Invoice Approval Template for Streamlining Your Business Process

In every organization, managing financial documents efficiently is crucial for maintaining smooth operations. A structured system can help eliminate delays, reduce errors, and ensure all procedures are followed accurately. Creating a streamlined approach to document verification and management can significantly impact the overall productivity of a business.

Standardizing workflows for reviewing and approving financial documents allows teams to work with greater consistency. By adopting an organized method, companies can ensure that all necessary checks are in place before processing payments or completing transactions. This not only saves time but also improves transparency and accountability throughout the entire process.

Moreover, having a clear structure for document handling minimizes the risk of overlooking critical details. By implementing an effective framework, businesses can foster better communication between departments and provide employees with the tools needed for faster decision-making.

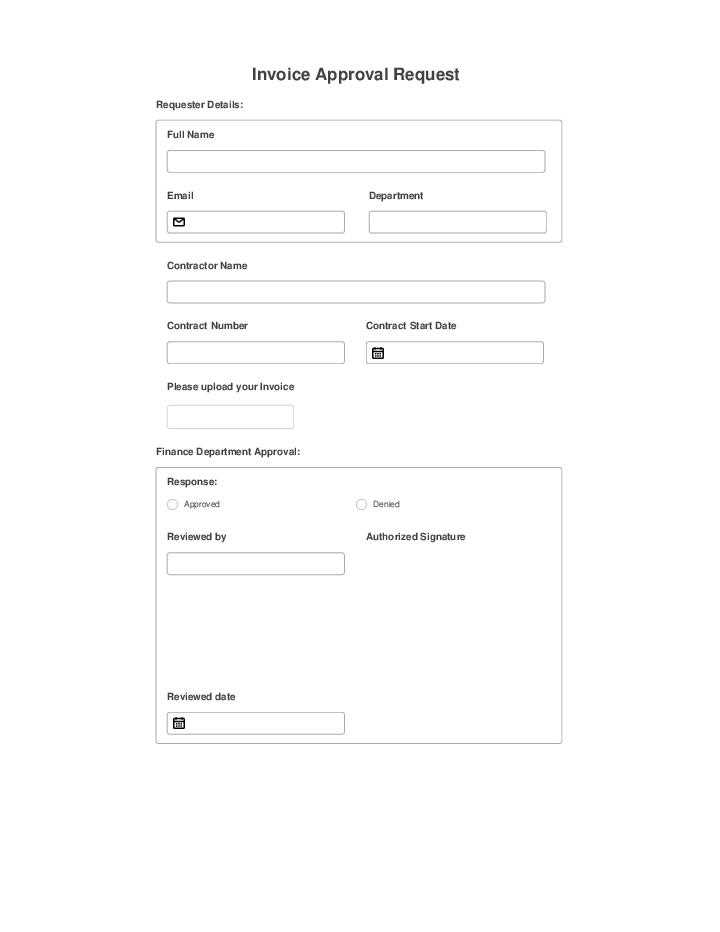

