Effective Invoice Approval Email Template for Streamlining Your Workflow

Efficient communication is crucial when managing financial transactions within a business. Having a clear and concise way to confirm and finalize payment-related actions can save both time and resources, ensuring smooth operations. By using a standardized method, you can enhance consistency, reduce misunderstandings, and avoid delays in payments.

Creating a streamlined process for confirming transaction details fosters transparency and helps maintain strong relationships with vendors, clients, or partners. It allows everyone involved to be on the same page, reducing the risk of errors and facilitating faster decision-making. This structured approach is essential for businesses looking to optimize their financial workflows.

In this guide, we’ll explore how to craft the perfect message to confirm payment decisions. Whether you are managing accounts payable or confirming payment releases, using a well-structured format can significantly improve your internal processes and communication efficiency.

Invoice Approval Email Template Overview

In any business transaction, confirming financial agreements quickly and accurately is essential. A well-structured message can ensure that all parties involved have a clear understanding of payment decisions, reducing the risk of errors and delays. A standardized format for these communications is key to streamlining the process, improving efficiency, and fostering good relationships between stakeholders.

Importance of Using a Standardized Communication Format

Having a consistent format for confirming financial actions ensures that the message is clear and concise, which leads to faster processing and fewer misunderstandings. When both internal teams and external partners use a similar communication structure, everyone can easily follow the steps needed for the transaction to proceed smoothly.

- Ensures clear and transparent communication

- Reduces the chance of mistakes or miscommunication

- Speeds up the decision-making process

- Improves workflow efficiency

Key Elements of an Effective Financial Confirmation Message

A successful confirmation note typically includes several key elements that guide the recipient through the necessary actions or decisions. These components ensure clarity and help recipients understand exactly what is required on their end.

- A clear subject line indicating the purpose of the communication

- A polite and professional greeting

- A detailed breakdown of the items or services in question

- A call to action, such as requesting confirmation or additional steps

- Clear contact information for any questions or follow-ups

Why You Need an Invoice Approval Template

Having a predefined structure for confirming financial transactions is essential for maintaining efficiency and consistency in business operations. Without a clear format, communication can become disorganized, leading to delays, confusion, and potential errors in processing. By using a standardized approach, businesses can ensure that key details are communicated effectively and that the process moves forward without unnecessary obstacles.

Key Reasons for Implementing a Standardized Format

Using a structured communication method benefits both internal teams and external partners by providing clarity and reducing the likelihood of mistakes. Here are some reasons why a consistent approach is crucial:

- Improved Accuracy: A consistent format helps avoid overlooking important details, ensuring that all necessary information is included in each communication.

- Faster Decision-Making: With a clear and easy-to-read structure, recipients can quickly review the details and make informed decisions, leading to faster response times.

- Streamlined Workflow: By eliminating the need for back-and-forth clarification, a standardized approach helps keep the process moving smoothly and efficiently.

- Professionalism: A polished and formal communication style enhances the company’s credibility and builds trust with clients, vendors, and partners.

- Record-Keeping: A consistent method helps in maintaining an organized record of transactions, making it easier to refer back to past communications when necessary.

