How Intuit Invoice Templates Can Simplify Your Billing Process

Managing financial transactions efficiently is essential for any business. One of the most critical tasks is ensuring that all invoices are clear, professional, and easy to process. Having the right tools to generate these documents can save valuable time and reduce errors. With the right system in place, you can focus more on growing your business rather than dealing with administrative tasks.

There are various solutions available that allow you to create professional billing documents that meet your specific needs. These tools often come with pre-designed formats that can be easily customized. Whether you’re handling one-time payments or setting up recurring charges, these solutions provide flexibility and reliability.

By using digital billing solutions, you can enhance the accuracy of your transactions and improve cash flow management. Customizing your billing forms to reflect your brand’s identity while maintaining a streamlined workflow has never been easier. These tools offer everything from easy client data entry to automated reminders, ensuring that you stay on top of your finances.

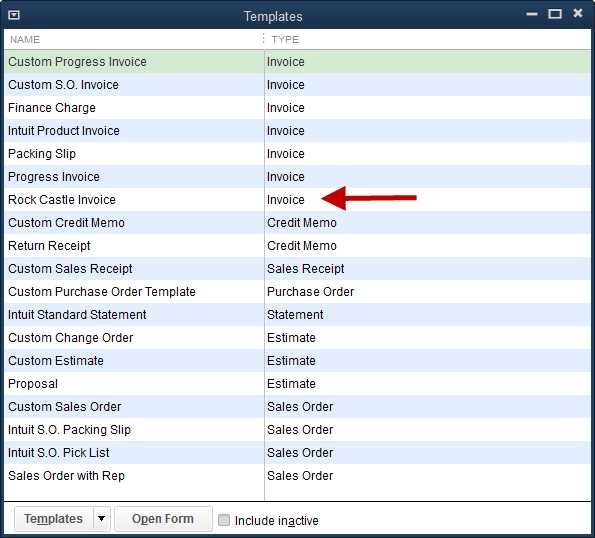

Understanding Intuit Invoice Templates

Effective financial management begins with the ability to create accurate and professional billing documents. These documents are essential for tracking payments, ensuring clarity in transactions, and maintaining strong client relationships. A well-structured billing system can simplify this process, offering a clear layout that both businesses and customers can easily understand. Utilizing ready-made solutions for creating these forms not only saves time but also improves the overall efficiency of managing business transactions.

Features of Ready-Made Billing Solutions

Modern tools designed for generating billing documents come equipped with a variety of features. They allow businesses to customize fields such as customer information, services provided, and payment terms. These features are built to ensure that all required information is included, making the documents both comprehensive and professional. Additionally, many of these systems allow for seamless integration with accounting software, making it easier to track payments and reconcile accounts.

Benefits of Customization and Flexibility

The ability to customize your billing forms is one of the key advantages of using digital tools. With these solutions, you can adjust the layout and design to suit your brand’s identity. Whether adding your company’s logo, changing fonts, or modifying section headers, customization options ensure that your documents reflect your business’s unique style. This flexibility not only enhances the presentation but also allows you to tailor the forms to meet specific needs, whether for one-time or recurring payments.

Why Choose Intuit for Invoices

When it comes to managing business transactions, using reliable and efficient tools is crucial. Many platforms offer solutions to help businesses create professional billing documents, but not all are created equal. Choosing the right software for generating these documents can streamline your operations and make the entire process more effective. With the right system, you can save time, reduce errors, and improve cash flow management.

Key Reasons to Use This Solution

- Ease of Use: The platform is designed to be user-friendly, allowing even those with minimal experience to create professional billing documents in minutes.

- Automation Features: Automate recurring billing cycles, saving you time and ensuring that invoices are sent on time.

- Customizable Layouts: Personalize your documents by adding your business logo, changing colors, or adjusting fields to suit your needs.

- Integration with Accounting Tools: Seamlessly sync your billing information with your financial software for accurate record-keeping and reporting.

- Security: Built-in security features protect sensitive customer and financial data, ensuring peace of mind.

Efficiency and Flexibility

The ability to customize billing documents is one of the major advantages of using this platform. It allows businesses to tailor the format to suit their needs while maintaining a high level of professionalism. The flexibility of this tool ensures that you can handle a variety of billing scenarios, from simple one-time payments to more complex subscription models, all within a single system.

