International Shipping Invoice Template for Efficient Global Transactions

When conducting cross-border business, proper documentation plays a crucial role in ensuring smooth and transparent exchanges. Clear and structured records are essential for both the sender and receiver, reducing the risk of misunderstandings and disputes. Having a well-organized form for each transaction helps maintain consistency and avoid costly errors in accounting or customs processes.

With the increasing complexity of global trade, it’s important to utilize a reliable method for creating and managing financial records. A standardized approach allows businesses to stay organized and ensures they meet all necessary regulatory requirements. By using a well-crafted document format, companies can save time, streamline workflows, and focus on growing their operations.

In this guide, we will explore how to create and use a suitable document format for your global transactions. From understanding the core elements to knowing how to properly customize and apply them, you will be equipped with the tools to manage your business activities more efficiently and professionally.

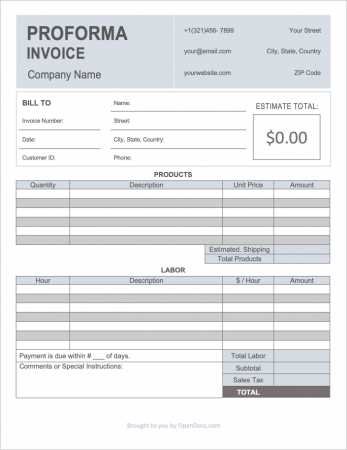

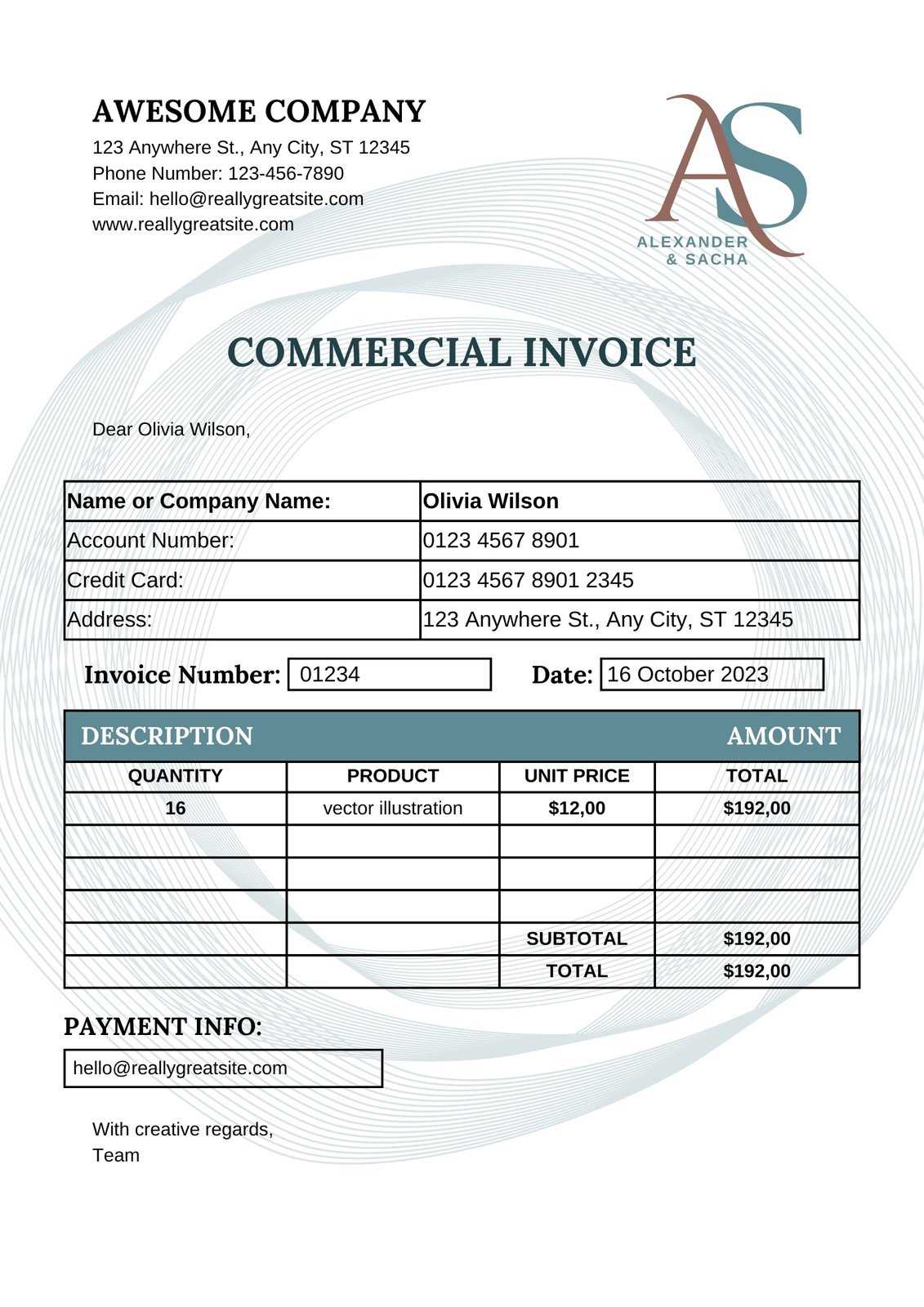

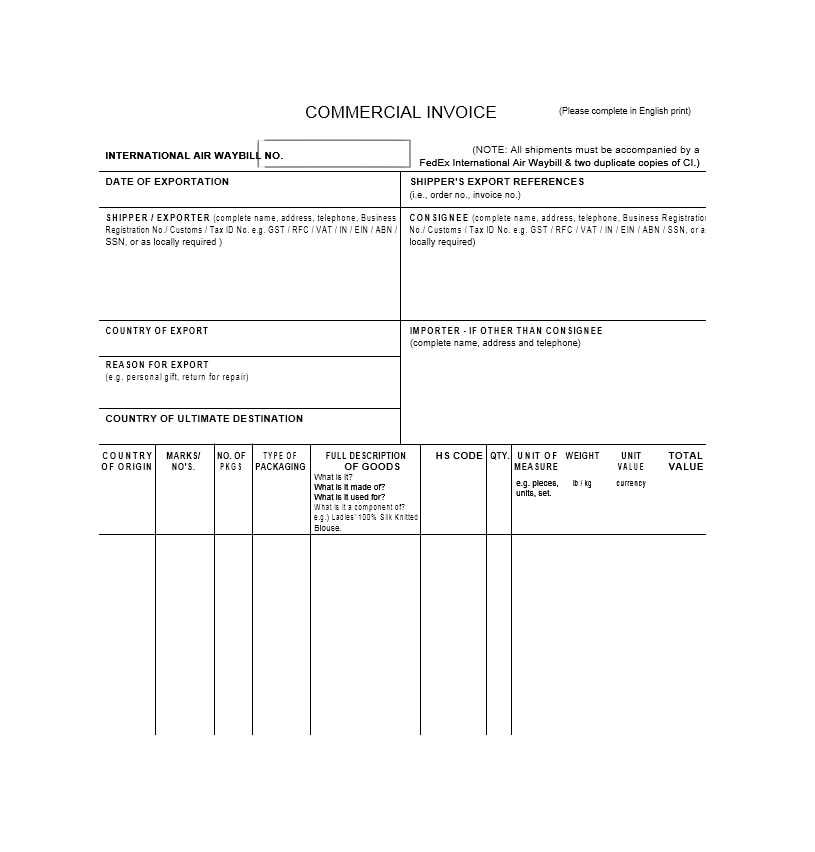

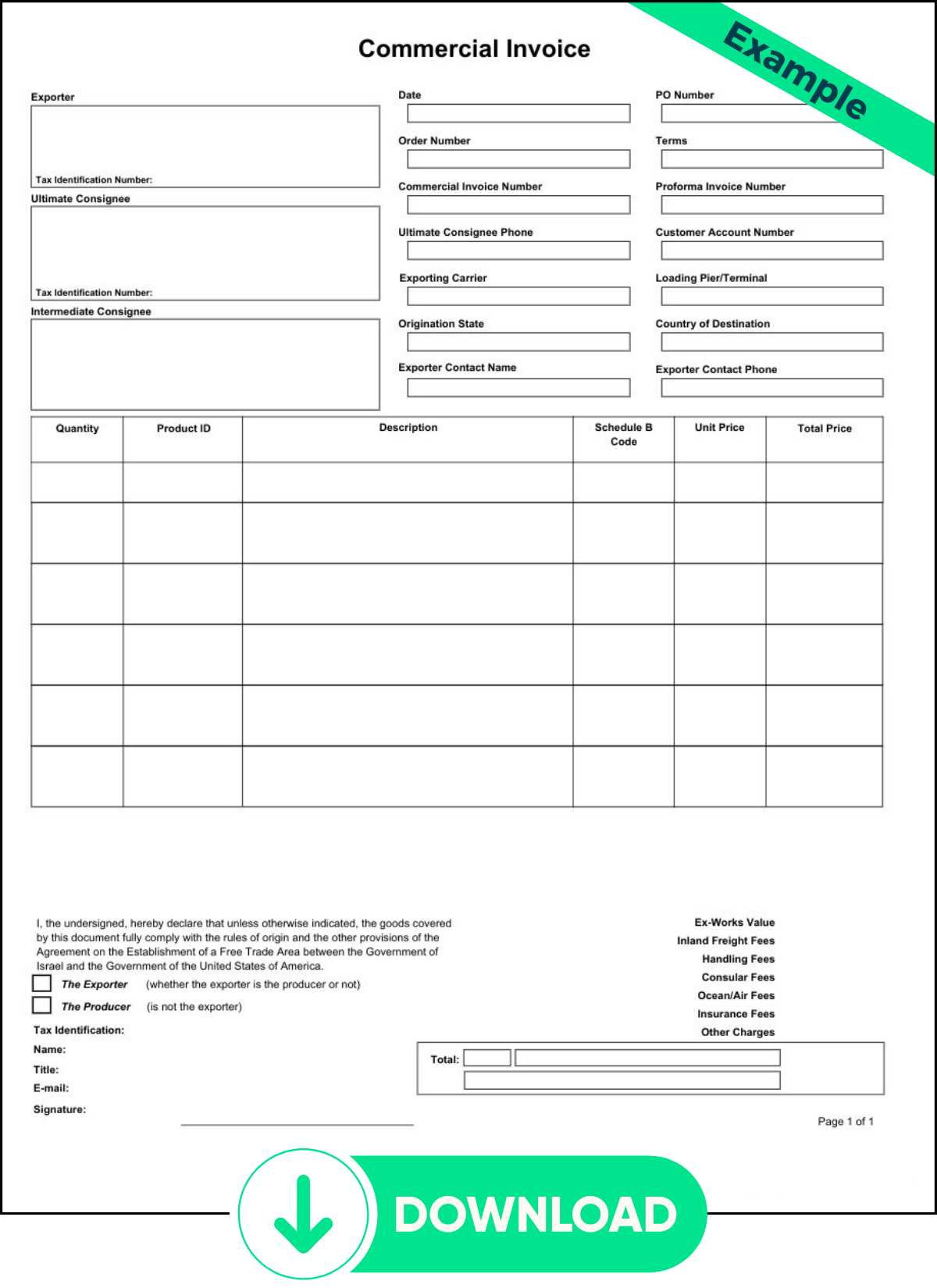

International Shipping Invoice Template

When managing cross-border transactions, having a structured document to detail the exchange of goods and services is essential. A standardized format simplifies the process, ensuring that all necessary information is included for both parties involved. This allows for clear communication, accurate financial records, and smooth processing through customs or payment channels.