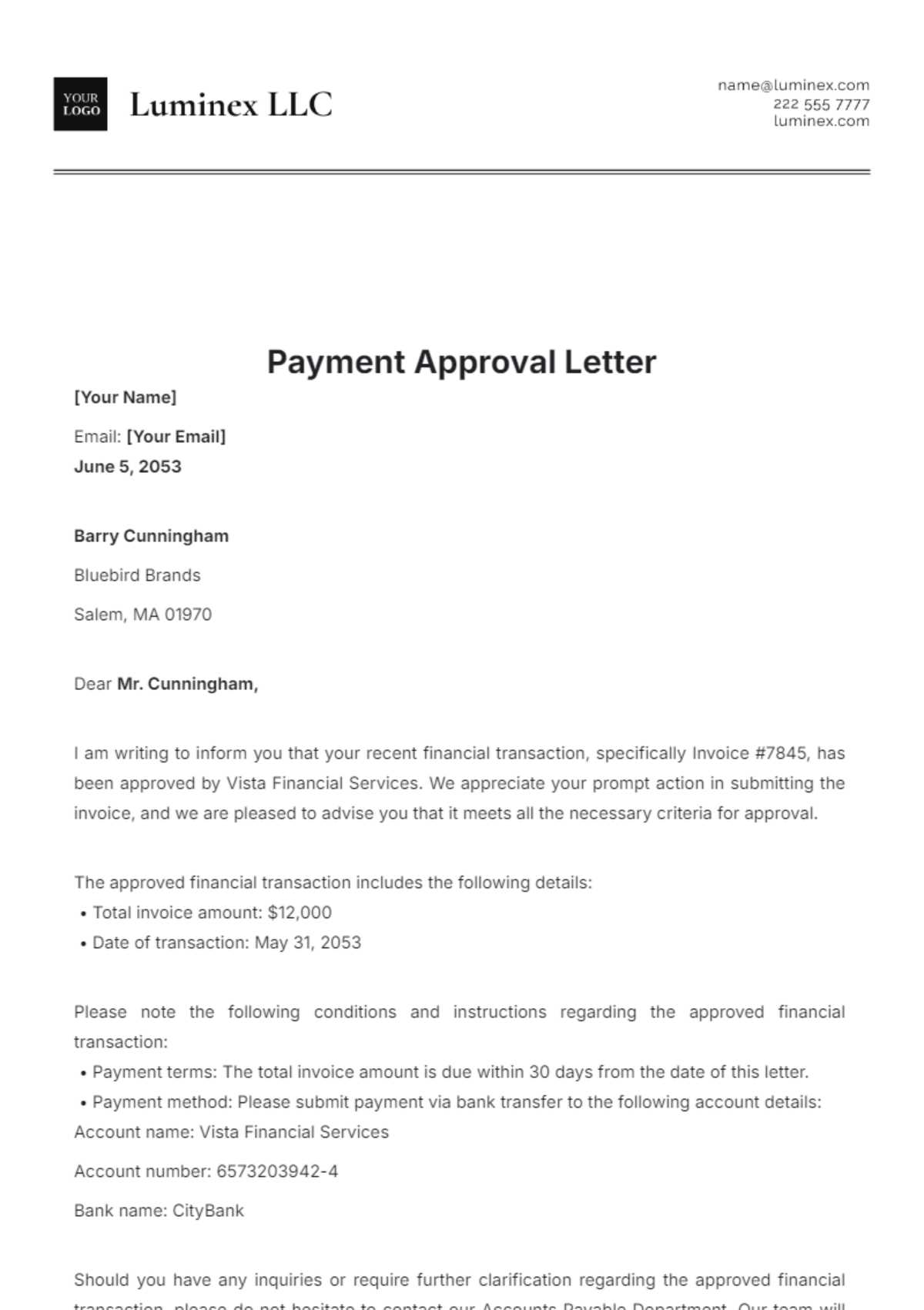

Key Elements of a Professional Template

A well-crafted message to confirm financial actions should include several essential components to ensure clarity and professionalism. Each section of the communication plays a vital role in guiding the recipient through the necessary steps while maintaining a clear and organized structure. The goal is to make the process as seamless and efficient as possible for all parties involved.

Essential Components of a Clear Message

To create an effective and professional communication, make sure the following elements are included:

- Subject Line: A concise and clear subject line that immediately informs the recipient of the purpose of the message, such as “Payment Confirmation Request” or “Transaction Details for Review.”

- Professional Salutation: A polite greeting that sets the tone of the message, such as “Dear [Recipient Name]” or “Hello [Team].”

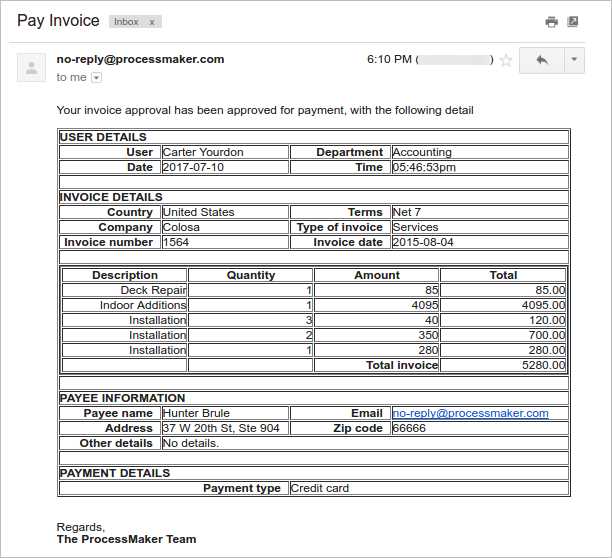

- Clear Transaction Details: Provide a breakdown of the key financial details, including amounts, dates, and descriptions, so the recipient can easily verify the information.

- Call to Action: Clearly state what is required from the recipient, whether it’s confirming details, approving a payment, or taking further action.

- Contact Information: Offer a way for the recipient to reach out in case of any questions or clarifications, ensuring smooth communication.

- Polite Closing: End with a professional sign-off, such as “Best regards” or “Sincerely,” to leave a positive impression.

Design and Formatting Tips for Readability

In addition to the content, the visual presentation of the message is equally important. A well-organized layout helps the recipient quickly digest the information and take the necessary actions.

- Use Short Paragraphs: Break the content into short, digestible paragraphs to avoid overwhelming the reader with long blocks of text.

- Bullet Points or Lists: Use bullet points or numbered lists to highlight key details, making them easier to scan.

- Bold Key Information: Emphasize important details, such as deadlines or amounts, by using bold text for better visibility.