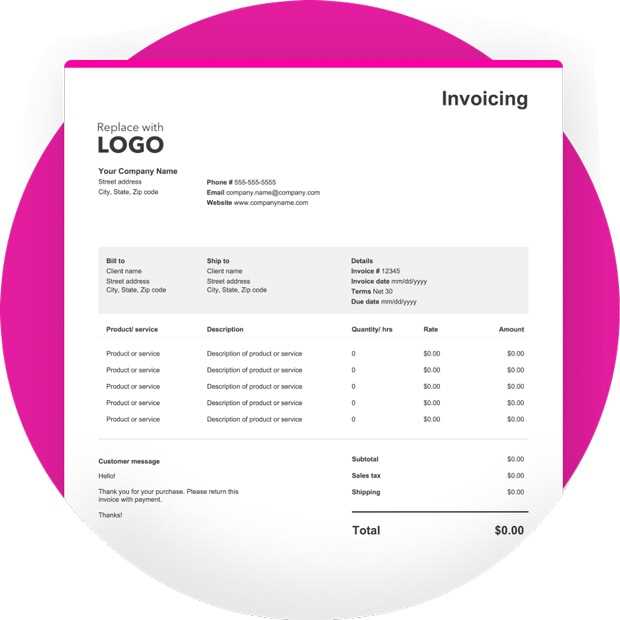

Benefits of Using Customizable Invoice Designs

Having the ability to personalize your billing documents offers numerous advantages, especially when it comes to aligning them with your brand identity and operational needs. Customizing the layout, content, and appearance of these forms can improve professionalism, enhance clarity, and make the entire process more efficient. Whether you are a small business or a large enterprise, the flexibility to modify your documents can lead to better customer relationships and smoother financial operations.

One of the key benefits of customizing billing forms is the ability to tailor them to your specific business requirements. This can include adjusting fields for particular services, adding payment terms, or including special notes that are relevant to your industry. Such flexibility ensures that the documents you send are always relevant and accurate, reducing confusion and improving communication with clients.

Moreover, personalized designs help reinforce your brand’s visual identity. By incorporating your company logo, using your brand colors, and selecting fonts that match your style, you can create cohesive and professional-looking documents. This attention to detail not only makes your paperwork look more polished but also strengthens your brand presence in the eyes of your clients.

How to Create Your First Invoice

Creating your first billing document can seem like a daunting task, but it doesn’t have to be. With the right tools, the process is straightforward and can be done in just a few steps. The key is to ensure that all the necessary information is included and that the layout is both professional and easy to understand. Once you’re familiar with the basic structure, generating these documents will become second nature.

Step-by-Step Guide to Creating a Billing Document

- Step 1: Start by choosing a platform or tool that offers easy customization. Look for one that provides a clear, simple interface with options for adding key details.

- Step 2: Fill in essential information such as your business name, contact details, and the client’s information. Make sure the client’s name and address are accurate.

- Step 3: List the products or services provided. Be as detailed as possible, including descriptions, quantities, and individual costs.

- Step 4: Specify the payment terms, such as due dates, payment methods, and any late fees if applicable.

- Step 5: Review your document for accuracy and clarity before finalizing it.

Personalizing the Document

Customizing your billing document is essential for making it reflect your brand’s identity. Add your company logo, adjust the colors, and select a professional font. This not only enhances the document’s appearance but also creates a consistent look across all your financial communications. Once your design is set, save the document and it’s ready to be sent to your client.

Key Features of Intuit Invoice Templates

When selecting a platform for creating professional billing documents, it’s essential to consider the features that can make the process more efficient and streamlined. A good solution should offer a range of tools that not only simplify document creation but also help you manage financial tasks with ease. The right set of features can save time, reduce errors, and ensure that your billing process is always accurate and professional.

One of the primary advantages of using a digital solution for creating billing documents is the variety of customizable options it offers. From adjusting layouts to adding specific fields, these tools allow you to tailor your forms to suit your exact business needs. Whether you’re providing a one-time service or setting up recurring payments, the flexibility of design ensures your documents are always aligned with your requirements.

Key Features to Look For

- Customizable Fields: Adjust sections such as product descriptions, pricing, and payment terms to match your business operations.

- Professional Design Options: Choose from a selection of polished, pre-designed layouts that can be personalized with logos, colors, and fonts.

- Automated Reminders: Set automatic reminders for overdue payments, helping you keep track of outstanding balances.

- Easy Client Management: Store and manage customer information directly within the system for quick access during the billing process.