The document should include several key sections to ensure compliance and reduce errors. Here are the main elements that should be part of every record for global exchanges:

- Sender and Receiver Information: Contact details for both parties involved, including full names, addresses, and phone numbers.

- Transaction Details: A clear description of the products or services exchanged, quantities, unit prices, and total cost.

- Payment Terms: The agreed payment method, due date, and any applicable taxes or fees.

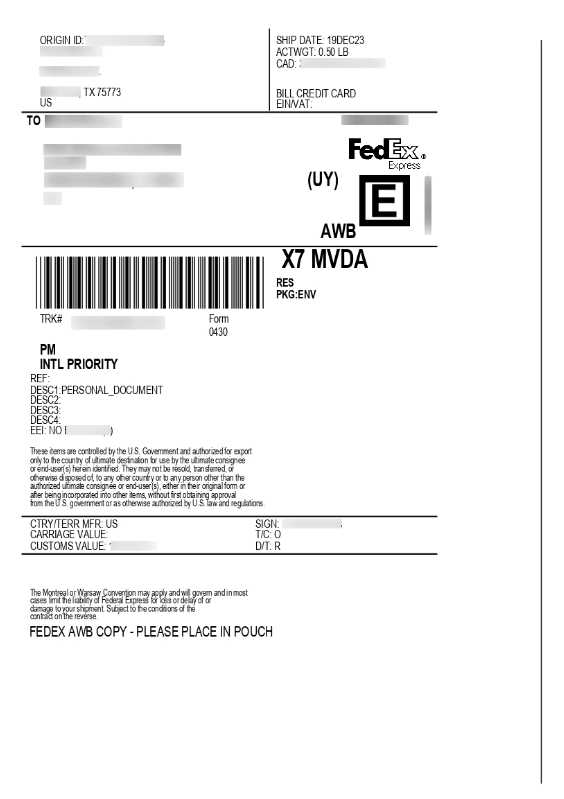

- Shipping Details: Information regarding shipping methods, tracking numbers, and expected delivery dates.

- Regulatory Information: Customs declarations, product classification codes, and other details required for border clearance.

By following this structure, businesses can ensure a seamless process from order creation to delivery. Whether using digital tools or manual creation, adhering to a reliable format is crucial for efficient management of global business dealings.

Why You Need a Shipping Invoice Template

In the world of global commerce, clear and accurate documentation is critical for ensuring smooth transactions. Having a reliable format for each exchange helps businesses stay organized, maintain proper records, and meet regulatory standards. A well-structured form not only facilitates easier communication between parties but also protects both the buyer and seller in case of disputes.

Using a standardized approach to document each sale or transfer brings numerous benefits. It ensures that all required details are included, such as product descriptions, pricing, and delivery terms. This consistency reduces errors and helps prevent misunderstandings, making it easier to track payments and resolve issues quickly.

Key advantages of using a reliable document format:

- Consistency: Standardized documents reduce the risk of omitting important information and ensure uniformity across transactions.

- Efficiency: Streamlines the process, saving time on creating records from scratch each time.

- Accuracy: Helps avoid costly mistakes and ensures compliance with customs regulations and tax laws.

- Transparency: Clearly outlines all costs and terms, reducing the likelihood of disputes or misunderstandings.

By adopting a consistent format for every transaction, businesses can save time, minimize errors, and focus on growth while ensuring they meet all legal and financial obligations.

Key Components of a Shipping Invoice

When documenting a commercial transaction, it’s essential to include specific details that ensure both clarity and legal compliance. A comprehensive document should provide a complete breakdown of the exchange, from the involved parties to the items being exchanged. These components help guarantee that both buyers and sellers are on the same page and that all necessary information is available for customs or financial processes.

Essential Information

First and foremost, each record should include the basic information about the parties involved. This includes full contact details for both the seller and buyer, such as names, addresses, and phone numbers. Additionally, each document must have a unique reference number for tracking purposes, as well as the date of the transaction. This ensures the document can be easily located and referenced in the future if needed.

