Inventory Invoice Template for Easy Stock Management

Efficient management of products and financial records is essential for any business dealing with physical goods. To ensure smooth operations, it is crucial to have a reliable system that helps track purchases, sales, and stock levels while maintaining accurate documentation for every transaction.

Proper documentation plays a vital role in both organizing the flow of goods and ensuring accurate financial reporting. Whether you’re running a small retail store or a larger distribution network, having a structured method to capture product details, quantities, and pricing will save time and reduce errors.

Incorporating a well-designed system for managing your transactions can significantly enhance your efficiency. By using predefined documents to record each transaction, you can simplify complex processes and avoid the confusion that often comes with manual entries. This also helps improve communication with suppliers and customers, offering clear and professional documentation every time a deal is made.

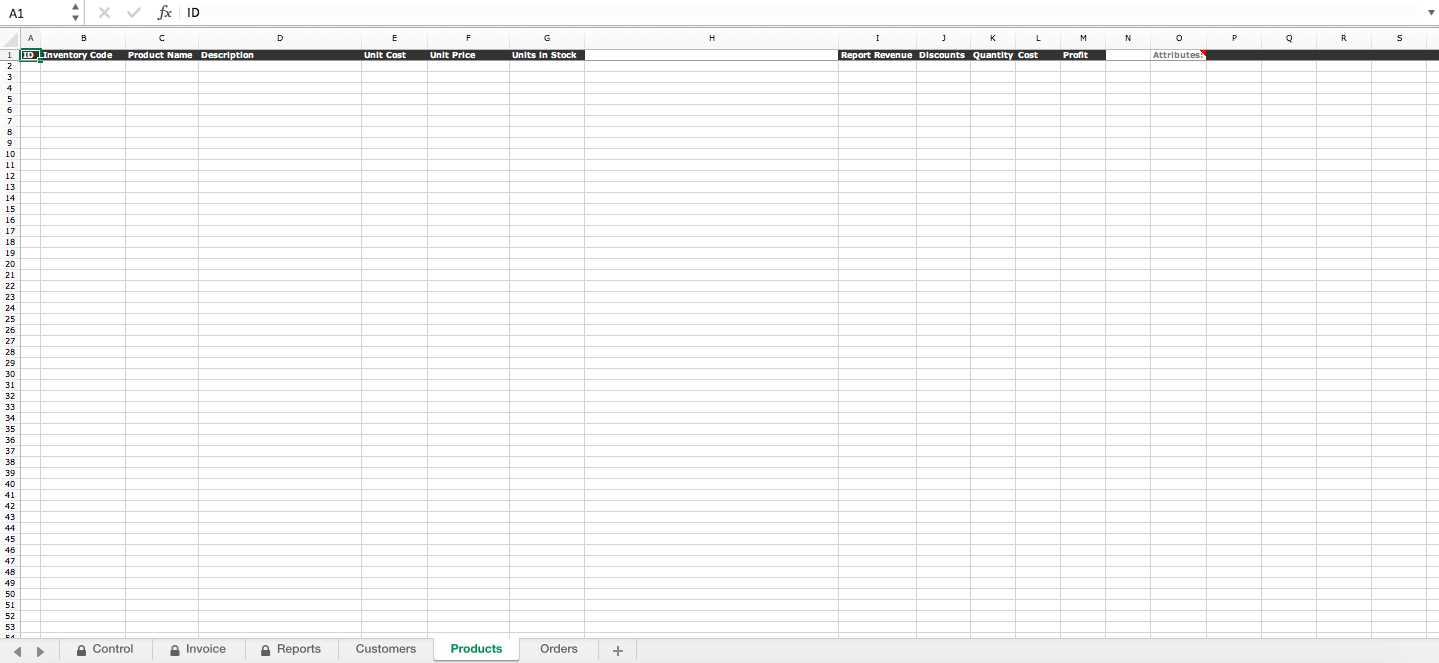

What is an Inventory Invoice Template

When managing stock and financial transactions, businesses rely on structured documents to keep track of purchases and sales. These documents are designed to capture key details of each transaction, ensuring clarity and accuracy in the recording process. Such records play an essential role in maintaining a smooth workflow between vendors, clients, and internal teams.