- Secure Digital Delivery: Send your documents electronically in a secure format, reducing the need for physical paperwork and ensuring timely delivery.

Saving Time with Pre-Formatted Templates

Efficiency is crucial when managing business operations, and this includes creating financial documents. Pre-designed forms that are ready for use can significantly reduce the amount of time spent on administrative tasks. These ready-made solutions allow you to quickly fill in the required details without worrying about layout, formatting, or structure. By using pre-formatted designs, businesses can streamline their billing processes and focus more on core activities.

One of the main advantages of using pre-designed documents is that they provide a consistent format that ensures all necessary information is included. This reduces the risk of missing crucial details, such as payment terms, client contact information, and itemized services. With everything already structured, all you need to do is input the specific data, making the process both faster and more reliable.

How Pre-Formatted Designs Save Time

- Ready-to-Use Layout: Skip the design phase and use a well-organized format that is easy to personalize with minimal effort.

- Eliminate Formatting Errors: Automatic formatting reduces the risk of mistakes, ensuring that all documents look professional and follow a uniform style.

- Speedy Customization: Quickly adjust fields for different clients, services, or payment plans without having to build a document from scratch.

Streamlining Administrative Tasks

Pre-made forms can be especially helpful when you need to generate multiple documents in a short amount of time. By using templates that require minimal customization, businesses can process transactions more efficiently and reduce administrative overhead. This means less time spent on paperwork and more time dedicated to growing your business.

Integrating Intuit with Accounting Software

Integrating your billing system with accounting software is a powerful way to streamline financial management. By connecting your billing platform with your accounting tools, you can automate data flow, reduce manual entry errors, and gain better insights into your financial status. This integration helps ensure that all transactions are accurately recorded and categorized, saving you time and effort in the long run.

When your billing system syncs with your accounting software, it allows for seamless data transfer, making it easier to track payments, update balances, and manage tax calculations. This eliminates the need to manually input the same information into multiple systems, reducing the chances of discrepancies. With everything in one place, you can focus more on growing your business and less on managing your finances.

Benefits of Integration

- Automated Data Sync: Automatically transfer payment and transaction details between systems, ensuring accurate record-keeping without extra effort.

- Real-Time Financial Insights: Gain immediate access to up-to-date financial reports and analysis, helping you make informed business decisions.

- Improved Accuracy: Reduce the risk of human error by eliminating manual data entry, ensuring all information is correctly entered into both systems.

- Time Savings: Free up valuable time by automating routine tasks, allowing you to focus on higher-priority business operations.

How to Set Up the Integration

Setting up the integration between your billing platform and accounting software is typically straightforward. Many modern platforms offer built-in integration features or simple third-party connectors that allow for a smooth connection. Once set up, the integration works automatically, syncing your financial data with minimal input required. Be sure to follow the platform’s instructions for syncing data to ensure everything is connected correctly and working as intended.

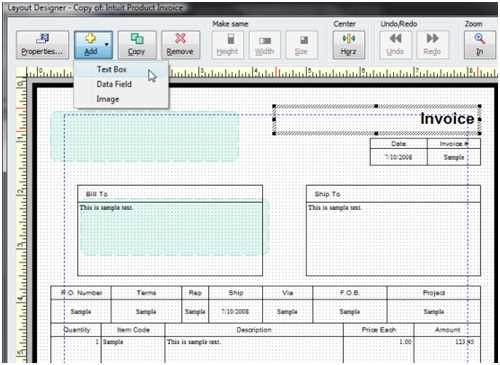

Customizing Templates to Fit Your Business

Every business has its own unique needs and branding, which is why customizing your billing documents is essential. A one-size-fits-all approach often doesn’t work when it comes to creating professional financial documents. The ability to tailor the design and structure of your forms ensures that they reflect your business identity while also meeting your operational requirements. Customization allows you to present your company’s personality while maintaining clarity and professionalism.

Customizing your forms enables you to add key elements specific to your business operations. Whether it’s incorporating unique service categories, modifying payment terms, or adjusting the overall layout, having control over the design ensures that all necessary details are easily accessible. A personalized document not only enhances the customer experience but also helps streamline your workflow.

How to Customize Your Billing Documents

- Add Your Logo: Include your business logo at the top of your document for a professional touch and to help reinforce your brand identity.

- Adjust Layout and Design: Choose from various layouts and modify sections to match the services you offer. You can add or remove fields as necessary.