How to Customize Your Approval Email

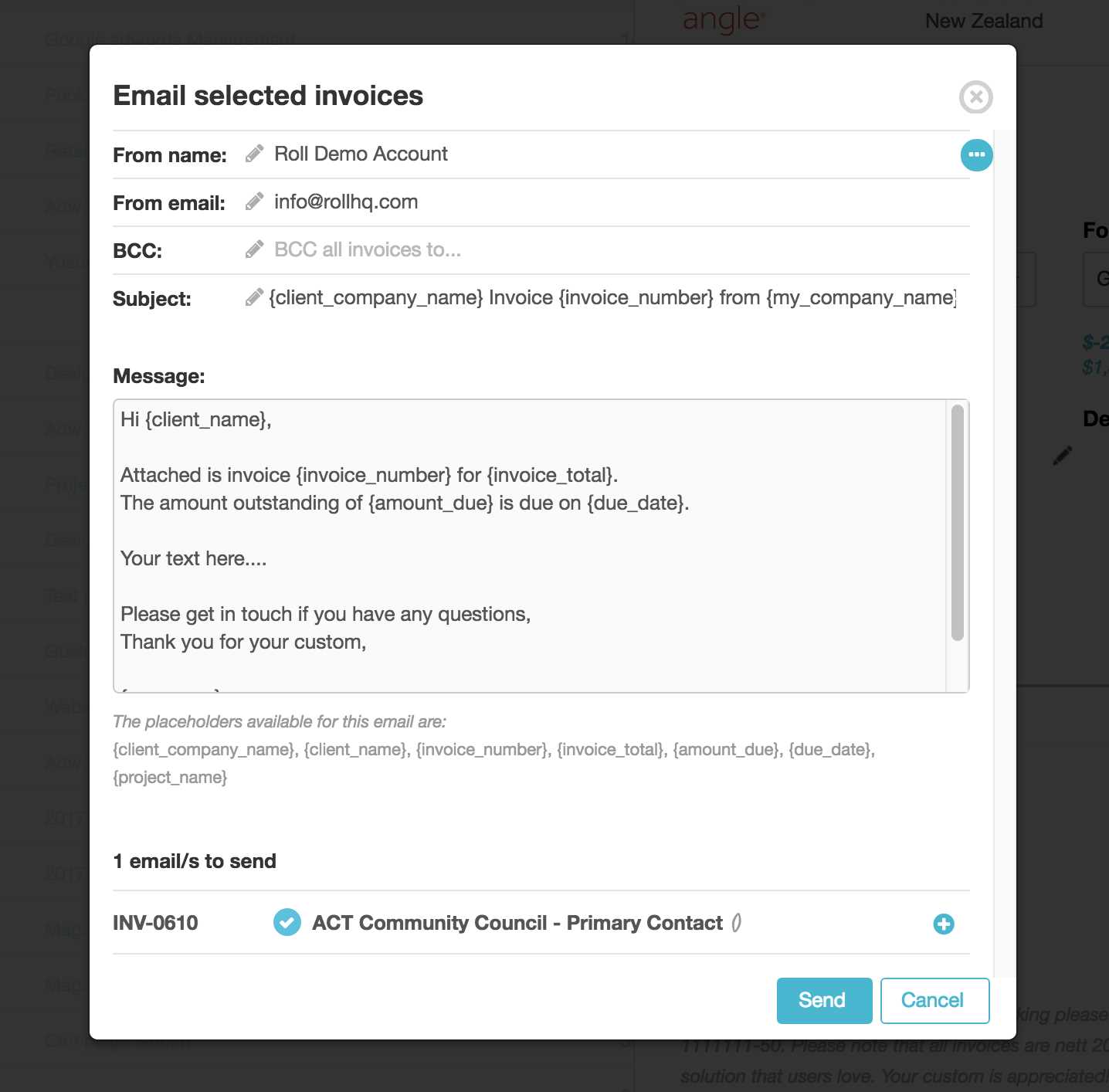

Tailoring your communication to fit specific needs and contexts is key to creating a professional and effective message. Customization ensures that the recipient understands exactly what is being requested, while also reflecting your company’s tone and values. Adjusting the content and structure allows for greater clarity and improves the chances of receiving a prompt response.

Steps for Personalizing Your Communication

Here are some key ways to customize your message for better engagement and clarity:

- Address the Recipient by Name: Personalize your greeting by using the recipient’s name rather than a generic salutation. For example, “Dear [Recipient’s Name],” helps create a more personal connection.

- Adjust the Language to Fit Your Audience: Consider the recipient’s familiarity with your business or the subject matter. If you’re writing to a colleague, the tone can be more casual; for clients or partners, ensure the language remains formal and respectful.

- Include Relevant Details: Make sure to mention any specific items, dates, or figures related to the transaction. The more precise you are, the easier it is for the recipient to verify and approve the details.

- Clarify the Call to Action: Customize the requested action. Whether you are asking for confirmation, further clarification, or approval, be explicit about what you need from the recipient and by when.

Formatting Tips for Clarity and Impact

Besides the content, how you present the information can make a huge difference. A clean, well-organized format will help the recipient quickly process the information and take appropriate action.

- Use Bullet Points or Lists: Present key details in bullet points or numbered lists. This makes the content easier to digest and allows the recipient to focus on the most important aspects.

- Highlight Key Dates or Amounts: If deadlines or amounts are important, emphasize them by making them bold or using a larger font size to draw attention.

- Include a Signature: Close your message with your name, position, and contact information. This gives the recipient a clear point of contact for any questions or clarifications.