At its core, this kind of document acts as a formal record that outlines the specifics of a product exchange. It typically includes the product’s description, quantity, price, and other critical details that provide both parties with a clear understanding of the transaction. Here’s what you might typically find in such a document:

- Product Name and Description – Clearly listed items that were sold or delivered.

- Quantity – The amount of products involved in the exchange.

- Unit Price – The cost per unit of the item being transacted.

- Total Price – The overall cost based on quantity and unit price.

- Transaction Date – The exact date of the sale or delivery.

- Seller and Buyer Information – Contact and business details for both parties involved.

By using such a record, businesses ensure that they have a professional and consistent approach to tracking the flow of goods and services. This standardization not only helps with internal record-keeping but also assists in maintaining legal compliance and avoiding misunderstandings during financial audits or disputes.

Key Features of an Inventory Invoice

To ensure smooth transactions and proper tracking of goods and services, it’s essential to have a document that includes all necessary details for both parties involved. This type of document not only helps businesses stay organized but also serves as an official record for accounting, reporting, and communication purposes.

Essential Information for Clear Documentation

Every well-organized record should contain specific information that provides clarity about the exchange. The most crucial elements include:

- Item Description – A detailed description of the goods or services involved in the transaction.

- Quantity – The exact number of units being exchanged, which helps track stock levels.

- Unit Price – The cost per individual item or unit, making it easier to calculate the overall value.

- Total Amount – The sum of the transaction, calculated based on quantity and unit price.

- Date – A record of the transaction date to provide a timeline for inventory management and financial tracking.

Contact and Transaction Details

To ensure smooth communication and resolve potential issues, the following details should be included:

- Buyer and Seller Information – Names, addresses, and contact information for both parties.

- Payment Terms – Clear instructions on payment deadlines and any discounts or fees associated with the transaction.

- Order Number or Reference Code – A unique identifier for easier tracking and follow-up.

These features not only simplify the process of tracking goods but also help prevent mistakes in accounting and inventory management. With all necessary details clearly laid out, both buyers and sellers can be confident that their transactions are properly documented and accurate.

Benefits of Using an Inventory Template

Having a structured approach to documenting transactions and managing stock is crucial for maintaining accuracy and efficiency. By utilizing a pre-designed framework for recording product details and prices, businesses can streamline their operations, reduce errors, and improve overall productivity. This method provides consistency across all exchanges, ensuring that key information is always captured correctly.

Time-Saving Efficiency

Using a predefined format allows businesses to quickly fill out essential details without worrying about missing any important information. The process becomes more efficient, as employees don’t need to create records from scratch each time. With automated calculations for totals and prices, errors are minimized, and time spent on manual calculations is reduced.

Consistency and Accuracy

Standardized records reduce discrepancies and help maintain uniformity across transactions. With a clear and consistent structure, both sellers and buyers can easily understand the key aspects of the exchange, such as quantities, pricing, and delivery terms. This level of consistency also ensures that accounting and reporting are straightforward, which is vital for financial audits.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Filling out pre-designed forms reduces time spent on manual tasks, speeding up the process. |

| Consistency | Standardized records help avoid confusion and ensure that all necessary details are included every time. |

| Accuracy | Automatic calculations and predefined fields minimize the chance of errors during data entry. |

| Improved Communication | Clear documentation fosters better communication between parties by providing a common understanding of the terms. |

By using a standardized format, businesses not only save time and resources but also ensure smooth operations and enhance communication with their clients or suppliers. The use of such a system helps foster a more organized and professional approach to managing stock and financial exchanges.

How to Create an Inventory Invoice

Creating a well-structured document for tracking transactions is crucial for maintaining organization and accuracy in your business operations. This document should capture all the necessary details about each sale or purchase, ensuring clarity for both the buyer and seller. A well-designed record simplifies the process of tracking goods, calculating costs, and ensuring timely payments.

The process of creating such a record involves several key steps. These steps help ensure that no important information is overlooked and that all parties involved are on the same page. Below are the essential stages to follow when crafting a detailed record for your transactions:

Step 1: Include Basic Information

Start by adding basic details about both parties. This includes the name and contact information for both the seller and the buyer. Additionally, include the document number and the date of the transaction. This information is essential for reference, especially in case of disputes or when you need to track the record for accounting purposes.