What is an Invoice Approval Template

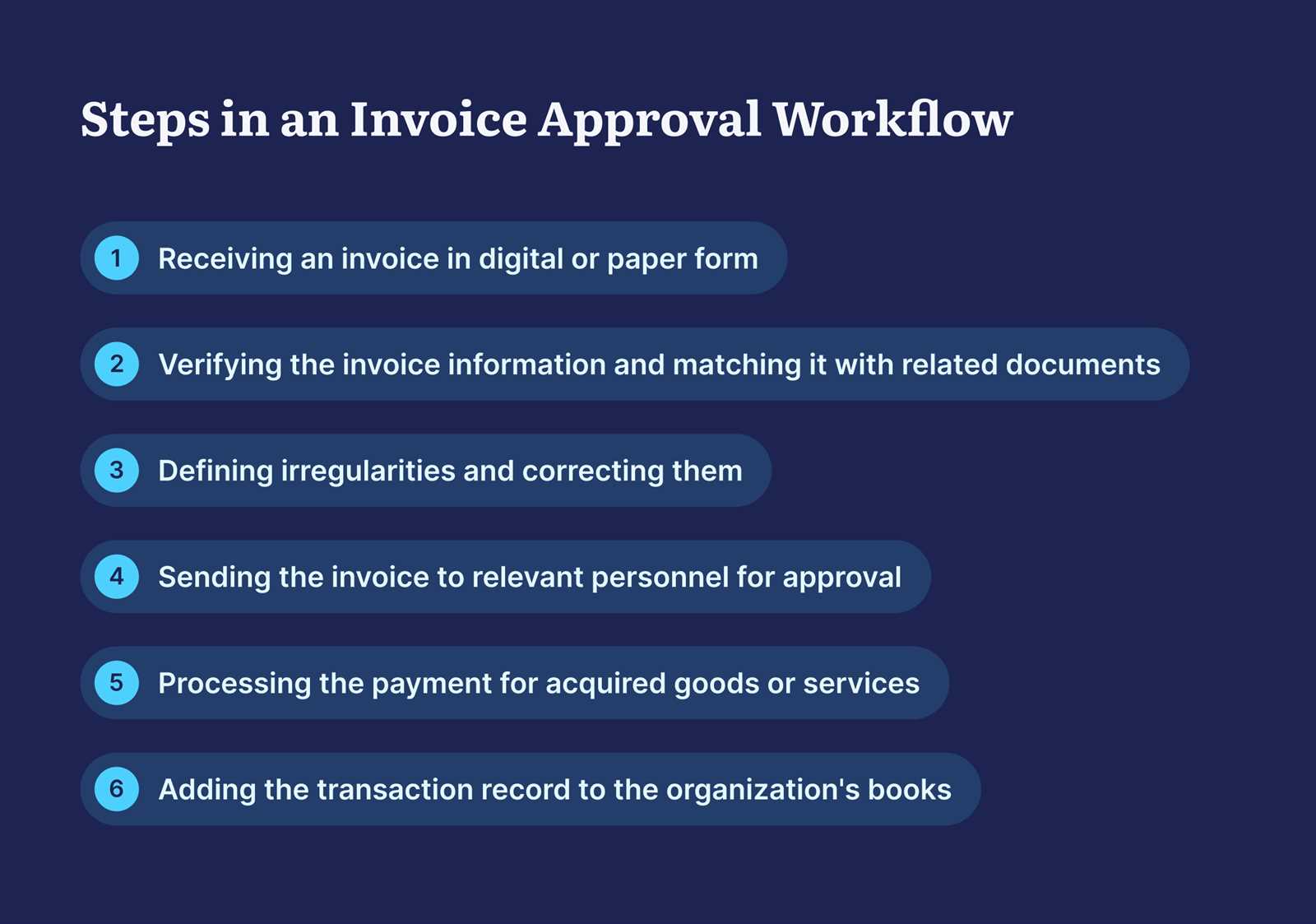

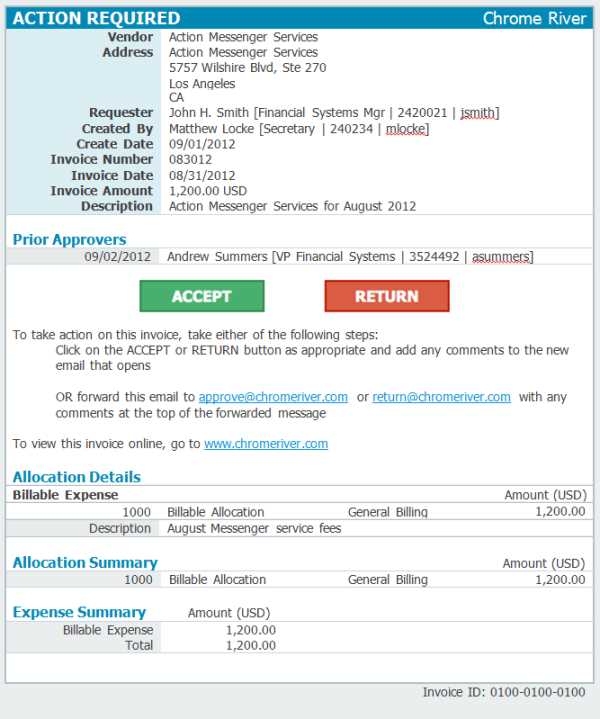

In business operations, a structured document processing method is essential for ensuring that financial transactions are reviewed and validated correctly before proceeding. This system typically outlines a set of steps to verify accuracy and confirm compliance, allowing the responsible parties to track and manage the review process efficiently.

At its core, it is a predefined format designed to help businesses maintain consistency in handling financial records. By organizing the required actions and approvals into a clear and simple format, companies can minimize confusion and streamline the verification procedure. This approach facilitates faster decision-making while reducing the risk of errors or oversight.

Such a system helps create a seamless flow, where each step is clearly marked and accountable. This not only ensures that the process is followed correctly but also enhances transparency, as all involved parties have clear guidelines to follow when verifying the documents in question.