Transaction and Payment Details

Next, the document should outline the specifics of the transaction itself. This includes a detailed description of the goods or services exchanged, quantities, unit prices, and the total amount due. Payment terms are also crucial, including the method of payment, due date, and any relevant taxes or shipping fees. Properly documenting these details ensures that both parties understand the financial commitments and timelines involved.

By covering these key components, a business can ensure smoother transactions and reduce the chances of errors or disputes, both during the exchange process and in future audits.

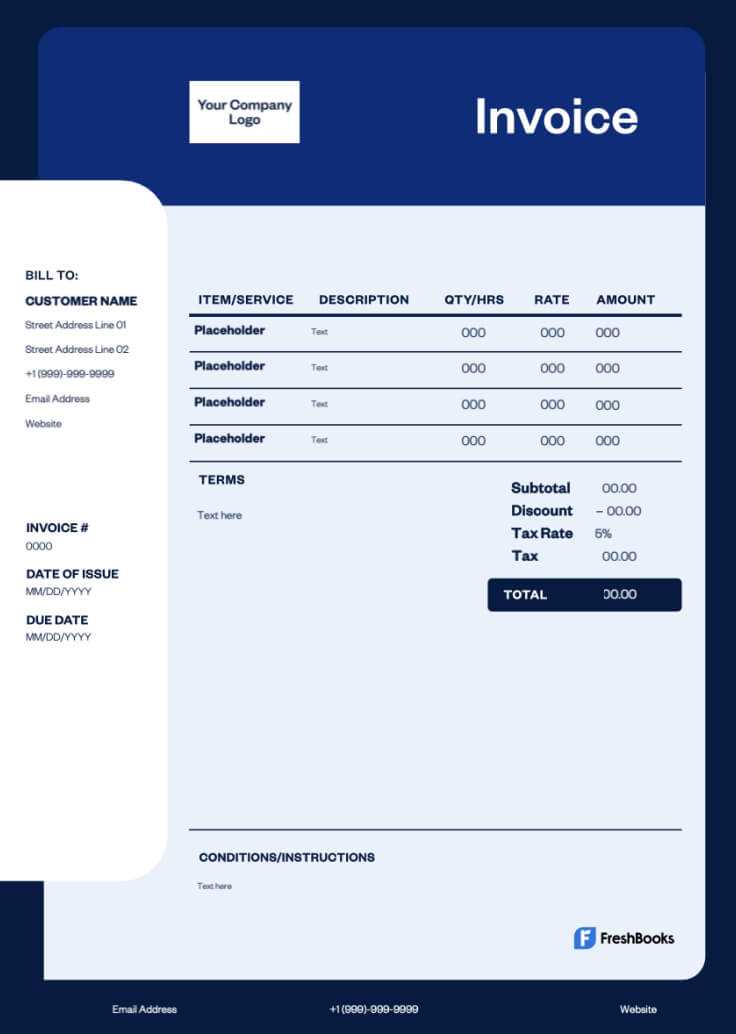

How to Create a Custom Invoice

Creating a tailored document for your business transactions is a simple yet important task. By personalizing each record, you ensure that all necessary information is clearly presented and suited to your specific needs. This can help streamline your financial processes, improve accuracy, and reduce the chance of errors that may arise from using generic forms.

Step 1: Gather Necessary Information

The first step in crafting a customized record is to collect all relevant details. This includes the full contact information of both the buyer and seller, such as names, addresses, and phone numbers. You should also ensure that the date of the transaction and a unique reference number are included to help track the document easily.

Step 2: Detail the Products or Services

Next, list the goods or services exchanged, including a detailed description, quantity, and unit price. Make sure to calculate the total cost for each item or service and the final sum due. Additionally, be sure to include any applicable taxes, fees, or discounts. Accurate product details help avoid confusion and ensure that both parties are aligned on what was exchanged and at what price.

By following these steps, you can create a custom document that is professional, clear, and aligned with your specific business requirements. This tailored approach enhances both communication and organization, helping to keep your financial records in order.

Best Practices for Shipping Documentation

Properly managing your business documents is essential for smooth operations and compliance. A well-organized and clear format ensures that all necessary details are included, reducing the likelihood of mistakes and misunderstandings. Following a set of best practices when creating and handling these records can help streamline the process, maintain accuracy, and avoid costly errors.

Key Practices for Effective Documentation

To ensure your documents are both professional and accurate, here are some best practices to follow:

- Use Consistent Formatting: Maintain uniformity across all records, from fonts and layout to the type of information presented. This helps prevent confusion and makes it easier to read and understand the document.

- Double-Check Details: Always verify that all contact information, product descriptions, quantities, and prices are correct before finalizing the document.

- Include a Unique Reference Number: Assign a unique identifier to each record for easy tracking and future reference.

- Clearly Outline Payment Terms: Be transparent about payment methods, due dates, and any additional charges. This helps both parties understand their obligations.

- Ensure Compliance with Regulations: Ensure that your records meet legal requirements and customs regulations, especially when dealing with cross-border transactions.

Organizing and Storing Documents

Once your documents are complete, organizing and securely storing them is equally important. Using digital tools to store and manage these records can help ensure they are easily accessible when needed. Additionally, implementing a system for categorizing and archiving documents will help you maintain an organized filing system that can be easily navigated for future reference or audits.