- Seller and Buyer Details – Name, address, phone number, and email of both parties.

- Transaction Date – The exact date when the exchange took place.

- Reference Number – A unique ID for easy tracking and future reference.

Step 2: List Products or Services

Next, list the goods or services involved in the transaction. Be sure to provide a clear description of each item, along with the quantity and unit price. This helps ensure that the buyer understands exactly what was provided and at what cost.

- Product Description – A brief description of each item or service offered.

- Quantity – The number of units being exchanged.

- Unit Price – The price per individual unit or service.

Step 3: Calcula

Choosing the Right Template for Your Business

Selecting the right framework for recording transactions is essential for any business aiming to streamline operations and maintain accurate records. The proper format not only ensures consistency but also makes tracking easier and more efficient. A good structure helps you manage details of every sale or purchase, making it simpler to stay organized and communicate clearly with clients or suppliers.

When choosing the right document format, it’s important to consider the nature of your business and its specific needs. Different industries may require different fields or sections, so it’s crucial to find one that suits your products, services, and processes. The right structure will help you capture all the necessary information without overwhelming your team or clients with unnecessary complexity.

Here are some key factors to consider when selecting a framework:

- Customization Options – Make sure the format can be easily adjusted to fit your specific needs, such as adding additional fields or removing unnecessary ones.

- User-Friendliness – Choose a design that is easy to use and fill out, both for your team and customers.

- Scalability – As your business grows, you’ll want a solution that can scale with you. Ensure the structure can handle increased volumes of transactions without becoming too complicated.

- Integration with Other Systems – If you use accounting or management software, ensure that your chosen framework can integrate smoothly for automatic calculations and easy data transfers.

By considering these factors, you can select a format that will support your business’s goals, improve organization, and create a more professional experience for both your team and your clients.

Customizing Your Inventory Invoice Template

Customizing your record-keeping document is an essential step in making sure it meets your business’s unique needs. A one-size-fits-all solution may not capture every detail relevant to your transactions, so personalizing your document can help improve accuracy, streamline your workflow, and provide a more professional experience for your clients. Customization allows you to tailor the format to fit the specific requirements of your industry and customer base.

Key Areas to Customize

When modifying your document structure, consider the following elements to ensure it aligns with your business processes:

- Logo and Branding – Include your company logo, color scheme, and contact information to maintain a professional and consistent brand image.

- Field Layout – Adjust the arrangement of fields to prioritize the most important information for your business, such as payment terms, discounts, or shipping details.

- Additional Information – Add custom fields like order numbers, customer IDs, or special notes to capture information that’s unique to your transactions.

- Payment Instructions – Customize the payment section to include your preferred methods, terms, and any late fees or discounts.

Design and Format Considerations

The layout and design of your document can greatly impact both functionality and readability. Ensuring that the document is easy to understand and visually appealing will improve your professional image and help avoid confusion in future transactions.

- Clear Sectioning – Use headings, borders, or shading to clearly distinguish between different sections (e.g., product list, payment details, seller information).

- Consistent Fonts and Colors – Stick to a readable font and a cohesive color scheme that reflects your brand

Common Mistakes in Inventory Invoices

Accurate documentation is key to smooth business operations, but mistakes can easily happen when recording transactions. Small errors in the details of a transaction can lead to confusion, payment delays, and strained relationships with customers or suppliers. Recognizing and avoiding these common mistakes can help maintain the integrity of your financial records and improve the overall efficiency of your processes.

Here are some frequent issues that businesses encounter when creating transactional documents:

- Incorrect Product Details – Listing the wrong product name, description, or SKU number can cause confusion for both parties and may lead to returns or complaints. Ensure that every item is clearly described and matches what was actually exchanged.

- Missing or Incorrect Quantities – Failing to accurately record the number of units can result in discrepancies between what was agreed upon and what was delivered. Double-check the quantities before finalizing the document.

- Pricing Errors – Simple mistakes in pricing, such as incorrect unit prices or failure to include discounts, can significantly affect the total amount due. Verify that the unit price matches what was agreed upon and that all additional charges are included.

- Omitting Payment Terms – If the document doesn’t specify payment deadlines, terms, or discounts for early payment, it can lead to misunderstandings and delays in receiving payment. Always include clear instructions regarding due dates and any conditions for payment.