Benefits of Using an Approval Template

Implementing a structured system for reviewing financial documents offers numerous advantages to businesses. A consistent approach ensures that each step of the process is completed accurately, allowing for faster decision-making and more efficient management of resources. By setting clear guidelines for verification, companies can avoid delays and reduce the likelihood of mistakes that can lead to costly errors.

One of the main benefits is improved organization. A predefined structure allows all stakeholders to follow the same process, eliminating confusion and ensuring that important details are not overlooked. This leads to a smoother workflow and a more effective use of time, as employees spend less time searching for information or clarifying steps.

Additionally, using such a system enhances accountability. With each stage clearly defined, it becomes easier to track progress and identify bottlenecks. This transparency improves communication within teams and between departments, ensuring that everyone is aligned and aware of their responsibilities throughout the entire process.

How to Create an Invoice Template

Creating a structured document for reviewing financial transactions requires careful planning and organization. A well-constructed system ensures that all necessary steps are followed, with clear sections for the required information and approval signatures. By setting up an efficient format, businesses can streamline their internal processes and reduce the chance of errors during the review phase.

Key Elements to Include

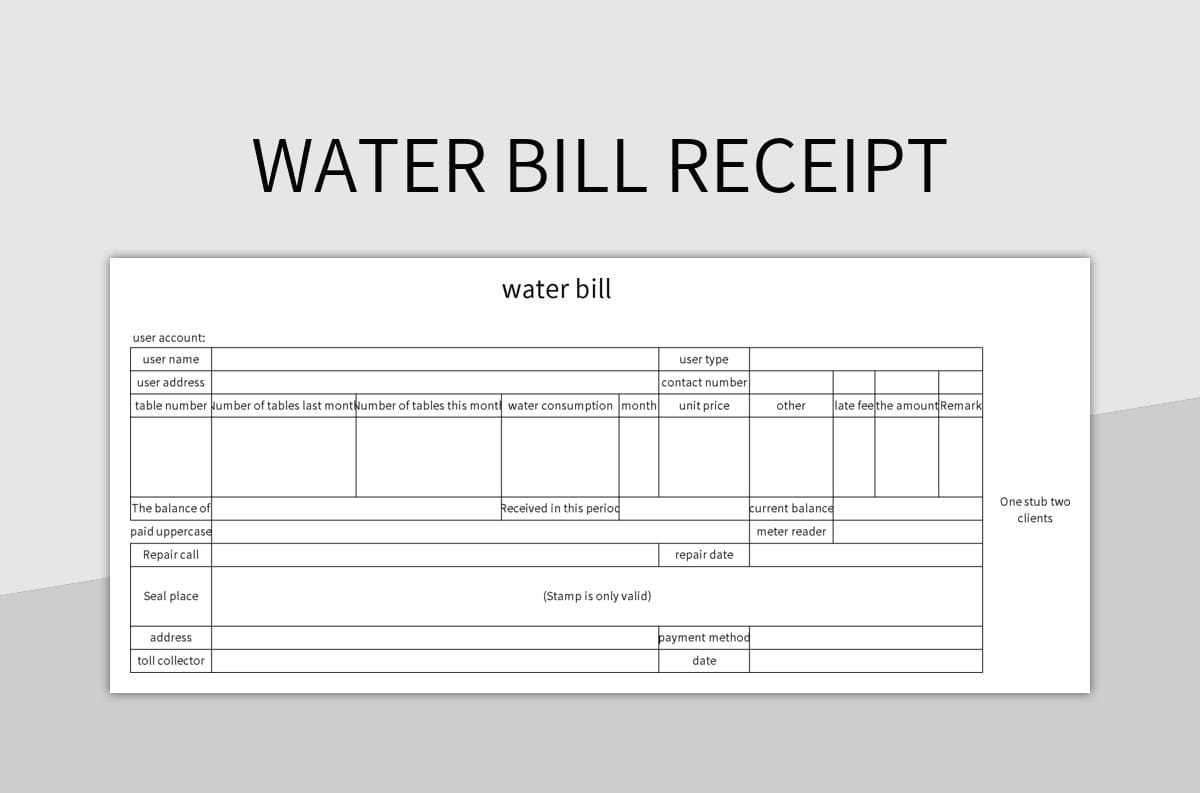

When building a system for managing financial records, several key components should be included to ensure completeness and accuracy. These elements typically cover basic information such as dates, amounts, and contact details, along with spaces for approval notes and signatures.

| Section | Details |

|---|---|

| Document Information | Dates, reference numbers, and unique identifiers |

| Amount & Breakdown | Detailed cost breakdown with subtotals |

| Approval Section | Spaces for signatures and comments from relevant parties |

| Payment Terms | Details of payment methods and deadlines |

Best Practices for Design

To ensure clarity and ease of use, the layout should be clean and simple. Group related information together and ensure that sections are clearly labeled. Avoid clutter and make sure that every field has a specific purpose, allowing the reviewer to quickly find the information needed for approval. Utilizing tools like spreadsheets or document-editing software can help in creating a consistent structure that suits the needs of your team.

