickly and function well on mobile devices.