- Inaccurate Tax Calculations – Not applying the correct tax rate or forgetting to include taxes altogether can cause issues with compliance and financial reporting. Ensure that tax rates are accurate based on location and product type.

Tip: Regularly reviewing your documents and training employees to catch these errors can help prevent mistakes from occurring in the first place. Using automated systems or predefined fields can also reduce human error and improve the accuracy of your records.

By being aware of these common mistakes, you can take proactive steps to prevent them, ensuring smooth transactions and maintaining strong, transparent relationships with

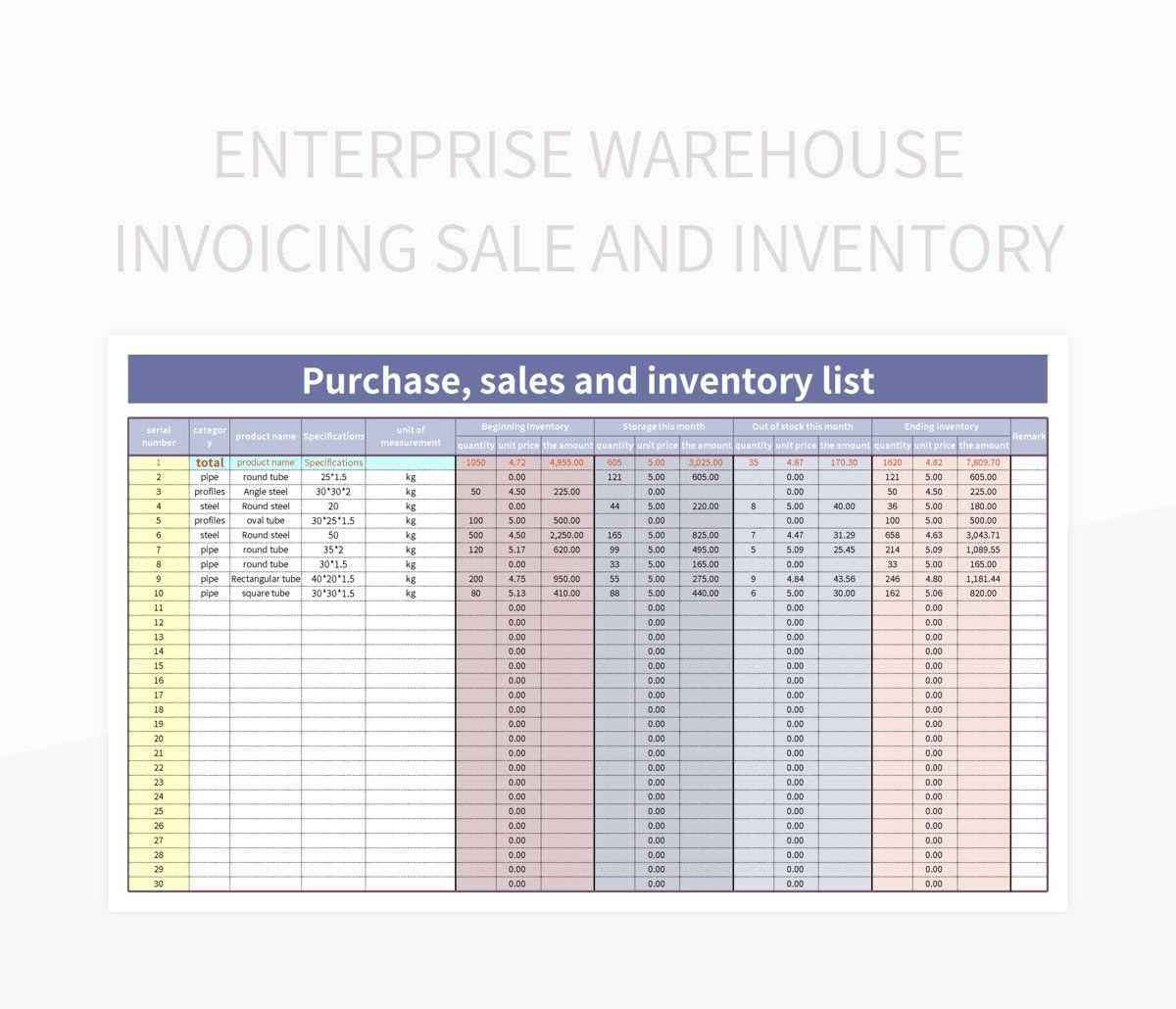

How to Track Inventory with Invoices

Properly managing stock levels is essential for any business that deals with physical goods. One effective way to track products and ensure that your records are up-to-date is by using detailed transaction records. These documents not only capture the exchange of goods but also help monitor the flow of items, making it easier to track stock levels and manage reordering.