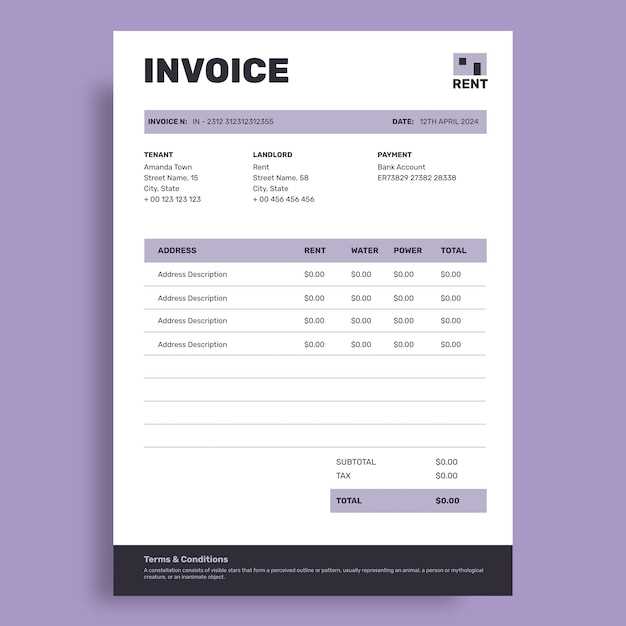

Key Elements of an Invoice Template

When creating a structured document for processing financial transactions, certain components are essential to ensure that all relevant information is captured and can be easily reviewed. These elements provide clarity and organization, enabling a smooth workflow from initial receipt to final approval. Each section serves a specific purpose and helps in maintaining consistency across documents.

Essential Components for Accuracy

A well-organized document should include several important sections that detail the transaction’s specifics. These sections ensure that both parties involved in the process have all the necessary information to proceed with confidence and efficiency.

| Section | Description |

|---|---|

| Basic Information | Details such as document number, date, and reference numbers |

| Cost Breakdown | Itemized list of costs, subtotals, and any applicable taxes |

| Verification Area | Space for signatures, comments, and approval status |

| Payment Terms | Information on payment methods, deadlines, and conditions |

Design Considerations for Clarity

The layout should be clean and intuitive, with each section clearly labeled. Grouping related information together helps the reviewer quickly find the necessary details. Consistent formatting across all documents will also improve legibility, making it easier to navigate through the process without unnecessary confusion.

Customizing Your Approval Workflow

Creating a personalized approach to handling financial documents is key to improving efficiency and ensuring the process aligns with your organization’s specific needs. Customization allows businesses to define their own set of rules and criteria, adapting the workflow to fit the size, structure, and objectives of the team. By tailoring the process, you can address unique challenges and optimize the time spent on document validation.

Setting Up Custom Review Stages

Every business operates differently, and therefore, the steps required to review and verify financial records can vary. By adjusting the number and order of review stages, you can match the workflow to your team’s capabilities and requirements. For example, some teams may need more in-depth checks for high-value transactions, while others may prefer a simplified process for smaller amounts.

Key factors to consider when customizing:

- Approval hierarchies: Define who needs to review the document at each stage.

- Decision timelines: Set clear deadlines to ensure swift processing.

- Review criteria: Specify the factors to be checked, such as costs, terms, or compliance.

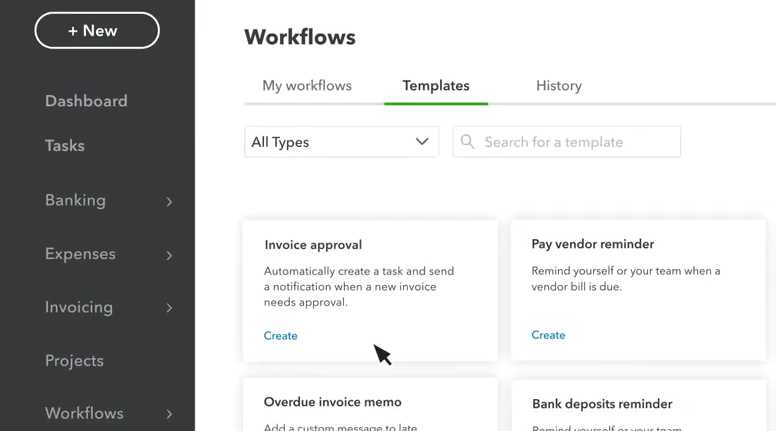

Integrating Automation for Efficiency

Automation can significantly enhance the speed and accuracy of your customized workflow. By incorporating tools that trigger automatic notifications, reminders, and alerts, the entire process becomes more seamless. This reduces manual errors and ensures that each stage is completed without delay, all while maintaining a high level of accuracy.