By following these best practices, businesses can ensure that their transactions run smoothly and efficiently, minimizing risks and improving overall workflow.

Understanding Shipping Costs and Charges

When conducting global transactions, understanding the various fees involved is essential for both businesses and customers. Shipping expenses can vary significantly depending on factors such as the delivery method, distance, weight, and customs duties. By having a clear understanding of these costs, businesses can better manage their budgets, avoid unexpected charges, and offer transparent pricing to customers.

Types of Charges to Consider

There are several types of fees that may be included in the overall cost of sending goods across borders. These may include:

- Freight Charges: The cost of transporting goods from the origin to the destination, which can depend on the weight, size, and delivery speed.

- Customs Duties and Taxes: Fees imposed by governments for importing or exporting goods. These may vary depending on the destination country and the product category.

- Insurance Costs: Additional fees for insuring goods during transit, which provide protection in case of loss or damage.

- Handling and Packaging Fees: Costs for preparing and packaging goods for transport, as well as handling fees associated with the logistics of moving items.

How to Calculate Shipping Expenses

To avoid unexpected charges, it’s important to calculate shipping expenses ahead of time. Start by determining the weight and dimensions of the goods, as these will directly impact the cost of transportation. Additionally, consider the destination country’s customs requirements and taxes to ensure accurate pricing. Many logistics providers offer online tools or calculators that can estimate these charges based on your specific shipment details.

By carefully considering all associated costs and clearly communicating them in your records, you can provide a more transparent and predictable experience for both parties involved in the transaction.

Legal Requirements for International Shipments

When moving goods across borders, it is essential to comply with various legal regulations to avoid delays, fines, or even confiscation of goods. Different countries have specific rules and requirements that must be followed, which can include documentation, taxes, customs procedures, and safety standards. Understanding these regulations is critical for both businesses and individuals engaged in global trade.

Key Legal Considerations

There are several legal factors to keep in mind when preparing goods for cross-border transport:

- Customs Declarations: Every shipment requires accurate and complete customs documentation. This includes a description of the goods, their value, origin, and any applicable harmonized codes to classify the items.

- Tariffs and Taxes: Import duties, value-added taxes (VAT), and other fees may be applicable depending on the destination country and the nature of the goods. Ensure these costs are calculated and included in the final pricing.

- Trade Compliance: Certain items may be subject to export controls, restrictions, or embargoes. It’s important to verify whether the goods being sent are allowed for trade in the destination country.

- Documentation Requirements: Ensure all necessary paperwork is provided, including proof of purchase, invoices, certificates of origin, and any licenses required for specific goods, such as pharmaceuticals or electronics.

How to Ensure Compliance

To avoid complications, it’s important to do thorough research or consult with a customs broker who can guide you through the process. Ensure that all required documentation is completed accurately and submitted in a timely manner. Many countries also require digital submission of certain forms, so it’s essential to keep up with the latest regulatory changes.

By adhering to legal requirements, you can ensure that shipments are processed efficiently and that your business remains compliant with all necessary regulations, reducing the risk of delays or fines.

How to Avoid Common Shipping Mistakes

Managing the movement of goods across borders can be complex, and mistakes during the process can lead to delays, additional costs, and customer dissatisfaction. Understanding the common pitfalls and how to prevent them is crucial for a smooth transaction and for maintaining good relations with your clients. By following some simple guidelines, you can avoid the most frequent errors that occur when sending products to other countries.

Frequent Errors to Avoid

Here are some of the most common mistakes made when preparing goods for transit, along with tips on how to avoid them:

- Incorrect Documentation: Ensure that all necessary documents are filled out accurately and completely. Missing or incomplete paperwork can delay processing and even result in fines or seizure of goods.

- Underestimating Costs: Be mindful of all associated costs, such as customs fees, taxes, and additional charges. These should be calculated in advance to avoid surprise expenses.

- Wrong Packaging: Ensure that items are securely packed and meet the requirements of the transport company. Improper packaging can lead to damage, delays, or rejection of goods.

- Failure to Check Regulations: Every country has different rules regarding what can and cannot be imported. Failing to verify these rules may result in fines or confiscation of prohibited items.

- Inaccurate Labeling: Ensure that all packages are labeled correctly, including the correct address, description of contents, and handling instructions. Mislabeling can cause delays and misdeliveries.

Best Practices for Smooth Transactions

To ensure smooth delivery and reduce the likelihood of errors, follow these best practices:

- Double-check everything: Before finalizing any transaction, verify all details, including documentation, contact information, and shipping costs.

- Stay updated: Regulations and fees can change frequently, so it’s important to keep up with any updates to ensure compliance.

- Use reliable services: Choose trusted carriers and service providers with good track records for handling cross-border transactions efficiently.

By taking these precautions and being proactive in planning your transactions, you can avoid common mistakes and ensure that your shipments reach their destination without any issues.

Formatting Your International Shipping Invoice

Creating clear and organized documents for cross-border transactions is essential for smooth operations and compliance. Properly structuring your paperwork ensures that all necessary details are included, making the process transparent for both you and your customers. The right format not only helps prevent mistakes but also ensures that customs, taxes, and fees are correctly calculated and paid.