By including key product details in each transaction record, you can maintain an accurate count of items in stock and identify trends in sales. Here’s how you can use transaction documents to effectively manage your goods:

Steps to Track Products

- Record Every Transaction – For each sale or purchase, make sure to document the products involved, including their quantities, unit prices, and any applicable discounts. This ensures that every movement of goods is accounted for.

- Update Stock Levels Immediately – After completing each sale or purchase, update your stock system right away. Deduct the sold quantities and add the newly received items. This real-time tracking prevents stockouts or overstocking.

- Include Unique Identifiers – Use product codes, serial numbers, or barcodes in your documentation to make tracking more accurate and avoid confusion with similar items.

- Track Returns and Adjustments – Record any returns or adjustments separately, and update your inventory records accordingly. This helps ensure that your stock count remains accurate even when items are returned or exchanged.

Using Transaction Records for Reordering

- Monitor Trends – By analyzing the sales data from your records, you can identify which products are selling quickly and which are not. This helps you predict when to reorder and avoid running out of high-demand items.

- Set Reordering Thresholds – Use the data to set minimum stock levels for each item. When stock falls below this threshold, you’ll know it’s time to place an order.

- Automate Reordering – Many businesses use software that integrates with their records to automate the reordering process. This can save time and prevent errors in manually tracking low stock levels.

By consistently using transaction records to monitor product movement, you can ensure your stock is always managed efficiently. This system reduces human error and gives you the insights needed to make informed decisions about inventory and reordering.

Essential Elements of an Inventory Invoice

When managing transactions involving products or services, having a structured and clear document is crucial for both tracking and communication. A well-designed record includes all the necessary details to ensure that both the seller and buyer have a mutual understanding of the exchange. Including the right elements helps avoid errors, clarifies payment terms, and supports effective accounting practices.

Key Information to Include

To create a comprehensive and professional document, certain pieces of information must always be present. These elements serve to define the transaction, ensuring it is both accurate and transparent:

- Seller and Buyer Information – Include the full names, addresses, contact details, and any business identification numbers for both parties involved in the transaction.

- Unique Reference Number – Each document should have a unique identifier for easy tracking and future reference. This could be an order number, reference code, or serial number.

- Transaction Date – Clearly indicate the date when the transaction took place. This helps with accounting and tracking delivery timelines.

- Product Description – List each product or service provided, with a brief but clear description to avoid confusion.

- Quantity and Unit Price – Specify the number of units involved in the transaction, as well as the agreed-upon price per unit or service. This helps in calculating the total cost.

- Total Amount – Sum up the total cost for each product or service, including any additional charges like taxes, shipping, or handling fees.

Additional Important Details

Beyond the basic information, there are additional details that enhance the clarity of the document and help with smooth transaction processing:

- Payment Terms – Specify the due date, method of payment, and any penalties or discounts for early or late payment.

- Shipping and Delivery Information – Include details about how the goods will be delivered, any shipping charges, and expected delivery dates.

- Return Policy or Warranty Information – If applicable, provide clear information on how returns or exchanges are handled or any warranties provided for the goods or services.

By ensuring all of these essential elements are included, you can create a document that accurately reflects the transaction, minimizes the risk of disputes, and supports effective tracking and accounting for your business.

How Inventory Invoices Improve Accuracy

Maintaining accurate records is essential for any business, especially when it comes to tracking transactions and managing stock. Clear and detailed documents help ensure that every aspect of the exchange is accounted for, reducing the likelihood of errors and discrepancies. By standardizing how goods and services are documented, businesses can improve operational accuracy, reduce misunderstandings, and streamline their processes.