Common Mistakes in Approval Processes

Even with a well-structured method in place, several common errors can disrupt the efficiency of reviewing and validating financial documents. These mistakes often lead to delays, confusion, and unnecessary complications. By understanding and addressing these issues early on, businesses can maintain a smoother workflow and avoid costly setbacks.

Overlooking Key Details

One of the most frequent errors in document validation is failing to check all critical details. Missing information such as payment terms, amounts, or reference numbers can cause delays in the processing stage and even lead to miscommunications. Thoroughly reviewing every section before moving forward is essential to ensure nothing is overlooked.

Lack of Clear Communication

Without clear and consistent communication between team members, misunderstandings are inevitable. This can result in incomplete or inaccurate information being passed along, causing approval delays. It’s important to have defined communication channels and ensure that all parties involved are on the same page throughout the process.

Insufficient Documentation

Failing to provide adequate backup or documentation can halt the review process. This can occur when records are incomplete, or necessary supporting materials are not submitted alongside the documents for verification. Ensuring that all relevant files and details are provided upfront can significantly reduce processing time and prevent unnecessary back-and-forth.

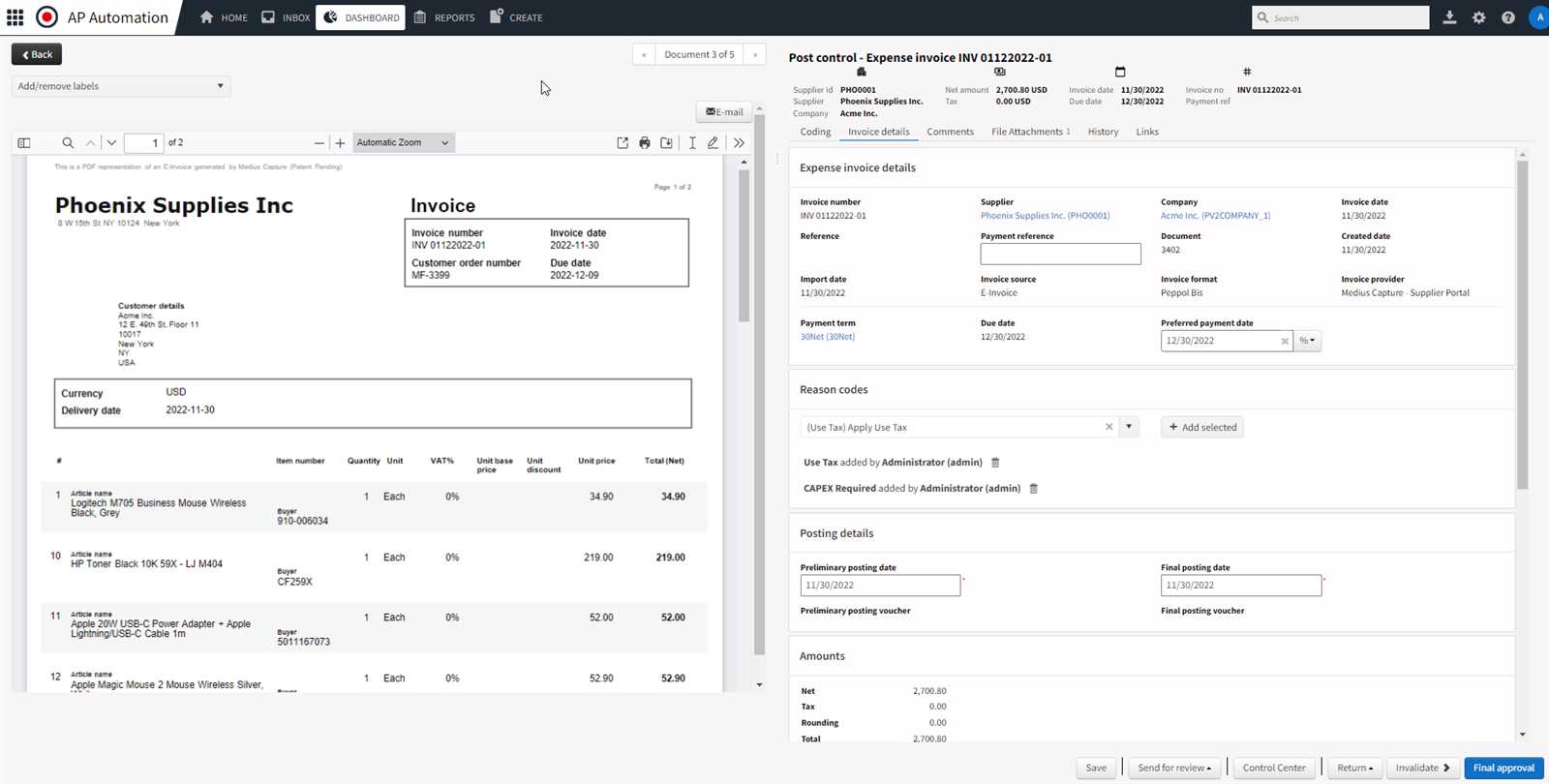

Digital vs Manual Invoice Approvals

When it comes to validating financial documents, businesses have two primary options: manual or digital processes. Each approach has its own set of advantages and challenges. While manual methods can provide a more personal touch, digital solutions often offer greater efficiency and scalability. Understanding the strengths and limitations of both can help organizations choose the best method for their needs.

Manual Process

In a traditional setup, the review and validation of documents are done by hand. This method relies on physical paperwork and requires individuals to manually check, sign, and approve each record. While it can offer a sense of control and personalization, it often comes with several drawbacks:

- Slower Processing: Manual review can be time-consuming, especially with large volumes of documents.

- Increased Risk of Errors: Human mistakes are more likely when handling paperwork manually.

- Limited Tracking: Keeping track of document status and progress can be challenging without automated tools.

- Higher Costs: Physical handling and storage of documents often result in additional expenses.

Digital Process

Digital solutions, on the other hand, use software and online platforms to automate many aspects of document management. This approach streamlines the review process and offers several significant benefits:

- Faster Turnaround: Automated workflows speed up document review and approval times.

- Better Accuracy: Automation reduces the chances of errors and inconsistencies.

- Improved Tracking: Digital systems can easily track the status of each document, providing real-time updates.

- Cost-Effective: Reduced need for physical storage and paper handling cuts down operational costs.