Best Practices for Writing Approval Emails

Crafting effective and professional messages to confirm financial transactions requires attention to detail, clarity, and politeness. By following a set of best practices, you can ensure that your communications are not only efficient but also maintain strong relationships with clients, vendors, and internal teams. A well-written message helps streamline processes and prevents confusion, ensuring swift and accurate decisions.

Essential Guidelines for Crafting Clear Communications

To maximize the effectiveness of your messages, consider the following best practices when drafting them:

- Be Clear and Concise: Avoid unnecessary details and keep your message focused on the key points. A clear and concise communication allows the recipient to quickly grasp the information and respond accordingly.

- Use a Professional Tone: Regardless of the familiarity between you and the recipient, always maintain a polite and professional tone. This sets the right tone for the interaction and fosters trust.

- Specify Deadlines: If the message requires action within a specific timeframe, make sure to clearly state any deadlines. This helps the recipient prioritize their tasks and take action promptly.

- Proofread for Errors: Double-check your communication for any spelling or grammatical mistakes. Errors can make your message appear unprofessional and can create confusion about the details.

Formatting for Maximum Clarity

In addition to content, the structure and visual presentation of your message play a significant role in readability. Make sure your communication is easy to navigate by following these formatting tips:

- Use Short Paragraphs: Break down the content into small, digestible chunks. This makes it easier for the recipient to absorb the information without feeling overwhelmed.

- Highlight Key Information: Use bold or italics to emphasize crucial details, such as amounts, dates, or action steps. This helps the recipient focus on the most important points.

- Include a Clear Call to Action: Always end your message with a clear and direct request. Whether you’re asking for confirmation or further action, make sure the recipient knows what is expected of them.

Common Mistakes in Invoice Approval Emails

Even with the best intentions, it’s easy to make mistakes when drafting messages to confirm financial actions. These errors can cause confusion, delay decisions, or even damage professional relationships. By identifying and avoiding common pitfalls, you can ensure that your communications are effective and professional, leading to smoother transactions and quicker responses.

Typical Errors to Avoid

Here are some of the most common mistakes that can occur when sending out messages for financial confirmations:

- Vague Subject Lines: A subject line that is too generic or unclear can lead to your message being overlooked or ignored. Always make sure the subject accurately reflects the purpose of the communication, such as “Payment Confirmation Required” or “Action Needed: Review Transaction Details.”

- Missing or Incorrect Details: Omitting important transaction details, like amounts, dates, or reference numbers, can lead to confusion or delays. Always double-check that all relevant information is included and accurate before sending.

- Unclear Requests: Failing to specify the exact action required from the recipient can lead to misunderstandings. Be explicit about whether you’re asking for confirmation, approval, or further information.

- Lack of Professional Tone: Using overly casual or informal language can make your message seem unprofessional. Always maintain a polite, respectful tone, even when dealing with routine tasks.

- Not Proofreading: Sending messages with grammatical errors, typos, or formatting issues can negatively impact your professionalism. Always proofread your communication before sending it to ensure it’s polished and error-free.

How to Fix These Mistakes

Being aware of these common mistakes is the first step in avoiding them. To improve the clarity and effectiveness of your messages, make sure to:

- Double-check for accuracy: Before sending, review all the details to ensure everything is correct.

- Clarify your request: Clearly state what is expected from the recipient, including any deadlines or specific actions.

- Maintain a professional tone: Use polite language and proper business etiquette in all your communications.

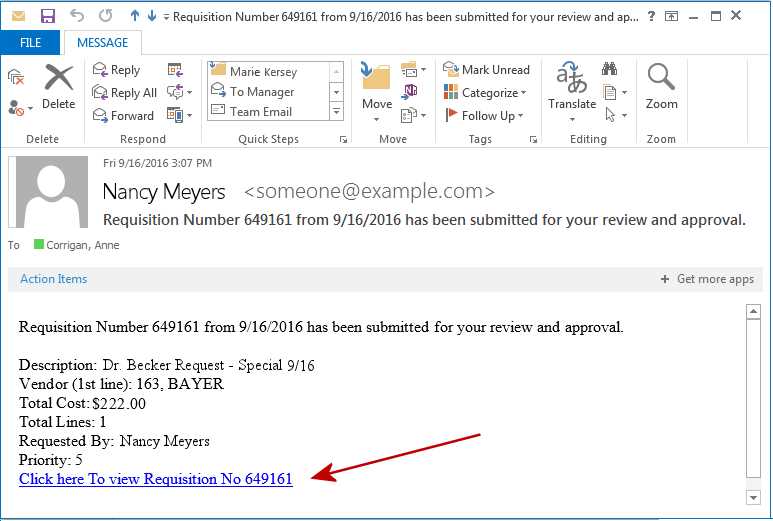

How to Ensure Quick Invoice Approval

To maintain smooth financial operations, it’s important to facilitate quick decisions when confirming transactions. A fast response from the recipient can help prevent delays in your processes and ensure timely processing of payments. By following some best practices and structuring your communication effectively, you can encourage quicker decisions and reduce the time spent waiting for responses.