- Change Fonts and Colors: Personalize the fonts and colors to align with your business’s visual style, ensuring consistency across all communications.

- Include Custom Fields: Add specific fields such as project descriptions, service categories, or special notes to make the document more relevant to your business model.

- Set Payment Terms: Tailor the payment terms section to reflect your preferred payment methods, due dates, and late fees.

Why Customization Matters

Customizing your forms not only helps convey professionalism but also makes your billing documents easier to understand. By including relevant details, you ensure that your clients have all the necessary information to make prompt payments. This level of personalization can also reduce confusion and the need for follow-up, streamlining your financial operations.

How to Add Your Logo to Templates

Incorporating your business logo into your financial documents is an essential step in building brand recognition and professionalism. Adding a logo to your billing forms not only makes them look polished but also helps reinforce your brand identity every time a client receives one. Fortunately, the process of adding your logo to a document is simple and can be done in just a few steps using most digital platforms designed for creating billing forms.

Steps to Add Your Logo

- Step 1: Prepare your logo image. Ensure that it is in a high-resolution format (such as PNG or JPG) for clarity when printed or viewed on screen.

- Step 2: Open your document in the design tool. Most platforms have a section where you can easily upload images or logos.

- Step 3: Find the “Insert Logo” or “Upload Image” button. This will prompt you to select your logo file from your device.

- Step 4: Position your logo. Once uploaded, you can drag and resize it to fit within the header or top section of the document.

- Step 5: Save your document. Ensure that your logo is placed correctly and looks balanced within the overall design before saving and using the document.

Why Add a Logo?

Including a logo in your business documents provides a professional appearance that helps establish trust with your clients. It also enhances the consistency of your brand’s presence across all communications, ensuring that clients immediately recognize your company’s materials. Moreover, a well-placed logo can make your forms appear more cohesive and organized, contributing to a positive overall client experience.

Best Practices for Professional Invoices

Creating professional and clear billing documents is crucial for maintaining strong client relationships and ensuring prompt payment. A well-structured document not only improves communication but also reflects your business’s professionalism and attention to detail. By following certain best practices, you can make sure that your billing documents are both effective and easy for your clients to understand.

Essential Tips for Professional Billing Documents

- Clear and Accurate Information: Always double-check that the details, such as client name, services, dates, and amounts, are correct. Mistakes can cause confusion and delays in payment.

- Use Simple and Readable Layouts: Choose a clean and organized format. Avoid clutter by separating sections clearly (e.g., services provided, total amount due) to improve readability.

- Include Your Contact Details: Make sure your business name, phone number, email, and website are prominently displayed so clients know how to reach you for questions or follow-ups.

- Provide Payment Terms: Clearly state your payment terms, such as the due date, accepted payment methods, and any late fees for overdue payments. This helps prevent confusion and encourages timely payments.

- Professional Language: Use polite and professional language throughout the document. Avoid jargon, and instead, focus on clarity and simplicity to make sure clients understand the terms.

- Ensure Consistency: Consistency in your document design, language, and branding ensures that your billing forms align with the rest of your company communications and look professional.

Design Considerations

- Branding: Incorporate your business logo and brand colors to create a cohesive look that aligns with your marketing materials and website.

- Formatting: Use bold headings, clear sections, and consistent fonts. This helps to guide the reader’s attention to key information, such as payment amounts and due dates.

- Digital and Print Compatibility: Ensure your documents are formatted to look great both on screen and when printed, as clients may view them on different devices or request paper copies.

By following these best practices, you can ensure that your billing documents are not only functional but also professional and trustworthy, fostering good relationships with your clients and improving your business’s overall efficiency.

Tracking Payments with Billing Documents

Effective payment tracking is essential for maintaining healthy cash flow and ensuring that clients pay on time. By using the right tools and processes, you can easily monitor outstanding balances, track received payments, and follow up on overdue amounts. With customizable billing documents, you can streamline the process and keep better records of all financial transactions.

When creating and sending billing forms, it’s important to include clear sections for tracking payment status. A well-organized system allows you to quickly check whether payments have been made, which clients are overdue, and what the current balance is. This not only helps in staying organized but also reduces the chances of missed or delayed payments.

How to Track Payments Effectively

- Include a Payment Status Section: Ensure each document clearly indicates the payment status (e.g., unpaid, paid, overdue) so you can easily identify outstanding amounts.