Despite these advantages, digital methods may require an initial investment in software or technology training. Businesses must weigh these costs against the benefits to determine which approach is most effective for their specific situation.

Improving Accuracy with Approval Templates

Ensuring the accuracy of financial records is crucial for businesses to maintain smooth operations and avoid costly errors. A structured approach to document verification can greatly enhance precision by providing clear guidelines and reducing the risk of oversight. Implementing predefined systems helps standardize the process, making it easier to catch mistakes before they affect the final outcome.

Key Benefits of Structured Systems

A well-organized approach to managing documents offers several advantages that contribute to overall accuracy:

- Consistency: With a defined format, every document is processed the same way, ensuring no important details are missed.

- Clear Criteria: Specific fields and sections make it easier to focus on essential elements, reducing the chance of overlooking important data.

- Minimized Errors: Predefined systems help automate some parts of the review, minimizing human error and improving the quality of the final decision.

- Efficient Checks: Built-in validation steps allow reviewers to easily spot discrepancies or missing information.

How to Improve Accuracy with Customization

By customizing the process to fit the needs of your organization, you can further enhance accuracy. Some steps to consider include:

- Automating Verification: Use software to automatically check for common issues, such as incorrect amounts or missing signatures.

- Establishing Clear Approval Stages: Create distinct stages for document review to ensure each aspect is thoroughly examined by the appropriate person.

- Regular Training: Educate team members on best practices and ensure they are familiar with the latest guidelines and tools.

Incorporating these strategies into your system will significantly reduce the likelihood of errors and enhance the overall accuracy of your document management process.

Best Practices for Invoice Review

Reviewing financial documents effectively is essential for maintaining accuracy, minimizing errors, and ensuring smooth operations. A well-established process allows businesses to quickly identify discrepancies, validate essential information, and make informed decisions. By following a set of best practices, organizations can improve their review procedures and enhance overall efficiency.

One of the key elements in a successful review process is having a clear, standardized approach. This ensures that everyone involved understands their role, the necessary steps, and what to look for during each stage of the review. Below are some best practices that can streamline the document validation process and help reduce the risk of mistakes.

- Establish Clear Guidelines: Define the critical elements that need to be checked during the review process. This may include verifying amounts, dates, terms, and references.

- Use a Consistent Format: Standardizing the layout and structure of documents helps reviewers quickly locate necessary information, reducing the likelihood of errors.