When used correctly, these detailed transaction records can greatly enhance precision in several key areas of your business:

Clear Documentation of Transactions

One of the primary ways these documents improve accuracy is by providing clear, structured information. By including precise details about the products or services exchanged–such as quantities, prices, and product descriptions–both parties have a shared understanding of the terms. This minimizes the risk of errors related to order fulfillment and payment calculations.

- Reduced Errors – Clearly defined fields help ensure that all necessary information is recorded correctly.

- Transparent Calculations – Automated calculations in these documents reduce the chance of mathematical errors, ensuring the correct amount is paid.

- Accurate Delivery Records – Shipping and delivery details are documented, preventing miscommunication and helping to track products through the delivery process.

Consistency Across Transactions

Consistency is another crucial benefit. When using a predefined structure for every transaction, it ensures that each record contains the same basic information in the same format. This reduces discrepancies between different records and makes it easier to track goods, services, and payments over time.

- Standardized Format – A consistent format makes it easier to review, compare, and analyze records, helping you maintain accuracy across all transactions.

- Efficient Auditing – Consistent records allow for quicker audits, as all the required details are in one place, reducing the tim

Integrating Invoices with Inventory Management Systems

Efficiently managing the flow of goods and services requires accurate record-keeping that seamlessly integrates with business operations. By linking detailed transaction documents with your stock control system, you can streamline operations, reduce errors, and ensure that your records are always up-to-date. This integration allows for automatic updates to stock levels, real-time tracking of sales and purchases, and improved decision-making.

Integrating transaction records with inventory systems provides several key benefits that help businesses stay organized and improve operational efficiency:

- Real-Time Stock Updates – Whenever a transaction occurs, the system automatically adjusts stock levels based on the quantities recorded, ensuring that inventory is always accurate without manual intervention.

- Faster Processing – By automating data transfer from transaction records to your inventory system, you eliminate the need for manual entry, reducing processing time and the risk of errors.

- Accurate Reporting – Integrated systems provide real-time insights into stock levels, sales trends, and purchase patterns, helping you make informed decisions on reordering and product management.

- Improved Order Fulfillment – Integration allows for quicker identification of low stock items, ensuring that reorders are placed on time and customers receive their orders without delay.

By combining transaction data with inventory management software, businesses can achieve a more efficient and accurate way to track stock movements and maintain organized records. This reduces the risk of overstocking or stockouts, while providing valuable insights into product performance and demand patterns.

Legal Considerations for Inventory Invoices

When dealing with transaction records, it’s important to be aware of the legal requirements that govern the documentation process. Properly structured documents are not only vital for business operations but also necessary for compliance with local laws and regulations. These records must adhere to certain legal standards to ensure that your business stays in good standing and avoids potential legal issues or penalties.

Here are several legal considerations to keep in mind when creating and maintaining your transaction records:

Required Information

- Accurate Record-Keeping – Ensure that all essential details are included in each document, such as the names and contact information of the involved parties, transaction date, and a clear breakdown of products or services exchanged. Incomplete or incorrect information can lead to disputes or legal complications.

- Tax Compliance – Be sure to include applicable tax rates, amounts, and any exemptions. Different regions have varying tax laws, and failing to include accurate tax information could result in legal penalties or audits.

- Clear Payment Terms – Clearly state payment terms, including due dates, late fees, and available payment methods. This protects both parties and ensures transparency in financial transactions.

Retention of Records

- Legal Requirements for Retention – Different jurisdictions may have specific rules regarding how long business records should be kept. Typically, documents related to transactions should be stored for several years, often 5-7 years, depending on local laws.

- Proper Storage – Legal compliance also extends to how these documents are stored. Secure digital storage or physical filing systems should be used to ensure that records are easily accessible in case of an audit or legal dispute.

- Data Protection – Be aware of data protection laws such as GDPR or CCPA if handling sensitive personal or financial data. Ensure that you are storing and processing this information securely and in accordance with applicable privacy regulations.

Dispute Resolution and Legal Protection

- Clear Ter

Free Inventory Invoice Templates Available

Many businesses, especially small and medium-sized enterprises, often look for ways to streamline their documentation process without spending on expensive software or services. Fortunately, there are numerous free resources available online that provide customizable forms for managing product transactions. These free documents are easy to use and can be tailored to meet the specific needs of your business.