Key Elements to Include

When structuring your document, it’s important to include the following key components for clarity and accuracy:

- Sender and Recipient Information: Clearly display the full names, addresses, and contact details of both the sender and the recipient. This ensures proper identification of the parties involved.

- Item Description: Provide a detailed description of the goods being sent, including quantities, unit prices, and any relevant serial numbers or product codes.

- Shipping Method and Terms: Specify the chosen delivery service, expected transit time, and any relevant shipping conditions. This helps to set expectations for delivery.

- Customs and Tax Information: Make sure to include any applicable customs duties, taxes, and fees. This is crucial for avoiding delays or complications with customs authorities.

- Total Amount: Clearly list the total cost of the transaction, including shipping fees, handling charges, and any additional costs such as insurance.

Best Practices for Layout and Clarity

While structuring the document is essential, how you present the information also matters. Here are some formatting tips to ensure clarity:

- Organized and Readable: Use clean fonts, proper headings, and sufficient spacing to make the document easy to read. Avoid cluttering the page with too much information.

- Consistent Design: Stick to a consistent layout with aligned text and sections. This not only makes the document look professional but also helps prevent errors.

- Clear Itemization: Use bullet points or tables to clearly list the items and their corresponding details. This helps avoid confusion and ensures transparency for both parties.

By following these guidelines, you can create professional and efficient documents that facilitate smooth transactions, compliance with regulations, and customer satisfaction.

Tax Implications in Global Shipping

When transporting goods across borders, understanding the tax obligations involved is essential for smooth and compliant transactions. Taxes and duties can vary significantly depending on the countries involved, the value of the goods, and their nature. Failure to account for these financial factors can lead to unexpected costs, delays, and potential legal complications. Therefore, it’s important to understand how taxes are applied to cross-border exchanges and how to manage them effectively.

Types of Taxes and Duties

There are several types of taxes and duties that may be applicable when goods are transported internationally. These can include:

- Customs Duties: These are fees imposed by the destination country on goods entering the country. The amount typically depends on the value, classification, and origin of the goods.

- Value Added Tax (VAT): In many countries, a VAT is applied to goods being imported, and it is usually calculated as a percentage of the value of the goods. This tax can be refunded in some cases, depending on the local regulations.

- Excise Taxes: Some products, such as alcohol or tobacco, may incur additional excise taxes due to their nature or potential impact on public health.

- Import Fees: Some countries may charge various import fees based on the method of transport, the type of goods, or the specific customs processes involved.

How to Handle Tax Obligations

Understanding and managing tax liabilities is crucial for preventing unexpected expenses and delays. Here are some strategies to effectively manage these obligations:

- Research Local Tax Regulations: Before sending goods across borders, ensure that you are aware of the tax rates and duties that apply in both the exporting and importing countries.

- Factor Taxes Into Pricing: Include potential duties and taxes in the pricing of goods to ensure that customers are fully informed and you avoid underestimating costs.

- Work with a Customs Broker: A customs broker can help navigate the complexities of international tax regulations and assist in preparing accurate documentation for smooth clearance through customs.

- Keep Records: Maintain accurate records of all transactions, taxes paid, and customs paperwork. This can help with audits and ensure compliance in the future.

By taking the time to understand tax obligations and planning accordingly, you can ensure that your cross-border transactions proceed smoothly without unexpected financial or regulatory issues.

Currency Considerations for International Invoices

When engaging in cross-border transactions, managing currency exchange is a critical aspect to ensure clarity and prevent misunderstandings. The use of multiple currencies can complicate pricing, payment, and accounting if not handled correctly. Understanding how to properly account for currency conversions, fluctuations, and the associated costs is essential for both the sender and the recipient to avoid discrepancies and ensure accurate payments.

Key Currency Factors to Consider

Several important elements should be taken into account when working with foreign currencies in business transactions:

- Currency Exchange Rates: Exchange rates fluctuate regularly, which can impact the final price of goods or services when converting from one currency to another. It’s important to monitor these rates or use a fixed rate if possible to avoid price volatility.

- Payment Terms: Agree on whether payments will be made in the currency of the seller’s country or the buyer’s country. This agreement can impact the total cost and the timing of the transaction.

- Conversion Fees: When dealing with different currencies, additional fees may apply when converting funds. These fees may be imposed by banks, payment processors, or currency exchanges, and should be factored into the cost of doing business.

- Currency Symbols and Formatting: Be consistent in how you present currencies on documents. Use the correct symbols, ISO currency codes, and clear formatting to avoid confusion and ensure that amounts are easy to read and understand.

Managing Currency Risks

Currency fluctuations can create risks for both buyers and sellers. Here are a few strategies to mitigate these risks:

- Use Fixed Exchange Rates: Some businesses may choose to lock in exchange rates in advance through contracts or forward exchange agreements. This can provide stability and certainty for both parties involved.

- Currency Hedging: Hedging allows businesses to protect themselves against unfavorable currency movements. It involves using financial instruments to offset potential losses due to exchange rate fluctuations.

- Invoice in One Currency: To simplify the process, businesses may choose to issue all invoices in one currency, regardless of the buyer’s location. This can help prevent confusion and reduce the impact of exchange rate fluctuations.