- Prioritize Accuracy Over Speed: Take the time to carefully examine each document. Rushed reviews often result in overlooked details and mistakes.

- Implement Multiple Review Stages: Set up a multi-step process where different team members review specific areas of the document, ensuring a thorough examination.

- Use Automation for Verification: Automating repetitive tasks such as checking totals, calculating taxes, or matching records can save time and reduce human error.

By adopting these best practices, businesses can improve their document review process, save time, and reduce the risk of financial discrepancies or mistakes. A structured, well-communicated approach helps ensure that every document is validated thoroughly before being approved or processed further.

Integrating Templates with Accounting Software

Seamlessly connecting document processing systems with accounting platforms can drastically improve efficiency and accuracy in financial management. When predefined systems are integrated with accounting software, the entire workflow–from document creation to final reconciliation–becomes more streamlined, automated, and error-free. This integration reduces the time spent on manual data entry and ensures that all necessary information is synchronized between systems.

Key Advantages of Integration

Integrating your document workflow with accounting software offers several benefits that can simplify financial management:

- Increased Efficiency: Automatic data transfer eliminates the need for double data entry, saving time and minimizing errors.

- Improved Accuracy: Information flows directly from one system to another, ensuring that data is accurate and up-to-date across platforms.

- Real-Time Updates: Integration allows for real-time tracking of expenses, payments, and financial records, offering better visibility into your business’s financial health.

- Faster Processing: The automatic synchronization of data speeds up the approval and processing of financial records.

How to Integrate with Accounting Software

Integrating predefined systems with accounting platforms typically involves the following steps:

- Select Compatible Software: Choose an accounting solution that supports integration with your current system or platform.

- Set Up Data Mapping: Define how data from documents should be mapped into the accounting software fields to ensure accuracy during synchronization.

- Automate Workflow: Use automated processes to route documents, trigger actions, and update records in real time.

- Test the Integration: Before going live, run tests to ensure that data flows smoothly and there are no errors in the integration.

By connecting document workflows to accounting systems, businesses can eliminate redundancies, improve financial oversight, and focus on more strategic tasks. Integration simplifies complex processes, ensuring that every step is handled efficiently and correctly.

| Benefit | Description |

|---|---|

| Increased Efficiency | Automates data entry and transfers information seamlessly between systems. |

| Improved Accuracy | Reduces manual input errors by synchronizing data automatically. |

| Real-Time Updates | Provides instant updates on financial records, expenses, and payments. |

| Faster Processing | Shortens the time taken for approval and payment processing with

Reducing Errors in Financial ApprovalsInaccuracies in financial decision-making can lead to costly mistakes, delayed payments, and poor business management. By focusing on best practices and utilizing streamlined processes, businesses can reduce the likelihood of errors during the review and validation stages. Implementing a clear, organized system ensures that every document is carefully evaluated, and all necessary steps are followed to minimize discrepancies. Effective Strategies for Error ReductionSeveral methods can help minimize the risk of mistakes during financial reviews:

Tools to Help Reduce ErrorsIn addition to implementing best practices, using the right tools can significantly reduce mistakes in financial processes:

By applying these strategies and leveraging available tools, businesses can significantly reduce the chances of errors in their financial decision-making processes. The result is a smoother, more efficient workflow that leads to fewer mistakes and faster, more reliable outcomes. Choosing the Right Template for Your Team

Selecting the appropriate system for managing financial documents is crucial to ensure smooth workflows and minimize errors. The right structure not only aligns with your team’s needs but also improves efficiency and transparency throughout the process. A well-chosen solution can simplify the review and approval stages, making it easier to handle multiple tasks at once while ensuring that all necessary steps are followed. When deciding on the best structure for your team, it’s important to consider factors like ease of use, compatibility with existing tools, and scalability. A flexible system that can be customized according to specific requirements allows teams to maintain control over the workflow while streamlining document handling. It also enhances collaboration by providing clear guidelines for each stage of the process. Key considerations when choosing a system for managing financial documents include:

By considering these factors, you can select the right system to streamline document management and improve efficiency within your team. A thoughtful choice can enhance collaboration, reduce the risk of errors, and ensure that the entire process runs smoothly from start to finish. How Templates Help in ComplianceEnsuring compliance with industry standards, regulations, and internal policies is critical for any organization. A well-structured system for managing documentation plays a crucial role in maintaining adherence to these rules. By providing a standardized format, the process helps businesses stay aligned with legal and regulatory requirements while minimizing the risk of non-compliance. Ensuring Consistency and AccuracyOne of the key ways a structured system aids in compliance is by ensuring consistency across all documents. A uniform format reduces the chance of errors or missing information, which can lead to legal complications or audit issues. It provides clear guidelines for what information needs to be included, preventing gaps or inconsistencies that could jeopardize regulatory adherence.