- Record Payment Dates: Make sure that every received payment is noted with the date it was made. This helps maintain an accurate payment history.

- Use Automated Reminders: Set up automated reminders for overdue payments, which will help you follow up with clients without manual effort.

- Keep Detailed Records: Maintain a record of all transactions, including partial payments, and make sure to update balances immediately after a payment is made.

- Reconcile Payments Regularly: Frequently reconcile your payment records with bank statements or financial systems to ensure that all transactions are accounted for.

Organizing Payment History

Using customizable forms allows you to create a consistent and clear structure for payment tracking. You can design your documents to include necessary details, such as payment methods, amounts, and due dates, while also leaving space to record payments. This way, every time a payment is made, you can update the document and keep your records up-to-date.

Exporting and Sharing Your Billing Documents

Once your billing documents are ready, the next step is to efficiently export and share them with your clients. The ability to export your documents in different formats and share them through secure channels makes the process much more streamlined and professional. Whether you choose to send your documents via email, print them for physical delivery, or store them for future reference, the right tools can simplify each of these tasks.

Exporting your documents allows you to save them in multiple formats like PDF or Excel, which are both easy to view and print. Sharing them becomes a breeze when you have multiple options, from secure email attachments to cloud-based storage platforms. This ensures that you can quickly and reliably deliver your documents to clients, regardless of location.

Steps to Export Your Documents

- Select the Format: Most tools allow you to export your documents in a variety of formats, such as PDF or Excel. Choose the one that suits your needs best based on client preferences.

- Download or Save: After selecting the format, download the file to your computer or save it to your cloud storage system for future access.

- Customize the Export: Some platforms allow you to make last-minute adjustments before exporting, such as adding additional notes or updating payment terms.

- Store for Recordkeeping: Once exported, ensure you store the document in an organized file system for easy retrieval in case of future inquiries or audits.

Sharing Your Documents

- Email Delivery: Send your documents directly to clients via email, either as attachments or as secure links to online versions.

- Cloud Sharing: Use cloud platforms such as Google Drive or Dropbox to share documents with clients. These services also allow for easy document tracking and real-time access.

- Printed Copies: For clients who prefer hard copies, simply print your documents and mail them using a reliable delivery service.

By using these tools and practices, you can ensure that your billing documents are delivered professionally and securely, helping you maintain smooth operations and positive client relationships.

Managing Client Details in Templates

Effectively managing client information within your billing documents is essential for maintaining organized records and fostering strong client relationships. Including key client details, such as contact information, transaction history, and service preferences, ensures that each document is personalized and accurate. It also helps to streamline communication and avoid errors when preparing future financial documents.

By storing client details within your customizable forms, you can save time on data entry and ensure consistency across all documents. This practice not only helps in creating tailored communication but also enables you to easily retrieve past records when needed. With the right system in place, managing client information becomes an efficient process that reduces administrative overhead.

Organizing Client Details

- Include Essential Contact Information: Always ensure that the client’s name, address, email, and phone number are clearly displayed on the document for easy reference.

- Store Payment History: Maintain a record of past payments within your document system. This allows you to quickly check if payments have been made or if there are any outstanding balances.

- Record Service Details: Include a section for each client’s specific services, including the type, quantity, and price, ensuring everything is correctly billed.

- Maintain Client Notes: Some systems allow you to add personalized notes or instructions related to a specific client. This can help in future communications or when offering tailored services.

Why Client Management Matters

Accurate and well-organized client information improves the efficiency of your operations, reduces mistakes, and enhances customer service. It ensures that your billing forms are always up-to-date and relevant, creating a seamless experience for both you and your clients. By effectively managing client details within your documents, you can build trust and streamline your financial processes.

Generating Recurring Billing Documents

For businesses that offer subscription-based services or regular billing cycles, automating the creation of recurring billing documents is an essential tool for efficiency. By setting up automatic billing schedules, you can ensure that invoices are generated and sent to clients on time, without the need for manual intervention. This automation helps maintain consistency, reduces the risk of errors, and saves valuable time.

Recurring billing allows you to streamline your operations by automatically issuing a document at specified intervals. Whether it’s weekly, monthly, or yearly, you can set up the system to generate and send out documents without needing to create each one individually. This method is especially useful for businesses with ongoing contracts or subscription services, ensuring that payments are processed regularly and consistently.