Effective Strategies for Speeding Up the Process

There are several key approaches you can take to ensure that your communications are acted upon swiftly:

- Provide Clear Instructions: Ensure that the recipient knows exactly what is expected of them and what steps they need to take. A well-defined request can prevent confusion and speed up the decision-making process.

- Use Precise Deadlines: Set a specific date or timeframe by which you need a response. This creates a sense of urgency and encourages prompt action.

- Highlight Key Details: Make the important information stand out in your communication, such as amounts or due dates. When critical details are easily visible, the recipient can quickly assess and act.

- Follow Up Timely: If you haven’t received a response by the specified deadline, send a polite reminder. A follow-up can encourage the recipient to prioritize the task.

How to Structure Your Message for Quick Action

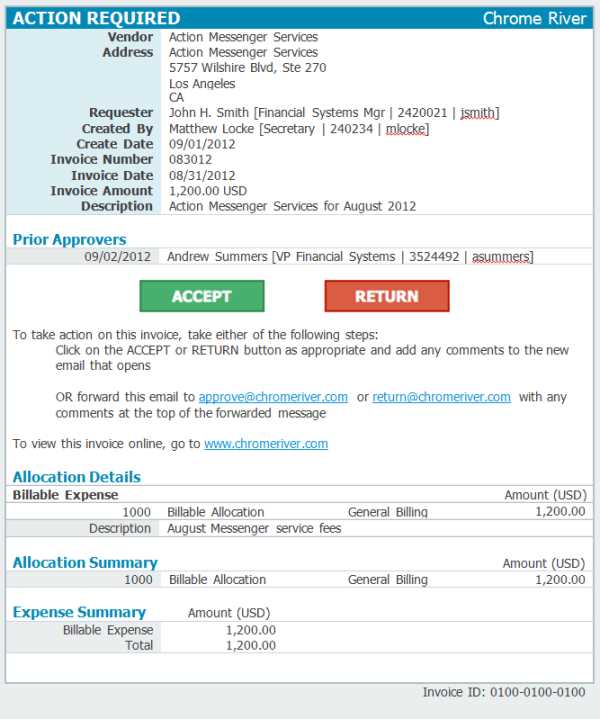

When crafting your message, the format and structure are just as important as the content. Here’s an example of a well-organized structure that can help speed up the process:

| Section | Description | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Subject Line | Make it clear and specific, e.g., “Immediate Action Required: Confirm Payment Details” | ||||||||||||||||||||

| Greeting | Address the recipient by name, making it personal and respectful. | ||||||||||||||||||||

| Transaction Summary | Provide a brief summary of the transaction, including amounts, dates, and any reference number