Proper currency management is essential for ensuring accurate financial transactions, reducing risks, and improving the efficiency of cross-border trade. By considering these factors and incorporating them into your invoicing practices, you can safeguard both your business and your customers against unnecessary costs and complications.

How to Use an Invoice Template Efficiently

Using a well-organized and standardized document for financial transactions can streamline your processes and reduce errors. Efficient use of such documents helps ensure clarity, consistency, and proper record-keeping. By following a few best practices, you can maximize the benefits of pre-designed document formats, saving both time and resources while maintaining professionalism.

Steps for Effective Usage

To make the most out of any structured document format, consider these key steps:

- Fill in All Relevant Details: Ensure that all necessary information is included, such as buyer and seller details, product descriptions, quantities, and pricing. Missing data can lead to confusion or disputes later on.

- Double-Check Accuracy: Before finalizing the document, review all fields for accuracy. This includes confirming figures, dates, and payment terms to avoid costly mistakes or misunderstandings.

- Customize for Specific Transactions: Personalize each document based on the specifics of the deal. This might include adjusting product or service descriptions or adding custom terms and conditions.

Best Practices for Ongoing Use

For continuous efficiency, it’s important to follow a few ongoing strategies:

- Save Templates for Future Use: Once you’ve created a clear and effective document format, save it for future transactions. This way, you don’t have to recreate it from scratch each time.

- Use Automation Tools: Consider integrating automated systems that can fill out these documents for you, based on predefined data or past transactions, to save even more time.

- Ensure Consistency: Consistency in your documents helps build trust with clients. Stick to the same format and style to avoid confusion and enhance professionalism.

By carefully customizing and reviewing your documents while leveraging automation and consistency, you can streamline your workflow and make financial transactions smoother and more efficient.

Automating Shipping Invoice Creation

Automating the creation of financial documents can save time, reduce human error, and increase operational efficiency. By utilizing software or automated systems, businesses can streamline the process of generating accurate documents, ensuring consistency and reducing the manual workload. This approach is especially beneficial for high-volume transactions or recurring processes, where speed and accuracy are essential.

Benefits of Automation

Automating the creation of such documents offers several advantages:

- Increased Efficiency: Automated systems can generate multiple documents in a fraction of the time it would take manually, freeing up resources for other important tasks.

- Improved Accuracy: Automation eliminates the risk of human error, ensuring that all details–such as amounts, dates, and payment terms–are correctly entered each time.

- Consistency: By using automated systems, you ensure that all documents follow the same format and structure, which enhances professionalism and reduces confusion.

- Easy Integration: Automation tools can integrate seamlessly with other business software, such as inventory or CRM systems, ensuring that the generated document includes the most up-to-date information.

How to Automate the Process

To effectively automate the creation of financial documents, businesses can follow these steps:

- Choose the Right Automation Tool: Select a tool or platform that suits your business needs, whether it’s a standalone software solution or an add-on for your existing system.

- Set Up Templates and Rules: Define the data fields and rules for automatic generation, such as pre-filling customer details, quantities, and pricing based on prior transactions.

- Integrate with Other Systems: Ensure that your automation tool connects with other key systems like inventory management or accounting software to ensure smooth and accurate data flow.

- Test and Monitor: Run several tests to confirm the automation works as intended. Monitor the process periodically to ensure everything is up to date and functioning properly.

By implementing automation for document generation, businesses can save time, improve accuracy, and ensure that all transactions are processed efficiently, making it a smart choice for any growing company.

Choosing the Right Invoice Template Software

Selecting the appropriate software for generating financial documents is crucial for businesses that need to handle transactions efficiently. The right tool can simplify the process of creating, sending, and managing these records, while also ensuring consistency and accuracy. With many options available, it’s important to evaluate key features and choose a solution that fits your business needs.

Key Features to Consider

When evaluating software, consider the following essential features to ensure it meets your requirements:

- User-Friendliness: The software should have an intuitive interface, making it easy for you and your team to use without extensive training.

- Customization Options: Look for tools that allow you to customize documents to reflect your brand, including adding logos, modifying fields, and adjusting layouts.

- Automated Data Entry: Ensure the software can integrate with other systems, such as your CRM or accounting tools, to automatically populate details like customer information and product prices.

- Cloud-Based Accessibility: Cloud-based solutions enable access from anywhere and ensure that your documents are always stored securely and backed up.

- Compliance Features: Make sure the software supports necessary tax calculations, regional laws, and industry-specific regulations to keep your transactions compliant.

- Multi-Currency and Multi-Language Support: If you deal with customers across various regions, choose software that supports multiple currencies and languages for convenience and accuracy.

How to Make the Best Choice

To find the most suitable software for your business, follow these steps:

- Define Your Needs: Determine the specific features your business requires, such as the ability to handle high volumes of transactions or the need for integration with other software.

- Test and Compare: Many software providers offer free trials. Take advantage of these to explore the interface, evaluate features, and compare options before making a commitment.

- Read Reviews and Feedback: Research customer reviews and feedback to learn about other users’ experiences with the software and how well it fits their needs.

- Consider Future Growth: Choose software that can scale with your business. Look for options that offer flexible plans or additional features that will accommodate your growth over time.

By carefully evaluating these factors, you can select the right software that will streamline your documentation process, reduce errors, and improve efficiency, making your financial transactions smoother and more organized.