These ready-made resources can help businesses quickly generate accurate records and stay organized. Below are some of the most common types of freely available transaction documents that businesses can use:

Types of Free Transaction Records

Document Type Description Key Features Basic Sales Record A simple document for recording product or service exchanges. Item descriptions, quantities, prices, and total amounts. Purchase Order Form Used for detailing incoming goods or services for future receipt. Order number, supplier details, item descriptions, and expected delivery dates. Shipping Receipt Documents shipped goods and provides delivery confirmation. Shipment details, tracking number, recipient information, and delivery date. Return Form Used to track returned items and adjust inventory levels. Return reason, items returned, and restocking fees. Where to Find Free Resources

- Online Business Tools Websites – Many websites offer downloadable and customizable records that can be tailored to fit your business requirements. Some of these are Excel or PDF files that can be edited directly on your computer.

- Accounting Software Providers – Several accounting software solutions provide free versions or templates as part of their offerings, which businesses can use for simple record-keeping.

- Small Business Resource Platforms – Websites dedicated to helping small businesses often provide free, professional-grade forms that help maintain organized transaction logs.

By utilizing free resources, businesses can save time and money while ensuring they are maintaining accurate and professional transaction records. Whether you are tracking sales, purchases, or returns, there are many free options available to suit your needs and keep your operations running smoothly.

Using Inventory Templates for Business Efficiency

Efficient business operations are built on effective processes that reduce time spent on repetitive tasks, improve accuracy, and help teams stay organized. By using structured documents for recording transactions, businesses can streamline workflows, ensure consistency, and minimize errors. These pre-designed tools allow businesses to capture critical information quickly and maintain a standardized approach to managing goods and services.

Utilizing these standardized documents can bring several advantages that significantly improve overall business efficiency:

- Time Savings – Pre-made documents eliminate the need to create forms from scratch, reducing the time spent on administrative tasks. With ready-to-use structures, employees can focus on more critical activities.

- Reduced Human Error – Consistent formats ensure that important data is recorded accurately every time. Standardizing how records are kept reduces the chance of omissions or mistakes that could lead to financial discrepancies or operational delays.

- Improved Accuracy in Financial Reporting – Organized and consistent record-keeping makes it easier to generate accurate reports. This is especially beneficial during audits, helping businesses keep track of every transaction and maintain transparency in financial statements.

- Better Communication – Clear, standardized documents help ensure that all stakeholders have the same understanding of a transaction. This reduces confusion and fosters better communication between suppliers, customers, and internal teams.

By implementing structured forms for each step in the process–whether it’s for sales, procurement, or returns–companies can boost their operational efficiency and ensure that their records are accurate and easy to manage. This organization not only saves time but also improves decision-making and overall performance.

Best Practices for Managing Inventory Invoices

Effective management of transaction records is essential for smooth business operations, ensuring that all purchases, sales, and returns are accurately documented and easily accessible. By following best practices for handling these documents, businesses can maintain organized records, avoid errors, and improve overall operational efficiency. These practices help streamline workflows, provide clarity, and ensure compliance with legal and financial requirements.

Here are some key best practices to follow when managing transaction records:

- Standardize Record Formats – Establish a consistent structure for all transaction documents. This makes it easier to track information and ensures that all necessary details are included every time, reducing the risk of mistakes or missing data.

- Keep Detailed and Clear Descriptions – Ensure that each product or service listed in the record has a clear description, including item codes, quantities, and prices. This helps prevent confusion and makes it easier to reconcile purchases and sales.

- Integrate with Accounting Systems – Link transaction records directly to your accounting or financial management software. This integration allows for automatic updates to financial records, reducing manual data entry and minimizing errors.

- Use Digital Tools for Record Keeping – Move away from paper-based records and use digital tools to store, organize, and retrieve transaction documents. Digital storage makes it easier to search for specific transactions, track inventory levels, and manage financial data efficiently.

- Implement Regular Audits – Periodically review transaction records to ensure they are accurate and up-to-date. Regular audits help identify discrepancies early and provide an opportunity to make corrections before they become larger issues.

- Maintain Backup Copies – Ensure that all records are backed up, either in the cloud or on secure servers. This protects the business from data loss due to technical failures or unforeseen events.

- Train Employees on Proper Proce