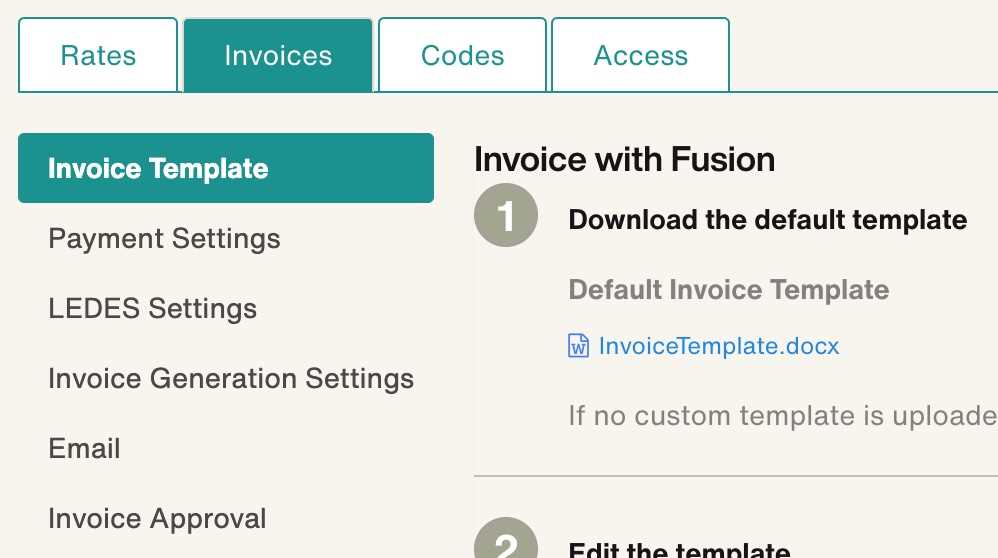

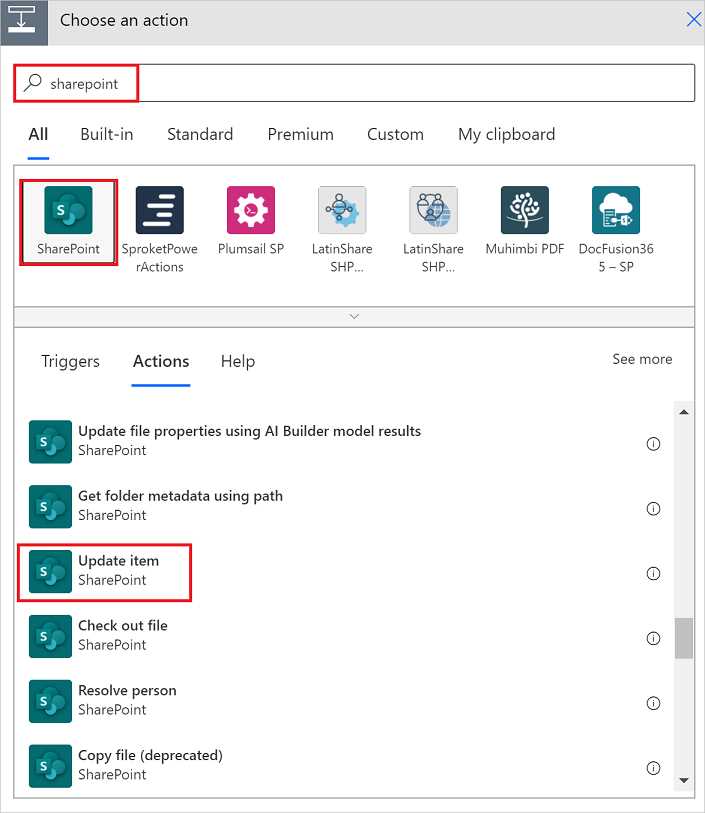

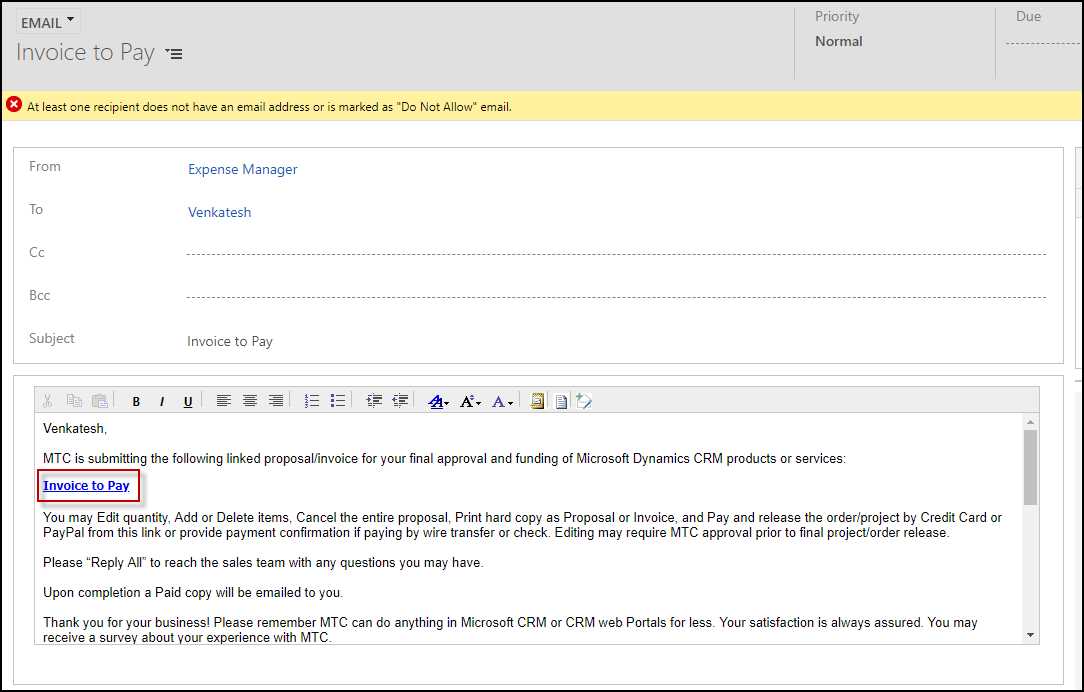

Streamlining Communication with Automated TemplatesAutomating routine communication processes can significantly improve efficiency and reduce the time spent on repetitive tasks. By using pre-written, customizable formats, businesses can ensure that every message is consistent, accurate, and sent at the right time. Automation not only speeds up the workflow but also minimizes human error and ensures that no important details are overlooked. Benefits of Automating Your Communication ProcessImplementing automated systems for financial confirmations or similar processes offers several advantages:

How to Implement Automated Communication

To effectively automate your communication, follow these key steps:

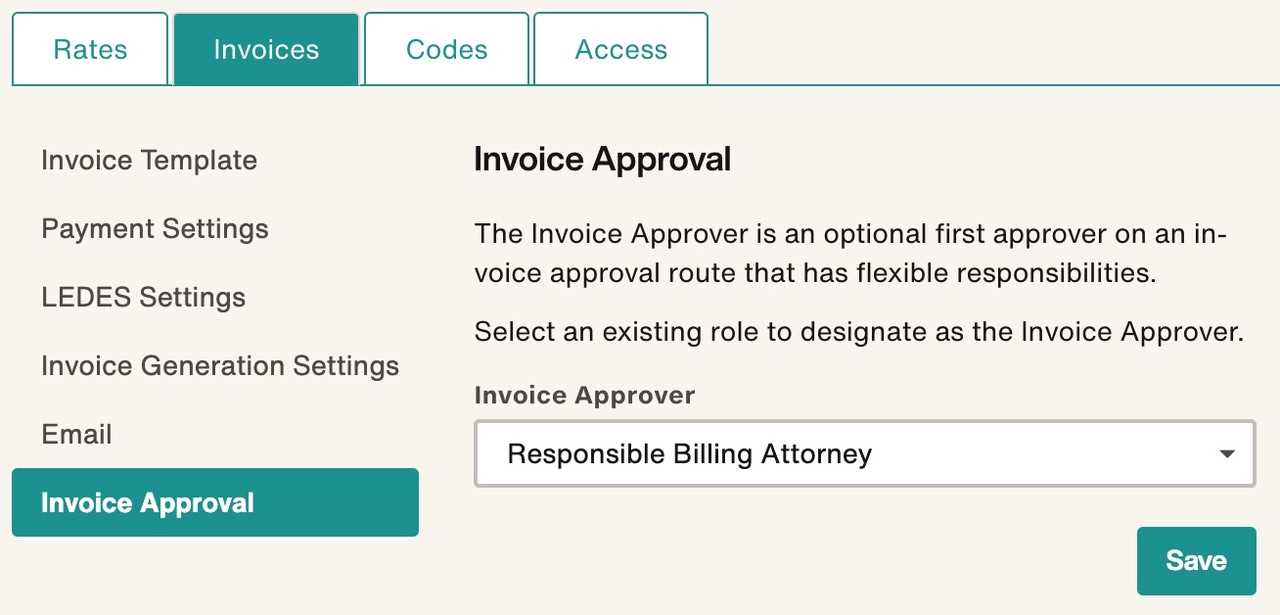

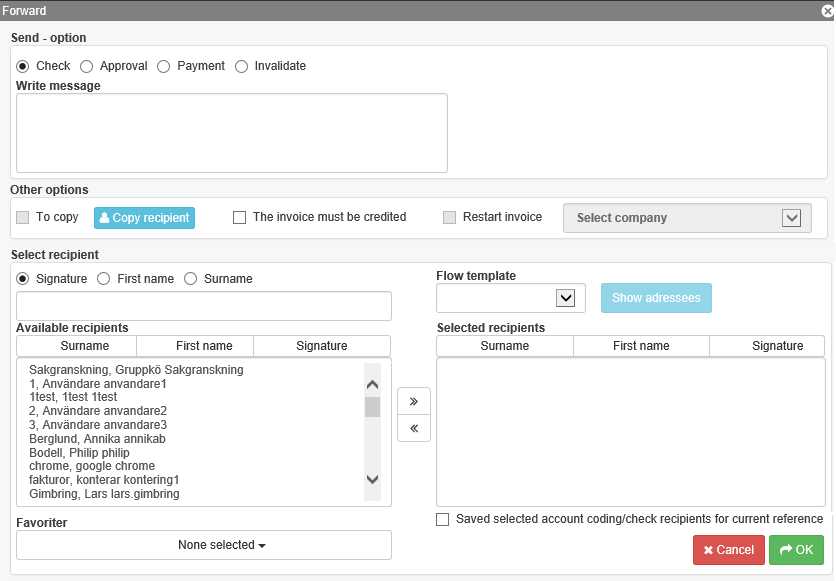

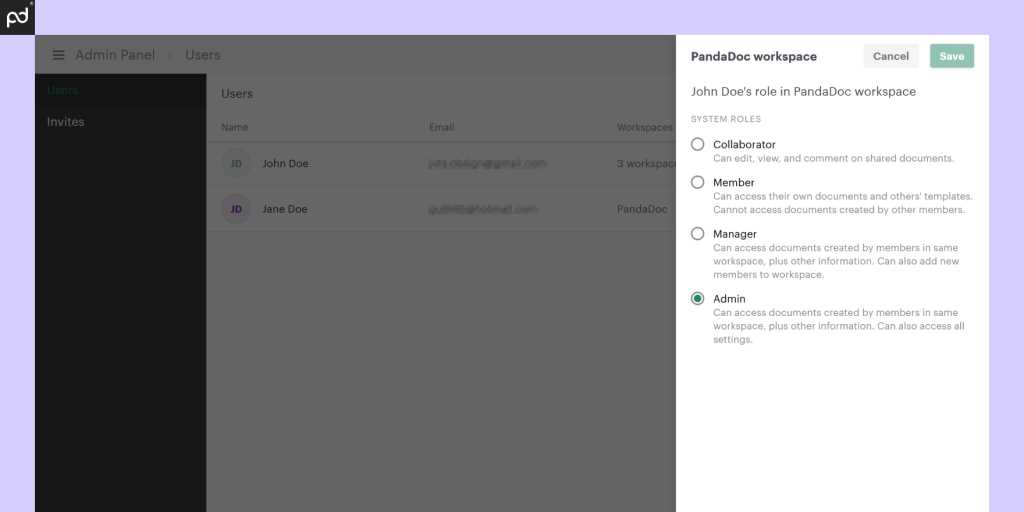

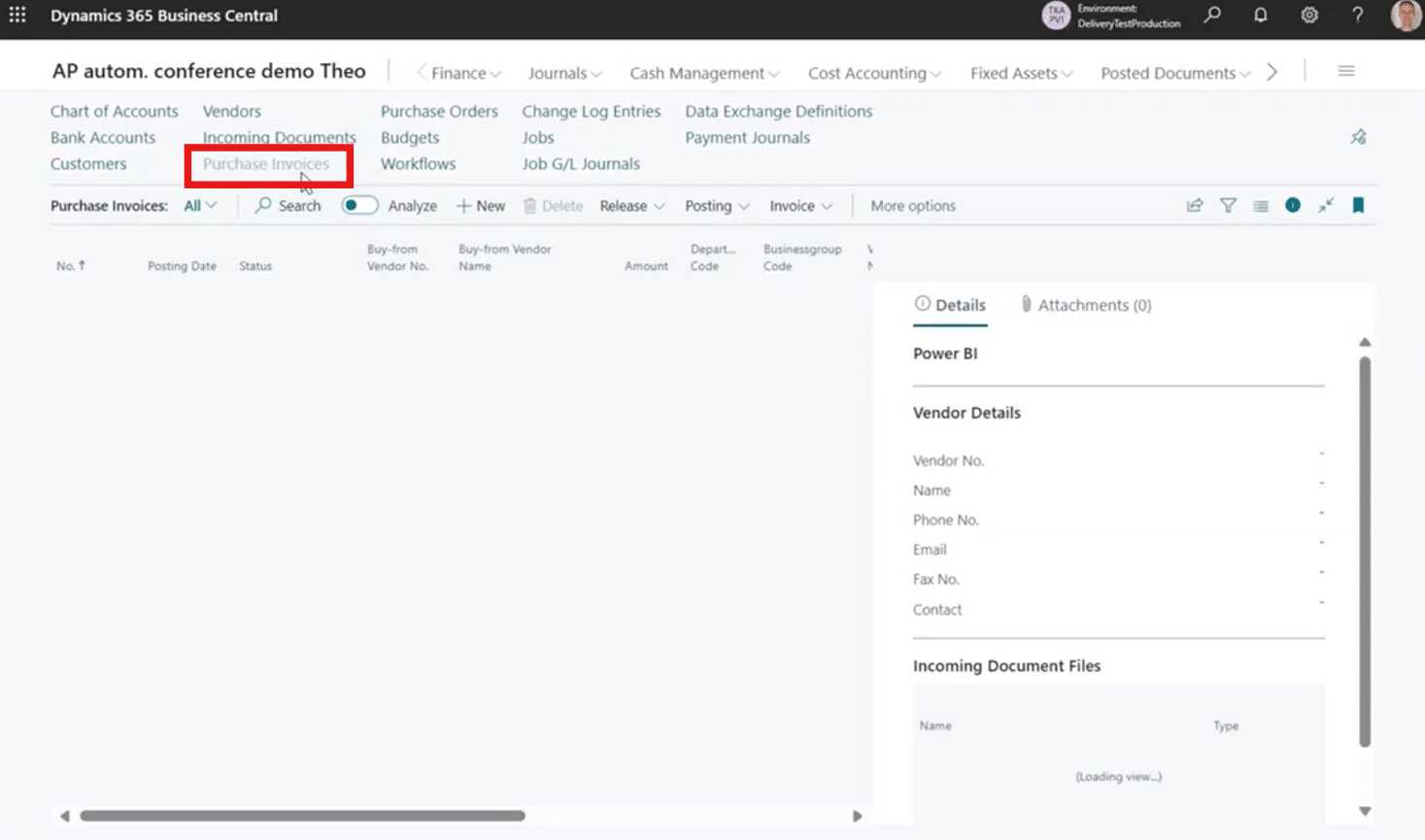

Integrating Invoice Approval into Your WorkflowIncorporating a smooth process for confirming financial transactions within your overall business workflow is crucial for efficiency and productivity. By integrating this process into your existing systems, you can minimize delays, streamline communication, and ensure that everything moves forward without unnecessary obstacles. A well-integrated process helps reduce friction between teams and departments while maintaining consistency and accuracy. Steps for Seamless IntegrationTo successfully integrate the confirmation process into your daily operations, consider the following steps:

Monitoring and Optimizing the Process

Once the process is in place, continuous monitoring and optimization are key to maintaining its efficiency. Here are some tips for ongoing success:

Tips for Clear and Concise Email WritingEffective communication relies on clarity and brevity, especially when conveying important business information. A well-structured message helps ensure that your recipient understands the request or information right away, saving time and reducing the likelihood of confusion. By applying a few simple strategies, you can improve the readability of your messages and make them more efficient to process. Key Strategies for Writing Concise MessagesTo ensure that your messages are both clear and to the point, consider implementing the following techniques:

Enhancing Readability with Proper Structure

Good structure plays a significant role in making your message easier to read and understand. Here are a few tips to improve your message layout:

|