Setting Up Recurring Billing

- Choose a Billing Cycle: Determine how often your documents need to be generated, such as monthly, quarterly, or annually, based on your business model.

- Input Client Information: Ensure that all client details, including contact information and payment terms, are correctly entered into your system before setting up the recurring billing schedule.

- Set Payment Terms: Define the terms of payment for each cycle, including due dates, amounts, and any applicable discounts or late fees.

- Automate Document Generation: Enable the recurring billing feature in your system to automatically generate documents for each billing cycle and send them to the client on the scheduled date.

- Track Payment History: Regularly review payment records to ensure that payments are being processed correctly and that no issues arise during the recurring cycles.

Benefits of Recurring Billing

- Time-Saving: Automating billing reduces the manual effort required to generate documents, allowing you to focus on other important tasks.

- Consistency: Ensures that clients are billed on time, every time, helping to maintain smooth cash flow and reduce administrative overhead.

- Improved Cash Flow: Regular billing helps businesses predict and manage cash flow more effectively, as payments are collected on a consistent basis.

- Enhanced Client Experience: Cli

Common Mistakes to Avoid with Billing Documents

When creating and managing billing documents, it’s easy to overlook small details that can lead to big problems. Simple mistakes such as incorrect amounts, missing information, or unclear payment terms can delay payments, cause confusion, and damage client relationships. By being aware of the most common errors, you can ensure that your billing process is smooth, professional, and efficient.

The following table highlights some of the most common mistakes businesses make when preparing billing documents, along with tips on how to avoid them:

Error Solution Incorrect Amounts Always double-check that the amounts listed are accurate and reflect any discounts, taxes, or adjustments before sending the document. Missing Client Information Ensure that the client’s name, address, and contact details are correct and complete. This helps avoid confusion and ensures accurate communication. Unclear Payment Terms Clearly state the payment due date, payment methods, and any late fees or penalties for overdue payments. Avoid ambiguous language. Not Including an Itemized List Provide a detailed breakdown of the services or products provided, including quantities and individual costs, to avoid misunderstandings. Forgetting to Include Tax Ensure that any applicable taxes are calculated and displayed clearly, so there are no surprises for the client. Overcomplicating the Design Keep your documents clean and easy to read. Avoid cluttering them with unnecessary information or complex layouts. By carefully reviewing each document for these common mistakes, you can prevent delays, maintain professionalism, and ensure a smooth payment process for your business and clients. Small det

How Intuit Improves Cash Flow Management

Efficient cash flow management is essential for businesses of all sizes, ensuring that operations run smoothly and that there are sufficient funds to cover expenses. By automating billing and tracking processes, financial software tools can simplify cash flow management, making it easier to stay on top of payments and avoid delays. This enables businesses to maintain a healthy financial position and avoid liquidity issues.

One of the key benefits of using automated billing solutions is the ability to manage and track cash inflows more effectively. By generating accurate and timely documents, businesses can reduce the risk of errors, missed payments, and delays. In addition, these tools often come with features that allow you to set up reminders and automatic payment tracking, ensuring that payments are received on time and cash flow remains consistent.

Key Features for Cash Flow Management

- Automated Billing: Automating the creation and sending of billing documents reduces manual effort and ensures timely invoicing, which is crucial for maintaining steady cash flow.

- Payment Tracking: Real-time tracking of payments allows businesses to easily identify outstanding balances and follow up on overdue amounts, reducing the likelihood of missed payments.

- Recurring Billing Options: For businesses with subscription models, automated recurring billing ensures that payments are received on a predictable schedule, improving cash flow forecasting.

- Customizable Payment Terms: By customizing payment terms, businesses can set due dates, payment methods, and late fees that align with their cash flow needs and client expectations.

- Integrated Financial Reports: Many software tools integrate with accounting systems, providing businesses with real-time financial reports that offer insights into cash flow trends, helping them make informed decisions.

How It Helps Businesses Stay on Track

- Predictable Cash Flow: With automated and recurring billing, businesses can forecast their cash flow more accurately, reducing uncertainty and helping with budgeting.

- Reduced Administrative Burden: Automation decreases the time spent on administrative tasks, such as manually generating and sending documents, allowing businesses to focus more on growth and strategy.

- Improved Client Relationships: By providing clients with clear, timely, and accurate billing information, businesses foster trust and improve the likelihood of on-time payments.

By leveraging technology to streamline billing and payment processes, busine