How to Manage Invoice Disputes

Handling disputes over financial records requires a structured approach to maintain positive relationships with clients and ensure that your business operations continue smoothly. Resolving discrepancies in charges, payment terms, or any other details quickly and efficiently is vital for customer satisfaction and maintaining the integrity of your business transactions. Here are some effective strategies to manage disputes professionally.

The first step in managing any disagreement is understanding the root cause. Whether it’s due to a clerical error, miscommunication, or a misunderstanding of terms, identifying the problem early will help resolve the issue before it escalates. Clear communication, proper documentation, and a transparent process are key components to addressing these disputes effectively.

Steps to Resolve a Dispute

Follow these steps to handle disputes promptly and professionally:

| Step | Description |

|---|---|

| 1. Identify the Issue | Review the documents carefully to determine exactly where the disagreement lies, whether it’s an overcharge, missing items, or miscalculation. |

| 2. Communicate Clearly | Contact the client to discuss the issue, providing clear explanations and evidence to support your position. Open communication is critical for understanding the other party’s perspective. |

| 3. Negotiate a Solution | Work collaboratively with the client to find a mutually agreeable resolution. This may involve issuing a refund, providing a discount, or adjusting the terms of the agreement. |

| 4. Document the Agreement | Once an agreement is reached, make sure to document the solution in writing, including any new terms or revised amounts. This helps prevent future misunderstandings. |

| 5. Follow-Up | Ensure that the customer is satisfied with the resolution and confirm that no further disputes arise. Maintaining regular communication helps in strengthening the client relationship. |

By following these structured steps and remaining calm and professional, you can resolve disputes efficiently and maintain a positive business reputation. Always keep records of all communication and agreements to protect both parties involved and prevent similar issues from arising in the future.

Tracking Payments and Outstanding Invoices

Keeping track of payments and pending financial documents is essential for maintaining a healthy cash flow and ensuring that your business is properly compensated. Managing overdue balances, monitoring transaction statuses, and staying on top of payment schedules allows you to avoid disruptions and potential financial strain. A clear process for tracking these transactions is vital to maintaining organized records and building trust with your clients.

There are several strategies to effectively monitor the status of payments and outstanding amounts. Implementing a systematic approach will help identify potential issues early, ensuring they are addressed before they escalate. Accurate record-keeping, timely follow-ups, and automated reminders can make this process much more efficient and less time-consuming.

Best Practices for Monitoring Payments

- Maintain Accurate Records: Keep detailed logs of all transactions, including dates, amounts, payment methods, and any communication with clients.

- Use Payment Tracking Software: Leverage tools that allow you to automatically track and categorize payments. These systems often provide notifications for overdue accounts.

- Establish Clear Payment Terms: Define payment deadlines and methods upfront to avoid misunderstandings. Providing clients with clear expectations helps minimize delays.

- Send Regular Reminders: If payments are overdue, send polite reminders to clients. Automated systems can help you keep track of these follow-ups without added manual effort.

How to Handle Outstanding Balances

- Review Payment History: If a payment has not been made on time, check the client’s payment history to assess if this is a recurring issue.

- Contact the Client: Reach out promptly to inquire about the overdue balance. Ensure clear and open communication to address any potential reasons for the delay.

- Offer Payment Plans: In some cases, offering flexible payment options can help clients settle their dues in a way that works for both parties.

- Consider Late Fees: If delays persist, you may consider implementing late fees, but always make sure this is stated in your original terms.

By staying organized and proactive, you can efficiently track payments and outstanding amounts, ensuring that your business remains financially healthy and that your client relationships remain positive.

Ensuring Accuracy in Shipping Documentation

Accuracy in business documentation is critical to avoid errors that can lead to delays, disputes, or financial losses. When managing paperwork related to goods movement and transactions, every detail must be correct to ensure smooth operations. Errors in records not only affect the flow of goods but can also harm customer relationships and create complications in the financial reporting process.

To avoid these issues, it’s essential to establish a process that prioritizes accuracy at every step. This includes cross-checking data, confirming key details with clients, and using tools that minimize human error. Below are some practices that can help ensure your documentation is flawless.

Key Practices for Accurate Documentation

- Double-Check Key Information: Always verify critical details such as product descriptions, quantities, prices, and destination addresses. Even minor mistakes can lead to costly errors.

- Automate Data Entry: Where possible, use automated systems to input data into documents. Automation reduces the risk of human error and speeds up the process.

- Standardize Formats: Use standardized formats for all documentation. This makes it easier to spot discrepancies and ensures consistency across documents.

- Confirm Client Information: Before finalizing any document, confirm the details with your client, especially the billing and shipping addresses, to avoid misunderstandings.

Tools to Improve Accuracy

| Tool | Benefit |

|---|---|

| Accounting Software | Automatically generates accurate financial records and tracks payments with minimal manual input. |

| Data Entry Automation Tools | Reduces human error by auto-filling fields based on pre-set information. |

| Barcode Scanning | Ensures accurate product identification and tracking during processing. |

By following these guidelines and leveraging available tools, businesses can enhance the accuracy of their documentation processes and reduce the risk of errors. This not only saves time and resources but also improves customer satisfaction by ensuring timely and accurate delivery of goods and services.