Meeting Regulatory Requirements

Adhering to legal and industry-specific regulations often requires businesses to follow certain procedures and document retention policies. Using a structured system helps automate and streamline compliance with these rules, making it easier to meet the necessary standards for record-keeping, approvals, and documentation retention.

Incorporating a standardized system into daily operations simplifies the complexity of maintaining compliance. By automating routine tasks and enforcing consistency, organizations can focus more on their core functions while ensuring they remain compliant with industry and legal standards. Common Approval Challenges and Solutions

Managing the process of reviewing and validating business documents can present various challenges. From delays to miscommunications, these obstacles can slow down workflows and create confusion within teams. Understanding common difficulties and implementing solutions to overcome them is essential for maintaining smooth operations and ensuring that tasks are completed on time. Delays in ProcessingOne of the most frequent issues organizations face is delays in processing due to bottlenecks in the workflow. These delays can occur when the necessary stakeholders are unavailable or when there’s confusion about which stage the document is in. A lack of clarity on responsibility and timing can lead to missed deadlines and frustrated teams.

Miscommunication Among Team MembersMiscommunication between team members is another common issue that can lead to errors or inefficiencies. If team members aren’t clear on the specific steps they need to follow or the exact information they need to review, it can lead to incomplete or incorrect document processing.

Lack of Transparency and TrackingWithout proper tracking and visibility, it can be difficult to understand where a document is in the process and who is responsible for each stage. This lack of transparency can lead to delays, mistakes, and frustration for team members.

By addressing these common challenges with practical solutions, organizations can streamline their document management processes and ensure greater efficiency, accuracy, and satisfaction among team members. Automating the Invoice Approval ProcessStreamlining the document review process through automation can significantly reduce manual effort, minimize errors, and speed up approval cycles. By integrating automated workflows, businesses can ensure that every step is followed consistently, with fewer delays or oversights. Automation not only helps increase efficiency but also provides greater transparency, making it easier to track progress and identify potential bottlenecks in real-time. One of the key advantages of automating the review and validation process is the reduction in human error. Manual handling of documents often leads to mistakes, such as missed signatures or incorrect data entry, which can be costly for organizations. By automating these tasks, businesses can ensure that each step is carried out according to predefined rules, minimizing the chance of errors. Benefits of Automation:

Automation tools also offer features such as automated notifications and alerts, reminding team members when their input is required or when an approval stage is reached. This proactive approach helps to avoid delays and ensures that each participant in the workflow stays on top of their responsibilities. Integrating Automation with Existing Systems: For maximum effectiveness, automation tools should be integrated with your current document management system or accounting software. This integration ensures seamless data transfer, reducing the need for manual intervention and increasing accuracy. By embracing automation, businesses can create a more efficient, error-free process that ultimately leads to faster decisions and improved workflow management. Tracking and Auditing Invoice ApprovalsEffective monitoring and auditing of document validation processes are crucial for ensuring compliance, transparency, and accountability. By tracking the status of each document through its lifecycle, organizations can identify any issues or delays early on, ensuring a smoother workflow. This level of oversight is especially important for financial transactions, where accuracy and documentation integrity are paramount. With the right tracking system in place, businesses can gain insight into who approved what and when, providing a clear audit trail for each transaction. This not only helps prevent fraudulent activities but also ensures that every decision is backed by proper documentation, making the entire process more reliable and transparent. Key Advantages of Tracking and Auditing:

How to Implement Tracking and Auditing:

By implementing effective tracking and auditing methods, businesses can not only ensure that the approval process is accurate and efficient but also build a more secure and compliant operational environment. Maintaining Consistency in ApprovalsEnsuring consistency in document validation is key to fostering a smooth and effective workflow. A standardized process ensures that all documents are reviewed, processed, and approved according to the same criteria, reducing the risk of errors and confusion. When consistency is maintained, organizations can expect improved efficiency, better communication among teams, and a stronger compliance culture. Without a clear and consistent process in place, teams may inadvertently miss critical steps or introduce discrepancies that can compromise the integrity of the entire validation process. A structured approach helps avoid these pitfalls by establishing clear guidelines for each stage, ensuring that no steps are skipped and that all necessary checks are performed. Strategies to Maintain Consistency

Benefits of Consistency in Document Processing

By fostering a culture of consistency in validation processes, businesses can enhance accuracy, improve workflow efficiency, and minimize the risk of non-compliance. |